Influence of the Industry’s Output on Electricity Prices: Comparison of the Nord Pool and HUPX Markets

Abstract

:1. Introduction

1.1. Motivation and Incitement

1.2. Literature Review

1.3. Research Contribution

2. Materials and Methods

- Ad. (1).

- Ad. (2).

- absolute (prices in euro);

- relative (natural logarithms of prices).

- Coef.—structural parameters of the model; the model is centered around the mean value (β0), which allows the price level to be easily assessed, while regression coefficient (β1) allows for the assessment of the strength of the reaction of electricity prices to changes in industrial production;

- S.E.—standard error of structural parameters, a measure of differentiation of parameters;

- Conf Int 2.5%; Conf Int 97.5%—confidence interval of structural parameters. With 95% probability, the designated range covers the actual parameters of the model for a given economy;

- z-ratio—significance statistics for structural parameters;

- p-value—significance level of structural parameters; p < 0.05 was considered to indicate the statistical significance of the model parameters, so if p > 0.05, the structural parameter was considered to be irrelevant;

- variance inflation factor (VIF)—indicates how much the variance of a coefficient is inflated due to the correlations among the predictors in the model;

- Var (resid.)—residual variance;

- S.E.—residual standard error;

- IGLS—−2 * log likelihood statistics.

- Depending on the VIF value, the values of the predictor coefficients may be more or less reliable. Thus:

- VIF = 1 means uncorrelated coefficients,

- 1 < VIF < 5 moderately correlated predictor coefficients,

- VIF > 5 highly correlated predictor coefficients.

