4.1. Findings on Cost Overruns

The distribution of real cost overruns by the dam for our sample of 57 power-only dams has a mean of 24% and a standard deviation of 42%. Real cost overruns range from −41.8% to 176.7% of the estimated real costs. Over 70% of the projects experienced overruns, with half of the overruns within the 0–25% range. The distribution of real cost overruns is positively skewed; the coefficient of skewness is 1.53.

Both the impacts of inflation and the real cost overruns are reported in

Table 4. The averages are the weighted averages of the various dams, where the weights are the proportions of the MWs of capacity represented by each dam in the total sample. As shown in column 2, the cumulative movements in prices have, on average, increased the nominal cost of these dams by 52.6% of the estimated real base cost. The estimated real base cost includes the non-price contingencies that are usually included at the appraisal time but excludes the price contingencies. The total nominal escalation of costs ranges from 87.4% of base cost estimates in Latin America and the Caribbean to 13% in Europe and Central Asia. In East Asia and Pacific, Sub-Saharan Africa, and South Asia, the nominal cost escalation rates are 35.5%, 31.0%, and 18.4%, respectively. The dams implemented in Latin America and the Caribbean have suffered more from inflation than those in other regions.

The weighted average real cost overrun is calculated as 31.4% of the estimated real cost for the sample of 57 power-only dams. This number falls to 23.6% of the estimated real cost if we exclude five outliers in our sample of 57 dams. The analysis of the real cost overruns’ distribution shows that there are five outliers in the dataset, and the highest number of outliers is in Latin America and the Caribbean: three out of five outliers. The remaining two outliers are in East Asia and the Pacific and South Asia.

The lowest real cost overruns are found for the eight dams built in Europe and Central Asia, averaging only 2.7% over those projected by region. Europe and Central Asia’s experience contrasts with that of Latin America and the Caribbean, where real costs are, on average, 55.2% higher than initial estimates, with a cost overrun more than twenty-fold those estimated for Europe and Central Asia. Even after removing the outliers, the estimated real cost overrun in Latin America and the Caribbean stands at 40.7% of the estimated real cost; this is still much higher than the whole sample’s weighted average. Every country in Latin America and the Caribbean has witnessed very high real cost overruns. Pehuenche dam in Chile and Aguamilpa dam in Mexico have witnessed real cost overruns of −42.8% and −6.2%, respectively, of the estimated real costs. However, these are the only cases where the real cost overruns are low in Latin America and the Caribbean. In the same countries, other dams have had high real cost overruns, such as La Huguera dam in Chile and Zimapan dam in Mexico, with 80.9% and 77.9%, respectively, of the estimated real costs.

The average real cost overrun is also low in Sub-Saharan Africa, at 9.8% of the estimated real costs. This is followed by South Asia, where the average real cost overrun is 13.2% of the estimated real costs. This value falls further to 5.1% if the outlier is removed from the calculation.

The average real cost overrun for dams in East Asia and the Pacific is 20.2% of the estimated cost. After removing the outlier, the weighted average real cost overrun is still almost the same as if the outlier was not removed. The outlier dam’s capacity is very small, making little difference when it is removed.

