Australia’s Energy Security and Statecraft in an Era of Strategic Competition

Abstract

:1. Introduction

2. Materials and Methods

2.1. Methods

2.1.1. The SWOT Method

2.1.2. The 4A Framework

2.2. Key Concepts and Theory

2.2.1. National Interest

2.2.2. Energy Security

“… the adequate, reliable and competitive supply of energy where adequacy is the provision of sufficient energy to support economic and social activity; reliability is the provision of energy with minimal disruptions to supply; and competitiveness is the provision of energy at an affordable price which does not adversely impact on the competitiveness of the economy and which supports continued investment in the energy sector [21].”

2.2.3. Energy Statecraft

“Statecraft is the art of defining and pursuing national objectives in their domestic and international contexts. It is larger than domestic or international relations, and broader than national security, economic or social policy. It is a conceptual construct of the nation, the state and all their internal and external relationships, which unifies approaches to all areas of policy [24].”

2.3. The Australian Government’s Approach to Energy Policy and Market Intervention

“A key to better market outcomes is to limit the role of government in markets … Policy interventions in the market framework should not be used to force market outcomes beyond the reliable and competitively priced supply of energy [42].”

- Australia can, and should, continue to play a major role in supplying the domestic and world economies with low-cost energy [46];

- Export development will continue to play a critical role in Australia’s energy future and bring substantial economic benefits to the nation [47];

- Australia must be a productive, cost-competitive, and reliable energy supplier if we are to secure private sector investment in energy resources developments to increase exports … the best way to ensure energy supply at the lowest possible cost is to build more competitive energy markets … LNG export industry, underpinned by foreign investment, provides an enormous opportunity for the nation’s economy … With the right policy settings, our importance to global energy markets will continue to grow [42].

3. Results

3.1. Strengths

3.1.1. Reliable and Stable Supplier of Energy

3.1.2. Extensive Traditional Energy Resources

3.1.3. Extensive Renewable Energy Resources

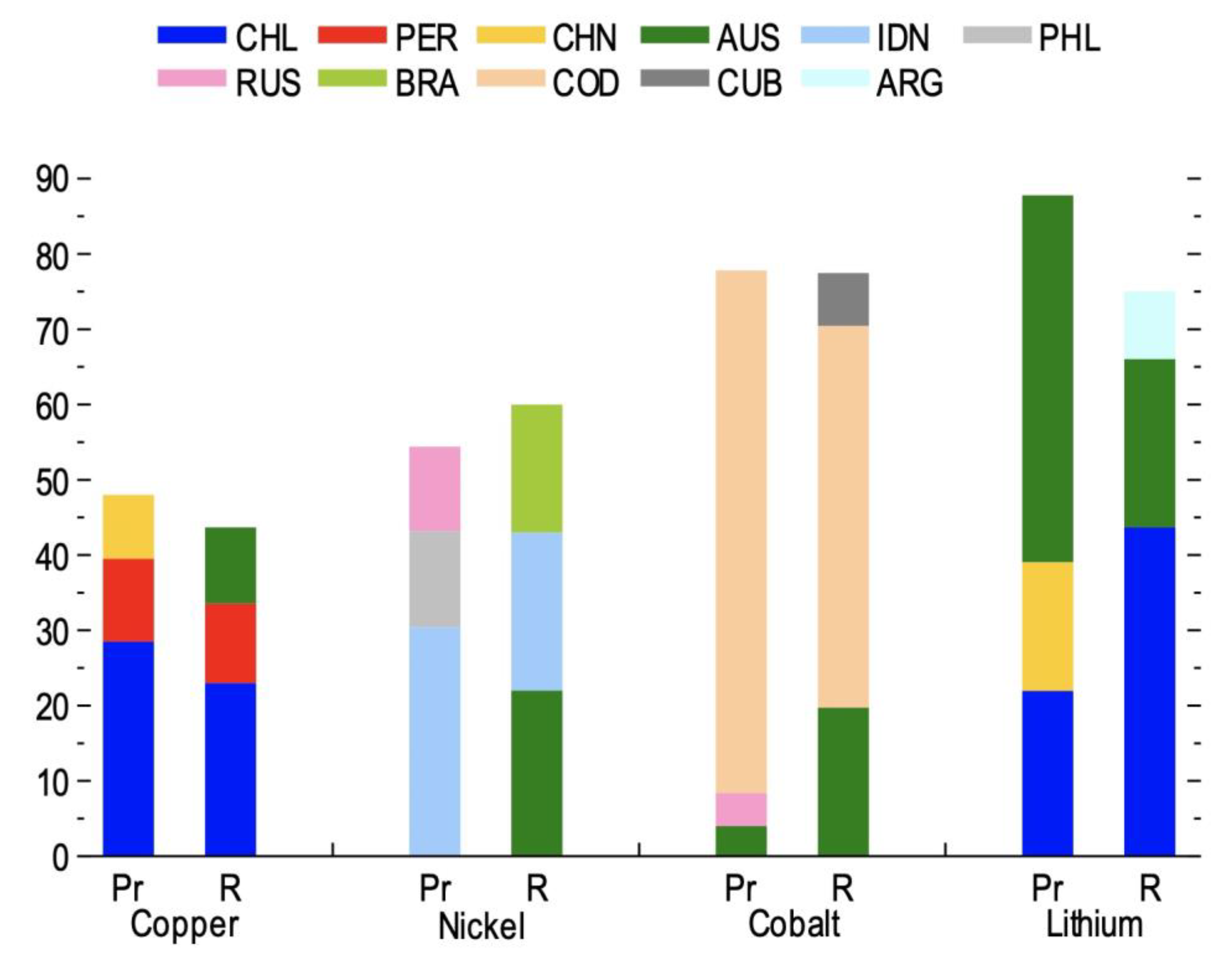

3.1.4. Extensive Critical Mineral and Rare Earth Resources

3.2. Weaknesses

3.2.1. Market-Based Approach

3.2.2. Energy Transition Laggard

- Political division, or national polarization, between those who support large-scale exploitation of fossil fuels and those who advocate that the nation should grasp the opportunity of its rich renewable resources [70];

