1. Introduction

Green hydrogen mainly refers to hydrogen produced via water electrolysis powered entirely by Renewable Energy Sources (RESs), such as solar, wind, hydro, geothermal, or tidal energy [

1]. Electrolysis allows renewable energy to be stored in the H

2 molecule for an unlimited time, without some of the problems encountered in batteries (aging, self-discharge, environmental impact), potentially contributing to a more effective exploitation of RES. Hydrogen can be green also if electricity is directly drawn from the grid, provided such energy is certified as originating 100% from renewable sources. In specific policy frameworks, the definition of green (or renewable) hydrogen also includes additional low-carbon production routes, such as hydrogen from biomass and steam reforming of biomethane; however, these remain out of the scope of the present review.

In the European Union, green hydrogen plays a central role in several overarching strategies for energy resilience and decarbonization, such as REPowerEU and the European Green Deal. These combined actions aim to meet up to 10% of the EU’s final energy consumption by 2050 using renewable hydrogen [

2]. A clear commitment to significantly improve the share of green hydrogen in its energy consumption by 2035 has also been announced in China through the Medium and Long-Term Plan for the Development of Hydrogen Energy Industry (2021–2035) [

3]. Similar agendas have been adopted in many other regions worldwide, with countries such as Japan, Australia, and the United States also launching national green hydrogen strategies to promote the development of green hydrogen technologies and infrastructure as part of their energy transition plans [

4].

Such central actions, implemented by means of suitable financial incentives and regulatory frameworks, have enabled the launch of a large number of R&D projects and high Technology Readiness Level (TRL) demonstration initiatives. These efforts have also paved the way for the first practical attempts to establish green hydrogen markets, particularly in the industrial and mobility sectors, where full profitability needs to be pursued through further technological development and economies of scale, with the aim of gradually reducing reliance on incentives and favorable regulatory conditions.

The resulting number of green hydrogen initiatives worldwide is remarkably high, and these have been in recent years the subject of numerous scientific papers and reviews, each with a specific scope, to tackle policies, techno-economic advancements, market development, and the identification of major challenges. Green hydrogen production methods have been reviewed in [

5], highlighting that while electrolysis remains central, being the most mature technology available, emerging technologies such as photoelectrochemical cells and biological methods show some potential to reduce the production cost. In particular, photocatalytic approaches aim to directly convert solar energy into hydrogen using semiconductor materials capable of both absorbing light and catalyzing water splitting, such as TiO

2,

–Fe

2O

3, and perovskite. Hence, they combine into a single system the two steps that are typically separated in the classical PV-powered electrolysis: light harvesting and electrochemical water splitting. However, this technology currently suffers from a number of critical issues: low efficiency due to limited light absorption, photo-corrosion of materials due to electrochemical side reactions, and challenges in scaling up the photocatalytic reactor. Biological methods use microorganisms such as algae and bacteria to produce hydrogen through various metabolic processes, including fermentation (dark or photo-enhanced), biophotolysis (direct and indirect), microbial electrolysis, etc. Despite their potential advantages (such as the improved organic waste exploitation, the potentially negative carbon emissions, and the prospected cost competitiveness), these emerging biological systems also face important limitations, including the high sensitivity to operating conditions, the slow production rates, and the system complexity, which currently prevent their wider adoption.

Configurations and components of green hydrogen energy systems are analyzed in [

6], for both stationary and transport applications, including their potential in integrated multi-vector energy systems (electricity, cooling, and heating). A techno-economic review of green hydrogen production plants is carried out in [

7], and recommendations for cost-effectiveness and energy efficiency are given in terms of energy source, electrolyzer, and hydrogen storage choice. Optimization techniques in green hydrogen production systems are reviewed in [

8], with a special emphasis on the role of artificial intelligence (AI) in energy production prediction and energy management. A comprehensive analysis of large-scale hydrogen storage technologies is given in [

9], ranging from compressed and cryogenic systems to liquid organic and solid-state carriers, alongside an assessment of material, cost, infrastructure, and economic considerations. Green hydrogen policies, targets, and strategies adopted in the EU, the US, Japan, Canada, Australia and other industrialized countries are discussed in [

4], highlighting their geopolitical role, the importance of managing raw material supply chains and establishing synergies to accelerate technological advancements in the sector.

Despite the large number of ongoing and planned green hydrogen initiatives, the abundance of scientific literature addressing its effective integration into existing or newly planned energy systems, as well as the extensive financial support and general consensus surrounding green hydrogen as a promising carbon-free energy carrier, green hydrogen technologies still struggle to achieve maturity and commercial viability. Therefore, most of the current initiatives are demonstration projects rather than profitable and long-lasting production facilities, and may even be decommissioned once their specific R&D objectives are met and funding sources are discontinued.

In this scenario, this paper gives a comprehensive overview of existing and emerging green hydrogen infrastructures covering the most prominent end uses, i.e., heat and power, mobility, and industry. After discussing the current scenario of green hydrogen initiatives, with the identification of the geographical distribution of projects and the end-use allocation, trends will be identified with respect to future sectoral evolution and technological choices related to electrolyzer and storage solutions. Finally, the primary challenges that may have limited the wider adoption and deployment of these technologies will be discussed, with particular focus on the financial viability of the most promising applications.

2. Current Scenario

The number of operational and planned green hydrogen ecosystem projects worldwide is vast and in the order of thousands, reflecting the growing global interest in hydrogen as a key factor in the ongoing energy transition efforts. Many online databases exist that list such projects and provide the most relevant key data. One of the most exhaustive resources is represented by the International Energy Agency (IEA) database [

10], while other useful tools include the NREL database, focusing on the US green hydrogen scenario [

11], the Global Green Hydrogen Projects Database from the company Commodity Inside Ltd. (London, UK) which covers over 500 electrolyzer projects around the world [

12], the annual reports from the Hydrogen Council with McKinsey&Company (New York, NY, USA) addressing global trends and investments in the hydrogen industry [

13], or the SkHyline initiative, with focus on green hydrogen projects in European Alpine regions [

14]. In addition to databases, many dedicated reviews have been periodically published in specialized journals over the years to tackle scientific and technological advancement in the field [

6,

15,

16,

17].

The total number of low-carbon hydrogen-related projects in the latest version of the IEA database released in October 2024 is 2440, covering projects with commissioning years up to 2043 (plus a number of projects without a definite launching year). The vast majority are represented by green hydrogen projects based on electrolysis (92% of total), while the remaining include Carbon Capture, Utilization, and Storage (CCSU) technologies, hydrogen from biomass, methane splitting, waste conversion, nuclear power, etc., which remain outside the scope of this paper. In order to extract reliable statistics aimed at highlighting current trends for green hydrogen ecosystems, a subset of all IEA-documented projects has been considered, focusing on those with an actual or expected commissioning year between 2020 and 2025. Older projects have been excluded, as their scale, technologies, and objectives may be less relevant today, while uncertainties and documented inconsistencies emerging for future projects have suggested disregarding at this stage those with commissioning years starting from 2026 (these future projects will, however, be reconsidered in

Section 4.1 in the analysis of past and future trends, and some of the most prominent ones will be described in more detail later in the manuscript). At the same time, only projects with a clearly renewable source of energy and expressly reported use of electrolyzer technologies were considered. By applying these criteria, the number of green hydrogen projects worldwide was narrowed down to 490, which together correspond to a total theoretically installed electrolyzer power of 30 GW.

