Abstract

To achieve the goal of sustainable development, China has implemented the energy conservation and emission-reduction policy. So far, there is still little evidence of the impact of the policiy on corporate behaviour. Therefore, this study collects data on Chinese A-share listed companies from 2010 to 2017 and applies the staggered difference-in-differences method to analyse the impact of the energy conservation and emission-reduction policy on the environmental, social and governance performance of companies in China. The result shows that the energy conservation and emission-reduction policy reduces environmental, social and governance performance, and this negative effect increases over time. Meanwhile, a further mechanism analysis confirms that the negative impact on environmental, social and governance performance operates through the incentive effect on environmental performance, the crowding-out effect on social performance and the spillover effect on governance performance. Furthermore, the negative effect is heterogeneous across companies and cities. Overall, our results provide empirical evidence for optimising energy conservation and emission-reduction policies in developing countries.

1. Introduction

In 2006, the United Nations Principles for Responsible Investment (UN-PRI) considered environmental, social and governance (ESG) factors as crucial indicators to measure sustainable development and introduced the concept of ESG policy. This approach aimed to help enterprises adapt to the new trend of sustainable development by focusing on enterprises’ non-financial reporting and stakeholders’ value [1]. Over time, ESG performance has become a crucial criterion for measuring corporate sustainability and has also been regarded as a solution to sustainable development challenges (such as climate change, inequality and pollution) at the enterprise level.

Considering the sustainable development challenges, governments have introduced many environmental policies. Among them, fiscal policy is essential to cope with the impact of climate change [2,3,4]. Due to its extensive development path, China has become one of the world’s largest energy consumers and carbon emitters [5,6]. Therefore, China has proposed the 3060 targets: peak carbon emissions by 2030 and carbon neutrality by 2060, and taken measures to save energy and reduce emissions. The energy-saving and emission-reduction (ESER) policy issued by the central government in 2011 is a new attempt to save energy and reduce emissions in China. Previous studies [6,7,8] have documented the effects of the ESER policy on pollution reduction and carbon emissions in Chinese cities. However, relatively little evidence is available on the impact of the ESER policy at the enterprise level.

This study used a staggered difference-in-differences (DID) approach to estimate the ESER policy effect on ESG performance in China. Since 2011, the ESER policy has been implemented in three batches, with 30 pilot cities, aiming to achieve environmental goals by integrating fiscal policies. Meanwhile, enterprises are indispensable participants in this policy and sustainable development. To this end, this study focuses on the following questions: Can the ESER policy affect ESG performance? If so, what are the channels, and does this effect vary across ESG contexts and cities?

This study relates to the vast literature on ESG. Investors, shareholders and governments have increasingly scrutinised companies’ ESG performances as a risk management concern, and firms have become a crucial component of their competitive strategy [9,10]. More than 2000 empirical studies show that ESG performance positively impacts a firm’s financial performance, in line with the concept of sustainable development [11]. ESG research focuses on the impact of policies adopted by government entities at different levels on the ESG performance of companies and the impact of companies’ ESG performance on their operating conditions. Companies disclosing non-financial environment-related information depend on their decisions on public policies and social concerns [12,13]. External investors, such as financial institutions, are more willing to provide financing to companies that align with the concept of sustainable development from the perspective of green finance [14]. Although firms’ disclosure of environmental information raises operating costs, it may reduce financing costs, helping obtain more long-term loans and government subsidies and enhancing green innovation [15,16].

From the social responsibility perspective, previous studies have shown that corporate firms’ social responsibility significantly impacts their ability to receive financing [17] and sustainability [18]. However, a company’s social responsibility is not directly linked to profitability [19]. While disclosing social responsibility information may positively affect society, it also squeezes shareholder equity [20]. Corporate governance is a fundamental condition for sustainable business, and good corporate governance may improve the sustainable development of a company [21]. Governments and corporate governors increasingly value the ESG performance of listed companies [22,23]. A good ESG performance helps companies enjoy cheaper financing and gain a better social reputation while achieving better market value performance. Many countries have introduced various types of reform initiatives. Through monetary and fiscal instruments, such as green finance, they aim to help companies move closer to the best companies under the ESG evaluation system.

This study also relates to the recent literature on evaluating the effects of the ESER policy. To achieve the objectives of energy conservation and pollution reduction, governments use fiscal policies, including financial subsidies, to incentivise specific entities to move towards the desired policy direction. A well-designed fiscal policy considers the needs of multiple stakeholders and promotes sustainable development while ensuring reasonable economic growth [24]. However, China’s economic development and urbanisation rates have posed significant challenges to its sustainable development, especially concerning environmental pollution and energy emission reduction [25]. Moreover, previous research has shown a significant inverted-U relationship between economic development level and carbon emissions [26]. The ESER policy, proposed in 2011, aims to promote sustainable development by encouraging energy conservation and emissions reduction through green production practices [27]. Empirical studies have indicated that ESER demonstration policies may reduce carbon emissions in pilot cities through emission reduction and energy structure adjustments [6,7].

Furthermore, the ESER policy may induce corporate green technological innovation by enhancing adaptability and organisational effectiveness [28]. However, some empirical studies have revealed limitations of the emission-reduction policy, such as significant pollution reduction only during the demonstration period and significant emission-reduction effects only for target pollutants. In addition, emission-reduction targets may adversely affect industrial green production performance [8,29].

A considerable body of empirical literature exists on the effectiveness of the ESG policy in reducing emissions at the city and corporate levels. However, the impact of the ESER policy on corporate ESG performance remains relatively unexplored. Hence, this study uses a staggered difference-in-differences (DID) approach to estimate the effect of the ESER policy on ESG performance in China. Furthermore, it investigates the impact of the ESER policy on various dimensions of corporate performance, particularly concerning environmental (E), social (S) and governance (G) aspects.

This study contributes to existing research from the following perspectives. First, this paper enriches the literature on evaluating the impact of the ESER policy. Although some studies [6,7,8] have investigated the ESER policy’s effect from the city’s perspective, the impact of the ESER policy on enterprises is still unknown. Enterprises play a prominent role in energy use and pollutant emissions, serving as intermediaries for the ESER policy. Consequently, evaluating the ESER policy effect is crucial to examine its impact on enterprises’ behaviours.

Second, our study extends the literature that examines whether government-led green fiscal policies are effective and provides further empirical evidence on the reasons. Some studies have demonstrated an implementation gap in environmental policies in developing countries [30,31,32] due to their relatively weak legal and institutional environments [33]. Our study provides new evidence for this implementation gap and explores the reasons for this gap.

Third, we mitigate estimation bias by using the staggered DID method. Previous studies [34,35] have mostly used the two-way fixed-effects difference-in-differences (TWFEDID) method to evaluate policy effects. However, the latest research shows that when treatment timing varies, the TWFEDD estimator fails to identify interpretable treatment effect parameters. Hence, researchers should consider an approach that is robust to treatment effect heterogeneity and dynamics [36,37]. On the one hand, our study uses negative weights to show the bias of the TWFEDD estimator. On the other hand, the ESER policy is staggered and time-limited, and these characteristics make the heterogeneous treatment effects more complex. To address bias, our study uses the DIDM estimator proposed by de Chaisemartin and D’Haultfœuille [38], which does not rely on any treatment effect homogeneity condition.

