Investment and Production Strategies of Renewable Energy Power under the Quota and Green Power Certificate System

Abstract

:1. Introduction

2. Literature Review

3. Model Description and Hypothesis

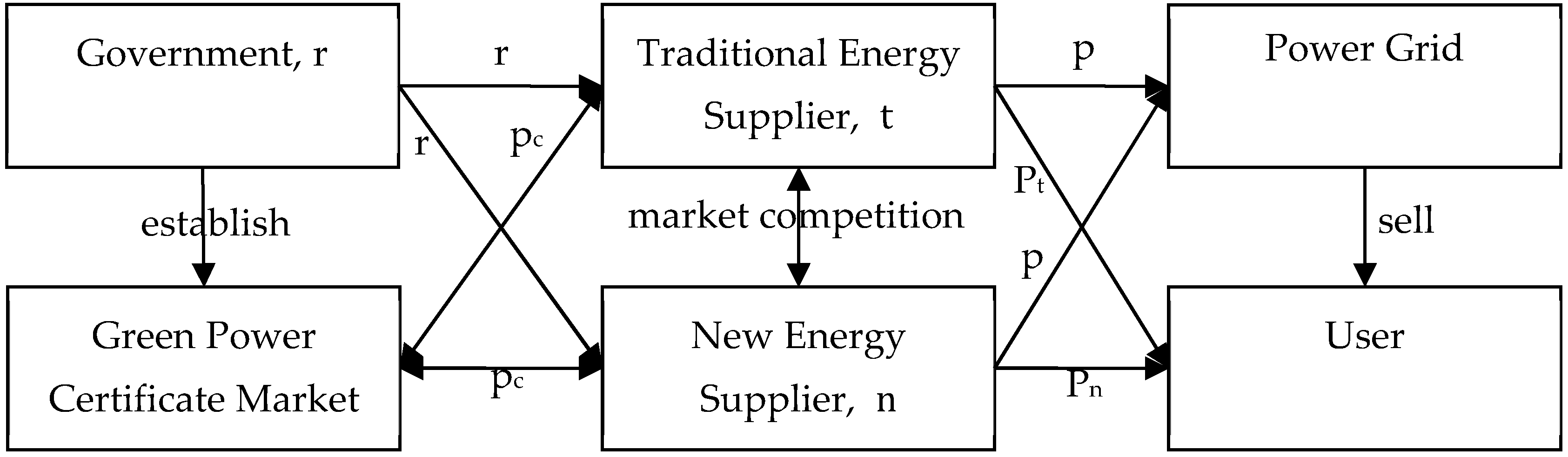

3.1. Model Description

3.2. Model Hypothesis and Establishment

4. Investment and Production Strategy Analysis of Renewable Energy Power under Different Scenarios

4.1. Investment and Production Strategy Analysis of Renewable Energy Power under the Scenario of Direct Sale of Power

4.2. Investment and Production Strategy Analysis of Renewable Energy Power under the Scenario of Purchase and Sale by Power Grids