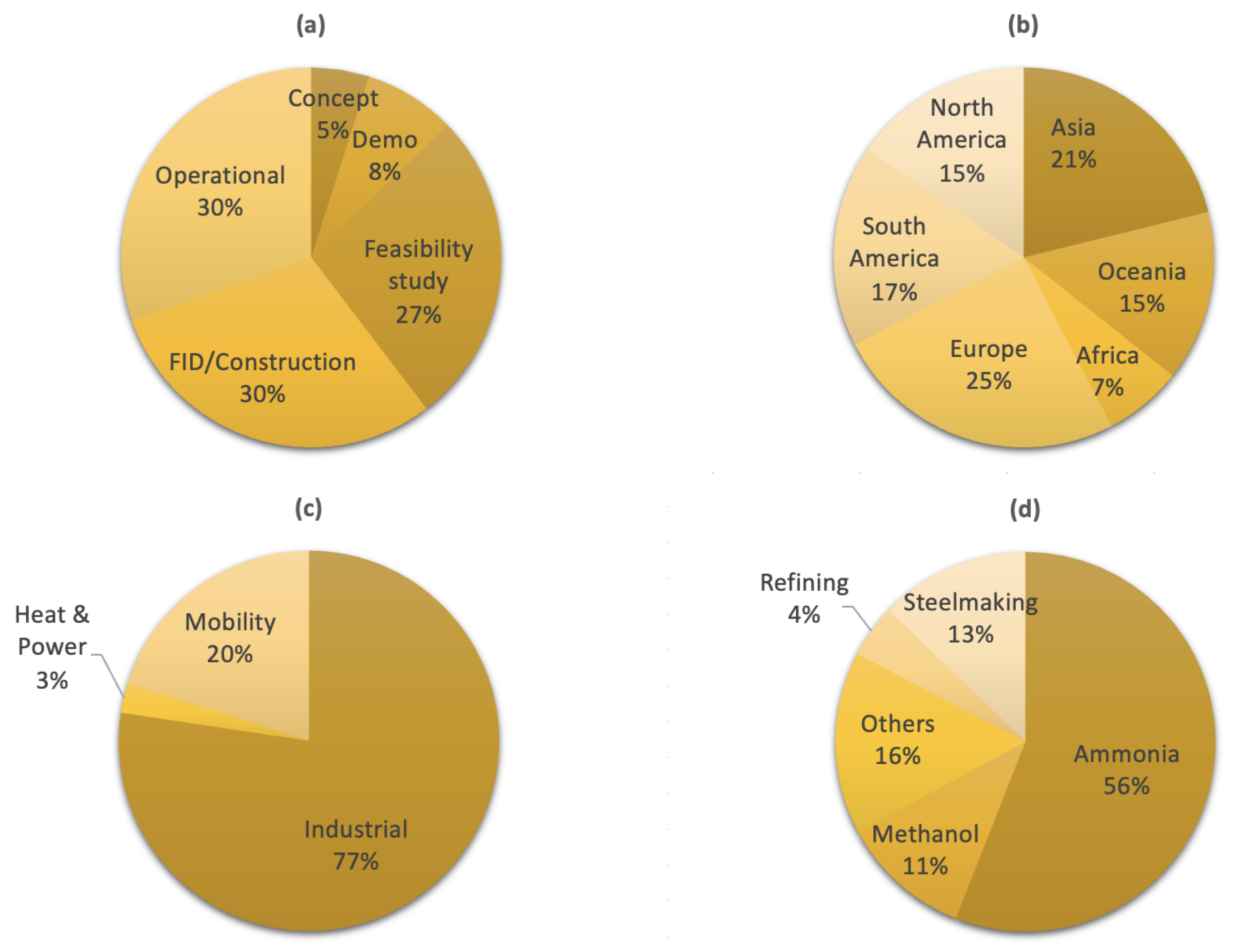

Figure 1 presents preliminary statistics on the selected projects. The graph in

Figure 1a illustrates their current development stage, showing that 30% of the projects are currently operational and an equal amount are under construction, while the remaining 40% are still in their early stages, including conceptualization, demonstration, and feasibility assessment. This relatively low rate of operational projects, as reported in the October 2024 update of the IEA database for projects with commissioning years between 2020 and 2025, suggests a potentially important implementation gap between project announcements and actual deployment, as often observed in emerging technology sectors, where delays and uncertainties may affect the success rate of projects that have not yet secured funding or reached a Final Investment Decision (FID). According to a recent analysis of the fate of 190 projects listed in the IEA database, only 7% of the capacity planned to be operational by 2023 was actually installed on time [

18]. The majority of the remaining projects reported delays and some were withdrawn and disappeared from the database altogether. This discrepancy underscores the importance of distinguishing between announced capacity and realized capacity when assessing the actual growth of green hydrogen deployment. This potentially introduces some uncertainties also with respect to other information provided in

Figure 1, since many announced projects remain subject to reorientation, scaling back or even cancellation in event of drastic changes in the energy markets or funding opportunities, which could affect their viability, timelines, scope, and funding decisions.

Figure 1b illustrates the geographical distribution of the projects by installed electrolyzer power (current and planned), indicating that Europe and Asia have been the main forging ground for green hydrogen initiatives in the last six years, accounting together for 46% of the total. These are followed by Oceania and North and South America, where activity is also significant and in the range 15–17% for each of these regions, while Africa is lagging behind with an installed power share of 7%. The distribution is more polarized when the number of projects is taken into account rather than the installed power: 57% of all selected projects are carried out in Europe and 19% are in Asia. This also results in a smaller average installed electrolyzer power per project in Europe (29 MW) compared to Asia (73 MW) and the Americas (196 MW), possibly indicating that funding mechanisms and political agendas in Europe have somewhat favored smaller and decentralized demonstration infrastructures rather than larger investments and economies of scale. Looking at individual countries, the highest total announced power is in the United States, China, Brazil, Chile, and Australia.

The selected projects have been further categorized based on the green hydrogen end use, distinguishing among power and heat applications (mainly represented by power-to-power systems and natural gas blending), direct use in the mobility sector (excluding synthetic fuels), and industrial applications. In cases of multiple end uses, for example, a project producing hydrogen for both mobility and grid injection, the project total installed power has been simultaneously allocated to each of them. The power allocation according to this classification is illustrated in the pie chart of

Figure 1c, where a clear predominance of industrial use (77%) emerges over mobility (20%) and power and heat (3%). This trend is also reflected in the average installed power per project, with industrial projects reaching 78 MW on average, while mobility projects stand at 26 MW, and power and heat applications at 19 MW per project. A more detailed breakdown of industrial applications is given in

Figure 1 d: here the largest share of hydrogen is absorbed by ammonia synthesis (56%), followed by steelmaking processes (13%), methanol production (11%) and crude oil refining (4%). These figures differ from those reported for gray hydrogen use, especially with regard to the emerging significant use in steelmaking processes [

19], indicating that the penetration of green hydrogen is gradually shifting classical hydrogen consumption patterns to also fully exploit decarbonization opportunities in new, hard-to-abate industrial sectors. Moreover, when post-2025 projects are taken into account, a further shift in end uses becomes evident, as this moves increasingly towards green ammonia production, which is the form of hydrogen that takes better advantage of the future establishment of cross-national hydrogen energy markets.

3. Overview of Green Hydrogen Initiatives

In this section, selected ongoing and planned green hydrogen initiatives worldwide, classified according to the main hydrogen end uses as per

Figure 1c,d, are described, providing an overview of current directions, priorities, and approaches in the different sectors.

3.1. Heat and Power

The role of green hydrogen in heat and power ecosystems is mainly to serve as a renewable energy storage medium, enabling the decoupling of energy generation from electricity and/or heat consumption. These projects are currently characterized by limited electrolyzer sizes and mostly address energy needs in buildings.

As a first important application, small-scale electrolyzers can be found in RES-based electric microgrids serving small communities or specific services, where hydrogen storage—alone or in combination with other energy storage options and backup systems—can be employed either for short-term energy needs, such as managing day–night cycles in PV-based systems, or for long-term, seasonal storage to address extended periods of low renewable generation. Such systems will be discussed in this section in both off-grid and grid-connected configurations, alongside other promising heat and power routes such as natural gas blending and combined heat and power (CHP) systems.

3.1.1. Off-Grid Power Systems

Grid-disconnected electrical RES-based microgrids represent a promising application for green hydrogen [

17]. They are designed for remote locations, with the primary objective of ensuring the energy self-sufficiency of a small community or service and the minimization of power shortages [

20]. Direct benefits reside in the carbon emission reduction if the system replaces conventional fossil fuel generators, as well as facilitating access to electricity for isolated communities through a sustainable and resilient solution. According to recent IEA estimates, 750 million people in the world in 2023 did not have access to electricity, and the majority of them live in Sub-Saharan Africa [

21]. This scenario offers, together with the appropriate amount of necessary water, good potential for the future development of new hydrogen-based microgrids relying on RESs, with a significant expected global impact.

The most classical configuration includes local renewable energy generation (typically from photovoltaic panels or wind turbines, or their combination) and one or more storage options, for example, a Li-ion battery pack for short-term storage and green hydrogen production for medium- to long-term storage. A fuel cell system completes the microgrid, converting hydrogen into energy to cover the applied load during times when both renewable energy generation is insufficient and the battery is depleted. A smart Energy Management System (EMS) guarantees the optimal use of renewable energy, and this often corresponds to prioritizing battery charging and discharging to cover short cycles over hydrogen storage, which is intended for longer storage durations [

22], although more elaborated approaches have also been proposed including electrolyzer prioritizing strategies [

23], battery-to-electrolyzer energy transfers [

24], as well as various optimization techniques (fuzzy logic, heuristic algorithms, model predictive control, etc.) and AI-based algorithms [

25,

26]. A number of strategies for efficient energy dispatch and profit allocations in cooperative multiagent RES-based energy systems with green hydrogen production have also been proposed, often based on game theory applications [

27]. In these systems, all key processes (renewable energy generation, hydrogen production, storage, and consumption) take place on-site and with limited physical footprint, while the power output of the installation typically remains below the MW scale.

