The Corporate Economic Performance of Environmentally Eligible Firms Nexus Climate Change: An Empirical Research in a Bayesian VAR Framework

Abstract

1. Introduction

2. Literature Review

3. Data and Methodology

4. Results

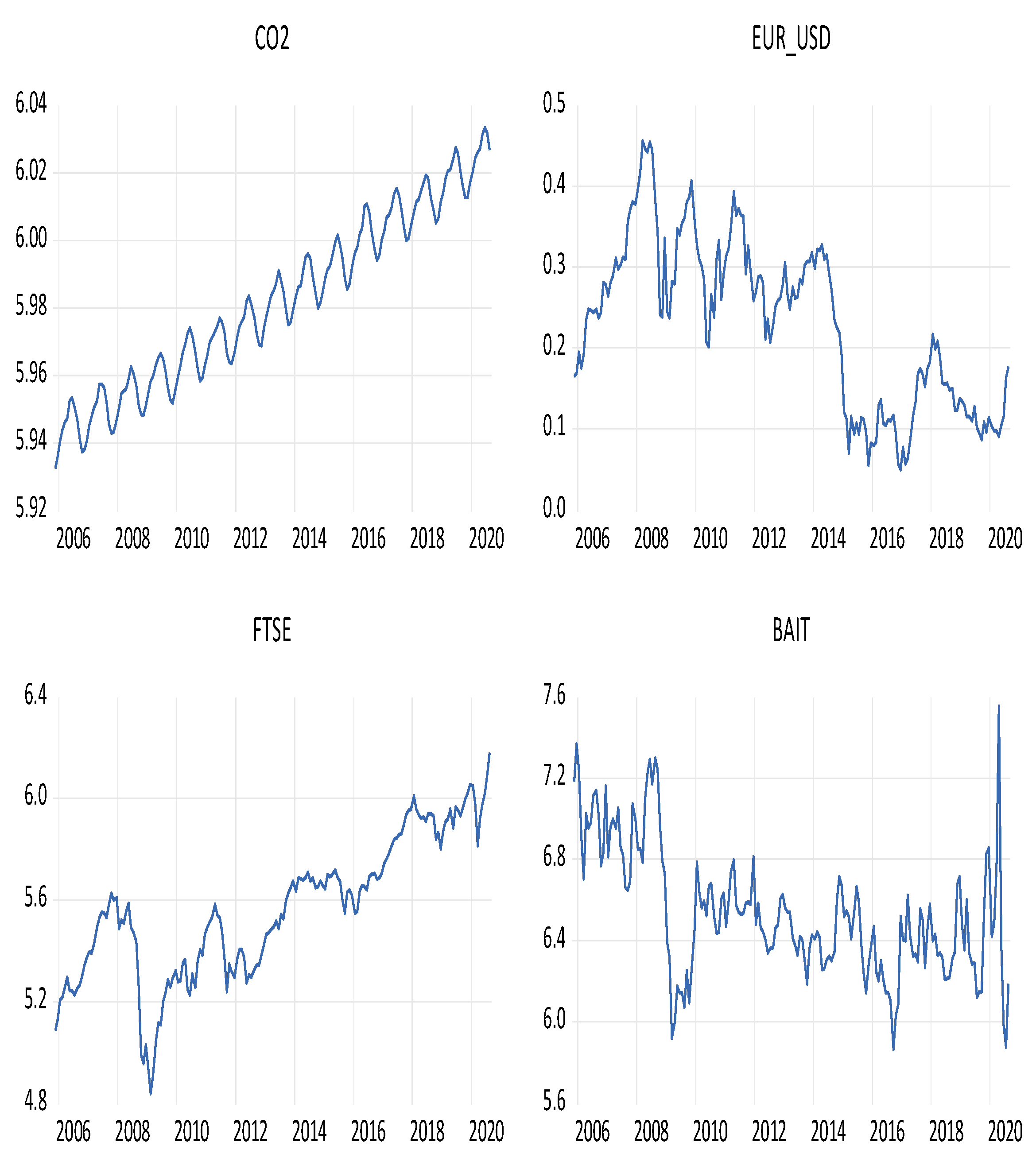

4.1. Descriptive Statistics

4.2. Break Unit Root Tests

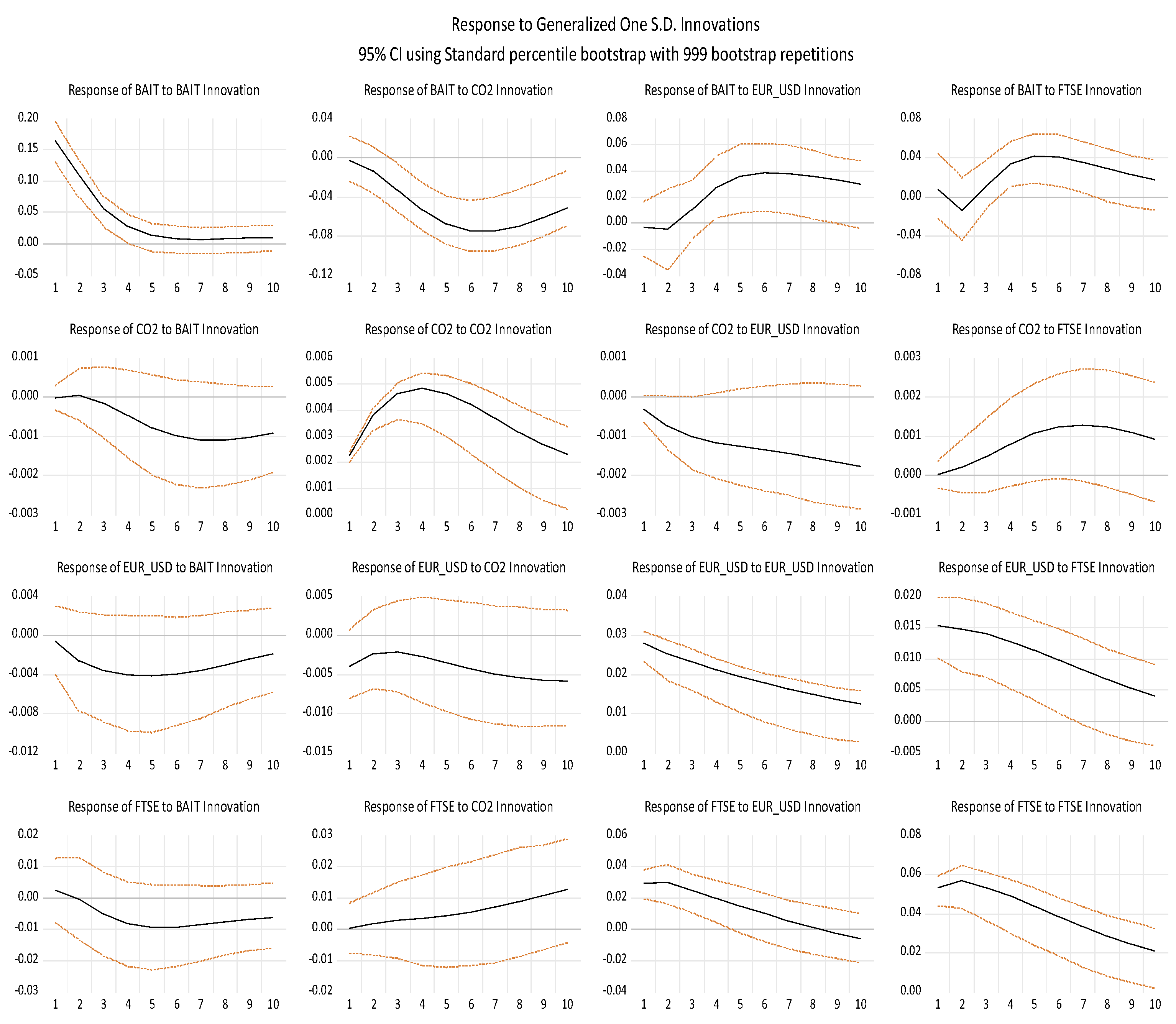

4.3. Impulse Response Analysis

4.4. Variance Decomposition Analysis

4.5. Forecast Evaluation

5. Discussion

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Abbreviations

| FTSE EO | Financial Times Stock Exchange Environmental Opportunities Index Series |

| BAIT | Baltic Clean Tanker Index |

| BVAR | Bayesian Vector Autoregression Model |

| CO2 | carbon emissions |

| CH4 | methane |

| N2O | nitrous oxide |

| IRFs | impulse response functions |

| FEVDs | variance decomposition functions |

| EKC | Environmental Kuznets Curve hypothesis |

References

- Ahmad, A.; Zhao, Y.; Shahbaz, M.; Bano, S.; Zhang, Z.; Wang, S.; Liu, Y. Carbon emissions, energy consumption and economic growth: An aggregate and disaggregate analysis of the Indian economy. Energy Policy 2016, 96, 131–143. [Google Scholar] [CrossRef]

- Sharifi, A. Co-benefits and synergies between urban climate change mitigation and adaptation measures: A literature review. Sci. Total Environ. 2021, 750, 141642. [Google Scholar] [CrossRef] [PubMed]

- NASA. Global Climate Change. 2020. Available online: https://climate.nasa.gov/ (accessed on 10 May 2022).

- Jum’A, L.; Zimon, D.; Ikram, M. A relationship between supply chain practices, environmental sustainability and financial performance: Evidence from manufacturing companies in Jordan. Sustainability 2021, 13, 2152. [Google Scholar] [CrossRef]

- IPCC. Climate Change. The Physical Science Basis. A Summary for Policy Makers. 2021. Available online: https://www.ipcc.ch/report/ar6/wg1/downloads/report/IPCC_AR6_WGI_SPM_final.pdf (accessed on 23 February 2022).

