Impact Analysis of a National and Corporate Carbon Emission Reduction Target on Renewable Electricity Use: A Review

Abstract

1. Introduction

2. Literature Review

2.1. The Development of International Carbon Reduction Action and Related Studies

2.2. Corporate Carbon Reduction and Related Studies on the Adoption of Renewable Energy

3. Research Methodology

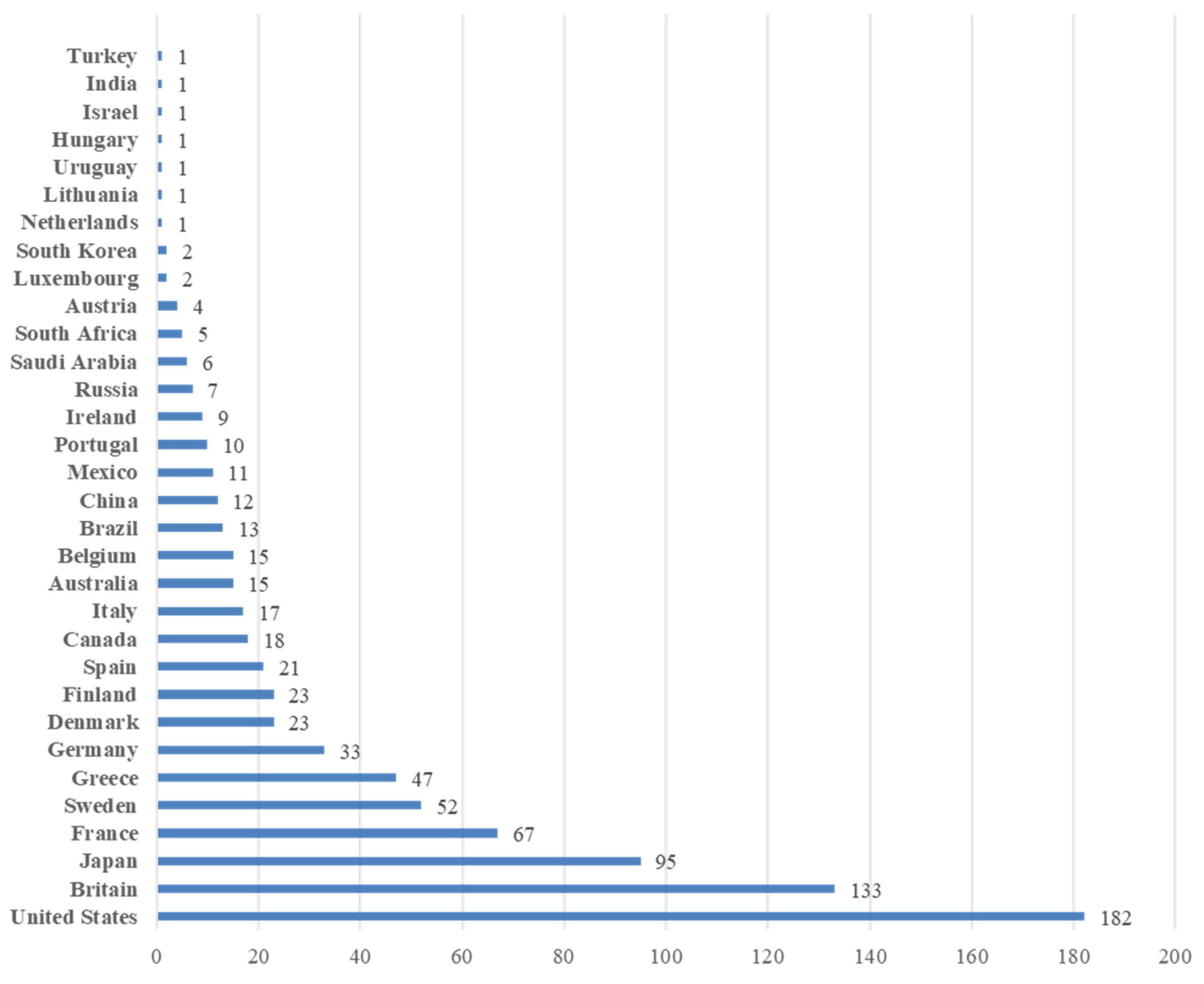

3.1. Data Sources

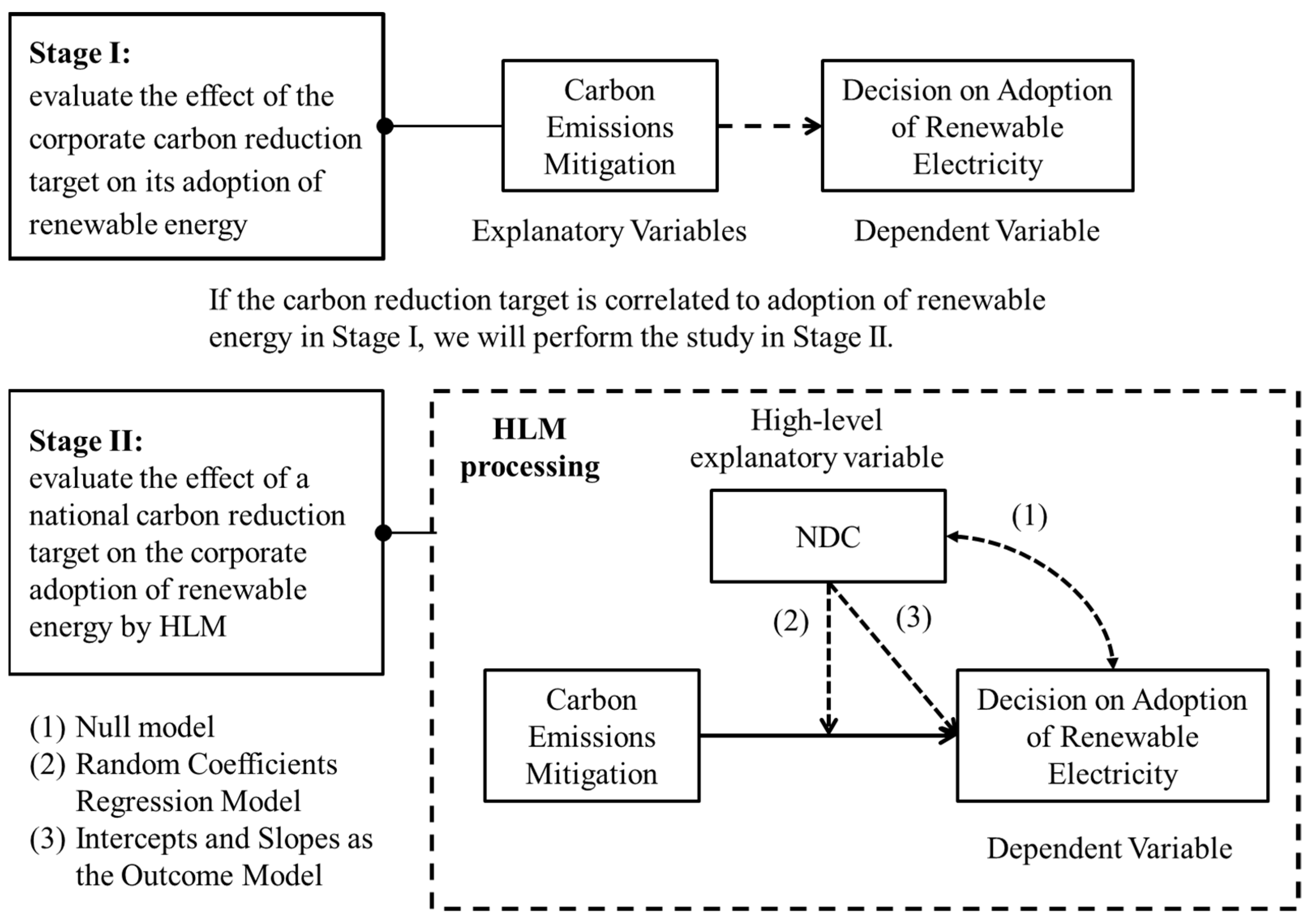

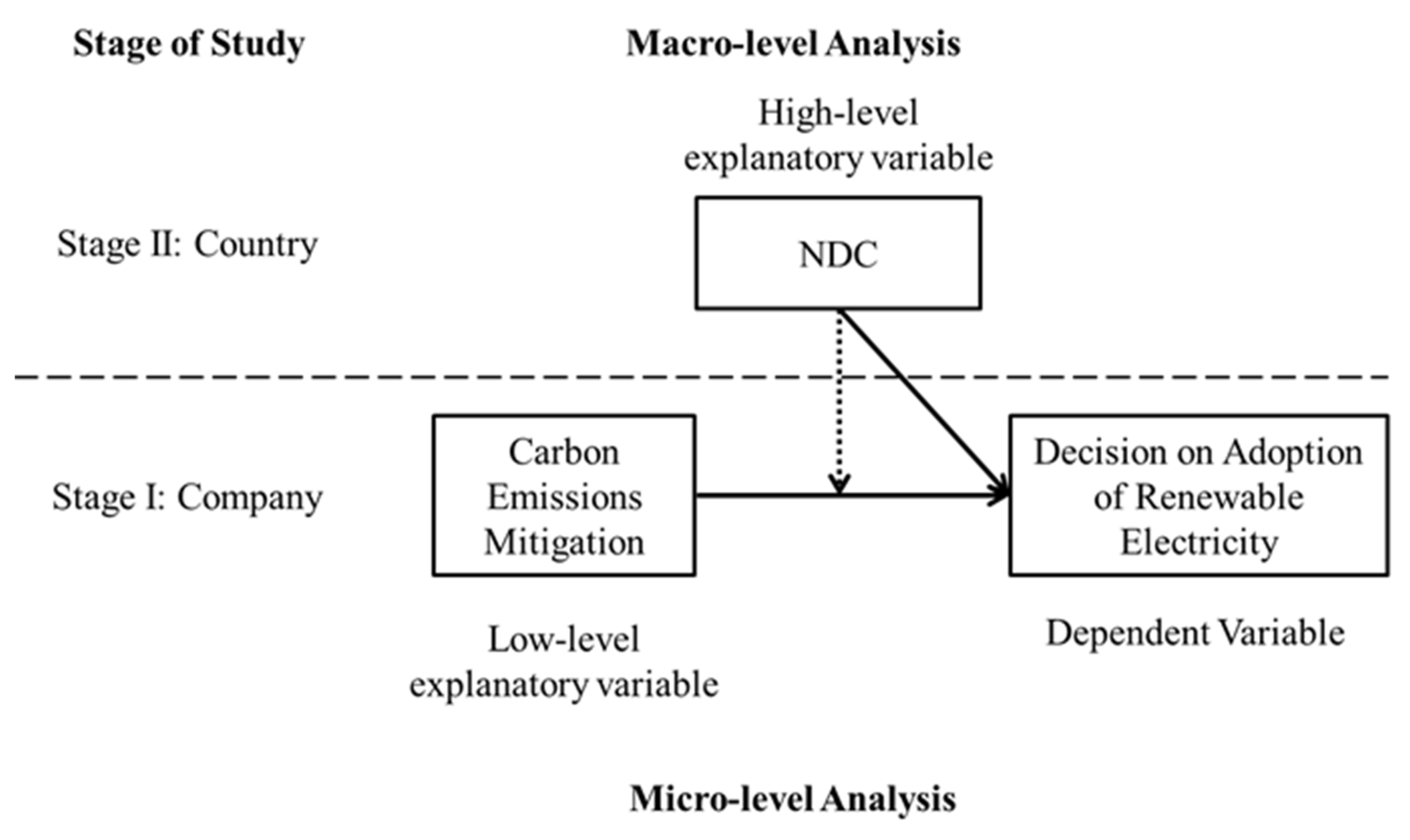

3.2. Empirical Model

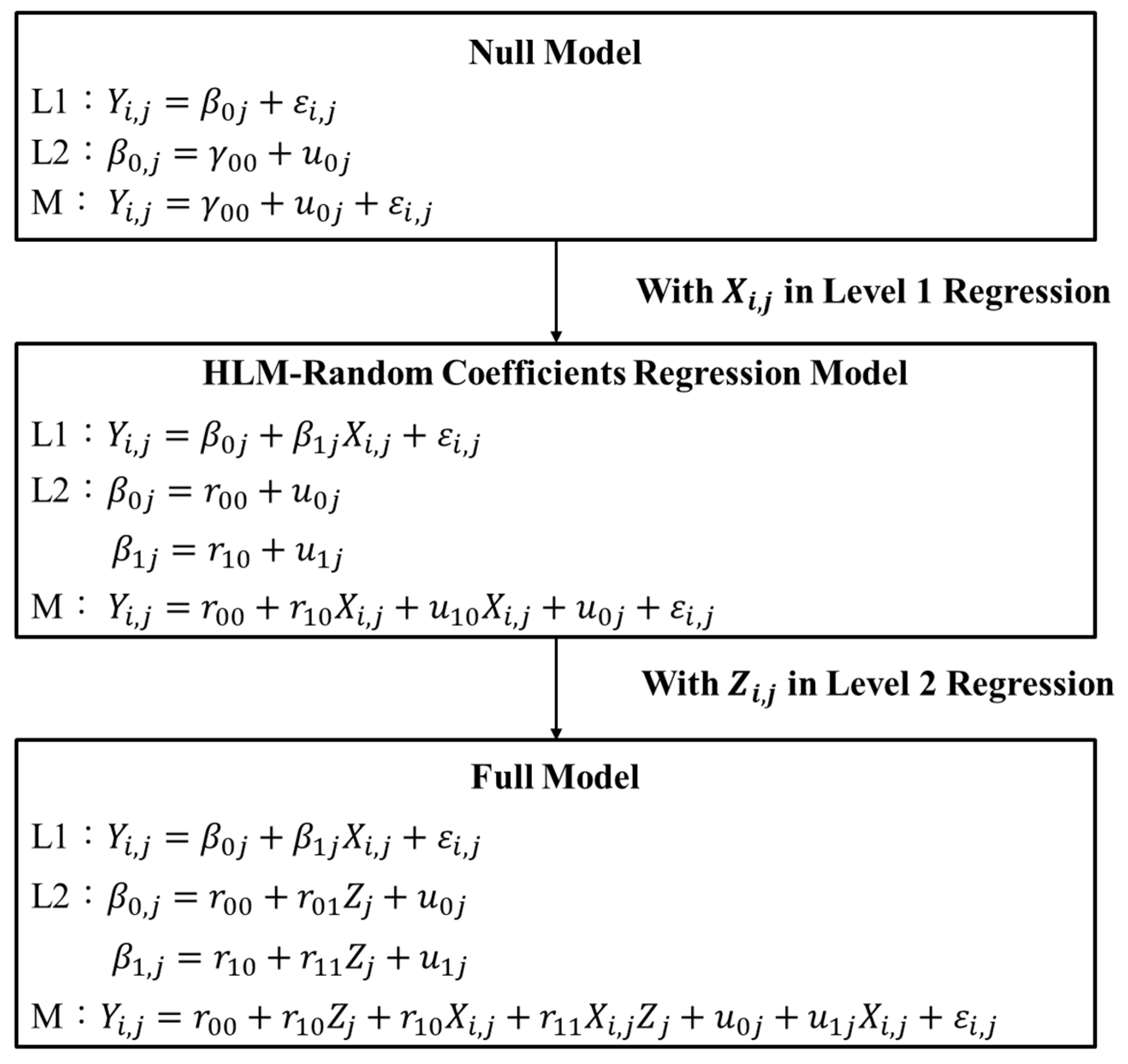

- HLM-ANOVA Model

- HLM-Random Coefficients Regression Model

- Intercepts and Slopes as the Outcome Model

4. Empirical Results

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| greenhouse gas | GHG |