5. Numerical Analysis

5.1. Impact of Quota Changes on the Investment and Production of Renewable Energy

5.2. Impact of Green Power Certificate Price on the Investment and Production of Renewable Energy

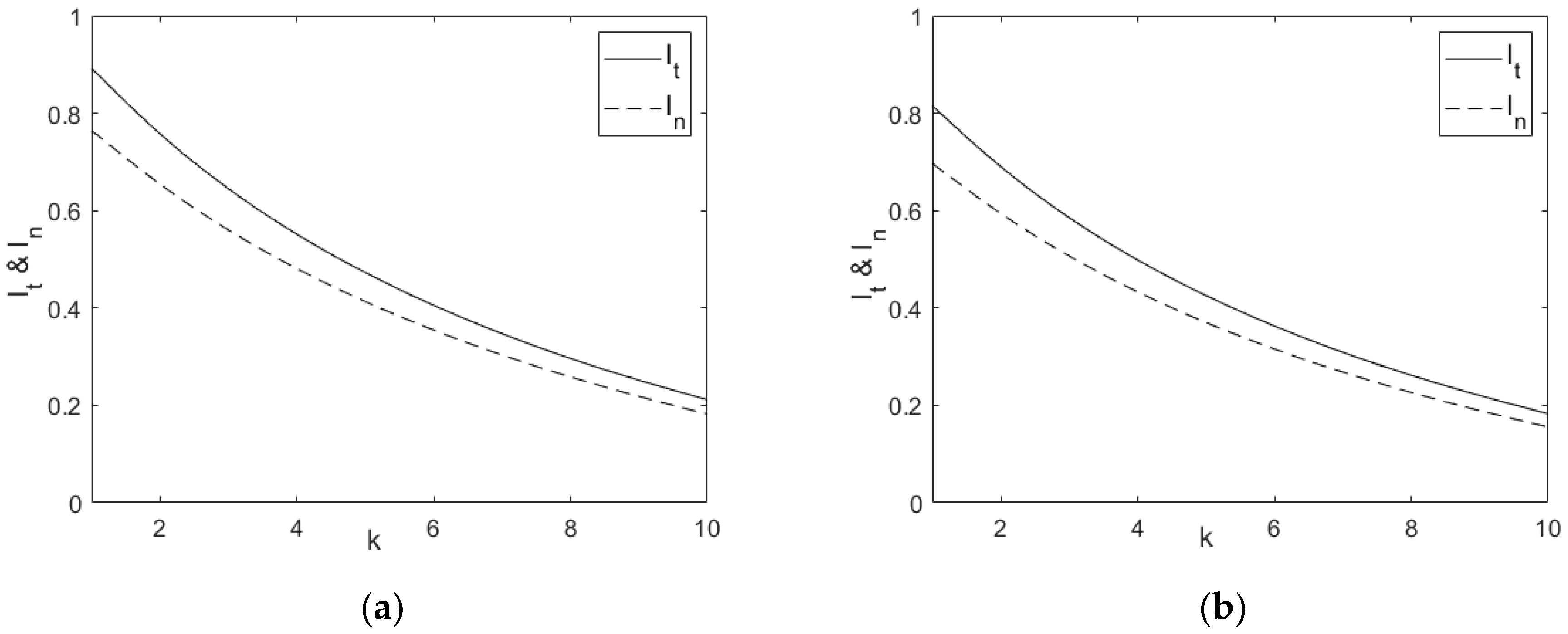

5.3. Impact of Technology Cost and User Preference on the Investment and Production of Renewable Energy

6. Discussion

7. Conclusions

Author Contributions

Funding

Conflicts of Interest

Nomenclature

| Abbreviations and acronyms | |

| Renewable energy quota | |

| Penalty fee for not fulfilling the quota | |

| Traditional energy supplier | |

| New energy supplier | |

| Functions and variables | |

| Utilization level of renewable energy of traditional energy supplier | |

| Utilization level of renewable energy of new energy supplier | |

| Market demand of traditional energy supplier (100 billion kW·h) | |

| Market demand of new energy supplier (100 billion kW·h) | |

| Price of traditional energy supplier (0.1 CNY/kW·h) | |

| Price of new energy supplier (0.1 CNY/kW·h) | |

| Purchase price of power grid (0.1 CNY/kW·h) | |

| Green power certificate price (0.1 CNY/kW·h) | |

| Cost of traditional energy supplier (0.1 CNY/kW·h) | |

| Cost of new energy supplier (0.1 CNY/kW·h) | |

| Market influences of traditional energy supplier (100 billion kW·h) | |

| Market influences of new energy supplier (100 billion kW·h) | |

| Revenue of traditional energy supplier (10 billion CNY) | |

| Revenue of new energy supplier (10 billion CNY) | |

| Parameters | |

| Cost elasticity coefficient of the utilization level of renewable energy | |

| Demand elasticity coefficient of price | |

| Substitution elasticity coefficient of price | |

| Demand elasticity coefficient of the utilization level of renewable energy | |

| Substitution elasticity coefficient of the utilization level of renewable energy | |

Appendix A. Proof of Theorem 2

Appendix B. Proof of Theorem 3

References

- Ding, Z.L. Research on China’s “Carbon Neutral” Framework Route. Available online: https://wenhui.whb.cn/third/baidu/202105/30/407093.html (accessed on 30 May 2021).

- National Development and Reform Commission of China; National Energy Board of China. 14th Five-Year Modern Energy System Planning. Available online: http://zfxxgk.nea.gov.cn/2022-01/29/c_1310524241.htm (accessed on 22 March 2022).

- National Development and Reform Commission of China; National Energy Board of China. Opinions on Improving the Institutional Mechanism and Policy Measures for Energy Green and Low-Carbon Transformation. Available online: http://zfxxgk.nea.gov.cn/2022-01/30/c_1310464313.htm (accessed on 10 February 2022).

