On the Relationship between Oil and Exchange Rates of Oil-Exporting and Oil-Importing Countries: From the Great Recession Period to the COVID-19 Era

Abstract

:1. Introduction

2. Methodology

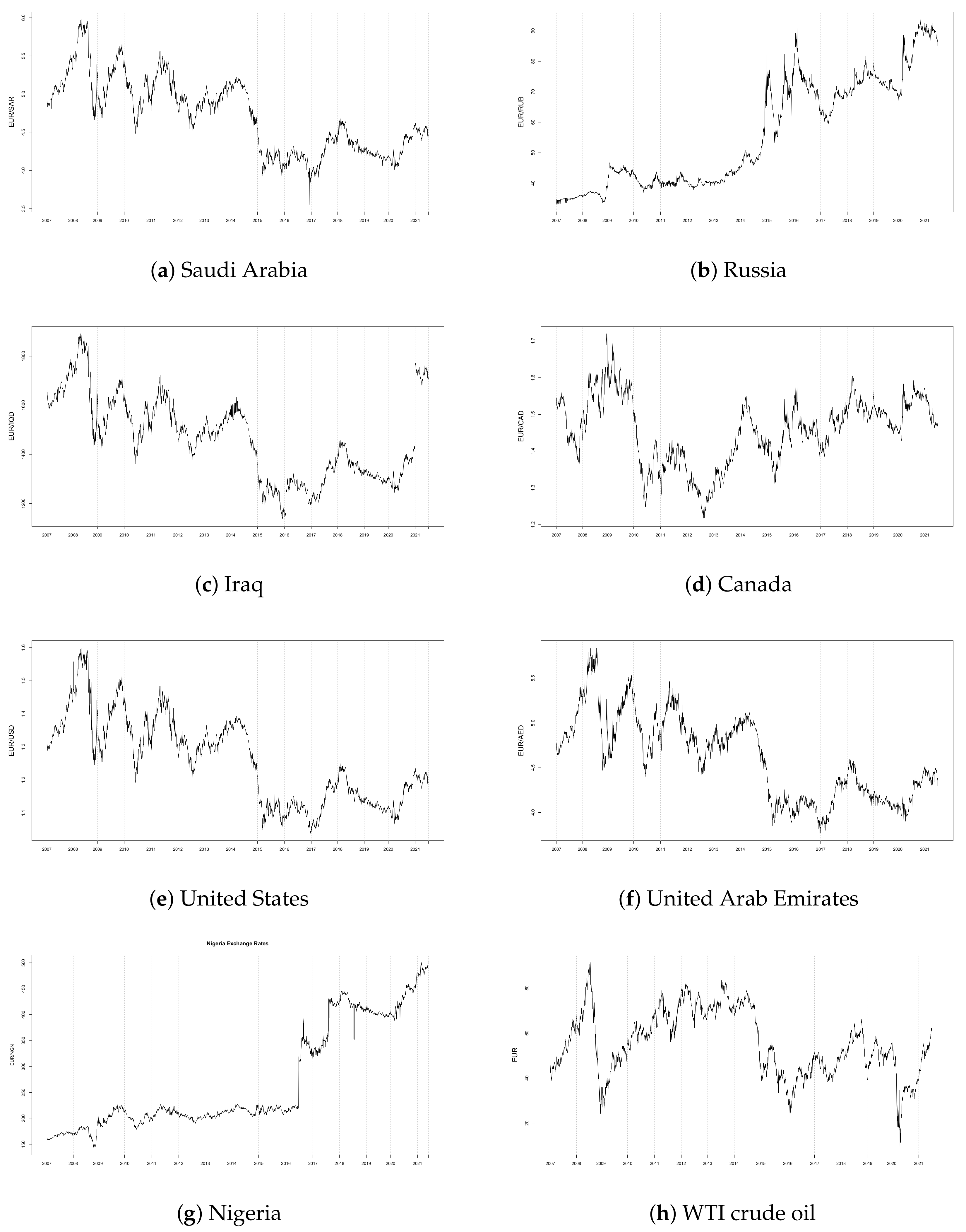

3. Empirical Analysis

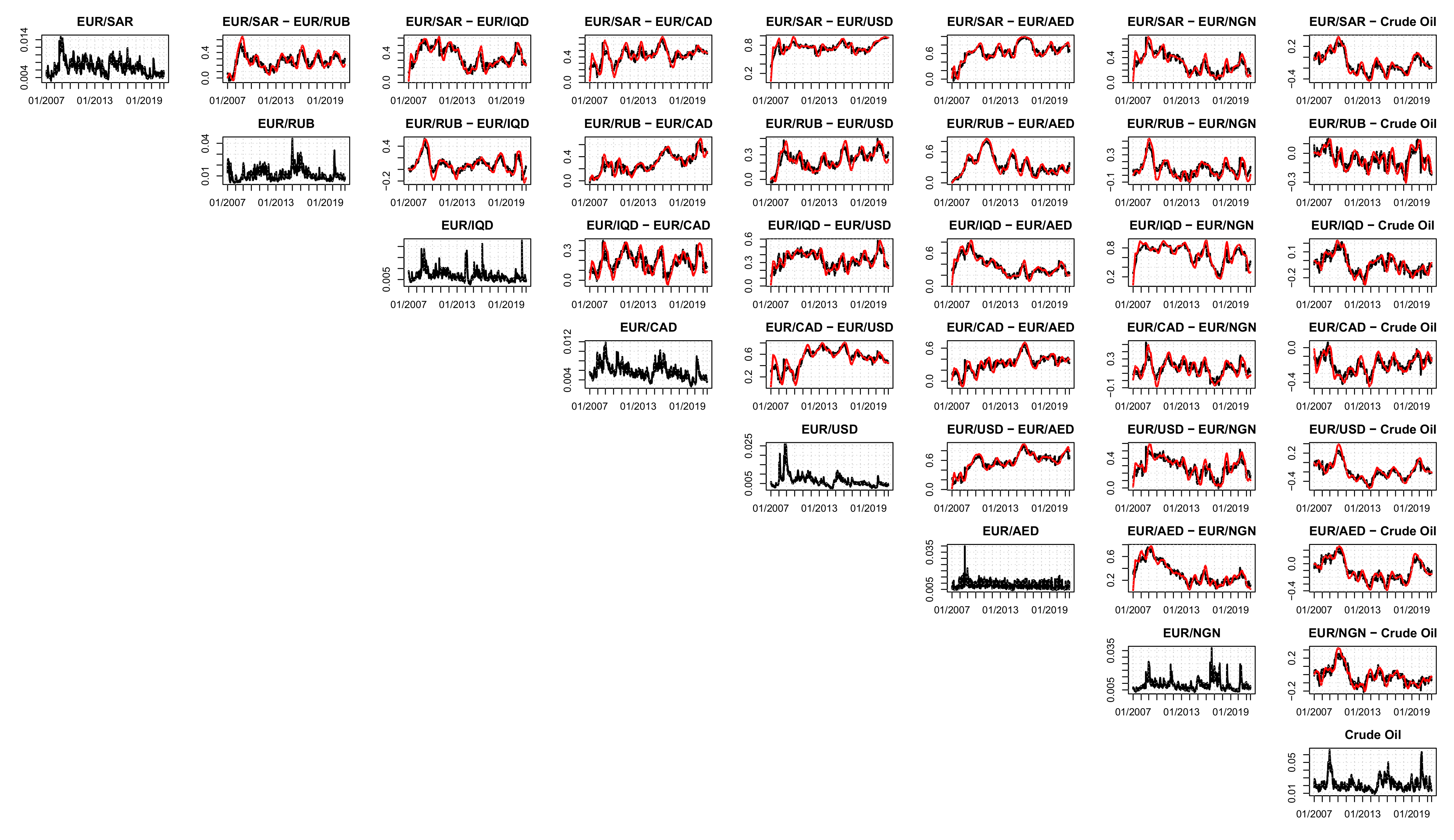

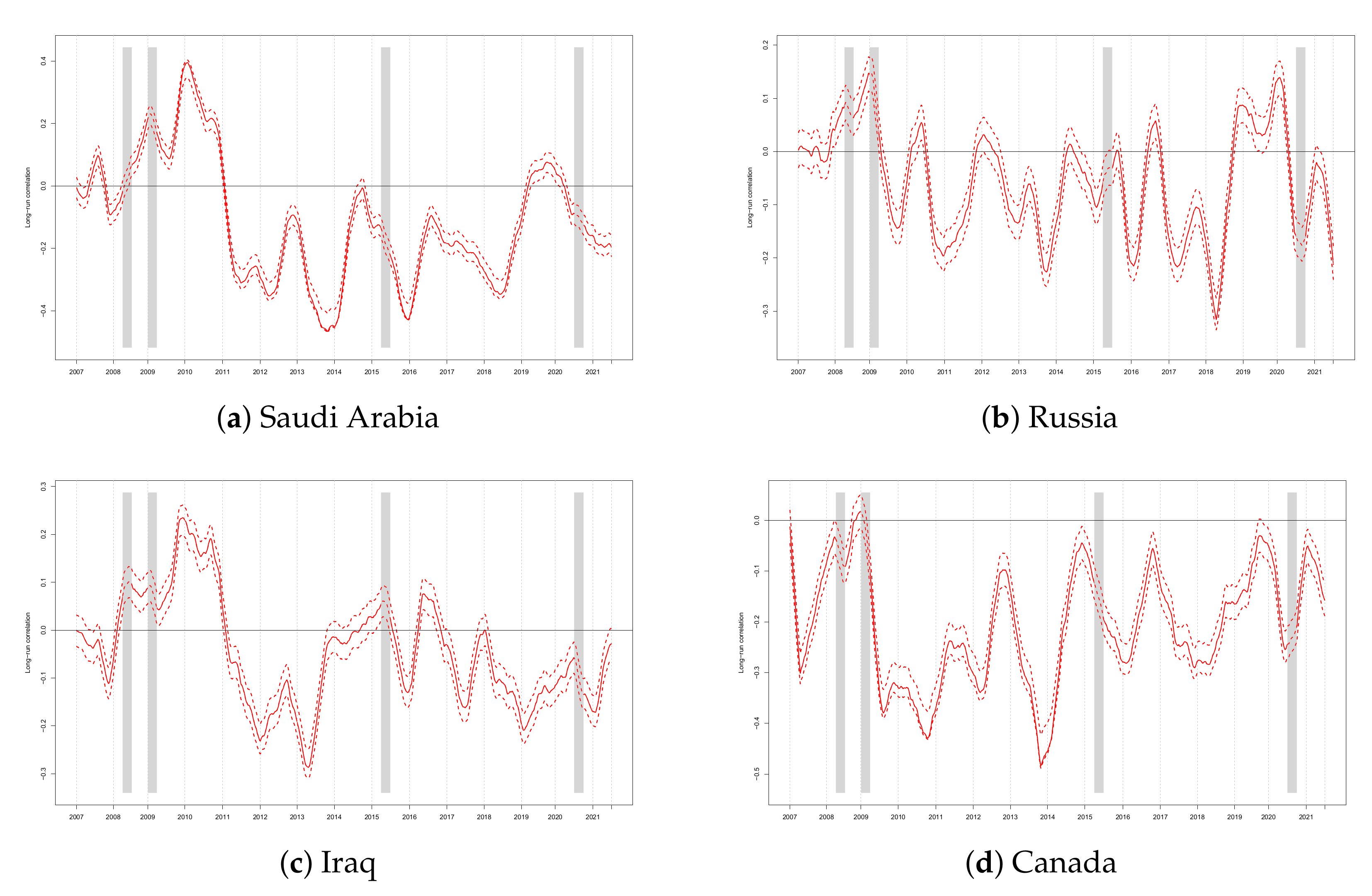

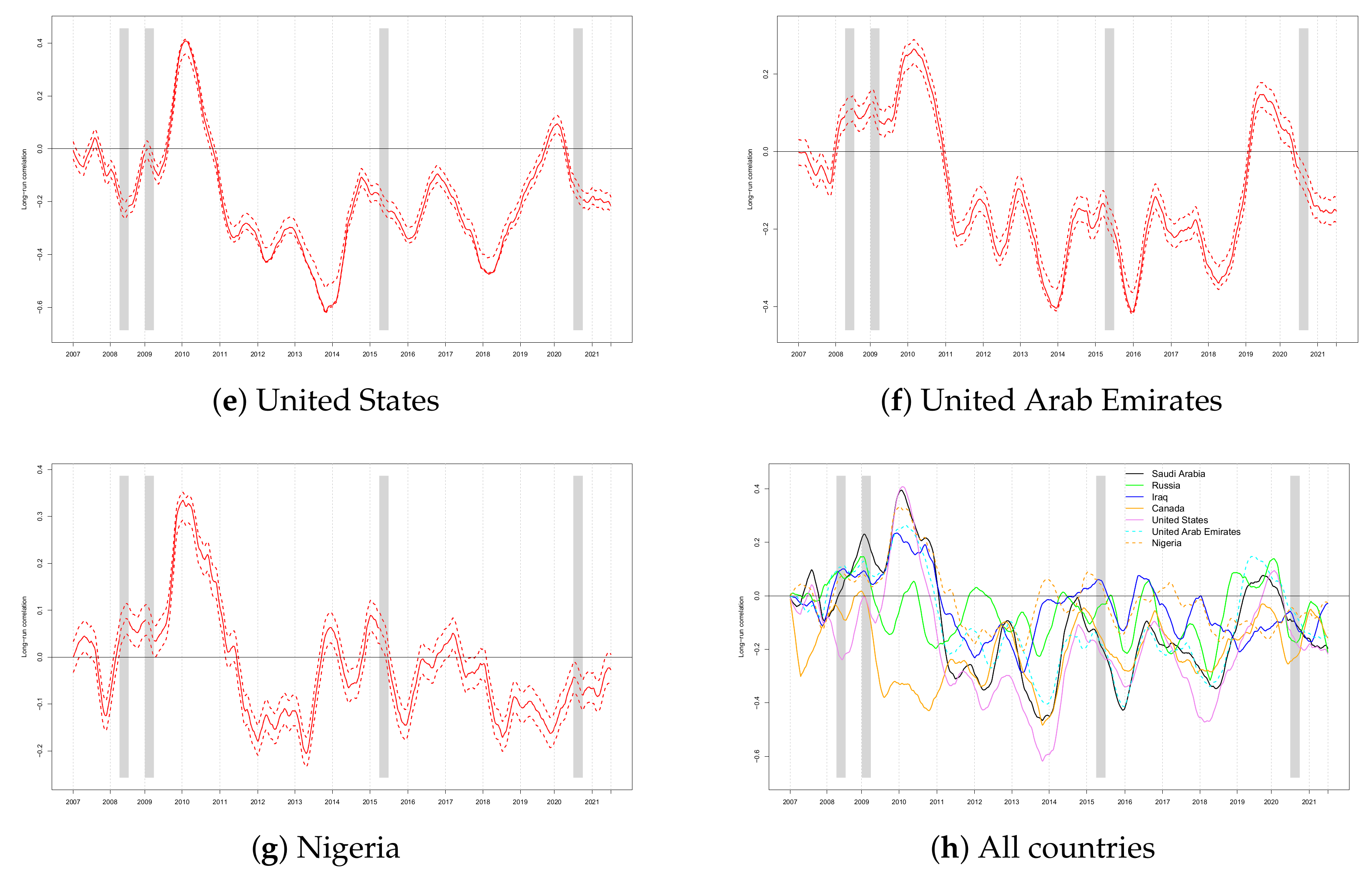

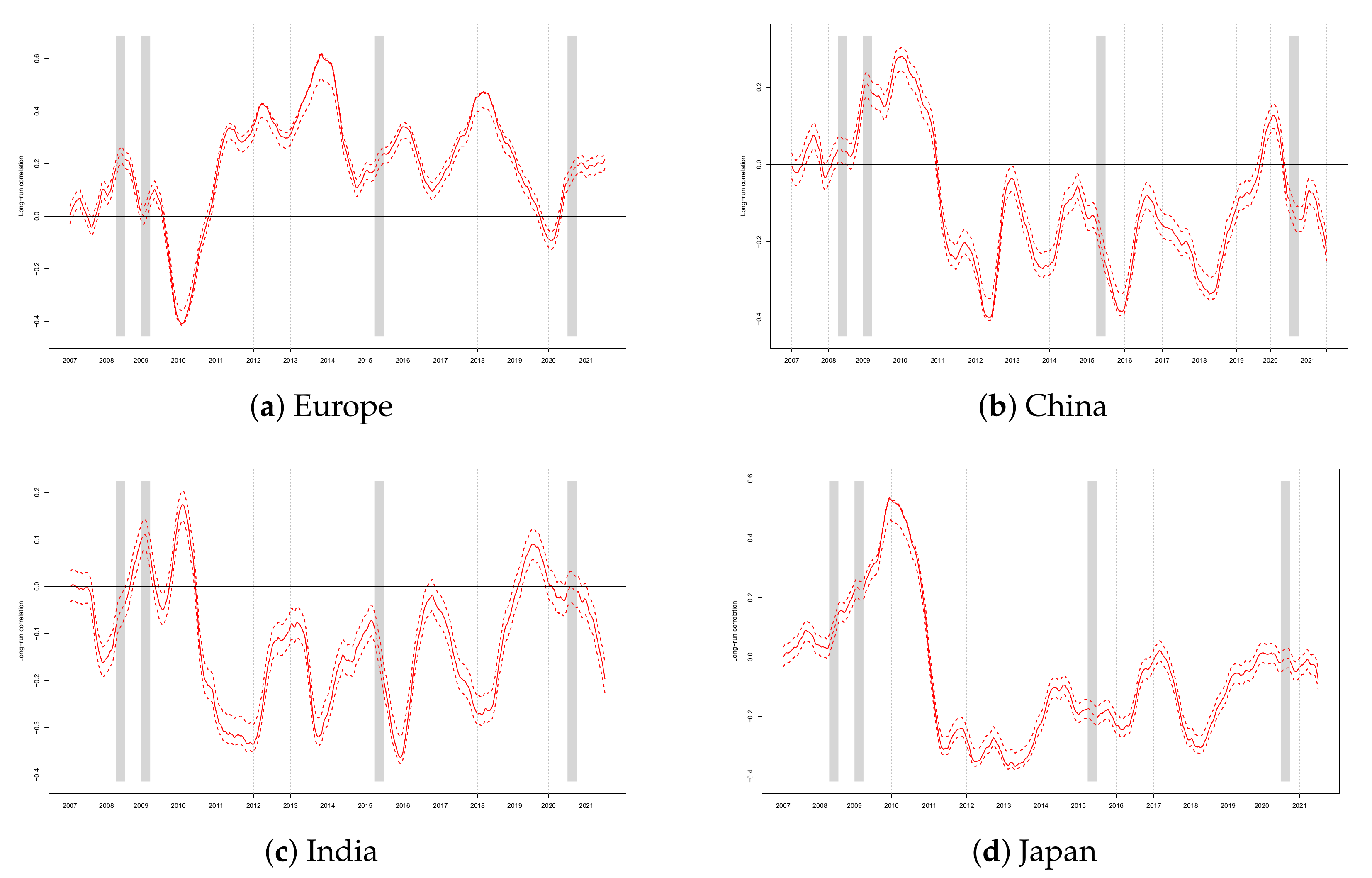

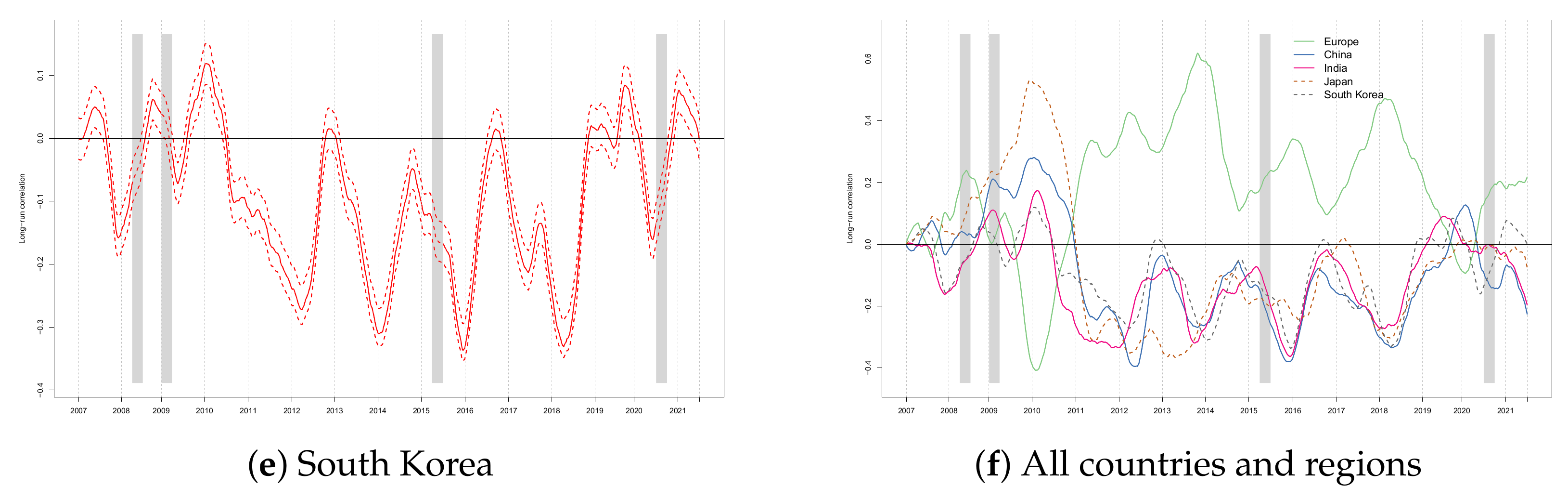

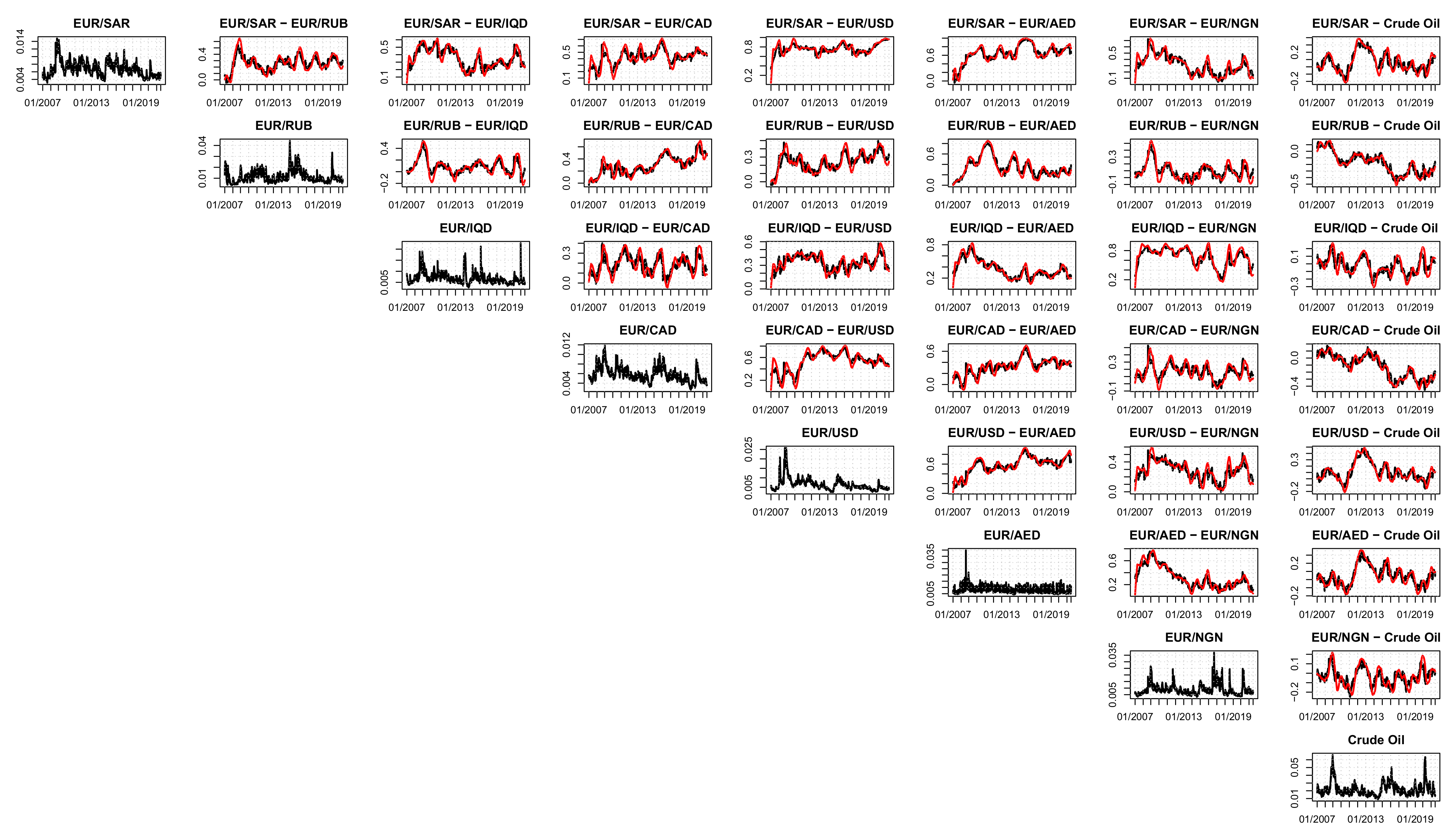

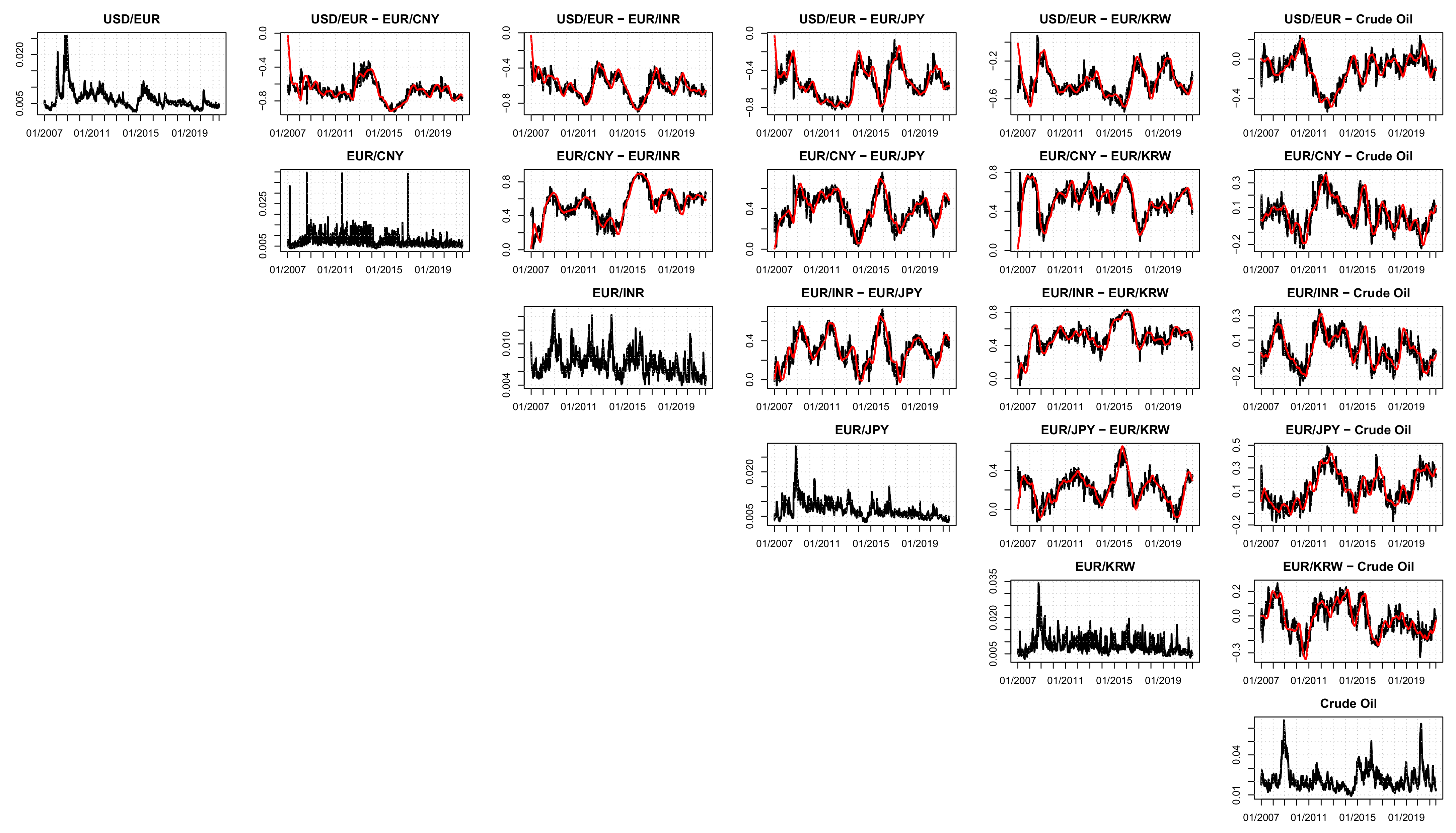

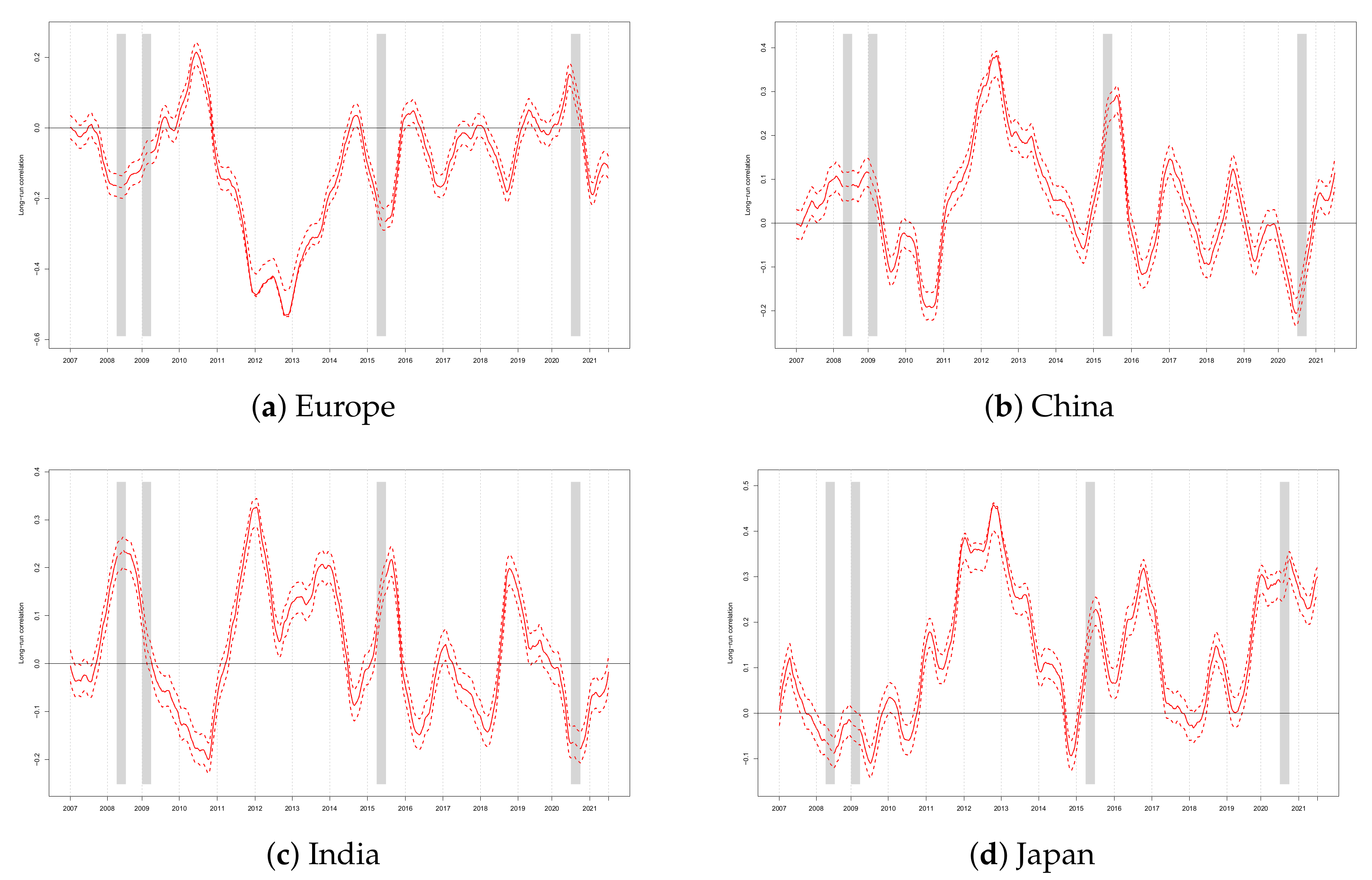

