Decarbonisation Prospects of the Chemical and Petrochemical Industry in Italy

Abstract

1. Introduction

2. Method and Data

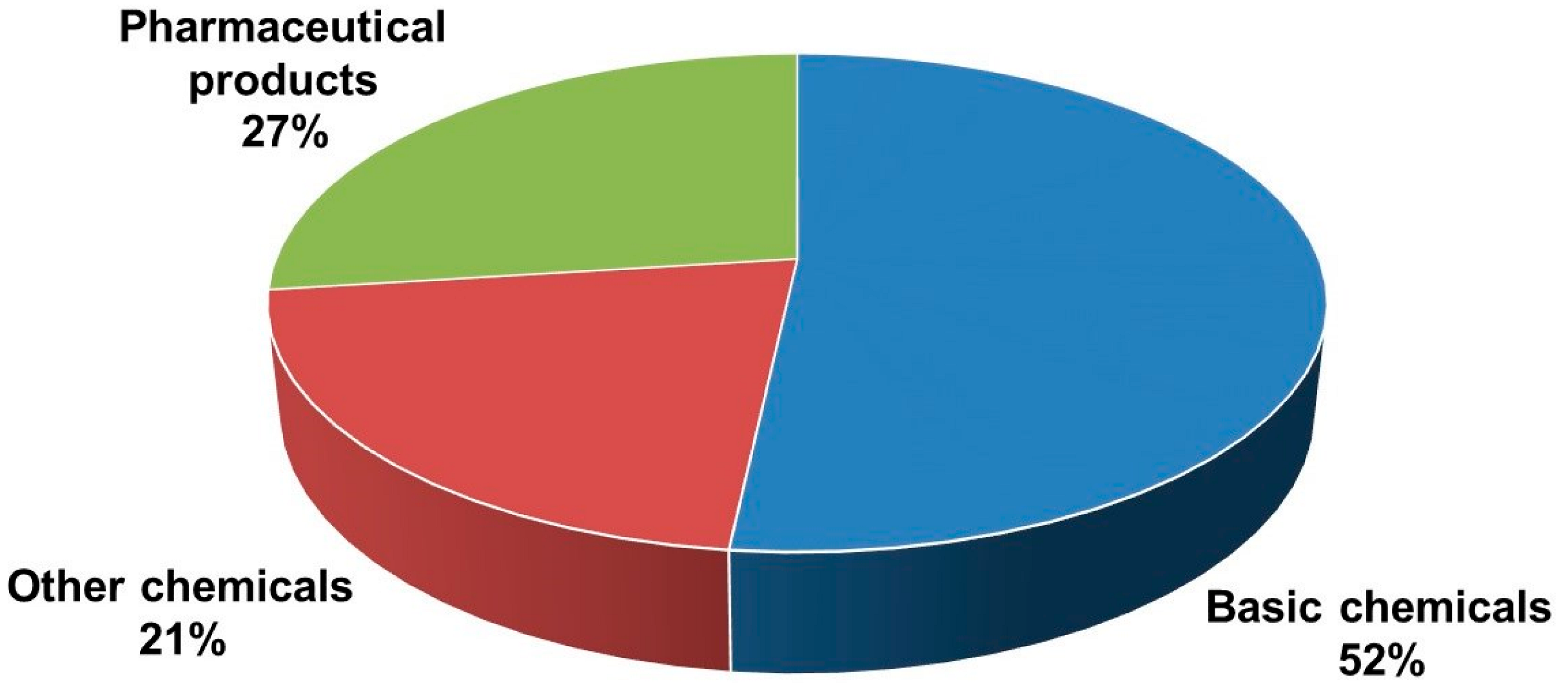

3. C&P Industry

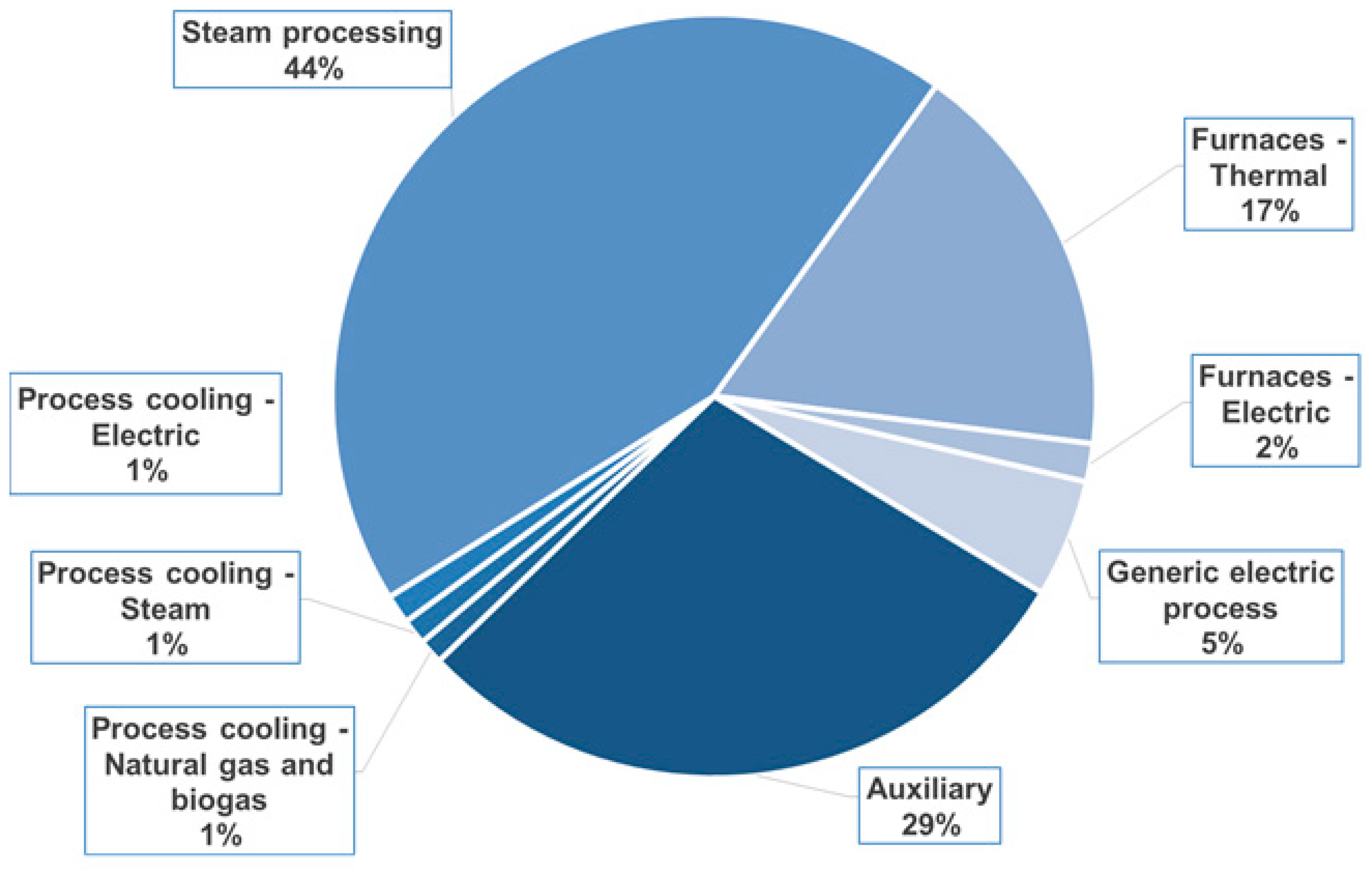

3.1. Production Processes

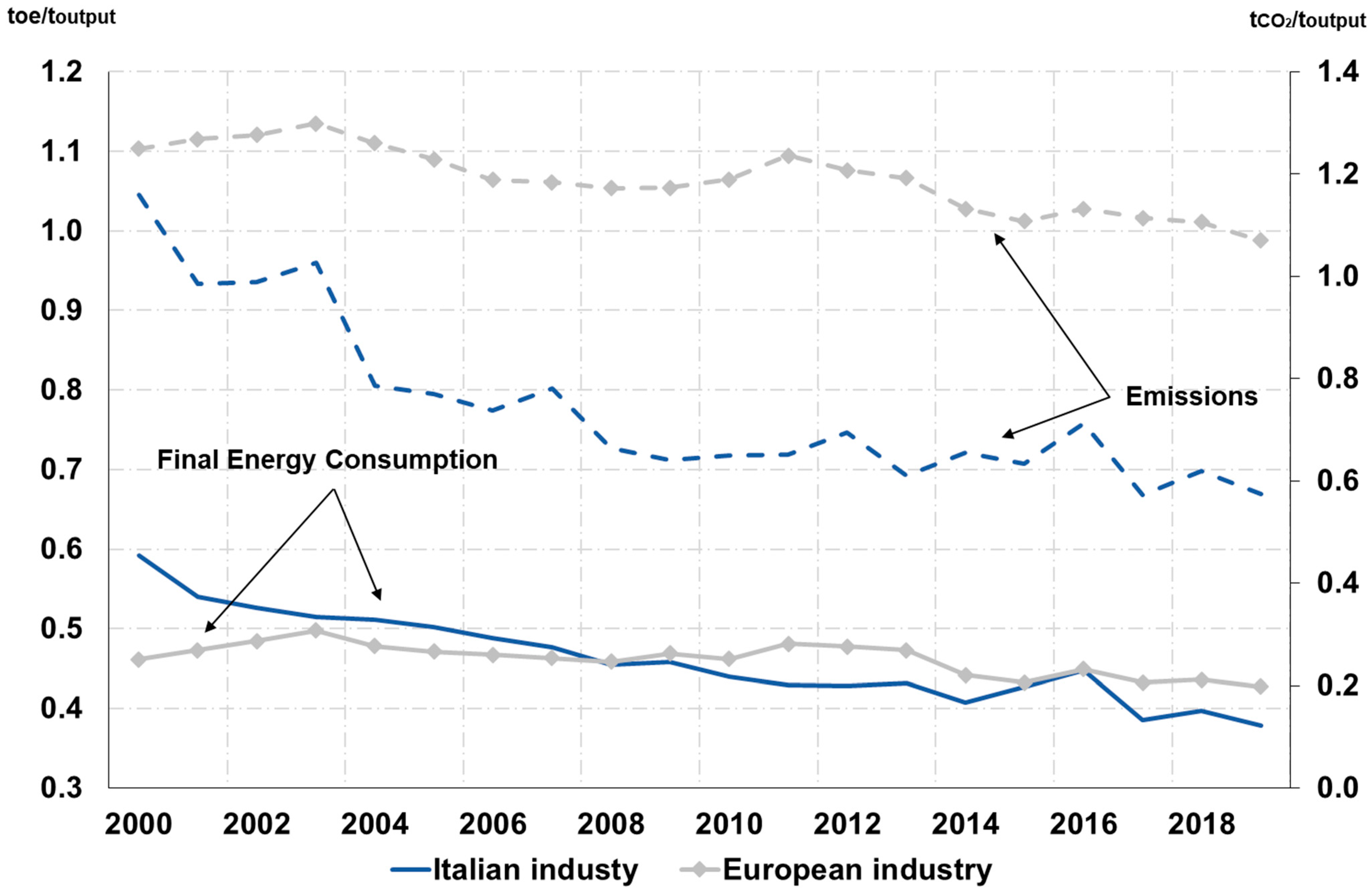

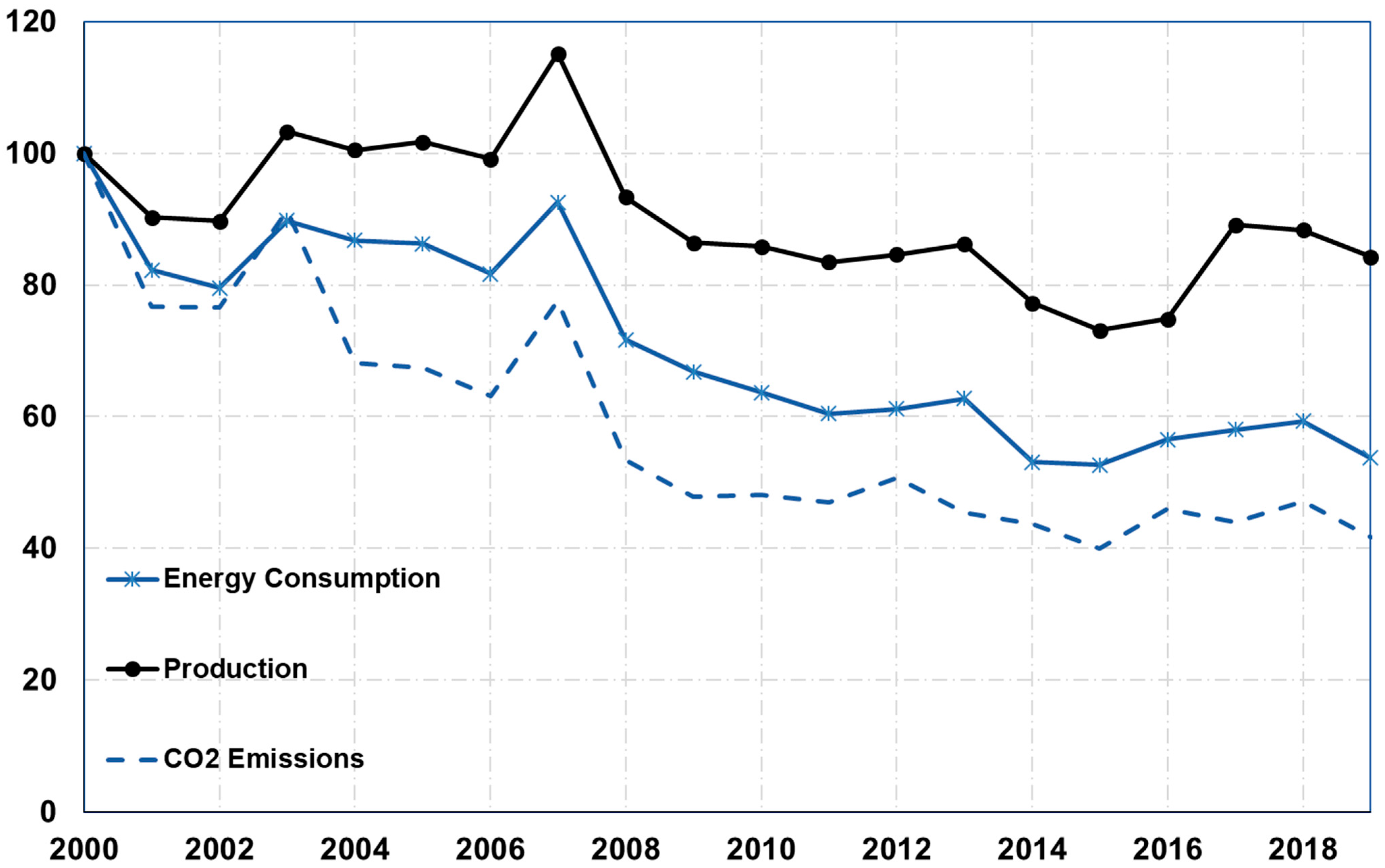

3.2. Energy Consumption and Environmental Performance

4. Decarbonisation Routes

4.1. Energy Efficiency Enhancement

4.2. Waste Recovery and Utilisation

4.3. Electrification

4.4. Hydrogen

4.5. Biomass-Based Solutions

4.6. CCUS

5. Discussion

6. Concluding Remarks

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Abbreviations

| BAT | Best Available Technology |

| BREF | BAT Reference Document |

| BTX | Benzene Toluene Xylene |

| CBAM | Carbon Border Adjustment Mechanism |

| CCS | Carbon Capture and Storage |

| CCU | Carbon Capture and Utilisation |

| C&P | Chemical and Petrochemical |

| CHP | Combined Heat and Power |

| DME | Dimethyl Ether |

| EC | European Commission |

| ETS | Emissions Trading System |

| EU | European Union |

| GDP | Gross Domestic Product |

| GTO | Glycerol-to-Olefin |

| IEA | International Energy Agency |

| R&D | Research & Development |

| SMR | Steam Methane Reforming |

| TRL | Technology Readiness Level |

References

- European Environment Agency. Total Greenhouse Gas Emissions in the Chemical Industry (Indicator). 16 April 2024. Available online: https://www.eea.europa.eu/en/european-zero-pollution-dashboards/indicators/total-greenhouse-gas-emissions-in-the-chemical-industry (accessed on 12 February 2025).