| non-governmental organizations | NGOs |

| Nationally Determined Contributions | NDCs |

| Group of Twenty | G20 |

| Hierarchical Linear Modeling | HLM |

| Conference of the Parties | COP |

| Science Based Target Initiative | SBTi |

| Bloomberg New Energy Finance | BNEF |

| corporate social responsibility | CSR |

| Middle East and North Africa | MENA |

| clean development mechanism | CDM |

| science-based targets | SBTs |

| analysis of variance | ANOVA |

| intra-class correlation coefficient | ICC |

| renewable energy certificates | RECs |

| Power Purchase Agreements | PPAs |

| Akaike information criterion | AIC |

References

- Saran, S. Global Governance and Climate Change. Glob. Gov. 2009, 15, 457–460. Available online: http://www.jstor.org/stable/27800775 (accessed on 5 January 2020). [CrossRef]

- Rosenau, J.N. Governance in the Twenty-First Century. Glob. Gov. 1995, 1, 13–43. Available online: http://www.jstor.org/stable/27800099 (accessed on 5 January 2020). [CrossRef]

- Dingwerth, K.; Pattberg, P. Global Governance as a Perspective on World Politics. Glob. Gov. 2006, 12, 185–203. Available online: http://www.jstor.org/stable/27800609 (accessed on 5 January 2020). [CrossRef]

- Biermann, F.; Pattberg, P.; van Asselt, H.; Zelli, F. The Fragmentation of Global Governance Architectures: A Framework for Analysis. Glob. Environ. Politics 2009, 9, 14–40. [Google Scholar] [CrossRef]

- Lederer, M. Global governance. In Research Handbook on Climate Governance; Bäckstrand, K., Lövbrand, E., Eds.; Edward Elgar Publishing: Cheltenham, UK, 2015; pp. 3–13. [Google Scholar] [CrossRef][Green Version]

- Weiss, T.; Thakur, R.; Ruggie, J. Global Governance and the UN: An Unfinished Journey; Indiana University Press: Bloomington, IN, USA, 2010; pp. 1–420. [Google Scholar]

- Andonova, L.; Betsill, M.; Bulkeley, H. Transnational Climate Governance. Glob. Environ. Politics 2009, 9, 52–73. [Google Scholar] [CrossRef]

- Persson, Å. Global adaptation governance: An emerging but contested domain. WIREs Clim. Chang. 2019, 10, e618. [Google Scholar] [CrossRef]

- The Paris Agreement (United Nations Framework Convention on Climate Change). Available online: https://unfccc.int/process-and-meetings/the-paris-agreement/the-paris-agreement (accessed on 23 January 2022).