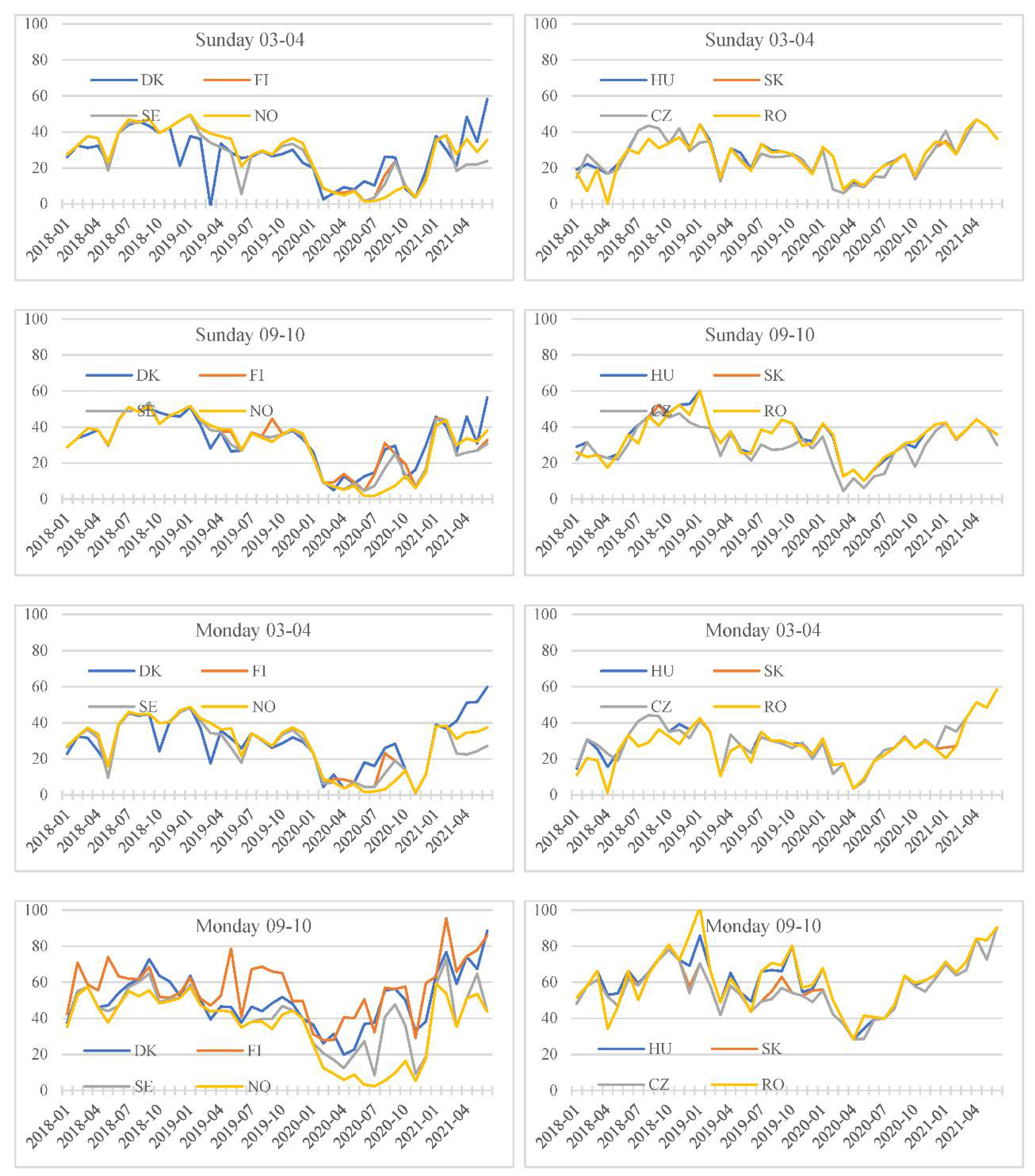

- Nord Pool: Denmark, Norway, Sweden, Finland.

- HUPX: the Czech Republic, Slovakia, Hungary, Romania.

- Sunday, hours between 03–04 and 09–10,

- Monday, hours between 03–04 and 09–10.

3. Results

3.1. Variation in Electricity Prices and the Industry’s Output

3.2. Model Approach of the Impact of Industry’s Output on Electricity Prices

- a model that shows absolute responses of electricity prices,

- a model that shows relative responses of electricity prices.

4. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Abbreviations

| SDG 8 | Sustainable Development Goal 8 |

| IGLS | iterative generalised least squares procedure |

| OLS | ordinary least squares method |

| Coef. | coefficient |

| S.E. | standard error |

| Conf Int | confidence interval |

| z-ratio | z statistics |

| p-value | significance level of structural parameters, p < 0.05 was considered to in- |

| VIF | variance inflation factor |

| Var (resid.) | residual variance |

| Countries | |

| DK | Denmark |

| FI | Finland |

| SE | Sweden |

| NO | Norway |

| HU | Hungary |

| SK | Slovakia |

| CZ | Czechia |

| RO | Romania |

References

- Safa, H. The impact of energy on global economy. Int. J. Energy Econ. Policy 2017, 7, 287–295. [Google Scholar]

- Wu, X.F.; Chen, G.Q. Global primary energy use associated with production, consumption and international trade. Energy Policy 2017, 111, 85–94. [Google Scholar] [CrossRef]

- Cass, D. Optimum growth in an aggregative model of capital accumulation. Rev. Econ. Stud. 1965, 32, 233–240. [Google Scholar] [CrossRef] [Green Version]

- Koopmans, T.C. Objectives, constraints, and outcomes in optimal growth models. Econometrica 1967, 35, 110–132. [Google Scholar] [CrossRef]

- Cleveland, C.J.; Kaufmann, R.K.; Stern, D.I. Aggregation and the role of energy in the economy. Ecol. Econ. 2000, 32, 301. [Google Scholar] [CrossRef]

- Ayres, R.U.; Warr, B. Accounting for growth: The role of physical work. Struct. Chang. Econ. Dyn. 2005, 16, 181–209. [Google Scholar] [CrossRef]

- Van de Ven, D.J.; Fouquet, R. Historical energy prices and their changing effect on the economy. Energy Econ. 2017, 62, 204–216. [Google Scholar] [CrossRef] [Green Version]

- Lee, K.; Ni, S.; Ratti, R. Oil shocks and the macroeconomy: The role of price variability. Energy J. 1995, 16, 39–56. [Google Scholar] [CrossRef] [Green Version]

- Barsky, R.B.; Kilian, L. Do we really know that oil caused the great stagflation? A monetary alternative. NBER Macroecon. Annu. 2011, 16, 137–183. [Google Scholar] [CrossRef]