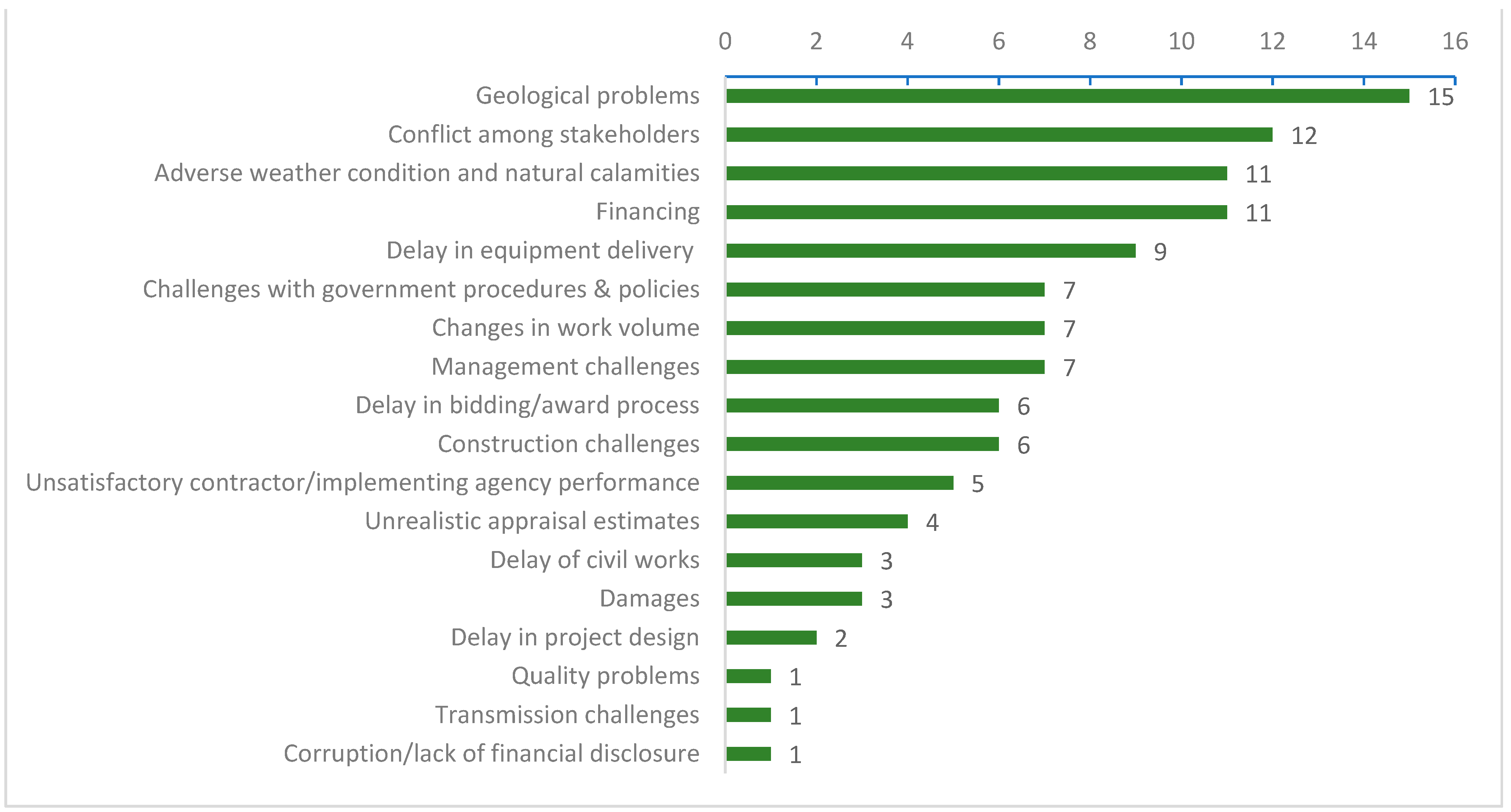

To look more deeply at the reasons for the cost overruns, each of the ICRs is reviewed to find the factors that have led to the cost overrun. The reasons for this are summarized in

Figure 1.

Five reasons account for 64.7% of the total reasons for the cost overruns: change in work volume, geological problems, inflation/currency fluctuations, unrealistic appraisal estimates, and real price escalation. Resettlement costs are identified as a significant cause of cost overruns in only three cases. The World Bank appears to have dealt effectively with these issues before the start of the projects. However, other implementation issues, such as unsatisfactory contractor/implementing agency performance, management challenges, transportation challenges, challenges with government procedures and policies, and construction challenges, account for a total of 14 of the reasons given for the cost overruns. The “force majeure”-type challenges of geology and adverse weather conditions account for 13 reasons, a similar number to the incidence of implementation problems and changes in work volumes.

Clearly, the project managers and consultants who planned these projects underestimated both the average magnitude and the range of physical contingencies required by these dam projects. The uncertainty in estimating costs and implementation challenges has led to a very significant downward bias in the estimated costs compared with actual experience.

Table 5 shows the data analysis results for the incidence of cost overrun by the size of hydropower-generation capacity installed (MW), which is further filtered by the type of dam (with or without storage). There is no simple linear relationship between the degree of cost overrun and a dam’s capacity, or between cost overrun and the type of dam. However, dams of larger size, with an installed capacity above 700 MW, perform much poorer in cost planning.

