Optimal Bidding Scheduling of Virtual Power Plants Using a Dual-MILP (Mixed-Integer Linear Programming) Approach under a Real-Time Energy Market

Abstract

1. Introduction

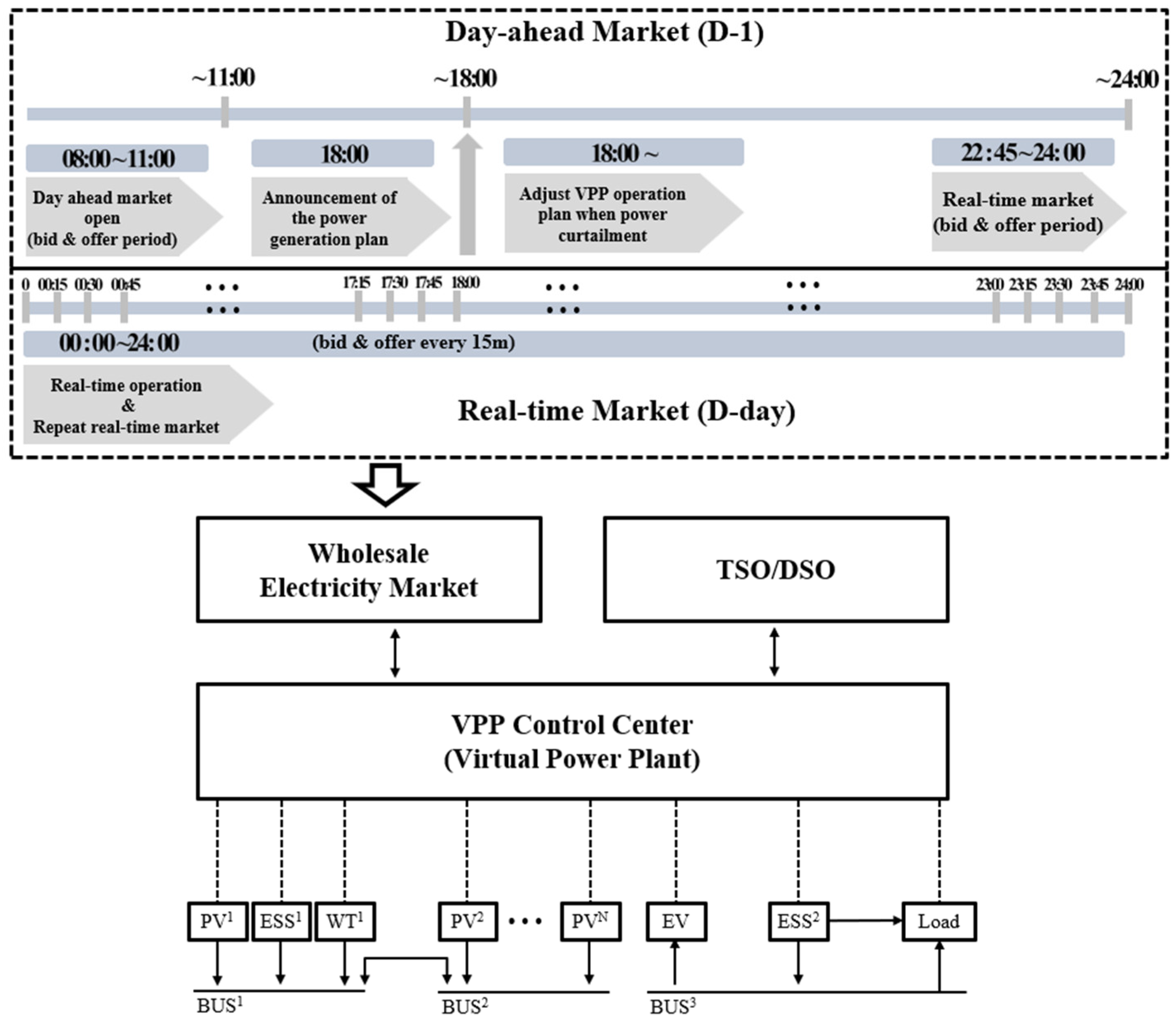

