Renewable Energy Status in Azerbaijan: Solar and Wind Potentials for Future Development

Abstract

:1. Introduction

2. Materials and Methods

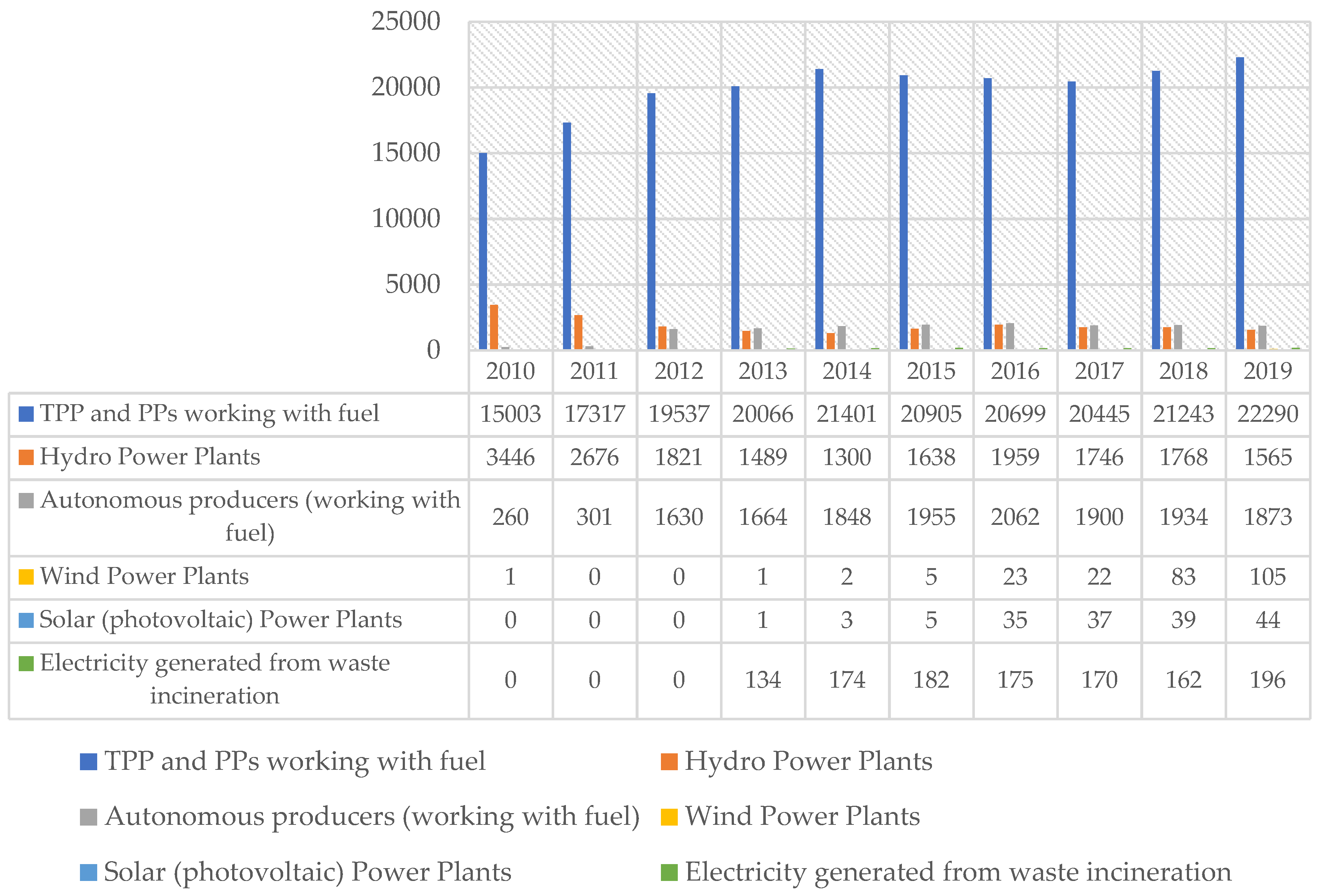

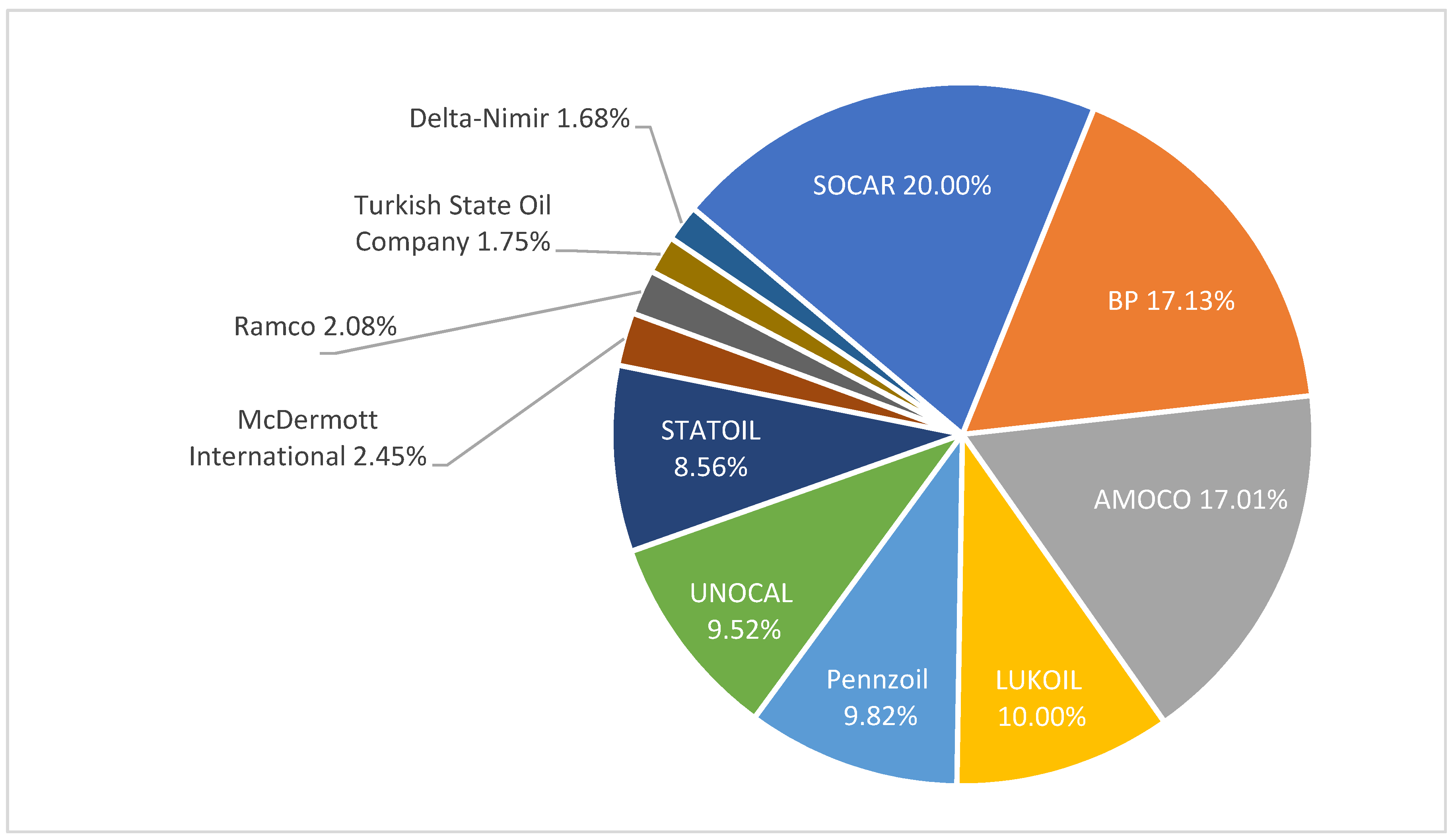

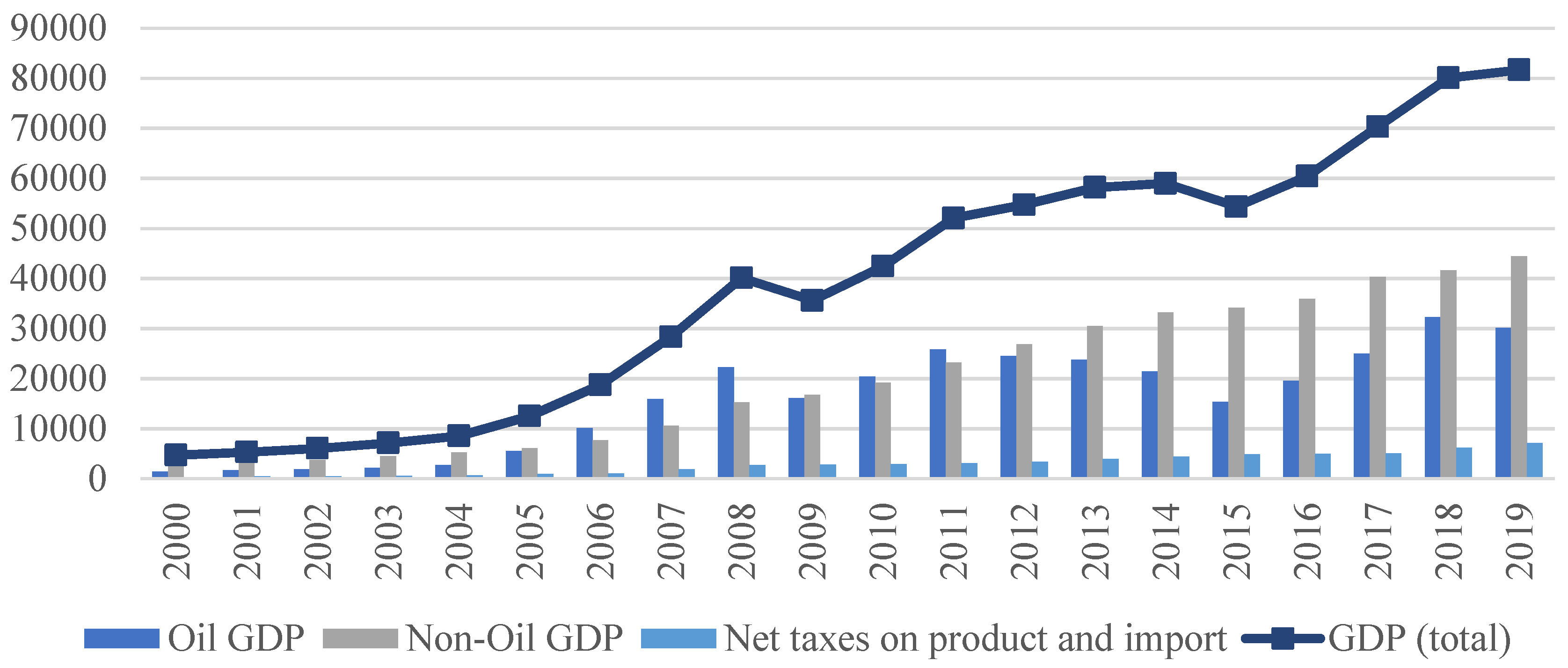

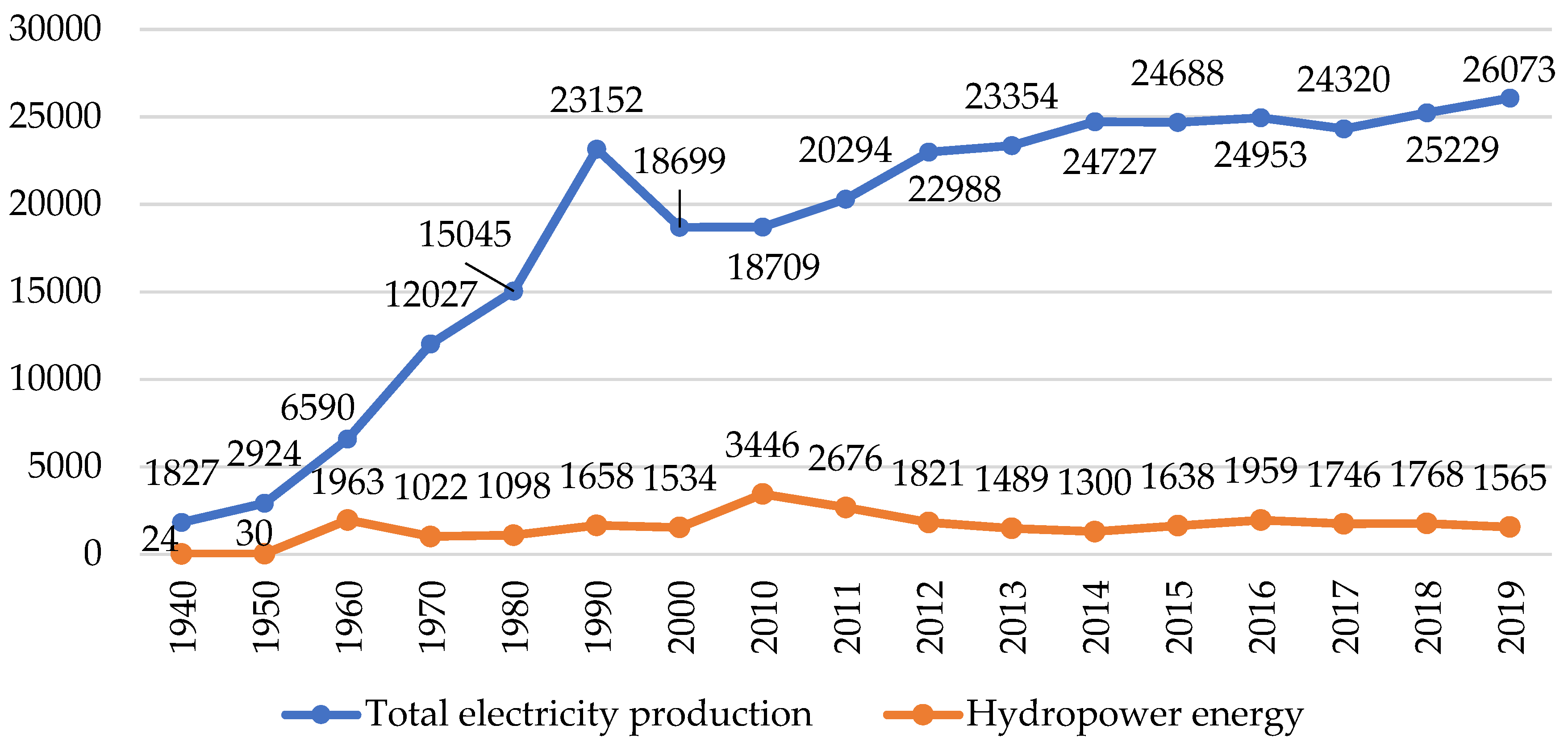

3. Energy Infrastructure, Production and Consumption in Azerbaijan

Own Elaboration

4. Potential of Renewable Energy in Azerbaijan and Its Integration into the Energy System

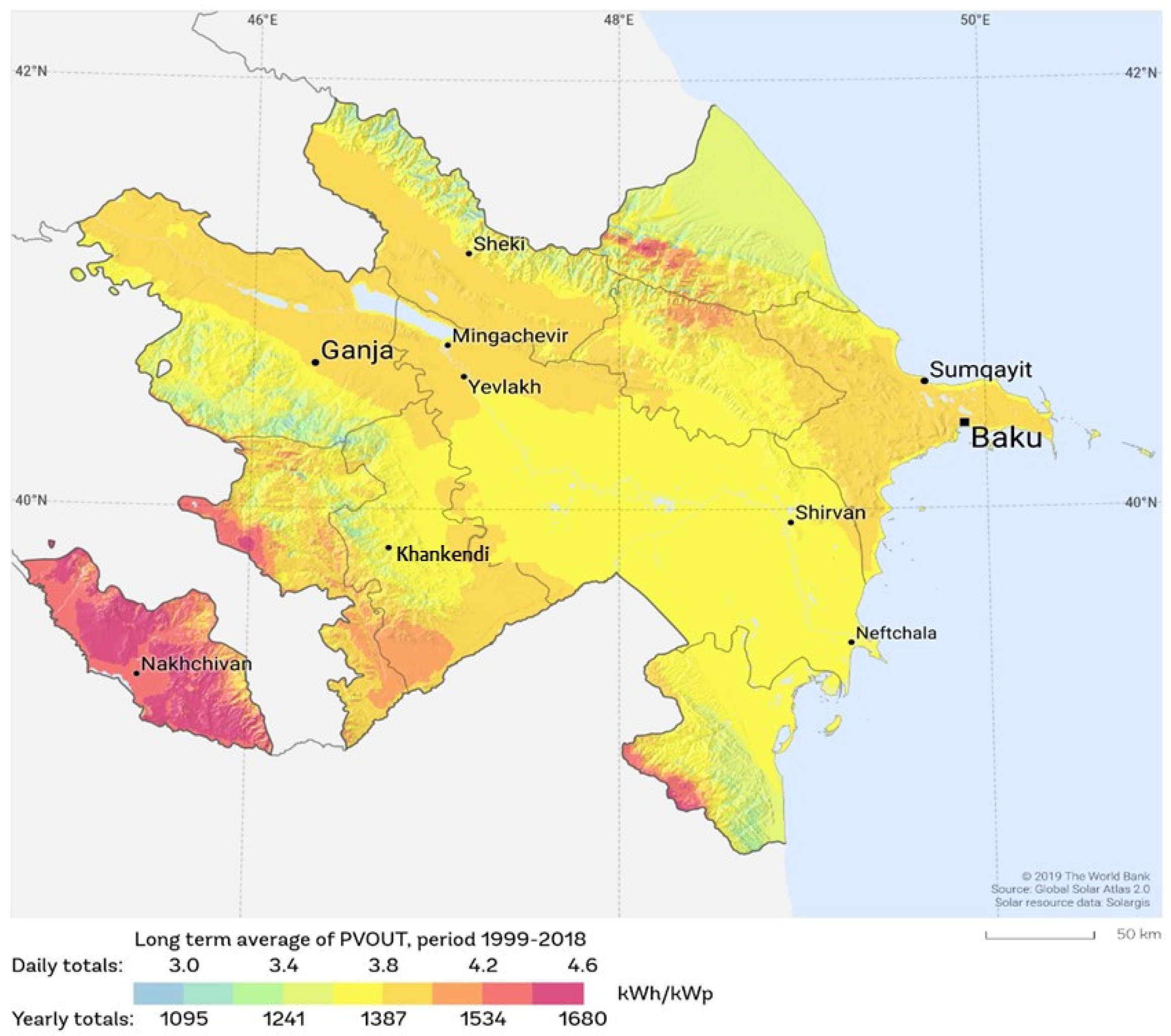

4.1. Solar Potential

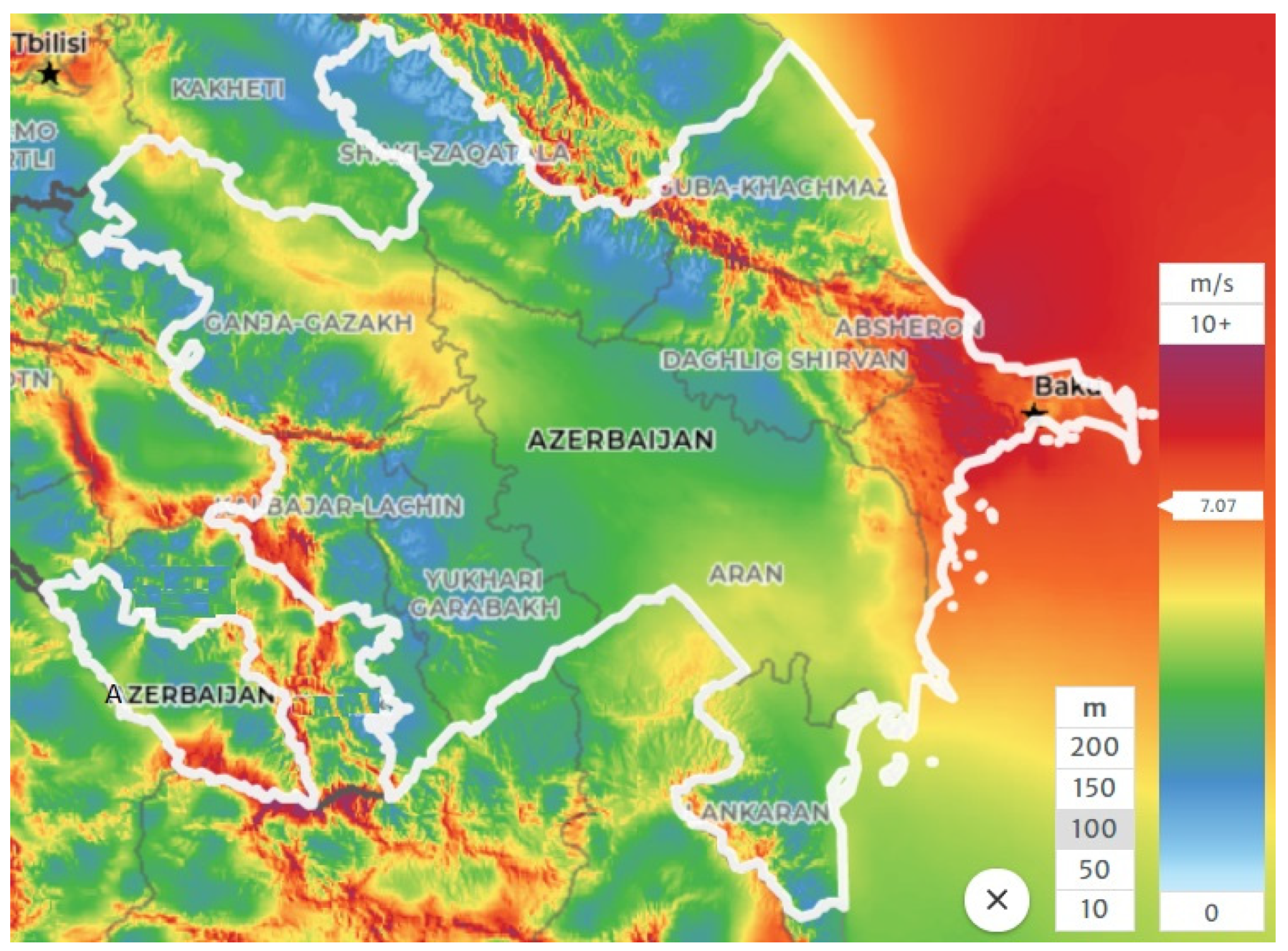

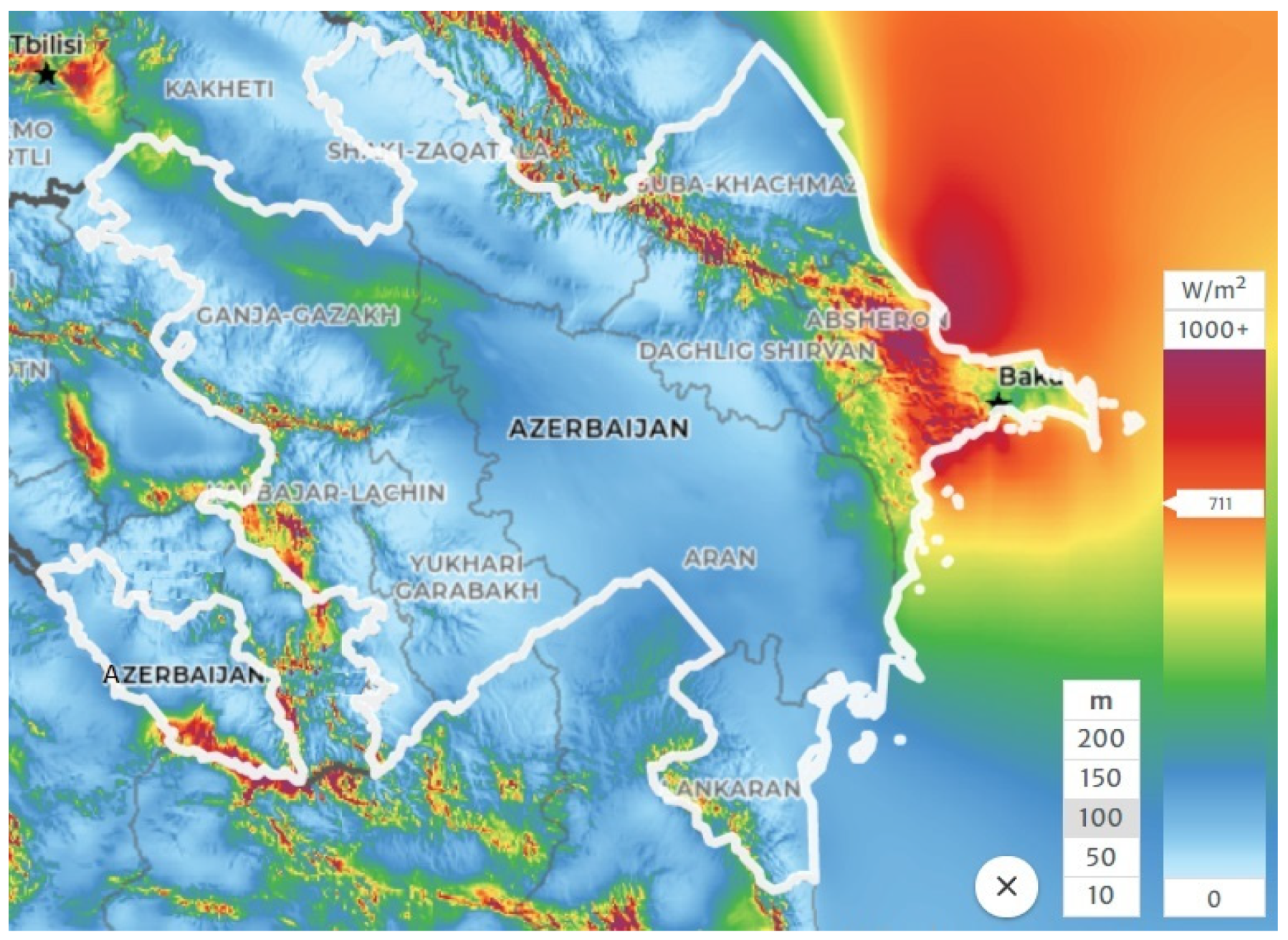

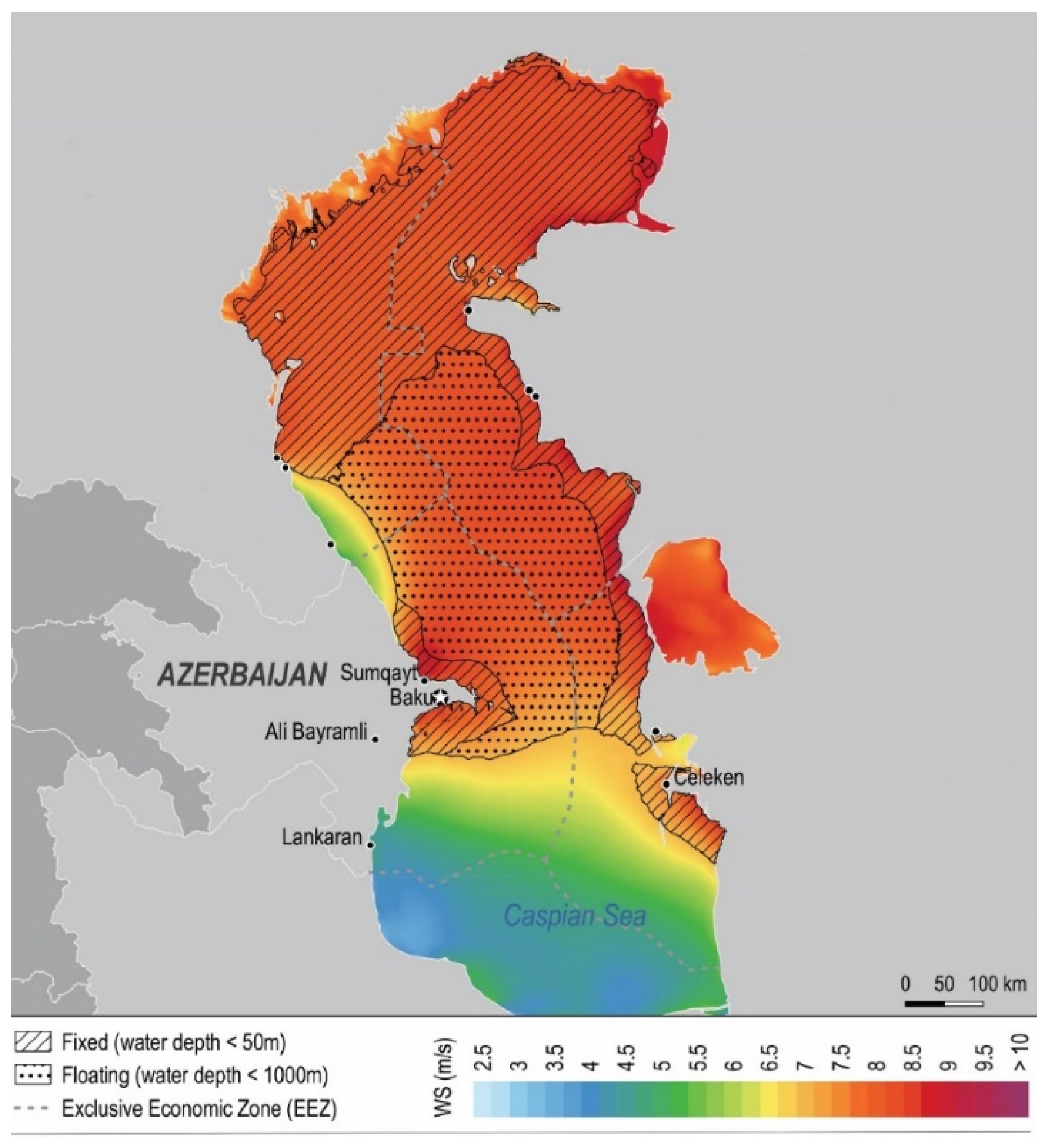

4.2. Wind Potential

5. Legal Framework Regulating Renewables and Incentivization

- The Law on Energy (Law 541-IQ, 1998);

- The Law on Electrical Power (Law 459-IQ, 1998);

- The Law on Electrical and Thermal Power Plants (Law 784-IQ, 1999);

- The Law on Utilization of Renewable Sources in the Electricity Production (Law 339-VIQ, 2021);

- The Law on Efficient Use of Energy Resources and Effectiveness of Energy (Law 359-VIQ, 2021).

- State utilities;

