Abstract

This research paper presents a comprehensive study on the implementation of photovoltaic (PV) energy systems at Al-Abrar Mosque in Saudi Arabia. The primary objective was to explore optimal regional solar power strategies. By synergistically integrating technical evaluations of the PV system with economic analyses, including the payback period and levelized cost of energy (LCOE), alongside an investigation of net metering and net billing scenarios, we delineated a pathway toward achieving net zero billing for the mosque’s energy requirements. This study examined two scenarios: Scenario I involved net metering, while Scenario II explored net billing. Our theoretical and simulation results, derived from detailed analyses conducted using PVsyst software, unequivocally demonstrated the superiority of net metering for this specific application. With net metering, the mosque’s energy needs can be efficiently met using minimal infrastructure—comprising only 34 photovoltaic modules and a single inverter. In contrast, net billing requires significantly higher resource demands, underscoring the economic and spatial advantages of net metering. Additionally, the payback period for Scenario I is 7.9 years, while for Scenario II, it extends to 87 years. Through rigorous simulations, this study reaffirmed the practicality and feasibility of the net metering approach within the context of Saudi Arabia. Furthermore, our research provides actionable insights for implementing sustainable solutions at specific sites, such as the Al-Abrar Mosque, and contributes to advancing renewable energy knowledge in the region.

1. Introduction

In the mid-1980s, the annual consumption of coal was around 10 billion metric tons. This figure is projected to soar to 55 billion metric tons by 2025, indicating a significant increase in fossil fuel use. This rapid consumption is likely to exhaust finite resources and exacerbate climate change and global warming. Therefore, efficient utilization of fossil fuels and the development of clean energy sources are crucial to achieving economic progress without causing severe environmental impacts. Solar energy is a promising alternative; the global photovoltaic (PV) industry has been expanding at an average compound annual growth rate of over 35% over the last decade. By the end of 2021, the worldwide PV capacity was estimated at 714 GW5 [1].

According to the International Energy Agency, in 2021, global carbon dioxide emissions from fossil fuel combustion and industrial activities rose by about 2.1 gigatons compared to 2020 levels [2]. Fossil fuels remain the dominant energy source, accounting for about 80% of global energy production [2]. Transportation contributes significantly, responsible for 24% of direct carbon dioxide emissions. Additional emissions come from the use of thermal energy in the building and industrial sectors [3]. A critical strategy to reduce carbon dioxide emissions and support the transition to a decarbonized energy system is to increase reliance on renewable energy sources.

Energy plays a pivotal role in a country’s economic and socio-economic development, providing a key resource for growth and productivity. Access to electricity is linked to economic opportunities and increased productivity. Consequently, ensuring the availability of sufficient, environmentally friendly, and affordable electricity is vital for sustainable development. Currently, about 14% of the world’s population, approximately 1.06 billion people, lack access to electricity [4].

In Saudi Arabia, electricity consumption has surged over the past decade, with an annual growth rate between 7% and 8%. During the summer, peak electricity demand rose dramatically, nearly doubling (a 93% increase) from 2004 to 2013, reaching a peak of 54 GW. This upward trend continued with an annual growth rate exceeding 6% from 2013 to 2020. To meet this increasing demand, the King Abdullah Center for Atomic and Renewable Energy plans to boost capacity to 120 GW by 2032 [5].

The growing electricity demand in Saudi Arabia is largely driven by the country’s varied climate regions, leading to high cooling and heating needs. Cooling accounts for 40% to 71% of energy consumption in villas across these regions, emphasizing the urgency for developing effective energy efficiency measures.

Saudi Arabian buildings face substantial challenges, particularly the predominant use of air conditioning (AC) units, which are responsible for up to 70% of electricity usage in residential buildings. Additionally, inadequate insulation in building envelopes, with up to 70% of residential buildings lacking proper thermal insulation, exacerbates energy inefficiency [6]. A government survey revealed that around 60% of summer electricity consumption is attributed to AC systems. The Saudi Ministry of Water and Electricity reported a 35% increase in electricity consumption over the past two decades, primarily due to extensive air conditioning use in the summer. This necessitates urgent measures to rectify energy consumption patterns in residential buildings and transition toward more energy-efficient construction.

Energy demand in Saudi Arabia is distributed across residential, commercial, and government sectors, with residential electricity consumption constituting about 49% of the total annual usage. Industry consumes approximately 19%, followed by the commercial and government sectors with 16% and 11%, respectively [7]. Various studies conducted by the King Abdullah Petroleum Studies and Research Center (KAPSARC) affirm that residential buildings contribute to roughly 50% of the total electricity consumption in the country [5,8,9]. The annual average growth rate in total electricity consumption is estimated to range between 5% and 8%, indicating a trajectory where oil production and consumption may reach equilibrium by 2035 [6].

Saudi Arabia meets its energy demands primarily through conventional crude oil, heavy crude oil, and gas extraction. The country’s electricity consumption exceeds one-third of its daily oil production, amounting to 11.04 million barrels per day in 2020, marking a decrease from 11.83 million barrels per day in the previous year [10]. The rapid economic growth, population surge, and urban development fueled by crude oil earnings have led to a heightened demand for electricity. A 2016 report on Saudi Arabia’s power market revealed that 40% of electricity was sourced from oil, 50% from natural gas, and the remaining fraction from renewable energy sources [11,12].

Introducing photovoltaic (PV) technology presents a promising avenue for sustainable development and reduced dependence on fossil fuels in the Middle East. Despite its potential benefits, the widespread adoption of PV systems faces challenges [13,14], including substantial initial investment, discouraging building owners and developers. Dust storms and elevated airborne particles in the Middle East result in dust accumulation on PV modules, affecting energy production and increasing maintenance costs [15,16,17]. Additionally, harsh weather conditions and high ambient temperatures in the region have detrimental effects on PV system efficiency [18,19,20,21]. Factors such as sandstorms and dust buildup contribute to abrasion and premature degradation of PV modules [22,23]. The scarcity of skilled labor and the absence of robust regulatory frameworks are barriers to developing and adopting PV technology across many Middle Eastern countries in the building sector [24].

Addressing these challenges requires focused efforts on implementing government incentives and subsidies, promoting local manufacturing of PV components, investing in research and development for enhanced PV efficiency under extreme conditions, and reinforcing policies supporting the integration of PV systems into buildings.

In pursuing cleaner and more sustainable energy sources, many countries, including Saudi Arabia, are investing in renewable energy. Solar energy, wind power, hydropower, and biomass are recognized as abundant and environmentally friendly forms of energy within the spectrum of renewable energy sources (RESs) [25]. Solar photovoltaic (PV) technology stands out as one of the most promising RESs, with global installed capacity exceeding 303 GW by the end of 2016 [26].

Solar PV technology, harnessing solar energy through directly converting sunlight into electricity, finds diverse applications. Buildings, in particular, have become a successful context for their implementation [27,28,29]. Solar PV panels can be integrated into buildings through various methods, including installation on roofs, walls, floors, or window coatings. Although rooftop installations constitute the predominant mode of PV generation in buildings, the technology’s versatility enables applications at various scales, from small-scale installations of a few watts to large-scale projects generating hundreds of megawatts.

This paper conducted a detailed analysis of solar photovoltaic (PV) systems, specifically focusing on the techno-economic assessment of integrating such a system into the Al-Abrar Mosque. The analysis encompassed both financial considerations and technical performance evaluations. Islam, boasting approximately 1.6 billion followers globally and prevailing in nearly 50 countries [30], places mosques at the center of daily prayers, weekly sermons, and various religious and social activities. With an estimated 3.5 million mosques globally, accommodating diverse worshippers [31], governments recognize the imperative to address energy concerns within these structures, prompting dedicated research from various perspectives.

Despite life cycle analyses aiming to enhance energy efficiency through renewable measures, such as the ‘Smart Mosque’ concept by Deloitte, studies on the economic aspects of solar PV on mosque rooftops remain limited. Despite the advantageous roof space offered by mosques for solar PV installations, financial evaluations are scarce, with exceptions like a 2014 study in Kuwait [29] and a specific mosque study in Malaysia showcasing a 47% reduction in energy bills through PV system installation [32].

Recent developments underscore the growing financial viability of solar PV systems in mosques, driven by decreasing capital costs. This trend is particularly evident in countries with high energy prices, like Jordan, which is planning to integrate solar PV systems into numerous mosques [33,34]. Similarly, Saudi Arabia, with its extreme climate and a significant number of mosques, is contemplating widespread solar PV system deployment. However, distinctive features, including substantial air conditioning needs and regulatory changes, require a specialized evaluation of the financial feasibility of installing solar PV systems on mosque rooftops in the Saudi Arabian context [35].

In pursuing this evaluation, this paper presents a comprehensive techno-economic analysis centered on installing a solar PV system on the rooftop of the Al-Abrar Mosque in the Governorate of Unaizah, located in the Al Qassim Province, Saudi Arabia. The study aimed to assess the financial implications and broader policy considerations arising from deploying PV systems on mosque rooftops. Serving as a foundational component, the study offers valuable insights for policymakers, aiding in determining the justifiability of a nationwide PV deployment program on mosques in the kingdom and beyond. Notably, the study distinguishes itself by rigorously validating theoretical modeling and technical assumptions by examining an operational physical system.

