Research on Carbon Emission Reduction Investment Decision of Power Energy Supply Chain—Based on the Analysis of Carbon Trading and Carbon Subsidy Policies

Abstract

:1. Introduction

2. Literature Review

3. Symbolic and Basic Model Assumptions

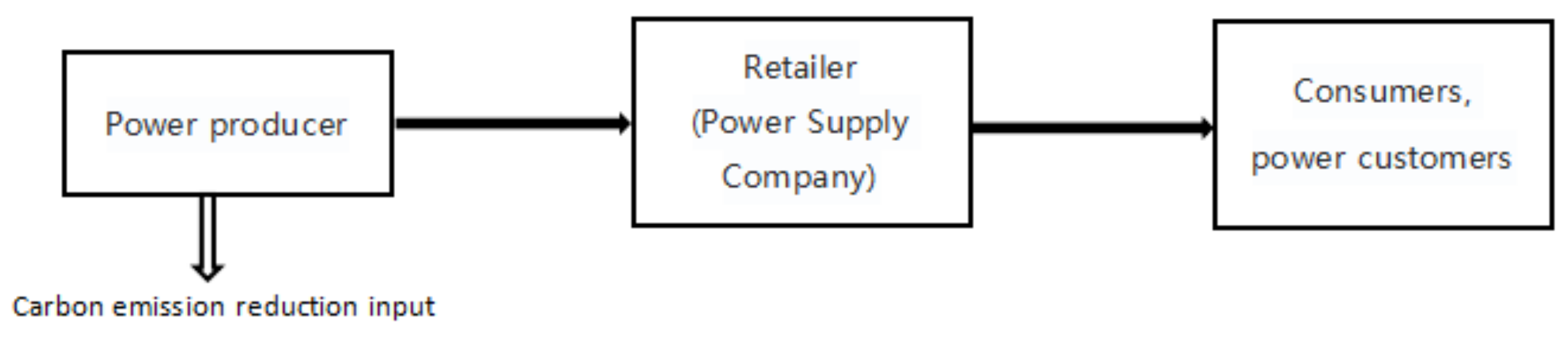

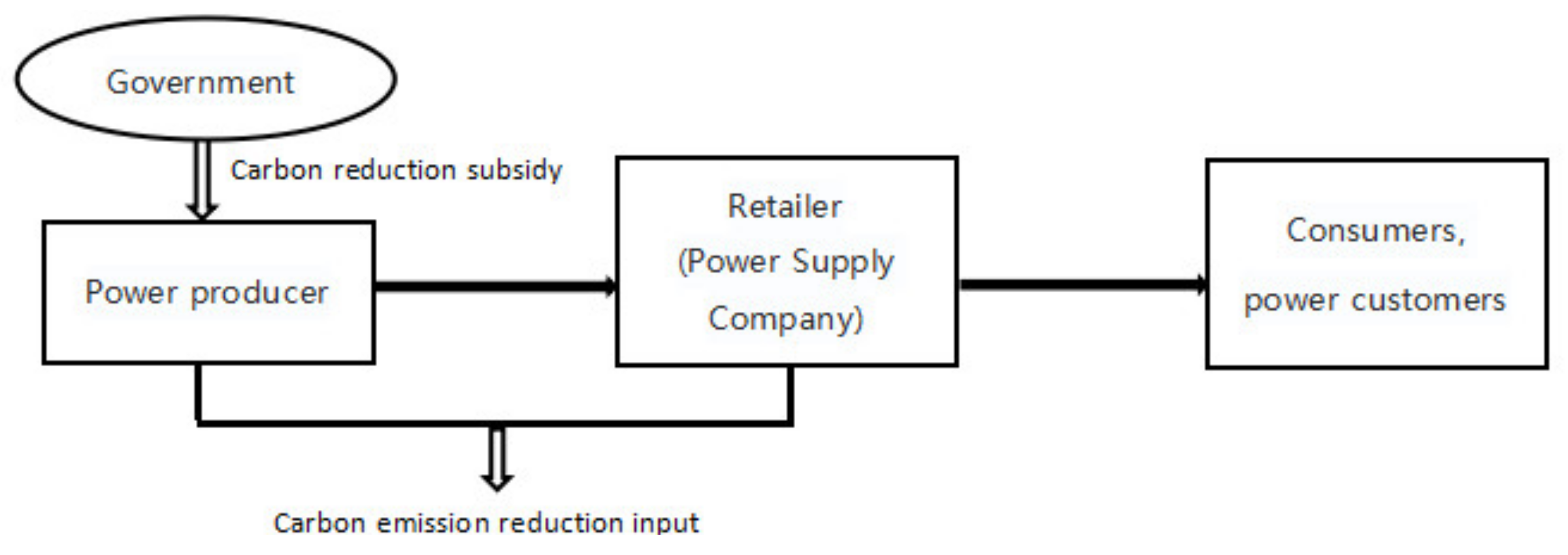

3.1. Problem Description

3.2. Problem Description

- Power producers reduce carbon emissions by increasing the input of carbon reduction technologies in their production process. Therefore, it is assumed that the rate of the difference between the carbon emission before and after the emission reduction activities of the producer and the carbon emission before emission reduction is , where is inversely proportional to the degree of carbon reduction. The smaller the , the higher the level of carbon reduction. The larger the is , the lower the carbon reduction level.

- In order to reduce carbon emissions, the power producer must make some emission reduction input. Assuming that the carbon emission reduction cost input is , is the carbon emission reduction cost coefficient [28], assuming that the failure of the emission reduction investment of power producers and the risk aversion of investment of power producers is not considered.

- Assume that the market demand function of electric power products is , where is the market size, is the market retail price, is the low-carbon preference of consumers, and is the consumer price sensitivity coefficient [29].

- In order to encourage a low-carbon power industry and sustainable consumption of the energy economy, the government sets a carbon emission cap, , for power producers to constrain the carbon emissions of enterprises and allow carbon trading. The market price for carbon is . At the same time, the government also provides help and support for enterprises’ carbon emission reduction activities, that is, carbon emission reduction subsidies, with a subsidy rate of .

- The supply chain system introduces a cost-sharing contract. In order to encourage electric power producers to reduce emissions, electric power retailers are willing to share the carbon emission reduction costs of electric power producers. The sharing rate is recorded as [26].

4. Modeling and Analysis

4.1. Decentralized Supply Chain Decision Making without Government Carbon Subsidies (Model D)

4.2. Centralized Supply Chain Decision Making with Government Carbon Subsidies (Model C)

4.3. Centralized Supply Chain Decision Making with Government Carbon Subsidies and Carbon Emission Reduction Investment Allocation (Model U)

