Assessment of Battery Energy Storage Systems Using the Intuitionistic Fuzzy Removal Effects of Criteria and the Measurement of Alternatives and Ranking Based on Compromise Solution Method

Abstract

1. Introduction

- ➢

- The present study analyzes the limitations of the existing literature on BESSs from uncertain and sustainability perspectives.

- ➢

- The determination of the criteria weights is an important task for decision makers. However, existing studies on the intuitionistic fuzzy “measurement of alternatives and ranking based on compromise solution (MARCOS)” method [29,30,31,32] have ignored the criteria weight determination process. To overcome the limitation of the existing MARCOS approaches [29,30,31,32], this study introduces an improved intuitionistic fuzzy MARCOS method with a new criteria weight-determining model.

- ➢

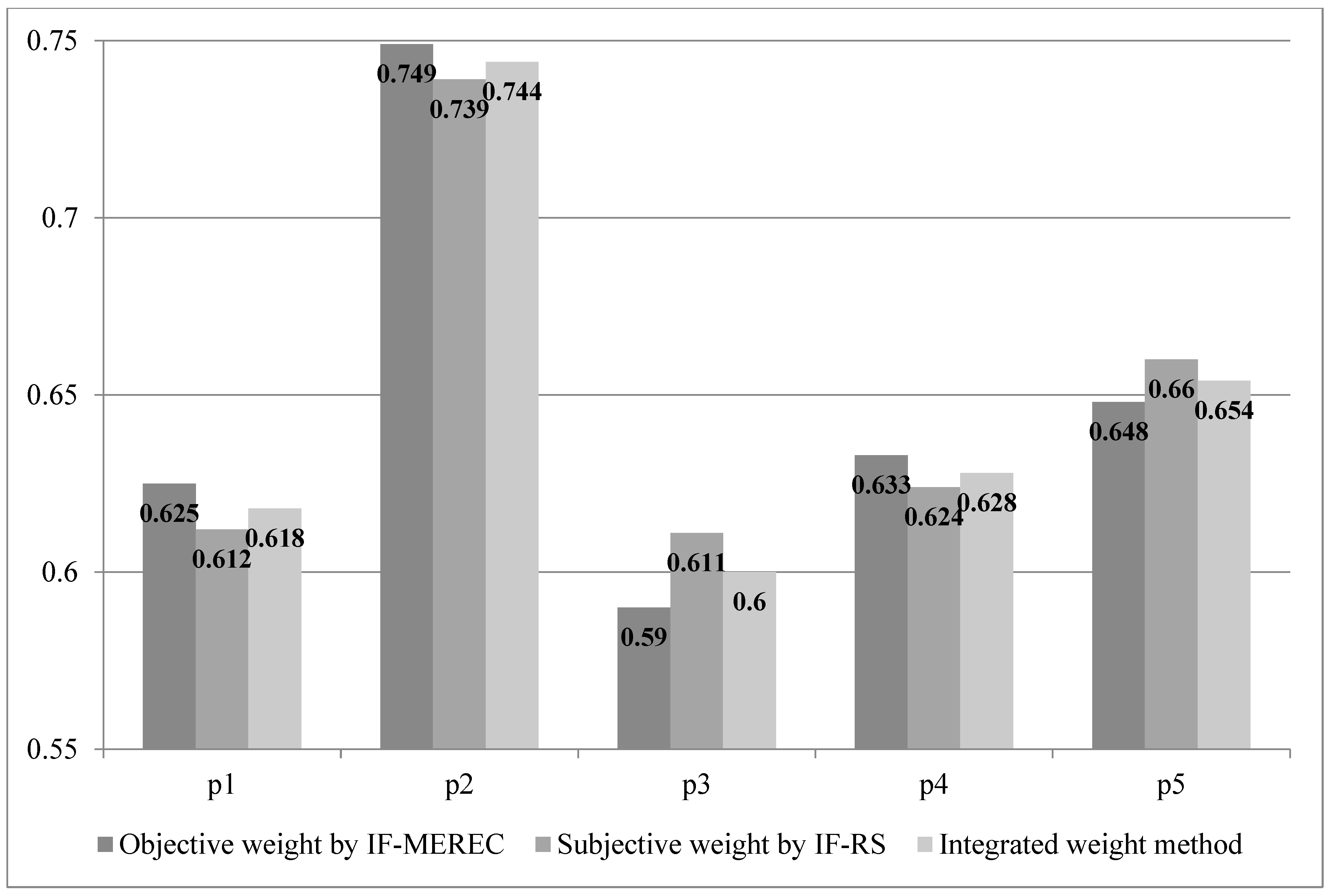

- To derive the criteria weights, we propose an integrated weighting model by combining the objective weights based on the method using the removal effects of criteria (MEREC) and the subjective weights that are based on the “rank sum (RS)” model with the intuitionistic fuzzy information. A combined technique that is based on the integration of the objective and subjective weighting methods can overcome the insufficiencies which arise either in an objective weighting model or a subjective weighting model.

- ➢

- Some authors [17,25] have evaluated the BESSs, however, these studies have limitations in dealing with the complex BESS selection problem in an intuitionistic fuzzy environment. However, the assessment of the BESSs can be considered as a MADA problem due to the existence of numerous sustainability aspects. To handle this issue, we implemented the proposed MARCOS method to solve a case study of BESSs from an intuitionistic fuzzy perspective.

2. Literature Review of IFSs and MADA Methods

3. Proposed Intuitionistic Fuzzy-Based MADA Method

3.1. Preliminaries

3.2. Introducing the IF-MEREC-RS-MARCOS Approach

4. Case Study: Assessment of BESS

4.1. Comparison Study

4.1.1. IF-COPRAS Model

4.1.2. IF-WASPAS Model

- (a)