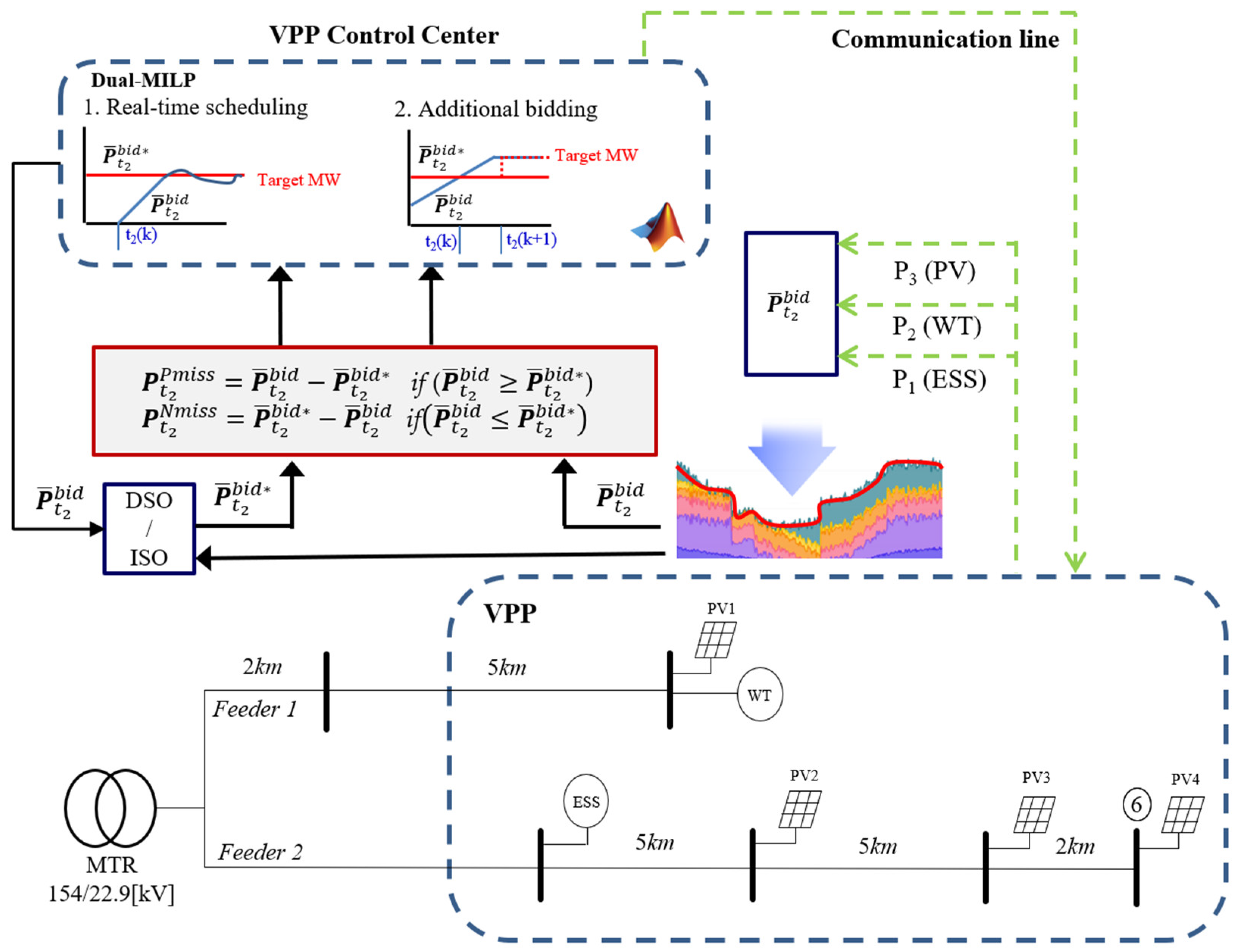

2. Description and Framework of the VPP and Energy Market

3. Optimal Scheduling of VPP Using the Dual-MILP Approaches

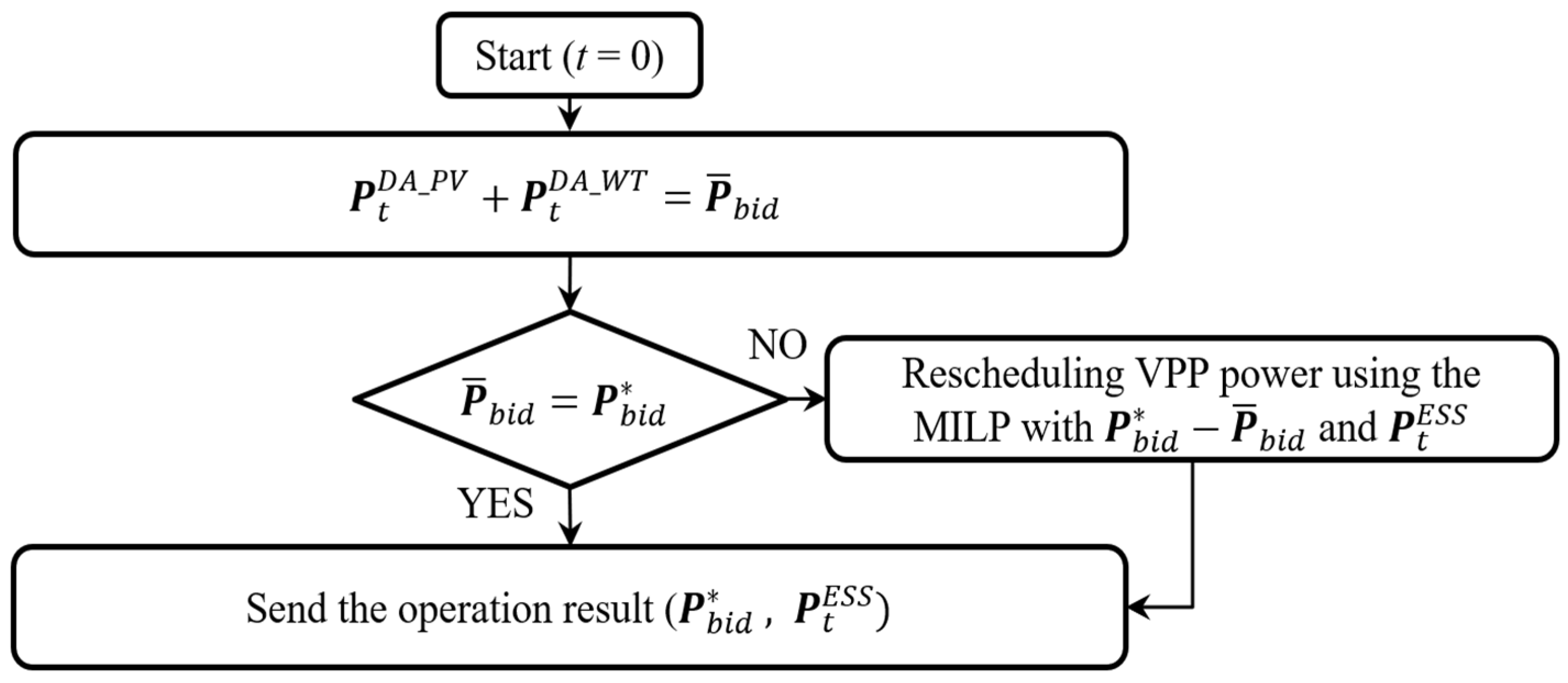