5. Numerical Simulation

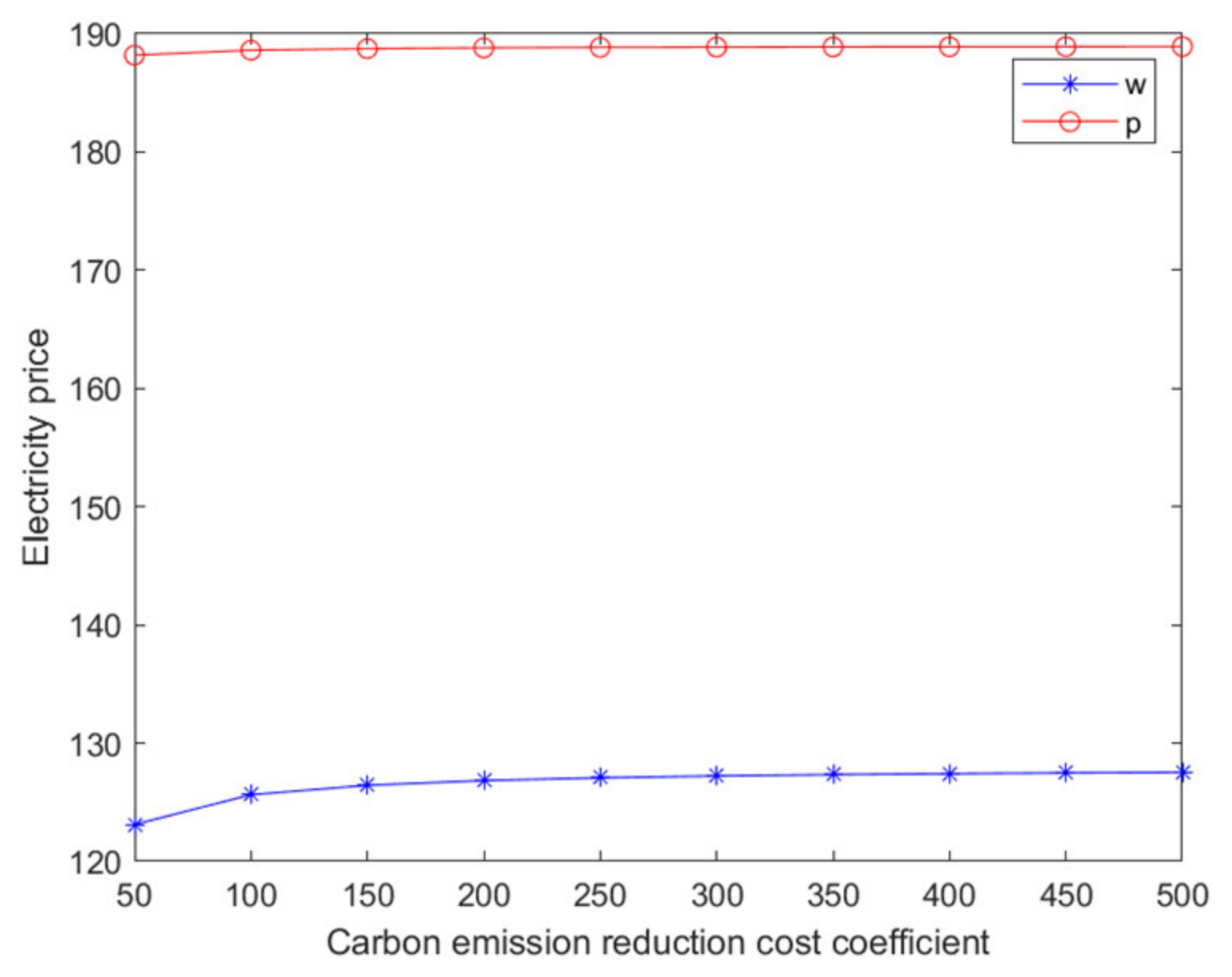

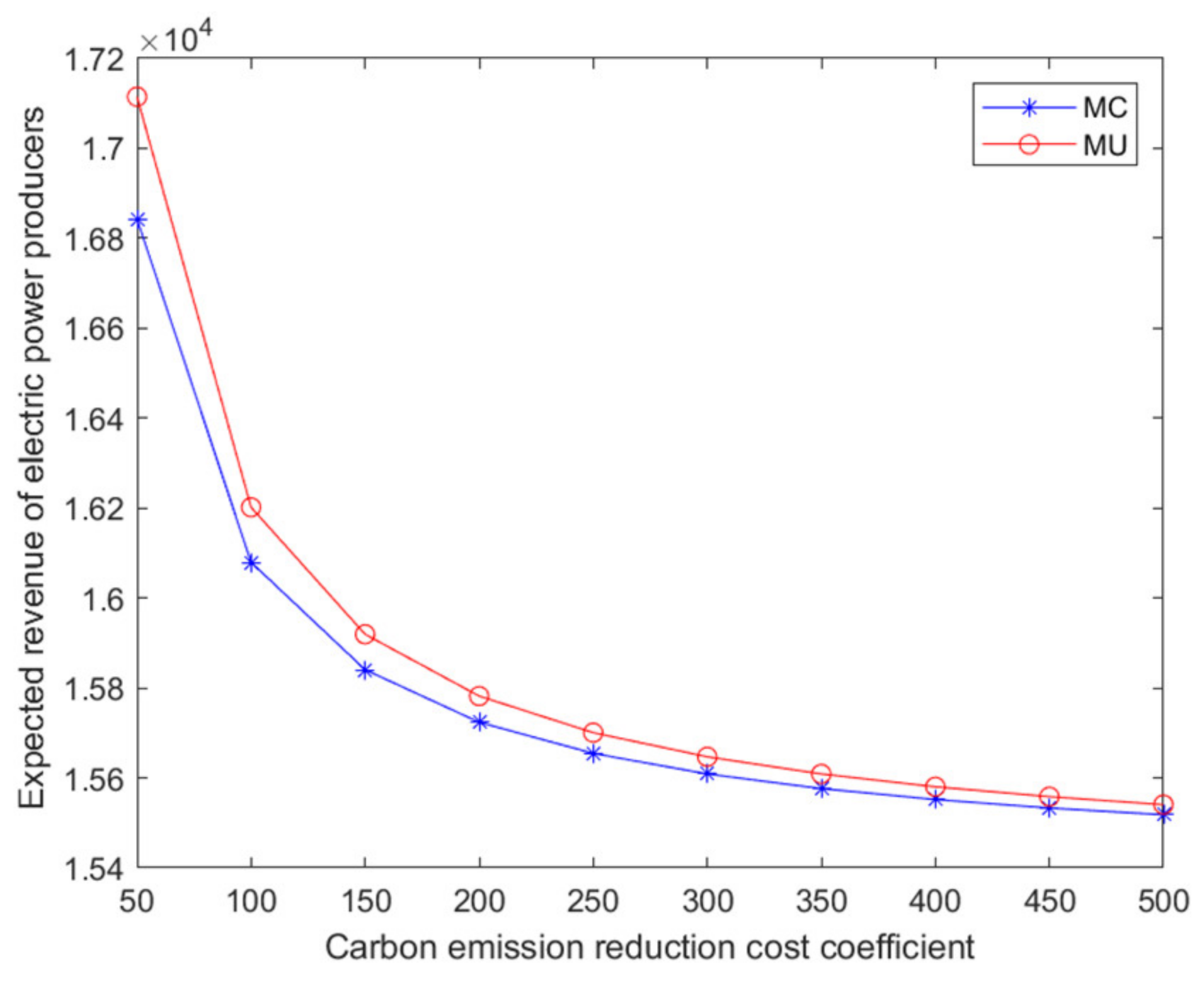

5.1. The Influence of Carbon Abatement Investment Cost Coefficient on Electric Power Price and Supply Chain Benefit

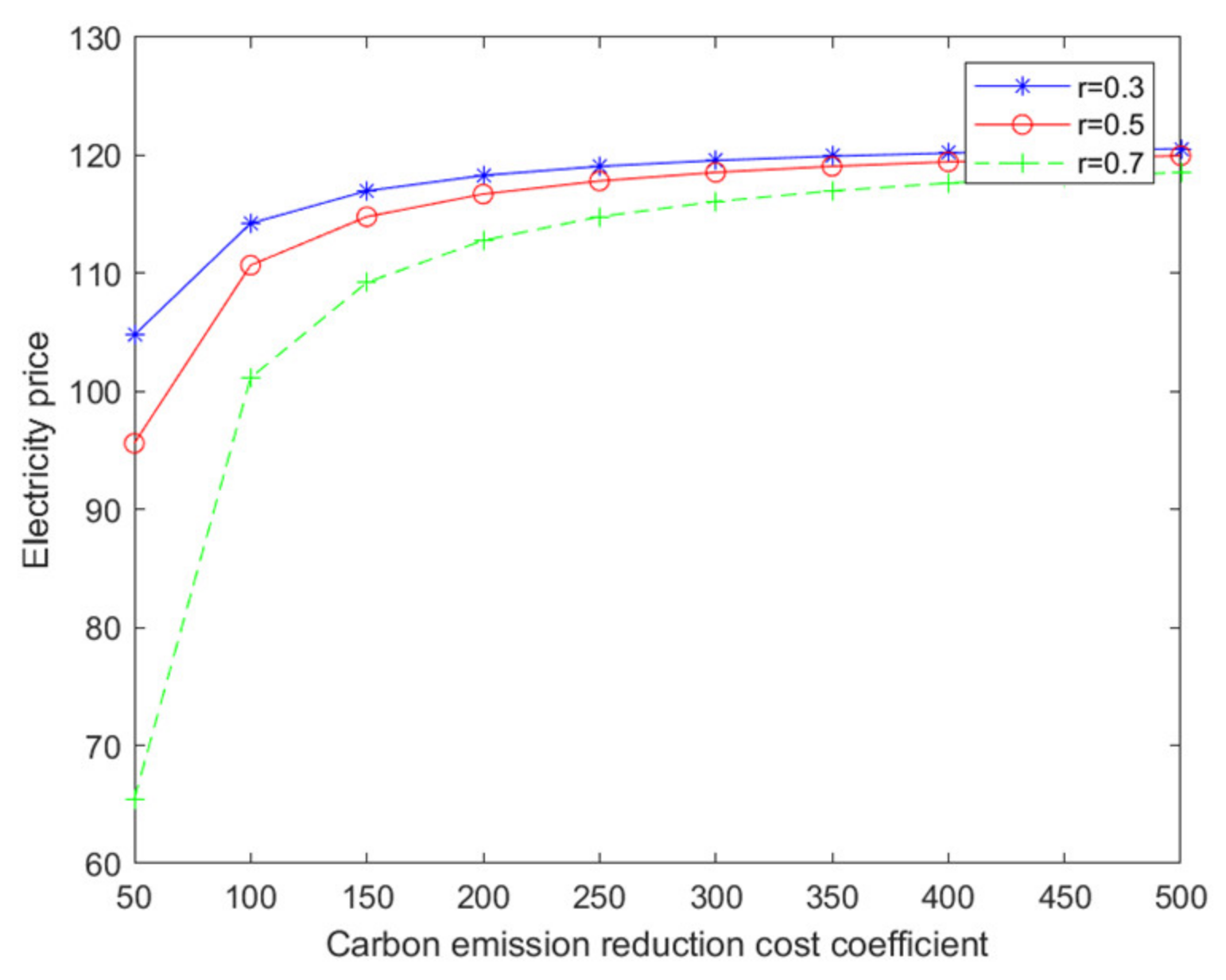

5.2. The Influence of Carbon Emission Reduction Investment Cost Coefficient and Government Carbon Subsidy Rate on Electric Power Price and Supply Chain Benefit

5.3. The Influence of Carbon Emission Reduction Investment Cost Coefficient and Government Carbon Subsidy Rate on Electric Power Price and Supply Chain Benefit

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Abbreviations

| Q | Raw market demand for electricity without carbon emission reductions and price changes. |

| c | The cost for an electricity producer to produce a unit of electricity. |

