Abstract

The U.S. has transitioned from being the 20th-century global leader in civilian nuclear power to a nation searching for ways to revive its once-dominant nuclear enterprise. The future of U.S. civilian nuclear power transcends that of a science and technology issue and, fundamentally, is a policy issue. This is a policy paper that uses a nuclear power policy framework to analyze current and historical U.S. civilian nuclear power policy and to identify weaknesses and deficiencies that need to be overcome in order for the U.S. to (1) leverage advanced nuclear reactors as a domestic technology to meet energy security and reliability objectives under carbon constraints, (2) operationalize national security as a priority objective and (3) restore the U.S. as a major global exporter of nuclear technology. The results of this analysis indicate that the national security implications of U.S. nuclear power have been marginalized in general due to the domestic market challenges of competing with less expensive and oftentimes more socially acceptable technologies, as well as the international challenges of competing with state-owned nuclear enterprises. The results are then discussed and used for making three following policy recommendations: (1) conduct a U.S. nuclear industrial base review; (2) create a demand signal using U.S. military installations; and (3) shift away from a sell-side nuclear vendor model for global exports to a buy-side model brokered by a third-party integrator that can work with multiple U.S. nuclear partners.

1. Introduction

The U.S. is in a sharply-divided debate as to which energy resources will power its 21st-century economy—a debate in which energy is viewed largely as a market commodity, with price and affordability as drivers, as a climate change issue, with CO2 reduction as a driver, or some combination of both [1,2,3,4,5,6]. However, the specter of climate change has sparked intense scrutiny of the U.S. electric power sector, with the preponderance of this attention centered around urgent calls from the scientific community to reduce global carbon emissions. These calls have inspired an array of public movements and political rhetoric, as well as a variety of ad hoc policy responses and pledges at the local, state, and federal levels aimed primarily at replacing high-carbon fossil fuel energy resources with low- or zero-carbon resources. The phrase energy transition is regularly invoked to characterize these actions, with the catalyst and driving force being global climate change [7,8].

To this end, President Biden issued an executive order, putting the climate crisis at the center of foreign policy and national security [9]. Meanwhile, U.S. cities, states, corporations, and academics are proposing policies and strategies characterized as clean energy transition, sustainable transition, socially just and equitable transition, 100% renewable energy transition, zero-carbon economy, carbon neutrality, and fossil fuel divestment [10,11,12,13,14,15]. Many of these proposed transitions include target dates for implementation. Moreover, renewables are regularly promoted as the preferred alternative to fossil fuels, particularly for the U.S. electric power sector, and the growth of renewable energy is often used as a proxy indicator that the energy transition is well underway [16,17,18,19].

The proposed U.S. energy transition itself is a top–down policy decision, as is the promotion of renewable energy. However, the adequacy of renewable energy as a replacement for fossil fuels is unproven at the scale of an industrial economy the size of the U.S. While nuclear power has received renewed attention in recent U.S. discussions, arguments in support of nuclear power are predominantly motivated by concerns around carbon reduction and climate change while arguments against nuclear power largely revolve around cost, safety, and a proposed lack of necessity. Existing U.S. nuclear reactors are Generation III or older, with two Generation III+ reactors currently under construction [20]. While current U.S. reactors service the power generation sector, attention is being directed toward utilizing nuclear reactors for industrial processes [21,22,23]. Using offtake heat from nuclear reactors for appropriate industrial applications represents an added value proposition that can improve the current economics of nuclear power. However, light water reactors operate at temperatures that are low relative to many industrial needs. On the other hand, advanced reactors, particularly those using coolants, such as molten salts, which have much higher heat capacities than light water, have the potential for use in a broader range of industrial applications requiring higher temperatures. As will be discussed in this paper, small modular reactors (SMRs) and microreactors represent a class of advanced reactors that can lend themselves to improving the economics through industrial applications, as well as combined heat and power. For these reasons and more, nuclear reactors with more advanced operational and safety characteristics have been under development for some time and are now being elevated in renewed considerations for nuclear power [24,25].

This paper contends that the market aspects of U.S. nuclear power, in general, and advanced nuclear power, in particular, face substantial headwinds, domestically and globally. It also contends that the future of U.S. civilian nuclear power transcends that of a science and technology issue and, fundamentally, is a policy issue contingent upon not only the science and technology but also economics and societal aspects, both of which are subjective and complex. Moreover, what has been marginalized from U.S. nuclear power policy, if not dismissed, are the national security implications of nuclear power. This, then, is a policy paper that addresses these national security implications, discusses the current domestic and global challenges to U.S. nuclear power, and proposes specific policy recommendations for leveraging advanced nuclear reactors to operationalize national security as a priority objective within U.S. nuclear power policy, thereby aligning U.S. nuclear policy with 21st-century realities. As a policy paper, and due to the fact that U.S. nuclear power policy is a decades-old legacy issue of statecraft, a review of past U.S. civilian nuclear policy and technology innovations is a necessary inclusion in this analysis in order to lay the foundation for the primary point of contention in this paper. That being, U.S. civilian nuclear power is inherently a national security issue, and advanced nuclear reactors offer a national security value-added proposition for the U.S.

2. Methods

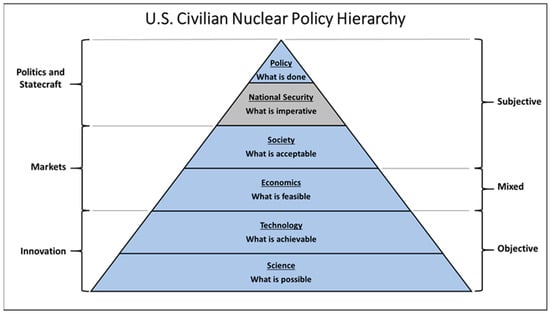

U.S. civilian nuclear policy is framed here as a hierarchy of three broad domains, innovation, markets, and politics/statecraft, thereby spanning from the purely objective laws of science and nature to highly subjective social and political norms and ideals (Figure 1). While the basic sciences and laws of nature dictate what is possible, innovation leverages those laws in the development of technology for deployment within society. Innovation is then constrained by economic feasibility and societal acceptance—if a technology is unaffordable or society rejects it, the technology will not be consumed. A final constraint prior to policy development is national security, which is characterized here as a gray area in the current U.S. civilian nuclear policy debate for reasons that will be evaluated and included in this analysis.

Figure 1.

The proposed hierarchy illustrating the constraints on U.S. civilian nuclear policy, ranging from science to technology to economics to society to national security. National security is the gray area focused on in this paper as the dismissed constraint.

Energy policy, in general, is contingent upon this hierarchy, although national security is often a latent constraint that becomes evident during times of energy crises or shortages. However, national security is a vital concern for which the economics and societal aspects of this energy policy hierarchy may be bypassed, provided the science and technology are achievable. One example is the U.S. military and defense capabilities, which is an evident case for national security but for which there is no market or civilian demand signal. Nonetheless, there is a critical need for an industrial base and supply chain to sustain U.S. manufacturing capacity. While often referenced as the Defense Industrial Base, the overall U.S. industrial base, in civilian and defense sectors, is fundamental to ensuring this industrial capability. Similarly, policies have been deployed in the past to ensure sufficient industrial capacity for the U.S. energy sectors, particularly oil, natural gas, coal, and the electric power sector [26].

The methodology in this paper uses this nuclear policy hierarchy to analyze current U.S. civilian nuclear power policy and identify weaknesses and deficiencies that need to be overcome in order for the U.S. to leverage advanced nuclear reactors as a domestic technology to meet energy security and reliability objectives under carbon constraints and to restore the U.S. as a major global exporter of nuclear technology. To do so, a bottom-up analysis is conducted, beginning with the innovation aspects of the U.S. civilian nuclear power sector, both current and historical. This includes the U.S. definition of advanced nuclear reactors, as given by the U.S. Congress, along with a broad characterization of advanced nuclear reactor designs being proposed and developed. Next, the market aspects of civilian nuclear power are analyzed within the current context of energy resources for the U.S. electric power sector. This includes both economic and societal aspects, meaning costs and societal acceptance. Since levelized cost of electricity (LCOE) is often used in the U.S. for comparison of energy resources and technologies for power generation, a simplified version of LCOE is included in the analysis in order to highlight that national security is a non-monetized benefit of civilian nuclear power. Lastly, the political and statecraft aspects of U.S. civilian nuclear power are analyzed. This is characterized here as the gray area of national security for the U.S. civilian nuclear power policy for reasons that are discussed. The historical aspects represent a necessary review of the U.S. civilian nuclear power legacy. The overall analysis of these domains is then used for making three policy recommendations.

