Impact of the COVID-19 Pandemic Crisis on the Efficiency of European Intraday Electricity Markets

Abstract

:1. Introduction

1.1. Contributions

1.2. Paper Structure

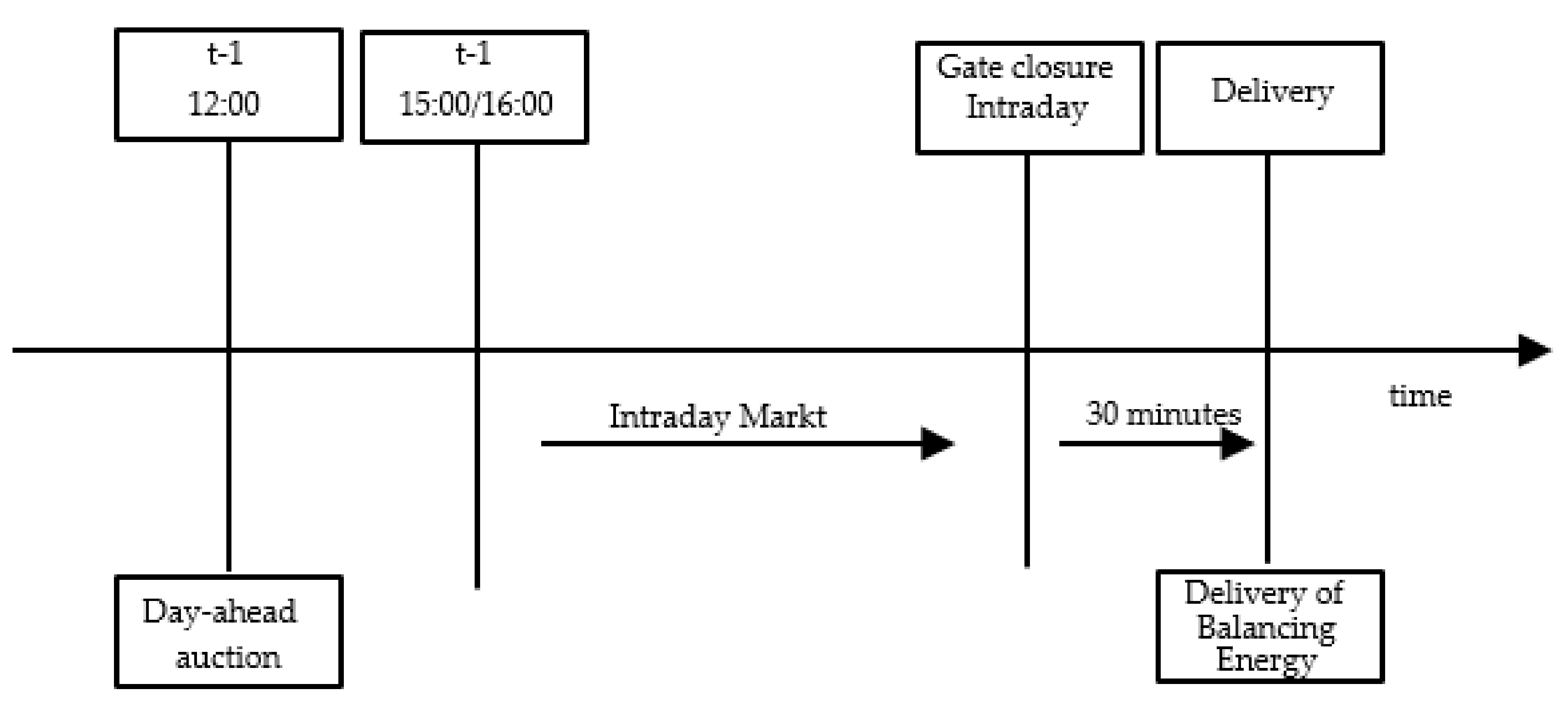

2. Materials and Methods

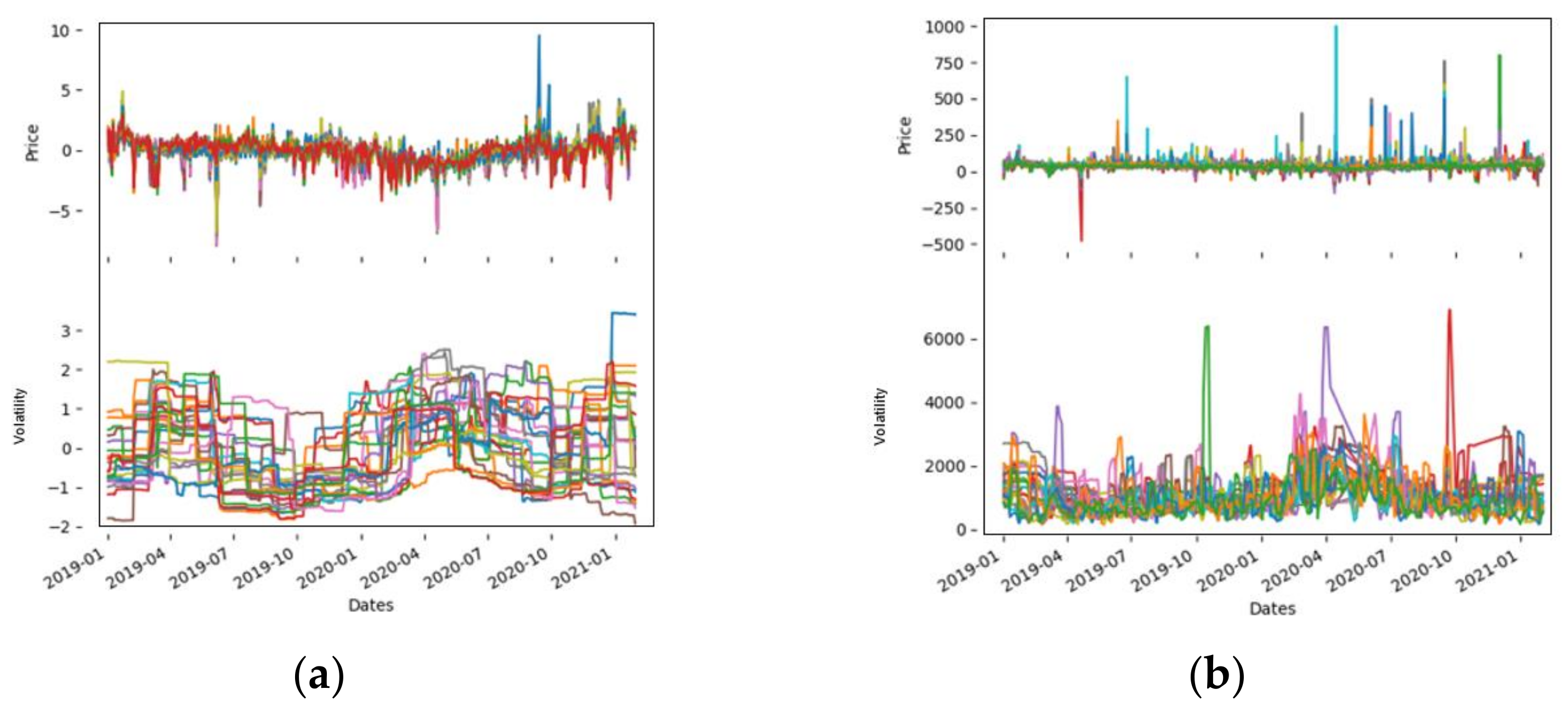

2.1. Price Analysis

- S = Spot Price

- σ = Spot Price Volatility

- dt = variance

2.2. Volume Analysis

2.3. Programming Language

2.4. Data

2.4.1. Electricity Prices

2.4.2. Electricity Volumes

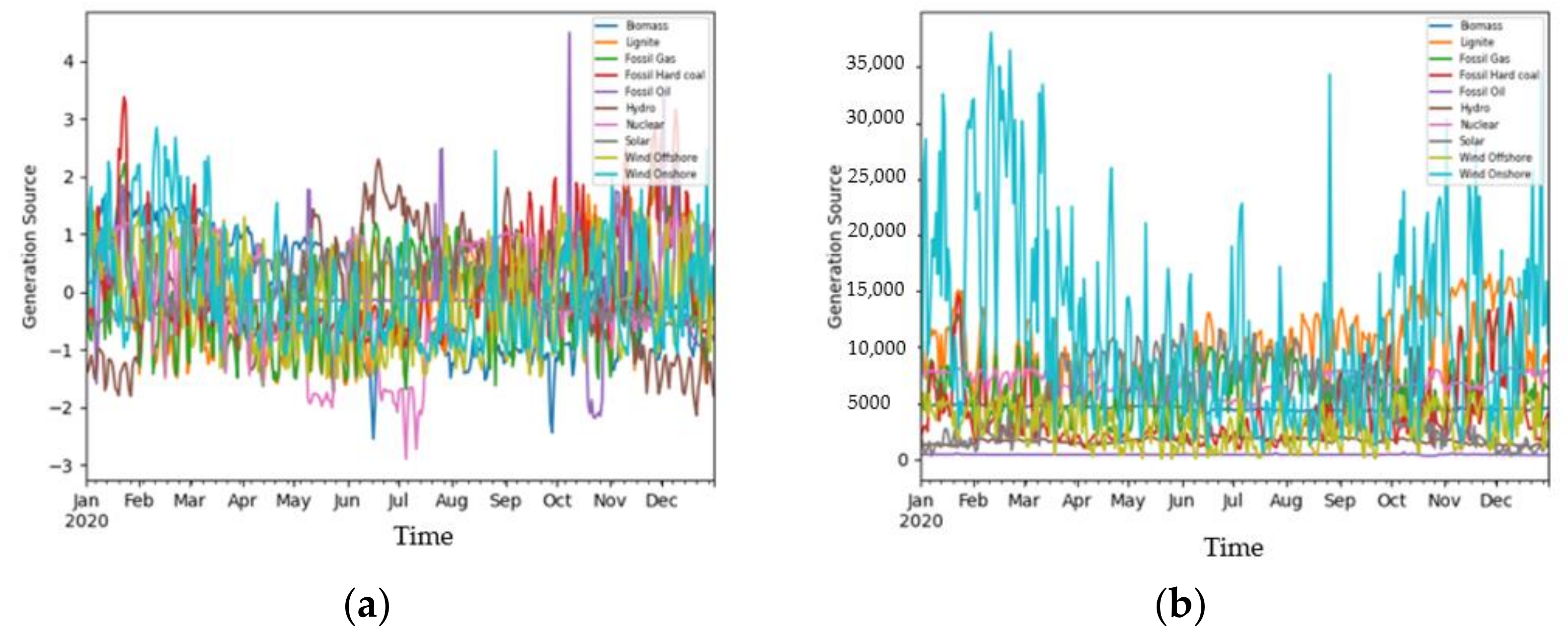

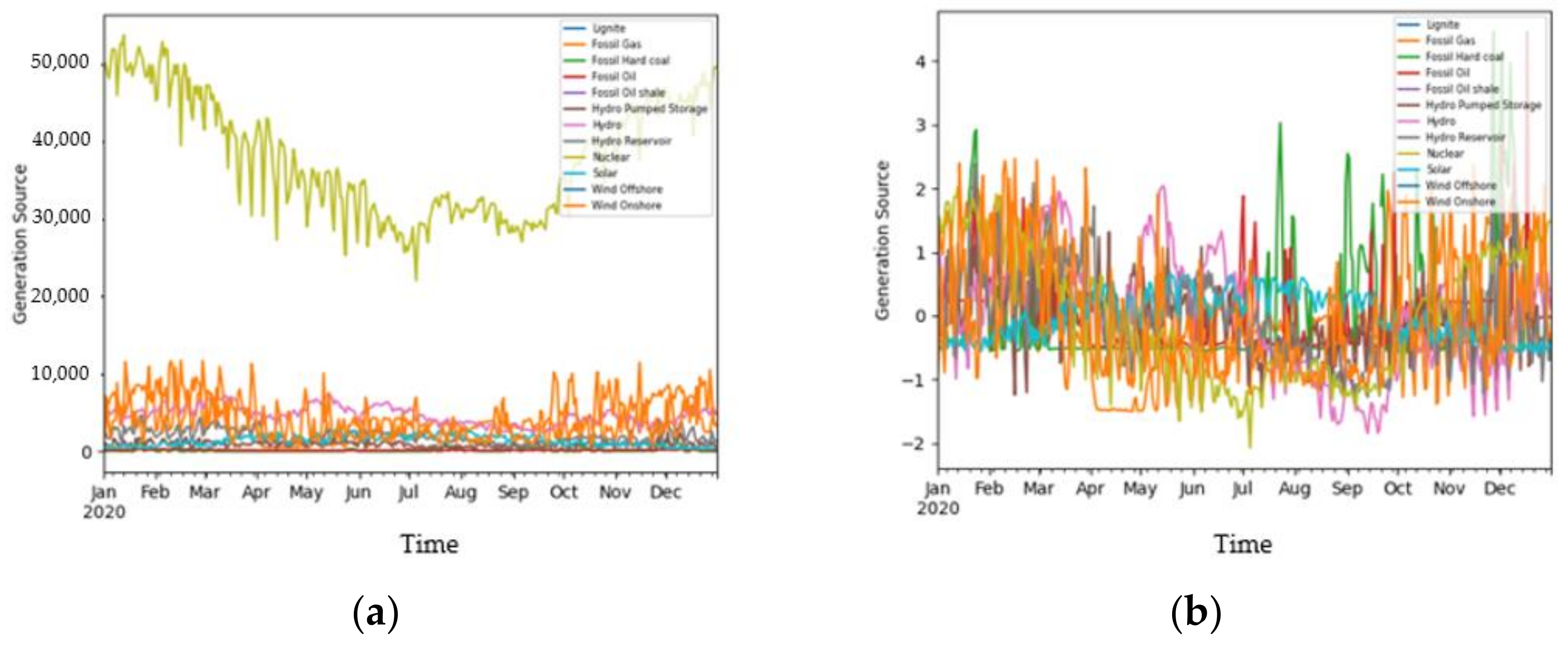