- Energy & Climate Intelligence Unit. Available online: https://eciu.net/netzerotracker (accessed on 23 January 2022).

- Wirth, D.A. The Paris Agreement as a New Component of the UN Climate Regime. Int. Organ. Res. J. 2017, 12, 185–214. [Google Scholar] [CrossRef]

- Taebi, B.; Safari, A. On Effectiveness and Legitimacy of ‘Shaming’ as a Strategy for Combatting Climate Change. Sci. Eng. Ethics 2017, 23, 1289–1306. [Google Scholar] [CrossRef]

- Sutherland, P. Obligations to Reduce Emissions: From the Oslo Principles to Enterprises. J. Eur. Tort Law 2017, 8, 177–216. [Google Scholar] [CrossRef]

- Zhang, B.; Lai, K.H.; Wang, B.; Wang, Z.H. Shareholder Value Effects of Corporate Carbon Trading: Empirical Evidence from Market Reaction Towards Clean Development Mechanism in China. Energy Policy 2017, 110, 410–421. [Google Scholar] [CrossRef]

- Le, T.H.; Nguyen, C.P.; Park, D. Financing Renewable Energy Development: Insights from 55 Countries. Energy Res. Soc. Sci. 2020, 68, 101537. [Google Scholar] [CrossRef]

- Carfora, A.; Pansini, R.V.; Romano, A.A.; Scandurra, G. Renewable Energy Development and Green Public Policies Complementarities: The Case of Developed and Developing Countries. Renew. Energy 2018, 115, 741–749. [Google Scholar] [CrossRef]

- What is the Kyoto Protocol? (United Nations Framework Convention on Climate Change). Available online: https://unfccc.int/kyoto_protocol (accessed on 23 January 2022).

- Royden, A.U.S. Climate Change Policy Under President Clinton: A Look Back. Gold. Gate Univ. Law Rev. 2002, 32. Available online: https://digitalcommons.law.ggu.edu/ggulrev/vol32/iss4/3 (accessed on 21 January 2022).

- Christoff, P. Cold climate in Copenhagen: China and the United States at COP15. Environ. Politics 2010, 19, 637–656. [Google Scholar] [CrossRef]

- History of Non-Party Stakeholder Engagement (United Nations Framework Convention on Climate Change). Available online: https://unfccc.int/climate-action/introduction-climate-action/history-non-party-stakeholder-engagement (accessed on 23 January 2022).

- Hall, N.; Persson, Å. Global Climate Adaptation Governance: Why Is It Not Legally Binding? Eur. J. Int. Relat. 2017, 24, 540–566. [Google Scholar] [CrossRef] [PubMed]

- CDP. Available online: https://www.cdp.net/en (accessed on 24 January 2022).

- Science Based Targets. Available online: https://sciencebasedtargets.org/ (accessed on 24 January 2022).

- RE100. Available online: https://www.there100.org/ (accessed on 24 January 2022).

- González-Ramos, M.; Donate, M.; Guadamillas, F. The Effect of Technological Posture and Corporate Social Responsibility on Financial Performance through Corporate Reputation. Int. J. Innov. 2018, 6, 164–179. [Google Scholar] [CrossRef]

- Akrout, M.M.; Othman, H.B. Environmental Disclosure and Stock Market Liquidity: Evidence from Arab MENA Emerging Markets. Appl. Econ. 2016, 48, 1840–1851. [Google Scholar] [CrossRef]

- Matsumura, E.M.; Prakash, R.; Vera-Muñoz, S.C. Firm-Value Effects of Carbon Emissions and Carbon Disclosures. Account. Rev. 2014, 89, 695–724. [Google Scholar] [CrossRef]

- Harrast, S.A.; Olsen, L.M. Climate Change Disclosures Are Getting Hotter. J. Corp. Account. Financ. 2016, 27, 21–28. [Google Scholar] [CrossRef]

- Shin, H.J.; Ellinger, A.E.; Nolan, H.H.; DeCoster, T.D.; Lane, F. An Assessment of the Association between Renewable Energy Utilization and Firm Financial Performance. J. Bus. Ethics 2018, 151, 1121–1138. [Google Scholar] [CrossRef]

