Abstract

Electricity generation using distributed renewable energy systems is becoming increasingly common due to the significant increase in energy demand and the high operation of conventional power systems with fossil fuels. The introduction of distributed renewable energy systems in the electric grid is crucial for delivering future zero-emissions energy systems and is cost-effective for promoting and facilitating large-scale generation for prosumers. However, these deployments are forcing changes in traditional energy markets, with growing attention given to transactive energy networks that enable energy trading between prosumers and consumers for more significant benefits in the cluster mode. This change raises operational and market challenges. In recent years, extensive research has been conducted on developing different local energy market models that enable energy trading and provide the opportunity to minimize the operational costs of the distributed energy resources by promoting localized market management. Local energy markets provide a stepping stone toward fully transactive energy systems that bring adequate flexibility by reducing users’ demand and reflecting the energy price in the grid. Designing a stable regulatory framework for local electricity markets is one of the major concerns in the electricity market regulation policies for the efficient and reliable delivery of electric power, maximizing social welfare, and decreasing electric infrastructure expenditure. This depends on the changing needs of the power system, objectives, and constraints. Generally, the optimal design of the local market requires both short-term efficiencies in the optimal operation of the distributed energy resources and long-term efficiency investment for high quality. In this paper, a comprehensive literature review of the main layers of microgrids is introduced, highlighting the role of the market layer. Critical aspects of the energy market are systematically presented and discussed, including market design, market mechanism, market player, and pricing mechanism. We also intend to investigate the role and application of distributed ledger technologies in energy trading. In the end, we illuminate the mathematical foundation of objective functions, optimization approaches, and constraints in the energy market, along with a brief overview of the solver tools to formulate and solve the optimization problem.

1. Introduction

Due to the environmental issues of the conventional power system, which uses mainly coal, diesel, and natural gas-based units system for electricity generation [1], new policies and initiatives have been made to boost the integration of clean and renewable energy resources into the electrical power system to restructure the traditional system for reducing energy production costs, mitigating greenhouse gas emissions, and a more sustainable energy system [2]. Recently, the integration or interconnection of distributed energy sources, including renewable energies, have been observed to proliferate and eventually take up a remarkable share in worldwide distribution level networks, with the share of global renewable energy potentially reaching 36% by 2030 [3]. This approach has led to the emergence of a new structure called a microgrid. Microgrids are rapidly becoming attractive because they assist in reducing the load congestion on the traditional power system, have a less environmental impact, intensify the power generation capacity, are easy to install, offer localized generation to the consumers, and are highly efficient with increased reliability [4]. Additionally, they can serve as transactive energy agents to provide beneficial solutions to electricity mislaid in conventional power systems [5].

As conventional systems are continuously being changed by variable renewable generation units with the increasing number of consumers in the distribution network, flexible energy utilization is needed to enable consumers to have some scale in the power system [6]. In the face of this transition, electricity systems and markets face significant complexity and challenges concerning their design and operation [7]. Power system flexibility represents the degree to which a power system can adjust the power generation or demand according to the energy market in reaction to both anticipated and unanticipated variability. Power system flexibility is described as the capacity of power delivered from the distributed energy resources to the power system network for reliable and sustained supply during transient and significant imbalances. In this complex environment, demand response (DR) is becoming an integral part of power systems and microgrids due to its applications in load peak-valley shifting [8,9], congestion management [10,11,12], system reliability [13,14], and in reducing the emitted greenhouse gases [15,16]. DR is described as the behavior of the orientation of the market and the direction of the customer’s electricity consumption. DR allows the customers to manage and control their power usage preferences in a way that will benefit them, including selling\buying electricity to the microgrid [17]. A recent study in Northern European countries (Norway and Sweden) [18] asserted that DR decreases peak load, replaces peak generation capacity, raises capacity factors of off-peak generation, and lowers energy system capital and operating costs. Moreover, using DR in the analyzed regions reduces the need for battery storage and other storage technologies as well as flexible natural gas-fired generation capacity. Furthermore, the numerical results in [19] demonstrated the benefits of DR applications in the energy market in Germany by smoothing the effect of DR on the residential load, which directly affects the operation of conventional power plants. The proposed DR program increases the utilization of renewable energy resources capacities, as the curtailment of renewable plants decreases by 35–77% depending on the power generation in the system.

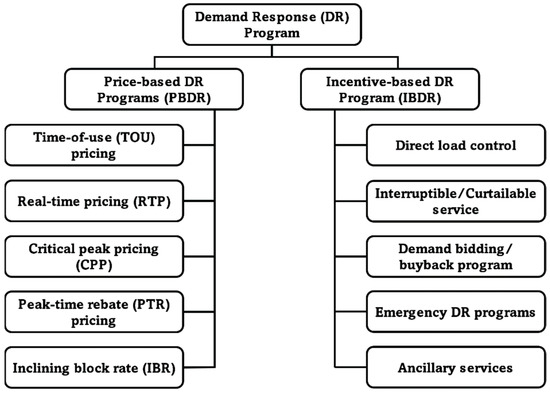

DR is divided mainly into two types of price-based demand response (PBDR) and incentive-based demand response (IBDR), as shown in Figure 1 [12]. In PBDRs, the system operator designs different tariff structures like real-time pricing (RTP), critical peak pricing (CPP), inclined block tariff (IBT), time-of-use (TOU), and peak load pricing [20]. DR is a concept in microgrids that have been widely implemented in recent studies. For example, in [21], a theoretical framework to study the joint cost and the emission pollution problem in the microgrid is addressed. The model proposed in this study consists of a tidal stream turbine (TST), photovoltaic (PV), wind turbine (WT), combined heat and power (CHP), boiler, and microturbine (MT).

Figure 1.

DR programs classification.

The results demonstrated that the microgrid performance increases in the proposed design through employing the DR program. In [22], the authors implemented a price-based DR and included an energy storage system (ESS), PV, and WT. The demand response was formulated as a mathematical model considering the unit commitment (UC) and the grid constraints. In [23], a DR program in home energy management uses an intelligent system method and optimization algorithms for efficiently modelling and managing thermal appliance storage and temperature. Numerical results illustrated that the proposed algorithm could reduce up to 20% of the electricity price per day by controlling the operational power of electrical appliances. The authors of [24] proposed a novel integrated model using two-program-stages including the energy efficiency program and DR. In the first level, the authors determined the over-the-midterm horizon time using the energy efficient investment model. Then, the unit commitment formulates the problem based on the interactions between the energy efficiency program and DR. Several analyses concluded that the proposed can decline peak demand considerably and prevent the startup of expensive power plants. In [25], a novel DR has been presented, which includes a distributed energy resources saving approach using energy blockchain in a residential area to enhance a collaborative distributed storage system and interactive demand reduction. The proposed DR scheme reduces the consumption by 35% during the peaks and can genuinely manage the distributed energy resources by incentivizing customers to discharge their electric vehicles (EVs) and the optimal control of the PV and loads to the block mining process.

The interconnection of large-scale microgrids based on renewable energy sources and storage systems has introduced novel energy markets that stem from a DR program which benefits the development of a local market for local energy trading [26]. A local energy market is defined as a centralized platform able to change the structure of the energy system by integrating prosumers and consumers into the energy supply system using different energy resources [27]. A local market is a concept that improves adequacy and prevents congestion in a residential area that incorporates prosumers and consumers through incentivizing self-consumption and using local flexibility from the local production, generation, and energy storage facilities. Local energy markets rely on the market mechanism to conduct energy transactions to break monopolies and open electricity generation and retail to competition [28].