- Liu, C.-C.; Niu, Z.-W.; Li, Q.-L. The impact of lean practices on performance: Based on meta-analysis and Bayesian network. Total Qual. Manag. Bus. Excel. 2020, 31, 1225–1242. [Google Scholar] [CrossRef]

- IEA. Global Energy Review 2021; IEA: Paris, France, 2021; Available online: https://www.iea.org/reports/global-energy-review-2021 (accessed on 20 June 2022).

- Khatibi, F.S.; Dedekorkut-Howes, A.; Howes, M.; Torabi, E. Can public awareness, knowledge and engagement improve climate change adaptation policies? Discov. Sustain. 2021, 2, 18. [Google Scholar] [CrossRef]

- Vasilev, Y.; Cherepovitsyn, A.; Tsvetkova, A.; Komendantova, N. Promoting Public Awareness of Carbon Capture and Storage Technologies in the Russian Federation: A System of Educational Activities. Energies 2021, 14, 1408. [Google Scholar] [CrossRef]

- Grossman, G.; Krueger, A. Environmental Impacts of a North American Free Trade Agreement (No. 3914); National Bureau of Economic Research, Inc.: Cambridge, MA, USA, 1991. [Google Scholar]

- Shafik, N.; Bandyopadhyay, S. Economic Growth and Environmental Quality Time-Series and Cross-Country Evidence. In World Development Report; World Bank Publications: Washington, DC, USA, 1992. [Google Scholar]

- Panayotou, T. Empirical tests and policy analysis of environmental degradation at different stages of economic development. In World Employment Research Programme; International Labour Organization: Geneva, Switzerland, 1993. [Google Scholar]

- Yilanci, V.; Pata, U.K. Investigating the EKC hypothesis for China: The role of economic complexity on ecological footprint. Environ. Sci. Pollut. Res. 2020, 27, 32683–32694. [Google Scholar] [CrossRef]

- Bibi, F.; Jamil, M. Testing environment Kuznets curve (EKC) hypothesis in different regions. Environ. Sci. Pollut. Res. 2021, 28, 13581–13594. [Google Scholar] [CrossRef]

- Rahman, M.M.; Kashem, M.A. Carbon emissions, energy consumption and industrial growth in Bangladesh: Empirical evidence from ARDL cointegration and Granger causality analysis. Energy Policy 2017, 110, 600–608. [Google Scholar] [CrossRef]

- Andersson, F.N. International trade and carbon emissions: The role of Chinese institutional and policy reforms. J. Environ. Manag. 2018, 205, 29–39. [Google Scholar] [CrossRef]

- Tenaw, D.; Beyene, A.D. Environmental sustainability and economic development in sub-Saharan Africa: A modified EKC hypothesis. Renew. Sustain. Energy Rev. 2021, 143, 110897. [Google Scholar] [CrossRef]

- Lise, W. Decomposition of CO2 emissions over 1980–2003 in Turkey. Energy Policy 2006, 34, 1841–1852. [Google Scholar] [CrossRef]

- Halicioglu, F. An econometric study of CO2 emissions, energy consumption, income and foreign trade in Turkey. Energy Policy 2009, 37, 1156–1164. [Google Scholar] [CrossRef]

- Wang, S.; Fang, C.; Wang, Y. Spatiotemporal variations of energy-related CO2 emissions in China and its influencing factors: An empirical analysis based on provincial panel data. Renew. Sustain. Energy Rev. 2016, 55, 505–515. [Google Scholar] [CrossRef]

- He, Z.; Xu, S.; Shen, W.; Long, R.; Chen, H. Impact of urbanization on energy related CO2 emission at different development levels: Regional difference in China based on panel estimation. J. Clean. Prod. 2017, 140, 1719–1730. [Google Scholar] [CrossRef]

- Pata, U.K. The effect of urbanization and industrialization on carbon emissions in Turkey: Evidence from ARDL bounds testing procedure. Environ. Sci. Pollut. Res. 2018, 25, 7740–7747. [Google Scholar] [CrossRef] [PubMed]

- Ozatac, N.; Gokmenoglu, K.K.; Taspinar, N. Testing the EKC hypothesis by considering trade openness, urbanization, and financial development: The case of Turkey. Environ. Sci. Pollut. Res. 2017, 24, 16690–16701. [Google Scholar] [CrossRef]

- Bento, J.P.; Moutinho, V. CO2 emissions, non-renewable and renewable electricity production, economic growth, and ınternational trade in Italy. Renew. Sustain. Energy Rev. 2016, 55, 142–155. [Google Scholar] [CrossRef]

- Jalil, A.; Mahmud, S.F. Environment Kuznets curve for CO2 emissions: A cointegration analysis for China. Energy Policy 2009, 37, 5167–5172. [Google Scholar] [CrossRef]