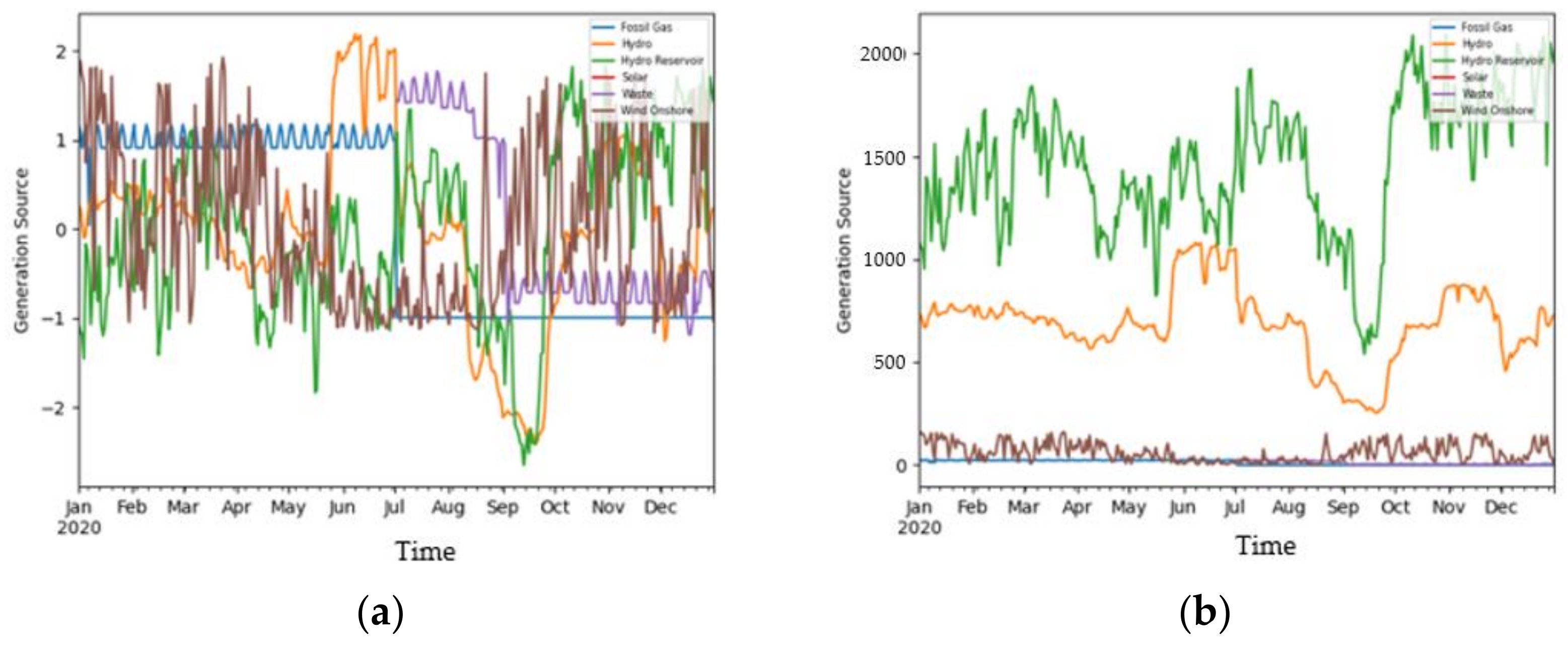

2.4.3. Electricity Generation

3. Results

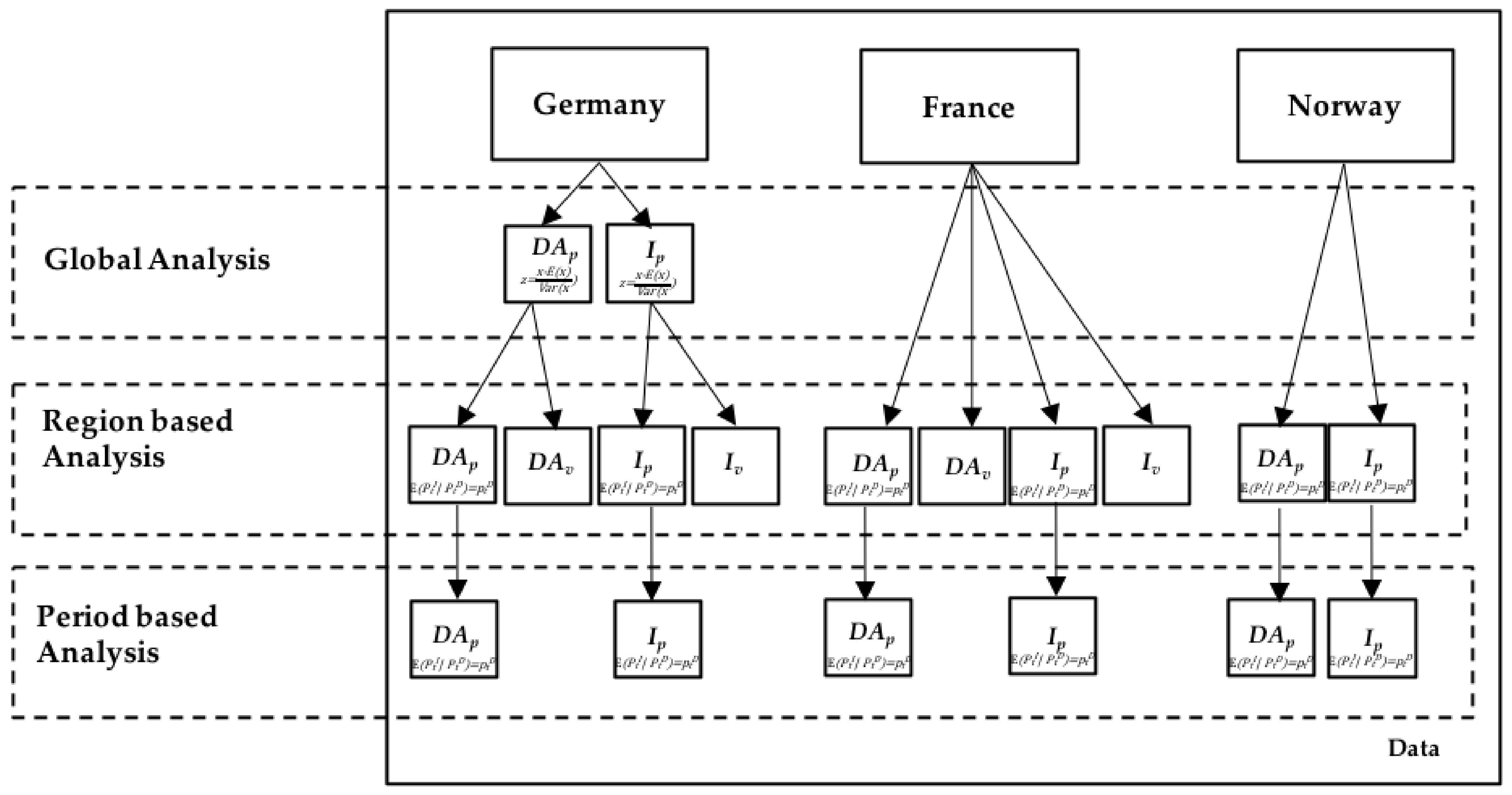

3.1. Results on the Overall Investigation

3.2. German Electricity Prices

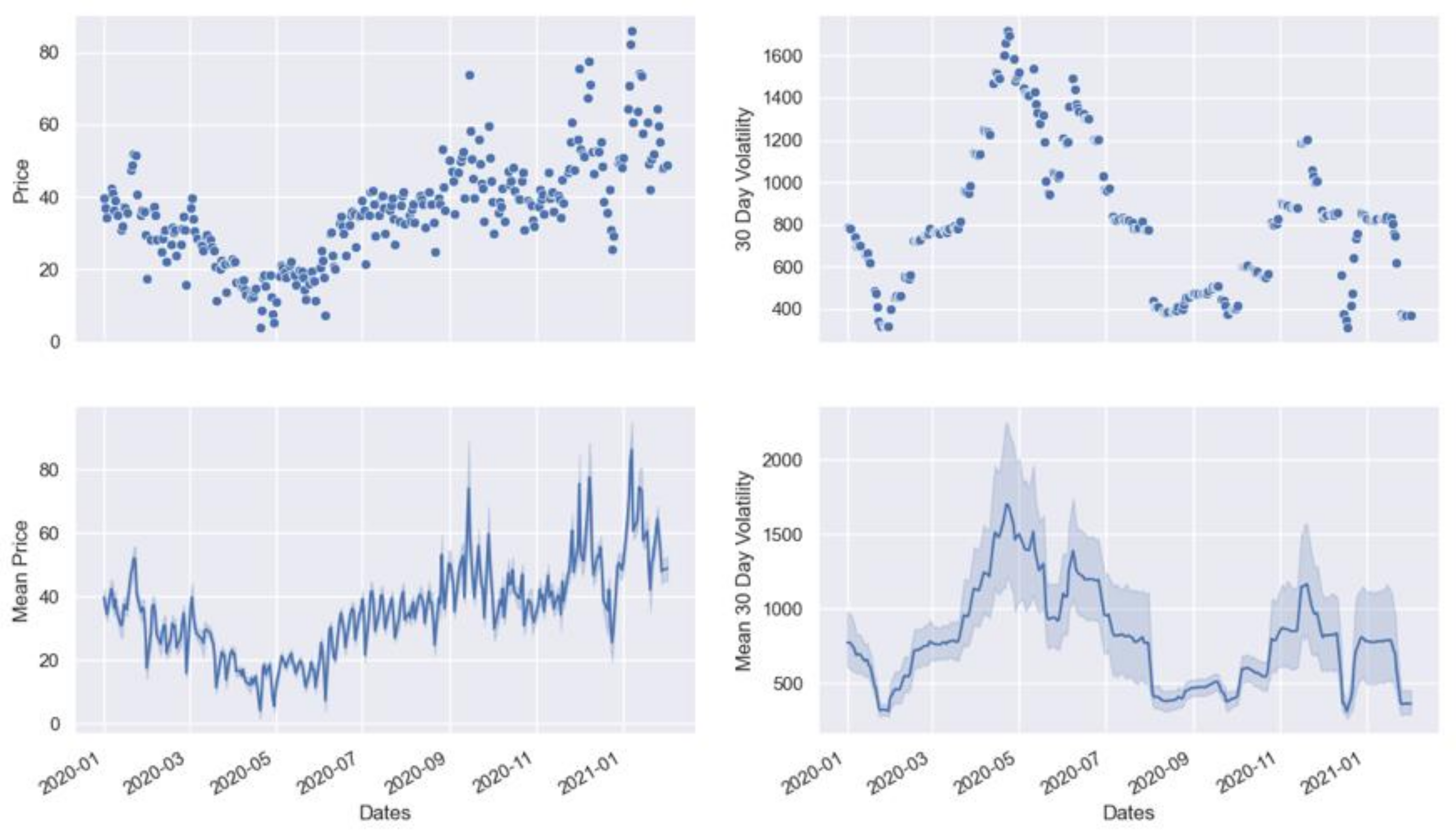

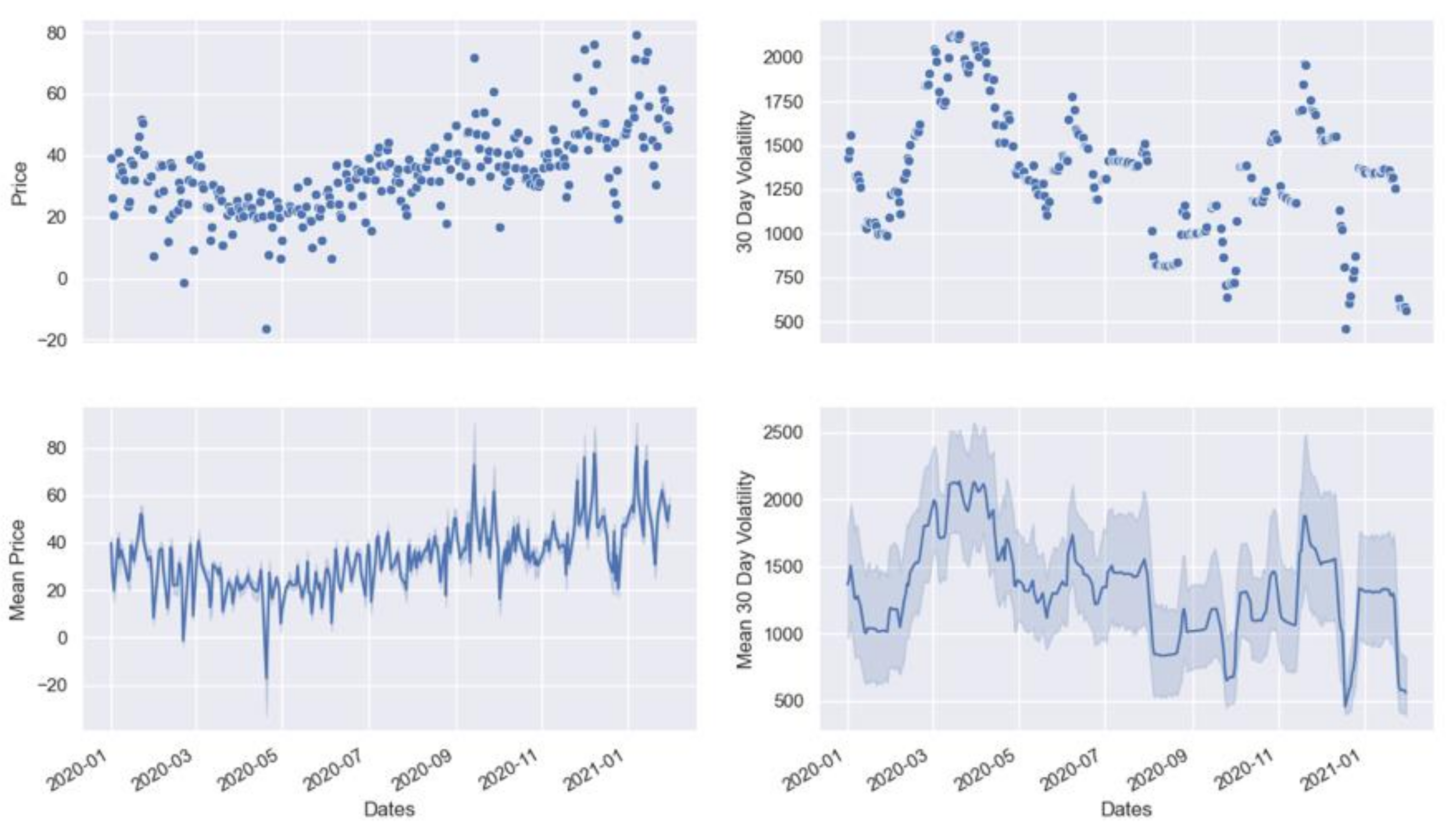

3.2.1. German Intraday Prices

3.2.2. German Day-Ahead Prices

- Compared with France and NO1, Germany has the most diverse energy mix, but is also heavily dependent on the fluctuating energy production from on-shore wind, which accounts for the largest share even before lignite;

