1. Introduction

As a part of the energy transition to carbon neutrality, a continuous reduction in natural gas consumption is expected to decarbonize the energy sector and increase energy efficiency, especially the use of gas infrastructure and alternative fuels such as hydrogen. The decline in natural gas consumption combined with the additional supply constraint and decline in domestic production, as well as the increase of CO2 emission prices, have positioned hydrogen as an alternative to natural gas.

Due to current circumstances, investments in existing production capacities or in the new research to increase the use of hydrogen are being considered in Europe to increase the security of supply and to enable a more effective transition of the economy from fossil-based to RES-based (Renewable energy sources). The topic of hydrogen production and its economics in different scenarios has only been intensively researched in the last few years, although hydrogen production technology by electrolyzers has been known for a long time. The decarbonization of the energy system manifests itself in low-carbon power generation and the use of batteries and Power-to-gas systems.

In view of the above, the authors believe that an analysis of the possibility of replacing natural gas with yellow hydrogen using the existing electricity and gas infrastructure is required, along with an economically justified investment in the Power-to-gas system.

The Power-to-gas system plays an important role, enabling long-term and seasonal storage of electricity and hydrogen production as a substitute for natural gas through water electrolysis [

1]. Although there are four types of water electrolysis processes, alkaline water electrolysis (ALK), solid oxide electrolysis (SOE), microbial cell electrolysis (MEC), and proton exchange membrane (PEM) electrolysis [

2], two processes are predominantly used for water electrolysis in Power-to-gas systems, called ALK and PEM electrolyzers. In studies, the PEM electrolyzer is more commonly used due to its high output pressure, operational flexibility, and fast start-up time, which is important in intermittent power generation, high efficiency, and lower projected cost [

1,

3]. Alkaline electrolyzers have more mature operational technology and lower initial investment cost [

4]. Compared to alkaline electrolyzers, the PEM electrolyzer has higher efficiency, shorter start-up and ramp-up times measured in minutes or even seconds, and a wider range of hydrogen production rates [

5]. One of the most important features of electrolyzers is their ability to operate at a variable load, which makes them suitable for use in systems with a high percentage of renewable energy sources [

6]. PEM electrolyzers showed excellent dynamic characteristics and stable independent hydrogen production [

7] and better integration with fluctuating and intermittent power generation [

8]. Due to better performance, PEM electrolyzers justify higher initial capital costs than alkaline electrolyzers. Considering the expected price decrease of PEM electrolyzers due to technological innovations and larger implementation, i.e., economies of scale, authors [

9] performed a techno-economic evaluation of different Power-to-gas system configurations, confirming that systems with alkaline electrolyzers have significantly higher production costs than PEM electrolyzers [

9]. The authors [

10] conducted an analysis of electrolyzers performing water electrolysis technology at low or high temperatures. Alkaline and PEM electrolyzers performing water electrolysis at low temperatures are able to produce hydrogen with high output pressure, while SOE electrolyzers operating at high temperatures are not yet able to do so. In one of the hydrogen utilization options analyzed in the above work, hydrogen with an output pressure of 20 bar from the electrolyzer is directly compressed to a pressure of 75 bar and injected into the gas grid without intermediate storage [

10].

The overview of research results relevant to the topic of this paper is presented in the following table. The first group of works investigates the possibilities of hydrogen production using different countries and scenarios as examples. Another group of papers relevant to this research relates to the potential of the gas grid to absorb the produced hydrogen.

Blending hydrogen into the existing gas infrastructure is a promising option for transporting renewable energy sources from the production site to the end users using the existing gas grid, thus avoiding congestion in the power grid but also the construction of new energy infrastructure. Existing gas infrastructure can be repurposed for hydrogen technologies, which would significantly reduce infrastructure investment costs [

11] and accelerate the development of the hydrogen economy [

12]. Blending hydrogen into the existing gas infrastructure at a certain percentage is the key factor enabling hydrogen production in the initial phase of the energy transition.

Within this first group of papers, research related to the methodology is distinguished. Considering the fact that the price of electricity is the largest part of the price of hydrogen, the calculation of the production price of yellow hydrogen in the model applied in this paper is based on the projected hourly electricity prices for the period from 2025 to 2050. In such a way that the given amount of hydrogen for each individual year is produced in the hours when the price of electricity on the market is low, according to the descending order, i.e., the so-called merit order model, which affects the profitability of yellow hydrogen production. Numerous other authors have used a similar methodology, such that the electrolyzer operates when the price in the electricity market is low, i.e., below the marginal profitability price, in order to maximize hydrogen production and reduce operating costs. It means that the electrolyzer does not operate when the price of electricity in the market is high. In their study, authors [

13] set a limit equal to the production cost of green hydrogen at a fixed cost of electricity. If the selling price of hydrogen were higher than the production price, assuming the price of electricity does not change, it would be profitable to produce hydrogen, while otherwise, it would be profitable to sell electricity in the market [

14]. Another method is to determine the price-duration curve using several historical years of electricity prices from the spot market to determine different possible future electricity prices and flexibility in electrolysis operation [

15]. The author [

16] uses the mentioned methods in his study and uses them to determine the minimum market value of RES. In the mentioned study, the merit order model and the price-duration curve were applied to electricity production from renewable sources, i.e., each renewable source is included in the order of its marginal cost [

16].

While in this paper, this method is applied to hours with cheaper electricity prices in the market for the optimal number of operating hours of the electrolyzer in the year it produces yellow hydrogen.