- Shahbaz, M.; Lean, H.H.; Shabbir, M.S. Environmental Kuznets curve hypothesis in Pakistan: Cointegration and granger causality. Renew. Sustain. Energy Rev. 2012, 16, 2947–2953. [Google Scholar] [CrossRef]

- Robalino-López, A.; Mena-Nieto, Á.; García-Ramos, J.E.; Golpe, A.A. Studying the relationship between economic growth, CO2 emissions, and the environmental kuznets curve in Venezuela (1980–2025). Renew. Sustain. Energy Rev. 2015, 41, 602–614. [Google Scholar] [CrossRef]

- Paramati, S.R.; Alam, M.S.; Chen, C.-F. The effects of tourism on economic growth and CO2 emissions: A comparison between developed and developing economies. J. Travel Res. 2016, 56, 712–724. [Google Scholar] [CrossRef]

- Zhang, L.; Gao, J. Exploring the effects of international tourism on China’s economic growth, energy consumption and environmental pollution: Evidence from a regional panel analysis. Renew. Sustain. Energy Rev. 2016, 53, 225–234. [Google Scholar] [CrossRef]

- Acheampong, A.O. Economic growth, CO2 emissions and energy consumption: What causes what and where? Energy Econ. 2018, 74, 677–692. [Google Scholar] [CrossRef]

- Mardani, A.; Streimikiene, D.; Nilashi, M.; Arias Aranda, D.; Loganathan, N.; Jusoh, A. Energy consumption, economic growth, and CO2 emissions in G20 countries: Application of adaptive neuro-fuzzy inference system. Energies 2018, 11, 2771. [Google Scholar] [CrossRef]

- Bosah, P.C.; Li, S.; Ampofo, G.K.M.; Asante, D.A.; Wang, Z. The Nexus Between Electricity Consumption, Economic Growth, and CO2 Emission: An Asymmetric Analysis Using Nonlinear ARDL and Nonparametric Causality Approach. Energies 2020, 13, 1258. [Google Scholar] [CrossRef]

- Koc, S.; Bulus, G.C. Testing validity of the EKC hypothesis in South Korea: Role of renewable energy and trade openness. Environ. Sci. Pollut. Res. 2020, 27, 29043–29054. [Google Scholar] [CrossRef]

- Dinda, S.; Coondoo, D. Income and emission: A panel data-based cointegration analysis. Ecol. Econ. 2006, 57, 167–181. [Google Scholar] [CrossRef]

- Dedeoğlu, D.; Kaya, H. Energy use, exports, imports and GDP: New evidence from the OECD countries. Energy Policy 2013, 57, 469–476. [Google Scholar] [CrossRef]

- Barassi, M.; Spagnolo, N. Linear and non-linear causality between CO2 emissions and economic growth. Energy J. 2012, 33. [Google Scholar] [CrossRef]

- Septon, K. Campus Cafeteria Serves as Sustainable Model for Energy-Efficient Food Service (Fact Sheet); (No. NREL/FS-6A42-60338); National Renewable Energy Lab. (NREL): Golden, CO, USA, 2013.

- Liu, Y.; Failler, P.; Peng, J.; Zheng, Y. Time-Varying Relationship between Crude Oil Price and Exchange Rate in the Context of Structural Breaks. Energies 2020, 13, 2395. [Google Scholar] [CrossRef]

- Apergis, N.; Payne, J.E. A panel study of nuclear energy consumption and economic growth. Energy Econ. 2010, 32, 545–549. [Google Scholar] [CrossRef]

- Menyah, K.; Wolde-Rufael, Y. CO2 emissions, nuclear energy, renewable energy and economic growth in the US. Energy Policy 2010, 38, 2911–2915. [Google Scholar] [CrossRef]

- Boontome, P.; Therdyothin, A.; Chontanawat, J. Investigating the causal relationship between non-renewable and renewable energy consumption, CO2 emissions and economic growth in Thailand. Energy Procedia 2017, 138, 925–930. [Google Scholar] [CrossRef]

- Sinha, A.; Shahbaz, M. Estimation of Environmental Kuznets Curve for CO2 emission: Role of renewable energy generation in India. Renew. Energy 2018, 119, 703–711. [Google Scholar] [CrossRef]

- Adebayo, T.S.; Odugbesan, J.A. Modeling CO2 emissions in South Africa: Empirical evidence from ARDL based bounds and wavelet coherence techniques. Environ. Sci. Pollut. Res. 2020, 28, 9377–9389. [Google Scholar] [CrossRef]

- Murshed, M. Modeling primary energy and electricity demands in Bangladesh: An Autoregressive distributed lag approach. Sustain. Prod. Consum. 2021, 27, 698–712. [Google Scholar] [CrossRef]

