Modeling Framework Simulating the TERRE Activation Optimization Function

Abstract

1. Introduction

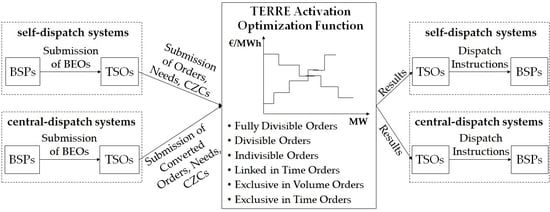

General Framework on Electricity Balancing

- (a)

- the inclusion of all formats of BEOs provisioned in the implementation framework of TERRE project and the analytical mathematical representation of their clearing conditions;

- (b)

- the combination of self-dispatch and central dispatch systems; for the latter, a local pre-process takes place before the TERRE clearing process for the conversion of BEOs to standard products as required by EBGL;

- (c)

- the implementation of imbalance netting;

- (d)

- the incorporation of counter-activations;

- (e)

- the consideration of both elastic and inelastic orders submitted by the participating TSOs so as to cover their needs, along with a tolerance band for facilitating the clearing process in the presence of large indivisible blocks; and

- (f)

- the inclusion of ramping constraints for the central dispatch bidding zones in the overall regional clearing model for technical feasibility purposes.

2. Main Balancing Arrangements Setups and RR Balancing Process

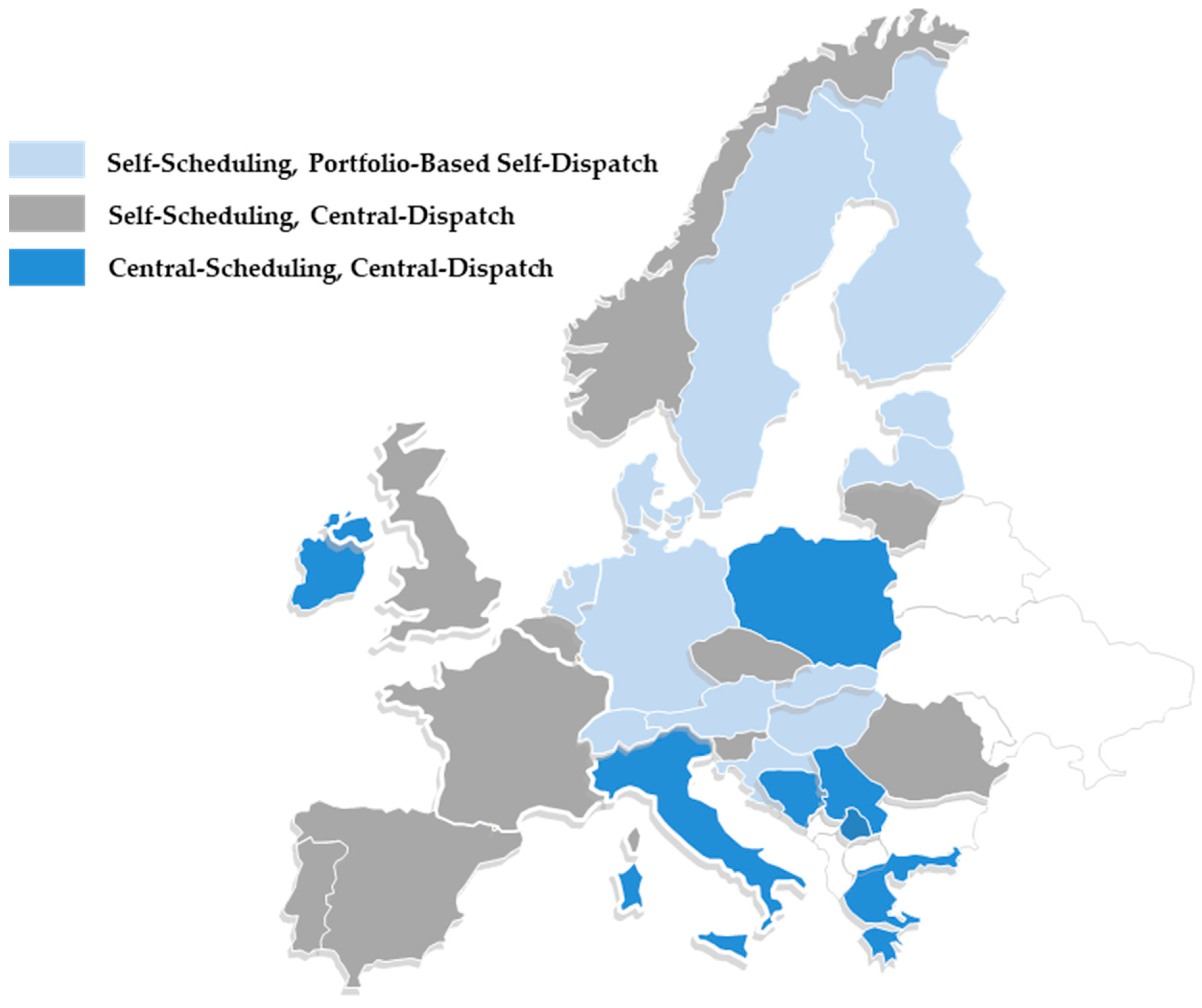

- (a)

- Bidding Zone A expresses the 1st setup, with self-scheduling at the day-ahead stage, issuance of portfolio-based dispatch instructions by the TSO to the BSPs and self-dispatch on an entity basis. Specifically, in this setup, the BSPs take day-ahead and/or intra-day commitment decisions for their Balance Service Entities (BSEs), namely generating units and/or demand response resources and/or energy storage resources. In real time, they acquire portfolio-based dispatch instructions by the TSO and freely allocate these instructions to their BSEs (self-scheduling), namely they determine the desired dispatch position of each BSE they operate based on their own economic criteria and taking into account BSEs’ technical constraints in conjunction with the demand elements they are balancing with. Typical examples of this setup are Switzerland, Germany, and the Netherlands, as shown in Figure 2.

- (b)

- Bidding Zone B expresses the 2nd setup, with self-scheduling at the day-ahead stage, participation in the real-time balancing energy market per BSE (e.g., generating unit) and central-dispatch on an entity basis (not on a portfolio basis). A typical example of this setup are France and Belgium (see Figure 2).

- (c)

- Bidding Zone C expresses the 3rd setup, with central (TSO-oriented) scheduling at the day-ahead stage and central (TSO-oriented) dispatch in real time on an entity basis. In this setup, the TSO considers all BSEs and the needs of the system overall to determine an efficient operational schedule (central scheduling) at the day-ahead and intra-day stage and issue optimal dispatch instructions in real time (central dispatch) directly to the BSEs. Typical examples of this setup are Italy and Greece (see Figure 2).

