Insurance Programs in the Renewable Energy Sources Projects

Abstract

1. Introduction

2. Materials and Methods

- energy;

- oil and gas production and processing;

- telecommunication systems;

- credit systems; and

- insurance systems.

- identification of systemic and non-systemic risks of the consumer;

- identification and assessment of insurance risks; and

- assessment of the frequency, severity, spread of damage, and the possibility of cumulation of insurance risks.

- the possibility of accepting the consequences of events on the part of the insurer; and

- ensuring the broadest possible protection of the policyholder/insured.

- reducing the costs of bankruptcy;

- reduction of the tax burden; and

- positive impact on the company’s investments by eliminating the problem of underinvestment.

- increasing the possibility of raising capital;

- the possibility of increasing financial leverage;

- a decrease in the cost of capital;

- avoidance of expenses related to a temporary bad financial situation or bankruptcy;

- obtaining tax benefits; and

- ensuring the stability of funds allocated for the company’s strategic investments.

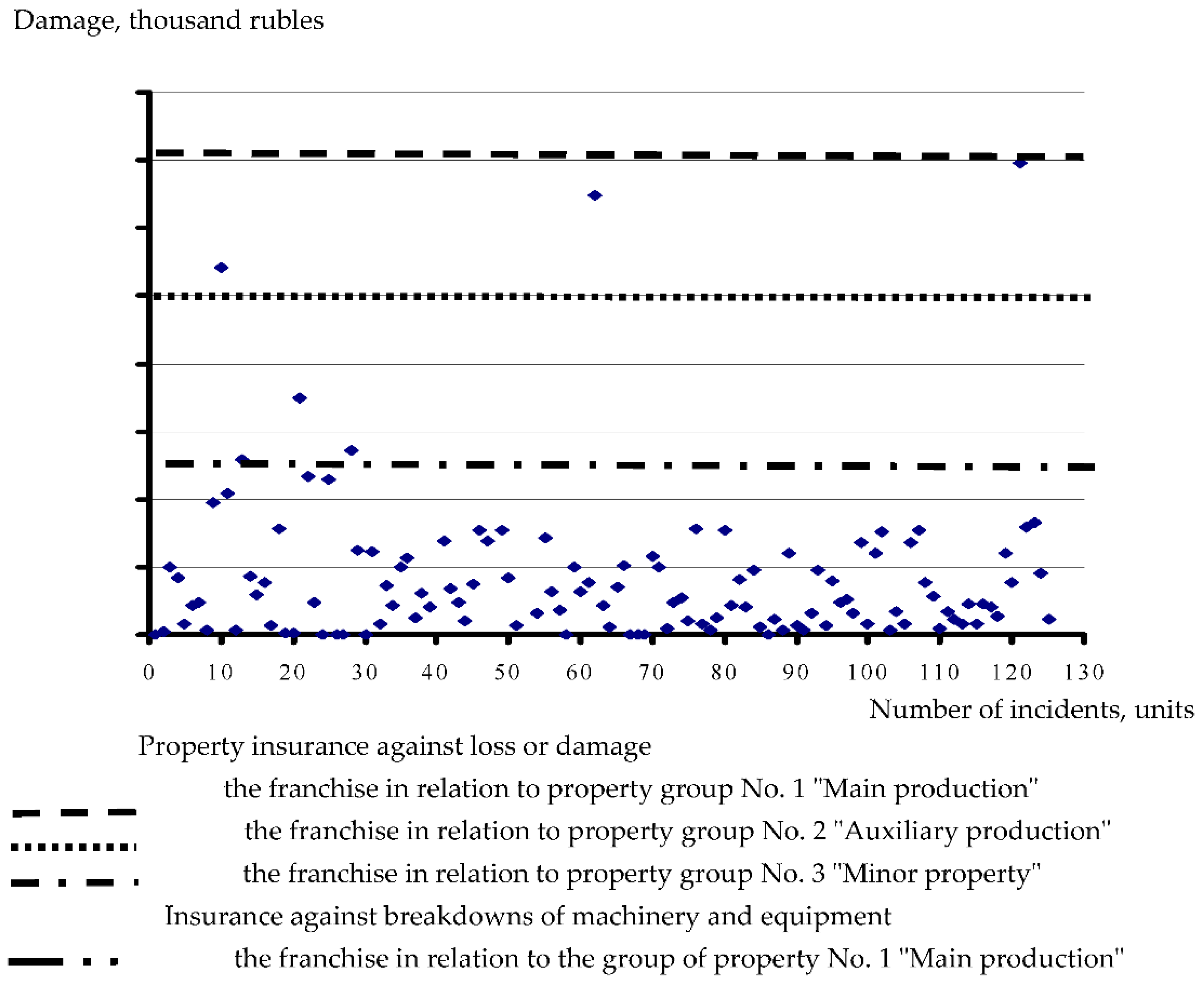

- franchises by property groups; and

- changes in insurance coverage, and changes in insurance and reinsurance coverage (in shares, by company).

- I.

- Distribution and assessment of impact by types of production of goods/works/services (for example, main and auxiliary production or lines).

- II.

- Distribution and assessment of risk complexes, if possible, to compensate for damages by own funds (self-insurance).

- III.

- Distribution and assessment of risk complexes according to the degree of impact on the continuity of production of goods/works/services.

- IV.

- Distribution and assessment of risk complexes to assess the effectiveness of insurance programs (retro-assessment).

- V.

- Distribution and assessment of risk complexes according to the degree of impact on the financial result.

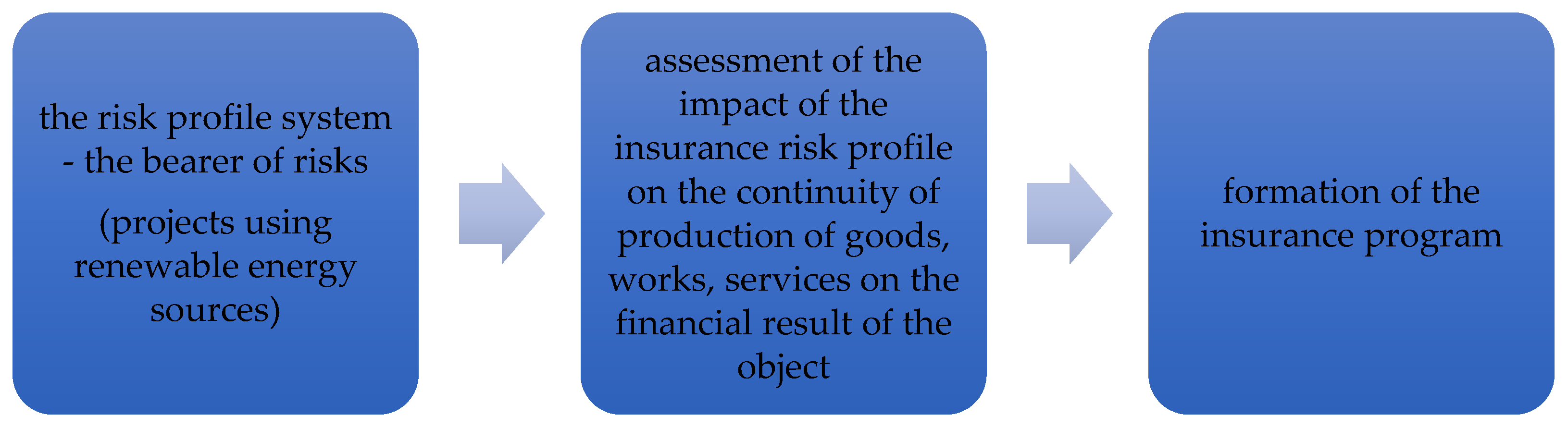

- formation of a complex of insurance risks based on the results of clause 2 “Assessment of the impact of the insurance risk profile on the continuity of production of goods, works, services; on the financial result of the object ”;

