1. Introduction

Energy consumption and the factors influencing it are very important problems not only from the point of view of the internal profits of a company but also the impact on the environment. Transport, in particular, is a very energy-intensive field. On the one hand, energy consumption in transport affects the depletion of natural resources, and on the other—the pollution of the environment is caused by exhaust emissions. Supply chains can be more or less transport-intensive and, therefore, more or less energy-intensive. The transport intensity of the supply chain depends on various factors but is primarily related to strategic decisions made by the supply chain leaders, especially the location of individual links in the supply chain (suppliers, manufacturers, distribution centers, and stores) and the modes of transport, which are used to move products in a supply chain.

Many companies source or outsource production in countries with low production costs (e.g., in the Far East) and, therefore, the sources of supply or production are located far away from the places of distribution and sales. Supply goods and finished products are transported over long distances on a mass scale, e.g., from Southeast Asia to Europe by sea transport, but also by rail and air transport. Long geographical distances make these chains transport and energy-consuming, which has a negative impact on the natural environment. The costs of purchasing or producing goods in low-cost countries were so low that this strategy was profitable, even though it involved higher long-distance transportation costs and long order lead times and, therefore, high inventory and lost sale costs.

Increasing transport costs (similarly to increasing labor costs or increasing public pressure to improve the working conditions and the level of environmental protection in countries with low production costs) reduces the efficiency of global procurement or production strategies in countries with low production costs. So, the question is, is this strategy still effective in the face of the enormous rise in oil prices? Will the increase in transport costs make companies shift from the currently utilized global strategy of supply chains to local ones, which are less energy-consuming? These are the research questions posed by the authors to which they wanted to find answers during their study.

The presented research results concern issues that are important both from theoretical and practical points of view. For some time now, both in the scientific community and in the field of business practice, there has been a lively discussion about the future of the globalization strategy. The return of production from low-cost countries (mainly from the Far East) to Europe has been anticipated for a long time.

For many years, profound changes in global supply chains have been predicted, including the return of production from low-cost countries to Europe and the loosening of ties between partners in these chains (transition from Lean to Agile Strategy). Such views were expressed when the global economic crisis broke out in 2008, later during the pandemic, and now in connection with rising energy costs and rates for transport services. It was predicted that supply problems, increased costs of transport and production in low-cost countries, and growing market demands would cause a large-scale return of production from the Far East to Europe, and thus changes in the transport services market. The authors of this article were skeptical of such views. Currently, however, the situation has changed significantly, as the cost of energy consumption is an important factor in the efficiency of logistics processes.

In the opinion of the authors, such views should be verified on the basis of the results of research carried out in enterprises and on the basis of the results of calculating the profitability of applying a specific strategy. The results of such research are presented in this article.

2. Review of the Literature

An important factor in the efficiency of processes in supply chains is the cost of energy used not only in logistics but also in production processes. Therefore, an important question arises here, of course, in the context of the recent increase in energy prices: what is the impact of the increase in fuel and energy prices on the applied supply chain strategies, especially in relation to the chains operating on a global scale?

The share of energy consumption costs in transport is significant in all modes of transport. According to various reports, in maritime transport, they can amount to 30–50% and even 40 and 63% [

1,

2]. Fuel consumption costs in other modes of transport have a very similar share—e.g., intermodal rail transport, inland transport, and even the least “mass” mode of transport, i.e., road transport (more information later in the article).

The COVID-19 pandemic was the reason the environment in which companies and their supply chains have had to operate has become unstable, which creates the need to at least revise the existing ways of functioning and perhaps even the entire strategy [

3,

4,

5]. New supply chain operation models are being developed for industries such as textiles and clothing, where uncertainty in demand and the risk of disruptions are the most critical [

6,

7,

8,

9,

10,

11]. The textile and clothing industry is one of the most globalized industries in the world economy, which makes supply chains in this sector highly vulnerable to external influences [

12,

13,

14]. The 2020 autumn study from the Polish Economic Institute showed that companies from this sector of the economy are facing two contradictory challenges—the need to quickly respond to market needs and to reduce production costs [

15]. An important factor in the efficiency of supply chains, including their costs, are the distances at which goods are moved [

16]. The costs of these processes are largely influenced by the energy consumption at individual stages of the supply chain and the prices of this energy.

Various scenarios of supply chain strategies are being presently considered [

17], including the reallocation of production sources (shifting production closer to consumers), shortening supply chains, and finding ways to cut costs.

Many authors point to diverse measures that can help in protecting companies from disruptions. For example, on the one hand, greater integration and cooperation of partners in supply chains, and on the other hand, the use of Agile strategies (instead of Lean) focusing on alternative sources of supply, alternative ways of delivering goods (routes, transport technologies), and buying and transporting in quantities exceeding current needs (i.e., deviating from JIT deliveries and creating inventories) to ensure product availability or increase the flexibility of distribution channels [

10,

11,

12,

13,

14,

15,

16,

17,

18,

19,

20]. Other proposals for action include increasing automation and increasing the efficiency of information exchange with partners in supply chains [

21].

Taking into account the above-mentioned phenomena in the environment of supply chains, however, the question arises whether the changes predicted for years: a shift from globalization to production in the region or even local, could not take place right now?