3. Analysis

3.1. Innovation: U.S. Civilian Nuclear Power

Nuclear power provided 18.9% of U.S. electricity generation in 2022 [27]. The current U.S. civilian nuclear fleet comprises thermal light-water reactors (LWRs), either pressurized water reactors (PWRs) or boiling water reactors (BWRs), with solid low-enriched U-235 (LEU) fuel enriched to 3–5%, and light water serving as both the moderator and coolant. Moreover, the fuel cycle is open, meaning that U.S. reactors operate as burners with no fuel recycling. The adoption of PWRs and BWRs extends back to the mid-1950s and the early stages of U.S. nuclear technology development as policymakers debated PWRs, BWRs, sodium graphite, molten salt fast breeder reactors, and other designs under development. Eventually, the decision to go with the PWR was a top–down political decision influenced by the advantages of light water as a coolant compared with that of sodium, the simplicity of the PWR design, and the decision to use PWR technology in the emerging U.S. nuclear navy [28,29]. From this, the U.S. civilian nuclear program expanded using LWR technology throughout the 20th century.

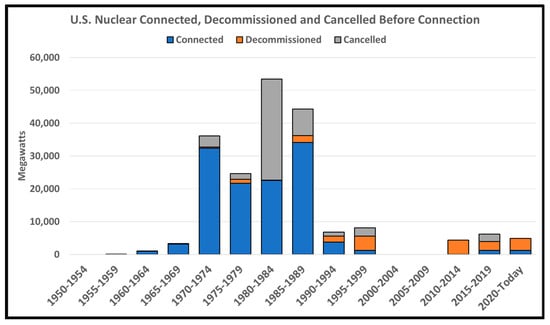

New nuclear construction in the U.S. has been largely dormant since the 1990s (Figure 2). The first new nuclear construction projects in the U.S. in over thirty years began in Georgia, USA, in 2009, with two new reactors planned at Plant Vogtle, and in South Carolina, USA, in 2013, with two new reactors planned at Plant V.C. Summer. Both projects involved Westinghouse AP1000 reactors [30,31,32]. Following several delays and cost overruns, the reactors in Georgia are scheduled to be online by the end of 2023 or the beginning of 2024 [33]. However, construction on the South Carolina reactors was halted in 2017 [34]. These were the first projects launched during President Obama’s efforts to ensure that nuclear power remained a vibrant component of the U.S.’s clean energy strategy, motivated by concerns over climate change and the need for reliable, low-carbon power generation [35]. Prior to this activity, the most recent new nuclear construction project to start in the U.S. was the Harris-1, 980 MWe reactor in North Carolina, USA, in January 1987 [36]. The last nuclear grid connection was the Comanche Peak-2, 1250 MWe reactor in Texas, USA, in April 1993 [37]. The 1210 MWe reactor at Watts Bar-1 was connected to the grid in February 1996, but it experienced significant delays, with construction having started in July 1973 [38]. Moreover, from 1974 to 2017, forty-six reactors on which construction was started were canceled and not connected to the grid [39].

Figure 2.

U.S. nuclear reactor activity since 1955. Reactors connected to grid; reactors decommissioned, and reactors canceled after construction began but before connection to the grid [39,40]. (Data Source: International Atomic Energy Agency’s Power Reactor System).

The decline in U.S. nuclear construction has been attributed to high-interest rates, escalation in construction costs, structural problems in the nuclear industry, overconfidence, public perception, nuclear accidents at Three Mile Island, Chernobyl, and Fukushima, and the inability to compete with less expensive natural gas and subsidized renewable [41,42,43,44].

The Science and Technology of Advanced Nuclear Reactors

Advanced nuclear reactors are classified as fission reactors, fusion reactors, or radioisotope power systems that utilize heat from radioactive decay to generate energy. This paper focuses on fission reactors for power generation. To that end, the U.S. Congress has defined advanced fission reactors, relative to current LWR designs, as “a nuclear fission reactor, including a prototype plant (as defined in sections 50.2 and 52.1 of title 10, Code of Federal Regulations (or successor regulations)), with significant improvements compared to reactors operating on 27 December 2020, including improvements such as the following:

- i.

- Additional inherent safety features;

- ii.

- Lower waste yields;

- iii.

- Improved fuel and material performance;

- iv.

- Increased tolerance to loss of fuel cooling;

- v.

- Enhanced reliability or improved resilience;

- vi.

- Increased proliferation resistance;

- vii.

- Increased thermal efficiency;

- viii.

- Reduced consumption of cooling water and other environmental impacts;

- ix.

- The ability to integrate into electric applications and nonelectric applications;

- x.

- Modular sizes to allow for deployment that corresponds with the demand for electricity or process heat; and

- xi.

- Operational flexibility to respond to changes in demand for electricity or process heat and to complement integration with intermittent renewable energy or energy storage [45].

These improvements are being pursued through various advancements in reactor design characteristics related to fuel material, fuel form, coolant, moderator, reactor type, reactor size, fuel cycle, and neutron spectrum (Table 1). Any combination of these would constitute an advanced reactor design. Although particular efforts are being directed toward fuel and coolant types, especially those of the molten salt/sodium and liquid metal type, as the heat capacities of these materials are much higher than those of light water and allow for high operating temperatures at low to near-atmospheric pressure. This translates to higher efficiencies for transferring heat from the nuclear fuel and, therefore, greater overall efficiencies and increased safety. Due to their modular design, meaning that the reactors are built offsite and transported to the site of deployment, SMRs and microreactors offer flexibility and, in the case of microreactors, transportability, both of which can be leveraged to achieve a level of decentralization by locating highly reliable generation in near proximity to high demand centers.

Table 1.

Design characteristics of advanced nuclear reactors. Information is taken from International Atomic Energy Agency and Holt, 2023 [46,47].

One of the world’s first electricity-generating nuclear power plants was the U.S. Experimental Breeder Reactor-I (EBR-I), a research reactor developed at the Argonne National Laboratory [48]. EBR-I was the world’s first breeder reactor. Beginning in 1964, Argonne National Laboratory designed, built, and demonstrated the Experimental Breeder Reactor-II (EBR-II), which served as the prototype for the Integral Fast Reactor (IFR) [49]. The IFR was tested in the 1990s and demonstrated as being technologically capable of completely shutting down in the event of a loss of coolant accident [50]. However, the program was abandoned in 1994 for non-technical reasons [51]. The U.S. has a history of research and development in advanced nuclear reactors and is currently taking the initiative to leverage that research and development for deployment within the next decade.

The NuScale SMR is a pressurized light-water small modular reactor (SMR) design with enhanced safety features and an expected deployment date of 2027 [52]. NuScale’s SMR, which was certified by the U.S. Nuclear Regulatory Commission (NRC) in February 2023, represents the first-ever SMR to receive U.S. NRC certification [53]. Terrapower’s Natrium technology is a sodium-cooled fast reactor with a molten salt storage system to provide flexibility and load-following capabilities [54]. The Natrium design includes features from the GEH Prism design, a fast reactor that is based on “the proven principles of the EBR-II” [55,56]. In 2021, an existing coal plant site in Wyoming, USA, was selected for construction of the first Natrium reactor. Construction was set to begin in 2023, and an original in-service date of 2028 was projected. However, the Natrium reactor uses high-assay, low-enriched uranium (HALEU) as a fuel, and, according to the U.S. Department of Energy, “Currently, there is a very limited domestic capacity to provide HALEU from either DOE or commercial sources. This presents a significant obstacle to the development and deployment of advanced reactors and increases the risk of private investment to develop an assured supply of HALEU or to support the infrastructure required to produce it” [57,58]. The only commercially available supplier is Russia. Consequently, the project has been delayed for two years since the U.S. does not have the enrichment capacity to supply HALEU fuel [59].

X-energy is partnering with Dow, Inc. to build the first Xe-100 advanced nuclear power plant on a Dow industrial site to provide the facility with process heat and power [60,61]. The Xe-100 is a small modular, pebble-bed, high-temperature gas-cooled reactor (HTGR) that uses meltdown-proof TRISO fuel technology. The Natrium and X-energy projects are receiving support through the U.S. Department of Energy’s Advanced Reactor Demonstration Program (ARDP), which was launched in 2020 to help domestic private industry demonstrate advanced reactors in the U.S. [62]. It has been reported that nine out of ten ARDP-funded projects will need HALEU fuel [63]. Other advanced nuclear reactors in the early development stages include Elysium’s MCSFR (Molten Chloride Salt Fast Reactor) and Flibe Energy’s LFTR (Lithium Fluoride Thorium Reactor). Flibe’s LFTR is unique in that it is a molten-salt reactor operating on the thorium fuel cycle [64].

Advanced nuclear science and technology is not a recent development in the U.S. There is a substantial and sound legacy from which future development and deployment can launch and is launching. Therefore, science and technology are not the only constraints to domestic deployment.