- European Parliament and Council. The Promotion of the Use of Energy from Renewable Sources. Available online: https://eur-lex.europa.eu/eli/dir/2018/2001/oj (accessed on 11 December 2018).

- Sgouridis, S.; Carbajales, M.; Csala, D. Comparative net energy analysis of renewable electricity and carbon capture and storage. Nat. Energy 2019, 4, 456–465. [Google Scholar] [CrossRef] [Green Version]

- Hansen, K.; Breyer, C.; Lund, H. Status and perspectives on 100% renewable energy systems. Energy 2019, 175, 471–480. [Google Scholar] [CrossRef]

- Nagaraju, G.; Sekhar, S.C.; Ramulu, B. An Integrated Approach Toward Renewable Energy Storage Using Rechargeable Hybrid Supercapacitors. Small 2019, 15, 1805418. [Google Scholar] [CrossRef] [PubMed]

- Talluri, G.; Lozito, G.M.; Grasso, F.; Iturrino Garcia, C.; Luchetta, A. Optimal Battery Energy Storage System Scheduling within Renewable Energy Communities. Energies 2021, 14, 8480. [Google Scholar] [CrossRef]

- Mehrasa, M.; Pouresmaeil, E.; Sepehr, A. Control technique for the operation of grid-tied converters with high penetration of renewable energy resources. Electr. Power Syst. Res. 2019, 166, 18–28. [Google Scholar] [CrossRef]

- Tang, Z.G.; Yang, Y.H.; Blaabjerg, F. An Inter linking Converter for Renewable Energy Integration into Hybrid Grids. IEEE. T. Power. Electr. 2021, 36, 2499–2504. [Google Scholar] [CrossRef]

- Li, L.L.; Wen, S.Y.; Tseng, M.L. Renewable energy prediction: A novel short-term prediction model of photovoltaic output power. J. Clean. Prod. 2019, 228, 359–375. [Google Scholar] [CrossRef]

- Lund, P.D. Effects of energy policies on industry expansion in renewable energy. Renew. Energy 2008, 34, 53–64. [Google Scholar] [CrossRef]

- Nowak, M.J.; James, V.U.; Golubchikov, O. The Role of Spatial Policy Tools in Renewable Energy Investment. Energies 2022, 15, 2393. [Google Scholar] [CrossRef]

- De, F.R.A.; Vogel, E.P.; Korzenowski, A.L.; Oliveira, R.L.A. Stochastic model to aid decision making on investments in renewable energy generation: Portfolio diffusion and investor risk aversion. Renew. Energy 2020, 162, 1161–1176. [Google Scholar]

- Milone, D.; Curto, D.; Franzitta, V.; Guercio, A.; Cirrincione, M.; Mohammadi, A. An Economic Approach to Size of a Renewable Energy Mix in Small Islands. Energies 2022, 15, 2005. [Google Scholar] [CrossRef]

- Elkadeem, M.R.; Wang, S.R.; Sharshir, S.W. Feasibility analysis and techno-economic design of grid-isolated hybrid renewable energy system for electrification of agriculture and irrigation area: A case study in Dongola, Sudan. Energy Convers. Manag. 2019, 196, 1453–1478. [Google Scholar] [CrossRef]

- Lund, P.D.; Lindgren, J.; Mikkola, J. Review of energy system flexibility measures to enable high levels of variable renewable electricity. Renew. Sustain. Energy Rev. 2015, 45, 785–807. [Google Scholar] [CrossRef] [Green Version]

- Long, Y.; Wang, Y.; Pan, C. Auction Mechanism of Micro-Grid Project Transfer. Sustainability 2017, 9, 1895. [Google Scholar] [CrossRef] [Green Version]

- Long, Y.; Wang, Y.; Pan, C. Incentive Mechanism of Micro-grid Project Development. Sustainability 2018, 10, 163. [Google Scholar] [CrossRef] [Green Version]

- Long, Y.; Pan, C.; Wang, Y. Research on a Microgrid Subsidy Strategy Based on Operational Efficiency of the Industry Chain. Sustainability 2018, 10, 1519. [Google Scholar] [CrossRef] [Green Version]

- Zhang, X.L.; Wang, R.S.; Huo, M.L. A study of the role played by renewable energies in China’s sustainable energy supply. Energy 2009, 35, 4392–4399. [Google Scholar] [CrossRef]