According to various opinions, company experts in richer countries will reduce dependence on global supply chains and their existing suppliers and reallocate production closer to their markets [

22]. It is this reallocation that may be the reason for increasing the degree of automation of production processes. However, contrary to numerous announcements of relocation of production from China, there are few examples of actually carried out relocations. Moving the production site is a complicated and time-consuming operation. The relocation of production requires not only investment, production potential, but also the creation of new supply chains from scratch, i.e., the acquisition of new suppliers who should have the appropriate technologies [

23,

24]. Only six percent of Polish companies are already beneficiaries of the transfer of production from China, and nearly eight percent would be potentially interested in such a relocation, despite the fact that the supply chain model used so far has turned out to be ineffective [

15].

The realization of logistics processes in supply chains is also associated with generating not only internal but external costs. Both of these types of costs are a derivative of, among others, the energy efficiency of production and logistics processes [

24]. These costs arise throughout the supply chains as well as in warehouses and transhipment centers, in which energy is also used for lighting, heating, and the movement of goods [

25]. It is in the context of energy consumption that it is worth noting that although there is usually a discrepancy between the business goals of enterprises and the social and environmental goals very often, increasing the efficiency of logistics processes is not only beneficial for enterprises, but also results in lowering external and social costs [

26].

However, external factors, including energy prices, may have an impact on the location of some supply chains. The best and closest example is the war in Ukraine, which had an impact on oil prices and, in turn, affected the prices of textile fibers such as polyester [

27,

28,

29]. The Ukraine war has affected energy markets due to the significant role of Russia in supplying natural gas and fertilizers. As a solution to this problem, some authors propose a switch from the 1st Generation biofuels to higher generations [

30]

After the pandemic (which is not over), the rise in energy prices is another challenge for companies. One can even ask if there are some connections between these phenomena. For example, a possible shortening of supply chains as a result of a pandemic would have a positive impact on the energy consumption of logistics processes, possibly also production. The relationships between these phenomena can actually be more complex. Disruptions caused by a pandemic can impact sourcing strategies. Instead of just-in-time deliveries—more often in small quantities—companies can purchase products from local suppliers in quantities that enable the use of energy-efficient means of transport [

31,

32,

33].

These phenomena are interrelated, although they are of a complex nature. The increase in fuel prices was forecast long before the pandemic because their level was too low and did not ensure adequate profitability, as a result of which no capital expenditure was incurred in this sector of the economy. The COVID-19 pandemic caused a drop in demand and a drop in prices, which further contributed to the deterioration of the situation in this market [

9]. The reopening and rapid opening of economies resulted in an increase in both freight and passenger transport, which in turn resulted in a sharp increase in fuel prices and, consequently, in the prices of transport services [

34].

The links between different phenomena are even more complex than one might think. For example, in the clothing industry—the use of fibers in the production of clothes indirectly affects the costs of transport and, consequently, the energy consumption of the world economy [

35]. The fashion industry relies to a large extent on the use of cheap synthetic fibers, especially polyester, to which “fast-fashion” also contributes. Polyester is cheap (cheaper than cotton) and durable, but consumers change them more often thanks to their lower prices and, therefore, it requires more transport in the supply chains and more consumption of energy.

The authors of this article dealt with the issue of the profitability of the supply chain strategy before the pandemic. The research carried out by them at that time indicated that, in many cases, retreat from globalization is economically unprofitable [

36,

37].

The rise in energy prices after the pandemic is another factor that could contribute to changing supply chain strategies. However, such intentions are not visible on the part of entrepreneurs. There is no willingness on the part of politicians to take action in the field of energy policy (such as new sources of energy and energy security) [

38].

Energy is also consumed in production. For example, it is estimated that 30–38% of the energy contained in total food production is lost [

39,

40]. Perhaps the current increase in energy prices will motivate enterprises to look for savings not only in logistics but also in the area of production. The results of the conducted research show that product design, cooperation and communication in supply chains, logistics, and the efficiency of the use of materials are areas for potential energy efficiency improvement [

41].

3. Materials and Methods

The authors conducted research on the impact of the increase in fuel and energy costs from mid-March to the end of June 2022, i.e., during the period of a large increase in fuel prices in which the increase is considered to be permanent. Two main research methods were used:

Based on telephone interviews conducted with Polish clothing companies, the authors studied the impact of the increase in fuel and energy costs on the effectiveness of the supply chain strategy, including the tendency to change the global strategy (production in the Far East) to local (production in Poland). The telephone interviews were conducted from mid-March to the end of June 2022. In two cases, companies did not agree to the interview, and replies were sent by e-mail instead.

The authors used the interview method because, as a research method, it is more precise and takes into account the specificity of each of the surveyed companies better than the survey. This is because, depending on the answers provided, the researcher has the opportunity to ask additional questions. The disadvantage of the interview, however, is that it is more time-consuming than survey research.

The research was carried out in over a dozen Polish companies at various stages of the clothing supply chains. These were supply companies (producing knitted fabrics for the needs of clothing companies), production companies (sewing plants), and distribution companies (distributing clothes in stationary stores and to online customers). These companies were of various sizes. They were both leaders of supply chains (production or commissioning production under their own brand according to their own projects) and participants in supply chains (production under the client’s brand and according to the client’s projects).