- (a)

- the BSEs’ technical limitations (e.g., the technical minimum, the ramp up/down rates, etc., of generating units) and

- (b)

- the already allocated upward and downward reserve quantities to the BSEs for FCR, aFRR, and mFRR at the formerly-executed Integrated Scheduling Process (ISP) [35]; these reserves must be available for possible activation after the RR clearing process and closer to real time (e.g., mFRR BE clearing, AGC operation, instant events).

- (a)

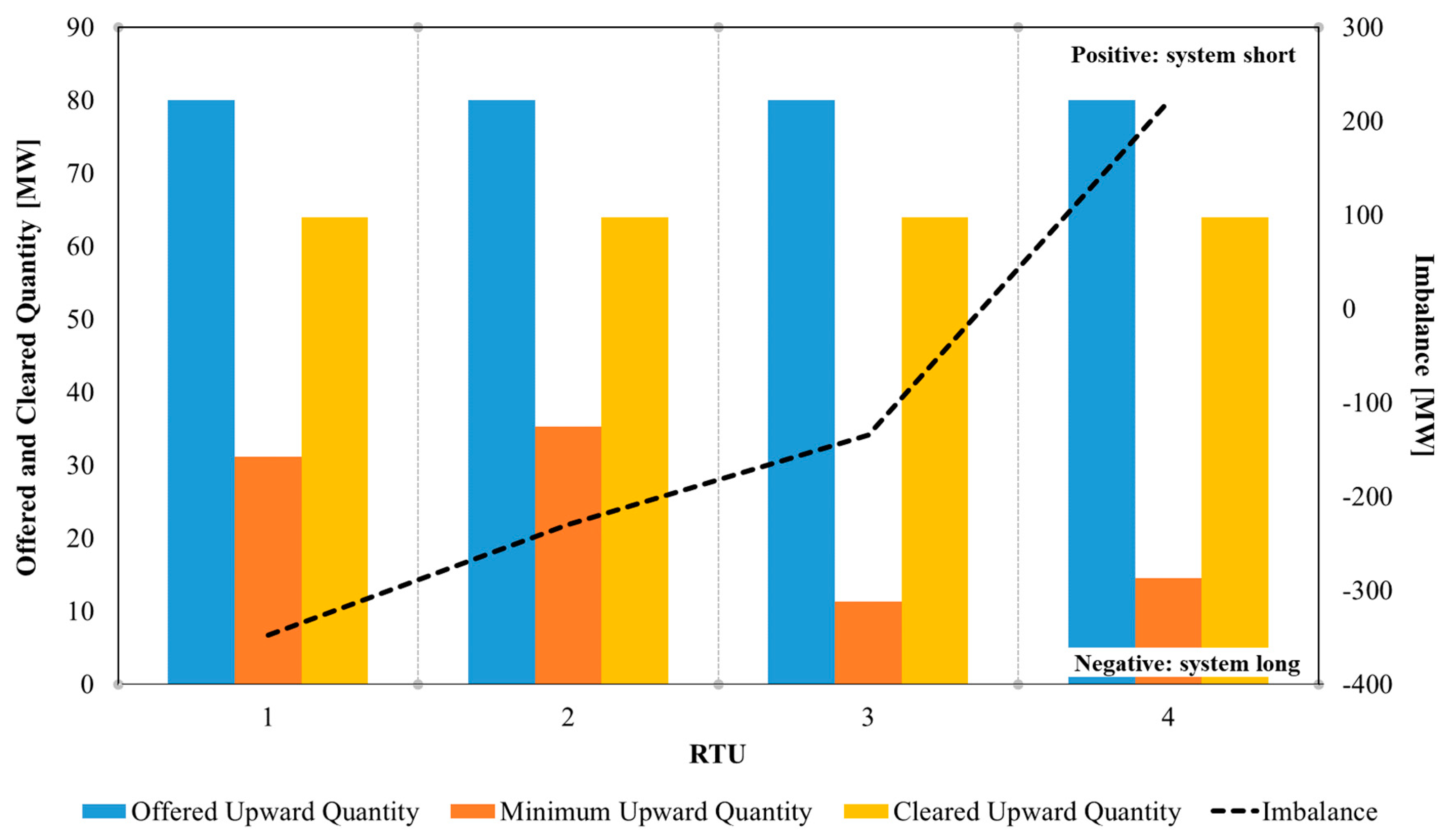

- a local RR Quantity Maximization Process, where the maximum quantity of upward and downward RR BE offered by each BSE is defined by the TSO subject to detailed unit technical limitations;

- (b)

- a local Mandatory Activation Process, driven by binding resource operating constraints of step (a); and

- (c)

- a local Conversion Process, during which the initially submitted BEOs are converted into RR standard products.

3. LIBRA Platform Orders Types

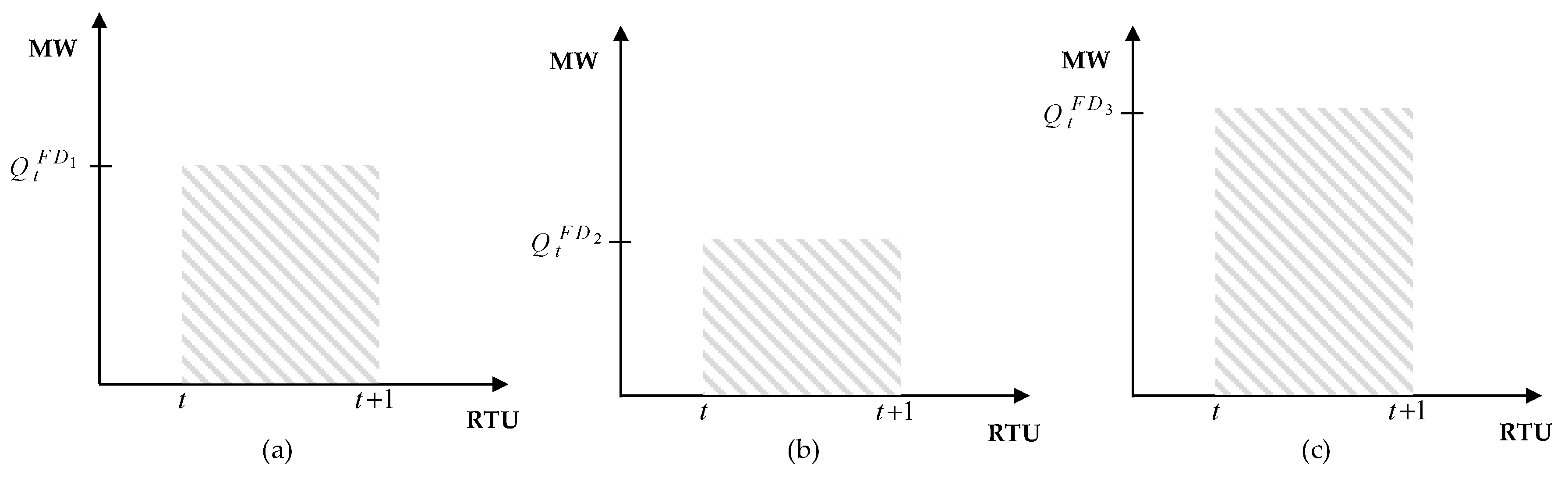

- Fully Divisible Order: It is an order submitted with a single quantity and a single price for a specific RTU. It has no minimum acceptance ratio, meaning that the quantity to be cleared by the AOF can range from zero to the offered quantity (see grey striped area in Figure 4a).