- Murshed, M.; Ahmed, Z.; Alam, S.; Mahmood, H.; Rehman, A.; Dagar, V. Reinvigorating the role of clean energy transition for achieving a low-carbon economy: Evidence from Bangladesh. Environ. Sci. Pollut. Res. 2021, 28, 67689–67710. [Google Scholar] [CrossRef]

- Bilgili, F.; Koçak, E.; Bulut, Ü. The dynamic impact of renewable energy consumption on CO2 emissions: A revisited Environmental Kuznets Curve approach. Renew. Sustain. Energy Rev. 2016, 54, 838–845. [Google Scholar] [CrossRef]

- Hanif, I. Impact of economic growth, nonrenewable and renewable energy consumption, and urbanization on carbon emissions in Sub-Saharan Africa. Environ. Sci. Pollut. Res. 2018, 25, 15057–15067. [Google Scholar] [CrossRef]

- Zafar, M.W.; Mirza, F.M.; Zaidi, S.A.H.; Hou, F. The nexus of renewable and nonrenewable energy consumption, trade openness, and CO2 emissions in the framework of EKC: Evidence from emerging economies. Environ. Sci. Pollut. Res. 2019, 26, 15162–15173. [Google Scholar] [CrossRef] [PubMed]

- Kirikkaleli, D.; Güngör, H.; Adebayo, T.S. Consumption-based carbon emissions, renewable energy consumption, financial development and economic growth in Chile. Bus. Strategy Environ. 2022, 31, 1123–1137. [Google Scholar] [CrossRef]

- Koengkan, M.; Fuinhas, J.A.; Silva, N. Exploring the capacity of renewable energy consumption to reduce outdoor air pollution death rate in Latin America and the Caribbean region. Environ. Sci. Pollut. Res. 2021, 28, 1656–1674. [Google Scholar] [CrossRef] [PubMed]

- Pata, U.K. Renewable and non-renewable energy consumption, economic complexity, CO2 emissions, and ecological footprint in the USA: Testing the EKC hypothesis with a structural break. Environ. Sci. Pollut. Res. 2021, 28, 846–861. [Google Scholar] [CrossRef] [PubMed]

- Sánchez-Chóliz, J.; Duarte, R. CO2 emissions embodied in international trade: Evidence for Spain. Energy Policy 2004, 32, 1999–2005. [Google Scholar] [CrossRef]

- Sapkota, P.; Bastola, U. Foreign direct investment, income, and environmental pollution in developing countries: Panel data analysis of Latin America. Energy Econ. 2017, 64, 206–212. [Google Scholar] [CrossRef]

- Baliga, R.; Raut, R.D.; Kamble, S.S. Sustainable supply chain management practices and performance. Manag. Environ. Qual. Int. J. 2019, 31, 1147–1182. [Google Scholar] [CrossRef]

- Panigrahi, S.S.; Bahinipati, B.; Jain, V. Sustainable supply chain management. Manag. Environ. Qual. Int. J. 2019, 30, 1001–1049. [Google Scholar] [CrossRef]

- De, D.; Chowdhury, S.; Dey, P.K.; Ghosh, S.K. Impact of Lean and Sustainability Oriented Innovation on Sustainability Performance of Small and Medium Sized Enterprises: A Data Envelopment Analysis-based framework. Int. J. Prod. Econ. 2020, 219, 416–430. [Google Scholar] [CrossRef]

- Gil, M.; Jiménez, J.B.; Lorente, J.C. An analysis of environmental management, organizational context and performance of Spanish hotels. Omega 2001, 29, 457–471. [Google Scholar] [CrossRef]

- Shahbaz, M.; Hye, Q.M.A.; Tiwari, A.K.; Leitão, N.C. Economic growth, energy consumption, financial development, international trade and CO2 emissions in Indonesia. Renew. Sustain. Energy Rev. 2013, 25, 109–121. [Google Scholar] [CrossRef]

- Xu, Q.; Lu, Y.; Lin, H.; Li, B. Does corporate environmental responsibility (CER) affect corporate financial performance? Evidence from the global public construction firms. J. Clean. Prod. 2021, 315, 128131. [Google Scholar] [CrossRef]

- Russo, M.V.; Fouts, P.A. A resource-based perspective on corporate environmental performance and profitability. Acad. Manag. J. 1997, 40, 534–559. [Google Scholar]

- Hatakeda, T.; Kokubu, K.; Kajiwara, T.; Nishitani, K. Factors influencing corporate environmental protection activities for greenhouse gas emission reductions: The relationship between environmental and financial performance. Environ. Resour. Econ. 2012, 53, 455–481. [Google Scholar] [CrossRef]

- Eccles, R.G.; Ioannou, I.; Serafeim, G. The impact of corporate sustainability on organizational processes and performance. Manag. Sci. 2014, 60, 2835–2857. [Google Scholar] [CrossRef]