2. Background and Hypotheses

2.1. Policy Background

China is the world’s largest carbon emitter [39]. Faced with increasing pressure to reduce emissions, the 12th Five-Year Plan has introduced a binding target to reduce carbon emission intensity by 17% by 2015. China has proposed several fiscal policies for renewable energy and green buildings to meet these targets. However, the related funds are scattered and have specific purposes, resulting in a lack of local government initiatives and limited policy impact. Against this background, China has promoted the ESER policy, which is an assessment-incentive policy.

The ESER policy was first implemented in 2011 to make pilot cities the front-runners in energy saving and emission reduction. The ESER policy is a systematic programme. Thirty demonstration cities (Table 1) were selected for the ESER policy by the central government in three batches. The first batch (2011) addressed eight cities, including Beijing and Hangzhou. The second batch (2013) comprised 10 cities, including Shijiazhuang and Tangshan. The third batch (2014) addressed 12 cities, comprising Tianjin and Xuzhou.

Table 1.

Details of demonstration cities.

The ESER policy is valid for three years. During these three years, the central government provides financial subsidies to demonstration cities, enriching the financial resources of local governments. In addition, demonstration cities are assessed annually, and the results are the standard for the scale of subsidies. Moreover, a pilot city is disqualified and all subsidies are deducted in the following three situations. First, the pilot city does not reach the ESER goals in three years. Second, the pilot city cheats or misappropriates the subsidies. Third, the pilot city fails to pass the annual assessment for two years. Therefore, the ESER policy is dual as it comprises target constraints and fiscal incentives.

2.2. Theoretical Hypotheses

2.2.1. Impact of the ESER Policy on ESG Performance

The essence of ESG is to coordinate economic, social and environmental benefits simultaneously. Recent studies have explored the factors that affect corporate ESG performance from the perspective of corporate characteristics such as size [40], cross-listing [41], internationalisation [42] and board and chief executive officers [43,44,45]. According to the environmental scanning theory [46], enterprises frequently conduct “environmental scanning” to assess external economic, social, legal and political situations and make decisions. Therefore, investigating the impact of these policies on ESG performance is necessary.

The Impact of the ESER policy on pollution and carbon emissions in Chinese cities has been verified [6,8], but its impact on ESG performance is still underexplored. As a regulatory tool with the dual characteristics of target assessment and financial incentives, the ESER policy encourages pilot cities to establish long-term ESER mechanisms through government-led and market-regulated measures. Meanwhile, enterprises, the main actors of the ESER policy, actively participate in pilot work under the incentive-constraint mechanism. On the one hand, the ESER policy puts forward the overall goals, main tasks and assessment indicators. Financial funds are deducted if the indicators are unmet, and the pilot city is disqualified. Therefore, local governments implement stricter environmental regulations and promote green technology and clean energy to achieve these goals, potentially improving enterprises’ ESG performances. On the other hand, in contrast with other environmental policies, in addition to target constraints, the ESER policy also provides enterprises with some incentives, such as subsidy investments and favourable taxes, which may encourage enterprises to save energy and reduce emissions. Thus, we propose the following hypothesis:

Hypothesis 1a.

The ESER policy may improve ESG performance.

As an environmental strategy, the ESER policy introduces higher requirements for energy saving and emission reduction, which may lead to additional costs and underinvestment by firms [47]. As a result, cash flows decrease, and debt uncertainty and the credit default rate are exacerbated [48,49]. These tight financing constraints leave firms with insufficient funds to support ESG activities. Furthermore, the ESER policy releases environmental governance signals. In response to these signals, enterprises try to improve environmental performance and reduce their social responsibility and governance efforts. Hence, when the environment, social responsibility and governance are considered as a whole, as in the definition of ESG, the ESER policy may mitigate ESG performance. Thus, we propose the following hypothesis:

Hypothesis 1b.

The ESER policy may mitigate ESG performance.

2.2.2. Incentive Effect of the ESER Policy on E Performance

The positive effect of the ESER policy on the environment has been well documented at the city level [6,7,8]. However, the impact at the enterprise level needs further exploration. First, according to Porter’s hypothesis [50], proper environmental regulation encourages enterprises to innovate to offset costs. The ESER policy establishes a promotion mechanism for advanced environmental protection technology to provide market information and encourages enterprises to invest in green technologies [6]. Simultaneously, green innovations enhance corporate reputation, lowering the threshold to finance various development resources and enabling companies to allocate more resources to green innovation [51]. Second, the ESER policy aims to make pilot cities the front-runners in energy saving and emission reduction. The pilot phenomenon increases the media’s intention to focus on enterprises’ behaviour in pilot cities. Consequently, enterprises must avoid being disciplined for environmental violations or falling behind due to the deflation of environmental protection goals [52]. Based on this discussion, we propose the following hypothesis:

Hypothesis 2.

The ESER policy may improve E performance.

2.2.3. Crowding-Out Effect of the ESER Policy on S Performance

Previous studies have used corporate social responsibility (CSR) to evaluate social responsibility performance. CSR activities encompass corporate social and environmental behaviours beyond the legal or regulatory requirements of the relevant market and/or economy [53]. Section 2.2.2. discussed the impact on environmental behaviour; thus, this section only analyses the impact on social externalities, including tax and donation. From a societal perspective, corporate tax payment ensures public goods’ financing [54]. When an enterprise does not pay its “fair share” of corporate taxes (called “tax aggressive”), the shortfall in corporate tax revenue produces a significant and potentially irrecoverable loss to society [55,56,57]. In addition, some studies have documented a negative and statistically significant association between social responsibility and tax aggressiveness, indicating that firms with lower social responsibility tend to avoid tax [58,59]. The ESER policy includes many tax incentives, which reduce the tax burden on green enterprises and provide space for enterprises to avoid taxes. As a result, the ESER policy may mitigate S performance from a tax perspective. In addition, faced with the increasing expected cost of pollution control, enterprises reallocate resources, arranging more environmental governance funds and fewer donations. Thus, the ESER policy may also mitigate S performance through donation channels. Therefore, we empirically test the following hypothesis:

Hypothesis 3.

The ESER policy may mitigate S performance.

2.2.4. Spill-Over Effect of the ESER Policy on G Performance

According to the higher-order theory, corporate executives play a major role in corporate behaviour and strategic choices [60,61]. Consequently, the degree of concern and awareness of environmental issues among executives is a key factor in formulating corporate green strategies and implementing corresponding goals [62,63,64]. Optimising the industrial layout and structure is one of the primary tasks of the ESER policy. Thus, the local government supports green industries and eliminates highly polluting industries, releasing a strong green signal to the market. In this context, corporate executives must improve environmental awareness and make decisions to achieve green transformation. Hence, the ESER policy may positively affect G performance, especially in green governance. Therefore, we propose the following hypothesis:

Hypothesis 4.