- Divisible Order: It is an order submitted with a single quantity and a single price for a specific RTU. It has a minimum acceptance ratio, meaning that the quantity to be cleared can range from a minimum quantity to the offered quantity (see grey striped area in Figure 4b).

- Indivisible Order: It is an order submitted with a single quantity and a single price for a specific RTU. Its minimum acceptance ratio is equal to one, meaning that the quantity to be cleared shall be identical with the offered quantity (see grey area in Figure 4c).

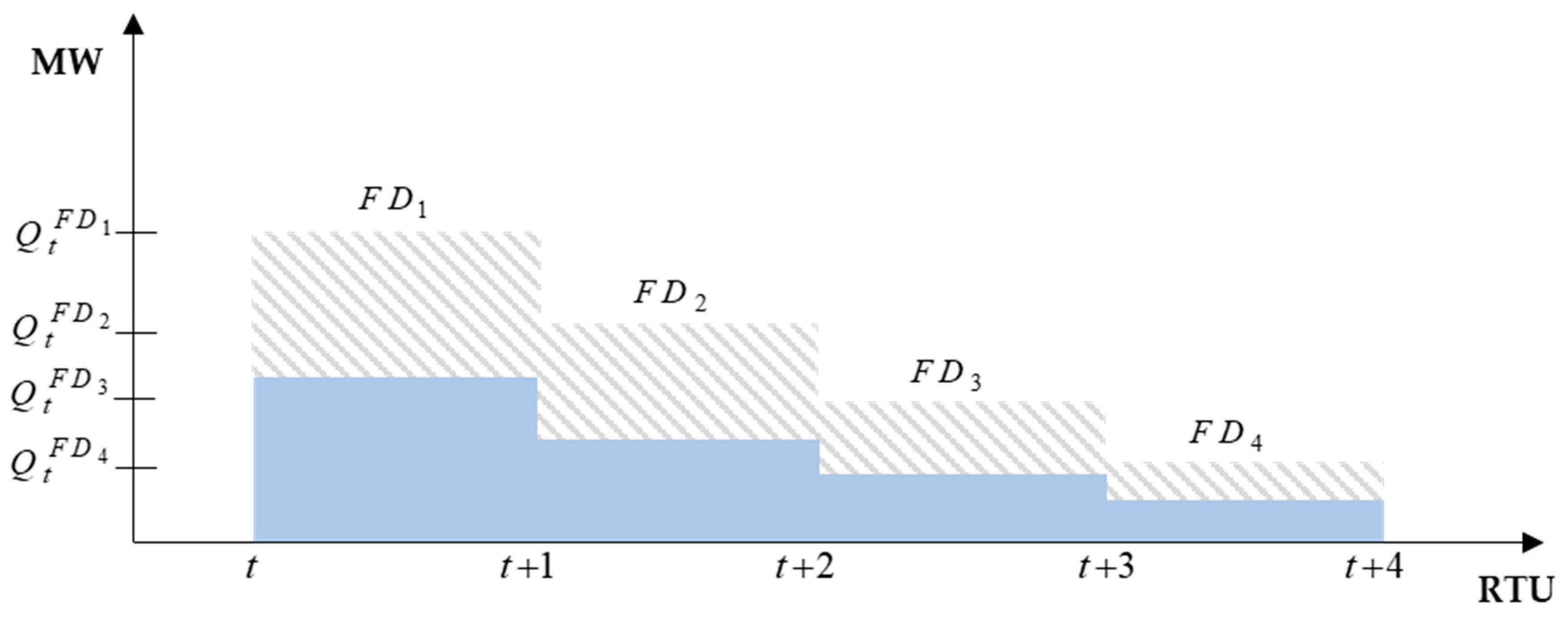

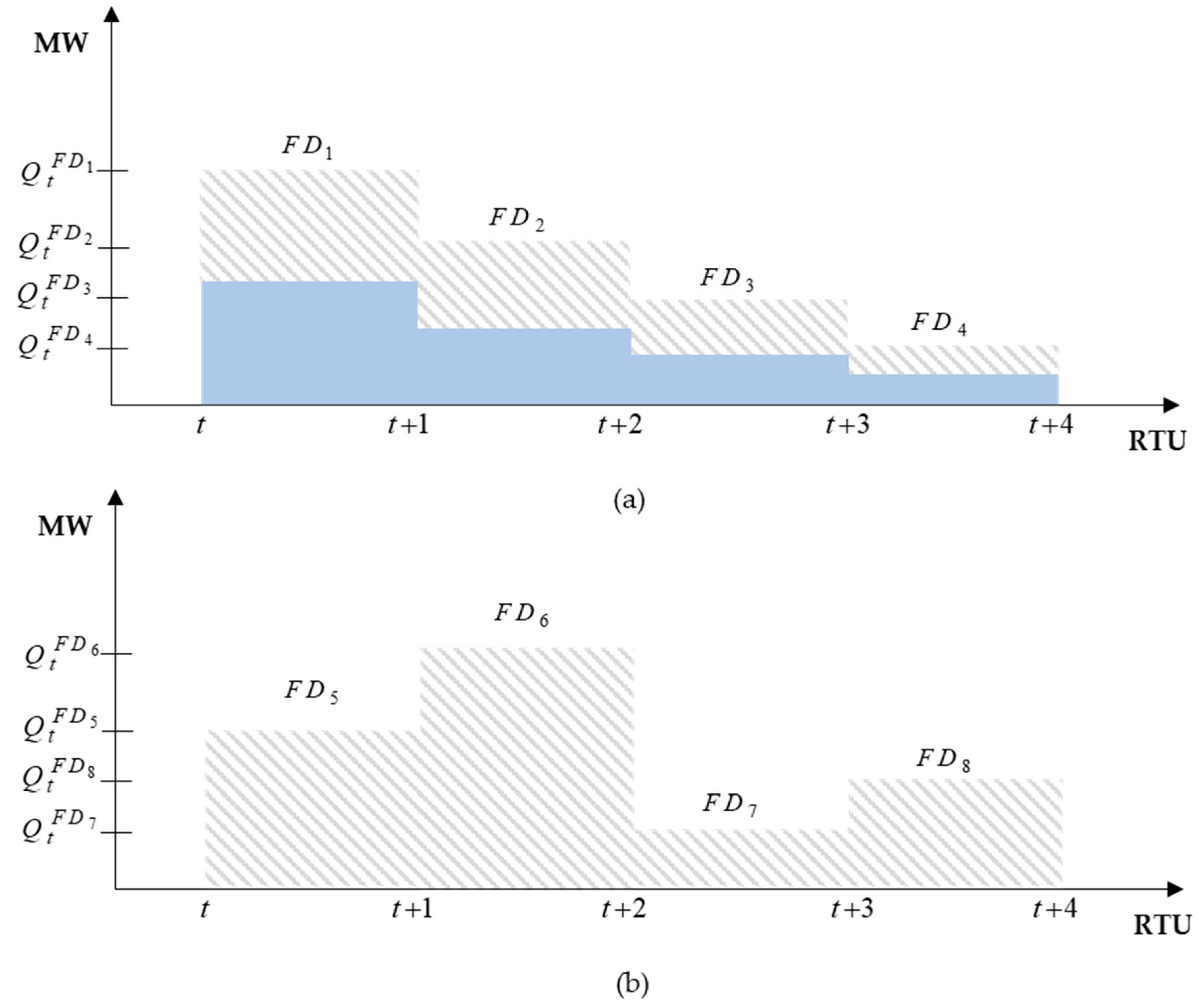

- Linked in Time Fully Divisible Orders: Discrete fully divisible orders with a single quantity and a single price which correspond to different RTUs. They have no minimum acceptance ratio. However, the attained acceptance ratios of these discrete orders shall be equal. For example, in Figure 5, four discrete fully divisible orders are presented for which the same acceptance ratio apply (see blue area).

- Linked in Time Divisible Orders: They are discrete divisible orders with a single quantity and a single price which correspond to different RTUs. They have a minimum acceptance ratio. Again, the attained acceptance ratio of these discrete orders shall be equal and greater than the minimum acceptance ratio.

- Linked in Time Indivisible Orders: They are discrete indivisible orders with a single quantity and a single price which correspond to different RTUs. Their minimum acceptance ratio is equal to one. The additional constraint is that the acceptance ratios of these discrete orders shall be equal.

- Exclusive in Volume Fully Divisible Orders: Discrete fully divisible orders belonging to the same group, with a single quantity and a single price which correspond to the same RTU, without a minimum acceptance ratio. The additional constraint is that only one of these orders can be cleared by the AOF. For example, Figure 6 presents three discrete fully divisible orders (Figure 6a–c) corresponding to a specific RTU, where only one of them can be cleared.

- Exclusive in Volume Divisible Orders: Discrete divisible orders belonging to the same group, with a single quantity and a single price which correspond to the same RTU, with a minimum acceptance ratio. Again, only one of these orders can be cleared by the AOF.

- Exclusive in Volume Indivisible Orders: Discrete indivisible orders belonging to the same group, with a single quantity and a single price which correspond to the same RTU, with a minimum acceptance ratio equal to one. Only one of these orders can be cleared by the AOF.

- Exclusive in Volume Linked in Time Fully Divisible Orders: Discrete fully divisible orders belonging to the same group, with a single quantity and a single price which correspond to the same RTU, without a minimum acceptance ratio. The additional constraint is that only one of these orders can be cleared by the AOF and the acceptance ratios of the cleared orders shall be equal. For example, Figure 7 presents two linked in time fully divisible orders (Figure 7a,b) belonging to the same group; only one of these two orders shall be cleared (see blue colored area in Figure 7a) and for the cleared order the same acceptance ratio shall apply for all RTUs.

- Exclusive in Volume Linked in Time Divisible Orders: Discrete divisible orders belonging to the same group, with a single quantity and a single price which correspond to the same RTU, with a minimum acceptance ratio. Again, only one of these orders can be cleared by the AOF; the acceptance ratio of the cleared orders shall be equal or greater than the minimum acceptance ratio.

- Exclusive in Volume Linked in Time Indivisible Orders: Discrete indivisible orders belonging to the same group, with a single quantity and a single price which correspond to the same RTU, with a minimum acceptance ratio equal to one. Only one of these orders can be cleared by the AOF; the acceptance ratios of the cleared orders shall be equal.