- Paralysis in climate change policy in the context of the inability of the political establishment to develop a sustainable consensus on climate change [73];

- Resistance of legal and regulatory arrangements in the electricity sector to adaptive change [74];

- Capture by the powerful resources sector [79];

- Australia’s federalist system of government [82].

3.2.3. Growing Liquid Fuel Import Dependence and Inadequate Stockpiles

3.2.4. Structural Deficiencies in the National Electricity Market

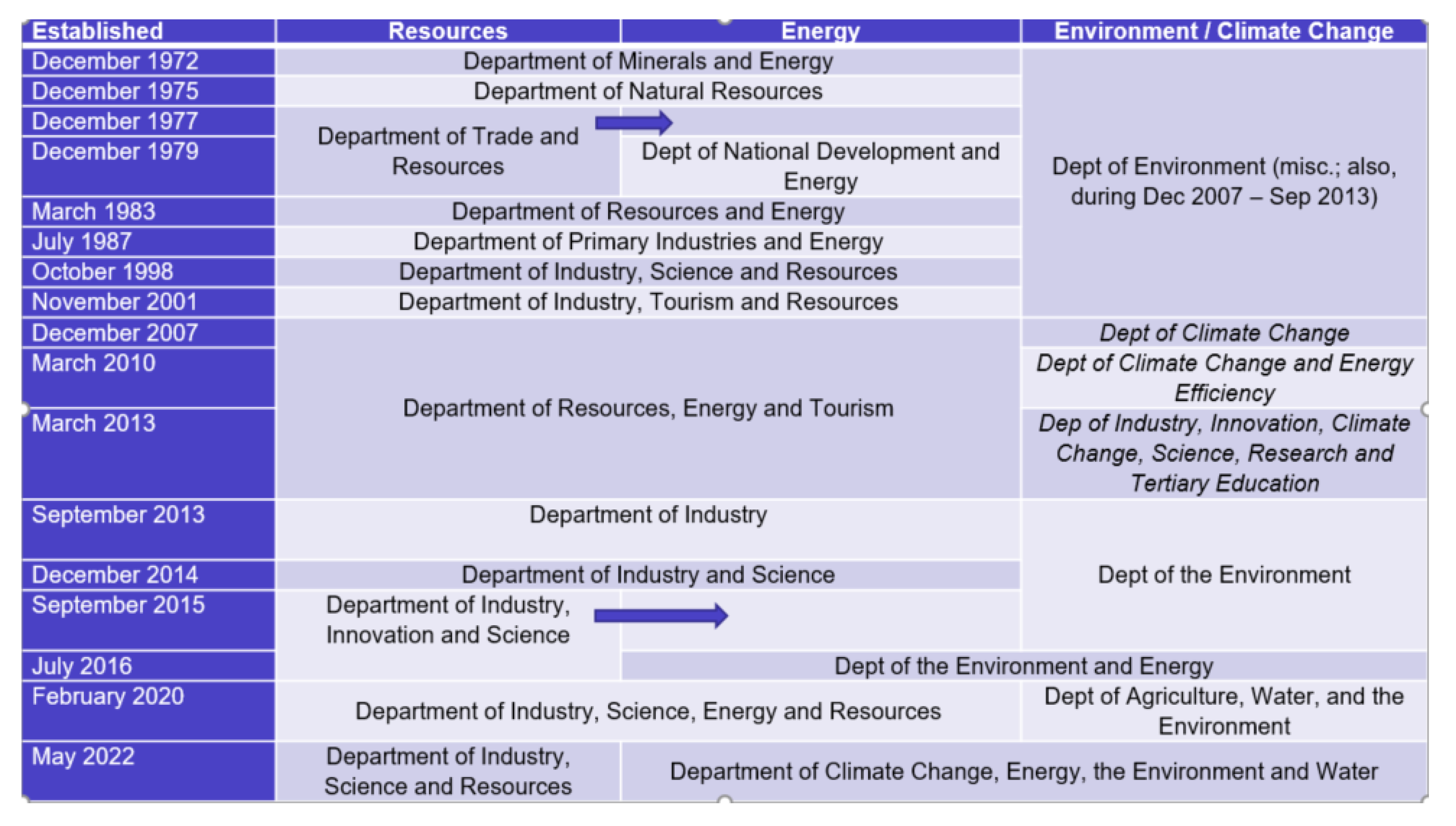

3.2.5. Departmental Inconsistency

3.2.6. Short Parliamentary Term and Electoral Cycle

3.3. Opportunities

3.3.1. LNG and Uranium Exports

3.3.2. Hydrogen Exports

3.3.3. Renewable Energy Exports

3.3.4. Critical Minerals and Rare Earth Exports

3.3.5. Battery Value Chains

3.3.6. Green Steel

3.3.7. Mining Companies and Critical Minerals as Instruments of Statecraft

3.4. Threats

3.4.1. Due to Slow Energy Transition and Climate Policy Stalemate

3.4.2. Job Losses Due to Net Zero Targets

3.4.3. Climate Change

3.4.4. Due to Growing Liquid Fuel Import Dependence

3.4.5. Due to Non-Interventionism and Prioritization of Energy Exports

3.4.6. Deficiencies in the National Electricity Market

3.5. The 4A Assessment

3.5.1. Availability

3.5.2. Accessibility

3.5.3. Affordability

3.5.4. Acceptability

4. Discussion and Policy Recommendations

5. Conclusions

Funding

Data Availability Statement

Conflicts of Interest

References

- Dalgaard, K.G. The energy statecraft of Brazil: Promoting biofuels to African countries. Foreign Policy Anal. 2017, 13, 317–337. [Google Scholar] [CrossRef]