3.2. Markets: Economics and Societal Disposition of U.S. Nuclear Power

In the early stages of U.S. nuclear development, nuclear proponents contended that U.S. electricity demand would be increasing and, even though the U.S. had substantial coal reserves, nuclear power would help extend the life of these reserves and diversify the energy portfolio [65]. Other proponents projected that it was not too much to expect that nuclear-powered electricity generation would be too cheap to meter [66], a prediction that proved to be overly optimistic. Currently, the economics of nuclear power face the challenge of other power generation technologies that have lower costs, are politically favored, and are more amenable to societal preferences. Combined, the economics of nuclear power coupled with society’s perceptions of nuclear power occupy a highly subjective space between nuclear reactor innovation and nuclear power policy (Figure 1). These represent formidable hurdles to the deployment of nuclear power, in general, and advanced reactors, in particular.

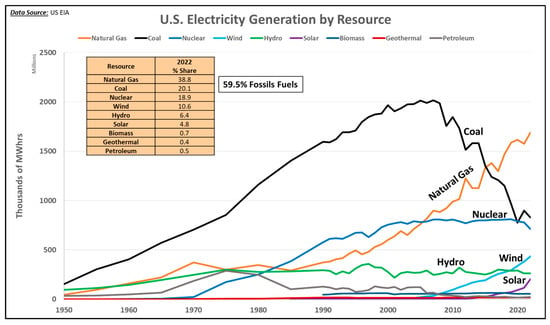

3.2.1. U.S. Nuclear Power Relative to Other Technologies

In 2022, U.S. electric power generation consisted of 38.8% natural gas, 20.1% coal, 18.9% nuclear, 10.6% wind, 6.4% hydroelectric, and 4.8% solar power, with nuclear power essentially being flat since about 2000 (Figure 3). A critical aspect of U.S. energy resource trends for its electric power sector is that each subsequent energy resource development added to, rather than displaced, previous resources. This provided the U.S. with improved reliability and a competitive advantage on the global stage, as well as an enhanced industrial capacity to advance the U.S. economy. America’s energy legacy, then, has been one of adding energy resources and technologies to its economy, thus increasing the diversity of its resource base and its energy technology capabilities. However, this trend currently is not holding as the U.S. is moving away from baseload coal-fired power plants and backfilling, predominantly, with natural gas plants. Previous U.S. energy transitions, then, can be characterized as organic, emergent, and competitive through the exploration, development, and deployment of energy-dense resources to facilitate rapid industrialization, economic development, and greater national security through an increased level of energy self-sufficiency. Here, organic and emergent transitions refer to the growth and development of the U.S. energy and electric power sectors being driven from the bottom up through competition and innovation to not only provide greater access to energy resources but also to develop the most efficient and economically viable technologies for unlocking high-density energy resources, such as nuclear energy, and deploying those resources within the U.S. economy.

Figure 3.

Trend for U.S. electricity generation, 1950–2022 [67].

Energy resource properties and power plant operation characteristics inform policy decisions within the U.S. electric power sector, with reliability, affordability, and carbon emissions being the key considerations (Table 2). Natural gas and coal are abundant domestic U.S. energy resources, and their associated power generation technologies are generally of low cost while capacity factors vary. Coal and natural gas are also transportable in primary form. Coal plants serve as baseload technologies, but the U.S. is shifting away from coal to natural gas combined-cycle plants. Consequently, capacity factors for coal-fired plants have decreased from 0.59 in 2013 to 0.48 in 2022, while capacity factors for natural gas combined-cycle plants increased from 0.49 to 0.57 over that same period [68,69]. Combined-cycle plants are being increasingly used as baseload plants. Given that coal is an onsite storable resource, and natural gas is a just-in-time flow resource subject to upstream conditions, coal can be characterized as a more reliable resource than natural gas. However, natural gas combustion turbines provide the necessary flexibility for load-following and short ramp times compared with coal, which results in low capacity factors for combustion turbines. Coal and natural gas plants are also affordable, mature technologies with generally affordable fuel costs. However, while coal prices tend to be stable, natural gas prices can be highly volatile. Coal and natural gas technologies, then, have unique reliability characteristics and are affordable but are carbon-emitters [70].

Table 2.

Energy resource properties and operation characteristics for U.S. power plants. Capacity factor data are sourced from the U.S. Energy Information Administration [68,69].

Solar and wind are also abundant domestic resources, although the actual primary resources are geographically fixed and cannot be transported in primary form. Moreover, the daily, monthly, and seasonal intermittency and variability of solar and wind combined with the lack of dispatchability for solar- and wind-generated electricity translate to lower capacity factors. In 2022, the capacity factor for utility-scale solar PV in the U.S. was 0.25, and for the wind, it was 0.36. Solar and wind are zero-cost resources, and solar PV and wind turbine construction costs continue to decrease in the U.S., making them cost-competitive, with coal and natural gas at the margins. However, their low capacity factors and intermittency are reliability concerns [71].

As is the case in most countries, U.S. nuclear power is a baseload technology with a 2022 capacity factor of 0.93. However, recent U.S. nuclear construction has proven to be a high-cost prospect for LNPPs [72]. This is creating strong societal and economic headwinds for consideration of new nuclear construction, given that natural gas combined cycle, solar PV, and wind power have lower costs with shorter construction times. While nuclear is a zero-carbon technology, the existing fleet of U.S. nuclear power plants have long ramping times and, therefore, are not dispatchable or load-following.

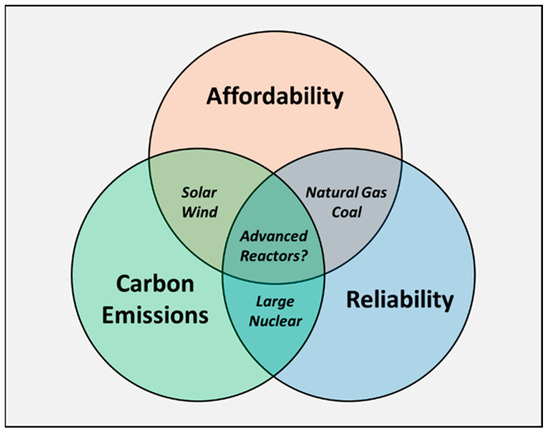

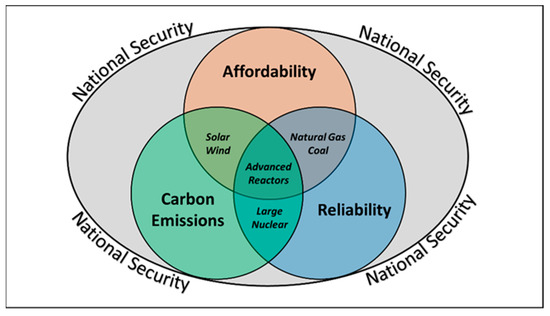

In all, natural gas and coal plants offer reliability and affordability but have carbon emissions. Solar PV and wind offer affordability and zero carbon but lack 24/7 reliability. Large nuclear plants provide reliable, zero-carbon baseload power but currently are not economically competitive at the margins with inexpensive natural gas plants or with solar and wind technologies, particularly if solar and wind are subsidized. As such, each energy resource and power plant technology has unique benefits and limitations with respect to reliability, affordability, and carbon emissions (Figure 4). At question here is whether advanced nuclear reactors can occupy the intersection of all three, particularly given the cost challenges of recent U.S. nuclear projects.

Figure 4.

Venn diagram of three key objectives for power generation technologies. Carbon emission, reliability, and affordability. A key question for this paper is, “Can advanced nuclear reactors meet all three?”.

3.2.2. The Insufficiency of Levelized Cost of Electricity for Nuclear Power

Levelized cost of electricity (LCOE) is a standard metric for comparing power generation technologies on an economic basis. LCOE is defined as the average revenue required per unit of electricity to recover the cost of constructing and operating a power plant. The simplified general calculation of LCOE is given by the following equation:

where t is the year of construction or operation, with t = 0 being the first year of construction; n is the lifetime of plant operation; Ct is capital investment costs in year t; Ot is operation and maintenance costs in year t; Et is electricity generated in year t, and r is the discount rate [73,74,75]. A sale price above LCOE generates a monetary gain, and a sale price below LCOE incurs a monetary loss. The intent of LCOE is to provide a metric for comparing costs across resources and technologies. However, this simplified version of LCOE treats all kWhrs as equal and fungible even though the technologies that generate those kWhrs are operationally different. As given by this equation, LCOE is a quantitative metric, but it is also subjective in that it does not distinguish or account for qualitative operational characteristics and differences across energy resources and technologies, such as baseload, resource availability and storability, ramping time, and load-following capabilities, nor does it account for low- and zero-carbon attributes (Table 2). These constitute non-monetized benefits, and attributes are unaccounted for in the simplified LCOE calculation of Equation (1); yet, they underpin grid reliability. Nonetheless, these benefits could be monetized through incentives that reward baseload capacity, flexibility, and load-following capabilities and penalize carbon emissions. Some markets attempt to adjust for this through capacity markets and other mechanisms [76,77,78,79,80,81,82]. The Lazard analysis of levelized costs for the most common power generation technologies includes an unsubsidized analysis, as well as analyses for LCOE sensitivity to federal tax subsidies, fuel prices, carbon pricing, cost of capital, and cost of firming intermittency. Ranges for unsubsidized LCOE are given in Table 3.