Low-carbon hydrogen includes green, blue, turquoise, and yellow hydrogen [

17]. The color of hydrogen depends on the method of hydrogen production, so green hydrogen is renewable hydrogen that is obtained from electricity produced exclusively from renewable energy sources such as wind, water, or sun. Grey hydrogen is the most common form of hydrogen production, which is produced from natural gas, or methane, using steam methane reforming, but without capturing the CO

2 emissions produced in the process. Yellow hydrogen is obtained from electricity taken from the power grid [

18], which has a certain share of electricity obtained from a nuclear power plant.

The color of the hydrogen also depends on the time dynamics and structure of the energy sector transformation. In addition, the amount of CO

2 emissions released during hydrogen production depends on the sources connected to the power grid [

18]. Namely, as the share of renewable energy sources increases, the hydrogen produced will move from the “yellow” to the “green” category. Hydrogen blending into the existing gas grid is a technology that allows hydrogen to replace fossil fuels without additional investment costs in the gas infrastructure. In addition, hydrogen blending represents an extraordinary advantage compared to the other energy transition options. The main challenges of hydrogen blending into the gas infrastructure are:

For the same energy demand, the amount of needed hydrogen is three times larger than the amount of natural gas needed.

Natural gas infrastructure needs to be changed (reconstructed) to be used for the transport of a higher share of hydrogen.

The objective of this research is to calculate the yellow hydrogen production price for each lifetime year of the Power-to-gas system to evaluate yellow hydrogen competitiveness compared to the fossil alternatives.

Therefore, the paper provides an economic framework for the assessment of the most efficient technology for hydrogen production, which is then integrated into the existing gas grid. The research tests the influence of the optimal number of operating hours of the electrolyzer with its activation as ancillary services provider in the power system on the viability of yellow hydrogen production at the existing gas-fired power plant site and attempts to answer the following research questions:

How can the infrastructure of existing gas-fired power plants be used for the energy transition until 2050?

At what electricity market wholesale prices can yellow hydrogen production be competitive to the price of natural gas increased by CO2 costs?

What is the impact of ancillary service income on the final production price of yellow hydrogen?

The contribution of this study is multiple. First, this paper considers not only electricity generated from RES but the entire energy mix of the power system. The configuration of the Power-to-gas system, which is located within the existing gas-fired power plant and uses electricity from the power system for hydrogen production, is a new contribution of this research and is a novelty compared to existing research from

Table 1. Second, this approach differs from the previous research that analyzes the impact of replacing natural gas in volume fraction. This approach is based on the calculation of the impact of natural gas replacement on the energy fraction, which we believe is a better approach. At smaller volume fractions, hydrogen has a lower density and no real impact on the total energy in the gas system, and for the aforementioned reason, the energy fraction can have a real impact on the blending of hydrogen into the gas system. Third, existing papers do not consider the integration of energy systems and the dependence of the production price of yellow hydrogen on the prices of fossil alternatives, and the use of existing gas infrastructure for the production and blending of hydrogen to the desired energy share. Fourth, not a single paper that has addressed the viability of hydrogen production has considered the benefits of providing ancillary services to the power system, considering the limits of scale and activation, which significantly affects the competitiveness of hydrogen production. This paper fills this gap and proposes a calculation model for analysis of the profitability of yellow hydrogen production and blending into the existing gas grid in a certain energy fraction.

2. Materials and Methods

The idea of this paper is therefore to investigate the viability of investing in a Power-to-gas system and propose a model that could be applicable in any country with similar existing sites and energy mix.

It is necessary to emphasize the two basic assumptions that form the basis of the model. Power-to-gas system located inside the existing gas-fired power plant uses electricity from the power grid and splits water molecules into oxygen and hydrogen in the electrolyzer through a chemical reaction. Resulting in so-called yellow hydrogen blended directly into the existing gas grid at an energy content of hydrogen of 10% by using available electricity and gas infrastructure.

The model includes all parameters required to calculate the production price of yellow hydrogen, as well as projections of electricity, natural gas, and CO2 prices for the analyzed period. Since variables fluctuate strongly and their fluctuations are very hard to project, sensitivity analysis is applied.

Figure 1 shows a data flow chart of input data and assumptions, optimization, and economic analysis used in the model. The following diagram provides a graphical overview of the interdependence of the model parameters.

The total consumption of natural gas in Croatia is taken from the annual energy report of the Energy Institute Hrvoje Pozar, [

25]. In 2015, total natural gas consumption in the Republic of Croatia was 23.4 TWh of which 9.8 TWh was imported, respectively in 2017, consumption was 28.0 TWh of which 16.8 TWH was imported. In 2019, total natural gas consumption was 27.0 TWh, of which 18.6 TWh was imported [

25], which indicates that domestic production is declining and, accordingly, dependence on imports is increasing, threatening the security of supply. Data from the energy sector of the Republic of Croatia were used to investigate the viability of yellow hydrogen production at the site of the existing gas-fired power plant, but the model is fully applicable to other countries and regions by simply changing the input parameters.

The model covers the period from 2025 to 2050, and the assumptions for the standard calculation are as follows:

The observed period of 25 years coincides with the lifetime of the Power-to-gas system;

The desired percentage of replacement of natural gas with hydrogen is determined in the model based on the natural gas consumption system in Croatia in 2019;

According to the system with annual natural gas consumption of 27.0 TWh, the percentage is based on the energy share (10%) of hydrogen injected into the existing gas grid, the amount of 2.7 TWh of replacement of natural gas with hydrogen;

Three specific observed years with realized electricity prices were chosen, which were distributed to all years of the model period using Monte Carlo simulation to obtain a more realistic projection of hourly electricity prices;

Yellow hydrogen production is carried out with an electrolyzer efficiency of 74% [

26];

Providing ancillary services of tertiary regulation for the power system.

