The Nexus Between Green Bonds, Green Credits, and the Energy Transition Toward Renewable Energy Sources: State of the Art

Abstract

1. Introduction

- What research problems dominate in the analyses?

- Where are the research works published?

- What regions are the leaders in research?

- What enterprises are studied?

2. Literature Review

3. Material and Method

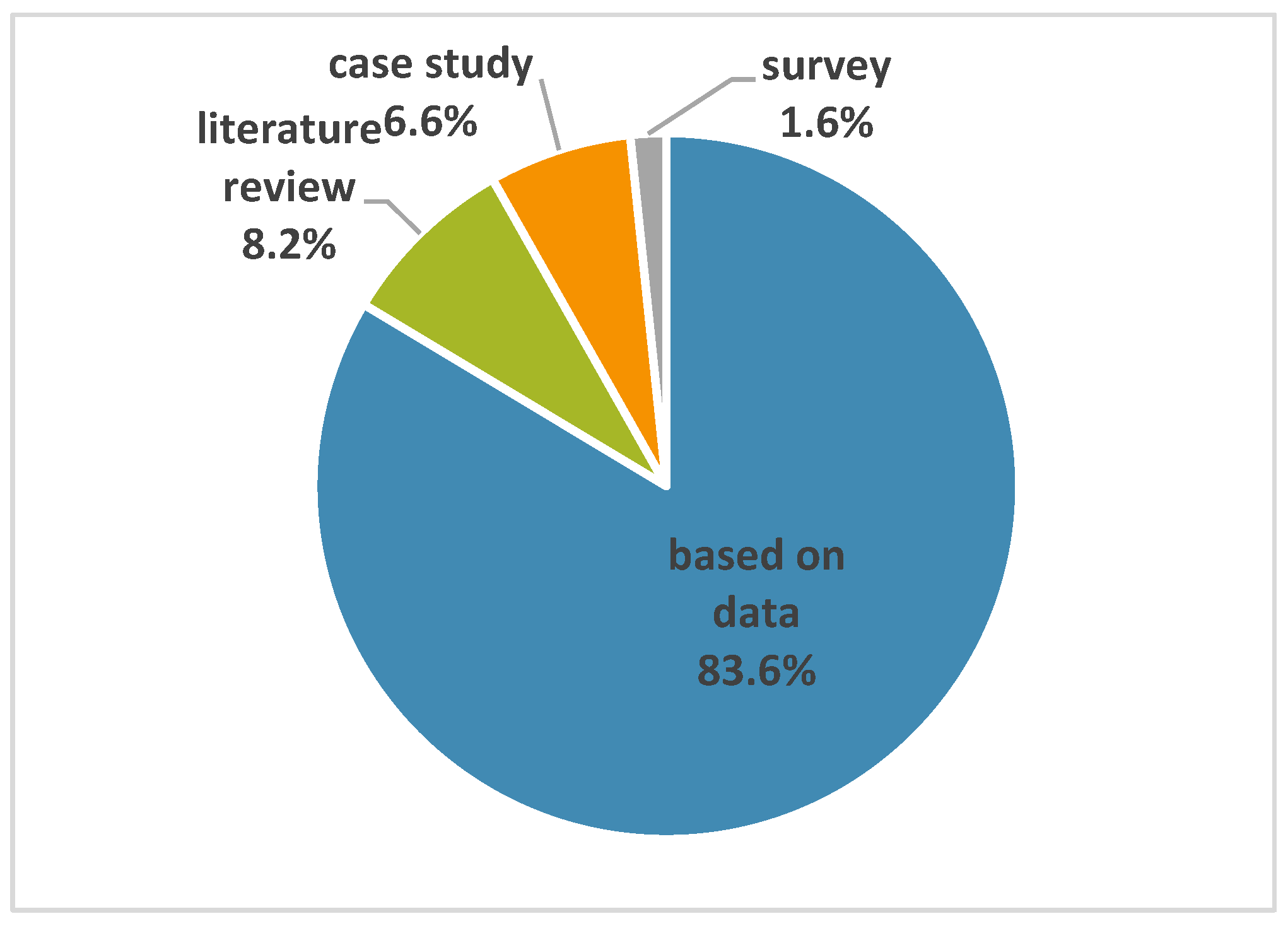

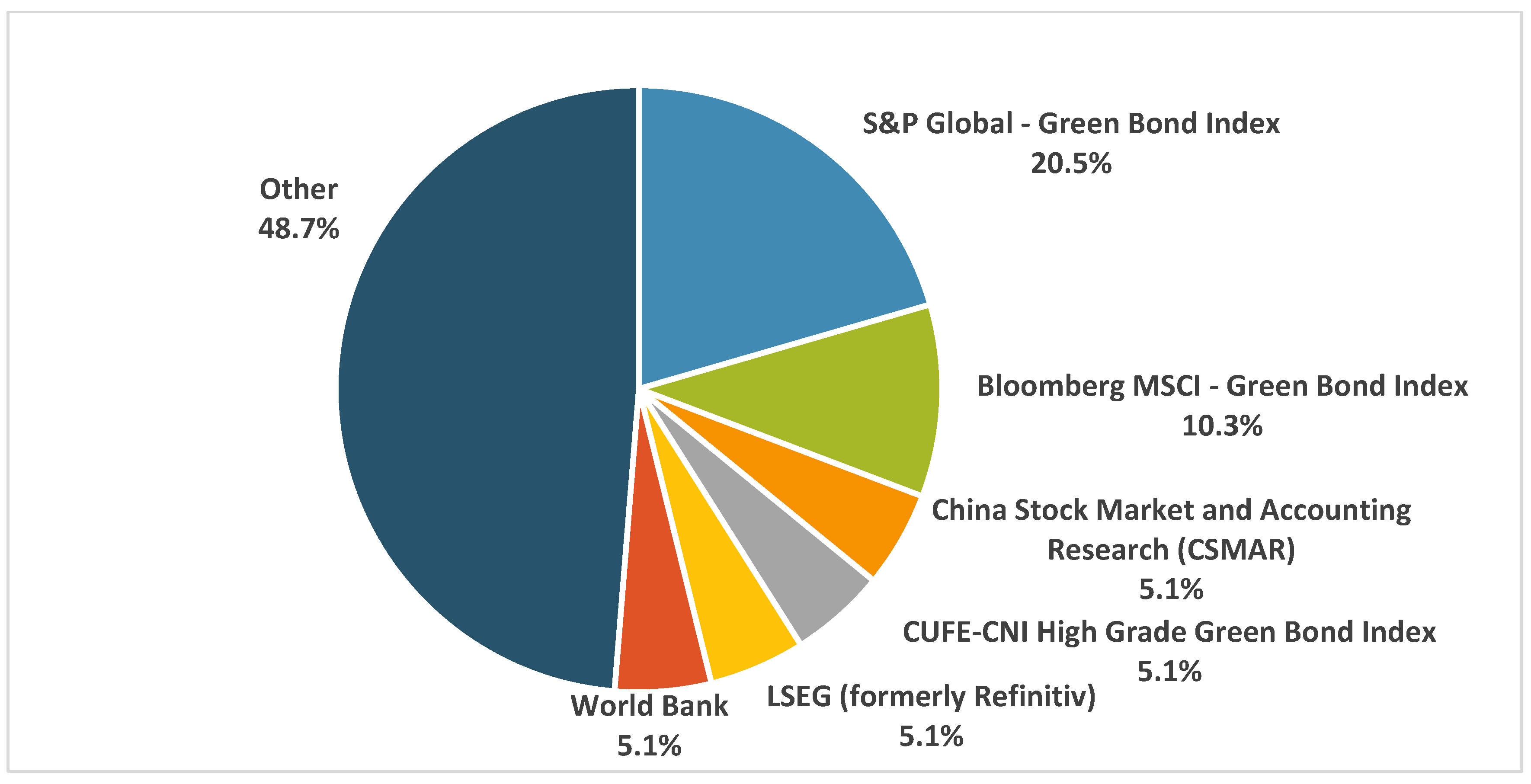

- What research issues dominate the analyzed literature?

- Which journals most frequently publish papers on the discussed topics?

