Distribution System Management Model Based on the Cooperative Concept of Unifying the Multi-Owned Networks

Abstract

1. Introduction

- (i)

- The argument between network owners in overlapping sales areas where there is a redundancy of investment in the distribution system due to the violation of the existing monopoly in power distribution.

- (ii)

- The difficulty in formulating a fair and non-discriminatory tariff for consumers across the distribution network when multiple grid owners are willing to physically combine their grids into a single multi-owned system.

2. Problem Formulation

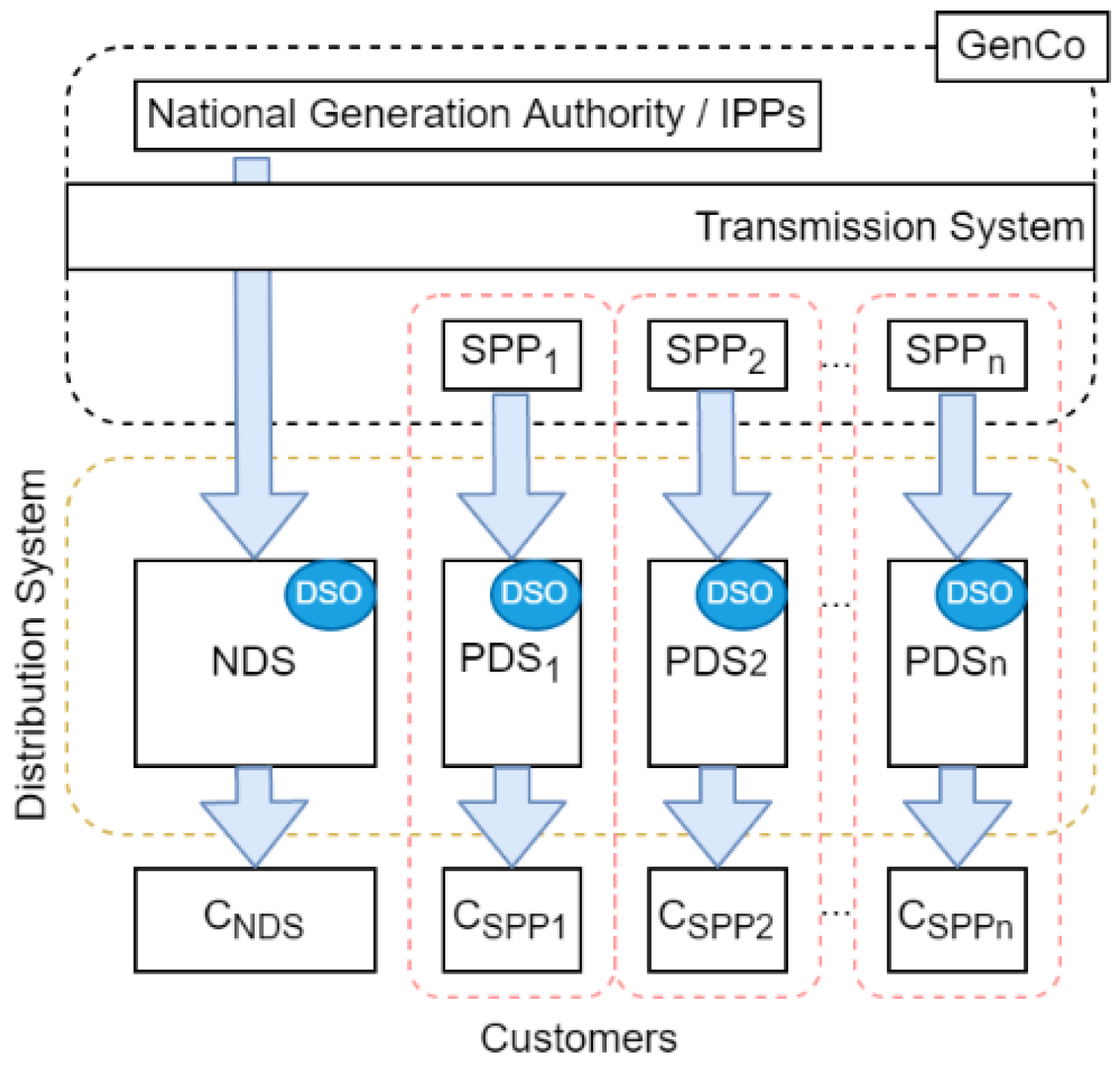

2.1. Unbundled Distribution System Management

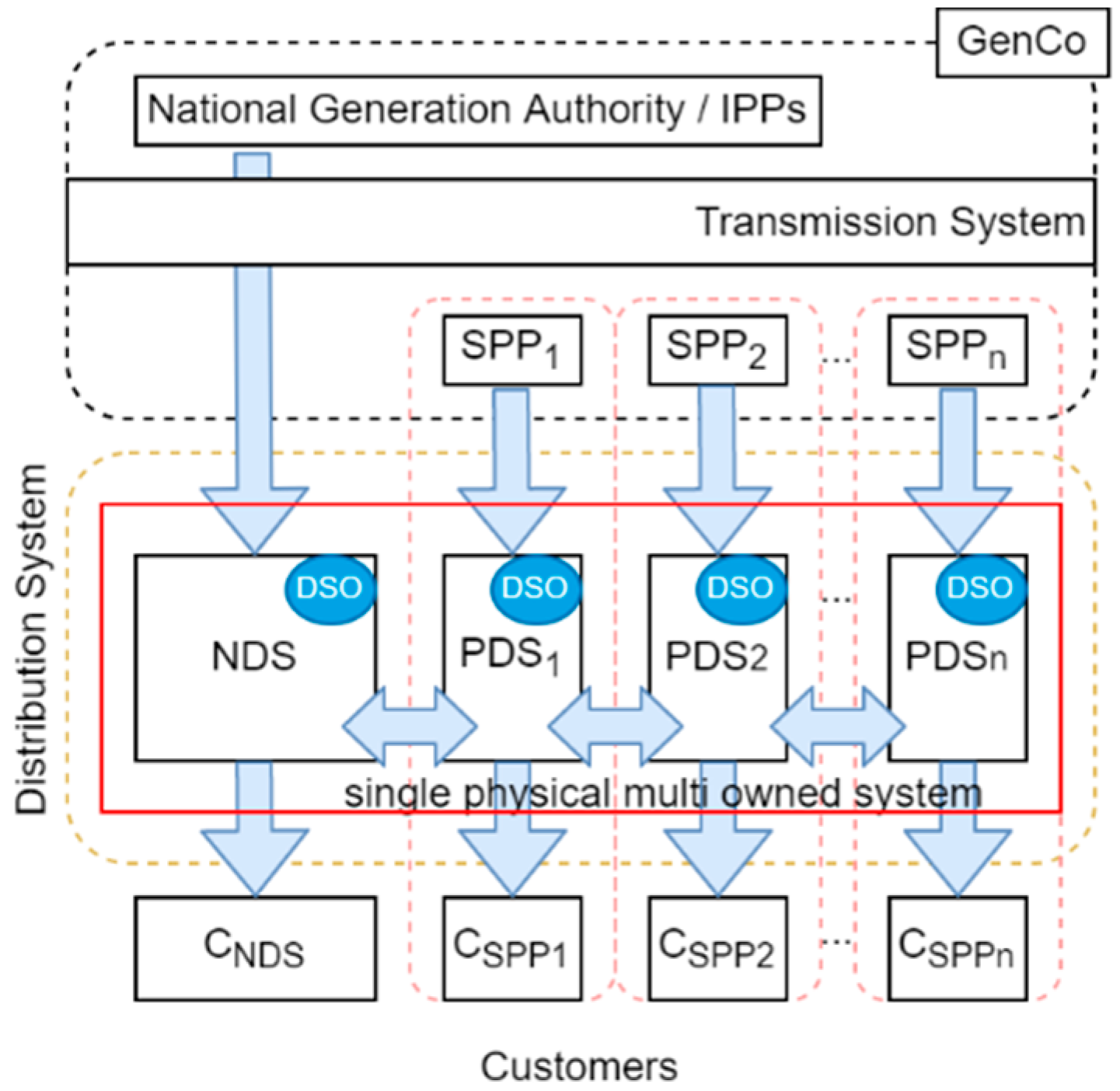

2.2. Distribution System Management Model with Cooperative Concept

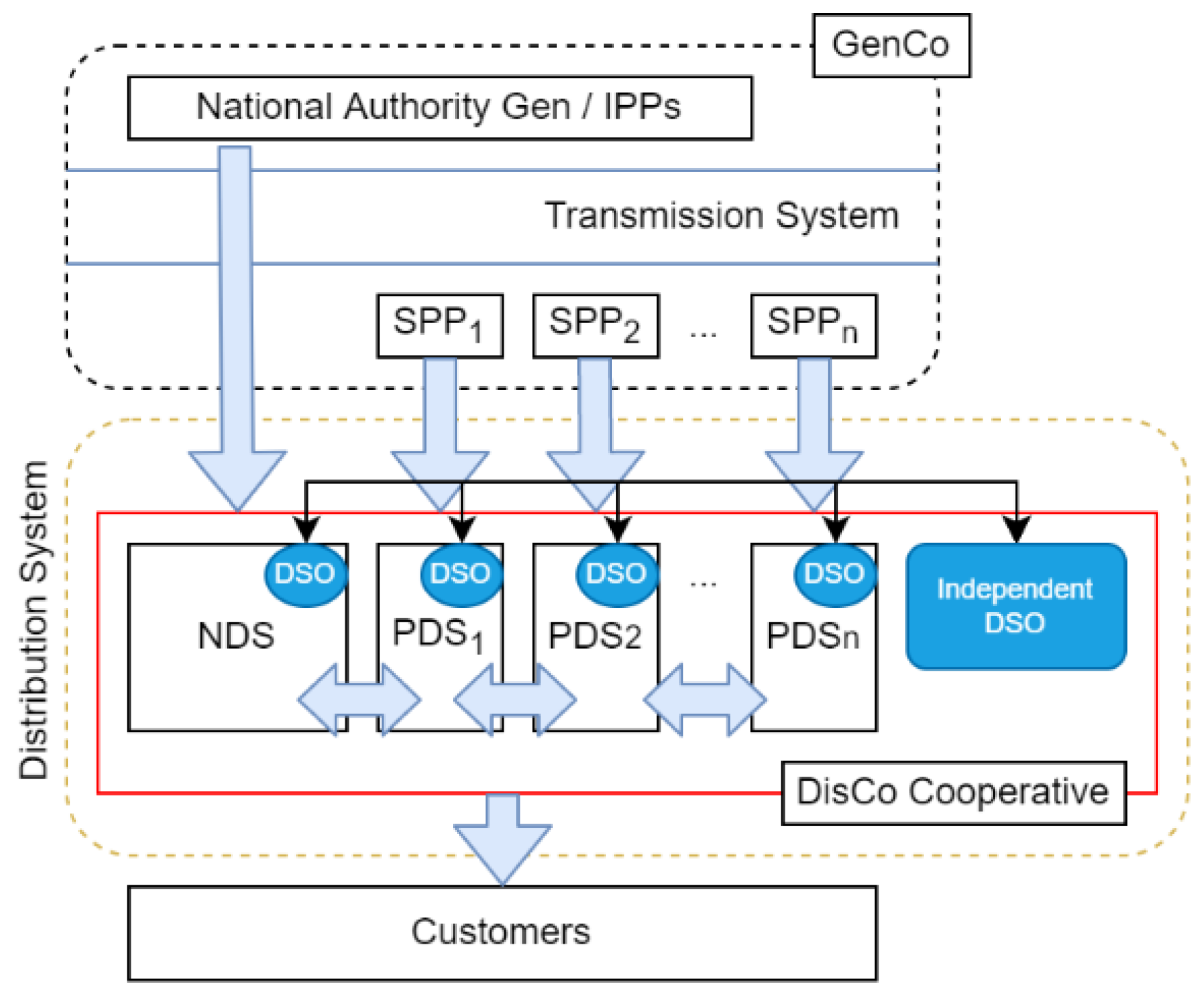

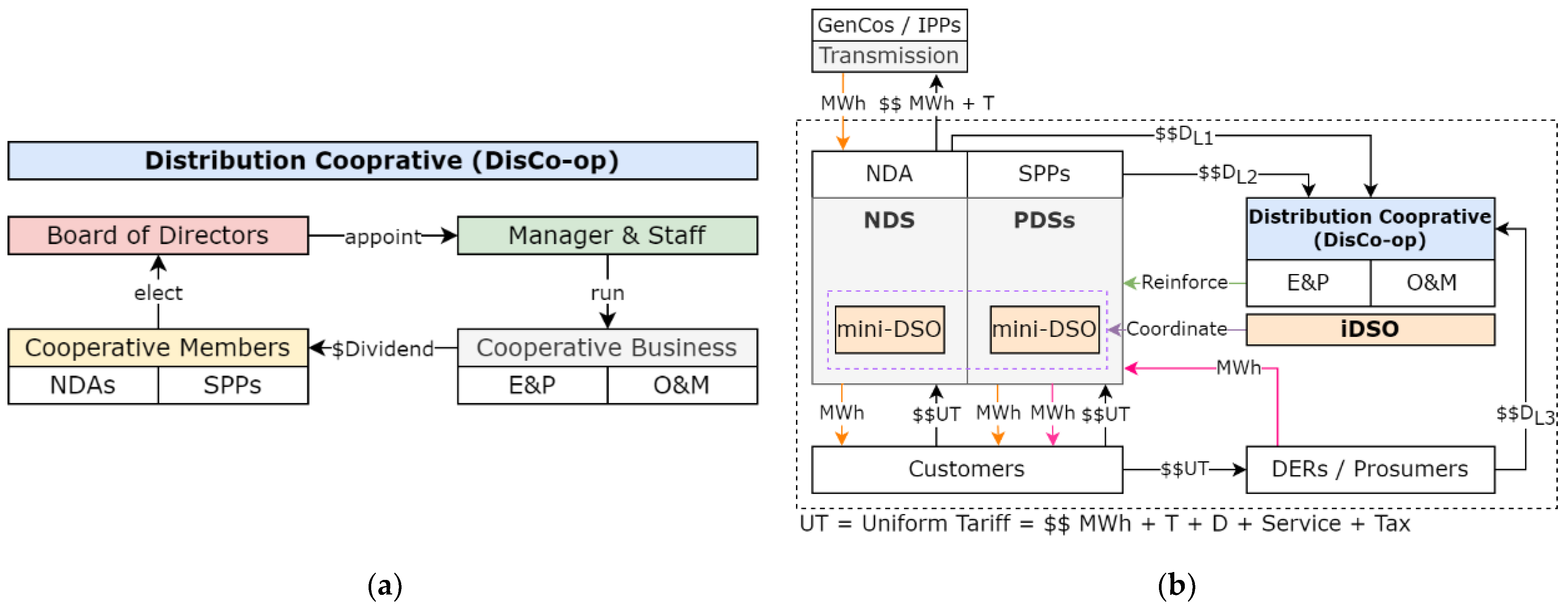

3. Distribution Cooperative (DisCo-Op) Model

3.1. Core Principles of Distribution Cooperatives

- Voluntary and open membership;

- Democratic member control;

- Member economic participation;

- Autonomy and independence;

- Education, training, and information;

- Cooperation among cooperatives;

- Concern for the community.

