1. Introduction

The global energy system faces a huge challenge. Climate change resulting from the burning of hydrocarbons, their rapid depletion, inequality in access to energy, and the announced fall in demand for conventional fuels, especially coal and oil, have forced the need to implement a new energy model that is based on unconventional energy sources. Its core is to be the zero-emission sources, energy saving, and energy efficient. In recent years, issues relating to climate change and the negative effects of this process have been analysed and discussed among politicians, scientists, and ordinary citizens around the world, and particularly strongly in Europe. Therefore, climate policy has become a catalyst for the development and dissemination of energy based on renewable sources of energy (RES). This, in turn, has resulted in faster development of technology and it has significantly accelerated the implementation of European Union (EU) climate policy objectives.

The transition to low-emission energy sources is taking place at different speeds in individual Member States of the Community. This is the result of divergent interests in the energy security of its members, and it leads to dissonance in the energy union [

1]. The new energy strategy sets ambitious targets for the use of renewable energy. EU decision-makers have assumed that, in 2030, 32% of the Community’s energy balance should come from RES [

2]. Achieving this target requires reducing dependence on fossil fuels. The unbalanced perception of this issue and the different security priorities among the EU Member States mean that there is a new division of the Community along the West-East axis, thus consolidating the division that has existed since the beginning of the entry into the organisation of countries that were satellite states of the former Union of Soviet Socialist Republics (USSR) for many years [

3].

It is worth adding that there is also a division that is related to energy priorities between the rich countries of northern Europe and the poorer south. The different degrees of implementation of the energy transition in the EU countries have contributed to the study of this phenomenon. This article aims to analyse the energy transformation in the Visegrad Group countries (V4), as they are largely dependent on the production of energy from burning fossil fuels and the transformation of the energy sector is a huge challenge for them. To achieve the assumed goal, it will be necessary to answer the following research questions:

What is the significance of the energy transformation for the security of the Visegrad Group countries?

What is the current state of energy security of each of the countries of the organisation under discussion?

What actions are taken by the V4 countries in order to comply with the requirements of the “European Green Deal”?

The methodology that is used in this manuscript is consistent with the assumed research objectives. The diversity of the energy transformation in the V4 countries was examined by using two qualitative methods, including literature analysis and comparative analysis. The first of the above-mentioned research methods allowed grouping literature sources on the basis of the adopted conceptual criteria. Comparative analysis was used to compare the studied phenomenon in the countries of the Visegrad Group, based on four diagnostic features: the share of RES in final energy consumption, reduction of CO2 emissions in the non-ESTS sector, date of withdrawal of coal from the economy, and energy efficiency. Thanks to a critical discourse analysis, it was possible to show social problems in the context of the energy transformation in the V4 group. The timeframe of the study was set for the period from 2020 to 2030, as these years are crucial for the implementation of the European Green Deal Programme.

The article consists of five parts. The literature review of the system transformation is presented after the introduction. The third part presents the energy security system in the Czech Republic, Slovakia, Poland, and Hungary. The state of energy transition in the Visegrad countries is discussed in the fourth part. The fifth part contains a summary of the results of a comparative analysis of the energy transformation based on the basis of legislative and strategic documents of the four examined countries against the legal framework that is imposed by the EU.

2. Literature Review

Central Europe is not a region that is generously endowed by nature with energy carries, especially those that are still desirable: natural gas and oil. Moreover, the region is also not a significant energy consumer.

The complex and painful economic transformation of Central European countries has significantly transformed all sectors of the economy, including the energy sector. These countries did not attach much importance to energy policy, which is why the sector has adapted to the new market conditions, while maintaining an almost unchanged energy supply structure [

4]. However, the last 15 years have been a time of fairly rapid economic growth for the Central European region, due to joining to EU [

5]. In this part of Europe, one grouping that was founded in 1991 under the name of the Visegrad Group, or V4, deserves attention. It consists of four neighbouring states: the Czech Republic, Poland, Slovakia, and Hungary, which, as a result of similar goals in foreign policy, the similarity of historical experiences and geographical proximity, have sought to strengthen cooperation. The main objective of the organisation was cooperation with the European Union and North Atlantic Treaty Organization (NATO) as part of the accession of member states to the aforesaid structures [

6].