One early example of such off-grid power systems is the hydrogen-integrated renewable microgrid installed in the isolated village of La Nouvelle, Réunion Island, which cannot be accessed by road [

28]. Equipped with a 1.4 MW Anion Exchange Membrane (AEM) electrolyzer, it provides electricity to several houses and services, relying solely on locally installed photovoltaic panels and ensuring uninterrupted power supply to the connected loads. Similar hydrogen-based microgrids serve a base-camp for workers in the Cerro Pabellón region in Chile, a mountain refuge in Col du Palet, France [

29], an Indian military base at 4400 m altitude on the Himalayas [

30], a 5-star ecotourism infrastructure in South Africa’s Madikwe Game Reserve [

31], or the remote Malay village of Kampung Batu 23 near Tapah, where batteries are replaced by supercapacitors [

32]. In these installations, hydrogen conversion typically covers major gaps in renewable energy availability, ranging from overnight hours, when solar generation ceases, to several days of unfavorable weather conditions, while seasonal storage appears less exploited. Here, green hydrogen competes primarily with the alternative of backup diesel generators, making it attractive not only in contexts where demonstrating a strong environmental commitment is itself a valuable objective but also in locations where diesel supply is costly or logistically challenging [

22].

Many companies around the world have begun commercializing stand-alone and ready-to-use turnkey solutions for green hydrogen-based independent microgrids, which integrate into a single device all essential components of the hydrogen storage cycle: electrolyzer, storage, fuel cells, and controls. These power-to-gas-to-power closed-loop solutions can be easily transported, installed, or relocated from one site to another, and this is expected to further contribute to their popularity. Notable examples include the modular devices by GKN Hydrogen (Bonn, Germany) [

33] and some of the customers of the electrolyzer manufacturer Enapter (Crespina Lorenzana, Italy) [

32].

3.1.2. Grid-Connected Systems

In grid-connected, RES-based power-to-power systems, green hydrogen integration enhances self-consumption and limits the transfer of excess renewable energy to the main grid, which is often discouraged by unfavorable compensation mechanisms, while the grid acts as a reliable and responsive backup system, ensuring continuous power supply in the event of microgrid failure or maintenance, or when specific components have been intentionally undersized based on cost-optimization considerations. Such aspects become particularly important in the presence of critical infrastructures such as emergency and security services. The external grid may also be exploited to better stabilize the electrolyzer operation around its rated power in case of part-load conditions, which could otherwise reduce efficiency and shorten the useful life of the electrolyzer. In other cases, it may serve the purpose of transporting renewable electricity generated in decentralized or distant locations if production of renewable energy on-site is impractical or insufficient. Finally, in larger setups, grid-connected systems may enable, under suitable regulatory frameworks, direct participation in the energy markets while buying, storing, or selling electricity based on price dynamics, and by providing grid stabilization services.

In this context, the Neue Weststadt project in Esslingen am Neckar, Germany, is successfully demonstrating the integration of green hydrogen in urban, grid-connected ecosystems. This climate neutral district, which remains in continuous development and is only partially operational at the time of writing, includes around 500 apartments and services and is equipped with a 1 MW alkaline (ALK) electrolyzer that converts renewable energy from locally distributed photovoltaic panels and regional wind sources into green hydrogen, with an average production of 250 kg/day [

34]. This hydrogen can then be used in multiple ways: converted back to electricity and heat in a combined heat and power plant when renewable energy production is low, distributed to a refueling station for mobility purposes, or injected into the natural gas distribution grid. A peculiar aspect of the installation is the recovery of waste heat from the hydrogen conversion process, which is then utilized in the local heating network, and this significantly enhances the overall energy efficiency up to 85% [

35]. Hydrogen storage is complemented by electrical storage in battery packs, which are primarily intended to support electric mobility or further stabilize the grid, while the external grid acts as a reliable backup solution. Another example of urban environment where green hydrogen can play a central role is Toyota’s Woven City, located at the base of Mount Fuji in Japan. This experimental smart city is designed more broadly to showcase cutting-edge technologies in the fields of energy, mobility, robotics, and artificial intelligence [

36]. Green hydrogen is the primary energy vector and powers both residential and commercial buildings for electricity and heating, as well as fuel cell vehicles operating in the city. As of May 2025, construction is well advanced and the official launch is expected later in the year.

Besides urban environments, grid-connected hydrogen-based renewable microgrids also show potential for applications in the agricultural sector, as currently addressed by the HydroGlen project. Still in the construction phase, this project relies on a combination of wind and solar energy to power a self-sustaining and research-oriented farming community in Glensaugh, Scotland, operated by the James Hutton Institute [

37]. The system integrates both battery storage and hydrogen storage for better energy management and is meant to operate primarily in a grid-connected mode, which helps when coping with occasional power losses by limiting system redundancies, and offering at the same time potential revenue opportunities by exporting excess energy. Once operational, the project will demonstrate one possible pathway for the decarbonization of rural and agriculture-oriented areas worldwide.

In grid-connected systems, green hydrogen is also being successfully considered solely as a dedicated backup resource in situations where external grid disruptions are frequent. This is the case of the Calistoga Resiliency Center, located in Calistoga, California, which is a hybrid energy storage system combining batteries and liquefied green hydrogen, able to ensure up to 48 h of backup power supply to around 2000 private customers and critical services during recurring safety power shut-off events caused by adverse weather conditions and wildfire risk [

38]. With a peak power of 8.5 MW and a total storage capacity of 293 MWh, it represents a carbon-free backup solution replacing traditional diesel generators. Under normal conditions, the microgrid remains in idle mode while the local community is powered by the main grid. In case of outages, which are frequent in the region, rapid response is first ensured by batteries, which provide black-start (restarting the local grid after the main grid shutdown) and grid-forming capabilities (establishing a stable power frequency and voltage). Once the microgrid is stabilized, a fuel cell stack intervenes, converting the stored hydrogen and ensuring a multi-day power supply to the local community.

In addition to small-scale infrastructures serving local communities, green hydrogen is also being considered as a flexible buffer for national or regional electricity grids, providing grid stabilization services in scenarios characterized by an increasing share of intermittent RES in the energy mix. Some projects have begun addressing this role, where the re-electrification of the stored hydrogen usually involves direct combustion in turbines, either as pure hydrogen or blended with natural gas for a swifter integration (as discussed in

Section 3.1.3). Gas turbines are often preferred over fuel cell stacks due to their more mature technology and the possibility of retrofitting existing facilities, leading to a swifter integration into the electric grids. Moreover, some of these systems enable heat recovery and reuse through CHP configurations, thereby improving overall energy efficiency. In this context, the EU-funded project HyFlexPower (2020–2024) has successfully demonstrated the operation of an industrial gas turbine using up to 100% green hydrogen [

39]. The facility included a 1 MW electrolyzer for on-site green hydrogen production, along with storage facilities holding up to one ton of hydrogen, leveraging an existing CHP natural gas plant at the Smurfit Kappa paper mill in Saillat-sur-Vienne, France. Building upon the success of the project, the infrastructure is now being further developed under a new initiative called HyCoFlex, aiming at establishing a set of technologies and best practices to switch existing industrial CHP power plants from fossil fuels to green hydrogen [

40]. One of the main challenges for large-scale power-to-gas-to-power applications is the large storage volume required and the associated cost and safety issues. These aspects will be discussed in more detail in

Section 5, with geological storage being proposed as a cost-effective and reliable, yet not fully mature, solution.

3.1.3. Natural Gas Blending

Green hydrogen can be blended with natural gas and injected into existing gas distribution networks as an effective strategy for partial decarbonization of residential and industrial natural gas end uses. It can be seen as an option for the storage and transportation of excess renewable energy that would otherwise be curtailed.

Natural gas blending is a very straightforward operation since it can take easy advantage of current infrastructures, and can increase in some contexts the energy combustion efficiency [

41]. The maximum amount of hydrogen that can be tolerated without requiring significant changes to distribution systems and end-use equipment remains an open matter and is best assessed on a case-by-case basis. Frequently employed values range between 5% and 30% [

42], and this variability accounts for different pipeline materials and resistance to hydrogen embrittlement, intended energy flow, tolerance to higher NOx formation, prioritization of safety aspects and leak detection capabilities, etc. Moreover, hydrogen blending increases the pressurization cost when taking into account the lower energy density and the higher pressurization power required per unit volume of hydrogen compared to methane (compression requirements may increase up to 260% if pure hydrogen is transferred [

43]). Higher hydrogen concentrations can more significantly reduce carbon emissions, but often demand costly pipeline upgrades and additional equipment in particular to comply with safety standards and pressurization requirements.

The use of green hydrogen for natural gas blending is a frequently adopted practice in green hydrogen projects, either as the primary end use or in combination with other applications if the objective is the development of fully integrated and versatile hydrogen ecosystems to cover energy demands over different sectors. Extensive lists of such projects can be found in [

42,

44]. As one of the early examples of green hydrogen utilization for natural gas blending, the GRHYD project was operational in Dunkirk, France, between 2018 and 2020 [

45]. It successfully tested the injection of up to 20% green hydrogen into the local distribution grid, supplying around 100 homes and a healthcare center. Almost at the same time, the HyDeploy project in the UK proved, through a number of different trials, the safety, feasibility, and public acceptance of hydrogen blending up to 20% (although not necessarily produced from renewable energy) [

46]. In particular, one trial supplied hydrogen to 100 homes and 30 university buildings in Keele while another trial addressed 668 homes and businesses for 10 months in Gateshead. Preliminary investigations have also been carried out in some regions to assess the feasibility of a 100% hydrogen distribution grid for residential use, as by the H21 project in the UK.

