1.1. Motivation and Background

As the world moves toward a cleaner energy matrix, renewable energy technologies have gained increasing importance. According to the World Energy Investment 2023 report, global investments in clean energy reached record levels in 2022, surpassing USD 1.7 trillion, and are expected to reach USD 1.9 trillion in 2023, where solar PV (photovoltaic) is expected to contribute more than USD 1 billion per day, surpassing upstream oil and gas investments for the first time in history. Global wind power investment is expected to grow by approximately 10% in 2023 and by approximately 25% from 2024 to 2030 [

1].

In recent years, the Brazilian renewable energy sector has experienced steady growth. In 2023, there will be two major transmission auctions scheduled, including the largest in terms of investment [

1]. Although hydropower still accounts for the majority of Brazil’s renewable energy capacity, wind and solar have grown rapidly. According to IRENA statistics [

2], wind and solar energy capacities in Brazil have increased by 11-fold (from 2202 MW to 24,163 MW) and over 1800-fold (from 13 MW to 24,079 MW), respectively, which paves the way for HRES growth in the future.

The Brazilian Electricity Regulatory Agency (ANEEL) established a favorable regulatory framework for the HRES, resulting in increased popularity of the technology due to the possibility of cost reduction, market opportunities, and complementarity between energy sources, which can result in more advantageous economic outcomes than stand-alone energy systems. However, the complexity of combining multiple sources of energy may influence the decision to invest in this technology [

3].

Brazil’s Decennial Energy Expansion Plan 2031 [

4] forecasts a significant rise in renewable energy capacity, escalating from 151 GW in 2022 to 267 GW by 2031. It is acknowledged by the government that the HRES plays a pivotal role in the energy sector; however, the energy sources are considered separately in their analysis, resulting in an important gap. Moreover, an extensive body of academic literature relies heavily on metrics such as the traditional (deterministic) DCF or the levelized cost of energy (LCOE) [

5]. Despite this, this approach has significant gaps from a variety of perspectives [

6], as well as ignoring important aspects of evaluating the economic attractiveness of energy projects, such as the time value of money and the unpredictable nature of renewable energy.

In order to transcend the limitations of the LCOE, a more comprehensive analytical framework may be required, offering a nuanced understanding of HRESs and providing a more cohesive and synergistic approach to energy planning and analysis. As indicated by [

5], approximately 85% of the reviewed papers used either discounted cash flow (DCF) or LCOE techniques. According to the authors, traditional project evaluation methods (TPEM), which refers to net present value (NPV), IRR, and payback period (PBP), were the largest category with 921 papers.

The DCF technique traditionally relies on deterministic forecasts of cash flows, whereas probabilistic cash flow analysis is associated with simulations and scenarios. However, when assessing the HRES, a probabilistic approach must not only be able to account for the energy intermittency but also consider the synergies’ impact on the decision metrics.

This study assumes that dynamic (probabilistic) DCF models can contribute significantly to the development of a more comprehensive analysis. A DCF model, unlike a LCOE, is designed to incorporate the time value of money into the long-term financial projections of a project. A probabilistic model can encompass various uncertainties, such as fluctuating market dynamics and long-term energy production, offering a robust platform for sensitivity and scenario analysis.

The purpose of this study is to present a new dynamic DCF approach that considers both the intermittency of the energy sources, as well as the synergies of the HRES, to assess the combination of wind and solar to maximize the 50th percentile of the HRES IRR and minimize its CV. Throughout this study, these combinations will be referred to as “optimal”.

Achieving both the maximization of IRR and the minimization of the CV is an indication that a wind–solar combination can be not only lucrative but can also demonstrate a certain degree of predictability in its returns, making it a useful metric for evaluating the feasibility of expanding the HRES. As a result, this new approach can facilitate informed investment decisions by incorporating dynamic financial structuring and incentives, as well as providing insights into the project’s IRR, thereby serving as a tool for navigating the complex renewable energy industry with a refined analytical perspective.

1.2. Literature Review

In Europe, the levelized cost of energy (LCOE) for renewable energy increased significantly between 2021 and 2022 due to higher financing costs and input costs for turbines and modules. Based on the data presented in [

1], the cost per MWh has increased from 50–55 USD/MWh in Q1 2021 to 70–75 USD/MWh in Q4 2022. Although the LCOEs for onshore wind and solar PV increased by 15% and 30%, respectively, their appeal remained unchanged due to their cost-effectiveness. Conversely, combining wind, solar PV, and batteries into hybrid systems can reduce the LCOE compared to isolated systems [

1].