3.1. Contemporaneous Correlations

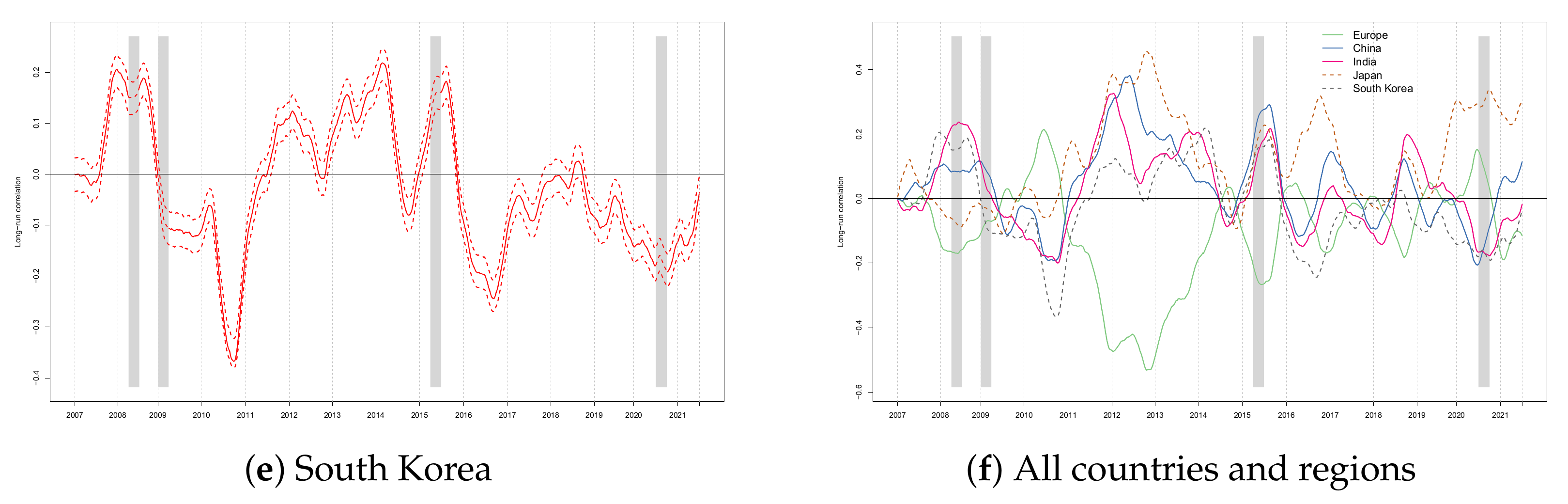

3.2. Lagged Correlations

4. Conclusions

Author Contributions

Funding

Conflicts of Interest

Abbreviations

| EIA | Energy Information Administration |

| OPEC | Organization of the Petroleum Exporting Countries |

| DCC | Dynamic conditional correlation |

| MIDAS | Mixing data sampling |

References

- Bildirici, M.; Guler Bayazit, N.; Ucan, Y. Analyzing crude oil prices under the impact of Covid-19 by using lstargarchlstm. Energies 2020, 13, 2980. [Google Scholar] [CrossRef]