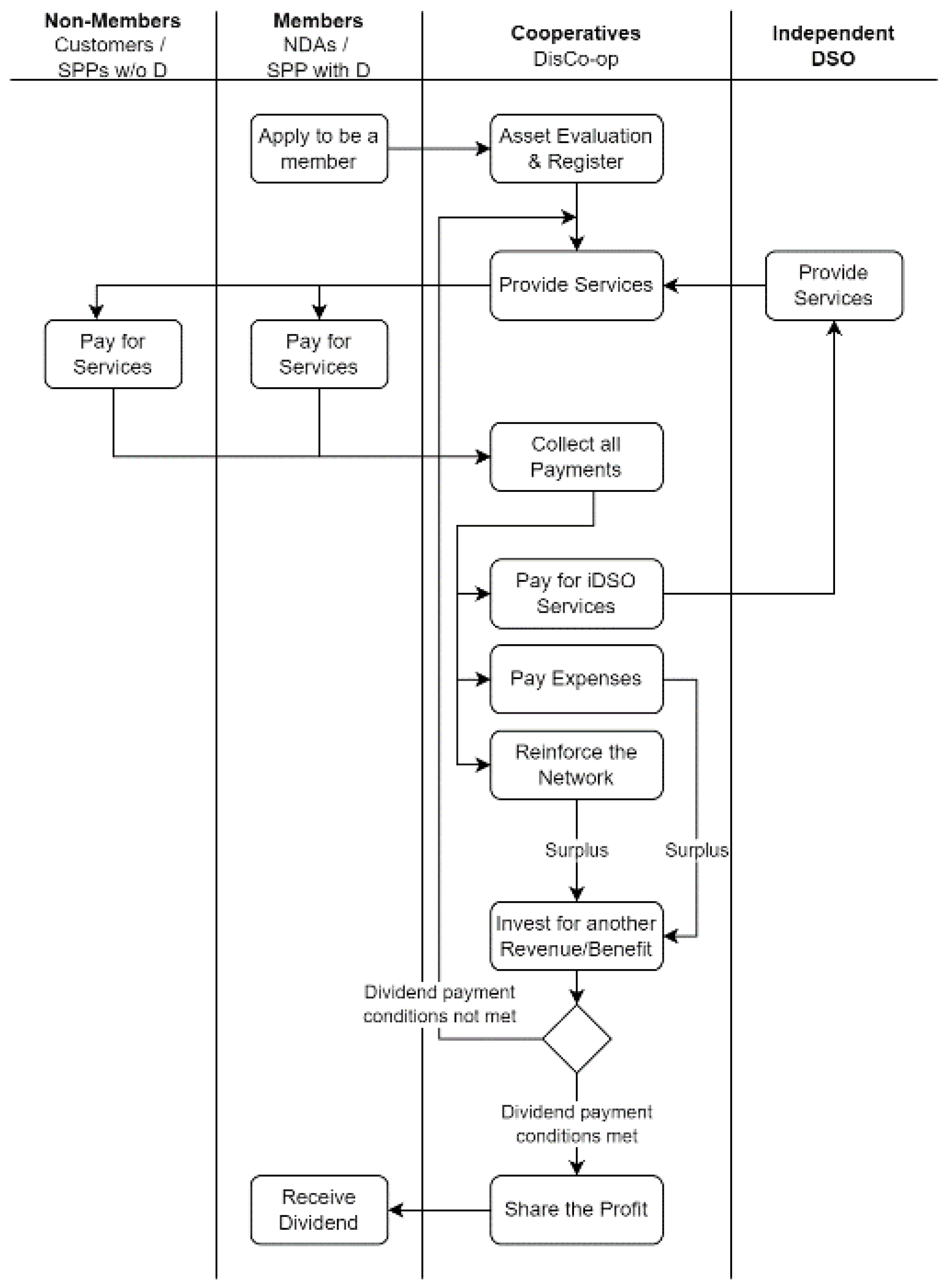

3.2. Functions of Distribution Cooperatives

3.2.1. Ownership Function

3.2.2. Operational Function

3.3. Recovery Return Concept

3.4. Cooperative Members

3.5. Boundaries of the Proposed Solution

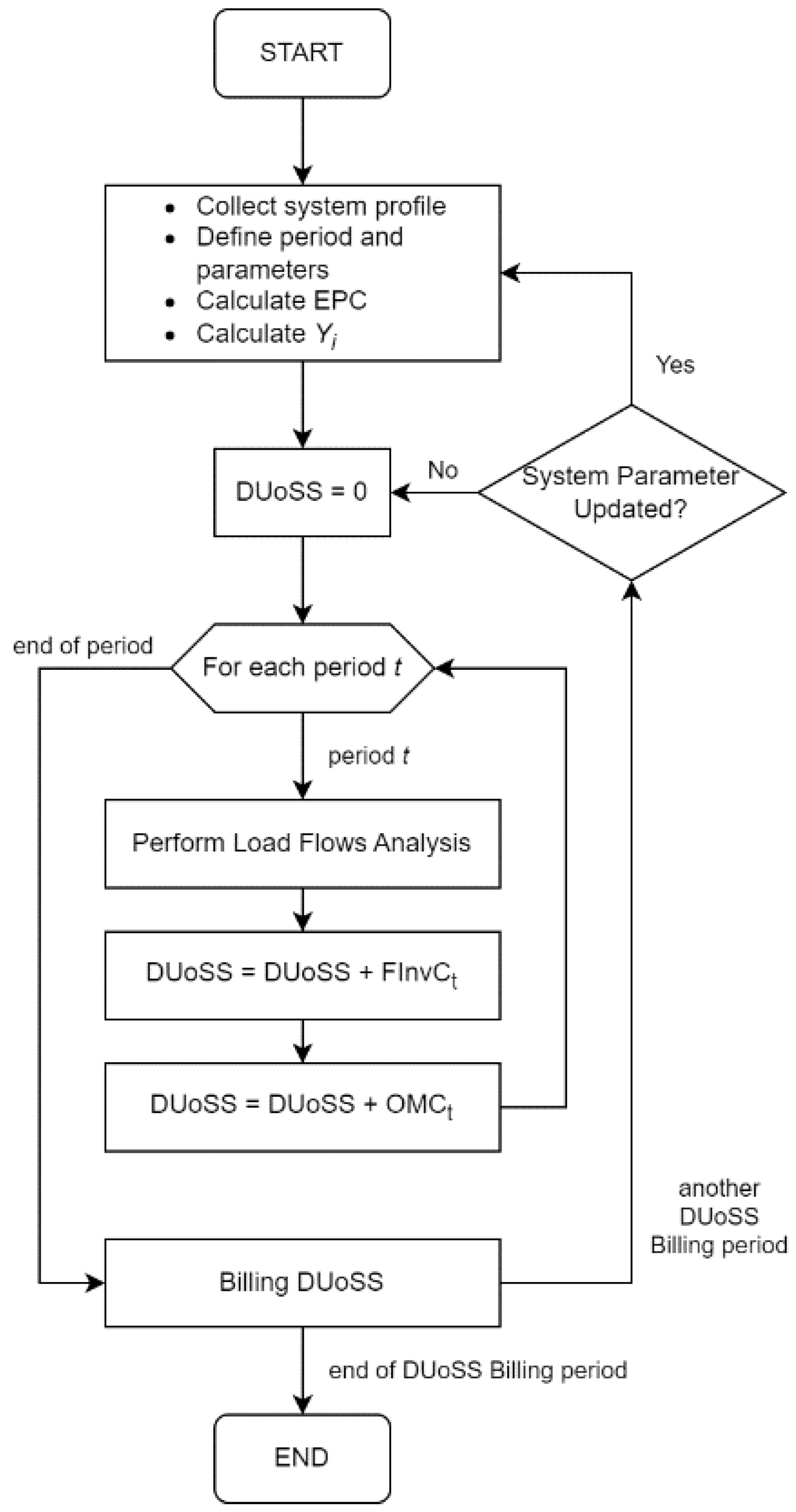

4. Distribution Use of Sharing System (DUoSS) Charges

4.1. Distribution Use-of-Sharing-System (DUoSS)

4.2. Future Network Reinforcement Cost (FinvC)

4.3. Network Operation and Maintenance Cost (OMC)

4.4. DUoSS Calculation Algorithm

4.5. Profit Sharing