According to [

7], the capital expenditures per megawatts (CAPEX/MW) of photovoltaics may decline by up to 75% by 2050. Onshore and offshore wind are expected to experience a decline of 40% and 50%, respectively, for the same period. A reduced CAPEX will result in a lower future LCOE, thereby increasing the competitiveness of HRESs. Complementarity between energy sources provides a basis for designing hybrid energy systems that combine multiple energy sources or technologies to achieve better results. Complementary energy sources can enhance system reliability and optimize hybrid renewable energy systems [

8]. According to [

9], wind and solar resources are more effectively matched in terms of load than individual resources.

In other studies [

10,

11,

12], the complementarity of wind and solar energy was examined in different countries, including Algeria, Brazil, and China. In Algeria [

10], high complementarity was found in coastal and highland regions and moderate complementarity along the coast. In Brazil [

11], the Northeast region displayed the strongest complementarity between wind and solar energy. Based on the specific study site in China [

12], the authors determined that a solar–wind ratio of 1:0.27 resulted in the most stable total renewable energy production.

A detailed analysis of optimum sizing approaches for HRESs has been presented in [

13], which reviews several optimization techniques in combination with HOMER (Hybrid Optimization of Multiple Energy Sources), a software developed by the National Renewable Energy Laboratory (NREL) which is current in version 3.16.2. As a result of the lack of open-source code, HOMER is described by the authors as a “black box” in terms of its internal operations.

HOMER has been widely used for analyzing hybrid energy system applications for a variety of purposes [

14,

15,

16,

17,

18]. A hydrogen energy storage vector was used in [

13] to overcome some limitations of solar and PV energy sources, such as variability and intermittency. Hybrid configurations have been found to be more economical and cost-effective than stand-alone configurations [

14,

15,

16,

17]. As a critical factor for economic viability, the regulatory framework has been mentioned in [

18]. The expansion of HRES is currently hindered by the lack of clear regulations in many countries, which creates an uncertainty environment.

It has been found, despite differences in methodology, that hybrid designs often lead to optimal and cost-effective solutions [

19,

20,

21,

22,

23,

24]. As part of the effort to provide electricity to rural areas in remote locations, a techno-economic feasibility study was conducted [

20]. According to the authors, a hybrid system provides more reliable and affordable electricity than grid extensions. A feasibility study on a HRES in Italy was conducted in [

21]. The hybrid system was found to be technically and economically feasible under a scenario where PV and wind are complementary throughout the year.

The lowest net present cost (NPC) was obtained with PV–wind–diesel–biomass [

22], PV–wind–battery [

23], and PV–battery [

24]. In [

22], PV was identified as the most suitable primary energy source. In a similar study conducted in [

24], PV coupled with battery storage was found to provide the greatest economic benefits. Although the PV–wind–battery combination in [

23] had the lowest NPC, the high investment in renewables resulted in a higher LCOE for households and corporations.

Approaches based on hybrid solutions have also been proven to be effective to improve grid stability and competitiveness of renewable sources [

25], overcome challenges like constrained energy transmission [

26], and to reduce power fluctuations from intermittent renewable sources [

27]. The introduction of a wind, solar, pumped-storage cooperative (WSPC) model by [

25] successfully enhanced the wind–solar competitiveness and led to better revenue distribution. The study presented in [

28] proposed an event-triggered distributed hybrid control (DHC) that optimized the energy hub device operation for minimum cost. A wider expansion in renewable energy can also benefit the entire market through energy price reduction [

29].

In [

6], it has been demonstrated that metrics such as the LCOE are insufficient for evaluating renewable energy sources. According to the authors, the LCOE ignores the time-dependent value of energy generation, overvalues variable renewable sources of energy, and does not adequately address the devaluation of renewable energy sources (RES) as they are generated. To provide a solution, the cost of valued energy (COVE) metric has been proposed, which weighs energy based on real-time market prices. As a result, the COVE was 25% higher than the LCOE for solar in California and 129% higher for wind in Texas. According to the authors, RES should be designed to minimize the COVE rather than the LCOE.