- Private generators—these actors possess rights to sell generated electricity to the state utility or the supply company (monopolized by public utilities). The excess volume of the generated electricity should be bought by state utilities;

- Energy supply companies (public utilities only);

- End consumers.

- Feed-in-Tariffs (FITs);

- Feed-in-premiums (also referred to as FIPs);

- Tradeable green certificates; and

- Investment grants [39].

6. Conclusions, Recommendations and Future Research Directions

6.1. Conclusions

- Azerbaijan historically had a developed hydrocarbon industry, roots of which go as far back as the 19th century;

- Oil and gas resources helped attract huge investments which became a driver of the economy, especially soon after independence was gained;

- Abundant domestic reserves ensured energy security;

- Oil and gas became the cornerstone of foreign trade;

- Extensive resources helped Azerbaijan become an investor in foreign markets, thus enhance political and economic relations with strategically important countries.

- Integration to the grid;

- Balancing supply and demand;

- Creating storage capacity;

- Establishing the necessary legal base.

6.2. Recommendations

- The legal framework should be further developed to include more specific details on the liberalization of the market, support mechanisms and the role of private actors or alternatively simple rules for contractual renewals big project should be established (resembling the Contract of the Century) (gap: imprecise legal framework);

- The energy market should be liberalized and supported with easy access to relevant information for all participants (gap: a limited number of companies involved in energy policy realization);

- Blurry and vague requirements to obtain contracts, permissions and licenses should be improved and made publicly available (gap: imprecise legal framework);

- Supportive policies should be applied to stimulate the inflow of private capital into the energy industry (gap: too few companies involved in energy policy realization);

- Efforts should be put in place to promote and support private and community-scale green energy generation (gap: too few companies involved in energy policy realization);

- Public awareness of the benefits of the renewable resource should be increased and backed with widely accessible information (gap: insufficient information on renewable energy potentials and opportunities);