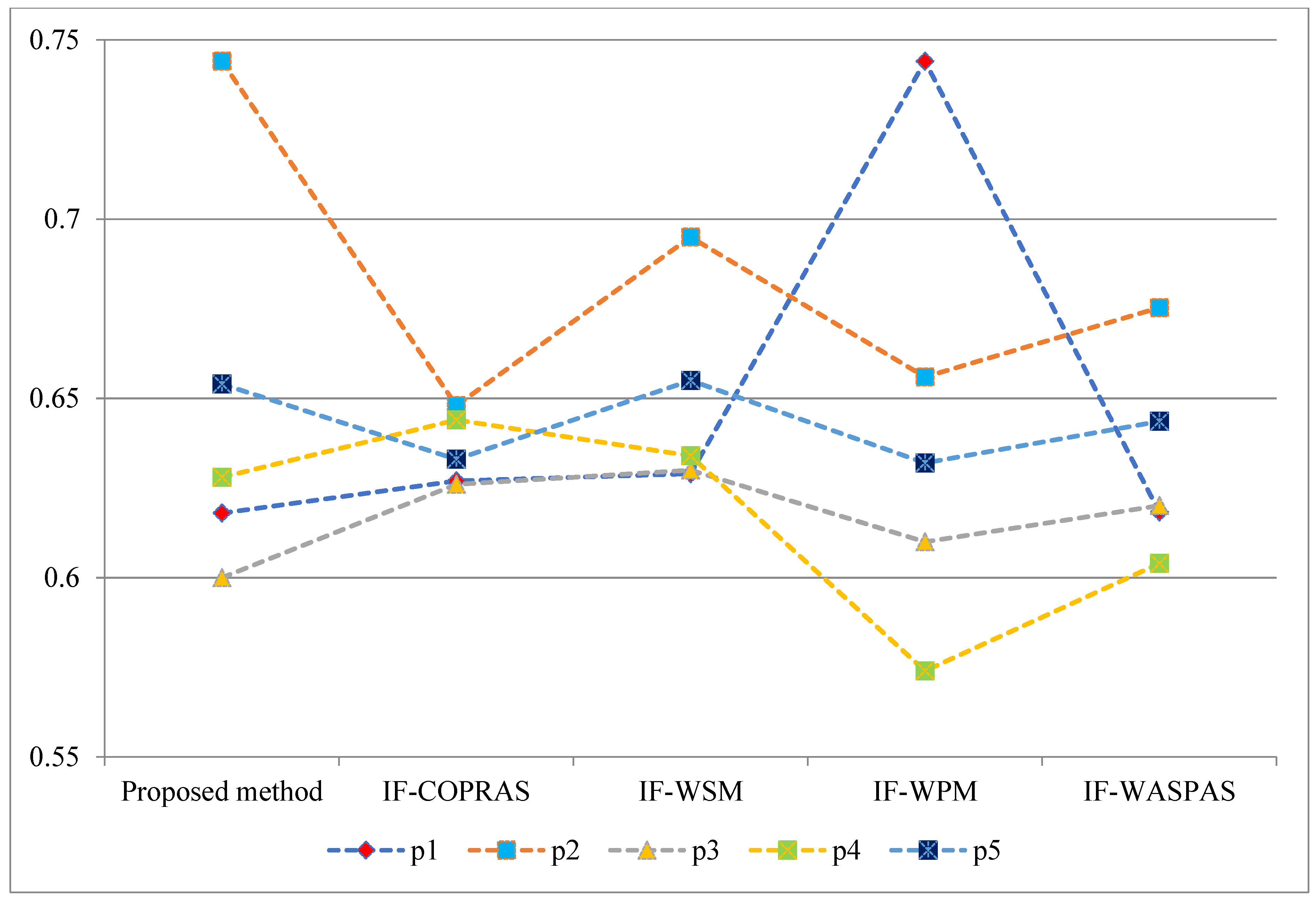

- The IF-WASPAS method computes only the objective weights of the criteria using a similarity measure, whereas the IF-COPRAS method considers the direct weights of the criteria. While the proposed approach computes the indicators’ weights using a combined IF-MEREC-RS process, which is the combination of the objective and subjective weighting models. Thus, the proposed method considers the advantages of both the objective and subjective weighting models.

- (b)

- When we were comparing it with other MADA models, we observed that the suitable choice with the use of all of the methodologies is the same, i.e., the alternative p2 (LIB). The CUFs in the IF-MEREC-RS-MARCOS model have used IF-IS and IF-AIS, while the IF-COPRAS model used the averaging operator and the IF-WASPAS model utilized the averaging and geometric operators. So, the IF-MEREC-RS-MARCOS method is more general and more flexible than the IF-COPRAS, IF-WSM, IF-WPM and IF-WASPAS ones. Because of this characteristic, the presented IF-MEREC-RS and IF-MARCOS methods can be applied more widely in realistic decision-making situations.

- (c)

- For the rational aggregation of the preferences, the MARCOS tool was pioneered by Stević et al. [49]. It gives a dynamic MADA model by (i) imposing the IF-IS and IF-AIS values, (ii) identifying the relations among the alternatives and the IS/AIS values, and (iii) characterizing the UD of each alternative that is associated with the IF-IS and the IF-AIS. According to Stević et al. [49], the outcomes that are acquired by the MARCOS method are more robust when they were compared to the other popular MCDM methods namely the VIKOR [36], TOPSIS [66], ARAS [67], COPRAS [68], and WASPAS [64] ones. Thus, the proposed hybrid MARCOS model handles the existing issues in the study of BESS assessments.

4.2. Sensitivity Assessment

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Abbreviations

| AFVs | Alternative fuel vehicles |

| AHP | Analytic hierarchy process |

| A-IF-DM | Aggregated intuitionistic fuzzy decision matrix |

| AOs | Aggregation operators |

| BESS | Battery energy storage systems |

| BMWD | Bio-medical waste disposal |

| BWM | Best worst method |

| COPRAS | Complex proportional assessment |

| CPT | Cumulative prospect theory |

| CRITIC | Criteria importance through intercriteria correlation |

| CS | Chemical storage |

| CSP | Cloud service provider |

| CUF | combined utility function |

| DEs | Decision experts |

| DNMA | Double normalization-based multiple aggregation |

| DR | Danube region |

| EMS | Electro-magnetic storage |

| EMS | Electro-magnetic storage |

| FDA | fuzzy-Delphi approach |

| FSs | Fuzzy sets |

| FWTT | Food waste treatment technology |

| GRA | Grey relational analysis |

| GSS | Green supplier selection |

| HF-MOOSRA | Hesitant fuzzy multi-objective optimization based on simple ratio analysis |

| HF-SOWIA | Hesitant fuzzy subjective and objective weight integrated approach |

| HLSS | Hydrogen large-scale seasonal storage |

| IF-AIS | intuitionistic fuzzy anti-ideal solution |

| IF-IS | intuitionistic fuzzy-ideal solution |

| IFSs | Intuitionistic fuzzy sets |

| IFWA | Intuitionistic fuzzy weighted averaging |

| IFWG | Intuitionistic fuzzy weighted geometric |

| IF-COPRAS | Intuitionistic fuzzy complex proportional assessment |

| IF-WASPAS | Intuitionistic fuzzy weighted aggregated sum product assessment |

| IFN | Intuitionistic fuzzy number |

| LAB | Lead-acid battery |

| LCTS | Low carbon tourism strategy |

| LDM | Linguistic decision matrix |

| LIB | Lithium-ion battery |

| LVs | Linguistic variables |

| MADA | Multi-attribute decision analysis |

| MAIRCA | Multi-attributive ideal-real comparative analysis |

| MARCOS | Measurement alternatives and ranking based on compromise solution |

| MEREC | Method based on the removal effects of criteria |

| MF | Membership function |

| MS | mechanical storage |

| MULTIMOORA | Multi-Objective Optimization on the basis of a Ratio Analysis plus the full multiplicative form |