- Bernanke, B.; Gertler, M.; Watson, M. Systematic monetary policy and the effect of oil price shocks. Brook. Pap. Econ. Act. 1997, 1, 91–142. [Google Scholar] [CrossRef] [Green Version]

- Hunt, R.; Isard, P.; Laxton, D. The macroeconomic effects of higher oil prices. Natl. Inst. Econ. Rev. 2002, 179, 87–103. [Google Scholar] [CrossRef]

- Bildirici, M.; Alp, E.A.; Bakirtas, T. The great recession and the effects of oil price shocks and the U.S. recession: A Markov-switching and TAR-VEC analysis. J. Energy Dev. 2011, 35, 215–277. [Google Scholar]

- Burbidge, J.; Harrison, A. Testing for the effects of oil-price using vector autoregressions. Int. Econ. Rev. 1984, 25, 459–484. [Google Scholar] [CrossRef]

- Mork, K.A.; Olsen, O.; Mysen, H.T. Macroeconomic responses to oil price increases and decreases in seven OECD countries. Energy J. 1994, 15, 19–35. [Google Scholar]

- Ewing, B.T.; Sari, R.; Soytas, U. Disaggregate energy consumption and industrial output in the United States. Energy Policy 2007, 35, 1274–1281. [Google Scholar] [CrossRef]

- Kilian, L. The economic effects of energy price shocks. J. Econ. Lit. 2008, 46, 871–909. [Google Scholar] [CrossRef] [Green Version]

- Lee, C.C. The causality relationship between energy consumption and GDP in G-11 countries revisited. Energy Policy 2006, 34, 1086–1093. [Google Scholar] [CrossRef]

- Narayan, P.K.; Smyth, R. Electricity consumption, employment and real income in Australia evidence from multivariate Granger causality tests. Energy Policy 2005, 33, 1109–1116. [Google Scholar] [CrossRef]

- Erol, U.; Yu, E.S. On the causal relationship between energy and income for industrialized countries. J. Energy Dev. 1987, 13, 113–122. [Google Scholar]

- Stern, D.I. A multivariate cointegration analysis of the role of energy in the US macroeconomy. Energy Econ. 2000, 22, 267–283. [Google Scholar] [CrossRef] [Green Version]

- Thoma, M. Electrical energy usage over the business cycle. Energy Econ. 2004, 26, 463–485. [Google Scholar] [CrossRef]

- Mir, A.A.; Alghassab, M.; Ullah, K.; Khan, Z.A.; Lu, Y.; Imran, M. A review of electricity demand forecasting in low and middle income countries: The demand determinants and horizons. Sustainability 2020, 12, 5931. [Google Scholar] [CrossRef]

- Weron, R. Electricity price forecasting. a review of the state-of-the-art with a look into the future. Int. J. Forecast. 2014, 30, 1030–1081. [Google Scholar] [CrossRef] [Green Version]

- Härdle, W.K.; Trück, S. The Dynamics of Hourly Electricity Prices; SFB 649 Discussion Paper 2010–013. 2010. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2894267 (accessed on 1 August 2022).

- McCulloch, J.; Ignatieva, K. Intra-day electricity demand and temperature. Energy J. 2020, 41, 161–181. [Google Scholar] [CrossRef]

- Karakatsani, N.V.; Bunn, D.W. Forecasting electricity prices: The impact of fundamentals and time-varying coefficients. Int. J. Forecast. 2008, 24, 764–785. [Google Scholar] [CrossRef]

- Fanone, E.; Gamba, A.; Prokopczuk, M. The case of negative Day-ahead electricity prices. Energy Econ. 2013, 35, 22–34. [Google Scholar] [CrossRef]

- Huisman, R.; Huurman, C.; Mahieu, R. Hourly electricity prices in day-ahead markets. Energy Econ. 2007, 29, 240–248. [Google Scholar] [CrossRef] [Green Version]

- Christensen, T.M.; Hurn, A.S.; Lindsay, K.A. Forecasting spikes in electricity prices. Int. J. Forecast. 2012, 28, 400–411. [Google Scholar] [CrossRef]

