Abstract

Nowadays, the importance of activities for the protection of the environment is growing. This approach has a major impact on the current energy and mining policy in Poland. On the one hand, the energy policy has imposed several restrictions to which the Polish economy will have to adapt; on the other, however, it raises great social opposition from professional groups that will be at risk of changing or losing their jobs and income, which implies extensive restructuring processes. These processes involve the decarbonisation of the economy and include, among others: sustainable production and consumption, sustainable municipal management and high quality of life in the city, waste management, sustainable transport, and energy management. The aim of the article is to indicate the importance of investment outlays and costs incurred when purchasing alternative fuels that would replace hard coal in Poland. It is part of the process of adjusting to the requirements of the new energy policy adopted by Poland as an EU member. In order to ensure energy security by abandoning coal mining, disproportionately high investment outlays for such a transformation would have to be incurred, as well as significant resources that would have to be allocated in the future to the purchase of alternative fuels. The result of the scenario methods used is the proposition of the proprietary RCAES index, which is to facilitate the transition from fossil fuels to alternative fuels, which the authors will fill in the gap existing in this area.

1. Introduction

With Poland’s accession to the European Union, the Polish economy must adapt to the requirements of the European Union [1]. New challenges related to energy security resulting from the international geopolitical situation [2,3] and experience in implementing competitive electricity and gaseous fuels markets entail the need to update the energy forecast also for Poland and to formulate a new energy strategy [4,5]. To meet the environmental protection requirements [6], especially in reducing atmospheric pollution causing global warming [7], Poland had to assess its capabilities in this regard [8]. This contributed to the implementation of changes in the energy policy up to 2040 [9,10].

Poland is not only using coal for much of its energy mix [11]. Poland is also a significant producer of coal. The decarbonisation of the energy sector is, therefore, closely linked to the linear reduction of the coal sector [12].

The diversification of energy sources in Poland towards renewable energy sources (RES) is a direct result of the transformation of the European energy sector [13,14]. The main reason for this process is the growing demand for electricity, which necessitates not only increasing the volume of its production but also the necessity to reduce the harmful impact on the environment caused by the processing of conventional energy carriers (fossil fuels). The entire transformation is to contribute to increasing the energy security of Poland and the other EU Member States, and thus the entire European Union [15].

Ensuring Poland’s energy security will require several changes, which implies incurring new investment outlays and relating additional costs to these changes [16]. They should be, however, considered from both broad and detailed perspectives. The following areas are of great importance for the energy sector and changes in the purchase of alternative fuels for Poland’s energy security: sustainable production and consumption, sustainable municipal management and high quality of life in the city, waste management, and sustainable transport energy management [17].

This study aims to indicate the importance of investment outlays and costs incurred when purchasing alternative fuels that would replace hard coal in Poland. This is part of the process of adapting our current energy policy to the requirements of the new energy policy, which was adopted by Poland as a member of the European Union. Detailed objectives were formulated as research questions and included in the part covering the research methodology.

The research hypotheses are:

Hypothesis 1 (H1).

The use of alternative fuels can ensure Poland’s energy security.

Hypothesis 2 (H2).

Process “The use of alternative fuels” requires new investment outlays and determines a higher level of purchase costs of alternative fuels.

2. Literature Review—Background of the European Union Energy Policy

The European Union declared the aim of achieving a climate-neutral economy by 2050 [18]. This means there is a necessity to make significant investments and, thus, ensure the sources of the required financing [19]. Especially in the case of economies where the majority of energy is obtained from coal, broad energy sector transformation [20,21] will be necessary, followed by capital flow, financial support policy, and legal regulation [22,23].

The next industrial revolution should profoundly transform not only the world economy, especially in developed countries, but also entire societies and the global financial system [24,25,26]. At the moment, both the challenges and opportunities that this revolution should bring in the context of the energy sector have already been identified [27]. They show that electricity will become a global catalyst for changes in industry and services and that energy security will determine the next technological revolution on a global scale [28]. However, the energy sector itself is also susceptible to changes implied by business (24/7 digital economy), regulators and politicians (decarbonisation and an increase in the share of renewable energy sources), and nature (global warming and extreme weather phenomena).

The shape of the national energy strategy is largely determined by the European Union’s climate and energy policy [29], and in particular by the EU’s desire to achieve climate neutrality by the middle of this century, including various stimulus mechanisms accompanying the implementation of this goal in the coming decades. The transformation of the energy sector and the transition to low-carbon energy is therefore a direct result of the implementation of the EU’s 2020–2030 targets in the field of climate and energy [30,31,32].

In November 2019, the Polish Ministry of Energy published for the first time a draft document titled “Poland’s energy policy until 2040” (tentatively called PEP2040) [33]. It assumes a 20-year period for the implementation of the country’s energy transformation process [34]. The global target adopted in this project is based on five specific objectives [35]:

- (1)

- reduction in the share of coal-based electricity production to the level of 56–60% in 2030;

- (2)

- increasing the share of renewable energy sources in gross final energy consumption to 21–23% in 2030;

- (3)

- implementation of nuclear power by 2033;

- (4)

- achieving an improvement in energy efficiency by 23% until 2030 (the 2007 forecasts are the reference); and

- (5)

- reducing the level of CO2 emissions by 30% until 2030 (the figures from 1990 are the reference point).

In the light of the research, by 2040 [36], the demand for energy in Poland may increase by 50%, from the current 160 TWh to 240 TWh. Ensuring the stability of the sector, energy security and the implementation of the eight EPP2040 strategies will be a major challenge for the energy sector [37,38].

The energy policy assumes a further revision of the key EU regulations concerning the energy sector, which will respect the goals of the EU’s energy and climate policy after 2030 and the tools for its implementation. The new “Energy policy of Poland until 2040” [36] was based on the three pillars:

- just transition [39];

- zero-emission energy system [40];

- good air quality.

A just transition should stimulate new development opportunities in regions whose communities will be most negatively impacted by the low-carbon energy transition. It is therefore essential that it provides new jobs for people who have lost them as a result of the transformation, and that it also enables the development of new industries that build up based on transformations in the energy sector. All pro-development activities related to the transformation of the so-called coal regions will be financed with funds at the level of approximately PLN 60 billion. The shielding programs will cover not only entire regions but also individual energy consumers, who may suffer from the disproportionate increase in the prices of energy carriers. Additionally, these funds are intended to stimulate their active participation in building a low-emission energy system. The implementation of the above actions is to ensure a fair and effective transformation of the energy sector, in which everyone will have a chance to participate. It is assumed that for this purpose the competitive advantages of the Polish economy will be used, thus stimulating new development opportunities and infrastructure modernization on a large scale. It is estimated that the transformation of the energy sector will contribute to the creation of 300,000 new jobs in business sectors with the highest growth potential, including, in particular, those related to renewable energy sources, development of network infrastructure, digitization, electromobility, thermal modernization, and nuclear energy [41,42,43].

The second of the pillars of the new energy policy assumes the reduction of the emissivity of energy production as a result of the wide development of alternative sources of its acquisition, including wind energy, and increasing the share of distributed and civic energy in the total energy production. This pillar also involves investments in the country’s energy security through the temporary use of new electricity production technologies based on gaseous fuels [44,45,46].