- Mensi, W.; Reboredo, J.C.; Ugolini, A. Price-switching spillovers between gold, oil, and stock markets: Evidence from the USA and China during the COVID-19 pandemic. Resour. Policy 2021, 73, 102217. [Google Scholar] [CrossRef]

- Bouri, E.; Demirer, R.; Gupta, R.; Pierdzioch, C. Infectious diseases, market uncertainty and oil market volatility. Energies 2020, 13, 4090. [Google Scholar] [CrossRef]

- Kilian, L. Not all oil shocks are alike: Disentangling demand and supply shocks in the crude oil market. Am. Econ. Rev. 2009, 99, 1053–1069. [Google Scholar] [CrossRef] [Green Version]

- Peersman, G.; Van Robays, I. Oil and the euro area economy. Econ. Policy 2009, 24, 603–651. [Google Scholar] [CrossRef]

- Baumeister, C.; Van Robays, I.; Peersman, G. The Economic Consequences of Oil Shocks: Differences across Countries and Time. In Inflation in an Era of Relative Price Shocks; Reserve Bank of Australia: Sydney, Australia, 2010; pp. 91–128. [Google Scholar]

- Kilian, L.; Rebucci, A.; Spatafora, N. Oil shocks and external balances. J. Int. Econ. 2009, 77, 181–194. [Google Scholar] [CrossRef] [Green Version]

- Barnett, A.; Straub, R. What Drives U.S. Current Account Fluctuations; ECB Working Paper Series No. 959, November; European Central Bank: Frankfurt, Germany, 2008. [Google Scholar]