- determination of the insurance values of objects—carriers of risk (recovery, balance sheet, residual, market and the moment of the formation of the program);

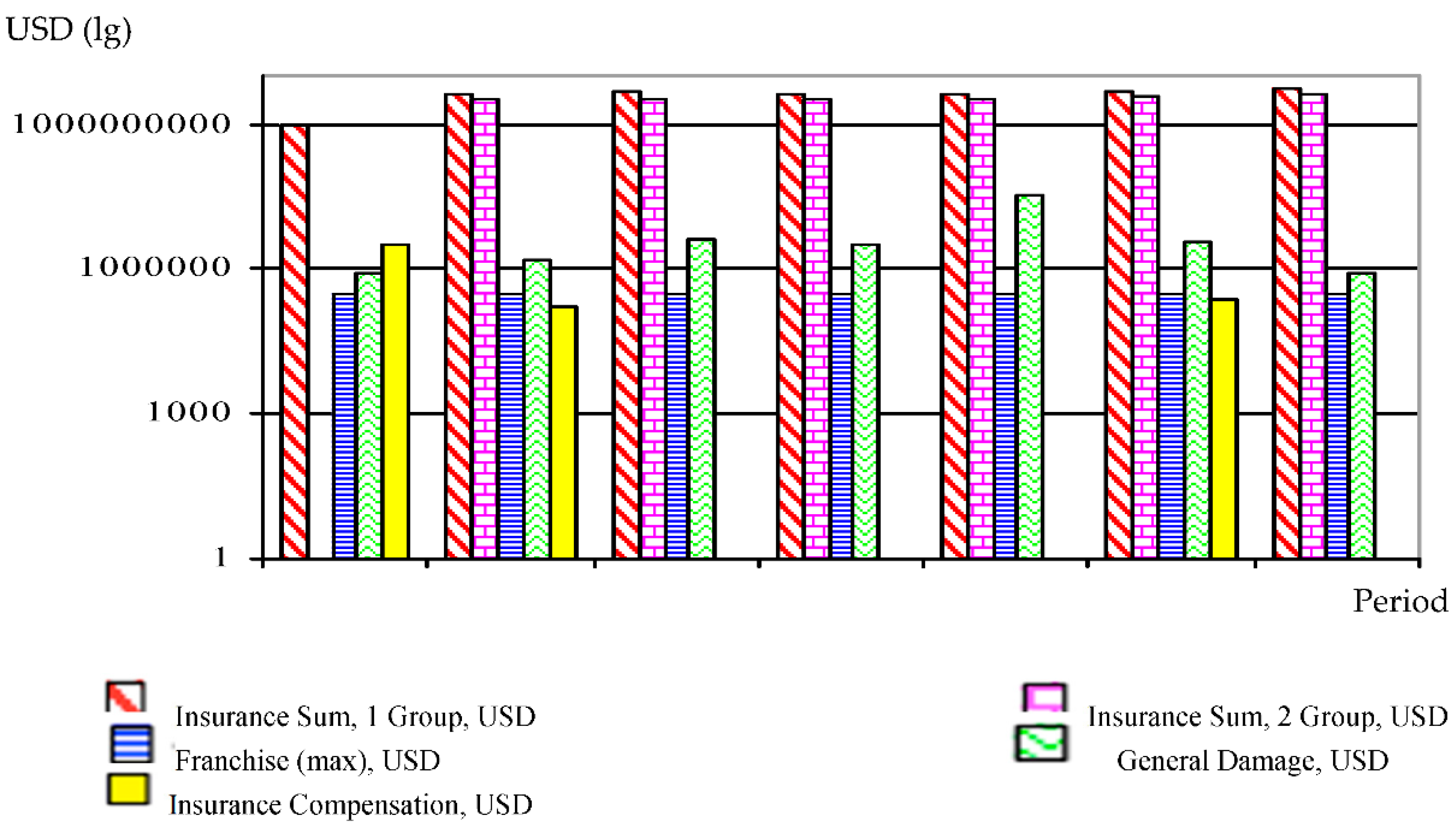

- determination of values and their recognition as insurance for voluntary forms of insurance can be based on the ratio of indicators: insurance premium (depending on the insured amount, which, in turn, is based on the accepted insurance value)/insurance damage/insurance payments—an example of calculations;