The third pillar involves extensive investments in the transformation of the heating sector, both systemic and individual, electrification of the transport sector, and promotion of passive and zero-emission construction [47]. These actions mean a gradual abandonment of the use of fossil fuels and thus the improvement of air quality in Poland, which is of great importance in the context of the health of its inhabitants.

3. Materials and Methods

The changes taking place in the external environment of enterprises contribute to the dynamic development of renewable energy sources, as well as the transformation of operations based on coal. At the same time, many of the activities and processes towards decarbonisation and climate neutrality, including the large-scale use of renewable energy and the intensification of energy efficiency measures along the entire value chain, present enterprises with hitherto unknown and unique challenges and opportunities for business transformation. A coherent long-term strategy for alternative fuels must meet the energy needs of all transport modes and be in line with the EU 2020 strategy, including decarbonisation. However, the available alternatives along with the capital expenditure and costs vary from industry to industry.

The following research questions were asked in the study:

- (1)

- In what direction is Poland’s energy policy heading?

- (2)

- What will be the consequences of the transformation of the mining sector in the world, including Poland?

- (3)

- What effects will the redirection of investment outlays on the purchase of alternative fuels bring in the context of energy security in the world, including Poland?

- (4)

- What is the impact of redirecting the cash flow of revenues from the sale of coal to the purchase of other energy fuels?

- (5)

- To what extent will the purchase of alternative fuels cover the energy value obtained from coal?

The main aim of the article is to indicate the importance of investment outlays and costs incurred when purchasing alternative fuels that would replace hard coal in Poland. This is part of the process of adapting our current energy policy to the requirements of the new energy policy, which was adopted by Poland as a member of the European Union. The specific goals are to search for answers to the above research questions. The research hypotheses are: (H1) The use of alternative fuels can ensure Poland’s energy security, and (H2) Process “The use of alternative fuels” requires new investment outlays and determines a higher level of purchase costs of alternative fuels.

To confirm the hypotheses and achieve the research objectives, the following methods and techniques are used:

- desk research,

- review of legal acts,

- method of analysis and comparisons,

- the scenario planning method.

Scenario planning is based on scenarios, and its essence is the use of scenarios for management in the enterprise and their implementation in practice. Herman Kahn [48] is considered to be the precursor of scenario methods. The energy crisis that took place in the early 1970s undermined the usefulness of forecasts based on extrapolation, consisting of searching for regularities in the development of past events and transferring them into the future [49]. In Europe, the scenario concepts were applied by Michael Godet at the DATAR (Délégation en eménagement des territoires et action régionale center) [50]. Scenario methods are used in research on strategic planning as one of the concepts of methodological solutions.

The research process was carried out in the following stages:

- (1)

- Initial research: the research area and problem were defined, research questions and objectives were identified, and a research hypothesis was formulated.

- (2)

- Basic research: an analysis of legal acts and a critical analysis of the literature in the area of investment outlays and the level of alternative fuel costs in the context of the new Polish energy policy were performed; the literature on the subject was investigated to find the answers on the consequences of the transformation of the mining sector in the world, including Poland; the website of the Industrial Development Agency and Euracoal Market Reports were analysed; scenarios (simulations) of the impact of redirecting the cash flow of revenues from coal sales on the example of a leading company from the coal sector to the purchase of other energy fuels were developed, and an answer was sought—to what extent the purchase of alternative fuels will cover the energy value obtained from coal.

- (3)

- Inference: The study was carried out in the period January 2020–June 2021. The layout and content of the study were subordinated to the implementation of the main and detailed research objectives, as well as to confirm the hypothesis.

Energy policy in the era of full membership in the European Union is a very big challenge for the economies of the Member States. Scenario methods make it possible to use the influence of different variables (types of clean fuel) and evaluate them to achieve the same energy value. Certain variables influencing the new clean energy policy can be freely shaped depending on the availability and their prices on the market; hence this method seems to be applicable in the conditions of a low-emission energy policy. For this, a valuable way to predict the future is to create scenarios as hypothetical and possible paths of development of the studied objects, which were used by the authors of the study, who finally proposed the original RCAES Index.

4. Results and Discussion

4.1. Importance of the Mining Sector for the Polish Economy

Coal is an important source of primary energy in the world. It ranks second after crude oil. In recent years, a decline in the share of coal in the global primary energy consumption in Europe can be observed. The share of coal in electricity production decreased last year in the European Union by 24 percent, according to the report “European energy sector” in 2019 [51]. In place of coal for energy production, wind, solar, and gas power plants are more and more often used. Coal remains the dominant fuel in the Asia-Pacific region of India, Southeast Asia, and several other countries. In 2019, the share of hard coal in the primary energy balance in this part of the world was 47% [52]. As a consequence of the transformation of the mining sector, hard coal production is to be limited by 2022 in Europe, except for in Poland. Demand for coal is also to be reduced in the US [53].

The slowdown of the Chinese economy, which is the largest coal consumer in the world along with the policy of decarbonisation, led to a decline in global coal consumption in 2019 after several years of stable growth [54]. Coal production in the EU fell by 24% in 2019. The production of hard and brown coal decreased by 32% and 16%, respectively. This change is being driven by the rising CO2 emission allowance prices and the implementation of renewable energy sources. Half of the decline in coal consumption was replaced by gas and the other half by the solar and wind power plants. It is expected that the decline in coal consumption will continue: Greece and Hungary committed to phasing out coal in 2019, which means that as many as 15 of the EU Member States have withdrawn from the use of coal. However, some EU Members have not started this process yet. This includes Bulgaria, Croatia, Poland, Romania, and Slovenia [55].

The decrease in the share of coal in energy production means that CO₂ emissions in the European energy sector fell by a record 120 Mt or 12% in 2019. This is possibly the biggest decline in history. Stationary emissions under the EU Emissions Trading System (EU ETS), including heavy industry, decreased by 7.6% in 2019, meaning industrial emissions are likely to have decreased by only 1%. Nevertheless, total emissions covered by the EU ETS are falling much faster than the cap; showing the central role of further strengthening the EU ETS to accelerate climate action in Europe [56].

Renewable energy sources have hit a new record covering 35% of the electricity demand in the EU. For the first time, combined wind and solar power supplied more electric power than that obtained from coal, accounting for 18% of EU electricity production in 2019 [57]. This means more than a 100% increase in the market share compared to 2013. Growth in wind and solar power production was the strongest in Western Europe, to which both Poland and Greece have contributed. The rest of the Eastern European countries produce much less energy from such sources. The economic opportunities for cheap renewable energy sources have become increasingly apparent. In 2019, auction prices for offshore wind (UK) and solar (Portugal) fell below wholesale prices to unprecedented record lows. During the same year, there were also declines in wholesale prices in countries with the most developed solar and wind energy sectors [47].