The authors used a previously prepared general list of questions during their research. Some questions varied depending on whether it was a supply chain leader or just a participant. In addition, sub-questions were usually added after each general question, depending on the answers given. The questions from the general list for clothing companies from all groups were as follows:

Has the rise in fuel and energy prices had an impact on your business?

Has this growth forced your company to make changes to reduce fuel and energy consumption or are such changes planned?

Has the increase in transport costs made it more profitable to outsource production in Poland (higher production costs, but lower transport costs), or is it still more profitable to outsource production in the Far East?

A question for leaders of supply chains that are not manufacturers, but distributors that outsource the production of clothing to sewing factories:

- 4.

Does the company plan to change the place of outsourcing production from global production in the Far East to local production in Poland in order to reduce transport costs?

A question for a sewing room that is not a leader but a participant in the supply chain:

- 5.

Is there an increase in the number of production orders in your company by customers who have previously outsourced production abroad, e.g., in the Far East?

The results of this part of the research are presented in

Section 4.1.

The second part of the research consisted of simulating the impact of changes in transport rates (as a result of an increase in energy prices) on the profitability of using a specific supply chain strategy (local supply, global supply). The simulation model developed by the authors was used to calculate profitability. The model used real data from the transport services market. The model, simulation method, and its results are presented in

Section 4.2. The research presented in

Section 4.1. was focused on the clothing industry—a specific sector of the economy prone to globalization. This section presents the results of the simulations carried out, which were also extended to other industries.

The problem presented in this article has been the subject of research conducted by the authors of this article for years. Presented below are the results of the simulations carried out using the model previously presented in a publication before the onset of the rise in energy costs [

36].

The calculations were performed for:

Four delivery options were taken into account, the first three of which concerned deliveries from the Far East to Europe, and the fourth—local deliveries:

Sea transport in 40 ‘containers—deliveries every 6 weeks, one delivery of 6 containers;

Rail transport—delivery of one 40 ‘container every 3 weeks;

Air transport—every week;

Road transport—daily deliveries.

