1. Introduction

An essential objective of any country should be to achieve economic growth without affecting its environment. The relationship between economic growth and the environment can be seen in the environmental Kuznets curve. It is considered that carbon emissions today are one of the leading causes of global warming and climate change, that is because, in recent decades, it this has been an issue that has received much attention from environmentalists, international organizations, and governments of different countries [

1]. More recently, the relationship between environmental pollution, energy consumption, and macroeconomic variables (e.g., financial development and economic growth) have received considerable attention in the scientific literature.

One of the first studies to test the hypothesis of an inverted U-shaped relationship between environmental degradation and economic development was Panayotuo [

2]. With cross-sectional data, his results supported the hypothesis of an inverted U for a sample of developed and developing countries that he called the environmental Kuznets curve. Since then, the empirical evidence has not achieved a consensus.

To mention some studies with favorable results, for example, Cansino et al. [

3] use a representative sample of 18 Latin American countries for 1996–2013. The main findings show that the relationship between income and greenhouse gas (GHG) emissions confirms the traditional environmental Kuznets curve hypothesis. Moreover, they also show that the quality of institutions and technological progress improve environmental sustainability. The document also contributes to the growing body of literature on the pollution haven hypothesis (PHH). Jimenez et al. [

4] analyze the impact of economic growth on the environment during 1971–2015 in Ecuador through the environmental Kuznets curve hypothesis. The results reveal a direct and positive short-term relationship between economic growth and CO

2 emissions. The authors confirm the hypothesis for this country, which opens the door to discussing optimal production conditions while minimizing contamination. In another study, Ridzuan [

5] examines the influence of income inequality on the environmental Kuznets curve, that is, the impact of income inequality at the turning point of the curve. Using a large sample (N = 170–174) of countries for the period 1991–2010, the author finds evidence of the environmental Kuznets curve hypothesis for SO

2 emissions, and income inequality has a significant impact on the inflection point. Income inequality increases the curve’s turning point, suggesting that high inequality can be detrimental to the environment. Furthermore, inequality appears to be more important than corruption in determining the inflection point of the curve. Altıntaş and Kassouri [

6] use two environmental degradation indicators, such as the ecological footprint and CO

2 emissions, to verify the environmental Kuznets curve hypothesis. They estimate a heterogeneous panel model with data from 14 European countries during the period 1990–2014. These authors find evidence of the sensitivity of the hypothesis to the type of environmental degradation proxy used. Germani et al. [

7], analyzing a panel data set for 110 Italian provinces from 2010 to 2015, empirically evaluated the shape of environmental crimes Kuznets curve, controlling for demographic, judicial, and socioeconomic heterogeneity. The authors show evidence of an inverted U-shaped relationship for the Italian provinces.

Some studies where the results do not validate this hypothesis follow. Shujah-ur-Rahman [

8], using the ecological footprint to measure environmental quality, analyzes the environmental Kuznets curve for the 16 Central and Eastern European Countries (CEECs) for 1991–2014. The results show that in the long term, the effect of economic growth on the ecological footprint is not stable, and the relationship is in the form of N. There is a cubic functional form between per capita income and the ecological footprint for these countries. Pontarollo and Mendieta [

9], applying a Bayesian comparison approach, analyze the existence of an inverted U-curve relationship between land consumption and economic development, namely the environmental Kuznets curve, with data ranging from 2007 to 2015 for 221 cantons of Ecuador. The results do not support the inverted U-shaped Kuznets curve hypothesis. In contrast, the curvature is convex, which means higher land consumption levels for higher wealth levels. Gavrilyeva et al. [

10] analyze the environmental Kuznets curve hypothesis for the Republic of Sakha (Yakutia) 2013–2017. The results show that, unlike Russia, the environmental Kuznets curve model has not been confirmed for Yakutia. Economic growth has led to an increase in emissions, but the region is still not at the maximum of the curve. Finally, some studies where empirical evidence has been mixed are the following. Sencer Atasoy [

11] studies the validity of the hypothesis of the environmental Kuznets curve for the 50 U.S. states during the period 1960–2010. Using panel data, the estimator augmented mean group (AMG) validates the hypothesis for 30 of the 50 states with inflection points for per capita income between

$1292 and

$48,597. The estimator common correlated effects mean group (CCEMG) provides only evidence for 10 states with inflection points between

$2457 and

$14,603. Churchill et al. [

12] test the environmental Kuznets curve’s hypothesis for a panel of 20 Organization for Economic Cooperation and Development (OECD) countries from 1870 to 2014. The authors find the validity of the hypothesis for the panel as a whole with three of four estimators. However, the country-specific results only provide mixed support for the hypothesis. The hypothesis is valid for nine of the 20 countries, with five exhibiting a traditional inverted U-shaped relationship, three exhibiting an N-shaped relationship, and one an inverted N-shaped relationship. Arango et al. [

13] review the environmental Kuznets curve’s hypothesis for Canada, Mexico, and the United States from 1990–2016. The results of Mexico and the USA confirm the hypothesis of the environmental Kuznets curve. However, for Canada, the hypothesis does not hold.

