Farmer Interest in and Willingness to Grow Pennycress as an Energy Feedstock

Abstract

1. Introduction

2. Data and Methods

2.1. Survey and Data Collection

2.2. Economic Model

2.3. Statistical Analysis Methods

2.3.1. Factor Analysis of Farmer Attitudes toward Pennycress

2.3.2. Estimation of the Model for Interest in and Willingness to Accept the Bid to Grow Pennycress

3. Results and Discussion

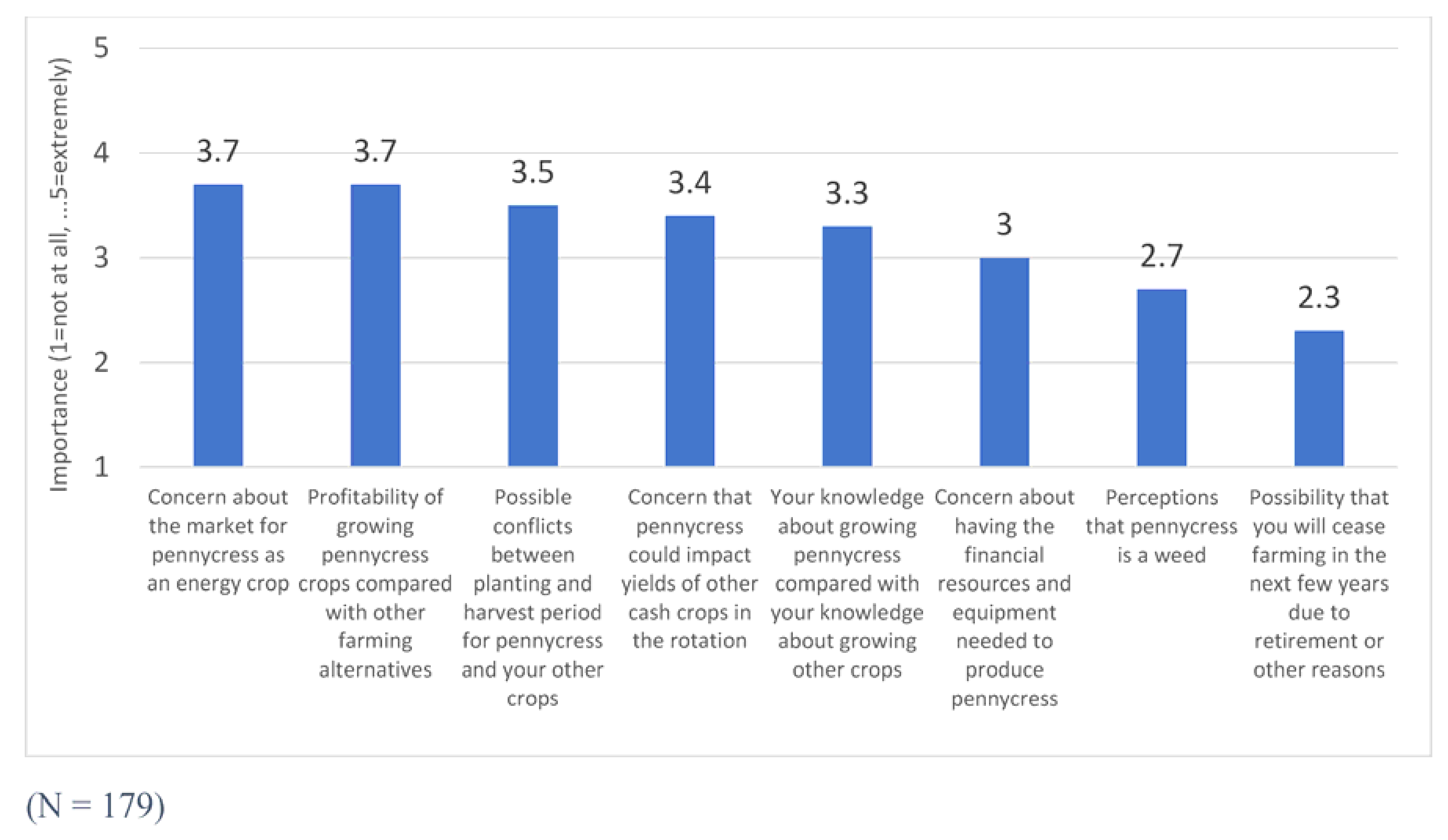

3.1. Farmer Opinions Regarding Influences on Decisions to Plant Pennycress and Potential Benefits from Planting Pennycress