- Rickne, J. Oil Prices and Real Exchange Rate Movements in Oil-Exporting Countries: The Role of Institutions; Technical Report; Research Institute of Industrial Economics: Stockholm, Sweden, 2009. [Google Scholar]

- Serven, L.; Solimano, A. Private investment and macroeconomic adjustment: A survey. World Bank Res. Obs. 1992, 7, 95–114. [Google Scholar] [CrossRef]

- Bagella, M.; Becchetti, L.; Hasan, I. Real effective exchange rate volatility and growth: A framework to measure advantages of flexibility vs. costs of volatility. J. Bank. Financ. 2006, 30, 1149–1169. [Google Scholar] [CrossRef]

- Kilian, L.; Zhou, X. Oil Prices, Exchange Rates and Interest Rates; Technical Report, CEPR Discussion Paper No. DP13478; CEPR: London, UK, 2019. [Google Scholar]

- Brahmasrene, T. Crude Oil Prices and Exchange Rates: Causality, Variance Decomposition and Impulse Response. Energy Econ. 2014, 44, 407–412. [Google Scholar] [CrossRef]

- Beckmann, J.; Czudaj, R.; Arora, V. The Relationship between Oil Prices and Exchange Rates: Theory and Evidence; Technical Report, US Energy Information Administration Working Paper Series; U.S. Department of Energy: Washington, DC, USA, 2017.