The ESER policy may improve G performance.

3. Materials and Methods

3.1. Estimation Framework

The DID model is widely used to evaluate policy performance. This approach deals with endogeneity and controls for the impact of unobservable individual heterogeneity on the explained variable [65]. Therefore, this study employs the staggered DID model to investigate the effect of the ESER policy on ESG performance. Based on previous studies [6,7,8], the staggered DID model may be specified as follows:

where denotes the ESG performance of enterprise in year . indicates whether the city where enterprise is located is listed as a demonstration city and obtains a subsidy from the central government in year . If so, equals one, and zero otherwise. The parameter of interest, , captures the treatment effect of the ESER policy. If is significant and positive, the ESER policy may improve ESG performance. On the contrary, if is significant and negative, the ESER policy may mitigate ESG performance. is a vector of control variables, and represent enterprise and year fixed effects, respectively, and is the error term. Standard errors are clustered at the industry level to control for potential heteroskedasticity and serial correlation of the error term.

3.2. Data and Variables

Due to the availability of ESG scores and the time of the policy, our initial sample includes A-share listed companies from 2010 to 2017. The sample is further refined using the following criteria: (i) we exclude financial firms, real estate firms, firms with missing financial data and special treatment firms (ST, *ST, PT); (ii) to avoid the influence of extreme values, all continuous variables are winsorised at the 1% and 99% quantiles. In addition, information on the list of ESER cities is manually collected from the official websites of China’s MF and local governments (Figure 1). The ESG scores are obtained from the Sino-Security Information Service ESG Rating Database, the main financial data from the China Stock Market and Accounting Research (CSMAR) database and patent data from the China patent database.

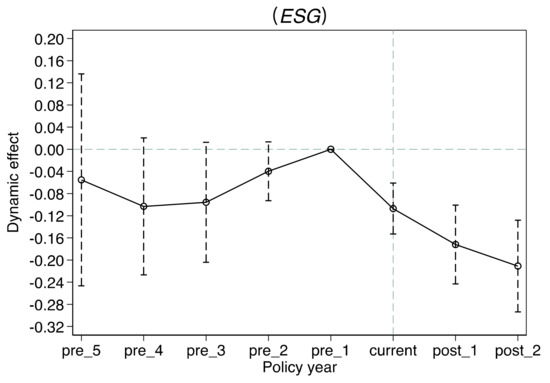

Figure 1.

Tests for parallel trend assumption (ESG). Notes: This figure displays the regression coefficients from Equation (2) and their 95% confidence intervals.

3.2.1. Measures of ESG Performance

In recent studies, we use the ESG rating of the Sino-Security Information Service (SSIS) to measure ESG performance, a popular way to evaluate ESG performance [64,66]. The SSIS ESG evaluation system is based on the core ESG connotation and practice of the Chinese market, which includes three primary indicators, 14 secondary indicators, 26 tertiary indicators and more than 130 underlying data indicators. In line with the SSIS ESG rating, we use a nine-point scale to assign scores to nine grades (one to nine) in descending order. A higher score represents better ESG performance.

In addition, we divide ESG performance into E, S and G performances to discuss the impact of the ESER policy on the environment, social responsibility and governance. We use the ESER and social responsibility scores from Hexun.com to measure E and S performances, respectively. We use the score of environmental information disclosure carriers from the CSMAR database to measure G performance.

3.2.2. Measures of the ESER Policy

is the critical, independent variable representing the policy effect. If enterprise i is in the pilot city, and the city obtains a subsidy from the central government in year t, takes the value of one, and zero otherwise. The ESER policy is a step-by-step, time-limited programme. A total of 30 demonstration cities are selected for the ESER policy in three batches, and the policy lasts for three years (Figure 1). Considering the alternate entry and exit process, the sample cannot be divided into control and treatment groups. Thus, the TWFEDID estimator is biased. In the recent literature, the main solution to this issue is to delete the observations that exit the policy. De Chaisemartin and D’Haultfœuille [38] have proposed a robust estimator for this case. We will discuss this problem in Section 4.2.4 to ensure that the conclusions of our study are robust.

3.2.3. Control Variables

Following previous studies, we further control for the following variables: firm size (scale), leverage (lev), return on assets (roa), operating income growth (growth), total asset turnover (tat), equity concentration (top) and the shareholding proportion of institutional investors (institute). In addition, the year and individual fixed effects are included in the model.

Table 2 and Table 3 present the definitions and descriptive statistics of the variables, respectively.

Table 2.

Variable definitions.

Table 3.

Descriptive statistics.

4. Results

4.1. Baseline Estimates

To explore the effect of the ESER policy on ESG performance, we estimate Equation (1), and the baseline regression results are reported in Table 4. Columns (1) and (3) report the results from Equation (1) without any controls, whereas Columns (2) and (4) add seven control variables. We include year and firm fixed effects; standard errors are clustered by industry. In Columns (1)–(4), the policy coefficients are all negative and significant, indicating that the ESER policy reduces ESG performance and verifies Hypothesis 1b. This finding is consistent with the results of Shu and Tan [67], who document that carbon control policy risk negatively and significantly impacts ESG performance.

Table 4.

Effect of the ESER policy on ESG performance.

Regarding economic significance, our results indicate that the ESER policy decreases the score of ESG performance by 0.1101 and leads to a drop in ESG performance by 2%. It is worth noting that this finding seems to deviate from the original intention of the ESER policy. To explore the reasons, we split ESG performance into E, S and G performances and discuss the impact on these aspects in Section 4.3.

4.2. Robustness Checks

4.2.1. Parallel Trend Test

The DID method relies on the parallel trend hypothesis, which implies that companies in pilot and non-pilot cities have common trends in ESG performance before implementing the ESER policy. If not, the differences between enterprises in pilot and non-pilot cities may be influenced by heterogeneous factors rather than the ESER policy. Thus, we examine the parallel trends of enterprises in pilot and non-pilot cities. Following Beck et al. [68], the regression formulation is as follows:

where are relative year variables indicating . If company is in the pilot city, equals one; otherwise, it equals zero. As the ESER policy was implemented in three batches in 2012, 2014 and 2015, the range of values for was . The benchmark time category is . Thus, the parameter of interest, , captures the difference in ESG performance between pilot and non-pilot cities. The other variables are defined in Equation (1).

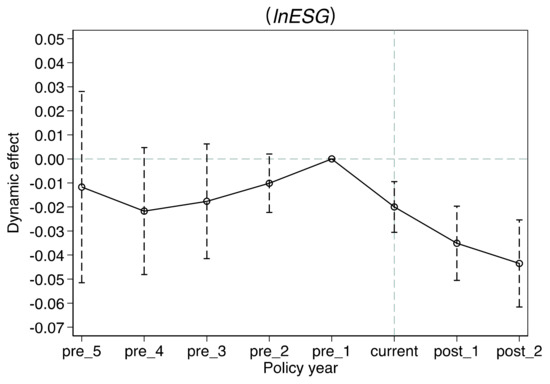

Figure 1 and Figure 2 show the results of tests for the parallel trend assumption. The estimated coefficients are negative but not significant in the pre-ESER period. These results indicate that enterprises in pilot and non-pilot cities follow common trends before the ESER policy. In the post-ESER period, the coefficients on and are negative and statistically significant, showing that the differences in and among enterprises in pilot and non-pilot cities begin to diverge. Thus, our estimates satisfy the parallel trend hypothesis.