In this study, a stochastic discounted cash flow (DCF) model based on long-term expectations of wind and solar energy production is used to evaluate an optimal HRES configuration. The objective of this study is to identify the optimal combinations of wind–solar in relation to the total HRES installed capacity to maximize the 50th percentile of the IRR, which will be referred to as for brevity, and to minimize the coefficient of variation (CV) of the estimated IRR. Although maximizing may result in higher potential returns, minimizing the CV may indicate a more reliable and consistent IRR. Several metrics can be used by decision-makers when evaluating investments, and the metric chosen will be dependent on the risk management strategy. Based on the results of the study, the hybrid system in Brazil achieves the best scale gains in every scenario; however, the optimal wind–solar ratio varies based on the objective.

1.3. Paper Organization

This paper is organized as follows: Materials and Methods (

Section 2) presents the model. The variables and equations of the cash flow model are described in

Section 2.1 (Cash Flow Model). In segments 2.1.1 and 2.1.2, gross revenue and costs/expenses are discussed, respectively. Segment 2.1.3 describes the investment decision. In

Section 2.2, the data and variables modeled are outlined. Results are presented in

Section 3. In

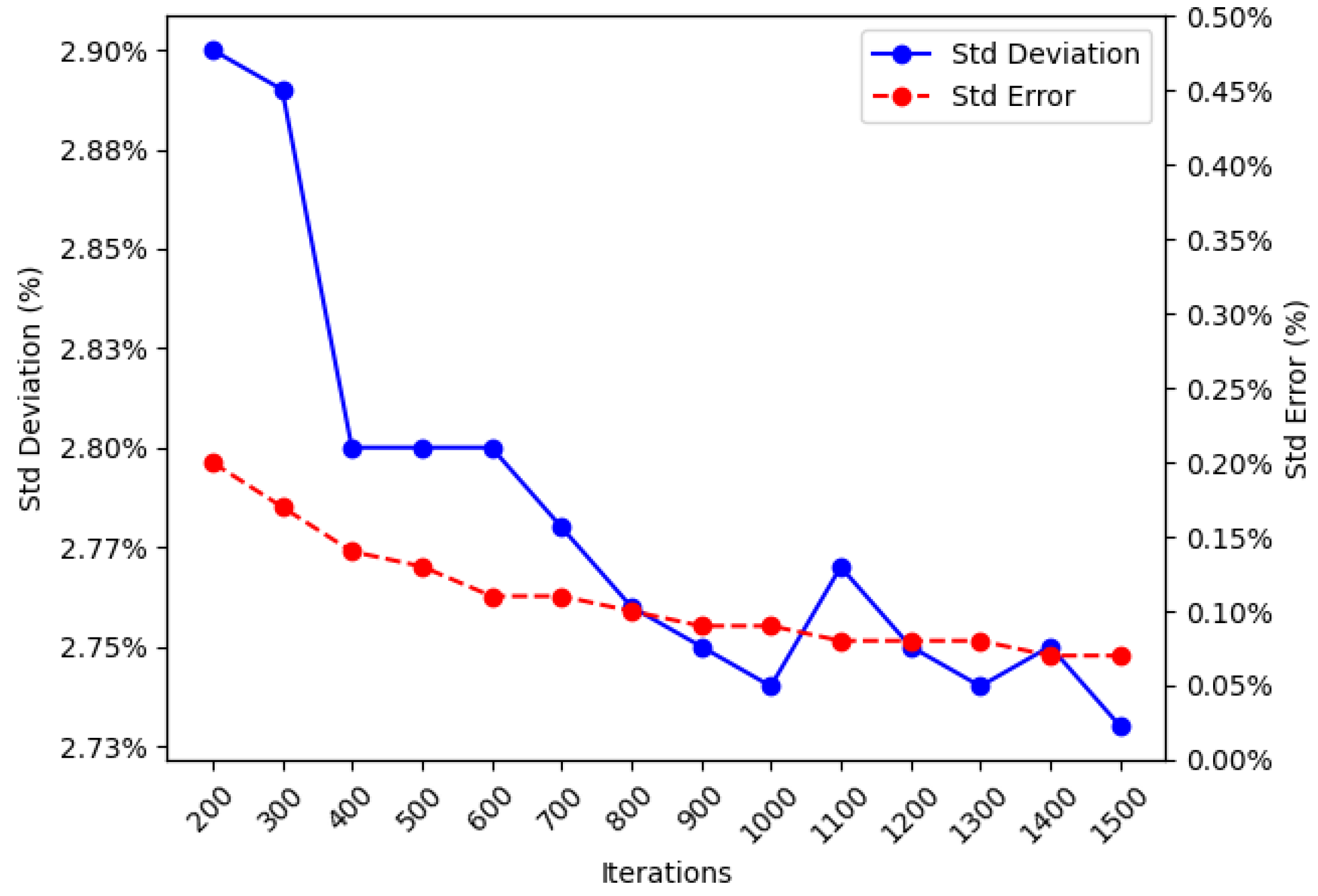

Section 3.1, the Convergence Test is presented.

