The Network of Dominant Owners of Wind Development in Galicia (Spain) (1995–2017): An Approach Using Power Structure Analysis

Abstract

1. Introduction

2. Literature Review

3. Research Design and Case Study

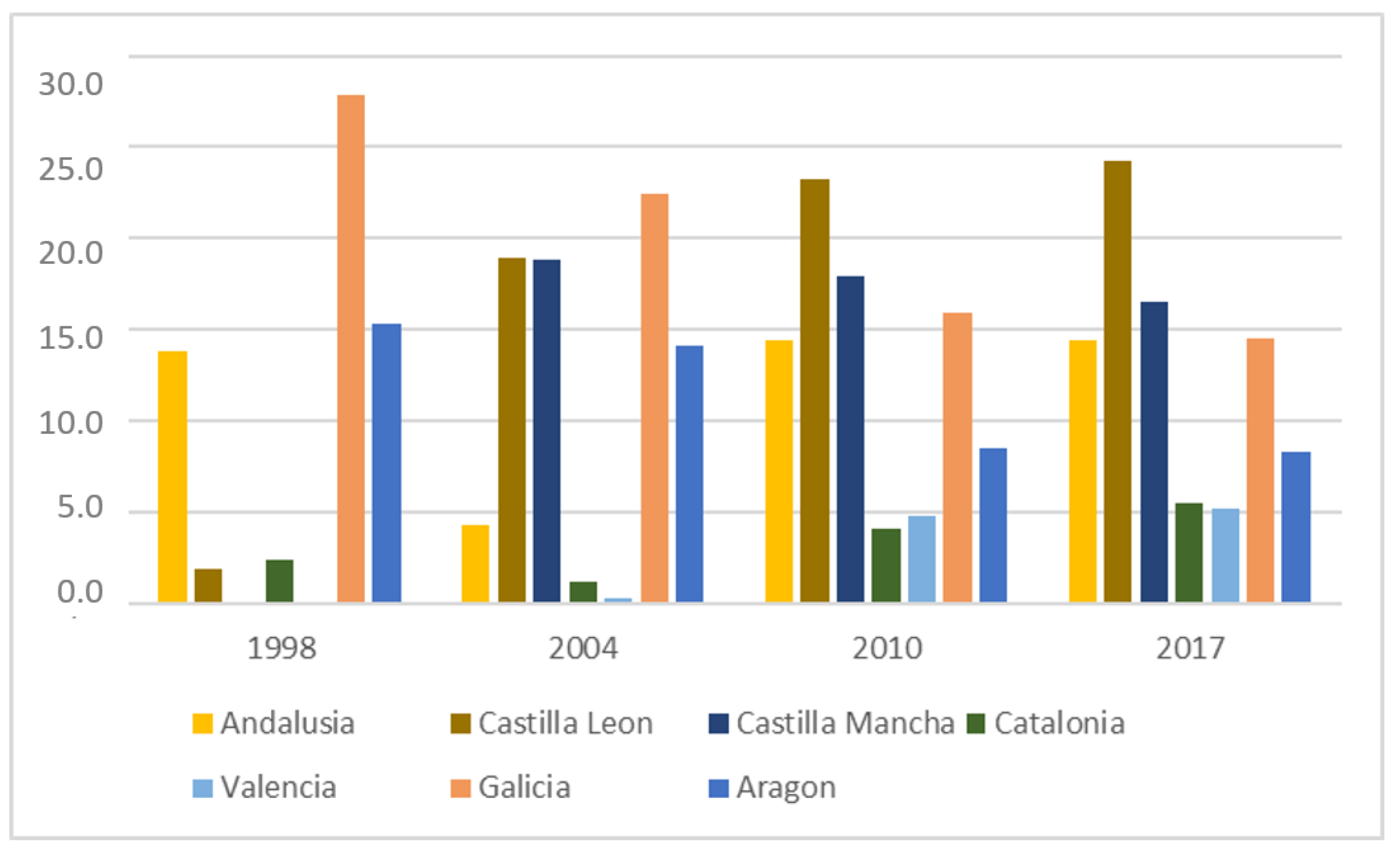

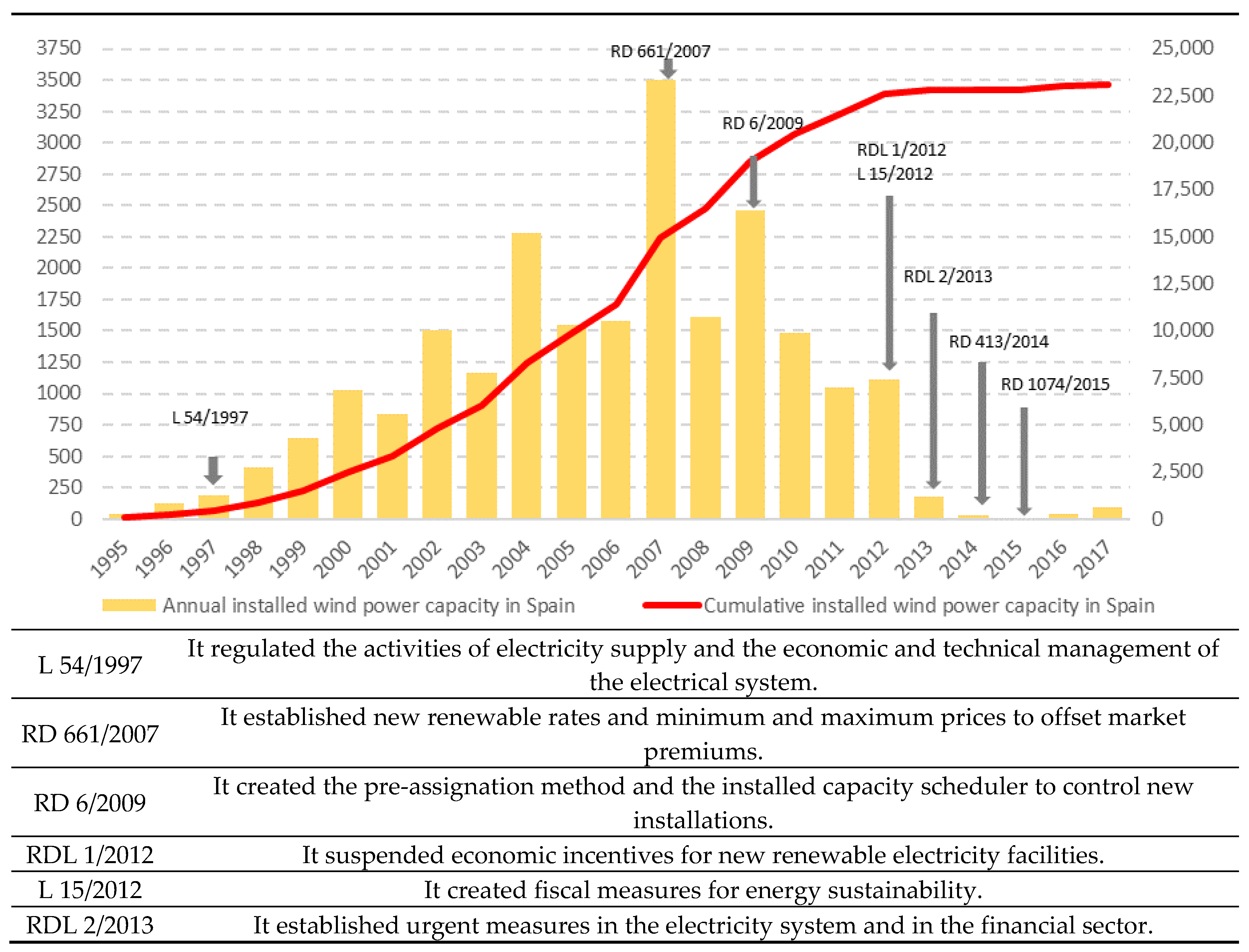

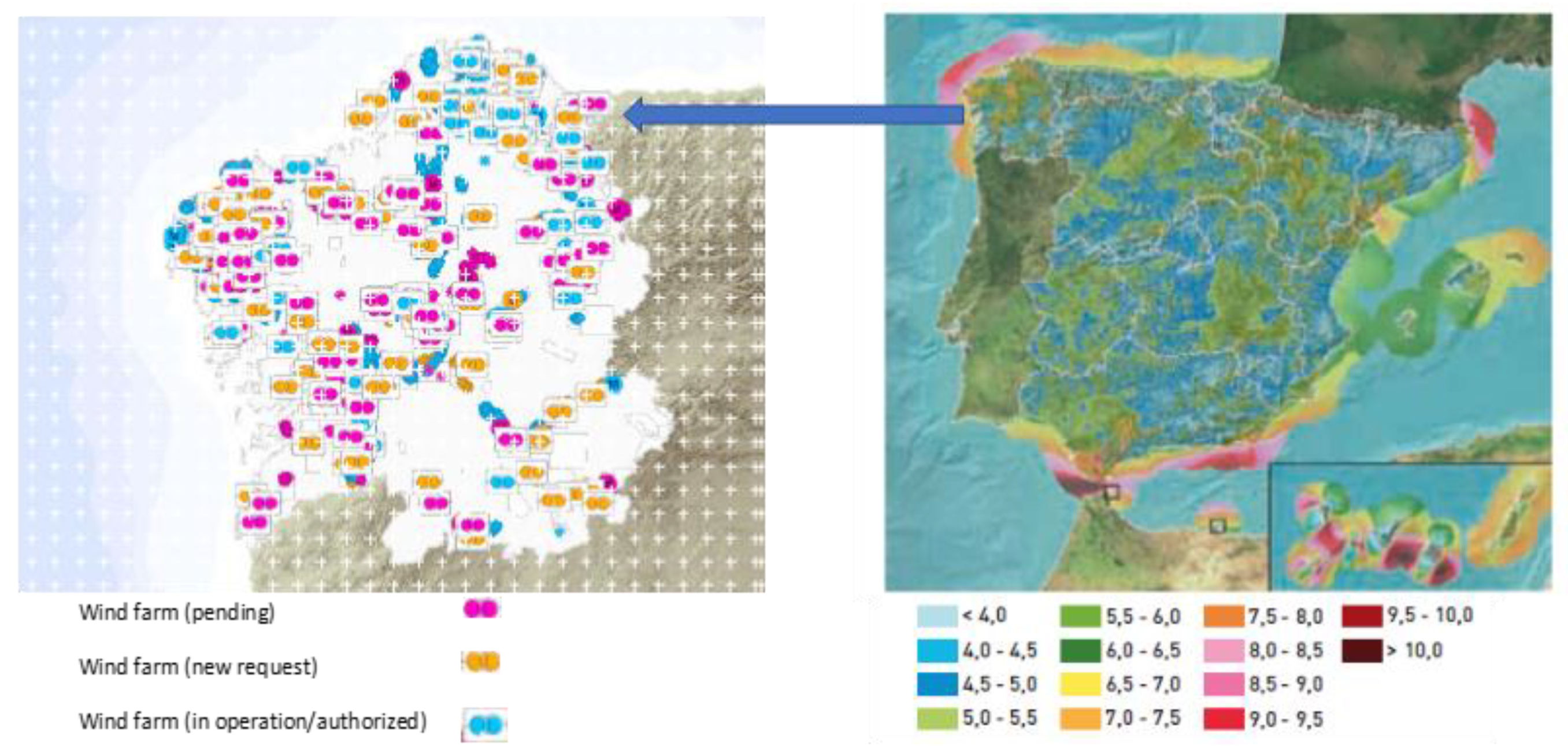

Case Study: The Region of Galicia

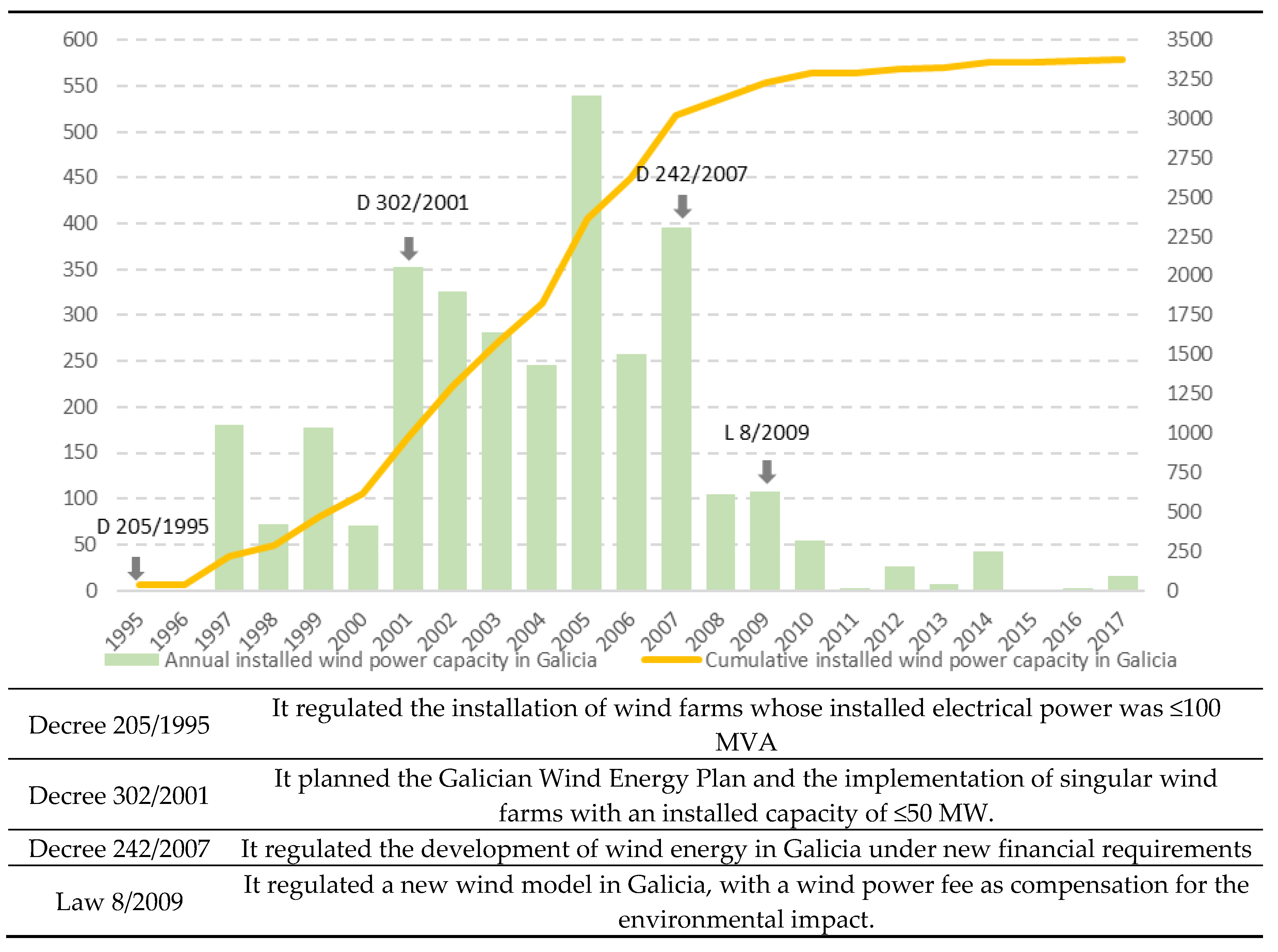

4. Galician Wind Development (1995–2017): Principal Results of the Analysis