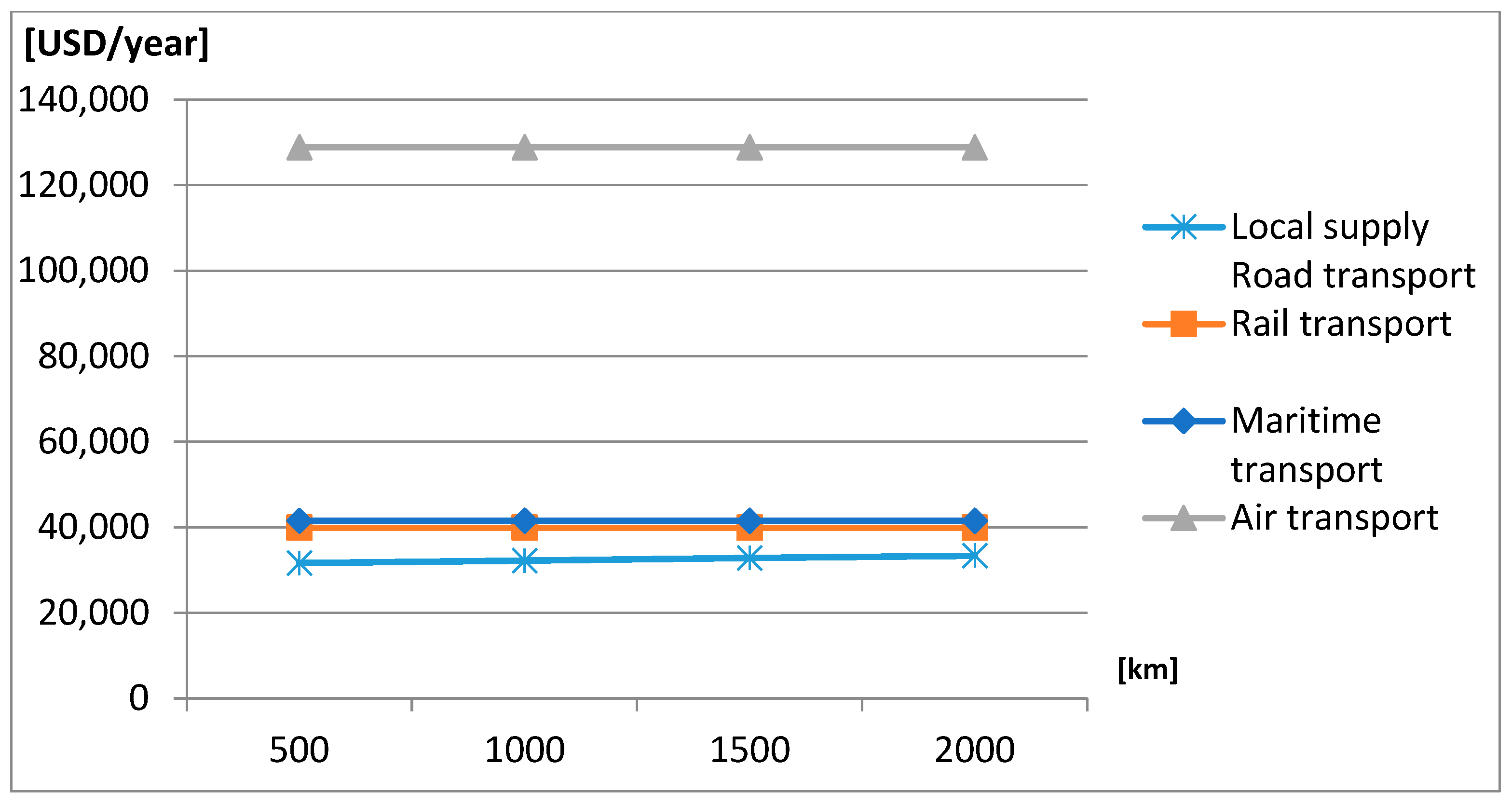

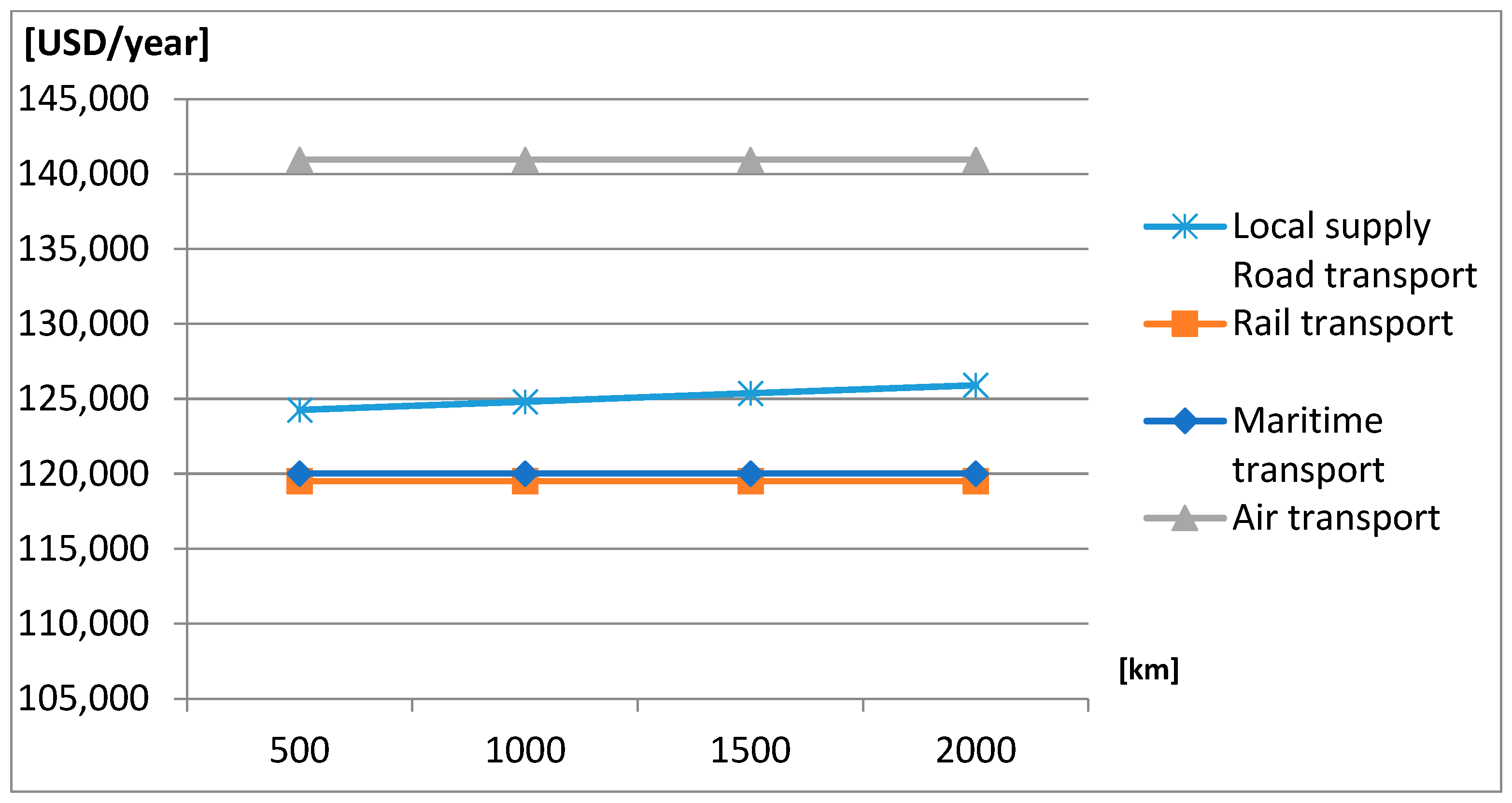

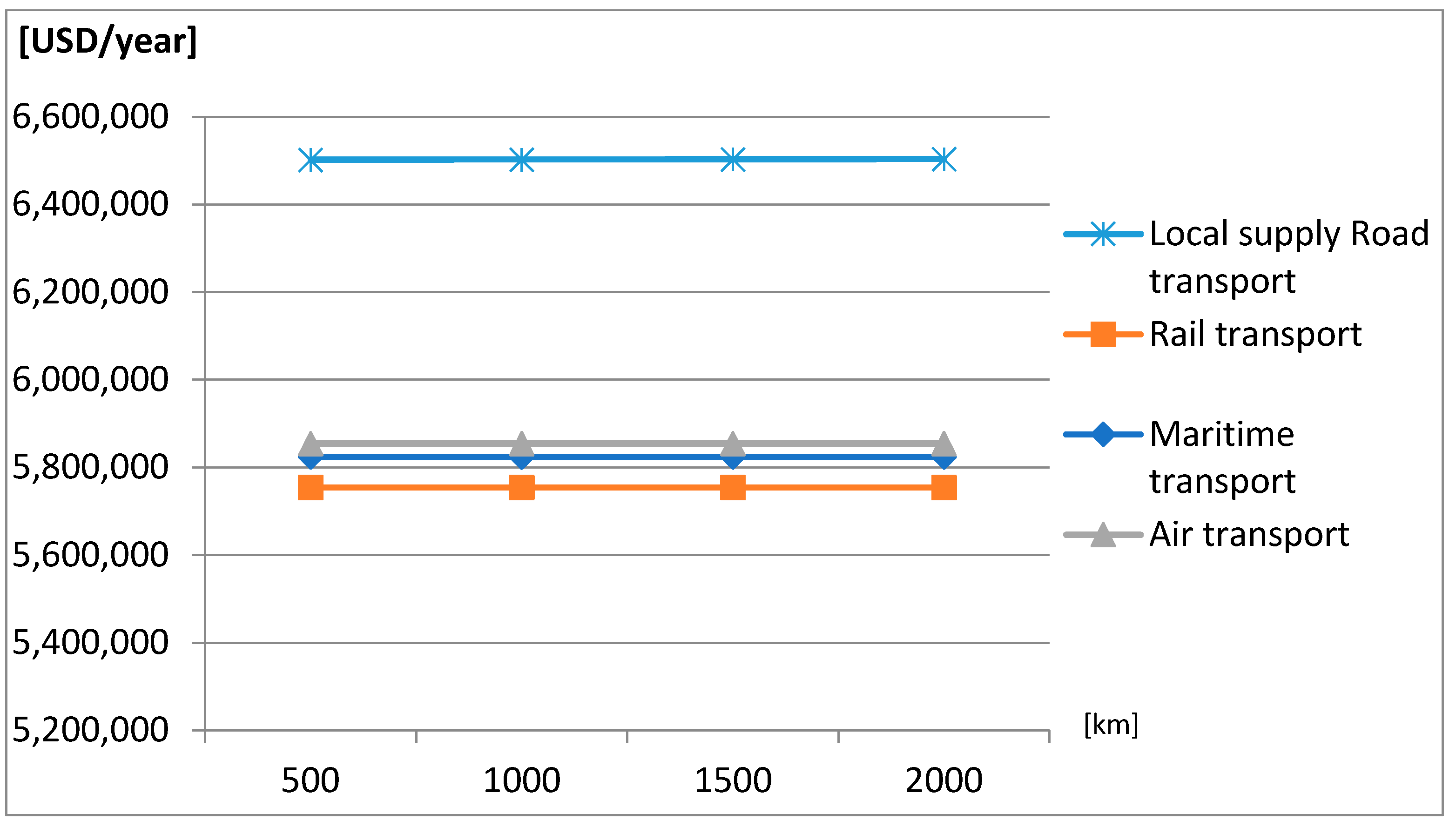

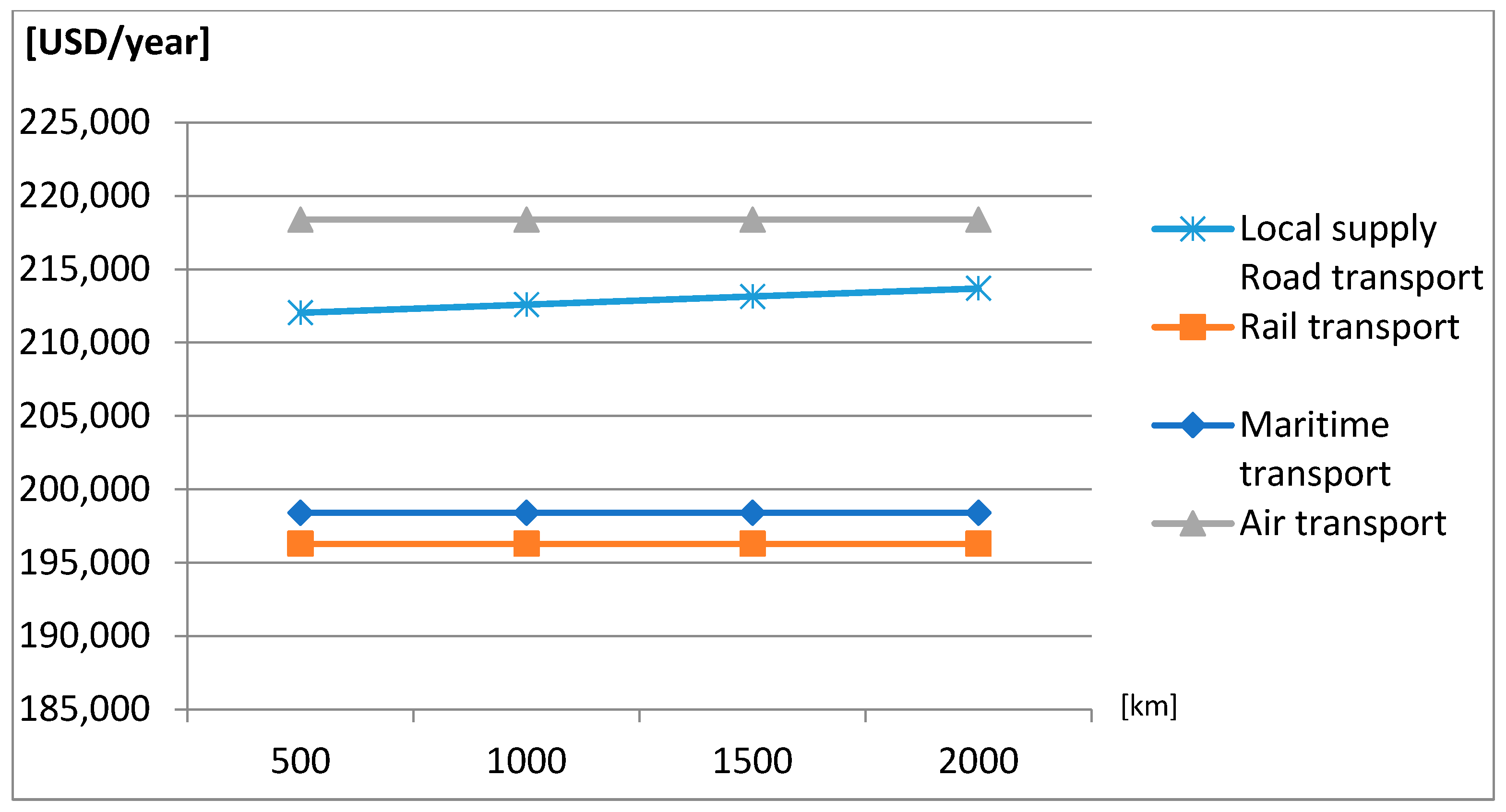

The simulations were carried out for 4 groups of products—office supplies, cheap electronic products, expensive electronic products, and clothing.

The variants of demand for which calculations were performed were as follows:

Normal distribution (Gaussian distribution) of daily demand—standard deviation 5% of the average daily demand;

Normal distribution (Gaussian distribution) of daily demand—standard deviation 30% of the average daily demand;

Daily gamma distribution—standard deviation of 3% of the average daily demand;

Variable average demand during the delivery period.

The model allows for the calculation of the efficiency of a given strategy using the criteria of total costs. Total yearly costs are a sum of the costs of logistics processes, which can be calculated with the use of the following formula:

where:

—Total yearly costs;

n—Number of working days during a year;

—Inventory costs (value of goods x inventory costs) per day i;

—Warehousing costs (number of units x costs of storing per unit) per day i;

—Transportation costs (costs of transportation by a vehicle of a given capacity) per day i;