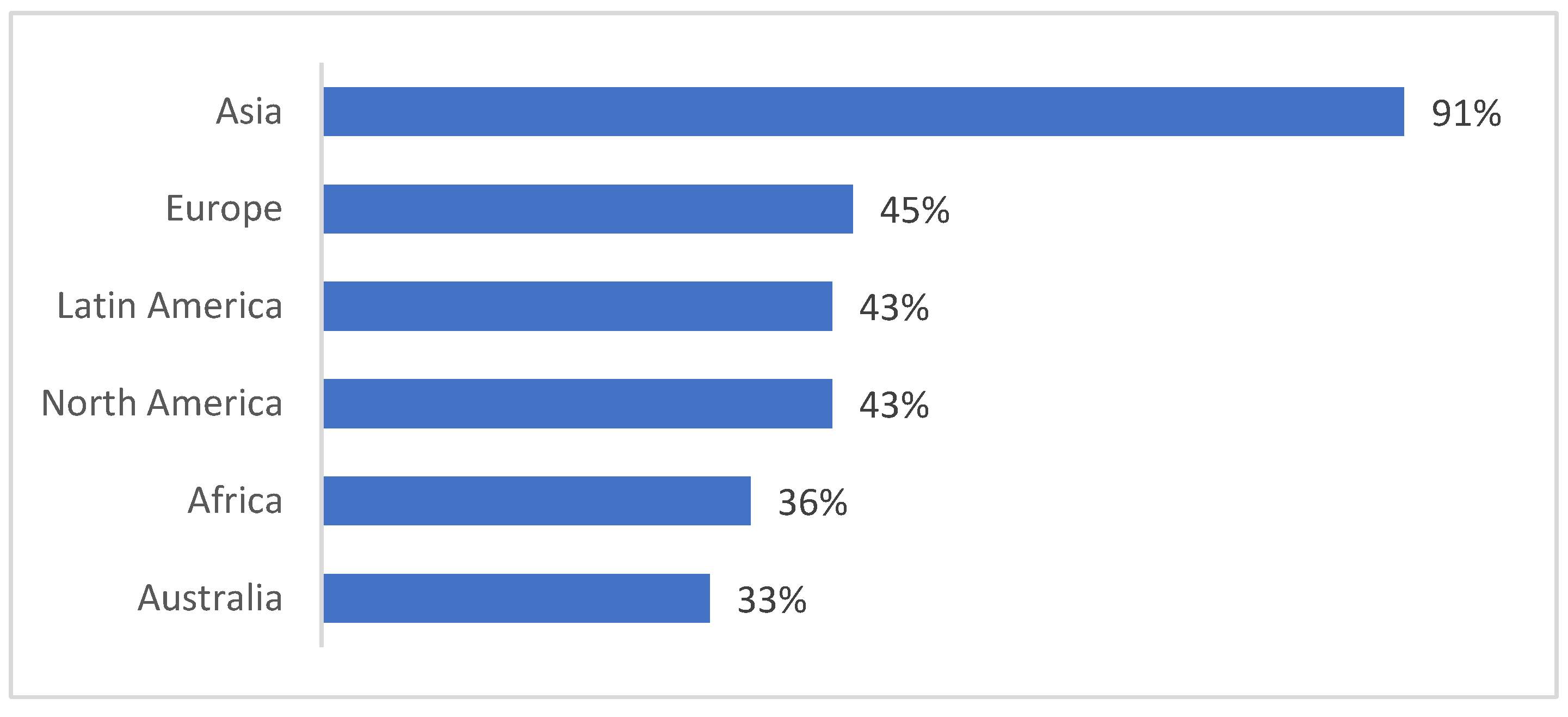

- Which geographic regions are leading the way in green finance research?

- What types of enterprises are most frequently analyzed in publications?

- (1)

- (“green bond*” OR “green credit*”) AND “energy transition”,

- (2)

- (“green bond*” OR “green credit*”) AND “energy transformation”,

- (3)

- (“green bond*” OR “green credit*”) AND “renewable energy sources”.

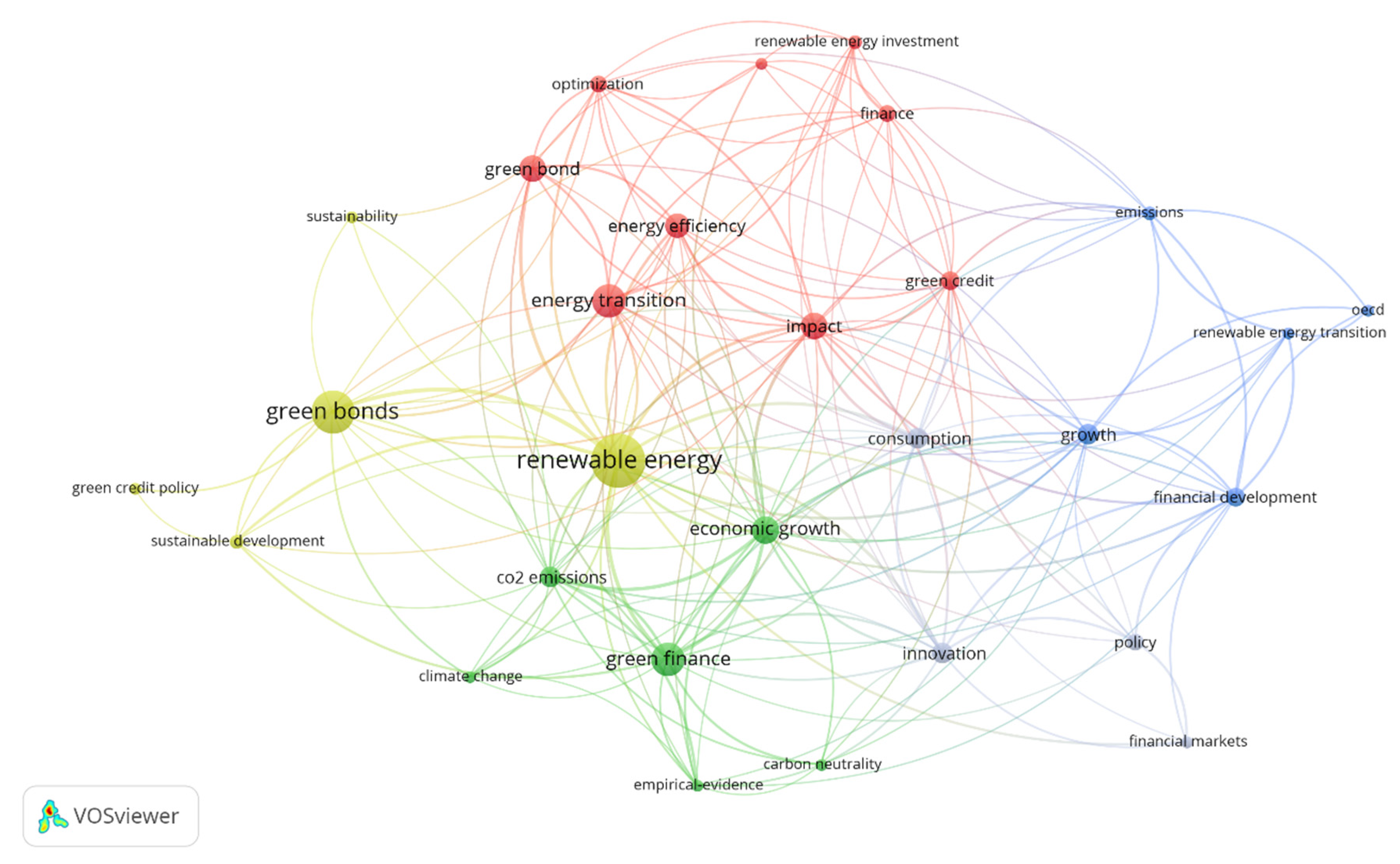

- Cluster 1.1 (red color): energy efficiency, energy transition, finance, green credit, impact, optimization, renewable energy investment, supply chain, sustainability;

- Cluster 1.2 (green color): carbon neutrality, climate change, CO2 emissions, economic growth, empirical evidence, green finance;

- Cluster 1.3 (lavender color): consumption, financial markets, innovation, policy, renewable energy;

- Cluster 1.4 (blue color): emissions, financial development, growth, OECD, renewable energy transition, sustainability;

- Cluster 1.5 (yellow color): green bonds, green credit policy, sustainable development.

- Cluster 2.1 (red color): economic growth, energy, environment, financing, green finance, sustainable development;

- Cluster 2.2 (green color): climate change, energy transition, innovation, investor, policymaker, relationship;

- Cluster 2.3 (blue color): carbon emission, China, energy efficiency, evidence, green financing.