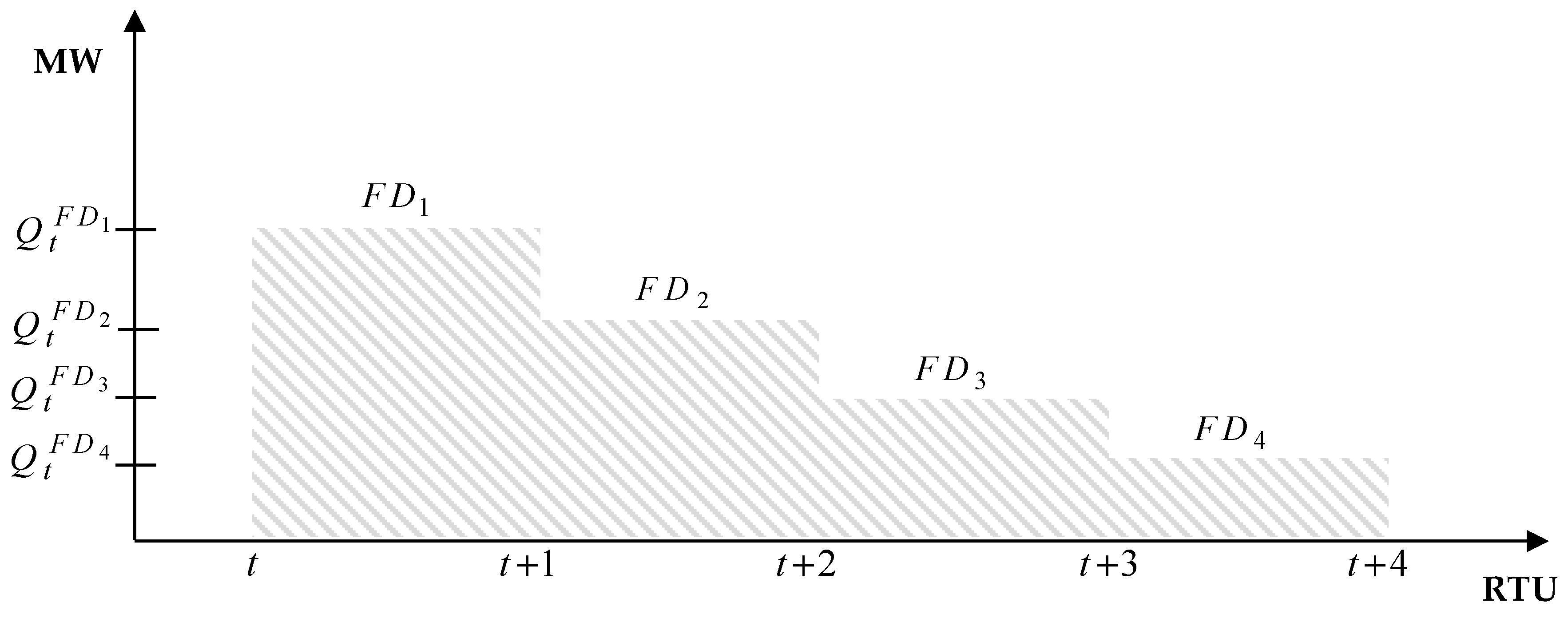

- Exclusive in Time Fully Divisible Orders: Discrete fully divisible orders with a single quantity and a single price which correspond to different RTUs, without a minimum acceptance ratio. Only one of these orders can be cleared by the AOF. For example, in Figure 8, four discrete fully divisible orders are presented, where only one them can be cleared.

- Exclusive in Time Divisible Orders: Discrete divisible orders with a single quantity and a single price which correspond to different RTUs, with a minimum acceptance ratio. Only one of these orders can be cleared by the AOF.

- Exclusive in Time Indivisible Orders: Discrete indivisible orders with a single quantity and a single price which correspond to different RTUs, with a minimum acceptance ratio equal to one. Again, only one of these orders can be cleared by the AOF.

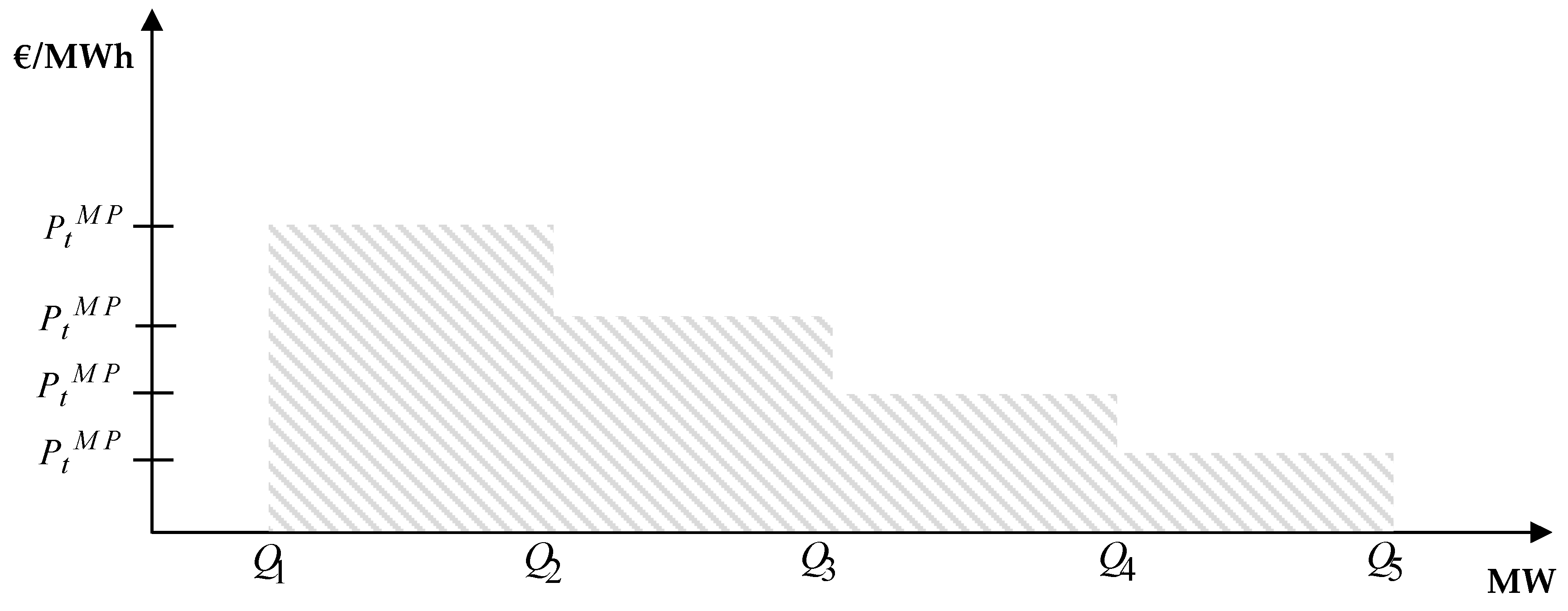

- Multi-part Fully Divisible Order: Order submitted with variable quantities and variable prices for one or more RTUs, without a minimum acceptance ratio. An example is provided in Figure 9.

- Multi-part Divisible Order: Order with variable quantities and variable prices for one or more RTUs, with a minimum acceptance ratio.

- Multi-part Indivisible Order: Order submitted with variable quantities and variable prices for one or more RTUs, with a minimum acceptance ratio equal to one.

4. Activation Optimization Function Mathematical Formulation

4.1. Problem Formulation

4.1.1. Objective Function

4.1.2. Order Clearing Constraints

4.1.3. Power Balance Constraints

4.1.4. Cross Zonal Capacity Constraints

4.1.5. Tolerance Band Constraints

4.1.6. Interconnection Controllability Constraints

4.1.7. Ramping Constraints in Clearing Process

4.2. Solution Methodology

- Step 1: Execution of conversion process for the central-dispatch bidding zones, based on the process presented in [36]. The converted BEOs are inserted in the subsequent AOF clearing process in step 2.

- Step 2: Execution of AOF clearing process jointly for self-dispatch and central-dispatch bidding zones and acquiring of the clearing results.

- Step 3: Check for PAOs: A check is performed for the presence of PAOs (namely cleared orders with negative welfare [17]). In case there are PAOs, these are removed from the order book and Step 2 is executed again with the remaining orders. Otherwise, when no more PAOs are found, the process terminates.