- Negrete-Pincetic, M.; de Castro, L.; Pulgar-Painemal, H.A. Electricity Supply Auctions: Understanding the Consequences of the Product Definition. Electr. Power Energy Syst. 2015, 64, 285–292. [Google Scholar] [CrossRef]

- Zachmann, G. Electricity wholesale market prices in Europe: Convergence? Energy Econ. 2008, 30, 1659–1671. [Google Scholar] [CrossRef]

- Pellini, E. Convergence across European Electricity Wholesale Spot Markets: Still a Way to Go. Essays on European Electricity Market Integration. Ph.D. Thesis, University of Surrey, Guildford, UK, 2014; pp. 100–132. [Google Scholar]

- Figueiredo, N.C.; da Silva, P.P. The “Merit-order effect” of wind and solar power: Volatility and determinants. Renew. Sustain. Energy Rev. 2019, 102, 54–62. [Google Scholar] [CrossRef]

- Sensfuß, F.; Ragwitz, M.; Genoese, M. The merit-order effect: A detailed analysis of the price effect of renewable electricity generation on spot market prices in Germany. Energy Policy 2008, 36, 3086–3094. [Google Scholar] [CrossRef] [Green Version]

- Moselle, B.; Padilla, J.; Schmalensee, R. Harnessing Renewable Energy in Electric Power Systems: Theory, Practice, Policy; Earthscan, Routledge: New York, NY, USA, 2010. [Google Scholar]

- Hox, J.J. Multilevel Analysis: Techniques and Applications; Erlbaum: Mahwah, NJ, USA, 2002. [Google Scholar]

- Bryk, A.S.; Raudenbush, S.W. Hierarchical Linear Models; Sage: Newbury Park, CA, USA, 1992. [Google Scholar]

- Mass, J.; Hox, J.J. The Influence of Violations of Assumptions on Multilevel Parameter Estimates and Their Standard Errors. Comput. Stat. Data Anal. 2003, 46, 427–440. [Google Scholar] [CrossRef]

- El-Horbaty, Y.S.; Hanafy, E.M. Some Estimation Methods and Their Assessment in Multilevel Models: A Review. Biostat. Biom. Open Access J. 2018, 5, 555662. [Google Scholar] [CrossRef]

- Goldstein, H. Multilevel Mixed Linear Model Analysis Using Iterative Generalized Least-Squares. Biometrika 1986, 73, 43–56. [Google Scholar] [CrossRef]

- Goldstein, H. Multilevel Statistical Models; Institute of Education: London, UK, 1995. [Google Scholar]

| Market | Country | Source | ||||||

|---|---|---|---|---|---|---|---|---|

| Fossil Fuels | Nuclear | Wind | Hydro | Biofuels | Solar | Other | ||

| Nord Pool | Denmark | 15.7 | 0.0 | 56.8 | 0.0 | 20.6 | 4.1 | 2.8 |

| Finland | 13.6 | 33.9 | 11.6 | 23.1 | 16.8 | 0.3 | 0.7 | |

| Sweden | 0.5 | 30.0 | 16.8 | 44.2 | 6.8 | 0.6 | 1.1 | |

| Norway | 1.3 | 0.0 | 6.4 | 92.0 | 0.0 | 0.0 | 0.3 | |

| HUPX | Hungary | 37.3 | 46.2 | 1.9 | 0.7 | 6.2 | 7.1 | 0.6 |

| Slovakia | 21.5 | 53.6 | 0.0 | 16.7 | 5.8 | 2.3 | 0.1 | |

| Czechia | 48.7 | 36.9 | 0.9 | 4.2 | 6.4 | 2.8 | 0.1 | |

| Romania | 34.9 | 20.5 | 12.4 | 28.1 | 1.0 | 3.1 | 0.0 | |

| Statistic | Sunday 03–04 | |||||||

| Denmark | Finland | Sweden | Norway | Hungary | Slovakia | Czechia | Romania | |

