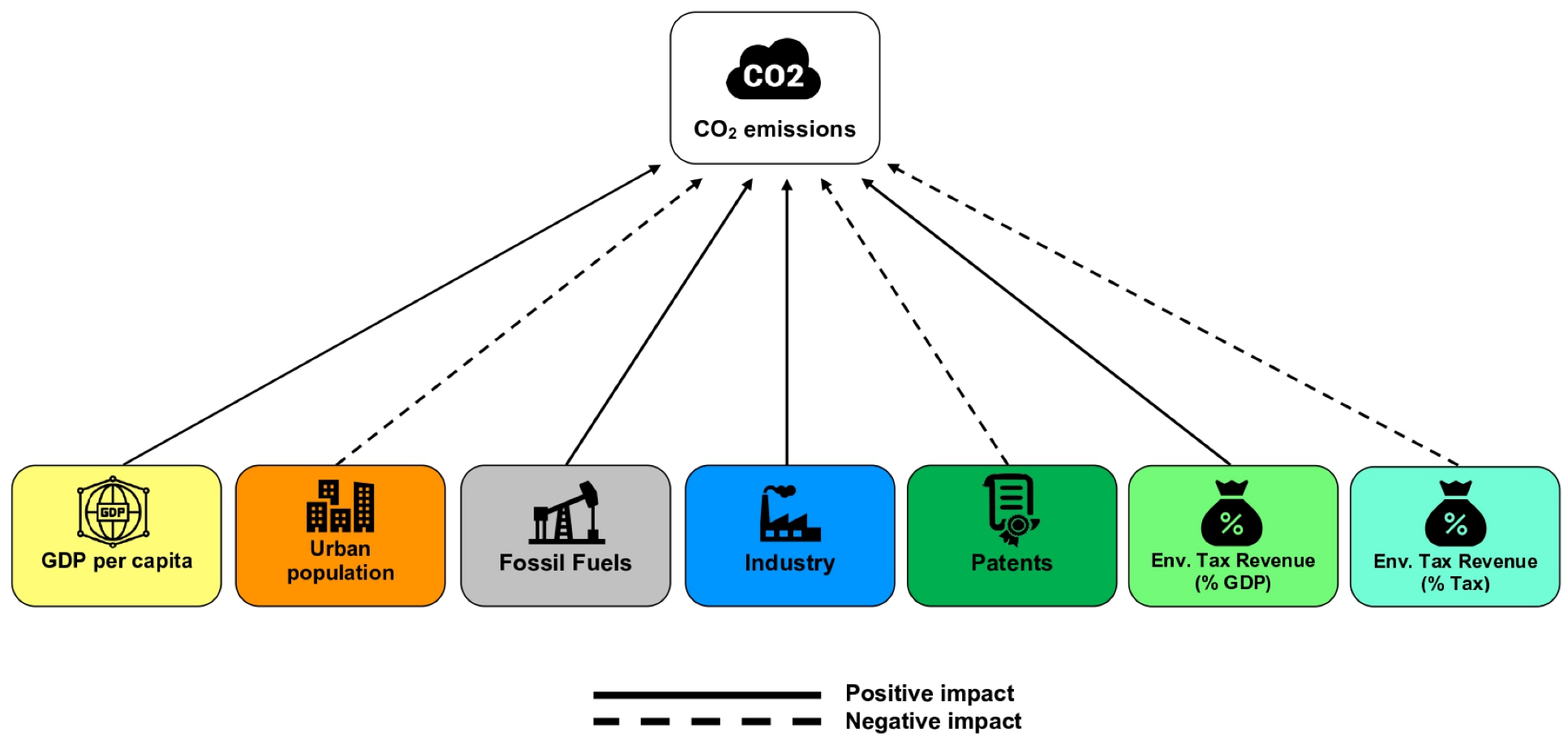

This part will show the literature relevant to the empirical analysis. First, the relationship between environmental policies and greenhouse gas emissions was reviewed, considering environmental tax revenues as an indicator to measure the impact of government regulations. This analysis is followed by a review of the relationship between phenomena innovation through environmental patents and CO2 gas emissions.

2.1. The Relationship between Environmental Policies and CO2 Gas Emissions

The study by Ahmed shows that stringent environmental policies enhanced green innovation in 20 OECD countries [

17]. However, these regulations may cause short-term negative economic shocks. Albulescu et al. [

2] explored the effect of environmental policy stringency on the air pollution problem (CO

2 emissions) in 32 countries from the OECD from 1990 to 2015, employing a panel data methodology. The researchers discovered that a rise in policy stringency negatively affects environmental degradation, and environmental stringency has a stronger impact in countries with lower levels of environmental degradation. Moreover, there is a need to change policy stringency measures to environmental degradation levels to improve their effectiveness [

2].