The governments of countries with high penetration of distributed energy resources have undertaken their transition by starting with renewable energy generation regulations to encourage the incorporation of the local energy market in the electricity sector [29]. For example, in the pan-European market system, with increasing integration of distributed energy resources into the local market, the total generation costs and the greenhouse gases (GHG) have been reduced by up to 5.8% and 3.1%, respectively [30]. The local energy market model has been integrated into a wholesale electricity market model in Germany and France. The wholesale market results are used as input for subsequent transmission grid calculations. This toolchain of models is applied in different scenarios of the local energy market [31]. In Denmark, the local market has been established to secure the technical integration of a large proportion of wind power and other fluctuating renewable energy sources into the energy system [32]. In Norway, several pilot tests have been proven to combine the local energy market concept and the real-time shared knowledge about energy needs among households and communities [33].

Spain has introduced the concept of a local energy market and the shared self-consumption in Royal Decrees 244/2019 and 23/2020. This regulation introduced a compensation mechanism for prosumers with installed power until 100 kW, establishing an offset price for self-consumption surpluses supplied to the national grid [34]. China made steady progress in integrating the local power market, continuing to transition electricity transactions toward mid- to long-term bilateral contracts. The Northern provinces in China have created a local energy market system called “generation rights trading”, allowing provinces to freely buy and sell excess power without reducing generators’ revenue [35]. The African Development Bank (AfDB) aims to bring access to clean and affordable off-grid energy to 6 million people in Burkina Faso, Mozambique, Liberia, Zambia, and Uganda by 2025, building on the success of an earlier pilot program. This fund provides financing for companies offering off-grid solutions and offers technical assistance and capacity building for the local energy market [36]. In order to boost the local energy market access in the remote area, The Tsévié in Togo introduced a three-year municipal energy program. This energy program aims at developing sustainable biomass use, deploying distributed rooftop solar PV, increasing the adoption of electric motorcycles, and a gradual shift to public transport [36]. In Colombia and South America, the countries introduced the obligation for all power companies operating in the local energy market to ensure that at least 10% of the electricity they distribute is generated using the renewable energy technologies [37]. Recently, the Brazilian government adopted the auction system as a scheduling tool for the expansion of the local energy market program. With the large growth in the installed capacity of renewable energy resources in Brazil, the aim of the local energy market is to render the process more transparent for society, as well as to seek a fair price, encouraging as many prospective bidders as possible, so as to avoid congestion [38]. In the long term, these programs will assist to build up a sufficient local energy market to increase local autarky and, hence, facilitate local electricity balances. Eventually, this will lead to a reduction in the electricity transmission and, further, a reduction in dispatch and grid expansion measures.

2. Related Work and Contribution

Comprehensive review papers have addressed the local energy markets, including DR and energy-transactive technologies. The recent publication in Ref. [2] analyzed the market scope, modeling assumptions, market objectives, and a mechanism of the existing literature about the local energy market. These attributes have been discussed thoroughly and presented illustrative examples of different methods and mechanisms found in the literature. In addition, the main market mechanism properties, including market efficiency, the tractability of the market mechanism, incentive compatibility, individual rationality, budget balance, and privacy preservation have been evaluated. The authors of [39] introduced various concepts and technologies for achieving energy efficiency in modern transmission and distribution systems, including the local energy markets, distributed ledger technology, and peer-to-peer transactive energy exchanges in microgrids. Moreover, the authors discussed the application of the Virtual Power Plant (VPP) aggregator and residential prosumers endowed with the transactive controller to manage the electrical storage system and assist the local energy market. In [40], the main challenges in the modern power system and microgrids are addressed, such as integrated energy flexibility and optimization with active end users, and regulatory cyber-physical environment to integrate energy communities and maximize the profits of all market participants. Furthermore, this study focused on advanced technologies such as P2X and V2G technology that have been used to achieve energy flexibility and guarantee grid-interactive stability and reliability. In [1], the concept of a local energy market and a critical analysis of the energy trade within a transactive energy system are presented. This study also reviewed the systematic potentials and the main challenges of community-based energy markets and peer-to-peer energy transactive.

In the literature [41], the authors addressed two significant issues in the local energy markets, which are the excessive confidence in historical data and statistical analysis for managing the local energy market and for predicting the future price behavior for more structural analysis, and the omission of analyzing renewable energy resources due to computational complexity, modelling limitations, and insufficient data. Ref. [42] focuses on classifying the local energy market structures, the market mechanism, the physical layer, the information and communication technology (ICT) layer, and market participants. At the end of this study, the authors discussed the challenges to the existing energy infrastructure, the ongoing research efforts from academia, and future research directions in the local energy market. Ref. [43] aims to understand the impact of the local energy market models on grid infrastructure, including the impacts on the operation, control, and scheduling of renewable energy resources. This study presents the relationship between the market models and the impact of local energy market integration in the power systems layer. The approaches that have been applied to integrate physical network constraints into the market mechanisms, their advantages, drawbacks, and scaling potential are also introduced. Authors of [44] systematically classify market players in local energy markets, discuss market clearing, and analyze different criteria, some objective functions, and constraints, including scalability, overhead requirements, and network constraints management.

This literature review shows that the design of the local energy market has attracted the attention of the academic and industrial sectors, including research and technology, such as computer science, optimization, and artificial intelligence. However, none of the above surveys discuss the different design of the local market and their algorithmic aspects, including their objective functions and constraints in the energy management system and the distributed energy resources. The main contributions of this systematic literature review are summarized as follows:

- This research illustrates the status of the market layer in the microgrid and provides a comprehensive review of the energy market in the microgrid, elaborating on the mechanism and design of the energy market. It also includes various studies conducted by researchers on competition indices and market concentration for evaluating the energy market.

- This work describes the relationships of energy trading mechanisms with energy markets, analyzes current studies and their shortcomings for quality energy delivery, and identifies technologies utilized in energy trading based on recent literature.

- A systematic discussion on objective functions, constraints, and optimization approaches used in energy markets, describing mathematical formulations and the implementation of strategies for state-of-art energy market studies in energy management systems.

The content of this paper enables researchers to alleviate the shortcomings and formulate new techniques and objective functions to augment the trend of the energy market. This paper is structured as follows. Section 3 presented the methodology used for the systematic literature review, including the literature search. Section 4 describes the microgrid architecture, communication technologies, microgrid control structure, and market operator. The function of the market players, market design, and pricing mechanism has been explained in the subsequent section. Section 5 presents a detailed review of the energy market including mechanisms, participation, methods, and technologies used in energy trading. Section 6 provides an overview of objectives, optimization methods, and constraints of energy management systems in the energy market. Then Section 7 concludes the paper.

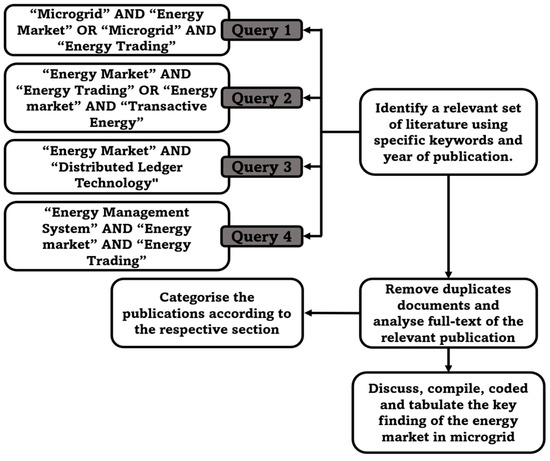

3. Methodology

In this study, we want to present the state-of-art energy market mechanisms, methods, and designs, combined with energy trading strategies and energy management systems in the microgrid. Hence, the study provides the objective functions and constraints of which energy markets paradigm is best fitted for the end-user to maximize their profit. In this literature review paper, we followed a systematic approach to selecting papers related to the energy market in the microgrid. This section details the process used to search for relevant literature, decide which literature to include in or exclude from the review, and extract and analyze data consistently from each piece of literature. Figure 2 represents the three main stages of the review work performed in the current study.