- Fratzscher, M.; Schneider, D.; Van Robays, I. Oil Prices, Exchange Rates and Asset Prices; Technical Report, CESifo Working Paper Series; European Central Bank: Frankfurt, Germany, 2013. [Google Scholar]

- Kumar, S. Asymmetric impact of oil prices on exchange rate and stock prices. Q. Rev. Econ. Financ. 2019, 72, 41–51. [Google Scholar] [CrossRef]

- Kim, J.; Jung, H. Dependence Structure between Oil Prices, Exchange Rates, and Interest Rates. Energy J. 2018, 39, 233–258. [Google Scholar] [CrossRef] [Green Version]

- Blokhina, T.; Karpenko, O.; Guirinskiy, A. The Relationship between Oil Prices and Exchange Rate in Russia. Int. J. Energy Econ. Policy 2014, 6, 721–726. [Google Scholar]

- Hasanov, F.; Mikayilov, J.; Bulut, C.; Suleymanov, E.; Aliyev, F. The role of oil prices in exchange rate movements: The CIS oil exporters. Economies 2017, 5, 13. [Google Scholar] [CrossRef] [Green Version]

- Reboredo, J.C. Modelling oil price and exchange rate co-movements. J. Policy Model. 2012, 34, 419–440. [Google Scholar] [CrossRef]

- Beckmann, J.; Czudaj, R.L.; Arora, V. The relationship between oil prices and exchange rates: Revisiting theory and evidence. Energy Econ. 2020, 88, 104772. [Google Scholar] [CrossRef]

- Engle, R.F. Dynamic conditional correlation: A simple class of multivariate generalized autoregressive conditional heteroskedasticity models. J. Bus. Econ. Stat. 2002, 20, 339–350. [Google Scholar] [CrossRef]

- Colacito, R.; Engle, R.F.; Ghysels, E. A component model for dynamic correlations. J. Econom. 2011, 164, 45–59. [Google Scholar] [CrossRef] [Green Version]

- Ghysels, E.; Sinko, A.; Valkanov, R. MIDAS regressions: Further results and new directions. Econom. Rev. 2007, 26, 53–90. [Google Scholar] [CrossRef]

- Filis, G.; Degiannakis, S.; Floros, C. Dynamic correlation between stock market and oil prices: The case of oil-importing and oil-exporting countries. Int. Rev. Financ. Anal. 2011, 20, 152–164. [Google Scholar] [CrossRef]

- Nelson, D.B. Conditional heteroskedasticity in asset returns: A new approach. Econometrica 1991, 59, 347–370. [Google Scholar] [CrossRef]

- Candila, V. Multivariate Analysis of Cryptocurrencies. Econometrics 2021, 9, 28. [Google Scholar] [CrossRef]

- Asgharian, H.; Christiansen, C.; Hou, A.J. Macro-finance determinants of the long-run stock–bond correlation: The DCC-MIDAS specification. J. Financ. Econom. 2015, 14, 617–642. [Google Scholar] [CrossRef]

- Yang, L.; Yang, L.; Ho, K.C.; Hamori, S. Determinants of the long-term correlation between crude oil and stock markets. Energies 2019, 12, 4123. [Google Scholar] [CrossRef] [Green Version]

- Sebai, S.; Naoui, K.; ben brayek, A. A study of the interactive relationship between oil price and exchange rate: A copula approach and a DCC-MGARCH model. J. Econ. Asymmetries 2015, 12, 173–189. [Google Scholar] [CrossRef]

- Yang, L.; Cai, X.J.; Hamori, S. What determines the long-term correlation between oil prices and exchange rates? N. Am. J. Econ. Financ. 2018, 44, 140–152. [Google Scholar] [CrossRef]

- Amano, R.A.; Van Norden, S. Oil prices and the rise and fall of the US real exchange rate. J. Int. Money Financ. 1998, 17, 299–316. [Google Scholar] [CrossRef]

- John, M.; Wu, Y.; Narayan, M.; John, A.; Ikuta, T.; Ferbinteanu, J. Estimation of dynamic bivariate correlation using a weighted graph algorithm. Entropy 2020, 22, 617. [Google Scholar] [CrossRef]

- Choi, J.E.; Shin, D.W. Nonparametric estimation of time varying correlation coefficient. J. Korean Stat. Soc. 2021, 50, 333–353. [Google Scholar] [CrossRef]

- Candila, V. dccmidas: A Package for Estimating DCC-Based Models in R. R Package Version 0.1.0. 2021. Available online: https://www.researchgate.net/publication/350064227_dccmidas_A_package_for_estimating_DCC-based_models_in_R (accessed on 24 August 2021).

- Jawadi, F.; Louhichi, W.; Ameur, H.B.; Ftiti, Z. Do Jumps and Co-jumps Improve Volatility Forecasting of Oil and Currency Markets? Energy J. 2019, 40, SI2. [Google Scholar] [CrossRef]

| Currency | Min. | Max. | Mean | SD | Skew. | Kurt. | |

|---|---|---|---|---|---|---|---|

| WTI crude oil EUR | −0.077 | 0.077 | 0.000 | 0.023 | −0.122 | 1.785 | |

| Oil-exporting countries | |||||||

| Saudi Arabia | EUR/SAR | −0.063 | 0.034 | −0.000 | 0.007 | −0.108 | 4.134 |

| Russia | EUR/RUB | −0.077 | 0.077 | 0.000 | 0.013 | 0.238 | 6.123 |

| Iraq | EUR/IQD | −0.070 | 0.077 | −0.000 | 0.007 | 0.295 | 13.210 |

| Canada | EUR/CAD | −0.039 | 0.034 | 0.000 | 0.006 | −0.023 | 2.808 |

| United States | EUR/USD | −0.077 | 0.077 | −0.000 | 0.007 | −0.215 | 26.867 |

| United Arab Emirates | EUR/AED | −0.069 | 0.044 | −0.000 | 0.008 | 0.054 | 3.347 |