Europe’s energy transition is gaining momentum. Fighting the climate crisis is the main goal of all EU policies for the next five years as described in the European Green Deal: Europe is set to become the first continent to achieve greenhouse gas emissions neutrality by 2050, and the EU Commission put forward a proposal to raise the European gas reduction target by 2030, up to −50% or −55% below 1990 levels [58]. This means that emissions in the energy sector will decrease, even if the demand for electricity increases as a direct result of increased electrification of transport and heating [59]. These trends are presented in Figure 1.

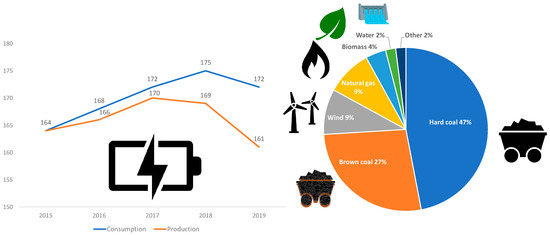

Figure 1.

Distribution of coal production and consumption in Poland in 2020. Source: Own research based on Sandbag, Agora Energiewende (accessed on 2 November 2021).

As shown in the Figure 1, total global coal consumption in 2019 was 172 TWh, while production was 161 TWh. Electricity production in Poland shown in the diagram indicates that over 47% of energy production is generated with the use of hard coal, 27% with brown coal, while the same ratio for wind and natural gas is 9%, biomass 4%, and water and other sources are 2%. Less and less hard coal is mined in the European Union and its consumption is also falling, according to Eurostat data. In terms of extraction, Poland comes first, ahead of the Czech Republic and Germany. The production of hard coal in the EU is also lower each year. In 2018, it amounted to almost 74 million tons, 6% less than in 2018, and by 80% less than 1990. In 2018, only five Member States mined hard coal: Poland (63.4 million tonnes), the Czech Republic (4.5 million tonnes), Germany (2.8 million tonnes), Great Britain (2.6 million tonnes), and Spain (0.5 million tons). Poland was responsible for 86% of extraction of this raw material in the community. Thus, if the production of coal in the European Union countries is reduced, it will result in the transfer of coal production outside the EU, as the demand for coal does not decrease worldwide [60]. Summing up, the conducted restrictive climate policy in the EU does not affect global decarbonisation.

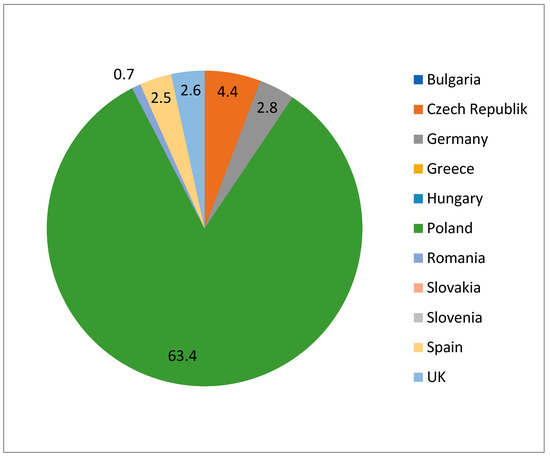

Among the EU countries which are hard coal producers, Poland is the leader, followed by the Czech Republic, Great Britain, Germany, and Spain. Poland is a major global producer of hard coal and the largest in the European Union. For many years, the European Union remained the largest coal importer in the world and was overtaken by China only in 2012. Coal production in individual EU countries in % is shown below [61].

Germany remained the largest among the major hard coal importers in the European Union in 2020 (presented Figure 2). The other major importers are Italy, Spain, and the Netherlands. The largest, almost a 60% drop in coal imports, was recorded in Great Britain due to the increase in the emission tax. In 2019, the UK steel sector had a slightly larger share of the 7.9 million tonnes coal market than the energy sector. In the UK, 2.3% of total energy production came from coal. Production from coal-fired power plants decreased by 59% compared to 2018. Stockpiles at power plants were reduced, thus reducing imports to 5.5 million tonnes in 2019, mainly from Russia and the USA. Coal production in Great Britain in 2019 amounted to 2.2 million tonnes, which means a decrease of 28%.

Figure 2.

Hard coal production (in mln t). Source: author’s study based on Euracoal Market Reports, http://euracoal2.org (accessed on 1 February 2022).

The main suppliers of coal to the European Union market in 2019 were Colombia and Russia. On the other hand, imports from South Africa decreased by around 30%. In the analyzed years, coal in the EU countries was ranked third with a 14% share in the European energy market, after crude oil (37%) and natural gas (23.5%). The structure of energy carriers in individual EU countries has been historically shaped based on the available natural resources. In France, nuclear energy dominated, while in Denmark it was wind energy, and in Scandinavia and Austria it was hydropower. Poland, the Czech Republic, Germany, and Bulgaria relied on hard coal and brown coal.

In summary, from the macroeconomic perspective, the transformation process of the mining sector may have very serious consequences for the economy of Poland and the EU, on the grounds of the following factors [62]:

- Poland ranks ninth in the world in coal mining;

- Poland occupies a leading position in coal mining in the European Union (50.3 million tons);

- At the same time, Poland and Germany are the largest consumers of this fossil fuel in the European Union, being responsible for more than half of its consumption.

In Poland, the demand for this raw material, according to long-term prospects, is expected to remain stable until 2022. Energy security is a strategic issue for every country. The generation and transmission of electricity is a crucial element of the modern economy, as it determines its efficiency. Compared to other European Union states, Poland is a very large and diversified base of mineral resources [63], and as such may become one of the leading guarantors of energy security in the European community [64].

The economic development of countries depends on access to energy. It is forecasted that until 2040, the world economy will grow at an average rate of 2.8% annually. Taking into account the predicted steady increase in efficiency in energy generation, the growth of the global energy sector will amount to 1.1% annually. The importance of conventional sources (energy from coal and crude oil—predicted increase by 0.4% per year) is expected to show a downward trend, with a simultaneous increase in the share of renewable sources (solar, wind, and geothermal energy—an increase of 7.4% per year). The goal of every economy is to strive for such a development of renewable energy that will ensure its achievement of a share of approx. 20% in energy production [65].

Summing up, from the macroeconomic perspective, the transformation process of the mining sector in the scale of the economy may have very serious consequences for the energy security of Poland, as well as the EU, because:

- Hard coal is still the dominant energy resource in Poland, and the main recipient of domestic steam coal producers in the domestic power industry (over 50% of total domestic steam coal sales);

- In 2019, 47% of electricity was generated in power plants using hard coal, and 27% in power plants using brown coal;

- Hard coal is the basic energy source, ensuring along with brown coal, a very high degree (70–80%) of energy independence for Poland;

- The average energy independence of the European Union was approx. 50% in 1990, while with the reduction of coal production, it continues to decline, reaching the level of nearly 30%.

Obtaining electricity from renewable energy sources entails significant costs that the Polish economy will not be able to bear without the support of the European Union [65].

4.2. Redirection of Investment Outlays for the Purchase of Alternative Fuels and the Energy Security of Poland

Ensuring Poland’s energy security requires significant investment outlays and incurring extra operational costs. Investment outlays create capital which increases the production capacity of the economy [66]. In the short term, changes in the size of investments primarily affect domestic demand. Professor S. Gomułka justifies that the high innovativeness of the Polish economy in the last 25 years has contributed to economic growth [67]. The measure of innovation is the GDP growth rate per employee or labor hour. This ratio grew faster in Poland than in the USA and Western Europe, although spending on research and development is much higher there than in Poland. We owe this growth mainly to the transfer of technology and know-how resulting from the inflow of foreign investments.