5. Discussion: From Small Local Businesses to the Predominance of Foreign Investment Funds

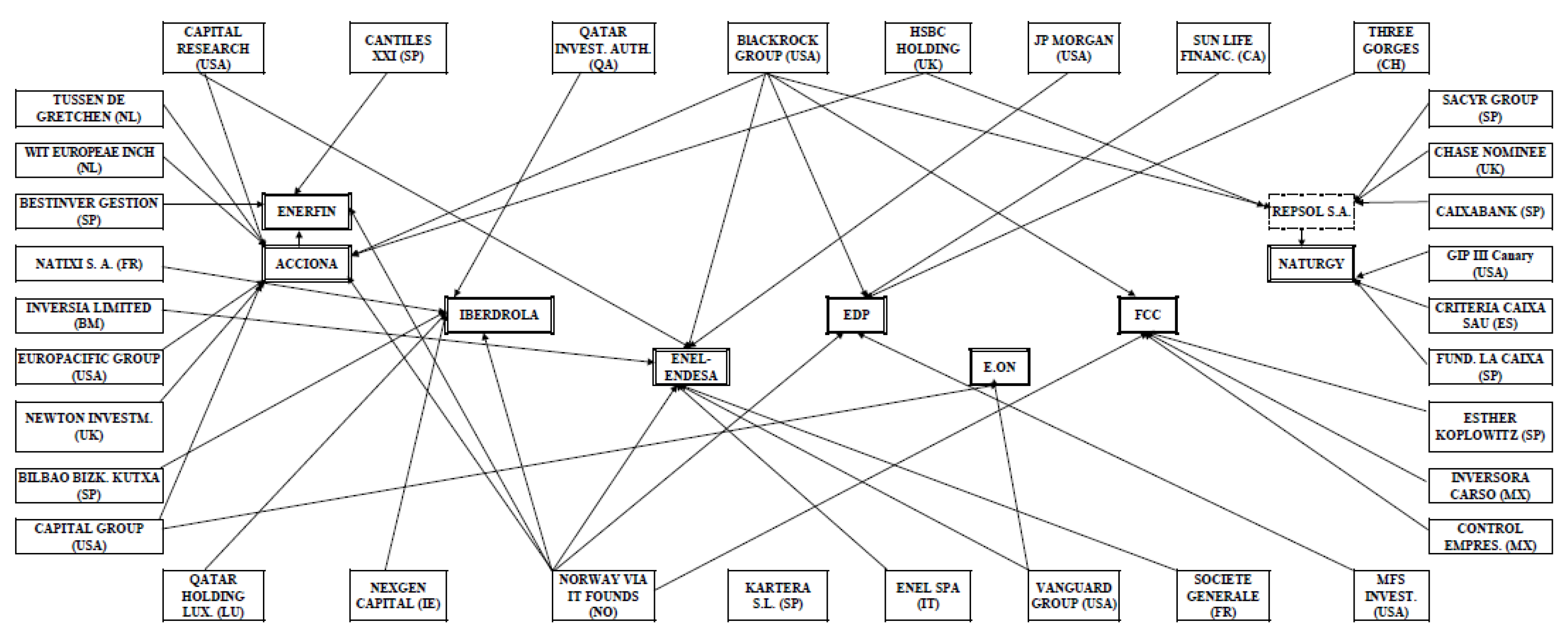

- The companies Acciona, Iberdrola, Enel, Endesa, Edp and Naturgy, stand out in this list. Naturgy, Endesa and Iberdrola also operate in other markets, and it is important to realize that two companies, Endesa (connected to EnelSpa) and Iberdrola, represent nearly 70% of the Spanish electricity market. This situation seems to hide a policy of intense involvement in wind resources in Galicia, like the situation in the hydroelectric sector, as described by Beiras [74]. It is also possible to think of a vertical integration that could also entail implementing a series of measures such as asymmetric information, creating obstacles for companies trying to enter the market, due to its economic, financial and interest capacity. In light of these facts, it could be surmised that the companies cooperate in organizing the industry, although this is difficult to prove. On the same basis, we can establish the origin of this cooperation in Endesa during its process of constitution.