Table 3.

Unsubsidized, levelized costs for common power generation technologies, as analyzed and reported by Lazard [83].

While the simplified LCOE accounts for the amortization period, it does not explicitly account for the technical lifetime of a power plant. For a nuclear power plant, this can be 60-plus years, which is at least twice as long as for other plants [84]. This means that, in the second half of a nuclear plant’s expected lifetime, recapitalization will be required to replace the generation lost from other power plants retiring after having reached their technical end of life, but prior to the nuclear plant reaching its technical end of life. The value prospect for nuclear is long-term. With LCOE as the dominant metric for determining energy resource and power plant technology portfolios, nuclear technology will have difficulty standing up to short-term marginal prices of low-cost natural gas and subsidized renewables.

3.2.3. Societal Disposition toward Advanced Nuclear Technology

While nuclear power has been a highly reliable, low-carbon power generation technology in the U.S., with capacity factors above 0.9 and zero onsite carbon emissions, it has detractors. General arguments against nuclear power often are associated with cost, safety, necessity, and the association of civilian nuclear power with nuclear weapons [85,86,87]. Others see nuclear power as being an ethical decision required for minimizing the impacts of climate change, but the proliferation of nuclear weapons is the most plausible candidate for overturning an ethical decision to deploy nuclear to that end [88]. Some contend that renewable energy alone is the way forward and that nuclear power is unnecessary [89,90,91,92]. Others project that without the inclusion of its carbon reduction benefits, nuclear power expansion is not expected to occur [93]. These competing interests are a fair characterization of the current U.S. nuclear power debate.

Recent Gallup polling in 2023 indicates that “Americans are more supportive of using nuclear energy as a source of electricity in the U.S. now than they have been since 2012”, with 55% “strongly” or “somewhat” favoring it [94]. Gallup polls since 1994 found that Americans tend to favor nuclear power when oil prices are high and are less likely to favor it when oil prices are low. Polling by the Pew Research Center in 2022 indicated somewhat mixed views on the use of nuclear power in the U.S., with 35% saying that the federal government should encourage it and 26% saying that the government should discourage it [95]. The 2022 Pew poll, which was conducted prior to Russia’s invasion of Ukraine, indicated much stronger support for the federal government to encourage solar and wind power technologies. Some studies indicate that opinions on civilian nuclear power are strongly associated with proliferation concerns over nuclear weapons, while others indicate that public opinion is impacted by past accidents at Three Mile Island, Chernobyl, and Fukushima [96,97,98]. In more targeted polling about advanced reactors, a 2023 survey on U.S. public awareness of small modular reactors found that only 20% of respondents had ever heard of small modular reactors, with 67% having never heard of small modular reactors [99].

Public opinion on nuclear power is influenced by social and political circumstances surrounding energy issues at the time of polling, such as high oil and natural gas prices or instability in energy-rich areas of the world [100]. Societal acceptance is also influenced by economics, which, in turn, is impacted not only by market prices of oil, natural gas, and coal but also by subsidies for renewable energy, such as solar and wind. Given that nuclear power is a reliable technology with the highest capacity factor of all generation technologies and that it emits no onsite carbon, it is understandable that the U.S.’s acceptance of nuclear power is increasing. However, nuclear power remains a long-term investment, so short-term public opinion polls on nuclear power will not necessarily contribute to a stable, principled foundation on which to develop a long-term policy.

3.3. Politics and Statecraft: The Gray Area of National Security in the U.S. Nuclear Policy

The U.S. nuclear science and technology enterprise had its beginnings in being a military application, demonstrating through the Manhattan Project that nuclear fission could be harnessed and applied to military weaponry [101]. Realizing that this science and technology could not be contained and monopolized by the U.S. long-term, concerns over the proliferation of nuclear weapons dominated early U.S. debates as to how best to control this new energy resource and technology [102]. Inherent in these concerns was the U.S. losing its advantage to the Soviet Union. Consequently, U.S. civilian nuclear policy originated as a top–down national security issue with the establishment of the Atomic Energy Commission (AEC) in 1946 and eventually led to the establishment of the International Atomic Energy Agency (IAEA) to provide stewardship over an emerging global nuclear fuel and technology ecosystem. The extension of nuclear science into the U.S. civilian sector remained a technology hurdle. President Eisenhower’s Atoms for Peace program was a two-fold diplomatic framework that leveraged the potential value of nuclear power for civilian purposes while at the same time purposing to keep the U.S. engaged in the global nuclear network and on the leading technological edge of reactor development [102,103]. Anticipating increased U.S. demand for electricity, and even though coal, oil, and natural gas remained plentiful, H.D. Smyth contended that nuclear power represented the energy future for electric power generation and would bolster long-term energy security [65].

In 1955, the original principles of U.S. nuclear power policy were explicitly stated. Not only would the U.S. work to prevent the diversion of fissionable materials to non-peaceful uses, but the U.S. also would advance its domestic nuclear science, technology, and engineering to counter any efforts by its strategic competitor, at that time the Soviet Union, to establish civilian nuclear partnerships with other countries [104].

“In the interests of national security, U.S. programs for the development of the peaceful uses of atomic energy should be directed toward:

a. Maintaining U.S. leadership in the field, particularly in the development and application of atomic power;

b. Using such U.S. leadership to promote cohesion within the free world and to forestall successful Soviet exploitation of the peaceful uses of atomic energy to attract the allegiance of the uncommitted peoples of the world;

c. Increasing progress in developing and applying the peaceful uses of atomic energy in free nations abroad;

d. Assuring continued U.S. access to foreign uranium and thorium supplies;

e. Preventing the diversion to non-peaceful uses of any fissionable materials provided to other countries.

U.S. programs for the development of the peaceful uses of atomic energy should be carried forward as rapidly as the interests of the United States dictate, seeking private financing wherever possible”[104].

The civil–military dual utility of atomic energy and the understanding that this dual utility could not be monopolized by the U.S. compelled U.S. policymakers to deal with nuclear technology as having a value proposition that transcended other energy commodities such as coal, oil, and natural gas. As such, U.S. civilian nuclear power was originally treated as a technology of special dispensation requiring a policy framework structured around novel national security principles. Early policymakers understood that they were dealing with matters of statecraft, not only technology issues [102].

Nuclear technology was deemed to have a strategic national security value proposition that was measured in terms of technological advantage relative to the Soviet Union—America’s great power competitor in the second half of the 20th century. Much of the world was in economic recovery or economic development following World War II, and energy security was foundational to both. Therefore, the relative advantage in nuclear technology translated to a relative advantage in global influence—the advantage and influence both great powers at that time were competing to gain. In 1954, the U.S. enacted the Atomic Energy Act for the development, use, and control of atomic energy for the general welfare, domestically and globally, to promote world peace and to increase the standard of living [105]. Section 123 of the Atomic Energy Act, entitled “Cooperation with Other Nations”, dictated the terms under which the U.S. nuclear companies exported their technologies and provided technical assistance to another country. As of 5 December 2022, the U.S. had twenty-three so-named 123 Agreements covering forty-seven countries [106]. As such, the U.S. originally dealt with nuclear power as both a science and technology issue and as a matter of statecraft and diplomacy by way of 123 Agreements. It also, early on, was a bipartisan issue as Republicans and Democrats competed for which political party would be the champion for U.S. nuclear power [107,108].

However, the national security implications of civilian nuclear power currently are a gray area for the U.S. nuclear policy. While affordability, reliability, low-carbon, flexibility, and resource storability are accepted value propositions, with efforts to monetize them, the national security value proposition of nuclear is addressed more perfunctorily by a general acknowledgment, not by formal measures to monetize that value proposition—although it is the original first principle of the U.S. nuclear policy.

4. Discussion and Policy Recommendations

It is a fair question to ask, “If the U.S. market does not select nuclear power on the basis of cost, is the absence of nuclear power from the U.S. power sector a reasonable outcome?” Similarly, “If the U.S. society does not support nuclear power, is it a reasonable outcome for nuclear power to be precluded, by policy, from the U.S. power sector?” Standard market forces of economic viability and societal acceptance might suggest that the answer to both questions is “yes”. It means that if the market and society do not support nuclear power, then it is a reasonable outcome for nuclear power technologies to be excluded from the U.S. economy. However, relegating U.S. civilian nuclear power to that of a market commodity and submitting its fate to market forces alone and popular opinion circumvents and disregards the original first principles of nuclear power as a national security issue (Figure 1) [104]. Moreover, the energy market is not fundamentally a free and fair market as long as resources continue to be subsidized and favored by policymakers. Such is the case for renewables, which are beneficiaries of the recently proposed Inflation Reduction Act. Nonetheless, even if the market were free, fair, and without subsidies, the contention here is that nuclear power has such a core national security value proposition that market forces alone are insufficient signals for excluding it. Americans expect that the U.S. Government will protect and defend the United States and, in doing so, will commit resources to ensure their freedoms. This paper proposes that the national security value proposition of nuclear power should be incorporated into the 21st-century U.S. efforts to revitalize its nuclear enterprise, but to do so will require addressing several domestic and global challenges.