- formation of a complex of insurance risks for compulsory types of insurance (OSAGO, civil liability in the operation of hazardous production facilities, certain types of professional liability depending on the specifics of production and technology).

- VI.

- Budgeting of insurance by compulsory types (by cost, type, production).

- VII.

- Calculation of the effectiveness of insurance contracts (taking into account unrealized insurance risks); budgeting of a comprehensive insurance.

- VIII.

- Formation of technical specifications and announcement of a competition for insurers.

- IX.

- Holding a competition for insurers (including reinsurance programs); choice of insurance program strategies (with and without reinsurance levels, only direct insurance), for example, based on the results of stochastic modeling using software Risk Explorer Solutions [46], comparison of the expected profit, when the insurance premium rate is changing for different situations (with an excess of loss and proportional) (Figure 4).

- X.

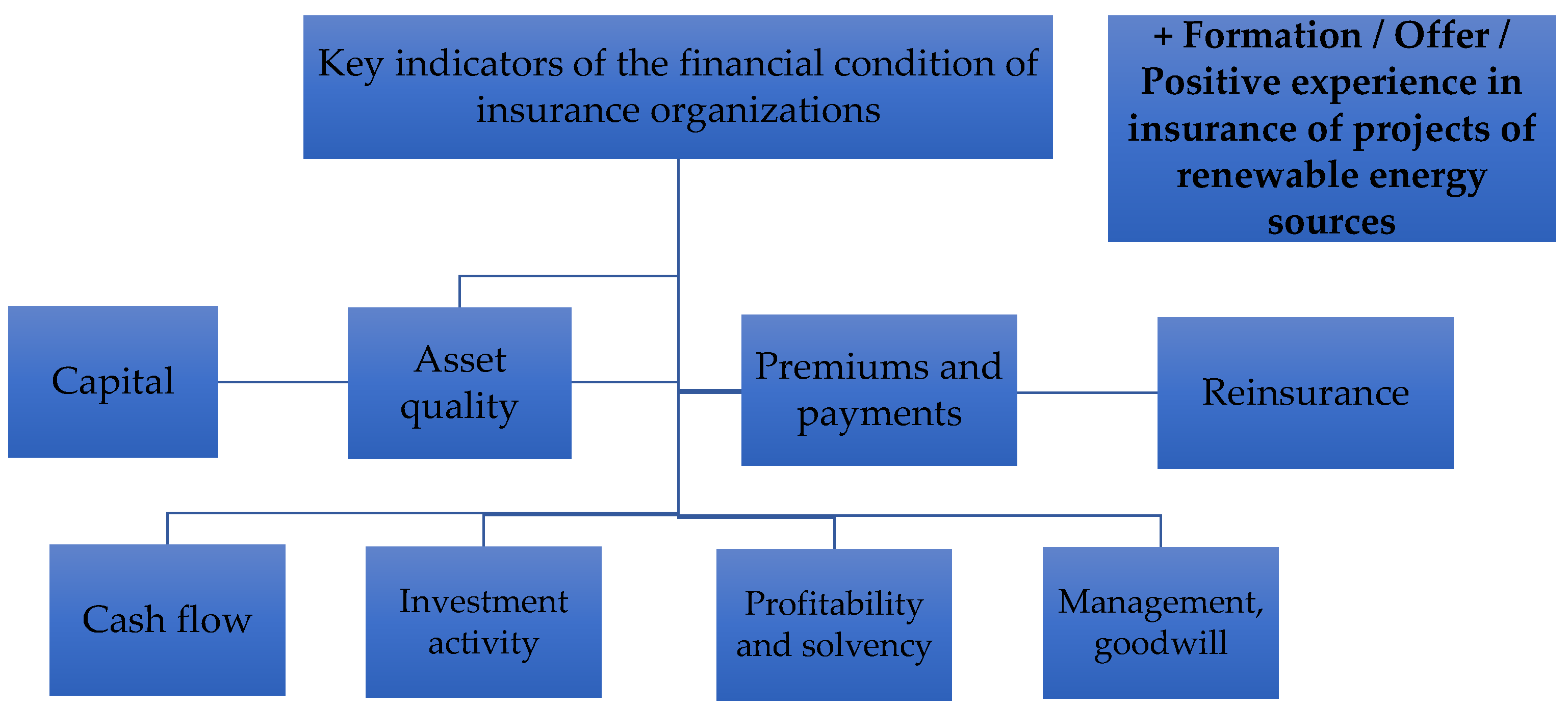

- Assessment of insurers—participants of insurance programs by key indicators (including insurance brokers and reinsurers)—and work and assessment key financial indicators.

3. Results

4. Discussion

- assessing the risk of default by insurance companies—counterparties in documentary and programmatic terms;

- calculating the aggregate limit of own retention of each insurance company, depending on the risk indicator of this insurance company in documentary and programmatic terms;

- determining differentiated franchises depending on the level of production risk in documentary and programmatic terms;

- determining differentiated limits of liability depending on the level of industrial risk in documentary and programmatic terms;

- determining a differentiated set of risks for various types of property and property rights in documentary terms; and

- determining the insurable value for various types of property in documentary terms.