Furthermore, the investigation incorporated the modeling of policy impact, specifically the implementation of a net-metering mechanism, on the project’s financial viability. The results indicated that net metering has a more pronounced positive effect on the economic health of the mosque compared to its application in the residential sector, owing to distinct load profiles. The significance of these findings is underscored by the utilization of a rich data set spanning two years.

Subsequent sections will outline the literature review. Section 3 presents the materials and methods employed in this case study, providing insights into the data collection and analysis methodology. Following this, Section 4 scrutinizes the measured performance outcomes and evaluates the impact of input variability on both technical and economic indicators within the contexts of net metering and net billing scenarios. Section 5 undertakes a comparative analysis between Scenario I and II, shedding light on the contrasting outcomes and implications. Section 6 summarizes the key findings and implications of the investigation, offering valuable insights into the techno-economic feasibility of implementing a rooftop solar PV system at Al-Abrar Mosque.

2. Literature Review

The scholarly exploration surrounding masjids and mosques unveiled a multifaceted narrative that underscores the pivotal role of these sacred spaces in fostering thermal comfort, advancing energy conservation, and exploring the feasibility of renewable energy sources to construct sustainable environments. Spanning across national borders, a thorough literature review revealed a wealth of global studies focusing on Turkey and the Kingdom of Saudi Arabia. These studies delved into various facets, ranging from the economic viability of integrating innovative technologies to examining architectural and operational strategies to enhance energy efficiency.

The research conducted by Ali and colleagues was centered on establishing a framework for designing energy systems in rural areas. It delved into the techno-economic viability of various hybrid energy systems (HES) for a village located in the Dera Ismail Khan district of Pakistan. The investigative process included an initial resource evaluation, followed by system optimization and economic viability analysis through the application of HOMER PRO software (version 3.14.2), aimed at addressing the village’s highest electricity demands. The scarcity of wind and biomass resources at the site led to the recommendation of a HES configuration that primarily relied on solar photovoltaic (PV) panels, with battery storage, a diesel generator for backup, and intermittent access to the national power grid. Sensitivity assessments incorporating macroeconomic factors and the PV panels’ derating factor affirmed the system’s robustness and potential for commercial success. The findings revealed that systems integrated with the grid were more cost-effective, with levelized costs of electricity (LCOE) at $0.072/kWh and $0.078/kWh, which was more favorable than the LCOE for isolated systems, priced at $0.145/kWh and $0.167/kWh. Notably, the LCOE for the grid-connected configurations was also competitive against the current government tariffs, underscoring their economic advantage and their capability to deliver uninterrupted electricity around the clock [36].

In related research, Ali and a team explored the preferences for energy sources used in cooking and lighting within rural Pakistani communities, aligning with the United Nations’ Sustainable Development Goals that emphasize clean energy. This study leveraged an extensive dataset gathered from three Pakistani districts over the course of 2020 and 2021, utilizing multivariate probit (MVP) models and Chi-square tests to discern the determinants of energy selection. The Chi-square test outcomes indicated that variables such as the age and education of the household head, the household’s size and income, the proximity to markets and wood sources, as well as the ownership of biogas systems, had a significant influence on choices related to cooking. Moreover, the MVP analysis suggested that factors like the level of education, the presence of school-going children, access to credit, and the involvement of women are influential in increasing the propensity to adopt clean energy solutions [37].

In Turkey, notable research endeavors, including those by Atmaca and Gedik [38,39], have meticulously scrutinized energy consumption in mosques, employing rigorous measurements and surveys to assess thermal comfort levels. Their findings shed light on the intricate dynamics of energy utilization, revealing an annual energy use intensity (EUI) of 93.4 kWh/m2, with a well-balanced distribution between air conditioning (AC) and lighting systems. Similarly, scholars like Habeebullah [40] in Saudi Arabia have explored the economic feasibility of integrating ice thermal storage into the Grand Holy Mosque in Makkah, navigating the complexities of optimizing energy savings against the prevailing subsidized electricity rates.

Khalid Mohamed et al. examined the operational performance of photovoltaic (PV) systems in the Maldives, focusing on a 6.6 kWp rooftop system at STECO’s bus station in K. Male’. Using International Electrotechnical Commission IEC 61724 standards [41] and PVsyst software (version 7.4.2), they compared actual 2022 data with simulations. Key metrics—performance ratio, capacity utilization factor, and system efficiency—showed lower operational figures compared to simulations. The economic analysis revealed a 4.3-year payback period with an 11% discount rate. Their study provided valuable insights into the feasibility and effectiveness of rooftop PV in the Maldives, paving the way for future solar energy projects in similar regions [42].

According to Kwame Asante et al., Ghanaian schools face increasing electricity debt due to high energy costs, leading to frequent disconnections by utility companies. A study at the University of Environment and Sustainable Development (UESD) explored rooftop solar PV systems as a solution, using Google Earth (version 7.3.4) to evaluate rooftop potential for energy generation. The economic analysis found positive outcomes for the project, with a net present value (NPV) of 15.15 million Ghana Cedi (GHS), an internal rate of return (IRR) of 21%, a discounted payback period (DPP) of 8 years, and a profitability index (PI) of 1.6. These findings suggest that rooftop solar can reduce schools’ electricity costs, create revenue from excess energy, and contribute to a sustainable energy transition [43].

Bourhan Tashtoush et al.’s research focused on creating an eco-friendly energy system for residential buildings by optimizing both on-grid and off-grid photovoltaic (PV) setups. Their study centered on a 10-apartment building with a total floor area of 1500 m2, utilizing rooftop PV panels to reduce carbon emissions. They used BEopt software (version 3.0.1) to model energy consumption and PVsyst to simulate the system’s behavior, aiming to find a cost-effective solution. The optimal setup included a 15.5 kWh Li-Ion battery, a 3.7 kW inverter, and eight 555 W modules, which could cover over 95% of the building’s energy needs with a 5.7-year payback period. This approach could significantly cut carbon emissions if widely adopted in Jordan, reducing CO2 by about 5.33 million metric tons [44].

The literature review also delved into the innovative endeavors of researchers such as Al-Tamimi et al. [45], who implemented transparent glass to delineate zones within mosque halls in Najran, Saudi Arabia. This strategic intervention resulted in a significant 63.4% reduction in annual energy consumption, showcasing promising avenues for energy-saving initiatives in mosque architecture. Furthermore, contributions from studies by Azmi and Kandar [46], Baharudin and Ismail [47], and Elshurafa et al. [48] underscored the imperative for environmentally sustainable mosque structures and explored the utilization of photovoltaic (PV) systems in mosques.

Transitioning from the broader literature review to the specific context of this paper, our focus converged on Al-Abrar Mosque in the Governorate of Unaizah, situated in the Al Qassim Province, Saudi Arabia. Against a backdrop of extensive global and regional studies, this research endeavors to present a comprehensive techno-economic analysis elucidating the installation of a rooftop solar photovoltaic (PV) system at the Al-Abrar Mosque. This study evaluated the financial implications and broader policy considerations arising from deploying PV systems on mosque rooftops, accounting for mosques’ distinctive features and energy needs within the Saudi Arabian context. Moving forward, subsequent sections delve into the specific methodologies employed, data analyses conducted, and results obtained from the study on Al-Abrar Mosque. By meticulously scrutinizing the operational and financial aspects, this research aimed to contribute to the evolving landscape of mosque sustainability while serving as a foundational resource for informing policymakers and stakeholders about the viability of a nationwide PV deployment program on mosques in the kingdom and beyond. The comparative Table 1 presented below outlines the key authors identified in this literature review and their respective focuses, setting the stage for a deeper exploration of the intricacies surrounding mosque energy consumption and sustainability.

Table 1.

A Literature Review of Energy Efficiency and Sustainability Initiatives in Mosque Infrastructure.

Extensive exploration into masjids and mosques, as evidenced by the studies mentioned, signifies a collective endeavor to enhance our comprehension of energy consumption patterns and sustainability considerations within these sacred structures. This broad inquiry transcends geographical boundaries, focusing on regions like Turkey and the Kingdom of Saudi Arabia. The studies encompass a spectrum of topics, including the assessment of thermal comfort levels, the economic feasibility of innovative technologies, and the integration of renewable energy systems. As we transition to a more focused analysis in this paper, the subsequent sections delve into the financial implications of deploying a solar photovoltaic (PV) system on the rooftop of Al-Abrar Mosque in the Governorate of Unaizah, Saudi Arabia. Specifically, we examined the mosque’s engagement with net metering and billing mechanisms. The aim was to comprehensively understand the financial feasibility and broader policy considerations associated with PV deployment on mosque rooftops, contributing valuable insights for policymakers and stakeholders. The following section outlines the specifics of our study on Al-Abrar Mosque, emphasizing the intricate interplay between net metering, net billing, and the financial viability of sustainable energy solutions for religious structures in the Saudi Arabian context.