3.1. Day-Ahead Market Scheduling

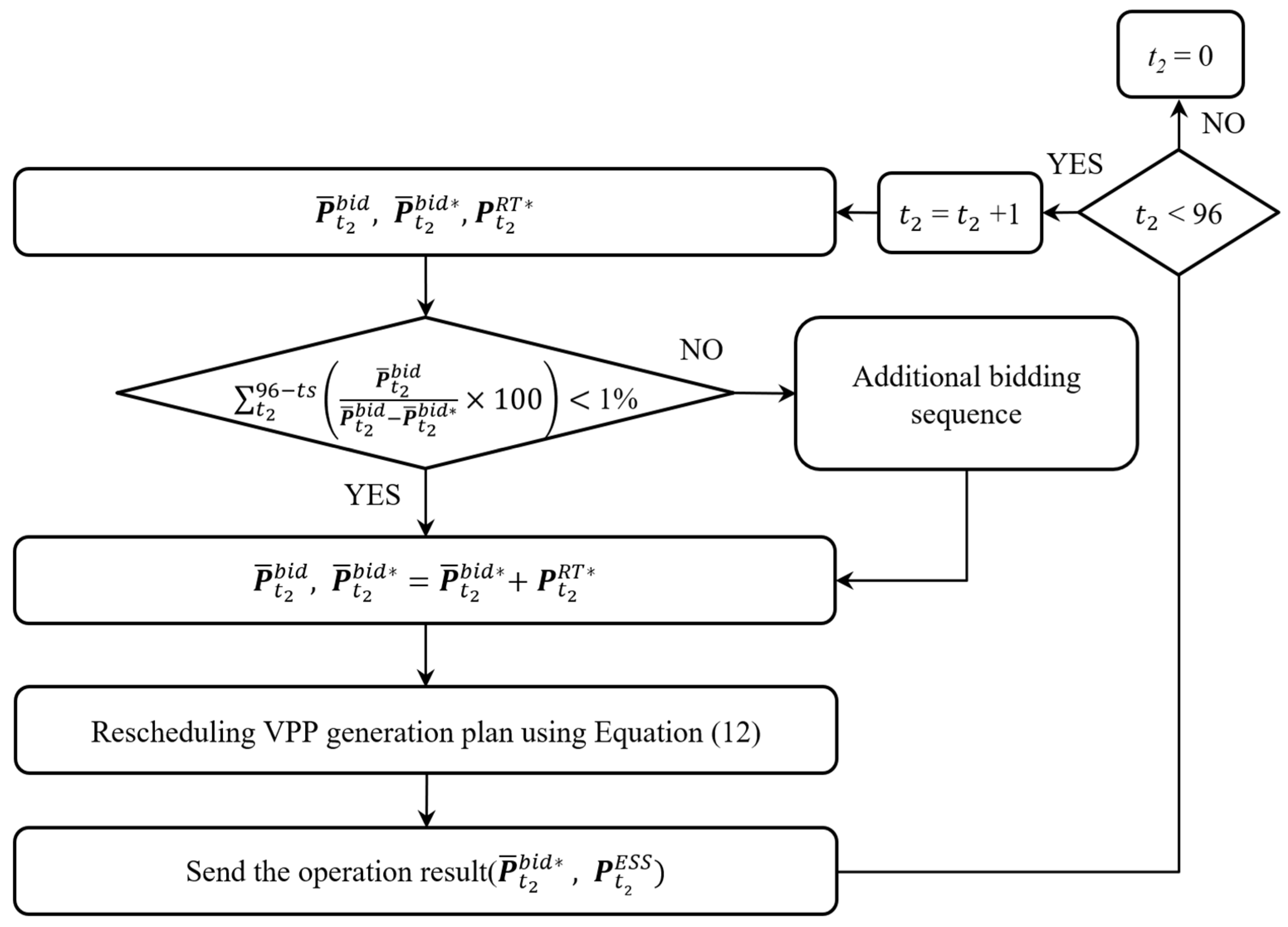

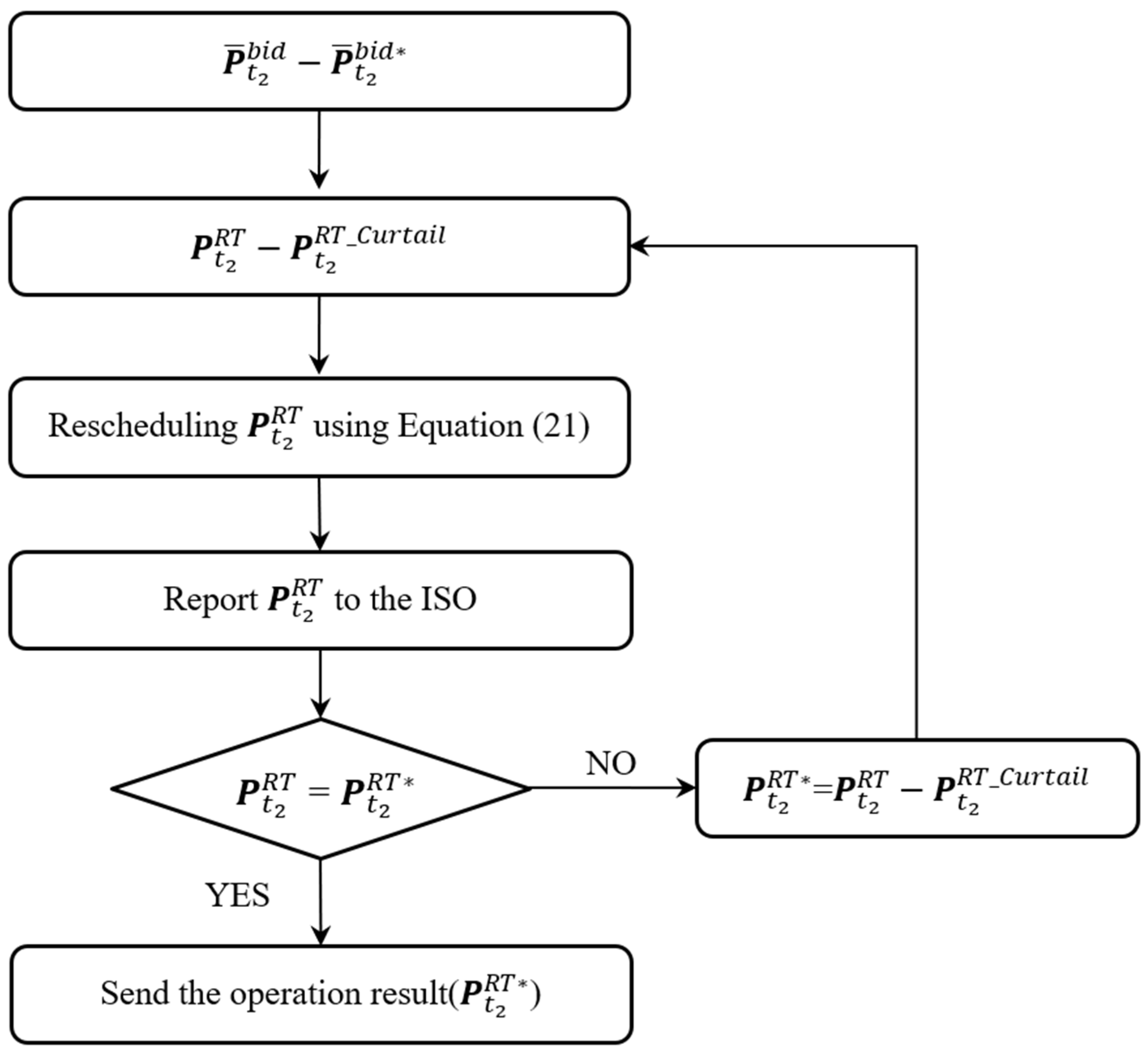

3.2. Real-Time Market Scheduling

3.3. Optimal Additional Bidding in the Real-Time Market