Figure 2.

Flowchart of the systematic literature review.

The first stage was conducted by searching through the most appropriate databases. We evaluated the relevant publications from Google Scholar, Web of Science, Scopus, Science Direct, IEEE Xplore databases, MDPI, International reports, and handbooks. The search criteria encompassed the terms “microgrid” AND “energy market” OR “microgrid” AND “energy trading” OR “energy market” AND “energy trading” OR “energy market” AND “transactive energy” OR “energy market” AND “distributed ledger technology” OR “energy management system” AND “energy market” AND “energy trading” in the title, abstract, main body, and summary. As the topic of the energy market and transactive energy is unlimited, boundary time was set on the published guideline to ensure the comprehensiveness of the analysis during the search. Therefore, we focused on the most relevant studies published within the last 6 years, i.e., from 2017 to 2023. By choosing such a period, the content of the scientific literature would reflect the state-of-art and development trends. As a result, 648 publications were retrieved after using all 4 search queries.

The second stage involved refining the eligibility criteria for the publications. The authors reviewed the title and abstract and screened the body of each paper. One author has reviewed the title and abstract. Papers were kept in the review at the title and abstract review stage if the reviewer was in doubt. During this process, 378 papers were removed due to the context being out of the proposed study and leaving 270 papers in the full-text review. At this stage, the authors decided to include equations from specific references based on the journal’s impact factor and number of citations.

The final stage of the review methodology comprises discussions of the energy market in the microgrids and distributed energy systems. The selected publications’ methods, strategies, suggestions, and discussions were summarized, coded, and categorized to generate comprehensive tables and figures.

4. Microgrid Energy Market

The microgrid can be defined as a network consisting of different elements (distributed energy resources, energy storage systems, and loads) at a local scale either connected to the grid “grid-connected mode” or isolated “islanded-mode”. In a grid-connected mode, power exchanges between the microgrid and the utility grid and vice-versa [45]. The power mismatch problem in grid-connected microgrids can be solved by controlling the generation or by varying the demand using load control. In the islanded mode, the microgrid is not connected to the primary grid, and the consumption is served from standalone distributed energy resources within the microgrid. The power mismatch in the islanded microgrid is solved using a proper control scheme to schedule the loads and distribute energy resources, including the energy storage systems [46]. The control actions in the microgrid are centrally evaluated at the microgrid central controller (MGCC) for solving the economic optimization problem aimed at minimizing the trade-off between the internal production resources and the power exchanged with the utility grid. To achieve this objective, the microgrid with the grid utility is formulated by mathematical equations [47].

A microgrid structure is divided into three types: AC microgrid, DC microgrid, and AC/DC (hybrid) microgrid [48]. In recent years, research has continuously been conducted on various microgrid features, particularly the reliability and quality of electrical power [49]. The microgrid management system’s modern architecture is investigated, consisting of renewable energy resources, centralized/decentralized control, and protection strategies in both AC/DC microgrid systems. As expected, the microgrid is also associated with its share of drawbacks and technical complexities in the operation modes. The operation modes in the microgrid and its problems are investigated from different aspects, and some review literature on the classification and analysis of microgrid architecture have been published, including the impact of grid integration in microgrids with distributed energy resources, protection schemes, power quality, and stability of the microgrid, for example, ref. [47] defines the economical, reliable, and secure operation of microgrids operating either on the grid-connected mode or islanded mode. Authors of [50] present the operating modes and the different control techniques in AC microgrids. In [51], a detailed review has been carried out on the DC microgrid, architecture, topology, protection standards, protection issues and challenges, protective devices, and various protection solutions in terms of fault detection, location, and classification. The authors of [52] introduce different aspects of microgrid management, including control and energy management, different constraints, communication technologies, types of distributed energy resources and load, mathematical modelling, problem solvers, microgrid networks, and programming, including uncertainty and modelling. In [4,53], the protection challenges for both DC and AC microgrids, the different protection methods for DC and AC microgrids, their features and challenges, the protection equipment, standards, and future scope for improvement are discussed. In [54], the authors present a comprehensive methodology for microgrid stability classification based on the parameters of the microgrid, as well as characteristics investigation, which considers the microgrid operation mode, types of disturbance, and time frame. In [55], the authors summarize the optimization framework for microgrid operation, which contains the optimization objective for the microgrid operation, decision variables and constraints, along with systematically reviewing the optimization algorithms for microgrid operations, which are the most commonly used. The authors of [56] provide a comprehensive review of microgrid cybersecurity, while ref. [57] provides a review concerned about cyber-attacks on microgrids. In particular, communication protocols, standards, and vulnerabilities highlight the most recent cybersecurity technologies applied in microgrids.

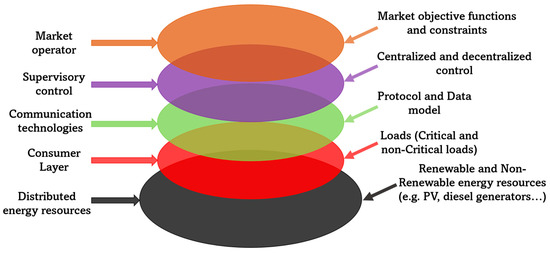

Choosing the proper components in the microgrid architecture is a critical challenge since it significantly impacts the system’s reliability and the project’s economic viability. The microgrid components are selected based on the existing and planned distributed generators, loads, the space to place the energy storage devices, the existing communications, and the difficulty of placing new electrical lines [58]. Based on the above review papers, the most common architecture of microgrids consists of different distributed energy resources, loads, communication technologies, operation control, and market control, as illustrated in Figure 3. The function of each component has been explained in the following subsections.

Figure 3.

Microgrid architecture model.

4.1. Microgrid Components

Microgrids can have diverse components and architecture, which the internal stakeholder structure and the microgrid ownership can predominantly design. Moreover, operational ownership is generally decided based on the ownership of physical components such as distributed generators, energy storage systems, and power electronic converters, and each component brings about the control, protection, and management action connected either in autonomous or grid-tied mode through the plug and play (PP) mechanism [59]. The microgrid ownership can be the distribution system operator (DSO), end consumer, independent power producer (IPP), or energy supplier [60].

4.1.1. Distributed Energy Resources

Distributed energy resources (DERs) are energy resources that are typically located at the user’s sites, where the energy is used to meet the consumer’s needs. The DERs consist of small modular power sources and storage technologies. Generally, DERs provide electrical power at a low-cost production and high reliability and security with less environmental impact. The power sources can be renewable sources, such as solar cells and wind turbines, or non-renewable resources such as fuel cells, diesel generators, and combined heat and power (CHP) units. According to [60], a microgrid should have one or more controllable DERs units to enhance the flexibility and reliability of the power system. Moreover, it has been found that multiple smaller DGs are better at automatic load following, thereby improving energy security. Renewable energy sources are intermittent and fluctuate in their output due to the uncertainty and volatility of weather conditions [61]. Therefore, an extensive storage system must be installed to cover these resources’ intermittence. The energy storage devices such as batteries, flywheels, energy capacitors, compressed air, and ultra-capacitors must be included in microgrid operation, especially in islanded mode, to ensure uninterrupted power supply during disturbances and drastic load changes, and to minimize the peak load and avoid the reliability problems. Usually, energy storage system is used to supply energy to the load during demand by storing energy and producing electricity [59]. Electric vehicles (EVs) are considered an alternative option to store power at night when the operation cost of electricity generation is low. These storage options provide more stability and allow the DERs to continuously meet the loads’ needs.

