Energy Efficiency and Economic Policy: Comprehensive Theoretical, Empirical, and Policy Review

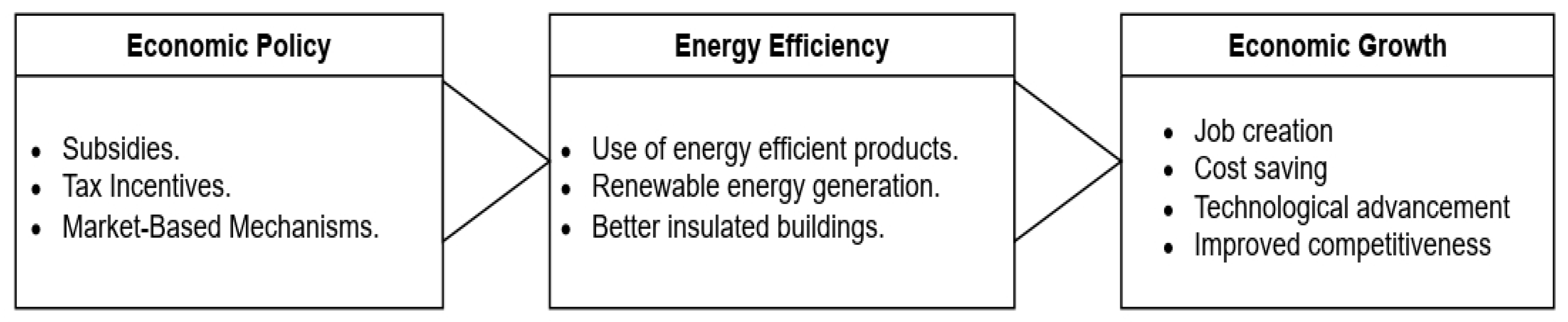

Abstract

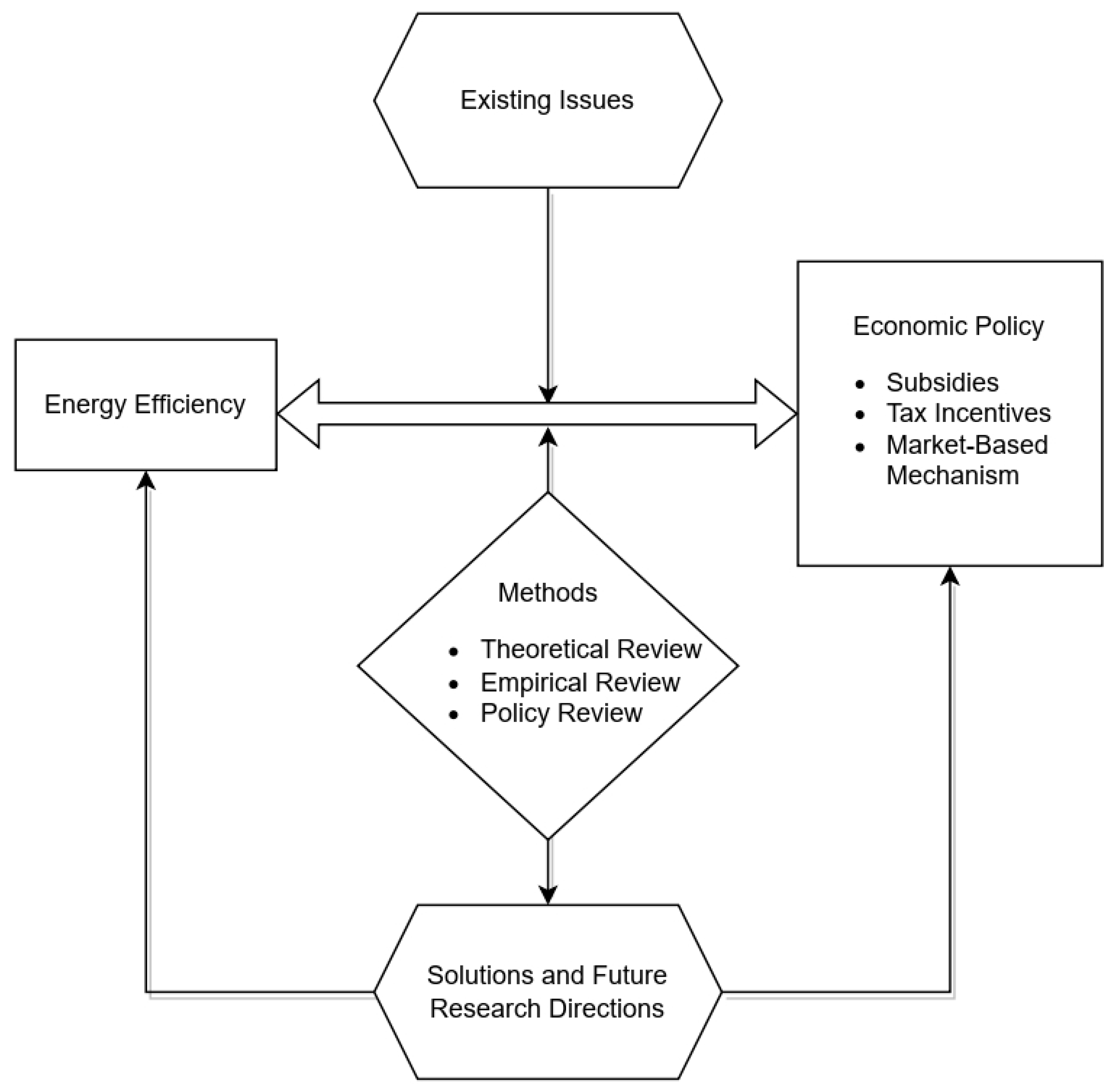

1. Introduction

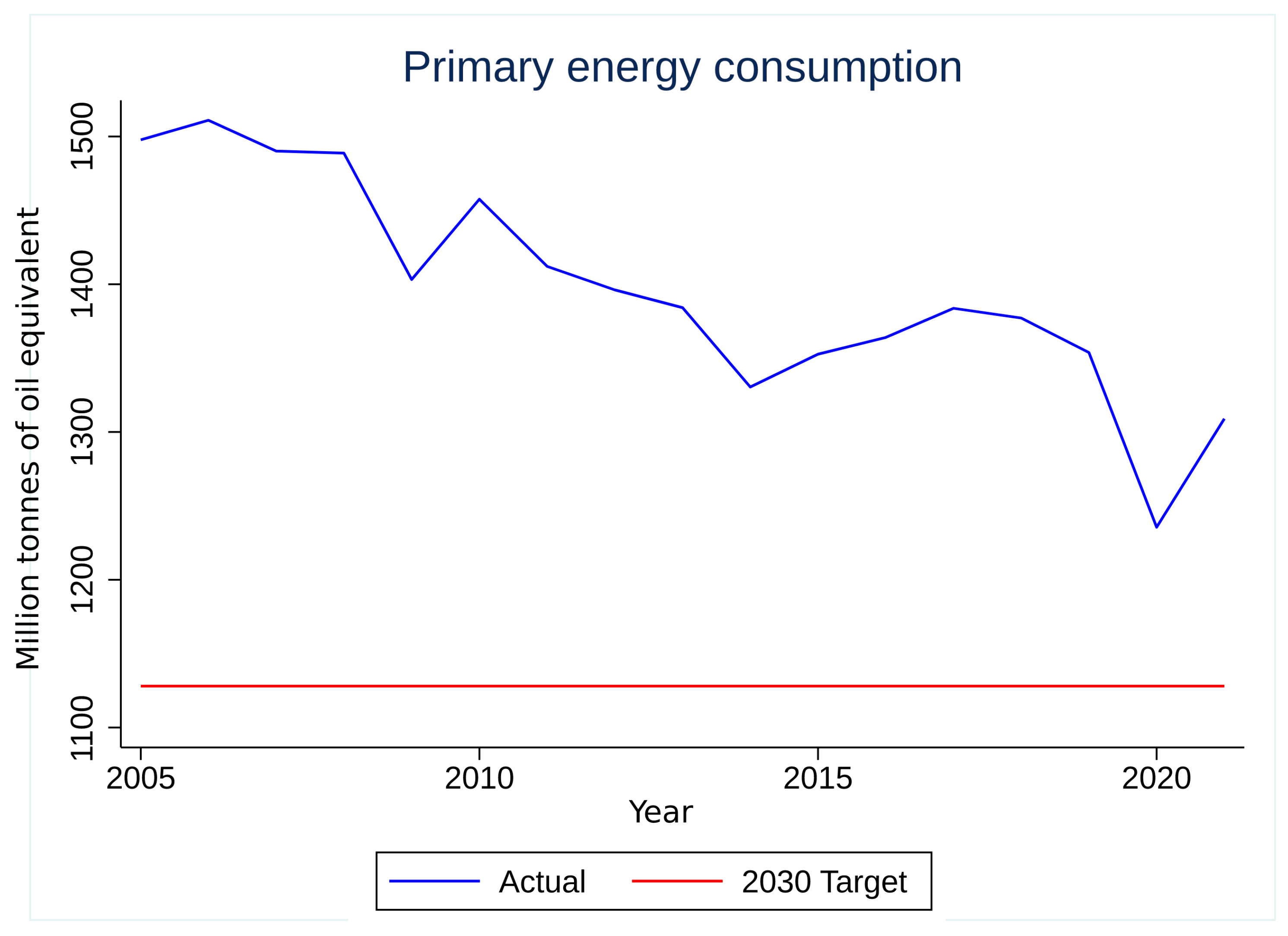

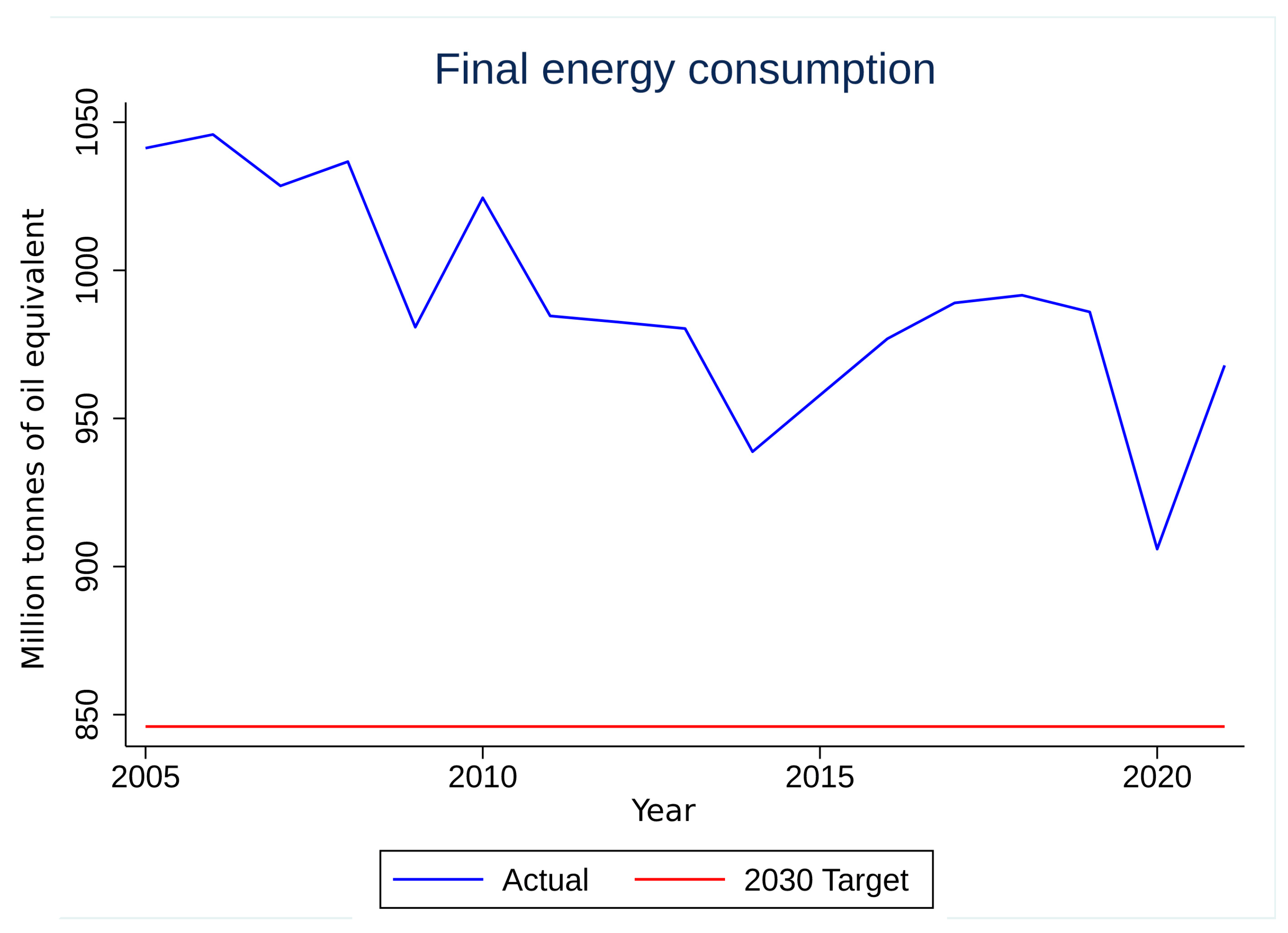

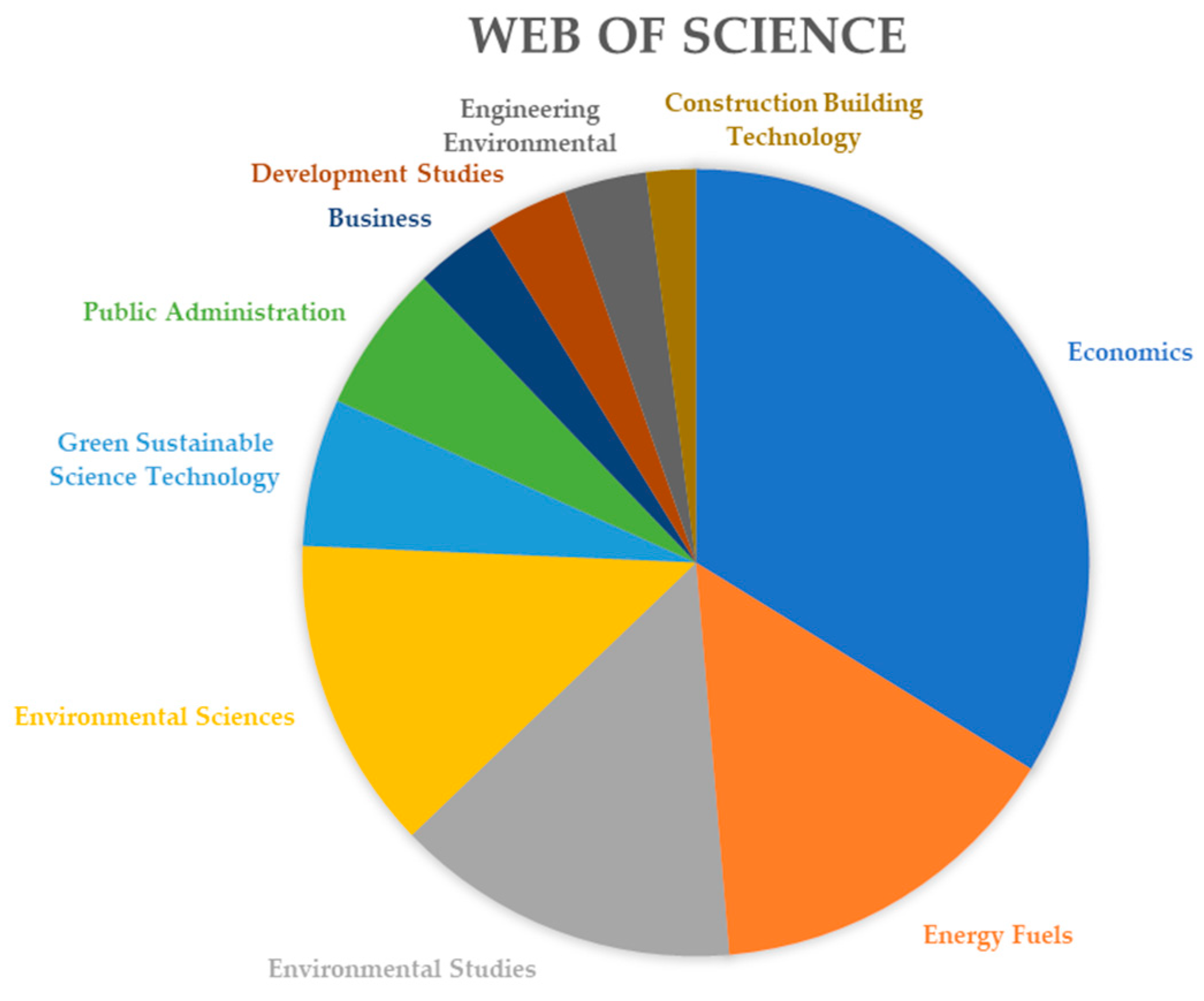

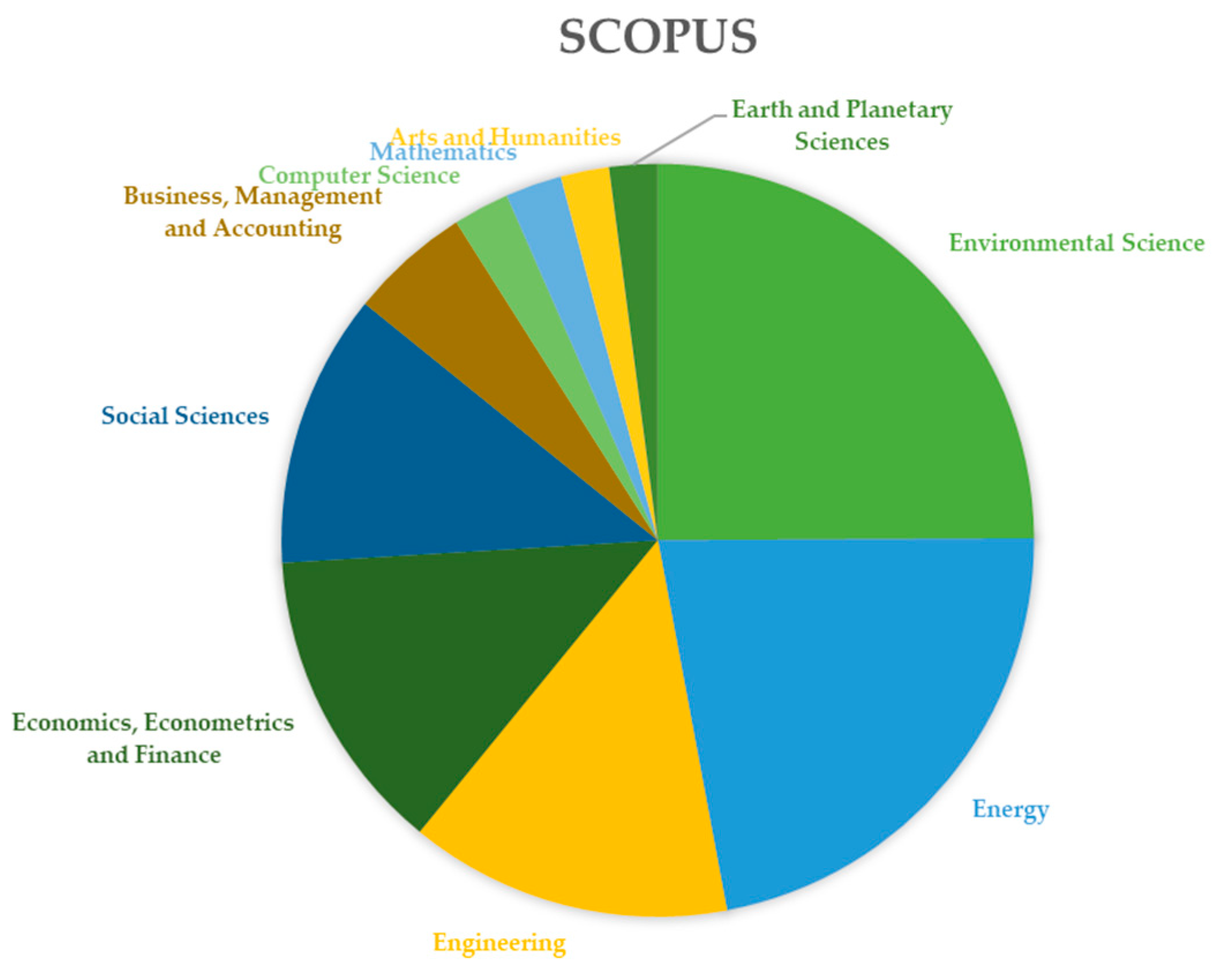

2. Energy Efficiency; State-of-the-Art, Issues, and Case of EU-27 2030

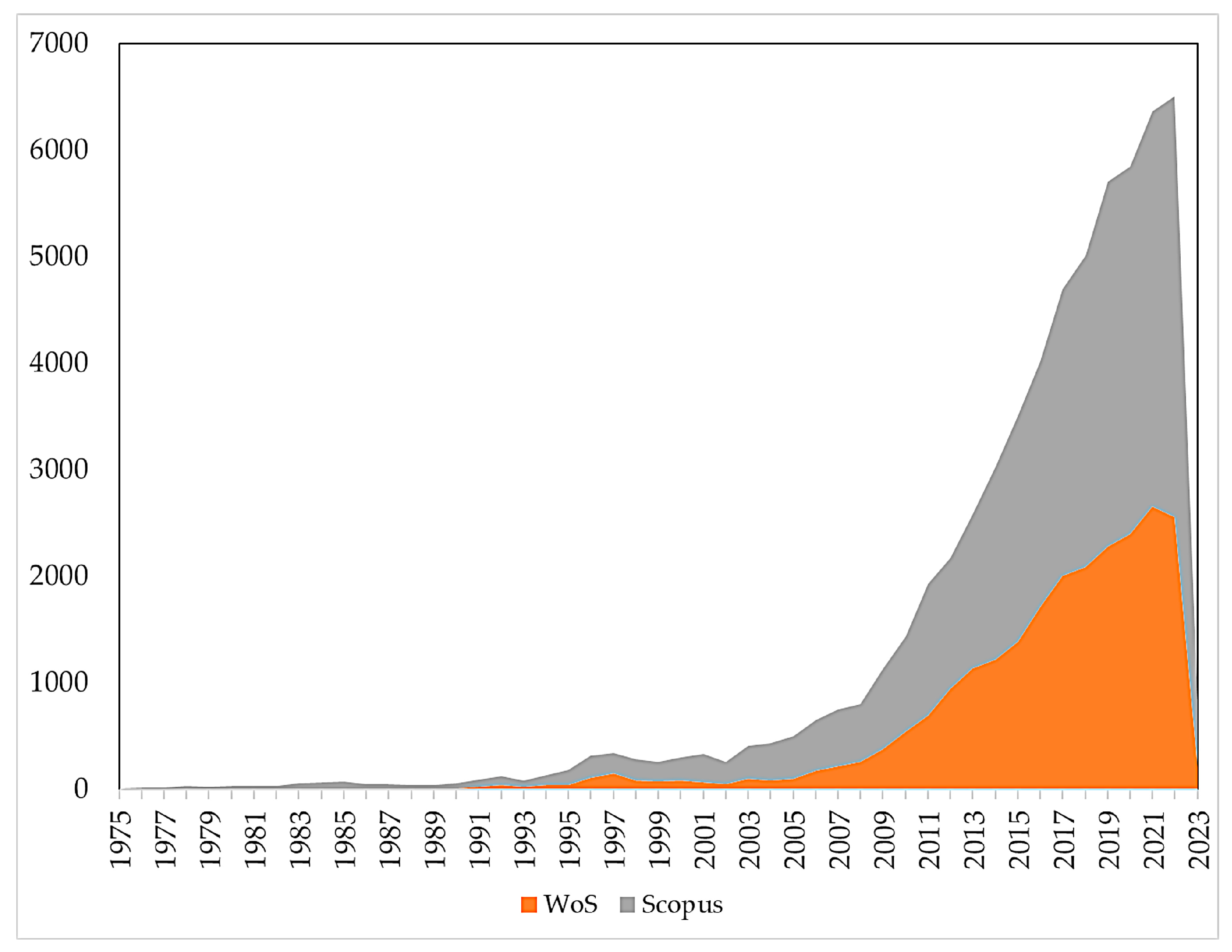

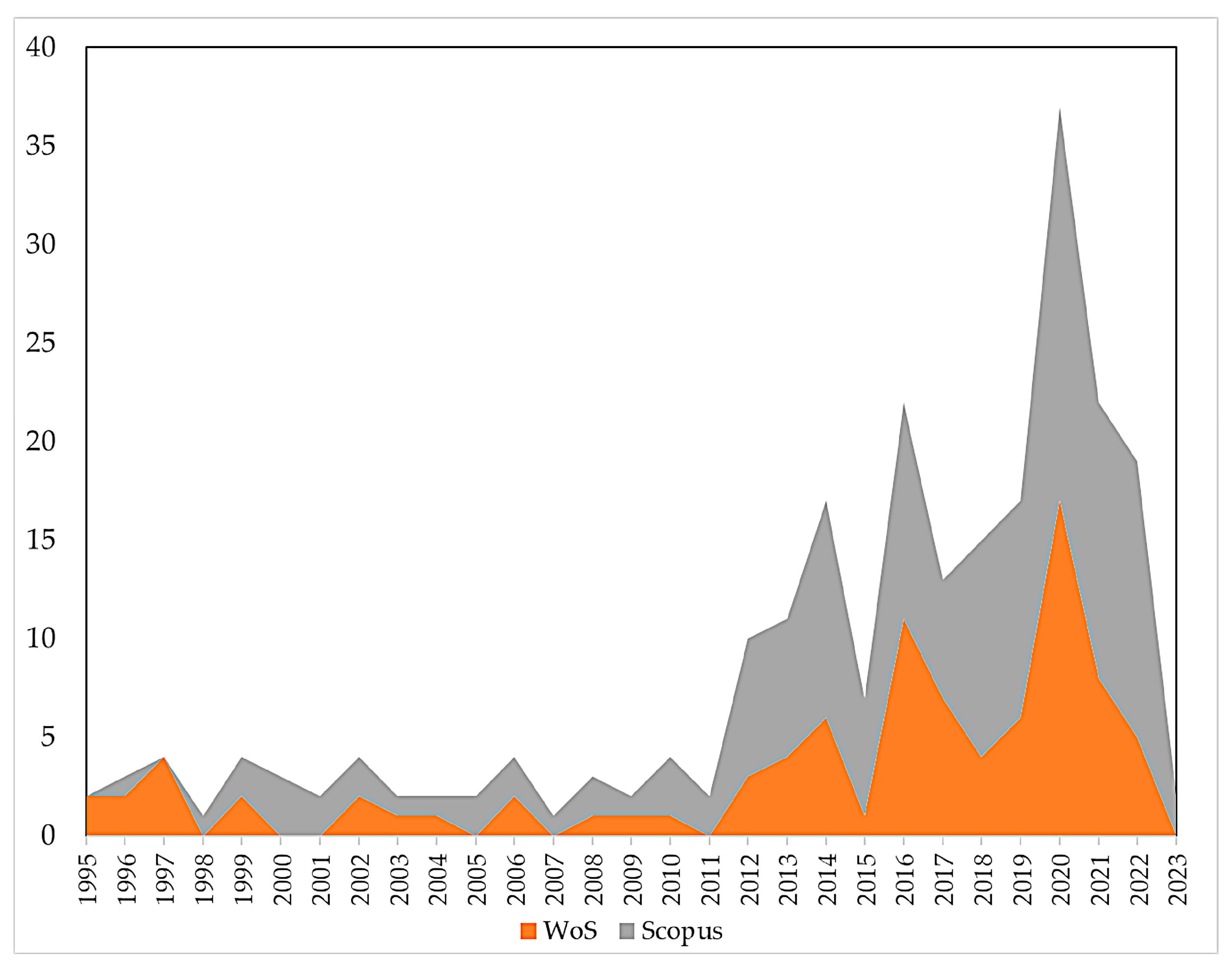