| NaSB | Sodium-sulfur battery |

| NF | Non-membership function |

| NiMHB | Nickel-metal Hydride battery |

| q-ROFSs | q-rung orthopair fuzzy sets |

| RES | Renewable energy source |

| RP | Reference point |

| RS | Rank sum |

| SAA | Simulated annealing algorithm |

| SVNSs | Single-valued neutrosophic sets |

| SWM | Solid waste management |

| T2FSs | Type 2 fuzzy sets |

| TNFNs | Trapezoidal neutrosophic fuzzy numbers |

| TOPSIS | Technique for order of preference by similarity to ideal solution |

| TSPs | Telecom service providers |

| UDs | Utility degrees |

| VRFB | Vanadium Redox Flow Battery |

| ZnBrFB | Zinc Bromine flow battery |

Appendix A

| Parameters | p1 | p2 | p3 | p4 | p5 |

|---|---|---|---|---|---|

| q1 | (VL,VL,ML,ML) | (ML,L,VL,VL) | (MH, ML,A,L) | (L,ML,A,L) | (A,L,ML,ML) |

| q2 | (ML,ML,A,L) | (VL,L,VL,ML) | (A,A,ML,ML) | (VL,L,ML,L) | (VVL,L,ML,L) |

| q3 | (MH,ML,A,VH) | (A,VH,ML,MH) | (MH,A,VH,H) | (VH,H,A,MH) | (VVH,A,H,MH) |

| q4 | (A,MH,MH,H) | (H,AH,H,MH) | (MH,H,A,H) | (H,ML,MH,VH) | (MH,A,MH,ML) |

| q5 | (MH,H,A,MH) | (VH,H,VH,A) | (ML,MH,A,MH) | (VH,ML,A,MH) | (MH,MH,H,VH) |

| q6 | (A, MH,VH,A) | (ML,MH,A,H) | (H,VH,A,MH) | (A,MH,A,H) | (MH,A,H,A) |

| q7 | (L,L,L,VL) | (VL,ML,VL,A) | (A,L,A,ML) | (ML,L,A,A) | (A,ML,ML,L) |

| q8 | (VL,L,A,ML) | (A,VL,L,VL) | (A,MH,VL,L) | (VL,ML,VL,ML) | (A,L,ML,VL) |

| q9 | (A,H,MH,H) | (VVH,H,H,A) | (MH,H,A,H) | (MH,H,A,MH) | (ML,A,MH,VH) |

| q10 | (VVH,H,A,MH) | (MH,H,VH,H) | (ML,MH,A,VH) | (H,ML,A,H) | (MH,H,VH,VH) |

| q11 | (MH,A,L,ML) | (A,ML,AH,H) | (H,A,H,VVH) | (MH,ML,A,VH) | (A,A,MH,H) |

| q12 | (VVH,ML,A,MH) | (VH,MH,A,MH) | (VH,A,MH,ML) | (ML,MH,VH,H) | (VH,VH,H,MH) |

| q13 | (H,H,VH,A) | (H,VH,VH,MH) | (MH,ML,A,MH) | (MH,H,MH,H) | (A,ML,MH,VH) |

| Parameters | p1 | p2 | p3 | p4 | p5 |

|---|---|---|---|---|---|

| q1 | (0.307, 0.592, 0.101) | (0.281, 0.618, 0.101) | (0.468, 0.429, 0.103) | (0.385, 0.513, 0.101) | (0.406, 0.493, 0.101) |

| q2 | (0.409, 0.490, 0.101) | (0.274, 0.625, 0.101) | (0.452, 0.447, 0.101) | (0.306, 0.594, 0.101) | (0.284, 0.615, 0.101) |

| q3 | (0.598, 0.315, 0.087) | (0.600, 0.314, 0.086) | (0.673, 0.243, 0.084) | (0.668, 0.246, 0.086) | (0.697, 0.217, 0.086) |

| q4 | (0.603, 0.295, 0.102) | (0.793, 0.156, 0.051) | (0.628, 0.269, 0.103) | (0.649, 0.262, 0.089) | (0.538, 0.361, 0.102) |

| q5 | (0.603, 0.294, 0.102) | (0.729, 0.200, 0.071) | (0.528, 0.371, 0.102) | (0.608, 0.307, 0.085) | (0.683, 0.230, 0.087) |

| q6 | (0.632, 0.285, 0.083) | (0.557, 0.339, 0.104) | (0.666, 0.247, 0.087) | (0.577, 0.320, 0.103) | (0.590, 0.307, 0.103) |

| q7 | (0.382, 0.513, 0.105) | (0.328, 0.569, 0.102) | (0.435, 0.464, 0.101) | (0.431, 0.468, 0.101) | (0.408, 0.492, 0.101) |

| q8 | (0.362, 0.536, 0.102) | (0.317, 0.581, 0.102) | (0.419, 0.476, 0.105) | (0.300, 0.598, 0.101) | (0.366, 0.532, 0.102) |

| q9 | (0.629, 0.267, 0.103) | (0.719, 0.195, 0.086) | (0.628, 0.269, 0.103) | (0.603, 0.294, 0.102) | (0.598, 0.315, 0.087) |

| q10 | (0.692, 0.221, 0.086) | (0.711, 0.205, 0.084) | (0.595, 0.317, 0.087) | (0.591, 0.302, 0.106) | (0.736, 0.192, 0.072) |

| q11 | (0.461, 0.436, 0.103) | (0.753, 0.204, 0.043) | (0.709, 0.203, 0.088) | (0.598, 0.315, 0.087) | (0.580, 0.317, 0.103) |

| q12 | (0.636, 0.277, 0.088) | (0.644, 0.271, 0.084) | (0.614, 0.301, 0.085) | (0.656, 0.258, 0.086) | (0.739, 0.189, 0.071) |

| q13 | (0.699, 0.216, 0.085) | (0.741, 0.189, 0.071) | (0.531, 0.368, 0.102) | (0.650, 0.248, 0.101) | (0.599, 0.314, 0.087) |

| Parameters | p1 | p2 | p3 | p4 | p5 |

|---|---|---|---|---|---|

| q1 | (0.592, 0.307, 0.101) | (0.618, 0.281, 0.101) | (0.429, 0.468, 0.103) | (0.513, 0.385, 0.101) | (0.493, 0.406, 0.101) |

| q2 | (0.490, 0.409, 0.101) | (0.625, 0.274, 0.101) | (0.447, 0.452, 0.101) | (0.594, 0.306, 0.101) | (0.615, 0.284, 0.101) |

| q3 | (0.598, 0.315, 0.087) | (0.600, 0.314, 0.086) | (0.673, 0.243, 0.084) | (0.668, 0.246, 0.086) | (0.697, 0.217, 0.086) |

| q4 | (0.603, 0.295, 0.102) | (0.793, 0.156, 0.051) | (0.628, 0.269, 0.103) | (0.649, 0.262, 0.089) | (0.538, 0.361, 0.102) |

| q5 | (0.603, 0.294, 0.102) | (0.729, 0.200, 0.071) | (0.528, 0.371, 0.102) | (0.608, 0.307, 0.085) | (0.683, 0.230, 0.087) |

| q6 | (0.632, 0.285, 0.083) | (0.557, 0.339, 0.104) | (0.666, 0.247, 0.087) | (0.577, 0.320, 0.103) | (0.590, 0.307, 0.103) |

