Abstract

The environmental sustainability of the battery-powered electric ferry (BEF) depends on the share of renewable energy sources (RESs) in the power system. The BEFs impose significant load on the power grid and it is challenging to achieve their sustainability in isolated energy systems (IES), such as islands that have limited land available for integrating RESs. The proposed solution for achieving the sustainability of BEF in such challenging environments is the integration of a standalone onshore charging station (OCS) powered with a hybrid offshore RES. The nexus between the electricity supply of the offshore photovoltaic (PV) and wind power systems and the electricity demand of BEF can reduce the required capacity of the energy storage systems (ESSs) and improve the environmental and economic performance of the standalone OCS. This study considered 45 standalone OCS scenarios to select the share of the offshore RES that matches the BEF electricity demand and improves the economic and environmental indicators of the standalone OCS. The model included characterisation of the offshore RES electricity supply, BEF electricity demand, critical excess of electricity production (CEEP), critical deficit of electricity production (CDEP) and costs. Simulations were conducted in EnergyPLAN, which used a high-resolution spatiotemporal dataset (8784 h) for the Island of Cres for 2030. The results confirmed that standalone OCS with the hybrid offshore RES provides a better match with BEF electricity demand compared to the scenarios based on an individual offshore RES.

1. Introduction

The battery-powered electric ships are regarded as energy-efficient [1] and environmentally friendly solutions for maritime transportation [2]. The lithium-ion batteries are the state-of-the-art technology for decarbonising short sea shipping [3]. However, the carbon footprint (CF) of all-electric ships can be comparable to diesel-powered ships if the electricity is generated using fossil fuels [4].

The standalone charging stations integrated with RES represent a sustainable charging solution for electric vehicles (EVs) [5]. The study by Eldeeb et al. [6] indicated that deployment of the photovoltaic (PV) power systems and EV enable charging stations to participate in the energy and EV arbitrage markets. The energy storage system (ESS) is an alternative for retaining high dispatchable generation capacity and decreasing the vulnerability to periods of deficit of renewable electricity generation [7]. This technology is a core component of the charging stations, taking up to more than 51% of the total power system’s cost [8].

The hybrid PV–wind power systems have been proposed in the literature as solutions for decreasing the variability and increasing the flexibility of RES generation [9,10,11]. The study by Sterl et al. [12] demonstrated that hybrid PV and wind power systems can achieve a balanced power output and reduce ESS requirements. The study by Wankouo Ngouleu et al. [13] demonstrated that PV/wind/ESS standalone hybrid system is a more reliable and a cost-effective configuration for meeting the electricity demand. However, the proposed hybrid PV–wind power systems are difficult to extrapolate to other sectors, because they rely on case specific simplifications [14].

The spatiotemporal simplifications include relatively low temporal and spatial resolution as the average year is usually split in a low number of time-slices, while RES generation is usually demonstrated on the national level [15]. On one hand, these simplified approaches are reducing the modelling complexity to keep simulations computationally tractable [16], neglecting the nexus between RES electricity supply and electricity demand within a smaller control zone such as BEF electricity demand. On the other hand, references dealing with BEF set the analysis boundaries to the ship’s power system and regularly underestimate the challenge of meeting the growing electricity demand of BEF with insufficient RES power capacities.

A holistic approach that includes coupling of the PV and wind power systems to match the electricity demand of the standalone OCS is required to minimise the periods of excess or deficit in electricity production and improve the sustainability of the BEF. Such an approach considers that standalone OCS powered with an offshore RES can ensure sustainability of the BEF in energy challenging environment such as isolated energy systems (IESs) of islands. The integration of standalone OCS powered with offshore PV and wind power systems is desirable, but there is no clear model in the literature that demonstrates an appropriate RES ratio for the electricity demand of BEF.

There is a need for a mathematical model that considers the synergy between offshore RES and BEF to improve the environmental and economic sustainability of electric mobility in maritime transport. This study proposes a method to determine an appropriate offshore PV–wind power capacity ratio for different BEF charging cases. The novel contributions of this study include a model of multi-energy standalone OCS that provides power supply generated from an offshore RES to a BEF; acquisition and application of realistic high-resolution spatiotemporal data; modelling of the electricity demand of the BEF and OCS depending on the charging schedule; simulating the offshore electricity supply from 100% PV, 100% wind and hybrid PV–wind power systems; and selecting the ratio of the offshore PV and wind power systems for different BEF charging cases to improve the economic and environmental performance of the BEF.