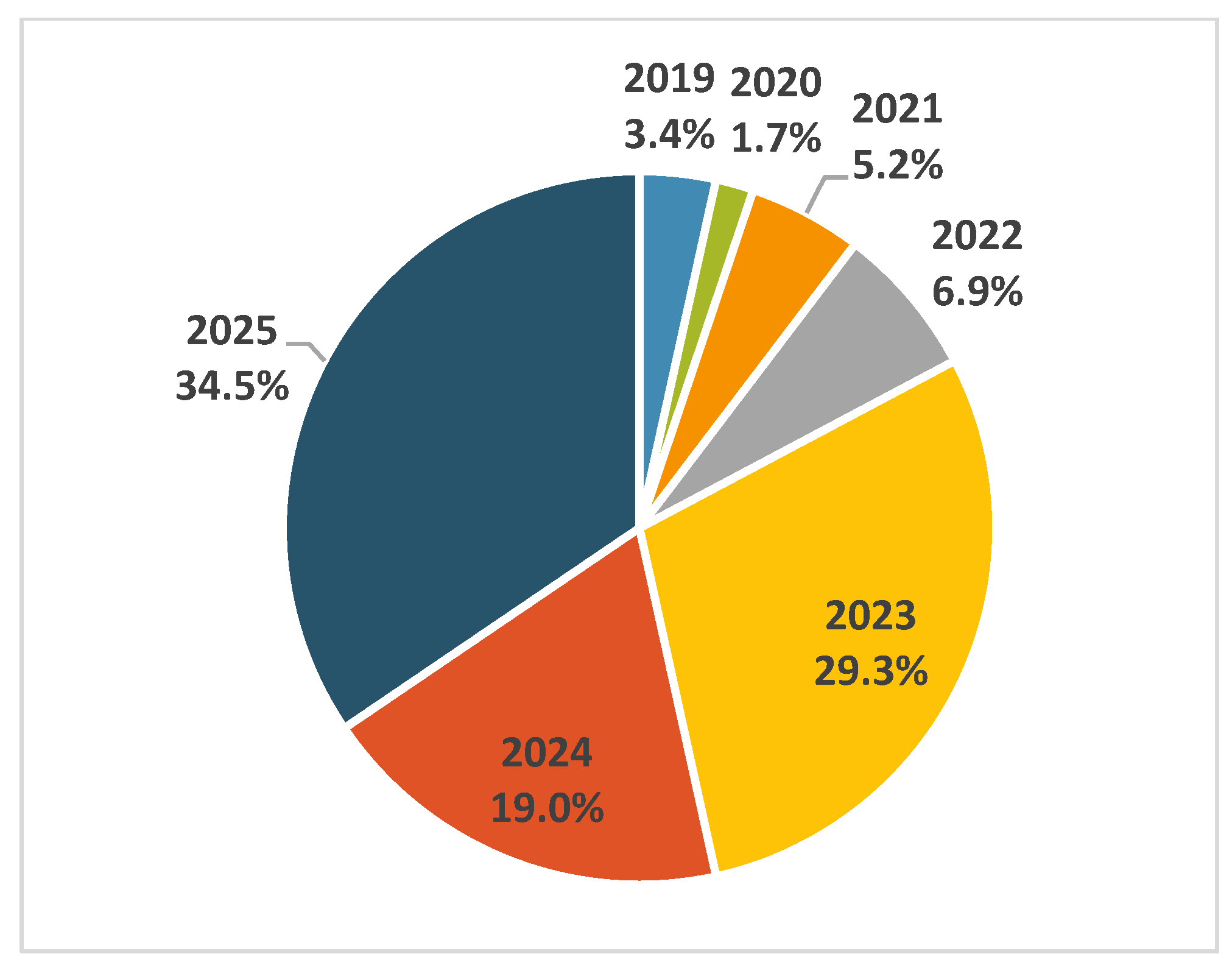

- X1—release year 2024 or later;

- X2—small enterprises;

- X3—medium enterprises;

- X4—large enterprise;

- X5—investment funds and insurance;

- X6—manufacturing/production;

- X7—service;

- X8—brown company (heavy polluting company);

- X9—municipal green bonds and government bonds;

- X10—city/cities;

- X11—bank;

- X12—authors’ continent of origin: Europe;

- X13—authors’ continent of origin: North America;

- X14—authors’ continent of origin: Latin America;

- X15—authors’ continent of origin: Asia;

- X16—authors’ continent of origin: Australia;

- X17—authors’ continent of origin: Africa;

- X18—developing countries;

- X19—developed countries;

- X20—GBCO (green bonds have a stronger impact on reducing CO2);

- X21—GBIET (green credit intensification of the energy transition);

- X22—GBRC (green bonds reduce cost);

- X23—GBRES (green bonds support technological innovation in renewable energy);

- X24—GBRR (green bonds reduce risk);

- X25—GBS (stakeholder interest stimulates the growth of the green bond market);

- X26—GCCO (green credits have a stronger impact on reducing CO2);

- X27—GCF (green bonds finance the energy transition);

- X28—GCIET (green bonds intensification of the energy transition.);

- X29—GCRES (green credit support technological innovation in renewable energy);

- X30—GCRR (green credit reduce risk).

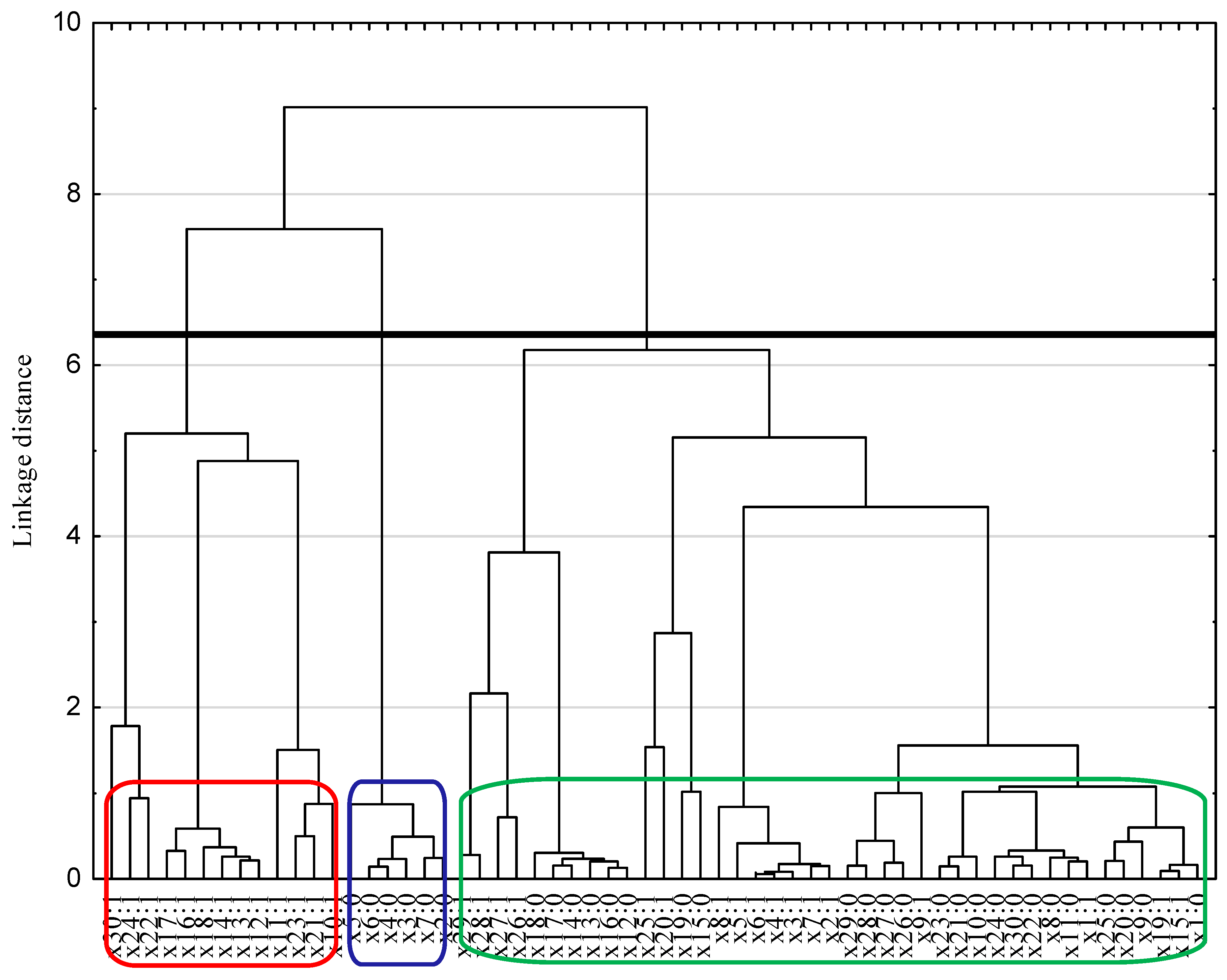

4. Results

- Group I (red color) includes articles on various continents, except for Asia. The research results indicate that green credits contribute to the intensification of energy transition and also reduce risk. On the other hand, green bonds support technological innovations in the field of renewable energy, and reduce costs and risk. It is also important that the interest of stakeholders (e.g., banks, city leaders) stimulates growth of the green bond market.