- The wide confidence levels could be explained by the strongly fluctuating electricity production via offshore wind;

- Day-ahead and intraday prices diverge sharply in the first half of the year but have converged significantly in the second half of the year;

- The first lockdown shows a fundamentally lower price level than the second. At the same time, the first lockdown is the period with the highest volatility;

- The price level in January 2021 is significantly higher than the price level in January 2020.

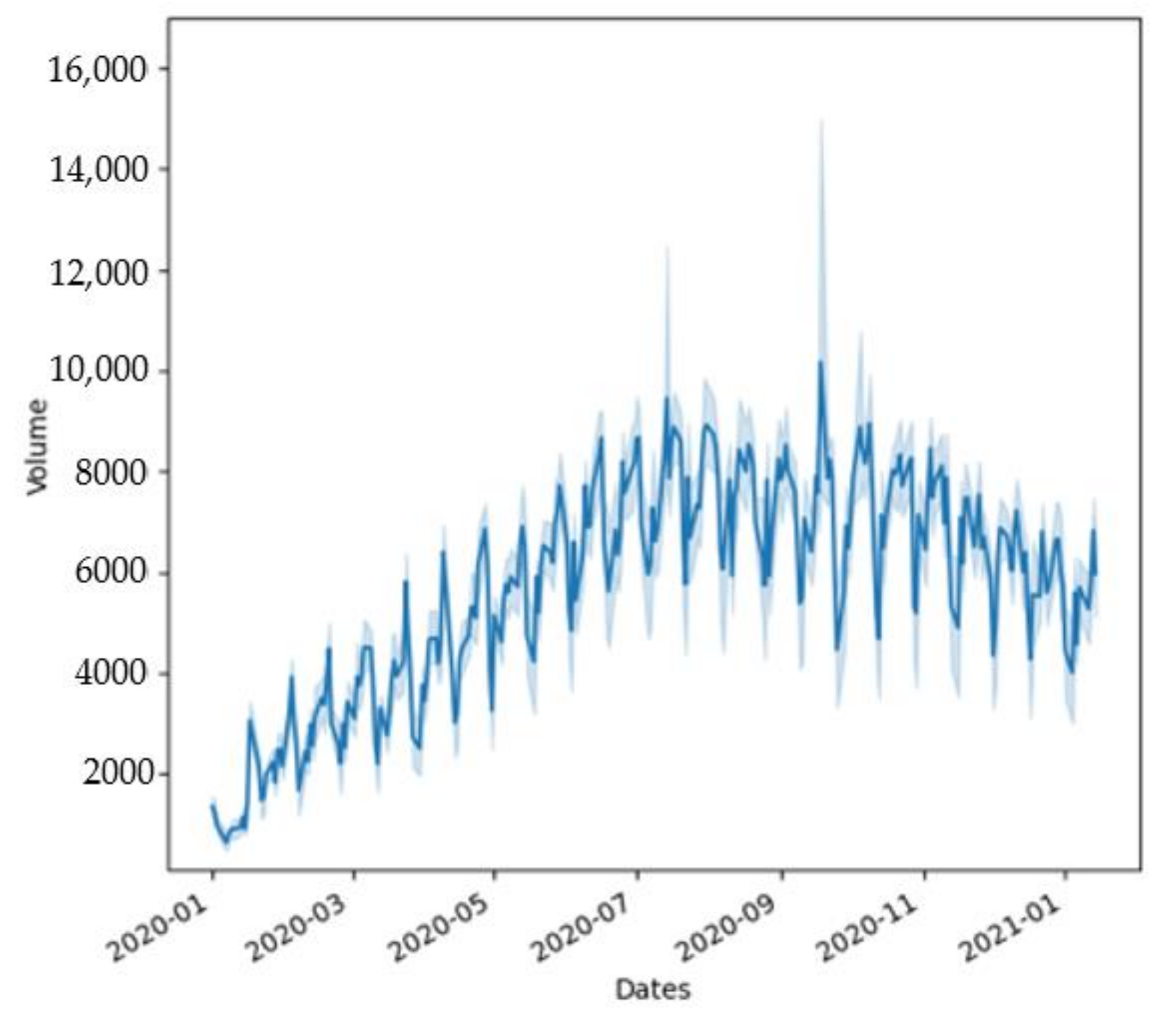

3.2.3. German Traded Volumes

- In January 2020, higher volumes were traded than in January 2021;

- In the first lockdown, the standard deviation in the day-ahead area was higher than in later periods, and more average daily volume was traded in the day-ahead market. It does not decrease again until late summer;

- On the day-ahead market, it is noticeable that the confidence level is always quite constant and that the volumes increase in the summer months;

- In the second lockdown, more was traded in the intraday area/less was traded in the day-ahead area (compared to the first lockdown period).