2. Materials and Methods

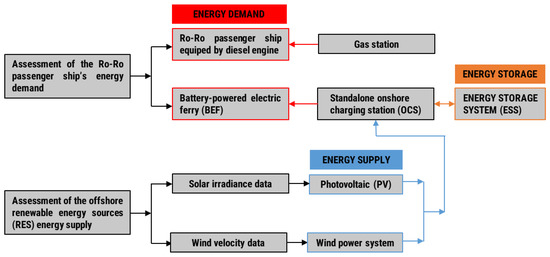

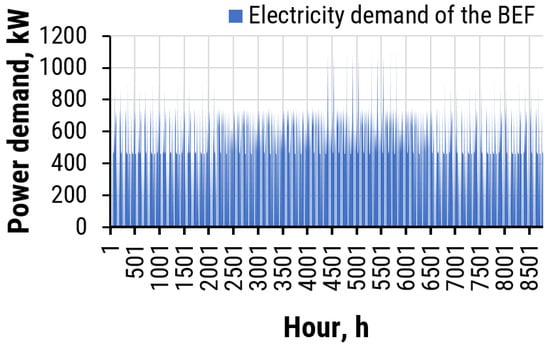

The EnergyPLAN [17] is an input–output model for simulating the hourly operation of remote areas, islands, cities, regions and relatively small countries. In this study, EnergyPLAN was used to simulate the hourly operation of an IES, which includes a BEF and a standalone OCS powered with offshore PV and wind power systems. The proposed method makes a significant contribution towards improving the sustainability of the BEF through the synergy between the offshore RES electricity supply and BEF electricity demand. The input data for EnergyPLAN depend on the considered case study and include weather condition data and operating schedule of the ro-ro passenger ships. However, the method is general and can be applied to other cases and locations, allowing the inclusion of other RESs if their integration is more appropriate for different weather conditions and BEF electricity demands. The flowchart of the proposed method is shown in Figure 1.

Figure 1.

Flowchart of the proposed method.

The proposed model considered 2 BEF charging cases and 11 offshore RES power system scenarios without and with ESS to determine the appropriate share of the offshore PV and wind power systems for different BEF electricity demands. Therefore, 44 standalone OCS scenarios (BEF) and a business as usual (ro-ro passenger ship with diesel engine) scenario were analysed in total. These scenarios create a common ground for demonstrating the nexus between offshore RES electricity supply and BEF electricity demand. The model offers an opportunity to determine the share of offshore RES appropriate for the BEF electricity demand, aiming to minimise the critical excess of electricity (CEEP) and critical deficit of electricity production (CDEP). Figure 2 shows the modelling diagram of the 100% RES standalone OCS for BEF.

Figure 2.

Model of the 100% RES standalone OCS for BEF.

2.1. Assessment of the Ro-Ro Passenger Ship’s Demand

A ferry’s operative speed usually differs from its design speed, vde (nm/h), because ferries need to follow an operating schedule. The average operative speed of the selected ferry, vave (nm/h), is determined as a ratio of the length, l (nm), and duration, t (h), of a one-way trip. The average main engine power, PME,ave (kW), can be calculated using Equation (1) [18]:

where PME (kW) is the main engine power. The average auxiliary engine power, PAE,ave (kW), is assumed to be 50% of the auxiliary engine power, PAE (kW). The average engine power, Pave (kW), is calculated using Equation (2):

The energy consumption of a ferry, EC (kWh/nm), can be calculated using Equation (3):

The total annual fuel demand of the ferry with diesel engines, Fdiesel (GWh/year), is calculated using Equation (4):

where CF is the conversion factor assumed to be 0.01163 GWh/t [19], SFC (t/GWh) is the specific fuel consumption assumed to be 215 t/GWh [20] and d (kWh) is the hourly energy demand of the ferry.

The battery capacity of the BEF, BCBEF (kWh), is increased by 65%, which enables the state-of-charge (SOC) of the BEF to range between 20% and 80%, and ensures safe navigation. The BCBEF can be calculated using Equation (5) [21]:

where lRT (nm) refers to the length of the round trip.

2.2. Assessment of the Offshore RES Power Supply

The installed power capacity of the offshore RES and their 8784 hourly electricity production distributions are required for simulating the operation of the standalone OCS. The total annual production, ETotal (GWh/year), is the sum of the hourly electricity production of the offshore PV, eoffshore_PV (MWh), and wind, eoffshore_Wind (MWh), power systems:

The total annual electricity demand of the standalone OCS, DTotal (GWh/year), is the sum of all its hourly electricity demands, dOCS (MWh):

The difference between the dOCS and eTotal determines the import and export of electricity according to the EnergyPLAN documentation [22], and can be calculated using Equation (8):

In this study, the capacity values of the energy transmission lines were eliminated to simulate the operation of the standalone OCS. The surplus of electricity production is observed as CEEP and deficit of electricity production is observed as CDEP.

2.3. Economic Assessment of the Ship’s Power System and Offshore RES

The business as usual (BAU) scenario considered the investment cost, ICDF (EUR), of the ferry with diesel engines, which includes the purchase of a new diesel engine. The ICDF is calculated by multiplying the assumed conversion factor of 250 EUR/kW with the PME. The operating cost, OCDF (EUR), of the ferry with diesel engines includes the maintenance and fuel consumption costs. The annual maintenance cost can be calculated by multiplying the ferry’s annual energy consumption with the specific maintenance cost of 0.014 EUR/kWh [23]. The annual fuel consumption costs of the ferry with diesel engine are calculated by multiplying the annual energy consumption of a ferry, SFC and projected price of light fuel oil, which is assumed to be 20.5 EUR/GJ in 2030 [24]. The CO2 emission costs were assumed to be 180 EUR/t for 2030 [25].

The calculation of the investment cost and operating cost of the BEF is based on the characteristics of the selected battery. Approximately 45% of the investment costs of the battery power system refer to the costs of the battery [26]. The total investment costs of a battery power system, ICBEF (EUR), can be calculated using Equation (9):

where BCBEF denotes the battery capacity calculated using Equation (5) and BP denotes the lithium-ion battery price, which is assumed to be 180 EUR/kWh in 2030 [27]. The maintenance costs of the ship’s power system with batteries refer to the battery replacement costs during ferry’s lifetime. The annual electricity cost is calculated by multiplying the annual electricity demand with the assumed electricity price. The investment cost, lifetime, as well as fixed operation and maintenance costs of the offshore RES and ESS installed with the OCS are presented in Table 1.

Table 1.