- Parker, T. Sustainable energy: Cutting science’s electricity bill. Nature 2011, 480, 315–316. [Google Scholar] [CrossRef]

- Banos, R.; Manzano-Agugliaro, F.; Montoya, F.G. Optimization methods applied to renewable and sustainable energy: A review. Renew. Sustain. Energy Rev. 2011, 15, 1753–1766. [Google Scholar] [CrossRef]

- Wang, J.H.; Conejo, A.J.; Wang, C.S.; Yan, J.Y. Smart grids, renewable energy integration, and climate change mitigation—Future electric energy systems. Appl. Energy 2012, 96, 1–3. [Google Scholar] [CrossRef]

- Chu, S.; Majumdar, A. Opportunities and challenges for a sustainable energy future. Nature 2012, 488, 294–303. [Google Scholar] [CrossRef]

- Ellabban, O.; Abu-Rub, H.; Blaabjerg, F. Renewable energy resources: Current status, future prospects and their enabling technology. Renew. Sustain. Energy Rev. 2014, 39, 748–764. [Google Scholar] [CrossRef]

- Kunjana, C.; Somboon, N. Impact assessment of renewable generation on electricity demand characteristics. Renew. Sustain. Energy Rev. 2014, 39, 995–1004. [Google Scholar]

- Mathiesen, B.V.; Lund, H.; Connolly, D. Smart Energy Systems for coherent 100% renewable energy and transport solutions. Appl. Energy 2015, 145, 139–154. [Google Scholar] [CrossRef]

- Weitemeyer, S.; Kleinhans, D.; Vogt, T. Integration of Renewable Energy Sources in future power systems: The role of storage. Renew. Energy 2015, 75, 14–20. [Google Scholar] [CrossRef] [Green Version]

- Andrés, I.; Rodrigo, M.; Alejandro, B.; Hugh, R. CVaR constrained planning of renewable generation with consideration of system inertial response, reserve services and demand participation. Energy Econ. 2016, 59, 104–117. [Google Scholar]

- Wang, H.Z.; Lei, Z.X.; Zhang, X. A review of deep learning for renewable energy forecasting. Energy Convers. Manag. 2019, 198, 111799. [Google Scholar] [CrossRef]

- Dominguez-Navarro, J.A.; Dufo-Lopez, R.; Yusta-Loyo, J.M. Design of an electric vehicle fast-charging station with integration of renewable energy and storage systems. Int. J. Elec. Power 2019, 105, 46–58. [Google Scholar] [CrossRef]

- Vergara-Dietrich, J.D.; Morato, M.M.; Mendes, P.R.C. Advanced chance-constrained predictive control for the efficient energy management of renewable power systems. J. Process. Contr. 2019, 74, 120–132. [Google Scholar] [CrossRef]

- Hustveit, M.; Forgner, J.S.; Fleten, S.E. Tradable green certificates for renewable support: The role of expectations and uncertainty. Energy 2017, 141, 1717–1727. [Google Scholar] [CrossRef]

- Alizamir, S.; de Véricourt, F.; Sun, P. Efficient feed-in-tariff policies for renewable energy technologies. Rairo-Oper. Res. 2016, 64, 52–66. [Google Scholar] [CrossRef] [Green Version]

- Sun, J.; Li, M.; Zhang, Z.; Xu, T.; He, J.; Wang, H.; Li, G. Renewable Energy Transmission by HVDC Across the Continent: System Challenges and Opportunities. CSEE. J. Power Energy 2017, 3, 353–364. [Google Scholar] [CrossRef]

- Yang, X.L.; He, L.Y.; Xia, Y.F.; Chen, Y.F. Effect of government subsidies on renewable energy investments: The threshold effect. Energy Policy 2019, 132, 156–166. [Google Scholar] [CrossRef]

- Zhang, Q.; Wang, G.; Li, Y. Substitution effect of renewable portfolio standards and renewable energy certificate trading for feed-in tariff. Appl. Energy 2018, 227, 426–435. [Google Scholar] [CrossRef] [Green Version]

- Vlachos, A.G.; Biskas, P.N. Embedding renewable energy pricing policies in day-ahead electricity market clearing. Electr. Power Syst. Res. 2014, 116, 311–321. [Google Scholar] [CrossRef]