Several multidisciplinary studies cover the wide variety of distributed energy resources deployed in microgrids, including renewable and non-renewable resources, and energy storage technologies. Table 1 summarizes various studies integrating distributed energy resources and energy storage systems with microgrids.

Table 1.

Summary of different distributed energy resources applied in the microgrids.

4.1.2. Loads

The loads are appliances or equipment that consume electrical energy connected to the microgrid, such as homes, offices, industries, and many other places. These loads require electricity at different points in the day depending on usage profiles, activities of customers, and weather conditions [6]. Loads play a vital role in the optimum power system operation to achieve the DR program in order to schedule energy in the microgrid and modify the load pattern. Statistical metrics are usually used to construct the pattern of use. Ideally, the loads connected to the microgrid must be controllable with more flexibility when these are used to provide more reliability in matching demand and the power dispatch from the DERs [79]. Depending on their specific properties, controllable loads can either be shifted, curtailed, or completely disconnected. Since the microgrid supplies different types of consumers, including residential, commercial, and industrial, the classification of loads is essential to achieve the expected operating strategy and provide power balance or voltage control services [80].

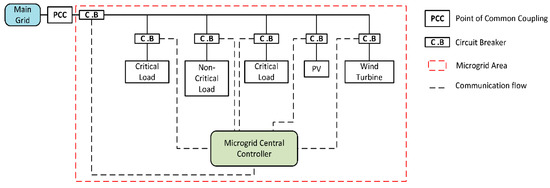

The loads in a microgrid can be classified into critical and non-critical loads. Critical loads such as medical equipment and the fire department need high power quality and reliability, contrary to the non-critical loads such as residences and industry, which require a lower service quality [81]. The controllable loads can be reduced or shed during the critical time and for which the demand can be scheduled among a set of pre-defined operations at different time points. The MGCC sends the signal to controllable loads units for achieving a step change in electricity consumption, which can be based on a pricing signal, activities, and disturbance in the power supply [82]. Figure 4 illustrates the block diagram of critical and non-critical loads connected with MGCC.

Figure 4.

Block diagram of critical and non-critical loads connected with MGCC.

4.1.3. Communication Technologies

Microgrid systems require an efficient data communication system for fast, continuous, and effective operation. The communication technologies allow the optimum local operation and efficient information exchange between the microgrid components and the grid utility. Moreover, the communication technology system provides the market platform and connects the prosumers to the local energy market and energy transactions. The communication technology system of the market operates under a set of market allocation rules, payment rules, and a clearly defined bidding format. Wide area networks (WAN), field area networks (FAN), local area networks (LAN), and neighborhood area networks (NAN) are the most used communication network for data exchange in the microgrid [83]. The communication technologies in the microgrid system are selected based on cost-efficiency, transmittable range, security features, bandwidth, power quality, and the number of repetitions. In the literature, communication technologies have been classified into two categories: wired technologies and wireless technologies. Wired technologies have been widely used for their better performance than wireless technologies regarding reliability, robustness, security, and bandwidth properties. However, this technology costs high, and its implementation is complicated [84]. There are several wired technologies applied in microgrids, for example, the serial communication RS-232/422/485, bus-based technologies (e.g., Modbus, Profibus, CANBus), Ethernet (IEEE 802.3 technology and Ethernet port), and power line communication (e.g., DLC, PLC, BPLC) [46].

On the other hand, wireless technologies are often used to improve accessibility to services, including clean energy, at an affordable cost for small remote communities and difficult geographic circumstances. The most popular wireless technologies used in microgrids IEEE 802.11, Wi-Fi (WLANs), family standards IEEE 802.15 (wireless personal area network, WPANs), and IEEE 802.15.4 standard (low-rate wireless personal area network, LR-WPAN) [46].

4.1.4. Supervisory Control

A robust controller is recommended for optimal control of a microgrid’s voltage and frequency for ensuring microgrid operation with high stability, reliability, and many economic goals [59]. The purpose of supervisory control in the microgrid is to ensure each system’s optimized and coordinated operation during grid-connected and islanded modes while guaranteeing minimal operation costs, performing essential tasks such as controlling the power quality, and optimizing system operation through an enhanced system’s intelligence level. Several supervisory control techniques have been reported in the literature and broadly classified into centralized control, decentralized control, and distributed control [85]. Centralized control highly promotes microgrid control. In centralized control, each microgrid is connected to the grid utility and the other microgrids through a centralized control center to manage the operation of different distributed energy units in the microgrid system. Generally, centralized control is used for small-scale microgrids, not large-scale microgrids. This type of control has many features, such as flexibility, lesser complexity, stability, reliability, and suitability to provide a set point to a local controller (LC) [85].

The decentralized control strategy uses local measurements of each microgrid system and decides the actions at the component level. The decentralized control strategy uses local measurements of each microgrid system and decides the actions at the component level with a plug-and-play possibility [6]. The decentralized control technique can enhance active and reactive power sharing without a communication network in DERs units. The decentralized control is usually employed in the high-rated microgrid with large-scale components, whereas the centralized control structure would be sluggish [86].

In the distributed control approach, the local units are operated using various centralized controllers or central agents, and each central agent uses data from other neighboring agents and information from local microgrids and LCs [87]. All the devices in the distributed control work together to reach a collective decision based on the set goals, and then each control center decides the power flow to the load based on the power generation of the same microgrid and power availability from other microgrids. Compared with centralized control, distributed control has many advantages as the operation of the whole system doesn’t fail for the failure of a single device and also gives a better stability performance, and only limited information can be shared between each pair of nodes [85].

4.1.5. Market Operator

The operators (participants) and the utility have different goals in grid-connected mode. The market operators in the microgrid will strive for market clearing and serve the customers by the optimal tariff operation, meaning the minimization of operating energy and capital costs over the lifetime of the microgrid. In contrast, the utility is more concerned about the microgrid’s reliability, voltage stability and power quality, and rightfully so, as it is becoming increasingly important with the increased integration of distributed generation and inverter-based loads [49]. The market operator is the entity in charge of carrying out the tariff calculation and the market procedures according to the design of the market mechanism. The market operator can be deployed with a fixed price in a monopoly market. However, for an ideal competition environment, a broader policy must be considered [88].

The market operation proceeds in three stages: negotiation, clearing, and settlement. At the beginning of the negotiation stage, the microgrid units register with the market operator, indicating that they wish to participate in the market [89]. The market operator then updates the forecasts and broadcasts initial prices. The market participants and utility operators then negotiate through bids and asks. The market clears when the negotiations have reached a steady state. The spot value of the cleared bid/ask is binding, while all futures values are non-binding advisory set points. The settlement phase may occur immediately, following the operating interval or after some other specified period depending on the settlement rules [90].