3.3. French Electricity Prices

3.3.1. French Intraday Prices

3.3.2. French Day-Ahead Prices

- In France, less nuclear power is produced in the summer months, and a little more use is made of renewable energy sources such as solar. No link between generation and price level is visible;

- Table 5 shows that there are no major fluctuations between day-ahead and intraday. Thus, it can be said for the forecast accuracy that it is higher in France;

- In the first lockdown, prices fell sharply and showed a high volatility. In the second lockdown, prices rose sharply, and volatility was low;

- Day-ahead and intraday prices were always close to each other in the mean and median. However, they also show strong outliers.

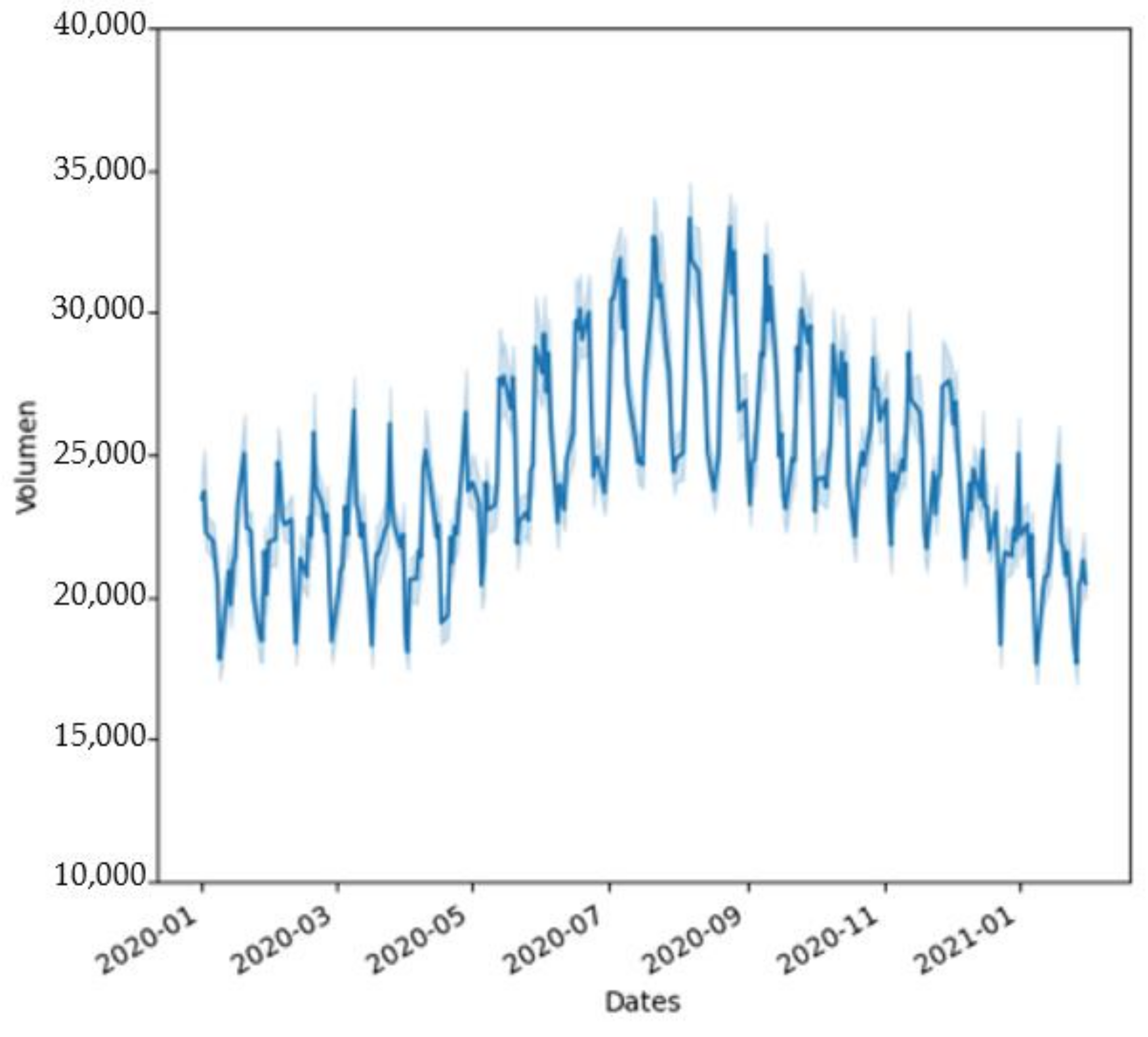

3.3.3. French Traded Volumes

- During the first lockdown, less than normal trading took place on the intraday market;

- During the second lockdown, the most trading took place on the intraday market. The standard deviation was also above average;

- During the summer months, less than average was traded via the day-ahead market;

- In January 2021, more than the average was traded on the day-ahead market and more compared to the previous year;

- The standard deviation of the day-ahead volumes is quite constant.