- Research and development of the renewables industry, including collection of proper data, should be promoted and supported by the government (gap: insufficient information on renewable energy potentials and opportunities);

- Experience of successful countries in terms of REI development should be assessed and considered as domestic expertise on green resources is low (gap: insufficient information on the best practices fitted to the size and characteristics of Azerbaijan available).

6.3. Future Research Directions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- International Renewable Energy Agency. Renewable Power Generation Costs in 2020; Abu Dhabi, United Arab Emirates. 2021. Available online: https://www.irena.org/publications/2021/Jun/Renewable-Power-Costs-in-2020 (accessed on 12 July 2021).

- International Energy Agency. Global Energy Review 2021; IEA: Paris, France, 2021. [Google Scholar]

- BP. Statistical Review of World Energy 2020, BP 69th Edition. Available online: https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy-economics/statistical-review/bp-stats-review-2020-full-report.pdf (accessed on 12 July 2021).

- The State Program on Use of Alternative and Renewable Energy Sources in Azerbaijan. 2004. Available online: http://www.inogate.org/documents/AZ_2004_10_21_State_Program_on_Renewable_Energy_of_Azerbaijan_Republic.pdf (accessed on 15 July 2021).

- Higgins, J.P.T.; Thomas, J.; Chandler, J.; Cumpston, M.; Li, T.; Page, M.J.; Welch, V.A. Cochrane Handbook for Systematic Reviews of Interventions, 2nd ed.; John Wiley & Sons: Chichester, UK, 2019. [Google Scholar]

- Schünemann, H.; Brożek, J.; Guyatt, G.; Oxman, A. GRADE Handbook. 2013. Available online: https://gdt.gradepro.org/app/handbook/handbook.html (accessed on 28 December 2021).

- Nijat, I. Azerbaijan’s Wind Energy Potential and its Utilization Perspectives; Published by academia.edu. 2014. Available online: https://www.academia.edu/19045528/Az%C9%99rbaycan%C4%B1n_K%C3%BCl%C9%99k_Enerji_Potensial%C4%B1_v%C9%99_Onlardan_%C4%B0stifad%C9%99_%C4%B0mkanlar%C4%B1_Wind_Energy_Potential_of_Azerbaijan_and_Availability_of_Its_Using (accessed on 15 July 2021).

- LatLong Latitude and Longitude Finder. 2021. Available online: https://www.latlong.net/ (accessed on 10 July 2021).

- The European Union. Living in the EU. 2019. Available online: https://europa.eu/european-union/about-eu/figures/living_en#tab-0-1 (accessed on 10 July 2021).