He et al. [

18] conducted an empirical study of OECD countries and China from 2004 to 2016 to answer if the environmental tax policy helps to reduce pollutant emissions. The results showed that overall environmental taxes facilitate reducing pollutant emissions in the selected cases.

The effect of industrial structure and environmental regulations on carbon dioxide emission in 30 provinces in China was studied by Chen et al. [

19], who observed that industrial restructuring could help to reduce carbon dioxide emissions. However, if the maximization level of the industrial structure is observed at a lower scale, environmental regulation stimulates carbon dioxide emission, and if it is high, environmental regulation significantly restricts carbon dioxide emission. Thus, policies related to environmental regulation adequate for indigenous conditions should be formulated based on the evolution of specific native industrial structures [

19].

Neves et al. [

20] investigated whether environmental regulation reduces environmental pollution, such as CO

2 gas emissions, in European Union countries between 1995 and 2017. Their findings showed that environmental regulation effectively reduces CO

2 gas emissions in the long term. In addition, policies that support renewable energy sources reduce CO

2 gas emissions in the short and long term. The effectiveness of these policies is further endorsed by a decrease in carbon dioxide emissions linked to foreign direct investment, indicating that the EU has effectively attracted innovative and high-quality investments [

20].

In the same vein, Wang and Zhang [

21] examined the effects of environmental regulations on CO

2 gas emission by considering 282 cities in China. The authors discovered an inverted U-shaped relationship, showing the direct impact of environmental regulations on CO

2 gas emission. This finding implies that environmental regulations can effectively moderate CO

2 gas emissions through technological innovation and restructuring of industrial structure. However, foreign direct investment indicates a pollution paradise effect within the constraints of environmental regulations [

21]. Finally, Eskander and Fankhauser [

22], in their study of 133 countries between 1999 and 2016, found both long- and short-term effects of environmental regulation on reducing carbon dioxide emissions.

Baloch et al. [

23] analysed the role of governance in mitigating CO

2 emissions for Brazil, Russia, India, China and South African countries (BRICS) from 1996 to 2017. The results indicated that governance has a negative and significant effect on CO

2 emissions, helps to shape the Environmental Kuznets Curve hypothesis, and reduces CO

2 gas emissions in BRICS countries.

2.2. The Relationship between Innovation and CO2 Gas Emissions

Koçak and Ulucak [

24] investigated the impact of energy consumption and R&D development spending on reducing CO

2 gas emissions in OECD countries. Based on their findings, R&D spending on energy efficiency and fossil energy has an increasing effect on CO

2 gas emissions; however, no significant relationship was found between R&D spending on renewable energy and CO

2 gas emissions. Therefore, the study suggests strong evidence that R&D spending on energy and storage reduces CO

2 gas emissions.

Petrović and Lobanov [

25], working on the effect of research and development expenditure on CO

2 gas emissions between 1981 and 2014 in 16 OECD countries, show a negative effect of R&D expenditure on CO

2 gas emissions, i.e., high R&D expenditure on average reduces CO

2 gas emissions. However, this hypothesis is not effective in 40% of countries. The results suggest that the average expected effect of R&D investments on CO

2 gas emissions should not be considered adverse until it is empirically estimated, as stated by different studies.

When considering OECD countries, Cheng et al. [

26] investigated the direct and moderating effects of technological innovation, measured by the development of patents, on CO

2 gas emissions. The results show that technological innovation is directly responsible for reducing CO

2 gas emissions. However, this effect is considerably asymmetric and heterogeneous at different quantiles. Furthermore, technological innovations affect CO

2 emissions by increasing the negative impacts of renewable energy sources.

Similarly, Alam et al. [

27], in their research, also considered OECD countries to investigate the impacts of the stock market and R&D investment on CO

2 gas emissions and green energy consumption. The authors found that the stock market and R&D investment have a significant long-run equilibrium relationship with CO

2 gas emissions and clean energy. Moreover, the long-run elasticities show a significant positive impact of stock market growth and R&D on clean energy consumption and a negative effect on CO

2 gas emissions.

Ahmad et al. [

28] studied the impacts of innovation shocks in determining CO

2 emission levels in OECD economies. The results support that positive innovation shocks improve environmental quality, but negative shocks disrupt it.

Hashmi and Alam [

29] focused on the dynamic relationships between innovation, environmental regulation, CO

2 gas emissions, economic growth and population in OECD countries, covering the years 1999 to 2014, and showed that an increase in environmentally friendly patents decreases carbon gas emissions, while an increase in environmental revenues per capita reduces carbon gas emissions in OECD nation-states.