In the long run, apart from the size of investment outlays themselves, their effectiveness becomes of key importance—that is, how much productive capital is generated for a given investment volume. The influence of state policy on investment decisions is different in the state sector, where officials and politicians directly make investment decisions, than in the private sector, where the state creates a regulatory environment.

The impact of investments on economic growth is diversified in the short and long term. In the short time horizon, i.e., within a few years, the size of investment expenditure, which is one of the components of domestic demand, is important. The contribution of investments to domestic demand is subject to large fluctuations during the business cycle. For example, the slowdown in investments in Poland in 2001 reduced domestic demand 2001 by 2.5 percentage points, and their rapid growth in 2007 increased it by 3.9 percentage points. No other component of GDP was subject to such large fluctuations as investments, which is not a special feature of Poland—generally, in the business cycle, investments are characterized by greater volatility than other components of GDP [68].

The level of costs and funds, i.e., their acquisition and spending, correlate with investment outlays. Redirecting cash flows into infrastructure is often seen as a solution to the problems of unemployment, rural depopulation, or a general way to stimulate the economy. However, collective work analyzing many previous studies indicates that the positive economic impact of this type of funds allocation may be of minor impact on GDP. Based on the research conducted by Holmgren and Merkel [69] (meta-analysis of 776 estimates of the direction and strength of the impact on GDP of individual types of investments in transport infrastructure about the production of individual sectors from 78 articles, studying mainly the USA and Europe), it should be concluded that a 1% increase in infrastructure results in the change of production from −0.06% (reduces) to 0.52%. At the same time, the most precise estimates indicate the impact of such fund spending on the production level is close to zero. The result of Holmgren and Merkel [69] is confirmed by García’s research [70]. The study looked at 794 estimates from over 150 studies. Their results range from an impact of 0.09% to as much as 0.17%. However, their meta-regression model already shows a higher positive effect.

Summing up, after analyzing the redirection of cash flows to the purchase of alternative fuels, i.e., redirection of flows to the energy sector, it should be emphasized that this confirms the thesis of European research that such redirection of cash flows into investments in other sectors (energy) is falsely perceived as a solution to the problems of unemployment, depopulation of rural areas and weak economic growth [71].

To meet the needs of the country’s energy policy, the article presents the impact of redirecting the cash flow of revenues from the sale of coal on the example of a leading company from the coal sector to the purchase of other energy fuels, and also questions to what extent the purchase of alternative fuels will cover the energy value obtained from coal. During the simulation, additional sources of electricity were introduced as an alternative to the incineration of waste, fuel oil, natural gas, and wood. Research conducted in Sweden shows that out of 510 kg of municipal waste produced every year by Sweden, 490 kg are recovered and only 20 kg are thrown away [72].

4.3. Scenarios in the Adjustment Process

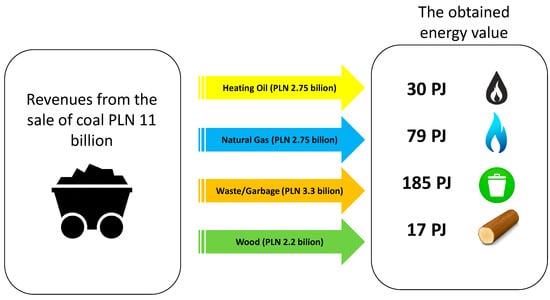

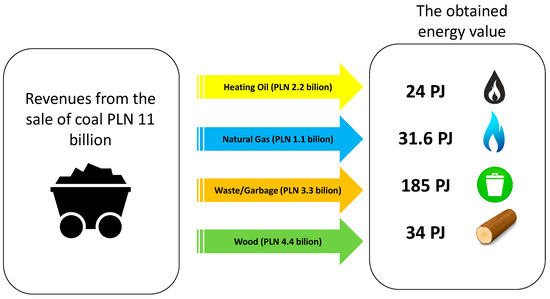

An in-depth analysis of the literature as well as the conducted research created the basis for undertaking and presenting a scenario approach to the process of changes in the energy policy, taking into account investment outlays and the costs of purchasing alternative fuels. The first set of scenarios (scenarios 1–4) assumes that the entire revenue stream that we obtain from the sale of coal is allocated to the purchase of a specific alternative fuel, e.g., wood, natural gas, heating oil, obtaining fuel from waste. The simulation also shows what energy value can be obtained by allocating PLN 11 billion for the purchase of a given fuel, as presented below(Table 1).

Table 1.

Estimation of the energy value of the alternative fuels, assuming that all income is spent on the purchase of one type of fuel only compared to the energy value obtained from coal.

It should be emphasized that the reference point for all scenarios is the energy value obtained from hard coal. After analyzing the energy value that we would obtain from the purchase of alternative fuels, it should be clearly stated that in addition to the calorific value, the price for which we can buy alternative fuel is also very important.

An additional advantage of waste incineration plants is that incinerators are very profitable. Two tons of waste is the energy equivalent of 1 ton of coal; however, the coal needs to be purchased. Let us assume that the cost of one ton of coal is PLN 300, and by burning (and thus utilizing) waste, we receive an additional premium of at least PLN 200. The difference between the two amounts clearly shows that we have the differential cost of PLN 500 per ton. In addition, the largest incinerators are combined heat and power plants—they sell electricity and heat at the same time. It would seem that garbage is a fuel of little value due to moisture. However, the Swedes coped with this by using boilers (including ones that have been designed and produced in Poland) adapted to burning wet waste and raw biomass, e.g., grass, leaves, wet branches. Wet garbage together with fire gives steam, which is a valuable energy carrier. On the other hand, additional condensation of steam means that we recover 30 percent more heat. An additional advantage of waste disposal in Poland would be the reduction of gas imports by 40 percent.

Scenarios 5 to 8 present the energy value that can be obtained if the revenue from the sale of coal of PLN 11 billion is redirected to the purchase of alternative fuels in different proportions. Scenario 5 assumes that 30% of the revenue from the sale of coal is spent on waste disposal, 25% on the purchase of gas and heating oil, and 20% on the purchase of wood. The energy value obtained from the purchase of these fuels is 311 PJ and is presented in Figure 3 and Table 2.

Figure 3.

Scenario 5—energy value of the assumed mix of alternative fuels. Source: own study.

Table 2.

Estimation of the energy value for scenario 5.

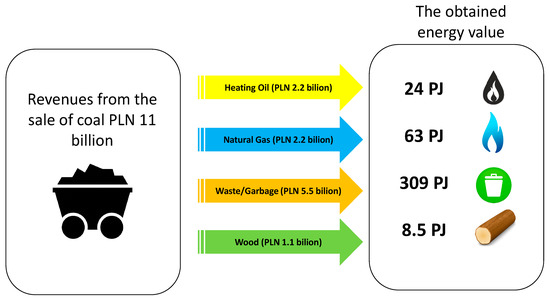

Simulation 6 assumes that 50% of the revenue from the sale of coal is spent on waste disposal, 20% on the purchase of gas and heating oil, and 10% on the purchase of wood. This simulation allows us to obtain an energy value of 404.5 PJ, which is shown in Figure 4 and Table 3.