- International Renewable Energy Agency. Renewable Energy Capacity Statistics; International Renewable Energy Agency: Abu Dhabi, United Arab Emirates, 2020. [Google Scholar]

- Nicolas, N. Top Ten Countries with the Highest Proportion of Renewable Energy. 2020. Available online: https://www.smart-energy.com/renewable-energy/top-ten-countries-with-the-highest-proportion-of-renewable-energy/ (accessed on 28 December 2021).

- Miryusif, M. Azerbaijan’s Oil History; Azerbaijan International: Baku, Azerbaijan, 2002.

- Vassiliou, M.S. Historical Dictionary of the Petroleum Industry; Scarecrow Press Inc.: Lanham, MD, USA, 2009. [Google Scholar]

- Ibrahimov, M.I.M. Pre-Revolutionary History of Azerbaijani Oil; Elm: Baku, Azerbaijan, 1991. [Google Scholar]

- State Statistics Committee of the Republic of Azerbaijan. Production of Electricity. 2021. Available online: https://www.stat.gov.az/source/balance_fuel/?lang=en (accessed on 25 July 2021).

- Sagheb, M.J.N. Azerbaijan’s ‘Contract of the Century’ Finally Signed with Western Oil Consortium; Azerbaijan International: Baku, Azerbaijan, 1994.

- State Statistics Committee of the Republic of Azerbaijan. System of National Accounts and Balance of Payments. 2021. Available online: https://www.stat.gov.az/source/system_nat_accounts/?lang=en (accessed on 28 July 2021).

- The World Bank. Inflation, Consumer Prices, Azerbaijan. 2021. Available online: https://data.worldbank.org/indicator/FP.CPI.TOTL.ZG?end=2020&locations=AZ&start=1992&view=chart (accessed on 14 September 2021).

- Yusifov, J. Overview of the Renewable Energy Developments in Azerbaijan. 2018. Available online: https://www.irena.org/-/media/Files/IRENA/Agency/Events/2018/Oct/2-Azerbaijan-country-presentation--Jabir-Yusifov.pdf?la=en&hash=38569254F73994725DEBDC2B96C9FF6C2BEC48D5 (accessed on 28 July 2021).

- Ministry of Energy of the Republic of Azerbaijan. Utilization of Renewable Energy Resources in Azerbaijan. 2020. Available online: https://minenergy.gov.az/az/alternativ-ve-berpa-olunan-enerji/azerbaycanda-berpa-olunan-enerji-menbelerinden-istifade (accessed on 2 August 2021).

- Azerbaijan State Agency for the Alternative and Renewable Energy Sources. History. 2018. Available online: http://www.area.gov.az/page/41 (accessed on 4 August 2021).

- State Statistics Committee of the Republic of Azerbaijan. Energy Balance of Azerbaijan. 2020. Available online: https://www.stat.gov.az/source/balance_fuel/?lang=en (accessed on 4 August 2021).

- The International Renewable Energy Agency. Renewables Readiness Assessment: Republic of Azerbaijan; International Renewable Energy Agency: Abu Dhabi, United Arab Emirates, 2019.

- Ministry of Energy of the Republic of Azerbaijan. Perspectives of Renewable and Alternative Energy Sources in Azerbaijan; Ministry of Energy of the Republic of Azerbaijan: Baku, Azerbaijan, 2014.

- Zhang, T. What’s a Good Value for kWh/kWp? An Overview of Specific Yield. 2017. Available online: https://www.solarpowerworldonline.com/2017/08/specific-yield-overview/#:~:text=Specific%20yield%20(or%20simply%20%E2%80%9Cyield,Location (accessed on 16 September 2021).

- The World Bank Group Global Solar Atlas. Global Solar Atlas. 2021. Available online: http://www.globalsolaratlas.info/ (accessed on 12 August 2021).

- The Ministry of Energy of the Republic of Azerbaijan. Development of the Renewable Industry in Azerbaijan; Ministry of Energy of the Republic of Azerbaijan: Baku, Azerbaijan, 2020.

- Mustafayev, F. The Potential Role of Renewable Energy in Providing Energy Security of Azerbaijan. Unpublished. Ph.D. Thesis, University of Gdansk, Sopot, Poland, 2021. [Google Scholar]

- Energy Solutions. How Much Energy Do Solar Panels Produce for Your Home? 2020. Available online: https://www.yesenergysolutions.co.uk/advice/how-much-energy-solar-panels-produce-home#:~:text=Solar%20panel%20output%20per%20square%20metre&text=rated%20to%20produce%20roughly%20265,of%20power%20(in%20ideal%20conditions) (accessed on 2 September 2021).

- Sharma, G. Production Cost of Renewable Energy Now ‘Lower’ Than Fossil Fuels. 2018. Available online: https://www.forbes.com/sites/gauravsharma/2018/04/24/production-cost-of-renewable-energy-now-lower-than-fossil-fuels/#23914695379c (accessed on 2 September 2021).

- Vestas, V117-3.45 MW® at a Glance. 2021. Available online: https://www.vestas.com/en/products/4-mw-platform/v117-3_45_mw#!at-a-glance (accessed on 22 September 2021).

- Gamesa, S. Onshore Wind Turbines. 2021. Available online: https://www.siemensgamesa.com/en-int/products-and-services/onshore/wind-turbine-sg-3-4-145 (accessed on 22 September 2021).

- The World Bank Group Global Wind Atlas. Global Wind Atlas. 2021. Available online: http://www.globalwindatlas.info/ (accessed on 3 September 2021).

- APA Economics. Two WEPs to Be Constructed in Khizi with Total Output Capacity of 204 MW. 2019. Available online: https://banker.az/xizida-umumi-gucu-204-mvt-olan-iki-kul%C9%99k-enerjisi-stansiyasi-tikil%C9%99c%C9%99k/ (accessed on 3 September 2021).

- The World Bank. Offshore Wind Technical Potential in the Caspian Sea. 2020. Available online: https://documents1.worldbank.org/curated/en/802421586850648405/pdf/Technical-Potential-for-Offshore-Wind-in-Caspian-Sea-Map.pdf (accessed on 5 September 2021).

- Onea, F.; Rusu, E. An Assessment of Wind Energy Potential in the Caspian Sea. Energies 2019, 12, 2525. [Google Scholar] [CrossRef] [Green Version]

- The National Academy of Sciences of Azerbaijan. Development Perspectives of Alternative Energy in Azerbaijan; The National Academy of Sciences of Azerbaijan: Baku, Azerbaijan, 2004.

- Ministry of Energy of the Republic of Azerbaijan. Energy Sector in Azerbaijan; Ministry of Energy of the Republic of Azerbaijan: Baku, Azerbaijan, 2020.

- Council of European Energy Regulators. Status Review of Renewable Support Schemes in Europe for 2016 and 2017. 2018. Available online: https://www.ceer.eu/documents/104400/-/-/80ff3127-8328-52c3-4d01-0acbdb2d3bed (accessed on 8 September 2021).

- APA. Azerbaijan Develops Renewable Energy Industry. 2019. Available online: https://apa.az/az/senaye-ve-energetika/azerbaycan-berpa-olunan-enerji-menbelerinden-istifadesi-sahesinde-isleri-genislendirir-541364 (accessed on 8 September 2021).