EU is now pointing to a vision of a green Europe, free of coal and other fossil fuels, on its members. However, the positions of the members of the community with regard to energy security differ and influence the decisions taken by them through joint initiatives due to their different geographical location, natural resources, history, and political traditions. For this reason, the differences in the progress of the energy transition reflect the divergent interests of individual countries in terms of energy security. The deepening division of the Union into western and eastern countries reflects a different approach to energy security [

3]. The eastern cluster of the divided EU includes, among others, the Visegrad Group states. The history of belonging to the Eastern bloc and heritage of the socialist energy system is their common feature. These countries were the most important importers of Russian energy resources during the entire period of socialism. After the collapse of the USSR, the V4 countries still depended almost completely on Russian imports for about 20 years [

7]. It was only in the last decade that work began on changing energy dependence on the Russian superpower. The still less developed infrastructure, which is in need of modernisation in many countries, makes the markets in this part of Europe less resistant to possible disruptions in the supply of fossil fuels. The hard coal and lignite industry is an important branch of industry in Central European countries (Poland, the Czech Republic, and Slovakia); hence, a large number of people are employed in the mining sector, and coal is a strategic hydrocarbon on whose resources the economy in these countries is based. For this reason, the transition to renewable energy is associated with much higher costs than in Western Europe. The standard of living in this part of Europe is lower than in the countries of Western Europe; therefore, the citizens of these countries are more sensitive to energy price increases [

8].

Recently, V4 countries have openly expressed their concerns and preferences regarding the future of energy security both in their own country and in the region as a whole. Measures taken in relation to this, including further support for the development of nuclear energy, the implementation of natural gas diversification projects, or criticism of the far-reaching strategy of the European Green Deal, are proof of the individual approach of these countries to the changes imposed by the European Union [

9].

At present, the most important objective of the V4 group is to strengthen cooperation, particularly by agreeing on a common strategy for energy security and regional emergency planning for natural gas supplies [

10], as well as to promote the concept of a fair transition in climate policy, which, while striving for better use of non-traditional energy sources, will preserve jobs and take the social consequences of the changes that are to take place in the economy into account, especially those relating to living standards and electricity prices [

11].

4. Results: Energy Transformation in V4 Countries

Energy and climate policy is always shaped by many political, economic, social, security, and environmental issues. The multidimensional nature of energy policy is evident in Central Europe due to the source of energy imports and Russia’s role in the European energy mix. The Central and Eastern European region also acts as an intermediary in the distribution of Russian fossil fuels to Western Europe. The existing conviction that local production and combustion of fossil fuels will guarantee cheap energy for households means that the policy of adapting to climate change in Central European countries lags behind the rest of Europe.

Current energy situation in the Visegrad countries is presented in

Table 1. In the energy mix of Poland and the Czech Republic, coal ranks first, while in Slovakia and Hungary the dominant source of energy is nuclear energy. Imported gas consumption is growing in all V4 countries. RES constitute a small part of the energy balance of the analyzed group.

All of the analysed countries have, over the last decade, transposed EU legislative standards on green energy sources into their strategic documents and legislation. Each Member State of the European Community has committed itself in the EU Renewable Energy Directive (2009/28/EC) to achieving a specific share of energy from renewable sources in the gross final consumption of energy by 2020. The Czech Republic and Hungary have committed themselves to achieve a 13% share of RES in gross final energy consumption, while Slovakia and Poland have committed themselves to achieve 14% and 15%, respectively, in the designated period, according to the National RES Action Plans [

34].

The Czechs and Hungarians have done best in the implementation of EU law, as evidenced by the rapid achievement of the RES targets set for 2020. This was made possible by the appropriate legal framework and the financing of projects using green energy, unfortunately, mainly from external sources (EU funds). When external funding is reduced, it may prove difficult to find national sources of support for this technology, due to the ambivalent attitude of the political elite to unconventional sources [

35].

Poland has, to a certain point in time, achieved its objective in accordance with the indicative course set out in the EU RES Directive. At that time, two main RES technologies were developed thanks to support in the green certificate system: co-firing of biomass in existing coal units and onshore wind power. Unfortunately, the changes that were introduced in 2016 in legal regulations concerning support for RES, consisting mainly in the transition from the green certificate system to the auction system, made it impossible for Poland to achieve the assumed 20% by 2020. Failure to meet the EU target means that it is necessary to make up for the lack of green energy through statistical transfers, involving the purchase of ‘virtual’ energy from RES from Member States that have developed a surplus of this energy as part of their targets. In the case of Poland, the costs of such a transfer may amount to as much as PLN eight billion [

36].