| ω | Ex-factory price per unit of electricity. |

| p | Market retail price per unit of electricity. |

| e | Carbon emission per unit of electricity produced before carbon emission reduction by electric power producer. |

| E | The free carbon allowance set by the government. |

| t | The market price for each unit of carbon emitted. |

| φ | Carbon emission reduction rate. |

| η | Carbon emission reduction cost coefficient. |

| λ | The proportion of government subsidies for carbon emission reduction input costs. |

| b | Price sensitivity of consumers. |

| β | The low-carbon preference coefficient of consumers. |

| θ | Retailer’s share rate of carbon reduction costs. |

References

- Sadik-Zada, E.R.; Ferrari, M. Environmental Policy Stringency, Technical Progress and Pollution Haven Hypothesis. Sustainability 2020, 12, 3880. [Google Scholar] [CrossRef]

- Hu, A.G. China’s Goal of Achieving Carbon Peak by 2030 and Its Main Approaches. J. Beijing Univ. Technol. 2021, 21, 1–15. [Google Scholar]

- Scott, M.H.; Chris, T.H.; Christopher, L.W. The importance of carbon footprint estimation boundaries. Environ. Sci. Technol. 2008, 42, 5839–5842. [Google Scholar]

- Lee, K.H. Integrating carbon footprint into supply chain management: The case of Hyundai Motor Company (HMC) in the automobile industry. J. Clean. Prod. 2011, 19, 1216–1223. [Google Scholar] [CrossRef]

- Dong, L.L.; Fan, R.G. Optimal regulatory strategy and the corresponding optimal boundary of government low-carbon subsidies. China Popul. Resour. Environ. 2021, 31, 13–22. [Google Scholar]