More recently, grid blending has been a key component in the ongoing Green Hysland project, which aims at establishing a full green hydrogen ecosystem on the island of Mallorca, Spain [

47]. In September 2024, the Spain’s first injection of green hydrogen into a natural gas network took place, with a hydrogen content limited to 2% but intended to reach 20% at later project stages. Once fully operational, the project plans to produce approximately 300 tons of renewable hydrogen annually by utilizing two dedicated photovoltaic plants in Lloseta and Petra. This hydrogen will be produced by a 2.5 MW electrolyzer in Lloseta and transported through a dedicated hydrogen pipeline to the Cas Tresorer distribution center. Besides grid blending, end uses for the produced hydrogen also include mobility and industry and important milestones have been the completion of the pipeline, the injection of hydrogen into the gas grid, and the initial distribution of hydrogen for mobility purposes.

Natural gas blending is expected to remain a key sector for green hydrogen use also in the future, as projects continue to grow in scale and cover new applications, even if its impact on future hydrogen demand in Europe is expected to remain modest [

48]. In particular, the Kintore Hydrogen project in Scotland is a large-scale green hydrogen initiative aiming to produce up to 500 MW electrolyzer capacity by 2028, with a potential expansion to 3 GW [

49], using surplus electricity from Scottish offshore wind farms. The hydrogen will be blended with natural gas in the high-pressure grid, after being pressurized to 94 bar gauge to align with the existing gas transmission network. Future expansions of the project also aim to supply hydrogen to industrial hubs.

3.2. Industrial Use

Green hydrogen finds a fertile ground in industrial environments, and this is for a number of valid reasons. Industries generally have better access to financial and human capital compared to other contexts and can often offset the costs of new environmentally friendly infrastructures by exploiting dedicated decarbonization incentives and environmental policies. Many companies are also motivated by the opportunity to showcase their commitment to environmental sustainability and climate change mitigation actions.

In most industrial applications, green hydrogen is used as a feedstock rather than for power generation, and as such it essentially remains indistinguishable from conventional (or gray) hydrogen produced by methane steam reforming. Therefore, another major advantage is that switching to green hydrogen often requires little or no modification of existing industrial processes in which hydrogen is going to be used, making adoption easier and more cost-effective. Furthermore, compared to power generation, the direct use of hydrogen as feedstock avoids the energy losses associated with gas-to-power conversion, which significantly reduces overall efficiency in other contexts such as residential microgrids.

Table 1 lists selected notable cases of hydrogen-based industrial projects that are either currently operational or in the development phase. It emerges that the industries where green hydrogen has attracted significant attention are the petrochemical industry (hydrocracking, methanol production, synfuel production, etc.), ammonia production, and the steel-making industry, which are all considered hard-to-abate sectors for decarbonization. However, virtually any industrial sector where hydrogen is used can potentially switch to green hydrogen (fine chemicals, food industry, electronics, and semi-conductors industry, etc.) and green hydrogen can also replace fossil fuels in a number of combustion processes where high-temperature heat is needed.

Concerning the petrochemical industry, one of the successful initiatives is the REFHYNE demonstration project, producing green hydrogen for various crude oil treatments (hydrocracking, desulfurization, hydrogenation) at the Shell Energy and Chemicals Park in Wesseling, Germany [

50]. The project installed a Proton Exchange Membrane (PEM) electrolyzer with a peak capacity of 10 MW producing approximately 1300 tons of green hydrogen per year using renewable electricity, making it the largest of its kind in Europe at the time of commissioning (2021). Building on the successful completion in 2024 of the first demonstration facility (referred to as REFHYNE I), Shell has already taken the financial investment decision to proceed with REFHYNE II, which will install a 100 MW electrolyzer at the same location and produce up to 44 tons of green hydrogen daily, to be further used in refinery processes and other local industries as demand grows [

51]. Still with reference to the petrochemical sector, the Kuqa green hydrogen project, developed by Sinopec (Beijing, China), is currently one of China’s largest renewable hydrogen production facilities. The project utilizes a 260 MW solar power plant to generate electricity, which is then partly used to power a 20 MW alkaline electrolyzer with a capacity of 20,000 tons per year of hydrogen. Again, this is intended primarily for use in nearby refining and chemical processes, supporting the decarbonization of Sinopec’s operations. A similar example in the petrochemical industry is the Baofeng plant in China, developed by Baofeng Group (Henan, China). It operates using a dedicated 200 MW photovoltaic farm to feed a 20 MW alkaline electrolyzer and produces up to 16,000 tons of green hydrogen annually together with 80,000 tons of oxygen as by-product. This green hydrogen is used in the Baofeng carbon-to-chemicals facilities, reducing, in particular, the carbon footprint of the synthesis of methanol.

Increasing attention is currently being directed towards industrial green hydrogen use for the direct synthesis of ammonia via the classic Haber–Bosch process. In addition to serving as a valuable commodity for the market and the fertilizer industry, ammonia also plays the role of an effective hydrogen carrier because it can be liquefied, stored, and transported over long distances more easily compared to gaseous hydrogen. An outstanding example is the Puertollano Green Hydrogen Project implemented near Ciudad Real, Spain, which is currently Europe’s largest green hydrogen facility dedicated to industrial applications [

52]. Developed by Iberdrola (Bilbao, Spain), the plant integrates a 100 MW photovoltaic solar installation, a 20 MWh lithium-ion battery system, and a 20 MW electrolyzer to produce green hydrogen entirely from renewable sources. The hydrogen generated is stored at 60 bar and used by the company Fertiberia (Madrid, Spain) to produce green ammonia and, subsequently, emission-free fertilizers. Puertollano serves as a perfect example of a large-scale, mature demonstration project for green hydrogen ecosystems, effectively integrating all necessary players in a complete and well-coordinated framework. The growing interest towards green ammonia production is further confirmed by the significant efforts and resources currently injected into the ambitious NEOM Green Hydrogen Project in Saudi Arabia, set to become the world’s largest green hydrogen plant at the time it will be commissioned (expected by the end of 2026) [

53]. The plant will be powered entirely by solar and wind energy and will produce up to 600 tons of green hydrogen per day, which will be converted into green ammonia for shipping to industrial sites worldwide. The project has already secured a 30-year exclusive off-take agreement, ensuring stable revenues that will support continuous operation [

54].

A third promising industrial sector for green hydrogen is the steel industry. In blast furnace operations, hydrogen has proven to be an effective reducing agent for converting iron ore into iron, offering at the same time a significantly lower carbon footprint than traditional coke or coal when green hydrogen is used. Among the early efforts to investigate the feasibility of this application is the H2FUTURE project, a European initiative that successfully operated a 6 MW PEM electrolyzer at the Voestalpine steel plant in Linz, Austria, powered by renewable electricity supplied by Verbund (Vienna, Austria) [

55]. Although the project focused mainly on the operation of the electrolyzer as a grid-balancing tool at different levels of reserve capacity (primary, secondary, and tertiary) by absorbing excess renewable energy from the grid, it paved the way for a deeper penetration of green hydrogen in steel manufacturing environments and prepared the terrain for future development in this field. In fact, the project ended in 2021, and the concept of fossil-free steel production was then successfully demonstrated in the HYBRIT (Hydrogen Breakthrough Ironmaking Technology) initiative in Sweden led by the companies SSAB (Stockholm, Sweden), LKAB (Luleå, Sweden), and Vattenfall (Stockholm, Sweden) [

56]. The successful replacement of coke in blast furnaces by green hydrogen and the subsequent production of novel iron sponge material can be regarded as one of the most significant breakthrough innovations in the steel sector in recent years. Building on the success of the first demonstration plant, the HYBRIT consortium has planned the construction of a full-scale fossil-free steel plant in Gällivare, Sweden, for the production of 1.2 million tons of crude steel annually, which amounts to 25% of Sweden’s total steel production and a cut of 10% of Sweden’s total carbon dioxide emissions.

3.3. Mobility

Green hydrogen has been widely considered for applications in the mobility sector, particularly as a clean energy carrier in fuel cell electric vehicles, where it generates electricity onboard through electrochemical conversion.

Early green hydrogen facilities in the mobility sector have often been small-scale and self-contained systems where green hydrogen is generated on-site using solar or wind power, then stored and distributed locally through dedicated refueling facilities. Despite the difficulties for fuel cell vehicles to penetrate the automotive market, the number of such systems has been gradually increasing worldwide during the last decade (as in the UK, Germany, US, China, Japan, South Korea, etc.), consequently showcasing the technology to a wider consumer base.