4.6. When the NDA Is Unavailable

5. DUoSS: Numerical Example

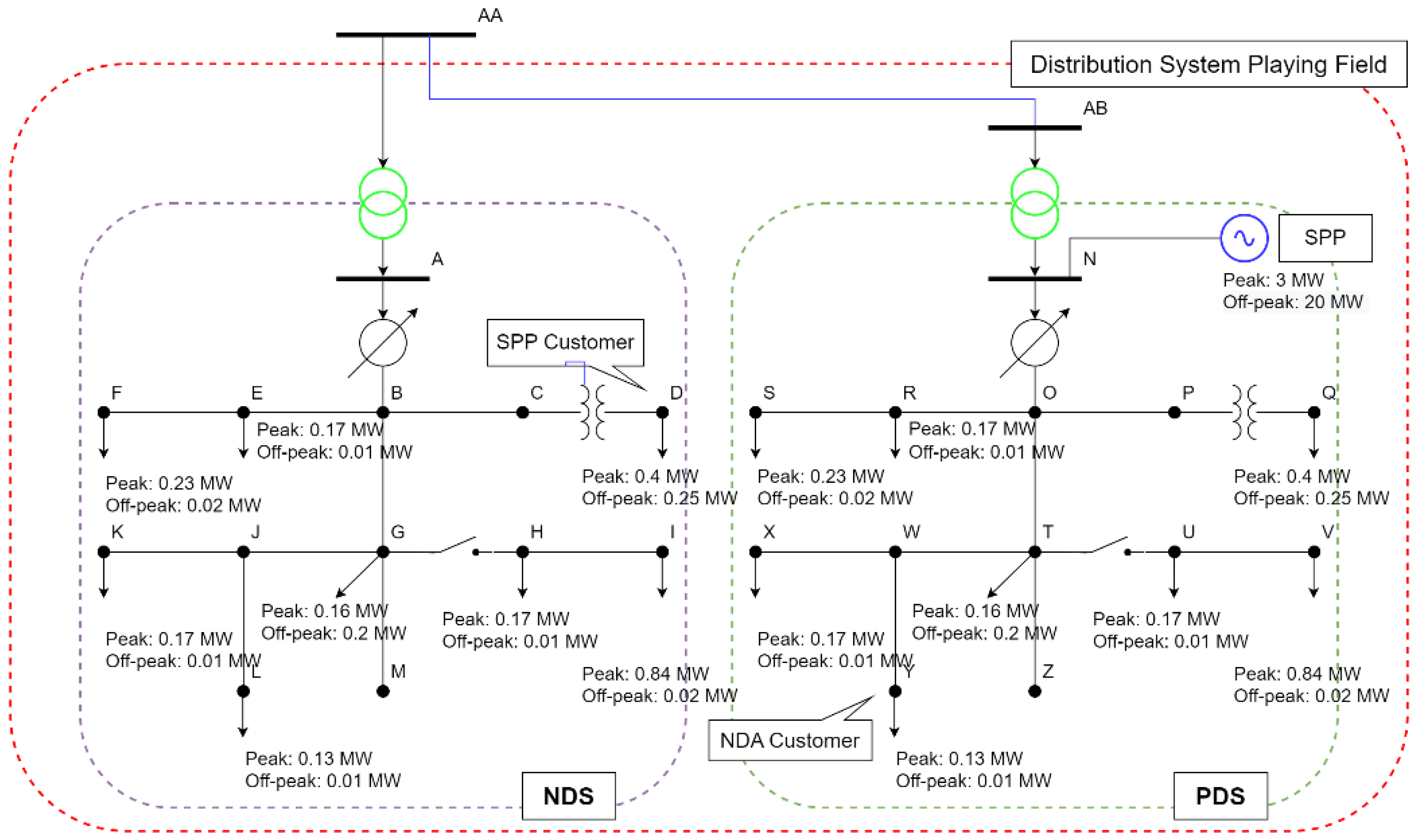

5.1. Simulation on an Integrated Test System

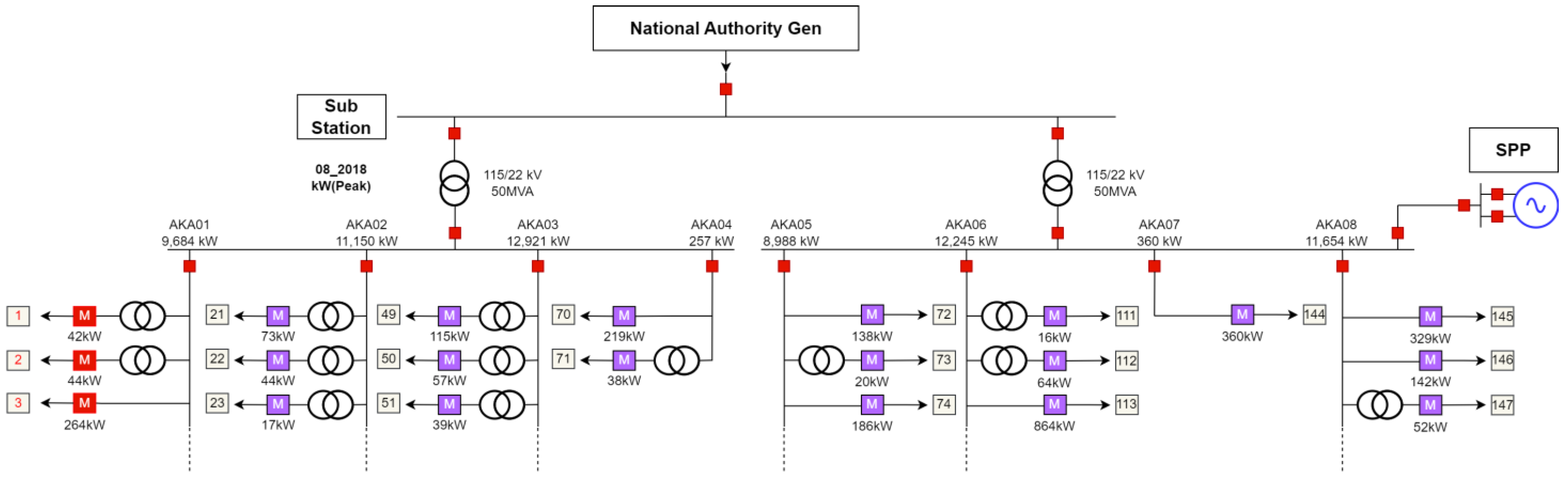

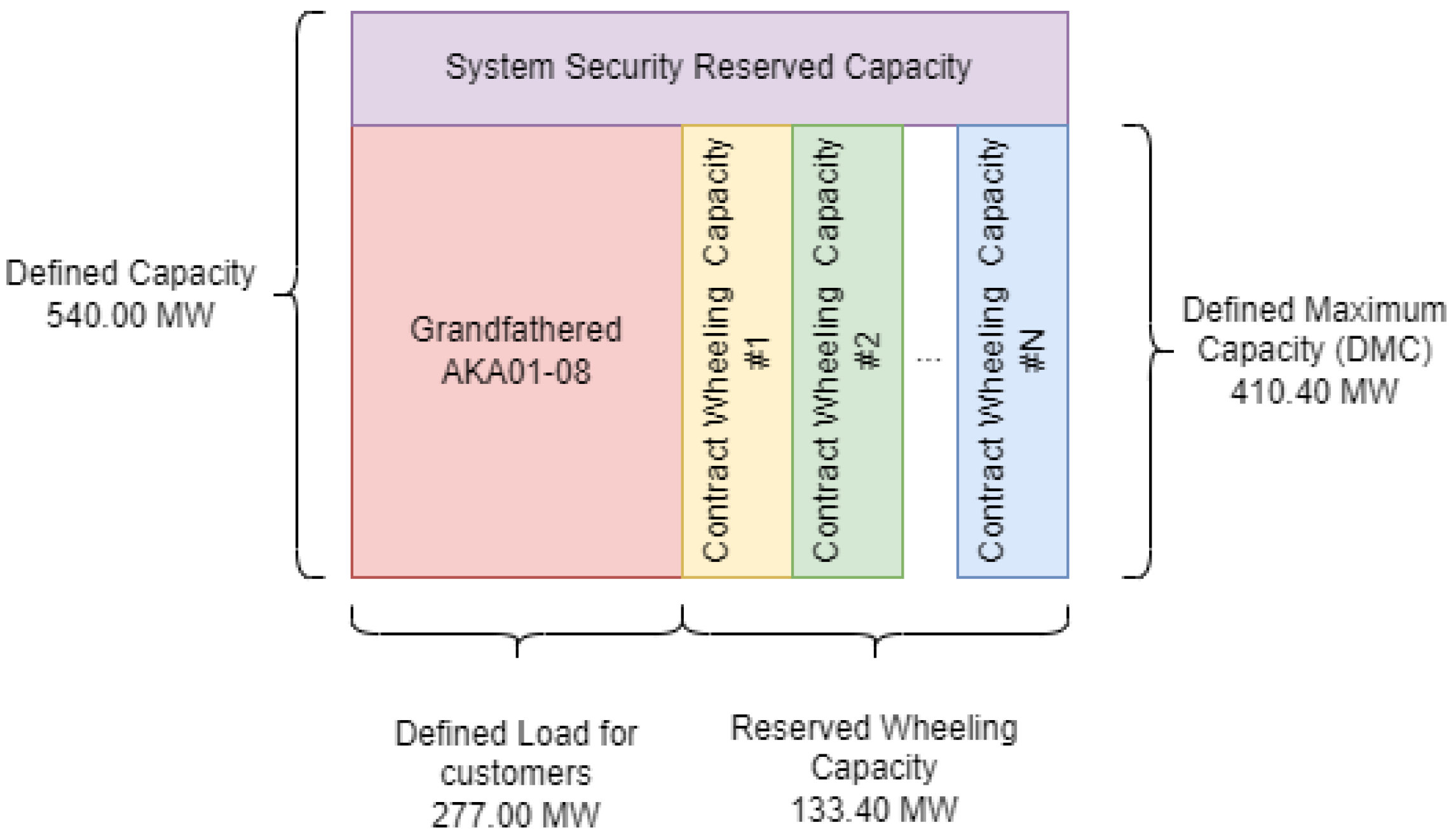

5.2. Simulation of the PEA’s Distribution System: Amata City Industrial Estate

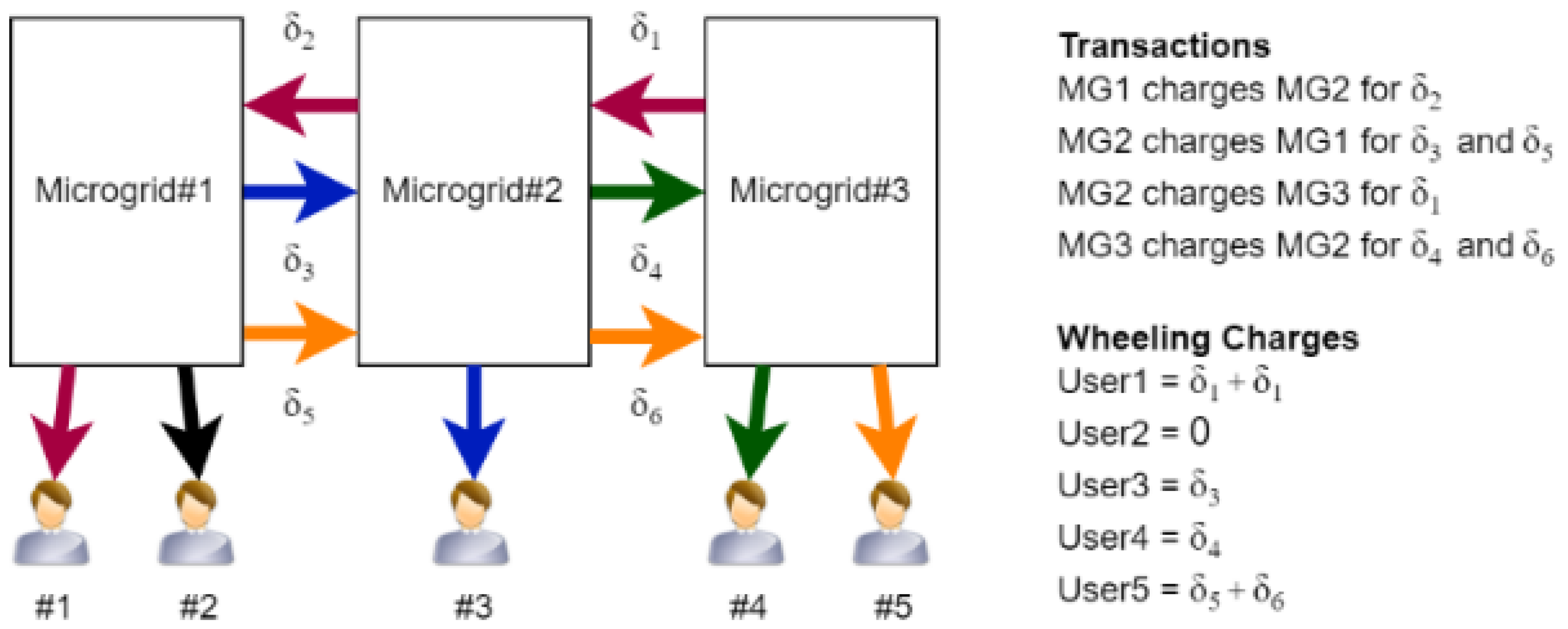

6. Comparison between the DisCo-Op Model and the Traditional Wheeling Model

7. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| D | Distribution usage charge in UT |