Figure 4.

Scenario 6—energy value of the assumed mix of alternative fuels. Source: own study.

Table 3.

Estimation of the energy value for scenario 6.

Scenario 7 assumes that 30% of the revenue from the sale of coal is spent on waste disposal, 10% on the purchase of gas, 20% on the purchase of heating oil, and 40% on the purchase of wood. Appropriate estimates are presented in Figure 5 and Table 4.

Figure 5.

Scenario 7—energy value (PJ) of the assumed mix of alternative fuels (in PLN). Source: own study.

Table 4.

Estimation of the energy value for scenario 7.

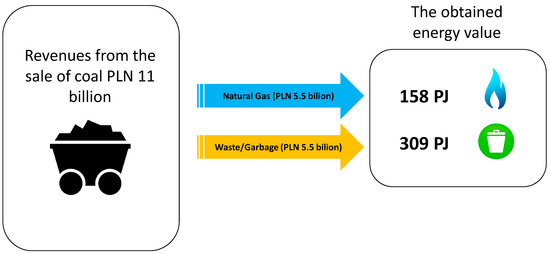

The use of the purchase of such fuels allows for the energy value of 274.6 PJ to be obtained. Scenario 8 assumes that 50% of the revenue from the sale of coal is spent on waste disposal, and 50% on the purchase of gas. In this simulation, we assume that we allocate the revenues from the sale of coal to the purchase of fuels with the highest calorific values, as shown in Figure 6 and Table 5.

Figure 6.

Scenario 8—energy value (PJ) of the purchased mix of alternative fuels. Source: own study.

Table 5.

Estimation of the energy value for scenario 8.

The next table (Table 6) GOOD compares the value of energy obtained from a given type of alternative fuel for the purchase of which PLN 11 billion was allocated compared to the energy value of coal also purchased for PLN 11 billion.

Table 6.

Estimation of the share of the energy value of alternative fuels compared to the energy value of coal, assuming that the entire cash flow is allocated to the purchase of only one energy fuel (scenarios 1–4).

In the case of waste disposal (Table 6), almost 61% of the energy value that can be obtained from coal could be covered. On the other hand, when buying gas, only 30% of the energy value that can be obtained from coal can be covered, as the price impact decreases its efficiency. In the case of heating oil, this ratio drops to 11.5%. The least efficient fuel type is wood, mainly due to the low calorific value. Spending PLN 11 billion on the purchase of wood can cover only 8% of the energy value of hard coal purchased for the same amount.

The scenarios proposed by the authors indicate that implementing “just transition” in Poland requires the application of an appropriate energy mix, with the use of alternative fuels to obtain an energy value equivalent to the energy value of coal.

When analyzing the energy values of coal and the cost of replacing them with alternative fuels, it should be stated that heating oil has a similar energy value to coal. However, replacing coal with heating oil requires its purchase, as in the case of gas. Wood has the lowest energy value, which in turn requires a very large demand for this raw material to ensure the same energy value that coal provides.

The simulations shown above indicate that the use of alternative fuels makes it possible to replace hard coal. However, they will not provide 100% of the energy value obtained from coal combustion. Replacing hard coal with heating oil generates almost four times higher purchase costs, and with wood 3000 times higher, to receive the same calorific value. If we follow the analyzed ratio about high-methane natural gas, the indicator shows almost 1:1 to ensure energy security and stability of supplies. However, then another problem appears with generating a surplus for the purchase of this raw material. It should be noted that while wood and biogas are raw materials that Poland can produce internally, the remaining types of alternative fuels (including natural gas) need to be imported from abroad, incurring additional outlays including investment, additional logistics costs, e.g., transport, storage.

The RCAES Index is an initial measure that may be a tool for improving the decarbonisation process in coal-based countries. The proposed method of index construction enables the selection of alternative energy sources, i.e., fuel oil, wood, garbage (waste), and gas, and be maybe a universal modeling instrument for the decarbonisation process. The proposed index was designed for all entities related to the coal and energy sectors.

Therefore, as a result of the research, the authors of the study recommend the RCAES Index:

where n is the percentage of alternative fuels involvement depending on the level of expenditure of a given entity—a more expensive or cheaper mix (Equation (1)):

Index RCAES = n HO + n W + n GAR + n G

heating oil—HO

wood—W

garbage/waste—GAR

gas—G

The proposed index is a universal instrument that can be used in subsequent research to improve practices and prepare other countries’ economies for changes in the energy security of a given country.

5. Conclusions and Recommendations

The results of the conducted research have shown that to ensure energy security by resigning from coal mining, disproportionate investment outlays and high costs need to be incurred to secure the transformation of the energy sector in Poland. However, this requires a good condition of the Polish economy and high GDP to meet the financial requirements of such a transformation [73,74,75,76,77].

The article aimed to indicate the importance of investment outlays and costs incurred when purchasing alternative fuels that would replace hard coal in Poland. This is a necessary step in the process of adjusting our current energy policy to the requirements of the new energy policy adopted by Poland as a member of the European Union. A long-term, stable energy policy and regulations based on it usually guarantee energy development. The implemented EU energy policy determines the development of Polish energy policy, and then implementing regulations into Polish law has an impact on the functioning of individual economic entities in the domestic energy market.

Based on the results obtained, the following conclusions should be drawn:

- The replacement of coal with heating oil generates purchase costs that are four times higher compared to the cost of purchasing coal which secures the same energy value. For wood, the purchase costs surpass 3000 times the cost of coal purchase. If we follow the analyzed ratio in relation to high-methane natural gas, the indicator shows almost equal cost efficiency compared to hard coal to ensure energy security and stability of supplies. However, natural gas requires generating an extra surplus for the purchase of this raw material which needs to be imported from abroad.

- Wood and biogas are raw materials that Poland can produce internally; however, their calorific value is low compared to coal, making them an ineffective energy source. The remaining alternative fuels proposed need to be imported from abroad, incurring additional costs such as transportation, storage, and in the case of waste, the costs of their disposal.

- Poland’s energy policy requires the use of a large variety of fuels to secure the energy value which is currently being obtained from hard coal.

- The most important consequence of the global mining sector transformation includes the change in energy sources, which is associated with the abandonment of coal mining. For example, closure of the mine, change, and liquidation of employment in the hard coal sector and mining-related sectors.

- The effects of redirecting investment outlays to the purchase of alternative fuels in the context of global energy security will be mainly photovoltaic panels and alternative sources such as gas, incineration plants, and others.

- Redirection of the cash inflows from coal sales to the purchase of other energy fuels will be reflected in increased costs for the economy and GDP.

- Purchase of alternative fuels will cover the energy value obtained from coal at the level of almost 70%.