Slovakia has also easily achieved the Union’s target for the production of green energy. Thanks to the launch of the “Greenery for Households” program, which supports the production of heat and electricity from small, household renewable energy systems, this form of energy generation has developed at both the regional and local level. Energy from renewable sources is promoted through a feed-in tariff. Energy companies are obliged to purchase energy from RES. Other sources of green energy are of marginal importance in energy production. It is worth adding that, while neighbouring countries are investing in wind energy, in Slovakia the development of wind energy was stalled in 2009, when investors were unable to obtain permission from the network operator to join into it. The Slovak government considers wind energy to be unstable, with large fluctuations in production and not worth the investment [

22].

Until recently, the V4 countries did not want to hear about the decarbonisation of the economy. Today, the situation has changed. Hard coal mines are being closed due to low raw material prices and strong foreign competition, and lignite mines are also being closed due to emission regulations and pollution charges. Both in the Czech Republic, Slovakia and Hungary, national strategic plans have been drawn up to help the coal regions to switch to other activities.

The Czech Government has introduced the RESTART programme, which aims to stimulate the development of three mining regions in the country [

37]. The mining regions are among the least developed in the country and the cause of these problems is seen in mining. Too much pollution, the flight of secondary and higher education graduates from these regions, as well as poor support for business development and limited supply on the labour market prevent the development of small and medium-sized enterprises. Low skills characterise local industry, so low added value means that purchasing power is not increasing in this region [

37]. The financial support of the RESTART programme amounts to EUR 1.5 billion until 2030 and it includes a large part of national and EU funds [

38].

Slovak climate policy was defined in the studies “Environmental Strategy-Greener Slovakia” that was published in 2018 and in Low-Carbon Development Strategy of the Slovak Republic until 2030 with a View to 2050. Among other things, it includes adaptation measures for the coal region of Slovakia, called Upper Nitra, which, like Polish Silesia, is a very economically developed area with a high density of industrial sector. It is worth adding that this region was qualified in 2017 for a pilot EU programme supporting the transformation of coal mining regions. Slovakia was one of the first countries in the V4 group to give a specific date for the end of coal mining, 2023 and announced the gradual phasing out of the production of electricity and heat from this energy source [

39,

40]. Review of energy transformation goals for 2030 in V4 countries is shown in

Table 2.

Poland has also created its action plan as part of the energy transformation. The assumptions and objectives of the energy policy are included in the “National Energy and Climate Plan for 2021–2030”. The document sets out the climate and energy objectives to be achieved by Poland in the next 10 years. The most important issue for this country is to reduce the share of coal in electricity production. Poland is to reduce energy production from coal by 56–60% by 2030, according to the provisions contained in the above document. The share of coal-fired power plants will be systematically reduced as a result of the phasing out of old, worn-out conventional generation sources that do not meet environmental pollution requirements. Gas will be a very important energy carrier in the transition period, in both the power industry and in heating [

41]. Poland will be one of the few countries to close down its coal sector as the last one, according to the latest announcements of the Polish government, in 2049 [

42].

The high level of environmental pollution from the emission of harmful greenhouse gases into the atmosphere is one of the biggest problems of the countries under discussion. All countries of the Visegrad Group have taken appropriate measures to reduce their emissions. Poland is the largest emitter in the region, followed by the Czech Republic, Hungary, and Slovakia. The Polish government has announced that, in the next decade, it will work to reduce emissions by at least 7% in sectors that are not covered by the ECTS programme when compared to 2005 [

45]. Similar positions are held by Hungarians, Czechs (14% reduction as compared to 2005) [

46], and Slovaks (12% reduction as compared to 2005) [

47].