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Stiglitz, J. Growth with Exhaustible Natural Resources: Efficient and Optimal Growth Paths. Rev. Econ. Stud. 1974, 41, 139–152. [Google Scholar] [CrossRef]

- Stern, D.I. Modeling International Trends in Energy Efficiency and Carbon Emissions Crawford School of Public Policy; Environmental Economics Research Hub Research Report 1054; The Australian National University: Canberra, Australia, 2010. [Google Scholar]

- Soimakallio, S.; Saikku, L. CO2 emissions attributed to annual average electricity consumption in OECD (the Organisation for Economic Co-operation and Development) countries. Energy 2012, 38, 13–20. [Google Scholar] [CrossRef]

- Stern, D.I.; Cleveland, C.J. Energy and Economic Growth, Working Papers in Economics, No. 0410; Department of Economics, Rensselaer Polytechnic Institute: Troy, NY, USA, 2004. [Google Scholar]

- Cleveland, C.J.; Kaufmann, R.K.; Stern, I.D. Aggregation and the role of energy in the economy. Ecol. Econ. 2000, 32, 301–317. [Google Scholar] [CrossRef]

- Costantini, V.; Martini, C. The causality between energy consumption and economic growth: A multi-sectoral analysis using non-stationary cointegrated panel data. Energy Econ. 2010, 32, 591–603. [Google Scholar] [CrossRef]

- Bretschger, L. Economics of technological change and the natural environment: How effective are innovations as a remedy for resource scarcity? Ecol. Econ. 2005, 54, 148–163. [Google Scholar] [CrossRef]

- Ackerman, F.; Daniel, J. (Mis) Understanding Climate Policy: The Role of Economic Modelling; WWF: Cambridge, UK, 2014; Available online: https://www.foe.co.uk/sites/default/files/downloads/synapsemisunderstanding-climate-policy-low-res-46332.pdf (accessed on 19 June 2021).

- Report of the World Commission on Environment and Development: Our Common Future. Available online: https://sustainabledevelopment.un.org/content/documents/5987our-common-future.pdf (accessed on 29 August 2021).