Figure 2.

Tests for parallel trend assumption (lnESG). Notes: This figure displays the regression coefficients from Equation (2) and their 95% confidence intervals.

4.2.2. Placebo Test

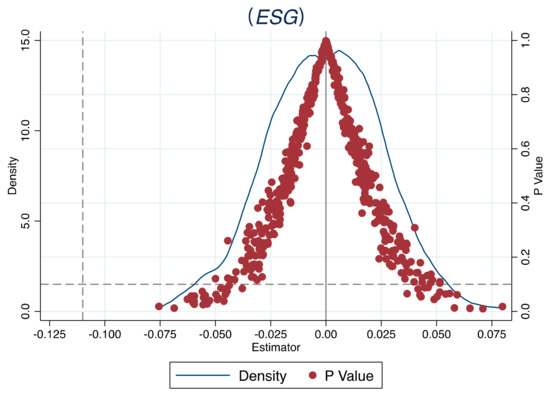

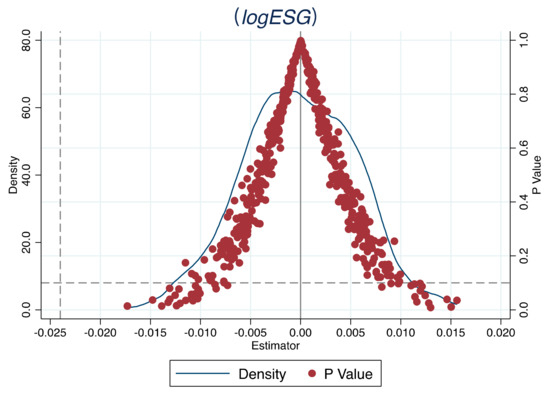

To further verify that the decrease in ESG performance is influenced by the ESER policy and not by other unobservable factors, we conducted a placebo test. Following previous studies [7,33], we design a pseudo-treatment variable according to the distribution of the in the baseline model and perform a random data generation process 500 times to avoid contamination caused by any rare events. Figure 3 and Figure 4 illustrate the distribution of the estimated coefficients and the p-values of the pseudo-treatment variables.

Figure 3.

Placebo test (ESG). Notes: This figure displays the distribution of the density, p value and estimator. The vertical dashed lines represent actual estimates.

Figure 4.

Placebo test (lnESG). Notes: This figure displays the distribution of the density, p value and estimator. The vertical dashed lines represent actual estimates.

In Figure 3 and Figure 4, we find that both distributions of the pseudo-coefficients are centred at approximately zero. The vertical dashed lines represent actual estimates using the true ESER policy event. Our true estimate is an outlier in the two simulations. Most p-values are greater than 0.10, implying that the coefficients are insignificant at the 10% level. Overall, these findings suggest that unobserved factors do not drive the significantly negative effect of the ESER policy on ESG performance, and our conclusion is robust.

4.2.3. Event Study

To reflect the dynamic effect of the ESER policy, we construct an event study to analyse the year-wise dynamic effect considering the following model [8]:

where is a set of variables representing ; denotes the year in which city enterprise is located when applying the ESER policy, and is [−5, 2]. The results of Equation (3) are reported in Table 5.

Table 5.

Effect of the ESER policy on ESG performance (Event study).

Table 5 shows that all five pre-treated indicators are not significant at the 10% level, while treated indicators are significant at the 1% level. This result meets the parallel trend assumption and verifies that the ESER policy mitigates ESG performance. The estimation results of and indicate that the coefficients show an increasing trend after implementing the ESER policy. In addition, these coefficients are negative and statistically significant at the 1% level. These findings mean that the ESER policy significantly reduces ESG performance, and this negative impact worsens over time.

The increasing negative impact of the ESER policy on ESG performance may be determined by its characteristics. As mentioned above, the demonstration period of the ESER policy is three years. If the pilot city fails to achieve the emission reduction and energy-saving goals, government subsidies are deducted. Therefore, the closer pilot cities move to the goals’ deadlines, the more governments tighten environmental regulations, leading firms to spend more money and effort on ESER at the expense of social responsibility and corporate governance, causing a continued decline in ESG performance.

4.2.4. Discussion on Heterogeneous Treatment Effects

Recent literature [36,37] contends that the heterogeneity of treatment effects across groups and time dimensions in the overlapping treatment scenario may create negative weights and bias for TWFEDID estimators. Robust estimators are suggested to deal with heterogeneous treatment effects. To test for heterogeneous treatment effects and obtain robust estimates of treatment effects when policies overlap in terms of adoption and exit, we adopt the DIDM estimator proposed by de Chaisemartin and D’Haultfoeuille [38], which does not rely on treatment effect homogeneity and can be applied for the assessment of policies with entry and exit. In addition, we extend the period of samples to 2010–2020 to verify whether the conclusions of this study still hold after the ESER policy was eliminated in 2017. Table 6 shows the sum of the negative weights and average treatment effect based on repeated sampling (50 times) and using the DIDM estimator.

Table 6.

Negative weight test and average treatment effects of the ESER policy.

The percentage of negative weights for the baseline regression is 0.00%, which implies that the sum of the positive weights is equal to one, while the sum of the negative weights is equal to zero. The average treatment effects on the treated are −0.1670 and −0.0336, respectively. These findings indicate that the proportion of negative weights due to heterogeneous treatment effects in the baseline regression is small, and the average treatment effect remains stable. Thus, the bias is not severe, and the conclusion of the baseline regression is robust.

4.3. Further Analysis

Theoretically, ESG focuses on enterprises’ sustainable development, consistent with ESER policy’s focus. However, why does such a negative impact (as shown in Section 4.1) occur in the policy implementation process? To explore this phenomenon, we decompose ESG performance into E performance (environment), S performance (social responsibility) and G performance (governance). Table 7 reports the estimates of the impact of the ESER policy on the E, S and G performances.

Table 7.

Impact on E, S and G performances.

The coefficients on E and G performances are positive and significant, whereas the coefficient on S performance is negative and significant. These results show the promotion effect on E and G performances and the inhibitory effect on S performance, verifying Hypotheses 2, 3 and 4. Due to inconsistent statistical criteria, although the estimated coefficients show the positive or negative impact of the ESER policy on E, S and G performances, we cannot compare the absolute magnitude of different effects)Therefore, we may infer that the negative impact of the ESER policy on ESG performance mainly stems from the crowding-out effect on social responsibility, as discussed in Section 2.2.3.