3.2. Estimated Probit Models for Farmer Interest in and Willingness to Accept the Farmgate Price to Grow Pennycress

4. Conclusions and Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Fan, J.; Shonnard, D.R.; Kalnes, T.N.; Johnsen, P.B.; Rao, S. A life cycle assessment of pennycress (Thlaspi arvense L.) -derived jet fuel and diesel. Biomass Bioenergy 2013, 55, 87–100. [Google Scholar] [CrossRef]

- U.S. Environmental Protection Agency (US EPA). Regulation of Fuels and Fuel Additives: Changes to Renewable Fuel Standard Program; Final Rule; US EPA: Washington, DC, USA, 2010.

- Kim, S.; Dale, B.E. Life cycle assessment of various cropping systems utilized for producing biofuels: Bioethanol and biodiesel. Biomass Bioenergy 2005, 29, 426–439. [Google Scholar] [CrossRef]

- Urbanchuk, J.M. An Economic Analysis of Legislation for a Renewable Fuels Requirement for Highway Motor Fuels; AUS Consultants: Mount Laurel, NJ, USA, 2001. [Google Scholar]

- Zhou, X.V.; Clark, C.D.; Nair, S.S.; Hawkins, S.A.; Lambert, D.M. Environmental and economic analysis of using SWAT to simulate the effects of switchgrass production on water quality in an impaired watershed. Agric. Water Manag. 2015, 160, 1–13. [Google Scholar] [CrossRef]

- Markel, E.; English, B.C.; Hellwinckel, C.; Menard, R.J. Potential for pennycress to support a renewable jet fuel industry. Ecol. Pollut. Environ. Sci. 2018, 1, 95–102. [Google Scholar]

- Centre for Agriculture and Bioscience International (CABI). Thlaspi arvense (Field Pennycress). Available online: https://www.cabi.org/isc/datasheet/27595 (accessed on 6 January 2019).

- Trejo-Pech, C.O.; Larson, J.A.; English, B.C.; Yu, T.E. Cost and Profitability Analysis of a Prospective Pennycress to Sustainable Aviation Fuel Supply Chain in Southern USA. Energies 2019, 12, 3055. [Google Scholar] [CrossRef]

- U.S. Department of Energy. 2016 Billion-Ton Report: Advancing Domestic Resources for a Thriving Bioeconomy; Volume 1: Economic Availability of Feedstocks; ORNL/TM-2016/160; Oak Ridge National Laboratory: Oak Ridge, TN, USA, 2016.

- Carr, P. Potential of Fanweed and Other Weeds as Novel Industrial Oilseed Crops. In New Crops; John Wiley and Sons: New York, NY, USA, 1993. [Google Scholar]

- Isbell, T.; Chermak, S. Thlaspi arvense (Pennycress) germination, development and yield potential. In Proceedings of the Association for the Advancement of Industrial Crops Conference, Fort Collins, CO, USA, 19–22 September 2010. [Google Scholar]

- Phippen, W.; Phippen, M. Evaluation of field pennycress (Thlaspi arvense) populations. In Proceedings of the Association for the Advancement of Industrial Crops Conference, Fort Collins, CO, USA, 19–22 September 2010. [Google Scholar]

- Alhotan, R.A.; Wang, R.L.; Holser, R.A.; Pesti, G.M. Nutritive value and the maximum inclusion level of pennycress meal for broiler chickens. Poult. Sci. 2017, 96, 2281–2293. [Google Scholar] [CrossRef] [PubMed]

- Miller, P.; Sultana, A.; Kumar, A. Optimum scale of feedstock processing for renewable diesel production. Biofuels Bioprod. Biorefining 2012, 6, 188–204. [Google Scholar] [CrossRef]

- Moser, B.R.; Knothe, G.; Vaughn, S.F.; Isbell, T.A. Production and Evaluation of Biodiesel from Field Pennycress (Thlaspi arvense L.) Oil. Energy Fuels 2009, 23, 4149–4155. [Google Scholar] [CrossRef]