5. Test Case and Results

5.1. Case Description

5.2. Test Results

5.2.1. Regional Results of Activation Optimization Function

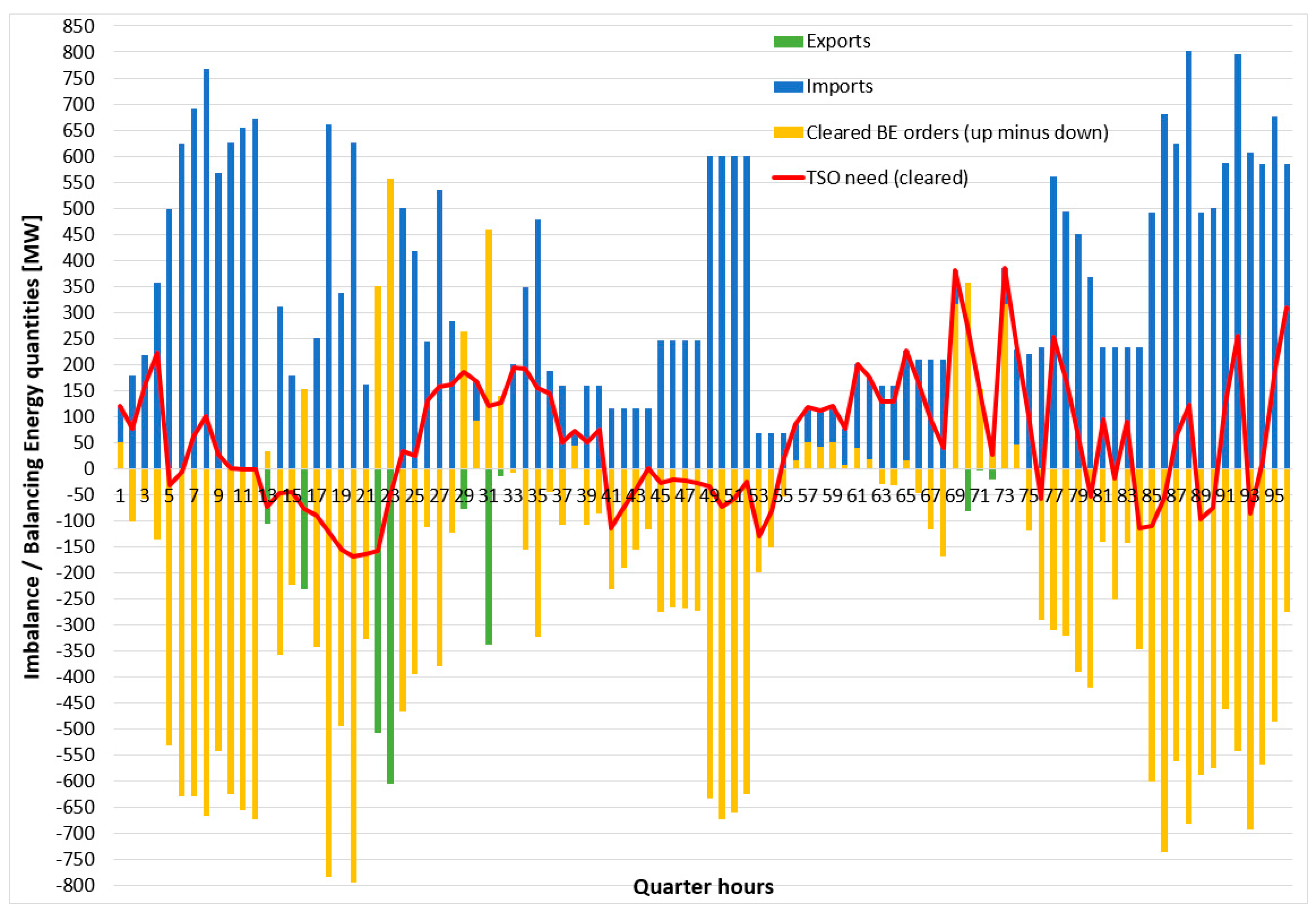

- (a)

- The imbalance netting effect, when there is sufficient CZC in the interconnections eliminates the need to fully cover all imbalances in all countries. Table 2 provides the sum of absolute upward and downward cleared TSO needs in each market, along with the absolute value of the net (upward minus downward) BE activations from local BSPs in each market. In order to eliminate the counter-activations that may occur due to the non-intuitive situation of upward BEOs being offered with a lower price than respective downward BEOs, we consider only the net BE cleared quantities of BSPs in each market. As shown, the cleared BE quantities are just a small portion of the cleared TSO needs in both directions, which signals the high economic efficiency attained by the imbalance netting (i.e., netting of TSO needs of opposite sign) resulted from the cross-border RR BE procurement process.