The conclusions further emphasize the purposefulness of the considerations, thus indicating that the main hypothesis, that the use of alternative fuels can ensure Poland’s energy security, has not been confirmed. The main research objective has been achieved, but it should be mentioned that to ensure energy security, abandoning coal mining requires disproportionate economic outlays and high levels of GDP, which would have to be allocated to the purchase of alternative fuels [78,79].

It should be emphasized that coal is the economically best raw energy material, although the costs of its extraction and exploitation are high. In the case of coal-dependent economies, it is virtually impossible to reduce the size of this sector in a short period. The energy security of each country should also be taken into account. The abandonment of this raw material may disturb the stability of energy supplies, therefore the RCAES Index proposed by the authors should be verified in subsequent studies in the case of economies of other coal-dependent countries.

Author Contributions

Conceptualization, M.W.-J. and I.E.; Data curation, M.W.-J., I.E., M.C. and K.O.; Formal analysis, B.S., M.W.-J., I.E., M.C. and K.O.; Funding acquisition, M.W.-J., M.C., I.E., B.S. and K.O.; Methodology, B.S. and M.W.-J.; Project administration, M.W.-J., K.O. and M.C.; Resources, M.W.-J., B.S. and M.C.; Software, M.C.; Supervision, M.W.-J., B.S. and M.C.; Validation, M.W.-J. and M.C.; Visualization, M.W.-J., M.C. and B.S.; Writing—original draft, I.E., M.W.-J., M.C., B.S. and K.O.; Writing—review and editing, M.W.-J. and M.C. All authors have read and agreed to the published version of the manuscript.

Funding

The project was financed within the framework of the program of the Minister of Science and Higher Education under the name „Regional Excellence Initiative” in the years 2019–2022; project number 001/RID/2018/19; the amount of financing PLN 10,684,000.00; The publication was financed from the subsidy granted to the Cracow University of Economics (to M.W.-J. and I.E.).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data is contained within the article.

Acknowledgments

The authors thank the anonymous Reviewers and the Editors for their valuable contributions that significantly improved this manuscript.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Hoppe, T.; De Vries, G. Social Innovation and the Energy Transition. Sustainability 2019, 11, 141. [Google Scholar] [CrossRef]

- Oyewunmi, T.; Crossley, P.; Talus, K.; Sourgens, F.; Jones, K.B.; Jervey, B.B.; Roche, M. Decarbonization and the Energy Industry: An Introduction to the Legal and Policy Issues. Tulane Public Law Research Paper No. 20-9. 2020. Available online: https://ssrn.com/abstract=3548837 (accessed on 7 November 2021).

- Victoria, M.; Zhu, K.; Brown, T.; Andresen, G.B.; Greiner, M. Early Decarbonisation of the European Energy System Pays off. Nat. Commun. 2020, 11, 6223. [Google Scholar] [CrossRef] [PubMed]

- Hübler, M.; Löschel, A. The EU Decarbonisation Roadmap 2050 What Way to Walk? Energy Policy 2013, 55, 190–207. [Google Scholar] [CrossRef]

- Global Economic Prospects, June 2020; The World Bank: Washington, DC, USA, 2020; ISBN 978-1-4648-1553-9.

- Zenghelis, D. Securing Decarbonisation and Growth. Natl. Inst. Econ. Rev. 2019, 250, R54–R60. [Google Scholar] [CrossRef]

- Fay, M.; Hallegatte, S.; Vogt-Schilb, A.; Rozenberg, J.; Narloch, U. Decarbonizing Development: Three Steps to a Zero-Carbon Future. Renew. Resour. J. 2015, 29, 11–19. [Google Scholar] [CrossRef]

- Tran, T.H.; Mao, Y.; Siebers, P.O. Optimising Decarbonisation Investment for Firms towards Environmental Sustainability. Sustainability 2019, 11, 5718. [Google Scholar] [CrossRef]

- Capros, P.; Tasios, N.; de Vita, A.; Mantzos, L.; Paroussos, L. Model-Based Analysis of Decarbonising the EU Economy in the Time Horizon to 2050. Energy Strategy Rev. 2012, 1, 76–84. [Google Scholar] [CrossRef]

- Leal-Arcas, R. New Frontiers of International Economic Law: The Quest for Sustainable Development. Univ. Pa. J. Int. Law 2018, 40, 83. [Google Scholar]

- Drożdż, W.; Kinelski, G.; Czarnecka, M.; Wójcik-Jurkiewicz, M.; Maroušková, A.; Zych, G. Determinants of Decarbonization—How to Realize Sustainable and Low Carbon Cities? Energies 2021, 14, 2640. [Google Scholar] [CrossRef]

- Wójcik-Jurkiewicz, M.; Czarnecka, M.; Kinelski, G.; Sadowska, B.; Bilińska-Reformat, K. Determinants of Decarbonisation in the Transformation of the Energy Sector: The Case of Poland. Energies 2021, 14, 1217. [Google Scholar] [CrossRef]

- Bilan, Y.; Streimikiene, D.; Vasylieva, T.; Lyulyov, O.; Pimonenko, T.; Pavlyk, A. Linking between Renewable Energy, CO2 Emissions, and Economic Growth: Challenges for Candidates and Potential Candidates for the EU Membership. Sustainability 2019, 11, 1528. [Google Scholar] [CrossRef]

- Bigerna, S.; D’Errico, M.C.; Polinori, P. Heterogeneous impacts of regulatory policy stringency on the EU electricity Industry: A Bayesian shrinkage dynamic analysis. Energy Policy 2020, 142, 111522. [Google Scholar] [CrossRef]

- Knobloch, F.; Pollitt, H.; Chewpreecha, U.; Daioglou, V.; Mercure, J.F. Simulating the Deep Decarbonisation of Residential Heating for Limiting Global Warming to 1.5 °C. Energy Effic. 2019, 12, 521–550. [Google Scholar] [CrossRef]

- Zhou, L.; Li, J.; Li, F.; Meng, Q.; Li, J.; Xu, X. Energy Consumption Model and Energy Efficiency of Machine Tools: A Comprehensive Literature Review. J. Clean. Prod. 2016, 112, 3721–3734. [Google Scholar] [CrossRef]

- Zimon, G. An Assessment of the Strategy of Working Capital Management in Polish Energy Companies. Int. J. Energy Econ. Policy 2019, 9, 552–556. [Google Scholar] [CrossRef][Green Version]

- Audoly, R.; Vogt-Schilb, A.; Guivarch, C.; Pfeiffer, A. Pathways toward Zero-Carbon Electricity Required for Climate Stabilization. Appl. Energy 2018, 225, 884–901. [Google Scholar] [CrossRef]

- Azevedo, I.; Shaner, M.; Stagner, J.; Chiang, Y.; Benson, S.; Caldeira, K.; Fennell, P.; Edmonds, J.; Ingersoll, E.; Jaramillo, P.; et al. Net-Zero Emissions Energy Systems. Science 2018, 360, 9793. [Google Scholar] [CrossRef]

- Ayoub, A.; Gaigneux, A.; LeBrun, N.; Acha, S.; Lambert, R.; Shah, N. The Development of a Carbon Roadmap Investment Strategy for Carbon Intensive Food Retail Industries. Energy Procedia 2019, 161, 333–342. [Google Scholar] [CrossRef]

- Ang, B.W.; Su, B. Carbon Emission Intensity in Electricity Production: A Global Analysis. Energy Policy 2016, 94, 56–63. [Google Scholar] [CrossRef]

- Blyth, W.; Bunn, D.; Chronopoulos, M.; Munoz, J.; Bunn, D.W. Systematic Analysis of the Evolution of Electricity and Carbon Markets under Deep Decarbonisation, Norwegian School of Economics. 2014, pp. 1–36. Available online: https://openaccess.nhh.no/nhh-xmlui/handle/11250/227052 (accessed on 7 November 2021).