- ICF International. Economic Analysis of US Decarbonization Pathways: Summary and Findings; ICF International: Faifax, VA, USA, 2015. [Google Scholar]

- European Commission. A Framework Strategy for a Resilient Energy Union with a Forward-Looking Climate Change Policy. 2015. Available online: https://www.eea.europa.eu/policy-documents/com-2015-80-final (accessed on 17 November 2020).

- Barton, B.; Redgwell, C.; Ronne, A.; Zillman, D.N. Managing Risk in a Dynamic Legal and Regulatory Environment, Energy Security; Oxford University Press: New York, NY, USA, 2004; p. 5. [Google Scholar]

- Tosun, J.; Biesenbenderm, S.; Schulze, K. Energy Policy Making in the EU Building the Agenda; Springer: London, UK, 2015. [Google Scholar]

- Redgwell, C. International Legal Responses to the Challenges of a Lower-Carbon Future: Climate Change, Carbon Capture and Storage, and Biofuels. In Beyond the Carbon Economy. Energy Law in Transition; Zillman, D.N., Redgwell, C., Omorogbe, Y.O., Barrera-Hernandez, L.K., Eds.; Oxford University Press: New York, NY, USA, 2008; pp. 85–108. [Google Scholar]

- Chovancová, J.; Vavrek, R. (De)coupling Analysis with Focus on Energy Consumption in EU Countries and Its Spatial Evaluation. Pol. J. Environ. Stud. 2020, 29, 2091–2100. [Google Scholar] [CrossRef]

- Pukala, R. Use of Neural Networks in Risk Assessment and Optimization of Insurance Cover in Innovative enterprises, Engineering Management in Production and Services; Faculty of Engineering Management, Bialystok University of Technology: Bialystok, Poland, 2016; Volume 8, pp. 43–56. [Google Scholar]

- Jastrzębska, M.; Janowicz-Lomott, M.; Łyskawa, K. Zarządzanie Ryzykiem w Działalności Jednostek Samorządu Terytorialnego ze Szczególnym Uwzględnieniem Ryzyka Katastroficznego; Wolters Kluwer: Warszawa, Poland, 2014. [Google Scholar]

- Froot, K.A.; Scharfstein, D.S.; Stein, J.C. Risk Management: Coordinating Corporate Investment and Financing Policies. J. Financ. 1993, 48, 1629–1658. [Google Scholar] [CrossRef]

- McShane, M.; Nair, A.; Rustambekov, E. Does Enterprise Risk Management Increase Firm Value? J. Account. Audit. Financ. 2011, 26, 641–658. [Google Scholar] [CrossRef]

- Bromiley, P.; McShane, M.; Nair, E.; Rustambekov, E. Enterprise Risk Management: Review, Critique, and Research Directions. Long Range Plan 2015, 48, 265–276. [Google Scholar] [CrossRef]

- Ward, S. Exploring the role of the corporate risk manager. Risk Manag. 2001, 3, 7–25. [Google Scholar] [CrossRef]

- Hubbard, D. The Failure of Risk Management: Why It’s Broken and How to Fix It; John Wiley & Sons: Hoboken, NJ, USA, 2009; p. 46. [Google Scholar]

- Doherty, N.A. Integrated Risk Management; McGraw: New York, NY, USA, 2002. [Google Scholar]

- Beaumont, V.W. Zen and 5 steps to ERM. Risk Manag. 2007, 54, 36–40. [Google Scholar]

- Vavrek, R. Disparity of Evaluation of Municipalities on Region and District Level in Slovakia. In Proceedings of the Hradec Economic Days 2015, Hradec Králové, Czech Republic, 3–4 February 2015; Jedlička, P., Ed.; University of Hradec Králové: Hradec Králové, Czech Republic, 2015. [Google Scholar]

- Adamišin, P.; Vavrek, R. Analysis of the Links between Selected Socio-economic Indicators and Waste Management at the Regional Level in the Slovak Republic. In Proceedings of the 5th Central European Conference in Regional Science, Košice, Slovakia, 5–8 October 2014; Nijkamp, P., Kourtit, K., Bucek, M., Hudec, O., Eds.; Technical University of Košice: Košice, Slovakia, 2014. [Google Scholar]