| q7 | (0.513, 0.382, 0.105) | (0.569, 0.328, 0.102) | (0.464, 0.435, 0.101) | (0.468, 0.431, 0.101) | (0.492, 0.408, 0.101) |

| q8 | (0.536, 0.362, 0.102) | (0.581, 0.317, 0.102) | (0.476, 0.419, 0.105) | (0.598, 0.300, 0.101) | (0.532, 0.366, 0.102) |

| q9 | (0.629, 0.267, 0.103) | (0.719, 0.195, 0.086) | (0.628, 0.269, 0.103) | (0.603, 0.294, 0.102) | (0.598, 0.315, 0.087) |

| q10 | (0.692, 0.221, 0.086) | (0.711, 0.205, 0.084) | (0.595, 0.317, 0.087) | (0.591, 0.302, 0.106) | (0.736, 0.192, 0.072) |

| q11 | (0.461, 0.436, 0.103) | (0.753, 0.204, 0.043) | (0.709, 0.203, 0.088) | (0.598, 0.315, 0.087) | (0.580, 0.317, 0.103) |

| q12 | (0.636, 0.277, 0.088) | (0.644, 0.271, 0.084) | (0.614, 0.301, 0.085) | (0.656, 0.258, 0.086) | (0.739, 0.189, 0.071) |

| q13 | (0.699, 0.216, 0.085) | (0.741, 0.189, 0.071) | (0.531, 0.368, 0.102) | (0.650, 0.248, 0.101) | (0.599, 0.314, 0.087) |

| Parameters | asj | ||||||

|---|---|---|---|---|---|---|---|

| p1 | p2 | p3 | p4 | p5 | |||

| q1 | 0.350 | 0.279 | 0.363 | 0.334 | 0.326 | 0.150 | 0.0978 |

| q2 | 0.341 | 0.279 | 0.365 | 0.341 | 0.337 | 0.138 | 0.0903 |

| q3 | 0.350 | 0.276 | 0.384 | 0.347 | 0.343 | 0.101 | 0.0662 |

| q4 | 0.351 | 0.290 | 0.382 | 0.345 | 0.330 | 0.103 | 0.0673 |

| q5 | 0.351 | 0.286 | 0.373 | 0.342 | 0.342 | 0.107 | 0.0701 |

| q6 | 0.353 | 0.273 | 0.384 | 0.340 | 0.335 | 0.117 | 0.0763 |

| q7 | 0.343 | 0.274 | 0.367 | 0.329 | 0.326 | 0.162 | 0.1060 |

| q8 | 0.345 | 0.275 | 0.368 | 0.342 | 0.330 | 0.141 | 0.0923 |

| q9 | 0.353 | 0.286 | 0.382 | 0.342 | 0.335 | 0.103 | 0.0675 |

| q10 | 0.357 | 0.285 | 0.378 | 0.341 | 0.345 | 0.094 | 0.0613 |

| q11 | 0.338 | 0.287 | 0.387 | 0.341 | 0.334 | 0.114 | 0.0748 |

| q12 | 0.353 | 0.280 | 0.380 | 0.346 | 0.346 | 0.097 | 0.0636 |

| q13 | 0.358 | 0.287 | 0.373 | 0.346 | 0.335 | 0.102 | 0.0666 |

| Parameters | d1 | d2 | d3 | d4 | AIF-DM Values | rj | ||

|---|---|---|---|---|---|---|---|---|

| q1 | H | A | ML | H | (0.589, 0.305, 0.106) | 0.358 | 13 | 0.0256 |

| q2 | MH | A | ML | ML | (0.483, 0.415, 0.102) | 0.466 | 10 | 0.0513 |

| q3 | H | MH | A | A | (0.585, 0.312, 0.103) | 0.637 | 3 | 0.1111 |

| q4 | MH | L | ML | A | (0.461, 0.436, 0.103) | 0.513 | 9 | 0.0598 |

| q5 | ML | MH | VH | ML | (0.598, 0.317, 0.085) | 0.641 | 1 | 0.1282 |

| q6 | A | H | MH | A | (0.585, 0.312, 0.103) | 0.636 | 4 | 0.1026 |

| q7 | ML | A | H | MH | (0.567, 0.328, 0.105) | 0.381 | 11 | 0.0427 |

| q8 | MH | A | L | VH | (0.578, 0.334, 0.088) | 0.378 | 12 | 0.0342 |

| q9 | A | ML | MH | H | (0.561, 0.334, 0.104) | 0.614 | 6 | 0.0855 |

| q10 | H | ML | A | MH | (0.564, 0.331, 0.105) | 0.617 | 5 | 0.0940 |

| q11 | VH | ML | MH | ML | (0.596, 0.318, 0.086) | 0.639 | 2 | 0.1197 |

| q12 | ML | MH | MH | A | (0.533, 0.365, 0.102) | 0.584 | 8 | 0.0684 |

| q13 | H | ML | ML | MH | (0.542, 0.352, 0.106) | 0.595 | 7 | 0.0769 |

| p1 | p2 | p3 | p4 | p5 | |||

|---|---|---|---|---|---|---|---|

| q1 | (0.054, 0.930, 0.017) | (0.058, 0.925, 0.018) | (0.034, 0.954, 0.012) | (0.043, 0.943, 0.014) | (0.041, 0.946, 0.013) | (0.058, 0.925, 0.018) | (0.034, 0.954, 0.012) |

| q2 | (0.047, 0.939, 0.015) | (0.067, 0.912, 0.020) | (0.041, 0.945, 0.014) | (0.062, 0.919, 0.019) | (0.065, 0.915, 0.020) | (0.067, 0.912, 0.020) | (0.041, 0.945, 0.014) |

| q3 | (0.078, 0.903, 0.020) | (0.078, 0.902, 0.020) | (0.094, 0.882, 0.024) | (0.093, 0.883, 0.024) | (0.101, 0.873, 0.026) | (0.100, 0.873, 0.026) | (0.078, 0.903, 0.020) |

| q4 | (0.057, 0.925, 0.018) | (0.095, 0.889, 0.016) | (0.061, 0.920, 0.019) | (0.064, 0.918, 0.017) | (0.048, 0.937, 0.015) | (0.095, 0.889, 0.016) | (0.048, 0.937, 0.015) |

| q5 | (0.088, 0.886, 0.027) | (0.121, 0.853, 0.026) | (0.072, 0.906, 0.022) | (0.089, 0.890, 0.022) | (0.108, 0.864, 0.028) | (0.121, 0.853, 0.026) | (0.072, 0.906, 0.022) |

| q6 | (0.086, 0.894, 0.021) | (0.070, 0.908, 0.022) | (0.094, 0.882, 0.024) | (0.074, 0.903, 0.023) | (0.077, 0.900, 0.024) | (0.093, 0.882, 0.024) | (0.070, 0.908, 0.022) |