4.1. Domestic Challenges

The science of advanced nuclear reactors is sound and has precedent within the U.S. legacy of nuclear research and development, so advanced reactors are not fundamentally constrained by the underlying science and technology. Commercial-scale development and deployment of advanced reactor technologies within the U.S. power generation sector face several hurdles with respect to the economics and societal disposition of advanced nuclear.

Within the market space, social and political efforts are reframing the energy policy debate to focus on climate change and low carbon emissions, as amplified by President Biden’s elevation of climate change to the center of U.S. foreign policy and national security [109]. To that end, current efforts to keep economically challenged large nuclear plants operating are primarily for meeting carbon emission targets and climate objectives while maintaining grid reliability [110]. Existing nuclear power, then, is not excluded altogether from this reframing, nor is advanced nuclear power, as evidenced by the Advanced Reactor Demonstration Program (ARDP) discussed previously. However, commoditizing nuclear power, particularly advanced nuclear power, as a market commodity to compete with coal, oil, natural gas, solar, and wind while continuing to use LCOE as the dominant metric for selecting across these technologies is problematic for the long-term prospects of nuclear. It dismisses the baseload and reliability value of nuclear and does not address fundamental structural issues constraining the potential deployment of advanced nuclear reactors.

Recent experience with the construction of the AP1000 reactors in Georgia and South Carolina, USA, exposed the difficulties of reviving an industry that has been dormant for over three decades. While a recent study reported that the experience with the first-of-a-kind (FOAK) AP1000 units in Georgia, USA, will be highly beneficial should a utility opt for the next AP1000 project, it remains speculative as to whether major improvements can be made for the second-of-a-kind deployment of these designs [111]. Nonetheless, a key structural issue that should be of concern is the need for a mature supply chain. This will be particularly challenging for advanced nuclear reactors without a strong demand signal and book of business for spinning up a secure and efficient supply chain. Natural gas power plants, solar PV facilities, and wind turbines already have established supply chains that afford them a significant near-term competitive advantage in cost and in meeting construction and management timelines. This will be a challenge as construction costs for advanced reactors are difficult to predict, and utilities are hesitant to assume the risk of a FOAK design [112]. Moreover, public opinion may be influenced not only by cost but also by concerns over safety and the question of necessity if there is the perception that zero-carbon solar PV and wind turbines alone can substitute for zero-carbon advanced nuclear reactors.

Currently, the demand signal for power generation technologies comes from private utilities, with the costs for those technologies paid for by ratepayers within the utility’s service area. The U.S. electricity market structure plays a leading role in an energy generation mix and selection of technologies and has a particular impact on nuclear power. In traditional vertically-integrated rate-regulated markets, the utility is given a monopoly market with rates set by regulators. Utilities operating within a regulated market structure are afforded a guaranteed consumer base and a generally stable revenue stream on which it can develop integrated resource plans around a diverse portfolio of energy resources and technologies in order to optimize for cost, reliability, and low carbon over the long term. Utilities operating within a deregulated structure operate within a competitive market where rates are market-based rather than regulator-set [113]. The competitive market structure has created concerns as to whether such a market can allocate sufficient and adequate levels of competitive generation and provide for future capacity [113].

Since 2013, twelve nuclear reactors have been shut down in the U.S., with another three reactors planned for shutdown by 2025. An additional twenty reactors faced permanent shutdown but were spared by state intervention via subsidies to keep the reactors in operation. For most of these thirty-five reactors, markets and economics were an underlying issue [114]. Of the thirty-five reactors, thirty are located in states operating under non-traditional competitive market structures [115]. In the U.S., individual states determine their own market structure, and in states with a competitive market structure and aggressive renewable energy standards, nuclear reactors face particularly difficult economics.

4.2. Global Challenges: U.S. Nuclear Disposition Relative to Other Countries

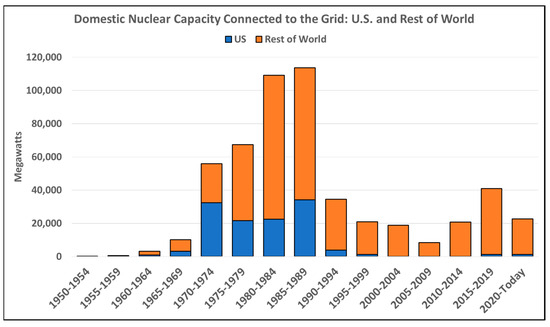

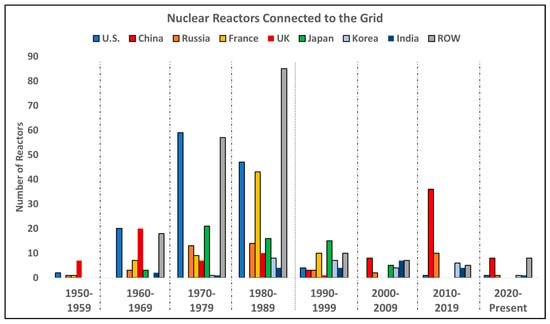

The U.S. has transitioned from being the 20th-century global leader in civilian nuclear power, in terms of domestic deployment and global exports, to a nation searching for ways to revive its once-dominant nuclear enterprise [103,116,117,118]. This is particularly relevant given the U.S. civilian nuclear position relative to other countries and the national security implications of that position (Figure 5 and Figure 6). Given the decline in new U.S. nuclear construction, the threat of premature closure of existing reactors, and with no new large nuclear power plant construction projects projected, it is reasonable to assume that at the completion of Vogtle Units 3 and 4 in Georgia, USA, large nuclear construction in the U.S. may conclude.

Figure 5.

U.S. nuclear capacity connected to the grid relative to the rest of the world [119]. (Data Source: International Atomic Energy Agency’s Power Reactor System).

Figure 6.

Comparison of nuclear reactors connected to the grid for leading civilian nuclear power countries [119]. (Data Source: International Atomic Energy Agency’s Power Reactor Information System).

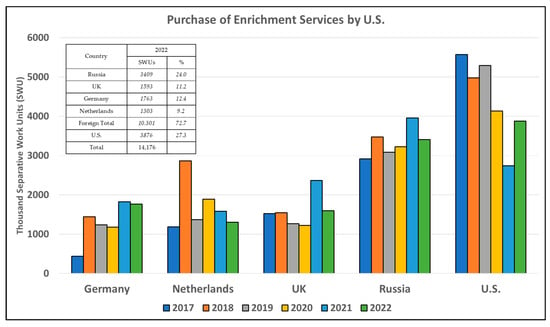

Currently, China leads the world in reactors under construction and, since 2000, has led the world in reactors connected to the grid (Table 4). According to the World Nuclear Association, “The USA has been overtaken in world markets by Russia and South Korea in securing export contracts, particularly for nuclear power reactors. China opted for a US design—the Westinghouse AP1000—as its standard Generation III reactor in 2007, but there has not been much else. Czech, Indian, South African, and Saudi Arabian plans open opportunities” [120]. Chinese nuclear vendors operate under what is characterized as “the government’s powerful industrial policy support”, while Russia’s state-owned nuclear corporation, Rosatom, has nearly monopolized the supply of nuclear assemblies in Eastern Europe [121,122]. Some predict that nuclear power for state-owned enterprises, such as those in China and Russia, are likely to have a bright future relative to liberalized markets, such as in the U.S., where public opinion, public opposition, political ideologies, and market competition serve as challenges to new nuclear projects [123]. Regarding nuclear fuel, the U.S. has resorted to outsourcing its uranium supply and enrichment services, reflecting the consequences of a short-sighted nuclear power policy and leading to additional structural deficiencies in the U.S. nuclear enterprise (Figure 7). Furthermore, in 2005, the U.S. Nuclear Regulatory Commission (NRC) issued a construction authorization for a Mixed Oxide Fuel Fabrication Facility, with construction starting two years later [124]. The NRC terminated the construction authorization in 2019. The project was about 70% complete and had a cost of at least $7.7 billion, which was above the original estimate of $4.9 billion [125].

Table 4.

Nuclear reactors connected to the grid or under construction globally since 2000 [119]. (Data Source: International Atomic Energy Agency’s Power Reactor Information System).

Figure 7.

Purchase of enrichment services by U.S. civilian reactor owners from 2017 to 2022 [126] (Data Source: U.S. Energy Information Administration.