| DL | Distribution usage charge for local system |

| DisCo-op | Distribution cooperative |

| DSO | Distribution system operator |

| DUoSS | Distribution use-of-sharing-system charge, expressed in GBP |

| E and P | Expansion and planning |

| iDSO | Independent distribution system operator |

| NRI | Net return on investment |

| MWh | Megawatt hours |

| NDA | National distribution authority |

| NDS | National distribution system |

| NRI | Net return on investment |

| O and M | Operation and maintenance |

| PDS | Private distribution system |

| SPP | Small power producer |

| T | Transmission usage charge in UT |

| UT | Uniform tariff |

| Indices | |

| i | Network user i in distribution system |

| j | DUoSS calculation period in period td |

| k | Network user a = national distribution authority (NDA) p = small power producer (SPP) c = customer |

| m | DisCo-op’s member m |

| n | Distribution line n of the playing field |

| t | DUoSS calculation period |

| Dividend calculation period | |

| Parameters | |

| Benchmark future network reinforcement rate of line n (GBP/kW) | |

| Critical flow of line n (kW) | |

| NDA’s regulatory factor | |

| DisCo-op’s utilisation factor | |

| Maximum capacity of line n (MW) | |

| Actual network operation and maintenance equivalent periodic cost of line (GBP) | |

| Number of shares held by member i at period td (GBP) | |

| Variables | |

| Future network reinforcement cost calculated for period t (GBP) | |

| Operation and maintenance cost of the existing network calculated for period t (GBP) | |

| Equalisation cost to balance actual cost and calculated cost (GBP) | |

| Future network reinforcement cost for user k (GBP) | |

| Operation and maintenance cost for user k (GBP) | |

| Equalisation cost for user k (GBP) | |

| Benchmark future network reinforcement rate at circuit i (GBP/kW) | |

| Power flow from user k’s generation in circuit i in the off-peak period (kW) | |

| Power flow for user k’s demand in circuit i in the peak period (kW) | |

| Monetary reward for network contribution for the SPP for circuit i (GBP) | |

| Monetary reward for network contribution for the customers for circuit i (GBP) | |

| Actual flows of line n (kW) | |

| Power flow caused by demand in line n (kW) | |

| Power flow caused by generation in line n (kW) | |

| Network operation and maintenance equivalent periodic cost of line (GBP) | |

| Sharing factor of line n | |

| Operation and maintenance charge rate of line n (GBP/kW) | |

| Power flows in line n that belong to user k (MW) | |

| The surplus of the cooperative for period td (GBP) | |

| Actual O and M expenses for period td (GBP) | |

| Actual income collected from DUoSS for period td (GBP) | |

| Actual saving reserved for future expansion and planning for period td (GBP) | |

| Dividend for member m for period td (GBP) | |

| Contribution of member m for period td (GBP) | |

| Amount of investment from member m for period td (GBP) | |

| Spending of member m for period td (GBP) | |

| Future network reinforcement charge paid by member m for period j (GBP) | |

| Reward received by member m for period j (GBP) | |

| Charge for network operation and maintenance paid by member m for period j (GBP) |

References

- Sukunta, M. PURPA-Qualifying Capacity Increases, but It’s Still a Small Portion of Added Renewables. Available online: https://www.eia.gov/todayinenergy/detail.php?id=36912 (accessed on 16 August 2018).

- Li, J.; Ma, G.; Li, T.; Chen, W.; Gu, Y. A Stackelberg game approach for demand response management of multi-microgrids with overlapping sales areas. Sci. China Inf. Sci. 2019, 62, 1–13. [Google Scholar] [CrossRef]

- PEA. Pricing Distribution System Use or Connection Service (Wheeling Charge); The Provincial Electricity Authority (PEA): Bangkok, Thailand, 2019. [Google Scholar]

- Thitapars, S.; Prukpanit, P.; Leeprechanon, N. The Distribution Service Pricing for Third-Party Access to Preserve the Responsibility of National Distribution Service Operator in Thailand: The Case of Industrial Estates. Int. Trans. J. Eng. Manag. Appl. Sci. Technol. 2022, 13, 1–18. [Google Scholar]

- Energy Sector Management Assistance Program. Mini Grids in Cambodia: A Case Study of a Success Story; The International Bank for Reconstruction and Development/The World Bank Group: Washington, DC, USA, 2017. [Google Scholar]

- ADB. Philippines Energy Sector Assessment, Strategy, and Road Map; Asian Development Bank: Mandaluyong, Philippines, 2018; p. 56. [Google Scholar]

- Ruff, L.E. Stop Wheeling and Start Dealing: Resolving the Transmission Dilemma. Electr. J. 1994, 7, 24–43. [Google Scholar] [CrossRef]

- Leeprechanon, N.; David, A.K.; Moorthy, S.S.; Liu, F. Transition to an electricity market a model for developing countries. IEEE Trans. Power Syst. 2002, 17, 885–894. [Google Scholar] [CrossRef]

- Jadhav, A.M.; Abhyankar, A.R. Emergence of distribution system operator in the Indian power sector and possible way ahead. Energy Policy 2022, 160, 112650. [Google Scholar] [CrossRef]

- Mousavi, M.; Wu, M. A DSO Framework for Market Participation of DER Aggregators in Unbalanced Distribution Networks. IEEE Trans. Power Syst. 2022, 37, 2247–2258. [Google Scholar] [CrossRef]

- COOP Cooperative Identity, Values & Principles. Available online: https://www.ica.coop/en/cooperatives/cooperative-identity (accessed on 9 May 2021).

- Frederick, D.A. Co-ops 101: An Introduction to Cooperatives; United States Department of Agriculture: Washington, DC, USA, 1997.

- Tremblay, E.; Hupper, A.; Waring, T.M. Co-operatives exhibit greater behavioral cooperation than comparablebusinesses: Experimental evidence. J. Co-Oper. Organ. Manag. 2019, 7, 100092. [Google Scholar]

- Frank, T.; Mbabazize, M.; Shukla, J. Savings and Credit Cooperatives (Sacco’s) Services’ Terms and Members’ Economic Development in Rwanda: A Case Study of Zigama Sacco Ltd. Int. J. Community Coop. Stud. 2015, 3, 1–56. [Google Scholar]

- Ghauri, S.; Mazzarol, T.; Soutar, G.N. Why do SMEs join Co-operatives? A comparison of SME owner-managers and Co-operative executives views. J. Co-op. Organ. Manag. 2021, 9, 100128. [Google Scholar] [CrossRef]

- Verhees, F.J.H.M.; Sergaki, P.; Duk, G.V. Building up active membership in cooperatives. A Mediterr. J. Econ. Agric. Environ. 2015, 14, 42–52. [Google Scholar]

- Shleifer, A. A Theory of Yardstick Competition. RAND J. Econ. 1985, 16, 319–327. [Google Scholar] [CrossRef]

- Spann, R.M. Rate of Return Regulation and Efficiency in Production: An Empirical Test of the Averch-Johnson Thesis. Bell J. Econ. Manag. Sci. 1974, 5, 38–52. [Google Scholar] [CrossRef]

- EGAT. EGAT ft Annoucement. Available online: http://www.egat.co.th/ft/20200807%20Direct%20Rate_Nov2018_Additional%2016Jul2020.pdf (accessed on 16 July 2020).

- Energy Policy and Planning Office. PricewaterhouseCoopers Thailand: Electricity Power Tariff; Energy Policy and Planning Office: Bangkok, Thailand, 2005.

- Levett, J.L. Distribution Wheeling for Small Power Producers Within Industrial Estates; National Energy Policy Office: Bangkok, Thailand, 1997.

- Lee, W.; Lin, C.; Swift, L. Wheeling Charge under a Deregulated Environment. IEEE Trans. Ind. Appl. 2001, 37, 1778–1783. [Google Scholar]

- Sood, Y.; Padhy, N.; Gupta, H. Wheeling of power under deregulated environment of power system-a bibliographical survey. IEEE Trans. Power Syst. 2002, 17, 870–878. [Google Scholar] [CrossRef]

- Bialek, J. Tracing the flow of electricity. IEE Proc.—Gener. Transm. Distrib. 1996, 143, 313–320. [Google Scholar] [CrossRef]

- Bialek, J. Topological generation and load distribution factors for supplement charge allocation in transmission open access. IEEE Trans. Power Syst. 1997, 12, 1185–1193. [Google Scholar] [CrossRef]

- Kirschen, D.; Allan, R.; Strbac, G. Contributions of individual generators to loads and flows. IEEE Trans. Power Syst. 1997, 12, 52–60. [Google Scholar] [CrossRef]

- Ng, W.Y. Generalized Generation Distribution Factors for Power System Security Evaluations. IEEE Trans. Power Appar. Syst. 1981, PAS-100, 1001–1005. [Google Scholar] [CrossRef]

- Yang, Z.; Lei, X.; Yu, J.; Lin, J. Objective transmission cost allocation based on marginal usage of power network in spot market. Int. J. Electr. Power Energy Syst. 2020, 118, 105799. [Google Scholar] [CrossRef]

- Li, R.; Yokoyama, R.; Chen, L. A Pricing Method for Transmission Loss Based on Sensitivity Analysis. IEEE Trans. Power Syst. 2006, 21, 1201–1208. [Google Scholar] [CrossRef]

- Cory, B. Pricing in electricity transmission and distribution. In Proceedings of the 8th Mediterranean Electrotechnical Conference on Industrial Applications in Power Systems, Computer Science and Telecommunications (MELECON 96), IEEE, Bari, Italy, 16 May 1996; Volume 1. [Google Scholar]