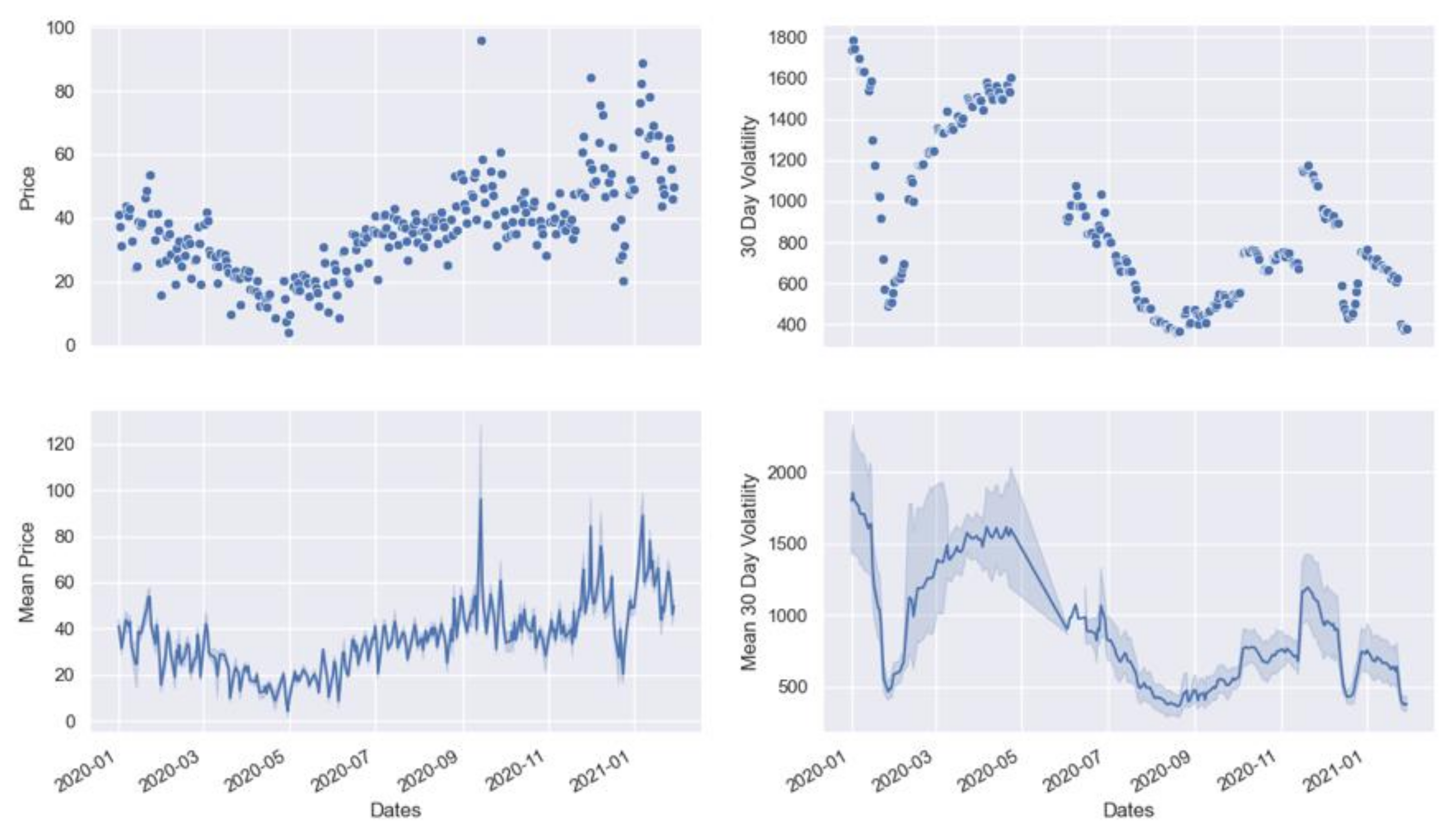

3.4. Norwegian Electricity Prices

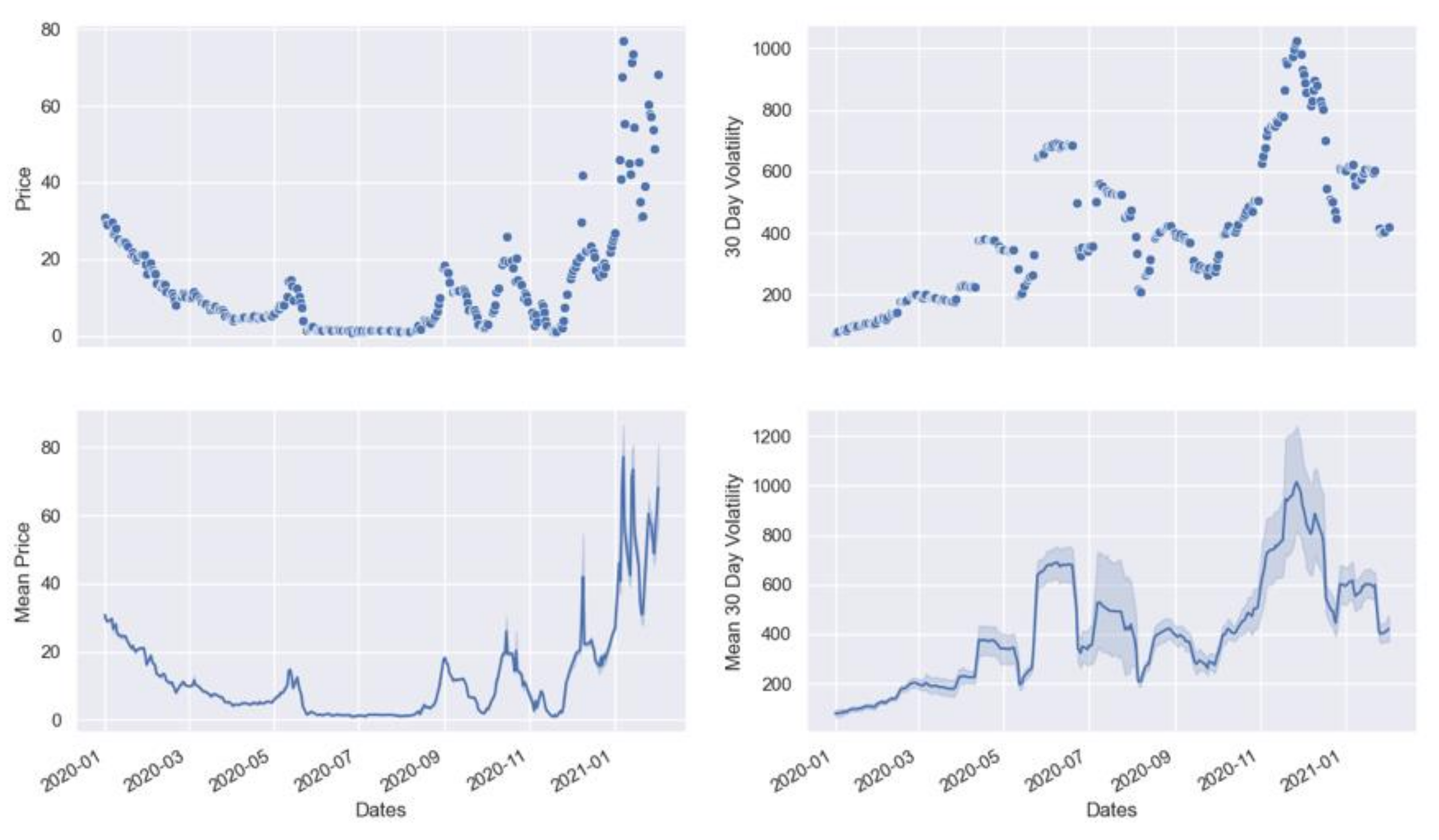

3.4.1. NO1 Intraday Prices

3.4.2. NO1 Day-Ahead Prices

- During the first lockdown, the price in the day-ahead and intraday area fell sharply. This trend was reinforced in the summer months. In the summer months, less electricity was produced by waste and wind power;

- In the second lockdown, the price level and the level of volatility increased. At the beginning of the second lockdown, the production of hydropower by water reservoirs collapsed;

- The price level in January 2021 is significantly higher than the price level in January 2020. The same applies to volatility;

- Intraday and day-ahead prices both have low confidence level shears and have a similar shape (low prices in summer and high prices in winter);

- There are no strong outliers, as is the case with German and French prices. Intraday prices show more outliers than Day-Ahead prices;

- Hydropower as the largest generation source can be stored and is more independent of the weather;

- Both curves show very similar price and volatility developments.

4. Discussion

4.1. Critical Appraisal

4.2. Research Limitations

5. Conclusions and Outlook

- All products considered show a higher price in January 2021 compared to the previous year;

- In the case of German electricity, however, a lower daily average volume was traded in January 2021 compared to the previous year. The volume in France remains constant in the intraday area and is increased in the day-ahead area;

- All prices considered fell in the first lockdown, whereas volatilities rose sharply in some cases;

- In contrast to France and Germany, the electricity prices for NO1 show fewer outliers, which could be explained by the generation from water reservoirs and hydropower;

- All prices increased in the second lockdown. Unlike the other products, the volatility of NO1 increased particularly strongly in the second lockdown. This suggests that NO1 was hit harder by the second lockdown than by the first.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Marshman, D.; Brear, M.; Jeppesen, M.; Ring, B. Performance of wholesale electricity markets with high wind penetration. Energy Econ. 2020, 89, 104803. [Google Scholar] [CrossRef]

- Detemple, J.; Kitapbayev, Y. The value of green energy under regulation uncertainty. Energy Econ. 2020, 89, 104807. [Google Scholar] [CrossRef]

- Härtel, P.; Korpås, M. Demystifying market clearing and price setting effects in low-carbon energy systems. Energy Econ. 2020, 93, 105051. [Google Scholar] [CrossRef]

- Halbrügge, S.; Schott, P.; Weibelzahl, M.; Buhl, H.U.; Fridgen, G.; Schöpf, M. How did the German and other European electricity systems react to the COVID-19 pandemic? Appl. Energy 2021, 285, 116370. [Google Scholar] [CrossRef]

- Ghiani, E.; Galici, M.; Mureddu, M.; Pilo, F. Impact on Electricity Consumption and Market Pricing of Energy and Ancillary Services during Pandemic of COVID-19 in Italy. Energies 2020, 13, 3357. [Google Scholar] [CrossRef]

- Duso, T.; Szücs, F.; Böckers, V. Abuse of dominance and antitrust enforcement in the German electricity market. Energy Econ. 2020, 92, 104936. [Google Scholar] [CrossRef]

- Kuppelwieser, T.; Wozabal, D. Intraday Power Trading: Towards an Arms Race in Weather Forecasting? Eur. J. Oper. Res. 2021, in press. [Google Scholar]

- ENTSO-E. Actual Generation per Production Type. Available online: https://transparency.entsoe.eu/generation/r2/actualGenerationPerProductionType/show (accessed on 5 June 2021).