In this study, we have utilized the powerful PVsyst program to model the operation of a 19.38 KWp Rooftop Solar PV System at Al-Abrar Mosque, Saudi Arabia. PVsyst is renowned for its capability to simulate PV systems under varying conditions, encompassing solar irradiance and system configuration. The software facilitates accurate predictions of energy generation, performance ratios, and financial metrics, rendering it an invaluable tool in the feasibility assessment of solar projects. However, a collective and detailed analysis, including losses, economic aspects, cost-effectiveness with a simple payback period, and carbon balance, has not been previously conducted in the mentioned research and studies. This study developed the solar power plant layout after assessing the project site’s solar resource potential and conducted a study to determine the optimal approach between net metering and net billing to achieve net zero billing for this project. Key aspects to consider include panel orientation analysis. With the aid of the PVsyst program, we aimed to simulate the energy generation profile and the techno-economics feasibility of a 19.38 KWp rooftop solar PV System at Al-Abrar Mosque, Saudi Arabia. The realistic definition of technical, economic, and financial parameters allows the user to obtain results related to the economic feasibility through the most widespread economic criteria (net present value, internal rate of return (IRR), and payback), and evaluate its funding feasibility. Additionally, this procedure enables the assessment of the cost competitiveness of PV installations based on the levelized cost of electricity.

3. Materials and Methods

3.1. Location and Meteorological Data

Our investigation’s decision to focus on the Al-Abrar Mosque is grounded in several critical factors. Firstly, the selection of Unaizah, the locale where the mosque is situated, is justified by its favorable meteorological conditions. Unaizah falls within climate zone 1, characterized by a dry, hot climate, and benefits from abundant sunshine hours throughout the year. These conditions make Unaizah an ideal location for deploying photovoltaic (PV) systems.

Additionally, the choice of Al-Abrar Mosque for this study is influenced by personal proximity, as the author resides close to the mosque. Moreover, the researcher aimed to conduct a comprehensive study to achieve net zero metering, making Al-Abrar Mosque a fitting case for investigation. This confluence of personal proximity and research objectives further reinforced the rationale for selecting the Al-Abrar Mosque as the focal point of our investigation.

To conduct precise simulations, we integrated the precise geographic coordinates of Al-Abrar Mosque into simulation software, extracting relevant meteorological data. By concentrating on this specific mosque, our study aimed to tailor standalone PV systems to meet the mosque’s unique energy requirements, ultimately striving for net zero metering.

For our study, we accessed meteorological data from the integrated meteorological database within the PVsyst software. Unaizah’s climate aligns with climate zone 1, as defined by the Saudi Building Energy Conservation Code 602. A dry, hot climate characterizes this zone. The meteorological data collected for Unaizah revealed favorable parameters, including ambient temperatures, Global Horizontal Irradiance (GHI), and Global Tilted Irradiance (GTI)—all conducive to efficient solar energy generation. Moreover, Unaizah benefits from abundant sunshine hours year-round, further enhancing the feasibility of deploying PV systems in this area. By meticulously incorporating the precise coordinates of the Al-Abrar Mosque into PVsyst, our simulation process gained access to essential meteorological information. This integration significantly enhanced the accuracy and reliability of our simulation results, providing a comprehensive understanding of the solar energy potential at Al-Abrar Mosque.

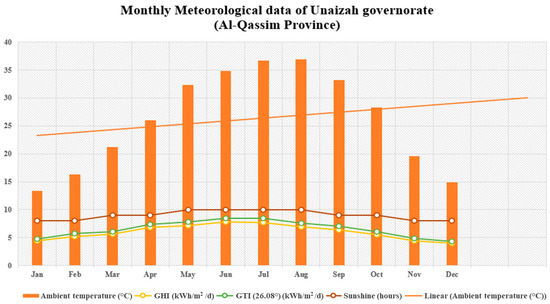

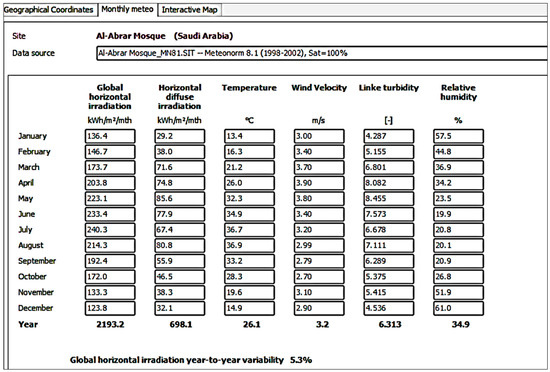

The provided data offer insights into the monthly meteorological conditions in the Unaizah governorate, depicted in Figure 1 and summarized in Table 2. Figure 1 presents a visual representation of the data in Table 2, illustrating the fluctuations in various meteorological parameters throughout the year. The monthly average meteorological data for ambient temperature, global horizontal irradiance (GHI), global tilted irradiance (GTI) at a tilt angle of 26.08°, and sunshine hours are shown in Table 2. These parameters play crucial roles in understanding the region’s solar energy potential and climatic conditions. Beginning with ambient temperature, the data reveal fluctuations throughout the year, with January exhibiting the lowest average temperature of 13.4 °C and August recording the highest at 36.9 °C. This variation reflects the seasonal changes characteristic of the region, with colder temperatures in the winter months and hotter temperatures in the summer months.

Figure 1.

Monthly meteorological data of Unaizah governorate [53].

Table 2.

Monthly Average Meteorological Data for Ambient Temperature, GHI, GTI, and Sunshine Hours at 26.34° Tilt [53].

Global horizontal irradiance (GHI) and global tilted irradiance (GTI) represent solar irradiance received at the Earth’s surface and on a tilted surface, respectively. The data indicate an increase in GHI and GTI from January to June, corresponding to the transition from winter to summer. May and June register the highest values for GHI and GTI, aligning with the peak solar intensity experienced during the summer. Subsequently, there is a gradual decrease in GHI and GTI from July to December as the region transitions from summer to winter.

Sunshine hours, representing the duration of sunlight received per day, also exhibit seasonal variations. The data show an increase in sunshine hours from winter to summer, with May, June, and July recording the highest values of 10 h per day. Conversely, there is a decrease in sunshine hours from August to December as the days become shorter during the winter months. The mean values in Table 2 offer a comprehensive summary of the meteorological conditions throughout the year. With an average ambient temperature of 26.1 °C, GHI of 6.01 kWh/m2/d, GTI of 6.55 kWh/m2/d, and sunshine hours of 9 h per day, these statistics provide valuable insights for assessing the solar energy potential and climate characteristics of Unaizah governorate.

3.2. Insightful Data Collection

The meticulous gathering of energy consumption and billing data for a substantial duration provides a robust dataset to evaluate the mosque’s energy needs precisely. These data include fluctuations in energy demand across different seasons, prayer times, and congregation sizes. Such granularity allowed us to identify specific patterns and trends that were instrumental in designing and optimizing the PV system.

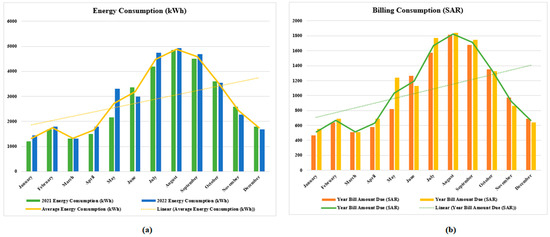

Table 3 provides a detailed breakdown of monthly energy consumption and corresponding billing amounts for 2021 and 2022, offering valuable insights into the energy usage patterns and associated costs for Al-Abrar Mosque.

Table 3.

The mean energy consumption and corresponding billing amount for Al-Abrar Mosque.

3.2.1. Monthly Energy Consumption

The monthly energy consumption exhibits notable variations, reflecting the influence of seasonal factors, prayer schedules, and congregation sizes. Notable observations include the peak energy demand in the summer months, particularly July and August, coinciding with increased cooling needs during warmer weather. It is also interesting to note the relatively stable energy consumption during March and November, possibly indicating consistent energy usage patterns (see Figure 2).

Figure 2.

(a) Energy consumption (kWh). (b) Billing consumption (SAR).

3.2.2. Monthly Billing Amounts

The billing amounts mirror the fluctuations in energy consumption, directly impacted by the pricing structure and tariff rates. Months with higher energy consumption, such as July and August, correspondingly reflect elevated billing amounts. The stable billing amounts in March and November suggest a consistent cost structure.

3.2.3. Seasonal Trends

Analyzing the combined data for the entire year unveils distinct seasonal trends. Summer months, characterized by higher temperatures, increase energy consumption for cooling purposes, leading to higher billing amounts. Conversely, energy consumption tends to decrease during cooler months, aligning with lower billing amounts. Recognizing these seasonal trends is pivotal for devising strategies to optimize energy use and reduce costs.

3.2.4. Yearly Totals and Averages

The annual totals comprehensively overview the mosque’s energy consumption and associated costs. In 2021, the total energy consumption was 32,760 kWh, resulting in a billing amount of 12,359.28 SAR. In 2022, both energy consumption and billing amounts slightly increased, totaling 34,500 kWh and 12,999.6 SAR, respectively.