Data for the capital (CAPEX) and operating (OPEX) costs of the Power-to-gas system were taken from the literature reviewed and the annual reports of the Croatian national energy institutions to determine the price of yellow hydrogen produced for each year of the model period. The specific values of CAPEX and OPEX Power-to-gas systems from the collected data in the literature vary widely [

2,

8,

11,

20,

26,

27,

28,

29,

30], and

Table 2 shows the selected values used for the input parameters in the economic viability model of yellow hydrogen production.

As our model includes the income from the provision of ancillary services to the power system, it needs to be explained in more detail. Ancillary services are necessary for the operation of the power system. Their most important function is to balance the time difference between power generation and consumption, thus ensuring the safe and stable operation of the power system. Ancillary services of power and frequency regulation (P/f) are organized as a hierarchical structure on three-time levels consisting of primary (FCR), secondary (aFRR), and tertiary (mFRR) regulation. For every 100 MW of newly installed variable renewable energy sources, 4–10 MW of reserve power is needed in the ancillary services mechanism to ensure the normal and stable operation of the power system [

13]. Electrolyzers included in the ancillary services mechanism can lower electricity consumption by decreasing the production when there is a shortage of electricity in the system, and they provide additional electricity consumption by increasing the production and if needed use storage of hydrogen when there is a surplus of electricity in the system. By including the power plant in the system of secondary regulation of ancillary services to the power system, the potential additional revenue from the power plant can be realized, which affects the return on investment in the Power-to-gas system, i.e., lower production costs for hydrogen.

Data on the cost of network charges and the cost of providing ancillary services of tertiary regulation (mFRR) were taken from the Croatian Transmission System Operator report [

31]. The data according to which the income from tertiary regulation is calculated in the model are shown in

Table 3.

The formula for the calculation of the income from the tertiary regulation provision is as follows:

In this case, income from the tertiary reserve is calculated from reserve price in positive and negative directions as well as a share of electrolyzer in meeting tertiary power reserve as shown in

Table 3. Income from the activated energy is calculated with hourly electricity prices corrected with the coefficient for energy and share of activated energy in total tertiary power reserve taking into account that negative energy activation carries negative income and lowers total income from tertiary regulation.

The total demand for tertiary regulation in the Croatian transmission system is set to 120.0 MW/h. The model predicts that the electrolyzer will provide 20% of the volume in the positive direction and 10% of the volume in the negative direction. The maximum power of 24.0 MW of the electrolyzer will be used in case of the need to include it in the tertiary regulation. It is also expected that activation will occur in both directions at a rate of 1% per year and that the price will remain the same for the entire model period corresponding to the base year 2021.

The values in

Table 4 refer to 2028 when the investment is expected to be completed and the electrolyzer is installed at full capacity. Electrolyzer will be built in stages during the first three years, so it will operate with reduced capacity, while in the remaining years of the model period, it will operate at the full required installed capacity. The production efficiency of the electrolyzer is taken from the study by [

26]. The fixed costs of the electrolyzer are taken from several different sources as it consists of several separate parts [

2,

8,

11,

20,

26,

27,

28,

29,

30]. The input parameters of the model, which are the same for each year of the period, are listed in

Table 4. They refer to the number of operating hours of the PEM electrolyzer, its efficiency, and installed power, the desired share and amount of replacement of natural gas with hydrogen relative to the total consumption of natural gas, and the constant hydrogen production cost.

The hourly projection of the electricity prices is the most sensitive parameter of the input variables in the model, to which special attention was paid. For each individual year of the observed period, the movement of the electricity price at the hourly level was projected in such a way that the realized electricity price on the Croatian electricity market was taken at the hourly level for the years 2018-2020. For each of the three selected years, the realized hourly electricity price was divided by the average annual realized electricity price to obtain coefficients for the difference between the annual and hourly prices. Using Monte Carlo simulation, three specific years are each selected in a specific ratio and distributed over all years of the future period, while the coefficients of the selected year are multiplied by the projected annual electricity price for each hour of each annual model period. The coefficients are calculated according to the following formula:

The electricity market price is included in the model because it reflects the movement of supply and demand, and such a price provides a better and more realistic result in the scenarios. To calculate the coefficients for projecting electricity prices for the selected period of the model, three specific base years of realized electricity market prices at the hourly level were used. Therefore, the fluctuations in electricity prices can be seen, i.e., in this way, the relationship between higher and lower hourly electricity prices can be seen most clearly in a year when climatic conditions (especially hydrology) are better, such as in 2019, then worse, such as in 2018, or in a year when a specific event such as a pandemic occurs, such as in 2020. If the average of three years were used for such a calculation, the larger differences between higher and lower hourly prices would even out, and price fluctuations would not occur as they do in one or three separately observed years. In this way, a more realistic hourly projection of electricity prices was obtained for all model years. The plot of electricity price fluctuations between the three separately observed years is shown in

Figure 2.

According to the results of the Monte Carlo simulations, the model period is distributed in such a way that a 40% share of the years is allocated to the base year 2018, then a 52% share is allocated to the years of the base year 2019, and an 8% share is allocated to the years of the base year 2020. In the Monte Carlo simulation, the year 2020 was limited to a maximum repeatability of 10%, because the authors believe that a given year, like a pandemic, cannot repeat more than three times in the projection of a 25-year period. In this way, the parameter of the input variable of the model, the hourly projection of the electricity price, was determined, reflecting a more realistic approach to the projection according to the specifics of individual years rather than their average.