- Picciariello, A.; Reneses, J.; Frias, P.; Söder, L. Distributed generation and distribution pricing: Why do we need new tariff design methodologies? Electr. Power Syst. Res. 2015, 119, 7. [Google Scholar] [CrossRef]

- Yang, Z.; Zhong, H.; Xia, Q.; Kang, C.; Chen, T.; Li, Y. A structural transmission cost allocation scheme based on capacity usage identification. IEEE Transactions on Power Systems 2016, 31, 2876–2884. [Google Scholar] [CrossRef]

- Mancera, C.T.; Monroy, A.C. Pricing of Distribution Networks with Distributed Generation: Application of Nodal Pricing. In Proceedings of the Innovative Smart Grid Technologies (ISGT Latin America), 2011 IEEE PES Conference, IEEE, Medellin, Colombia, 19–21 October 2011. [Google Scholar]

- Jenkins, N.; Ekanayake, J.B.; Strbac, G. Distributed Generation. The Institution of Engineering and Technology: London, UK, 2010; pp. 143–164. [Google Scholar]

- Gholizadeh-Roshanagh, R.; Zare, K. Electric power distribution system expansion planning considering cost elasticity of demand. IET Gener. Transm. Distrib. 2019, 13, 5229–5236. [Google Scholar] [CrossRef]

- Mazzola, L.; Denzler, A.; Christen, R. Peer-to-Peer Energy Trading in Microgrids: Towards an Integrated Open and Distributed Market. In Proceedings of the 2020 International Conference on Electrical Engineering and Control Technologies (CEECT), IEEE, Melbourne, VIC, Australia, 10–13 December 2020. [Google Scholar]

- Paudel, A.; Beng, G.H. A Hierarchical Peer-to-Peer Energy Trading in Community Microgrid Distribution Systems. In Proceedings of the 2018 IEEE Power & Energy Society General Meeting (PESGM), IEEE, Portland, OR, USA, 5–10 August 2018. [Google Scholar]

- Khajeh, H.; Firoozi, H.; Laaksonen, H.; Shafie-Khah, M. Peer-to-peer flexibility trading of end-users at distribution networks. CIRED—Open Access Proc. J. 2020, 2020, 797–799. [Google Scholar] [CrossRef]

- Zhong, W.; Xie, S.; Xie, K.; Yang, Q.; Xie, L. Cooperative P2P Energy Trading in Active Distribution Networks: An MILP-Based Nash Bargaining Solution. IEEE Trans. Smart Grid 2020, 12, 1264–1276. [Google Scholar] [CrossRef]

- Teotia, F.; Mathuria, P.; Bhakar, R. Peer-to-peer local electricity market platform pricing strategies for prosumers. IET Gener. Transm. Distrib. 2020, 14, 4388–4397. [Google Scholar] [CrossRef]

- Zhong, W.; Xie, K.; Liu, Y.; Xie, S.; Xie, L. Nash Mechanisms for Market Design Based on Distribution Locational Marginal Prices. IEEE Trans. Power Syst. 2022, 37, 4297–4309. [Google Scholar] [CrossRef]

- Hayes, A. Patronage Dividend. Available online: https://www.investopedia.com/terms/p/patronagedividend.asp (accessed on 5 May 2021).

- Cathy, C.-O. How Worker Co-ops Decide to Share Profits. Available online: https://cdi.coop/profit-sharing-in-worker-coops/ (accessed on 13 March 2021).

- IEEE Resources | PES Test Feeder—13-bus Feeder. Available online: http://site.ieee.org/pes-testfeeders/files/2017/08/feeder13.zip (accessed on 17 May 2020).

| Literature Group | Ref. | Summary |

|---|---|---|

| Transmission and Distribution management model | [7,8,9,10] | The primary focus of this group is the transmission and distribution management model. These models are interesting but may need to adapt a bit for overlapping sales areas. Therefore, these concepts have been applied to develop a novel distribution management model in this paper. |

| Cooperatives model | [11,12,13,14,15,16] | The primary focus of this group is the concept of cooperatives. Therefore, these papers are used to support the cooperative concept of the proposed model. |

| Wheeling Charges | [4,22,23] | These methods are traditional methods that are currently used. A method is chosen from this group for comparison in the numerical example. |

| Power flows analysis and tracing | [24,25,26,27,28,29] | Some approaches are chosen to be fundamental calculations of the distribution pricing model in this paper. |

| Distribution Use-of-System charges (DUoS) | [30,31,32,33,34,35] | Some approaches are chosen to adapt to the distribution pricing model in this paper. |

| Optimal price for Electricity Trading | [2,36,37,38,39,40,41] | The primary focus of this group is to review the current trend in energy pricing studies. A gap regarding network usage pricing is identified. |

| Network Users | DL (GBP) | E&P (GBP) | O&M (GBP) | D (GBP) |

|---|---|---|---|---|

| A | 31.5622 | 58.3014 | ||

| B | 113.9299 | 108.2740 | ||

| C | 148.2242 | 466.4110 | ||

| D | 34.2901 | 77.0411 | ||

| Total—NDA | 328.0064 | 5.1000 | 322.9064 | 710.0275 |

| E | 194.2448 | 322.7397 | ||

| F | 170.0302 | 209.8953 | ||

| G | 33.0661 | 40.4049 | ||

| H | 115.1716 | 82.0384 | ||

| Total—SPP | 512.5127 | 0.0000 | 512.5127 | 655.0783 |

| NRI (GBP) | 10,000.0000 | Surplus (GBP) | 10,000.0000 | |

| Shares (%) | Dividend (GBP) | |||

| NDA | 47.10 | 4710.0000 | ||

| SPP | 52.90 | 5290.0000 |

| Circuit | Yi (GBP/kW/Period) | Safety Limit Capacity * (MW) | Maximum Capacity (MW) | EMC (GBP/Circuit) | EPC (GBP/Circuit) |

|---|---|---|---|---|---|

| AA-AB AA-A, AB-N A-B, N-O | 0.01 | 16.00 | 20.00 | 3000.00 | 50.00 |

| 0.01 | 16.00 | 20.00 | 3000.00 | 50.00 | |

| 0.01 | 16.00 | 20.00 | 3000.00 | 50.00 | |

| B-C, O-P C-D, P-Q | 0.03 | 1.00 | 1.25 | 1800.00 | 30.00 |

| 0.03 | 1.00 | 1.25 | 1800.00 | 30.00 | |

| B-E, O-R E-F, R-S B-G, O-T G-H, T-U | 0.03 | 1.00 | 1.25 | 1800.00 | 30.00 |

| 0.03 | 1.00 | 1.25 | 1800.00 | 30.00 | |

| 0.01 | 16.00 | 20.00 | 3000.00 | 50.00 | |

| 0.03 | 1.00 | 1.25 | 1800.00 | 30.00 | |

| H-I, U-V G-J, T-W | 0.03 | 1.00 | 1.25 | 1800.00 | 30.00 |

| 0.03 | 1.00 | 1.25 | 1800.00 | 30.00 | |

| J-K, W-X | 0.03 | 1.00 | 1.25 | 1800.00 | 30.00 |

| J-L, W-Y | 0.03 | 1.00 | 1.25 | 1800.00 | 30.00 |

| G-M, T-Z | 0.01 | 16.00 | 20.00 | 3000.00 | 50.00 |

| Total | 62,400.00 | 990.00 | |||

| Defined Period | Peak | 9.00 a.m.–9.00 p.m. | Off-peak | 9.00 p.m.–9.00 a.m. | |

| Regulatory factor | 5% | ||||

| Circuit | Service Provider | Power Flows (MW) | Critical Flows (MW) | Yi (GBP/kW/ Period) | Cumulative Network Reinforcement Cost (GBP/kW) | Network Reinforcement Charges (GBP) | Total Charges (GBP) | Actual Cost (GBP) | |||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Peak | Off-Peak | Peak | Off-Peak | Peak | Off-Peak | ||||||||

| AA-AB | NDA |  | 0.27 |  | 19.47 | 16.00 | 0.01 | 0.00 | −0.01 | 0.00 | 0.00 | 0.00 | 194.70 |

| AA-A | NDA |  | 3.27 |  | 0.53 | 16.00 | 0.01 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| A-B | NDA |  | 3.27 |  | 0.53 | 16.00 | 0.01 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| B-C | NDA |  | 0.40 |  | 0.25 | 1.00 | 0.03 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| B-E | NDA |  | 0.40 |  | 0.03 | 1.00 | 0.03 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| B-G | NDA |  | 2.47 |  | 0.25 | 16.00 | 0.01 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| C-D | SPP |  | 0.40 |  | 0.25 | 1.00 | 0.03 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| E-F | NDA |  | 0.23 |  | 0.02 | 1.00 | 0.03 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| G-H | NDA |  | 1.01 |  | 0.03 | 1.00 | 0.03 | 0.03 | 0.00 | 0.03 × 170 = 5.10 | 0.00 | 5.10 | 30.30 |

| G-J | NDA |  | 0.30 |  | 0.03 | 1.00 | 0.03 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| G-M | NDA | - | - | 16.00 | 0.01 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ||