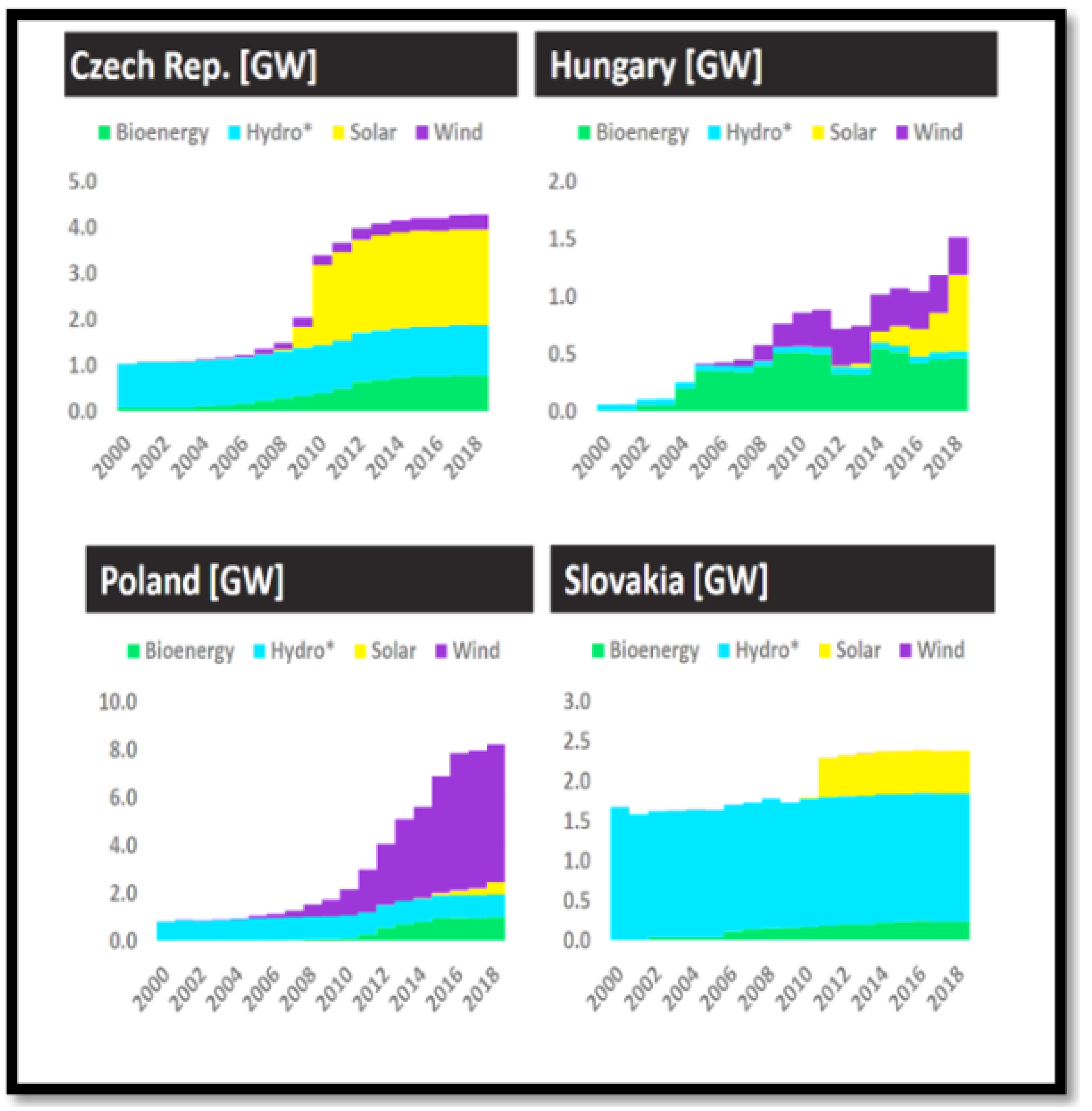

The development of RES is another element of the energy transformation (

Figure 1). All four examined countries have announced a significant increase in the share of this clean form of energy. The Czech Republic, thanks to the development of hydroelectric power plants and biomass, is expected to reach 22% in gross final energy consumption in 2030. A similar level was set by Poles (21–23%), who are developing wind energy both at sea and on land and photovoltaics. Hungarians assume that, in less than a decade, they will achieve 21%, mainly due to solar energy, biomass, and geothermal energy, while Slovaks will achieve their target of 19.2% thanks to small hydroelectric and biomass plants [

31,

32,

39,

46].

The phasing out of the coal sector in the Visegrad countries will create a large number of unemployed people (90,000 in Poland and 20,000 in the Czech Republic), and it is also worth adding that the sectors providing services for mines and power plants employ four times as many workers, so the transformation in these countries should be carried out at a moderate pace [

48]. Poland is in the worst situation when compared to other EU countries, because of its different starting point, economic, energy and technological conditions, reduction potential, and financial capacity. Therefore, the costs of the energy transformation will be the highest of all members of the community [

41]. According to preliminary estimates of Polish government representatives, they will amount to EUR 240 billion and will be twice as high as the EU average. For this reason, Poland draws attention to the need for further financing of gas projects, which, in its case, as in the case of Hungary, will be the most effective and fastest way to reduce CO

2 emissions, and will become a transitional solution to the full achievement of climate targets [

49]. The Czechs, on the other hand, are seeking, in the forum of the European Community, to classify nuclear energy as a green energy source. Such a change in the provisions would enable the three V4 countries to receive funds for developing the nuclear sector [

49].