Table 5, column 4, shows that, on average, dams with a capacity of 700–1499 MW have, by the time of completion, cost overruns of 42.9% of real cost estimates at appraisal. Projects above 1500 MW capacity have average real cost overruns of 33.8%. Very small dams (0–99 MW) seem to have much better estimates at appraisal, with relatively lower real cost overruns of 9.9% on average of the real cost estimates during planning. This is followed by medium (300–699 MW) and small (100–299 MW) projects, with average real cost overruns of 12.9% and 31.1%, respectively, of the real cost estimates during planning.

Physical contingency estimates do not differ much for the various size categories: the physical contingency estimate is about 9–11% of real cost estimates (

Table 5, column 3). This shows evidence of a common methodology used by the World Bank in estimating physical contingencies.

At the appraisal stage, an average 18.3% change in price level is projected for the 57 dams in this study (

Table 6, column 4). The actual results show a 21.2% change in nominal costs due to price escalation (

Table 6, column 5). Considering the error between the estimated price contingency and the actual price escalation, expressed as a percentage of estimated real cost, the average error due to the inflation forecast is only 2.9% points. This reveals that, on average, the inflation forecasts for cost projections in the World Bank projects have not been systematically biased over the entire period for this portfolio of dams. However, errors in the forecasting of prices from project to project may be a significant source of risk when planning the financing arrangements of such schemes.

There is evidence here of substantial learning since 1998 in relation to price level projections by World Bank project appraisers. The results for the 16 dams completed between 1998 and 2015 are, on average, the most accurate predictions. The weighted average price contingency proposed by the World Bank analysts is 13.3%, while the actual weighted average price increase experienced is 15.3%. The average error due to the inflation forecast is only two percentage points.

This is not the case for the dams completed in earlier periods. The price levels are either underestimated or overestimated well below or above the actual price levels. The weighted average price contingency proposed by the World Bank analysts for 21 dams completed between 1975 and 1987 is 19%, while the actual weighted average price increase experienced is 36.1%. More than 17 percentage points underestimate the average error due to the inflation forecast. The converse is the case for the period 1988–1997. The weighted average price contingency proposed by the World Bank analysts for 20 dams completed between 1988 and 1997 is 21.8%, while the actual weighted average price increase experienced is only 9.2%. A total of 12.6 percentage points overestimate the average error due to the inflation forecast.

In

Table 6, a comparison is made between, on one side, the cost overrun estimations for the 21 hydropower dams included in the dataset used by Bacon et al. [

51] and completed before 1987 and, on the other, the measured cost overrun of dams completed between 1988 and 2015. There is evidence here of substantial learning since 1998. The level of real cost overrun in 1988–1997 is more than 16.8% lower, at 30.5% of the estimated real cost than that in the period prior to 1987, when it is 47.4%. Furthermore, in the period following 1998, the real cost overrun continues to fall. It reduces dramatically to 10.5%, an almost five-fold reduction in real cost overrun compared to the period before 1987 (

Table 6, column 3).

The next step is to understand and identify the possible reasons, if any, for the substantial reduction in the real cost overrun over time. Therefore, the authors investigate whether there is any relationship between the size of the dam and the year of completion, the type of dam (with or without storage), and the year of completion.

Table 7 is a cross tabulation showing the types and sizes of dams, and how many of them were built in each time period.

As shown in

Table 7, the type of dam that WBG has financed has shifted over time from those with storage to more of those without storage, and the average size of dams has reduced. This is one possible explanation for why the real cost overrun has reduced dramatically over time.

4.2. Findings on Time Overruns

The majority of dams in this study experienced time overruns, with an average time overrun of 13.8 months or 20.2% of the project’s scheduled completion time. This is the weight-adjusted average of installed capacity for each project to the total installed capacity for all the projects in this sample. More than 77% of the sample projects experienced a time overrun of more than 10% of the initial time estimated for completion. The time overrun’s overall net cost is 11.1% of the estimated real construction cost (

Table 8, column 7). This cost could have been avoided if there had been no delays in construction. In South Asia, all five projects experienced significant time overrun. The average time overrun is 33.1% of the estimated construction schedule at the appraisal stage, and the cost of time overrun to society averages 28.7% of the project’s estimated real cost.