4.4. Machanisms

Our analysis documents the negative impact of the ESER policy on ESG performance. In addition, we find a negative effect on S performance and a positive effect on E and G performances. However, the mechanisms are still unclear. As discussed in Section 2.2, the ESER policy may affect ESG performance through the incentive effect on E performance, the crowding-out effect on S performance and the induction of spill-over effect on G performance. In this section, we discuss the incentive, crowding-out and spill-over channels. Table 8 shows the result of the mechanisms analysis.

Table 8.

Mechanism analysis.

The ESER policy is a green fiscal strategy that promotes low-carbon economic transformation through fiscal incentives and environmental regulation. On the one hand, the ESER policy sets specific targets to induce enterprises to save energy and reduce emissions externally. On the other hand, the ESER policy offers tax incentives and subsidies, which lead enterprises to save energy and reduce emissions internally. Therefore, we consider the internal and external channel incentive effects on E performance. Based on Porter’s hypothesis, from the external channel, proper environmental regulation encourages enterprises to innovate, offsetting additional costs. Thus, following [69], we adopt the number of granted green patents to measure green innovation. Green patents are divided into four types: independent green invention patents, independent green utility patents, joint green invention patents and joint green utility patents. The green patents data are collected from the website of the Patent Search and Analysis System of the National Intellectual Property Administration of China and the Green Patent Research Database.From the internal channel, the ESER policy focuses on environmental performance. Hence, influenced by the reputation effect, enterprises tend to avoid being disciplined for environmental violations or falling behind due to the deflation of environmental protection goals [52], improving environmental performance. Therefore, we adopt the number of media reports (the number of times an enterprise’s name appears in the headlines of media reports as a measure) to measure the media attention of enterprises.

Columns (1) to (5) of Table 8 display the results of the incentive effect on E performance through the green patents and media channels. First, the coefficient on joint green utility patents is positive and significant at the 5% level, whereas the coefficients on other types of green patents are positive but not significant. This finding indicates that the ESER policy may promote joint green utility patents but has no significant effect on other types of green patents. Invention patents require more time, costs and effort than utility patents. In addition, to encourage the development of green technologies, the ESER policy builds a platform for corporate cooperation in green technology innovation, motivating enterprises to jointly develop green technologies. Second, the coefficient on media attention is positive and significant at the 10% level, which indicates that the ESER policy, as a demonstration policy, raises media attention to enterprises located in ESER cities, motivating them to improve environmental performance.

As discussed in Section 2.2.3, the ESER policy may mitigate S performance through the tax and donation channels. Thus, we examine the mechanisms through which the crowding-out effect impacts S performance from the perspective of tax and donation. We adopt the income tax to profit ratio to measure tax contribution and the logarithm of the donation amount to measure donation contribution. Columns (6) and (7) of Table 8 report the results for the tax and donation channels. The coefficient on tax contribution is negative and significant at the 1% level. This result shows that the ESER policy reduces enterprises’ tax contributions owing to tax incentives and tax avoidance. Moreover, the coefficient on donation is negative but not significant. These results indicate that the crowding-out effect of the ESER policy on S performance is concentrated in the tax contribution channel rather than in the donation channel.

As discussed in Section 2.2.4, the ESER policy measures, such as supporting green industries and gradually eliminating high-polluting industries, release a strong green signal to the market. In this context, corporate executives are induced to improve their environmental awareness for the sustainable development of enterprises. Thus, the ESER policy may improve green governance by stimulating managers’ awareness of green development. We use the environmental awareness score from Hexun.com to measure the understanding of green governance. Column (8) of Table 8 shows environmental awareness’s positive and significant effects.

The findings in Table 8 confirm Hypotheses 2, 3 and 4, revealing that the ESER policy may promote E and G performances through innovation, media and awareness channels while mitigating S performance through tax contribution.

4.5. Heterogeneous Effects

4.5.1. Heterogeneous Analysis of Firm-Level Characteristics

Table 9 presents the heterogeneous impact of firm-level characteristics, including state ownership and industry. First, it should be noted that state-owned enterprises (SOEs) and non-SOEs are unique institutional environments in China. Columns (1) and (4) of Table 9 show that the coefficient on is negative and significant in non-SOEs but not in SOEs. Based on the resource access theory, SOEs are more closely tied to the government and have easier access to policy, funding and resource support. Thus, the incentive effect of the green fiscal policy is at play, whereas the constraining impact may be challenging to enforce. By contrast, non-SOEs are more likely to be influenced by policies. When environmental regulations are strengthened to alleviate financial constraints, non-SOEs prefer to change the allocation of resources or use tax incentives to reduce the tax burden, generating a more pronounced crowding out of social responsibility.

Table 9.

Results of heterogeneous analysis: Firm-level characteristics.

We also examine whether industry characteristics influence this effect. Based on whether the enterprise belongs to high-pollution (high-pollution industries include thermal power, iron and steel, cement, electrolytic aluminium, coal, metallurgy, chemicals, petrochemicals, building materials, paper, brewing, pharmaceuticals, fermentation, textiles, tannery and mining), high-emission (high-emission industries include petrochemical, chemical, building materials, iron, and steel, non-ferrous, paper, power and aviation), and high-energy-consuming industries (high-energy-consuming industries include the chemical raw material and chemical product manufacturing industry, non-metallic mineral products industry, ferrous metal smelting and rolling processing industry, non-ferrous metal smelting and rolling processing industry, petroleum processing, coking and nuclear fuel processing industry, electricity and heat production and supply industry), we divide the sample into pollution and non-pollution groups. Columns (5)–(8) of Table 9 show that the coefficients on are significant and negative in both the pollution and non-pollution groups, whereas the absolute value of the pollution group (−0.1483 and −0.0266) is larger than that of the non-pollution group (−0.0909 and −0.0169). These findings suggest that the negative impact of the ESER policy on the pollution group is greater than that on the non-pollution group. To achieve the goal of policy, the ESER policy implements various measures, such as eliminating backward production capacity, raising the entry threshold and energy consumption limits for high-pollution, high-emission and high energy-consuming industries, and strengthening energy-saving and environmental protection indicator constraints. As a result, these measures increase the cost for enterprises in the pollution group, squeezing out social responsibility and leading to a decline in ESG performance.

4.5.2. Heterogeneous Analysis of City-Level Characteristics

Table 10 represents the heterogeneous impact of city-level characteristics, including environmental concern and resource endowment. First, local governments have an information advantage compared to the central government. They may formulate effective policies based on regional characteristics. However, this advantage depends on whether local governments are concerned about environmental issues. If so, local governments will increase funding and policies to improve the environment, which can facilitate the implementation of the ESER policy. The annual work reports of local governments reflect their priorities for the year. Therefore, we use the proportion of environment-related words to the full-text words in the annual work reports of the local government to measure the government’s attention to environmental issues.

Table 10.

Results of heterogeneous analysis: City-level characteristics.

We divide the sample cities into groups depending on the median of the proportion, with the group above the 50th percentile indicating high environmental concern. Columns (1)–(4) of Table 10 show the estimation results. The coefficient on Policy is negative and statistically significant for cities with high environmental concerns, while it is insignificant for cities with low environmental concerns. These findings suggest that the more the local government focuses on environmental issues, the more the crowding-out effect of the ESER policy is reinforced, resulting in a lower ESG performance.