Larger centralized systems dedicated to green hydrogen production for mobility have also gradually gained importance in the last decade, integrated with suitable hydrogen storage and transportation solutions. One of the most notable projects has been H2RES in Denmark, a now discontinued initiative which was led by the offshore wind energy leader Ørsted (Hørsholm, Denmark). The project aimed to explore the integration of offshore wind energy with hydrogen production, utilizing two 3.6 MW offshore wind turbines to power a 2 MW electrolyzer located near Copenhagen to produce up to approximately 1000 kg of green hydrogen per day, primarily intended for zero-emission road transport in the Greater Copenhagen area [

57]. The site featured a modular storage system enabling easy transport of hydrogen to refueling stations and other locations without requiring large-scale on-site storage facilities.

The development of larger-scale production sites intended for the mobility sector is only justified if supported by an adequate hydrogen demand, with many initiatives specifically aimed at stimulating such demand. For example, the former EU-funded projects JIVE and JIVE 2 have supported the establishment of fuel cell (FC) bus fleets across 22 European locations [

58], while the later European flagship initiative H2ME (Hydrogen Mobility Europe) has deployed a total of 1400 FC vehicles, including cars, vans, and trucks, in addition to the installation of 49 hydrogen refueling stations across 8 European countries [

59]. Many smart city or smart community projects also include, or plan to include, hydrogen-based private and public mobility as a key component for the full integration of sustainable solutions, as is the case of the already mentioned Toyota Woven City in Japan, Neue Weststadt in Germany, and Green Hysland in Mallorca.

Demonstration projects for green hydrogen use in the mobility sector have also involved maritime applications. One of the important milestones in this context has been the European project HySeas III, successfully completed in 2022, which led to the development of the world’s first marine-certified hydrogen fuel cell module and the design of a passenger and car ferry powered by hydrogen produced from wind energy [

60]. Moreover, the French hydrogen-powered vessel Energy Observer concluded in 2024 a seven-year global voyage, covering over 68,000 nautical miles and visiting 50 countries, relying solely on hydrogen produced onboard from wind and solar energy [

61].

3.4. Multi-Sectoral Ecosystems

Integrated multi-sectoral ecosystems, which are characterized by the combination of multiple end uses and different stakeholders within a certain area, are increasingly common, as they allow for the exploitation of synergies in production, storage, and distribution infrastructures. However, their higher degree of complexity also requires careful effective coordination and interaction between all parties involved. Such systems are often referred to as green hydrogen valleys and are typically intended to demonstrate the feasibility of a regional hydrogen economy based on cooperation among industry players, energy providers and distributors, public authorities, and research institutions. In addition to technological demonstration, hydrogen valleys also aim to support regional development, create jobs, and propose models for large-scale deployment. For these reasons, hydrogen valleys have become a central focus of many political decarbonization agendas, including that of the European Commission, which has provided strong and consistent financial support for their continuous development. In particular, 6 large-scale and 15 small-scale hydrogen valleys have been financially supported so far in Europe by the EU Clean Hydrogen Partnership or the former Fuel Cells and Hydrogen Joint Undertaking [

62], and further support will be provided through forthcoming calls for proposals.

One notable green hydrogen ecosystem has been established in the Orkney Islands of Scotland (UK), which produces more renewable energy (mainly from wind and tidal sources) than their electrical grid can accommodate. Supported over the years by a cluster of funding initiatives (BIG HIT, HyDIME, PITCHES, etc.), the ecosystem uses excess RES energy to produce green hydrogen, which is consequently stored in compressed gas cylinders and distributed to various sites on the islands for use in heating, transport, and power generation [

63]. In particular, the islands have integrated hydrogen into their transportation network, including hydrogen-fueled vans and passenger vehicles, and hydrogen refueling stations have been established. Maritime and aviation applications are also being considered, with the aim of developing hydrogen/diesel injection systems in commercial ferries, and hydrogen/electric internal flights. On the islands, green hydrogen is also used to heat buildings through fuel cell systems and provides backup power to remote areas that are difficult to connect to the grid.

A similar initiative, known as Green Hysland and previously mentioned in

Section 3.1.3, is currently underway on the island of Mallorca, Spain, where gas blending into the existing natural gas grid complements the range of end uses [

47]. By adjusting hydrogen production based on energy availability, grid balancing services have been considered in the completed HyBalance project, which featured a 1.2 MW PEM electrolyzer producing up to 500 kg of green hydrogen per day from surplus wind power [

64]. The produced hydrogen was supplied to industrial uses (mostly metal processing) through a dedicated pipeline and to refueling stations in the Copenhagen area. Although the project officially ended in 2020, the hydrogen production plant remains operational. As a last example of notable multi-purpose green hydrogen ecosystems, Energiepark Mainz is a green hydrogen production facility located in Mainz, Germany, which uses PEM electrolyzers to convert into hydrogen the renewable energy imported from the medium-voltage grid of Stadtwerke Mainz (Mainz, Germany), the local utility company [

65]. Here too, the hydrogen produced by the facility is partly injected into the local natural gas grid, partly used for mobility purposes, and partly employed in industrial processes, while balancing the local grid with respect to the intermittency of renewable power generation.

Despite the higher complexity, costs, and associated risk, multi-sectoral projects are expected to deliver important advantages if successful. These include greater flexibility in managing energy sources, potential economies of scale, and a more effective and significant impact on decarbonization efforts over an entire region.

4. Identifying Trends and Challenges

Based on the description of the current scenario, common patterns, and challenges can be identified in existing and planned green hydrogen initiatives.

4.1. Sectoral Overview

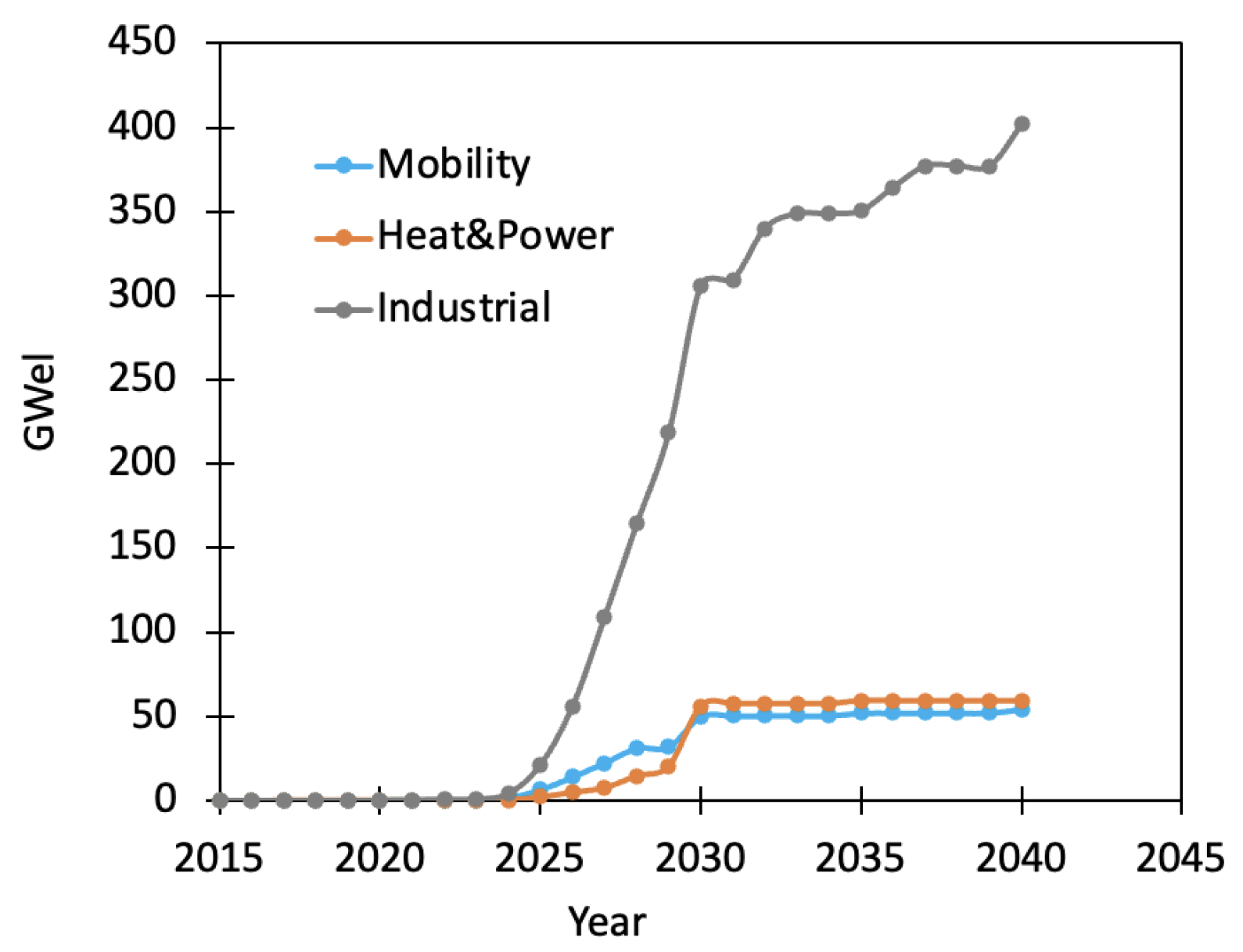

The industrial sector accounts for the largest share of total installed electrolyzer capacity among green hydrogen initiatives, as well as the largest individual project sizes. This is driven by the existing demand for hydrogen in specific industrial sectors, the potential for economies of scale, and the opportunities for revenue generation. This is already evident with reference to projects with commissioning years between 2020 and 2025, where industrial initiatives have been characterized by an average installed capacity of 78 MW per project, compared to 26.5 MW and 19.4 MW for mobility and heat and power applications, respectively. Furthermore, when projects announced for the next five years are taken into account, the average installed capacity in industrial initiatives is projected to increase by a factor of 7, due to the expected commissioning of a number of GW-scale projects worldwide (see planned projects in

Table 1 for some examples). These are set to gradually become the norm across the sector rather than the exception.