- Van Prooijen, A.M. Public Trust in Energy Suppliers’ Communicated Motives for Investing in Wind Power. J. Environ. Psychol. 2019, 61, 115–124. [Google Scholar] [CrossRef]

- Nilsen, T. Innovation from the Inside Out: Contrasting Fossil and Renewable Energy Pathways at Statoil. Energy Res. Soc. Sci. 2017, 28, 50–57. [Google Scholar] [CrossRef]

- Wang, D.D.; Sueyoshi, T. Climate Change Mitigation Targets Set by Global Firms: Overview and Implications for Renewable Energy. Renew. Sustain. Energy Rev. 2018, 94, 386–398. [Google Scholar] [CrossRef]

- Ioannou, I.; Li, S.X.; Serafeim, G. The Effect of Target Difficulty on Target Completion: The Case of Reducing Carbon Emissions. Account. Rev. 2016, 91, 1467–1492. [Google Scholar] [CrossRef]

- Gouldson, A.; Sullivan, R. Long-Term Corporate Climate Change Targets: What Could They Deliver? Environ. Sci. Policy 2013, 27, 1–10. [Google Scholar] [CrossRef]

- Wang, D. A Comparative Study of Firm-Level Climate Change Mitigation Targets in the European Union and the United States. Sustainability 2017, 9, 489. [Google Scholar] [CrossRef]

- Huang, Y.A.; Weber, C.L.; Matthews, H.S. Categorization of Scope 3 Emissions for Streamlined Company Carbon Footprinting. Environ. Sci. Technol. 2009, 43, 8509–8515. [Google Scholar] [CrossRef]

- Ari, I.; Yikmaz, R.F. The Role of Renewable Energy in Achieving Turkey’s NDC. Renew. Sustain. Energy Rev. 2019, 105, 244–251. [Google Scholar] [CrossRef]

- Chunark, P.; Limmeechokchai, B.; Fujimori, S.; Masui, T. Renewable Energy Achievements in CO2 Mitigation in Thailand’s NDCs. Renew. Energy 2017, 114, 1294–1305. [Google Scholar] [CrossRef]

- Hu, W.C.; Lin, J.C.; Fan, C.T.; Lien, C.A.; Chung, S.M. A Booming Green Business for Taiwan’s Climate Perspective. Renew. Sustain. Energy Rev. 2016, 59, 876–886. [Google Scholar] [CrossRef]

- Blok, K.; Höhne, N.; van der Leun, K.; Harrison, N. Bridging the Greenhouse-Gas Emissions Gap. Nat. Clim. Chang. 2012, 2, 471–474. [Google Scholar] [CrossRef]

- Hsu, A.; Moffat, A.S.; Weinfurter, A.J.; Schwartz, J.D. Towards a New Climate Diplomacy. Nat. Clim. Chang. 2015, 5, 501–503. [Google Scholar] [CrossRef]

- Chiou, H.J.; Wen, F.H. Hierarchical Linear Modeling of Contextual Effects: An Example of Organizational Climate of Creativity at Schools and Teacher’s Creative Performance. J. Educ. Psychol. 2007, 30, 1–35. [Google Scholar] [CrossRef]

- Goldstein, H. Multilevel Statistical Models, 4th ed.; John Wiley: New York, NY, USA, 2011. [Google Scholar]

- Hox, J.J. Multilevel Analysis: Techniques and Applications, 2nd ed.; Lawrence Erlbaum: Mahwah, NJ, USA, 2010. [Google Scholar]

- Raudenbush, S.W.; Bryk, A.S. Hierarchical Linear Models: Applications and Data Analysis Methods, 2nd ed.; Sage: Newbury Park, CA, USA, 2002. [Google Scholar]

- Burstein, L.; Linn, R.L.; Capell, F.J. Analyzing Multilevel Data in the Presence of Heterogeneous Within-Class Regressions. J. Educ. Stat. 1978, 3, 347–383. [Google Scholar] [CrossRef]

- Anton, W.R.; Deltas, Q.G.; Khanna, M. Incentives for Environmental Self-Regulation and Implications for Environmental Performance. J. Environ. Econ. Manag. 2004, 48, 632–654. [Google Scholar] [CrossRef]

- Bowen, F.E. Environmental Visibility: A Trigger of Green Organizational Response? Bus. Strategy Environ. 2000, 9, 92–107. [Google Scholar] [CrossRef]

- Jin, T.; Shi, T.; Park, T. The quest for carbon-neutral industrial operations: Renewable power purchase versus distributed generation. Int. J. Prod. Res. 2018, 56, 5723–5735. [Google Scholar] [CrossRef]