Next, we examine the different treatment effects of resource endowments. We divide the sample cities into resource- and non-resource-based cities based on government documents. Columns (9) to (12) of Table 10 report the estimation results. The coefficient on Policy is negative and significant in non-resource-based cities, whereas it is lower and insignificant in resource-based cities. These findings indicate that the ESER policy has a negative impact on ESG performance, which is not observed in resource-based cities. This result may be due to the so-called resource curse and Dutch disease, confirmed in previous studies [7,70,71]. The development of resource-based cities is excessively dependent on resource exploitation and processing, which may lead to higher environmental pollution. Hence, it is difficult for resource-based cities to achieve their goals of industrial transformation. In addition, resource-based cities prefer to relax their environmental regulations in pursuit of economic development.

4.6. Summary

This section uses the DID method to verify the impact of the ESER policy on ESG performance, and finds that the ESER policy has a negative impact on ESG performance, which seems to deviate from the original intention of the ESER policy. To find the reason, we split ESG performance into E, S and G performances, and find that the negative impact is mainly caused by the crowding-out effect on social responsibility. In addition, we discuss the mechanisms and heterogeneous effects of firm-level and city-level characteristics.

5. Conclusions

This study explores the impact of the ESER policy on ESG performance. Using a panel dataset of China’s A-share listed enterprises from 2010 to 2017, we find consistent and robust evidence supporting the negative impact of the ESER policy on ESG performance. The ESER policy significantly decreases ESG performance in pilot cities by 2% compared to non-pilot cities, and this negative effect increases over time. Notably, this finding seems to deviate from the original intention of the ESER policy. To explore the reason for this divergence, we split ESG performance into E, S and G performances and find an incentive effect on E performance, a crowding-out effect on S performance and a spill-over effect on G performance, and the crowding-out effect on S performance is the main reason for negative impact.

Furthermore, the mechanism analysis demonstrates that the incentive effect on E performance is mainly driven by green innovation and media attention, the crowding-out impact on S performance is motivated by tax incentives and avoidance and the spill-over effect on G performance is achieved by raising managers’ environmental awareness. Moreover, treatment effects differ widely across enterprises and cities. From the perspective of firm characteristics, non-SOEs and enterprises in high-polluting, high-emission and high-energy-consuming industries exhibit a more pronounced negative effect. From the perspective of city characteristics, the negative impact on enterprises in cities with high environmental concerns and non-resource-based cities is more significant.

Our results have meaningful implications for policymakers and firm managers. First, regarding the incentive effect on E performance, policymakers should realise the pivotal role of fiscal policy in sustainable development and improve green fiscal policy to achieve China’s 3060 goals. Second, when formulating green fiscal policies, policymakers should integrate environmental goals with the sustainable development of enterprises to avoid achieving 3060 goals at the expense of firm development. Economic development is a top priority for developing countries such as China. Strengthening environmental targets may have some negative impacts on enterprises, such as an increase in costs and the crowding out of social responsibilities, which may, in turn, affect the fiscal revenues of local governments. Therefore, policymakers should consider enterprises’ environmental and development goals and avoid forcing enterprises to reduce production to reach environmental goals. Doing so, win–win economic development and environmental protection may be achieved. Third, policymakers should reform the fiscal relationship between the central and local governments and increase the local government’s financial resources. As the heterogeneity analysis shows, resource-based cities rely on high-pollution industries and tend to relax environmental regulations for fiscal revenue. Thus, the central government should increase transfer payments when implementing a green fiscal policy to ease fiscal pressure on local governments. Finally, firms should establish ESG-management mechanisms and incorporate environmental goals and social responsibility into their corporate decisions to promote sustainable development. It should be noted that, due to the limitation of data, this study does not discuss the differences on the impact on A-shared listed and non-A-shared listed companies. Further research could focus on the behaviour and choices of different firms and discuss how to construct a more precise green fiscal policy to enhance the effectiveness of policies.

Author Contributions

Conceptualization, S.M., Y.T. and X.Z.; Methodology and software, S.M. and Y.T.; Validation, X.Z.; Formal analysis, S.M., Y.T. and X.Z.; Data curation, Y.T. and X.Z.; Writing-Original Draft Preparation, S.M. and Y.T.; Writing-Review & Editing, S.M., Y.T., X.Z. and X.H. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the Research Foundation for Youth Scholars of Beijing Technology and Business University, grant number QNJJ2021-44, and the R&D Program of Beijing Municipal Education Commission, grant number 19008023155.

Data Availability Statement

Publicly available datasets were analyzed in this study.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Leins, S. ‘Responsible investment’: ESG and the Post-crisis Ethical Order. Econ. Soc. 2020, 49, 71–91. [Google Scholar] [CrossRef]

- Acemoglu, D.; Aghion, P.; Bursztyn, L.; Hemous, D. The Environment and Directed Technical Change. Am. Econ. Rev. 2012, 102, 131–166. [Google Scholar] [CrossRef] [PubMed]

- Aghion, P.; Dechezleprêtre, A.; Hémous, D.; Martin, R.; Van Reenen, J. Carbon Taxes, Path Dependency, and Directed Technical Change: Evidence from the Auto Industry. J. Pol. Econ. 2016, 124, 1–51. [Google Scholar] [CrossRef]

- Hanna, R.; Victor, D.G. Marking the Decarbonization Revolutions. Nat. Energy 2021, 6, 568–571. [Google Scholar] [CrossRef]

- Dong, F.; Liu, Y. Policy Evolution and Effect Evaluation of New-Energy Vehicle Industry in China. Resour. Policy 2020, 67, 101655. [Google Scholar] [CrossRef]

- Wang, Z.; Qiu, S. Can “Energy Saving and Emission Reduction” Demonstration City Selection Actually Contribute to Pollution Abatement in China? Sustain. Prod. Consum. 2021, 27, 1882–1902. [Google Scholar] [CrossRef]

- Xu, T.; Kang, C.; Zhang, H. China’s Efforts Towards Carbon Neutrality: Does Energy-Saving and Emission-Reduction Policy Mitigate Carbon Emissions? J. Environ. Manag. 2022, 316, 115286. [Google Scholar] [CrossRef]

- Lin, B.; Zhu, J. Impact of Energy Saving and Emission Reduction Policy on Urban Sustainable Development: Empirical Evidence from China. Appl. Energy 2019, 239, 12–22. [Google Scholar] [CrossRef]

- Galbreath, J. ESG in Focus: The Australian Evidence. J. Bus. Ethics 2013, 118, 529–541. [Google Scholar] [CrossRef]

- Baldini, M.; Maso, L.D.; Liberatore, G.; Mazzi, F.; Terzani, S. Role of Country- and Firm-Level Determinants in Environmental, Social, and Governance Disclosure. J. Bus. Ethics 2018, 150, 79–98. [Google Scholar] [CrossRef]