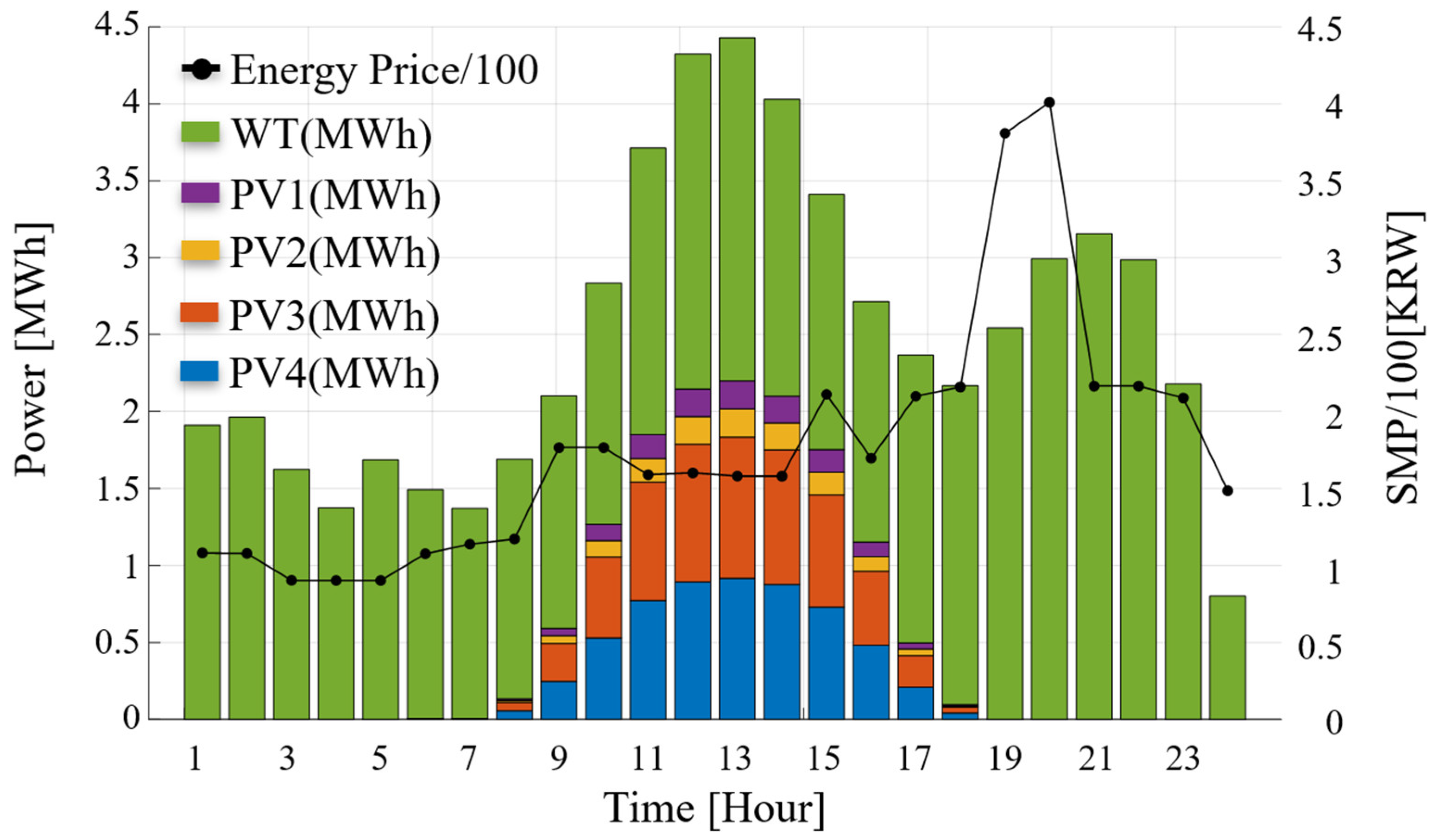

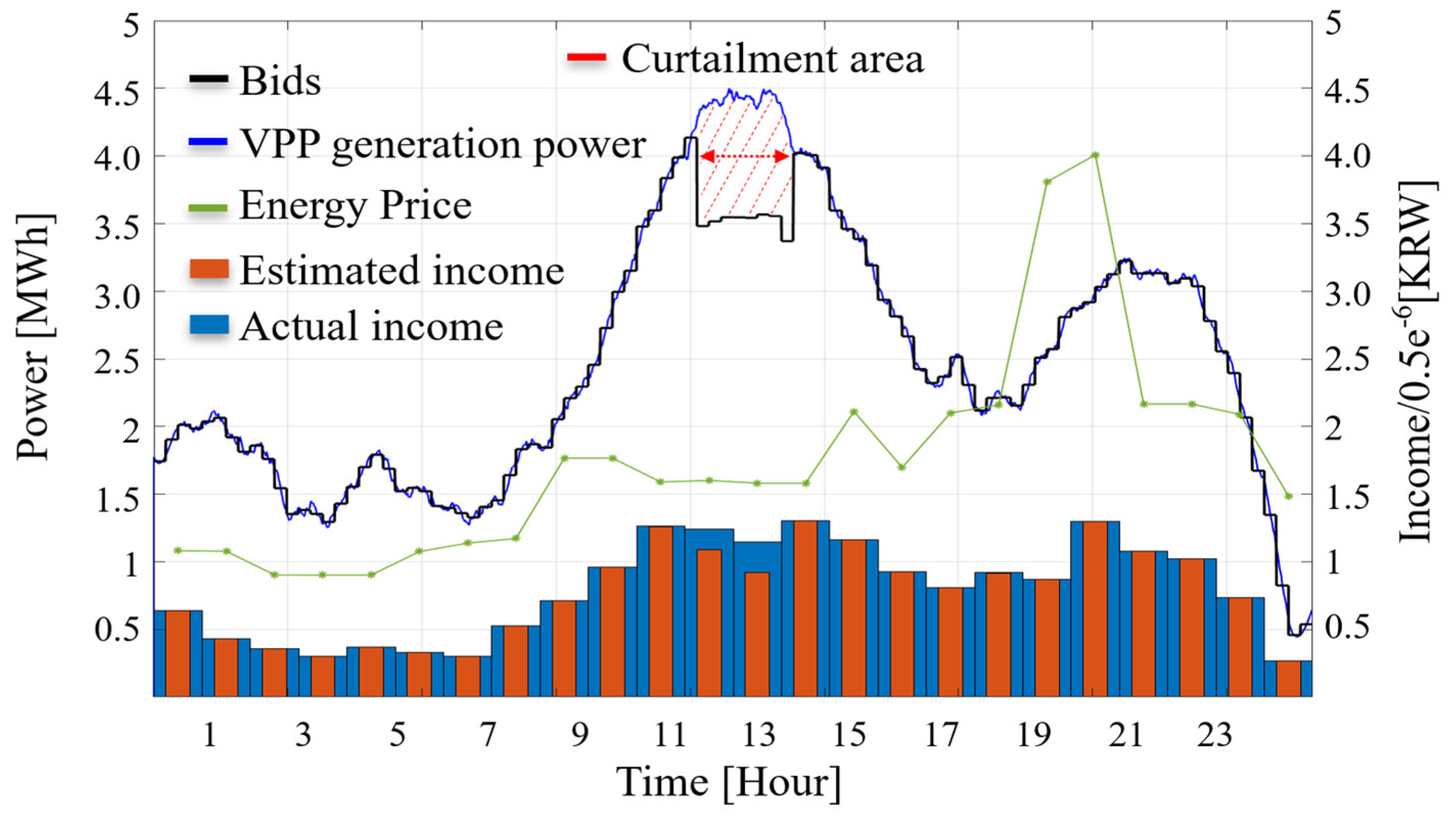

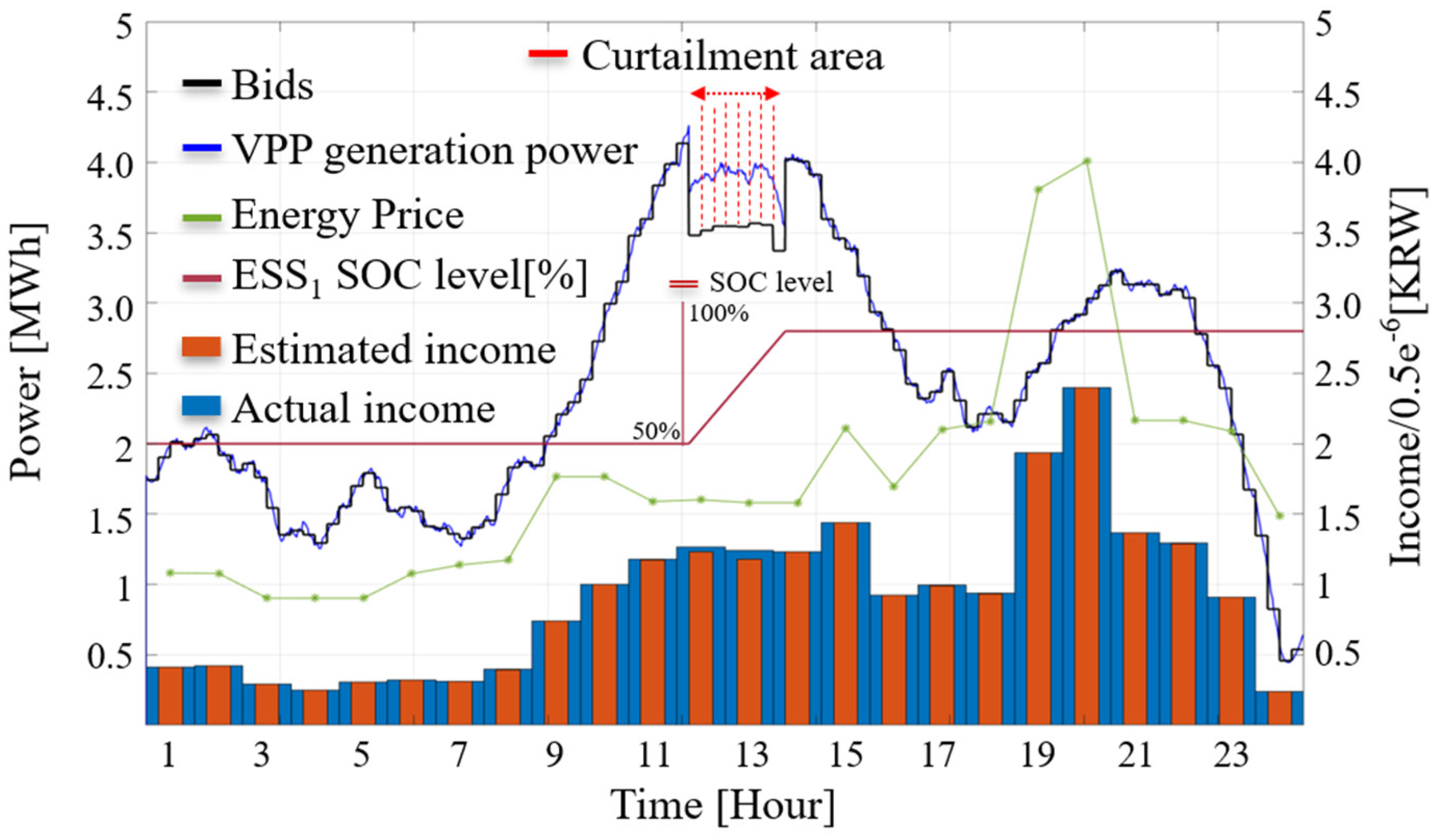

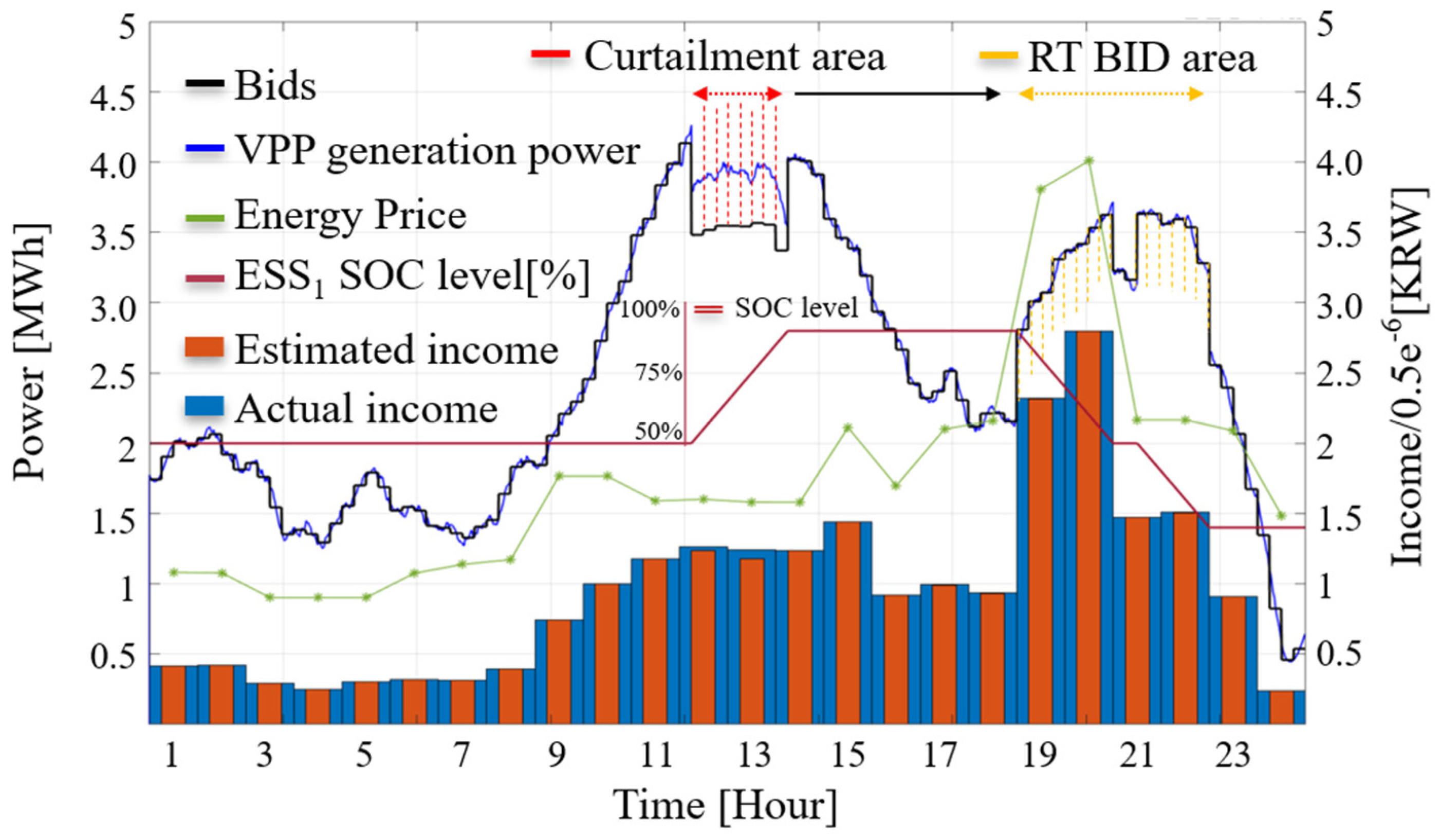

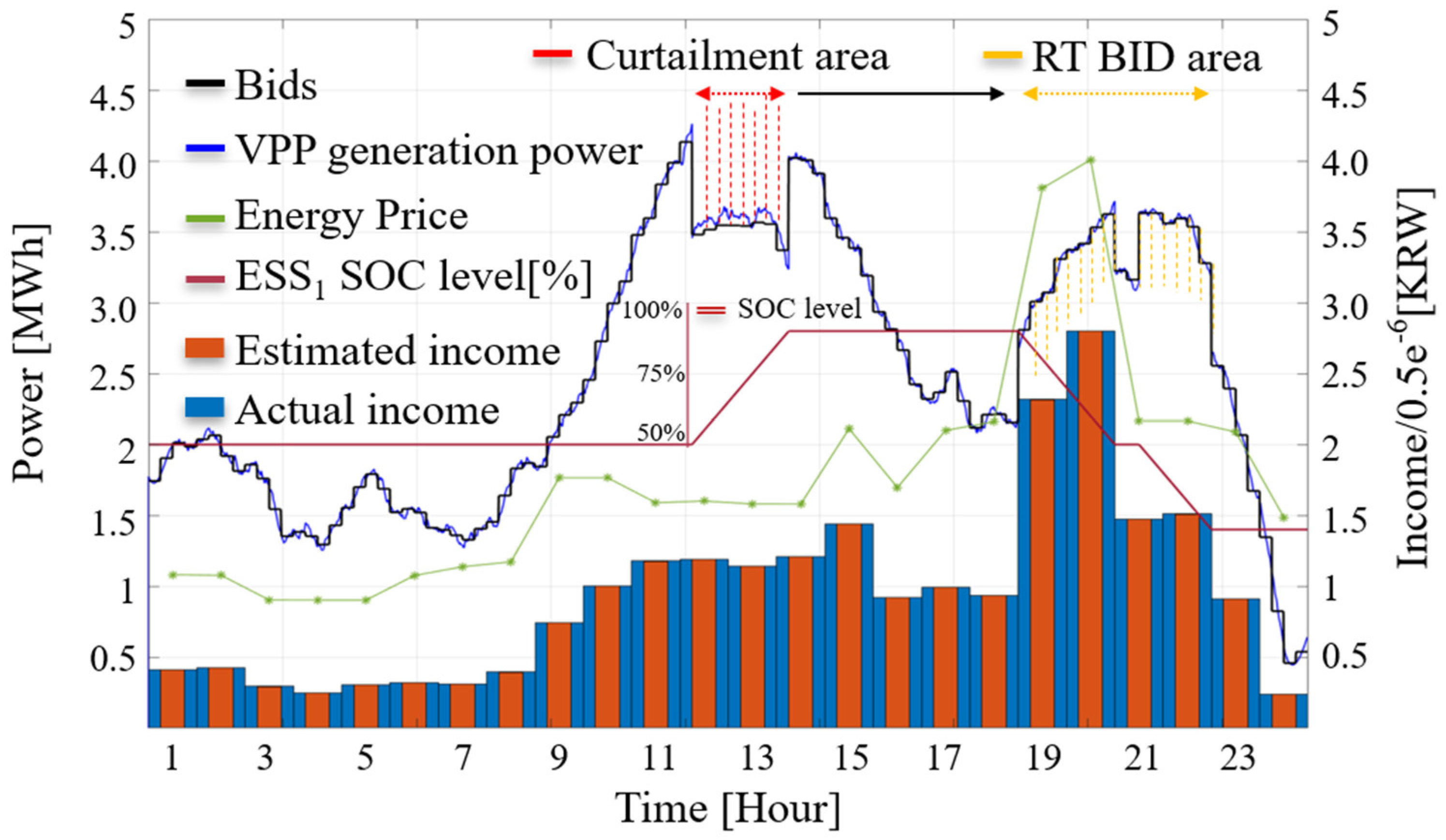