China and Russia are U.S. competitors—economically, militarily, geopolitically, and strategically [127,128,129,130]. Currently, the U.S. is lagging behind both countries in civilian nuclear deployment. If nuclear power was solely a carbon emissions and global climate issue, lagging behind Russia and China in nuclear deployment may not necessarily be a priority concern for the U.S. as deploying more zero-carbon nuclear power would forego future carbon emissions. However, as anticipated by early U.S. civilian nuclear power policymakers, a relative advantage in nuclear technology translates to a relative advantage in global influence—an advantage and influence that Russia and China are competing to gain through civilian nuclear collaboration with other countries [103,131,132,133,134,135]. Such competition between great powers is inherent throughout history, and it should not be met with panic. Rather, it should be met with building the institutional and industrial capacity to compete and win. In the case of nuclear power, the world is at a critical moment when energy security, climate change, and the threat of disruptions to the global energy network are merging into a perfect storm of security-related concerns. Within this perfect storm, a relative advantage in civilian nuclear science is the national security proposition for civilian nuclear power, as articulated by early U.S. civilian nuclear policymakers.

As previously discussed, the U.S. is facing challenges in the domestic deployment of advanced nuclear power. At the same time, the U.S. perhaps faces complex challenges to ramp up global exports. At the center of these challenges are the U.S. nuclear industrial base and supply chain. For the past three-plus decades, the very time span during which U.S. nuclear construction was dormant, China and Russia established mature, reliable, and, increasingly, domestically-sourced supply chains for efficient construction and deployment of nuclear reactors [122]. China and Russia were able to accomplish this in a fairly short period of time because their top–down state-owned structure not only gives them an advantage in decision-making but also in operating off of state treasuries while U.S. nuclear vendors operate from a private sector, profit-driven position. Part of the challenge, then, is to reestablish the national security proposition for U.S. nuclear while keeping it as a private endeavor.

4.3. Operationalizing the National Security Value of U.S. Advanced Nuclear Power: A Focus on the Industrial Base

This paper contends that the national security value proposition for civilian nuclear power, as proposed by early U.S. policymakers, is a gray area in current U.S. nuclear power policy and is not incorporated into the traditional model for selecting energy resources and technologies for the electric power sector. Advanced nuclear reactors offer a renewed opportunity for the U.S. to reestablish itself as a global civilian nuclear competitor while restoring national security as the overarching priority based on the first principles of the U.S. nuclear policy (Figure 8). To that end, three recommendations are offered here.

Figure 8.

An augmented Venn diagram of the three key objectives for power generation technologies. Advanced nuclear reactors offer a renewed opportunity for the U.S. to reestablish itself as a global civilian nuclear competitor while restoring national security as the overarching priority based on first principles of U.S. nuclear power policy.

First, the nuclear industrial base and supply chain deficiencies should be prioritized and developed utilizing the defense industrial base model. Currently, the U.S. nuclear industry is relying on demand signals from utilities to build up a book of business to establish the supply chain. However, this places the burden on the individual ratepayers within markets where utilities have opted for advanced nuclear reactors. As previously discussed, this will be a particular challenge for competitive electricity markets. Moreover, while operational characteristics such as reliability, flexibility, and baseload could be monetized, the national security value of nuclear power is a different prospect as, by definition, it is a national-level proposition that will benefit all U.S. citizens. Therefore, it should be paid for by U.S. taxpayers, not only the ratepayers within a utility’s electricity market. This being the case, the recommendation here is for the U.S. Congress to appropriate funds for the nuclear industrial base to ensure that the capacity of that industrial base can be sustained even when market signals cannot sustain it. This is not an unprecedented approach. The defense industrial base is congressionally appropriated, is bipartisan, and is built on the principles of ensuring that the U.S. has the industries to support vital national interests and national security, but it is executed by private industry. Similarly, funding to stand up and sustain the industrial base for advanced nuclear reactors can be appropriated by Congress while being executed by private U.S. vendors.

While efforts such as the Advance Reactor Development Program incentivize advanced reactor development and deployment in select locations, the private utility sector alone may not create sufficient demand signals in these early stages of ANR development. An option is to leverage U.S. military bases and installations to create a demand signal [136]. Grid security is a priority for the military; therefore, isolating these installations from the national grid has a national security value proposition of its own. Deploying advanced nuclear reactors, particularly SMRs and microreactors, at these installations can provide grid security while also creating a consistent demand signal [137]. SMRs, which range from 20 MW to 300 MW in capacity, are appropriate for large, permanent military bases, primarily for power generation. For military installations, such as forward-operating sites, microreactors offer operating characteristics not only for power generation but also for desalination if forward-operating sites call for and allow it. Moreover, microreactors are sufficiently small in size, and they can be mobilized and deployed at remote locations, thereby reducing the time required for fuel resupply. A promising design is the heat pipe-cooled microreactor, which is essentially a solid-state design that offers advantages such as strong negative feedback, long life, robustness, an independent emergency rod shutdown system, and passive heat removal [138]. Mobility and site flexibility are novel and key benefits of microreactors. As military applications of SMRs and microreactors develop into state-of-the-art, the U.S. industry will be looking for economically feasible state-of-the-shelf technologies for deployment within the U.S. economy. Beyond their utility for commercial power generation, the smaller-sized SMR and microreactor units hold promise for remote industrial applications such as hard rock mining and oil and gas development, as well as for energy-intensive facilities such as data centers. Additionally, SMRs that use high heat capacity molten salts have increased utility for industrial processing requiring high temperatures.

Second, in conjunction with leveraging military installations to create a demand signal for advanced reactors, the U.S. Department of Defense (USDoD) should be charged with conducting a nuclear industrial base review similar to that required by Executive Order 13,806 for the Defense Industrial Base [139]. Market analysis has been performed for microreactors, and supply chain analyses have been conducted for U.S. nuclear power in general [140,141]. However, an industrial base analysis will look not only at supply chains but also at domestic manufacturing capacity and opportunities for mutual collaboration with allied global partners in order to increase economic and industrial efficiencies. The National Technology and Industrial Base (NTIB) could be leveraged for exploring and shaping potential allied partnerships around nuclear manufacturing, global export agreements, and the nuclear fuel cycle [142]. The U.S. DoD, alongside Congress and the Defense Industry, have developed a cohesive, competitive, and well-understood requirement-based approach to resourcing U.S. defense. It has successfully maintained a competitive defense industry that supports not only US National Security needs but those of its allies. Maintaining strategic and technological advantage in military capability is understood, which includes private industries as well as a diverse supply chain and installations, shipyards, and geographically dispersed military bases.

Last, for the U.S. to reassert itself as a competitor in global nuclear exports, it needs to restructure its 20th-century approach, which operated from a position of relative dominance in nuclear expertise. There was a time when the U.S. was not only the preferred nuclear partner but it was the dominant nuclear partner in terms of nuclear technology. Leveraging 123 Agreements, the U.S. could strike deals with other countries and dictate conditions on U.S. terms. These terms generally aligned with original U.S. nuclear policy principles to prevent the diversion to non-peaceful uses of any fissionable materials provided to other countries [104]. U.S. nuclear vendors benefitted from this position of dominance and operated from a sell-side position where they sold nuclear reactors to countries that had limited alternatives. The 21st century has unfolded much differently. As U.S. nuclear construction went dormant, Russian and Chinese state-owned nuclear enterprises occupied the space vacated by the U.S. and now hold a strong position in domestic deployment and global exports. Russian and Chinese state-owned enterprises are in a position to function as vertically-integrated corporations offering a range of services, including construction, operation, maintenance, security, finance, education, and decommissioning. U.S. nuclear vendors accustomed to operating from a sell-side posture as per the 20th-century model do not necessarily have sufficient institutional capacity to function as a vertically-integrated entity offering a range of services competitive with those of a state-owned enterprise.

It is recommended here that the U.S. shift away from its 20th-century sell-side U.S. vendor model to a buy-side model focused on a country’s broader energy and security needs. This could be brokered by a third-party integrator that can work with multiple U.S. nuclear partners, as identified in DoD’s nuclear industrial base review and included in the National Technology and Industrial Base. The third-party integrator would leverage U.S. advanced nuclear offerings with advanced nuclear offerings of allied partners in a best-of-business approach that includes reactor technology, construction, operation, maintenance, security, finance, education, and decommissioning. This would serve as a multi-partner vertically-integrated entity that could compete with state-owned nuclear enterprises. Building off of the nuclear industrial base review and a goal of having at least two Small Modular Reactor vendors fully productionized for domestic and international deployment and national security requirements, the DoD could lead a requirement-based competition to obtain 10 SMRs built and operating within 10 years. This aligns with how other strategic acquisitions are developed where there is a need for a fully funded system design and development effort, considered non-recurring engineering, that would progress two vendors into full-rate production. This is also consistent with the recent U.S. Department of Energy’s liftoff strategy, except that it follows a DoD acquisition model, not one of piecing together first-of-a-kind risk and asking the ratepayers to assume that risk [143].