- Ismayilov, E. Tendering Mechanisms for Alternative Energy Industry to Be Prepared by the End of This Year. 2019. Available online: https://apa.az/az/xeber/senaye-ve-energetika/aera-azerbaycanda-alternativ-enerji-sahesinde-herraclarin-kecirilmesi-qaydalari-bu-il-hazir-olacaq-559496 (accessed on 9 September 2021).

- The United Nations Framework Convention on Climate Change (UNFCCC). Intended Nationally Determined Contribution (INDC) of the Republic of Azerbaijan. 2015. Available online: https://www4.unfccc.int/sites/ndcstaging/PublishedDocuments/AzerbaijanFirst/INDCAzerbaijan.pdf (accessed on 22 September 2021).

- International Renewable Energy Agency. Solutions to Integrate High Shares of Variable Renewable Energy; International Renewable Energy Agency: Abu Dhabi, United Arab Emirates, 2019.

- Leisch, J.C.J. Integrating Variable Renewable Energy into the Grid: Key Issues; National Renewable Energy Laboratory (NREL): Golden, CO, USA, 2015.

- IRENA. Measuring the Economics; IRENA: Abu Dhabi, United Arab Emirates, 2016.

- Singh, N.; Nyuur, R.; Richmond, B. Renewable Energy Development as a Driver of Economic Growth: Evidence from Multivariate Panel Data Analysis. Sustainability 2019, 11, 2418. [Google Scholar] [CrossRef] [Green Version]

- Czako, V. Employment in the Energy Sector; EUR 30186 EN; Publications Office of the European Union: Luxembourg, 2020; ISBN 978-92-76-18206-1. JRC120302. [Google Scholar] [CrossRef]

- Pollin, R.; Wicks-Lim, J.; Peltier, H. Green Prosperity: How Clean-Energy Policies Can Fight Poverty and Raise Living Standards in the United States; Political Economy Research Institute, University of Massachusetts at Amherst: Amherst, MA, USA, 2009.

- G8 Renewable Energy Task Force. Chairmen’s Report; Okinawa Summit Communiqué: Nago, Japan, 2001.

- Rutovitz, J.; Dominish, E.; Downes, J. Calculating Global Energy Sector Jobs: 2015 Methodology Update. 2015. Referenced by Czako, V., Employment in the Energy Sector; EUR 30186 EN; Publications Office of the European Union: Luxembourg, 2020. [Google Scholar]

- The Government of the Republic of Azerbaijan. Azerbaijan 2030: National Priorities on the Socio-Economic Development; The Government of the Republic of Azerbaijan: Baku, Azerbaijan, 2021.

| Total Installed Costs | Levelized Cost of Electricity | |||||

|---|---|---|---|---|---|---|

| (2020 USD/kW) | (2020 USD/kWh) | |||||

| 2010 | 2020 | Percent Change | 2010 | 2020 | Percent Change | |

| Solar PV | 4731 | 883 | −81% | 0.381 | 0.057 | −85% |

| Onshore wind | 1971 | 1355 | −31% | 0.089 | 0.039 | −56% |

| Offshore wind | 4706 | 3185 | −32% | 0.162 | 0.084 | −48% |

| Geographical Location (Mid Point) | Territory Size (km2) | Population (Million) | Installed Renewable Capacity, 2019, MW | |

|---|---|---|---|---|

| Azerbaijan | 40.1431° N, 47.5769° E | 86,600 | 10.0 | 1279 |

| Austria | 47.5162° N, 14.5501° E | 83,879 | 8.58 | 20,628 |

| Portugal | 39.3999° N, 8.2245° W | 92,226 | 10.0 | 14,068 |

| Greece | 39.0742° N, 21.8243° E | 131,957 | 10.7 | 9805 |

| Croatia | 45.1000° N, 15.2000° E | 56,594 | 4.0 | 3005 |

| Thermal Power Plants (TPP) | Hydro Power Plants (HPP) | Small Hydro Power Plants (SHPP) |

|---|---|---|

| Azerbaijan TPP—2400 MW | Mingachevir HPP—402 MW | Gulabird SHPP—7.5 MW |

| Janub PP—780 MW | Shamkir HPP—380 MW | Oghuz SHPP 1,2 & 3–3.6 MW |

| Sumgait PP—525 MW | Yenikend HPP—150 MW | Goychay SHPP—3.1 MW |

| Shimal 1 and 2 PPs—800 MW | Fuzuli HPP—25 MW | Ismayıllı-1 SHPP—1.6 MW |

| Sangachal PP—300 MW | Takhtakorpu HPP—25 MW | Ismayıllı-2 SHPP—1.6 MW |

| Baku TEC—107 MW | Shamkirchay HPP—25 MW | Balaken-1 SHPP—1.5 MW |

| Baku PP—105 MW | Varvara HPP—16.5 MW | Gusar SHPP—1 MW |

| Shahdagh PP—105 MW | Araz HPP—44 MW | Vaykhır HPP—5 MW |

| Astara PP—87 MW | Bilev HPP—22 MW | |

| Shaki PP—87 MW | Arpachay 1, Arpachay 2—21.9 MW | |

| Khachmaz PP—87 MW | Ordubad HPP—36 MW | |

| Nakhchivan PP—87 MW | ||

| Nakhchivan gas-turbine PP—64 MW |

| Name of the WEP | Output Capacity (MW) | Location |

|---|---|---|

| Gobustan | 2.7 | Gobustan |

| Shurabad | 15 | Khizi |

| 25 | Khizi | |

| Pirakushkul | 60 | Pirakushkul 1 |

| 150 | Pirakushkul 2 | |

| Shurabad | 33 | Khizi |

| Sitalchay | 25 | Khizi |

| Khizi | 3.6 | Khizi |

| Mushfiq | 9 | Mushfiq settlement |

| Pirallahi Wind Park | 15 | Caspian Sea |

| New Yashma | 50 | Khizi |

| Ecological Park | 0.04 | Baku |

| Clean City | 9.6 | Zira |

| Samukh Agro-Energy Complex | 5 | Samukh |

| TOTAL | 402.94 |

| Project Title | Capacity (MW) |

|---|---|

| Khizi-1 (Shurabad) | 56.1 |

| Khizi-2 HES | 69.0 |

| Khizi-3 | 135.0 |

| Absheron HES | 55.2 |

| Lokbatan | 26.7 |

| Gobustan HES | 8.0 |

| TOTAL | 350 |

| Project | Capacity (MW) |

|---|---|

| Surakhani | 1.7 |

| Sumgait | 1.8 |

| Pirallahi-1 | 2.2 |

| Pirallahi-2 | 7.2 |

| Samukh-1 | 0.4 |

| Samukh-2 | 7.2 |

| Gobustan HES (solar component) | 5.0 |

| Khizi-2 HES (solar component) | 10.0 |

| Absheron HES (solar component) | 10.0 |

| Siyazan | 4.5 |

| TOTAL | 50 |

| Actors | Roles | |

|---|---|---|

| 1 | Ministry of Energy | Regulates the market; acts as the main body responsible to implement the legal acts |