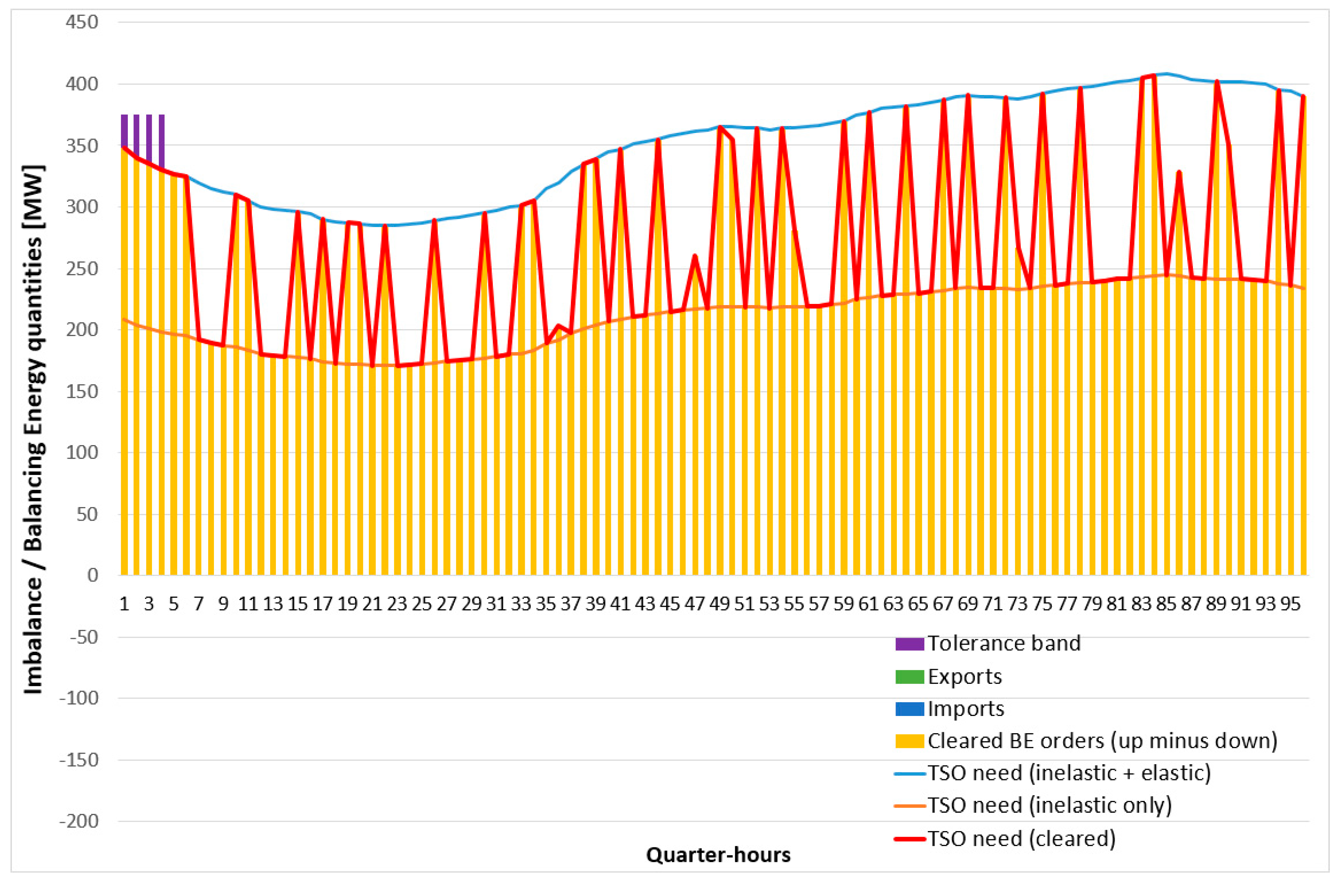

- (b)