- Embaye, W.T.; Bergtold, J.S.; Archer, D.; Flora, C.; Andrango, G.C.; Odening, M.; Buysse, J. Examining farmers’ willingness to grow and allocate land for oilseed crops for biofuel production. Energy Econ. 2018, 71, 311–320. [Google Scholar] [CrossRef]

- Jensen, K.; Clark, C.D.; Ellis, P.; English, B.; Menard, J.; Walsh, M.; Ugarte, D.D.L.T. Farmer willingness to grow switchgrass for energy production. Biomass Bioenergy 2007, 31, 773–781. [Google Scholar] [CrossRef]

- Qualls, D.J.; Jensen, K.L.; Clark, C.D.; English, B.C.; Larson, J.A.; Yen, S.T. Analysis of factors affecting willingness to produce switchgrass in the southeastern United States. Biomass Bioenergy 2012, 39, 159–167. [Google Scholar] [CrossRef]

- Lynes, M.K.; Bergtold, J.S.; Williams, J.R.; Fewell, J.E. Willingness of Kansas farm managers to produce alternative cellulosic biofuel feedstocks: An analysis of adoption and initial acreage allocation. Energy Econ. 2016, 59, 336–348. [Google Scholar] [CrossRef]

- Fewell, J.E. Essays on Kansas Farmers’ Willingness to Adopt Alternative Energy Crops and Conservation Practices. Ph.D. Thesis, Kansas State University, Manhattan, KS, USA, 2013. [Google Scholar]

- Biodiesel Magazine. Making Pennycress Pay Off. Available online: http://www.biodieselmagazine.com/articles/2047/making-pennycress-pay-off/ (accessed on 10 January 2019).

- Oak Ridge National Laboratory (ORNL). Image Gallery Gateway, U.S. Department of Energy Office of Biological and Environmental Research. Available online: https://public.ornl.gov/site/gallery/highressurvey.cfm (accessed on 10 January 2019).

- Blamey, R.K.; Bennett, J.W.; Morrison, M.D. Yea-Saying in Contingent Valuation Surveys. Land Econ. 1999, 75, 126. [Google Scholar] [CrossRef]

- NASS USDA. 2017 Census of Agriculture. Available online: https://www.nass.usda.gov/Publications/AgCensus/2017/index.php (accessed on 1 June 2020).

- Heckman, J.J. Sample Selection Bias as a Specification Error. Econometrica 1979, 47, 153. [Google Scholar] [CrossRef]

- Van de Ven, W.P.; Van Pragg, B.M. The demand for deductibles in private health insurance: A probit model with sample selection. J. Econom. 1981, 17, 229–252. [Google Scholar] [CrossRef]

- Harper, D.; Kim, J.-O.; Mueller, C.W. Introduction to Factor Analysis: What It Is and How to Do It. Contemp. Sociol. A J. Rev. 1980, 9, 562. [Google Scholar] [CrossRef]

- Kim, J.O.; Mueller, C.W. Factor Analysis: Statistical Methods and Practical Issues; SAGE Publications: Thousand Oaks, CA, USA, 1978. [Google Scholar]

- Kaiser, H.F. The varimax criterion for analytic rotation in factor analysis. Psychometrika 1958, 23, 187–200. [Google Scholar] [CrossRef]

- Bartlett, M.S. The effect of standardization on a X2 approximation in factor analysis. Biometrika 1951, 38, 337–344. [Google Scholar]

- DiStefano, C.; Zhu, M.; Mindrila, D. Understanding and using factor scores: Considerations for the applied researcher applied researcher. Pract. Assess. Res. 2009, 14, 20. [Google Scholar]

- Thomson, G.H. The Factorial Analysis of Human Ability; University of London Press: London, UK, 1951. [Google Scholar]

- STATA. Release 16; StataCorp: College Station, TX, USA, 2019. [Google Scholar]

- Greene, W. Econometric Analysis, 8th ed.; Pearson Education: New York, NY, USA, 2018. [Google Scholar]

