Predicting Renewable Energy Investment Using Machine Learning

Abstract

1. Introduction

2. Contributions and Related Work

3. Datasets

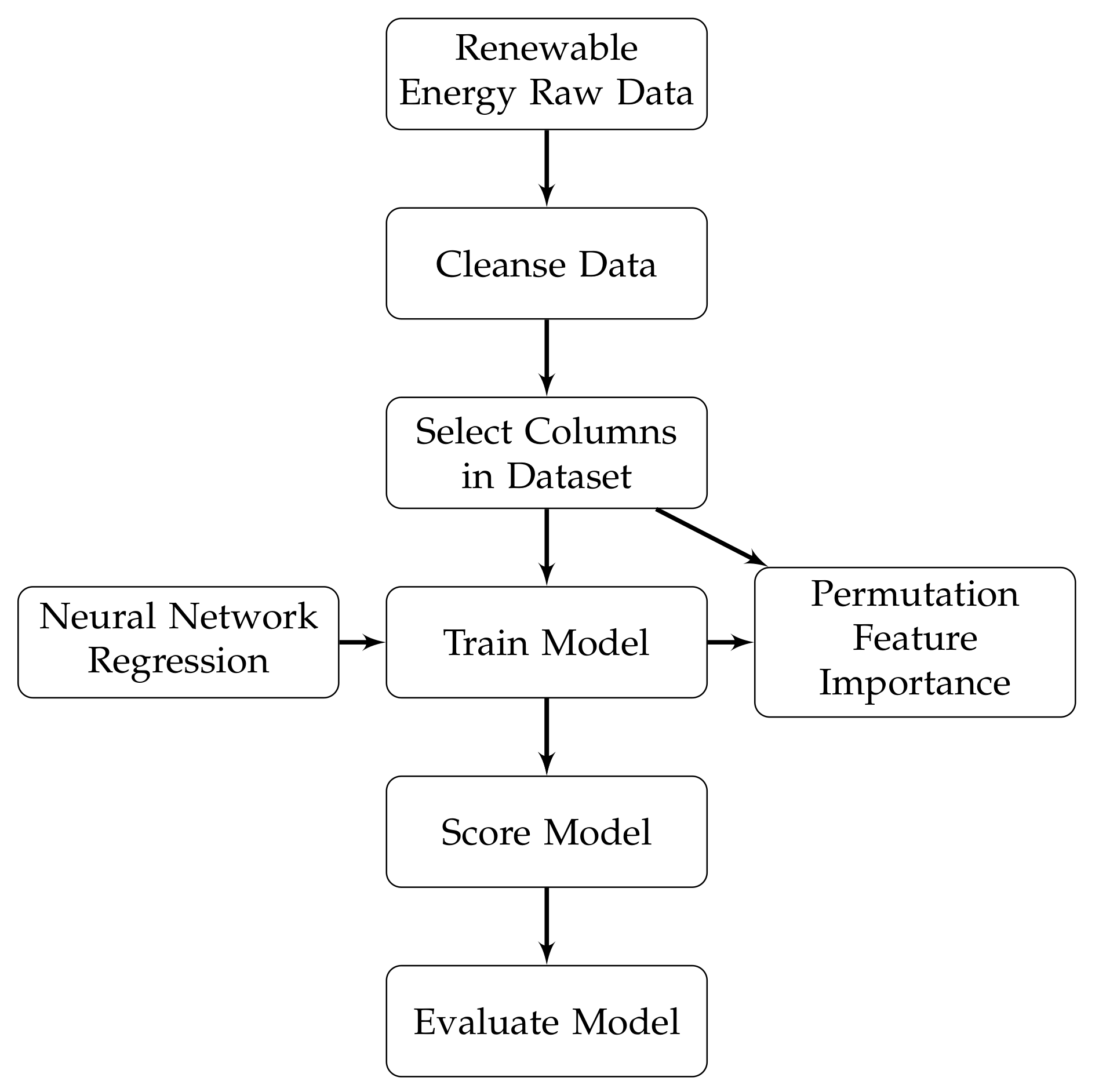

4. Materials and Methods

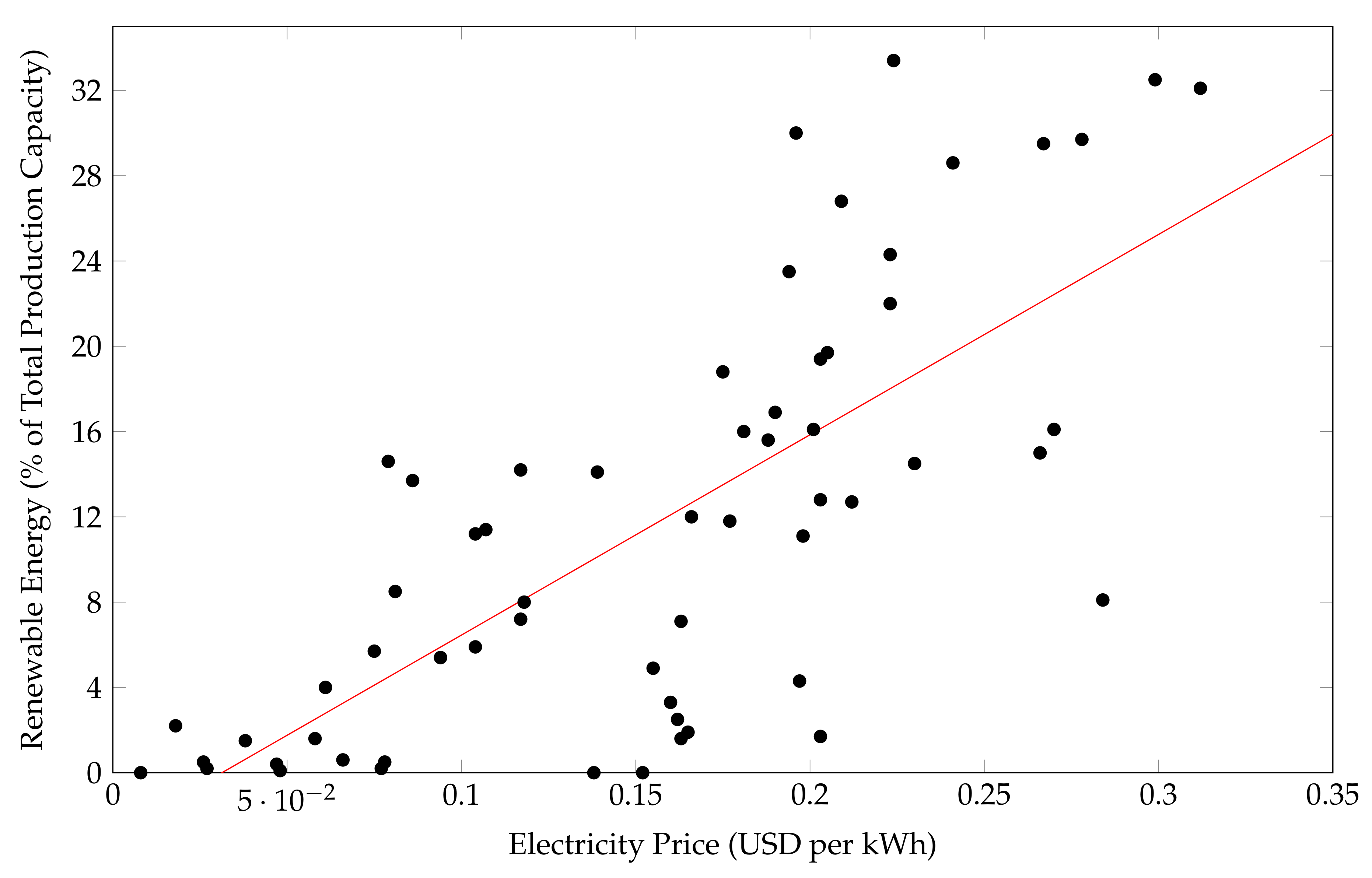

4.1. Linear Regression Using Only Electricity Prices

4.2. Machine Learning with Multiple Features

5. Results

6. Sample Use Case

7. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Martinez, R.; Hosein, P. The Impact of Low Electricity Prices on Renewable Energy Production. In Proceedings of the 2018 International Conference and Utility Exhibition on Green Energy for Sustainable Development (ICUE), Phuket, Thailand, 24–26 October 2018; pp. 1–6. [Google Scholar]

- Council of the European Union. Council Adopts Climate-energy Legislative Package; Council of the European Union: Brussels, Belgium, 2009. [Google Scholar]

- Mulder, M.; Scholtens, B. The impact of renewable energy on electricity prices in the Netherlands. Renew. Energy 2013, 57, 94–100. [Google Scholar] [CrossRef]

- Johnson, E.; Oliver, M. Renewable energy and wholesale electricity price variability. In Proceedings of the IAEE Energy Forum; First Quarter; International Association for Energy Economics: Bergen, Norway, 2019. [Google Scholar] [CrossRef]