The projection of electricity prices is a very important parameter for the water electrolysis process, which requires large amounts of electricity. The amount of electricity needed to produce 1 kg of hydrogen depends on the efficiency of the electrolyzer used in the Power-to-gas system. The efficiency of the electrolyzer is defined as the hydrogen production expressed by the lower heating value divided by the electricity consumption of the electrolyzer. For the different electrolyzer efficiency, a different amount of electricity is used to produce 1 kg of hydrogen. For example, with an electrolyzer efficiency of 65%, it takes 60.6 kWh of electricity to produce 1 kg of hydrogen [

32], and with an efficiency of 60%, it takes 55.0 kWh of electricity [

33]. In addition, some authors use electricity prices for industry from the Statistical Office of the European Communities, EUROSTAT, as the basis for calculating the hydrogen production price [

34].

In the model, the projection of electricity prices at the hourly level is based on coefficients determined using the realized electricity prices of the Croatian Power Exchange. The realized annual electricity price in the Republic of Croatia was 51.00 EUR/MWh in 2018, 49.55 EUR/MWh in 2019, and 38.30 EUR/MWh in 2020. The obtained coefficients for each hour of the selected year are multiplied by the projected annual electricity price resulting from the Monte Carlo simulation, where the selected years are distributed over the entire model period. The formula for the projection of electricity prices at the hourly level is given as follows:

Data according to the TYNDP under the ENTSO-E and ENTSO-G [

5] baseline scenario were used to project electricity, natural gas, and CO

2 prices in the model. The data includes price projections from 2025 to 2050 for every fifth year, which authors distributed to each year and hour of the period using the linear method according to the previously mentioned coefficients and Monte Carlo simulation.

Table 5 shows the projected electricity market price, natural gas price, and CO

2 emission price for the selected observed years.

The largest contributor to the production price of yellow hydrogen is the electricity cost, followed by the characteristics of the PEM electrolyzer and the constant and variable costs of the Power-to-gas system production. Prices for electricity, natural gas, and CO

2 are taken from the European Ten-Year Plan for the Development of Electricity and Gas Networks (TYNDP), according to the baseline scenario of the European Network of Transmission System Operators for Electricity (ENTSOE), and the European Network of Transmission System Operators for Gas (ENTSO-G) [

5]. The formula for the calculation of the yellow hydrogen production price is given as follows:

In this case, CAPEX refers to the fixed production costs of yellow hydrogen, which include the price of the electrolyzer and the compressor. OPEX refers to the variable price of electricity and the fees for grid usage, then the cost of chemical water preparation and the cost of maintaining the system. UPPU refers to the total revenues from ancillary services.

Our research results show that incentives for hydrogen production are necessary. The premium incentive system for the development of renewable energies and hydrogen production technology is part of the investment cycle of the energy transition, and such projects are implemented exclusively on a market basis. The amount of the premium for yellow hydrogen production is calculated according to the following formula:

Therefore, the premium is a variable part of the system and depends on the market price: the higher the market price for natural gas and CO2 emissions, the lower the premium for hydrogen production. If the market price for natural gas and CO2 emissions is higher than the cost of hydrogen production, then the premium is no longer needed, which is the goal of the energy transition.

3. Results

The results of this analysis are applicable to European countries within the same regulatory framework and with a similar energy mix, but for the sake of a more realistic approach in this model, a part of the empirical data is taken from the Croatian electricity and natural gas system and market.