In Europe and Central Asia, time overruns occurred in all eight projects implemented in this analysis. The average time slippage is 17.1 months, or 22% of the estimated construction schedule, at the cost of 18.2% of the projects’ estimated real cost. In Sub-Saharan Africa, time overruns occurred in 9 of the 12 projects in this analysis. The average time slippage is 11.1 months, or 21.3% of the estimated construction schedule, at the cost of 9.3% of the projects’ estimated real cost. In Latin America and the Caribbean, time overruns occurred in 14 of the 16 projects in this analysis. The average time slippage is 18.5 months, or 26.9% of the estimated construction schedule, at the cost of 10.4% of the projects’ estimated real cost.

Projects in East Asia and the Pacific show better implementation performances than those in other regions. The construction schedule estimates at appraisal are more realistic. With an average construction schedule of 90.7 months, the average delay in completion is only 3.2 months and the associated cost to society of this overrun averages 3.6% of the estimated real cost.

The underlying causes of the time overruns, as reported in

Figure 2, are quite varied. The five reasons most frequently given are geological problems (15), conflict among stakeholders (12), adverse weather and national calamities (11), financing (11), and delay in equipment delivery (9). The next five most important identified causes are challenges from government procedures and policies (7), changes in work volume (7), management challenges (7), delays in the bidding/award process (6), and construction challenges (6). Interestingly, among the top ten factors causing time overruns, only two, geological problems and changes in work volumes, rank in the top five causes of real cost overruns.

In addition to the findings on the severity of time overrun across regions, we investigate whether the bias in the estimated time for constructing these dams varies by size and type (with or without storage) of the dam.

Table 9 summarizes the variations between the scheduled length of construction and the actual completion period of dams, distributed according to size and type of dam.

Table 9, column 4 shows the time overrun across the various sizes of hydropower projects. While the average time overrun for all 57 dams is 20.2% of the scheduled time, there is a large difference between the time overrun of the four large dams (>1500 MW capacity), at an average of only 8.5%, and that of the remaining 53 dams, at an average of 29.4% of the initially scheduled time for completion.

In terms of the time overruns’ costs, the highest costs are incurred by the smallest dams (0–99 MW) at an average of 34.2% of the estimated real costs (

Table 9, column 5). This is followed by large (700–1499 MW), very large (above 1500 MW), and medium (300–699 MW) dams, with averages of 14%, 9.5%, and 8.3%, respectively, of cost of time overrun as a percentage of estimated real costs. Smaller dams (100–299 MW) have relatively smaller amounts of cost of time overrun, at 6.4% of the estimated costs. The very large dams are more efficient electricity generators than the smaller dams. The cost of time overruns associated with a smaller slippage in schedule is proportionally much higher than in the smaller dams. The time slippage was much larger. Still, the cost of the time overruns was proportionally smaller.

Bacon et al. [

9] found that the average slippage in the actual construction length of hydropower projects was 28% of the time scheduled. In

Table 10, a comparison is made between the 21 dams completed prior to 1987 and those completed after 1987. The slippage time decreases to 9.9 months for the projects completed after 1998 compared with the ones completed before 1998, but at a higher cost. This occurs because, compared with the thermal alternatives, the hydropower dams built since 1998 are lower-cost generators of electricity than dams built before 1998. The average time overrun as a percentage of the initially scheduled time for the projects completed after 1998 falls to 17.8% from the average value of 30.4% for 1988–1997. The cost of time overrun as a percentage of the estimated real costs increases to 16.4% in the period after 1998, 72% higher than that of 1975–1987, and almost twice that of the period 1988–1997. It is clear that, as the cost of thermal-generated electricity rises with increases in fuel prices, the loss to the country rises from the delay in the supply of lower-cost hydro-generated electricity.

The estimated cost of time overruns in these results is smaller than the magnitude of the real cost overruns. While the extension to the implementation schedules for the completion of the dams may be significant in terms of calendar months, the real costs imposed by these delays are 11.1% of the initial real cost estimate for the projects. These estimates include the impact of the delay on both the PV of construction costs and the PV of the electricity system’s increased running costs as it tries to make up for the loss in electricity generated by the dams as a result of the delay.

However, the loss from time costs as measured here is a loss to the economy due to the loss of a low-cost service. This is usually neglected when considering the cost of time delays. This cost is over and above the additional costs incurred to complete a facility’s construction that a time delay might impose.