Cost database of the offshore RES [28] and ESS [29].

3. Case Study

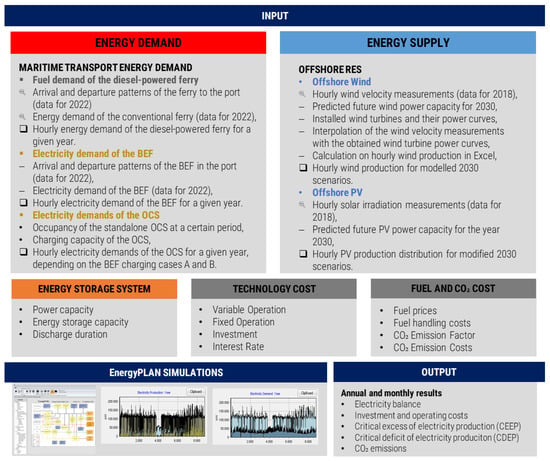

The high resolution datasets (8784 h) of the offshore RES electricity supply and electricity demand of the BEF were calculated for a ro-ro passenger ship that connects the Island of Cres with the Island of Krk (Figure 3).

Figure 3.

Location of the Croatian ferry route [30].

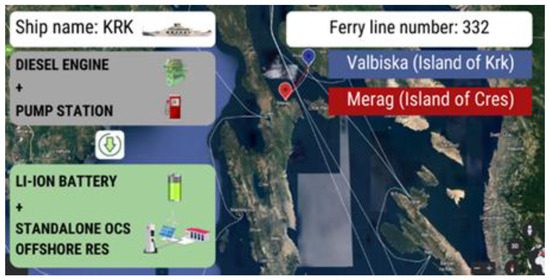

Technical characteristics of the ferry are acquired from the Croatian register of shipping [31], while its operating schedule is obtained from Jadrolinija d.d. [32]. The average price of diesel fuel in Croatia was assumed to be 1.77 EUR/L, while the average electricity price in Croatia was assumed to be 0.078 EUR/kWh [21]. Figure 4 shows the hourly electricity demand distribution of the BEF throughout the year.

Figure 4.

Hourly electricity demand of the BEF for 2030.

The analysis of the 24 h period of BEF electricity demand indicated two appropriate BEF charging cases, whose characteristics are listed in Table 2.

Table 2.

Characteristics of the BEF charging cases A and B.

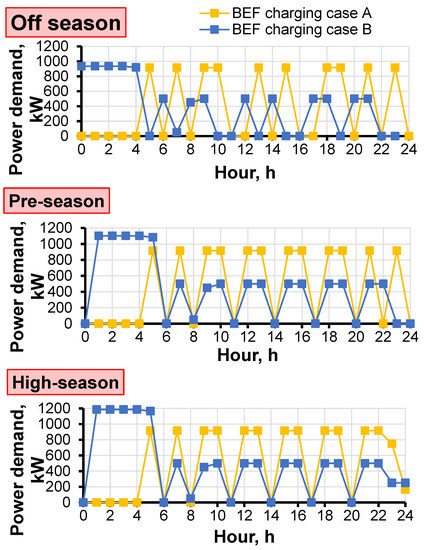

The hourly electricity demand of the OCS for BEF charging cases A and B for 2030 are determined according to the start and end dates of the off season, pre-season and high-season [32]. Figure 5 shows the 24 h period of OCS electricity demand distribution of the BEF charging cases A and B for off season, pre-season and high-season operating profiles.

Figure 5.

The 24 h OCS electricity demand of the BEF charging cases A and B.

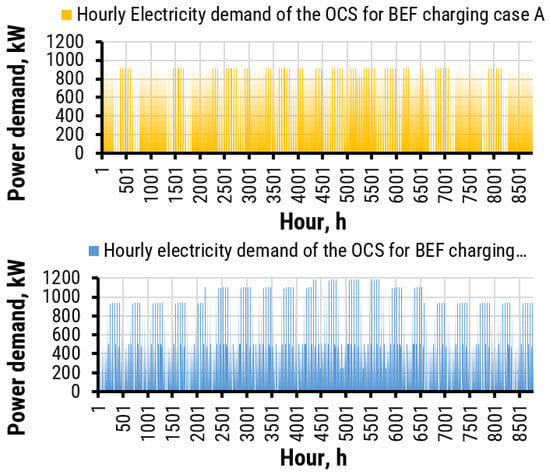

Figure 6 shows the 8784 h period of standalone OCS electricity demand of the BEF charging cases A and B.

Figure 6.

The 8784 h standalone OCS electricity demand for BEF charging cases A and B.

The Island of Cres and its environment have increased potential for integrating PV and wind power systems [33]. In this case study, the scenario modelling considered that the installed power capacity of each offshore RES units ranges from 0 MW to 10 MW with a step of 1 MW. In the hybrid electricity supply scenarios, the total offshore RES power capacity was assumed to be 10 MW to ensure at least 1 MW of the offshore PV or wind power. The total offshore RES capacity was set to zero only in scenario 1 (BAU scenario). Characteristics of the offshore RES electricity supply scenarios are presented in Table 3.

Table 3.

Characteristics of the offshore RES electricity supply scenarios.