| 2 | Azerenerji OJSC | Produces electricity |

| 3 | Azerishiq OJSC | Sells and distributes electricity |

| 4 | SAARE | Responsible for the development of the REI |

| Renewables | Technical Capacity, MW |

|---|---|

| Solar | 23,040 |

| Wind | 3000 |

| Bio/Waste | 380 |

| Small Hydropower | 520 |

| Total | 26,940 |

| Project Name and Location | Planned Output Capacity | Estimated Generation |

|---|---|---|

| Project 1—2200 hectares in Hajigabul district | 1100 MW (4.4 million panels × 250 W) | 1.46 million MWh/year |

| Project 2—850 hectares in Absheron peninsula | 425 MW (1.7 million panels × 250 W) | 579,000 MWh/year |

| Project 3—2600 hectares next to Alat settlement | 1300 MW (5.4 million panels × 250 W) | 1.725 million MWh/year |

| Project Name | Estimated Installed Capacity | Estimated Generation |

|---|---|---|

| Area 1–794 ha | 372.5 MW (1.49 million panels × 250 W) | 385,000 MWh/year |

| Area 2–514 ha | 240 MW (963,000 panels × 250 W) | 250,000 MWh/year |

| Area 3–416 ha | 195 MW (780,000 panels × 250 W) | 202,000 MWh/year |

| Settlement | March | June | September | December | Annual Average |

|---|---|---|---|---|---|

| Shubani | 8.7/14.5 | 8.5/12.5 | 8.2/11.5 | 7.2/10 | 8/145 |

| Sumgait | 7.7/14.6 | 6.4/9.1 | 6.9/10.7 | 6.8/13 | 7/139 |

| Puta | 7.2/10.8 | 7.3/10.8 | 6.4/9.5 | 5.5/7.5 | 6.7/114 |

| Pirallahı | 7.2/8.6 | 6.2/4.2 | 6.5/5.8 | 6.6/6.2 | 6.6/72 |

| Bina | 7.3/11.5 | 6.7/7.5 | 5.8/7 | 5.8/7.8 | 6.4/100 |

| Sangimughan | 6.9/7.3 | 5.6/5.1 | 6.9/6.9 | 6.7/6.3 | 6.4/73 |

| Baku | 6.9/7.5 | 6.5/6.2 | 6.2/4.7 | 5.6/4.8 | 6.3/67 |

| Chilov island | 6.6/5.3 | 5.8/4 | 6.3/4.1 | 6.3/5.2 | 6.2/54 |

| Oil rocks | 6.9/6.9 | 5.3/3.3 | 6.4/4 | 6.7/4 | 6.2/52 |

| Mardakan | 6.6/7.4 | 5.8/4.7 | 5.4/5.2 | 5.6/4.6 | 5.9/67 |

| Mashtaga | 6.7/7.9 | 5.7/4.2 | 5.3/4.7 | 5.4/5.4 | 5.8/64 |

| Davachi | 4.6/4.8 | 4.6/4.2 | 4.6/5 | 4.1/3.4 | 4.5/51 |

| Neftchala | 4.8/3.8 | 4.4/2.3 | 4.2/2.9 | 3.7/1.9 | 4.2/30 |

| Sara island | 4.4/4.3 | 4.5/4 | 3.9/3.3 | 3.2/2.1 | 4/36 |

| Alat | 4/4.1 | 4.1/2.8 | 4.2/3.3 | 3.3/2.5 | 3.837 |

| Astara | 2.8/1.3 | 2.7/0.5 | 2.7/0.3 | 2.7/1.1 | 2.8/30 |

| Khachmaz | 2.4/0.9 | 2.5/0.9 | 2.3/1.2 | 2/0.6 | 2.3/13 |

| Guba | 1.8/0.8 | 2.1/0.4 | 1.9/0.2 | 1.7/0.4 | 1.9/6 |

| Lankaran | 1.7/0.5 | 1.9/0.3 | 1.8/0.2 | 1.4/0.2 | 1.8/3 |

| Project Name | Planned Output Capacity | Estimated Generation |

|---|---|---|

| Khizi 2 | 69 MW (20 turbines × 3.45 MW) | 192,000 MWh/year |

| Khizi 3 | 135.3 MW (41 turbines × 3.3 MW) | 414,000 MWh/year |

| Gizildash | 105 MW (35 turbines × 3.0 MW) | 313,670 MWh/year |

| Pirekushkul | 78 MW (26 turbines × 3.0 MW) | 225,000 MWh/year |

| Absheron-Garadagh | 55.2 MW (16 turbines × 3.45 MW) | 198,000 MWh/year |

| Project Name | Planned Output Capacity | Annual Estimated Production |

|---|---|---|

| Ganja-Gazakh (at a projected area of ≈700 ha) | 138 MW (40 Siemens SG 3.4 turbines) | ≈362,000 MWh/year |

| Kalbajar-Lachin (at a projected area of ≈350 ha) | 69 MW (20 Siemens SG 3.4 turbines) | ≈181,000 MWh/year |

| Total | 207 MW (60 Siemens SG 3.4 turbines) | ≈543,000 MWh/year |

| Generation | Public utilities | Transmission grid | A public utility in charge for:

| Transmission grid operator | Public utility | Suppliers | Public utilities |

| Private companies | Private companies |

| Names of Documents | |

|---|---|

| Energy Sector in Azerbaijan | Development of the Renewables in Azerbaijan |

| Feed-in-Tariffs | Mechanism to offer high potential zones to private investors either directly or through a selection process |

| Special mechanisms to support active market actors | Feed-in-Tariffs |

| Provision of subsidized loans | Special tax and customs regimes |

| Research and development support | Net metering/net billing |

| Other support mechanisms | |

| Strengths |

|

| Weaknesses |

|

| Opportunities |

|

| Threats |

|

| Sector | Construction & Installation | Manufacturing | Operation & Maintenance |

|---|---|---|---|

| Solar PV | 13.0 | 6.70 | 0.70 |

| Wind onshore | 3.20 | 4.70 | 0.30 |

| Wind offshore | 8.00 | 15.6 | 0.20 |

| Hydro-large | 7.40 | 3.50 | 0.20 |

| Oil and gas | 1.30 | 0.93 | 0.14 |

| Coal | 11.2 | 5.40 | 0.14 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mustafayev, F.; Kulawczuk, P.; Orobello, C. Renewable Energy Status in Azerbaijan: Solar and Wind Potentials for Future Development. Energies 2022, 15, 401. https://doi.org/10.3390/en15020401

Mustafayev F, Kulawczuk P, Orobello C. Renewable Energy Status in Azerbaijan: Solar and Wind Potentials for Future Development. Energies. 2022; 15(2):401. https://doi.org/10.3390/en15020401

Chicago/Turabian StyleMustafayev, Feyruz, Przemyslaw Kulawczuk, and Christian Orobello. 2022. "Renewable Energy Status in Azerbaijan: Solar and Wind Potentials for Future Development" Energies 15, no. 2: 401. https://doi.org/10.3390/en15020401

APA StyleMustafayev, F., Kulawczuk, P., & Orobello, C. (2022). Renewable Energy Status in Azerbaijan: Solar and Wind Potentials for Future Development. Energies, 15(2), 401. https://doi.org/10.3390/en15020401