4.3. Findings on Net Benefits of Hydropower Dams

The discrepancy between the appraisal and the actual rates of return of dams in this study is analyzed based on the ‘avoided cost’ methodology for electricity generation. Here, the hydropower dams’ economic benefits are measured as the cost savings that would be incurred by generating an equivalent amount of electricity with a similar load factor with a configuration of alternative thermal technologies. The rates of return of this portfolio of dams are estimated twice. First, we estimate the ex-ante rates of return based on the estimated construction costs of the dams at the time of appraisal. Second, the rates of return are calculated based on the actual construction costs of the dams. The results are presented in

Table 11, by region.

In this study, the internal rates of return are the discount rates at which the estimated benefits associated with the avoided costs of the dams over the projects’ operating life are equal to the actual costs of the dams. This analysis is carried out both excluding the SCC at USD 39 and including this positive global externality of hydropower dams.

The differences between the estimated ex-ante and ex-post rates of return are directly associated with the magnitude of the cost overruns included in the estimated ex-post rates of return. Intuitively, the systematic pattern of errors in cost projections identified in the study suggests that the ex-post rates of returns are more likely to be somewhat below their estimated ex-ante values.

The quantities and load factor of the electricity generated by each hydropower dam are those projected at the appraisal stage. Any loss of output due to delays in the dam completion is accounted for in the analysis. When the dam is delayed, the benefit projected profile is shifted to the period when the dam actually begins operations. Hence, the benefits of the dam will have a lower PV. The benefits of the individual dams—that is, the cost savings from not employing the replacement plant—are estimated using actual data for HFO, NG, diesel, and coal prices corresponding to each of the years the hydropower dams have operated to date. For periods from 2015 to the end of the hydropower dams’ life cycle (40 years), the HFO, NG, diesel, and coal prices are assumed to be fixed in real terms at USD 356.5 per tonne, USD 5.6 per thousand cubic feet, USD 737.1 per tonne, and USD 93.2 per tonne, respectively.

For the 57 dams in this study, the average ex-ante rate of return, excluding the benefits of carbon emissions avoided by these hydropower dams, estimated at the time of appraisal for the whole portfolio, is 17.4%. In contrast, the ex-post average rate of return is 15.4%. Both the ex-ante and the estimated ex-post rates of return exclude the external benefits of reduced greenhouse gas (GHG) emissions due to the substitution of hydro generation for thermal. The PV of the net benefits evaluated as of 2016 (expressed in terms of the 2016 price level) amounts to USD 529 billion

Table 11.

Table 11 shows the distribution of the results by region regarding rates of return and PVs expressed in 2016 USD prices. The highest rates of return are realized in South Asia and East Asia, and the Pacific. The five dams constructed in South Asia, representing about 2.3 GW of installed capacity, have produced an economic net benefit of about USD 50 billion for the region. The ex-post economic internal rate of return (EIRR) for the region is 21%, falling slightly below the rate of return at the time of the appraisal, which is estimated to be 21.7%. The 16 dams constructed in East Asia and the Pacific, representing about 7.1 GW of installed capacity, have produced an economic net benefit of about USD 100 billion for the region. The ex-ante EIRR for the region is 18.5%, and the ex-post EIRR is 17.0%.

The 16 dams built in Latin America and the Caribbean represent about 10.3 GW of installed capacity. The 17% ex-ante EIRR estimated for the region turns out to be 13.7% ex-post. The deviation between the ex-ante and ex-post EIRR for the region is explained by the high magnitude of real cost overruns. Notwithstanding the high level of overruns, the dam investments have contributed an overall net economic gain of USD 232 billion to the region.

A total of USD 89 billion worth of net gains are expected to be realized in Sub-Saharan Africa by the end of the operating life cycle of the 12 dams built in the region. For this sub-sample, the ex-ante EIRR is estimated at 16.1%, and the ex-post EIRR is 15.1%.

The lowest rates of return are realized in Europe and Central Asia. Eight dams built in the region represent about 3.1 GW of installed capacity and have produced an economic net benefit of about USD 57 billion for the region. The ex-ante EIRR is estimated at 13.7% for this region, but the ex-post results show that the projects’ actual EIRR is 13.5% on average.