- E.on and Enerfin (which are part of the matrix company Elecnor), who have relevant experience in Spain as well as an international presence.

- FCC (Fomento de Construcciones y Contratas) a multinational construction company (domiciled in Spain), which has diversified its activities and has a noticeable presence in the renewables sector.

- Canepa Green Energy Luxembourg and Hopefield Investments, both of which are investment funds linked to the ownership of a wind farm.

- Energy companies such as Norvento, Adelanta and Engasa, who have mainly developed their business at a regional level.

- Companies connected to business groups that are principally involved in other activities. Examples of such companies are: Jealsa (canned fish), Gestamp (automotive services), Fergo Galicia (excavation and construction), Epifanio Campo-Rodonita.

- Mixed companies, financed by public and private capital, examples being: Sotavento, Somozas Council-Cobra, Hidroeléctrica del Arnoya.

- Smaller scale electricity production companies, or regional investment firms, for instance: Okechobee Energías, Vento Continuo Galego, Sergio Farina and Patricia Gómez.

- Acciona is a wind farm-owning concern and a dominant owner, among other reasons because other firms such as Enerfin participate., and this connection, and the possible status of Acciona as an interest group, can be seen. However, Witgroup owns 27% of Acciona.

- Naturgy has the energy group Repsol S.A. for one of their principal shareholders. In turn, Repsol’s principal shareholders are: CaixaBank (Spain), Sacyr Group (Spain), Chase Nominee (UK) and Blackrock Group (USA). Both Naturgy and Repsol are considered interest groups.

- Hopefield Investments and Canepa Green Energy are isolated models of ownership, according to Domholf (2012). They each finance only one company and are therefore not included in the definitive matrix or in the network.

- In Norway, Vanguard Group and Blackrock Group act as “ownership reference centres” and they are principal dominant owners, given that they are shareholders in many companies.

6. Conclusions and Policy Implications

Author Contributions

Funding

Conflicts of Interest

Abbreviations

| AEE | Asociación Empresarial Eólica |

| CNMV | Comisión Nacional de la competencia (Spanish Securities Exchange Commission) |

| DOGA | Official Bulletin of the Government of Galicia |

| EDP | Energias de Portugal company |

| INEGA | The Galicia Energy Institute |

| IRENA | International Renewable Energy Agency |

| kW | kilowatt |

| MVA | megavolt ampere |

| MW | megawatt |

| UE | European Union |

| WWEA | World Wind Energy Association |

References

- Delina, L. Clean energy financing at Asian Development Bank. Energy Sust. Devel. 2011, 15, 195–199. [Google Scholar] [CrossRef]

- Maruyama, Y.; Nishikido, M.; Iida, T. The rise of community wind power in Japan: Enhanced acceptance through social innovation. Energy Policy 2007, 35, 2761–2769. [Google Scholar] [CrossRef]

- Wei, M.; Patadia, S.; Kammen, D.M. Putting renewables and energy efficiency to work: How many jobs can the clean energy industry generate in the US? Energy Policy 2009, 38, 919–931. [Google Scholar] [CrossRef]

- Masini, A.; Menichetti, E. Investment decisions in the renewable energy sector: An analysis of non-financial drivers. Technol. For. Soc. Change 2013, 80, 510–524. [Google Scholar] [CrossRef]

- Meng, Y. Wind power industry: A study on the public policy in the perspective of industrial evolution. Sci. Technol. Inf. 2010, 3, 190–191. [Google Scholar]

- Mielnik, O.; Goldemberg, J. Converging to a common pattern of energy use in developing and industrialized countries. Energy Policy 2000, 28, 503–508. [Google Scholar] [CrossRef]

- Justus, D. International Energy Technology Collaboration and Climate Change Mitigation. Case Study 5: Wind Power Integration Into Electricity Systems. 2005. Available online: http://www.oecd.org/dataoecd/22/37/34878740.pdf (accessed on 30 September 2020).

- Klassen, G.; Miketa, A.; Larsen, K.; Sundqvist, T. The impact of R&D innovation for wind energy in Denmark, Germany and the United Kingdom. Ecol. Econ. 2005, 54, 227–240. [Google Scholar]

- Danish Energy Authority. Offshore Wind Farms and the Environment; Danish Energy Authority: Copenhagen, Denmark, 2006. [Google Scholar]

- Vindmølleindustriens. Las 21 Preguntas Más Frecuentes Sobre Energía Eólica. 2003. Available online: http://www.windpower.org/es/faqs/htm; (accessed on 4 April 2020).

- Kreusel, J. El futuro está aqui: Conexión de la mayor zona de parques eólicos marinos con transmisión por HVBC. Revista ABB 2008, 4, 40–43. [Google Scholar]

- Barradale, M.J. Impact of public policy uncertainty on renewable energy investment: Wind power and the production tax credit. Energy Policy 2010, 38, 7698–7709. [Google Scholar] [CrossRef]

- Denholm, P.; Hand, M.; Jackson, M.; Ong, S. Land-Use Requirements of Modern Wind Power Plants in the United States; NREL/TP-6A2-45834; National Renewable Energy Laboratory: Golden, CO, USA, 2009. [Google Scholar]

- Brown, J.P.; Pender, J.; Wiser, R.; Lantz, E.; Hoen, B. Ex post analysis of economic impacts from wind power development in U.S. counties. Ener. Econ. 2012, 34, 1743–1754. [Google Scholar] [CrossRef]

- Bhattacharyya, S.C. Financing energy access and off-grid electrification: A review of status, options and challenges. Renew Sust. Energy Rev. 2013, 20, 462–472. [Google Scholar] [CrossRef]