- European Council. European Green Deal. Available online: https://www.consilium.europa.eu/en/policies/green-deal/ (accessed on 16 January 2024).

- International Energy Agency (IEA); International Council of Chemical Associations (ICCA); DECHEMA. Technology Roadmap: Energy and GHG Reductions in the Chemical Industry via Catalytic Processes; International Energy Agency: Paris, France, 2013.

- Saygin, D.; Gielen, D. Zero-Emission Pathway for the Global Chemical and Petrochemical Sector. Energies 2021, 14, 3772. [Google Scholar] [CrossRef]

- European Commission; Directorate General for Internal Market, Industry, Entrepreneurship and SMEs. Transition Pathway for the Chemical Industry; Publications Office: Luxembourg, 2023. Available online: https://data.europa.eu/doi/10.2873/873037 (accessed on 9 May 2024).

- European Commission, Joint Research Centre. Energy Efficiency and GHG Emissions: Prospective Scenarios for the Chemical and Petrochemical Industry; Publications Office: Luxembourg, 2017. Available online: https://data.europa.eu/doi/10.2760/630308 (accessed on 5 February 2024).

- CEFIC. The Carbon Managers—Modelling Possible Pathways for the EU Chemical Sector’s Transition Towards Climate-Neutrality and Circularity with iC2050. 2025. Available online: https://cefic.org/resources/the-carbon-managers-ic-2050/ (accessed on 5 August 2025).

- Chung, C.; Kim, J.; Sovacool, B.K.; Griffiths, S.; Bazilian, M.; Yang, M. Decarbonizing the chemical industry: A systematic review of sociotechnical systems, technological innovations, and policy options. Energy Res. Soc. Sci. 2023, 96, 102955. [Google Scholar] [CrossRef]

- Woodall, C.M.; Fan, Z.; Lou, Y.; Bhardwaj, A.; Khatri, A.; Agrawal, M.; McCormick, C.F. Technology options and policy design to facilitate decarbonization of chemical manufacturing. Joule 2022, 6, 2474–2499. [Google Scholar] [CrossRef]

- Gerres, T.; Ávila, J.P.C.; Llamas, P.L.; Román, T.G.S. A review of cross-sector decarbonisation potentials in the European energy intensive industry. J. Clean. Prod. 2019, 210, 585–601. [Google Scholar] [CrossRef]

- Bataille, C.; Åhman, M.; Neuhoff, K.; Nilsson, L.J.; Fischedick, M.; Lechtenböhmer, S.; Solano-Rodriquez, B.; Denis-Ryan, A.; Stiebert, S.; Waisman, H.; et al. A review of technology and policy deep decarbonization pathway options for making energy-intensive industry production consistent with the Paris Agreement. J. Clean. Prod. 2018, 187, 960–973. [Google Scholar] [CrossRef]

- Rehfeldt, M. A review of the emission reduction potential of fuel switch towards biomass and electricity in European basic materials industry until 2030. Renew. Sustain. Energy Rev. 2020, 120, 109672. [Google Scholar] [CrossRef]

- Madeddu, S.; Ueckerdt, F.; Pehl, M.; Peterseim, J.; Lord, M.; Kumar, K.A.; Krüger, C.; Luderer, G. The CO2 reduction potential for the European industry via direct electrification of heat supply (power-to-heat). Environ. Res. Lett. 2020, 15, 124004. [Google Scholar] [CrossRef]

- Bahman, N.; Al-Khalifa, M.; Al Baharna, S.; Abdulmohsen, Z.; Khan, E. Review of carbon capture and storage technologies in selected industries: Potentials and challenges. Rev. Environ. Sci. Biotechnol. 2023, 22, 451–470. [Google Scholar] [CrossRef]

- Olabi, A.G.; Wilberforce, T.; Elsaid, K.; Sayed, E.T.; Maghrabie, H.M.; Abdelkareem, M.A. Large scale application of carbon capture to process industries—A review. J. Clean. Prod. 2022, 362, 132300. [Google Scholar] [CrossRef]

- Griffin, P.W.; Hammond, G.P.; Norman, J.B. Industrial energy use and carbon emissions reduction in the chemicals sector: A UK perspective. Appl. Energy 2018, 227, 587–602. [Google Scholar] [CrossRef]

- Nurdiawati, A.; Urban, F. Towards Deep Decarbonisation of Energy-Intensive Industries: A Review of Current Status, Technologies and Policies. Energies 2021, 14, 2408. [Google Scholar] [CrossRef]

- IRENA. Reaching Zero with Renewables: Eliminating CO2 Emissions from Industry and Transport in Line with the 1.5 °C Climate Goal; International Renewable Energy Agency: Abu Dhabi, United Arab Emirates, 2020.

- Koasidis, K.; Nikas, A.; Neofytou, H.; Karamaneas, A.; Gambhir, A.; Wachsmuth, J.; Doukas, H. The UK and German Low-Carbon Industry Transitions from a Sectoral Innovation and System Failures Perspective. Energies 2020, 13, 4994. [Google Scholar] [CrossRef]

- European Environment Agency. EU Emissions Trading System (ETS) Data Viewer; European Environment Agency: København, Denamark, 2025.

- European Commission, Joint Research Centre. JRC-IDEES-2021, The Integrated Database of the European Energy System: Data Update and Technical Documentation; Publications Office: Luxembourg, 2024. Available online: https://data.europa.eu/doi/10.2760/614599 (accessed on 18 June 2024).

- Federchimica. L’industria Chimica in Cifre 2020, Centro Studi di Federchimica. 2020. Available online: https://www.federchimica.it/docs/default-source/materiali-assemblea-2020/1-pubblicazioni/l'industria-chimica-in-cifre-2020.pdf?sfvrsn=e3904b93_4 (accessed on 5 August 2025).