Carbon dioxide emissions are widely used in the existing literature as a variable that measures environmental degradation. However, one of the alternative variables recently introduced in some studies [

6,

14,

15] is the per capita ecological footprint, which has the advantage of covering various aspects of environmental degradation such as farmland footprint, carbon footprint, the land footprint of grazing, and so forth, in contrast to conventional greenhouse gases [

6]. The carbon dioxide emissions indicator does not consider the complex nature of environmental degradation, while the ecological footprint is more appropriate because it tracks the use of multiple categories of productive surface areas [

15]. The ecological footprint estimates the quantity of natural capital necessary to sustain the resource demand and waste absorption requirements in global hectares or hectares of globally standardized bioproductivity [

16]. The fact that CO

2 emissions tend to trend upward poses a problem for those studies that focus on CO

2 emissions in their analysis of the environmental Kuznets curve hypothesis since it can skew estimates. Following this idea, economists should investigate the hypothesis considering a more inclusive environmental degradation indicator, such as the per capita ecological footprint [

15].

New variables have also recently been included that could help explain the behavior of the curve. For example, research on the environmental Kuznets curve hypothesis has also incorporated the consumption of renewable energy as one of the variables under study because the evidence shows that the increase in renewable energy consumption can help reduce environmental pressure and dependence on fossil fuels [

16,

17,

18,

19,

20,

21,

22,

23]. Another variable that can be considered to reduce polluting emissions is the development of patents. In this sense, Popp [

24] argues that the use of patents offers several advantages when analyzing technological change and its effect on the environment since they provide detailed records of each invention with each patent’s bibliographic data, and if patent data are available for many countries, these can be used to examine innovative activity levels between countries. Patents are related to technology, which can be useful if this improves existing technology and reduces polluting emissions [

1]. Recently, Töbelmann and Wendler [

25] analyze environmental innovation’s impact on carbon dioxide emissions for the European Union (EU-27) countries for 1992–2014. Using the generalized method of moments in the context of dynamic panel data, these authors find that environmental innovation contributes to reducing carbon dioxide emissions, while innovative activity, in general, does not cause such a reduction in emissions.

Another variable is trade openness or international trade. According to Churchill et al. [

12], the effect of trade openness on the environment can be positive or negative. Trade can increase pollution and environmental degradation due to increased production, market activities, and access to goods and services through trade openness [

26]. However, trade can also reduce pollution and environmental degradation when trade allows access to technologies that promote environmentally friendly production [

27,

28]. Some works that use trade openness in the hypothesis of the environmental Kuznets curve are Allard et al. [

29] and Gómez and Rodríguez [

23].

Recently, quantile regression methods have also been used to estimate the environmental Kuznets curve more adequately. For example, Wang et al. [

30] analyze the effect of democracy, political globalization, and urbanization concerning particulate matter (PM2.5) concentrations in the G20 countries, using quantile regression in panel data for a sample period 2000 to 2014. The results confirm the existence of the environmental Kuznets curve for some countries. Allard et al. [

29] analyze the N form of the environmental Kuznets curve, using a quantile regression analysis in panel data for 74 countries for 1994–2012, and considering additional variables such as technological development, renewable energy consumption, trade, and institutional inequality. The results show evidence of the N-shaped Kuznets curve for all income groups, except for the upper middle-income countries. They also find evidence of a negative relationship between renewable energy consumption and emissions. Albulescua et al. [

31], using a quantile regression analysis in panel data, study the relationship between foreign direct investment (FDI), income, and environmental pollution for 14 countries in Latin America (Argentina, Brazil, Bolivia, Chile, Colombia, Costa Rica, Honduras, Mexico, Nicaragua, Panama, Paraguay, Peru, Uruguay, and Venezuela) for the period 1980–2010. The results show that FDI does not have a clear impact on pollution, and the hypothesis of the environmental Kuznets curve is partially validated for these countries. Cheng et al. [

1] use the quantile regression method to examine the impact of economic growth, renewable energy, and patents on 35 OECD countries’ carbon emissions during 1996–2015. The results do not validate the environmental Kuznets curve. They show that technological development does not show a statistically significant relationship, while renewable energy does show a negative and statistically significant relationship with emissions. Ike et al. [

32] analyze the dynamic effect of oil production on carbon emissions in 15 oil-producing countries for the period 1980–2010, using the method of moments quantile regression (MMQR) with fixed effects, where the results confirm the hypothesis of the Kuznets curve for countries with medium and high emissions.