4.2. Market Players

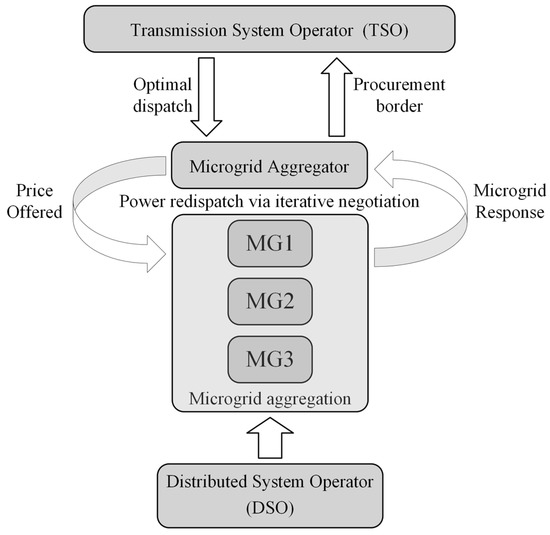

The integration of renewable energy resources in the power system has motivated the modern electricity markets that stem from a distributed market architecture where the microgrid community represents multiple microgrid agents upstream. Compared with the traditional market, the microgrid community and microgrid agents are both consumers and prosumers [91]. An exemplary architecture of the microgrid energy market for residential consumers and prosumers is represented in Figure 5. Generally, the following market players are considered in the modern microgrid energy market models:

Figure 5.

Example setup of microgrid market players.

The distribution system operator (DSO) is responsible for the operation and planning of the distribution grid utility, including DERs, as well as providing rules and mechanisms that properly value the benefits provided by DERs. The services of the traditional DSOs are to manage the local grid utility in case of forced and planned outages and ensure the grid utility operation and maintenance securely [92]. The modern DSO is an independent entity, without any acquiring biasing objectives, which are responsible for the operation and the planning of distribution systems as individual producers/consumers, ensuring balancing between supply and demand at the distribution level, and providing proper, fair compensation via some market mechanism [93].

The transmission system operator (TSO) is the entity responsible for controlling and operating the transmission grid. This includes monitoring and controlling the current grid topology and the voltage in all parts of the transmission grid. TSOs ensure the reliability of the transmission of power from DERs to DSOs by way of a high-voltage electrical grid. TSOs are responsible for operating the balancing market and providing grid access to the electricity market participant according to non-discriminatory and transparency in the market.

The aggregator is a novel architecture of energy service providers in the microgrid energy market that operates between a group of consumers and TSO, DERs, and electricity suppliers for the balancing energy market by undertaking balance responsibility [2]. Aggregators can enter the market and engage with consumers without the consent of energy suppliers to operate on behalf of a group of consumers producing their electricity by selling the excess electricity they produce. Aggregators can assess consumers’ consumption profiles to provide offers that reflect their needs and lifestyle and increase their benefits [94].

4.3. Market Mechanism

The market operator implements the market mechanism for setting rules and market policies for the market participants’ interaction and delivering an efficient energy trading experience. The market mechanism aims to provide payment rules and to lay out an efficient allocation of the energy exchange in the market and an employable approach for buying and selling [95]. The market mechanism involves different sub-markets with complementing functions to allocate resources and offer different trading opportunities where market participants maximize their revenue and minimize their energy costs [2]. The market mechanism can represent DERs and grid utility constraints at several locations and different time horizons consisting of a day-ahead (DA) spot market, an intraday (ID) market, a balancing (BA) market, and an imbalance settlement [96].

Given the market mechanism, the authors in [97] introduced a mechanism market concept of a microgrid aggregator to operate a small-scale microgrid in real-time for the day-ahead to balance the market bidding using a hierarchical market strategy. The risk-constrained mean-variance model and the event-driven mechanism constraints have been proposed to depress the effects of uncertainty in renewable energy sources and to reach the cleared quantity of the upper market. In [98], a novel market mechanism was developed to quantify the value of emergency energy transactions in renewable-based multi-microgrid systems. The proposed market mechanism integrates the pool emergency transactions and bilateral contracts to minimize the system risk in the face of different contingency events. In addition, an optimization approach was developed to optimize the bidding strategy of the microgrid in the market. In [99], a market mechanism based on multi-time interval electricity markets for microgrids is designed to use DERs and participants’ storage. In addition, a novel bid structure for energy storage system participation has been proposed to allow the storage system units to communicate their cost to the market using energy-cycling functions that map prices to cycle depths. The market-clearing price is reduced using schedules and payments based on traditional energy prices for power supply and the cost of operation of the energy storage system in [100] designed an integrated dynamic market mechanism (DMM), which incorporates real-time market clearing and frequency regulation, allowing market players, including renewable energy resources and flexible consumers, to continuously negotiate electricity prices at the wholesale level while using the most recent information on the available power from the wind turbine and the quality of grid frequency. The authors of [101] introduced the spot market power mitigation clearing mechanism (MPMCM) to manage the limited potential market power execution, avoid overregulation, and maintain an actual market supply-demand situation. The proposed MPMCM consists of three processes: market power evaluation, bidding capacity division, and bidding capacity constraint. The MPMCM is formulated into bidding constraints set and adequately integrated into the local market clearing procedure. A bi-level objective function with equilibrium constraints market equilibrium model is proposed to formulate the MPMCM for market simulation. In [102], a double-sided auction market mechanism is presented for pricing the zero marginal cost renewable energy resource in the DERs. The proposed market mechanism has evolved into a set-and-forget bidding market for participants to integrate honesty as a key strategy. The authors of [103] present a market mechanism for smart charging stations for electric vehicles (EVs) that allocate the optimal charge and discharge status to provide power network stability and allow vehicles to express individual preferences regarding their charging rates. This mechanism considers network-specific constraints such as total voltage drop, network load, and phase unbalance for the participants who want to receive higher rates regardless of paying a higher price.

4.4. Pricing Mechanism

The substance objective for designing the market mechanism is to use value-based signals to incentivize market players to provide an efficient power supply for the demand by controlling the power dispatch of DERs, considering multiple constraints in generation supply capacity, transmission, flexibility, energy storage, and demand elasticity. The market mechanism implements the pricing mechanism for prices to be discovered and aims at efficiently allocating energy supply and demand. The pricing mechanism indicates that the price producers can charge for a specific commodity or consumers need to pay to obtain a particular service. The price signal is information conveyed to producers and prosumers where the prosumers can generate profits by pricing their energy by including the extra fees, such as taxes [16].

Different factors can change the price in the energy market, for example, the taxes and surcharges of the traditional energy, the power quantity of supply and demand, and the locations of the consumers and producers. Furthermore, the shortage in the local power supply leads to an increase in the market price, while the surplus of power reduces the market price. Pricing mechanisms can be classified based on price formation mechanism to single auction, double auction, uniform-price auction mechanism, and distributed optimization pricing mechanism [104]. Table 2 shows the advantages and disadvantages of the auction pricing mechanism in the energy market.

Table 2.

Summary of the typical auction price formation mechanism in the energy market.

4.5. Energy Market Design

Energy markets with more participants usually focus on scheduling devices, such as renewable energy resources, energy storage systems, EVs, and controlled loads. The primary purpose of energy market design for energy services is to schedule DERs and loads before the supply time to reduce energy costs by managing load and generation resources for participation in external energy markets or engaging in local energy trading [16]. The optimal design of energy markets for the customers can maximize residential and industrial energy efficiency efforts, prepares society for renewable and clean energy technology, and democratizes demand response [114]. At the TSO level, the aggregator determines the power generation/load scheduling in different market time horizons for local participation, considering the technical constraints of the transmission network. The schedule is carried out to ensure that this particular dispatch is possible, given the network capacity [93]. The energy schedule should depend on the market design to cover the various stages of the market. Generally, the market design can include a day-ahead market, an intraday market, and a real-time market [115]. Table 3 illustrates a comparison of the different market designs that have been proposed in the literature.