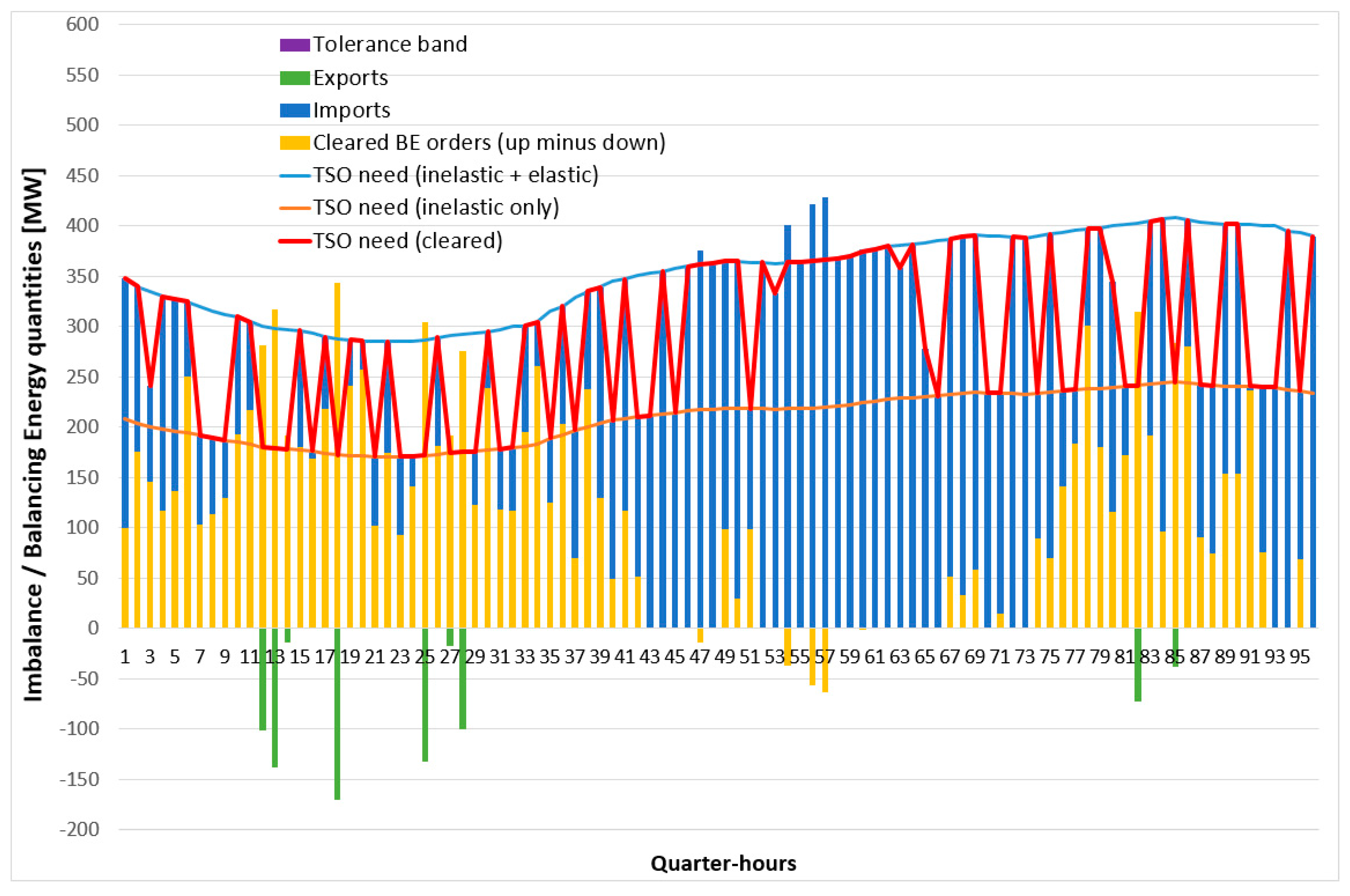

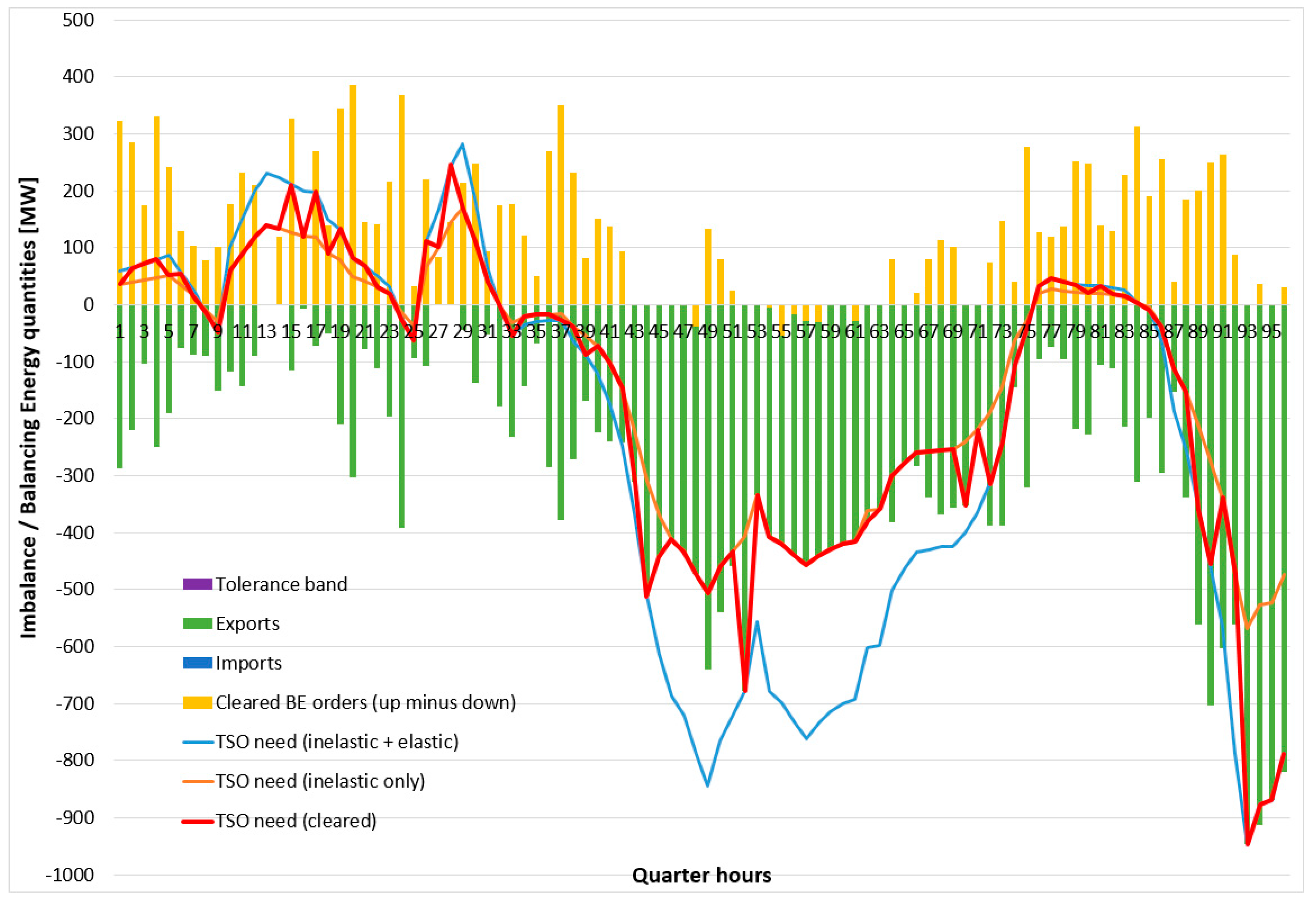