This research studies the relationship between economic growth, renewable energy consumption, trade openness, patenting activity, and environmental degradation (measured by the ecological footprint) for United States–Mexico–Canada Agreement (USMCA) member countries through econometric analysis with panel data during 1980–2016. This agreement entered into force on 1 July 2020. Their economic and commercial relations have formally integrated these countries since the North American Free Trade Agreement (NAFTA) began in 1994. Therefore, it would be necessary for this region to design environmental policies that accompany this new free trade agreement to seek economic benefits and reduce environmental degradation. It is a region where the population, which generates demand for goods and services, has grown enormously since it went from 319.5 to 489.9 million people from 1980 to 2018, while production has grown from 3.354 to 23.47 billion US dollars in the same period [

33] with a side effect of environmental damage.

The contributions of this paper to the analysis of this region are the following. First, it is one of the first studies that use the ecological footprint to validate the environmental Kuznets curve. Second, renewable energy, trade openness, and patents are included as additional variables to verify if they contribute to reducing environmental degradation. Third, the new MMQR with fixed effects by Machado and Silva [

34] is used. The article is structured as follows: after the Introduction, the following section briefly describes the reviewed theoretical literature. Then in the third section, the econometric methodology is analyzed. The results are then presented and interpreted in the fourth section. Finally, the paper proposes some conclusions.

2. Theoretical Review

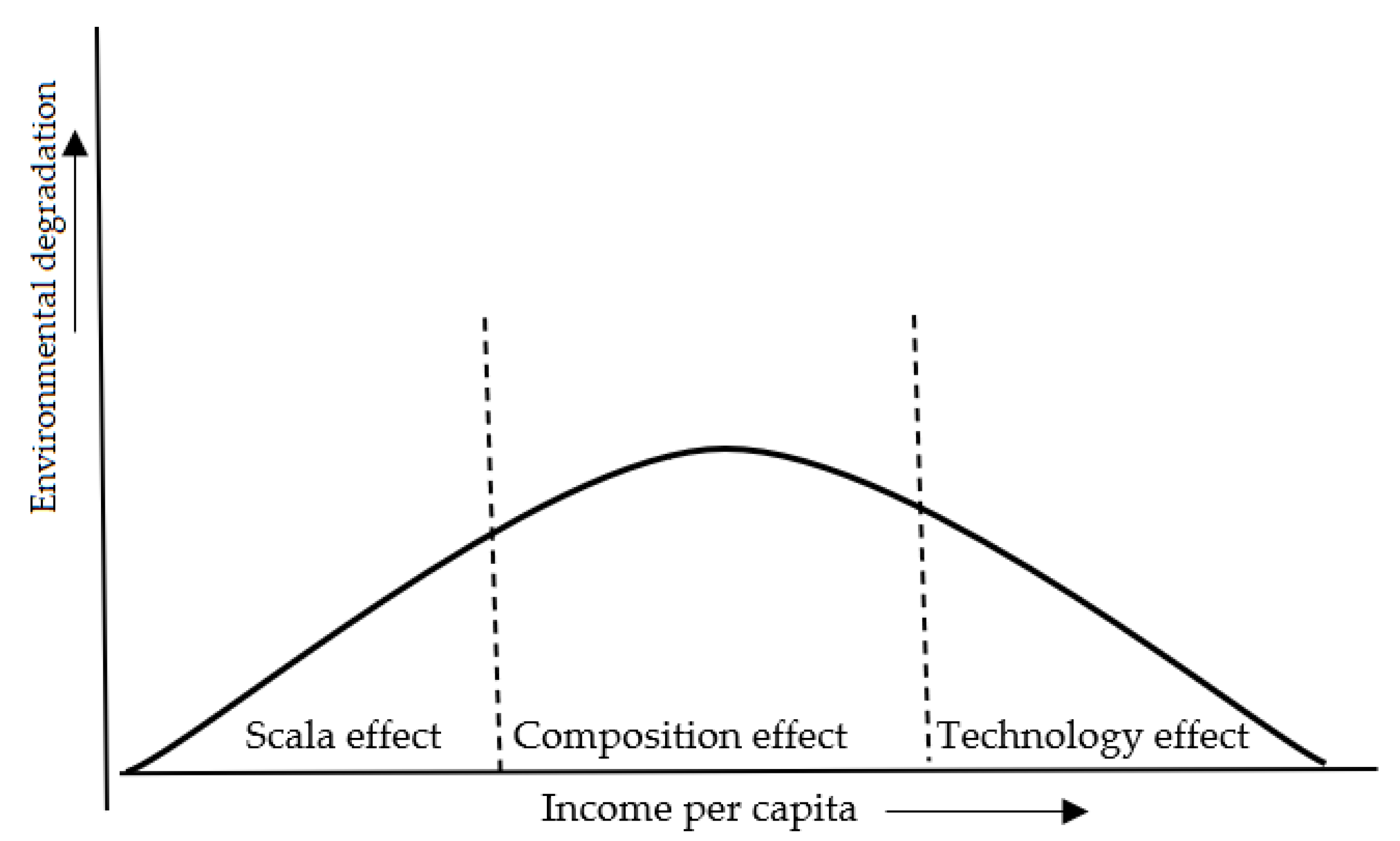

The environmental Kuznets curve hypothesis postulates an inverted U-shaped relationship between different pollutants and per capita income [