Chen and Lee [

30] explored the effect of technological innovation, particularly on reducing CO

2 gas emissions, in 96 countries from 1996 to 2018. Their study found that both CO

2 gas emissions and R&D intensity showed a significant spatial correlation within these countries. Furthermore, technological innovation does not significantly affect CO

2 gas emissions worldwide. However, cluster-based studies have reported that technological innovation in nations with high technology, high output, and high CO

2 gas emissions could significantly decrease CO

2 gas emissions in adjacent countries.

Cheng et al. [

31] aimed to disclose the impacts of environmental patents and renewable energy on CO

2 gas emissions considering BRICS economies from 2000 to 2013. The study showed that renewable energy decreases CO

2 gas emissions per capita, the progress of environmental patents accelerates carbon dioxide emissions per capita, and GDP per capita increases CO

2 gas emissions per capita. Meirun et al. [

32] studied the effects of green technology innovation on economic development and CO

2 gas emissions in Singapore, considering the period from 1990 to 2018, and found a positive and significant relationship with long-term and short-term carbon dioxide emissions.

Khattak et al. [

33] explored the effect of technology innovation, green energy use, and income on environmental degradation in BRICS economies (e.g., China, India, Russia, South Africa, and Brazil). Their results indicated that innovation activities did not disrupt CO

2 gas emissions in all countries except Brazil. However, the authors also showed that green energy consumption had mitigated environmental degradation (CO

2 gas emissions) in BRICS. Furthermore, they found a bidirectional causal relationship between CO

2 gas emissions and technological innovation.

The study on the effect of R&D development expenditure on air pollution (CO

2 gas emissions) conducted by Fernández et al. [

34], which included the European Union, the United States, and China, between 1990 and 2013, showed that R&D expenditure contributed positively to the reduction of CO

2 gas emissions of developed countries. The European Union is where the effect of this variable is lowest, followed by the United States, where energy consumption pollutes the most. The results obtained for China are different due to its economic and environmental performance. Du et al. [

35] tried to determine whether technological innovations fostered a decrease in CO

2 emissions in 71 economies between 1996 and 2016. Their findings showed that green technology innovations are only effective in economies with a high-income level, and innovations do not significantly reduce CO

2 emissions for economies with income levels below the threshold.

Dauda et al. [

36] investigated the relationship between innovation, trade liberalisation, and environmental degradation (CO

2 emissions) in selected African nations and found an inverted U-shaped relationship between environmental degradation and innovation. However, they observed that renewable energy use has less environmental degradation at the panel level.

Ganda [

37] explored the impact of innovation and technology investments on environmental degradation (carbon emissions) in selected OECD economies. The authors found that consumption and spending on green energy research and development are negatively correlated with environmental degradation (carbon emissions). The research suggested that innovation and technology investments in these countries affect emissions differently and still have the potential to reduce environmental quality. They stressed that patents, including specifications of natural environmental standards and researchers empowered with ecological skills and knowledge, would facilitate the achievement of zero emissions targets.

Hasanov et al. [

38] showed that technological progress and green energy consumption mitigate the CO

2 emissions in BRICS countries in the short run. However, the gross domestic product and import size increased pollution in the long and short term. Therefore, they recommended implementing measures and regulations and establishing legislative frameworks that promote technological advances and transition to sustainable energy.

Wang and Zhu [

39] investigated whether energy technology innovations contribute to reducing CO

2 gas emissions in China. The results indicated that technological innovation in renewable energy technologies facilitates the reduction of CO

2 gas emissions, while fossil energy technology innovation is ineffective in reducing carbon emissions. Moreover, economic growth can agglomerate carbon emissions from low-growth provinces to neighbouring high-growth provinces; mandatory environmental regulation in China would shift carbon emissions from provinces with strict regulations to neighbouring provinces with lax regulations.

Abid et al. [

40] investigated the effect of technological development innovation, financial development, and FDI on environmental degradation in G8 countries from 1990 to 2019. The authors found that these countries showed a statistically significant long-term and negative relationship between CO

2 and foreign direct investment, financial development, and technological innovation. Furthermore, a long-run bidirectional causality was found between economic growth, financial development, urbanization, trade openness, CO

2 gas emissions, and energy consumption; however, a unidirectional causality exists between CO

2 gas emissions and foreign direct investment.

Cheng et al. [

41] investigated the impact of green energy and innovation on environmental degradation (CO

2 emissions) in OECD countries. Their findings provided comprehensive, important information on the relationship between carbon emissions per capita and different variables. More specifically, their impact on carbon emissions per capita is significant and positive for economic growth but decreases for fast-growing emissions countries. The results do not support the Environmental Kuznets Curve hypothesis. On the contrary, their impacts on carbon emissions showed an inverted U-shaped trend for renewable energy at different quantile levels.