- Lew, G.; Sadowska, B.; Chudy-Laskowska, K.; Zimon, G.; Wójcik-Jurkiewicz, M. Influence of Photovoltaic Development on Decarbonization of Power Generation—Example of Poland. Energies 2021, 14, 7819. [Google Scholar] [CrossRef]

- Bigerna, S.; D’Errico, M.C.; Polinori, P. Energy security and RES penetration in a growing decarbonized economy in the era of the 4th industrial revolution. Technol. Forecast. Soc. Chang. 2021, 166, 120648. [Google Scholar] [CrossRef]

- Åhman, M.; Nilsson, L.J.; Johansson, B. Global Climate Policy and Deep Decarbonization of Energy-Intensive Industries. Clim. Policy 2017, 17, 634–649. [Google Scholar] [CrossRef]

- Shahbaz, M.; Nasir, M.A.; Hille, E.; Mahalik, M.K. UK’s net-zero carbon emissions target: Investigating the potential role of economic growth, financial development and R&D expenditures based on historical data (1870–2017). Technol. Forecast. Soc. Chang. 2020, 161, 120255. [Google Scholar]

- Chalvatzis, K.J. Electricity generation development of eastern Europe: A carbon technology management case study for Poland. Renew. Sustain. Energy Rev. 2009, 13, 1606–1612. [Google Scholar] [CrossRef]

- Tvinnereim, E.; Mehling, M. Carbon Pricing and Deep Decarbonisation. Energy Policy 2018, 121, 185–189. [Google Scholar] [CrossRef]

- Jackson, R.B.; le Quéré, C.; Andrew, R.M.; Canadell, J.G.; Korsbakken, J.I.; Liu, Z.; Peters, G.P.; Zheng, B. Global Energy Growth Is Outpacing Decarbonization. Environ. Res. Lett. 2018, 13, 120401. [Google Scholar] [CrossRef]

- Zamasz, K. Energy Company in a Competitive Energy Market. Polityka Energetyczna 2018, 21, 35–48. [Google Scholar] [CrossRef]

- Leal-Arcas, R. Towards Sustainability in Trade, Energy and Climate. Mod. Environ. Sci. Eng. 2020, 6, 1–30. [Google Scholar] [CrossRef]

- The Intergovernmental Panel on Climate Change (IPCC). AR5 Synthesis Report: Climate Change 2014. Available online: https://www.ipcc.ch/report/ar5/syr/ (accessed on 1 July 2021).

- Marx, C. Climate Change and Financial Sustainability: A Regulator’s Perspective. ERA Forum 2020, 21, 171–175. [Google Scholar] [CrossRef]

- Kaszyński, P.; Kamiński, J. Coal Demand and Environmental Regulations: A Case Study of the Polish Power Sector. Energies 2020, 13, 1521. [Google Scholar] [CrossRef]

- Noothout, P.; de Jager, D.; Tesnière, L.; van Rooijen, S. The Impact of Risks in Renewable Energy Investments and the Role of Smart Policies. DiaCore 2016. [Google Scholar] [CrossRef]

- Ministry of Climate and Environment. Energy Policy of Poland until 2040 (PEP2040); Ministry of Climate and Environment: Warsaw, Poland, 2021. [Google Scholar]

- Tsakalidis, A.; Gkoumas, K.; Pekár, F. Digital Transformation Supporting Transport Decarbonisation: Technological Developments in EU-Funded Research and Innovation. Sustainability 2020, 12, 3762. [Google Scholar] [CrossRef]

- Palmer-Wilson, K.; Donald, J.; Robertson, B.; Lyseng, B.; Keller, V.; Fowler, M.; Wade, C.; Scholtysik, S.; Wild, P.; Rowe, A. Impact of Land Requirements on Electricity System Decarbonisation Pathways. Energy Policy 2019, 129, 193–205. [Google Scholar] [CrossRef]

- Spencer, T.; Pierfederici, R.; Sartor, O.; Berghmans, N.; Samadi, S.; Fischedick, M.; Knoop, K.; Pye, S.; Criqui, P.; Mathy, S. Tracking Sectoral Progress in the Deep Decarbonisation of Energy Systems in Europe. Energy Policy 2017, 110, 509–517. [Google Scholar] [CrossRef]

- Barrett, J.; Cooper, T.; Hammond, G.P.; Pidgeon, N. Industrial Energy, Materials and Products: UK Decarbonisation Challenges and Opportunities. Appl. Therm. Eng. 2018, 136, 643–656. [Google Scholar] [CrossRef]

- Svensson, O.; Khan, J.; Hildingsson, R. Studying Industrial Decarbonisation: Developing an Interdisciplinary Understanding of the Conditions for Transformation in Energy-Intensive Natural Resource-Based Industry. Sustainability 2020, 12, 2129. [Google Scholar] [CrossRef]

- Allevi, E.; Oggioni, G.; Riccardi, R.; Rocco, M. Evaluating the Carbon Leakage Effect on Cement Sector under Different Climate Policies. J. Clean. Prod. 2017, 163, 320–337. [Google Scholar] [CrossRef]

- Thiel, C.; Nijs, W.; Simoes, S.; Schmidt, J.; van Zyl, A.; Schmid, E. The Impact of the EU Car CO2 Regulation on the Energy System and the Role of Electro-Mobility to Achieve Transport Decarbonisation. Energy Policy 2016, 96, 153–166. [Google Scholar] [CrossRef]

- Berkenkamp, M.; Götz, P.; Heddrich, M. Integration of European Energy Market. Poland and Baltic Sea Region; Energy Brainpool: Frankfurt/Berlin, Germany, 2016. [Google Scholar]

- Cheema-Fox, A.; Laperla, B.R.; Serafeim, G.; Turkington, D.; Wang, H. Decarbonization Factors. Harvard Business School Working Paper, No. 20-037. September 2019. Available online: https://www.hbs.edu/faculty/Pages/item.aspx?num=56840 (accessed on 7 November 2021).