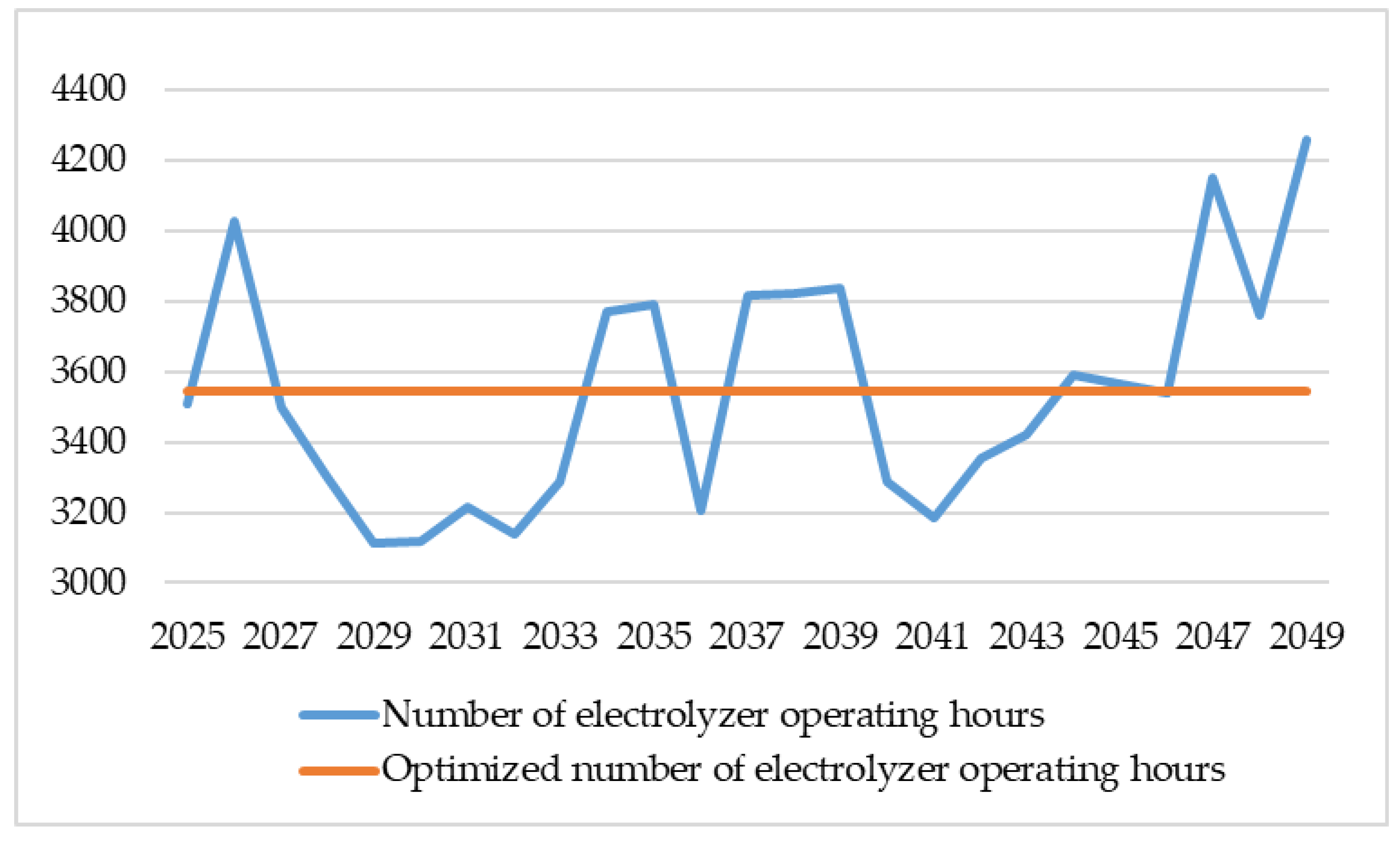

The optimal number of electrolyzer operating hours is an extremely important performance parameter that determines the size (power) of the electrolyzer required to produce a given amount of hydrogen (10%). Therefore, an important part of the electrolyzer size analysis is based on the optimal number of operating hours, which depends on the capital and operating costs, i.e., the unit price of the electrolyzer and the variability of projected electricity prices in the market. The merit order model determines the number of operating hours of the electrolyzer separately for each year of the model based on the ordered forecast electricity prices in the hours when the electrolyzer operates. Then, the optimal number of operating hours of the electrolyzer was determined for the entire period of the model, as shown in

Figure 3.

The calculation of the yellow hydrogen production price considers the time required to build the Power-to-gas system and install the electrolyzer at the gas-fired power plant, as well as to reach the specified percentage of hydrogen in the gas grid. Therefore, in 2028, the model expects to achieve the specified percentage and amount of replacement of natural gas with hydrogen, as well as the total installed capacity of electrolyzers.

The projected data of hourly electricity prices for a period of 25 years reflect the coefficients of the ratio between the realized annual and hourly electricity prices for the three selected years 2019–2021, taken from the Croatian national electricity market. The natural gas and CO

2 prices are taken from the literature [

25] and are projected in the model on an annual basis. The optimization part of the model refers to the selection of the size of the electrolyzer in such a way that the number of operating hours and the projection of electricity prices are used to select the optimal number of operating hours so that the capacity of the electrolyzer is optimally used. The economic part of the model refers to the fixed and variable production costs and ancillary services income that affect the yellow hydrogen production price. The economic part of the model calculates the return on investment and competitiveness with fossil alternatives.

The obtained research results related to electricity are presented in

Table 6. The table shows data for the selected six model years.

Assuming that the optimal number of operating hours is chosen and thus the installed capacity of the electrolyzer is the same for the entire analyzed period, the fixed costs are the same in all years, while the operating costs change depending on the forecasted electricity market price.

The amount of 2.7 TWh of produced hydrogen, which is replaced by the natural gas in the existing gas network, also reduces CO

2 emissions by 540,000 tons per year. To further reduce the production price of yellow hydrogen, revenue from ancillary services provided by the electrolyzer to the power grid is included in the model. The amount of hydrogen produced, and the unit price of yellow hydrogen produced, expressed in two units of measure (per MWh and per kg), are shown in

Table 7.