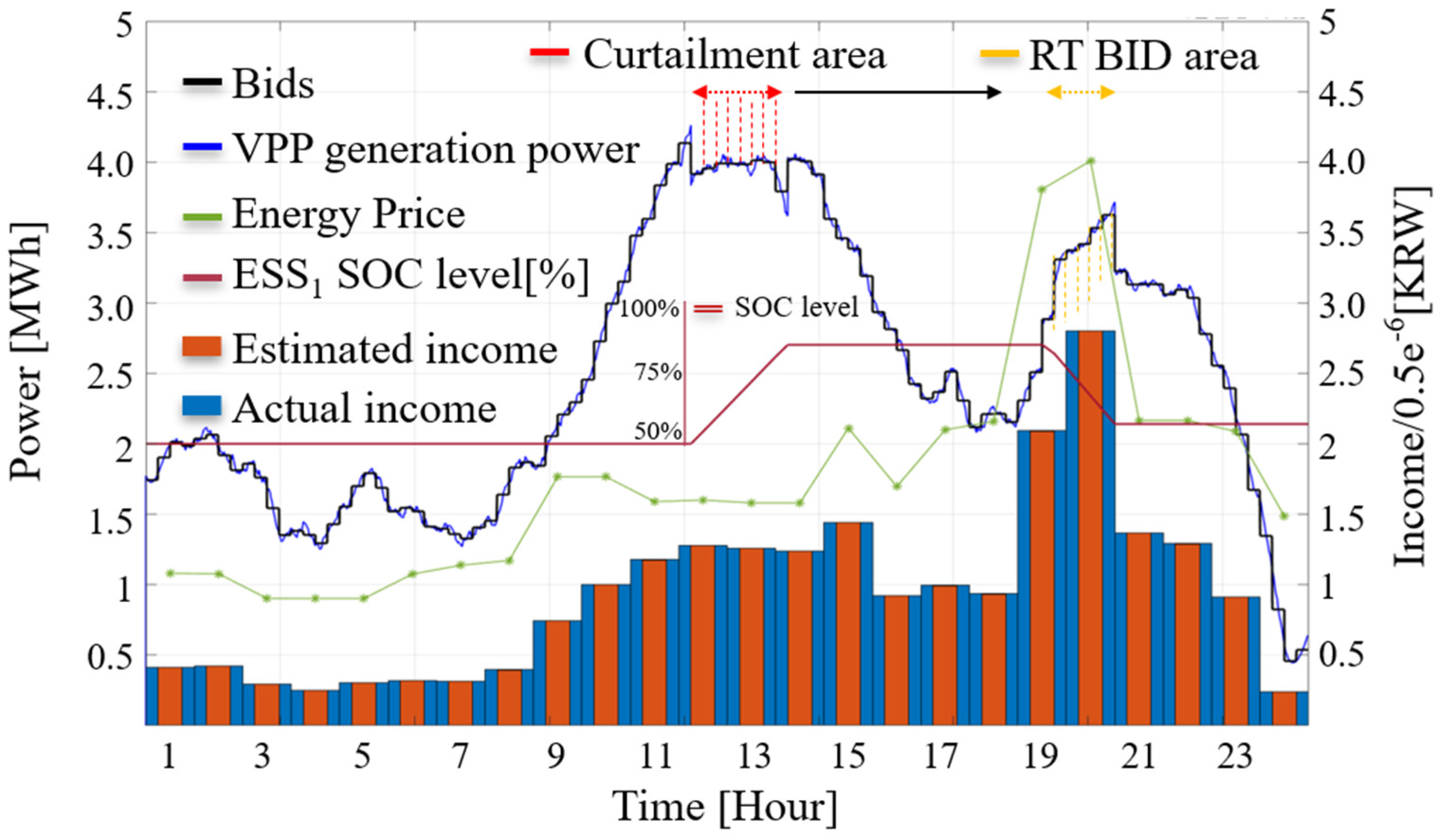

4. Simulation Analysis and Comparison

4.1. Definition of Simulation Scenarios

4.2. Simulation Results

5. Conclusions

- (1)

- The proposed Dual-MILP algorithm schedules ESS generation every 15 min, considering curtailment areas and generation errors. Additionally, it performs real-time supplementary bidding for the area that can achieve optimal profit in the next time slot.