Table 11 column 9 shows how many dams in each region have actual negative NPVs. The highest number of negative NPV dams is in Latin America and the Caribbean, where half of the dams have negative NPVs. This could be explained by the high magnitude of real cost overruns in the region. This region is followed by South Asia and Sub-Saharan Africa, where 40% and 16.7% of the dams, respectively, have negative NPVs (

Table 11, column 9). In Europe and Central Asia and East Asia and the Pacific, 12.5% of the dams have negative NPVs.

The PVs of the net benefits are reported in

Table 12, column 6, by size (installed capacity) and type (with or without storage) of dams. The results show that the dams’ internal rates of return (columns 7 and 8) increase with the size of generating capacity of the dam. Larger dams produce the bulk of the benefits and have relatively higher return rates on their investment outlays. Smaller dams have lower return rates, and the highest number of negative NPV projects is among these smaller dams. Some 36.8% of the smallest dams with 0–99 MW of installed capacity, 30% of medium-sized dams with 300–699 MW of installed capacity, and 22.2% of dams with 100–299 MW of installed capacity have actual negative NPVs. That is not the case with the large-scale dams, where only one in ten have an actual negative NPV.

When it comes to dam types, there seems to be no significant difference in rates of return according to whether or not a dam has storage. There is a considerable difference in rates of return in large dams of 700–1499 MW of installed capacity. However, the number of dams with storage and without storage in this installed capacity range is not comparable. Therefore, this case is ignored.Concerning the relevance of hydropower in renewable energy targets, the SCC emissions avoided by hydropower dams are an indispensable part of this analysis. Adding this global benefit to the results increases the ex-ante EIRR for host countries in the portfolio from 17.4% to 19.5%, and ex-post EIRR from 15.4% to 17.3% (

Table 13).

For the sample of 57 dams, there is, on average, a 2.1% difference between ex-ante EIRRs calculated including and those calculated excluding the benefit of the avoided social cost of carbon emission

Table 13. There is, on average, a 1.9% difference between ex-post EIRRs calculated including and those calculated excluding the benefit of the avoided social cost of carbon emission. The PV of the net benefits evaluated as of 2016 (expressed in terms of the 2016 price level) increases from USD 529 billion with the addition of USD 342 billion of benefits of avoided carbon emissions, making the PV of net benefits USD 871 billion (

Table 13, columns 6–8).

Table 13 shows that 16 dams in Latin America and the Caribbean avoid 386 million tonnes of carbon dioxide emissions throughout the lives of the projects; 16 dams in East Asia and the Pacific avoid 367 million tonnes of carbon dioxide emissions throughout the project lives. Eight dams in Europe and Central Asia, five in South Asia, and twelve in Sub-Saharan Africa avoid 136 million tonnes, 105 million tonnes, and 75 million tonnes of carbon dioxide emissions, respectively, throughout their project lives.

These estimates of reductions in GHG emissions have not taken the carbon emissions by the dam reservoirs into consideration. The role of dam reservoirs as carbon sinks or sources is highly reservoir-specific [

52]. Information is not available to make this adjustment for each of the hydro dams. However, according to the International Hydro Association (2020) [

53], the global medium GHG estimate of the emission intensity of the hydropower reservoirs was 18.5 gCO

2 eq/kwh. This is the grams of carbon dioxide equivalent per kilowatt-hour of electricity generated over the dams’ life cycle. Applying this rate of carbon source to the total generation of entire portfolio hydro dams, it would reduce the net carbon savings of the hydro dams by 7.22%. The estimated total amount of CO

2 saved by this portfolio of hydro dams is 1069 million tons, with this adjustment, the estimated amount of carbon saved would fall to 992 million tons. This adjustment has only a marginal impact on the overall economic rate of return of the portfolio of projects.