- Krinsky, I.; Robb, A.L. On Approximating the Statistical Properties of Elasticities. Rev. Econ. Stat. 1986, 68, 715. [Google Scholar] [CrossRef]

| Farm or Farmer Attribute | Sample | 2017 USDA Census of Agriculture a | ||

|---|---|---|---|---|

| Hectares Farmed (hectares) | 492 (n = 160) | 142 with 128 hectares harvested | ||

| Farm Income | ||||

| Less than $10,000 | 4.50% | 37.00% | ||

| $10,000–$24,999 | 8.11% | 17.00% | ||

| $25,000–$49,999 | 14.41% | 13.00% | ||

| $50,000 and greater | 72.97% | 33.00% | ||

| (n = 111) | ||||

| Farmer Age | 58.11 (n = 166) | 59.4 | ||

| Farmer State of Residence | Percent by State | Farms with Corn for Grain | ||

| Respondents vs. Corn Farmer Respondents | Operations | Percent | ||

| Alabama | 3.5% | 1.4% | 1463 | 2.4% |

| Arkansas | 3.5% | 1.4% | 1440 | 2.4% |

| Illinois | 53.8% | 63.0% | 34,792 | 56.8% |

| Kentucky | 6.9% | 4.3% | 5760 | 9.4% |

| Missouri | 19.7% | 18.8% | 13,184 | 21.5% |

| Mississippi | 2.9% | 2.9% | 1427 | 2.3% |

| Tennessee | 9.8% | 8.0% | 3172 | 5.2% |

| Total Operations | (n = 173) | (n = 138) | 61,238 | |

| Variable Name | Definition | Mean (N1 = 137) a | Mean (N2 = 79) b |

|---|---|---|---|

| Interest | 1 if interested in growing pennycress, 0 otherwise | 0.577 | ----- |

| Accept | 1 if would accept the farmgate pennycress price and grow pennycress at the price offered, 0 otherwise | ----- | 0.544 |

| Price | $0.11, $0.22, $0.33, $0.44, $0.55 per kg at the farmgate | ----- | 0.328 |

| AgeLt40 | 1 if aged under 40 years old, 0 otherwise | 0.080 | 0.089 |

| AgeGt65 | 1 if aged greater than 65 years old, 0 otherwise | 0.409 | 0.405 |

| Education | Education level (1 = elementary/middle, 2 = some hs c, 3 = hs c graduate, 4 = some college, 5 = bs d degree, 6 = post graduate or professional degree) | 4.328 | 4.468 |

| LogHectares | Log of total hectares in row crops (502.215 hectares, 579.105 hectares, respectively) | 5.737 | 5.935 |

| Share Rent | Share of crop hectares that are rented | ----- | 0.484 |

| Debt Free | 1 if farm 0 debt in 2018, 0 otherwise | ----- | 0.266 |

| Late Adopter | 1 if agree that tend to be reluctant about adopting new production methods or crops until see others adopt, 0 otherwise | 0.314 | ----- |

| Concerned Loss | 1 if agree tend to be more concerned about a large loss to farming operation than missing a substantial gain | ----- | 0.658 |

| Winter Cover Crop | 1 if regularly plant winter crops that are not harvested, 0 otherwise | 0.445 | 0.494 |

| NoTill | 1 if use no till methods, 0 otherwise | 0.693 | 0.658 |

| Familiar | 1 if familiar with pennycress, 0 otherwise | 0.358 | ----- |

| Production Concerns | Production concerns factor (See Table 3) | 0.053 | ----- |

| Social Benefits | Social benefit factor (See Table 4) | 0.016 | ----- |

| Financial Concerns | Financial concern factor (see Table 3) | ----- | 0.088 |

| Financial Benefits | Financial benefit factor (see Table 4) | ----- | −0.011 |

| Importance of Potential Barrier on Decision to Grow Pennycress (1 = not at all, …, 5 = extremely) | |||

| Cease Farming | Concern will cease farming due to retirement or other reasons soon | 2.380 | ----- |

| Pennycress Weed | Perceptions that pennycress is a weed | 2.796 | ----- |

| Knowledge Pennycress | Your knowledge about growing pennycress compared with growing other crops | 3.336 | ----- |

| Financial Resources | Concern about having financial resources and equipment needed to produce pennycress | ----- | 2.911 |

| Potential Barriers/Concern on Decision to Grow Pennycress (n = 179) | Factor 1 “Production Concerns” | Factor 2 “Financial Concerns” |

|---|---|---|

| Possible conflicts between planting and harvest period for pennycress and your other crops | 0.7250 | 0.3796 |

| Concern that pennycress could impact yields of other cash crops in the rotation | 0.7231 | 0.3270 |