- Federchimica. L’industria Chimica in Cifre 2022, Centro Studi di Federchimica. 2022. Available online: https://www.ctf.unifi.it/upload/sub/qualit/2024/l%20industria-chimica-in-cifre-2022.pdf (accessed on 5 August 2025).

- Federchimica. L’industria Chimica in Cifre 2024, Centro Studi di Federchimica. 2024. Available online: https://www.federchimica.it/docs/default-source/la-chimica-in-cifre/l'industria-chimica-in-cifre_mag2019.pdf?sfvrsn=e0e57493_57 (accessed on 5 August 2025).

- Federchimica. ‘La Performance sui Mercati Internazionali’. Available online: https://www.federchimica.it/industria-chimica-in-cifre/la-performance-sui-mercati-internazionali (accessed on 5 July 2024).

- WSP, DNV GL. Industrial Decarbonisation & Energy Efficiency Roadmaps to 2050—Chemicals; Department of Energy and Climate Change: London, UK, 2015.

- Bazzanella, A.M.; Ausfelder, F. Low Carbon Energy and Feedstock for the European Chemical Industry; DECHEMA: Frankfurt am Main, Germany, 2017. [Google Scholar]

- RSE. L’Efficienza Energetica nell’Industria: Potenzialità di Risparmio Energetico e Impatto sulle Performance e sulla Competitività delle Imprese; RSE: Milano, Italy, 2018. [Google Scholar]

- Eurostat. Eurostat Database. Available online: https://ec.europa.eu/eurostat/data/database (accessed on 24 June 2025).

- Confindustria. Piano D’azione per L’idrogeno. Focus Tecnologie Industriali. 2022. Available online: https://www.confindustria.it/documenti/piano-dazione-per-lidrogeno/ (accessed on 5 August 2025).

- ISPRA. Italian Greenhouse Gas Inventory 1990–2021 National Inventory, 383/2023. 2023. Available online: https://www.isprambiente.gov.it/it/pubblicazioni/rapporti/italian-greenhouse-gas-inventory-1990-2021-national-inventory-report-2023 (accessed on 5 August 2025).

- ISPRA. Il Sistema EU-ETS in Italia e nei Principali Paesi Europei; ISPRA: Rome, Italy, 2020.

- Boston Consulting Group. Industrial Decarbonization Pact: Un’alleanza per la Piena Decarbonizzazione dei Settori Hard to Abate. 2022. Available online: https://www.bcg.com/publications/2022/industrial-decarbonization-pact (accessed on 5 August 2025).

- Odyssee. About the Odyssee-Mure Project—Sectoral Profile: Industry. 2021. Available online: https://www.odyssee-mure.eu/publications/efficiency-by-sector/industry/industry-eu.pdf (accessed on 11 December 2023).

- L’industria Chimica in Cifre 2021, Centro Studi di Federchimica. 2021. Available online: https://www.ctf.unifi.it/upload/sub/inserimento-nel-mondo-del-lavoro/industria-chimica-in-cifre_2021.pdf (accessed on 5 August 2025).

- Material Economics. Industrial Transformation 2050—Pathways to Net-Zero Emissions from EU Heavy Industry. The Strategic Innovation Program RE: Source. 2019. Available online: https://materialeconomics.com/node/13 (accessed on 5 August 2025).

- Federchimica. Responsible Care—29° Rapporto Annuale 2023. 2024. Available online: https://www.federchimica.it/l'industria-chimica-in-italia-rapporto-2023-2024/responsible-care-l-impegno-dell-industria-chimica-per-lo-sviluppo-sostenibile (accessed on 5 August 2025).

- Liu, L.; Ramakrishna, S. (Eds.) An Introduction to Circular Economy; Springer: Singapore, 2021. [Google Scholar] [CrossRef]

- Federchimica. Annuario sulla Ricerca Chimica 2023. 2023. Available online: https://annuario.federchimica.it/ (accessed on 5 August 2025).

- Versalis. Versalis: Construction Site for Plastics Chemical Recycling Plant Opens in Mantua. 31 October 2023. Available online: https://versalis.eni.com/en-IT/news/press-release/2023/mantova-hoop.html (accessed on 10 July 2024).

- Versalis. Versalis: Eni’s Porto Marghera Transformation Continues. 2 May 2022. Available online: https://versalis.eni.com/en-IT/news/press-release/2022/versalis-enis-porto-marghera-transformation-continues.html (accessed on 10 July 2024).

- LyondellBasell. LyondellBasell Successfully Starts Up New Pilot Molecular Recycling Facility. 8 September 2020. Available online: https://www.lyondellbasell.com/en/news-events/corporate--financial-news/lyondellbasell-successfully-starts-up-new-pilot-molecular-recycling-facility/ (accessed on 10 July 2024).

- LyondellBasell. LyondellBasell to Build Industrial-scale Advanced Recycling Plant in Germany. 20 November 2023. Available online: https://www.lyondellbasell.com/en/news-events/corporate--financial-news/lyondellbasell-to-build-industrial-scale-advanced-recycling-plant-in-germany/ (accessed on 10 July 2024).

- Van Kranenburg, K.; Schols, E.; Gelevert, H.; de Kler, R. Empowering the Chemical Industry—Opportunities for Electrification, TNO—ECN (VoltaChem). 2016. Available online: https://www.tno.nl/media/7514/voltachem_electrification_whitepaper_2016.pdf (accessed on 8 July 2024).