- Group II (blue color) contains articles that discuss two types of relationships. The first concerns the impact of green loans on CO2 reduction and technological innovations in renewable energy. The second illustrates how green bonds support energy transition financing.

- Group III (green color) includes papers covering companies of various sizes (small, medium, large) that were published in 2024 and later. These include research covering stakeholders, manufacturing/production and service sectors in developed countries in Asia. The articles discuss issues related to brown companies and the impact of green bonds on CO2 reduction.

5. Discussion

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Abbreviations

| OECD | Organisation for Economic Co-operation and Development |

| RES | Renewable Energy Sources |

| MCA | Multiple Correspondence Analysis |

| SDGs | Sustainable Development Goals |

| IMF | International Monetary Fund |

| WOS | Web of Science |

| UNDP | United Nations Development Programme |

References

- Maino, A.G. Financing the Energy Transition: The Role, Opportunities and Challenges of Green Bonds; Oxford Institute for Energy Studies: Oxford, UK, 2022. [Google Scholar]

- Zioło, M.; Bąk, I.; Spoz, A. Incorporating ESG Risk in Companies’ Business Models: State of Research and Energy Sector Case Studies. Energies 2023, 16, 1809. [Google Scholar] [CrossRef]

- Csalódi, R.; Czvetkó, T.; Sebestyén, V.; Abonyi, J. Sectoral Analysis of Energy Transition Paths and Greenhouse Gas Emissions. Energies 2022, 15, 7920. [Google Scholar] [CrossRef]

- Wang, S.; Sun, L.; Iqbal, S. Green Financing Role on Renewable Energy Dependence and Energy Transition in E7 Economies. Renew. Energy 2022, 200, 1561–1572. [Google Scholar] [CrossRef]

- Xu, J.; Liu, Q.; Wider, W.; Zhang, S.; Fauzi, M.A.; Jiang, L.; Udang, L.N.; An, Z. Research Landscape of Energy Transition and Green Finance: A Bibliometric Analysis. Heliyon 2024, 10, e24783. [Google Scholar] [CrossRef] [PubMed]

- Minh Sang, N. Mapping the Evolution of Green Finance through Bibliometric Analysis. Environ. Econ. 2024, 15, 1–15. [Google Scholar] [CrossRef]

- Krause, J.; Myroshnychenko, I.; Tiutiunyk, S.; Latysh, D. Financial Instruments of the Green Energy Transition: Research Landscape Analysis. Financ. Mark. Inst. Risks 2024, 8, 198–212. [Google Scholar] [CrossRef]

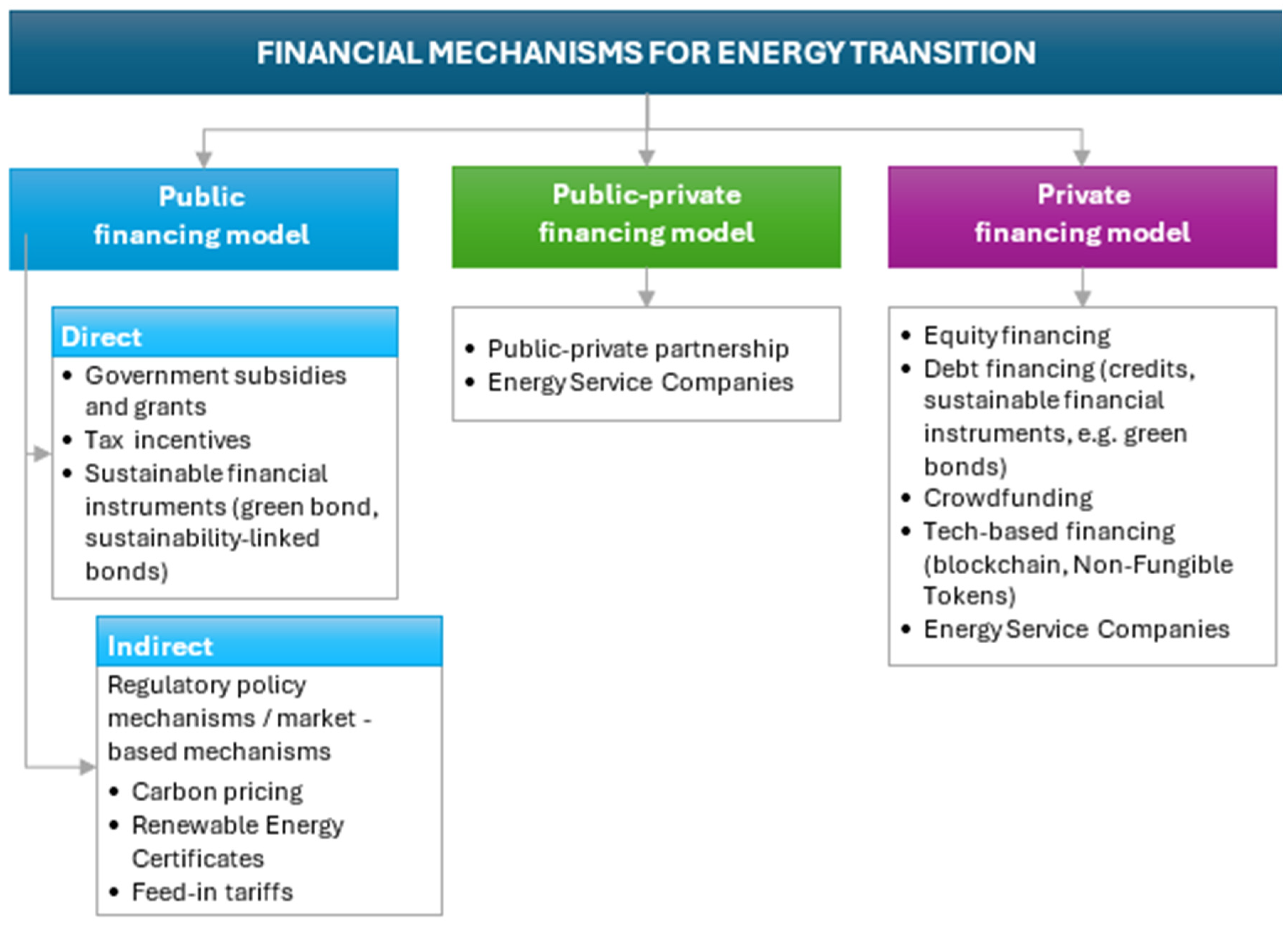

- Michalski, D.; Hawranek, P. Financial Instruments of Green Transition. Internetowy Kwart. Antymonop. I Regul. 2023, 12, 8–28. [Google Scholar] [CrossRef]

- Sartzetakis, E.S. Green Bonds as an Instrument to Finance Low Carbon Transition. Econ. Change Restruct. 2021, 54, 755–779. [Google Scholar] [CrossRef]

- Zhang, K.; Wang, Y.; Huang, Z. Do the Green Credit Guidelines Affect Renewable Energy Investment? Empirical Research from China. Sustainability 2021, 13, 9331. [Google Scholar] [CrossRef]

- Wen, H.; Lee, C.C.; Zhou, F. Green Credit Policy, Credit Allocation Efficiency and Upgrade of Energy-Intensive Enterprises. Energy Econ. 2021, 94, 105099. [Google Scholar] [CrossRef]

- Benlemlih, M.; Jaballah, J.; Kermiche, L. Does Financing Strategy Accelerate Corporate Energy Transition? Evidence from Green Bonds. Bus. Strategy Environ. 2023, 32, 878–889. [Google Scholar] [CrossRef]

- Zhang, W.; Xi, B. The Effect of Carbon Emission Trading on Enterprises’ Sustainable Development Performance: A Quasi-Natural Experiment Based on Carbon Emission Trading Pilot in China. Energy Policy 2024, 185, 113960. [Google Scholar] [CrossRef]

- UNDP. What Is Renewable Energy? Available online: https://www.un.org/en/climatechange/what-is-renewable-energy (accessed on 26 May 2024).