- Cui, X.M. Incentive Mechanism of Enterprises Energy-saving and Emission Reduction. Ecol. Econ. 2010, 8, 46–48+87. [Google Scholar]

- Zhang, G.X.; Zhang, X.T.; Chen, S.J.; Cha, G.R.; Wang, L.L. Signaling Game Model of Government and Enterprise Based on the Subsidy Policy for Energy Saving and Emission Reduction. Chin. J. Manag. Sci. 2013, 21, 129–136. [Google Scholar] [CrossRef]

- Jiang, J.X.; He, X.H.; Hu, W.F. Emission Reduction Strategies of Three-tier Supply Chain Considering Carbon Subsidies and Corporate Social Responsibility. Syst. Eng. 2022, 40, 97–106. [Google Scholar]

- Zou, H.; Qin, H. Research on pricing decision-making for low-carbon supply chain considering risk aversion under carbon trading. J. Railw. Sci. Eng. 2022, 1–9. [Google Scholar] [CrossRef]

- Zhang, L.H.; Dong, K.; Zhang, R. Strategic Choice Analysis for Supply Chain in ‘Cap and Trade’ System and Carbon Emission Reduction Technology. Chin. J. Manag. Sci. 2019, 27, 63–72. [Google Scholar] [CrossRef]

- Du, S.F.; Hu, L.; Song, M.L. Production optimization considering environmental performance and preference in the cap-and-trade system. J. Clean. Prod. 2016, 112, 1600–1607. [Google Scholar] [CrossRef]

- He, H.; Ma, C.S.; Wu, Z.H. Pricing Decision with Green Technology Input under Cap-and-trade Policy. Chin. J. Manag. Sci. 2016, 24, 74–84. [Google Scholar] [CrossRef]

- Xu, X.Y.; Xu, X.P.; He, P. Joint production and pricing decisions for multiple products with cap-and-trade and carbon tax regulations. J. Clean. Prod. 2016, 112, 4093–4106. [Google Scholar] [CrossRef]

- Yang, L.; Zhang, Q.; Ji, J.N. Pricing and carbon emission reduction decisions in supply chains with vertical and horizontal cooperation. Int. J. Prod. Econ. 2017, 191, 286–297. [Google Scholar] [CrossRef]

- Zhu, P.F.; Xu, W.M. On The Impact of Government’s S&T Incentive Policy on the R&D input and its patent output of large and medium-sized Industrial enterprises in Shanghai. Econ. Res. J. 2003, 6, 45–53+94. [Google Scholar]

- Zu, Y.F.; Chen, L.H.; Fan, Y. Research on low-carbon strategies in supply chain with environmental regulations based on differential game. J. Clean. Prod. 2018, 177, 527–546. [Google Scholar] [CrossRef]

- Zhou, W.Q.; Nie, M. Practice and Enlightenment of Public policies of Promoting Low-carbon Technological Innovation. Forum Sci. Technol. China 2011, 7, 18–23. [Google Scholar] [CrossRef]

- Fang, H.Y.; Da, L.Q.; Zhu, C.N. Firm’s Market Performance Analysis under Different Government R&D Subsidy Policies. Ind. Eng. J. 2012, 15, 33–40. [Google Scholar]

- Shu, Y.B.; Zhang, L.Y.; Zhang, Y.Z.; Wang, Y.H.; Lu, G.; Yuan, B.; Xia, P. Carbon Peak and Carbon Neutrality Path for China’s Power Industry. Strateg. Study CAE 2021, 23, 1–14. [Google Scholar] [CrossRef]

- Du, D.M.; Cao, D.H.; He, Q. Diecussion on low-carbon transformation of China’s power industry under the “double-carbon” goal. Therm. Power Gener. 2022, 1–9. [Google Scholar] [CrossRef]

- Zhao, Z.Y.; Li, Z.W.; Yao, X. Study on cost of wind power electricity based on the certified emission reduction income. Renew. Energy Resour. 2014, 32, 662–667. [Google Scholar] [CrossRef]

- Duan, J.M.; Wang, Z.X.; Wang, C.M.; Zhou, Q.Y.; Han, J.H. Renewable Power Planning Considering Carbon Emission Reduction Benefits. Power Syst. Technol. 2015, 39, 11–15. [Google Scholar] [CrossRef]