26]. Economic development can be divided into three stages: scale effect, composition effect, and technical effect (

Figure 1). In the first stage of economic development (scale effect), it is established that increases in production cause increases in environmental degradation and, therefore, economic growth increases environmental degradation (pre-industrial economies). In the second stage of economic development (composition effect), in the beginning, economic growth continues to increase pollution when the economic structure changes from agriculture to more energy-intensive manufacturing industries; this positive trend remains until the structure of the economy changes towards the service sector and light manufacturing industries, and therefore, higher economic growth could reduce environmental pollution (industrial economies). Finally, in the third stage (technical effect), improvements in productivity and adaptation of cleaner technology, together with greater awareness, environmental spending, and the application of environmental regulations will gradually reduce environmental degradation (service economy) [

2,

35,

36,

37].

The environmental Kuznets curve shows that in the early stages of economic development, environmental pressure increases faster than income due to greater use of natural resources and more significant emission of pollutants, people are too poor to pay for their abatement or are indifferent when faced with environmental degradation, while at higher levels of economic growth, people value the environment more and regulatory institutions become effective; therefore, pollution levels decrease [

26].

The following model can be used to test the hypothesis of the environmental Kuznets curve [

26]:

where

is an indicator of environmental degradation,

is the income level, and

are other variables that can influence the environment. The relationship between the environment and economic growth/development can be tested in Equation (1), and the Kuznets curve hypothesis holds when

.

Economic growth appears to be a powerful way to improve environmental quality in the long term. Therefore, policies that aim to stimulate growth, such as trade liberalization, economic restructuring, and so forth, may also be suitable for reducing environmental degradation [

2]. In other words, it seems that the best way to improve the environment, in the long run, is to become rich [

38]. Environmental improvements will not be demanded when the poorest sectors of society do not meet their basic needs (e.g., nutrition, education, health care, etc.) [

39]. Otherwise, the wealthiest societies will demand measures to achieve less environmental degradation and press for more stringent protective measures and regulations [

26].

3. Data and Econometric Models

This research analyzes the impact of gross domestic product (GDP), renewable energy (RE), trade openness (TO), and patents applied (P) on the ecological footprint (EF) (as an alternative measure of environmental degradation), making use of annual data of the USMCA member countries for the period 1980 to 2016. The variables GDP per capita (constant dollars of 2010), TO (defined as exports plus import divided by GDP), and the P were taken from the World Bank [

33]. Data on RE (measured in thousand toe, a tone of oil equivalent) were taken from the Renewable Energy Indicators of the OECD [

40], while the EF was taken over by the Global Footprint Network [

41]. All variables are expressed in natural logarithms. The following model is proposed to test the environmental Kuznets curve:

where

indicates the cross-section (the three countries),

is the time range of the data period, and

represents the error term. The parameters

,

,

,

, and

represent the long-term elasticity of RE (measured in thousand toe), GDP (GDP per capita in constant dollars of 2010), GDPS (GDP Squared), TO (exports plus import divided by GDP), and P (number of patents applied) concerning environmental degradation, EF (global hectares per person), respectively. It is expected that

because an increase in renewable energy use can decrease environmental damage. To test the hypothesis, it is expected that

, an increase in the income level generates an increase in emissions, while to form the inverted U, it is expected that

. According to Churchill et al. [

12], to verify the environmental Kuznets curve hypothesis, the GDP coefficient must be positive due to the scale effect when economic activity and environmental degradation tend to increase. Moreover, the GDPS coefficient must be negative via the composition effect when degradation is reduced. New technologies become more environmentally friendly in the later stages of development as the economy shifts towards services and light manufacturing industries. Moreover,

can be positive or negative. Trade can increase pollution due to increased production, market activities, and access to goods and services through trade openness [

26]. However, trade can also reduce pollution and environmental degradation when it allows access to technologies that promote environmentally friendly production [

27,

28]. Finally, it is expected that

, since another variable that reduces pollutant emissions is the development of patents. Patents are related to technology, as they are useful to improve existing technologies and reducing polluting emissions [

1].

In studies that use time series, knowing the order of integration of the variables and testing the existence of cointegration relationships between variables, it is essential to avoid spurious results. Unit root tests on panel data have greater power than time series unit root tests. According to Baltagi [

42], when combining the time series with the cross-sectional data, there are many observations, more degrees of freedom, more variability, less collinearity, and greater efficiency. However, recent studies on panel data have concluded that it is likely that these models present a considerable cross-sectional dependence on errors, which may be due to the presence of common shocks, unobserved components, spatial or spill effects [

43]. First-generation panel unit root and cointegration tests developed in the 1990s, which commonly assumed cross-sectional independence, may be inadequate and lead to significant size distortions in the presence of cross-section dependence. However, second-generation panel unit root and cointegration tests have been developed that consider the possible dependence of cross-sections in the data [

44]. In this sense, three cross-sectional dependence tests (Breusch–Pagan LM, Bias-corrected scaled LM, Pesaran CD) are applied in this paper. Also, first and second generation unit root and cointegration tests are applied considering the possibility of cross-sectional dependence in the group of countries being analyzed.