—Costs of lost sales (quantity of goods which were not sold x value of goods) per day i;

—Costs of the purchase of goods from a supplier.

The results of those simulations indicated that a double increase in shipping rates for shipping containers from Asia to Europe would have little impact on the costs of the global sourcing strategy for the cheapest goods. In the case of more expensive products, the optimal solution was deliveries from global suppliers using rail transport that was more expensive and faster than sea transport. As for the variants of demand, the best solution was not to move production to Europe but to use the fastest mode of air transport.

The situation in the market for transport services has changed radically over the last year. The increase in fuel and energy prices resulted in an increase in the prices of transport services, although to a different extent in various modes of transport. Moreover, the quality of service has also deteriorated, and the uncertainty and unreliability of deliveries have increased. Over the years before the pandemic, the delivery of containers from Asia to Europe with the use of the maritime transport was not only the cheapest transport solution, but the deliveries were also timely. As a result, companies were able to organize container deliveries by sea without increasing inventory and without worsening the logistical level of customer service. Currently, the costs of transport services are higher, and the quality is worse. Therefore, the question arises if the present conditions are favorable for the return of production to Europe. The model used by the authors allows for simulations that can give an answer to this question.

4. Results

4.1. The Impact of the Increase in Fuel Prices on Polish Clothing Companies—Based on Interview Research

Polish clothing companies that are both leaders and participants of supply chains were surveyed. Clothing companies that are leaders in supply chains can be divided into the following groups depending on their place in the supply chain:

Global supply chain leaders;

Leaders of regional supply chains;

Local supply chain leaders.

Global supply chain leaders are companies that outsource the production of clothes under their own brand and according to their own designs to sewing plants located in countries with low production costs (mainly Southeast Asia). These clothes are transported to Poland mainly by sea, stored in one or more warehouses in Poland or other European countries, and sold in showrooms in Poland and other European countries and via the Internet. Some of these companies also usually outsource a small part of their production to sewing factories in Poland.