- Evans, B.; Parksa, J.; Theobalda, K. Urban wind power and the private sector: Community benefits, social acceptance and public engagement. J. Environ. Plan. Manag. 2011, 54, 227–244. [Google Scholar] [CrossRef]

- D’Souza, C.; Yiridoe, K. Social acceptance of wind energy development and planning in rural communities fo Australia: A consumer analysis. Energy Policy 2014, 74, 262–270. [Google Scholar] [CrossRef]

- Patlitzianas, K.D.; Kolybiris, C. Effective financing for provision of renewable electricity and water supply on islands. Energy Sust. Devel. 2012, 16, 120–124. [Google Scholar] [CrossRef]

- Garcia-Lopez, M.; Quero, M.; Aviles Palacios, C. La articulación de un project finance como instrumento de financiación de parques eólicos: Un caso práctico. In Estableciendo Puentes en una Economía Global; Escuela Superior de Gestión Comercial y Marketing, ESIC: Seville, Spain, 2008; p. 39. [Google Scholar]

- Moszoro, M. Project Finance: Financiación de un Parque Eólico. IESE, F-886, 01/2013. Available online: https://www.iese.edu/wp-content/uploads/2018/11/PPSRC-2012-2013.pdf (accessed on 30 September 2020).

- Ming, Z.; Ximei, L.; Yulong, L.; Lilin, P. Review of renewable energy investment and financing in China: Status, mode, issues and countermeasures. Renew. Sustain. Energy Rev. 2014, 31, 23–37. [Google Scholar] [CrossRef]

- Mielnik, O.; Goldemberg, J. Foreign direct investment and decoupling between energy and gross domestic product in developing countries. Energy Policy 2002, 30, 87–89. [Google Scholar] [CrossRef]

- Krug, M.; Ohlhorst, D. Optimizing the Local Embedding of Renewable Energy Plants (2020): The Role of Nature Conservation in Relation to other Acceptance Factors. J. Environ. Pol. Admin. 2020, 27, 77–102. [Google Scholar]

- Hübner, G.; Pohl, J.; Warode, J.; Gotchev, B.; Nanz, P.; Ohlhorst, D. Naturverträgliche Energiewende. Akzeptanz und Erfahrungen vor Ort, Gefördert durch das BfN mit Mitteln des Bundesministerium für Umwelt, Naturschutz und nukleare Sicherheit. BMU; FKZ: 35 16830 10A; 2019. Available online: https://www.bfn.de/fileadmin/BfN/gesellschaft/Dokumente/BfN-Broschuere_Akzeptanz_bf.pdf (accessed on 30 September 2020).

- Wang, S.; Wang, S. Impacts of wind energy on environment: A review. Renew. Sustain. Energy Rev. 2015, 49, 437–443. [Google Scholar] [CrossRef]

- Leiren, M.D.; Aakre, S.; Linnerud, K.; Julsrud, T.E.; Di Nucci, M.-R.; Krug, M. Community Acceptance of Wind Energy Developments: Experience from Wind Energy Scarce Regions in Europe. Sustainability 2020, 12, 1754. [Google Scholar] [CrossRef]

- Devine-Wright, P.; Batel, S.; Aas, O.; Sovacool, B.; LaBelle, M.C.; Ruud, A. A conceptual framework for understanding the social acceptance of energy infrastructure: Insights from energy storage. Energy Policy 2017, 107, 27–31. [Google Scholar] [CrossRef]

- Devine-Wright, P. Beyond NIMBYISM: Towards an Integrated Framework for Understanding Public Perceptions of Wind Energy. Wind Energy 2005, 8, 125–139. [Google Scholar] [CrossRef]

- Boon, F.; Dieperink, C. Local civil society based renewable energy organizations in the Netherlands: Exploring the factors that stimulate their emergence and development. Energy Policy 2014, 69C, 297–307. [Google Scholar] [CrossRef]

- Motuso, M.; Maruyama, Y. Local acceptance by people with unvoiced opinions living close to a wind farm: A case study from Japan. Energy Policy 2016, 91, 362–370. [Google Scholar] [CrossRef]

- Walker, K.; Adams, N.; Gribben, B.; Gellatly, B.; Nygaard, N.G.; Henderson, A.; Marchante Jimémez, M.; Schmidt, S.R.; Rodriguez Ruiz, J.; Paredes, D.; et al. An evaluation of the predictive accuracy of wake effects models for offshore wind farms. Wind Energy 2015, 19, 979–996. [Google Scholar] [CrossRef]

- Warren, C.; McFadyen, M. Does Community Ownership Affect Public Attitudes to Wind Energy? A Case Study from South-West Scotland. Land Use Policy 2010, 27, 204–213. [Google Scholar] [CrossRef]

- Linnerud, K.; Toney, P.; Simonsen, M.; Holden, E. Does change in ownership afect community attitudes toward renewable energy projects? Evidence of a status quo bias. Energy Policy 2019, 131, 1–8. [Google Scholar] [CrossRef]

- Simón, X.; Copena, D.; Montero, M. Strong wind development with no community participation. The case fo Galicia (1995–2009). Energy Policy 2019, 133, 110930. [Google Scholar] [CrossRef]

- Copena, D.; Pérez-Neira, D.; Simon, X. Local Economic Impact of Wind Energy Development: Analysis of the Regulatory Framework, Taxation, and Income for Galician Municipalities. Sustainability 2019, 11, 2403. [Google Scholar] [CrossRef]

- Liebe, U.; Bartzak, A.; Meyerhoff, J. A turbine is not only a turbine: The role of the social context and fairness characteristics for the local acceptance of wind power. Energy Policy 2017, 107, 300–308. [Google Scholar] [CrossRef]