3.2.5. Aligning Consumption with Billing

Our primary objective was to bridge the gap between energy consumption, as measured by the mosque’s metering system, and the corresponding energy billing. By analyzing the collected data, we aimed to understand the intricacies of the mosque’s energy usage profile and the financial implications reflected in the billing records. This alignment is pivotal for achieving a net-zero scenario where the energy generated by the PV system compensates for the energy consumed, resulting in a balanced financial outcome.

3.3. Technical Factors

- System Efficiency:

To gauge the solar system’s efficiency, we calculated system efficiency as the energy generated from PV systems divided by the solar irradiance on PV arrays under standard test conditions (STC):

- Solar Fraction:

The solar fraction, dependent on the PV system’s contribution to the site, is calculated by dividing the energy generated from PV systems by the site’s energy load:

- Capacity Factor:

The capacity factor (CF) is determined by the ratio of the annual energy output by the PV system to the energy generated by the PV, factoring in the maximum capacity and the total hours in a year:

- Performance Ratio:

The performance ratio (PR) is the ratio of the actual energy generated by a PV system to the energy produced under standard test conditions (STC) and the same global irradiation:

- System Efficiency ():

System efficiency is one of the most important values when comparing solar panels. The efficiency of the PV module () is determined using the equation:

where EAC is the AC-generated energy output. It is the in-plane solar radiation and Am is the area of the module (m2). Additionally, the inverter efficiency () is derived from the equation:

where is the inverter’s efficiency, EAC is the AC-generated energy output, and EDC is the DC-generated energy output [54].

The decision to replace the inverter every 10 years is an intriguing facet of the design assumptions. This choice adds a temporal dimension to the analysis, recognizing the dynamic nature of technology and the need for periodic upgrades to maintain optimal system performance.

3.4. Financial Factors

Moving into the financial realm, we focused on parameters vital for optimal system design:

- Net Present value (NPV):

Net present value (NPV) is a financial metric used to evaluate the profitability of an investment or project. It represents the difference between the present value of cash inflows and outflows over a specific time, discounted at a predetermined rate (usually the cost of capital or the desired rate of return). In simpler terms, NPV calculates the current value of all future cash flows generated by an investment, considering the time value of money.

Mathematically, NPV is calculated using the formula [42]:

CFt = Cash flow at time t;

r = Discount rate (the rate used to discount future cash flows);

n = Number of periods.

If the NPV is positive, it indicates that the present value of cash inflow exceeds the present value of cash outflow, meaning the investment is expected to generate returns greater than the initial investment. A negative NPV suggests that the project will likely result in a loss.

- Cost of Energy (COE):

COE reflects the price per kWh, covering all items in the electricity bill. It considers distribution costs, energy costs, environmental factors, and fuel cost variations:

- Payback Period:

The payback period signifies the time required for the solar system to recover its initial investment:

- The Levelized Cost of Energy (LCOE)

The LCOE is the unit cost of energy calculated by considering all of the costs incurred from the installation phase of the power plant to the start of production. The obtained figure gives the break-even point in the sale of energy. It is calculated according to the formula used by PVsyst to calculate LCOE [42]:

It = Investment and expenditures for the year (t);

Mt = Operational and maintenance expenditures for the year (t);

Et = Electricity production for the year (t);

r = Discount rate that could be earned in alternative investments;

n = Lifetime of the system.

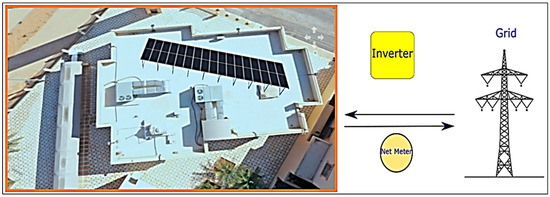

3.5. Configuration of the System

The grid-connected PV system configuration, as illustrated in Figure 3, presents a relatively straightforward setup compared to off-grid PV systems that require battery storage. This configuration consists of essential components such as PV solar panels, an inverter, a meter, wiring, and a mounting system. Any surplus electricity the system generates is seamlessly fed into the utility grid, with its flow monitored and measured by a meter. The meter at the Al-Abrar Mosque tracks electricity imported from the grid when required. This site has a flat roof with no obstructions or shading. It has a strong structure with concrete tiles that can bear the load of a photovoltaic (PV) system.

Figure 3.

Schematic diagram of a grid-connected solar PV system.

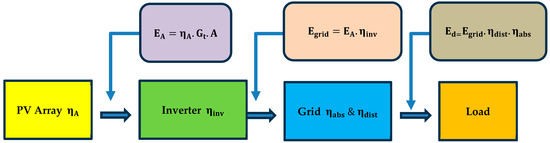

Determination of Efficiency

The energy output of a photovoltaic (PV) array is commonly defined by its efficiency, denoted as . This efficiency is integral to calculating the energy delivered by the array, represented by (see Figure 4):

Figure 4.

Flow chart of efficiency calculations.

In this equation, A signifies the area covered by the PV array, represents the average hourly solar irradiance, and is the efficiency of the PV array.

The energy incorporated into the grid is essentially the total energy generated by the PV array, accounting for losses incurred during the inversion process. This relationship is expressed as below (see Figure 4):

where is the efficiency of the inverter.

However, considering the grid’s configuration, not all of the energy made available to it is necessarily absorbed. Thus, the actual energy delivered to the grid is determined by the equation (see Figure 4):

Here, is the distribution network losses and denotes the rate of PV energy absorption by the grid.

4. Results and Discussion

This study undertook extensive simulations of net metering and net billing for Al-Abrar Mosque utilizing PVsyst software. These methodologies, situated within the domain of distributed generation (DG), present considerable promise for institutions such as Al-Abrar Mosque to adopt sustainable energy practices and attain net zero billing. Integrating photovoltaic (PV) systems is a pivotal mechanism in aligning energy consumption with billing parameters.

Net energy metering, colloquially termed net metering, facilitates DG system proprietors in exporting surplus electricity back to the utility grid, accumulating kilowatt-hour credits. These credits serve to offset electricity consumption across billing cycles. Billing is contingent upon net energy consumption, calculated by deducting the electricity generated by the DG system from the owner’s consumption. This necessitates the utilization of either a bidirectional meter or two unidirectional meters to gauge both energy production and consumption accurately.

In contrast, net billing entails real-time monitoring of a DG system owner’s electricity consumption or export activities. This framework applies the retail rate to net consumption while imposing a distinct “sell rate” for electricity generated by the DG system and exported to the grid. This sell rate may be called a feed-in tariff (FIT) in certain markets. Unlike net metering, net billing does not directly offset generation against consumption but employs distinct consumption and export rates. A comparative examination and discussion of the challenges associated with both approaches was conducted.

- Scenario I Net Metering:

This section comprehensively analyzed a prominent case study focused on grid-connected photovoltaic (PV) systems, specifically delving into Scenario I: zero energy with net metering. Integrating solar power into existing electrical grids has evolved as a pivotal avenue in pursuing sustainable energy solutions. This scenario delved into the intricate dynamics of a grid-connected PV system engineered to achieve zero-net energy consumption, employing the innovative net metering mechanism.

4.1. Theoretical Calculations for Solar Panel Sizing

The annual radiation received by Al-Abrar Mosque is a crucial parameter for assessing its solar energy potential (see Figure 5). With a measured value of 2193.2 kWh/m2/mth, these data provide a foundation for further calculations to optimize the mosque’s solar power generation.

Figure 5.

Geographical site parameters.

The successful implementation of a solar power system relies heavily on the precise sizing of the solar panels, considering factors such as average daily radiation, peak sun hours, and energy consumption. The following details the process of determining the optimal number of photovoltaic (PV) modules for Al-Abrar Mosque, emphasizing this calculation’s critical role in achieving an efficient and reliable solar installation.

Average daily radiation (ADR): The average daily radiation is calculated by dividing the total annual solar radiation by the number of days in a year:

So, Al-Abrar Mosque locations’ peak sun hours (PSH)

is 19.38 kWp (after rounding up the number of modules) (34 modules × 0.570 kWp (nominal power of PV module (kWp))):

connected in two strings of 17 modules for each string.

4.2. Optimal Module Quantity and String Configuration

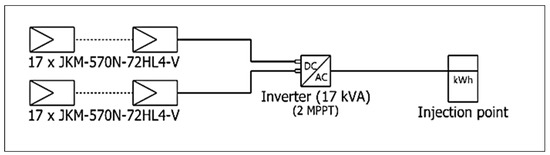

Establishing the optimal number of modules is crucial in determining the solar PV system’s efficiency at Al-Abrar Mosque. The peak power requirement (19.164 kWp) divided by the nominal power of each module (0.57 kWp) yields 33.621 modules, rounded up to 34 for practicality (see Figure 6).

Figure 6.

The topology of the connection of the PV array.

The solar modules were arranged in two arrays, each consisting of 17 modules, as illustrated in the design layout within PVsyst. This arrangement aimed to optimize the load distribution and maximize the solar energy utilization, thereby ensuring enduring energy independence. The careful configuration balances technical intricacies, practical installation requirements, and long-term performance, representing a notable advancement toward establishing a dependable solar energy solution for the mosque.