| q7 | (0.052, 0.931, 0.017) | (0.061, 0.921, 0.019) | (0.045, 0.940, 0.015) | (0.046, 0.939, 0.015) | (0.049, 0.935, 0.016) | (0.061, 0.920, 0.019) | (0.045, 0.940, 0.015) |

| q8 | (0.047, 0.938, 0.015) | (0.053, 0.930, 0.017) | (0.040, 0.946, 0.013) | (0.056, 0.927, 0.017) | (0.047, 0.938, 0.015) | (0.056, 0.927, 0.017) | (0.040, 0.946, 0.013) |

| q9 | (0.073, 0.904, 0.023) | (0.092, 0.883, 0.025) | (0.073, 0.904, 0.023) | (0.068, 0.911, 0.021) | (0.067, 0.915, 0.017) | (0.092, 0.882, 0.025) | (0.067, 0.915, 0.017) |

| q10 | (0.087, 0.890, 0.023) | (0.092, 0.884, 0.024) | (0.068, 0.915, 0.017) | (0.067, 0.911, 0.022) | (0.098, 0.880, 0.022) | (0.098, 0.880, 0.022) | (0.068, 0.915, 0.018) |

| q11 | (0.058, 0.923, 0.019) | (0.127, 0.857, 0.016) | (0.113, 0.856, 0.031) | (0.085, 0.894, 0.021) | (0.081, 0.894, 0.025) | (0.127, 0.857, 0.016) | (0.058, 0.922, 0.019) |

| q12 | (0.064, 0.919, 0.017) | (0.066, 0.918, 0.016) | (0.061, 0.924, 0.015) | (0.068, 0.915, 0.017) | (0.085, 0.896, 0.019) | (0.085, 0.896, 0.019) | (0.061, 0.924, 0.015) |

| q13 | (0.083, 0.896, 0.022) | (0.092, 0.887, 0.020) | (0.053, 0.931, 0.016) | (0.073, 0.905, 0.023) | (0.064, 0.920, 0.016) | (0.092, 0.887, 0.020) | (0.053, 0.931, 0.016) |

| p1 | p2 | p3 | p4 | p5 | |||

|---|---|---|---|---|---|---|---|

| q1 | 0.062 | 0.067 | 0.040 | 0.050 | 0.048 | 0.067 | 0.040 |

| q2 | 0.054 | 0.077 | 0.048 | 0.071 | 0.075 | 0.077 | 0.048 |

| q3 | 0.087 | 0.088 | 0.106 | 0.105 | 0.114 | 0.114 | 0.087 |

| q4 | 0.066 | 0.103 | 0.071 | 0.073 | 0.055 | 0.103 | 0.055 |

| q5 | 0.101 | 0.134 | 0.083 | 0.099 | 0.122 | 0.134 | 0.083 |

| q6 | 0.096 | 0.081 | 0.106 | 0.086 | 0.088 | 0.105 | 0.081 |

| q7 | 0.061 | 0.070 | 0.053 | 0.053 | 0.057 | 0.070 | 0.053 |

| q8 | 0.055 | 0.062 | 0.047 | 0.065 | 0.054 | 0.065 | 0.047 |

| q9 | 0.085 | 0.105 | 0.084 | 0.079 | 0.076 | 0.105 | 0.076 |

| q10 | 0.099 | 0.104 | 0.077 | 0.078 | 0.109 | 0.109 | 0.077 |

| q11 | 0.068 | 0.135 | 0.128 | 0.095 | 0.093 | 0.135 | 0.068 |

| q12 | 0.073 | 0.074 | 0.068 | 0.077 | 0.094 | 0.094 | 0.069 |

| q13 | 0.093 | 0.103 | 0.061 | 0.084 | 0.072 | 0.103 | 0.061 |

| 0.999 | 1.203 | 0.971 | 1.015 | 1.058 | 1.282 | 0.844 |

| BESS | Ranks | |||

|---|---|---|---|---|

| p1 | 0.779 | 1.184 | 0.618 | 4 |

| p2 | 0.939 | 1.426 | 0.744 | 1 |

| p3 | 0.757 | 1.150 | 0.600 | 5 |

| p4 | 0.792 | 1.203 | 0.628 | 3 |

| p5 | 0.825 | 1.253 | 0.654 | 2 |

| Options | Ranking | ||||||

|---|---|---|---|---|---|---|---|

| p1 | (0.504, 0.404, 0.092) | 0.550 | (0.117, 0.842, 0.041) | 0.137 | 0.627 | 96.71 | 4 |

| p2 | (0.584, 0.338, 0.078) | 0.623 | (0.092, 0.870, 0.038) | 0.111 | 0.648 | 100.00 | 1 |

| p3 | (0.512, 0.395, 0.093) | 0.558 | (0.146, 0.808, 0.046) | 0.169 | 0.626 | 96.65 | 5 |

| p4 | (0.508, 0.400, 0.092) | 0.554 | (0.113, 0.846, 0.040) | 0.134 | 0.644 | 99.49 | 2 |

| p5 | (0.533, 0.378, 0.089) | 0.577 | (0.116, 0.843, 0.041) | 0.137 | 0.633 | 97.68 | 3 |

| Options | Ranks | |||||

|---|---|---|---|---|---|---|

| p1 | (0.580, 0.322, 0.097) | (0.558, 0.343, 0.099) | 0.629 | 0.744 | 0.6183 | 4 |

| p2 | (0.654, 0.264, 0.082) | (0.611, 0.300, 0.089) | 0.695 | 0.656 | 0.6753 | 1 |

| p3 | (0.581, 0.321, 0.097) | (0.561, 0.341, 0.098) | 0.630 | 0.610 | 0.6201 | 3 |

| p4 | (0.586, 0.317, 0.097) | (0.567, 0.420, 0.013) | 0.634 | 0.574 | 0.6040 | 5 |

| p5 | (0.609, 0.298, 0.093) | (0.584, 0.320, 0.095) | 0.655 | 0.632 | 0.6436 | 2 |

| Weighting Model | CUFs for Prioritizing BESSs | Rank | ||||

|---|---|---|---|---|---|---|

| p1 | p2 | p3 | p4 | p5 | ||

| IF-MEREC | 0.625 | 0.749 | 0.590 | 0.633 | 0.648 | |

| IF-RS | 0.612 | 0.739 | 0.611 | 0.624 | 0.660 | |

| Integrated method | 0.618 | 0.744 | 0.600 | 0.628 | 0.654 | |

References

- Mitali, J.; Dhinakaran, S.; Mohamad, A.A. Energy storage systems: A review. Energy Storage Sav. 2022, 1, 166–216. [Google Scholar] [CrossRef]

- Bizon, N. Effective mitigation of the load pulses by controlling the battery/SMES hybrid energy storage system. Appl. Energy 2018, 229, 459–473. [Google Scholar] [CrossRef]

- Gao, H.; Li, W.; Cai, H. Distributed control of a flywheel energy storage system subject to unreliable communication network. Energy Rep. 2022, 8, 11729–11739. [Google Scholar] [CrossRef]