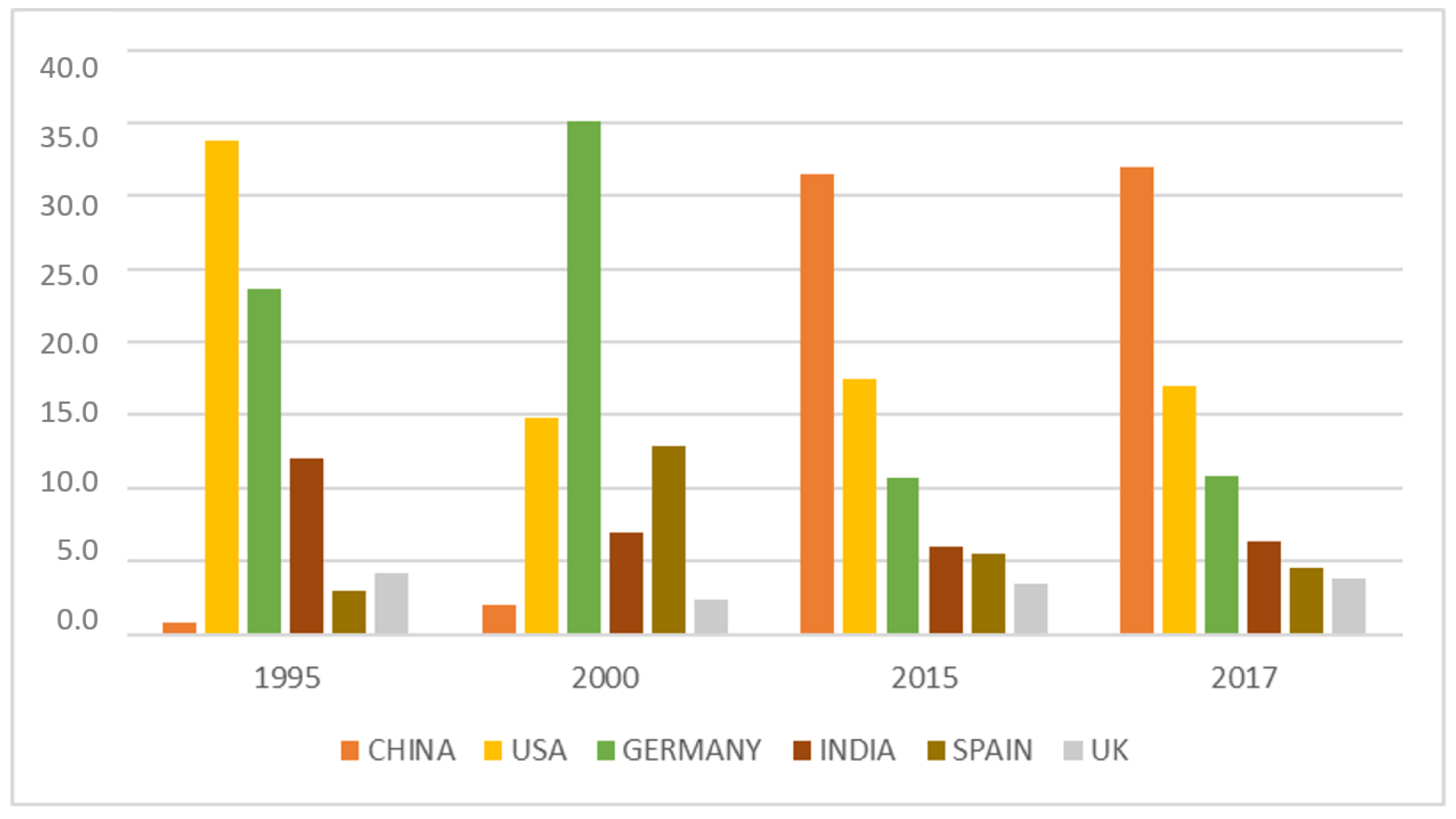

- Regueiro-Ferreira, R.; Doldán Garcia, X. Comparing Wind Development Policies in Europe, Asia and America. Energy Environ. 2015, 26, 319–335. [Google Scholar] [CrossRef]

- Rand, J.; Hoen, B. Thirty years of North American wind energy acceptance research: What have we learned? Energy Res. Soc. Sci. 2017, 29, 135–148. [Google Scholar] [CrossRef]

- Fast, S.; Mabee, W.; Baxter, J.; Christidis, T.; Driver, L.; Hill, S.; McMurtry, J.J.; Tomkow, M. Lessons learned from Ontario wind energy disputes. Nat. Energy 2016, 1, 15028. [Google Scholar] [CrossRef]

- Instituto para el Ahorro y la Diversificación de la Energía (IDAE) (2000): Impactos Ambientales de la Producción Eléctrica; Análisis del Ciclo de Vida de Ocho Tecnologías de Generación Eléctrica: Madrid, Spain, 2000.

- European Wind Energy Asocciation. Wind Energy Review; European Wind Energy Asocciation: Brussels, Belgium, 2012. [Google Scholar]

- Muñoz, J.; Serrano, A. La configuración del sector eléctrico y el negocio de la construcción de las centrales nucleares. Cuad. Ruedo Ibér. 1979, 63–66, 127–268. [Google Scholar]

- Rajan, R.; Zingalse, L. Protecting Capitalism from the Capitalists-Unleashing the Power of Financial Markets to Create Wealth and Spread Opportunity; Crown: New York, NY, USA, 2003. [Google Scholar]

- Carroll, W.K.; Sapinski, J.P. Corporate elites and intercorporate networks. In The SAGE Handbook of Social Network Analysis; Carrington, P., Scott, J., Eds.; SAGE Publications: Nubury Park, CA, USA, 2011; Volume 13, pp. 181–195. [Google Scholar]

- Mintz, B.; Shwartz, M. The Power Structure of American Business; University of Chicago Press: Chicago, IL, USA, 1985. [Google Scholar]

- Park, L.; Park, F. Anatomy of Big Business; Lewis and Samuel: Toronto, ON, Canada, 1973. [Google Scholar]

- Ratcliff, R.E. The economic elite and the social structure in Canada. Can. J. Econ. Polit. Sci. 1980, 23, 376–394. [Google Scholar]

- Scott, J. Capitalist Property and Financial Power; Wheatsheaf Books: Brighton, UK, 1986. [Google Scholar]

- Pérez, S.G.; Sánchez, C.B.; Martín, D.J.S. Politically connected firms in Spain. Bus. Res. Q. 2015, 18, 230–245. [Google Scholar]

- Chen, C.J.P.; Li, Z.; Su, X.; Sun, Z. Rent-seeking incentives, corporate political connections, and the control structure of private firms: Chinese evidence. J. Corp. Financ. 2011, 17, 229–243. [Google Scholar] [CrossRef]

- La Porta, R.; López de Silanes, F.; Schleifer, A.; Vishny, R. Law and finance. J. Pol. Econ. 1998, 106, 1113–1155. [Google Scholar] [CrossRef]