- Schultz, T.; Nagel, M.; Engenhorst, T.; Nymand-Andersen, A.; Kunze, E.; Stenner, P.; Lang, J.E. Electrifying chemistry: A company strategy perspective. Curr. Opin. Chem. Eng. 2023, 40, 100916. [Google Scholar] [CrossRef]

- Mallapragada, D.S.; Dvorkin, Y.; Modestino, M.A.; Esposito, D.V.; Smith, W.A.; Hodge, B.-M.; Harold, M.P.; Donnelly, V.M.; Nuz, A.; Bloomquist, C.; et al. Decarbonization of the chemical industry through electrification: Barriers and opportunities. Joule 2023, 7, 23–41. [Google Scholar] [CrossRef]

- Zhang, J.; Li, X.; Zheng, J.; Du, M.; Wu, X.; Song, J.; Cheng, C.; Li, T.; Yang, W. Non-thermal plasma-assisted ammonia production: A review. Energy Convers. Manag. 2023, 293, 117482. [Google Scholar] [CrossRef]

- Gao, Y.; Neal, L.; Ding, D.; Wu, W.; Baroi, C.; Gaffney, A.M.; Li, F. Recent Advances in Intensified Ethylene Production—A Review. ACS Catal. 2019, 9, 8592–8621. [Google Scholar] [CrossRef]

- Borealis. Accelerating Electrification with the “Cracker of the Future” Consortium. Available online: https://www.borealisgroup.com/news/accelerating-electrification-with-the-cracker-of-the-future-consortium (accessed on 5 August 2025).

- Shell. Shell and Dow Start Up E-Cracking Furnace Experimental Unit. Available online: https://www.shell.com/business-customers/chemicals/media-releases/2022-media-releases/shell-and-dow-start-up-e-cracking-furnace-experimental-unit.html (accessed on 5 August 2025).

- Fraunhofer ISI. Direct Electrification of Industrial Process Heat. An Assessment of Technologies, Potentials and Future Prospects for the EU, 329/04-S-2024/EN. 2024. Available online: https://www.agora-industry.org/fileadmin/Projects/2023/2023-20_IND_Electrification_Industrial_Heat/A-IND_329_04_Electrification_Industrial_Heat_WEB.pdf (accessed on 5 August 2025).

- European Hydrogen Observatory. Hydrogen Production Capacity 2022. Available online: https://observatory.clean-hydrogen.europa.eu/tools-reports/datasets (accessed on 12 December 2024).

- Solvay e Sapio: Al via il Progetto Hydrogen Valley Rosignano. ICP Magazine, 8 June 2023. Available online: https://www.icpmag.it/industria-di-processo/industria-chimica/item/19238-solvay-e-sapio-al-via-il-progetto-hydrogen-valley-rosignano/ (accessed on 5 August 2025).

- Meccagri.Cloud. Energie Rinnovabili: In Umbria il Primo Impianto per la Produzione di Biometanolo da Biogas. 21 June 2023. Available online: https://www.meccagri.cloud/energie-rinnovabili-in-umbria-il-primo-impianto-per-la-produzione-di-biometanolo/ (accessed on 5 August 2025).

- Olabi, G.; Abdelkareem, M.A.; Al, M.; Shehata, N.; Alami, A.H.; Radwan, A.; Wilberforce, T.; Chae, J.; Taha, E. Recent progress in Green Ammonia: Production, applications, assessment; barriers, and its role in achieving the sustainable development goals. Energy Convers. Manag. 2023, 277, 116594. [Google Scholar] [CrossRef]

- Fan, D.; Dai, D.-J.; Wu, H.-S. Ethylene Formation by Catalytic Dehydration of Ethanol with Industrial Considerations. Materials 2012, 6, 101–115. [Google Scholar] [CrossRef]

- Zhang, M.; Yu, Y. Dehydration of Ethanol to Ethylene. Ind. Eng. Chem. Res. 2013, 52, 9505–9514. [Google Scholar] [CrossRef]

- Igwebuike, C.M.; Awad, S.; Andrès, Y. Renewable Energy Potential: Second-Generation Biomass as Feedstock for Bioethanol Production. Molecules 2024, 29, 1619. [Google Scholar] [CrossRef] [PubMed]

- Althoff, J.; Biesheuvel, K.; De, A.; Pelt, H.; Ruitenbeek, M.; Spork, G.; Tange, J.; Wevers, R. Economic Feasibility of the Sugar Beet-to-Ethylene Value Chain. ChemSusChem 2013, 6, 1625–1630. [Google Scholar] [CrossRef] [PubMed]

- Broda, M.; Yelle, D.J.; Serwańska, K. Bioethanol Production from Lignocellulosic Biomass—Challenges and Solutions. Molecules 2022, 27, 8717. [Google Scholar] [CrossRef]

- Zacharopoulou, V.; Lemonidou, A. Olefins from Biomass Intermediates: A Review. Catalysts 2017, 8, 2. [Google Scholar] [CrossRef]

- Phung, T.K.; Pham, T.L.M.; Vu, K.B.; Busca, G. (Bio)Propylene production processes: A critical review. J. Environ. Chem. Eng. 2021, 9, 105673. [Google Scholar] [CrossRef]

- Pomalaza, G.; Ponton, P.A.; Capron, M.; Dumeignil, F. Ethanol-to-butadiene: The reaction and its catalysts. Catal. Sci. Technol. 2020, 10, 4860–4911. [Google Scholar] [CrossRef]

- Boulamanti, A.; Moya, J.A. Energy Efficiency and GHG Emissions: Prospective Scenarios for the Chemical and Petrochemical Industry; JRC: Petten, The Netherlands, 2017. [Google Scholar]