Some methods have been developed to estimate the cointegration relationships in panel data, such as the fully modified ordinary least squares (FMOLS) and dynamic ordinary least squares (DOLS) estimators [

45,

46,

47], which generate coefficient estimators that are asymptotically unbiased and normally distributed [

46,

47]. The FMOLS estimator behaves relatively well and, even in small samples, generates consistent estimates and allows controlling the endogeneity of its regressors and the serial correlation [

46]. In this investigation, the FMOLS estimators will be used to generate consistent estimates in small samples and control heterogeneity and serial correlation in non-stationary series panels.

Additionally, in this investigation, the Machado and Silva [

34] method of moments quantile regression with fixed effects is employed. According to the authors, this approach may be adequate in two scenarios: panel data models with individual effects and models with endogenous explanatory variables. Additionally, this approach is considered the most appropriate technique that incorporates asymmetric and non-linear links by simultaneously treating heterogeneity and endogeneity [

48]. According to Ike et al. [

32], this approach provides an empirical idea about the distributive heterogeneity of this emissions–income relationship incorporating fixed effects. Therefore, this method allows heterogeneous links between income and emissions in different conditional quantiles distribution of emissions, which could not be captured by applying conventional regressions based on average parameter estimation. An assessment of the environmental Kuznets hypothesis at different quantiles of the conditional distribution of emissions is necessary for several reasons. First, unlike estimates of conditional means that are prone to distorting effects of outliers, estimates of the conditional quantiles are more robust to the outliers emanating from the dependent variable [

49]. Second, according to Ike et al. [

32], the conditional mean estimate cannot represent the full distribution of the impact of income on emissions. In addition to the quantile regression, it has a more intuitive appeal, especially in panel regressions because it stratifies the distributive effect of the variables independent of the dependent variable in different quantile ranges, so the conditional quantile estimates provide more information, which is not accessible with the conditional mean estimates.

Cheng et al. [

1] argue that the quantile regression method is more useful than the least squares method because both individual and distributional heterogeneity can be considered, which provides more comprehensive information between the variables. Panel quantile regression provides a complete picture of the relationship between variables compared to pooled OLS and fixed-effects regression [

29].

In the analysis of panel data, the presence of heterogeneity of the cross-sectional units may be expected. To verify the causal relationships between the variables, a new proposal developed by Dumitrescu and Hurlin [

50] is considered for testing causality in heterogeneous panel data models. These authors consider two dimensions: heterogeneity of the causal relationship and heterogeneity of the regression model used. The null hypothesis of non-homogeneous causality is contrasted with the alternative that there are two subgroups: one characterized by the causal relationship between two variables and another subgroup for which there is no causal relationship between these two variables [

50]. According to the authors, Monte Carlo experiments show that the standardized panel has excellent statistical properties in small samples, even when there is cross-section dependency.

4. Results and Discussion

This section discusses the main results achieved in this research.