- Khan, Z.; Sisi, Z.; Siqun, Y. Environmental regulations an option: Asymmetry effect of environmental regulations on carbon emissions using non-linear ARDL. Energy Sources Part A Recover. Util. Environ. Eff. 2019, 41, 137–155. [Google Scholar] [CrossRef]

- Jiang, C.; Ma, X. The impact of financial development on carbon emissions: A global perspective. Sustainability 2019, 11, 5241. [Google Scholar] [CrossRef]

- Ye, Y.; Khan, Y.A.; Wu, C.; Shah, E.A.; Abbas, S.Z. The impact of financial development on environmental quality: Evidence from Malaysia. Air Qual. Atmos. Health 2021, 14, 1233–1246. [Google Scholar] [CrossRef]

- Ma, C.Q.; Liu, J.L.; Ren, Y.S.; Jiang, Y. The Impact of economic growth, FDI and energy intensity on China’s manufacturing industry’s CO2 emissions: An empirical study based on the fixed-effect panel quantile regression model. Energies 2019, 12, 4800. [Google Scholar] [CrossRef]

- Cetin, M.A. Investigating the environmental Kuznets curve and the role of green energy: Emerging and developed markets. Int. J. Green Energy 2018, 15, 37–44. [Google Scholar] [CrossRef]

- Lütkepohl, H. Vector autoregressive models. In Handbook of Research Methods and Applications in Empirical Macroeconomics; Edward Elgar Publishing: Cheltenham, UK, 2013. [Google Scholar]

- Ivanov, V.; Kilian, L. A practitioner’s guide to lag order selection for VAR impulse response analysis. Stud. Nonlinear Dyn. Econ. 2005, 9, 1–36. [Google Scholar] [CrossRef]

- Giannone, D.; Reichlin, L.; Sala, L. VARs, common factors and the empirical validation of equilibrium business cycle models. J. Econ. 2006, 132, 257–279. [Google Scholar] [CrossRef]

- Arellano, M.; Bond, S. Some Tests of Specification for Panel Data: Monte Carlo Evidence and an Application to Employment Equations. Rev. Econ. Stud. 1991, 58, 277–297. [Google Scholar] [CrossRef]

- Kang, S.H.; Islam, F.; Tiwari, A.K. The dynamic relationships among CO2 emissions, renewable and non-renewable energy sources, and economic growth in India: Evidence from time-varying Bayesian VAR model. Struct. Chang. Econ. Dyn. 2019, 50, 90–101. [Google Scholar] [CrossRef]

- Baumeister, C.; Korobilis, D.; Lee, T. Energy markets and global economic conditions. Rev. Econ. Stat. 2020, 104, 828–844. [Google Scholar] [CrossRef]

- Lopreite, M.; Zhu, Z. The effects of ageing population on health expenditure and economic growth in China: A Bayesian-VAR approach. Soc. Sci. Med. 2020, 265, 113513. [Google Scholar] [CrossRef]

- Huber, F.; Feldkircher, M. Adaptive Shrinkage in Bayesian Vector Autoregressive Models. J. Bus. Econ. Stat. 2019, 37, 27–39. [Google Scholar] [CrossRef]

- Piaggio, M.; Padilla, E.; Román, C. The long-term relationship between CO2 emissions and economic activity in a small open economy: Uruguay 1882–2010. Energy Econ. 2017, 65, 271–282. [Google Scholar] [CrossRef]

- Ozturk, I. A literature survey on energy–growth nexus. Energy Policy 2010, 38, 340–349. [Google Scholar] [CrossRef]

- Pata, U.K. The influence of coal and noncarbohydrate energy consumption on CO2 emissions: Revisiting the environmental Kuznets curve hypothesis for Turkey. Energy 2018, 160, 1115–1123. [Google Scholar] [CrossRef]

- Kraft, J.; Kraft, A. On the relationship between energy and GNP. J. Energy Dev. 1978, 3, 401–403. [Google Scholar]

- Lise, W.; Van Montfort, K. Energy consumption and GDP in Turkey: Is there a co-integration relationship? Energy Econ. 2007, 29, 1166–1178. [Google Scholar] [CrossRef]

- Luzzati, T.; Orsini, M.; Gucciardi, G. A multiscale reassessment of the Environmental Kuznets Curve for energy and CO2 emissions. Energy Policy 2018, 122, 612–621. [Google Scholar] [CrossRef]

- Guo, Y. Financial development and carbon emissions: Analyzing the role of financial risk, renewable energy electricity, and human capital for China. Discret. Dyn. Nat. Soc. 2021, 2021, 1025669. [Google Scholar] [CrossRef]

- Carney, M. Breaking the tragedy of the horizon–climate change and financial stability. Speech Given Lloyd’s Lond. 2015, 29, 220–230. [Google Scholar]