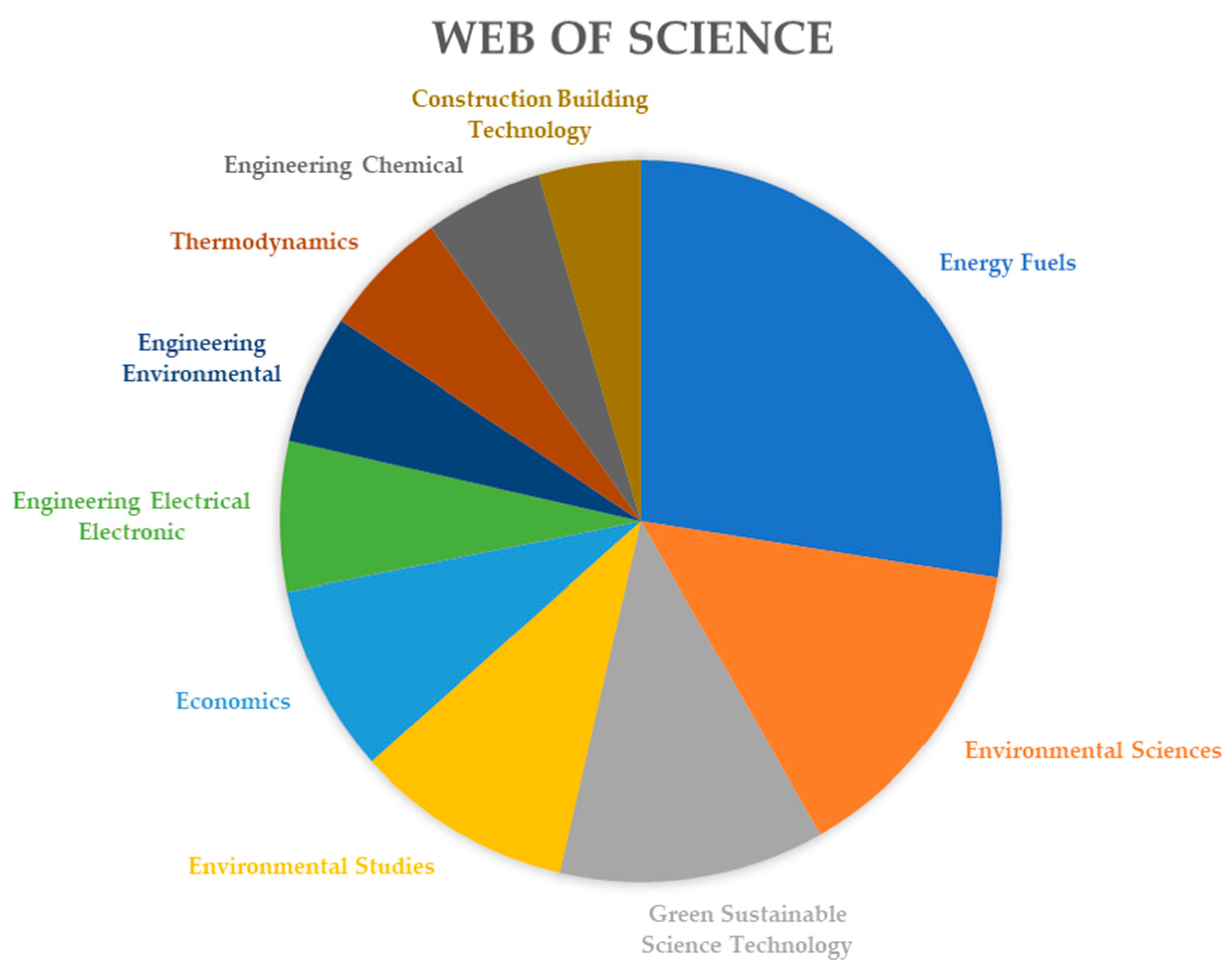

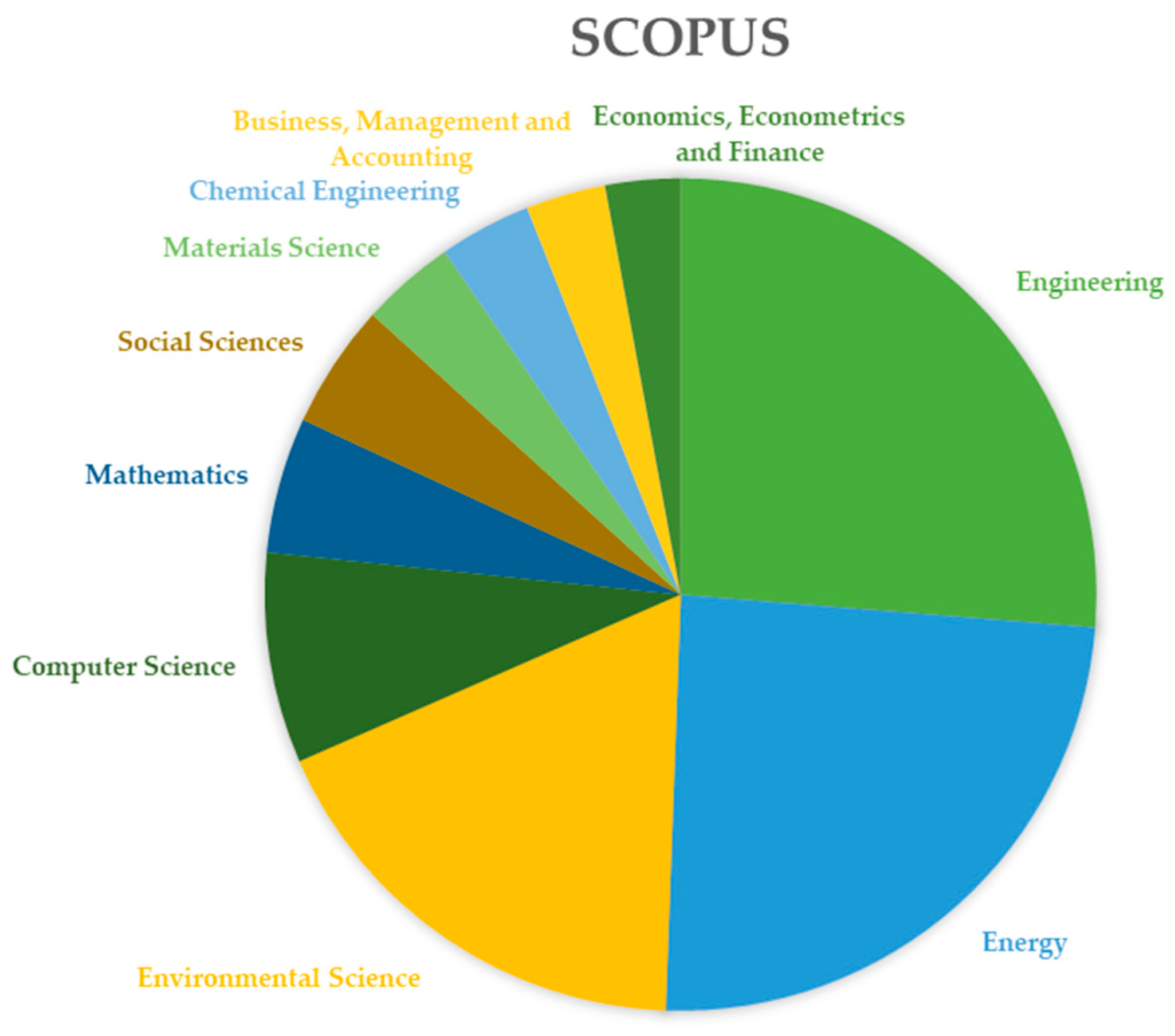

3. Statistical Research Trends

4. Subsidies

5. Tax Incentives

6. Market-Based Mechanisms

7. Conclusions

Evaluation of Economic Policy

8. Future Research Directions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Uddin, M.; Rahman, A.A. Energy efficiency and low carbon enabler green IT framework for data centers considering green metrics. Renew. Sustain. Energy Rev. 2012, 16, 4078–4094. [Google Scholar] [CrossRef]

- Mushafiq, M.; Prusak, B. Nexus between stock markets, economic strength, R&D and environmental deterioration: New evidence from EU-27 using PNARDL approach. Environ. Sci. Pollut. Res. 2022, 1–20. [Google Scholar] [CrossRef]

- Petkova-Chobanova, B.; Babayan, T.; Gorovykh, I. Energy efficiency policies and programmes in the Eastern Partnership and Central Asian countries: The role of the Energy Charter PEEREA review process. In Energy Efficiency in Developing Countries; Routledge: London, UK, 2020; pp. 163–176. [Google Scholar] [CrossRef]

- Acuner, E.; Özgür Kayalica, M. A review on household energy consumption behavior: How about migrated consumers? Environ. Econ. 2018, 9, 8–21. [Google Scholar] [CrossRef]

- Worrell, E.; Bernstein, L.; Roy, J.; Price, L.; Harnisch, J. Industrial energy efficiency and climate change mitigation. Energy Effic. 2009, 2, 109–123. [Google Scholar] [CrossRef]

- Mills, E. Building commissioning: A golden opportunity for reducing energy costs and greenhouse gas emissions in the United States. Energy Effic. 2011, 4, 145–173. [Google Scholar] [CrossRef]