| H-I | NDA |  | 0.84 |  | 0.02 | 1.00 | 0.03 | 0.00 | 0.00 | 0.03 × 840 = 25.20 | 0.00 | 25.20 | 0.00 |

| J-K | NDA |  | 0.17 |  | 0.01 | 1.00 | 0.03 | 0.03 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| J-L | NDA |  | 0.13 |  | 0.01 | 1.00 | 0.03 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| AB-N | SPP |  | 0.27 |  | 19.47 | 16.00 | 0.01 | 0.00 | −0.02 | 0.00 | −0.02 × −2000 = 400.00 | 400.00 | 194.70 |

| N-O | SPP |  | 3.27 |  | 0.53 | 16.00 | 0.01 | 0.00 | −0.02 | 0.00 | 0.00 | 0.00 | 0.00 |

| O-P | SPP |  | 0.40 |  | 0.25 | 1.00 | 0.03 | 0.00 | −0.02 | 0.00 | 0.00 | 0.00 | 0.00 |

| O-R | SPP |  | 0.40 |  | 0.03 | 1.00 | 0.03 | 0.00 | −0.02 | 0.00 | −0.02 × 10 = −0.20 | −0.20 | 0.00 |

| O-T | SPP |  | 2.47 |  | 0.25 | 16.00 | 0.01 | 0.00 | −0.02 | 0.00 | −0.02 × 200 = −4.00 | −4.00 | 0.00 |

| P-Q | SPP |  | 0.40 |  | 0.25 | 1.00 | 0.03 | 0.00 | −0.02 | 0.00 | −0.02 × 250 = −5.00 | −5.00 | 0.00 |

| R-S | SPP |  | 0.23 |  | 0.02 | 1.00 | 0.03 | 0.00 | −0.02 | 0.00 | −0.02 × 20 = −0.40 | −0.40 | 0.00 |

| T-U | SPP |  | 1.01 |  | 0.03 | 1.00 | 0.03 | 0.03 | −0.02 | 0.03 × 170 = 5.10 | −0.02 × 10 = −0.20 | 4.90 | 30.30 |

| T-W | SPP |  | 0.30 |  | 0.03 | 1.00 | 0.03 | 0.00 | −0.02 | 0.00 | 0.00 | 0.00 | 0.00 |

| T-Z | SPP | - | - | 16.00 | 0.01 | 0.00 | −0.02 | 0.00 | 0.00 | 0.00 | 0.00 | ||

| U-V | SPP |  | 0.84 |  | 0.02 | 1.00 | 0.03 | 0.00 | −0.02 | 0.03 × 840 = 25.20 | −0.02 × 20 = −0.40 | 24.80 | 0.00 |

| W-X | SPP |  | 0.17 |  | 0.01 | 1.00 | 0.03 | 0.03 | −0.02 | 0.00 | −0.02 × 10 = −0.20 | −0.20 | 0.00 |

| W-Y | NDA |  | 0.13 |  | 0.01 | 1.00 | 0.03 | 0.00 | −0.02 | 0.00 | −0.02 × 10 = −0.20 | −0.20 | 0.00 |

| Total | 60.60 | 389.40 | 450.00 | 450.00 | |||||||||

| Equalisation | 0.00 | ||||||||||||

| Accumulative Charges | 450.00 | 450.00 | |||||||||||

Power Flows by current.

Power Flows by current.  Power Flows against current.

Power Flows against current.| Circuit | EPC (GBP) ϕUTILISE = 1 | Line Capacity (MW) | (GBP/kW) | Sharing Factor (F) | |

|---|---|---|---|---|---|

| Peak | Off-Peak | ||||

| AA-AB AA-A A-B | 50.00 | 20.00 | 0.0026 | 74.0741 | 1.0272 |

| 50.00 | 20.00 | 0.0026 | 6.1162 | 37.7358 | |

| 50.00 | 20.00 | 0.0026 | 6.1162 | 37.7358 | |

| B-C B-E | 30.00 | 1.25 | 0.0252 | 3.1250 | 5.0000 |

| 30.00 | 1.25 | 0.0252 | 3.1250 | 41.6667 | |

| B-G C-D E-F G-H | 50.00 | 20.00 | 0.0026 | 8.0972 | 80.0000 |

| 30.00 | 1.25 | 0.0252 | 3.1250 | 5.0000 | |

| 30.00 | 1.25 | 0.0252 | 5.4348 | 62.5000 | |

| 30.00 | 1.25 | 0.0252 | 1.2376 | 41.6667 | |

| G-J G-M | 30.00 | 1.25 | 0.0252 | 4.1667 | 62.5000 |

| 50.00 | 20.00 | 0.0026 | N/A | N/A | |

| H-I | 30.00 | 1.25 | 0.0252 | 1.4881 | 62.5000 |

| J-K | 30.00 | 1.25 | 0.0252 | 7.3529 | 125.0000 |

| J-L | 30.00 | 1.25 | 0.0252 | 9.6154 | 125.0000 |

| AB-N | 50.00 | 20.00 | 0.0026 | 74.0741 | 1.0272 |

| N-O | 50.00 | 20.00 | 0.0026 | 6.1162 | 37.7358 |

| O-P | 30.00 | 1.25 | 0.0252 | 3.1250 | 5.0000 |

| O-R | 30.00 | 1.25 | 0.0252 | 3.1250 | 41.6667 |

| O-T | 50.00 | 20.00 | 0.0026 | 8.0972 | 80.0000 |

| P-Q | 30.00 | 1.25 | 0.0252 | 3.1250 | 5.0000 |

| R-S | 30.00 | 1.25 | 0.0252 | 5.4348 | 62.5000 |

| T-U | 30.00 | 1.25 | 0.0252 | 1.2376 | 41.6667 |

| T-W | 30.00 | 1.25 | 0.0252 | 4.1667 | 62.5000 |

| T-Z | 50.00 | 20.00 | 0.0026 | N/A | N/A |

| U-V | 30.00 | 1.25 | 0.0252 | 1.4881 | 62.5000 |

| W-X | 30.00 | 1.25 | 0.0252 | 7.3529 | 125.0000 |

| W-Y | 30.00 | 1.25 | 0.0252 | 9.6154 | 125.0000 |

| Total | 990.00 | ||||

| User | Total Usages (MW) | Charges (GBP) | Total (GBP) | ||

| Peak | Off-Peak | Peak | Off-Peak | ||

| AA (NDA) | ϕr = 0.05 | −44.50 | −44.50 | −89.00 | |

| D | 1.6000 | 1.5000 | 75.84 | 113.88 | 189.72 |

| E | 0.5100 | 0.0500 | 18.84 | 12.53 | 31.38 |

| F | 0.9200 | 0.1200 | 57.00 | 56.57 | 113.57 |

| G | 3.4800 | 1.0000 | 61.90 | 82.70 | 144.61 |

| H | 0.6800 | 0.0600 | 14.37 | 14.64 | 29.01 |

| I | 4.2000 | 0.1400 | 102.53 | 60.77 | 163.30 |

| K | 0.8500 | 0.0700 | 58.42 | 51.39 | 109.81 |

| L | 0.6500 | 0.0700 | 52.10 | 51.39 | 103.47 |

| N (DER) | 0.0000 | 37.8800 | 0.00 | 102.14 | 102.14 |

| Q | 1.2661 | 0.7500 | 82.27 | 87.76 | 170.03 |

| R | 0.3681 | 0.0200 | 21.58 | 11.49 | 33.07 |

| S | 0.7280 | 0.0600 | 60.69 | 54.48 | 115.17 |

| T | 2.5116 | 0.4000 | 80.53 | 61.81 | 142.34 |

| U | 0.5381 | 0.0300 | 17.10 | 13.59 | 30.69 |

| V | 3.4987 | 0.0800 | 116.01 | 58.68 | 174.69 |

| X | 0.7081 | 0.0400 | 61.15 | 50.34 | 111.49 |

| Y | 0.5415 | 0.0400 | 54.18 | 50.34 | 104.52 |

| Unused Circuits (DisCo-op) | 100.00 | 100.00 | 200.00 | ||

| Total | 990.00 | 990.00 | 1980.00 | ||

| User | Service Provider | FInvC (GBP) | Reward (GBP) | O&M (GBP) | Total DUoSS (GBP) |

|---|---|---|---|---|---|

| E | NDA | 0.0000 | 0.0000 | 31.3813 | 31.3813 |

| F | NDA | 0.0000 | 0.0000 | 113.5679 | 113.5679 |

| G | NDA | 0.0000 | 0.0000 | 144.6048 | 144.6048 |

| H | NDA | 5.1000 | 0.0000 | 29.0091 | 34.1091 |

| I | NDA | 25.2000 | 0.0000 | 163.2949 | 188.4949 |

| K | NDA | 0.0000 | 0.0000 | 109.8071 | 109.8071 |

| L | NDA | 0.0000 | 0.0000 | 103.4725 | 103.4725 |

| Y | NDA | 0.0000 | −0.2000 | 104.5152 | 104.3152 |

| Total—NDA Customer | 30.3000 | −0.2000 | 799.6528 | 829.7528 | |

| D | SPP | 0.0000 | 0.0000 | 189.7206 | 189.7206 |

| Q | SPP | 0.0000 | −5.0000 | 170.0302 | 165.0302 |

| R | SPP | 0.0000 | −0.2000 | 33.0661 | 32.8661 |

| S | SPP | 0.0000 | −0.4000 | 115.1716 | 114.7716 |

| T | SPP | 0.0000 | -4.0000 | 142.3388 | 138.3388 |

| U | SPP | 5.1000 | −0.2000 | 30.6940 | 35.594 |

| V | SPP | 25.2000 | −0.4000 | 174.6921 | 199.4921 |

| X | SPP | 0.0000 | −0.2000 | 111.4920 | 111.292 |

| Total—SPP Customer | 30.3000 | −10.4000 | 967.2054 | 987.1054 | |

| Regulatory Payment—NDA | −89.0000 | −89.0000 | |||

| Unused Lines—DisCo-op | 200.0000 | 200.0000 | |||

| Total | 400.0000 | −10.6000 | 1980.0000 | 2430.0000 | |

| User | Service Provider | Postage Stamp Rate (GBP/kW) | Power Flows (MW) | Network Usage Charges (GBP) | Total (GBP) | |||