5. Conclusions

This paper argues that the future of U.S. advanced nuclear reactors is fundamentally a policy issue contingent upon not only the science and technology of advanced nuclear reactors but also economics and societal aspects, both of which are subjective and complex. However, the commoditization of U.S. nuclear power as another market commodity has rendered numerous existing U.S. nuclear reactors uncompetitive against less-expensive natural gas and subsidized renewables and is limiting U.S. participation in the global export market. This is creating headwinds for the development and deployment of advanced nuclear reactors in the U.S. on the grounds of economics and societal acceptance.

This paper further contends that the national security value proposition of nuclear power, as proposed by early U.S. policymakers, has been marginalized, if not dismissed, from U.S. nuclear power policy and is not incorporated into the traditional model for selecting energy resources and technologies for the electric power sector and, therefore, is a gray area in current U.S. nuclear power policy. As such, advanced nuclear reactors offer a renewed opportunity for the U.S. to reestablish itself as a global civilian nuclear competitor while restoring national security as the overarching priority based on the first principles of U.S. nuclear policy. To that end, this paper makes three following recommendations:

- The fledgling status of the U.S. advanced nuclear reactors and the U.S. nuclear industrial base and supply chain represent a structural deficiency that should be prioritized. The recommendation here is for the U.S. Congress to engage in ensuring that the capacity of that industrial base can be sustained even when market signals cannot sustain it. While the private utility sector alone may not create sufficient demand signals in these early stages of advanced nuclear reactor development, an option is to leverage the U.S. military bases and installations to create an early and consistent demand signal;

- Charge the U.S. Department of Defense with conducting a nuclear industrial base review to evaluate not only supply chains but also domestic manufacturing capacity and opportunities for mutual collaboration with allied global partners in order to increase economic and industrial efficiencies;

- Shift from a sell-side nuclear vendor model for global exports to a buy-side model brokered by a third-party integrator that can work with multiple U.S. nuclear partners, as identified in the proposed DoD nuclear industrial base review.

Author Contributions

Conceptualization, D.G.; methodology, D.G.; validation, D.G. and M.H.; formal analysis, D.G.; investigation, D.G. and M.H.; resources, D.G.; data curation, D.G.; writing—original draft preparation, D.G. and M.H.; writing—review and editing, D.G. and M.H.; visualization, D.G. and M.H.; supervision, D.G.; project administration, D.G. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

All data are publicly available, as referenced in this paper.

Acknowledgments

The authors acknowledge Brendan Shanahan, Masters of International Policy, Center for International Trade and Security, School of Public and International Affairs, University of Georgia, and Jose Cartagena, Masters of International Policy, Center for International Trade and Security, School of Public and International Affairs, University of Georgia, for their diligent efforts in data collection and compilation.

Conflicts of Interest

The authors declare no conflict of interest in the design of this study, in the collection, analyses, or interpretation of data, in the writing of the manuscript, or in the decision to publish the results.

References

- Tice, D. Fastest Path to Universal Energy? Let the Market Decide. World Economic Forum, 9 May 2014. Available online: https://www.weforum.org/agenda/2014/05/africa-forum-energy-access-social-entrepreneur/ (accessed on 18 May 2023).

- Bade, G. Electricity Markets: States Reassert Authority over Power Generation. Utility Dive, 15 October 2018. Available online: https://www.utilitydive.com/news/electricity-markets-states-reassert-authority-over-power-generation/539658/ (accessed on 18 May 2023).

- Hartman, D. No Administration, Conservative or Liberal, Should Pick Winners and Losers. National Review, 19 January 2018. Available online: https://www.nationalreview.com/2018/01/conservative-energy-policy-let-market-decide/ (accessed on 18 May 2023).

- United States Climate Alliance. Governors’ Climate Resilience Playbook. 2021. Available online: https://static1.squarespace.com/static/5a4cfbfe18b27d4da21c9361/t/6186adf2875b2e694bdd0434/1636216308401/USCA+2021+Governors%27+Climate+Resilience+Playbook.pdf (accessed on 18 May 2023).

- Gattie, D. U.S. Energy and Electric Power Policy: The National Security Imperative. In Proceedings of the North Dakota Association of Rural Electric Cooperatives Association Annual Meeting, Mandan, ND, USA, 18–20 January 2022. [Google Scholar]

- Wilson, M.M. Poised to Enact Sweeping Energy, Climate Plan. E&E News Energy Wire. 31 March 2022. Available online: https://www.eenews.net/articles/md-poised-to-enact-sweeping-energy-climate-plan/ (accessed on 18 May 2023).

- United States Department of State and the United States Office of the President, 2021. The Long-Term Strategy of the United States: Pathways to Net-Zero Greenhouse Gas Emissions. Washington DC, November 2021. Available online: https://www.whitehouse.gov/wp-content/uploads/2021/10/US-Long-Term-Strategy.pdf (accessed on 18 May 2023).

- Tollefson, J. IPCC’s starkest message yet: Extreme steps needed to avert climate disaster. Nature 2022, 604, 413–414. [Google Scholar] [CrossRef]

- White House Briefing Room. Executive Order on Tackling the Climate Crisis at Home and Abroad. 27 January 2021. Available online: https://www.whitehouse.gov/briefing-room/presidential-actions/2021/01/27/executive-order-on-tackling-the-climate-crisis-at-home-and-abroad/ (accessed on 18 May 2023).

- Solomon, B.D.; Krishna, K. The coming sustainable energy transition: History, strategies, and outlook. Energy Policy 2011, 39, 7422–7431. [Google Scholar] [CrossRef]

- Carley, S.; Konisky, D.M. The justice and equity implications of the clean energy transition. Nat. Energy 2020, 5, 569–577. [Google Scholar] [CrossRef]

- Jacobson, M.Z. 100% Clean, Renewable Energy and Storage for Everything; Cambridge University Press: Cambridge, MA, USA, 2020. [Google Scholar]

- Faturahman, A.; Oktavyra, R.D.; Aris; Widya, T.R.; Habibillah, T.R. Observation of The Use of Renewable Energy Charging Infrastructure in Electric Vehicles. In Proceedings of the 2022 International Conference on Science and Technology (ICOSTECH), Batam City, Indonesia, 3–4 February 2022; pp. 1–9. [Google Scholar] [CrossRef]

- Bruggers, J. New Faces on a Vital National Commission Could Help Speed a Clean Energy Transition. Inside Climate News. 15 February 2022. Available online: https://insideclimatenews.org/news/15022022/ferc-clean-energy-transition/ (accessed on 30 March 2023).

- Tyson, A.; Funk, C.; Kennedy, B. Americans Largely Favor U.S. Taking Steps to Become Carbon Neutral by 2050. Pew Research Center. 1 March 2022. Available online: https://www.pewresearch.org/science/2022/03/01/americans-largely-favor-u-s-taking-steps-to-become-carbon-neutral-by-2050/ (accessed on 21 April 2023).

- Kemp, J. Global Energy Transition Already Well Underway. Reuters, 11 September 2020. Available online: https://www.reuters.com/article/uk-global-energy-kemp-idUKKBN2621W9 (accessed on 21 April 2023).

- Richard, C. Energy Transition Underway as Global Emissions Flatline. Wind Power Monthly, 11 February 2020. Available online: https://www.windpowermonthly.com/article/1673646/energy-transition-underway-global-emissions-flatline (accessed on 21 April 2023).

- S & P Global. What Is Energy Transition? 24 February 2020. Available online: https://www.spglobal.com/en/research-insights/articles/what-is-energy-transition (accessed on 21 April 2023).

- Alvarez, G. More Proof the Clean Energy Transition Is Well Underway: An Oil and Gas Major Embraces Renewables. The Power Line, 4 June 2021. Available online: https://cleanpower.org/blog/more-proof-the-clean-energy-transition-is-well-underway-an-oil-and-gas-major-embraces-renewables/ (accessed on 21 April 2023).

- Nuclear Power in the USA. 2023. World Nuclear Association. Available online: https://www.world-nuclear.org/information-library/country-profiles/countries-t-z/usa-nuclear-power.aspx (accessed on 14 July 2023).

- Peakman, A.; Merk, B. The Role of Nuclear Power in Meeting Current and Future Industrial Process Heat Demands. Energies 2019, 12, 3664. [Google Scholar] [CrossRef]

- Saeed, R.M.; Worsham, E.K.; Choi, B.H.; Joseck, F.C.; Popli, N.; Toman, J.; Mikkelson, D.M. Industrial Requirements Status Report and Down-Select of Candidate Technologies (No. INL/RPT-23-73026-Rev000); Idaho National Laboratory (INL): Idaho Falls, ID, USA, 2023. [Google Scholar]

- International Atomic Energy Agency, 2017. Industrial Applications of Nuclear Energy, IAEA Nuclear Energy Series No. NP-T-4.3. Available online: https://www-pub.iaea.org/MTCD/Publications/PDF/P1772_web.pdf (accessed on 8 August 2023).