- Ali, J.; Khan, W. Impact of COVID-19 pandemic on agricultural wholesale prices in India: A comparative analysis across the phases of the lockdown. Public Aff. 2020, 20, e2402. [Google Scholar] [CrossRef]

- Elsayed, A.H.; Nasreen, S.; Tiwari, A.K. Time-varying co-movements between energy market and global financial markets: Implication for portfolio diversification and hedging strategies. Energy Econ. 2020, 90, 104847. [Google Scholar] [CrossRef]

- Bompard, E.; Mosca, C.; Colella, P.; Antonopoulos, G.; Fulli, G.; Masera, M.; Poncela-Blanco, M.; Vitiello, S. The Immediate Impacts of COVID-19 on European Electricity Systems: A First Assessment and Lessons Learned. Energies 2020, 14, 96. [Google Scholar] [CrossRef]

- Adekoya, O.B.; Oliyide, J.A. How COVID-19 drives connectedness among commodity and financial markets: Evidence from TVP-VAR and causality-in-quantiles techniques. Resour. Policy 2020, 70, 101898. [Google Scholar] [CrossRef] [PubMed]

- Han, L.; Kordzakhia, N.; Trück, S. Volatility spillovers in Australian electricity markets. Energy Econ. 2020, 90, 104782. [Google Scholar] [CrossRef]

- Fezzi, C.; Fanghella, V. Real-Time Estimation of the Short-Run Impact of COVID-19 on Economic Activity Using Electricity Market Data. Environ. Resour. Econ. 2020, 76, 885–900. [Google Scholar] [CrossRef] [PubMed]

- Kath, C.; Ziel, F. The value of forecasts: Quantifying the economic gains of accurate quarter-hourly electricity price forecasts. Energy Econ. 2018, 76, 411–423. [Google Scholar] [CrossRef] [Green Version]

- Kath, C.; Ziel, F. Conformal prediction interval estimation and applications to day-ahead and intraday power markets. Int. J. Forecast. 2021, 37, 777–799. [Google Scholar] [CrossRef]

- Finnah, B.; Gönsch, J.; Ziel, F. Integrated day-ahead and intraday self-schedule bidding for energy storage systems using approximate dynamic programming. Eur. J. Oper. Res. 2021, 301, 726–746. [Google Scholar] [CrossRef]

- Maciejowska, K.; Nitka, W.; Weron, T. Day-Ahead vs. Intraday—Forecasting the Price Spread to Maximize Economic Benefits. Energies 2019, 12, 631. [Google Scholar] [CrossRef] [Green Version]

- Kramer, A.; Kiesel, R. Exogenous factors for order arrivals on the intraday electricity market. Energy Econ. 2021, 97, 105186. [Google Scholar] [CrossRef]

- Ghosh, S.; Bohra, A.; Dutta, S. The Texas Freeze of February 2021: Event and Winterization Analysis Using Cost and Pricing Data. In Proceedings of the IEEE Electrical Power and Energy Conference (EPEC), Toronto, ON, Canada, 22–31 October 2021; IEEE: Piscataway, NJ, USA; pp. 7–13. [Google Scholar] [CrossRef]

- Xiao, D.; AlAshery, M.K.; Qiao, W. Optimal price-maker trading strategy of wind power producer using virtual bidding. J. Mod. Power Syst. Clean Energy 2021, 1–13. [Google Scholar] [CrossRef]

- Snow, D. Machine Learning in Asset Management. SSRN Electron. J. 2019. [Google Scholar] [CrossRef]

- Rintamäki, T.; Siddiqui, A.S.; Salo, A. Does renewable energy generation decrease the volatility of electricity prices? An analysis of Denmark and Germany. Energy Econ. 2017, 62, 270–282. [Google Scholar] [CrossRef] [Green Version]

- Cramton, P. Electricity market design. Oxf. Rev. Econ. Policy 2017, 33, 589–612. [Google Scholar] [CrossRef] [Green Version]

- Malec, M.; Kinelski, G.; Czarnecka, M. The Impact of COVID-19 on Electricity Demand Profiles: A Case Study of Selected Business Clients in Poland. Energies 2021, 14, 5332. [Google Scholar] [CrossRef]

- Pilipović, D. Energy Risk; McGraw-Hill: New York, NY, USA, 1998; pp. 100–101. [Google Scholar]

- Verbeek, M. Modern Econometrics, 5th ed.; Wiley Custom: Croydon, UK, 2017; pp. 167–173. [Google Scholar]

- Löhndorf, N.; Wozabal, D. The Value of Coordination in Multimarket Bidding of Grid Energy Storage. Work. Pap. 2021. [Google Scholar] [CrossRef]

- Robert Koch Institut. Available online: https://www.rki.de/DE/Content/InfAZ/N/Neuartiges_Corona-virus/nCoV_node.html (accessed on 5 June 2021).

- Valitov, N.; Maier, A. Asymmetric information in the German intraday electricity market. Energy Econ. 2020, 89, 104785. [Google Scholar] [CrossRef]

- Governement. Available online: https://www.gouvernement.fr/en/coronavirus-covid-19 (accessed on 5 June 2021).

- Ursin, G.; Skjesol, I.; Tritter, J. The COVID-19 pandemic in Norway: The dominance of social implications in framing the policy response. Health Policy Technol. 2020, 9, 663–672. [Google Scholar] [CrossRef]

- Government.no. URL. Available online: https://www.regjeringen.no/en/topics/koronavirus-covid-19/id2692388/ (accessed on 5 June 2021).

- Wang, B.; Wang, J. Energy futures and spots prices forecasting by hybrid SW-GRU with EMD and error evaluation. Energy Econ. 2020, 90, 104827. [Google Scholar] [CrossRef]

- Se Prado, M.M.L. Machine Learning for Asset Managers; Cambridge University Press: Cambridge, UK, 2020; pp. 19–20. [Google Scholar]

- Selmi, R.; Bouoiyour, J.; Hammoudeh, S. Negative Oil: Coronavirus, a “Black Swan” Event for the Industry? 2020. Available online: https://hal.archives-ouvertes.fr/hal-02570614/document (accessed on 5 June 2021).

- Agnello, L.; Castro, V.; Hammoudeh, S.; Sousa, R.M. Global factors, uncertainty, weather conditions and energy prices: On the drivers of the duration of commodity price cycle phases. Energy Econ. 2020, 90, 104862. [Google Scholar] [CrossRef]

- Glas, S.; Kiesel, R.; Kolkmann, S.; Kremer, M.; Von Luckner, N.G.; Ostmeier, L.; Urban, K.; Weber, C. Intraday renewable electricity trading: Advanced modeling and numerical optimal control. J. Math. Ind. 2020, 10, 3. [Google Scholar] [CrossRef]

- Kiesel, R.; Paraschiv, F. Econometric analysis of 15-minute intraday electricity prices. Energy Econ. 2017, 64, 77–90. [Google Scholar] [CrossRef] [Green Version]

- Hadsell, L. The impact of virtual bidding on price volatility in New York’s wholesale electricity market. Econ. Lett. 2007, 95, 66–72. [Google Scholar] [CrossRef]

- Iria, J.; Soares, F.; Matos, M. Optimal supply and demand bidding strategy for an aggregator of small prosumers. Appl. Energy 2018, 213, 658–669. [Google Scholar] [CrossRef]

- Grimm, V.; Rückel, B.; Sölch, C.; Zöttl, G. The impact of market design on transmission and generation investment in electricity markets. Energy Econ. 2020, 93, 104934. [Google Scholar] [CrossRef]

- De Lagarde, C.M.; Lantz, F. How renewable production depresses electricity prices: Evidence from the German market. Energy Policy 2018, 117, 263–277. [Google Scholar] [CrossRef]