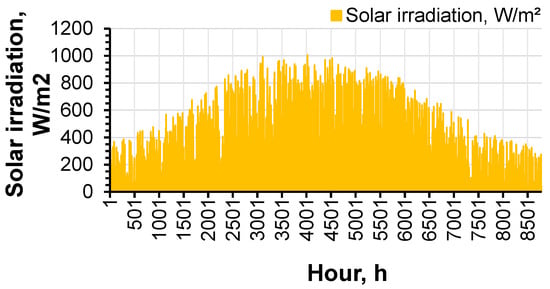

In 2018, the maximum solar irradiation on the Island of Cres reached the peak value of 1006 W/m2. Figure 7 shows the hourly solar irradiation distribution of the Island of Cres that was obtained from Meteonorm [34] for the year 2018. A correction factor of 10% was inserted into the EnergyPLAN to demonstrate higher energy conversion efficiency of the offshore PV compared to the onshore PV power systems [11].

Figure 7.

Solar irradiation distribution of the Island of Cres for 2018.

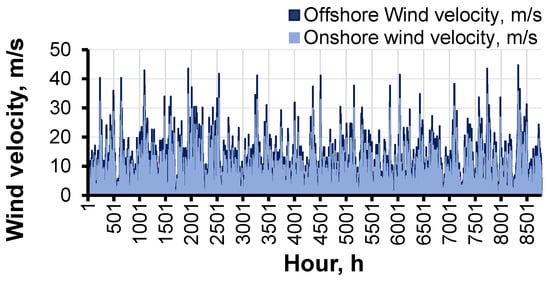

The measurements of the wind velocities for the Island of Cres were obtained from the Croatian Meteorological and Hydrological Service [35] for 2018. The offshore wind velocities were determined by increasing the wind velocity measurements by 25% [36]. The maximum offshore wind velocity for the year 2018 was 44.66 m/s. The hourly onshore and offshore wind velocity profiles are shown in Figure 8.

Figure 8.

Hourly wind velocity profiles of the Island of Cres for 2018.

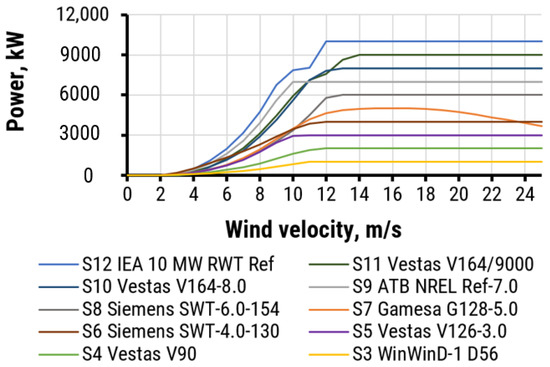

The hourly electricity production from wind turbines is calculated by interpolating the offshore wind velocity measurements with the power curve data of the selected wind power turbines. Figure 9 shows the power curves of the offshore wind turbines, which are assumed to provide power supply to the standalone OCS installed on the Island of Cres.

Figure 9.

Power curves of the selected wind turbines for the OCS [37,38,39].

4. Results and Discussion

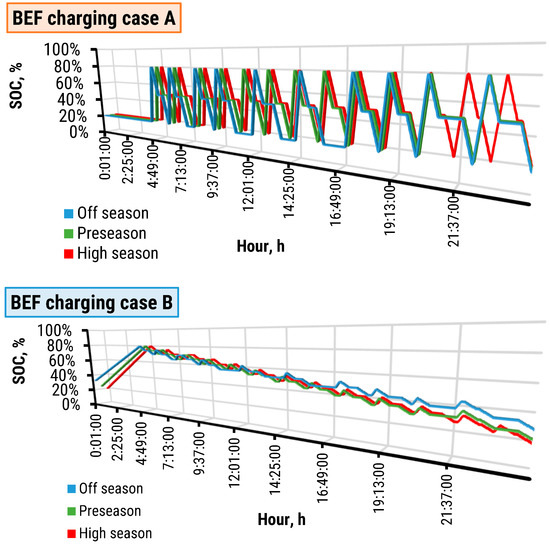

The analysis of the 44 standalone OCS configurations indicated the offshore PV and wind power scenario that provide the lowest CEEP, CDEP and system costs for the BEF charging case A or B. Figure 10 shows the SOC of the BEF during the 24 h period for the BEF charging cases A and B.

Figure 10.

The 24 h period SOC profile of the BEF charging cases A and B.

The comparison of the annual costs of the ship’s power system with diesel engines and batteries is presented in Table 4.

Table 4.

Comparison of the annual costs of the ship’s power system with diesel engines and batteries.

The analysis of the offshore RES potential confirmed that the variability in the solar and wind energy demonstrates an inverse correlation for the Island of Cres. Wind energy has the highest monthly energy yields during winter, while solar energy has the highest monthly energy yields during summer. The analysis of the 24 h period of the wind velocity and solar irradiation profiles indicated that wind velocity is higher during the night and lower during the day (especially during summer), while solar irradiation occurs only during the day.