- Miah, M.S.U.; Sulaiman, J.; Islam, M.I.; Masuduzzaman, M.; Giri, N.C.; Sarker, S.K.; Muyeen, S.M. Predicting Short-Term Energy Demand in the Smart Grid: A Deep Learning Approach for Integrating Renewable Energy Sources in Line with Sdgs 7, 9, and 13. 2023. Available online: https://ssrn.com/abstract=4534111 (accessed on 14 July 2025).

- Müller, F.; Neumann, M.; Elsner, C.; Claar, S. Assessing African Energy Transitions: Renewable Energy Policies, Energy Justice, and SDG 7. Politics Gov. 2021, 9, 119–130. [Google Scholar] [CrossRef]

- Sheraz, M.; Qin, Q.; Mumtaz, M.Z. Energy Transition in OECD Countries: Catalyzing Governance Quality for SDG 7 Attainment. Energy Policy 2024, 194, 114315. [Google Scholar] [CrossRef]

- Chen, J.; Huang, S.; Kamran, H.W. Empowering Sustainability Practices through Energy Transition for Sustainable Development Goal 7: The Role of Energy Patents and Natural Resources among European Union Economies through Advanced Panel. Energy Policy 2023, 176, 113499. [Google Scholar] [CrossRef]

- Cappellaro, F.; D’Agosta, G.; De Sabbata, P.; Barroco, F.; Carani, C.; Borghetti, A.; Lambertini, L.; Nucci, C.A. Implementing Energy Transition and SDGs Targets throughout Energy Community Schemes. J. Urban Ecol. 2022, 8, juac023. [Google Scholar] [CrossRef]

- Kartal, M.T.; Mukhtarov, S.; Depren, Ö.; Ayhan, F.; Ulussever, T. How Can SDG-13 Be Achieved by Energy, Environment, and Economy-Related Policies? Evidence From Five Leading Emerging Countries. Sustain. Dev. 2025, 33, 5110–5133. [Google Scholar] [CrossRef]

- He, X.; Khan, S.; Ozturk, I.; Murshed, M. The Role of Renewable Energy Investment in Tackling Climate Change Concerns: Environmental Policies for Achieving SDG-13. Sustain. Dev. 2023, 31, 1888–1901. [Google Scholar] [CrossRef]

- Mirziyoyeva, Z.; Salahodjaev, R. Renewable Energy and CO2 Emissions Intensity in the Top Carbon Intense Countries. Renew. Energy 2022, 192, 507–512. [Google Scholar] [CrossRef]

- Tian, J.; Culley, S.A.; Maier, H.R.; Zecchin, A.C. Is Renewable Energy Sustainable? Potential Relationships between Renewable Energy Production and the Sustainable Development Goals. npj Clim. Action 2024, 3, 35. [Google Scholar] [CrossRef]

- Li, M.; Geng, Y.; Zhou, S.; Sarkis, J. Clean Energy Transitions and Health. Heliyon 2023, 9, e21250. [Google Scholar] [CrossRef]

- Vatamanu, A.-F.; Onofrei, M.; Cigu, E.; Oprea, F. Renewable Energy Consumption, Institutional Quality and Life Expectancy in EU Countries: A Cointegration Analysis. Energy Sustain. Soc. 2025, 15, 2. [Google Scholar] [CrossRef]

- Cevik, S. Climate Change and Energy Security: The Dilemma or Opportunity of the Century? International Monetary Fund: Washington, DC, USA, 2022. [Google Scholar]

- Aslam, N.; Yang, W.; Saeed, R.; Ullah, F. Energy Transition as a Solution for Energy Security Risk: Empirical Evidence from BRI Countries. Energy 2024, 290, 130090. [Google Scholar] [CrossRef]

- Rabbi, M.F.; Popp, J.; Máté, D.; Kovács, S. Energy Security and Energy Transition to Achieve Carbon Neutrality. Energies 2022, 15, 8126. [Google Scholar] [CrossRef]

- Khan, K.; Su, C. wei Does Technology Innovation Complement the Renewable Energy Transition? Environ. Sci. Pollut. Res. 2022, 30, 30144–30154. [Google Scholar] [CrossRef]

- Yu, M.; Farooq, U.; Tabash, M.I.; Aljughaiman, A.A.; Almulhim, A.A. Technological Innovation and Trade Orientation as Drivers of Renewable Energy Consumption: Panel Evidence from G7 Economies. Glob. Chall. 2025, 9, 2400345. [Google Scholar] [CrossRef]

- Bamisile, O.; Xing, Y.; Acen, C.; Cai, D.; Zhang, G.; Adun, H.; Staffell, I. What Is the Cost and Potential of Low Carbon Electricity Transition in the MENA Region? Energy Strategy Rev. 2025, 59, 101762. [Google Scholar] [CrossRef]

- Osman, A.I.; Chen, L.; Yang, M.; Msigwa, G.; Farghali, M.; Fawzy, S.; Rooney, D.W.; Yap, P.-S. Cost, Environmental Impact, and Resilience of Renewable Energy under a Changing Climate: A Review. Environ. Chem. Lett. 2023, 21, 741–764. [Google Scholar] [CrossRef]

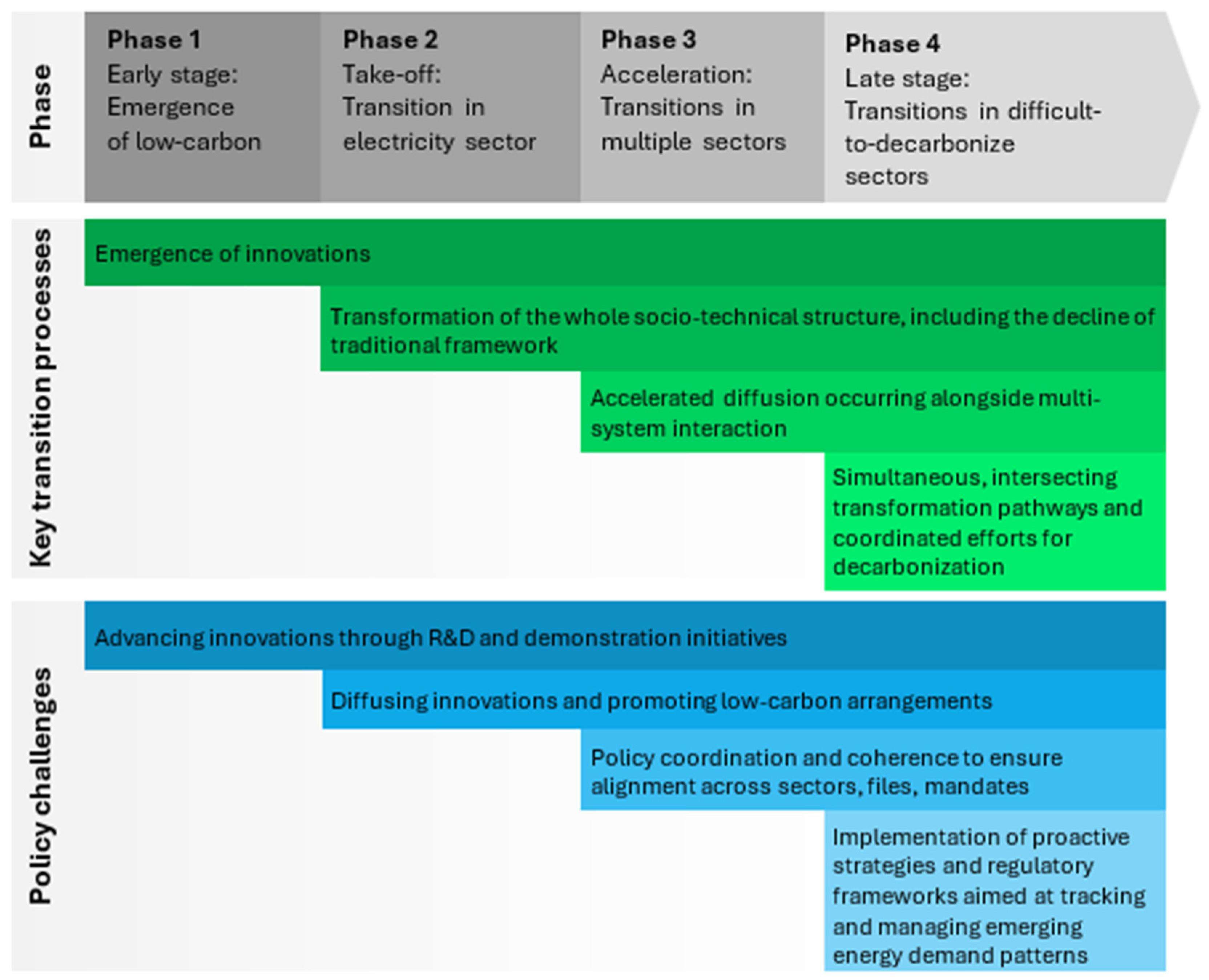

- Markard, J.; Rosenbloom, D. Phases of the Net-Zero Energy Transition and Strategies to Achieve It. arXiv 2023, arXiv:2311.09472. [Google Scholar] [CrossRef]