- Behabtu, H.A.; Messagie, M.; Coosemans, T.; Berecibar, M.; Fante, K.A.; Kebede, A.A.; Mierlo, J.V. A Review of Energy Storage Technologies’ Application Potentials in Renewable Energy Sources Grid Integration. Sustainability 2020, 12, 10511. [Google Scholar] [CrossRef]

- Deveci, M. Site selection for hydrogen underground storage using interval type-2 hesitant fuzzy sets. Int. J. Hydrogen Energy 2018, 43, 9353–9368. [Google Scholar] [CrossRef]

- Ren, J.; Ren, X. Sustainability ranking of energy storage technologies under uncertainties. J. Clean. Prod. 2018, 170, 1387–1398. [Google Scholar] [CrossRef]

- Ashby, M.F.; Polyblank, J. Materials for Energy Storage Systems—A White Paper; University of Cambridge: Cambridge, UK, 2012. [Google Scholar]

- Karellas, S.; Tzouganatos, N. Comparison of the performance of compressed-air and hydrogen energy storage systems: Karpathos island case study. Renew. Sustain. Energy Rev. 2014, 29, 865–882. [Google Scholar] [CrossRef]

- Punys, P.; Baublys, R.; Kasiulis, E.; Vaisvila, A.; Pelikan, B.; Steller, J. Assessment of renewable electricity generation by pumped storage power plants in EU Member States. Renew. Sustain. Energy Rev. 2013, 26, 190–200. [Google Scholar] [CrossRef]

- Sebastián, R.; Alzola, R.P. Flywheel energy storage systems: Review and simulation for an isolated wind power system. Renew. Sustain. Energy Rev. 2012, 16, 6803–6813. [Google Scholar] [CrossRef]

- Alotto, P.; Guarnieri, M.; Moro, F. Redox flow batteries for the storage of renewable energy: A review. Renew. Sustain. Energy Rev. 2014, 29, 325–335. [Google Scholar] [CrossRef]

- Dunn, B.; Kamath, H.; Tarascon, J.M. Electrical energy storage for the grid: A battery of choices. Science 2011, 334, 928–935. [Google Scholar] [CrossRef] [PubMed]

- Ali, J. A q-rung orthopair fuzzy MARCOS method using novel score function and its application to solid waste management. Appl. Intell. 2022, 52, 8770–8792. [Google Scholar] [CrossRef]

- Noriega, J.R.; Iyore, O.D.; Budime, C.; Gnade, B.; Vasselli, J. Characterization system for research on energy storage capacitors. Rev. Sci. Instrum. 2013, 84, 055109. [Google Scholar] [CrossRef]

- Díaz-González, F.; Sumper, A.; Gomis-Bellmunt, O.; Villafafila-Robles, R. A review of energy storage technologies for wind power applications. Renew. Sustain. Energy Rev. 2012, 16, 2154–2171. [Google Scholar] [CrossRef]

- Hall, P.J.; Bain, E.J. Energy-storage technologies and electricity generation. Energy Policy 2008, 36, 4352–4355. [Google Scholar] [CrossRef]

- Nojavan, S.; Majidi, M.; Esfetanaj, N.N. An efficient cost-reliability optimization model for optimal siting and sizing of energy storage system in a microgrid in the presence of responsible load management. Energy 2017, 139, 89–97. [Google Scholar] [CrossRef]

- Zhang, W.; Maleki, A.; Rosen, M.A.; Liu, J. Optimization with a simulated annealing algorithm of a hybrid system for renewable energy including battery and hydrogen storage. Energy 2018, 163, 191–207. [Google Scholar] [CrossRef]

- Li, J.; Yang, Q.; Robinson, F.; Liang, F.; Zhang, M.; Yuan, W. Design and test of a new droop control algorithm for a SMES/battery hybrid energy storage system. Energy 2017, 118, 1110–1122. [Google Scholar] [CrossRef]

- Guney, M.S.; Tepe, Y. Classification and assessment of energy storage systems. Renew. Sustain. Energy Rev. 2017, 75, 1187–1197. [Google Scholar] [CrossRef]

- Gumus, A.T.; Yayla, A.Y.; Çelik, E.; Yildiz, A. A combined fuzzy-AHP and fuzzy-GRA methodology for hydrogen energy storage method selection in Turkey. Energies 2013, 6, 3017–3032. [Google Scholar] [CrossRef]

- Özkan, B.; Kaya, İ.; Cebeci, U.; Başlıgil, H. A hybrid multicriteria decision making methodology based on type-2 fuzzy sets for selection among energy storage alternatives. Int. J. Comput. Intell. Syst. 2015, 8, 914–927. [Google Scholar] [CrossRef]

- Zhang, C.; Chen, C.; Streimikiene, D.; Balezentis, T. Intuitionistic fuzzy MULTIMOORA approach for multi-criteria assessment of the energy storage technologies. Appl. Soft Comput. 2019, 79, 410–423. [Google Scholar] [CrossRef]

- Pózna, A.I.; Hangos, K.M.; Magyar, A. Temperature dependent parameter estimation of electrical vehicle batteries. Energies 2019, 12, 3755. [Google Scholar] [CrossRef]

- Zhao, H.; Guo, S.; Zhao, H. Comprehensive assessment for battery energy storage systems based on fuzzy-MCDM considering risk preferences. Energy 2019, 168, 450–461. [Google Scholar] [CrossRef]

- Pamucar, D.; Deveci, M.; Schitea, D.; Erişkin, L.; Iordache, M.; Iordache, I. Developing a novel fuzzy neutrosophic numbers based decision making analysis for prioritizing the energy storage technologies. Int. J. Hydrog. Energy 2020, 45, 23027–23047. [Google Scholar] [CrossRef]

- Károlyi, G.; Pózna, A.I.; Hangos, K.M.; Magyar, A. An Optimized Fuzzy Controlled Charging System for Lithium-Ion Batteries Using a Genetic Algorithm. Energies 2022, 15, 481. [Google Scholar] [CrossRef]

- Atanassov, K.T. Intuitionistic fuzzy sets. Fuzzy Sets Syst. 1986, 20, 87–96. [Google Scholar] [CrossRef]

- Chaurasiya, R.; Jain, D. Generalized Intuitionistic Fuzzy Entropy on IF-MARCOS Technique in Multi-criteria Decision Making. In Advances in Computing and Data Sciences. ICACDS 2021. Communications in Computer and Information Science; Singh, M., Tyagi, V., Gupta, P.K., Flusser, J., Ören, T., Sonawane, V.R., Eds.; Springer: Cham, Switzerland, 2021; Volume 1440. [Google Scholar] [CrossRef]

- Rong, R.; Yu, L.; Niu, W.; Liu, Y.; Senapati, T.; Mishra, A.R. MARCOS approach based upon cubic Fermatean fuzzy set and its application in evaluation and selecting cold chain logistics distribution center. Eng. Appl. Artif. Intell. 2022, 116, 105401. [Google Scholar] [CrossRef]