- Herring, H. Energy efficiency—A critical view. Energy 2006, 31, 10–20. [Google Scholar] [CrossRef]

- Gustavsson, L.; Börjesson, P.; Johansson, B.; Svenningsson, P. Reducing CO2 emissions by substituting biomass for fossil fuels. Energy 1995, 20, 1097–1113. [Google Scholar] [CrossRef]

- Thollander, P.; Ottosson, M. An energy efficient Swedish pulp and paper industry—Exploring barriers to and driving forces for cost-effective energy efficiency investments. Energy Effic. 2008, 1, 21–34. [Google Scholar] [CrossRef]

- Solà, M.D.M.; de Ayala, A.; Galarraga, I.; Escapa, M. Promoting energy efficiency at household level: A literature review. Energy Effic. 2021, 14, 1–22. [Google Scholar] [CrossRef]

- Hesselink, L.X.W.; Chappin, E.J.L. Adoption of energy efficient technologies by households—Barriers, policies and agent-based modelling studies. Renew. Sustain. Energy Rev. 2019, 99, 29–41. [Google Scholar] [CrossRef]

- Cho, Y.; Koo, Y.; Huh, S.Y.; Lee, M. Evaluation of a consumer incentive program for an energy-efficient product in South Korea. Energy Effic. 2015, 8, 745–757. [Google Scholar] [CrossRef]

- Herring, H.; Roy, R. Technological innovation, energy efficient design and the rebound effect. Technovation 2007, 27, 194–203. [Google Scholar] [CrossRef]

- Stram, B.N. Key challenges to expanding renewable energy. Energy Policy 2016, 96, 728–734. [Google Scholar] [CrossRef]

- Kanwal, S.; Mehran, M.T.; Hassan, M.; Anwar, M.; Naqvi, S.R.; Khoja, A.H. An integrated future approach for the energy security of Pakistan: Replacement of fossil fuels with syngas for better environment and socio-economic development. Renew. Sustain. Energy Rev. 2022, 156, 111978. [Google Scholar] [CrossRef]

- Vivoda, V. Japan’s energy security predicament post-Fukushima. Energy Policy 2012, 46, 135–143. [Google Scholar] [CrossRef]

- Matsumoto, K.; Andriosopoulos, K. Energy security in East Asia under climate mitigation scenarios in the 21st century. Omega 2016, 59, 60–71. [Google Scholar] [CrossRef]

- Peng, H.R.; Tan, X.; Managi, S.; Taghizadeh-Hesary, F. Club convergence in energy efficiency of Belt and Road Initiative countries: The role of China’s outward foreign direct investment. Energy Policy 2022, 168, 113139. [Google Scholar] [CrossRef]

- Zhao, L.; Chau, K.Y.; Tran, T.K.; Sadiq, M.; Xuyen, N.T.M.; Phan, T.T.H. Enhancing green economic recovery through green bonds financing and energy efficiency investments. Econ. Anal. Policy 2022, 76, 488–501. [Google Scholar] [CrossRef]

- McLaughlin, E.; Choi, J.K.; Kissock, K. Techno-Economic Impact Assessments of Energy Efficiency Improvements in the Industrial Combustion Systems. J. Energy Resour. Technol. Trans. ASME 2022, 144, 082109. [Google Scholar] [CrossRef]

- Decanio, S.J. The efficiency paradox: Bureaucratic and organizational barriers to profitable energy-saving investments. Energy Policy 1998, 26, 441–454. [Google Scholar] [CrossRef]

- Trianni, A.; Cagno, E.; Farné, S. Barriers, drivers and decision-making process for industrial energy efficiency: A broad study among manufacturing small and medium-sized enterprises. Appl. Energy 2016, 162, 1537–1551. [Google Scholar] [CrossRef]

- Reuter, M.; Patel, M.K.; Eichhammer, W.; Lapillonne, B.; Pollier, K. A comprehensive indicator set for measuring multiple benefits of energy efficiency. Energy Policy 2020, 139, 111284. [Google Scholar] [CrossRef]

- Malinauskaite, J.; Jouhara, H.; Ahmad, L.; Milani, M.; Montorsi, L.; Venturelli, M. Energy efficiency in industry: EU and national policies in Italy and the UK. Energy 2019, 172, 255–269. [Google Scholar] [CrossRef]

- Henriques, J.; Catarino, J. Motivating towards energy efficiency in small and medium enterprises. J. Clean. Prod. 2016, 139, 42–50. [Google Scholar] [CrossRef]

- Gillingham, K.; Rapson, D.; Wagner, G. The rebound effect and energy efficiency policy. Rev. Environ. Econ. Policy 2016, 10, 68–88. [Google Scholar] [CrossRef]

- Dunlop, T. Mind the gap: A social sciences review of energy efficiency. Energy Res. Soc. Sci. 2019, 56, 101216. [Google Scholar] [CrossRef]

- Brockway, P.E.; Sorrell, S.; Semieniuk, G.; Heun, M.K.; Court, V. Energy efficiency and economy-wide rebound effects: A review of the evidence and its implications. Renew. Sustain. Energy Rev. 2021, 141, 110781. [Google Scholar] [CrossRef]

- Zhou, L.; Li, J.; Li, F.; Meng, Q.; Li, J.; Xu, X. Energy consumption model and energy efficiency of machine tools: A comprehensive literature review. J. Clean. Prod. 2016, 112, 3721–3734. [Google Scholar] [CrossRef]

- Apostolos, F.; Alexios, P.; Georgios, P.; Panagiotis, S.; George, C. Energy Efficiency of Manufacturing Processes: A Critical Review. Procedia. CIRP 2013, 7, 628–633. [Google Scholar] [CrossRef]

- Patterson, M.G. What is energy efficiency?: Concepts, indicators and methodological issues. Energy Policy 1996, 24, 377–390. [Google Scholar] [CrossRef]

- Staddon, S.C.; Cycil, C.; Goulden, M.; Leygue, C.; Spence, A. Intervening to change behaviour and save energy in the workplace: A systematic review of available evidence. Energy Res. Soc. Sci. 2016, 17, 30–51. [Google Scholar] [CrossRef]

- van den Broek, K.L.; Walker, I.; Klöckner, C.A. Drivers of energy saving behaviour: The relative influence of intentional, normative, situational and habitual processes. Energy Policy 2019, 132, 811–819. [Google Scholar] [CrossRef]

- Kettner, C.; Kletzan-Slamanig, D. Is there climate policy integration in European Union energy efficiency and renewable energy policies? Yes, no, maybe. Environ. Policy Gov. 2020, 30, 141–150. [Google Scholar] [CrossRef]

- Palmer, E. Introduction: The 2030 Agenda. J. Glob. Ethics 2015, 11, 262–269. [Google Scholar] [CrossRef]

- Oberthür, S.; Szulecki, K.; Claes, D.H. Hard or Soft Governance? The EU’s Climate and Energy Policy Framework for 2030. Polit. Gov. 2019, 7, 17–27. [Google Scholar] [CrossRef]

- Boto-Álvarez, A.; García-Fernández, R. Implementation of the 2030 agenda sustainable development goals in Spain. Sustainability 2020, 12, 2546. [Google Scholar] [CrossRef]

- Gao, Y.; Gao, X.; Zhang, X. The 2 °C Global Temperature Target and the Evolution of the Long-Term Goal of Addressing Climate Change—From the United Nations Framework Convention on Climate Change to the Paris Agreement. Engineering 2017, 3, 272–278. [Google Scholar] [CrossRef]

- Schleussner, C.F.; Rogelj, J.; Schaeffer, M.; Lissner, T.; Licker, R.; Fischer, E.M.; Knutti, R.; Levermann, A.; Frieler, K.; Hare, W. Science and policy characteristics of the Paris Agreement temperature goal. Nat. Clim. Chang. 2016, 6, 827–835. [Google Scholar] [CrossRef]

- Tanaka, K. Review of policies and measures for energy efficiency in industry sector. Energy Policy 2011, 39, 6532–6550. [Google Scholar] [CrossRef]

- Wang, Z.; Yao-Ping Peng, M.; Anser, M.K.; Chen, Z. Research on the impact of green finance and renewable energy on energy efficiency: The case study E−7 economies. Renew. Energy 2023, 205, 166–173. [Google Scholar] [CrossRef]

- Hepburn, C.; Qi, Y.; Stern, N.; Ward, B.; Xie, C.; Zenghelis, D. Towards carbon neutrality and China’s 14th Five-Year Plan: Clean energy transition, sustainable urban development, and investment priorities. Environ. Sci. Ecotechnology 2021, 8, 100130. [Google Scholar] [CrossRef] [PubMed]

- Zhang, L.; Huang, F.; Lu, L.; Ni, X.; Iqbal, S. Energy financing for energy retrofit in COVID-19: Recommendations for green bond financing. Environ. Sci. Pollut. Res. 2022, 29, 23105–23116. [Google Scholar] [CrossRef] [PubMed]

- Wu, C.; Yuan, Y.-H.; Yang, C.; Masron, T.A. Impact of Digital Finance on Energy Efficiency in the Context of Green Sustainable Development. Sustainability 2022, 14, 11250. [Google Scholar] [CrossRef]

- Zhu, T.; Curtis, J.; Clancy, M. Modelling barriers to low-carbon technologies in energy system analysis: The example of renewable heat in Ireland. Appl. Energy 2023, 330, 120314. [Google Scholar] [CrossRef]

- Poshnath, A.; Rismanchi, B.; Rajabifard, A. Adoption of Renewable Energy Systems in common properties of multi-owned buildings: Introduction of ‘Energy Entitlement’. Energy Policy 2023, 174, 113465. [Google Scholar] [CrossRef]