| mean | 26.79 | 26.35 | 26.20 | 27.82 | 28.20 | 26.38 | 26.51 | 26.27 |

| st.dev. | 13.39 | 13.63 | 13.79 | 14.58 | 9.93 | 10.48 | 10.62 | 10.36 |

| Statistic | Sunday 09–10 | |||||||

| Denmark | Finland | Sweden | Norway | Hungary | Slovakia | Czechia | Romania | |

| mean | 32.64 | 32.07 | 30.66 | 30.41 | 34.81 | 30.08 | 30.00 | 33.73 |

| st.dev. | 12.96 | 13.26 | 14.07 | 15.36 | 10.94 | 11.12 | 10.96 | 10.71 |

| Statistic | Monday 03–04 | |||||||

| Denmark | Finland | Sweden | Norway | Hungary | Slovakia | Czechia | Romania | |

| mean | 29.34 | 27.04 | 26.62 | 28.03 | 29.54 | 29.23 | 29.67 | 27.06 |

| st.dev. | 13.94 | 13.17 | 13.60 | 14.69 | 11.43 | 11.32 | 11.41 | 11.57 |

| Statistic | Monday 09–10 | |||||||

| Denmark | Finland | Sweden | Norway | Hungary | Slovakia | Czechia | Romania | |

| mean | 50.12 | 56.82 | 41.65 | 36.05 | 61.19 | 57.04 | 56.40 | 61.89 |

| st.dev. | 14.56 | 15.35 | 15.28 | 17.87 | 13.67 | 13.46 | 13.37 | 15.86 |

| Statistic | Nord Pool Country | HUPX Country | ||||||

|---|---|---|---|---|---|---|---|---|

| Denmark | Finland | Sweden | Norway | Hungary | Slovakia | Czechia | Romania | |

| mean | 103.97 | 106.93 | 104.41 | 99.91 | 106.73 | 106.03 | 101.15 | 106.57 |

| st.dev. | 7.45 | 7.21 | 11.39 | 9.21 | 11.39 | 12.97 | 10.18 | 12.08 |

| Group | Hour | Coef. | S.E. | Conf Int 2.5% | Conf Int 97.5% | z-Ratio | p-Value | VIF | Var (Resid.) | S.E. | IGLS | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| NORD POOL | Sunday 03–04 | β0 | 28.670 | 1.231 | 26.257 | 31.084 | 23.284 | 0.000 | 1.167 | 218.32 | 23.822 | 1381.61 |

| β1 | 0.168 | 0.122 | −0.072 | 0.408 | 1.373 | 0.170 | ||||||

| Sunday 09–10 | β0 | 32.809 | 1.207 | 30.444 | 35.173 | 27.192 | 0.000 | 1.167 | 209.62 | 22.872 | 1374.77 | |

| β1 | 0.163 | 0.120 | −0.072 | 0.398 | 1.358 | 0.174 | ||||||

| Monday 03–04 | β0 | 29.604 | 1.193 | 27.266 | 31.943 | 24.811 | 0.000 | 1.167 | 205.00 | 22.368 | 1371.03 | |

| β1 | 0.184 | 0.119 | −0.049 | 0.416 | 1.550 | 0.121 | ||||||

| Monday 09–10 | β0 | 47.775 | 3.670 | 40.582 | 54.968 | 13.018 | 0.000 | 1.019 | 232.84 | 25.715 | 1401.44 | |

| β1 | 0.241 | 0.131 | −0.015 | 0.497 | 1.842 | 0.065 | ||||||

| HUPX | Sunday 03–04 | β0 | 27.017 | 0.809 | 25.432 | 28.602 | 33.407 | 0.000 | 1.184 | 92.78 | 10.123 | 1237.84 |

| β1 | 0.327 | 0.062 | 0.204 | 0.449 | 5.240 | 0.000 | ||||||

| Sunday 09–10 | β0 | 31.860 | 0.892 | 30.111 | 33.608 | 35.722 | 0.000 | 1.141 | 89.08 | 9.838 | 1232.10 | |

| β1 | 0.379 | 0.061 | 0.259 | 0.499 | 6.178 | 0.000 | ||||||

| Monday 03–04 | β0 | 29.135 | 0.948 | 27.277 | 30.992 | 30.745 | 0.000 | 1.184 | 127.38 | 13.899 | 1291.09 | |