- Yeung, D.W.K.; Petrosyan, L.A. Asynchronous Horizons Durable-Strategies Dynamic Games and Tragedy of Cross-Generational Environmental Commons. Int. Game Theory Rev. 2021, 23, 2150020. [Google Scholar] [CrossRef]

- Lanne, M.; Nyberg, H. Generalized Forecast Error Variance Decomposition for Linear and Nonlinear Multivariate Models. Oxf. Bull. Econ. Stat. 2016, 78, 595–603. [Google Scholar] [CrossRef]

- Apergis, N.; Payne, J.E. The renewable energy consumption–growth nexus in Central America. Appl. Energy 2011, 88, 343–347. [Google Scholar] [CrossRef]

- Zhang, Y.; Zhang, S. The impacts of GDP, trade structure, exchange rate and FDI inflows on China’s carbon emissions. Energy Policy 2018, 120, 347–353. [Google Scholar] [CrossRef]

- Jorgenson, D.W.; Wilcoxen, P.J. Reducing US carbon emissions: An econometric general equilibrium assessment. Resour. Energy Econ. 1993, 15, 7–25. [Google Scholar] [CrossRef]

- Trinks, A.; Mulder, M.; Scholtens, B. An efficiency perspective on carbon emissions and financial performance. Ecol. Econ. 2020, 175, 106632. [Google Scholar] [CrossRef]

- Thomä, J.; Chenet, H. Transition risks and market failure: A theoretical discourse on why financial models and economic agents may misprice risk related to the transition to a low-carbon economy. J. Sustain. Financ. Investig. 2017, 7, 82–98. [Google Scholar] [CrossRef]

- Riti, J.S.; Shu, Y.; Song, D.; Kamah, M. The contribution of energy use and financial development by source in climate change mitigation process: A global empirical perspective. J. Clean. Prod. 2017, 148, 882–894. [Google Scholar] [CrossRef]

- Destek, M.A.; Sarkodie, S.A. Investigation of environmental Kuznets curve for ecological footprint: The role of energy and financial development. Sci. Total Environ. 2019, 650, 2483–2489. [Google Scholar] [CrossRef] [PubMed]

- Krogstrup, S.; Oman, W. Macroeconomic and Financial Policies for Climate Change Mitigation: A Review of the Literature; Danmarks Nationalbank: Copenhagen, Danmarks, 2019. [Google Scholar]

- Nasir, M.A.; Huynh, T.L.D.; Tram, H.T.X. Role of financial development, economic growth & foreign direct investment in driving climate change: A case of emerging ASEAN. J. Environ. Manag. 2019, 242, 131–141. [Google Scholar] [CrossRef]