|---|---|---|---|---|---|---|---|---|

| Peak | Off-Peak | Peak | Off-Peak | Peak | Off-Peak | |||

| E | NDA | 0.2804 | 0.2804 + 0.3090 | 0.17 | 0.01 | 47.6764 | 5.8949 | 53.5713 |

| F | NDA | 0.2804 | 0.2804 + 0.3090 | 0.23 | 0.02 | 64.5034 | 11.7898 | 76.2932 |

| G | NDA | 0.2804 | 0.2804 + 0.3090 | 1.16 | 0.2 | 325.3213 | 117.8981 | 443.2195 |

| H | NDA | 0.2804 | 0.2804 + 0.3090 | 0.17 | 0.01 | 47.6764 | 5.8949 | 53.5713 |

| I | NDA | 0.2804 | 0.2804 + 0.3090 | 0.84 | 0.02 | 235.5775 | 11.7898 | 247.3673 |

| K | NDA | 0.2804 | 0.2804 + 0.3090 | 0.17 | 0.01 | 47.6764 | 5.8949 | 53.5713 |

| L | NDA | 0.2804 | 0.2804 + 0.3090 | 0.13 | 0.01 | 36.4584 | 5.8949 | 42.3533 |

| Y | SPP | 0.3090 + 0.0214 | 0.3090 | 0.13 | 0.01 | 42.9561 | 3.0904 | 46.0465 |

| Total—NDA Customer | 887.4977 | 168.1478 | 1055.6455 | |||||

| D | NDA | 0.2804 | 0.2804 + 0.3090 | 0.40 | 0.25 | 112.1798 | 82.6078 | 194.7876 |

| Q | SPP | 0.3090 + 0.0214 | 0.3090 | 0.40 | 0.25 | 132.1725 | 3.0904 | 209.4328 |

| R | SPP | 0.3090 + 0.0214 | 0.3090 | 0.17 | 0.01 | 56.1733 | 6.1808 | 59.2637 |

| S | SPP | 0.3090 + 0.0214 | 0.3090 | 0.23 | 0.02 | 75.9992 | 61.8082 | 82.1800 |

| T | SPP | 0.3090 + 0.0214 | 0.3090 | 1.16 | 0.2 | 383.3003 | 3.0904 | 445.1085 |

| U | SPP | 0.3090 + 0.0214 | 0.3090 | 0.17 | 0.01 | 56.1733 | 6.1808 | 59.2637 |

| V | SPP | 0.3090 + 0.0214 | 0.3090 | 0.84 | 0.02 | 277.5623 | 3.0904 | 283.7431 |

| X | SPP | 0.3090 + 0.0214 | 0.3090 | 0.17 | 0.01 | 56.1733 | 3.0904 | 59.2637 |

| Total—SPP Customer | 1149.7341 | 203.6574 | 1353.3915 | |||||

| Total | 2037.2318 | 371.8052 | 2409.0370 | |||||

| Network User | Shares (GBP) | FInvC (GBP) | O&M (GBP) | Contribution | Dividend (GBP) |

|---|---|---|---|---|---|

| Surplus | 10,000.00 | ||||

| E | 0.0000 | 31.5622 | |||

| F | 0.0000 | 113.9299 | |||

| G | 0.0000 | 148.2242 | |||

| H | 5.1000 | 29.1901 | |||

| I | 25.2000 | 163.6568 | |||

| K | 0.0000 | 109.9881 | |||

| L | 0.0000 | 103.6535 | |||

| Y | 0.0000 | 104.5152 | |||

| NDA | 0.0000 | 0.0000 | |||

| Total | 540.00 | 30.3000 | 804.7200 | 0.4710 | 4709.62 |

| D | 0.0000 | 194.2448 | |||

| Q | 0.0000 | 170.0302 | |||

| R | 0.0000 | 33.0661 | |||

| S | 0.0000 | 115.1716 | |||

| T | 0.0000 | 142.3388 | |||

| U | 5.1000 | 35.794 | |||

| V | 25.2000 | 199.8921 | |||

| X | 0.0000 | 111.492 | |||

| SPP | 0.0000 | 194.2448 | |||

| Total | 450.00 | 30.3000 | 1064.2800 | 0.5290 | 5290.38 |

| Grand Total | 990.00 | 60.6000 | 1869.0000 | 1.0000 | 10,000.00 |

| System Load Parameters for Wheeling Charge Calculation | |||

|---|---|---|---|

| Designed Capacity (kW) | 540,000.00 | ||

| Defined Maximum Capacity (DMC) (kW) | 410,400.00 | ||

| Defined Load for Customers (kW) | 277,000.00 | ||

| Reserved Wheeling Capacity (kW) | 133,400.00 | ||

| Contract Wheeling Capacity (kW) | - | ||

| Feeder | MV—Maximum Demand (kW) | Feeder | MV—Maximum Demand (kW) |

| AKA01 | 9683.65 | AKA05 | 8988.05 |

| AKA02 | 11,150.27 | AKA06 | 11,244.88 |

| AKA03 | 12,921.05 | AKA07 | 360.00 |

| AKA04 | 257.20 | AKA08 | 11,653.98 |

| Total | 66,259.08 | ||

| Method | PEA’s Contribution ϕr = 5% (THB ‘000) | SPP and SPP’s Customers (THB ‘000) | PEA’s Customers (THB ‘000) | Total (THB ‘000) | Actual Cost (THB ‘000 per Month) |

|---|---|---|---|---|---|

| TOU Tariff | - | 1287.25 | 7520.57 | 8807.82 | 24,113.30 |

| Postage Stamp | - | 568.97 | 3324.12 | 3893.09 | 24,113.30 |

| TU Cost-Based | −194.65 | 597.42 | 3490.33 | 3893.09 | 24,113.30 |

| DisCo-op DUoSS—Monthly | |||||

| ϕUTILISE = 1 | −1205.67 | 2820.35 | 22,498.62 | 24,113.30 | 24,113.30 |

| ϕUTILISE = 0.16 | −194.66 | 455.35 | 3632.40 | 3893.09 | 3893.09 |

| Network Usage Rate = Actual Use/DMC = 66.26/410.40 = 0.16 | |||||

| Method | PEA’s Contribution ϕr = 5% (THB ‘000) | SPP and SPP’s Customers (THB ‘000) | PEA’s Customers (THB ‘000) | Total (THB ‘000) | Actual Cost (THB ‘000 per Month) |

|---|---|---|---|---|---|

| TOU Tariff | - | 6436.24 | 37,602.86 | 44,039.10 | 24,113.30 |

| Postage Stamp | - | 2844.84 | 16,620.62 | 19,465.46 | 24,113.30 |

| TU Cost-Based | −973.27 | 2987.09 | 17,451.65 | 19,465.46 | 24,113.30 |

| DUoSS—Monthly | |||||

| ϕUTILISE = 1 | −1205.67 | 2820.35 | 22,498.62 | 24,113.30 | 24,113.30 |

| ϕUTILISE = 0.81 | −973.27 | 2276.73 | 18,162.01 | 19,465.46 | 19,465.46 |

| Network Usage Rate = Actual Use/DMC = (66.26 × 5)/410.40 = 0.81 | |||||

| Topic | DisCo-op Model | Multi-Owned Distribution System When Each Network Is Physically Separated | Integrated Distribution System with a Traditional Wheeling Model |

|---|---|---|---|

1. Economic Efficiency

| Best | Worst | Moderate |

2. Network Operation

| Moderate | Best | Moderate |

3. Network Reinforcement

| Best | Moderate | Moderate |

| 4. Non-Discrimination | Best | N/A | Worst |

| 5. Easy to Understand | Moderate | Best | Worst |

| 6. Competition in Generations | Best | Worst | Moderate |

| 7. Benefit to the Network Owners | |||

| Best | N/A | Worst |

| Moderate | Best | Worst |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chiraprawattrakun, P.; Leeprechanon, N. Distribution System Management Model Based on the Cooperative Concept of Unifying the Multi-Owned Networks. Energies 2023, 16, 2163. https://doi.org/10.3390/en16052163

Chiraprawattrakun P, Leeprechanon N. Distribution System Management Model Based on the Cooperative Concept of Unifying the Multi-Owned Networks. Energies. 2023; 16(5):2163. https://doi.org/10.3390/en16052163

Chicago/Turabian StyleChiraprawattrakun, Pornthep, and Nopbhorn Leeprechanon. 2023. "Distribution System Management Model Based on the Cooperative Concept of Unifying the Multi-Owned Networks" Energies 16, no. 5: 2163. https://doi.org/10.3390/en16052163

APA StyleChiraprawattrakun, P., & Leeprechanon, N. (2023). Distribution System Management Model Based on the Cooperative Concept of Unifying the Multi-Owned Networks. Energies, 16(5), 2163. https://doi.org/10.3390/en16052163