Figure 2 illustrates the cumulated electrolyzer capacity by sector for projects expected to be launched up to 2040, according to the IEA green hydrogen project database. A certain level of uncertainty affects these figures, with a possible overestimation caused by the implementation gap effect already discussed in

Section 2 (many announced projects will face delays, be downsized, or even canceled) and a possible underestimation due to the fact that not all upcoming projects have been announced yet and additional capacity is likely to emerge at a later stage. Nevertheless, the overall trends appear indicative of the sector’s relative importance. A steep increase is observed in the industrial sector over the coming decade, with a total installed power expected to go from 21 GW in 2025 to 350 GW in 2035, driven by the commissioning of numerous high-capacity projects, whereas other sectors are clearly lagging behind. Notably, the plateau in mobility and heat and power after 2030 highlights that a limited number of projects has been announced for that period at the time of writing, but does not necessarily indicate a significant loss of momentum. In fact, this most likely reflects the contingent nature of such smaller projects, which depend more directly on political agendas and available funding, making them less likely to be planned far in advance. In contrast, the industrial sector appears to have already planned many large projects well beyond 2030, due to the longer times typically required for conceptualization and feasibility studies associated with large-scale initiatives. In particular, regarding the mobility sector, the potential for hydrogen applications remains high despite a number of important bottlenecks (see

Section 6.3). Transportation activities in the EU consumed 31% of total energy in 2022, surpassing both industry and families as the largest energy consumers, and road transportation accounts for 74% of total transportation energy consumption, making it the mobility sector’s biggest energy consumer. This leaves important space for green hydrogen, and if manufacturing technologies further develop, distribution infrastructure is improved and costs come down.

4.2. Renewable Energy Sources and Grid Interaction

Of 203 projects selected with the criteria given in

Section 2 and for which the renewable energy is clearly produced by a locally dedicated facility (excluding therefore projects importing green energy from the grid as well as projects with undeclared energy source), solar PV appears to be the most frequently adopted choice accounting for 57% of such projects. This is consistent with the fact that solar energy is widely available globally, although with differences in intensity and seasonal patterns, and highly predictable (while, for wind power generation, strong and consistent winds are more limited geographically). Other advantages of solar energy can be identified in the limited maintenance requirements and the high adaptability to a variety of surfaces (rooftops, small fields or unused land, water reservoirs, deserts), which has emerged as important factors especially for small-scale isolated or urban installations. Wind energy remains also a popular option, due to its technological maturity and cost effectiveness, with onshore and offshore wind installations that account for 23% and 11% of this subset of projects, respectively. However, offshore wind turbines generate a higher power output and have been the preferred choice in larger-scale projects in regions with high and consistent wind speed, with an average electrolyzer power of 184 MW per project with reference to the years between 2020 and 2025 (whereas onshore wind and solar PV plants are primarily found in smaller initiatives, with average electrolyzer size of 39 and 31 MW per project, respectively). One notable case of large-scale onshore installation is the ambitious Magellanes project cluster planned in southern Chile, currently in preliminary stages of feasibility study and environmental assessment [

66]. The Magallanes is a unique region which offers strong and steady winds across vast open areas year round, and this has made it possible to plan a cluster of nine large-scale green hydrogen projects, each with expected electrolyzer capacities around 1–2 GW, entirely dedicated to the production of green ammonia.

Hydropower also appears as a viable option and has been exploited in around 10% of the projects, while other RESs such as geothermal, biomass, and tides (as seen in BIG HIT) are only viable in very specific environments and therefore remain niche solutions with very limited overall impact.

Many projects do not directly include energy generation facilities, and the necessary renewable power is provided instead through an external distribution grid. From the available data, this approach appears particularly frequent in industrial projects (as seen in REFHYNE I and II, HYBRIT, and H2FUTURE, just to mention a few), since it is common for private companies to exploit existing mechanisms such as power purchase agreements and renewable energy certificates to import renewable energy from the grid in order to meet carbon emissions quotas or demonstrate their voluntary environmental commitment. This allows industries to classify their locally produced hydrogen as green, although the actual effectiveness of some of these instruments on the intended carbon emission cut is under scrutiny [

67]. From an operational point of view, this arrangement helps decrease the complexity and physical footprint of the infrastructure while concentrating efforts and resources primarily on hydrogen production and integration into the intended ecosystem. Furthermore, this guarantees a more stable and reliable energy supply compared to most on-site renewable power installations. At the same time, however, the challenges posed by flexible operation and intermittent power availability become critical factors that must be adequately addressed (where relevant for the specific RES), and this is important for the swift operation of both the electrolyzer and of the entire grid.

In view of the worldwide expected growth of green hydrogen production for industrial use, envisioning the simultaneous operation of a growing number of large-scale electrolyzers within a grid that is increasingly powered by intermittent renewable sources may lead to significant imbalances between power generation and demand and to sub-optimal electrolyzer operation. In this scenario, it is crucial that electrolyzers can function as a variable grid-connected load, promptly adapting to fluctuations in renewable energy availability by dynamically adjusting power consumption and hydrogen production. Despite the wide availability of theoretical studies addressing the optimal simultaneous operation of multiple grid-connected electrolyzers (e.g., [

68,

69]), no demonstration projects are known to have tested these aspects on the larger scale.

As a further advancement, electrolyzers have also been proven capable of providing ancillary services for grid stabilization such as frequency and voltage control [

70]—services otherwise traditionally provided by dedicated fossil fuel-based facilities. This flexible operation can be properly encouraged through dynamic electricity pricing or financial incentives, allowing electrolyzer operators to participate more actively in energy markets as crucial grid-stabilizing assets and potentially increasing the infrastructures revenues [

71]. The benefits associated with providing balancing services have been specifically exploited in many of the selected projects in

Table 1. In particular, the 6 MW electrolyzer in the H2FUTURE project has been proven capable of stabilizing frequency fluctuations in the main grid by acting as a primary, secondary, and tertiary reserve by adjusting the power consumption at different response delays. Similarly, electrolyzer ancillary services for grid stabilization have been successfully validated in both REFHYNE I and HyBalance, and this has contributed to strengthen the project’s business case [

70].