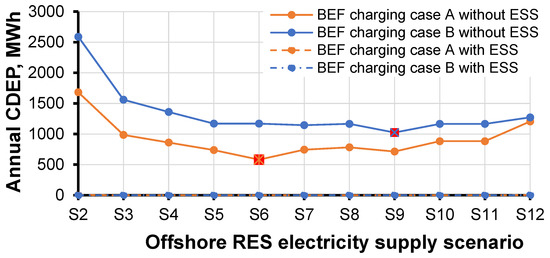

The following section demonstrates the results of coupling the BEF charging cases A and B with the considered offshore RES electricity supply scenarios and indicates the appropriate PV/wind ratio for the standalone OCS. Figure 11 shows the values of the CDEP in the BEF charging cases A and B with and without ESS. It should be noted that CDEP for scenarios 2 and 12 are not visible in Figure 11 because the CDEP values are relatively low. The electricity supply scenario 6 (60% PV and 40% wind power capacity) provided the minimal value of the total annual CDEP of 581.21 MWh in the BEF charging case A. This confirmed that standalone OCS opts for higher PV ratio in the electricity mix when the BEF is charging after each round trip. The electricity supply scenario 9 (30% PV and 70% wind power system) provided the minimum value of the total annual CDEP of 1024.07 MWh in the BEF charging case B. This indicated that standalone OCS opts for higher wind power ratio in the electricity mix when the BEF is charging during the night. The total annual CDEP was eliminated in the hybrid offshore RES power system scenarios with the ESS, while in the boundary scenarios 2 (100% PV) and 12 (100% wind), the CDEP significantly reduced. The CDEP in the BEF charging case A decreased to 3660 kWh in scenario 2 (100% PV) and 2196 kWh in scenario 12 (100% wind), while in the BEF charging case B, it decreased to 732 kWh and 2196 kWh, respectively.

Figure 11.

The annual values of the CDEP in BEF charging cases A and B.

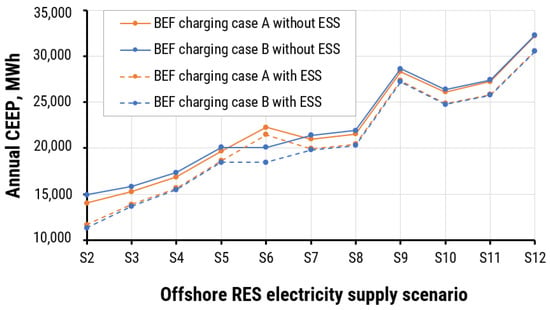

Figure 12 shows the total annual CEEP for the considered electricity supply scenarios and BEF charging cases A and B with and without ESS. In both the BEF charging cases, minimum total annual CEEP occurred in the electricity supply scenario 2 (100% PV and 0% wind power system capacity), because the electricity generation from the PV power system is lower compared to the wind power system with an installed power capacity of 10 MW.

Figure 12.

Total annual CEEP in the BEF charging cases A and B.

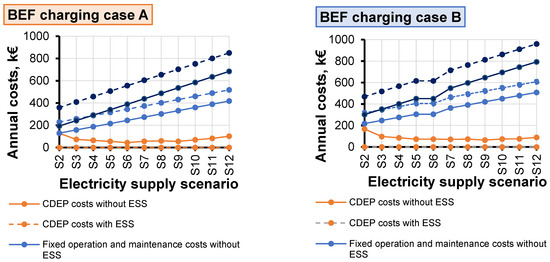

Figure 13 shows the annual investment costs, fixed operation and maintenance costs, as well as the CDEP costs for the BEF charging cases A and B with and without ESS. The integration of the ESS increased the annual investment costs, fixed operation and maintenance costs of the standalone OCS, but eliminated the CDEP costs in all hybrid offshore PV–wind power system scenarios.

Figure 13.

Annual costs of the IES for BEF charging cases A and B.

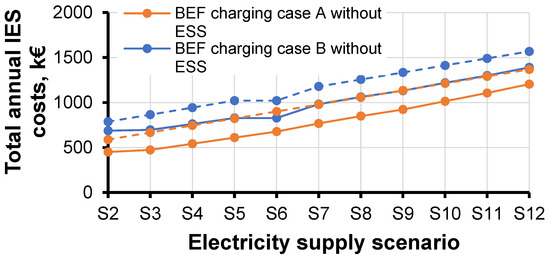

The economic assessment of the standalone OCS in this study is focused on the costs related to the BEF and offshore RES. The costs related to the OCS such as investment cost, maintenance cost and replacement costs were not considered in this study, because these costs are equal in the BEF charging cases and offshore RES electricity supply scenarios. Nevertheless, the results of the standalone OCS simulations confirmed that adjusting of the offshore PV–wind power ratio can improve the techno-economic performance of the IES. Figure 14 shows the total annual costs of the IES for 44 simulated combinations of the BEF charging cases and offshore RES electricity supply scenarios.

Figure 14.

Total annual costs of the IES for the BEF charging cases A and B.

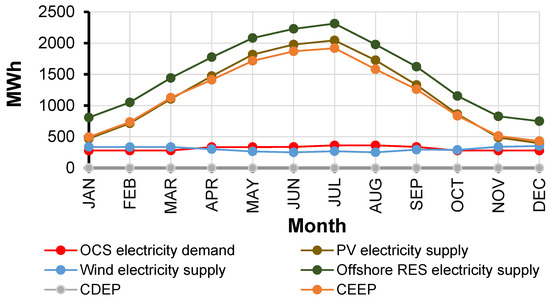

The appropriate standalone OCS scenario is selected based on the nexus between BEF and offshore RES, where one of the main conditions for ensuring feasibility is that the integrated ESS needs to eliminate the CDEP. Bearing in mind that ESS did not manage to eliminate the CDEP in the boundary electricity supply scenarios, the combination of the electricity supply scenario 3 (90% PV and 10% wind power ratio) with ESS and BEF charging case A were selected as the appropriate scenario matrix. This configuration eliminated the CDEP, while providing the lowest total annual costs and CEEP. The average monthly values of the OCS electricity demand, offshore RES electricity supply, CEEP and CDEP for the electricity supply scenario 3 and BEF charging case A are shown in Figure 15.

Figure 15.