- Friede, G.; Busch, T.; Bassen, A. ESG and Financial Performance: Aggregated Evidence from More than 2000 Empirical Studies. J. Sustain. Fin. Investig. 2015, 5, 210–233. [Google Scholar] [CrossRef]

- Darrell, W.; Schwartz, B.N. Environmental Disclosures and Public Policy Pressure. J. Acc. Public Policy 1997, 16, 125–154. [Google Scholar] [CrossRef]

- Clarkson, P.M.; Li, Y.; Richardson, G.D.; Vasvari, F.P. Revisiting the Relation between Environmental Performance and Environmental Disclosure: An Empirical Analysis. Acc. Organ. Soc. 2008, 33, 303–327. [Google Scholar] [CrossRef]

- Zhang, C.; Zhou, B. Where Should the Money Go? The Green Effect of Governmental Guidance When Sustainable Finance Impacts Brown Firms. Pacific-Basin Fin. J. 2023, 78, 101961. [Google Scholar] [CrossRef]

- Lai, H.; Wang, F.; Guo, C. Can Environmental awards Stimulate Corporate Green Technology Innovation? Evidence from Chinese Listed Companies. Environ. Sci. Pollut. Res. 2022, 29, 14856–14870. [Google Scholar] [CrossRef]

- Song, M.; Wang, S.; Zhang, H. Could Environmental Regulation and R&D Tax Incentives Affect Green Product Innovation? J. Clean. Prod. 2020, 258, 120849. [Google Scholar] [CrossRef]

- El Ghoul, S.; Guedhami, O.; Kwok, C.C.Y.; Mishra, D.R. Does Corporate Social Responsibility Affect the Cost of Capital? J. Bank. Fin. 2011, 35, 2388–2406. [Google Scholar] [CrossRef]

- Christensen, H.B.; Hail, L.; Leuz, C. Mandatory CSR and Sustainability Reporting: Economic Analysis and Literature Review. Rev. Acc. Stud. 2021, 26, 1176–1248. [Google Scholar] [CrossRef]

- Aupperle, K.E.; Carroll, A.B.; Hatfield, J.D. An Empirical Examination of the Relationship between Corporate Social Responsibility and Profitability. Acad. Manag. J. 1985, 28, 446–463. [Google Scholar] [CrossRef]

- Chen, Y.C.; Hung, M.; Wang, Y. The Effect of Mandatory CSR Disclosure on Firm Profitability and Social Externalities: Evidence from China. J. Acc. Econ. 2018, 65, 169–190. [Google Scholar] [CrossRef]

- Aras, G.; Crowther, D. Governance and Sustainability: An Investigation into the Relationship between Corporate Governance and Corporate Sustainability. Manag. Decis. 2008, 46, 433–448. [Google Scholar] [CrossRef]

- Atan, R.; Alam, M.M.; Said, J.; Zamri, M. The Impacts of Environmental, Social, and Governance Factors on Firm Performance: Panel Study of Malaysian Companies. MEQ 2018, 29, 182–194. [Google Scholar] [CrossRef]

- Miralles-Quirós, M.M.; Miralles-Quirós, J.L.; Valente Gonçalves, L.M. The Value Relevance of Environmental, Social, and Governance Performance: The Brazilian Case. Sustainability 2018, 10, 574. [Google Scholar] [CrossRef]

- Pablo-Romero, M.D.P.; De Jesús, J. Economic Growth and Energy Consumption: The Energy-Environmental Kuznets Curve for Latin America and the Caribbean. Renew. Sustain. Energy Rev. 2016, 60, 1343–1350. [Google Scholar] [CrossRef]

- Yue, L.; Xue, D.; Draz, M.U.; Ahmad, F.; Li, J.; Shahzad, F.; Ali, S. The Double-Edged Sword of Urbanization and Its Nexus with Eco-efficiency in China. Int. J. Environ. Res. Public Health 2020, 17, 446. [Google Scholar] [CrossRef]

- Cheng, Z.; Li, L.; Liu, J. The Emissions Reduction Effect and Technical Progress Effect of Environmental Regulation Policy Tools. J. Clean. Prod. 2017, 149, 191–205. [Google Scholar] [CrossRef]

- Wu, J.; Lv, L.; Sun, J.; Ji, X. A Comprehensive Analysis of China’s Regional Energy Saving and Emission Reduction Efficiency: From Production and Treatment Perspectives. Energy Policy 2015, 84, 166–176. [Google Scholar] [CrossRef]

- Jin, H.; Yang, J.; Chen, Y. Energy Saving and Emission Reduction Fiscal Policy and Corporate Green Technology Innovation. Front. Psychol. 2022, 13, 1056038. [Google Scholar] [CrossRef]

- Yao, Y.; Jiao, J.; Han, X.; Wang, C. Can Constraint Targets Facilitate Industrial Green Production Performance in China? Energy-Saving Target vs Emission-Reduction Target. J. Clean. Prod. 2019, 209, 862–875. [Google Scholar] [CrossRef]

- Tu, Z.; Hu, T.; Shen, R. Evaluating Public Participation Impact on Environmental Protection and Ecological Efficiency in China: Evidence from PITI Disclosure. China Econ. Rev. 2019, 55, 111–123. [Google Scholar] [CrossRef]

- Yang, Z.; Fan, M.; Shao, S.; Yang, L. Does Carbon Intensity Constraint Policy Improve Industrial Green Production Performance in China? A Quasi-DID Analysis. Energy Econ. 2017, 68, 271–282. [Google Scholar] [CrossRef]

- Shao, S.; Yang, Z.; Yang, L.; Ma, S. Can China’s Energy Intensity Constraint Policy Promote Total Factor Energy Efficiency? Evidence from the Industrial Sector. Energy J. 2019, 40, 101–128. [Google Scholar] [CrossRef]

- Yu, Y.; Zhang, N. Low-Carbon City Pilot and Carbon Emission Efficiency: Quasi-Experimental Evidence from China. Energy Econ. 2021, 96, 105125. [Google Scholar] [CrossRef]

- Aaronson, D.; Agarwal, S.; French, E. The Spending and Debt Response to Minimum Wage Hikes. Am. Econ. Rev. 2012, 102, 3111–3139. [Google Scholar] [CrossRef]

- Chaney, T.; Sraer, D.; Thesmar, D. The Collateral Channel: How Real Estate Shocks Affect Corporate Investment. Am. Econ. Rev. 2012, 102, 2381–2409. [Google Scholar] [CrossRef]

- Callaway, B.; Sant’Anna, P.H.C. Difference-in-Differences with Multiple Time Periods. J. Econ. 2021, 225, 200–230. [Google Scholar] [CrossRef]

- Goodman-Bacon, A. Difference-in-Differences with Variation in Treatment Timing. J. Econ. 2021, 225, 254–277. [Google Scholar] [CrossRef]

- De Chaisemartin, C.; D’Haultfœuille, X. Two-Way Fixed Effects Estimators with Heterogeneous Treatment Effects. Am. Econ. Rev. 2020, 110, 2964–2996. [Google Scholar] [CrossRef]