- Saha, A.; Pamucar, D.; Gorcun, O.F.; Mishra, A.R. Warehouse site selection for the automotive industry using a fermatean fuzzy-based decision-making approach. Expert Syst. Appl. 2023, 211, 118497. [Google Scholar] [CrossRef]

- Ecer, F.; Pamucar, D. MARCOS technique under intuitionistic fuzzy environment for determining the COVID-19 pandemic performance of insurance companies in terms of healthcare services. Appl. Soft Comput. 2021, 104, 107199. [Google Scholar] [CrossRef]

- Zadeh, L.A. Fuzzy sets. Inf. Control. 1965, 8, 338–353. [Google Scholar] [CrossRef]

- Tripathi, D.K.; Nigam, S.K.; Rani, P.; Shah, A.R. New intuitionistic fuzzy parametric divergence measures and score function-based CoCoSo method for decision-making problems. Decis. Mak. Appl. Manag. Eng. 2022; in press. [Google Scholar] [CrossRef]

- Tripathi, D.; Nigam, S.K.; Mishra, A.R.; Shah, A. A Novel Intuitionistic Fuzzy Distance Measure-SWARA-COPRAS Method for Multi-Criteria Food Waste Treatment Technology Selection. Op. Res. Eng. Sci. Theory Appl. 2022; in press. [Google Scholar] [CrossRef]

- Mishra, A.R.; Rani, P. Shapley divergence measures with VIKOR method for multi-attribute decision making problems. Neural Comput. Appl. 2019, 31, 1299–1316. [Google Scholar] [CrossRef]

- Tao, R.; Liu, Z.; Cai, R.; Cheong, K.H. A dynamic group MCDM model with intuitionistic fuzzy set: Perspective of alternative queuing method. Inf. Sci. 2021, 555, 85–103. [Google Scholar] [CrossRef]

- Kumari, R.; Mishra, A.R. Multi-criteria COPRAS method based on parametric measures for intuitionistic fuzzy sets: Application of green supplier selection. Iran. J. Sci. Technol Trans. Electr. Eng. 2020, 44, 1645–1662. [Google Scholar] [CrossRef]

- Rani, P.; Mishra, A.R.; Ansari, M.D.; Ali, J. Assessment of performance of telecom service providers using intuitionistic fuzzy grey relational analysis framework (IF-GRA). Soft Comput. 2021, 25, 1983–1993. [Google Scholar] [CrossRef]

- Gohain, B.; Chutia, R.; Dutta, P. Distance measure on intuitionistic fuzzy sets and its application in decision-making, pattern recognition, and clustering problems. Int. J. Intell. Syst. 2022, 37, 2458–2501. [Google Scholar] [CrossRef]

- Keshavarz-Ghorabaee, M.; Amiri, M.; Zavadskas, E.K.; Turskis, Z.; Antucheviciene, J. Determination of objective weights using a new method based on the removal effects of criteria (MEREC). Symmetry 2021, 13, 525. [Google Scholar] [CrossRef]

- Rani, P.; Mishra, A.R.; Saha, A.; Hezam, I.M.; Pamucar, D. Fermatean Fuzzy Heronian Mean Operators and MEREC-Based Additive Ratio Assessment Method: An Application to Food Waste Treatment Technology Selection. Int. J. Intell. Syst. 2021, 37, 2612–2647. [Google Scholar] [CrossRef]

- Mishra, A.R.; Saha, A.; Rani, P.; Hezam, I.M.; Shrivastava, R.; Smarandache, F. An Integrated Decision Support Framework Using Single-Valued-MEREC-MULTIMOORA for Low Carbon Tourism Strategy Assessment. IEEE Access 2022, 10, 24411–24432. [Google Scholar] [CrossRef]

- Ul Haq, R.S.; Saeed, M.; Mateen, N.; Siddiqui, F.; Naqvi, M.; Yi, J.B.; Ahmed, S. Sustainable material selection with crisp and ambiguous data using single-valued neutrosophic-MEREC-MARCOS framework. Appl. Soft Comput. 2022, 128, 109546. [Google Scholar] [CrossRef]

- Yu, Y.; Wu, S.; Yu, J.; Chen, H.; Zeng, Q.; Xu, Y.; Ding, H. An integrated MCDM framework based on interval 2-tuple linguistic: A case of offshore wind farm site selection in China. Process Saf. Environ. Prot. 2022, 164, 613–628. [Google Scholar] [CrossRef]

- Stillwell, W.G.; Seaver, D.A.; Edwards, W. A comparison of weight approximation techniques in multiattribute utility decision making. Organ Behav. Hum Perform. 1981, 28, 62–77. [Google Scholar] [CrossRef]

- Narayanamoorthy, S.; Annapoorani, V.; Kang, D.; Baleanu, D.; Jeon, J.; Kureethara, J.V.; Ramya, L. A novel assessment of biomedical waste disposal methods using integrating weighting approach and hesitant fuzzy MOOSRA. J. Clean. Prod. 2020, 275, 122587. [Google Scholar] [CrossRef]

- Hezam, I.M.; Mishra, A.R.; Rani, P.; Cavallaro, F.; Saha, A.; Ali, J.; Strielkowski, W.; Štreimikienė, D. A Hybrid Intuitionistic Fuzzy-MEREC-RS-DNMA Method for Assessing the Alternative Fuel Vehicles with Sustainability Perspectives. Sustainability 2022, 14, 5463. [Google Scholar] [CrossRef]

- Stević, Ž.; Pamučar, D.; Puška, A.; Chatterjee, P. Sustainable supplier selection in healthcare industries using a new MCDM method: Measurement Alternatives and Ranking according to COmpromise Solution (MARCOS). Comput. Ind. Eng. 2020, 140, 106231. [Google Scholar] [CrossRef]

- Tadic, S.; Kilibarda, M.; Kovac, M.; Zecevic, S. The assessment of intermodal transport in countries of the Danube region. Int. J. Traffic Transp. Eng. 2021, 11, 375–391. [Google Scholar]

- Miomir, S.; Stevic, Z.; Kumar, D.D.; Marko, S.; Pamucar, D. A New Fuzzy MARCOS Method for Road Traffic Risk Analysis. Mathematics 2020, 8, 457. [Google Scholar]

- Stevic, Z.; Brkovic, N. A Novel Integrated FUCOM-MARCOS Model for Evaluation of Human Resources in a Transport Company. Logistics 2020, 4, 4. [Google Scholar] [CrossRef]

- Anysz, H.; Nicał, A.; Stevic, Z.; Grzegorzewski, M.; Sikora, K. Pareto optimal decisions in multi-criteria decision making explained with construction cost cases. Symmetry 2021, 13, 46. [Google Scholar] [CrossRef]

- Pamucar, D.; Ecer, F.; Deveci, M. Assessment of alternative fuel vehicles for sustainable road transportation of United States using integrated fuzzy FUCOM and neutrosophic fuzzy MARCOS methodology. Sci. Total Environ. 2021, 788, 147763. [Google Scholar] [CrossRef]