4.3. Economic Feasibility Study Parameters of Net Metering Scenario I

Embarking on the journey toward sustainable energy solutions, evaluating a solar photovoltaic (PV) project’s financial and operational aspects is pivotal for informed decision-making. The following set of calculations serves as a comprehensive toolkit, enabling a thorough analysis of the economic and energy performance associated with the solar initiative designed for Al-Abrar Mosque.

The payback period, a critical financial indicator, signifies the duration required for the initial capital cost to be recouped through total annual savings. This insight into the project’s economic feasibility aids in assessing its sustainability and financial impact over time [55]:

Simplified Levelized Cost of Energy (LCOE) Calculation [56]:

where:

O and M Cost is the operation and maintenance costs necessary to keep a facility working during its whole lifetime. Maintenance includes repairs, periodic cleaning costs, and exchanging the solar inverters every 10 years of the project’s lifetime. It is recommended that the solar panels be cleaned at least two times a month.

The levelized cost of energy (LCOE) is a crucial metric in energy economics, representing the cost per unit of electricity produced and serving as a key economic feasibility index. LCOE is a comprehensive approach that distinguishes it from other methods, incorporating the present value of future cash flows by integrating a discount rate. By considering the time value of money, LCOE offers a forward-looking perspective on the economic viability of energy projects. This facilitates comparative analyses of different energy sources and technologies, enabling stakeholders to make informed decisions. In the context of energy transition and sustainability, LCOE guides investments toward economically viable and environmentally sound pathways, playing a pivotal role in shaping the future of energy.

The formula used by PVsyst to calculate LCOE is:

It = Investment and expenditures for the year (t);

Mt = Operational and maintenance expenditures for the year (t);

Et = Electricity production for the year (t);

r = Discount rate that could be earned in alternative investments;

n = Lifetime of the system.

As per a 2024 report by solar energy expert Sarah Thompson at MOKOENERGY [57], the average total cost of a solar inverter for a medium-sized solar panel system installation ranges from $800 to $3000. The pricing of solar inverters varies based on their size and whether they are string inverters, microinverters, or string inverters with DC power optimizers. While string inverter systems typically boast lower upfront costs, installations utilizing microinverters tend to offer more durable performance. The cost of a solar inverter can significantly fluctuate depending on several factors. Here is a breakdown of the average cost range for different types of inverters:

String Inverters:

- Average cost range: $1000–$3000 for residential systems.

- Cost per watt: $0.10–$0.20 per watt.

According to SOLAIRWORLD [58], solar inverters for a medium-sized setup typically range from $1000 to $1500. However, the cost can escalate significantly with larger installations. These costs are subject to change, influenced by market conditions, installation size, and specific inverter technology. Additionally, the average cost of a solar inverter was approximately $0.28 per watt, with a price range spanning from as low as $0.10 to as high as $0.50 per watt.

4.3.1. Operating and Maintenance Cost (O and M Cost) or Yearly Cost

A comprehensive evaluation of a system’s operation and maintenance (O and M) costs goes beyond routine expenses, encompassing factors like provisions for inverter replacement and cleaning costs relative to solar array rating (SAR/Wp), which is crucial for understanding financial dynamics. In solar energy systems, O and M costs for most components are specified annually, except for generators, where costs are hourly and projected by multiplying by the total operating hours per year. The grid O and M cost, calculated by subtracting the revenue from the selling power to the grid from the annual procurement costs, provides insights into net financial impact. Our analysis included the provision for inverter replacement and yearly cleaning costs, adding financial layers while considering the price of inverter replacement after a decade aids long-term sustainability assessment. This meticulous O and M cost analysis aids informed financial planning, resource allocation, and strategic decision-making in energy systems management. See Table 4 for the calculations.

Inverter Price = Inverter Price in SAR/Wp × System Power in kWp × 1000 = 0.48 × 19.38 × 1000 = 9302.4 SAR (the inverter will be replaced every 10 years of the system’s lifetime)

Provision Amount = Inverter Price × Yearly Cost of Provision for

Inverter Replacement × Times of Inverter Replacement During the

Project Lifetime = 9302.4 × 0.050 × 2 = 930.24 SAR

Yearly Cleaning Cost = Yearly Cost of Cleaning in SAR/Wp × System

Power in kWp × 1000 = 0.04 × 19.38 × 1000 = 775.2 SAR

Operational Expenditure (OPEX) incl. VAT Without incl. Inflation = 930.24 + 775.2 = 1705.44 SAR/year

Operational Expenditure (OPEX) incl. VAT and Inflation (Total Yearly Cost) = 2185 SAR/year

Total Operation and Maintenance Cost Through the Project’s Lifetime = Total Yearly Cost × Project’s Lifetime = 2185 × 25 = 54625 SAR

Maintenance provision for inverter replacement = 930.24 SAR/year

Cleaning = 775 SAR/year

Total of Operating Costs (OPEX) = 1705.44 SAR/year

Total of Operating Costs (OPEX including inflation (2%)) = 2185 SAR/year

Table 4.

Yearly maintenance cost.

The data in Table 5 outline the system energy production (in kWh) over 25 years, presenting a detailed chronology of annual output. The system exhibits a gradual decline in energy production over the years, reflecting the components’ expected degradation due to aging.

Table 5.

System Lifetime Energy Production: A Quantitative Overview for First Scenario.

There is a relatively modest decrease in energy production in the initial years, with a more noticeable decline observed in the latter half of the 25 years. This pattern aligns with common expectations for solar energy systems, where efficiency may diminish gradually over time due to wear and tear, environmental conditions, and technological aging.

The cumulative energy production for the entire 25-year duration amounts to 924,131 kWh. This cumulative total provides a holistic perspective on the system’s overall performance and underscores its sustained contribution to energy generation throughout its operational lifespan.

Analysis of the annual energy production figures and the cumulative total is crucial for stakeholders. It informs decision-making processes regarding system maintenance, potential upgrades, or considerations for future investments. Moreover, these data aid in evaluating the long-term economic viability of the system by projecting its energy-generating capacity over the designated 25-year period.

4.3.2. Capital Cost Calculations

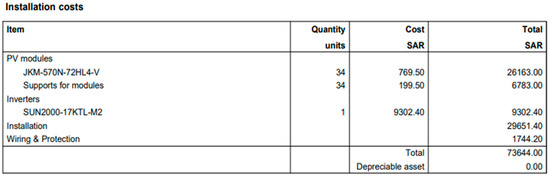

Table 6 provides a comprehensive breakdown of the average prices for various components constituting a solar PV system in Saudi Arabia, offering valuable insights into the cost structure and considerations for prospective stakeholders. The detailed breakdown of solar PV system components and their respective prices in Saudi Arabia provides a transparent view of the cost considerations. This information is invaluable for stakeholders, enabling them to make informed decisions regarding the selection of components that align with their quality and performance expectations. It also considers the investment required for a robust and enduring solar energy infrastructure.

Table 6.

Solar PV System Components and Costs in Saudi Arabia: A Comprehensive Overview.

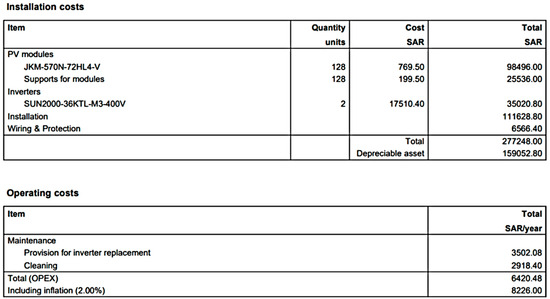

The installation cost of a photovoltaic (PV) system encompasses various components, including modules, inverters, installation, wiring, and protection measures. The comprehensive breakdown of these costs is summarized in Figure 7.

Figure 7.

Installation cost of PV system.

Consumption tariffs in Saudi Arabia for all categories of consumption as approved by the Council of Ministers’ Decree dated 12 December 2017 [59], which have been applied since 1 January 2018, are shown in Table 7.

Table 7.

Electricity Tariff in Saudi Arabia.

Monthly Fee for Meters

Saudi Electricity Company charges a constant monthly amount based on the capacity of the breakers. The company charges this monthly for meter readings, maintenance, and bill preparation, as shown in Table 8 [60].

Table 8.

Breaker Capacity-Based Fee Structure for Meter Reading, Maintenance, and Bill Preparation in Riyals [60].

According to the electricity tariff for governmental facilities from Table 8 plus the monthly fee for the Al-Abrar Mosque energy meter from Table 9 with 300 amperes breaker capacity in addition to a 15% VAT tax, the average annual consumption bill of the Al-Abrar Mosque is 12,679 SAR.