- La Porta, R.; López de Silanes, F.; Schleifer, A.; Vishny, R. Corporate ownership around the word. J. Financ. 1999, 54, 471–517. [Google Scholar] [CrossRef]

- Facio, M.; Lang, L. The ultimate ownership of Western European Corporations. J. Financ. Econ. 2002, 65, 365–395. [Google Scholar] [CrossRef]

- Khanna, T.; Palepu, K. Is group affiliation profitable in emerging markets? An analysis of diversified Indian business groups. J. Financ. 2000, 55, 867–891. [Google Scholar] [CrossRef]

- Agraval, A.; Knoeber, C. Do some outside directors play a political role? J. Law Econ. 2001, 44, 179–198. [Google Scholar] [CrossRef]

- Stafsudd, A. Corporate networks as informal governance mechanisms: A small worlds approach to Sweden. Corp. Gov. Intern. Rev. 2009, 17, 62–76. [Google Scholar] [CrossRef]

- EL Parlamento Europeo y el Consejo de la Unión Europea. DDirectiva 2013/34/UE del Parlamento Europeo y del Consejo de 26 de junio de 2013 Sobre los Estados Financieros Anuales, los Estados Financieros Consolidados y otros Informes Afines de Ciertos Tipos de Empresas, por la que se Modifica la Directiva 2006/43/CE del Parlamento Europeo y del Consejo y se Derogan las Directivas 78/660/CEE y 83/349/CEE del Consejo Diario Oficial de la Unión Europea (L182/19-76). D. Off. Union Eur. 2013, 182, 19–76. [Google Scholar]

- Domhoff, G.W. (Ed.) Power Structure Research; Sage: Beverly Hills, CA, USA, 1980. [Google Scholar]

- Domhoff, G.W. How to Do a Power Structure Research. 2019. Available online: https://whorulesamerica.ucsc.edu/methods/how_to_do_power_structure_research.html (accessed on 3 August 2020).

- Domhoff, G.W. The Corporate Rich and the Power Elite in the Twentieth Century; Routdlegde: Abingdon, UK, 2020. [Google Scholar]

- Domhoff, G.W. Is the Corporate Elite Fractured, or is there Continuing Corporate Dominance? Two Contrasting Views. Class, Race and Corporate Power, 3 (Issue 1, Article 1). 2015. Available online: https://digitalcommons.fiu.edu/classracecorporatepower/vol3/iss1/1/ (accessed on 3 August 2020).

- Domhoff, G.W. Who Rules America? The Triumph of the Corporate Rich, 7th ed.; McGraw-Hill Education: New York, NY, USA, 2015. [Google Scholar]

- The Galicia Energy Institut—Instituto Energético de Galicia (Inega). Relación de Parques Eólicos Autorizados. Available online: http://www.inega.es (accessed on 3 August 2020).

- SABI. Sistema de Análisis de Balances Ibéricos. Available online: www.usc.es/servizos/biblioteca/basesdedatos/SABI (accessed on 3 August 2020).

- Spanish Securities Exchange Commission—Comisión Nacional de la Competencia. Available online: www.cncompetencia.es (accessed on 3 August 2020).

- International Renewable Energy Agency (IRENA). Data Stastistics. Available online: http://www.irena.org/ourwork/Knowledge-Data-Statistics/Data-Statistics (accessed on 3 August 2020).

- World Wind Energy Association (WWEA). Data Stastistics. Available online: http://www.wwindea.org/2017-statistics/ (accessed on 3 August 2020).

- Rodriguez, X.; Regueiro-Ferreira, R.; Doldán-García, X.R. Analysis of productivity in the Spanish wind industry. Renew. Sustain. Energy Rev. 2020, 118, 109573. [Google Scholar] [CrossRef]

- Asociación Empresarial Eólica (AEE). Observatorio Eólico. Available online: http://www.aeeolica.es/contenidos.php?c_pub=2 (accessed on 3 August 2020).

- Wind Registry of Galicia. Available online: https://www.arcgis.com/apps/webappviewer/index.html?id=4bae3fad95b6439bacef9d1a316765e9 (accessed on 8 October 2020).

- Instituto para la Diversificación, el Ahorro y la Eficiciencia Energética (IDAE). Plan de Foment de las Energías Renovables en España (1995–2000); IDEA: Madrid, Spain, 1999. [Google Scholar]

- Instituto para la Diversificación, el Ahorro y la Eficiciencia Energética (IDAE). Plan de Foment de las Energías Renovables en España (2005–2010); IDEA: Madrid, Spain, 2005. [Google Scholar]

- Instituto para la Diversificación, el Ahorro y la Eficiciencia Energética (IDAE). Análisis del Recurso. Atlas Eólico de España 2011–2020. Available online: https://www.idae.es/uploads/documentos/documentos_11227_e4_atlas_eolico_331a66e4.pdf (accessed on 8 October 2020).

- Beiras Torrado, X.M. O Atraso Económico de Galiza; Edicións Laiovento: Santiago de Compostela, Spain, 1995. [Google Scholar]

- Decanio, S.J. Barriers within firms to energy-efficient investments. Energy Policy 1994, 21, 906–914. [Google Scholar] [CrossRef]

| Research Phase | Information Provider | Secondary Information | Contents | Relevance |

|---|---|---|---|---|

| 1 | Xunta de Galicia Goverment (by The Galicia Energy Institute—INEGA) | DOGA, Official Bulletin of Galicia | Temporary dynamic of installation of wind farms | To understand the legislative framework |

| Regulatory documents at especially Galician level | Legislative framework | To identify the owning companies of wind farms in Galicia | ||

| Register of Wind farms allocated in Galicia (1995–2017) | To know the capacity assigned by wind farms to wind companies in Galicia | |||

| 2 | Author’s elaboration | None | List of total MW (megawatt) assigned by companies. | To identify the leading companies by capacity |

| Wind farm owning companies in Galicia by total power assigned | ||||

| 3 | Sabi database | Corporate shareholding ownership | Corporate information on wind farm owning companies | To identify the dominant owners of wind-owning companies in Galicia |

| Spanish Securities Exchange Commission (CNMV) | ||||

| 4 | Author’s elaboration | None | Matrix of relation of wind dominant owners in Galicia | To identify the origin of the capital |