- BP. Statistical Review of World Energy; BP: London, UK, 2021. [Google Scholar]

- Drempetic, S.; Klein, C.; Zwergel, B. The Influence of Firm Size on the ESG Score: Corporate Sustainability Ratings under Review. J. Bus. Ethics 2020, 167, 333–360. [Google Scholar] [CrossRef]

- Yu, E.P.Y.; Van Luu, B.V. International Variations in ESG Disclosure—Do Cross-Listed Companies Care More? Int. Rev. Financ. Anal. 2021, 75, 101731. [Google Scholar] [CrossRef]

- Attig, N.; Boubakri, N.; El Ghoul, S.; Guedhami, O. Firm Internationalization and Corporate Social Responsibility. J. Bus. Ethics 2016, 134, 171–197. [Google Scholar] [CrossRef]

- Tamimi, N.; Sebastianelli, R. Transparency among S&P 500 Companies: An Analysis of ESG Disclosure Scores. Manag. Decis. 2017, 55, 1660–1680. [Google Scholar] [CrossRef]

- Hegde, S.P.; Mishra, D.R. Married CEOs and Corporate Social Responsibility. J. Corp. Fin. 2019, 58, 226–246. [Google Scholar] [CrossRef]

- Aabo, T.; Giorici, I.C. Do Female CEOs Matter for ESG Scores? Glob. Fin. J. 2022, in press. [Google Scholar] [CrossRef]

- Daft, R.L.; Sormunen, J.; Parks, D. Chief Executive Scanning, Environmental Characteristics, and Company Performance: An Empirical Study. Strat. Mgmt J. 1988, 9, 123–139. [Google Scholar] [CrossRef]

- Viscusi, W.K. Frameworks for Analyzing the Effects of Risk and Environmental Regulations on Productivity. Am. Econ. Rev. 1983, 73, 793–801. [Google Scholar]

- Balachandran, B.; Nguyen, J.H. Does Carbon Risk Matter in Firm Dividend Policy? Evidence from a Quasi-Natural Experiment in an Imputation Environment. J. Bank. Fin. 2018, 96, 249–267. [Google Scholar] [CrossRef]

- Kabir, M.N.; Rahman, S.; Rahman, M.A.; Anwar, M. Carbon Emissions and Default Risk: International Evidence from Firm-Level Data. Econ. Model. 2021, 103, 105617. [Google Scholar] [CrossRef]

- Porter, M.E.; Linde, C. Toward a New Conception of the Environment-Competitiveness Relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef]

- He, F.; Du, H.; Yu, B. Corporate ESG Performance and Manager Misconduct: Evidence from China. Int. Rev. Financ. Anal. 2022, 82, 102201. [Google Scholar] [CrossRef]

- Zumente, I.; Bistrova, J. ESG Importance for Long-Term Shareholder Value Creation: Literature vs. Practice. J. Open Innov. Technol. Mark. Complex. 2021, 7, 127. [Google Scholar] [CrossRef]

- Kitzmueller, M.; Shimshack, J. Economic Perspectives on Corporate Social Responsibility. J. Econ. Lit. 2012, 50, 51–84. [Google Scholar] [CrossRef]

- Freise, A.; Link, S.; Mayer, S. Taxation and Corporate Governance—The State of the Art. In Tax and Corporate Governance; Schön, W., Ed.; Springer: Berlin/Heidelberg, Germany, 2008. [Google Scholar]

- Freedman, J. Tax and Corporate Responsibility. Tax J. 2003, 695, 1–4. [Google Scholar]

- Slemrod, J. The Economics of Corporate Tax Selfishness. Natl. Tax J. 2004, 57, 877–899. [Google Scholar] [CrossRef]

- Williams, D.F. Developing the Concept of Tax Governance; KPMG: London, UK, 2007; p. 16. [Google Scholar]

- Lanis, R.; Richardson, G. Corporate Social Responsibility and Tax Aggressiveness: An Empirical Analysis. J. Acc. Public Policy 2012, 31, 86–108. [Google Scholar] [CrossRef]

- Christensen, J.; Murphy, R. The Social Irresponsibility of Corporate Tax Avoidance: Taking CSR to the Bottom Line. Development 2004, 47, 37–44. [Google Scholar] [CrossRef]

- Hambrick, D.C. Upper Echelons Theory: An Update. Acad. Manag. Rev. 2007, 32, 334–343. [Google Scholar] [CrossRef]

- Hambrick, D.C.; Mason, P.A. Upper Echelons: The Organization as a Reflection of Its Top Managers. Acad. Manag. Rev. 1984, 9, 193–206. [Google Scholar] [CrossRef]

- Delmas, M.; Toffel, M.W. Stakeholders and Environmental Management Practices: An Institutional Framework. Bus. Strategy Environ. 2004, 13, 209–222. [Google Scholar] [CrossRef]

- Zhang, B.; Wang, Z.; Lai, K.H. Mediating Effect of Managers’ Environmental Concern: Bridge between External Pressures and Firms’ Practices of Energy Conservation in China. J. Environ. Psychol. 2015, 43, 203–215. [Google Scholar] [CrossRef]

- Li, J.; Lian, G.; Xu, A. How Do ESG Affect the Spillover of Green Innovation among Peer Firms? Mechanism Discussion and Performance Study. J. Bus. Res. 2023, 158, 113648. [Google Scholar] [CrossRef]

- Tan, X.; Choi, Y.; Wang, B.; Huang, X. Does China’s Carbon Regulatory Policy Improve Total Factor Carbon Efficiency? A Fixed-Effect Panel Stochastic Frontier Analysis. Technol. Forecast. Soc. Chang. 2020, 160, 120222. [Google Scholar] [CrossRef]

- Luo, C.; Wei, D.; He, F. Corporate ESG Performance and Trade Credit Financing—Evidence from China. Int. Rev. Econ. Fin. 2023, 85, 337–351. [Google Scholar] [CrossRef]

- Shu, H.; Tan, W. Does Carbon Control Policy Risk Affect Corporate ESG Performance? Econ. Modell. 2023, 120, 106148. [Google Scholar] [CrossRef]

- Beck, T.; Levine, R.; Levkov, A. Big Bad Banks? The Winners and Losers from Bank Deregulation in the United States. J. Fin. 2010, 65, 1637–1667. [Google Scholar] [CrossRef]

- Wang, H.Q.; Zhang, Y. Trade Structure Upgrading, Environmental Regulation and Green Technology Innovation in Different Regions of China. China Soft Sci. 2020, 2, 174–181. [Google Scholar]

- Ruan, F.; Yan, L.; Wang, D. The Complexity for the Resource-Based Cities in China on Creating Sustainable Development. Cities 2020, 97, 102571. [Google Scholar] [CrossRef]

- Shao, S.; Zhang, Y.; Tian, Z.; Li, D.; Yang, L. The Regional Dutch Disease Effect Within China: A Spatial Econometric Investigation. Energy Econ. 2020, 88, 104766. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).