Average monthly values of the OCS electricity demand, offshore RES supply, CEEP and CDEP of the electricity supply scenario 3 and BEF charging case A.

The average monthly OCS electricity demand for case A is represented with the red curve. The peak OCS electricity demand of 363.07 MWh/month occurred in July and August, because the BEF navigates according to the high season operating schedule. The CDEP (grey curve) reduced to zero throughout the year with the integration of the ESS to the standalone OCS. The total annual costs of the appropriate scenario matrix, i.e., the BEF charging case A and electricity supply scenario 3, are estimated to be 667,000.00 EUR. Table 5 shows the annual costs of the appropriate IES scenario configuration.

Table 5.

The annual costs of the appropriate IES scenario configuration.

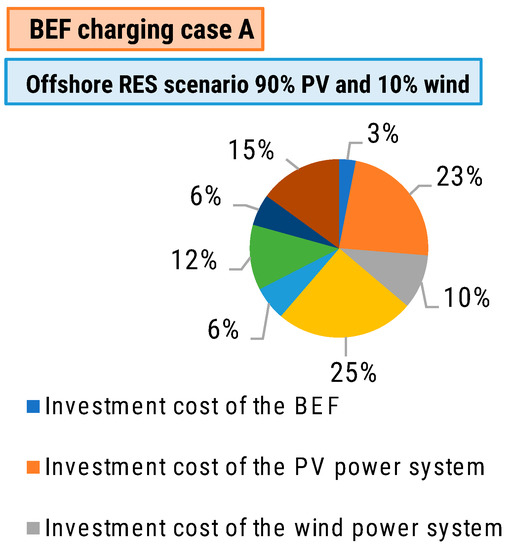

Further analysis of the results demonstrates that 61% of total annual IES costs refer to the annual investment costs, while other 39% refer to the fixed operational and maintenance costs. It should be emphasised that if the BEF was being charged using power from the national power grid, the operating costs of the BEF related to the costs of the electricity from external markets would reach a total annual value of 292,500.00 EUR. Figure 16 shows the shares of individual annual costs for the appropriate scenario mix.

Figure 16.

Share of individual annual costs in the IES for the appropriate scenario mix.

5. Conclusions

Electricity generation from the offshore RES emerged as a solution for achieving the sustainability of the BEF that connects IES, such as remote islands. The stochastic behaviour of the offshore RES requires integration of the ESS to maintain a stable operation of the IES, i.e., standalone OCS. The sustainable energy transition pathways of the short sea shipping necessitate joint deployment models that incorporate the variability and uncertainty of the offshore renewable electricity generation and BEF electricity demand. This study performed a holistic offshore RES assessment and characterised the synergy between the electricity supply from offshore PV and wind power systems and the BEF electricity demand. The Croatian ferry route that connects the Island of Cres with the Island of Krk was selected as a case study area. The scenarios in this study were modelled to select the appropriate offshore RES power system configuration whose electricity supply provides the lowest CDEP for different BEF charging cases. Additional electricity supply scenarios with ESS were developed to indicate the PV–wind ratio with the lowest costs of the IES, CEEP and CDEP. The main findings of the 45 considered IES scenarios are summarised as follows:

- The electricity supply scenario 6 (60% PV and 40% wind power system) provides the minimal annual value of the CDEP in the BEF charging case A, because charging of the BEF in case A occurs mainly during the day.

- The electricity supply scenario 9 (30% PV and 70% wind power system) provides the minimal annual value of the CDEP in the BEF charging case B, because charging of the BEF in case B occurs mainly during the night.

- The integration of the ESS did not manage to eliminate the CDEP in the boundary with 100% PV and 100% wind power system scenarios. However, the installed capacity of the ESS managed to eliminate the CDEP in the offshore hybrid PV–wind power system scenarios.

- The analysis indicated that combination of the BEF charging case A and electricity supply scenario 3 (90% PV and 10% wind power system) with ESS is the appropriate configuration for the standalone OCS, because it ensures the lowest total annual IES costs, CEEP and CDEP.

The proposed method addressed the temporal and spatial aspects of the offshore RES and BEF. The techno-economic analysis of the standalone OCS demonstrated its benefits from both BEF and RES point of views. However, some limitations of this study should be highlighted. First, it does not cover other relevant aspects such as optimised capacity sizing of the total installed offshore RES and ESS. Second, the BEF electricity demand was considered inelastic and high-resolution spatiotemporal assessment of the electricity market was not developed. The interconnection of the standalone OCS with the island’s electricity grid should be considered to enable the export of the excess electricity produced from offshore RES and improve the sustainability of the OCS. Third, further research needs to be conducted on the application of more complex optimisation techniques to determine the optimal installed power capacity of the offshore PV and wind power system configurations for specific maritime transport electricity demand at different locations in Croatia. Nevertheless, the results of this study clearly highlight the added value of exploring the synergy between hybrid offshore PV and wind power systems and BEF, which can minimise the CDEP, CEEP and costs of the standalone OCS.

Author Contributions

Conceptualisation, L.F.; methodology, L.F. and B.Ć.; validation, L.F., B.Ć., T.P. and N.V.; formal analysis, L.F.; investigation, L.F.; resources, L.F.; data curation, L.F.; writing—original draft preparation, L.F.; writing—review and editing, B.Ć., T.P. and N.V.; visualisation, L.F.; supervision, B.Ć., T.P. and N.V. All authors have read and agreed to the published version of the manuscript.