- Sovacool, B.K.; Geels, F.W.; Andersen, A.D.; Grubb, M.; Jordan, A.J.; Kern, F.; Kivimaa, P.; Lockwood, M.; Markard, J.; Meadowcroft, J.; et al. The Acceleration of Low-Carbon Transitions: Insights, Concepts, Challenges, and New Directions for Research. Energy Res. Soc. Sci. 2025, 121, 103948. [Google Scholar] [CrossRef]

- Alka, T.A.; Raman, R.; Suresh, M. Critical Success Factors for Successful Technology Innovation Development in Sustainable Energy Enterprises. Sci. Rep. 2025, 15, 14138. [Google Scholar] [CrossRef]

- Apata, O. Regulatory Innovation as a Catalyst for Energy Market Transformation. In Proceedings of the 2025 33rd Southern African Universities Power Engineering Conference (SAUPEC), Pretoria, South Africa, 29–30 January 2025; IEEE: Piscataway, NJ, USA, 2025; pp. 1–6. [Google Scholar]

- Alamooti, M.; Alamooti, M. Accelerating the Energy Transition: Policy and Regulatory Frameworks for Sustainable Energy Systems. In Proceedings of the The 5th International Conference on Biofuels and Bioenergy, Tokyo, Japan, 21–22 October 2024. [Google Scholar]

- Kamali Saraji, M.; Streimikiene, D. Challenges to the Low Carbon Energy Transition: A Systematic Literature Review and Research Agenda. Energy Strategy Rev. 2023, 49, 101163. [Google Scholar] [CrossRef]

- Energy Transition Investment Trends. Available online: https://about.bnef.com/insights/finance/energy-transition-investment-trends/ (accessed on 24 July 2025).

- Calcaterra, M.; Aleluia Reis, L.; Fragkos, P.; Briera, T.; de Boer, H.S.; Egli, F.; Emmerling, J.; Iyer, G.; Mittal, S.; Polzin, F.H.J.; et al. Reducing the Cost of Capital to Finance the Energy Transition in Developing Countries. Nat. Energy 2024, 9, 1241–1251. [Google Scholar] [CrossRef]

- Briera, T.; Lefèvre, J. Reducing the Cost of Capital through International Climate Finance to Accelerate the Renewable Energy Transition in Developing Countries. Energy Policy 2024, 188, 114104. [Google Scholar] [CrossRef]

- Polzin, F.; Sanders, M.; Steffen, B.; Egli, F.; Schmidt, T.S.; Karkatsoulis, P.; Fragkos, P.; Paroussos, L. The Effect of Differentiating Costs of Capital by Country and Technology on the European Energy Transition. Clim. Change 2021, 167, 26. [Google Scholar] [CrossRef]

- Schyska, B.U.; Kies, A. How Regional Differences in Cost of Capital Influence the Optimal Design of Power Systems. Appl. Energy 2020, 262, 114523. [Google Scholar] [CrossRef]

- Naran, B.; Buchner, B.; Price, M.; Stout, S.; Taylor, M.; Zabeida, D. Global Landscape of Climate Finance 2024. Available online: https://www.climatepolicyinitiative.org/publication/global-landscape-of-climate-finance-2024 (accessed on 24 July 2025).

- Geddes, A.; Schmidt, T.S.; Steffen, B. The Multiple Roles of State Investment Banks in Low-Carbon Energy Finance: An Analysis of Australia, the UK and Germany. Energy Policy 2018, 115, 158–170. [Google Scholar] [CrossRef]

- Wang, N.; Mogi, G. From Regulation to Deregulation: An Empirical Study of Japanese Electric Utility R&D Investment Behavior under Transition. Energy Procedia 2017, 105, 3193–3200. [Google Scholar] [CrossRef]

- Du, J.; Shen, Z.; Song, M.; Vardanyan, M. The Role of Green Financing in Facilitating Renewable Energy Transition in China: Perspectives from Energy Governance, Environmental Regulation, and Market Reforms. Energy Econ. 2023, 120, 106595. [Google Scholar] [CrossRef]

- Xu, W.; Yuan, Q.; Chen, N.; Ye, J. Green Finance and Energy Structure Transition: Evidence from China. Sustainability 2025, 17, 4838. [Google Scholar] [CrossRef]

- Aizawa, M. Green Finance and Climate Finance. Available online: https://www.boell.de/en/2016/11/30/green-finance-and-climate-finance (accessed on 29 June 2025).

- OECD. OECD Review on Aligning Finance with Climate Goals; OECD Publishing: Paris, France, 2024; ISBN 9789264408241. [Google Scholar]

- Sun, Y.; Bao, Q.; Taghizadeh-Hesary, F. Green Finance, Renewable Energy Development, and Climate Change: Evidence from Regions of China. Humanit. Soc. Sci. Commun. 2023, 10, 107. [Google Scholar] [CrossRef]

- Zhang, K.Q.; Chen, H.H.; Tang, L.Z.; Qiao, S. Green Finance, Innovation and the Energy-Environment-Climate Nexus. Front. Environ. Sci. 2022, 10, 879681. [Google Scholar] [CrossRef]

- Wan, Q.; Qian, J.; Baghirli, A.; Aghayev, A. Green Finance and Carbon Reduction: Implications for Green Recovery. Econ. Anal. Policy 2022, 76, 901–913. [Google Scholar] [CrossRef]

- Gilchrist, D.; Yu, J.; Zhong, R. The Limits of Green Finance: A Survey of Literature in the Context of Green Bonds and Green Loans. Sustainability 2021, 13, 478. [Google Scholar] [CrossRef]

- Taghizadeh-Hesary, F.; Yoshino, N.; Phoumin, H. Analyzing the Characteristics of Green Bond Markets to Facilitate Green Finance in the Post-COVID-19 World. Sustainability 2021, 13, 5719. [Google Scholar] [CrossRef]

- Gabr, D.H.; Elbannan, M.A. Green Finance Insights: Evolution of the Green Bonds Market. Manag. Sustain. Arab Rev. 2024, 3, 274–297. [Google Scholar] [CrossRef]

- Bobojonova, M. The Role and Promising Directions of Green Bonds in Financing the Green Economy in the Global Financial Market. Int. J. Artif. Intell. 2025, 1, 1067–1071. [Google Scholar]

- Ahmed, R.; Yusuf, F.; Ishaque, M. Green Bonds as a Bridge to the UN Sustainable Development Goals on Environment: A Climate Change Empirical Investigation. Int. J. Financ. Econ. 2024, 29, 2428–2451. [Google Scholar] [CrossRef]

- Alamgir, M.; Cheng, M.-C. Do Green Bonds Play a Role in Achieving Sustainability? Sustainability 2023, 15, 10177. [Google Scholar] [CrossRef]

- Shang, Y.; Zhu, L.; Qian, F.; Xie, Y. Role of Green Finance in Renewable Energy Development in the Tourism Sector. Renew. Energy 2023, 206, 890–896. [Google Scholar] [CrossRef]

- Alsmadi, A.A.; Al-Okaily, M.; Alrawashdeh, N.; Al-Gasaymeh, A.; Moh’d Al-hazimeh, A.; Zakari, A. A Bibliometric Analysis of Green Bonds and Sustainable Green Energy: Evidence from the Last Fifteen Years (2007–2022). Sustainability 2023, 15, 5778. [Google Scholar] [CrossRef]

- Ye, X.; Rasoulinezhad, E. Assessment of Impacts of Green Bonds on Renewable Energy Utilization Efficiency. Renew. Energy 2023, 202, 626–633. [Google Scholar] [CrossRef]

- Wang, Y.; Taghizadeh-Hesary, F. Green Bonds Markets and Renewable Energy Development: Policy Integration for Achieving Carbon Neutrality. Energy Econ. 2023, 123, 106725. [Google Scholar] [CrossRef]

- Ojukwu, P.; Cadet, E.; Osundare, O.; Fakeyede, O.; Ige, A.; Uzoka, A. Advancing Green Bonds through FinTech Innovations: A Conceptual Insight into Opportunities and Challenges. Int. J. Eng. Res. Dev. 2024, 20, 565–576. [Google Scholar]