- Rintamaki, T.; Siddiqui, A.; Salo, A. Does renewable energy generation decrease the volatility of electricity prices? a comparative analysis of Denmark and Germany. Tech. Rep. 2014. [Google Scholar] [CrossRef]

- Sensfuß, F.; Ragwitz, M.; Genoese, M. The merit-order effect: A detailed analysis of the price effect of renewable electricity generation on spot market prices in Germany. Energy Policy 2008, 36, 3086–3094. [Google Scholar] [CrossRef]

- Möbius, T.; Müsgens, F. The effect of variable renewable energy sources on the volatility of wholesale electricity prices—A stylized full cost approach. In Proceedings of the 2015 12th International Conference on the European Energy Market (EEM), Lisbon, Portugal, 19–22 May 2015; pp. 1–5. [Google Scholar]

- Commission for Energy Regulation. Criteria for Gate 3 Renewable Generator Offers & Related Matters Proposed Direction to The System Operators. 2008. Available online: https://www.cru.ie/wp-content/uploads/2008/07/cer08260.pdf (accessed on 21 July 2020).

- Finn, P.; Fitzpatrick, C.; Leahy, M.; Relihan, L. Promotion of wind generated electricity using price responsive Demand Side Management: Price prediction analysis for imperfect energy storage. In Proceedings of the 2010 IEEE International Symposium on Sustainable Systems and Technology, Arlington, VA, USA, 17–19 May 2010; pp. 1–5. [Google Scholar]

- Kok, A.G.; Shang, K.; Yucel, S. Impact of Electricity Pricing Policies on Renewable Energy Investments and Carbon Emissions. Manag. Sci. 2018, 64, 131–148. [Google Scholar] [CrossRef]

- He, Z.X.; Xu, S.C.; Li, Q.B.; Zhao, B. Factors That Influence Renewable Energy Technological Innovation in China: A Dynamic Panel Approach. Sustainability 2018, 10, 124. [Google Scholar] [CrossRef]

- Mukhamediev, R.I.; Mustakayev, R.; Yakunin, K.; Kiseleva, S.; Gopejenko, V. Multi-Criteria Spatial Decision Making Support System for Renewable Energy Development in Kazakhstan. IEEE Access 2019, 7, 122275–122288. [Google Scholar] [CrossRef]

- Eschenbach, A.; Yepes, G.; Tenllado, C.; Gómez-Pérez, J.I.; Piñuel, L.; Zarzalejo, L.F.; Wilbert, S. Spatio-Temporal Resolution of Irradiance Samples in Machine Learning Approaches for Irradiance Forecasting. IEEE Access 2020, 8, 51518–51531. [Google Scholar] [CrossRef]

- Chow, C.W.; Belongie, S.; Kleissl, J. Cloud motion and stability estimation for intra-hour solar forecasting. Sol. Energy 2015, 115, 645–655. [Google Scholar] [CrossRef]

- Mohandes, M.A.; Rehman, S. Wind Speed Extrapolation Using Machine Learning Methods and LiDAR Measurements. IEEE Access 2018, 6, 77634–77642. [Google Scholar] [CrossRef]

- Worlddata: The World in Numbers. Available online: https://www.worlddata.info/ (accessed on 12 February 2020).

- ML Blog Team. Permutation Feature Importance. Available online: https://blogs.technet.microsoft.com/machinelearning/2015/04/14/permutation-feature-importance/ (accessed on 21 July 2020).

- Tariff Principles and Structures. 2018. Available online: http://www.ric.org.tt/price-review/ (accessed on 21 February 2020).

- Energy Subsidies. 2017. Available online: https://www.iea.org/topics/energy-subsidies/ (accessed on 21 July 2020).

- Sharma, C.; Bahadoorsingh, S.; Aiyejina, A. Integrating applicable sources of renewable energy in the Caribbean. In Proceedings of the 2011 IEEE Power and Energy Society General Meeting, Detroit, MI, USA, 24–28 July 2011; pp. 1–6. [Google Scholar]