- (2)

- Through this, the VPP configuration using PV, WT systems, and ESS demonstrated higher profitability in the complex energy market structure compared to standalone systems, thereby confirming the economic attractiveness of this VPP setup.

- (3)

- Additionally, it was demonstrated that a VPP based on an uncertain renewable energy resource can be characterized and quantified to provide flexibility and ancillary services. This interaction can assist grid system operators in managing and planning the transmission system.

- (4)

- The proposed strategy was formulated as a MILP model and simulated on a multi-energy system, demonstrating the effectiveness and applicability of the model.

- (5)

- In scenarios involving more dynamic markets within larger systems, computational efficiency becomes critical. To address this, it can be advantageous to use commercial solvers such as Gurobi, CPLEX, or CBC instead of the intlprog solver used here in the MATLAB (version R2020a) simulations in Section 4.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Zhao, Y.; Su, Q.; Li, B.; Zhang, Y.; Wang, X.; Zhao, H.; Guo, S. Have those countries declaring “zero carbon” or “carbon neutral” climate goals achieved carbon emissions-economic growth decoupling? J. Clean. Prod. 2022, 363, 132450. [Google Scholar] [CrossRef]

- Shabani, M.J.; Moghaddas-Tafreshi, S.M. Fully-decentralized coordination for simultaneous hydrogen, power, and heat interaction in a multi-carrier-energy system considering private ownership. Electr. Power Syst. Res. 2020, 180, 106099. [Google Scholar] [CrossRef]

- Breyer, C.; Khalili, S.; Bogdanov, D.; Ram, M.; Oyewo, A.S.; Aghahosseini, A.; Sovacool, B.K. On the history and future of 100% renewable energy systems research. IEEE Access 2022, 10, 78176–78218. [Google Scholar] [CrossRef]

- Shafiekhani, M.; Ahmadi, A.; Homaee, O.; Shafie-khah, M.; Catalão, J.P. Optimal bidding strategy of a renewable-based virtual power plant including wind and solar units and dispatchable loads. Energy 2022, 239, 122379. [Google Scholar] [CrossRef]

- Ela, E.; Diakov, V.; Ibanez, E.; Heaney, M. Impacts of variability and uncertainty in solar photovoltaic generation at multiple timescales. In Technical Report NREL; National Renewable Energy Lab.(NREL): Golden, CO, USA, 2013. [Google Scholar]

- Zhou, Y.; Wei, Z.; Sun, G.; Cheung, K.W.; Zang, H.; Chen, S. A robust optimization approach for integrated community energy system in energy and ancillary service markets. Energy 2018, 148, 1–15. [Google Scholar] [CrossRef]

- Vicente-Pastor, A.; Nieto-Martin, J.; Bunn, D.W.; Laur, A. Evaluation of flexibility markets for retailer–DSO–TSO coordination. IEEE Trans. Power Syst. 2018, 34, 2003–2012. [Google Scholar] [CrossRef]

- de Cerio Mendaza, I.D.; Szczesny, I.G.; Pillai, J.R.; Bak-Jensen, B. Demand response control in low voltage grids for technical and commercial aggregation services. IEEE Trans. Smart Grid 2015, 7, 2771–2780. [Google Scholar] [CrossRef]

- Nasiri, N.; Zeynali, S.; Ravadanegh, S.N.; Marzband, M. A hybrid robust-stochastic approach for strategic scheduling of a multi-energy system as a price-maker player in day-ahead wholesale market. Energy 2021, 235, 121398. [Google Scholar] [CrossRef]

- Amissah, J.; Abdel-Rahim, O.; Mansour, D.E.A.; Bajaj, M.; Zaitsev, I.; Abdelkader, S. Developing a three stage coordinated approach to enhance efficiency and reliability of virtual power plants. Sci. Rep. 2024, 14, 13105. [Google Scholar] [CrossRef]

- Li, S.; Huo, X.; Zhang, X.; Li, G.; Kong, X.; Zhang, S. A Multi-Agent Optimal Bidding Strategy in Multi-Operator VPPs Based on SGHSA. Int. Trans. Electr. Energy Syst. 2022, 1, 7584424. [Google Scholar] [CrossRef]

- Husin, H.; Zaki, M. A critical review of the integration of renewable energy sources with various technologies. Prot. Control Mod. Power Syst. 2021, 6, 1–18. [Google Scholar]

- Joos, M.; Staffell, I. Short-term integration costs of variable renewable energy: Wind curtailment and balancing in Britain and Germany. Renew. Sustain. Energy Rev. 2018, 86, 45–65. [Google Scholar] [CrossRef]

- Kane, L.; Ault, G. A review and analysis of renewable energy curtailment schemes and Principles of Access: Transitioning towards business as usual. Energy Policy 2014, 72, 67–77. [Google Scholar] [CrossRef]

- Bird, L.; Cochran, J.; Wang, X. Wind and solar energy curtailment: Experience and practices in the United States (No. NREL/TP-6A20-60983). In Technical Report NREL; National Renewable Energy Lab.(NREL): Golden, CO, USA, 2014. [Google Scholar]

- Park, S.Y.; Park, S.W.; Son, S.Y. Optimal VPP Operation Considering Network Constraint Uncertainty of DSO. IEEE Access 2023, 11, 8523–8530. [Google Scholar] [CrossRef]

- Ghanuni, A.; Sharifi, R.; Farahani, H.F. A risk-based multi-objective energy scheduling and bidding strategy for a technical virtual power plant. Electr. Power Syst. Res. 2023, 220, 109344. [Google Scholar] [CrossRef]

- Meng, Y.; Qiu, J.; Zhang, C.; Lei, G.; Zhu, J. A Holistic P2P market for active and reactive energy trading in VPPs considering both financial benefits and network constraints. Appl. Energy 2024, 356, 122396. [Google Scholar] [CrossRef]

- Maeyaert, L.; Vandevelde, L.; Döring, T. Battery storage for ancillary services in smart distribution grids. J. Energy Storage 2020, 30, 101524. [Google Scholar] [CrossRef]