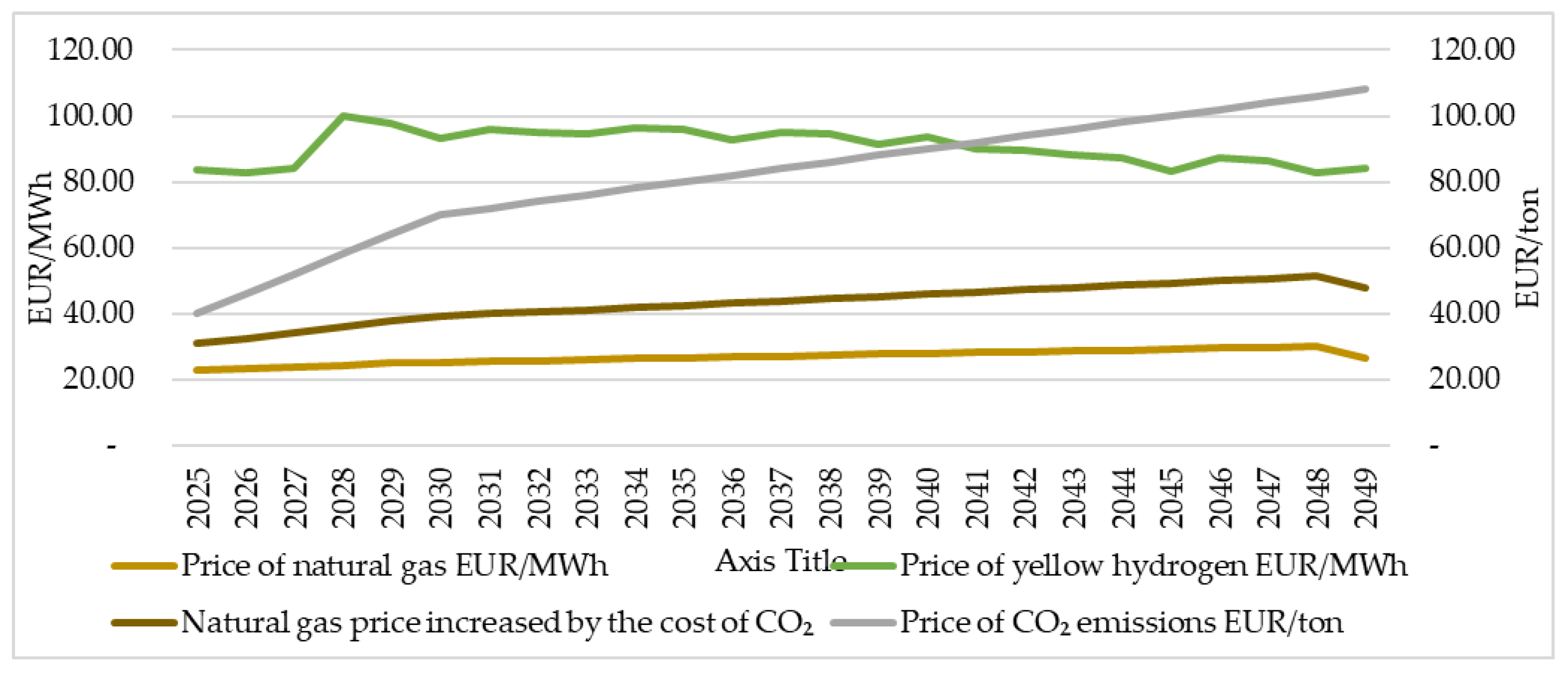

The main aim of this paper is to compare the calculated production cost of yellow hydrogen with the natural gas price increased by the CO

2 cost and to determine the profitability of hydrogen production in the observed scenarios.

Figure 4 shows a comparison of the yellow hydrogen production price shown in

Table 7 with the natural gas market price shown in

Table 5, increased by the cost of CO

2.

Although the price of CO

2 emissions is projected to be higher than the price of yellow hydrogen production after 2040,

Figure 4 shows that the price of yellow hydrogen production is far higher than the projected natural gas market price, which is increased by the cost of CO

2 emissions. The reason is the increase in the price of natural gas by 1/5 of the price of CO

2 emissions. It is clear that the hydrogen price in the given timeframe and scenarios is too high to be a viable substitution for natural gas. Clearly, incentives for hydrogen production are necessary to justify this investment.

Accordingly, with the projected natural gas prices and CO2 premium, the incentive for hydrogen production should be 52.90 EUR/MWh in 2025 and 36.18 EUR/MWh in 2050.

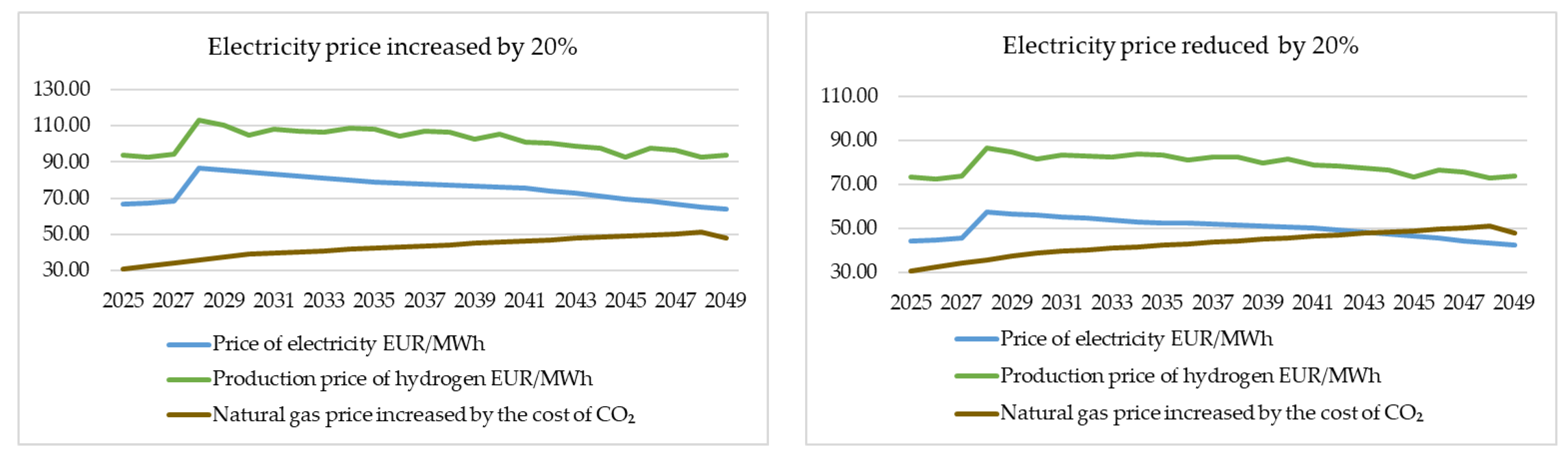

The sensitivity analysis was performed for the input parameters of the model for two cases: 20% higher and 20% lower electricity price than the reference value. Although the electricity market price affects the natural gas market price, the sensitivity analysis was performed only for the electricity price, while the other parameters remained unchanged.