- Shi, X. The future of ASEAN energy mix: A SWOT analysis. Renew. Sustain. Energy Rev. 2016, 53, 672–680. [Google Scholar] [CrossRef]

- Song, Y.; Zhang, M.; Sun, R. Using a new aggregated indicator to evaluate China’s energy security. Energy Policy 2019, 132, 167–174. [Google Scholar] [CrossRef]

- Chen, W.M.; Kim, H.; Yamaguchi, H. Renewable energy in eastern Asia: Renewable energy policy review and comparative SWOT analysis for promoting renewable energy in Japan, South Korea, and Taiwan. Energy Policy 2014, 74, 319–329. [Google Scholar] [CrossRef]

- Ishola, F.A.; Olatunji, O.O.; Ayo, O.O.; Akinlabi, S.A.; Adedeji, P.A.; Inegbenebor, A.O. Sustainable nuclear energy exploration in Nigeria–A SWOT analysis. Procedia Manuf. 2019, 35, 1165–1171. [Google Scholar] [CrossRef]

- Fertel, C.; Bahn, O.; Vaillancourt, K.; Waaub, J.-P. Canadian energy and climate policies: A SWOT analysis in search of federal/provincial coherence. Energy Policy 2013, 63, 1139–1150. [Google Scholar] [CrossRef]

- Shadman, S.; Chin, C.M.; Yap, E.H.; Sakundarini, N.; Velautham, S. The role of current and future renewable energy policies in fortifying Malaysia’s energy security: PESTLE and SWOT analysis through stakeholder engagement. Prog. Energy Environ. 2021, 16, 1–17. [Google Scholar]

- Yao, L.; Chang, Y. Energy security in China: A quantitative analysis and policy implications. Energy Policy 2014, 67, 595–604. [Google Scholar] [CrossRef]

- Tongsopit, S.; Kittner, N.; Chang, Y.; Aksornkij, A.; Wangjiraniran, W. Energy security in ASEAN: A quantitative approach for sustainable energy policy. Energy Policy 2016, 90, 60–72. [Google Scholar] [CrossRef]

- Malik, S.; Qasim, M.; Saeed, H.; Chang, Y.; Taghizadeh-Hesary, F. Energy security in Pakistan: Perspectives and policy implications from a quantitative analysis. Energy Policy 2020, 144, 111552. [Google Scholar] [CrossRef]

- Bin Amin, S.; Chang, Y.; Khan, F.; Taghizadeh-Hesary, F. Energy security and sustainable energy policy in Bangladesh: From the lens of 4As framework. Energy Policy 2022, 161, 112719. [Google Scholar] [CrossRef]

- Li, Y.; Chang, Y. Road transport electrification and energy security in the Association of Southeast Asian Nations: Quantitative analysis and policy implications. Energy Policy 2019, 129, 805–815. [Google Scholar] [CrossRef]

- APERC (Asia Pacific Energy Research Centre). A Quest for Energy Security in the 21st Century: Resources and Constraints; Institute of Energy Economics: Tokyo, Japan, 2007. [Google Scholar]

- Hallen, T.J. Great Powers, National Interests, and Australian Grand Strategy; School of Advanced Air and Space Studies, Air University, Maxwell Air Force Base: Montgomery, AL, USA, 2016. [Google Scholar]

- DFAT (Department of Foreign Affairs and Trade). Advancing the National Interest; Australian Government White Paper; Department of Foreign Affairs and Trade: Barton, Australia, 2003; p. v. [Google Scholar]

- Conley Tyler, M.; Ivimey, S. Balancing Australia’s national interests. In Australia’s Trade, Investment and Security in the Asian Century; Farrar, J., Hiscock, M., Lo, V.I., Eds.; World Scientific: Singapore, 2015; pp. 273–287. [Google Scholar]

- Thakur, R. Follow the yellowcake road: Balancing Australia’s national interests against international anti-nuclear interests. Int. Aff. 2013, 89, 943–961. [Google Scholar] [CrossRef]

- UNDP (United Nations Development Programme). World Energy Assessment, 2004 Update; UNDP: New York, NY, USA, 2004. [Google Scholar]

- Cherp, A.; Jewell, J. The concept of energy security: Beyond the four As. Energy Policy 2014, 75, 415–421. [Google Scholar] [CrossRef]

- Chester, L. Conceptualising energy security and making explicit its polysemic nature. Energy Policy 2010, 38, 887–895. [Google Scholar] [CrossRef]

- DIIS (Department of Industry, Innovation and Science). Energy Security; DIIS: Canberra, Australia, 2016. [Google Scholar]

- DEE (Department of the Environment and Energy). Liquid Fuel Security Review—Interim Report; DEE: Canberra, Australia, 2019. [Google Scholar]

- Prantl, J.; Goh, E. Rethinking strategy and statecraft for the twenty-first century of complexity: A case for strategic diplomacy. Int. Aff. 2022, 98, 443–469. [Google Scholar] [CrossRef]