Table 3.

Comparison of different market designs day-ahead, intraday, and real-time market.

In the aforementioned market’s designs, energy is traded for delivery to consumers during a specific period. However, the power systems need to be balanced at each instant time. In this context, the TSO faces uncertainties regarding the generation and consumption changes within the delivery period, even if all participants in the market are fully fulfilling their day-ahead or intraday commitments. Therefore, these balancing actions come at a cost, whereby either market participants on the consumer side have to control their consumption capacity, or DERs have to increase the power generation. Thus, the TSO must reimburse the participants who provide these ancillary services in the market to balance the power.

5. Energy Market and Energy Trading

Restructuring of the local energy markets is undergoing several developments to accommodate a large number of participants in energy markets for exposing the areas of generation, trading, and retail for competition through various trading instruments and balancing the supply and demand within the microgrid, and increasing cost efficiency. Local energy trading between prosumers is one of the new topologies of growing importance in distribution networks. In local energy trading, the prosumers are considered agents using different DERs connected with the main grid and trade their excess energy using specific policies and agreements. Since the number of energy market participants in the microgrids increases and the DERs and energy storage systems have become economically feasible, energy trading is gradually becoming a profit-making option for the prosumers, offering an open and flexible market for local transactive energy to sell their surplus energy [44]. In the energy trading market, all the peers and participants involved are rational and selfish and aim to maximize their benefits. To motivate various peers to participate in energy trading and to investigate the peer’s complex economic behavior, different strategies have been proposed to model the interaction between the participants [125]. The energy trading market encourages localized trading at the distribution level for effective microgrid operation, reducing the peak-to-average demand ratio through local energy trading during peak hours and mitigating the local market price spikes [126]. Due to the increase in system operation cost during peak hours, the agents can participate in local energy trading to improve their welfare by selling/buying their energy at a higher/lower price. Moreover, energy trading can reduce greenhouse gas emissions due to decreasing utilization of conventional and centralized energy resources such as fossil fuels and diesel generators [127].

In the local energy market, a successful business model is required to manage the local energy trading between the prosumers and consumers, decrease the grid dependency, and provide investment returns for the prosumers. Local energy trading can also be viewed from the standpoint of their pricing mechanism. The pricing mechanism in energy trading is essential because the cost of energy plays a significant role in determining the economic benefits of local energy trading. The pricing mechanism needs to be computationally effective and set with a targeted objective of trading [113]. Pricing mechanisms in energy trading can be generally classified into two methods: distributed methods and auction-based methods. In distributed methods, a large-scale objective function is divided into several sub-objectives which can be solved separately. In auction-based, the suppliers and consumers are arranged in ascending and descending orders to obtain the clearing price [128]. To design an appropriate market mechanism for local energy trading, the first step is to determine market participants and their objectives. Then, the corresponding objective function of market participants must be extracted and set the different approaches that can be applied for market clearing [44]. At the energy trading level, a proper metering and communication devices infrastructure is required across energy negotiation, delivery, and settlement stages [115]. Energy trading involves innovative market arrangements and policies for modern power systems with increasing penetration of DERs. The market energy trading is discussed from the following perspectives: the trading mechanism, the energy trading methods and techniques, and energy trading technologies.

5.1. Energy Trading Mechanism

The generation of electricity by prosumers is volatile and difficult to predict, as it is highly influenced by natural factors such as temperature, wind speed, and solar irradiation. When the microgrid operates in the islanded mode, the prosumers may not be able to generate enough power to supply their loads. However, when prosumers have an electrical energy surplus, there are several options. The energy can be stored in an energy storage system for subsequent use, it can be exported to the main electricity grid, or the excess electricity can be sold to other neighboring consumers [87]. Typically, conventional energy trading is based on single-way. Electricity is transmitted from large-scale generators to consumers over long distances.

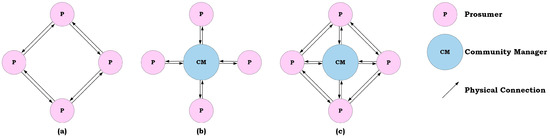

On the contrary, the modern approach based on decentralized energy trading encourages multi-directional trading within a local geographic area. Deploying decentralized energy resources requires a new decentralized energy market and the governance of the energy infrastructure. Therefore, it is essential to create a local energy market where energy can be traded locally [129]. From the viewpoint of market structure, the energy trading mechanism can be categorized into three types: (1) full P2P market, (2) community-manager-based market, and (3) hybrid P2P market. The typical structure and brief comparison of each type of energy-trading model are illustrated in Figure 6.

Figure 6.

Energy trading mechanism for energy market: (a) full P2P market, (b) community-manager-based market, and (c) hybrid P2P market.

The critical difference between the three types of energy trading market mechanisms is that fully P2P energy markets are based on direct energy trading between peers without a mediator, as illustrated in Figure 6a. Fully P2P energy markets allow prosumers to trade excess energy production between groups of prosumers and consumers and increase their benefits and consumer benefit. Peers can attract and negotiate directly with each other and decide on their energy trading parameters without involving any community manager (CM) or intermediary entities. The energy exchange price is set below the retail price to incentivize the peers to maximize the social welfare of the participants [129]. In full P2P energy markets, peers’ privacy is well secured, and peers can fully control their own devices, which gives more flexibility to end users, gives more opportunities to consume clean energy, and helps transition to a low-carbon energy system.

In contrast, the community-manager-based market includes a CM to manage, control, and coordinate trading activities inside a community. This type of market can be readily applied to community microgrids and clusters of prosumers, as shown in Figure 6b. In the community-manager-based P2P market, The CM acts as an intermediary between peers inside a community and the rest of the system. The participants communicate pre-defined and limited private information to a CM that returns a price signal. The CM plays the role of the local market operator, including the tasks related to market clearing and settlement. Moreover, The CM can be an intermediary entity when the peers need to buy/sell energy from/to the retailer or the wholesale market.

A hybrid P2P market combines the two previous models, as presented in Figure 6c. In a hybrid P2P market, the group of prosumers relies on a CM for controlling the energy trades, but this group and other peers can trade energy with each other in a P2P mode. However, this type of market needs a proper pricing mechanism for the coordination of local trades in the community with peers and the CM. Table 4 summarizes the potential advantages and disadvantages with references for all discussed P2P mechanisms.

Table 4.

Summary of energy trading mechanism for the P2P energy market.

5.2. Energy Market Participation

The main objective of energy trading is to maintain smooth operation within a microgrid by exchanging surplus or deficit power from the upstream network and creating earnings for the microgrid owner or market participants. As microgrids generally operate in the grid-connected mode, it is imperative to comprehensively understand the energy trading of the market participation model in microgrids [85,139]. The market participation model is crucial in promoting microgrids’ development and determining the return on investment based on the cost of energy purchased and sold during the participation. For instance, a microgrid may belong to various business entities, comprising both personal and overall interests in a global framework where each entity is pursuing the maximization of its own interest and making decisions aided by a support and information system, which is an integral part of a microgrid support management system [140].