Figure 5 shows the results of the sensitivity analysis.

According to

Figure 5, the yellow hydrogen price is higher when the electricity market price is higher, and vice versa. With the same natural gas market price and CO

2 emission price, the yellow hydrogen production price is still not competitive with the fossil alternative natural gas in both cases of the sensitivity analysis, and the application of a premium incentive system is necessary. In this case, the lack of competitiveness of yellow hydrogen production is reflected in the low projected natural gas market prices.

The results are relevant for the hydrogen production technology by water electrolysis with PEM electrolyzers. The results refer to the hydrogen production at the site of an existing power plant that has connections to the electricity and gas networks in order to minimize investment costs. Although the results are based on Croatian data, they are applicable to all countries of the Mediterranean region, given that the energy mixes are similar. The input data can also be easily replaced with data from other countries in order to obtain results for a specific country.

4. Discussion

The EU Hydrogen Strategy highlights hydrogen as an important lever for a successful energy transition, especially with regard to the use of existing gas infrastructure. A proposal for a hydrogen and decarbonized gas package, i.e., measures included in the existing regulatory framework for natural gas [

35], calls on the Member States to allow hydrogen blending in their national gas systems. The blending threshold is set up to 5% hydrogen content in the gas streams at interconnection points, in order to harmonize the cross-border flow of natural gas from 1 October 2025 onwards. The percentage of 10% for the replacement of natural gas with hydrogen, which reflects the energy share of hydrogen in the gas network, was used in this research assuming that the existing gas network can accommodate this without construction changes of the existing gas infrastructure.

The Power-to-gas system is located at the site of an existing, low-potential gas-fired power plant. The repurposing of existing energy infrastructure as part of the decarbonization of the energy sector also affects the fact that investment in repurposing is less intensive than investment in new infrastructure. For the existing gas-fired power plant that is considered economically unviable to operate, i.e., a gas-fired power plant that is no longer competitive due to its traditional power generation, significant investment would be required to decommission the plant. It makes repurposing the gas-fired power plant a better option than complete decommissioning and appropriate management of the infrastructure, i.e., returning to the previous state. The authors believe that the existing gas-fired power plant, with an expected low commitment in the future, is an ideal site to be converted to as it has all the necessary electricity and gas infrastructure. It means that the initial investment costs for conversion are much lower compared to building completely new infrastructure, especially under the conditions of growing spatial planning and environmental requirements.

After the water electrolysis process in the Power-to-gas system, the extracted oxygen and hydrogen are widely used. The oxygen can be compressed into bottles and used as an end product in hospitals, in the chemical industry, or in space missions. In this way, the additional revenue of the Power-to-gas system can be realized. However, in this paper, it is omitted and not considered because this revenue does not directly affect the price of the produced hydrogen, but rather the profit of the Power-to-gas system.

On the other hand, hydrogen can be used in the gas system, in transport, and in industry, it can be stored or re-generated. Considering that each of the possibilities of using hydrogen requires additional and more extensive research, the authors have chosen the possibility of using hydrogen in the gas system to take advantage of the existing energy infrastructure. Natural gas infrastructure can transport large amounts of energy over long distances, provide large seasonal storage capacities, and have larger cross-border capacities compared to electricity infrastructure [

36].

It should also be noted that hydrogen can be used in the gas system directly as a mixture with natural gas, or synthetic natural gas can be obtained through the methanation process and used as such in the gas system. In this analysis, only the direct blending of hydrogen into the existing gas system at a given energy content of 10% is processed. In this way, hydrogen is considered solely as an energy source that is blended into the gas grid to replace natural gas. The existing gas infrastructure can be decarbonized by blending hydrogen, replacing natural gas with biogas, or converting the gas grid to hydrogen [

11]. The comparison with biogas and the repurposing of the gas grid is not part of this analysis, as the purpose of the paper is the economic viability of replacing the natural gas component with hydrogen while using the existing gas infrastructure.

This paper assumes that the existing gas grid can accept hydrogen blending at the specified ratio at any time. Flexibility in PEM electrolyzer operation is important in this analysis to include the electrolyzer in providing ancillary services to the system to influence the final price of yellow hydrogen with additional income from ancillary services. The efficiency and expected price drop of PEM electrolyzers from the perspective of hydrogen production economics is certainly an important feature that makes the PEM electrolyzer suitable for use in this model compared to others.

The authors are aware of the uncertainties of future electricity price projections and other parameters, especially over a long period of time. Therefore, higher and lower electricity prices were analyzed using a sensitivity analysis. Different prices affect the hydrogen production price in the model, as well as natural gas and CO2 market prices. However, this reflects current or historical data for electricity prices against which the current competitiveness of hydrogen in the market is measured, whereas in this analysis the authors are interested in projecting electricity prices, i.e., the future competitiveness of hydrogen in the market. The paper presents subsidies for the first and last year of the project, but in the model, it is calculated for each year of the project. The greatest weakness of the research is the input data on the electricity price, natural gas, and CO2 emissions price.

It should be pointed out that this methodology can be applied in a number of other regions where a similar situation exists with existing gas-fired power plants. The challenge in the energy transition is precisely to use the existing gas infrastructure to replace natural gas with hydrogen, the combustion of which does not release CO2 and does not harm the environment while meeting decarbonization and climate goals so that the economy will be carbon-neutral by 2050.

The Croatian energy sector is a paradigm for European countries that has a certain share of gas-fired thermal plants and well-developed power systems. The model can be used for other European countries or regions to evaluate future interactions between the hydrogen market, electricity, natural gas, and CO2. It can also form the basis for future analyses of the use of existing energy infrastructure in the context of decarbonizing the energy sector. The model can be used in practice to assess the profitability of this or similar projects.