- Vavrek, R.; Chovancová, J. Energy Performance of the European Union Countries in Terms of Reaching the European Energy Union Objectives. Energies 2020, 13, 5317. [Google Scholar] [CrossRef]

- Wysokińska-Senkus, A.; Górna, J. Towards sustainable development: Risk management for organizational security. Entrep. Sustain. Issues 2021, 8, 527–544. [Google Scholar] [CrossRef]

- Plėta, T.; Tvaronavičienė, M.; Della Casa, S.; Agafonov, K. Cyber-attacks to critical energy infrastructure and management issues: Overview of selected cases. Insights Reg. Dev. 2020, 2, 703–715. [Google Scholar] [CrossRef]

- Domańska-Szaruga, B. Maturity of risk management culture. Entrep. Sustain. Issues 2020, 7, 2060–2078. [Google Scholar] [CrossRef]

- Mussapirov, K.; Jalkibaeyev, J.; Kurenkeyeva, G.; Kadirbergenova, A.; Petrova, M.; Zhakypbek, L. Business scaling through outsourcing and networking: Selected case studies. Entrep. Sustain. Issues 2019, 7, 1480–1495. [Google Scholar] [CrossRef]

- Froot, K.A.; Scharfstein, D.S.; Stain, J.C. Risk Management: Coordinating Corporate Investment and Financing Policies, NBER Working Paper. J. Financ. 1992, 4084, 2–5. [Google Scholar]

- Pukala, R.; Petrova, M. Application of the AHP method to select an optimal source of financing innovation in the mining sector. In Proceedings of the E3S Web of Conferences, IV-th IIMS, Kemerovo, Russia, 14–16 October 2019; Volume 105. [Google Scholar] [CrossRef]

- Kirillova, N.V. Insurance and Risk Management Systems in Russia 1. Econ. Bus. Rev. 2015, 1, 112. [Google Scholar] [CrossRef][Green Version]

- Kirillova, N.; Bazhenova, V. Corporate Insurance in the Russian Electric Power Industry. Rev. Bus. Econ. Stud. 2015, 1, 89–98. [Google Scholar]

- Kirillova, N. Regulation of Financial Condition Insurers in the Russian Federation and Assessment the Insurers by Insured. Copernic. J. Financ. Account. 2014, 3, 79–89. [Google Scholar] [CrossRef]

- Tsyganov, A.; Kirillova, N.; Kurganov, V. Insurance Mechanisms of Financial Support in the Field of Energy Conservation Activities. Financ. J. 2016, 2, 100–110. Available online: https://www.finjournal-nifi.ru/images/FILES/Journal/Archive/2016/2/fm_2016_2.pdf (accessed on 19 June 2021).

- Kirillova, N. Insurance of Industrial Enterprises: Theory, Methodology, Practice; Abstract of doctoral dissertation. Doctor’s Thesis, The Financial University under the Government of the Russian Federation, Moscow, Russia, 2008. Available online: https://elibrary.ru/item.asp?id=23832443; https://elibrary.ru/download/elibrary_23832443_63684365.pdf (accessed on 14 July 2021).

- Pukala, R.; Kirillova, N.; Dorozhkin, A. Insurance Instruments in Estimating the Cost Energy Assets with Renewable Energy Sources. Energies 2021, 14, 3672. [Google Scholar] [CrossRef]

- Mayers, D.; Smith, C.W. On the Corporate Demand for Insurance. J. Bus. 1982, 55, 190–205. [Google Scholar] [CrossRef]

- Borch, K. Static Equilibrium under Uncertainty and Incomplete Markets. Geneva Pap. Risk Insur.-Issues Pract. 1983, 8, 307–315. [Google Scholar] [CrossRef][Green Version]

- Vavrek, R. Evaluation of the Impact of Selected Weighting Methods on the Results of the TOPSIS Technique. Int. J. Inf. Tech. Dec. Mak. 2019, 8, 1821–1843. [Google Scholar] [CrossRef]

- OJSC Magnitogorsk Iron and Steel Works. Available online: http://eng.mmk.ru/corporate_governance/index.php (accessed on 14 July 2021).