| Nigeria | EUR/NGN | −0.077 | 0.077 | 0.000 | 0.010 | 0.375 | 14.872 |

| Oil-importing countries | |||||||

| Europe | USD/EUR | −0.077 | 0.077 | 0.000 | 0.007 | 0.235 | 26.867 |

| China | EUR/CNY | −0.077 | 0.077 | −0.000 | 0.008 | −0.008 | 14.033 |

| India | EUR/INR | −0.045 | 0.041 | 0.000 | 0.007 | 0.042 | 2.388 |

| Japan | EUR/JPY | −0.058 | 0.077 | −0.000 | 0.008 | −0.284 | 8.315 |

| South Korea | EUR/KRW | −0.077 | 0.077 | 0.000 | 0.009 | −0.019 | 7.300 |

| Estimate | Std. Error | t Value | Pr() | Sig. | |

|---|---|---|---|---|---|

| Saudi Arabia | |||||

| −0.134 | 0.004 | −32.351 | 0.000 | *** | |

| −0.061 | 0.011 | −5.455 | 0.000 | *** | |

| 0.986 | 0.000 | 3974.267 | 0.000 | *** | |

| 0.103 | 0.006 | 18.424 | 0.000 | *** | |

| Russia | |||||

| −0.227 | 0.095 | −2.389 | 0.017 | ** | |

| −0.006 | 0.028 | −0.206 | 0.837 | ||

| 0.972 | 0.009 | 103.250 | 0.000 | *** | |

| 0.226 | 0.023 | 9.803 | 0.000 | *** | |

| Iraq | |||||

| −0.290 | 0.011 | −25.602 | 0.000 | *** | |

| 0.019 | 0.027 | 0.700 | 0.484 | ||

| 0.969 | 0.002 | 589.088 | 0.000 | *** | |

| 0.194 | 0.030 | 6.407 | 0.000 | *** | |

| Canada | |||||

| −0.122 | 0.004 | −31.660 | 0.000 | *** | |

| 0.019 | 0.011 | 1.778 | 0.075 | * | |

| 0.988 | 0.000 | 2934.942 | 0.000 | *** | |

| 0.113 | 0.004 | 26.754 | 0.000 | *** | |

| United States | |||||

| −0.017 | 0.010 | −1.651 | 0.099 | * | |

| −0.018 | 0.014 | −1.307 | 0.191 | ||

| 0.998 | 0.001 | 1225.251 | 0.000 | *** | |

| 0.145 | 0.011 | 13.611 | 0.000 | *** | |

| United Arab Emirates | |||||

| −1.037 | 0.981 | −1.058 | 0.290 | ||

| −0.102 | 0.035 | −2.886 | 0.004 | *** | |

| 0.891 | 0.102 | 8.743 | 0.000 | *** | |

| 0.308 | 0.115 | 2.683 | 0.007 | *** | |

| Nigeria | |||||

| −0.119 | 0.151 | −0.789 | 0.430 | ||

| −0.008 | 0.021 | −0.396 | 0.692 | ||

| 0.985 | 0.015 | 67.631 | 0.000 | *** | |

| 0.202 | 0.057 | 3.534 | 0.000 | *** | |

| WTI crude oil | |||||

| −0.110 | 0.008 | −14.430 | 0.000 | *** | |

| −0.074 | 0.008 | −8.771 | 0.000 | *** | |

| 0.985 | 0.001 | 984.155 | 0.000 | *** | |

| 0.110 | 0.014 | 7.605 | 0.000 | *** | |

| Estimate | Std. Error | t Value | Pr() | Sig. | |

|---|---|---|---|---|---|

| Europe | |||||

| −0.017 | 0.010 | −1.657 | 0.098 | * | |

| 0.018 | 0.014 | 1.312 | 0.190 | ||

| 0.998 | 0.001 | 1222.118 | 0.000 | *** | |

| 0.145 | 0.011 | 13.567 | 0.000 | *** | |

| China | |||||

| −1.207 | 1.110 | −1.088 | 0.277 | ||

| −0.063 | 0.034 | −1.848 | 0.065 | * | |

| 0.875 | 0.113 | 7.716 | 0.000 | *** | |

| 0.379 | 0.122 | 3.100 | 0.002 | *** | |

| India | |||||

| −0.262 | 0.274 | −0.956 | 0.339 | ||

| 0.001 | 0.025 | 0.033 | 0.974 | ||

| 0.973 | 0.026 | 37.231 | 0.000 | *** | |

| 0.158 | 0.272 | 0.583 | 0.560 | ||

| Japan | |||||

| −0.172 | 0.022 | −7.974 | 0.000 | *** | |

| −0.057 | 0.013 | −4.338 | 0.000 | *** | |

| 0.982 | 0.002 | 468.840 | 0.000 | *** | |

| 0.162 | 0.035 | 4.630 | 0.000 | *** | |

| South Korea | |||||

| −0.360 | 0.086 | −4.168 | 0.000 | *** | |

| −0.047 | 0.018 | −2.616 | 0.009 | *** | |

| 0.960 | 0.009 | 107.259 | 0.000 | *** | |

| 0.272 | 0.026 | 10.439 | 0.000 | *** | |

| WTI crude oil | |||||

| −0.110 | 0.008 | −14.430 | 0.000 | *** | |

| −0.074 | 0.008 | −8.771 | 0.000 | *** | |

| 0.985 | 0.001 | 984.155 | 0.000 | *** | |

| 0.110 | 0.014 | 7.605 | 0.000 | *** | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Candila, V.; Maximov, D.; Mikhaylov, A.; Moiseev, N.; Senjyu, T.; Tryndina, N. On the Relationship between Oil and Exchange Rates of Oil-Exporting and Oil-Importing Countries: From the Great Recession Period to the COVID-19 Era. Energies 2021, 14, 8046. https://doi.org/10.3390/en14238046

Candila V, Maximov D, Mikhaylov A, Moiseev N, Senjyu T, Tryndina N. On the Relationship between Oil and Exchange Rates of Oil-Exporting and Oil-Importing Countries: From the Great Recession Period to the COVID-19 Era. Energies. 2021; 14(23):8046. https://doi.org/10.3390/en14238046

Chicago/Turabian StyleCandila, Vincenzo, Denis Maximov, Alexey Mikhaylov, Nikita Moiseev, Tomonobu Senjyu, and Nicole Tryndina. 2021. "On the Relationship between Oil and Exchange Rates of Oil-Exporting and Oil-Importing Countries: From the Great Recession Period to the COVID-19 Era" Energies 14, no. 23: 8046. https://doi.org/10.3390/en14238046

APA StyleCandila, V., Maximov, D., Mikhaylov, A., Moiseev, N., Senjyu, T., & Tryndina, N. (2021). On the Relationship between Oil and Exchange Rates of Oil-Exporting and Oil-Importing Countries: From the Great Recession Period to the COVID-19 Era. Energies, 14(23), 8046. https://doi.org/10.3390/en14238046