- Zhang, J.; Yang, G.; Ding, X.; Qin, J. Can Green Bonds Empower Green Technology Innovation of Enterprises? Environ. Sci. Pollut. Res. 2022, 31, 10032–10044. [Google Scholar] [CrossRef]

- Ren, P.; Cheng, Z.; Dai, Q. Can Green Bond Issuance Promote Enterprise Green Technological Innovation? N. Am. J. Econ. Financ. 2024, 69, 102021. [Google Scholar] [CrossRef]

- Wang, X.; Liu, Q. Information Disclosure and ESG Rating Disagreement: Evidence from Green Bond Issuance in China. Pac.-Basin Financ. J. 2024, 85, 102350. [Google Scholar] [CrossRef]

- Liang, Z.; Yang, X. The Impact of Green Finance on the Peer Effect of Corporate ESG Information Disclosure. Financ. Res. Lett. 2024, 62, 105080. [Google Scholar] [CrossRef]

- Makpotche, M.; Bouslah, K.; M’Zali, B. Long-Run Performance Following Corporate Green Bond Issuance. Manag. Financ. 2024, 50, 140–178. [Google Scholar] [CrossRef]

- Deng, Y.; Zhang, Z. The Spillover Effects of Green Bond Issuance in Peer Firms’ Financial Performance. Res. Int. Bus. Financ. 2025, 77, 102895. [Google Scholar] [CrossRef]

- Babic, M. Green Finance in the Global Energy Transition: Actors, Instruments, and Politics. Energy Res. Soc. Sci. 2024, 111, 103482. [Google Scholar] [CrossRef]

- Afridi, F.E.A.; Jan, S.; Ayaz, B.; Irfan, M. Green Finance Incentives: An Empirical Study of the Pakistan Banking Sector. Rev. Amazon. Investig. 2021, 10, 169–176. [Google Scholar] [CrossRef]

- Nguyen Van, H.; Nguyen Quoc, H.; Le Quoc, D. The Role of Green Credit in Promoting Sustainable Development in Vietnam: Evidence from Quantile-on-Quantile Regression. Res. World Agric. Econ. 2024, 6, 88–99. [Google Scholar] [CrossRef]

- Zhang, Y.; Wan, D.; Zhang, L. Green Credit, Supply Chain Transparency and Corporate ESG Performance: Evidence from China. Financ. Res. Lett. 2024, 59, 104769. [Google Scholar] [CrossRef]

- Yan, M.; Gong, X. Impact of Green Credit on Green Finance and Corporate Emissions Reduction. Financ. Res. Lett. 2024, 60, 104900. [Google Scholar] [CrossRef]

- Zhao, X.; Zeng, B.; Zhao, X.; Zeng, S.; Jiang, S. Impact of Green Finance on Green Energy Efficiency: A Pathway to Sustainable Development in China. J. Clean. Prod. 2024, 450, 141943. [Google Scholar] [CrossRef]

- Qiu, W.; Bian, Y.; Irfan, M.; Li, Y. Optimization Path of Green Credit to Energy Consumption Structure: A Symbiotic Development Perspective of Resource-Based and Non-Resource-Based Industries. Energy Environ. 2024, 35, 3–22. [Google Scholar] [CrossRef]

- Wang, Y. Can the Green Credit Policy Reduce Carbon Emission Intensity of “High-Polluting and High-Energy-Consuming” Enterprises? Insight from a Quasi-Natural Experiment in China. Glob. Financ. J. 2023, 58, 100885. [Google Scholar] [CrossRef]

- Guo, L.; Tan, W. Analyzing the Synergistic Influence of Green Credit and Green Technology Innovation in Driving the Low-Carbon Transition of the Energy Consumption Structure. Sustain. Energy Technol. Assess. 2024, 63, 103633. [Google Scholar] [CrossRef]

- Lv, C.; Fan, J.; Lee, C.-C. Can Green Credit Policies Improve Corporate Green Production Efficiency? J. Clean. Prod. 2023, 397, 136573. [Google Scholar] [CrossRef]

- Li, J.; Li, M.; Wang, T.; Feng, X. Analysis of the Low-Carbon Transition Effect and Development Pattern of Green Credit for Prefecture-Level Cities in the Yellow River Basin. Int. J. Environ. Res. Public Health 2023, 20, 4658. [Google Scholar] [CrossRef]

- Ma, D.; He, Y.; Zeng, L. Can Green Finance Improve the ESG Performance? Evidence from Green Credit Policy in China. Energy Econ. 2024, 137, 107772. [Google Scholar] [CrossRef]

- Peng, C.; Zhang, S.; Rong, X.; Chen, D. Is China’s Green Credit Policy Effective? -Based on the Perspective of Enterprise Environmental Performance and Economic Performance. Int. Rev. Econ. Financ. 2024, 94, 103410. [Google Scholar] [CrossRef]

- Jiang, S.; Ma, Z. How Does the Green Credit Policy Affect Corporate ESG Performance? Int. Rev. Econ. Financ. 2024, 93, 814–826. [Google Scholar] [CrossRef]

- Poggensee, J. Generating Shareholder Value through the Announcement of Sustainability-Linked Bond Issuance. J. Clim. Financ. 2025, 10, 100057. [Google Scholar] [CrossRef]

- Karlsson, H.; De Jounge, A. Sustainability-Linked Bonds: A Study Comparing the Yields of Sustainability-Linked Bonds and Green Bonds. Bachelor’s Thesis, Stockholm Business School, Stockholm, Sweden, 2024. Available online: https://su.diva-portal.org/smash/get/diva2:1848402/FULLTEXT01.pdf (accessed on 14 July 2025).

- Resendiz, J.L.; Shrimali, G. Sustainability-Linked Bonds: Modelling for Sustainability Performance. 2024. Available online: https://ssrn.com/abstract=4940677 (accessed on 12 August 2025).

- de Mariz, F.; Bosmans, P.; Leal, D.; Bisaria, S. Reforming Sustainability-Linked Bonds by Strengthening Investor Trust. J. Risk Financ. Manag. 2024, 17, 290. [Google Scholar] [CrossRef]

- Vulturius, G.; Maltais, A.; Forsbacka, K. Sustainability-Linked Bonds—Their Potential to Promote Issuers’ Transition to Net-Zero Emissions and Future Research Directions. J. Sustain. Financ. Investig. 2024, 14, 116–127. [Google Scholar] [CrossRef]

- Casao Mittler, R. Cost Benefit Comparison between Sustainability-Linked Bonds and Conventional Bonds. Master’s Thesis, Aalto University, Espoo, Finland, 2024. [Google Scholar]

- Lansink, A.O.; Kapelko, M. Do Sustainability-Linked Bonds Pay Lower Interest Rates? Corp. Soc. Responsib. Environ. Manag. 2025, 32, 5337–5347. [Google Scholar] [CrossRef]

- Lindgren, A. Capital Funding in an Environmentally Aware Market A Comparative Study of Sustainability Linked Loans and Green Bonds. Bachelor’s Thesis, University of Gothenburg, Gothenburg, Sweden, 2024. [Google Scholar]

- Strube, D. The Role of Sustainable Loan Products in Managing Sustainability Risks in German Regional Banks. In Proceedings of the 7th International Conference on Finance, Economics, Management and IT Business, Porto, Portugal, 5–6 April 2025; SCITEPRESS—Science and Technology Publications: Setúbal, Portugal, 2025; pp. 197–202. [Google Scholar]

- Hsu, V.; Lai, G.; Li, Y.; Liang, G. On the (In)Efficiency of Sustainability-Linked Loans. SSRN Electron. J. 2024. [Google Scholar] [CrossRef]

- Artiga Gonzalez, T.; Capera Romero, L.; Karmaziene, E.; Yuan, X. Green Gains: The Impact of REITs’ Environmental Performance on Sustainability-Linked Loan Interest Rates. Financ. Res. Lett. 2025, 71, 106415. [Google Scholar] [CrossRef]

- Pohl, C.D. The Interplay of Corporate Finance and Sustainability: Evidence from Sustainability-Linked Lending, Transparency Initiatives and Corporate Litigation. Ph.D. Thesis, Technische Universität Darmstadt, Darmstadt, Germany, 2025. [Google Scholar]

- Holzapfel, P.K.R.; Bánk, J.; Bach, V.; Finkbeiner, M. Relevance of Guarantees of Origin for Europe’s Renewable Energy Targets. Renew. Sustain. Energy Rev. 2024, 205, 114850. [Google Scholar] [CrossRef]