- Yan, K.; Li, H. State of the Art and Perspectives in Catalytic Conversion Mechanism of Biomass to Bio-aromatics. Energy Fuels 2021, 35, 45–62. [Google Scholar] [CrossRef]

- Wu, Y.; Yang, J.; Wu, G.; Gao, W.; Lora, E.E.S.; Isa, Y.M.; Subramanian, K.A.; Kozlov, A.; Zhang, S.; Huang, Y. Benzene, Toluene, and Xylene (BTX) Production from Catalytic Fast Pyrolysis of Biomass: A Review. ACS Sustain. Chem. Eng. 2023, 11, 11700–11718. [Google Scholar] [CrossRef]

- Origin Materials; Canadian Biomass. Origin Materials Starts up World’s First Commercial CMF Plant in Sarnia, Ont. 27 June 2023. Available online: https://www.canadianbiomassmagazine.ca/origin-materials-starts-up-worlds-first-commercial-cmf-plant-in-sarnia-ont/ (accessed on 28 June 2024).

- Anellotech. Bio-TCatTM Technology Viability Confirmed During Extensive Anellotech Pilot Plant Campaign. 5 May 2019. Available online: https://www.ifpenergiesnouvelles.com/article/bio-tcattm-technology-viability-confirmed-during-extensive-anellotech-pilot-plant-campaign (accessed on 5 August 2025).

- Novamont. Mater-Biopolymer. 2024. Available online: https://novamont.com/eng/page.php?id_page=110 (accessed on 11 July 2024).

- Novamont. Opening of the World’s First Industrial Scale Plant for the Production of Butanediol via Fermentation of Renewable Raw Materials. 29 September 2016. Available online: https://www.novamont.com/eng/read-press-release/mater-biotech/ (accessed on 11 July 2024).

- Versalis. Versalis: The Production of Bioethanol Up and Running at Crescentino. 16 February 2022. Available online: https://www.versalis.eni.com/en-IT/news/press-release/2022/versalis-the-production-of-bioethanol-up-and-running-at-crescentino.html (accessed on 11 July 2024).

- Matrica. Technology and Plants. Available online: https://www.matrica.it/plants.asp?ver=en (accessed on 5 August 2025).

- European Commission. Towards an Ambitious Industrial Carbon Management for the EU–Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions. 6 February 2024. Available online: https://energy.ec.europa.eu/system/files/2024-02/Communication_-_Industrial_Carbon_Management.pdf (accessed on 3 July 2024).

- IEA. Putting CO2 to Use—Creating Value from Emissions; IEA: Paris, France, 2019.

- Leeson, D.; Dowell, N.M.; Shah, N.; Petit, C.; Fennell, P.S. A Techno-economic analysis and systematic review of carbon capture and storage (CCS) applied to the iron and steel, cement, oil refining and pulp and paper industries, as well as other high purity sources. Int. J. Greenh. Gas Control 2017, 61, 71–84. [Google Scholar] [CrossRef]

- European Commission Joint Research Centre. Clean Energy Technology Observatory, Carbon Capture Utilisation and Storage in the European Union: Status Report on Technology Development, Trends, Value Chains and Markets: 2024; Publications Office: Luxembourg, 2024. Available online: https://data.europa.eu/doi/10.2760/0287566 (accessed on 21 May 2025).

- Peres, C.B.; Resende, P.M.R.; Nunes, L.J.R.; Morais, L.C.D. Advances in Carbon Capture and Use (CCU) Technologies: A Comprehensive Review and CO2 Mitigation Potential Analysis. Clean Technol. 2022, 4, 1193–1207. [Google Scholar] [CrossRef]

- Bonaventura, D.; Chacartegui, R.; Valverde, J.M.; Becerra, J.A.; Verda, V. Carbon capture and utilization for sodium bicarbonate production assisted by solar thermal power. Energy Convers. Manag. 2017, 149, 860–874. [Google Scholar] [CrossRef]

- Gabrielli, P.; Rosa, L.; Gazzani, M.; Meys, R.; Bardow, A.; Mazzotti, M.; Sansavini, G. Net-zero emissions chemical industry in a world of limited resources. One Earth 2023, 6, 682–704. [Google Scholar] [CrossRef]

- Bedocchi, C.; Cassetti, G. Electrification of Industrial Heat: The Key to a Sustainable and Competitive Industry; ECCO: Rome, Italy, 2025. [Google Scholar]

- ECCO. Plastics in Italy—A Vice or a Virtue? 2022. Available online: https://eccoclimate.org/wp-content/uploads/2022/04/Plastics-in-Italy.pdf (accessed on 5 August 2025).

- Rinke Dias de Souza, N.; Groenestege, M.; Spekreijse, J.; Ribeiro, C.; Matos, C.T.; Pizzol, M.; Cherubini, F. Challenges and opportunities toward a sustainable bio-based chemical sector in Europe. WIREs Energy Environ. 2024, 13, e534. [Google Scholar] [CrossRef]

- Terna. Progetto Pilota per il Coordinamento TSO-DSO per la Gestione delle Risorse di Flessibilità Distribuite Terna. 2023. Available online: https://www.terna.it/it/sistema-elettrico/progetti-pilota-delibera-arera-300-2017-reel/progetto-pilota-coordinamento-tso-dso (accessed on 26 May 2025).