- Kilcullen, D.J. Australian statecraft: The challenge of aligning policy with strategic culture. Secur. Chall. 2007, 3, 45–65. [Google Scholar]

- Mastanduno, M. Economics statecraft. In Foreign Policy: Theories, Actors, Cases; Smith, S., Hadfield, A., Dunne, T., Eds.; Oxford University Press: Oxford, UK, 2016; pp. 222–241. [Google Scholar]

- Baldwin, D.A. The power of positive sanctions. World Politics 1971, 24, 19–38. [Google Scholar] [CrossRef]

- Mastanduno, M. Economic statecraft, interdependence, and national security: Agendas for research. Secur. Stud. 1999, 9, 288–316. [Google Scholar] [CrossRef]

- Mastanduno, M. Economics and security in statecraft and scholarship. Int. Organ. 1998, 52, 825–854. [Google Scholar] [CrossRef]

- Vivoda, V. Sino-Japanese competition and energy security. In Chinese-Japanese Competition and the East Asian Security Complex: Vying for Influence; Reeves, J., Hornung, J., Nankivell, K.L., Eds.; Routledge: London, UK, 2017; pp. 86–99. [Google Scholar]

- Hill, C. The Changing Politics of Foreign Policy; Palgrave Macmillan: London, UK, 2003. [Google Scholar]

- Hermann, M.G.; Hermann, C.F. Who makes foreign policy decisions and how: An empirical inquiry. Int. Stud. Q. 1989, 33, 361–387. [Google Scholar] [CrossRef]

- Hancock, K.J.; Vivoda, V. International Political Economy: A field born of the OPEC crisis returns to its energy roots. Energy Res. Soc. Sci. 2014, 1, 206–216. [Google Scholar]

- Belyi, A.; Talus, K. (Eds.) Introduction. In States and Markets in Hydrocarbon Sectors; Palgrave Macmillan: London, UK, 2015; pp. 1–13. [Google Scholar]

- Umbach, F. Energy security in Eurasia: Clashing interests. In Russian Energy Security and Foreign Policy; Dellecker, A., Gomart, T., Eds.; Routledge: London, UK, 2011; pp. 24–38. [Google Scholar]

- Boussena, S.; Locatelli, C. Energy institutional and organizational changes in EU and Russia: Revisiting relations. Energy Policy 2013, 55, 180–189. [Google Scholar]

- Romanova, T. Energy demand: Security for suppliers? In International Handbook of Energy Security; Dyer, H., Trombetta, M.J., Eds.; Edward Elgar: Cheltenham, UK, 2013; pp. 239–257. [Google Scholar]

- Novikau, A. Rethinking demand security: Between national interests and energy exports. Energy Res. Soc. Sci. 2022, 87, 102494. [Google Scholar] [CrossRef]

- DISR (Department of Industry, Science and Resources). Resources and Energy Quarterly; Office of the Chief Economist: Canberra, Australia, 2022. [Google Scholar]

- Hunter, T.; Raszewski, S. Australia’s national interest in supplying gas resources to the Asian markets. In Australia’s Trade, Investment and Security in the Asian Century; Farrar, J., Hiscock, M., Lo, V.I., Eds.; World Scientific: Singapore, 2015; pp. 155–173. [Google Scholar]

- Vivoda, V. LNG export diversification and demand security: A comparative study of major exporters. Energy Policy 2022, 170, 113218. [Google Scholar]

- DPIE (Department of Primary Industries and Energy). Energy 2000: National Energy Policy Paper; Australian Government Publishing Service: Canberra, Australia, 1988. [Google Scholar]

- DIIS (Department of Industry, Innovation and Science). Energy White Paper 2015; DIIS: Canberra, Australia, 2015. [Google Scholar]

- Vivoda, V. State–market interaction in hydrocarbon sector: The cases of Australia and Japan. In States and Markets in Hydrocarbon Sectors; Belyi, A.V., Talus, K., Eds.; Palgrave Macmillan: London, UK, 2015; pp. 240–264. [Google Scholar]

- Vivoda, V. Australia and Germany: A new strategic energy partnership. In ASPI Strategy; Australian Strategic Policy Institute: Canberra, Australia, 2017. [Google Scholar]

- Yates, A.; Greet, N. Energy Security for Australia: Crafting a Comprehensive Energy Security Policy; Engineers: Barton, Australia, 2014. [Google Scholar]

- Energy Task Force. Securing Australia’s Energy Future; Energy Task Force: Apopka, FL, USA, 2004. [Google Scholar]

- DRET (Department of Resources, Energy and Tourism). Energy White Paper 2012: Australia’s Energy Transformation; DRET: Canberra, Australia, 2012. [Google Scholar]

- Leaver, R.; Ungerer, C. A natural power: Challenges for Australia’s resources diplomacy in Asia. In ASPI Strategy; Australian Strategic Policy Institute: Canberra, Australia, 2010. [Google Scholar]

- The Heritage Foundation. Australia. 2022 Index of Economic Freedom. 2022. Available online: https://www.heritage.org/index/pdf/2022/countries/2022_IndexofEconomicFreedom-Australia.pdf (accessed on 9 September 2022).

- Bonnor, J. Australia–India: An important partnership. South Asian Surv. 2008, 15, 165–177. [Google Scholar]

- Villalta, P.G. Drivers and difficulties in the economic relationship between Australia and the European Union: From conflict to cooperation. Aust. J. of Int. Aff. 2018, 72, 240–254. [Google Scholar] [CrossRef]

- Vivoda, V. ‘Steady as she goes’: Effect of the Fukushima disaster on Australia-Japan relations. Asian Int. Stud. Rev. 2018, 19, 87–114. [Google Scholar]

- BP. BP Statistical Review of World Energy, BP. 2022. Available online: https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy-economics/statistical-review/bp-stats-review-2022-full-report.pdf (accessed on 9 September 2022).