Inverter Price = Inverter Price in SAR/Wp × System Power in kWp × 1000 0.48 × 72.96 × 1000 = 35,020.8 SAR (as mentioned earlier, the inverter will be replaced every 10 years of the system’s lifetime)

Provision Amount = Inverter Price × Yearly Cost of Provision for Inverter Replacement × Times of Inverter Replacement During the Project Lifetime = 35,020.8 × 0.050 × 2 = 3502 SAR

Yearly Cleaning Cost = Yearly Cost of Cleaning in SAR/Wp × System Power in kWp × 1000 = 0.04 × 72.96 × 1000 = 2918.4 SAR

Operational Expenditure (OPEX) incl. VAT Without incl. Inflation = 3502.08 + 2918.4 = 6420.48 SAR/year

Operational Expenditure (OPEX) incl. VAT and Inflation (Total Yearly Cost) = 8226 SAR/year

Total Operation and Maintenance Cost Throughout the Project’s Lifetime = Total Yearly Cost × Project’s Lifetime = 8226 × 25 = 205,650 SAR

Table 9.

Operating and Maintenance Cost (Yearly Cost) For Scenario II.

The monthly electricity bill for Al-Abrar Mosque, as calculated by the Saudi Electricity Company (SEC), follows a specific equation.

The formula is designed to determine the amount due accurately, considering various factors. The equation is expressed as:

Bill Amount Due (SAR) = (Monthly Energy Consumption in (kWh) × Governmental Consumption Tariff in (SAR) + Service Fee in (SAR)) × 1.15 (Value Added Tax (VAT)).

This equation considers not only the energy consumption of the mosque in kilowatt-hours (kWh) but also factors in the governmental consumption tariff and a service fee, measured in Saudi Riyals (SAR). Additionally, including a 15% value added tax (VAT) in the final computation ensures accuracy and compliance with taxation regulations.

This comprehensive formula provides a transparent and standardized method for calculating the monthly electricity bill, accurately reflecting Al-Abrar Mosque’s energy consumption and associated charges. Understanding and applying this equation is crucial for the mosque to effectively manage its energy expenses and adhere to regulatory requirements set forth by the Saudi Electricity Company.

So, the economic feasibility parameter can be calculated as follows:

Project Capital Cost = 19.38 KWp × 3800 SAR/KWp = 73644 SAR.

Total Annual saving = 33630 KWh/Year × 0.32 SAR/KWh = 10761 SAR

To ensure utmost precision in our calculations, considering the value added tax (VAT) applicable in Saudi Arabia, which stands at 15% from 2018, is imperative. This tax is applied to the total bill amount. Therefore, the total annual savings can be determined as follows: total annual savings without the energy meter fee × 1.15. Plugging in the specific values results in a calculated total of 12,375.84 SAR. In parallel, the solar PV system under consideration is projected to generate an estimated 39,559 kWh/year. This anticipated energy surplus holds substantial value, as it can be sold back to the Saudi electricity company at a rate of 0.050 SAR/kWh [59]. Notably, this exchange of surplus energy contributes to the overall sustainability of the energy grid and presents a unique opportunity for financial gains.

Furthermore, observing that the annual total energy injected into the grid is almost equivalent to Al-Abrar Mosque’s annual average energy consumption is fascinating. This synchronization indicates the potential achievement of zero net yearly energy consumption, underscoring the efficacy of the designed solar PV system. This holistic approach incorporates the financial implications of the VAT and energy meter fees. It highlights the symbiotic relationship between solar energy production and consumption, fostering a sustainable and economically viable energy ecosystem.

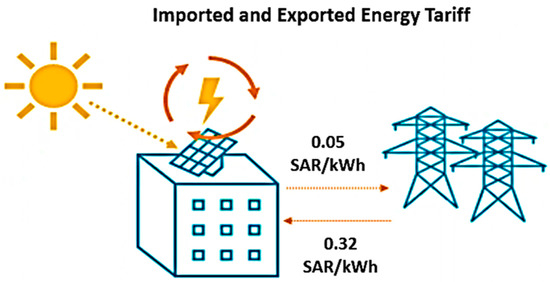

The tariff structure for energy transactions is defined by an imported energy tariff of 0.32 SAR/kWh for energy brought into the system. Conversely, the exported energy tariff stands at 0.050 SAR/kWh for surplus energy fed back into the grid (see Figure 8). This dual-tiered tariff system plays a pivotal role in determining the financial dynamics of the energy exchange, providing incentives for efficient energy management and contributing to a more sustainable energy ecosystem. Understanding these tariffs is essential for evaluating the economic aspects of the energy flow within the system.

Surplus Energy = 39,557 kWh/year – 33,630 kWh/year = 5927 kWh/Year

Surplus Energy Value = 5927 kWh × 0.050 SAR = 296 SAR/Year

Figure 8.

Imported and exported energy tariff.

PVsyst Validation: Ensuring Accuracy and Reliability

In the present section, an exhaustive investigation is carried out through a meticulous performance simulation to evaluate the project’s feasibility meticulously. Leveraging the sophisticated capabilities of the PVsyst software, the primary goal was to validate the theoretical calculations integrated into our analytical framework systematically. In tandem with this validation process, an in-depth economic study is executed, intricately examining various facets of the financial considerations. Furthermore, the anticipated benefits of mitigating CO2 emissions will be meticulously assessed.

4.3.3. Installation Simulation

Various factors, including weather conditions, geographical positioning, and the orientation and tilt of solar panels, influence the efficiency and productivity of photovoltaic (PV) panels. Simulating a PV system serves dual purposes: first, it offers a valuable estimate of the energy generated and its temporal distribution; second, it enables quantification of the potential disruptive influences. This comprehensive simulation approach aimed to identify vulnerabilities within the system, allowing for targeted optimization measures to enhance overall installation performance.

Within the PVsyst framework, a specific PV installation is examined within the context of a project, defining critical site and weather data. Operating within the confines of a designated project, operators can define various permutations for each parameter group. Subsequently, the simulation can be executed for any desired combination of these defined variations. This intricate simulation process empowers operators to explore and assess the system’s response to different scenarios, facilitating informed decision-making for effective optimization and performance enhancement.

4.4. Economic Feasibility Study Parameters of Net Billing Scenario II

In this context, the design of the grid-connected photovoltaic (PV) system, initially formulated in the first scenario, underwent modification to explore the possibility of attaining a zero annual electricity bill. As emphasized in the initial scenario, a notable contradiction exists between the tariffs associated with energy exported to and imported from the grid. This incongruity catalyzed resizing the PV system, a crucial adjustment aimed at effectively accommodating and capitalizing on the variances in these tariffs. The objective was to optimize the system’s configuration to leverage the financial advantages of exporting excess energy at favorable rates while minimizing costs associated with importing electricity from the grid. This nuanced approach to system design aligns with achieving a balanced and economically beneficial energy ecosystem.

4.4.1. Re-Sizing the PV System

The energy tariff for electricity imported from the grid is observed to be significantly higher, precisely 84.375% more, than the tariff applicable to energy exported from the photovoltaic (PV) system. This substantial difference is calculated based on the following comparison (see Figure 7):

A nuanced approach was adopted to rectify incongruities in energy consumption tariffs and attain a net annual billing amount of zero or near zero. The yearly average billing amount was bifurcated into two segments, each governed by specific tariff rates. The initial segment was subject to a rate of 0.32 SAR/kWh, while the subsequent segment was subject to a lower rate of 0.050 SAR/kWh. To ascertain the quantity corresponding to the latter segment, the total amount designated for the 0.050 SAR/kWh rate was divided by 0.050 SAR, employing the following calculated procedure (see Table 3):

Then,

connected in eight strings, 16 modules for each string, with a PV array area 331 m2 and two Huawei inverters, model: SUN2000-36KTL-M3-400V.

(6187.9 SAR incl. VAT), (see Table 3).

Project Capital Cost = 72.96 kWp × 3800 SAR/kWp = 277,248 SAR

To enhance the precision, consideration was given to the application of the Saudi Arabia value added tax (VAT), which stands at 15% from the year 2018 to the present, 2024. Consequently, the total annual savings, including the VAT tax, amount to 6187.92 SAR.

The envisaged solar photovoltaic (PV) system is projected to generate an estimated annual output of 126,794 kilowatt-hours per year (kWh/year), as computed previously. This surplus energy is intended for sale to the Saudi Electricity Company at 0.050 SAR per KWh. Notably, the annual aggregate energy injected into the grid significantly surpasses the Al-Abrar mosque’s average annual energy consumption, thereby facilitating the attainment of a zero yearly electricity bill.

The solar photovoltaic (PV) system analysis yielded several key results. The surplus energy generated annually is 109,979.4 kilowatt-hours (KWh), calculated by subtracting half of the yearly energy consumption (33,630/2 KWh) from the total annual energy output of 126,794.4 KWh. The monetary value of this surplus energy is computed as 5498.97 Saudi Arabian Riyals (SAR) per year, considering a selling rate of 0.050 SAR per KWh to the Saudi Electricity Company:

Surplus Energy = 126,794 KWh − (33,630/2) KWh = 109,979 KWh/Year

Surplus Energy Value = 109,979 KWh × 0.050 SAR = 5499 SAR/Year

However, despite the positive surplus energy and its corresponding value, the payback period for the PV system was calculated to be 87.22 years. This extended payback period, indicating unprofitability in the PVsyst model, raises concerns about the economic feasibility of the solar project.