- Luo, J.; Moncada, J.; Ramirez, A. Development of a Conceptual Framework for Evaluating the Flexibility of Future Chemical Processes. Ind. Eng. Chem. Res. 2022, 61, 3219–3232. [Google Scholar] [CrossRef]

- Cegla, M.; Semrau, R.; Tamagnini, F.; Engell, S. Flexible process operation for electrified chemical plants. Curr. Opin. Chem. Eng. 2023, 39, 100898. [Google Scholar] [CrossRef]

- Saccani, C.; Pellegrini, M.; Guzzini, A. Analysis of the Existing Barriers for the Market Development of Power to Hydrogen (P2H) in Italy. Energies 2020, 13, 4835. [Google Scholar] [CrossRef]

- Gandiglio, M.; Marocco, P. Mapping Hydrogen Initiatives in Italy: An Overview of Funding and Projects. Energies 2024, 17, 2614. [Google Scholar] [CrossRef]

- Paltsev, S.; Morris, J.; Kheshgi, H.; Herzog, H. Hard-to-Abate Sectors: The role of industrial carbon capture and storage (CCS) in emission mitigation. Appl. Energy 2021, 300, 117322. [Google Scholar] [CrossRef]

- Ministero dell’Ambiente e della Sicurezza Energetica. Piano Nazionale Integrato per L’energia e il Clima (PNIEC); Ministero dell’Ambiente e della Sicurezza Energetica: Rome, Italy, 2024.

- Global CCS Institute. 2025 Europe Forum on Carbon Capture and Storage: Recap. 13 May 2025. Available online: https://www.globalccsinstitute.com/resources/insights/2025-europe-forum-on-carbon-capture-and-storage-recap/ (accessed on 5 August 2025).

- Öhman, A.; Karakaya, E.; Urban, F. Enabling the transition to a fossil-free steel sector: The conditions for technology transfer for hydrogen-based steelmaking in Europe. Energy Res. Soc. Sci. 2022, 84, 102384. [Google Scholar] [CrossRef]

- Zibunas, C.; Meys, R.; Kätelhön, A.; Bardow, A. Cost-optimal pathways towards net-zero chemicals and plastics based on a circular carbon economy. Comput. Chem. Eng. 2022, 162, 107798. [Google Scholar] [CrossRef]

- Kearns, D.; Liu, H.; Consoli, C. Technology Readiness and Costs of CCS; Global CCS Institute: Melbourne, Australia, 2021. [Google Scholar]

- Mission impossible Partnership. Making Net-Zero Ammonia Possible: An Industry-Backed, 1 °C-Aligned Transition Strategy, September 2022. Available online: https://www.energy-transitions.org/publications/making-net-zero-ammonia-possible/ (accessed on 24 June 2024).

- SISTEMIQ. Planet Positive Chemicals. September 2022. Available online: https://www.systemiq.earth/systems/circular-materials/planet-positive-chemicals/ (accessed on 24 June 2024).

- Netherlands Enterprise Agency. Stimulation of Sustainable Energy Production and Climate Transition (SDE++). 15 September 2023. Available online: https://english.rvo.nl/subsidies-financiering/sde (accessed on 5 August 2025).

- European Commission. Commission Approves €4 Billion German State Aid Scheme Partially Funded Under Recovery and Resilience Facility to Help Industries Decarbonise Production Processes. 16 February 2024. Available online: https://ec.europa.eu/commission/presscorner/detail/en/ip_24_845 (accessed on 5 August 2025).

- European Commission. Carbon Border Adjustment Mechanism. Available online: https://taxation-customs.ec.europa.eu/carbon-border-adjustment-mechanism_en (accessed on 14 February 2025).

| Process | Brief Description |

|---|---|

| Cracking | Cracking, performed through catalytic (catalytic cracking) or thermal (steam cracking) means, is a means of obtaining lighter compounds from petroleum constituents. It is used to produce petrochemical products, such as ethylene, propylene, butadiene and BTX (benzene, toluene and xylene). |

| Reforming | Reforming is a chemical process in which hydrocarbons are restructured through the use of heat, pressure and/or a catalyst. It is applied in the production of methanol or BTX. |

| Haber–Bosch | In the Haber–Bosch process for ammonia production, natural gas and steam react on an iron-based catalyst at pressures of 150–350 bar and temperatures of 450–550 °C to form nitrogen and hydrogen and, ultimately, ammonia. The hydrogen is supplied by methane steam reforming. A large proportion of the CO2 formed during the reforming process is subsequently used for the production of urea. |

| Chloralkali process | The chloralkali process consists of the electrolysis of aqueous sodium chloride to produce chlorine. Hydrogen gas and sodium hydroxide are also produced. |

| Italy | EU 27 | |

|---|---|---|

| Energy consumption * [toe/toutput] (without feedstock) | 1.38 0.37 | 1.31 0.42 |

| Emissions * [tCO2/toutput] | 0.64 | 1.2 |

| Emission intensity * [tCO2/toe] | 1.74 | 2.84 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Di Lorenzo, G.; Bischi, A.; Desideri, U. Decarbonisation Prospects of the Chemical and Petrochemical Industry in Italy. Energies 2025, 18, 4346. https://doi.org/10.3390/en18164346

Di Lorenzo G, Bischi A, Desideri U. Decarbonisation Prospects of the Chemical and Petrochemical Industry in Italy. Energies. 2025; 18(16):4346. https://doi.org/10.3390/en18164346

Chicago/Turabian StyleDi Lorenzo, Giuseppina, Aldo Bischi, and Umberto Desideri. 2025. "Decarbonisation Prospects of the Chemical and Petrochemical Industry in Italy" Energies 18, no. 16: 4346. https://doi.org/10.3390/en18164346

APA StyleDi Lorenzo, G., Bischi, A., & Desideri, U. (2025). Decarbonisation Prospects of the Chemical and Petrochemical Industry in Italy. Energies, 18(16), 4346. https://doi.org/10.3390/en18164346