The energy infrastructure, especially the electricity system, is another problem arising during the system change. The electricity networks of the Visegrad countries and their system interconnections with neighbouring countries have been designed, so that they are based on the energy produced from coal or an atom distributed from specific production sites to other regions of the country. When coal is removed from the energy mix, it will be necessary to redesign the entire energy infrastructure in each of these countries. Poland will have to redesign its entire electricity grid, because both offshore wind and nuclear energy are to be located in the northern part of the country, in contrast to the current location of generation sources in the south of the country [

50].

It is also worth adding that all V4 countries continue to support the coal sector, regardless of the ageing, inefficient infrastructure, and the collapsing European coal sector. The actions of the governments of Poland and the Czech Republic, in particular, are aimed at maintaining the ideological significance of coal, because it plays an important role in the economy and appears to be an important element of sustainable prosperity. Over the decade in Poland by 2030, the government is expected to provide about PLN 150 billion for the coal sector [

51], while, in the Czech Republic, subsidies for fossil fuels are not given separately, but are rather determined together with the costs of the transformation, which will amount to CZK 1–5 billion [

52]. Slovakia allocates about EUR 100 million annually to the coal sector [

19].

The politicians of the countries in this region consider the use of coal to be their significant comparative advantage, which ensures that they maintain an optimum level of energy security. Unconventional sources, on the other hand, are seen as a risky investment with a low rate of return in terms of energy security. It is worth adding that society (especially its younger generations) is increasingly often protesting against the continuation of coal policy, demanding the rapid implementation of the principles of the European Green Deal.

5. Conclusions

Energy transformation aims at economic prosperity through the creation of new jobs, greater energy independence, and CO2 reduction. The transformation of the current system requires fundamental changes in the energy sector.

In recent years, many different programmes and strategies to mitigate climate change and, at the same time, to adapt to EU requirements have been initiated in the group of countries surveyed. All of the documents mentioned above talk about the promotion of renewable energy sources, which translates into a reduction in the production of energy from conventional sources, and the strategies of the V4 countries also assume the reduction of dependence on oil and gas imports from Russia. The Czech Republic, Slovakia, and Hungary are focusing on increasing energy production from the atom, which correlates with the reduction of CO2 emissions.

The conducted analysis showed that the measures proposed in the Strategies and National Ecological and Climate Plans are insufficient for ensuring the required energy transformation and achieving the long-term goal of the Paris Agreement. Out of the four analysed countries, only Slovakia significantly increased its climate goals, especially in terms of reducing CO2 emissions. Poland, the Czech Republic, and Hungary, on the other hand, increased their contribution to the EU’s 2030 renewable energy target, but still below the recommendations that were issued by the European Commission. The analysed countries only slightly increased their ambitions in terms of energy efficiency. V4 members are not interested in a sharp reduction and gradual phasing out of fossil fuel subsidies. Poland and the Czech Republic have declared that they will continue to burn coal after 2030.

Three mutually exclusive factors influence the speed of the energy transformation of the Visegrad countries: environmental factor, technical factor, and acceptability factor. The environmental factor emphasises the impact of government policies on climate change, man and their environment. The technical factor refers to using the current state of the art in ensuring energy security. The acceptability factor takes economic and political aspects into account. In this case, we are faced with a paradox, because even the best zero-emission technology is unacceptable if it entails too high financial and political costs. In fact, these factors correspond to three basic assumptions:

- (1)

continuity of energy;

- (2)

acceptability of prices to all consumers; and,

- (3)

environmentally friendly energy production and consumption.

The approach of the governments of Poland and Hungary, in particular to the implementation of RES, reflects their ambition to maintain strict control over the development of energy infrastructure. The wealth of national energy carriers is concentrated in the hands of state-owned enterprises. Thus, these state ambitions hinder decentralisation, as expressed in the EU strategy and limited competition.

The energy transformation is a huge challenge for the countries concerned, but it also provides an opportunity for economic growth and brings tangible benefits in the form of diversification of the energy balance and a cleaner environment. It is necessary to review the flexibility of the electricity systems in this group of countries, as the increasing penetration of photovoltaics and wind power on the electricity market will lead to grid loading and power cuts. The prerequisite for the success of the long-term transformation process is an appropriate adaptation policy, which is supported by national and European funds.