- Chen, R.; Fan, R.; Yao, Q.; Qian, R. Evolutionary dynamics of homeowners’ energy-efficiency retrofit decision-making in complex network. J. Environ. Manag. 2023, 326, 116849. [Google Scholar] [CrossRef]

- Upham, P.; Kivimaa, P.; Mickwitz, P.; Åstrand, K. Climate policy innovation: A sociotechnical transitions perspective. Env. Polit. 2014, 23, 774–794. [Google Scholar] [CrossRef]

- Bang, G. Energy security and climate change concerns: Triggers for energy policy change in the United States? Energy Policy 2010, 38, 1645–1653. [Google Scholar] [CrossRef]

- Haile, Y.; Min, H. Success factors for renewable energy businesses in emerging economies. Manag. Res. Rev. 2022. ahead of print. [Google Scholar] [CrossRef]

- Min, H.; Haile, Y. Examining the Role of Disruptive Innovation in Renewable Energy Businesses from a Cross National Perspective. Energies 2021, 14, 4447. [Google Scholar] [CrossRef]

- Timilsina, G.R.; Shah, K.U. Filling the gaps: Policy supports and interventions for scaling up renewable energy development in Small Island Developing States. Energy Policy 2016, 98, 653–662. [Google Scholar] [CrossRef]

- Wei, T.; Zhou, J.; Zhang, H. Rebound effect of energy intensity reduction on energy consumption. Resour. Conserv. Recycl. 2019, 144, 233–239. [Google Scholar] [CrossRef]

- Freire González, J. Empirical evidence of direct rebound effect in Catalonia. Energy Policy 2010, 38, 2309–2314. [Google Scholar] [CrossRef]

- Freire-González, J. Methods to empirically estimate direct and indirect rebound effect of energy-saving technological changes in households. Ecol. Modell. 2011, 223, 32–40. [Google Scholar] [CrossRef]

- Zakarya, M.; Gillam, L. Energy efficient computing, clusters, grids and clouds: A taxonomy and survey. Sustain. Comput. Informatics Syst. 2017, 14, 13–33. [Google Scholar] [CrossRef]

- Mushafiq, M.; Prusak, B. Does being socially good save firms from bankruptcy? A systematic literature review and bibliometric analysis. Ekon. I Sr. Econ. Environ. 2022, 83, 35–59. [Google Scholar] [CrossRef]

- Jaffe, A.B.; Newell, R.G.; Stavins, R.N. Energy-Efficient Technologies and Climate Change Policies: Issues and Evidence. SSRN Electron. J. 1999. [Google Scholar] [CrossRef]

- Martinot, E.; Borg, N. Energy-efficient lighting programs: Experience and lessons from eight countries. Energy Policy 1998, 26, 1071–1081. [Google Scholar] [CrossRef]

- Hua, L.; Wang, S. Antecedents of Consumers’ Intention to Purchase Energy-Efficient Appliances: An Empirical Study Based on the Technology Acceptance Model and Theory of Planned Behavior. Sustainability 2019, 11, 2994. [Google Scholar] [CrossRef]

- Blum, N.U.; Sryantoro Wakeling, R.; Schmidt, T.S. Rural electrification through village grids—Assessing the cost competitiveness of isolated renewable energy technologies in Indonesia. Renew. Sustain. Energy Rev. 2013, 22, 482–496. [Google Scholar] [CrossRef]

- Frondel, M.; Ritter, N.; Schmidt, C.M.; Vance, C. Economic impacts from the promotion of renewable energy technologies: The German experience. Energy Policy 2010, 38, 4048–4056. [Google Scholar] [CrossRef]

- Menanteau, P.; Finon, D.; Lamy, M.L. Prices versus quantities: Choosing policies for promoting the development of renewable energy. Energy Policy 2003, 31, 799–812. [Google Scholar] [CrossRef]

- Brown, R.; Webber, C.; Koomey, J.G. Status and future directions of the Energy Star program. Energy 2002, 27, 505–520. [Google Scholar] [CrossRef]

- Boyd, G.; Dutrow, E.; Tunnessen, W. The evolution of the ENERGY STAR® energy performance indicator for benchmarking industrial plant manufacturing energy use. J. Clean. Prod. 2008, 16, 709–715. [Google Scholar] [CrossRef]

- Yeatts, D.E.; Auden, D.; Cooksey, C.; Chen, C.F. A systematic review of strategies for overcoming the barriers to energy-efficient technologies in buildings. Energy Res. Soc. Sci. 2017, 32, 76–85. [Google Scholar] [CrossRef]

- Thiruchelvam, M.; Kumar, S.; Visvanathan, C. Policy options to promote energy efficient and environmentally sound technologies in small- and medium-scale industries. Energy Policy 2003, 31, 977–987. [Google Scholar] [CrossRef]

- Stieß, I.; Dunkelberg, E. Objectives, barriers and occasions for energy efficient refurbishment by private homeowners. J. Clean. Prod. 2013, 48, 250–259. [Google Scholar] [CrossRef]

- Buckman, G.; Diesendorf, M. Design limitations in Australian renewable electricity policies. Energy Policy 2010, 38, 3365–3376. [Google Scholar] [CrossRef]

- Nelson, T.; Nelson, J.; Ariyaratnam, J.; Camroux, S. An analysis of Australia’s large scale renewable energy target: Restoring market confidence. Energy Policy 2013, 62, 386–400. [Google Scholar] [CrossRef]

- Martin, N.J.; Rice, J.L. Developing renewable energy supply in Queensland, Australia: A study of the barriers, targets, policies and actions. Renew. Energy 2012, 44, 119–127. [Google Scholar] [CrossRef]

- Valentine, S. Braking wind in Australia: A critical evaluation of the renewable energy target. Energy Policy 2010, 38, 3668–3675. [Google Scholar] [CrossRef]

- Nie, P.Y.; Wang, C.; Yang, Y.C. Comparison of energy efficiency subsidies under market power. Energy Policy 2017, 110, 144–149. [Google Scholar] [CrossRef]

- Reina, V.J.; Kontokosta, C. Low hanging fruit? Regulations and energy efficiency in subsidized multifamily housing. Energy Policy 2017, 106, 505–513. [Google Scholar] [CrossRef]

- Frantál, B.; Dvořák, P. Reducing energy poverty in deprived regions or supporting new developments in metropolitan suburbs? Regional differences in the use of subsidies for home energy efficiency renovations. Energy Policy 2022, 171, 113250. [Google Scholar] [CrossRef]

- Huang, W.; Zhou, W.; Chen, J.; Chen, X. The government’s optimal subsidy scheme under Manufacturers’ competition of price and product energy efficiency. Omega 2019, 84, 70–101. [Google Scholar] [CrossRef]

- Harvey, L.D.D. Rethinking electric vehicle subsidies, rediscovering energy efficiency. Energy Policy 2020, 146, 111760. [Google Scholar] [CrossRef] [PubMed]

- Harvey, L.D.D. Cost and energy performance of advanced light duty vehicles: Implications for standards and subsidies. Energy Policy 2018, 114, 1–12. [Google Scholar] [CrossRef]

- Jiang, C.; Zhang, Y.; Bu, M.; Liu, W. The Effectiveness of Government Subsidies on Manufacturing Innovation: Evidence from the New Energy Vehicle Industry in China. Sustainability 2018, 10, 1692. [Google Scholar] [CrossRef]

- De Santis, M.; Silvestri, L.; Forcina, A. Promoting electric vehicle demand in Europe: Design of innovative electricity consumption simulator and subsidy strategies based on well-to-wheel analysis. Energy Convers. Manag. 2022, 270, 116279. [Google Scholar] [CrossRef]

- Lihtmaa, L.; Hess, D.B.; Leetmaa, K. Intersection of the global climate agenda with regional development: Unequal distribution of energy efficiency-based renovation subsidies for apartment buildings. Energy Policy 2018, 119, 327–338. [Google Scholar] [CrossRef]

- Siddique, M.B.; Bergaentzlé, C.; Gunkel, P.A. Fine-tuning energy efficiency subsidies allocation for maximum savings in residential buildings. Energy 2022, 258, 124810. [Google Scholar] [CrossRef]

- Surrey, S.S. Tax Incentives as a Device for Implementing Government Policy: A Comparison with Direct Government Expenditures. Harv. Law Rev. 1970, 83, 705. [Google Scholar] [CrossRef]

- Briant, A.; Lafourcade, M.; Schmutz, B. Can Tax Breaks Beat Geography? Lessons from the French Enterprise Zone Experience. Am. Econ. J. Econ. Policy 2015, 7, 88–124. [Google Scholar] [CrossRef]

- Batchelder, L.L.; Goldberg, F.T., Jr.; Orszag, P.R. Efficiency and Tax Incentives: The Case for Refundable Tax Credits on JSTOR. Stanf. Law Rev. 2006, 59, 23–76. [Google Scholar]

- Brown, M.A.; Southworth, F. Mitigating climate change through green buildings and smart growth. Environ. Plan. A 2008, 40, 653–675. [Google Scholar] [CrossRef]

- Kaygusuz, K. Energy for sustainable development: A case of developing countries. Renew. Sustain. Energy Rev. 2012, 16, 1116–1126. [Google Scholar] [CrossRef]

- Stevens, C. Linking sustainable consumption and production: The government role. Nat. Resour. Forum 2010, 34, 16–23. [Google Scholar] [CrossRef]