Funding

This research was conducted under the project Strengthening Transnational Co-operation, Knowledge and Technology Transfer in Development of Electric Vessels and Fostering Innovations in SME’s (ZEVinnovation), (Project Index No. 2018-1-1185) funded by Iceland, Liechtenstein and Norway through the EEA and Norway Grants Fund for Regional Cooperation and conducted by the Center of Technology Transfer LLC (Croatia) together with the University of Zagreb, Faculty of Mechanical Engineering and Naval Architecture (Croatia).

Acknowledgments

The advanced isolated energy system analysis on an hourly basis were simulated using the EnergyPLAN software developed and maintained by the Sustainable Energy Planning Research Group at Aalborg University, Denmark.

Conflicts of Interest

The authors declare no conflict of interest. The funders had no role in the design of the study; in the collection, analyses, or interpretation of data; in the writing of the manuscript; or in the decision to publish the results.

References

- Nuchturee, C.; Li, T.; Xia, H. Energy efficiency of integrated electric propulsion for ships—A review. Renew. Sustain. Energy Rev. 2020, 134, 110145. [Google Scholar] [CrossRef]

- Perčić, M.; Ančić, I.; Vladimir, N. Life-cycle cost assessments of different power system configurations to reduce the carbon footprint in the Croatian short-sea shipping sector. Renew. Sustain. Energy Rev. 2020, 131, 110028. [Google Scholar] [CrossRef]

- Armand, M.; Axmann, P.; Bresser, D.; Copley, M.; Edström, K.; Ekberg, C.; Guyomard, D.; Lestriez, B.; Novák, P.; Petranikova, M.; et al. Lithium-ion batteries—Current state of the art and anticipated developments. J. Power Sources 2020, 479, 228708. [Google Scholar] [CrossRef]

- Fan, A.; Wang, J.; He, Y.; Perčić, M.; Vladimir, N.; Yang, L. Decarbonising inland ship power system: Alternative solution and assessment method. Energy 2021, 226, 120266. [Google Scholar] [CrossRef]

- Ali, A.; Shakoor, R.; Raheem, A.; Muqeet, H.A.U.; Awais, Q.; Khan, A.A.; Jamil, M. Latest Energy Storage Trends in Multi-Energy Standalone Electric Vehicle Charging Stations: A Comprehensive Study. Energies 2022, 15, 4727. [Google Scholar] [CrossRef]

- Eldeeb, H.H.; Faddel, S.; Mohammed, O.A. Multi-Objective Technique for the Operation of Grid tied PV Powered EV Charging Station. Electr. Power Syst. Res. 2018, 164, 201–211. [Google Scholar] [CrossRef]

- Aaslid, P.; Korpås, M.; Belsnes, M.M.; Fosso, O.B. Stochastic operation of energy constrained microgrids considering battery degradation. Electr. Power Syst. Res. 2022, 212, 108462. [Google Scholar] [CrossRef]

- Jakhrani, A.Q.; Rigit, A.R.H.; Othman, A.K.; Samo, S.R.; Kamboh, S.A. Life cycle cost analysis of a standalone PV system. In Proceedings of the International Conference on Green and Ubiquitous Technology, Bandung, Indonesia, 7–8 July 2012; pp. 82–85. [Google Scholar] [CrossRef]

- Yan, J.; Qu, T.; Han, S.; Liu, Y.; Lei, X.; Wang, H. Reviews on characteristic of renewables: Evaluating the variability and complementarity. Int. Trans. Electr. Energy Syst. 2020, 30, e12281. [Google Scholar] [CrossRef]

- Golroodbari, S.Z.M.; Vaartjes, D.F.; Meit, J.B.L.; van Hoeken, A.P.; Eberveld, M.; Jonker, H.; van Sark, W.G.J.H.M. Pooling the cable: A techno-economic feasibility study of integrating offshore floating photovoltaic solar technology within an offshore wind park. Sol. Energy 2021, 219, 65–74. [Google Scholar] [CrossRef]

- López, M.; Rodríguez, N.; Iglesias, G. Combined Floating Offshore Wind and Solar PV. J. Mar. Sci. Eng. 2020, 8, 576. [Google Scholar] [CrossRef]

- Sterl, S.; Liersch, S.; Koch, H.; van Lipzig, N.P.M.; Thiery, W. A new approach for assessing synergies of solar and wind power: Implications for West Africa. Environ. Res. Lett. 2018, 13, 094009. [Google Scholar] [CrossRef]

- Wankouo Ngouleu, C.A.; Koholé, Y.W.; Fohagui, F.C.V.; Tchuen, G. Techno-economic analysis and optimal sizing of a battery-based and hydrogen-based standalone photovoltaic/wind hybrid system for rural electrification in Cameroon based on meta-heuristic techniques. Energy Convers. Manag. 2023, 280, 116794. [Google Scholar] [CrossRef]

- Simoes, S.; Zeyringer, M.; Mayr, D.; Huld, T.; Nijs, W.; Schmidt, J. Impact of different levels of geographical disaggregation of wind and PV electricity generation in large energy system models: A case study for Austria. Renew. Energy 2017, 105, 183–198. [Google Scholar] [CrossRef]

- Couto, A.; Estanqueiro, A. Exploring Wind and Solar PV Generation Complementarity to Meet Electricity Demand. Energies 2020, 13, 4132. [Google Scholar] [CrossRef]

- Peter, J. How does climate change affect electricity system planning and optimal allocation of variable renewable energy? Appl. Energy 2019, 252, 113397. [Google Scholar] [CrossRef]

- EnergyPLAN. Advanced Energy Systems Analysis Computer Model. Available online: https://www.energyplan.eu/ (accessed on 21 July 2023).