- Liu, L.; Bai, F.; Su, C.; Ma, C.; Yan, R.; Li, H.; Sun, Q.; Wennersten, R. Forecasting the occurrence of extreme electricity prices using a multivariate logistic regression model. Energy 2022, 247, 123417. [Google Scholar] [CrossRef]

- Tschora, L.; Pierre, E.; Plantevit, M.; Robardet, C. Electricity price forecasting on the day-ahead market using machine learning. Appl. Energy 2022, 313, 118752. [Google Scholar] [CrossRef]

- Shi, X.; Shen, Y. Macroeconomic uncertainty and natural gas prices: Revisiting the Asian Premium. Energy Econ. 2020, 94, 105081. [Google Scholar] [CrossRef]

- Moutinho, V.; Oliveira, H.; Mota, J. Examining the long term relationships between energy commodities prices and carbon prices on electricity prices using Markov Switching Regression. Energy Rep. 2022, 8, 589–594. [Google Scholar] [CrossRef]

| Statistics | German Intraday | German Day-Ahead | France Intraday | France Day-Ahead | NO1 Intraday | NO1 Day-Ahead |

|---|---|---|---|---|---|---|

| count | 6356 | 6532 | 5367 | 6532 | 6532 | 6248 |

| mean | 38.23 | 34.67 | 37.49 | 36.16 | 14.17 | 12.72 |

| std | 35.93 | 17.02 | 18.54 | 16.97 | 17.65 | 14.82 |

| median | 35.00 | 33.58 | 36.50 | 35.40 | 8.84 | 8.08 |

| min | −150.00 | −83.94 | −25.20 | −8.65 | −1.73 | 0.02 |

| max | 1000.00 | 189.25 | 328.20 | 189.25 | 205.68 | 152.25 |

| Observation Period | German Intraday | German Day -Ahead | France Intraday | France Day-Ahead | NO1 Intraday | NO1 Day-Ahead |

| January 2020 | 1 January 2020–31 January 2020 | 1 January 2020–31 January 2020 | 1 January 2020–31 January 2020 | 1 January 2020–31 January 2020 | 1 January 2020–31 January 2020 | 1 January 2020–31 January 2020 |

| January 2021 | 1 January 2021–31 January 2021 | 1 January 2021–31 January 2021 | 1 January 2021–31 January 2021 | 1 January 2021–31 January 2021 | 1 January 2021–31 January 2021 | 1 January 2021–31 January 2021 |

| First Lockdown | 3 March 2020-4 May 2020 | 3 March 2020-4 May 2020 | 3 March 2020-4 May 2020 | 3 March 2020-4 May 2020 | 2 March 2020-1 April 2020 | 2 March 2020-1 April 2020 |

| Second Lockdown | 2 November 2020-1 February 2021 | 2 November 2020-1 February 2021 | 15 October 2020-15 December 2020 | 15 October 2020-15 December 2020 | 2 November 2020-1 February 2021 | 2 November 2020-1 February 2021 |

| Summer Months | 4 May 2020-30 September 2020 | 4 May 2020-30 September 2020 | 1 July 2020-30 September 2020 | 1 July 2020-30 September 2020 | 4 May 2020-30 September 2020 | 4 May 2020-30 September 2020 |

| Statistics | German Intraday | German Day-Ahead | France Intraday | France Day-Ahead |

|---|---|---|---|---|

| count | 5689 | 6816 | 6392 | 6486 |

| mean | 5689.82 | 24,379.26 | 169.43 | 14,082.17 |

| std | 2844.92 | 4164.75 | 288.43 | 2814.81 |

| median | 5805.00 | 23,881.50 | 40.00 | 13,963.10 |

| min | 0.00 | 14,441.00 | 0.00 | 6892.00 |

| max | 61,234.00 | 43,600.00 | 2917.00 | 25,013.00 |

| Observation Period | Germany Intraday (Mean Price; Mean Vola) | Germany Intraday (Std Price; Std Vola) | Germany Day-Ahead (Mean Price; Mean Vola) | Germany Day-Ahead (Std Price; Std Vola) |

|---|---|---|---|---|

| January 2020 | 37.81; 1045.02 | 21.40; 308.11 | 33.91; 1138.85 | 13.54; 1066.01 |

| January 2021 | 54.51; 1110.88 | 26.48; 404.37 | 54.72; 1110.18 | 17.34; 944.49 |

| First Lockdown | 24.01; 1692.26 | 39.88; 531.82 | 21.60; 1842.29 | 13.03; 984.57 |

| Second Lockdown | 48.71; 1023.19 | 33.32; 399.93 | 48.31; 1226.78 | 17.71; 1047.86 |

| Summer Months | 38.10; 1146.86 | 39.42; 336.66 | 32.99; 1214.32 | 14.15; 916.56 |

| Observation Period | France Intraday (Mean Price; Mean Vola) | France Intraday (Std Price; Std Vola) | France Day-Ahead (Mean Price; Mean Vola) | France Day-Ahead (Std Price; Std Vola) |

|---|---|---|---|---|

| January 2020 | 38.31; 1221.29 | 12.21; 717.49 | 37.55; 546.84 | 10.73; 321.90 |

| January 2021 | 62.37; 601.00 | 18.39; 309.41 | 61.24; 644.05 | 17.17; 647.56 |

| First Lockdown | 22.00; 1397.17 | 9.78; 476.57 | 21.30; 1161.13 | 9.32; 795.95 |

| Second Lockdown | 47.09; 843.06 | 16.76; 405.42 | 46.26; 824.63 | 15.41; 651.17 |

| Summer Months | 41.45; 527.49 | 16.33; 242.01 | 40.76; 567.71 | 12.34; 490.50 |

| Observation Period | France Intraday (Mean) | France Intraday (Std) | France Day-Ahead (Mean) | France Day-Ahead (Std) |

|---|---|---|---|---|

| January 2020 | 178.21 | 292.91 | 14,724.14 | 2855.71 |

| January 2021 | 178.99 | 257.54 | 16,449.86 | 2642.51 |

| First Lockdown | 132.13 | 244.21 | 14,088.72 | 2381.12 |

| Second Lockdown | 195.73 | 309.71 | 14,373.57 | 2600.35 |

| Summer Months | 180.25 | 288.66 | 12,450.08 | 2650.61 |

| Observation Period | NO1 Intraday (Mean Price; Mean Vola) | NO1 Intraday (Std Price; Std Vola) | NO1 Day-Ahead (Mean Price; Mean Vola) | NO1 Day-Ahead (Std Price; Std Vola) |

|---|---|---|---|---|

| January 2020 | 25.34; 160.33 | 4.19; 100.58 | 23.68; 97.94 | 4.06; 29.08 |

| January 2021 | 59.16; 575.52 | 28.79; 124.94 | 52.41; 539.61 | 19.25; 162.48 |

| First Lockdown | 8.96; 354.71 | 4.86; 178.76 | 7.79; 193.10 | 2.05; 76.19 |

| Second Lockdown | 28.86; 773.76 | 28.10; 332.86 | 26.10; 688.65 | 22.98; 365.61 |

| Summer Months | 5.47; 620.98 | 5.20; 299.48 | 4.71; 419.00 | 4.65; 272.55 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Buescher, J.N.; Gottwald, D.; Momm, F.; Zureck, A. Impact of the COVID-19 Pandemic Crisis on the Efficiency of European Intraday Electricity Markets. Energies 2022, 15, 3494. https://doi.org/10.3390/en15103494

Buescher JN, Gottwald D, Momm F, Zureck A. Impact of the COVID-19 Pandemic Crisis on the Efficiency of European Intraday Electricity Markets. Energies. 2022; 15(10):3494. https://doi.org/10.3390/en15103494

Chicago/Turabian StyleBuescher, Jan Niklas, Daria Gottwald, Florian Momm, and Alexander Zureck. 2022. "Impact of the COVID-19 Pandemic Crisis on the Efficiency of European Intraday Electricity Markets" Energies 15, no. 10: 3494. https://doi.org/10.3390/en15103494

APA StyleBuescher, J. N., Gottwald, D., Momm, F., & Zureck, A. (2022). Impact of the COVID-19 Pandemic Crisis on the Efficiency of European Intraday Electricity Markets. Energies, 15(10), 3494. https://doi.org/10.3390/en15103494