- World Nuclear Association. World Uranium Mining Production. 2022. Available online: https://world-nuclear.org/information-library/nuclear-fuel-cycle/mining-of-uranium/world-uranium-mining-production.aspx (accessed on 9 September 2022).

- AIETI (Australian Industry Energy Transitions Initiative). Australian Industry Energy Transitions Initiative: Program Overview; AIETI: Sydney, Australia, 2020; Available online: https://energytransitionsinitiative.org/wp-content/uploads/2020/07/Australian-Industry-ETI-Program-Overview-July-2020.pdf (accessed on 9 September 2022).

- Pitron, G. The Geopolitics of the rare-metals race. Wash. Q. 2022, 45, 135–150. [Google Scholar]

- Boer, L.; Pescatori, A.; Stuermer, M. Energy Transition Metals; International Monetary Fund: Washington, DC, USA, 2021. [Google Scholar]

- Burke, J. Australia needs more than an accounting trick to secure its fuel reserve. In The Strategist; Australian Strategic Policy Institute: Canberra, Australia, 2020. [Google Scholar]

- Schott, S.; Campbell, G. National energy strategies of major industrialized countries. In International Handbook of Energy Security; Dyer, H., Trombetta, M.J., Eds.; Edward Elgar: Cheltenham, UK, 2013; pp. 174–205. [Google Scholar]

- Toscano, N. ‘Zero’ Chance Australian Lng Can Replace Russian Gas, Analysts Say. The Sydney Morning Herald, 24 February 2022. [Google Scholar]

- Vivoda, V. How Disrupted Russian Gas Supplies Will Hit Global and Australian Prices. The Conversation, 1 March 2022. [Google Scholar]

- Parry, N. Climate and energy: Divergent interests and approaches between Australia and the European Union. Glob. Aff. 2019, 5, 559–565. [Google Scholar] [CrossRef]

- IEA (International Energy Agency). CO2 Emissions from Fuel Combustion. IEA Atlas of Energy. 2022. Available online: http://energyatlas.iea.org/#!/tellmap/1378539487/4 (accessed on 9 September 2022).

- Agarwala, M. Debunking Australia’s Excuse for Climate Inaction. East Asia Forum, 22 March 2020. [Google Scholar]

- Saddler, H. Back of the Pack: An Assessment of Australia’s Energy Transition; The Australia Institute: Canberra, Australia, 2021. [Google Scholar]

- Smit, R.; Dia, H.; Surawski, N. The Road to New Fuel Efficiency Rules Is Filled with Potholes. Here’s how Australia Can Avoid Them. The Conversation, 23 August 2022. [Google Scholar]

- Downie, C. When the Tank’s Empty: Australia’s Impoverished Energy Security. The Interpreter, 27 April 2022. [Google Scholar]

- IEA (International Energy Agency). Global EV Outlook 2022: Securing Supplies for an Electric Future; OECD: Paris, France, 2022. [Google Scholar]

- Clarke, D.; Baldwin, K.; Baum, F.; Godfrey, B.; Richardson, S.; Robin, L.; Vivoda, V. Australian Energy Transition Research Plan: Transition Dynamics; ACOLA Research Briefing Paper, Report Five; Australian Council of Learned Academies: Acton, Australia, 2022. [Google Scholar]

- Hamilton, C.M.; Kellett, J. Renewable energy: Urban centres lead the dance in Australia? In Renewable Energy Governance; Michalena, E., Hills, J.M., Eds.; Springer: Berlin/Heidelberg, Germany, 2013; pp. 63–79. [Google Scholar]

- Warren, B.; Christoff, P.; Green, D. Australia’s sustainable energy transition: The disjointed politics of decarbonization. Environ. Innov. Soc. Transit. 2016, 21, 1–12. [Google Scholar]

- Wood, T. Australia’s Energy Transition: A Blueprint for Success; Grattan Institute: Melbourne, Australia, 2019; Available online: https://grattan.edu.au/wp-content/uploads/2019/09/922-Australia-energy-transition-a-blueprint-for-success.pdf (accessed on 9 September 2022).

- Ali, S.H.; Svobodovà, K.; Everingham, J.; Altingoz, M. Climate policy paralysis in Australia: Energy security, energy poverty and jobs. Energies 2020, 13, 4894. [Google Scholar] [CrossRef]

- Judson, E.; Fitch-Roy, O.; Pownall, T.; Bray, R.; Poulter, H.; Soutar, I.; Lowes, R.; Connor, P.M.; Britton, J.; Woodman, B.; et al. The centre cannot (always) hold: Examining pathways towards energy system de-centralisation. Renew. Sustain. Energy Rev. 2020, 118, 109499. [Google Scholar] [CrossRef]

- Falk, J.; Settle, D. Australia: Approaching an energy crossroads. Energy Policy 2011, 39, 6804–6813. [Google Scholar] [CrossRef]

- Holley, C.; Mutongwizo, T.; Shearing, C.; Kennedy, A. Shaping unconventional gas regulation: Industry influence and risks of agency capture in Texas, Colorado and Queensland. Environ. Plan. Law J. 2019, 36, 510–530. [Google Scholar] [CrossRef]