- Xu, Z.S. Intuitionistic fuzzy aggregation operators. IEEE Trans. Fuzzy Syst. 2007, 15, 1179–1187. [Google Scholar]

- Xu, G.L.; Wan, S.P.; Xie, X.L. A Selection Method Based on MAGDM with Interval-Valued Intuitionistic Fuzzy Sets. Math. Probl. Eng. 2015, 2015, 791204. [Google Scholar] [CrossRef]

- Ibrahim, H.; Ilinca, A.; Perron, J. Energy storage systems—Characteristics and comparisons. Renew. Sustain. Energy Rev. 2008, 12, 1221–1250. [Google Scholar] [CrossRef]

- Baker, J. New technology and possible advances in energy storage. Energy Policy 2008, 36, 4368–4373. [Google Scholar] [CrossRef]

- Chen H, Cong T N, Yang W, Tan, C, Li, Y, Ding, Y, Progress in electrical energy storage system: A critical review. Prog. Nat. Sci. 2009, 19, 291–312. [CrossRef]

- Yang, Z.; Zhang, J.; Kintner-Meyer, M.C.W.; Lu, X.; Choi, D.; Lemmon, J.P.; Liu, J. Electrochemical energy storage for green grid. Chem. Rev. 2011, 111, 3577–3613. [Google Scholar] [CrossRef] [PubMed]

- Leung, P.; Li, X.; De León, C.P.; Berlouis, L.; Low, C.T.J.; Walsh, F.C. Progress in redox flow batteries, remaining challenges and their applications in energy storage. RSC Adv. 2012, 2, 10125–10156. [Google Scholar] [CrossRef]

- Zhu, W.H.; Zhu, Y.; Davis, Z.; Tatarchuk, B.J. Energy efficiency and capacity retention of NiMH batteries for storage applications. Appl. Energy 2013, 106, 307–313. [Google Scholar] [CrossRef]

- Mishra, A.R.; Rani, P.; Pardasani, K.R.; Mardani, A. A novel hesitant fuzzy WASPAS method for assessment of green supplier problem based on exponential information measures. J. Clean. Prod. 2019, 238, 117901. [Google Scholar] [CrossRef]

- Mishra, A.R.; Singh, R.K.; Motwani, D. Multi-criteria assessment of cellular mobile telephone service providers using intuitionistic fuzzy WASPAS method with similarity measures. Granul. Comput. 2019, 4, 511–529. [Google Scholar] [CrossRef]

- Gitinavard, H.; Shirazi, M.A. An extended intuitionistic fuzzy modified group complex proportional assessment approach. J. Ind. Syst. Eng. 2018, 11, 229–246. [Google Scholar]

- Mishra, A.R. Intuitionistic fuzzy information with application in rating of township development. Iranian J Fuzzy Syst. 2016, 13, 49–70. [Google Scholar]

- Mishra, A.R.; Sisodia, G.; Pardasani, K.R.; Sharma KMulticriteria, I.T. personnel selection on intuitionistic fuzzy information measures and ARAS methodology. Iranian J Fuzzy Syst. 2020, 17, 55–68. [Google Scholar] [CrossRef]

- Mishra, A.R.; Rani, P.; Mardani, A.; Pardasani, K.R.; Govindan, K.; Alrasheedi, M. Healthcare evaluation in hazardous waste recycling using novel interval-valued intuitionistic fuzzy information based on complex proportional assessment method. Comput Ind Eng. 2020, 139, 106140. [Google Scholar] [CrossRef]

| Dimension | Criteria | Criteria Nature | Criteria Type |

|---|---|---|---|

| Economic (L1) | Operation cost (q1) | Quantitative | Min |

| Capital intensity (q2) | Quantitative | Min | |

| Energy storage system profit (q3) | Quantitative | Max | |

| Technology (L2) | Cycle life (q4) | Quantitative | Max |

| Safety (q5) | Qualitative | Max | |

| Specific energy (q6) | Quantitative | Max | |

| Self-discharge rate (q7) | Quantitative | Min | |

| Environmental (L3) | CO2 intensity (q8) | Quantitative | Min |

| Environmental impact (q9) | Qualitative | Min | |

| Social (L4) | Local development (q10) | Qualitative | Max |

| Job creation (q11) | Quantitative | Max | |

| Performance (L5) | Energy efficiency (q12) | Quantitative | Max |

| Energy intensity (q13) | Quantitative | Max |

| LVs | IFNs |

|---|---|

| Absolutely high (AH) | (0.95, 0.05) |

| Very very high (VVH) | (0.85, 0.1) |

| Very high (VH) | (0.8, 0.15) |

| High (H) | (0.7, 0.2) |

| Slightly high (MH) | (0.6, 0.3) |

| Average (A) | (0.5, 0.4) |

| Slightly low (ML) | (0.4, 0.5) |

| Low (L) | (0.3,0.6) |

| Very very low (VL) | (0.2, 0.7) |

| Very low (VVL) | (0.1, 0.8) |

| Absolutely low (AL) | (0.05, 0.95) |

| DEs | d1 | d2 | d3 | d4 |

|---|---|---|---|---|

| Ratings | VVH (0.85, 0.1) | VH (0.8, 0.15) | EH (0.95, 0.05) | H (0.7, 0.2) |

| 0.2585 | 0.2433 | 0.2752 | 0.2230 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mishra, A.R.; Tripathi, D.K.; Cavallaro, F.; Rani, P.; Nigam, S.K.; Mardani, A. Assessment of Battery Energy Storage Systems Using the Intuitionistic Fuzzy Removal Effects of Criteria and the Measurement of Alternatives and Ranking Based on Compromise Solution Method. Energies 2022, 15, 7782. https://doi.org/10.3390/en15207782

Mishra AR, Tripathi DK, Cavallaro F, Rani P, Nigam SK, Mardani A. Assessment of Battery Energy Storage Systems Using the Intuitionistic Fuzzy Removal Effects of Criteria and the Measurement of Alternatives and Ranking Based on Compromise Solution Method. Energies. 2022; 15(20):7782. https://doi.org/10.3390/en15207782

Chicago/Turabian StyleMishra, Arunodaya Raj, Dinesh Kumar Tripathi, Fausto Cavallaro, Pratibha Rani, Santosh K. Nigam, and Abbas Mardani. 2022. "Assessment of Battery Energy Storage Systems Using the Intuitionistic Fuzzy Removal Effects of Criteria and the Measurement of Alternatives and Ranking Based on Compromise Solution Method" Energies 15, no. 20: 7782. https://doi.org/10.3390/en15207782

APA StyleMishra, A. R., Tripathi, D. K., Cavallaro, F., Rani, P., Nigam, S. K., & Mardani, A. (2022). Assessment of Battery Energy Storage Systems Using the Intuitionistic Fuzzy Removal Effects of Criteria and the Measurement of Alternatives and Ranking Based on Compromise Solution Method. Energies, 15(20), 7782. https://doi.org/10.3390/en15207782