| 5 | Author’s elaboration | None | Corporate links network of wind development in Galicia | To identify the network of dominant owners |

| Shareholders of Wind Promoters in Galicia | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| SH1 | SH2 | SH3 | SH4 | SH5 | … | SH20 | … | SHN | ||

| Wind Promoters in Galicia | WP1 | X | X | |||||||

| WP2 | X | X | ||||||||

| WP3 | X | X | X | X | ||||||

| WP4 | ||||||||||

| WP5 | X | X | ||||||||

| … | X | X | ||||||||

| WP20 | X | |||||||||

| … | X | X | X | X | X | |||||

| WPN | X | X | X | |||||||

| Type of Wind Farm | Number | Installed Power (KW) |

|---|---|---|

| Wind Farms | 134 | 3,280,945 |

| Municipal Small Scale Wind Farms | 13 | 34,800 |

| Firms: Small Scale Wind Farms | 3 | 5200 |

| Experimental Wind Farms | 3 | 300 |

| Total | 153 | 3,321,245 |

| Wind Farm-Owning Companies | Total Capacity | Accumulated Capacity (%) | |

|---|---|---|---|

| Energy Groups and/or Investment Funds | Acciona ** | 963,820 | 88% |

| Iberdrola | 693,670 | ||

| Enel | 310,340 | ||

| Naturgy | 236,800 | ||

| EDP | 206,900 | ||

| Endesa-Enel | 153,640 | ||

| Enerfin-Elecnor | 144,575 | ||

| FCC | 64,210 | ||

| Hopefield investments * | 49,200 | ||

| E.on | 39,600 | ||

| Canepa Green Energy Luxm * | 33,600 | ||

| Regional Energy Companies, from Other Sectors and Mixed Companies | Norvento | 94,060 | 12% |

| Adelanta | 59,550 | ||

| Fergo Galicia | 48,430 | ||

| Engasa | 31,860 | ||

| Rodonita/Epifanio Campo | 28,800 | ||

| Gestamp | 23,500 | ||

| Okechobee energias | 20,000 | ||

| Jealsa | 19,500 | ||

| Sotavento | 17,560 | ||

| Ayuntamiento Somozas, Cobra | 10,500 | ||

| Galaipos S.L. | 9350 | ||

| Hidroeléctrica Arnoya | 8000 | ||

| Spanish Investments | 7200 | ||

| Vento Continuo Galego | 6000 | ||

| Sergio Farina, Patricia Gomez | 80 | ||

| Total capacity | 3,280,945 KW | 100% |

| Principal Wind Farm Owning Companies in Galicia | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Dominant Owners | ACCIONA | Edp | Endesa | Enel | Enerfin E. | E.on | Fcc | Iberdrola | Naturgy | |

| Acciona *** | Spain | 3.93% | ||||||||

| Bestinver Gestion | Spain | 4.76% | ||||||||

| Bilbao Bizkaia Kutxa | Spain | 4.92% | ||||||||

| Blackrock Group | USA | 1.04% | 1.31% | 1.31% | 0.13% | 5.34% | ||||

| Cantiles XXI | Spain | 52.76% | ||||||||

| Control Empresarial de Capitales | Mexico | 51.35% | ||||||||

| Capital Group Co | USA | 4.66% | 7.45% | |||||||

| Capital Research | USA | 4.1% | 4.81% | 4.81% | ||||||

| Cascade Investment | USA | 3.99% | ||||||||

| Criteria Caixa SAU | Spain | 24% | ||||||||

| Deutche Bank | Germany | 3.37% | ||||||||

| Enel Spa | Italy | 70% | 70% | |||||||

| Esther Koplowitz | Spain | 20.01% | ||||||||

| Europacific Growth | USA | 3.66% | ||||||||

| Fundación La Caixa | Spain | 24% | ||||||||

| GIP III Canary | USA | 20% | ||||||||

| HSBC Holding | UK | 3.71% | ||||||||

| Inversia Ltd. | BM | 0.82% | 0.82% | |||||||

| Inversora Carso S.A. | Mexico | 9.76% | ||||||||

| JP Morgan | USA | 0.73% | 0.73% | |||||||

| Kartera I. S.L. | Spain | 3.6% | ||||||||

| MFS Investement | USA | 3.1% | ||||||||

| Natixis S.A. | France | 4.84% | ||||||||

| Nexgen Capital L. | IE | 5.18% | ||||||||

| Newton Investments | UK | 2.92% | ||||||||

| Norway via it founds | Norway | 1.88% | 1.24% | 0.59% | 0.59% | 1.95% | 0.47% | 3.21% | ||

| Qatar Holding Luxemb | Luxemburg | 9.39% | ||||||||

| Qatar Investment A. | Qatar | 9.66% | ||||||||

| Repsol S.A. *** | Spain | 20% | ||||||||

| Societé Generalé | France | 0.65% | 0.65% | |||||||

| Sun Life Financial | Canada | 3.5% | ||||||||

| Three Gorges | China | 21.35% | ||||||||

| Tussen de Grechten B.V. | Netherlands | 27.8% | ||||||||

| Vanguard Group | USA | 0.67% | 0.67% | 1.26% | 0.54% | |||||

| Wit Europe Inch | Netherlands | 26.75% | ||||||||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Regueiro-Ferreira, R.M.; Doldán-García, X.R. The Network of Dominant Owners of Wind Development in Galicia (Spain) (1995–2017): An Approach Using Power Structure Analysis. Energies 2020, 13, 6080. https://doi.org/10.3390/en13226080

Regueiro-Ferreira RM, Doldán-García XR. The Network of Dominant Owners of Wind Development in Galicia (Spain) (1995–2017): An Approach Using Power Structure Analysis. Energies. 2020; 13(22):6080. https://doi.org/10.3390/en13226080

Chicago/Turabian StyleRegueiro-Ferreira, Rosa María, and Xoán R. Doldán-García. 2020. "The Network of Dominant Owners of Wind Development in Galicia (Spain) (1995–2017): An Approach Using Power Structure Analysis" Energies 13, no. 22: 6080. https://doi.org/10.3390/en13226080

APA StyleRegueiro-Ferreira, R. M., & Doldán-García, X. R. (2020). The Network of Dominant Owners of Wind Development in Galicia (Spain) (1995–2017): An Approach Using Power Structure Analysis. Energies, 13(22), 6080. https://doi.org/10.3390/en13226080