- Wu, P.I.; Qiu, K.Z.; Liou, J.L. Project cost comparison under the clean development mechanism to inform investment selection by industrialized countries. J. Clean. Prod. 2017, 166, 1347–1356. [Google Scholar] [CrossRef]

- Bogdanov, D.; Ram, M.; Aghahosseini, A.; Gulagi, A.; Oyewo, A.S.; Child, M.; Caldera, U.; Sadovskaia, K.; Farfan, I.; Barbosa, L.S.N.S.; et al. Low-cost renewable electricity as the key driver of the global energy transition towards sustainability. Energy 2021, 227, 120467. [Google Scholar] [CrossRef]

- Rachmaniar, A.; Supriyadi, A.P.; Pradana, H.; Mustriadhi, A. Carbon trading system as a climate mitigation scheme: Why Indonesia should adopt it? IOP Conf. Ser. Earth Environ. Sci. 2021, 739, 012015. Available online: https://iopscience.iop.org/article/10.1088/1755-1315/739/1/012015 (accessed on 23 January 2022). [CrossRef]

| Variable | Definition | Source | |

|---|---|---|---|

| RE100i | Whether company i has joined the RE100 initiative. | RE100 Annual Report | |

| REPRi | Average annual growth rate of renewable energy use by company i | RE100 Annual Report | |

| Xi | SBTi | Whether company i has disclosed its SBT. | BNEF |

| TSi | Average annual mitigation rate of carbon emissions for company i | BNEF | |

| CVsi | lnAi | Natural log of the total assets of company i | Compustat |

| Li | Leverage of company i, the ratio of long-term liabilities to total assets in the latest year | Compustat | |

| RDi | R&D intensity of company i, the ratio of R&D expenses to total sales in the latest year | Compustat | |

| Industryi | Industrial classification of company i | BNEF | |

| Model | Model 1-1 | Model 1-2 |

|---|---|---|

| Variables | RE100 | REPR |

| Intercept | −7.881 *** (66.79) | −0.022 * (−1.89) |

| SBT | 1.112 *** (6.67) | −0.006 (−0.80) |

| TS | 3.570 (0.55) | 0.224 ** (2.12) |

| lnA | 0.498 *** (29.72) | 0.003 ** (2.50) |

| L | 0.661 (0.91) | 0.012 (0.99) |

| RD | 3.961 ** (5.06) | −0.031 (−0.73) |

| Control Variables of Industrial Sector | Yes | Yes |

| Goodness of Fit | 487.166 | 0.035 |

| Observations | 829 | 829 |

| Model | Model 2-1 | Model 2-2 | ||||

|---|---|---|---|---|---|---|

| Variable | RE100 | REPR | ||||

| Fixed Effects | Component of Variance Var(u01) | Random Effects | Fixed Effects | Component of Variance Var(u01) | Random Effects | |

| Intercept (r0,0) | 0.087 *** (4.91) | 0.003 ** (1.77) | Yes | 0.010 *** (4.01) | 0.001 (0.94) | No |