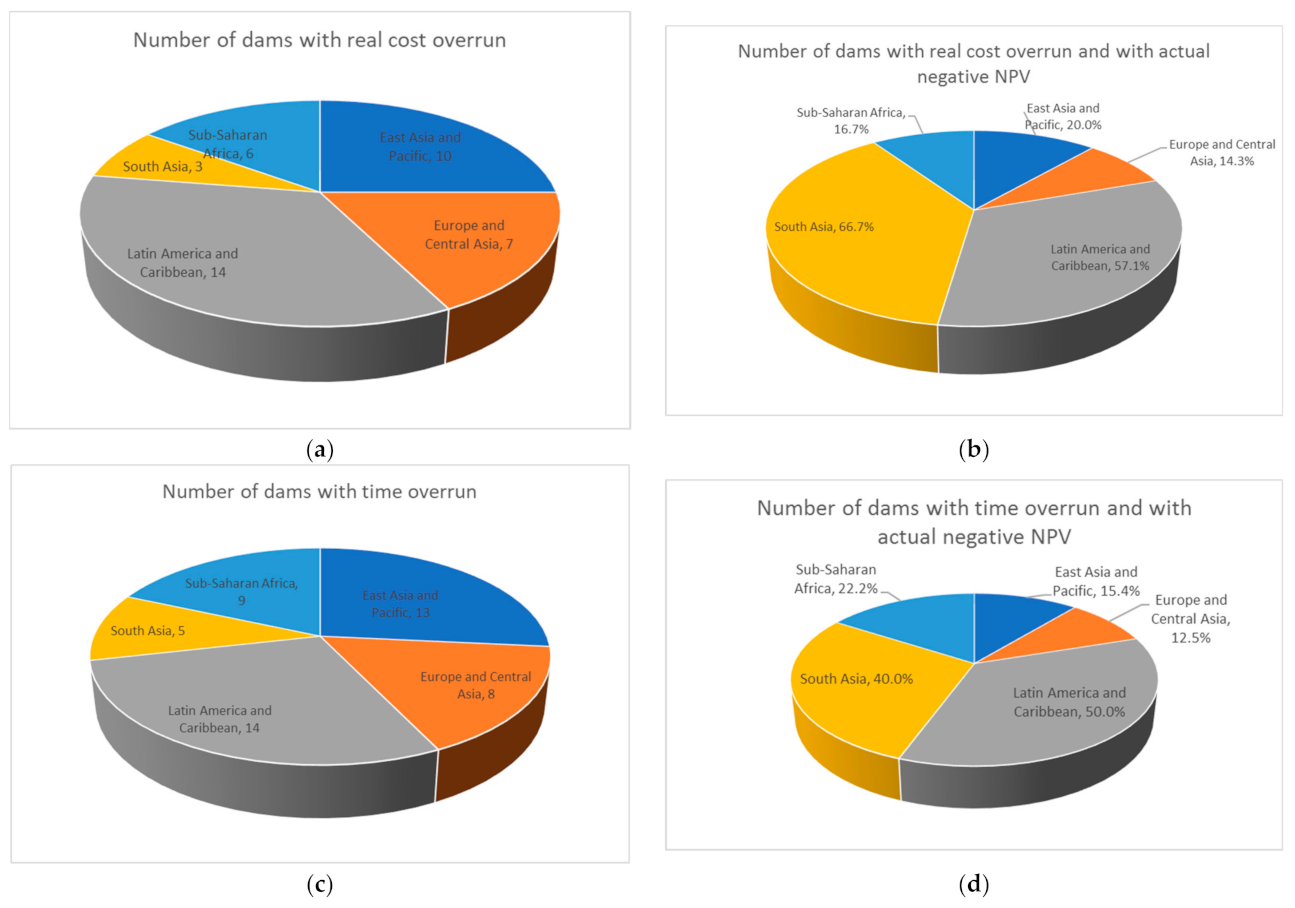

Figure 3 summarizes the number of dams in various regions with cost and time overruns.

Figure 3a shows the number of dams with cost overrun;

Figure 3b shows the number of dams with actual negative NPV in different regions with a cost overrun;

Figure 3c shows the number of dams with time overrun;

Figure 3d shows the number of dams with actual negative NPV in various regions with a time overrun.

Of the total 40 dams with a real cost overrun (

Figure 3a), 14 dams had a negative NPV. The region with the highest number of negative NPV dams is South Asia where out of three dams with cost overrun two have had an actual negative NPV. This has been followed by the Latin America and Caribbean region where 57.1% of dams with cost overrun have had an actual negative NPV (

Figure 3b) which could be attributable to high real cost overruns occurred in the region.

Of the total 49 dams with time overrun (

Figure 3c), 14 dams had a negative NPV. 50% of the dams with time overrun located in Latin America and the Caribbean have had an actual negative NPV which was followed by the South Asia region where 40% of dams with time overrun have had an actual negative NPV (

Figure 3d).