- United Nations Environment Programme. Financial Risk Management Instruments for Renewable Energy Projects; Summary Document; Words and Publications: Oxford, UK, 2004. [Google Scholar]

- Allianz Risk Barometer 2019. Allianz Global Corporate & Specialty. Available online: https://www.agcs.allianz.com/news-and-insights/news/allianz-risk-barometer-2019.html (accessed on 14 July 2021).

- Ultimate Risk Solution. Risk Explorer Solutions. Available online: https://www.ultirisk.com/products/1#top (accessed on 14 July 2021).

- Ministry of Energy of Russian Federation. Available online: https://minenergo.gov.ru/node/18976 (accessed on 14 July 2021).

| № | Types of Risk | Risk Characteristic | Possibility (+) of Insurance |

|---|---|---|---|

| 1 | Build and test | Risk of property damage or the possible third-party liability arising during construction or the testing of new plants (insurance terminology). | (+) |

| 2 | Business and strategic | Risk affecting the viability of the business, such as the risk of technological obsolescence. | (−) |

| 3 | Ecological | Risk of environmental damage caused by the installation and liability arising from such damage. | (−) |

| 4 | Financial | The risk of insufficient access to capital. | (−) |

| 5 | Market | The risk of an increase in prices for goods and other resources or a decrease in the price of electricity sold. | (−) (+) |

| 6 | Operating | Risk of unplanned plant shutdown, for example due to unavailability of resources, plant damage or component failure, including cyber threats. | (+) (−) |

| 7 | Political/regulatory | Risk associated with changes in government policies, such as subsidy policies, that affect the profitability of the enterprise. | (−) |

| 8 | Weather | Risk of reduced electricity generation due to lack of wind or sunlight. | (−) (+) |

| Life Phase | Examples of Insurance Products |

|---|---|

| Specifications, design, construction, testing, commissioning, revisions |

|

| Operation—operation and maintenance |

|

|

| Rank | Risk | 2018 Rank | Trend |

|---|---|---|---|

| 1 | Business interruption (incl. supply chain disruption) | 2 | Up |

| 2 | Natural catastrophes (e.g., storm, flood, earthquake) | 1 | Down |

| 3 | Changes in legislation and regulation (e.g., trade wars and tariffs, economic sanctions, protectionism, Brexit, Euro-zone disintegration) | 3 | = |

| 4 | Cyber incidents (e.g., cybercrime, IT failure/outage, data breaches, fines and penalties) | 4 | = |

| 5 | New technologies (e.g., impact of increasing interconnectivity, nanotechnology, artificial intelligence, 3D printing, autonomous vehicles, blockchain) | New | Up |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kirillova, N.; Pukala, R.; Janowicz-Lomott, M. Insurance Programs in the Renewable Energy Sources Projects. Energies 2021, 14, 6802. https://doi.org/10.3390/en14206802

Kirillova N, Pukala R, Janowicz-Lomott M. Insurance Programs in the Renewable Energy Sources Projects. Energies. 2021; 14(20):6802. https://doi.org/10.3390/en14206802

Chicago/Turabian StyleKirillova, Nadezda, Ryszard Pukala, and Marietta Janowicz-Lomott. 2021. "Insurance Programs in the Renewable Energy Sources Projects" Energies 14, no. 20: 6802. https://doi.org/10.3390/en14206802

APA StyleKirillova, N., Pukala, R., & Janowicz-Lomott, M. (2021). Insurance Programs in the Renewable Energy Sources Projects. Energies, 14(20), 6802. https://doi.org/10.3390/en14206802