Leaders of regional supply chains are companies that outsource the production of clothes under their own brand and according to their own designs to sewing plants located in the region of Eastern Europe (mainly Ukraine and Belarus—due to lower costs of sewing clothes than in Poland). The clothing is then transported to Poland by road transport and stored in one or more warehouses in Poland. Some of these companies also outsource production to sewing factories in Poland or have their own sewing rooms in Poland. The clothes are sold in showrooms mainly in Poland and via the Internet.

Leaders of local supply chains are companies that outsource the production of clothes under their own brand and according to their own designs to sewing plants located in Poland or sewing in their own sewing room in Poland. The clothes are stored in a warehouse in Poland and sold in showrooms in Poland and via the Internet.

There are also companies that are difficult to clearly classify into one group (e.g., a company that sews some of its clothes in its own sewing room in Poland and outsources some of its production to sewing factories in Eastern Europe).

Interviews with company managers showed that the increase in fuel and energy prices have had a significant impact on the surveyed companies—primarily on costs. This applied to both leaders and participants in supply chains (regardless of whether it was a global, regional, or local chain). This was indicated by both production and distribution companies. Not only was the increase in transport costs indicated here, but also in the costs of heating and electricity, which have been felt both in production (sewing rooms) and in distribution companies (distribution centers, warehouses, and showrooms). Firms also pointed to an overall increase in prices such as materials and packaging due to rising fuel and energy costs, as well as an increase in wages and salaries. Only one of the surveyed companies, a small local clothing company, stated that the impact of the increase in fuel and energy prices did not significantly affect the company.

Due to the increase in fuel and energy costs, two types of activities in companies were indicated. Firstly, cost saving practices were implemented (e.g., reducing energy costs by the installation of photovoltaic panels), and secondly, efforts were made to increase the price of their products. The clothing companies tried to pass the increased costs onto their recipients. In turn, their suppliers of both products and services tried to pass on their increased costs to clothing companies. Especially transport companies, in which the increase in fuel prices had a very large impact on their costs, began to significantly increase the price of their services.

When asked whether, due to the increase in transport costs, it is now more profitable to outsource production in Poland than in the Far East, the companies indicated that cost considerations still indicated greater profitability of production in the Far East. This was also indicated by companies that do not outsource production there. The companies that do not outsource production in the Far East, but produce in Poland or in the region, follow criteria such as the speed of response to market needs and quality considerations and not cost considerations. Some small companies indicated that they were considering outsourcing production in the Far East, but the size of the orders was a barrier (they would have to place larger orders—beyond required quantities). Therefore, although the costs of transport have increased (felt more by companies transporting long distances, i.e., from the Far East than locally), the difference in the cost of sewing clothes between Poland and, for example, Bangladesh is so huge that it is still more profitable to outsource sewing in the Far East than locally. This is due to the fact that local production also requires energy (the price of which increases) and various other costs, such as the cost of purchasing materials and wages and salaries, which also increase.

Due to the increase in fuel prices and transport costs, the companies that are the leaders of the supply chains do not plan to change the outsourced production from global to local. The recently observed changes in the location of production resulted from other factors, e.g., the desire to increase the speed of response to market needs, but above all, due to political factors. In connection with Russia’s invasion of Ukraine, the companies ordering sewing clothes there moved their production to Poland. This is also confirmed by the responses of sewing factories sewing clothes to order: after Russia’s invasion of Ukraine, they noticed an increased interest in their services.

The results of these studies seem to be surprising, especially in the context of the debate that has been going on for years about the shift away from globalization to local sources of supply. If we look at this problem from the point of view of the profitability of the procurement strategy, we see that the decisions made by entrepreneurs are justified.

4.2. The Impact of Changes in Transport Costs on the Profitability of Global Supply Chain Strategies

The assumptions for the calculations are presented in

Table 1 and

Table 2. In particular:

The increase in freight rates was taken into account—the highest in maritime transport, lower in rail transport, and the lowest in road transport in Europe (

Table 2);

Only one mode of transport was considered in the local supply strategy—road transport. It was assumed that the deliveries to a warehouse in this strategy would be realized by efficient means of transport, i.e., a tractor with a trailer (90 m3 of loading space). However, the number of options in terms of distance has been increased to analyze the impact of this parameter on the profitability of reallocating production from low-cost countries at different transport costs in Europe;

As for the characteristics of the demand, the last one—the riskiest for the global supply strategy, i.e., the variable average demand during the delivery period—was selected from the four demand variants.

As shown by the simulations carried out, despite a very large increase in rates, especially in sea transport, moving production to Europe is, in most cases, unprofitable. The explanation is that the costs of transport constitute a small percentage of the sales value. In the case of the most expensive products (group 3), transportation accounts for approx. 0.1% and in the case of the cheapest products—approx. 15% of sales.

For low-cost products (from the first group), the total delivery costs are lower when purchased in Europe than when sourced globally. It is not affected by the distance of deliveries within Europe—local sourcing is more efficient than global sourcing even at distances of 2000 km. For all of the other more expensive products, the local delivery strategy is the most expensive even for shorter distances (500 km).