4.3. Electrolyzer Technology

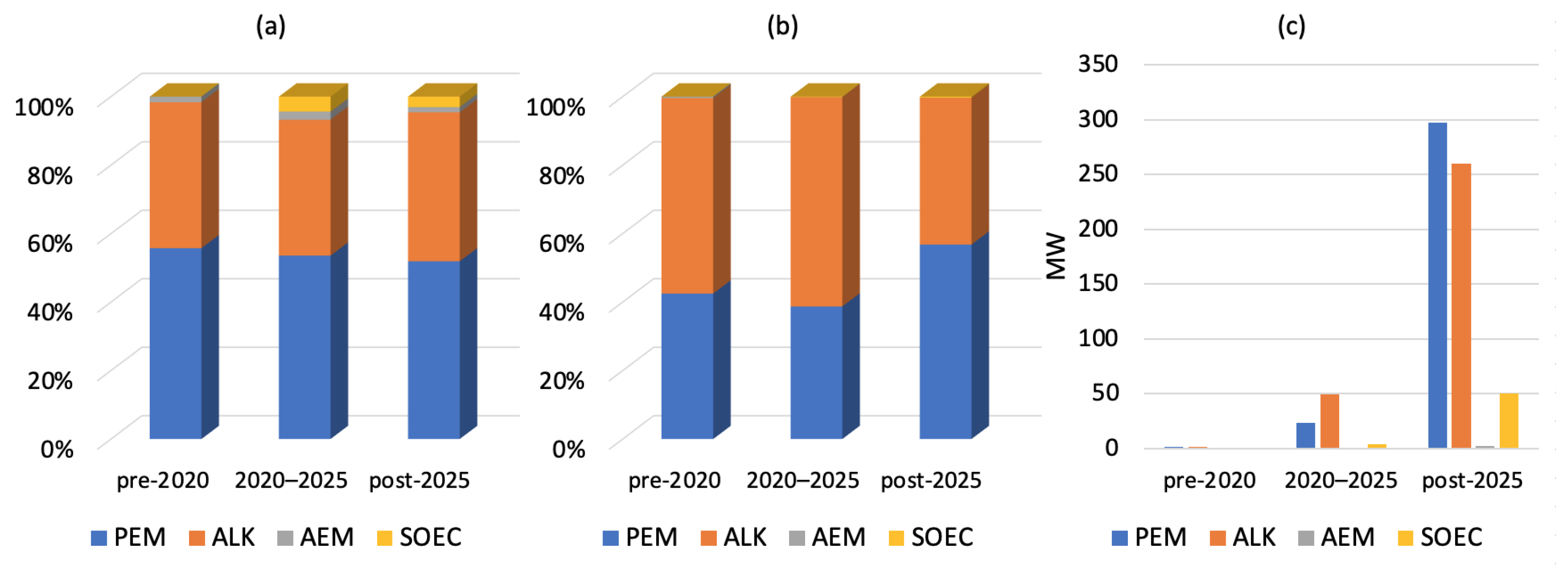

Trends in electrolyzer technologies based on the information reported in the IEA database are illustrated in

Figure 3 in terms of number projects per technology, installed power, and average power per project. For this analysis, projects have been classified into three main groups according to their launch date (pre-2020, between 2020 and 2025, and post-2025) in order to distinguish past, current, and future trends. Moreover, only projects for which the database provides information on the electrolyzer technology, the launch year, and—for future projects—a development status beyond mere conceptualization have been considered.

In every observed period, PEM and ALK electrolyzer installations together account for the vast majority of projects (

Figure 3a), with a combined adoption rate consistently exceeding 90%, leaving limited space for the deployment of alternatives such as the AEM and Solid Oxide Electrolysis Cell (SOEC) technologies. The two leading technologies appear to be relatively balanced in adoption, with only a slight predominance of PEM over ALK in any of the three observation periods; however, when considering the total installed power (

Figure 3b), the situation tends to reverse in favor of ALK in particular for projects commissioned before 2025.

The popularity of PEM technology can be justified by the milder operating conditions, the compactness and good capacity to adapt to fluctuations of the input, making them ideal for integration with intermittent sources like solar and wind [

72]. Moreover, PEM electrolyzers can provide hydrogen at high pressure, hence reducing the pressurization costs for storage. Alkaline systems remain still a frequently adopted technology, since they often represent a cheaper solution and a more mature technology compared to PEM. According to recent estimates, ALK electrolyzers can reduce the LCOH of green hydrogen by approximately 10%, owing to their lower capital and maintenance costs, which account for roughly one-third of the total LCOH, the remaining two-thirds being the energy costs [

73]. However, ALK electrolyzer are also characterized by slower response times, safety issues, and limited load range, which become critical factors when operated in dynamic conditions as typical in RES systems. Additionally, in some contexts they may not meet the high-purity hydrogen requirements needed for fuel cell applications [

72]. Notable cases of the use of alkaline electrolysis are found mostly within large industrial projects, where cost cutting solutions are prioritized, such as the Kuqa and Baofeng projects in China, which rely on the extensive Chinese expertise in this technology, or the forthcoming GW-scale NEOM production plant in Saudi Arabia. Safety issues, due to the formation of potentially explosive mixtures in the partial load operation of the alkaline electrolyzer, have been specifically reported for the Kuqa plant, leading to capacity cut and slow ramp-up [

74].

The preference for ALK technology in large-scale projects in recent years is evident when considering the average installed power for ALK units (49.1 MWel in 2020–2025), which is more than double that of PEM electrolyzers (23.6 MWel for the same period), as shown in

Figure 3c. For initiatives planned beyond 2025, the gap between PEM and ALK total installed power seems not only to be disappearing but likely reversing in favor of PEM, as more and more large-scale future projects have already announced to opt for this technology. This is particularly evident in

Figure 3c, where future projects are expected to reach an average installed capacity of 297 MW for PEM technology, thus surpassing ALK systems, which are projected to average 260 MW. This trend likely reflects the anticipated cost reductions and performance improvements of PEM technology, in contrast to ALK electrolyzers, which are expected to still remain the cheaper option by 2030 but with a more limited cost decline given their already more advanced level of maturity [

75]. It should be noted that these conclusions are based on anticipated data for future projects and therefore remain uncertain. This is primarily due to numerous initiatives, particularly smaller-scale projects, yet to be publicly disclosed, whereas larger, industrial-scale projects are more likely to have been announced in advance, as discussed in

Section 4.1, adding a certain bias to the projections. Secondly, many announced projects have not yet revealed their technological choices and have consequently been excluded from the analysis. Furthermore, given the rapidity of technological development in this field, project re-orientations and cancellations remain a possibility. Consistently, also other recent analyses report that current data do not support a definitive conclusion regarding whether PEM or ALK electrolyzers will emerge as the dominant technology in the near future [

72], confirming the uncertainties in this dynamic sector.

Only a very limited number of green hydrogen projects have adopted SOEC and AEM electrolyzers, and these are mostly small-scale demonstration initiatives, so that the relevant total installed power is negligible compared to PEM and ALK electrolyzers for all observed periods, as evident from

Figure 3b. SOEC electrolyzers promise to offer the highest efficiency and potential for cost reduction, but their adoption in practical applications is still limited by material degradation at high temperatures and long start-up times, which make them less suitable for intermittent hydrogen production. Degradation in SOECs takes place both at cell and stack level. At the cell level, performance losses are often linked to issues such as nickel particle agglomeration, carbon deposition, delamination at the electrode–electrolyte interface, and electrode coarsening. At the stack level, challenges include chromium contamination of the oxygen electrode from the interconnect material, sealing degradation, interconnect corrosion, and performance instability under variable operating conditions [

76,

77]. Thermal cycling adds mechanical stress due to repeated heating and cooling, contributing to material micro-structural damage. Reducing the operating temperature of SOECs could significantly enhance durability and performance by limiting degradation; however, this approach critically depends on the development of improved materials with higher ionic conductivity and enhanced electrocatalytic activity at lower temperatures [

76].

As promising development, due to their intrinsic design and materials, SOECs appear particularly suitable for reversible operation in polygeneration setups, producing green hydrogen via high-temperature electrolysis when excess renewable electricity is available, and switching to power generation mode by functioning as Solid Oxide Fuel Cells (SOFCs) when hydrogen or other fuels are supplied. In particular, additional production of hydrogen alongside electricity can also be achieved in reversed SOFC mode, when the unit is fed with (bio)methane and steam, and operated therefore as a steam reformer, resulting in high round-trip energy efficiencies and capital expenditures cost reduction, as investigated in the EU-funded projects SWITCH and REFLEX [

78,

79].

Concerning AEM electrolyzers, their main advantages consist in operation at low temperatures in a compact design (as in PEM electrolyzers) by using cheaper materials (as in ALK electrolyzers). Their main attractiveness lies in the limited physical footprint, the absence of hazardous liquid electrolytes, and the lower cost, which makes them particularly suitable for decentralized applications, where ease of handling, safety, and affordability are especially critical. In particular, some projections already indicate that AEM technology could achieve a lower capital cost per kW compared to PEM and ALK systems, although this may still come at the expense of a shorter stack lifetime [

80]. A quantitative evaluation of how key operating conditions such as temperature, pressure, electrolyte conductivity, membrane thickness, and catalyst layer properties affect AEM performance and efficiency is given in [

81], offering useful insights for optimizing design and operation. Although the materials to be employed are still under development and commercial maturity for large applications has not yet been reached, AEM electrolyzers have been proven suitable to work in small-scale decentralized RES systems (as discussed in

Section 3.1.1) and are currently being commercialized for this purpose [

32].

5. Hydrogen Storage and Transportation

The most suitable green hydrogen storage and transportation options depend on the required scale, the desired storage density, transportation distance, and the associated costs. Common storage solutions are generally classified into physical storage (compressed or liquefied gas, absorption in metal hydrides, geological storage) and chemical storage (conversion of green hydrogen into ammonia, synthetic fuels, and other hydrogen carriers). More mature technologies include hydrogen pressurization and liquefaction, while solid-state and underground storage are a more recent, yet promising, development, with clear benefits in specific applications. Chemical storage in the form of green ammonia also benefits from a well-established industrial production route, i.e., the conventional Haber–Bosch process for ammonia production, whereas alternative conversion pathways have only more recently begun to be explored.