- Sasidharan, N.; Singh, J.G.; Ongsakul, W. Real time active power ancillary service using DC community grid with electric vehicles and demand response. Procedia Technol. 2015, 21, 41–48. [Google Scholar] [CrossRef]

- Lin, W.T.; Chen, G.; Li, C. Risk-averse energy trading among peer-to-peer based virtual power plants: A stochastic game approach. Int. J. Electr. Power Energy Syst. 2021, 132, 107145. [Google Scholar] [CrossRef]

- Li, X.; Li, C.; Liu, X.; Chen, G.; Dong, Z.Y. Two-stage community energy trading under end-edge-cloud orchestration. IEEE Internet Things J. 2022, 10, 1961–1972. [Google Scholar] [CrossRef]

- Seven, S.; Yao, G.; Soran, A.; Onen, A.; Muyeen, S.M. Peer-to-peer energy trading in virtual power plant based on blockchain smart contracts. IEEE Access 2020, 8, 175713–175726. [Google Scholar] [CrossRef]

- Aguilar, J.; Bordons, C.; Arce, A.; Galán, R. Intent profile strategy for virtual power plant participation in simultaneous energy markets with dynamic storage management. IEEE Access 2022, 10, 22599–22609. [Google Scholar] [CrossRef]

- Jiang, Y.; Ren, Z.; Li, W. Committed carbon emission operation region for integrated energy systems: Concepts and analyses. IEEE Trans. Sustain. Energy 2023, 15, 1194–1209. [Google Scholar] [CrossRef]

- Li, Z.; Wu, L.; Xu, Y.; Wang, L.; Yang, N. Distributed tri-layer risk-averse stochastic game approach for energy trading among multi-energy microgrids. Appl. Energy 2023, 331, 120282. [Google Scholar] [CrossRef]

- Zhang, R.; Chen, Y.; Li, Z.; Jiang, T.; Li, X. Two-stage robust operation of electricity-gas-heat integrated multi-energy microgrids considering heterogeneous uncertainties. Appl. Energy 2024, 371, 123690. [Google Scholar] [CrossRef]

- Zhang, Z.; Zhao, Y.; Bo, W.; Wang, D.; Zhang, D.; Shi, J. Optimal Scheduling of Virtual Power Plant Considering Revenue Risk with High-Proportion Renewable Energy Penetration. Electronics 2023, 12, 4387. [Google Scholar] [CrossRef]

- Ghasemi-Olanlari, F.; Moradi-Sepahvand, M.; Amraee, T. Two-stage risk-constrained stochastic optimal bidding strategy of virtual power plant considering distributed generation outage. IET Gener. Transm. Distrib. 2023, 17, 1884–1901. [Google Scholar] [CrossRef]

- Wu, Q.; Li, C.; Bai, J. Optimal bidding strategy for multi-energy virtual power plant participating in coupled energy, frequency regulation and carbon trading markets. Int. J. Hydrogen Energy 2024, 73, 430–442. [Google Scholar]

- Yang, C.; Du, X.; Xu, D.; Tang, J.; Lin, X.; Xie, K.; Li, W. Optimal bidding strategy of renewable-based virtual power plant in the day-ahead market. Int. J. Electr. Power Energy Syst. 2023, 144, 108557. [Google Scholar] [CrossRef]

- Mei, S.; Tan, Q.; Liu, Y.; Trivedi, A.; Srinivasan, D. Optimal bidding strategy for virtual power plant participating in combined electricity and ancillary services market considering dynamic demand response price and integrated consumption satisfaction. Energy 2023, 284, 128592. [Google Scholar] [CrossRef]

- Hosseini, S.M.; Carli, R.; Dotoli, M. Robust Optimal Demand Response of Energy-efficient Commercial Buildings. In Proceedings of the 2022 European Control Conference (ECC), London, UK, 12–15 July 2022; pp. 1–6. [Google Scholar]

- Dang, J. SoC Feedback Control for Wind and ESS Hybrid Power System Frequency Regulation. IEEE J. Emerg. Sel. Top. Power Electron. 2013, 2, 79–86. [Google Scholar] [CrossRef]

- Bolzoni, A.; Parisio, A.; Todd, R.; Forsyth, A.J. Optimal virtual power plant management for multiple grid support services. IEEE Trans. Energy Convers. 2020, 36, 1479–1490. [Google Scholar] [CrossRef]

- Jiang, Y.; Dong, J.; Huang, H. Optimal bidding strategy for the price-maker virtual power plant in the day-ahead market based on multi-agent twin delayed deep deterministic policy gradient algorithm. Energy 2024, 306, 132388. [Google Scholar] [CrossRef]

| Scenario | Curtailment | Curtailment Quantity | Time | Real-Time Additional Bidding |

|---|---|---|---|---|

| Scenario 1 | 11:30~13:30 | |||

| Scenario 2 | 11:30~13:30 | |||

| Scenario 3 | 11:30~13:30 |

| Case | Penalty (A) | Curtailment Area Actual Income (B) | (A/B) % | Real-Time Additional Bidding Income (C) | (C/B) % |

|---|---|---|---|---|---|

| Case 1 | 187,750 | 1,204,850 | 15.5% | 0 | 0% |

| Case 2 | 46,969 | 1,206,531 | 3% | 0 | 0% |

| Case 3 | 46,969 | 1,206,531 | 3% | 554,949 | 45% |

| Case 4 | 0 | 1,165,000 | 0% | 554,949 | 47% |

| Case 5 | 0 | 1,269,700 | 0% | 277,785 | 21% |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yoon, S.-J.; Ryu, K.-S.; Kim, C.; Nam, Y.-H.; Kim, D.-J.; Kim, B. Optimal Bidding Scheduling of Virtual Power Plants Using a Dual-MILP (Mixed-Integer Linear Programming) Approach under a Real-Time Energy Market. Energies 2024, 17, 3773. https://doi.org/10.3390/en17153773

Yoon S-J, Ryu K-S, Kim C, Nam Y-H, Kim D-J, Kim B. Optimal Bidding Scheduling of Virtual Power Plants Using a Dual-MILP (Mixed-Integer Linear Programming) Approach under a Real-Time Energy Market. Energies. 2024; 17(15):3773. https://doi.org/10.3390/en17153773

Chicago/Turabian StyleYoon, Seung-Jin, Kyung-Sang Ryu, Chansoo Kim, Yang-Hyun Nam, Dae-Jin Kim, and Byungki Kim. 2024. "Optimal Bidding Scheduling of Virtual Power Plants Using a Dual-MILP (Mixed-Integer Linear Programming) Approach under a Real-Time Energy Market" Energies 17, no. 15: 3773. https://doi.org/10.3390/en17153773

APA StyleYoon, S.-J., Ryu, K.-S., Kim, C., Nam, Y.-H., Kim, D.-J., & Kim, B. (2024). Optimal Bidding Scheduling of Virtual Power Plants Using a Dual-MILP (Mixed-Integer Linear Programming) Approach under a Real-Time Energy Market. Energies, 17(15), 3773. https://doi.org/10.3390/en17153773