| β1 | 0.344 | 0.073 | 0.201 | 0.487 | 4.709 | 0.000 | ||||||

| Monday 09–10 | β0 | 58.480 | 0.998 | 56.523 | 60.436 | 58.589 | 0.000 | 1.184 | 141.32 | 15.420 | 1308.54 | |

| β1 | 0.423 | 0.077 | 0.273 | 0.574 | 5.505 | 0.000 |

| Group | Hour | Coef. | S.E. | Conf Int 2.5% | Conf Int 97.5% | z-Ratio | p-Value | VIF | Var (Resid.) | S.E. | IGLS | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| NORD POOL | Sunday 03–04 | β0 | 3.136 | 0.058 | 3.023 | 3.249 | 54.415 | 0.000 | 1.167 | 0.478 | 0.052 | 352.89 |

| β1 | 0.013 | 0.006 | 0.002 | 0.025 | 2.325 | 0.020 | ||||||

| Sunday 09–10 | β0 | 3.317 | 0.050 | 3.219 | 3.416 | 65.856 | 0.000 | 1.167 | 0.365 | 0.040 | 307.63 | |

| β1 | 0.012 | 0.005 | 0.002 | 0.022 | 2.446 | 0.014 | ||||||

| Monday 03–04 | β0 | 3.188 | 0.055 | 3.081 | 3.296 | 58.088 | 0.000 | 1.167 | 0.434 | 0.047 | 336.43 | |

| β1 | 0.014 | 0.005 | 0.003 | 0.025 | 2.565 | 0.010 | ||||||

| Monday 09–10 | β0 | 3.757 | 0.109 | 3.543 | 3.971 | 34.355 | 0.000 | 1.019 | 0.214 | 0.024 | 226.42 | |

| β1 | 0.008 | 0.004 | 0.000 | 0.016 | 2.082 | 0.037 | ||||||

| HUPX | Sunday 03–04 | β0 | 3.221 | 0.028 | 3.165 | 3.276 | 114.466 | 0.000 | 1.184 | 0.112 | 0.012 | 109.41 |

| β1 | 0.014 | 0.002 | 0.009 | 0.018 | 6.228 | 0.000 | ||||||

| Sunday 09–10 | β0 | 3.402 | 0.031 | 3.342 | 3.463 | 110.356 | 0.000 | 1.108 | 0.083 | 0.009 | 60.52 | |

| β1 | 0.013 | 0.002 | 0.009 | 0.017 | 6.933 | 0.000 | ||||||

| Monday 03–04 | β0 | 3.307 | 0.033 | 3.243 | 3.371 | 101.176 | 0.000 | 1.110 | 0.095 | 0.011 | 83.63 | |

| β1 | 0.012 | 0.002 | 0.008 | 0.016 | 5.978 | 0.000 | ||||||

| Monday 09–10 | β0 | 4.047 | 0.016 | 4.016 | 4.077 | 259.373 | 0.000 | 1.178 | 0.033 | 0.004 | −93.89 | |

| β1 | 0.007 | 0.001 | 0.005 | 0.010 | 6.123 | 0.000 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Rembeza, J.; Przekota, G. Influence of the Industry’s Output on Electricity Prices: Comparison of the Nord Pool and HUPX Markets. Energies 2022, 15, 6044. https://doi.org/10.3390/en15166044

Rembeza J, Przekota G. Influence of the Industry’s Output on Electricity Prices: Comparison of the Nord Pool and HUPX Markets. Energies. 2022; 15(16):6044. https://doi.org/10.3390/en15166044

Chicago/Turabian StyleRembeza, Jerzy, and Grzegorz Przekota. 2022. "Influence of the Industry’s Output on Electricity Prices: Comparison of the Nord Pool and HUPX Markets" Energies 15, no. 16: 6044. https://doi.org/10.3390/en15166044

APA StyleRembeza, J., & Przekota, G. (2022). Influence of the Industry’s Output on Electricity Prices: Comparison of the Nord Pool and HUPX Markets. Energies, 15(16), 6044. https://doi.org/10.3390/en15166044