- Curran, G. Divestment, energy incumbency and the global political economy of energy transition: The case of Adani’s Carmichael mine in Australia. Clim. Policy 2020, 20, 949–962. [Google Scholar]

- Hancock, L.; Ralph, N. A framework for assessing fossil fuel ‘retrofit’ hydrogen exports: Security-justice implications of Australia’s coal-generated hydrogen exports to Japan. Energy 2021, 223, 119938. [Google Scholar] [CrossRef]

- Goddard, G.; Farrelly, M.A. Just transition management: Balancing just outcomes with just processes in Australian renewable energy transitions. Appl. Energy 2018, 225, 110–123. [Google Scholar] [CrossRef]

- Chandrashekeran, S. Multidimensionality and the multilevel perspective: Territory, scale, and networks in a failed demand-side energy transition in Australia. Environ. Plan. A 2016, 48, 1636–1656. [Google Scholar]

- Jehling, M.; Hitzeroth, M.; Brueckner, M. Applying institutional theory to the analysis of energy transitions: From local agency to multi-scale configurations in Australia and Germany. Energy Res. Soc. Sci. 2019, 53, 110–120. [Google Scholar]

- Kallies, A. The Australian energy transition as a federalism challenge: (un)cooperative energy federalism? Transnatl. Environ. Law 2021, 10, 211–235. [Google Scholar] [CrossRef]

- Vivoda, V. What Russia’s War Means for Australian Petrol Prices: $2.10 a Litre. The Conversation, 24 February 2022. [Google Scholar]

- IEA (International Energy Agency). Oil Stockpiles of IEA Countries. 2022. Available online: https://www.iea.org/articles/oil-stocks-of-iea-countries (accessed on 9 September 2022).

- Rai, A.; Nelson, T. Australia’s National Electricity Market after twenty years. Aust. Econ. Rev. 2020, 53, 165–182. [Google Scholar] [CrossRef]

- Heath Pickering. Three-year parliamentary terms are woefully short. In Election Watch; The University of Melbourne: Melbourne, Australia, 2016.

- BP. BP Statistical Review of World Energy; BP: Singapore, 2021. [Google Scholar]

- Kemp, J.; McCowage, M.; Wang, F. Towards net zero: Implications for Australia of energy policies in East Asia. In RBA Bulletin; Reserve Bank of Australia: Sydney, Australia, 2021. [Google Scholar]

- Frontier Economics. International Aspects of a Power-to-X Roadmap. Executive Summary; Frontier Economics: Singapore, 2018. [Google Scholar]

- IEA (International Energy Agency). World Energy Outlook 2020; IEA: Paris, France, 2020. [Google Scholar]

- Hartley, P.G.; Au, V. Towards a large-scale hydrogen industry for Australia. Engineering 2020, 6, 1346–1348. [Google Scholar] [CrossRef]

- ACIL Allen Consulting. Opportunities for Australia from Hydrogen Exports; ACIL Allen Consulting for ARENA: Melbourne, Australia, 2018. [Google Scholar]

- Beck, F.J.; Bridges, T.; Purchase, R.; Venkataraman, M. Australia’s future as a zero-carbon energy exporter: An analysis of the recent reports on Australian hydrogen for export. In Zero-Carbon Energy for the Asia-Pacific Grand Challenge; ZCEAP Working Papers, ZCWP03-19; The Australian National University: Canberra, Australia, 2019. [Google Scholar]

- Gurieff, N.; Moghtaderi, B.; Daiyan, R.; Amal, R. Gas transition: Renewable hydrogen’s future in eastern Australia’s energy networks. Energies 2021, 14, 3968. [Google Scholar] [CrossRef]

- Boretti, A. Production of hydrogen for export from wind and solar energy, natural gas, and coal in Australia. Int. J. Hydrogen Energy 2020, 45, 3899–3904. [Google Scholar] [CrossRef]

- COAG Energy Council. Australia’s National Hydrogen Strategy; COAG Energy Council: Hawthorn, Australia, 2019. [Google Scholar]

- DISER (Department of Industry, Science, Energy and Resources). Growing Australia’s Hydrogen Industry. 2021. Available online: https://www.industry.gov.au/policiesand-initiatives/growing-australias-hydrogen-industry (accessed on 9 September 2022).

- WWF-Australia. Australian Renewable Export COVID-19 Recovery Package; WWF-Australia: Sydney, Australia, 2020. [Google Scholar]

- CSIRO (Commonwealth Scientific and Industrial Research Organisation). Asian Renewable Energy Hub. 2022. Available online: https://research.csiro.au/hyresource/asian-renewable-energy-hub/ (accessed on 9 September 2022).

- Boulaire, Fanny. Export possibilities mean Australia’s clean-energy future can also be the world’s. In The Strategist; Australian Strategic Policy Institute: Canberra, Australia, 2021.

- Briggs, C.; Rutovitz, J.; Dominish, E.; Nagrath, K. Renewable energy jobs in Australia—stage one; Institute for Sustainable Futures, University of Technology Sydney: Ultimo, Australia, 2020. [Google Scholar]

- Burke, P.; Aisbett, E.; Baldwin, K. To really address climate change, Australia could make 27 times as much electricity and make it renewable. The Conversation, 18 March 2022. [Google Scholar]

- The Transition to Clean Energy Will Mint New Commodity Superpowers. The Economist, 26 March 2022.

- DISER (Department of Industry, Science, Energy and Resources). 2022 Critical Minerals Strategy; DISER: Canberra, Australia, 2022. Available online: https://www.industry.gov.au/sites/default/files/2022-09/2022-critical-minerals-strategy_0.pdf (accessed on 9 September 2022).