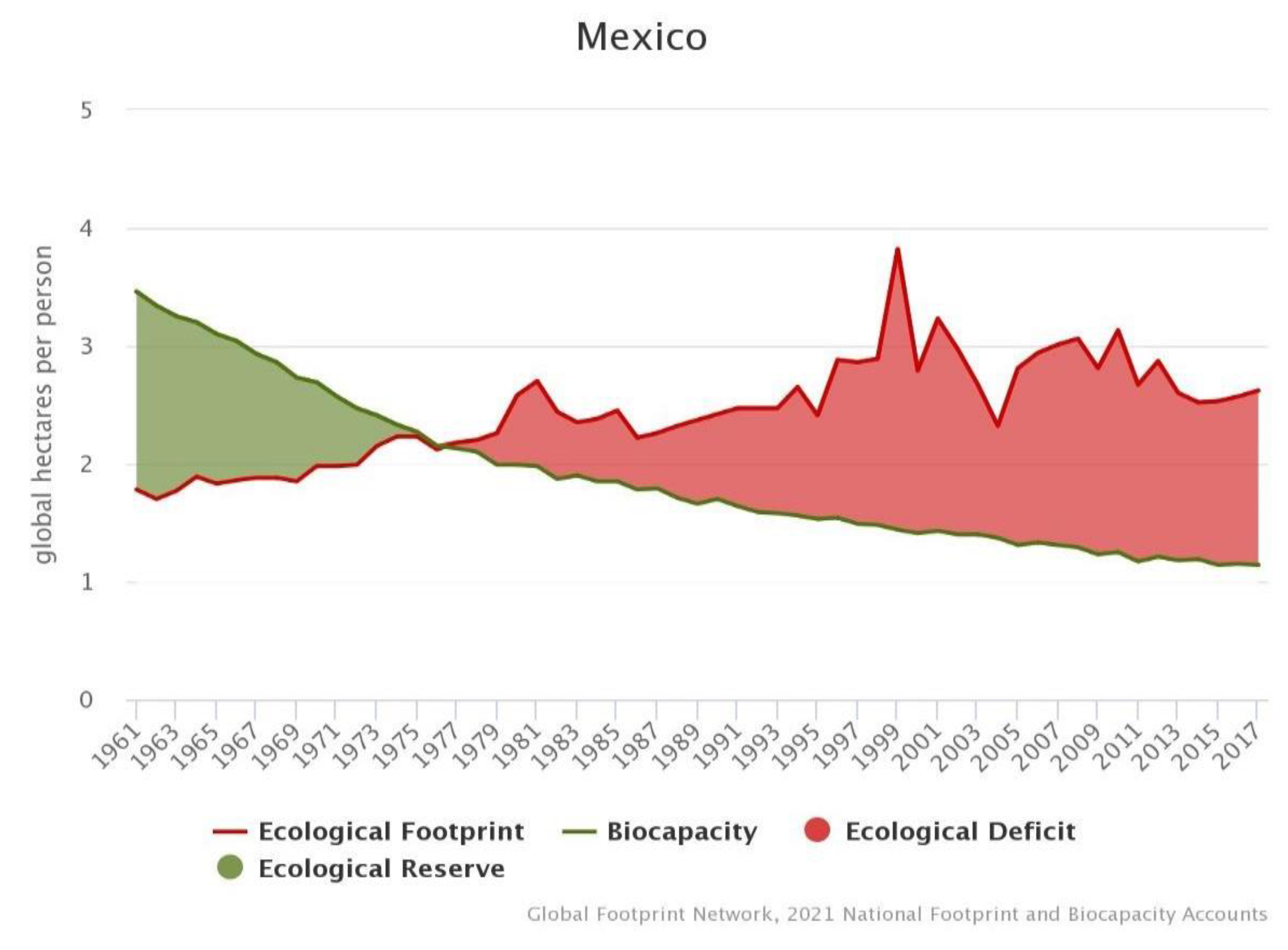

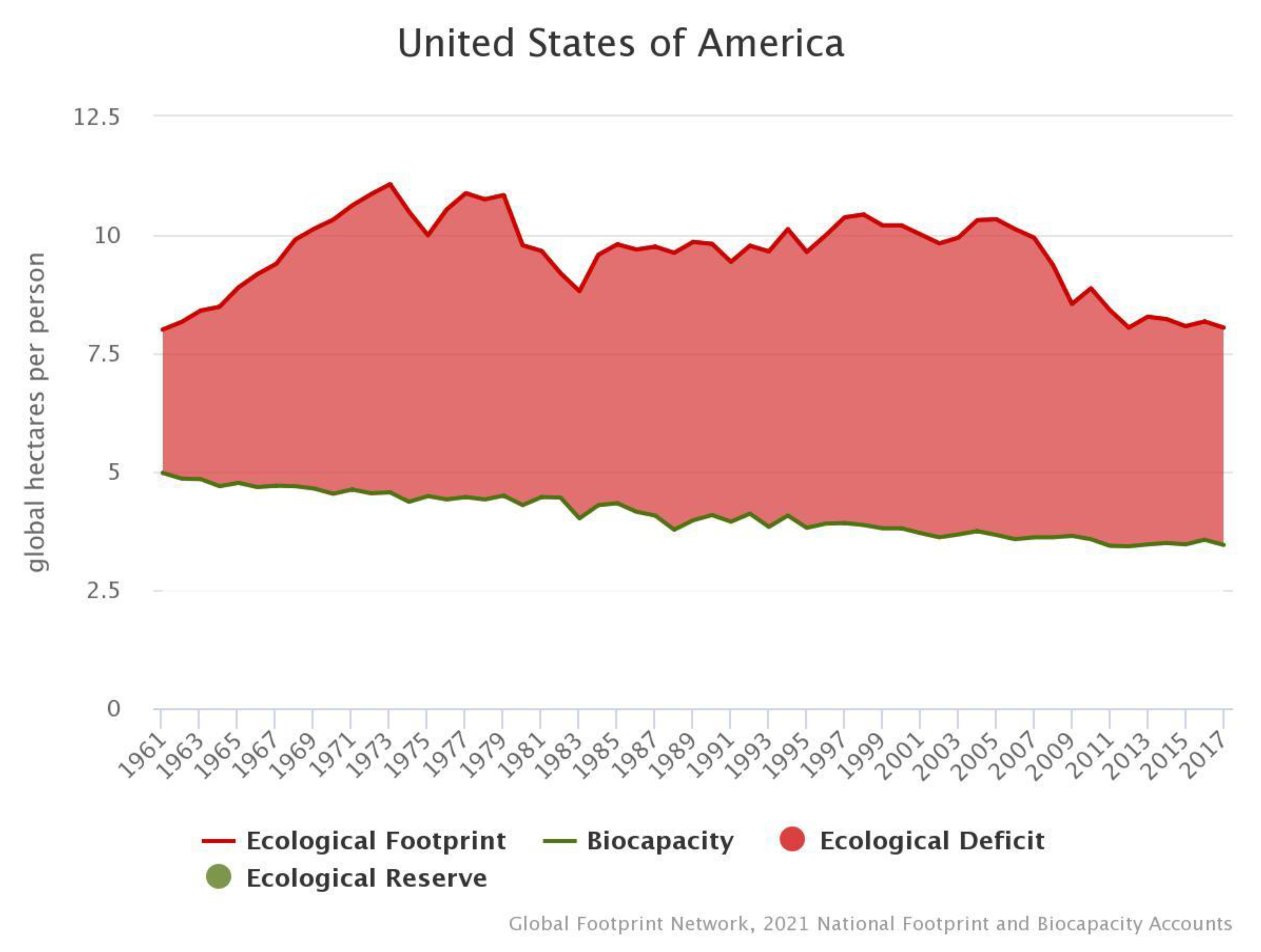

Figure 2,

Figure 3 and

Figure 4 show the behavior of the ecological footprint for the three countries.

In the case of Canada (

Figure 2), this is the only country in the sample that still shows an ecological footprint lower than its biocapacity per capita. That is to say that it does not yet present an ecological deficit. However, in the case of this country, it is observed that the gap tends to decrease steadily.

In Mexico’s case (

Figure 3), it shows that the ecological footprint exceeded the biocapacity since the end of the 1970s, showing a growing ecological deficit. In the USA (

Figure 4), an ecological deficit is observed throughout this period.

With panel data analysis, it is crucial to know whether there is a cross-sectional dependence in the variables used to apply the appropriate unit root tests. In this sense,

Table 1 shows the results of three cross-sectional dependence tests (Breusch–Pagan LM, Bias-corrected scaled LM, Pesaran CD). The null hypothesis of no cross-sectional dependence is rejected in the three tests for all variables with a significance level of 1% and 5%.

In this way, the first-generation panel data unit root tests of Levin, Lin, and Chu [

51], Im, Pesaran and Shin [

52], Fisher-type tests using ADF (ADF-Fisher) and PP (PP-Fisher) [

53,

54], and the second-generation PESCADF test by Pesaran [

55] are applied. However, the letter allows cross-sectional dependence in the variables. In

Table 2, the results of the four tests are shown. All variables present unit root in levels and are stationary in first differences, since they reject the null hypothesis of unit root at a significance level of 1%, except for the GDP and TO that reject it at 5% in the case of the PESCADF test.