| Concern about the market for pennycress as an energy crop | 0.4154 | 0.5810 |

| Profitability of growing pennycress crops compared with other farming alternatives | 0.4664 | 0.5796 |

| Potential Benefits from Growing Pennycress (n = 176) | Factor 1 | Factor 2 |

|---|---|---|

| “Financial Benefits” | “Social Benefits” | |

| Additional source of farm income | 0.7446 | 0.1737 |

| Opportunity to diversify crop species grown on your farm | 0.7442 | 0.2733 |

| Provide habitat for pollinators and native wildlife on your farm | 0.1479 | 0.7031 |

| Contribute to national energy security by producing pennycress for sustainable aviation fuel | 0.2230 | 0.8436 |

| Help the environment by producing pennycress for sustainable aviation fuel | 0.2318 | 0.7935 |

| Probit Model of Probability of a | ||||||||

|---|---|---|---|---|---|---|---|---|

| Farmer Interest in Growing Pennycress (Interest = 1) | Farmer Accepting the Pennycress Farmgate Price to Grow Pennycress (Accept = 1) | |||||||

| Variable Name | Estimated Coefficient | Marginal Effect | Estimated Coefficient | Marginal Effect | ||||

| Intercept | −2.581 | ** | ----- | −3.220 | ** | ----- | ||

| Price | 3.441 | *** | 0.980 | *** | ||||

| AgeLt40 | 0.118 | 0.039 | −1.470 | ** | −0.419 | ** | ||

| AgeGt65 | 0.294 | 0.097 | −0.681 | * | −0.194 | * | ||

| Education | 0.306 | ** | 0.102 | *** | 0.230 | 0.065 | ||

| LogHectares | 0.321 | *** | 0.107 | *** | 0.236 | 0.067 | ||

| Share Rent | ----- | ----- | 0.853 | * | 0.243 | * | ||

| No Debt | ----- | ----- | 0.839 | * | 0.239 | * | ||

| Familiar | 0.725 | *** | 0.241 | *** | ----- | ----- | ||

| Late Adopter | −0.134 | −0.045 | ----- | |||||

| Concerned Loss | ----- | ----- | −0.667 | * | −0.190 | * | ||

| Winter Cover Crop | 0.315 | 0.105 | 0.529 | 0.151 | ||||

| NoTill | −0.451 | * | −0.150 | * | −0.810 | ** | −0.231 | ** |

| Production Concerns | 0.357 | * | 0.119 | * | ----- | ----- | ||

| Social Benefits | −0.149 | −0.050 | ----- | ----- | ||||

| Financial Concerns | ----- | ----- | 0.147 | 0.042 | ||||

| Financial Benefits | ----- | ----- | 0.238 | 0.068 | ||||

| Cease Farming | 0.113 | 0.037 | ----- | ----- | ||||

| Pennycress Weed | −0.045 | −0.015 | ----- | ----- | ||||

| Knowledge Pennycress | −0.204 | * | −0.068 | * | ----- | ----- | ||

| Financial Resources | ----- | ----- | 0.108 | 0.031 | ||||

| LLR Test Against Intercept Only Model | 26.42 | ** | 29.2 | ** | ||||

| n | 137 | 79 | ||||||

| Pseudo R2 | 0.1415 | 0.2681 | ||||||

| Percent Correctly Classified | 67.15% | 70.89% | ||||||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhou, X.V.; Jensen, K.L.; Larson, J.A.; English, B.C. Farmer Interest in and Willingness to Grow Pennycress as an Energy Feedstock. Energies 2021, 14, 2066. https://doi.org/10.3390/en14082066

Zhou XV, Jensen KL, Larson JA, English BC. Farmer Interest in and Willingness to Grow Pennycress as an Energy Feedstock. Energies. 2021; 14(8):2066. https://doi.org/10.3390/en14082066

Chicago/Turabian StyleZhou, Xia Vivian, Kimberly L. Jensen, James A. Larson, and Burton C. English. 2021. "Farmer Interest in and Willingness to Grow Pennycress as an Energy Feedstock" Energies 14, no. 8: 2066. https://doi.org/10.3390/en14082066

APA StyleZhou, X. V., Jensen, K. L., Larson, J. A., & English, B. C. (2021). Farmer Interest in and Willingness to Grow Pennycress as an Energy Feedstock. Energies, 14(8), 2066. https://doi.org/10.3390/en14082066