The saving ratio, a metric assessing the proportion of savings relative to the total cost, is 1.84%. This metric was calculated by dividing the sum of annual savings and surplus energy value by half of the yearly energy cost for the mosque:

Furthermore, the levelized cost of electricity (LCOE) is computed at 0.16 SAR per KWh. This metric considers the total system cost, including the initial investment and operating expenses, divided by the total energy output over its lifespan. Notably, the calculated LCOE aligns closely with the PVsyst model result of 0.169 SAR per KWh:

4.4.2. Operating and Maintenance Cost (Yearly Cost) for Scenario II

Figure 9 displays the installation and operational expenses associated with photovoltaic (PV) systems. It provides a comprehensive overview of the costs of implementing and maintaining these solar energy systems.

Figure 9.

Installation and operating costs of the PV system.

Table 10 presents the yearly system energy production for Scenario II, incorporating the aging tool in PVsyst to account for the degradation of the solar photovoltaic (PV) system over its operational lifetime. The system’s total lifetime spans 25 years, with corresponding annual energy production values outlined for each year.

Table 10.

A Comprehensive Analysis of System Lifetime and Energy Production (KWh) for scenario II.

The trend in energy production exhibits a gradual decline over the years, reflective of the aging impact on the system’s efficiency. In the initial year, the system yields 148,515 kilowatt-hours (KWh), and this value progressively diminishes each subsequent year. By the 25th year, the annual energy production is recorded at 126,909 KWh.

The cumulative impact of this degradation is evident in the total energy production over the 25 years, summing to 3,460,245 kWh. This aggregate figure provides a comprehensive view of the overall energy output, considering the diminishing performance of the PV system as it ages.

Table 10, therefore, serves as a valuable tool for understanding the anticipated yearly energy production and the cumulative impact of aging on the system’s efficiency. It enables stakeholders to assess the long-term performance of the solar PV system and make informed decisions regarding maintenance, upgrades, or replacements to optimize energy generation over its operational lifespan.

5. Robustness Checks

In the realm of renewable energy research, particularly in the photovoltaic (PV) systems domain, the evaluation of technical and financial parameters is crucial for assessing the viability and effectiveness of such systems. Parameters such as performance ratio (PR), present net value (NPV), internal rate of return (IRR), and CO2 emission balance are integral metrics utilized to gauge the performance, profitability, and environmental impact of PV systems.

PVsyst, a widely recognized software tool in photovoltaics, offers comprehensive capabilities for simulating and analyzing the performance of PV systems. However, the accuracy and reliability of the results generated by PVsyst depend significantly on the input data, assumptions, and models employed. Thus, conducting robustness checks on the technical and financial parameters becomes imperative to ensure the credibility and validity of the findings derived from PVsyst simulations.

Robustness checks serve the purpose of validating the sensitivity of the results to variations in the input parameters and assumptions. They involve systematically altering critical variables within a reasonable range and observing their impact on performance indicators such as PR, NPV, IRR, and CO2 emission balance. By subjecting the model to diverse scenarios, researchers can ascertain the robustness of their conclusions and enhance the credibility of their analyses. This section presents a detailed exploration of the robustness checks conducted on technical and financial parameters using PVsyst simulations. We delved into the methodology employed to vary input parameters, the rationale behind the chosen ranges of variation, and the criteria for assessing the sensitivity of results. Additionally, we discuss the implications of the robustness checks on the interpretation of the findings and offer insights into the reliability and validity of the outcomes obtained from PVsyst simulations.

5.1. Geographic Data of the Site

Each point on the Earth’s vast expanse is distinctly identified through geographical coordinates encompassing longitude, latitude, and altitude. These coordinates serve as the geographical fingerprints of a location, offering a precise means of pinpointing a place on the planet.

Longitude, denoted by an angular measure, is the angle formed by two meridian planes passing through the Earth’s pole axis. In the case of Al-Abrar Mosque in Saudi Arabia, its longitudinal coordinates are precisely situated at 43.98° E.

Latitude, on the other hand, defines a location’s position about the equator. For Al-Abrar Mosque in Saudi Arabia, the latitude is recorded as 26.08° N. This value provides a crucial reference for understanding the mosque’s global positioning.

Altitude, an essential component of these coordinates, signifies the elevation of a location relative to sea level. Expressed typically in meters, Al-Abrar Mosque in Saudi Arabia stands at an altitude of 664 m. This vertical measurement adds a crucial dimension to understanding the mosque’s geographical profile, offering insights into its height above sea level and its placement within the Earth’s topography.

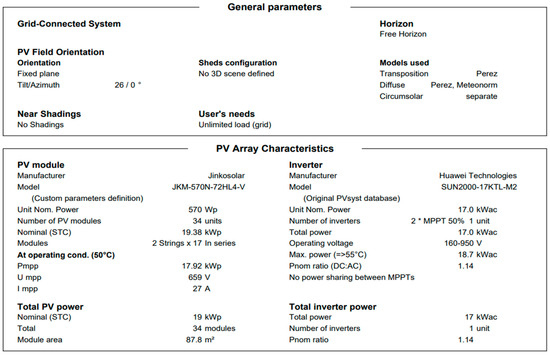

- Simulation approach under PVsyst

In the context of the Al-Abrar Mosque project in Unaizah, a 19.38 kWp grid-connected photovoltaic system is proposed for implementation in Saudi Arabia. This endeavor incorporates silicon monocrystalline technology, chosen for its efficacy, and employs an appropriate model tailored to ensure net metering within the project framework. Subsequently, the ensuing sections delineate the simulation procedures, which remain consistent irrespective of the technology employed.

- Creation of the Site

Selection of Geographical Location: Al-Abrar Mosque, Saudi Arabia.

- Acquisition of Meteorological Data

The geographical parameters for our installation, encompassing altitude, longitude, and latitude, were included.

Utilization of the Meteonorm database to import relevant weather data.

5.2. Description of the Installation (Grid-Connected)

- Orientation of the Solar Panel Array

Configuration of the parameters, including

“Plane Tilt” or the inclination of the panels set at 26°.

“Azimuth,” representing the orientation relative to the south, is established at 0°.

- Specification of Panels and Inverters

In the software, precisely identifying the panel type and inverter is imperative. In this instance, our system comprises the following components:

Selection of Modules for Each Technology:

For monocrystalline technology, the modules are the JKM-570N-72HL4-V, with a power rating of 570 Wp, provided by Jinkosolar.

Selection of inverter:

SUN2000-17KTL-M2 inverter from Huawei Technologies. In the specific context of the Al-Abrar Mosque Unaizah Project, the power capacity of the installation is stipulated at 19.38 kWp.

- Evaluation of the installation

After the simulation process, the PVsyst software generates comprehensive reports. These reports encompass an analysis of simulation parameters, including the geographic data of the site, the characteristics of the photovoltaic (PV) field, and the associated loss factors of the PV field. Additionally, the reports articulate the primary outcomes of the simulation, delineating key metrics such as the annual energy production, monthly performance index, normalized productions, and the annual energy balance. Furthermore, the report incorporates a schematic representation of the loss diagram spanning the entire year. This diagram elucidates various categories of losses contributing to the degradation of energy injected into the network, encompassing factors such as the irradiation level, field temperature, and losses attributed to the inverter.

PV array. The photovoltaic (PV) array in focus is structured as two strings, each comprised of 17 N-Series monocrystalline modules, contributing collectively to the solar field. In conformity with standard test conditions (STC), the cumulative power output of this specific configuration is meticulously quantified at 19.38 kilowatts peak (kWp). The ensuing discourse delves into the nuanced characteristics of this bifurcated arrangement, with a visual representation provided in Figure 10.

Figure 10.

General parameters, photovoltaic array characteristics, and array losses.

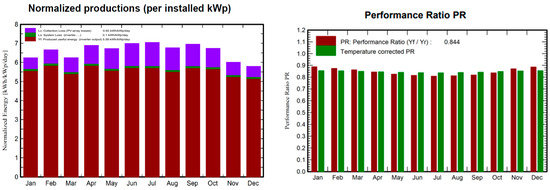

Installing monocrystalline solar panels yields an annual energy output of 39,559 kWh. The performance index, indicative of system efficiency, is calculated at 84.40%. Figure 11 comprehensively represents the key findings derived from this monocrystalline photovoltaic system. The depicted results encapsulate various significant parameters, shedding light on the installation’s operational performance and overall effectiveness. The subsequent sections delve into an in-depth analysis of these outcomes, elucidating their implications and offering insights into the efficacy of monocrystalline solar technology in energy generation.

Figure 11.

The normalized production per installed kilowatt-peak (kWP), performance ratio (PR), and overall balance.