- Brown, N.R. Engineering demonstration reactors: A stepping stone on the path to deployment of advanced nuclear energy in the United States. Energy 2021, 238, 121750. [Google Scholar] [CrossRef]

- Bistline, J.; James, R.; Sowder, A. Technology, Policy, and Market Drivers of (and Barriers to) Advanced Nuclear Reactor Deployment in the United States after 2030. Nucl. Technol. 2019, 205, 1075–1094. [Google Scholar] [CrossRef]

- Diaz, M.N. U.S. Energy in the 21st Century: A Primer; Congressional Research Service: Washington, DC, USA, 2021.

- Energy Information Administration. 2023. Electricity Data Browser. Available online: https://www.eia.gov/electricity/monthly/epm_table_grapher.php?t=table_1_01 (accessed on 15 May 2023).

- Weinberg, A.M.; Lewis, H.W. The First Nuclear Era: The Life and Times of a Technological Fixer. Phys. Today 1995, 48, 63–64. [Google Scholar] [CrossRef]

- Perry, R.; Alexander, A.J.; Allen, W.; DeLeon, P.; Gándara, A.; Mooz, W.E.; Rolph, E.S.; Siegel, S.; Solomon, K.A. Development and Commercialization of the Light Water Reactor, 1946–1976 (Vol. 2180); Rand Corporation: Santa Monica, CA, USA, 1977; p. 8. [Google Scholar]

- Hargreaves, S. Obama Gives $8 Billion to New Nuke Plants. CNN Money, 16 February 2010. Available online: https://money.cnn.com/2010/02/16/news/economy/nuclear/ (accessed on 15 June 2023).

- United States Nuclear Regulatory Commission. Summer, Unit 3 Combine License No. NPF-94. Available online: https://www.nrc.gov/reactors/new-reactors/large-lwr/col/summer/col3.html (accessed on 12 June 2023).

- United States Nuclear Regulatory Commission. Issued Combined Licenses and Limited Work Authorizations for Vogtle, Units 3 and 4. Available online: https://www.nrc.gov/reactors/new-reactors/large-lwr/col/vogtle.html (accessed on 12 June 2023).

- Amy, J. Third Nuclear Reactor Reaches 100% Power Output at Georgia’s Plant Vogtle. AP News, 29 May 2023. Available online: https://apnews.com/article/nuclear-reactor-georgia-power-plant-vogtle-63535de92e55acc0f7390706a6599d75 (accessed on 31 May 2023).

- Stelloh, T. Construction Halted at South Carolina Nuclear Power Plant. NBC New, 31 July 2017. Available online: https://www.nbcnews.com/news/us-news/construction-halted-south-carolina-nuclear-power-reactors-n788331 (accessed on 15 June 2023).

- House, W. Obama Administration Announces Actions to Ensure That Nuclear Energy Remains a Vibrant Component of the United States. White House Briefing Room, 6 November 2015. Available online: https://obamawhitehouse.archives.gov/the-press-office/2015/11/06/fact-sheet-obama-administration-announces-actions-ensure-nuclear-energy (accessed on 15 June 2023).

- International Atomic Energy Agency. Power Reactor System. Harris-1. Available online: https://pris.iaea.org/PRIS/CountryStatistics/ReactorDetails.aspx?current=704 (accessed on 14 July 2023).

- International Atomic Energy Agency. Power Reactor System. Comanche Peak-2. Available online: https://pris.iaea.org/PRIS/CountryStatistics/ReactorDetails.aspx?current=730 (accessed on 14 July 2023).

- International Atomic Energy Agency. Power Reactor System. Watts Bar-1. Available online: https://pris.iaea.org/PRIS/CountryStatistics/ReactorDetails.aspx?current=699 (accessed on 14 July 2023).

- Reuters. U.S. Nuclear Reactors That Were Cancelled after Construction Began. 31 July 2017. Available online: https://www.reuters.com/article/toshiba-accounting-westinghouse-reactors/factbox-u-s-nuclear-reactors-that-were-canceled-after-construction-began-idINKBN1AG280 (accessed on 12 June 2023).

- International Atomic Energy Agency. United States of America. Available online: https://pris.iaea.org/pris/CountryStatistics/CountryDetails.aspx?current=US (accessed on 12 June 2023).

- Hultman, N.; Koomey, J. Three Mile Island: The driver of US nuclear power’s decline? Bull. At. Sci. 2013, 69, 63–70. [Google Scholar] [CrossRef]

- E Hultman, N.; Koomey, J.G. The risk of surprise in energy technology costs. Environ. Res. Lett. 2007, 2, 034002. [Google Scholar] [CrossRef]

- Komanoff, C. Ten Blows That Stopped Nuclear Power: Reflections on the US Nuclear Industry’s 25 Lean Years; Komanoff Energy Associates: New York, NY, USA, 2005. [Google Scholar]

- Komanoff, C. Power Plant Cost Escalation: Nuclear and Coal Capital Costs, Regulation, and Economics; Van Nostrand Reinhold: New York, NY, USA, 1981. [Google Scholar]

- U.S. House of Representatives. Office of the Law Revision Counsel, United States Code. 42 U.S.C.A § 16271—Title 42, Chapter 149, Subchapter IX, Section 16271, Nuclear Energy. Available online: https://uscode.house.gov/view.xhtml?req=granuleid:USC-prelim-title42-section16271&num=0&edition=prelim (accessed on 15 May 2023).

- International Atomic Energy Agency. Advanced Reactors Information System. Available online: https://aris.iaea.org/ (accessed on 8 August 2023).

- Holt, M. Advanced nuclear reactors: Technology overview and current issues. In Congressional Research Service Report for Congress; Report (No. R45706); CRS: Washington, DC, USA, 2023. [Google Scholar]

- Argonne National Laboratory. Argonne’s Nuclear Science and Technology Legacy—Historical News Releases. Nuclear Engineering Division, 20 December 2011. Available online: https://www.ne.anl.gov/About/hn/news111220.shtml (accessed on 14 June 2023).

- Brook, B.W.; van Erp, J.B.; Meneley, D.A.; Blees, T.A. The case for a near-term commercial demonstration of the Integral Fast Reactor. Sustain. Mater. Technol. 2015, 3, 2–6. [Google Scholar] [CrossRef]

- Till, C.E.; Chang, Y.I. Plentiful Energy: The Story of the Integral Fast Reactor: The Complex History of a Simple Reactor Technoloogy, with Emphasis on Its Scientific Basis for Non-Specialists; Illustrated Edition; Create Space Independent Publishing Platform: Scotts Valley, CA, USA, 2012. [Google Scholar]

- Till, C.E. Plentiful energy and the Integral Fast Reactor story. Int. J. Nucl. Governance, Econ. Ecol. 2006, 1, 212. [Google Scholar] [CrossRef]

- Ingersoll, D.; Houghton, Z.; Bromm, R.; Desportes, C. NuScale small modular reactor for Co-generation of electricity and water. Desalination 2014, 340, 84–93. [Google Scholar] [CrossRef]

- Federal Register, National Archives. NuScale Small Modular Reactor Design Certification, A Rule by the Nuclear Regulatory Commission, 19 January 2023. Available online: https://www.federalregister.gov/documents/2023/01/19/2023-00729/nuscale-small-modular-reactor-design-certification (accessed on 8 June 2023).

- Natrium. Carbon-free Power for the Clean Energy Transition. 2023. Available online: https://natriumpower.com/ (accessed on 8 June 2023).

- Wald, M. With Natrium, Nuclear Can Pair Perfectly with Energy Storage and Renewables. Nuclear Energy Institute, 3 November 2020. Available online: https://www.nei.org/news/2020/natrium-nuclear-pairs-renewables-energy-storage (accessed on 8 June 2023).

- General Electric. GE Hitachi and PRISM Selected for U.S. Department of Energy’s Versatile Test Reactor Program. 13 November 2018. Available online: https://www.ge.com/news/press-releases/ge-hitachi-and-prism-selected-us-department-energys-versatile-test-reactor-program (accessed on 8 June 2023).

- U.S. Department of Energy HALEU Consortium. Office of Nuclear Energy. 8 August 2023. Available online: https://www.energy.gov/ne/us-department-energy-haleu-consortium (accessed on 11 August 2023).

- Singer, S. NRC Authorizes First US High-Assay Low-Enriched Uranium Enrichment Plant Critical for Advanced Reactors. Utility Dive, 22 June 2023. Available online: https://www.utilitydive.com/news/nrc-HALEU-doe-advanced-nuclear-plants/653629/ (accessed on 11 August 2023).

- World Nuclear News. HALEU Fuel Availability Delays Natrium Reactor Project. 15 December 2022. Available online: https://world-nuclear-news.org/Articles/HALEU-fuel-availability-delays-Natrium-reactor-pro (accessed on 15 June 2023).

- Reuters. Dow and X-Energy to build U.S. Gulf Coast Nuclear Demonstration Plant. 1 March 2023. Available online: https://www.reuters.com/business/energy/dow-x-energy-build-us-gulf-coast-nuclear-demonstration-plant-2023-03-01/ (accessed on 8 June 2023).