- Kalantzakos, S. The race for critical minerals in an era of geopolitical realignments. Int. Spect. 2020, 55, 1–16. [Google Scholar] [CrossRef]

- Yunis, J.; Aliakbari, E. Fraser Institute Annual Survey of Mining Companies 2021. Fraser Institute. 2022. Available online: https://www.fraserinstitute.org/sites/default/files/annual-survey-of-mining-companies-2021.pdf (accessed on 9 September 2022).

- Wilson, J.; Martinus, K. The governance of battery value chains: Security, sustainability and Australian policy options; Future Battery Industries CRC: Bentley, WA, USA, 2020. [Google Scholar]

- Best, A.; Vernon, C. State of Play, Australia’s Battery Industries as at March 2020; CSIRO: Canberra, Australia, 2020. [Google Scholar]

- CSIRO (Commonwealth Scientific and Industrial Research Organisation). Stored Energy Integration Facility (SEIF). CSIRO. 2021. Available online: https://www.csiro.au/en/research/technology-space/energy/Intelligent-systems/SEIF (accessed on 9 September 2022).

- Wood, T.; Dundas, G.; Ha, J. Start with Steel: A Practical Plan to Support Carbon Workers and Cut Emissions; Grattan Institute: Melbourne, Australia, 2020; Available online: https://grattan.edu.au/wp-content/uploads/2020/05/2020-06-Start-with-steel.pdf (accessed on 9 September 2022).

- DFAT (Department of Foreign Affairs and Trade). Africa and the Middle East. Available online: https://www.dfat.gov.au/geo/africa-middle-east/africa-region-brief (accessed on 9 September 2022).

- PwC. Australia-Africa Practice Group. Available online: https://www.pwc.com.au/mining/australia-africa-practice.html (accessed on 9 September 2022).

- Vivoda, V.; Kemp, D. How do national mining industry associations compare on sustainable development? The Extr. Ind. Soc. 2019, 6, 22–28. [Google Scholar] [CrossRef]

- Johnson, P. Australia labelled untrustworthy, a climate change ‘pariah’ after stoush with French President, COP26. ABC News, 4 November 2021. [Google Scholar]

- Eckersley, R. ‘The Australian way’: How Morrison trashed brand Australia at COP26. The Conversation, 12 November 2021. [Google Scholar]

- Climate Action Tracker. Australia. 2022. Available online: https://climateactiontracker.org/countries/australia/ (accessed on 9 September 2022).

- Burck, J.; Uhlich, T.; Bals, C.; Höhne, N.; Nascimento, L.; Wong, J.; Tamblyn, A.; Reuther, J. Climate Change Performance Index 2022. 2021. Available online: https://ccpi.org/wp-content/uploads/CCPI-2022-Results-1.pdf (accessed on 9 September 2022).

- Morgan, W.; Dean, A.; Bradshaw, S. A Fight for Survival: Tackling the Climate Crisis Is Key to Security in the Blue Pacific; The Climate Council: Potts Point, Australia, 2022. [Google Scholar]

- Hurst, D.; Karp, P. Australia’s lost influence in Pacific on display in Solomon Islands-China deal, Anthony Albanese says. The Guardian, 28 March 2022. [Google Scholar]

- Baume, M. Business/Robbery, etc. The EU’s green tariffs are aimed at the Asia/Pacific. Spectator, 21 August 2021. [Google Scholar]

- Gosens, J.; Turnbull, A.B.H.; Jotzo, F. China’s decarbonization and energy security plans will reduce seaborne coal imports: Results from an installation-level model. Joule 2022, 6, 782–815. [Google Scholar] [CrossRef]

- Hussey, C.; Daniel, W. Net Zero Jobs: An Analysis of the Employment Impacts of a Net Zero Emissions Target in Australia; Institute of Public Affairs: Melbourne, Australia, 2021; Available online: https://apo.org.au/sites/default/files/resource-files/2021-02/apo-nid310893.pdf (accessed on 9 September 2022).

- Ludlow, M. Australia’s extreme climate leaves it vulnerable to global warming. The Australian Financial Review, 10 August 2021. [Google Scholar]

- Hutley, N.; Dean, A.; Hart, N.; Daley, J. Uninsurable Nation: Australia’s Most Climate-Vulnerable Places; The Climate Council: Potts Point, Australia, 2022. [Google Scholar]

- Australian Security Leaders Climate Group. An Open Letter to Australia’s Political Leaders. 2022. Available online: https://www.aslcg.org/wp-content/uploads/2022/03/ASLCG_OpenLetter-1.pdf (accessed on 9 September 2022).

- Oloruntoba, R.; Kam, B.; Nguyen, H.; Warren, M.; Chhetri, P.; Thai, V. Conflict in the South China Sea threatens 90% of Australia’s fuel imports: Study. The Conversation, 22 August 2022. [Google Scholar]

- Mercer, D. Foreign oil dependence a ‘massive vulnerability’ as defence experts call for EVs, green transport. ABC News, 20 March 2022. [Google Scholar]

- Powers, J.; Wu, M. A clean energy agenda for the US Department of Defense. Atlantic Council, 14 January 2021. [Google Scholar]

- Yildirim, U.; Leben, W. The Australian Defence Force and its future energy requirements. In ASPI Special Report; Australian Strategic Policy Institute: Canberra, Australia, 2022. [Google Scholar]

- Fourmeau, C.; Mazzucchi, N.; Zimmermann, R. What to Expect from an Energy Transition for Australia’s Energy Security and Its Defence Force? NATO Energy Security Centre of Excellence: Vilnius, Lithuania, 2021. [Google Scholar]

- Taylor, M.; Hunter, T.S. A paradox of plenty: The Australian domestic gas supply regulatory dilemma. J. World Energy Law Bus. 2018, 11, 465–486. [Google Scholar] [CrossRef]

- ACCC (Australian Competition and Consumer Commission). Gas Inquiry 2017–2025: Interim Report. 2022. Available online: https://www.accc.gov.au/system/files/ACCC%20Gas%20Inquiry%20-%20July%202022%20interim%20report%20-%20FINAL.pdf (accessed on 9 September 2022).