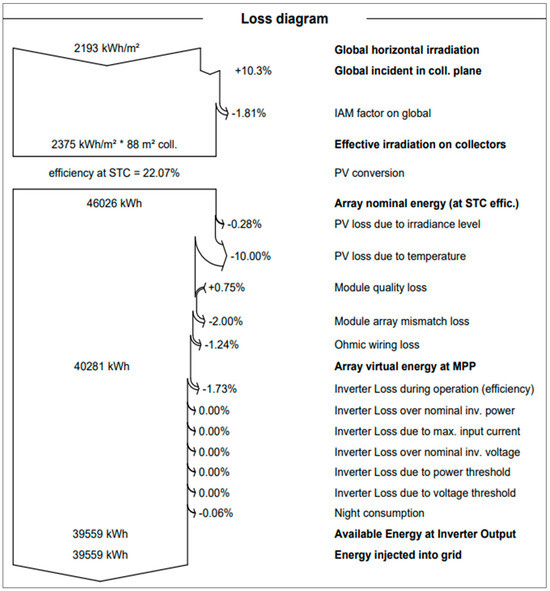

The energy integration into the network experiences degradation, a phenomenon elucidated by the illustrative representation in Figure 12 delineating the loss diagram of the photovoltaic (PV) field. The depicted diagram provides a schematic overview of the various factors contributing to the PV system’s diminution of energy quality and efficiency.

Figure 12.

Annual diagram of installation losses.

Understanding and mitigating energy losses are pivotal aspects of optimizing performance in the context of solar energy systems. The loss diagram serves as a visual aid to delineate the multifaceted nature of these losses, encompassing factors such as irradiance variations, module temperature effects, inverter inefficiencies, and other systemic challenges (see Figure 12).

5.3. Environmental Impact of the Project

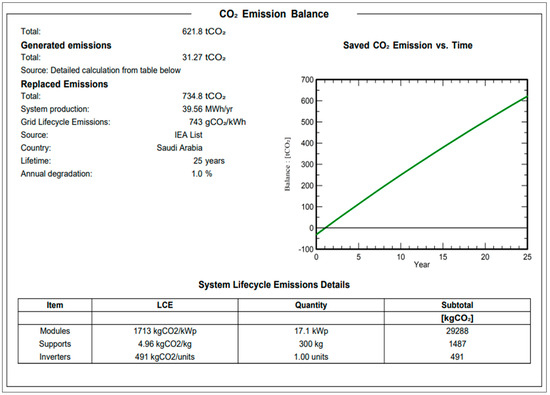

To conduct an economic assessment of the project, we relied on the carbon balance generated by PVsyst. The primary aim of this carbon assessment was to quantify the greenhouse gas emissions attributed to the site in question. The ensuing analysis unfolds over 25 years, offering a comprehensive depiction of the carbon footprint associated with the project.

Figure 13 visually presents the carbon footprint trends over the stipulated 25-year duration. The potential for reducing CO2 emissions is quantified in terms of tCO2/kWp. This metric elucidates the amount of CO2 that the national energy park would have otherwise released to generate an equivalent quantity of electricity over the operational lifespan of the photovoltaic system. Importantly, this calculation is adjusted to account for the quantity of CO2 emitted during the manufacturing phase of the photovoltaic system.

Figure 13.

Balance of CO2 emissions.

The project manifested a commendable reduction of approximately 621.8 tons of CO2 emissions. This significant decrease underscores the imperative to transition toward cleaner energy sources, with a particular emphasis on photovoltaics. The findings underscore the environmental efficacy of adopting photovoltaic systems and underscore the pivotal role such technologies play in mitigating the carbon footprint associated with conventional energy production. This necessitates a concerted effort to embrace sustainable energy alternatives, contributing to the imperative global shift toward a more environmentally responsible energy landscape.

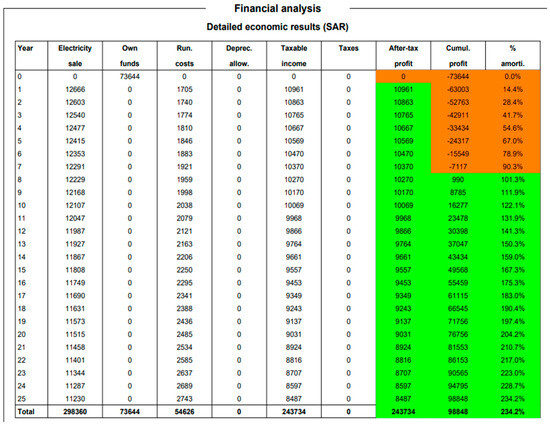

5.4. Payback Period

The payback period is a crucial financial metric that evaluates the time required for an investment to recover its initial cost. In the context of the provided economic analysis for the solar project, the payback period is calculated to be 7.9 years. This duration represents the time it takes for the cumulative positive cash flows generated by the project to offset the initial investment of 73,644.00 SAR (see Table 11).

Table 11.

Financial analysis.

A payback period of 7.9 years implies that, from the project’s initiation in 2025, it would take approximately 7.9 years to recoup the initial capital invested. Beyond this period, the project is anticipated to generate positive net cash flows, contributing to cumulative profits. The payback period serves as a crucial benchmark for investors, as a shorter payback period is generally considered more favorable, indicating a faster return on investment.

In this scenario, a 7.9-year payback period suggests a moderate but reasonable timeframe for the recovery of the initial investment. Investors and stakeholders may interpret this duration in the context of their risk tolerance and investment objectives.

While a 7.9-year payback period indicates a relatively steady return on investment, investors need to consider other financial metrics, such as the internal rate of return (IRR) and net present value (NPV), for a more comprehensive assessment of the project’s economic performance. These metrics provide additional insights into the project’s profitability and ability to generate positive returns over time, accounting for factors such as discount rates and the time value of money.

The financial analysis revolves around two key parameters: net present value (NPV) and internal rate of return (IRR). These metrics are essential in evaluating the profitability and viability of an investment opportunity. NPV represents the present value of all cash flows associated with an investment, discounted at a specific rate. In this case, the NPV is calculated considering the income variation over time and a discount rate of 3.00% per year. The NPV obtained is SAR 98,848. This positive NPV indicates that the project is expected to generate returns greater than the initial investment, which is a favorable outcome.

Moving on to IRR, the discount rate makes the net present value of all cash flows from a particular project equal to zero. In this scenario, the IRR is calculated at 13.4%. This means that the project is expected to yield a return of 13.4% annually, which exceeds the discount rate of 3.00%. Hence, the project is deemed financially attractive as it offers a rate of return higher than the cost of capital.

The provided financial data further supports the positive NPV and IRR. Over the 25 years, the project generates electricity sales revenue while incurring operational costs, depreciation allowances, taxes, and other expenses. Despite these costs, the project consistently generates after-tax profits, resulting in a cumulative profit of SAR 98,848 by the end of the project’s lifespan. The NPV and IRR serve as crucial metrics for decision-making. A positive NPV and an IRR greater than the discount rate indicate that the investment is financially viable and likely to generate returns higher than the cost of the capital. Therefore, based on these financial analyses, the investment in the project appears to be a prudent financial decision.

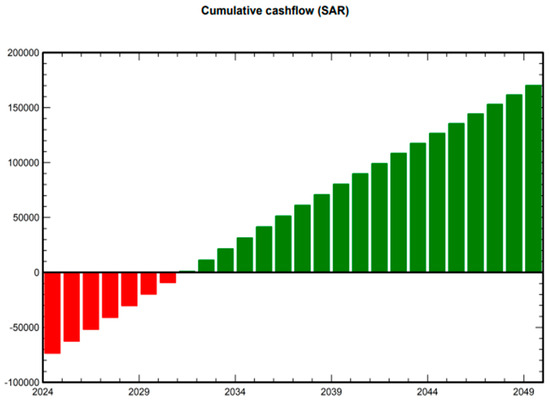

5.5. Cashflows and Discounted Payback Time

The cash flow analysis for the specified table reveals a comprehensive financial perspective, encompassing various parameters over the 25-year duration of the solar project. The initial year, Year 0, sets the stage with an investment of 73,644 SAR in own funds, representing the initial capital outlay. Notably, this negative cash flow in Year 0 signifies the expenditure incurred during the project’s initiation.

As the project progresses, Years 1 through 7 witness a steady generation of positive cash flows, primarily driven by electricity sales. During this period, the cumulative profit gradually increases, reaching 90.3% amortization by the end of Year 7 (see Figure 14 and Figure 15).

Figure 14.

Financial analysis: detailed economic results (SAR).

Figure 15.

Cashflows for the PV system.

The upward trend in cumulative profit underscores the project’s financial viability, with taxes and taxable income aligning to contribute to positive after-tax profits.

From Year 8 onwards, the cumulative profit continues to rise, reaching 101.3% amortization by the end of Year 8. This signifies that the project has not only recouped its initial investment but has generated a surplus in profits. The positive cash flows persist through subsequent years, resulting in a gradual increase in cumulative profit percentages.

By the culmination of the 25 years, the solar project demonstrates robust financial performance, with a cumulative profit of 98.85 SAR, equivalent to a remarkable 234.2% amortization. This indicates that not only has the project covered its initial costs but has also yielded a substantial profit, reaffirming its financial sustainability. The consistent positive cash flows throughout the project’s lifecycle underscores the potential for long-term economic gains, emphasizing the attractiveness of investing in solar energy as a viable and lucrative venture. This financial analysis elucidates the project’s ability to generate consistent returns, showcasing the economic feasibility and attractiveness of adopting solar photovoltaic systems for sustainable energy solutions.

6. Comparative Analysis