- Perčić, M.; Vladimir, N.; Fan, A. Life-cycle cost assessment of alternative marine fuels to reduce the carbon footprint in short-sea shipping: A case study of Croatia. Appl. Energy 2020, 279, 115848. [Google Scholar] [CrossRef]

- Eurostat. Statistics Explained. 2018. Available online: https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Glossary:Tonnes_of_oil_equivalent_(toe) (accessed on 18 May 2023).

- Ančić, I.; Vladimir, N.; Cho, D.S. Determining environmental pollution from ships using Index of Energy Efficiency and Environmental Eligibility (I4E). Mar. Policy 2018, 95, 1–7. [Google Scholar] [CrossRef]

- Perčić, M.; Frković, L.; Pukšec, T.; Ćosić, B.; Li, O.L.; Vladimir, N. Life-cycle assessment and life-cycle cost assessment of power batteries for all-electric vessels for short-sea navigation. Energy 2022, 251, 123895. [Google Scholar] [CrossRef]

- Lund, H.; Thellufsen, J.Z. EnergyPLAN. Advanced Energy Systems Analysis Computer Model, Documentation Version 15 [WWW Document]. 2019. Available online: https://www.energyplan.eu/wp-content/uploads/2019/09/EnergyPLAN-Documentation-Version15.pdf (accessed on 5 June 2023).

- Iannaccone, T.; Landucci, G.; Tugnoli, A.; Salzano, E.; Cozzani, V. Sustainability of cruise ship fuel systems: Comparison among LNG and diesel technologies. J. Clean. Prod. 2020, 260, 121069. [Google Scholar] [CrossRef]

- ENTSOG. Fuel Commodities and Carbon Prices. 2020. Available online: https://2020.entsos-tyndp-scenarios.eu/fuel-commodities-and-carbon-prices/ (accessed on 18 May 2023).

- European Parliament. 2030 Climate Target Plan: Extension of European Emission Trading System (ETS) to Transport Emissions. ENVI Workshop Proceedings. 2021. Available online: https://www.europarl.europa.eu/RegData/etudes/IDAN/2021/662927/IPOL_IDA(2021)662927_EN.pdf (accessed on 18 May 2023).

- Christos, B. Techno-Economical Feasibility Study on the Retrofit of Double-Ended Ro/Pax Ferries into Battery-Powered Ones. Ph.D. Dissertation, National Technical University of Athens, Athens, Greece, 2017. [Google Scholar] [CrossRef]

- Kortsari, A.; Mitropoulos, L.; Heinemann, T.; Mikkelsen, H.; Aifadoupoulou, G. Evaluating the Economic Performance of a Pure Electric and Diesel Vessel: The Case of E-ferry in Denmark. Trans. Marit. Sci. 2022, 11, 95–109. [Google Scholar] [CrossRef]

- EnergyPLAN. Useful Resources. Cost Database. Available online: https://www.energyplan.eu/useful_resources/costdatabase/ (accessed on 18 May 2023).

- Killer, M.; Farrokhseresht, M.; Paterakis, N.G. Implementation of large-scale Li-ion battery energy storage systems within the EMEA region. Appl. Energy 2020, 260, 114166. [Google Scholar] [CrossRef]

- Google Earth. 2023. Available online: https://earth.google.com/web/@44.86087805,14.2059433,-53.67737137a,198707.33108981d,34.96775148y,0h,0t,0r (accessed on 25 March 2023).

- CRS Web Reports. Available online: http://report.crs.hr/HRBWebReports/Default.aspx?ReturnUrl=%2Fhrbwebreports%2F (accessed on 25 March 2023).

- Jadrolinija. Državna Trajektna Linija Br 332. Available online: https://agencija-zolpp.hr/wp-content/uploads/2019/04/T-332-Valbiska-Merag-2023.pdf (accessed on 2 February 2023).

- Cerinski, V. Energetsko Planiranje Pametnog Otoka Cresa. Undergraduate Thesis, University of Zagreb, Faculty of Mechanical Engineering and Naval Architecture, Zagreb, Croatia, 2019. Available online: https://zir.nsk.hr/islandora/object/fsb%3A5261/datastream/PDF/view (accessed on 8 December 2022).

- Meteonorm. Available online: https://meteonorm.com/en/ (accessed on 1 May 2019).

- DHMZ. Croatian Meteorological and Hydrological Service. Available online: https://meteo.hr/index_en.php (accessed on 8 December 2022).

- Akhtar, N.; Geyer, B.; Rockel, B.; Sommer, P.S.; Schrum, C. Accelerating deployment of offshore wind energy alter wind climate and reduce future power generation potentials. Sci. Rep. 2021, 11, 11826. [Google Scholar] [CrossRef] [PubMed]

- Wind-Turbines-Models.Com. Turbines. Windturbines Database. Available online: https://en.wind-turbine-models.com/turbines (accessed on 4 March 2023).

- 2020ATB_NREL_Reference_7MW_200—NREL/Turbine-Models Power Curve Archive 0 Documentation. Available online: https://nrel.github.io/turbine-models/2020ATB_NREL_Reference_7MW_200.html (accessed on 13 March 2023).

- Pandit, R.; Kolios, A. SCADA Data-Based Support Vector Machine Wind Turbine Power Curve Uncertainty Estimation and Its Comparative Studies. Appl. Sci. 2020, 10, 8685. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).