- Alexander, M.M.; Sulkowski, A.J.; Wiggins, W.P. Sustainability & Tax Policy Fixing A Patchwork of Policies with a Coherent Federal FrameworK on JSTOR. Va. Environ. Law J. 2016, 35, 1–58. [Google Scholar]

- Markandya, A.; Ortiz, R.A.; Mudgal, S.; Tinetti, B. Analysis of tax incentives for energy-efficient durables in the EU. Energy Policy 2009, 37, 5662–5674. [Google Scholar] [CrossRef]

- Nadel, S. Energy Efficiency Tax Incentives in the Context of Tax Reform; American Council for an Energy-Efficient Economy: Washington, DC, USA, 2012. [Google Scholar]

- Dippenaar, M. The role of tax incentives in encouraging energy efficiency in the largest listed South African businesses. S. Afr. J. Econ. Manag. Sci. 2018, 21, a1723. [Google Scholar] [CrossRef]

- Villca-Pozo, M.; Gonzales-Bustos, J.P. Tax incentives to modernize the energy efficiency of the housing in Spain. Energy Policy 2019, 128, 530–538. [Google Scholar] [CrossRef]

- Zhou, Q.; Li, T.; Gong, L. The effect of tax incentives on energy intensity: Evidence from China’s VAT reform. Energy Econ. 2022, 108, 105887. [Google Scholar] [CrossRef]

- Bhandary, R.R.; Gallagher, K.S.; Zhang, F. Climate finance policy in practice: A review of the evidence. Clim. Policy 2021, 21, 529–545. [Google Scholar] [CrossRef]

- Portney, P.R.; Stavins, R.N. Public Policies for Environmental Protection; Routledge: England, UK, 2010; pp. 1–294. [Google Scholar] [CrossRef]

- Almeida, E.L.F. De Energy efficiency and the limits of market forces: The example of the electric motor market in France. Energy Policy 1998, 26, 643–653. [Google Scholar] [CrossRef]

- Pranindita, N.; Sagala, S.; Samosir, A.; Anhorn, J.; Van Laere, A.K.; Zacepins, A.; Sainz, A.; Rutz, D.; Rosslee, D.; Kirchmeyr, F.; et al. Biogas Market in Indonesia: The Roles of Carbon Trading. In Proceedings of the 2021 3rd International Sustainability and Resilience Conference: Climate Change, Sakheer, Bahrain, 15–16 November 2021; Institute of Electrical and Electronics Engineers Inc.: Piscataway, NJ, USA, 2021; pp. 199–204. [Google Scholar]

- Hashim, H.; Zubir, M.A.; Kamyab, H.; Zahran, M.F.I. Decarbonisation of the Industrial Sector Through Greenhouse Gas Mitigation, Offset, and Emission Trading Schemes. Chem. Eng. Trans. 2022, 97, 511–516. [Google Scholar] [CrossRef]

- Chesney, M.; Taschini, L. The Endogenous Price Dynamics of Emission Allowances and an Application to CO 2 Option Pricing. Appl. Math. Financ. 2012, 19, 447–475. [Google Scholar] [CrossRef]

- Zhao, X.; Shang, Y.; Ma, X.; Xia, P.; Shahzad, U. Does Carbon Trading Lead to Green Technology Innovation: Recent Evidence From Chinese Companies in Resource-Based Industries. IEEE Trans. Eng. Manag. 2022, 1–18. [Google Scholar] [CrossRef]

- Voland, N.; Saad, M.M.; Eicker, U. Public Policy and Incentives for Socially Responsible New Business Models in Market-Driven Real Estate to Build Green Projects. Sustainability 2022, 14, 7071. [Google Scholar] [CrossRef]

- Gou, Z.; Lau, S.S.Y.; Prasad, D. Market readiness and policy implications for green buildings: Case study from hong kong. J. Green Build. 2013, 8, 162–173. [Google Scholar] [CrossRef]

- Zajkowski, K. Settlement of reactive power compensation in the light of white certificates. In Proceedings of the E3S Web of Conferences 19, UNSP 01037, Polanica Zdroj, Poland, 13–15 September 2017. [Google Scholar]

- Zajkowski, K. Determination of the Environmental Impact of Reactive Power Compensation in the Power GrID. Nonconv. Technol. Rev. 2016, 20, 54–61. [Google Scholar]

- Lo, K. A critical review of China’s rapidly developing renewable energy and energy efficiency policies. Renew. Sustain. Energy Rev. 2014, 29, 508–516. [Google Scholar] [CrossRef]

- Mundaca, L. Markets for energy efficiency: Exploring the implications of an EU-wide ‘Tradable White Certificate’ scheme. Energy Econ. 2008, 30, 3016–3043. [Google Scholar] [CrossRef]

- Peñasco, C.; Anadón, L.D.; Verdolini, E. Systematic review of the outcomes and trade-offs of ten types of decarbonization policy instruments. Nat. Clim. Chang. 2021, 11, 257–265. [Google Scholar] [CrossRef]

- Giraudet, L.G.; Bodineau, L.; Finon, D. The costs and benefits of white certificates schemes. Energy Effic. 2012, 5, 179–199. [Google Scholar] [CrossRef]

- Langniss, O.; Praetorius, B. How much market do market-based instruments create? An analysis for the case of “white” certificates. Energy Policy 2006, 34, 200–211. [Google Scholar] [CrossRef]

- Parmentola, A.; Petrillo, A.; Tutore, I.; De Felice, F. Is blockchain able to enhance environmental sustainability? A systematic review and research agenda from the perspective of Sustainable Development Goals (SDGs). Bus. Strateg. Environ. 2022, 31, 194–217. [Google Scholar] [CrossRef]

- Perino, G.; Willner, M.; Quemin, S.; Pahle, M. The European Union Emissions Trading System Market Stability Reserve: Does It Stabilize or Destabilize the Market? Rev. Environ. Econ. Policy 2022, 16, 338–345. [Google Scholar] [CrossRef]

- Nguyen, M.A.T.; Yu, M.M.; Lirn, T.C. Airlines’ eco-productivity changes and the European Union Emissions Trading System. Transp. Res. Part D Transp. Environ. 2022, 102, 103100. [Google Scholar] [CrossRef]

- Fageda, X.; Teixidó, J.J. Pricing carbon in the aviation sector: Evidence from the European emissions trading system. J. Environ. Econ. Manage. 2022, 111, 102591. [Google Scholar] [CrossRef]

- EC Renewable Energy Directive. Available online: https://energy.ec.europa.eu/topics/renewable-energy/renewable-energy-directive-targets-and-rules/renewable-energy-directive_en (accessed on 5 February 2023).

- Zeng, L.; Du, W.; Zhang, W.; Zhao, L.; Wang, Z. An inter-provincial cooperation model under Renewable Portfolio Standard policy. Energy 2023, 269, 126771. [Google Scholar] [CrossRef]

- Guo, R.; Yuan, Y. Different types of environmental regulations and heterogeneous influence on energy efficiency in the industrial sector: Evidence from Chinese provincial data. Energy Policy 2020, 145, 111747. [Google Scholar] [CrossRef]

- Ngo, T.Q. How do environmental regulations affect carbon emission and energy efficiency patterns? A provincial-level analysis of Chinese energy-intensive industries. Environ. Sci. Pollut. Res. 2022, 29, 3446–3462. [Google Scholar] [CrossRef]

- Wang, F.; Xu, H.; Xu, T.; Li, K.; Shafie-khah, M.; Catalão, J.P.S. The values of market-based demand response on improving power system reliability under extreme circumstances. Appl. Energy 2017, 193, 220–231. [Google Scholar] [CrossRef]

- Papadaskalopoulos, D.; Strbac, G. Decentralized participation of flexible demand in electricity markets—Part I: Market mechanism. IEEE Trans. Power Syst. 2013, 28, 3658–3666. [Google Scholar] [CrossRef]

- Haley, B.; Gaede, J.; Winfield, M.; Love, P. From utility demand side management to low-carbon transitions: Opportunities and challenges for energy efficiency governance in a new era. Energy Res. Soc. Sci. 2020, 59, 101312. [Google Scholar] [CrossRef]

- Vine, E.; Hall, N.; Keating, K.M.; Kushler, M.; Prahl, R. Emerging issues in the evaluation of energy-efficiency programs: The US experience. Energy Effic. 2012, 5, 5–17. [Google Scholar] [CrossRef]

- Schiller Consulting, I.; Schiller, S.R.; Goldman, C.A.; Galawish, E. National Energy Efficiency Evaluation, Measurement and Verification (EM&V) Standard: Scoping Study of Issues and Implementation Requirements; Lawrence Berkeley National Lab: Berkeley, CA, USA, 2011. [Google Scholar]

- Meyers, S.; Kromer, S. Measurement and verification strategies for energy savings certificates: Meeting the challenges of an uncertain world. Energy Effic. 2008, 1, 313–321. [Google Scholar] [CrossRef]

- Belaïd, F.; Ranjbar, Z.; Massié, C. Exploring the cost-effectiveness of energy efficiency implementation measures in the residential sector. Energy Policy 2021, 150, 112122. [Google Scholar] [CrossRef]

- Fagan, J.E.; Reuter, M.A.; Langford, K.J. Dynamic performance metrics to assess sustainability and cost effectiveness of integrated urban water systems. Resour. Conserv. Recycl. 2010, 54, 719–736. [Google Scholar] [CrossRef]

- Dodoo, A.; Gustavsson, L.; Tettey, U.Y.A. Final energy savings and cost-effectiveness of deep energy renovation of a multi-storey residential building. Energy 2017, 135, 563–576. [Google Scholar] [CrossRef]