According to the above, it is possible to test the presence or absence of a long-term equilibrium relationship between the same order’s integrated variables. In this investigation, three cointegration tests with panel data are used: Pedroni [

56], Fisher-type [

53], and Westerlud [

57].

The results of the Pedroni test are shown in

Table 3 when the constant, and constant and trend are included. In both cases, the null hypothesis of no cointegration is rejected by the statistics Panel PP, Panel ADF, Group PP, and Group ADF, with a significance level of 1%.

Considering the two statistics of the Fisher test (trace test and max-eigen test) in

Table 4, they reject the null hypothesis of no cointegration at 1% of significance. Finally, given the cross-section dependence in the variables used, the Westerlund [

57] cointegration test is applied, which may be more appropriate because it relaxes the independence assumption. This cointegration test considers both cross-sectional dependence and heterogeneity. The group-mean tests (Gt and Ga) contrast the alternative hypothesis that at least one unit is cointegrated, while the panel tests (Pt and Pa) contrast the alternative hypothesis that the panel is cointegrated as a whole [

58].

Table 5 shows that the GT and Pt statistics reject the null hypothesis of no cointegration at 1% significance level, while the Pa statistic rejects it at 5% significance level.

Therefore, based on the Pedroni, Fisher-type, and Westerlund tests, it can be concluded that the variables are cointegrated and that there is a long-term equilibrium relationship between them. The OLS for estimating panel data models’ coefficients can be biased and inconsistent when the variables are cointegrated, so FMOLS estimators are usually more appropriate.