- Paris, A.; Hechelmann, R.; Buchenau, N. Exploring the Effect of Guarantees of Origin on the Decarbonization of Corporate Electricity Procurement: A Case Study of Germany and Norway. J. Ind. Ecol. 2024, 28, 1657–1669. [Google Scholar] [CrossRef]

- Sacchi, G.; Romanello, L.; Canavari, M. The Future of Organic Certification: Potential Impacts of the Inclusion of Participatory Guarantee Systems in the European Organic Regulation. Agric. Food Econ. 2024, 12, 2. [Google Scholar] [CrossRef]

- Dupont, K.A.; Cali, Ü.; Halden, U. A DLT-Based Proof of Concept Marketplace for Trading Guarantees of Origin. In Proceedings of the 2024 IEEE Power & Energy Society General Meeting (PESGM), Seattle, WA, USA, 21–25 July 2024; IEEE: Piscataway, NJ, USA, 2024; pp. 1–5. [Google Scholar]

- Aisbett, E.; Baldwin, K.; Pye, J.; White, L.V. Future Made in Australia (Guarantee of Origin) Bill 2024 [Provisions] and Related Bills: Submission to the Inquiry by ANU ZeroCarbon Energy for the Asia-Pacific (ZCEAP); Australian National University: Canberra, Australia, 2024. [Google Scholar]

- Snyder, H. Literature Review as a Research Methodology: An Overview and Guidelines. J. Bus. Res. 2019, 104, 333–339. [Google Scholar] [CrossRef]

- Lebart, L.; Morineau, A.; Warwick, K. Multivariate Descriptive Statistical Analysis: Correspondence Analysis and Related Techniques for Large Matrices; Wiley: New York, NY, USA, 1984. [Google Scholar]

- Greenacre, M.; Hastie, T. The Geometric Interpretation of Correspondence Analysis. J. Am. Stat. Assoc. 1987, 82, 437. [Google Scholar] [CrossRef]

- Greenacre, M. Multiple and Joint Correspondence Analysis. In Correspondence Analysis in the Social Sciences; Greenacre, M., Blasius, J., Eds.; Academic Press: San Diego, CA, USA, 1994; pp. 141–161. [Google Scholar]

- Beh, E.J.; Lombardo, R. Correspondence Analysis: Theory, Practice and New Strategies; John Wiley & Sons, Ltd.: Hoboken, NJ, USA, 2014. [Google Scholar]

- Kaufman, L.; Rousseeuw, P.J. Inding Groups in Data: An Introduction to Cluster Analysis, 1st ed.; Wiley-Interscience: Hoboken, NJ, USA, 2005. [Google Scholar]

- Eszergár-Kiss, D.; Caesar, B. Definition of User Groups Applying Ward’s Method. Transp. Res. Procedia 2017, 22, 25–34. [Google Scholar] [CrossRef]

- Grabiński, T. Metody Taksonometrii; Akademia Ekonomiczna: Kraków, Poland, 1992. [Google Scholar]

- Wang, G.; Cui, H.; Hausken, K. The Evolution of Green Finance Research: A Comprehensive Bibliometric Analysis. Heliyon 2025, 11, e42161. [Google Scholar] [CrossRef]

- Yun, X.; Hu, Y. An Overview of the Evolution in the Research Landscape of Green Finance. World 2024, 5, 1335–1366. [Google Scholar] [CrossRef]

- Mudalige, H.M.N.K. Emerging New Themes in Green Finance: A Systematic Literature Review. Future Bus. J. 2023, 9, 108. [Google Scholar] [CrossRef]

- Yameen, J.; Kijkasiwat, P.; Hussain, A.; Farooq, M.A.; Ajmal, T. Green Finance in Banking Industry: A Systematic Literature Review. SN Bus. Econ. 2024, 4, 91. [Google Scholar] [CrossRef]

- Liu, C.; Wu, S.S. Green Finance, Sustainability Disclosure and Economic Implications. Fulbright Rev. Econ. Policy 2023, 3, 1–24. [Google Scholar] [CrossRef]

- Muhmad, S.N.; Cheema, S.; Mohamad Ariff, A.; Nik Him, N.F.; Muhmad, S.N. Systematic Literature Review and Bibliometric Analysis of Green Finance and Renewable Energy Development. Sustain. Dev. 2024, 32, 7342–7355. [Google Scholar] [CrossRef]

- Abhilash; Shenoy, S.S.; Shetty, D.K. A State-of-the-Art Overview of Green Bond Markets: Evidence from Technology Empowered Systematic Literature Review. Cogent Econ. Financ. 2022, 10, 2135834. [Google Scholar] [CrossRef]

- Cortellini, G.; Panetta, I.C. Green Bond: A Systematic Literature Review for Future Research Agendas. J. Risk Financ. Manag. 2021, 14, 589. [Google Scholar] [CrossRef]

- Woode, J.K. Green Finance and Green Growth: A Systematic Literature Review on Awareness, Existing Channels, Instruments, and Techniques. Dev. Sustain. Econ. Financ. 2024, 1, 100004. [Google Scholar] [CrossRef]

| Type of Green Financial Instrument | Main Research Areas |

|---|---|

| Green Bonds | Part of green finance [54,55,56,57]; sustainable development [58,59]; energy transition [60,61,62,63]; innovation [64,65,66]; disclosure [67,68]; financial performance [69,70]. |

| Green Loans (Green credit) | Part of green finance [54,71,72]; sustainable development [73,74]; energy transition [75,76,77,78]; innovation [79,80]; financial performance [81,82,83,84]. |

| Sustainability-Linked Bonds (SLBs) | Market development and pricing [85,86,87]; transparency, credibility, and greenwashing [88,89]; ESG outcomes and economic efficiency [87,90,91]. |

| Sustainability-Linked Loans (SLLs) | Market development and pricing [92]; economic efficiency [93,94,95,96]. |

| Green Certificates/Guarantees of Origin) | Effectiveness of energy policy tools and regulatory impact [97,98,99]; market dynamics and pricing [100,101]. |

| K | |||||||

|---|---|---|---|---|---|---|---|

| 1 | 0.4522 | 0.2045 | 20.4485 | 20.4485 | 0.4371 | 17.7243 | 17.7243 |

| 2 | 0.3963 | 0.1571 | 15.7059 | 36.1544 | 0.3804 | 15.4232 | 33.1476 |

| 3 | 0.2719 | 0.0739 | 7.3923 | 43.5467 | 0.2550 | 10.3373 | 43.4849 |

| 4 | 0.2598 | 0.0675 | 6.7509 | 50.2976 | 0.2429 | 9.8477 | 53.3326 |

| 5 | 0.2352 | 0.0553 | 5.5338 | 55.8314 | 0.2183 | 8.8525 | 62.1851 |

| 6 | 0.2152 | 0.0463 | 4.6320 | 60.4634 | 0.1984 | 8.0449 | 70.2299 |

| 7 | 0.2130 | 0.0454 | 4.5374 | 65.0009 | 0.1962 | 7.9559 | 78.1859 |

| 8 | 0.2033 | 0.0413 | 4.1335 | 69.1344 | 0.1866 | 7.5657 | 85.7516 |

| 9 | 0.1937 | 0.0375 | 3.7503 | 72.8846 | 0.1770 | 7.1781 | 92.9297 |

| 10 | 0.1910 | 0.0365 | 3.6468 | 76.5314 | 0.1744 | 7.0703 | 100.0000 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zioło, M.; Bąk, I.; Spoz, A. The Nexus Between Green Bonds, Green Credits, and the Energy Transition Toward Renewable Energy Sources: State of the Art. Energies 2025, 18, 4370. https://doi.org/10.3390/en18164370

Zioło M, Bąk I, Spoz A. The Nexus Between Green Bonds, Green Credits, and the Energy Transition Toward Renewable Energy Sources: State of the Art. Energies. 2025; 18(16):4370. https://doi.org/10.3390/en18164370

Chicago/Turabian StyleZioło, Magdalena, Iwona Bąk, and Anna Spoz. 2025. "The Nexus Between Green Bonds, Green Credits, and the Energy Transition Toward Renewable Energy Sources: State of the Art" Energies 18, no. 16: 4370. https://doi.org/10.3390/en18164370

APA StyleZioło, M., Bąk, I., & Spoz, A. (2025). The Nexus Between Green Bonds, Green Credits, and the Energy Transition Toward Renewable Energy Sources: State of the Art. Energies, 18(16), 4370. https://doi.org/10.3390/en18164370