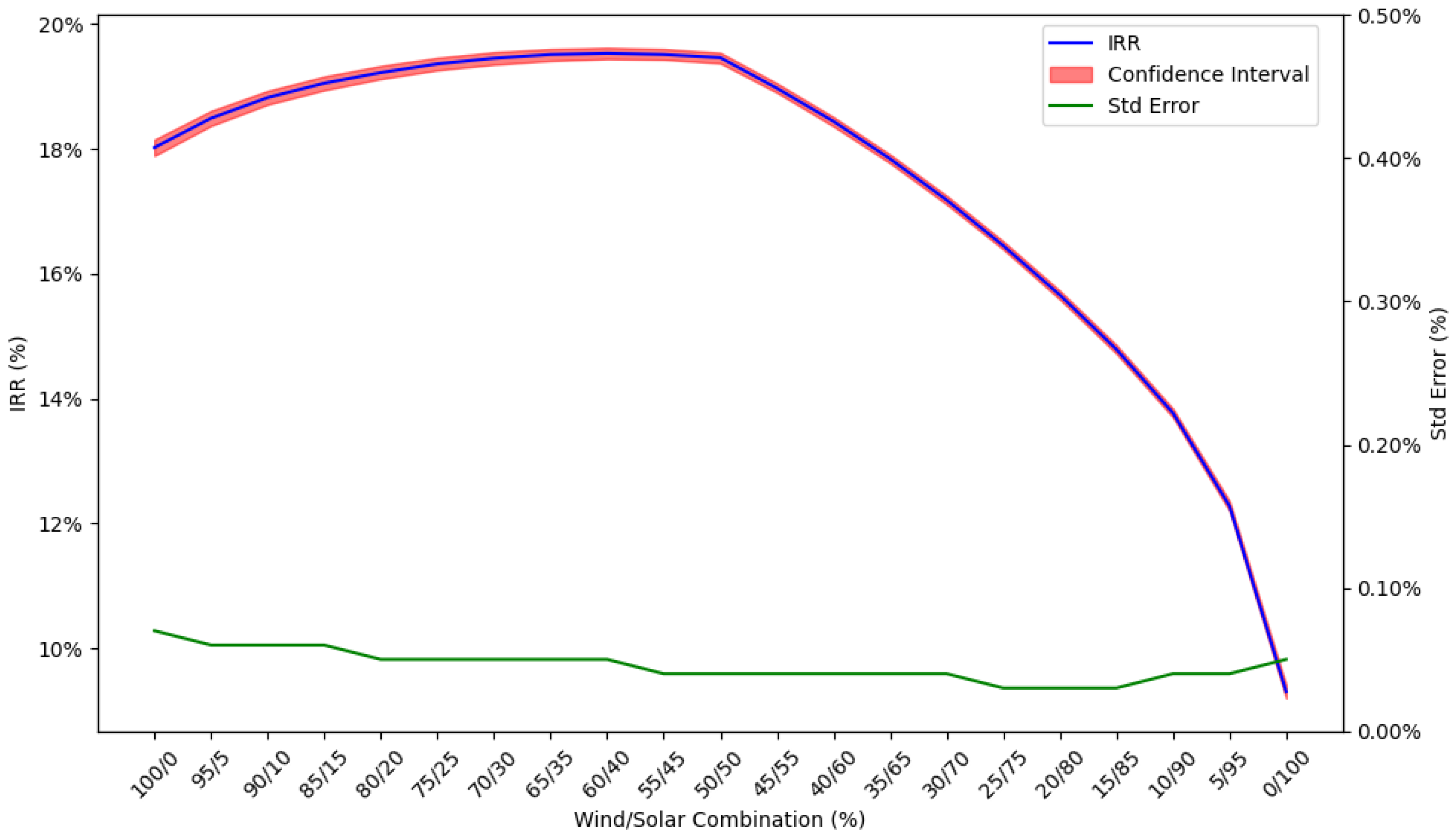

Section 3.2 presents the IRR and CV results along with specific statistical measures such as standard error lower and upper bounds.