- Liu, Z.; Zhu, K.W.; Yan, J.M.; Shi, Y.R. Scenario Design, Analysis and Evaluation on Carbon Emission Reduction in Power Industry. Power Syst. Technol. 2012, 36, 1–7. [Google Scholar] [CrossRef]

- Chen, Q.X.; Kang, C.Q.; Xia, Q.; Zhou, Y.C.; Yokoyama, R. Key Low-carbon Factors in the Evolution of Power Decarbonisation and Their Impacts on Generation Expansion Planning. Autom. Electr. Power Syst. 2009, 33, 18–23. [Google Scholar]

- Zhang, C.F.; Yuan, Y.; Zhang, X.S.; Cao, Y.; Zhao, M. Day-Ahead Dispatching Scheduling for Power Grid Integrated With Wind Farm Considering Influence of Carbon Emission Quota. Power Syst. Technol. 2014, 38, 2114–2120. [Google Scholar] [CrossRef]

- Guo, W.H.; Liang, L. Research on Cooperative Game of Supply Chain Cost Sharing in Carbon Emission Reduction. Front. Sci. Technol. Eng. Manag. 2021, 40, 83–89. [Google Scholar]

- Zhao, W.H.; Gao, J.Q.; Song, Y.J.; Yu, J.L. The Investment Analysis of Carbon Reduction on Power Industry Based on the Electricity Supply Chain. Sci. Technol. Manag. Res. 2017, 4, 242–249+259. [Google Scholar]

- Liu, B.; Li, T.; Tsai, S.B.; Rosen, M.A. Low Carbon Strategy Analysis of Competing Supply Chains with Different Power Structures. Sustainability 2017, 9, 835. [Google Scholar] [CrossRef]

- Zhou, Y.J.; Bao, M.J.; Chen, X.H.; Xu, X.H. Co-op Advertising and Emission Reduction Cost Sharing Contract and Coordination in Low-carbon Supply Chain Based on Fairness Concerns. Chin. J. Manag. Sci. 2017, 25, 121–129. [Google Scholar] [CrossRef]

- Bai, Q.G.; Xu, J.T.; Chauhan, S.S. Effects of sustainability investment and risk aversion on a two-stage supply chain coordination under a carbon tax policy. Comput. Ind. Eng. 2020, 142, 1–23. [Google Scholar] [CrossRef]

- Cao, X.Y.; Qin, Y.H.; Wang, J.; Liu, L.; Yang, C. Dual-channel Supply Chain Cooperative Emission Reduction Considering Subsidies and Promotion Cost Allocation in the Carbon Cap and Trade Regulation. Ind. Eng. J. 2022, 2, 28–36. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Che, C.; Zheng, H.; Geng, X.; Chen, Y.; Zhang, X. Research on Carbon Emission Reduction Investment Decision of Power Energy Supply Chain—Based on the Analysis of Carbon Trading and Carbon Subsidy Policies. Energies 2022, 15, 6151. https://doi.org/10.3390/en15176151

Che C, Zheng H, Geng X, Chen Y, Zhang X. Research on Carbon Emission Reduction Investment Decision of Power Energy Supply Chain—Based on the Analysis of Carbon Trading and Carbon Subsidy Policies. Energies. 2022; 15(17):6151. https://doi.org/10.3390/en15176151

Chicago/Turabian StyleChe, Cheng, Huixian Zheng, Xin Geng, Yi Chen, and Xiaoguang Zhang. 2022. "Research on Carbon Emission Reduction Investment Decision of Power Energy Supply Chain—Based on the Analysis of Carbon Trading and Carbon Subsidy Policies" Energies 15, no. 17: 6151. https://doi.org/10.3390/en15176151

APA StyleChe, C., Zheng, H., Geng, X., Chen, Y., & Zhang, X. (2022). Research on Carbon Emission Reduction Investment Decision of Power Energy Supply Chain—Based on the Analysis of Carbon Trading and Carbon Subsidy Policies. Energies, 15(17), 6151. https://doi.org/10.3390/en15176151