| Variables | FTEOAS | CO2 | EUR/USD | BAIT |

|---|---|---|---|---|

| Mean | 5.561 | 5.982 | 0.23 | 6.534 |

| Maximum | 6.18 | 6.033 | 0.456 | 7.556 |

| Minimum | 4.838 | 5.932 | 0.05 | 5.864 |

| Std.Dev | 0.276 | 0.026 | 0.103 | 0.318 |

| Skewness | −0.105 | 0.123 | 0.091 | 0.642 |

| Kurtosis | 2.459 | 1.92 | 2.005 | 3.235 |

| Jarque–Bera | 2.495 | 9.092 | 7.596 | 12.635 |

| Correlation matrix | ||||

| FTEOAS | 1 | |||

| CO2 | 0.840839 | 1 | ||

| EUR/USD | −0.518093 | −0.699190 | 1 | |

| BAIT | −0.285527 | −0.537993 | 0.321132 | 1 |

| Variables | ADF Break Unit Root | Break Date |

|---|---|---|

| FTSE | −2.8 (0.2) | 2013M06 |

| ΔFTSE | −12.8 *** (0.000) | 2008M10 |

| BAIT | −2.89 (0.10) | 2018M11 |

| ΔBAIT | −13.83 *** (0.00) | 2009M04 |

| CO2t | −1.18 (0.9) | 2006M6 |

| ΔCO2t | −5.66 *** (0.00) | 2006M05 |

| Euro/Dollar | −4.36 (0.10) | 2014M07 |

| ΔEuro/Dollar | −14.6 *** (0.00) | 2008M10 |

| Variance Decomposition of CO2 | ||||

|---|---|---|---|---|

| CO2 | BAIT | EUR_USD | FTSE | |

| 1 | 99.99851 | 0.000656 | 0.000653 | 0.000180 |

| 2 | 99.99814 | 0.000580 | 0.001143 | 0.000140 |

| 3 | 99.99620 | 0.001032 | 0.002656 | 0.000110 |

| 4 | 99.99104 | 0.003798 | 0.004947 | 0.000218 |

| 5 | 99.98302 | 0.008771 | 0.007766 | 0.000439 |

| 6 | 99.97283 | 0.015522 | 0.010920 | 0.000729 |

| 7 | 99.96107 | 0.023619 | 0.014265 | 0.001048 |

| 8 | 99.94825 | 0.032685 | 0.017696 | 0.001365 |

| 9 | 99.93480 | 0.042409 | 0.021134 | 0.001661 |

| 10 | 99.92101 | 0.052538 | 0.024525 | 0.001922 |

| Variance Decomposition of BAIT | ||||

| CO2 | BAIT | EUR_USD | FTSE | |

| 1 | 0.000647 | 99.93214 | 0.015436 | 0.051777 |

| 2 | 0.000654 | 99.91684 | 0.025692 | 0.056810 |

| 3 | 0.001733 | 99.77655 | 0.105224 | 0.116494 |

| 4 | 0.003985 | 99.50796 | 0.263561 | 0.224493 |

| 5 | 0.007670 | 99.12614 | 0.493223 | 0.372966 |

| 6 | 0.013077 | 98.64980 | 0.783032 | 0.554091 |

| 7 | 0.020494 | 98.09796 | 1.121127 | 0.760414 |

| 8 | 0.030194 | 97.48907 | 1.495812 | 0.984923 |

| 9 | 0.042422 | 96.84040 | 1.896014 | 1.221163 |

| 10 | 0.057394 | 96.16763 | 2.311618 | 1.463356 |

| Variance Decomposition of EUR_USD | ||||

| CO2 | BAIT | EUR_USD | FTSE | |

| 1 | 0.000654 | 0.014649 | 94.76806 | 5.216632 |

| 2 | 0.000659 | 0.014182 | 94.79656 | 5.188596 |

| 3 | 0.006936 | 0.015148 | 95.14940 | 4.828514 |

| 4 | 0.021941 | 0.016634 | 95.54341 | 4.418015 |

| 5 | 0.046354 | 0.018642 | 95.91371 | 4.021290 |

| 6 | 0.080505 | 0.021243 | 96.23763 | 3.660617 |

| 7 | 0.124579 | 0.024519 | 96.50494 | 3.345967 |

| 8 | 0.178658 | 0.028552 | 96.71039 | 3.082398 |

| 9 | 0.242736 | 0.033423 | 96.85135 | 2.872494 |

| 10 | 0.316728 | 0.039204 | 96.92673 | 2.717343 |

| Variance Decomposition of FTSE | ||||

| CO2 | BAIT | EUR_USD | FTSE | |

| 1 | 0.000170 | 0.049195 | 5.217315 | 94.73332 |

| 2 | 0.000168 | 0.047846 | 5.299099 | 94.65289 |

| 3 | 0.000270 | 0.032546 | 5.022295 | 94.94489 |

| 4 | 0.001029 | 0.036463 | 4.676703 | 95.28580 |

| 5 | 0.002458 | 0.063534 | 4.324008 | 95.61000 |

| 6 | 0.004457 | 0.111371 | 3.984949 | 95.89922 |

| 7 | 0.006908 | 0.176386 | 3.668583 | 96.14812 |

| 8 | 0.009690 | 0.255025 | 3.379385 | 96.35590 |

| 9 | 0.012691 | 0.344100 | 3.119598 | 96.52361 |

| 10 | 0.015806 | 0.440854 | 2.890201 | 96.65314 |

| Variable | RMSE | MAE |

|---|---|---|

| BAIT | 0.286360 | 0.218674 |

| CO2 | 0.015130 | 0.012809 |

| EUR_USD | 0.077399 | 0.062435 |

| FTSE | 0.204974 | 0.154078 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tsioptsia, K.-A.; Zafeiriou, E.; Niklis, D.; Sariannidis, N.; Zopounidis, C. The Corporate Economic Performance of Environmentally Eligible Firms Nexus Climate Change: An Empirical Research in a Bayesian VAR Framework. Energies 2022, 15, 7266. https://doi.org/10.3390/en15197266

Tsioptsia K-A, Zafeiriou E, Niklis D, Sariannidis N, Zopounidis C. The Corporate Economic Performance of Environmentally Eligible Firms Nexus Climate Change: An Empirical Research in a Bayesian VAR Framework. Energies. 2022; 15(19):7266. https://doi.org/10.3390/en15197266

Chicago/Turabian StyleTsioptsia, Kyriaki-Argyro, Eleni Zafeiriou, Dimitrios Niklis, Nikolaos Sariannidis, and Constantin Zopounidis. 2022. "The Corporate Economic Performance of Environmentally Eligible Firms Nexus Climate Change: An Empirical Research in a Bayesian VAR Framework" Energies 15, no. 19: 7266. https://doi.org/10.3390/en15197266

APA StyleTsioptsia, K.-A., Zafeiriou, E., Niklis, D., Sariannidis, N., & Zopounidis, C. (2022). The Corporate Economic Performance of Environmentally Eligible Firms Nexus Climate Change: An Empirical Research in a Bayesian VAR Framework. Energies, 15(19), 7266. https://doi.org/10.3390/en15197266