Table 6 shows the results of the FMOLS estimators of the long-term elasticities of all the variables. In the case of P, the coefficient is negative, but it is not statistically significant. The results agree with Cheng et al. [

1] and Allard et al. [

29]. These results would imply that technological development, in general, measured by the number of patents (green and non-green patents), is not enough to show evidence of a statistically negative relationship that could reduce environmental degradation. Regarding economic activity, GDP, the relationship is positive and statistically significant, which implies that as economic activity increases, environmental degradation also increases. The GDPS coefficient is negative and significant; therefore, the environmental Kuznets curve hypothesis is supported by the results for the USMCA countries. These results suggest that these countries’ economic development stages show an inverted U-shaped relationship between economic growth and environmental degradation. In the first two stages (scale effect and composition effect), both variables show a positive relationship until reaching a certain income level; after this point, environmental degradation tends to decrease. These results coincide with the work of Arango et al. [

13] and Gómez and Rodríguez [

23]. Concerning the first reference, the hypothesis of the environmental Kuznets curve is individually validated for Mexico and the United States, but not for Canada’s case, while Gómez and Rodríguez [

23] confirm the hypothesis for the group of the three countries.

Regarding the RE coefficient, the negative sign means that renewable energy contributes to improving the environment. Concerning TO, in this case, the relationship is positive and statistically significant, which implies that importing or exporting more environmentally friendly machinery and products is not enough to reduce environmental degradation measured by the EF. For this variable, the results also coincide with those of Allard et al. [

29], while they are different from those found in Gómez and Rodríguez [

23] for these same countries, given that in this study, the authors found a negative relationship between trade openness and carbon dioxide emissions. The method of moments quantile regression was also applied to confirm the results’ robustness (

Table 7).

The quantile regression confirms most of the results found with the FMLOS. For example, it is confirmed that the hypothesis of the environmental Kuznets curve from the third to the ninth quantile. In the lower part of the distribution, the first two quantiles, there is no evidence for such a hypothesis. These results are similar to those found by Ike [

32] for 15 oil-producing countries that applied this same econometric methodology. Concerning RE, a negative and statistically significant relationship between the fourth and sixth quantile is found, which implies that renewable energy reduces environmental degradation. In the case of patents, the two methods show no statistically significant relationship between technological development and environmental degradation. It is also confirmed that technological development, measured by patents, is insufficient to reduce environmental pollution. In the case of TO, the quantile regression does not show a statistically significant relationship. There is no statistical evidence that TO can reduce or increase environmental degradation. Once the existence of a long-term relationship between the variables has been proven, there must be a causal relationship in at least one direction [

59]. In so doing, a recent proposal developed by Dumitrescu and Hurlin [

50] to test causality in heterogeneous panel data models is considered.

Table 8 shows a bidirectional causal relationship between EF and ER, TO and P, economic activity, and TO, which indicates that the variables are complementary. Each one has important information that helps to predict the behavior of the other better. There is a unidirectional relationship of economic activity to P, which implies that the higher production of the USMCA countries encourages further patent development. There is also a unidirectional causal relationship from ER to P, which implies that renewable energy consumption contains essential information that better predicts the patenting activity’s behavior.

5. Conclusions

This paper reviews the Kuznets environmental curve for the USMCA member countries during the period 1980–2016. The panel data methods are used, such as the cross-sectional dependence, unit root, cointegration, and causality tests. Also, to estimate the long-term model, the FMOLS and the new method of moment quantile regression proposed by Machado and Silva [

34] are applied. The main results indicate that the variables show cross-section dependence, and they are integrated of order one. There is a long-term equilibrium relationship between these variables. Both methods show that renewable energy consumption reduces environmental degradation, and the hypothesis of the Kuznets curve for these countries is confirmed. In the case of the quantile regression, the hypothesis is validated from quantiles 3 to 9. Similar results are obtained by Gómez and Rodríguez [

23] and partially by Arango et al. [

13] for the same countries. Concerning P, there is not a statistically significant relationship in both methods. This implies that the innovative activity measured by the green and non-green patents is not enough to reduce the environmental degradation measured by the EF. In the case of TO, it is only significant with the FMOLS method and with a positive sign, which is different from the result found by Gómez and Rodríguez [

23] to the same countries, who find a negative relationship. These outcomes could explain how TO can help reduce CO2 emissions but it is not enough to reduce EF than a more comprehensive environmental degradation measure.

These results suggest that it is vital to promote renewable energy production and consumption, sensitize the population, and apply public policies to reduce environmental degradation and its economic, political, and social impacts. In this sense, it is crucial to take advantage of the economic benefits of trade openness without neglecting its effects on environmental degradation in the region. Part of these governments’ political agenda should consider that trade alone can generate further environmental degradation, so a better environmental policy must accompany this agreement. Moreover, they should also consider the innovative activity of green patents, and this could be incentivized to reduce environmental degradation. One of the limitations of this study is that it is carried out at the country level. It would be interesting to undertake this type of study within each country, for example, a panel data analysis with each country’s states or provinces. It would also be interesting to analyze the sensitivity of the environmental degradation measure for each country in order to validate the environmental Kuznets curve, for example, by comparing the results using CO2 and the ecological footprint as environmental degradation, among others. Further research should include variables such as the number of green patents to evaluate their effectiveness in limiting environmental degradation.