Therefore, for the local procurement strategy to be cost-effective, the production costs of producers in the Far East would have to increase—in the case of cheaper electronics by 25%, more expensive electronics by 15%, and clothing by 29%.

The results of the calculations do not take into account the impact of delays in deliveries on the costs of inventories and lost sales, which is a particularly significant problem in the case of deliveries by sea transport. However, if we assume that these costs would increase by as much as 30%, their impact on profitability is small, and in the case of the most expensive electronics, it is almost imperceptible.

5. Results

On the basis of the conducted research, conclusions were drawn concerning the impact of the increase in fuel and energy prices on the supply chain strategies of companies. Based on the interviews conducted in the garment industry, the increase in fuel and energy prices:

Significantly affected the costs of the surveyed clothing companies, in both manufacturing and distribution;

Not only affected the costs of transport but was felt wherever electricity was used (e.g., for heating or lighting), both in production (sewing rooms) and in distribution companies (distribution centers, warehouses, and showrooms);

The companies also felt the general increase in the prices of goods and services caused by the increase in fuel and energy costs;

The companies implemented cost savings and sought to increase the price of their products;

The increase in transport costs did not contribute to the greater profitability of ordering production in Poland than in the Far East. Companies that are leaders in supply chains do not plan to change the source of production from global to local;

The companies that recently started to locate the production of clothes in Poland made such a decision because they wanted to react quicker to market needs and wanted higher quality. Apart from this, the reason for which companies moved production from Eastern Europe to Poland was Russia’s invasion on Ukraine.

Changes in supply chain strategies due to the COVID-19 pandemic and the increase in fuel and energy prices will depend on the economic effectiveness of these strategies. For now, however, despite the increase in fuel and energy prices and the increase in transport rates, the global production strategy is still more profitable than the local production strategy. Such conclusions result from the interviews conducted with representatives of companies. It is amazing that not only is there a desire to move production to Europe, but there are even companies considering outsourcing production to the Far East. The interviews were conducted with employees of companies in the clothing industry. In order to check whether entrepreneurs’ decisions have rational foundations, the authors conducted simulations of the profitability of a given strategy using the developed simulation model. The simulations were carried out for various products—office products, high and low value electronics, and clothing. These products were characterized by different value and loading parameters, which affected the logistics costs.

Based on the conducted simulations, the following conclusions can be drawn:

The increase in transport costs was felt more by companies transporting long distances, i.e., from the Far East to Europe, not only due to the distance, but above all, because the rate of increase for maritime transport was the largest of all modes of transport;

The impact of changes in fuel prices on logistics strategies depends on the share of transport costs in total costs, and this, in turn, on the location of individual links in the supply chain (suppliers, producers, distribution warehouses and showrooms, and on the mode of transport that products move along the supply chain);

In companies ordering production in countries with low production costs, the share of the transport cost in the total cost is greater than in companies operating locally. Therefore, increasing the price of crude oil reduces the effectiveness of global supply chain strategies;

The simulations carried out indicate that despite a very large increase in rates for transport services, especially in sea transport, it is still not profitable to relocate production from the Far East to Europe due to the still lower production costs in low-cost countries;

To some extent, this is also due to the fact that local production also requires energy (the price of which is rising) and various other costs which are also increasing, e.g., material and wage costs.

The results of these simulations explained the reasons for the decisions of entrepreneurs and managers and confirmed that despite the increase in fuel and energy prices, the profitability of production is still higher in the Far East than in Poland. The views on the withdrawal from globalization are, therefore, premature in the opinion of the authors of this article.

6. Conclusions and Directions for Further Research

Contrary to what one might think, the costs of implementing logistics processes, in many cases, account for a small share of the value of sales. This share is large for cheap goods, which explains the profitability of local production for the cheapest goods in our simulations (group 1—“office products”). Thus, the paradoxical situation may arise that although there may be motivation to move production to low-cost countries with lower production costs, the sectors of high-value products may be the most “resistant” to the increase in energy costs. However, the profitability of a given strategy is influenced by many other factors than just the costs of transport or other logistic processes (e.g., storage). In the case of high-value products, the cost of maintaining inventories and the cost of lost sales may be very high. All the more so as the demand for such goods can be relatively more difficult to predict than in the case of cheap, mass-produced goods.

The conclusion that can be drawn from the research was that the most important determinant is still the relation of production costs in “low-cost” countries to the production costs in Europe. However, there are many more determinants, and it is difficult to point to any regularity here. The final decision is made by managers in companies based not only on objective premises but also on their individual opinions. The authors were met with such opinions in companies producing high-quality garments that would never transport their products in sea containers, and because of this, they produce in Europe. When it comes to high-quality clothing, it is usually carried on hangers, which is also an important factor in choosing a supply chain strategy. On the other hand, there is also the factor of the availability of technology and manpower with the required competencies to consider. In order for production to return to Europe, there would have to be workers who would like to perform a given task and often work hard. In old Europe, the young generation is not inclined to do hard, monotonous physical work (e.g., sewing clothes).

The research directions recommended by the authors concern the actual level of costs of both production and logistics processes in relation to the value of products and the impact of energy costs on the costs of these processes.