Before defining the energy trading market participation conditions for energy prosumers and consumers, the local electricity market structure must be studied. The market participation conditions are designed to increase profits for the energy prosumer through P2P energy trading by calculating the minimum energy trading price that ensures profitability for the energy prosumer. To expect profits from purchasing electricity through P2P energy trading from the energy consumer’s perspective, the electricity bill from purchasing a part of the electricity consumption from the energy prosumer through P2P energy trading should be lower than that of purchasing electricity entirely from the main grid. In contrast, from the energy prosumer’s perspective, two requirements should be met to expect profits from the sale of surplus electricity through P2P energy trading: (1) the profit from the sale of surplus electricity through P2P energy trading should be higher than that of the sale of surplus energy using other electricity trading methods; and (2) the generation cost of the DERs installed in the site should be made up for [141].

Investigating market participation models for energy trading is gaining popularity. For example, Ref. [142] presented the energy storage participation in an islanded microgrid to optimize energy exchange with the main grid. This participation involves the power injected into the microgrid by an aggregated set of various types of renewable energy resources and the electricity price market to minimize the energy cost on the microgrid. The results demonstrated that the microgrid performance using the best participation of all three players (hybrid energy storage system, PV, and wind generator) generates a 21% and 16% profit. Authors of [143] designed the engagement factor to determine the participation level of the participated microgrid in the case of power deficiency and the frequency regulation service provided economically based on the market trading results. This study considered different aspects of the microgrids, including the P2P bilateral energy trading market, balancing market, and the ancillary service market, to facilitate the energy and capacity trading between the peers. Authors of [141] calculated the minimum and maximum electricity trading prices for energy prosumers and consumers based on electricity trading prices and the market participation conditions. A P2P energy trading mechanism based on electricity trading prices is established to enable both the energy prosumers and consumers to increase their profits. According to the monthly electricity production and consumption results, the minimum electricity trading prices ranged from 0.05 $/kWh to 0.34 $/kWh, and 0.09 $/kWh to 0.32 $/kWh, respectively. Authors of [144] presented an optimization model for the best participation of the aggregator in energy and local flexibility markets. The proposed aggregator manages a set of DERs such as PV, electrochemical batteries, and thermal energy storage. The simulations analyzed different scenarios in which the aggregator participates in different markets and determines the changes in the schedule to attain minimum operation costs.

The participation of plug-in electric vehicles (PEVs) in the markets has been studied in [145] to deal with the problem of optimal scheduling problem considering the market price fluctuations, availability of the EVs in the market, and status of the reserve market. The participation of PEVs aims to maximize profit by charging the EV at the lowest price during the plug-in periods and participating in ancillary service markets. The numeric results illustrate that the EV aggregator obtained 23.8% less profit than the case, which neglects the market price fluctuations. In [146], the authors proposed the secondary reserve markets (SRMs) as an additional source of revenue. The market participation of the hybrid PV and energy storage plants has been simulated and validated for one year in six different markets. The SRM participation increased the total profits in the three scenarios by 4.64%, 4.83%, and 6.42%, respectively. The authors of [147] developed a control model to optimize microgrid dispatch in two states, one with market participation in real-time ancillary service markets and the other without market participation. Through participation in ancillary service markets, the model reduced the net operating cost by up to 9.74%.

5.3. Energy Market Competition

Under different types of microgrids and various combinations of DERs in the power network, each utility can change its investment decision regarding the implementation while considering the other government regulations and policies, the potential for future energy technologies, and the energy market competition [148]. Since the market participants always implicitly consider other participants’ reactions to their own investment decisions on adopting DERs, the market mechanism should simultaneously evaluate the competition among energy suppliers and energy consumers to generate more revenue in the market. There is no competition among a limited number of local prosumers in the energy market, and the consumer also has fewer choices. As a result, the local prosumers become a market monopoly. Market competition is an effective tool to reduce organized monopolies and provide the benefits of competition to customers in power generation and the local energy market. Competition provides a great stimulus to innovative tariffs, operations, and efficient purchasing/selling among the prosumers and consumers [149]. Market competition improves consumers’ social welfare by forcing sellers to reduce their prices for the most active customers to attract other customers and efficiently allocate resources. The lack of competition in the market indicates different pricing in the energy market, which raises energy trading issues, especially for vulnerable customers [148].

Different studies concentrated on the issue of competition in the energy sector by paying attention to competition and innovation, energy regulation, and the role of energy trading in the energy mix and energy security. For example, the authors in [150] provided various structural factors of market power and reviewed market results to analyze the intensity of competition in the energy market and examine whether the energy trading market is beneficial and functioning at an appropriate efficiency level. In [151], the authors applied several competition measures in the actual energy market dataset. Based on the data analysis, the standard measures of competition can be identified to increase or decrease the level of competitiveness for constrained electricity trading between various regional nodes. Ref. [152] provided some examples of countries that launched energy market measures and reform to attract investment in the energy market, increase the market competition, and offer tax incentives for the implementation.

A research framework addressed the energy competition market in [153] by presenting a multi-agent model of microgrid operators for energy market game competition and an optimal economic scheduling model. In addition, an optimization method is proposed for solving the microgrid group transaction model using the decentralization feature shared by transaction technology. Authors of [154] constructed a price-based model that organically integrates transaction technologies and microgrids for solving the issue of the insufficient utilization of electrical energy in the microgrid competition market. In [148], the authors proposed an evolutionary model combined with feasible options to guide the energy storage system subsidy policies based on the competition regulations for microgrids. The equilibrium positions of the market competition on the distribution network side were calculated based on the dynamic game method to ensure the investment value of the microgrid and to reduce the initial cost of such a capital-intensive component.

Table 5 describes the standard competition indices applied in the previous research and given as follows: the Herfindahl–Hirschman index (HHI), entropy concentration index (ECI), quality of service index (QoS), pivotal supplier index (PSI), and residual supply index (RSI).

Table 5.

More common competition indices used for describing energy markets.

5.4. Energy Trading Methods

Local energy trading between prosumers and consumers is a novel concept of growing importance in the energy sector. Specifically, P2P trading is based on a decentralized scheme to offer more flexibility and opportunities to consume clean energy and provide a trading option to the users while their autonomy and privacy are preserved. Additionally, the energy market participants can obtain benefits, such as reducing maintenance and operation costs, reducing the peak demand for electricity, and enhancing the distribution system’s reliability [159]. This trading mechanism creates a platform for all users to exchange their energy within the microgrid system with limited or no intervention from a third party or the presence of centralized authority [1]. An energy buying and selling platform allow for the storing of all the information related to production, consumption, and contractual relations between the participants. Implementing the P2P model and energy trading will impact the general energy market and community. An effect on the lifestyle patterns of the participants regarding the supply and demand for electricity improves transparency in energy transactions and reduces fraudulent transactions. Furthermore, the participants in the energy market have a more direct connection with each other, thus increasing a sense of attachment to the community and the participants [129]. As participants in the electricity market are part of the energy market, they need to use specific methods to determine their trading, which imposes technical constraints on energy trading in the market. The energy trading methods are essential for reducing loss, increasing profit, determining market equilibrium against demand management, and other objectives [159].

In general, existing energy trading methods can be classified according to the topology adopted in the market mechanism for a specific purpose. As described in Table 6, four trading methods have been applied in P2P energy trading in the literature.

Table 6.

The existing energy trading methods for P2P models.