5.1. Compressed Gas

Compressed hydrogen storage involves the storage of hydrogen gas at high pressures in special tanks. This method is a popular and straightforward solution for small-scale hydrogen storage, as it optimally combines simplicity with safety at reasonable cost while enhancing rapid scale-up through modularity. It is, in fact, widely used for both mobility (as in fuel cell vehicles) and stationary applications, with costs of storage estimated between 1.5 and 3

$ per kg at the time of writing [

82]. The important disadvantages of this storage method are, on one hand, the relatively low volumetric energy density, typically in the range of 1–5 MJ/L depending on storage pressure [

9], and on the other hand, the energy required for hydrogen compression, which can consume up to 10% of the energy content of the stored hydrogen.

Four main types of pressurized tanks are used for hydrogen storage, distinguished by their construction materials and maximum internal pressure [

9]. Types I and II are made primarily of metal and are suitable for stationary applications, where weight is not a critical factor, operating at pressures up to 300 bar. Types III and IV are made of fiber-reinforced composite materials, making them significantly lighter, more robust, and therefore ideal for use in fuel cell vehicles where hydrogen is stored at pressures of up to 700 bar. In order to withstand hydrogen embrittlement phenomena, high-grade steel, aluminum, and copper alloys must be used for the metal parts [

83].

5.2. Liquid Hydrogen

Liquid hydrogen storage is preferred in contexts where high energy density by volume is required, and the challenges and costs of cryogenic storage can be managed. It is therefore commonly used in large-scale facilities, with tank capacities which can reach several thousand cubic meters.

Hydrogen liquefaction involves cooling to −253 °C at atmospheric pressure (or higher under increased pressure), and storing in highly insulated tanks made of special materials, which minimize heat penetration [

83]. This leads to a significant increase in the hydrogen gravimetric and energy density (70.8 kg/m

3 and 8.5 MJ/L, respectively [

9]). Among the disadvantages of this solution is the high energy consumption for liquefaction (30–40% of hydrogen’s energy content), the boil-off losses due to gradual heat penetration, and the costly cryogenic infrastructures needed [

84]. Because of boil-off losses, liquid hydrogen is generally seen as less suitable for long-term storage, but it remains a promising option for hydrogen transportation thanks to its high density.

Liquid hydrogen storage is already adopted in space applications and some stationary industrial contexts, and, thanks to the gradual expansion of a green hydrogen economy, it is now also gaining more attention for long-distance transportation. In particular, the first liquefied hydrogen carriers have already started sailing the seas [

85], in the same way as liquefied natural gas is transported on maritime vessels.

5.3. Underground Storage

More and more large-scale projects are exploring the injection and geological storage of hydrogen in different underground environments, commonly referred to as underground hydrogen storage (UHS) [

86]. This solution promises large storage volumes, a small superficial footprint, the possibility of reusing depleted oil and gas fields, and a potential for cost cutting compared to conventional storage solutions [

87]. The most classical application is storage near hydrogen production facilities, where the choice of UHS solution is primarily dictated by the availability, in the proximity of the plant, of a suitable rock formation and by a number of other favorable factors (adequate depth and storage volumes, availability of auxiliary infrastructures, favorable regulatory framework, etc.). In perspective, UHS is expected to play a more crucial role in the successful development of transnational green hydrogen transportation networks (such as the South European Corridor), since it easily provides the necessary volumes required by intermediary and end stations located along the pipelines, providing important buffering functionality which guarantees continuity of supply. Suitable underground formations for UHS include the following cases.

Salt caverns. These are underground structures which can be artificially created in large salt deposits by solution mining techniques, which leave behind impermeable chambers suitable for hydrogen storage. This method is particularly suitable for hydrogen storage and, in the context of green hydrogen transnational transportation, it is currently being tested in France within the HyPSTER project [

88], in Germany by the H2Salt project [

89], as well as in other ongoing projects.

Porous reservoirs. These are geological structures where the available storage space is represented by the natural porosity of the rock; depleted natural gas or oil fields often offer the necessary rock porosity, in which hydrogen can be injected and stored similar to how the fossil fuel was originally trapped. This solution is being explored, for example, in Germany by the HyStorage project [

90] and in Austria by the USS 2030 project [

91], with the aim of gradually increasing storage hydrogen purity and of monitoring reservoir integrity and potential microbial activity. A feasibility study is also currently being carried out in Australia, as part of the H2RESTORE initiative, to assess the technical and economical viability of repurposing existing gas reservoirs for green hydrogen storage, which may be followed by the development of a demonstration facility and, eventually, by commercial operation [

92]. Alternatively, porous underground structures filled with saline water (aquifers) are also being explored for hydrogen storage, as in Belgium by the BE-HyStore project [

93].

Lined rock caverns. These refers to artificially constructed caverns in hard rock formations that are lined with specialized materials to ensure gas containment, as tested in Sweden by the already-mentioned HYBRIT project consortium [

56].

According to a recent survey considering 45 projects worldwide specifically addressing underground hydrogen storage, the majority of them (69%) aims at exploiting salt caverns, followed by porous reservoirs with a share of 27%, while lined rock caverns are only addressed by the remaining 4% of projects [

94]. This reflects the fact that salt deposits are abundant in some industrialized regions, and, thanks to their low permeability, have already been successfully employed in some relevant industrial contexts (early examples for the petrochemical industry date back to the 1970s in the UK and the 1980s in Texas, and these facilities are still operational [

95]). On the other hand, storage in porous reservoirs is still in its early stages and may require further technical validation. However, this is currently not considered a major obstacle to its further growth given the existing experience and know-how related to underground natural gas storage in similar environments [

94]. Finally, lined hard rock caverns are not expected to gain much popularity in the near future due to their higher costs and greater implementation complexity.

While salt caverns are the most technically mature option for underground hydrogen storage, their global availability is highly uneven. A recent geological analysis reports that about 174 major groups of salt deposits are known worldwide, and that only a small subset is actually usable for UHS due to geophysical factors and other constraints [

96]. As a consequence, salt caverns appear as a feasible storage option only in some parts of the United States, some parts of Europe, China, and Australia, and possibly India and Canada, while major parts of Africa, Latin America, and the Middle East as well as many countries in Europe may lack suitable sites. For reference, a global map of suitable and potentially suitable salt cavern locations is given in [

96], while ongoing and planned underground hydrogen storage projects worldwide are mapped in [

97]. The uneven distribution of salt caverns worldwide may result in a spatial mismatch between storage capacity availability and key nodes of the future green hydrogen value chain (production hubs, major industrial demand centers, ports, and terrestrial transport corridors), rendering them unfeasible to intercept a large share of future hydrogen storage needs.

5.4. Solid Phase Storage

Solid hydrogen storage refers to the use of specific solid materials that can chemically absorb hydrogen within a solid-state matrix and subsequently release it when needed. The two phenomena are driven by high pressure and heat removal during absorption (exothermic process) and low pressure and heat supply during desorption (endothermic process). Physical adsorption on carbon-based materials is also a potential option, though it is currently less explored because of its lower storage capacity and often impractical operating conditions [

98].

Solid storage is relatively safe and characterized by high volumetric density. Among the disadvantages are the large weight of the solid, the possible material degradation over time, the relatively slow absorption and desorption rates, and the need of effective heat flux management due to the significant thermal inertia of the solid phase. Such thermal effects can, however, be exploited for heating and cooling purposes in buildings [

99].

A wide variety of solid materials can absorb hydrogen; however, for practical applications, only specific metal hydrides (MHs) are commonly used. Among these, magnesium hydride (MgH

2) offers a high hydrogen storage capacity but requires elevated temperatures (300–400 °C) for desorption, while LaNi

5-based alloys, though lower in capacity, can operate efficiently at moderate temperatures (slightly above ambient temperature for absorption, 50–150 °C for desorption). Titanium-based alloys present a cost-effective alternative to lanthanum-based systems, although with somewhat lower storage performance. A comprehensive description of these materials in terms of performance (operating temperature range, volumetric density, storage capacity), maturity, and application potential is given in [

100]. In [

101], the mechanisms underlying hydrogen absorption and desorption in metal hydrides are discussed, with particular attention to activation energy, transition metal and oxide substitutions, and the role of materials such as magnesium-based hydrides, nanostructures, rare earth metals, and carbon nanotubes in enhancing storage performance.

A large number of experimental studies and prototypes have been proposed to demonstrate hydrogen storage in MHs [

9], however, most of these solutions lack the technological maturity needed for commercial viability. This is particularly true for large-scale industrial storage, where their adoption is limited by cost, thermal management challenges, and available capacity, making them less attractive than alternatives like liquid hydrogen and ammonia. In the transportation sector, the challenges posed by the significant weight, the long charging times and the excessive temperature range for the higher-capacity materials make solid storage unrealistic for road traffic and aviation, but some potential is kept for ship and rail transportation, where the gravimetric energy density and charging times represent less strict requirements [

100]. On the contrary, MH storage deployment seems to be more advanced in small-scale stationary applications, especially for their safety aspects, mild operating conditions and compact size. In fact, it is a frequent choice in compact, stand-alone green hydrogen production and storage systems available on the market and already described in

Section 3.1.1.

5.5. Chemical Storage