- AEMO (Australian Energy Market Operator). Quarterly Energy Dynamics—Q2 2022. 2022. Available online: https://www.aemo.com.au/-/media/files/major-publications/qed/2022/qed-q2-2022.pdf?la=en&hash=73DC1623997128E30EB3F6EBFD2E5AAC (accessed on 9 September 2022).

- DISR (Department of Industry, Science and Resources). Securing Australian Domestic Gas Supply. The Commonwealth of Australia. 2022. Available online: https://www.industry.gov.au/regulations-and-standards/securing-australian-domestic-gas-supply (accessed on 9 September 2022).

- Wood, T. Avoiding a gas shortage is one thing, but what’s needed is action on prices. The Conversation, 4 August 2022. [Google Scholar]

- Hannam, P. Australia’s high gas prices could be here to stay if threats don’t turn into action. The Guardian, 1 August 2022. [Google Scholar]

- Paul, S. Explainer: How top coal, LNG exporter Australia ran into a power crisis. Reuters, 17 June 2022. [Google Scholar]

- Shi, X. Solving Australia’s energy crisis. Policy Forum, Asia and the Pacific Policy Society, 13 June 2022. [Google Scholar]

- Geoscience Australia. Australia’s Energy Commodity Resources, 2021 Edition; Geoscience Australia: Canberra, Australia, 2021. [Google Scholar]

- IPSOS. The IPSOS Climate Change Report 2022. 2022. Available online: https://www.ipsos.com/sites/default/files/ct/publication/documents/2022-04/Ipsos%20Climate%20Change%20Report%202022.pdf (accessed on 9 September 2022).

- Wesley, M. Power plays: Energy and Australia’s security. In ASPI Strategy; Australian Strategic Policy Institute: Canberra, Australia, 2007. [Google Scholar]

- DFAT (Department of Foreign Affairs and Trade). Russia—Extension of Sanctions on Russia to Prohibit the Import into Australia of Russian Oil and Other Energy Products. Commonwealth of Australia 2022. Available online: https://www.dfat.gov.au/news/news/russia-extension-sanctions-russia-prohibit-import-australia-russian-oil-and-other-energy-products (accessed on 9 September 2022).

- Fuller, R. Buckminster. Synergetics: Explorations in the Geometry of Thinking; Estate of R. Buckminster Fuller: Portland, OR, USA, 1982. [Google Scholar]

- DFAT (Department of Foreign Affairs and Trade). Next Steps on U.S.-Australia Critical Minerals Collaboration. Commonwealth of Australia. 2021. Available online: https://www.dfat.gov.au/news/news/next-steps-us-australia-critical-minerals-collaboration (accessed on 9 September 2022).

- Sadiq, M.; Wen, F.; Dagestani, A.A. Environmental footprint impacts of nuclear energy consumption: The role of environmental technology and globalization in ten largest ecological footprint countries. Nucl. Eng. Technol. 2022, in press. [Google Scholar] [CrossRef]

- Wilson, S. What Would Be Required for Nuclear Energy Plants to Be Operating in Australia from the 2030s. A Preliminary Concept Study, The University of Queensland. 2021. Available online: https://energy.uq.edu.au/files/5963/WhatWouldBeRequired-FINAL.pdf (accessed on 9 September 2022).

- Sargeant, B. Challenges to the Australian Strategic Imagination. In Centre of Gravity; Series Paper No. 58; Strategic & Defence Studies Centre, Australian National University: Canberra, Australia, 2021. [Google Scholar]

- Garnaut, R. (Ed.) The Superpower Transformation: Making Australia’s Zero-Carbon Future; La Trobe University Press: Melbourne, Australia, 2022. [Google Scholar]

- Department of Energy. President Biden Invokes Defense Production Act to Accelerate Domestic Manufacturing of Clean Energy. U.S. Government 2022. Available online: https://www.energy.gov/articles/president-biden-invokes-defense-production-act-accelerate-domestic-manufacturing-clean (accessed on 9 September 2022).

- Hunt, J.; Riley, B.; O’Neill, L.; Maynard, G. Transition to renewable energy and Indigenous people in northern Australia: Enhancing or inhibiting capabilities? J. Hum. Dev. Capab. 2021, 22, 360–378. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Vivoda, V. Australia’s Energy Security and Statecraft in an Era of Strategic Competition. Energies 2022, 15, 6935. https://doi.org/10.3390/en15196935

Vivoda V. Australia’s Energy Security and Statecraft in an Era of Strategic Competition. Energies. 2022; 15(19):6935. https://doi.org/10.3390/en15196935

Chicago/Turabian StyleVivoda, Vlado. 2022. "Australia’s Energy Security and Statecraft in an Era of Strategic Competition" Energies 15, no. 19: 6935. https://doi.org/10.3390/en15196935

APA StyleVivoda, V. (2022). Australia’s Energy Security and Statecraft in an Era of Strategic Competition. Energies, 15(19), 6935. https://doi.org/10.3390/en15196935