Section 3.3 presents the confidence intervals,

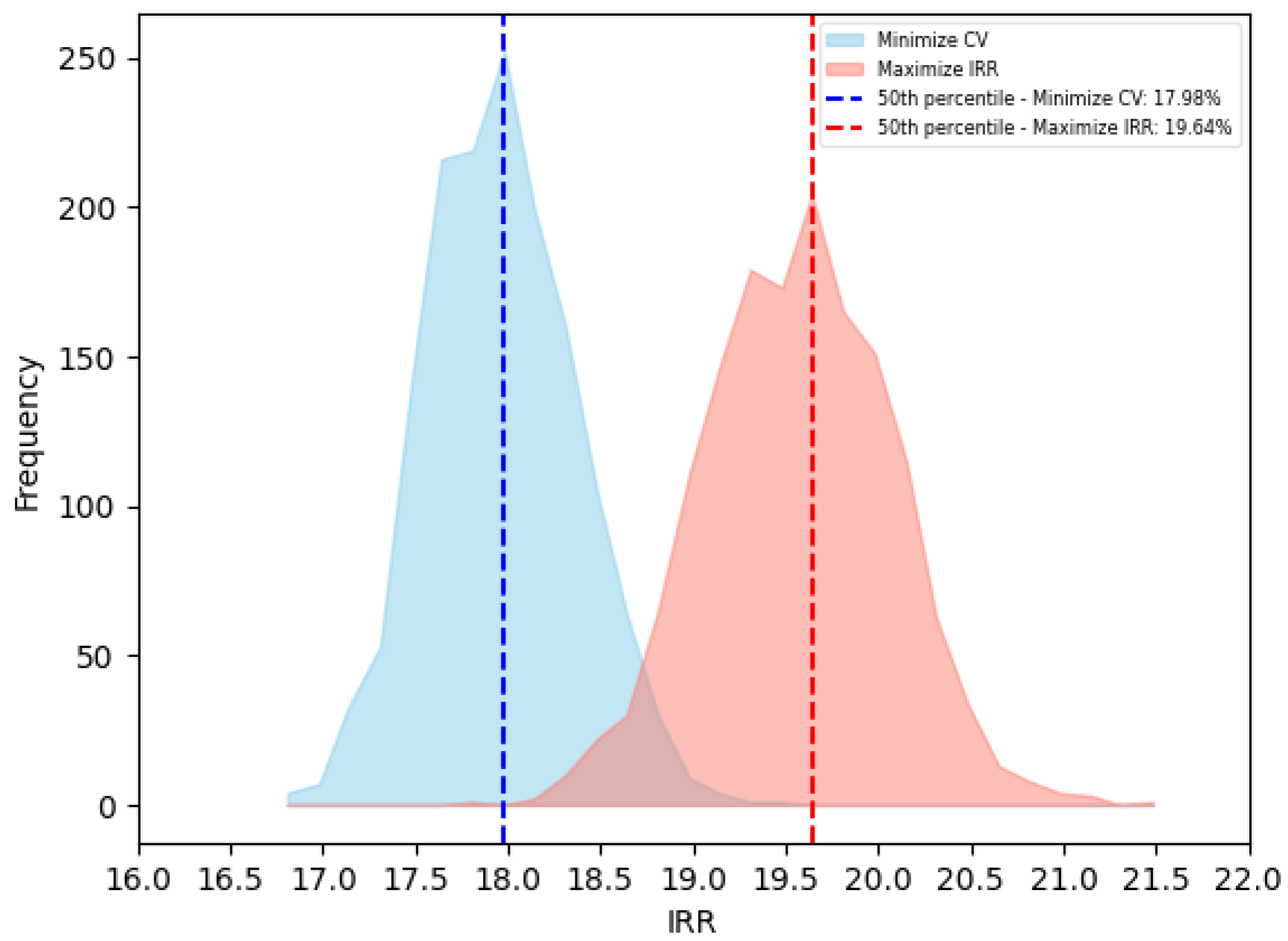

Section 3.4 presents the probability distributions, and

Section 3.5 presents the synergies of costs and revenues.

Section 3.6 presents the sensitivity analysis. The results and their implications are discussed in

Section 4, as well as future research directions.

Section 5 presents the conclusions.