- Streicher, K.N.; Mennel, S.; Chambers, J.; Parra, D.; Patel, M.K. Cost-effectiveness of large-scale deep energy retrofit packages for residential buildings under different economic assessment approaches. Energy Build. 2020, 215, 109870. [Google Scholar] [CrossRef]

- Arimura, T.H.; Li, S.; Newell, R.G.; Palmer, K. Cost-Effectiveness of Electricity Energy Efficiency Programs. Energy J. 2012, 33, 63–99. [Google Scholar] [CrossRef]

- Pinkerton, S.D.; Johnson-Masotti, A.P.; Derse, A.; Layde, P.M. Ethical issues in cost-effectiveness analysis. Eval. Program Plann. 2002, 25, 71–83. [Google Scholar] [CrossRef]

| Issues | Details |

|---|---|

| Lack of financing | Energy-saving measures often require a lot of financing up front, which businesses, governments, and households may not have easy access to. This can make it more challenging for individuals to use energy-saving technologies and methods, and it could mean missed chances to save energy and cut down on pollution [43,44]. |

| Barriers to the adoption of energy efficiency technologies | Adoption of energy-efficient solutions is hampered by factors such as a lack of knowledge about available technology, restricted access to necessary resources, and reluctance to change. For instance, individuals can be unaware of the options for increasing energy efficiency or the value of doing so. Additionally, there may be inadequate incentives for organizations and individuals to adopt energy-efficient technology [45,46,47]. |

| Resistance to policy and regulatory measures | There is opposition to policies and rules that are meant to make energy use more efficient, such as building codes, minimum energy performance standards, and requirements for energy labels. Policies that mandate the use of energy-efficient technology, for instance, may be met with resistance from businesses and individuals who view such mandates as an unnecessary burden or an unnecessary expense. Policies that prohibit the use of particular energy-intensive technologies or impose penalties for noncompliance may also meet opposition [48,49]. |

| Limited technical capacity | Some governments lack the necessary technical competence to fully adopt energy efficiency measures, and this is particularly true for developing nations. Some of these barriers include a scarcity of readily available data and knowledge about energy efficiency, as well as a shortage of trained people capable of designing, installing, and maintaining such technology. In addition, research and development funding for energy efficiency may be inadequate, slowing the introduction of cutting-edge efficiency measures [50,51,52]. |

| Rebound Effect | The phenomenon of the rebound effect is multifaceted and poses a significant challenge to the achievement of energy efficiency improvements and reduced energy consumption. The rebound effect can be defined as the situation in which energy savings achieved through efficiency improvements are offset by an increase in energy consumption. The rebound effect manifests in two primary forms: direct and indirect [53]. Direct rebound occurs when the efficiency gains in using a particular technology translate into lower costs, which, in turn, incentivizes users to increase their consumption of the technology, thereby offsetting some or all of the energy savings [54]. In contrast, indirect rebound arises when the efficiency improvements lead to reductions in the cost of goods and services, and consumers, as a result, increase their spending, thereby offsetting the gains from energy efficiency improvements by increasing energy consumption [55]. |

| Journals in WoS | Articles | Journals in Scopus | Articles |

|---|---|---|---|

| Energy Policy | 931 | Energy | 1724 |

| Journal Of Cleaner Production | 860 | Energy Policy | 1232 |

| Energy | 799 | Applied Energy | 1134 |

| Energies | 775 | Energies | 831 |

| Applied Energy | 550 | Journal Of Cleaner Production | 772 |

| Sustainability | 550 | Sustainability | 575 |

| Renewable and Sustainable Energy Reviews | 450 | Renewable Energy | 478 |

| Energy and Buildings | 430 | Energy Conversion and Management | 468 |

| Energy Economics | 388 | Energy And Buildings | 462 |

| Energy Conversion and Management | 364 | Renewable and Sustainable Energy Reviews | 441 |

| Journals in WoS | Articles | Journals in Scopus | Articles |

|---|---|---|---|

| Contemporary Economic Policy | 6 | Energy Policy | 13 |

| Energy Policy | 5 | Applied Energy | 6 |

| American Economic Journal Economic Policy | 3 | Climate Policy | 4 |

| Energy | 3 | Energy | 4 |

| Oxford Review of Economic Policy | 3 | Energies | 3 |

| Asian Economic Policy Review | 2 | Energy Economics | 3 |

| Ecological Economics | 2 | Environmental Innovation and Societal Transitions | 3 |

| Energy Economics | 2 | International Journal of Energy Economics and Policy | 3 |

| Environmental Innovation and Societal Transitions | 2 | Renewable Energy | 3 |

| Equilibrium Quarterly Journal of Economics and Economic Policy | 2 | Energy and Environment | 2 |

| Issues | Subsidies | Tax Incentives | Market-Based Mechanisms |

|---|---|---|---|

| Lack of financing | In order to combat the shortage of funding and make energy-efficient solutions more widely available and affordable, subsidies can provide direct financial assistance for their implementation. | Offering tax credits or deductions for investments in energy efficiency is one way that government programs may help bring down the price of energy-saving technology and practices. This has the potential to increase the demand for and adoption of energy-efficient solutions. | Market-based methods, such as cap-and-trade systems or carbon taxes, can place a price on carbon emissions, providing a financial incentive for firms and individuals to adopt energy-efficient technology and practices. As the price of carbon emissions rises, this might spur investment in efficient energy technologies. |

| Barriers to the adoption of energy efficiency technologies | By providing financial support for promotion, dissemination of information, installation and demonstration of these technologies, research and development, and the creation of stakeholder networks, subsidies can address the lack of awareness and access to information about energy-efficient technologies. | Increased public knowledge and the lower purchase prices made possible by tax incentives are two ways in which these kinds of technology might be made more widely available. | By providing a financial incentive for companies and individuals to adopt energy-efficient technology, market-based processes can aid in spreading energy efficiency knowledge. This can reduce the barriers to adopting energy-efficient solutions and help people adjust to the new normal. |

| Resistance to policy and regulatory measures | Subsidies provide monetary assistance for the adoption of energy-efficient technology and practices, which can help overcome resistance to policy and regulatory initiatives. With this backing, energy-efficient solutions may be made more easily accessible and inexpensive, which in turn can boost adoption and lessen resistance to change. | By making energy-efficient solutions more appealing and accessible and by lowering their cost, tax incentives can help diminish opposition to policy and regulatory actions. | In order to lessen opposition to policy and regulatory measures, market-based mechanisms might offer a financial incentive for firms and individuals to adopt energy-efficient technology and practices. |

| Limited technical capacity | Providing financing for energy efficiency research and development, as well as the training and development of trained professionals, is one way in which subsidies may help solve a shortage of technical competence. | Tax breaks can help alleviate a lack of technical expertise by stimulating investment in energy efficiency research and development and making professions in energy efficiency more appealing. | By providing a financial incentive for investment in energy efficiency R&D and the training of trained individuals, market-based methods can help alleviate the shortage of technical talent. To achieve this, market signals such as carbon pricing, emissions trading systems, and performance-based incentives are used to encourage people and companies to adopt more energy-efficient technologies and practices. |

| Rebound Effect | If the rebound effect proves to be considerable, it may be necessary to reevaluate the efficacy of subsidies for energy efficiency measures. In some instances, it may be necessary to curtail or terminate subsidies to prevent the rebound effect from nullifying potential energy savings. Nevertheless, it is crucial to consider the broader economic and social consequences of such a decision. Subsidies may be indispensable in promoting the adoption of energy-efficient technologies, particularly in low-income and disadvantaged communities, where the initial expenses associated with such technologies may represent a barrier to adoption. | Tax incentives can serve as an effective tool to discourage excessive energy consumption, and one way of achieving this is by implementing taxes on energy consumption. This mechanism motivates individuals and businesses to curb their energy usage to avoid paying higher taxes. As a result, such a measure encourages more efficient energy use, as individuals and businesses may be inclined to seek out more energy-efficient technologies or modify their energy consumption behavior. | Market-based mechanisms, including emissions trading or carbon taxes, can be employed as effective means of reducing the rebound effect. These mechanisms help internalize the negative externalities associated with energy use and incentivize energy-efficient behavior by raising the cost of energy consumption. This increased cost can motivate individuals and businesses to seek ways to reduce their energy consumption, thereby promoting more efficient energy use. |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mushafiq, M.; Arisar, M.M.K.; Tariq, H.; Czapp, S. Energy Efficiency and Economic Policy: Comprehensive Theoretical, Empirical, and Policy Review. Energies 2023, 16, 2381. https://doi.org/10.3390/en16052381

Mushafiq M, Arisar MMK, Tariq H, Czapp S. Energy Efficiency and Economic Policy: Comprehensive Theoretical, Empirical, and Policy Review. Energies. 2023; 16(5):2381. https://doi.org/10.3390/en16052381

Chicago/Turabian StyleMushafiq, Muhammad, Muzammil Muhammad Khan Arisar, Hanan Tariq, and Stanislaw Czapp. 2023. "Energy Efficiency and Economic Policy: Comprehensive Theoretical, Empirical, and Policy Review" Energies 16, no. 5: 2381. https://doi.org/10.3390/en16052381

APA StyleMushafiq, M., Arisar, M. M. K., Tariq, H., & Czapp, S. (2023). Energy Efficiency and Economic Policy: Comprehensive Theoretical, Empirical, and Policy Review. Energies, 16(5), 2381. https://doi.org/10.3390/en16052381