| Residuals (ε) | - | 0.095 *** (20.18) | - | - | 0.004 *** (20.27) | - |

| Goodness of Fit (AIC) | 0.04 | 0 | ||||

| Observations | 427.1 | −2270.7 | ||||

| Variables | RE100 | REPR | Observations |

|---|---|---|---|

| Fixed effect (r0,0) | 0.087 | 0.01 | 829 |

| uoj by Country | |||

| Australia | 0.036 | 0.001 | 15 |

| Austria | −0.010 | 0.000 | 4 |

| Belgium | 0.015 | 0.000 | 15 |

| Brazil | −0.025 | −0.001 | 13 |

| Canada | −0.010 | 0.001 | 17 |

| China | −0.001 | 0.000 | 12 |

| Denmark | 0.055 | 0.001 | 23 |

| Finland | −0.036 | −0.001 | 23 |

| France | 0.000 | 0.000 | 69 |

| Germany | −0.013 | 0.000 | 33 |

| Greece | −0.003 | 0.000 | 1 |

| Hungary | −0.003 | 0.000 | 1 |

| India | −0.038 | −0.002 | 45 |

| Ireland | 0.045 | 0.001 | 12 |

| Italy | −0.030 | −0.001 | 17 |

| Japan | 0.023 | −0.002 | 94 |

| Lithuania | −0.003 | 0.000 | 1 |

| Luxembourg | −0.007 | 0.000 | 3 |

| Mexico | 0.001 | 0.000 | 11 |

| Portugal | −0.022 | −0.001 | 11 |

| Russia | −0.005 | 0.000 | 2 |

| Saudi Arabia | −0.003 | 0.000 | 1 |

| South Africa | −0.012 | 0.000 | 5 |

| South Korea | −0.016 | 0.000 | 7 |

| Spain | −0.016 | −0.001 | 21 |

| Sweden | −0.042 | −0.002 | 53 |

| Turkey | −0.014 | 0.000 | 6 |

| United Kingdom (UK) | 0.025 | 0.003 | 136 |

| United States of America (USA) | 0.108 | 0.007 | 178 |

| Model | Model 3-1 | Model 3-2 | ||||

|---|---|---|---|---|---|---|

| Variable | RE100 | REPR | ||||

| Fixed Effects | Component of Variance Var(uij) | Random Effects | Fixed Effects | Component of Variance Var(uij) | Random Effects | |

| Intercept (r0,0) | −0.234 *** (-4.21) | 0.000 (0.00) | No | −0.020 * (−1.72) | 0.000 (0.00) | No |

| SBT (r1,0) | 0.0489 (1.40) | 0.001 (0.14) | No | −0.006 (−0.79) | 0.000 (0.00) | No |

| TS (r2,0) | 0.497 (0.79) | 1.355 ** (1.67) | Yes | 0.197 * (1.76) | 0.013 (0.94) | No |

| lnA | 0.034 *** (5.40) | - | - | 0.003 ** (2.40) | - | - |

| L | 0.009 (0.14) | - | - | 0.008 (0.67) | - | - |

| RD | 0.492 ** (2.44) | - | - | −0.033 (−0.79) | - | - |

| Residuals (ε) | - | 0.0832 *** (20.04) | - | - | 0.004 *** (20.28) | - |

| Control Variables of Industrial Sector | Yes | Yes | ||||

| Goodness of Fit (AIC) | 341.0 | −2280.5 | ||||

| Observations | 829 | 829 | ||||

| Model | Model 4-1 | Model 4-2 | ||||

|---|---|---|---|---|---|---|

| Variable | RE100 | REPR | ||||

| Fixed Effects | Component of Variance Var(uij) | Random Effects | Fixed Effects | Component of Variance Var(uij) | Random Effects | |

| Intercept (r0,0) | −0.228 *** (−4.07) | 0.000 (0.00) | No | −0.019 (−1.62) | 0.000 (0.00) | No |

| SBT (r1,0) | 0.066 (1.42) | 0.000 (0.17) | No | −0.005 (−0.49) | 0.000 (0.00) | No |

| TS (r2,0) | −0.011 (−0.01) | 1.328 * (1.63) | Yes | 0.159 (0.85) | 0.013 (0.93) | No |

| NDC (r0,1) | −0.008 (−0.38) | - | - | −0.002 (−0.34) | - | - |

| NDC×SBT (r1,1) | 0.040 (0.50) | - | - | 0.002 (0.11) | - | - |

| NDC×TS (r2,1) | −1.245 (−0.71) | - | - | −0.083 (−0.24) | - | - |

| lnA | 0.033 *** (5.22) | - | - | 0.003 ** (2.27) | - | - |

| L | 0.007 (0.11) | - | - | 0.008 (0.63) | - | - |

| RD | 0.487 ** (2.41) | - | - | −0.034 (−0.82) | - | - |

| Residuals (ε) | - | 0.083 *** (20.04) | - | - | 0.004 *** (20.28) | - |

| Control Variables of Industrial Sector | Yes | Yes | ||||

| Goodness of Fit (AIC) | 346.2 | −2274.9 | ||||

| Observations | 829 | 829 | ||||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chang, C.-H.; Lo, S.-F. Impact Analysis of a National and Corporate Carbon Emission Reduction Target on Renewable Electricity Use: A Review. Energies 2022, 15, 1794. https://doi.org/10.3390/en15051794

Chang C-H, Lo S-F. Impact Analysis of a National and Corporate Carbon Emission Reduction Target on Renewable Electricity Use: A Review. Energies. 2022; 15(5):1794. https://doi.org/10.3390/en15051794

Chicago/Turabian StyleChang, Chung-Hao, and Shih-Fang Lo. 2022. "Impact Analysis of a National and Corporate Carbon Emission Reduction Target on Renewable Electricity Use: A Review" Energies 15, no. 5: 1794. https://doi.org/10.3390/en15051794

APA StyleChang, C.-H., & Lo, S.-F. (2022). Impact Analysis of a National and Corporate Carbon Emission Reduction Target on Renewable Electricity Use: A Review. Energies, 15(5), 1794. https://doi.org/10.3390/en15051794