5. Conclusions

The main conclusion of this paper is that the production of yellow hydrogen with an electrolyzer located inside the existing gas-fired power plant cannot be economically viable and competitive in the observed scenarios and under assumed assumptions. According to the studies in

Table 1 [

13,

14], the green hydrogen production price from a hydropower plant is 3.86 EUR/kg at an electricity price of 50.00 EUR/MWh. In our model at the same electricity price, the yellow hydrogen production price is 3.43 EUR/kg. In the study from

Table 1 [

3], the green hydrogen production price from a wind farm is 2.32 EUR/kg with an electricity price of 55.00 EUR/MWh. At the same electricity price, in our model, the yellow hydrogen production price is 3.66 EUR/kg.

The number of operating hours of the electrolyzer is optimized here for the whole observed timeframe of 25 years. The amount of hydrogen is given, and due to the installed power of the electrolyzer, it is necessary to have the same number of operating hours for each year. By using the solver, it was calculated that the optimal number of operating hours yearly is 3542. Income from ancillary services reduces the hydrogen production price. From the moment when the electrolyzer operates at full installed capacity, income from ancillary services reduces the hydrogen production price by around 0.5 EUR/MWh.

The competitiveness of hydrogen against natural gas depends on the ratio of the electricity price and natural gas price increased by the CO

2 emission cost. Therefore, it cannot be viewed only through the electricity price without considering the natural gas and CO

2 emission price. It is important to note that the calculations are based on the electricity market prices from the respective ENTSO development plans [

5], which are several times lower than the current market prices in Europe during 2023. At current electricity prices, the unviability of yellow hydrogen production is even higher.

The natural gas price should be higher or equal to the hydrogen production price in order to avoid subsidies. In the whole model observed timeframe, the yellow hydrogen production price is not lower than the natural gas price increased by the CO2 emissions cost. In the first year of the model, the yellow hydrogen price is 83.68 EUR/MWh, and the natural gas price increased by the CO2 emissions cost is 30.79 EUR/MWh. In the last year of the model, the yellow hydrogen price is 84.00 EUR/MWh, and the natural gas price increased by the CO2 emissions cost is 47.82 EUR/MWh. There is a strong correlation between the market prices of natural gas and electricity. Hydrogen production from water electrolysis with electricity from the power grid is more expensive than natural gas price increased by the CO2 emission cost. Because of that, for these cases, it is necessary to create an adequate yellow hydrogen incentive mechanism. The premium incentive system for the development of hydrogen production technology is a part of the investment cycle of the energy transition. Therefore, the premium is a variable part of the incentive scheme and depends on the market price: the higher the market price for natural gas and CO2 emissions, the lower the premium for hydrogen production. If the market price for natural gas and CO2 emissions is higher than the hydrogen production cost, the premium is no longer needed, which is the goal of the energy transition.

At the assumed natural gas and CO2 emission prices, the incentives for hydrogen production need to be 52.90 EUR/MWh in 2025 and 36.18 EUR/MWh in 2050. However, without an appropriate package of incentive measures from European and national energy policies, hydrogen production will not be viable even in a location that does not require large infrastructure investments.

The results of this research clearly show the unviability of such investment, considering that the yellow hydrogen production price is several times higher than the natural gas price increased by the CO2 emission cost. In the long term timeframe, a solution could be to considerably increase the share of renewable energy sources in the electricity mix to reduce the correlation between electricity and natural gas prices.

Our research on yellow hydrogen production in an existing gas-fired power plant site shows that this is not yet feasible without financial incentives, but in energy terms, it could contribute to decarbonizing the energy system and meeting climate goals, while promoting the sustainability of existing gas infrastructure. Investing in hydrogen production would help reduce dependence on natural gas while decarbonizing the gas sector and leveraging existing gas infrastructure. By avoiding investments in energy infrastructure, i.e., connections to the electricity and gas system and the chemical water preparation, the difference between the hydrogen production price and natural gas market price is significantly reduced.

To date, synthetic gas or hydrogen is not recognized as a green gas eligible for a green gas feed-in tariff. Furthermore, the question of the maximum hydrogen concentration in the hydrogen-natural gas blend is still open. The permissible concentrations for the direct injection of hydrogen into the natural gas grid vary greatly in the individual EU countries, as the possibility of transporting hydrogen through the gas grids was not considered when the existing gas regulations were introduced. It is therefore crucial to remove the legal barriers to blending hydrogen with natural gas by harmonizing blending concentrations and setting limits based on physical constraints. Even if favorable economic conditions exist, Power-to-Hydrogen pathways will only develop if appropriate regulations make this possible. The attention of policymakers should be drawn to this issue. Investigating the incentives and regulatory barriers for the deployment of hydrogen systems is an important policy task to achieve the goals of the EU Green Deal.

The authors are aware of uncertainties in future electricity and CO2 emission price projections. Still, this is the first attempt to evaluate the viability of hydrogen production at the site of the existing gas-fired power plant, considering the existing infrastructure, the supply of electricity from the power grid, and the inclusion of the power plant in the ancillary service mechanism. Electricity and natural gas price projections are very unclear at the moment due to the energy market crisis, leading to a higher level of uncertainty in any future energy sector scenario analysis. However, the model is developed and tested on the Croatian empirical data and it can be further used to simulate different market conditions and projections. Further research could expand this approach and address the cost-benefit model of hydrogen production at renewable energy plant sites and the integration of hydrogen into the existing natural gas grid.