- Brockway, P.E.; Owen, A.; Brand-Correa, L.I. Estimation of global final-stage energy-return-on-investment for fossil fuels with comparison to renewable energy sources. Nat. Energy 2019, 4, 612–621. [Google Scholar] [CrossRef] [Green Version]

- Blaszke, M.; Nowak, M.; Śleszyński, P.; Mickiewicz, B. Investments in Renewable Energy Sources in the Concepts of Local Spatial Policy: The Case of Poland. Energies 2021, 14, 7902. [Google Scholar] [CrossRef]

| The Scenario of Direct Sale of Power | ||||||||

|---|---|---|---|---|---|---|---|---|

| 0.1 | 0.091 | 0.562 | 5.483 | 5.983 | 23.235 | 12.885 | 52.622 | 24.422 |

| 0.3 | 0.243 | 0.653 | 5.335 | 5.714 | 24.496 | 13.553 | 53.523 | 25.083 |

| 0.5 | 0.346 | 0.744 | 5.218 | 5.522 | 25.153 | 14.205 | 54.441 | 25.770 |

| 0.7 | 0.424 | 0.835 | 5.111 | 5.335 | 26.285 | 14.795 | 53.586 | 26.445 |

| 0.9 | 0.487 | 0.926 | 5.033 | 5.274 | 26.515 | 15.126 | 52.787 | 27.265 |

| The Scenario of Purchase and Sale by Large Power Grids | ||||||||

| 0.1 | 0.093 | 0.573 | - | - | 36.745 | 12.645 | 35.745 | 6.322 |

| 0.3 | 0.242 | 0.669 | - | - | 38.473 | 13.323 | 36.478 | 6.915 |

| 0.5 | 0.375 | 0.765 | - | - | 40.055 | 13.815 | 37.955 | 7.665 |

| 0.7 | 0.474 | 0.861 | - | - | 40.827 | 14.105 | 35.202 | 8.285 |

| 0.9 | 0.543 | 0.958 | - | - | 41.265 | 14.268 | 34.365 | 8.891 |

| The Scenario of Direct Sale of Power | ||||||||

|---|---|---|---|---|---|---|---|---|

| 0.1 | 0.085 | 0.533 | 5.459 | 5.783 | 22.915 | 13.125 | 43.118 | 24.266 |

| 0.2 | 0.113 | 0.609 | 5.295 | 5.595 | 23.838 | 14.031 | 44.462 | 25.167 |

| 0.3 | 0.151 | 0.685 | 5.177 | 5.444 | 24.585 | 15.184 | 45.633 | 26.017 |

| 0.4 | 0.212 | 0.761 | 5.086 | 5.358 | 25.072 | 16.203 | 44.897 | 26.978 |

| 0.5 | 0.276 | 0.839 | 5.024 | 5.289 | 25.328 | 17.545 | 43.951 | 27.863 |

| The Scenario of Purchase and Sale by Large Power Grids | ||||||||

| 0.1 | 0.093 | 0.514 | - | - | 36.785 | 12.565 | 21.598 | 4.164 |

| 0.2 | 0.118 | 0.553 | - | - | 38.273 | 13.161 | 22.474 | 4.336 |

| 0.3 | 0.147 | 0.608 | - | - | 39.345 | 13.869 | 23.332 | 4.689 |

| 0.4 | 0.192 | 0.886 | - | - | 40.172 | 13.727 | 22.344 | 5.213 |

| 0.5 | 0.258 | 0.778 | - | - | 40.595 | 15.855 | 21.292 | 5.890 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Song, M.; Wang, Y.; Long, Y. Investment and Production Strategies of Renewable Energy Power under the Quota and Green Power Certificate System. Energies 2022, 15, 4110. https://doi.org/10.3390/en15114110

Song M, Wang Y, Long Y. Investment and Production Strategies of Renewable Energy Power under the Quota and Green Power Certificate System. Energies. 2022; 15(11):4110. https://doi.org/10.3390/en15114110

Chicago/Turabian StyleSong, Min, Yu Wang, and Yong Long. 2022. "Investment and Production Strategies of Renewable Energy Power under the Quota and Green Power Certificate System" Energies 15, no. 11: 4110. https://doi.org/10.3390/en15114110

APA StyleSong, M., Wang, Y., & Long, Y. (2022). Investment and Production Strategies of Renewable Energy Power under the Quota and Green Power Certificate System. Energies, 15(11), 4110. https://doi.org/10.3390/en15114110