- Fortes, P.; Simoes, S.G.; Gouveia, J.P.; Seixas, J. Electricity, the Silver Bullet for the Deep Decarbonisation of the Energy System? Cost-Effectiveness Analysis for Portugal. Appl. Energy 2019, 237, 292–303. [Google Scholar] [CrossRef]

- Kulovesi, K.; Oberthür, S. Assessing the EU’s 2030 Climate and Energy Policy Framework: Incremental Change toward Radical Transformation? Rev. Eur. Comp. Int. Environ. Law 2020, 29, 151–166. [Google Scholar] [CrossRef]

- Kahn, H.; Wiener, A.J. The Year 2000: A Framework for the Next Thirty-Three Years; Hardcover; MacMillan Publishing Company: London, UK, 1967; ISBN 978-0025604407. [Google Scholar]

- Cabała, P. Planning a scenario in an enterprise. Przegląd Organ. 2007, 4, 14–16. [Google Scholar] [CrossRef]

- Godet, M. The Crisis in Forecasting and the Emergence of the ‘Perspective’ Approach; Pergamon Press Inc.: New York, NY, USA, 1979; p. 49. [Google Scholar]

- Mullally, G.; Byrne, E. A Tale of Three Transitions: A Year in the Life of Electricity System Transformation Narratives in the Irish Media. Energy Sustain. Soc. 2015, 6, 3. [Google Scholar] [CrossRef]

- Hildingsson, R.; Kronsell, A.; Khan, J. The Green State and Industrial Decarbonisation. Environ. Politics 2019, 28, 909–928. [Google Scholar] [CrossRef]

- Schmidt, S.; Weigt, H. Interdisciplinary Energy Research and Energy Consumption: What, Why, and How? Energy Res. Soc. Sci. 2015, 10, 206–219. [Google Scholar] [CrossRef]

- Schmidt, S.; Weigt, H. A Review on Energy Consumption from a Socio-Economic Perspective: Reduction Through Energy Efficiency and Beyond. SSRN Electron. J. 2014. [Google Scholar] [CrossRef][Green Version]

- De Leon Barido, D.P.; Avila, N.; Kammen, D.M. Exploring the Enabling Environments, Inherent Characteristics and Intrinsic Motivations Fostering Global Electricity Decarbonization. Energy Res. Soc. Sci. 2020, 61, 101343. [Google Scholar] [CrossRef]

- Immink, H.; Louw, R.T.; Brent, A.C. Tracking Decarbonisation in the Mining Sector. J. Energy S. Afr. 2018, 29, 14–23. [Google Scholar] [CrossRef]

- Ang, B.W.; Choong, W.L.; Ng, T.S. Energy security: Definitions, dimensions and indexes. Renew. Sustain. Energy Rev. 2015, 42, 1077–1093. [Google Scholar] [CrossRef]

- Wiese, C.; Larsen, A.; Pade, L. Interaction effects of energy efficiency policies: A review. Energy Effic. 2018, 11, 2137–2156. [Google Scholar] [CrossRef]

- Linares, P.; Labandeira, X. Energy efficiency: Economics and policy. J. Econ. Surv. 2010, 24, 573–592. [Google Scholar] [CrossRef]

- Lovins, A.B.; Üge-Vorsatz, D.; Mundaca, L.; Kammen, D.M.; Glassman, J.W. Recalibrating climate prospects. Environ. Res. Lett. 2019, 4, 120201. [Google Scholar] [CrossRef]

- International Energy Agency (IEA). World Energy Outlook 2020; IEA: Paris, France, 2020. [Google Scholar]

- Gorynia, M.; Nowak, J.; Wolniak, R. On the Path of Poland’s Globalization. In Foreign Direct Investment in Central and Eastern Europe; Routledge: London, UK, 2018; pp. 230–246. [Google Scholar]

- Rabe, M.; Streimikiene, D.; Bilan, Y. EU Carbon Emissions Market Development and Its Impact on Penetration of Renewables in the Power Sector. Energies 2019, 12, 2961. [Google Scholar] [CrossRef]

- Wąchol, J. Reformy Gospodarcze w Górnictwie a Koszty Ekonomiczne I Społeczne w Polsce; Wyd AGH: Kraków, Poland, 2002. [Google Scholar]

- Fornalczyk, A.; Choroszczek, J.; Mikulec, M. Restrukturyzacja Górnictwa Węgla Kamiennego; Poltext: Warszawa, Poland, 2008. [Google Scholar]

- Energy Perspectives 2013. In Long Macroeconomic Perspective; Statoil: Stavanger, Norway, 2012.

- Gomułka, S. Wzrost gospodarczy Polski w perspektywie światowej i długofalowej: Do roku 2015, ostatnie dwa lata prognozy. In Raport. Perspektywy dla Polski; Forum Obywatelskiego Rozwoju: Warsaw, Poland, 2017; pp. 23–45. [Google Scholar]

- Zieniuk, P. Disclosures Regarding the Risk of Estimated Measurement in the Financial Statements—Behavioral Aspects. Zesz. Teor. Rachun. 2019, 104, 171–188. [Google Scholar] [CrossRef]

- Holmgren, J.; Merkel, A. Much ado about nothing?—A meta-analysis of the relationship between infrastructure and economic growth. Res. Transp. Econ. 2017, 63, 13–26. [Google Scholar] [CrossRef]

- Garcia, V.A.; Meseguer, J.A.; Ortiz, L.P.; Tuesta, D. Infractructure and Economic Growth from a Meta Analysis Approach: Do All Roads Lead to Rome? Working Paper; BBVA Research: Madrid, Spain, 2017. [Google Scholar]

- Kasperowicz, R.; Štreimikienė, D. Economic growth and energy consumption: Comparative analysis of V4 and the “old” EU countries. J. Int. Stud. 2016, 9, 181–194. [Google Scholar] [CrossRef]

- Kasperowicz, R. Economic growth and energy consumption in 12 European countries: A panel data approach. J. Int. Stud. 2014, 7, 112–122. [Google Scholar] [CrossRef]

- Senkus, P.; Glabiszewski, W.; Wysokińska-Senkus, A.; Cyfert, S.; Batko, R. The Potential of Ecological Distributed Energy Generation Systems, Situation, and Perspective for Poland. Energies 2021, 14, 7966. [Google Scholar] [CrossRef]

- Czakon, W.; Mucha-Kuś, K.; Sołtysik, M. Coopetitive Platform: Common Benefits in Electricity and Gas Distribution. Energies 2021, 14, 7113. [Google Scholar] [CrossRef]

- Kiuila, O. Decarbonisation perspectives for the Polish economy. Energy Policy 2018, 118, 69–76. [Google Scholar] [CrossRef]

- Toborek-Mazur, J.; Wójcik-Jurkiewicz, M. Multi-Energy Concern as an Example of the Implementation of Agenda 2030: Poland as a Case Study. Energies 2022, 15, 1669. [Google Scholar] [CrossRef]

- Zamasz, K.; Kapłan, R.; Kaszynski, P.; Saługa, P. An Analysis of Support Mechanisms for New CHPs: The Case of Poland. Energies 2020, 13, 5635. [Google Scholar] [CrossRef]

- Czarnecka, M.; Kinelski, G.; Stefańska, M.; Grzesiak, M.; Budka, B. Social Media Engagement in Shaping Green Energy Business Models. Energies 2022, 15, 1727. [Google Scholar] [CrossRef]

- Işik, C.; Kasımatı, E.; Ongan, S. Analyzing the causalities between economic growth, financial development, international trade, tourism expenditure and/on the CO2 emissions in Greece. Energy Sources Part B Econ. Plan. Policy 2017, 12, 665–673. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).