5.5. Energy Trading and Distributed Ledger Technologies

The energy trading platform allows the participants in the market to store their information related to consumption, production, and contractual relations between the buyer and seller. The traditional energy market consists of complex procedures that require third-party intermediaries such as brokers, trading agents, exchanges, price reporters, logistic providers, banks, and regulators to validate the digital transaction to make a trust, secure, and successful transaction. Energy exchange platforms based on P2P architecture are currently popular for solving third-party needs or central data centers [170]. From a security perspective, energy exchange platforms enhance the trustworthiness and integrity of transactive energy data by supporting multifactor verification using distributed ledger technologies [171]. Distributed ledger technology (DLT) is a cyber-consensus and secure, access, store, and update record-keeping mechanism in a transparent and trust manner across the P2P trading platform [1]. DLT solves the problem of third-party needs and moves the definition from individual trust to community trust. DLTs are immutable, decentralized digital lists of transaction records updated by market participants and characterized by the distributed ledger, smart contract, and cryptography to guarantee the validity of the transaction lists. Lists of transaction record are updated by network participants and cryptographically sealed to guarantee the validity of the transaction records [172]. The application of distributed ledger technology for peer-to-peer energy trading in microgrids and local energy communities is a promising solution [173].

The DLTs architecture is defined in various forms of a block and chains to apply secure peer-to-peer platforms for the energy market operation. However, the most popular has been that which is based on the blockchain technique. Blockchain is an innovative technology based on DLT designed to enhance the system’s security and decentralize transactions. Blockchain technology is a chained ledger of transactions that securely hosts critical information across all industries and sectors. In the energy market, blockchain technology proved to be a secure, hack-resistant technology for processing digital transactions and energy trading applications [174]. Recently, there have been various research and projects linking blockchain to energy trading. For example, Ref. [95] assessed the design of P2P energy transactions for a local energy market in Brooklyn microgrid. The authors suggested that the energy transaction was set up by adopting blockchain technology as the main information and communication technology, modelling a blockchain-based energy market. in the authors of [175] eliminated the monopolization and the central controlling entity of the main grid by adopting a blockchain-hybrid P2P energy trading model with a new bidding mechanism. This hybrid P2P trading model positively impacts the main grid’s sustainability by reducing the peak-to-average ratio (PAR) and the cost of electricity which benefits both prosumers and consumers, respectively. In [176], the authors proposed a methodology using a permissioned blockchain system to bridge all entities in the microgrid for validating the voting of the energy market participants. The proposed method focuses on solving the privacy-preserving problems in microgrids, increasing the ability of data protection, and ensuring microgrids’ performance. In [177], the authors introduced a blockchain-based model to solve a microgrid’s technical and economic problems. The proposed model records transmission line losses of energy transactions between different entities and makes technical decisions in the energy market.

In [25], the authors presented a DR program solution that utilizes energy blockchain to minimize the demand, save the surplus energy from the DERs, and efficiently incorporate consumers’ block mining ability. The authors of [173] designed a distributed double auction trading platform using a blockchain to enable P2P trading between individual users of the LV network. In this study, the local P2P energy trading market and electricity distribution network were investigated, and the potential impacts of large-scale adoption of P2P energy trading on the distribution of network operations were analyzed. In [178], the authors proposed a blockchain technology for a localized P2P electricity trading model for locally buying and selling electricity among plug-in EVs in microgrids. The proposed model is based on a consensus of proof of work by achieving the DR program by providing incentives to discharging EVs to balance local electricity demand and increase their profits. The authors of [161] introduced a local energy market design and simulation using eleven households in the microgrid that are prosumers and eight households that are owners of an EV. The model presented by the authors is based on blockchain technology and allows local energy trading between prosumers and consumers without needing a central intermediary. In [179], the authors employed blockchain technology to lead a secure, transparent, and decentralized energy trading for the optimal scheduling of interconnected microgrids by priority, using the critical load’s index. The proposed model includes the incentive contract price to increase the purchasing power and reduce the selling price.

Blockchain is applied in [180] to the transactive energy and carbon market for microgrids. The deployment of blockchain ensures safe, secure, and transparent microgrid transactions by using asymmetric encryption, i.e., public and private keys. A game theory with externalities is used to model the microgrid cooperative behaviors considering the constraints of the power distribution network. Other DLT techniques that have also been highlighted in the literature are directed acyclic graph (DAG) [181,182], IOTA [183,184], hashgraph [185], flowchain [186,187], holochain [188,189], and several hybrid systems [190,191]. The advantages and disadvantages of distributed ledger technologies are summarized in Table 7.

Table 7.

Summary of the advantages and disadvantages of different distributed ledger technologies.

6. Energy Market in Energy Management System

P2P energy trading in a distribution system has been proposed as a means to facilitate the uptake of DER. Within the emerging concept of energy trading, the P2P model is a DER integration approach that allows the harnessing of the inherent flexibility of the demand side program. Multiple bilateral transactions’ price and energy are negotiated simultaneously in a P2P market according to a predetermined market design [192]. P2P markets rely on multi-bilateral energy transactions between prosumers and end users. The active participants can automatically negotiate their actions in the market using P2P market algorithms, clearing models, and energy management systems models, allowing a dynamic balance between supply and demand [43]. An energy management system is used in the energy market to plan equipment operations such as DERs, controlled loads, energy storage systems, or the electricity imported from the main grid, to reduce the operating costs, use energy most effectively, and minimize the environmental impacts [193].

Moreover, the energy management system automatically secures the energy supply for market participants while implementing a specific bidding strategy. There are different types of energy management systems that can apply several types of optimization techniques. The energy management system needs access to the (real-time) supply and demand data of the market participants. The energy management system forecasts consumption and generation using this data and then designs the optimal bidding strategy for the energy market by casting the energy management problem as an optimization problem. Additionally, it can estimate of the offer curve function to quantify the costs and react to variable prices via predicting the amounts on the market platform [95]. Several energy management systems are available to determine value, such as an organized market, tariffs, self-optimization, and bilateral contracts using different optimization parameters. To plan the optimal usage of microgrids and energy trading, mathematical algorithms can combine rules for equipment used in the rule-based energy management system or generation and load forecasts [43].

The energy markets aim to achieve optimal system-wide performances by dynamically aligning individual and global objectives for applications using scheduling energy management to mitigate voltage fluctuations caused by high penetration of renewable energy resources, managing the start-up and shutdown operation of the DERs, and reducing the use of the fossil fuel [194]. There are common system characteristics and requirements to be considered in the energy management system in the energy market. In this section, the underlying key elements are described and analyzed. The descriptions below are given in general terms, and they are general and not tailored to a specific model. Detailed descriptions and specific problem formulations with examples are put forward in this section.

6.1. Objective Functions of Energy Market in Energy Management System

The economic concepts of energy management systems in the energy market and the development of strategies are to achieve benefits using certain objective functions. The objective function in the energy market allows autonomous or grid-connected decision-making to provide a set of operation points for the various loads and energy resources along different time frames subjected to energy market parameters and one or more constraints. The decision-making can be cast as minimizing or maximizing an objective function that aligns individual users’ objectives with the aggregator’s objective. In the energy market, the designed objectives can be achieved through control and price signals that enhance and coordinate the active users’ participation [20]. The choice of the objective function is governed by the users’ participation nature, including residential, commercial, and small industrial electricity, the geographical area, installation of the utility in a microgrid, capacity, types of tariff, energy storage, government policies, and the nature of the energy market. One critical feature that affects the choice of the objective function is the consideration of the power losses within the optimization formulation. Energy management in the energy market can be defined as a single objective function or a multi-objective function, where more than one objective should be fulfilled simultaneously. The research community has used five main types of mathematical models to formulate the objective functions in energy markets, i.e., linear programming (LP), non-linear programming (NLP), quadratic programming (QP), convex programming (CP), and least square programming (LSP) [195].