| Feature | Score |

|---|---|

| Population growth/year | 0.710288 |

| Electricity price (USD per kWh) | 0.495201 |

| Daily max temperature (degrees Celsius) | 0.113028 |

| GDP per capita | 0.090674 |

| Education expenditure per capita (USD) | 0.050768 |

| Intelligence quotient | 0.027817 |

| Population (millions) | 0.019825 |

| Area km | 0.017498 |

| CO emissions per capita | 0.01183 |

| Average annual income (USD) | 0.001193 |

| Evaluation Metric | Score |

|---|---|

| Negative Log Likelihood | Infinity |

| Mean Absolute Error | 0.665773 |

| Root Mean Squared Error | 1.169323 |

| Relative Absolute Error | 0.067183 |

| Relative Squared Error | 0.008557 |

| Coefficient of Determination | 0.991443 |

| Country | APE (LR) | APE (NN) | Country | APE (LR) | APE (NN) |

|---|---|---|---|---|---|

| Argentina | 392.372 | 2.8507 | Luxembourg | 33.9118 | 5.4487 |

| Australia | 39.4596 | 2.5862 | Malaysia | 29.3025 | 3.7823 |

| Austria | 25.7625 | 0.8656 | Mexico | 44.6364 | 2.8097 |

| Bangladesh | 59.1375 | 49.4726 | Netherlands | 18.00136 | 2.7328 |

| Belgium | 17.7669 | 0.264 | New Zealand | 17.0076 | 0.4832 |

| Canada | 37.3043 | 1.2517 | Nigeria | 2065.15 | 1052.4627 |

| Chile | 0.7832 | 1.0751 | Norway | 267.3939 | 13.3669 |

| China | 62.2233 | 0.8866 | Pakistan | 27.3245 | 4.0198 |

| Colombia | 675.3562 | 5.2668 | Peru | 262.7511 | 54.3189 |

| Croatia | 5.7283 | 0.8164 | Philippines | 5.4282 | 5.7157 |

| Czech Republic | 28.9448 | 0.2596 | Poland | 28.0186 | 4.8618 |

| Denmark | 39.7154 | 0.5794 | Portugal | 22.535 | 4.1574 |

| Egypt | 154.9909 | 4.2129 | Russian Federation | 449.5666 | 62.3755 |

| Finland | 34.8229 | 0.4869 | Saudi Arabia | 1507.2 | 1848.1694 |

| France | 11.5917 | 0.9375 | Singapore | 562.8157 | 15.845 |

| Germany | 39.9498 | 0.6905 | South Africa | 74.7281 | 17.3794 |

| Greece | 37.5929 | 21.6941 | South Korea | 12.3097 | 3.8784 |

| Hungary | 27.9992 | 23.9604 | Spain | 24.843 | 2.9067 |

| India | 69.0541 | 3.3218 | Sweden | 48.3186 | 1.9428 |

| Indonesia | 16.3661 | 4.2728 | Switzerland | 41.3711 | 0.4542 |

| Iran | 282.35 | 2.623415 | Thailand | 43.0542 | 2.0617 |

| Ireland | 21.8713 | 1.6142 | Trinidad and Tobago | 348.75 | 273.1092 |

| Israel | 137.8469 | 9.6998 | Turkey | 38.7 | 2.0391 |

| Italy | 31.0143 | 2.1261 | United Arab Emirates | 784.84 | 75.4234 |

| Japan | 47.1826 | 4.6452 | United Kingdom | 45.7077 | 0.1413 |

| Range | 2018 | 2019 | 2020 | 2021 |

|---|---|---|---|---|

| 1–400 kWh | 0.039 | 0.080 | 0.120 | 0.163 |

| 401–1000 kWh | 0.048 | 0.098 | 0.148 | 0.201 |

| Over 1000 kWh | 0.055 | 0.113 | 0.171 | 0.233 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hosein, G.; Hosein, P.; Bahadoorsingh, S.; Martinez, R.; Sharma, C. Predicting Renewable Energy Investment Using Machine Learning. Energies 2020, 13, 4494. https://doi.org/10.3390/en13174494

Hosein G, Hosein P, Bahadoorsingh S, Martinez R, Sharma C. Predicting Renewable Energy Investment Using Machine Learning. Energies. 2020; 13(17):4494. https://doi.org/10.3390/en13174494

Chicago/Turabian StyleHosein, Govinda, Patrick Hosein, Sanjay Bahadoorsingh, Robert Martinez, and Chandrabhan Sharma. 2020. "Predicting Renewable Energy Investment Using Machine Learning" Energies 13, no. 17: 4494. https://doi.org/10.3390/en13174494

APA StyleHosein, G., Hosein, P., Bahadoorsingh, S., Martinez, R., & Sharma, C. (2020). Predicting Renewable Energy Investment Using Machine Learning. Energies, 13(17), 4494. https://doi.org/10.3390/en13174494