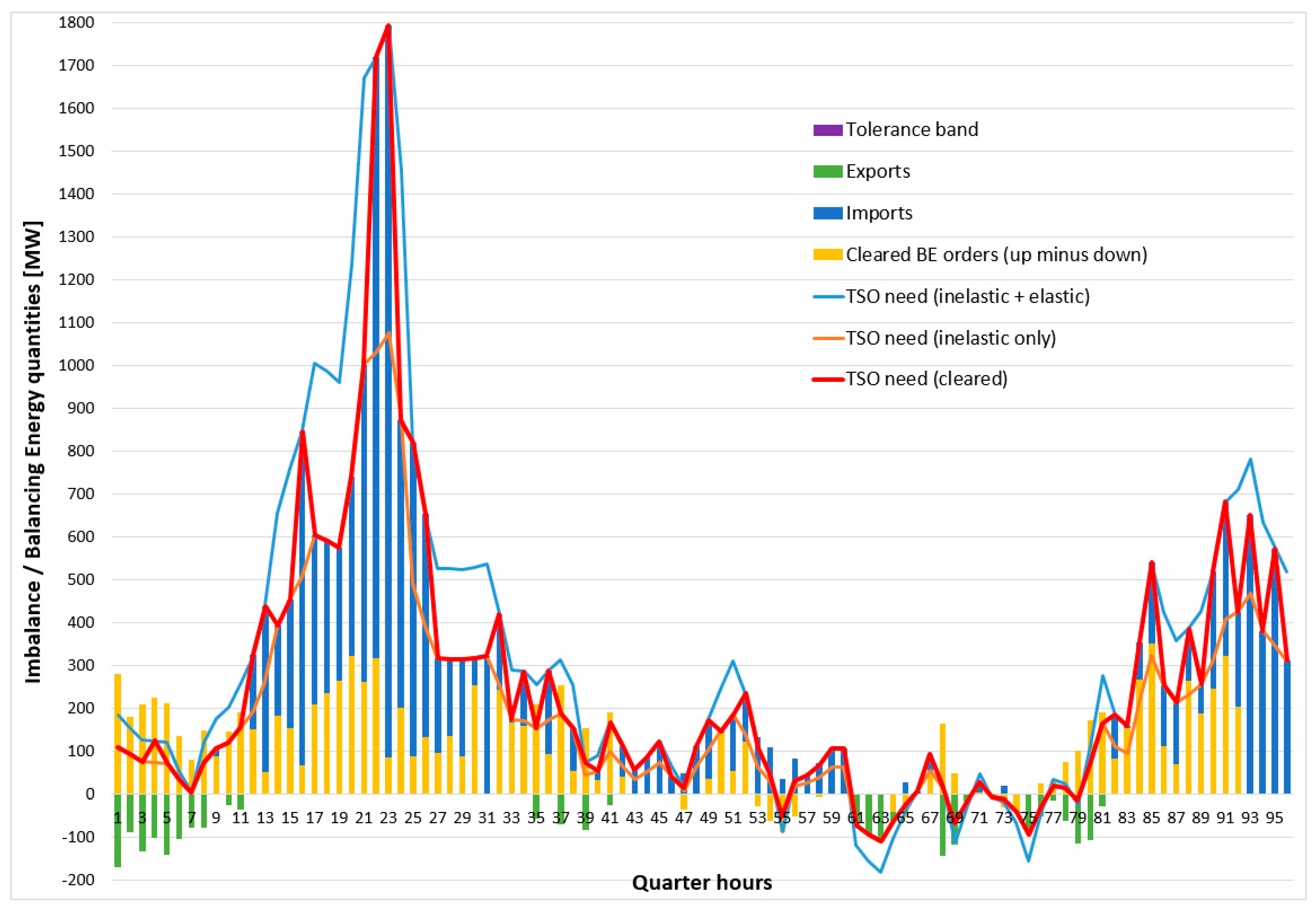

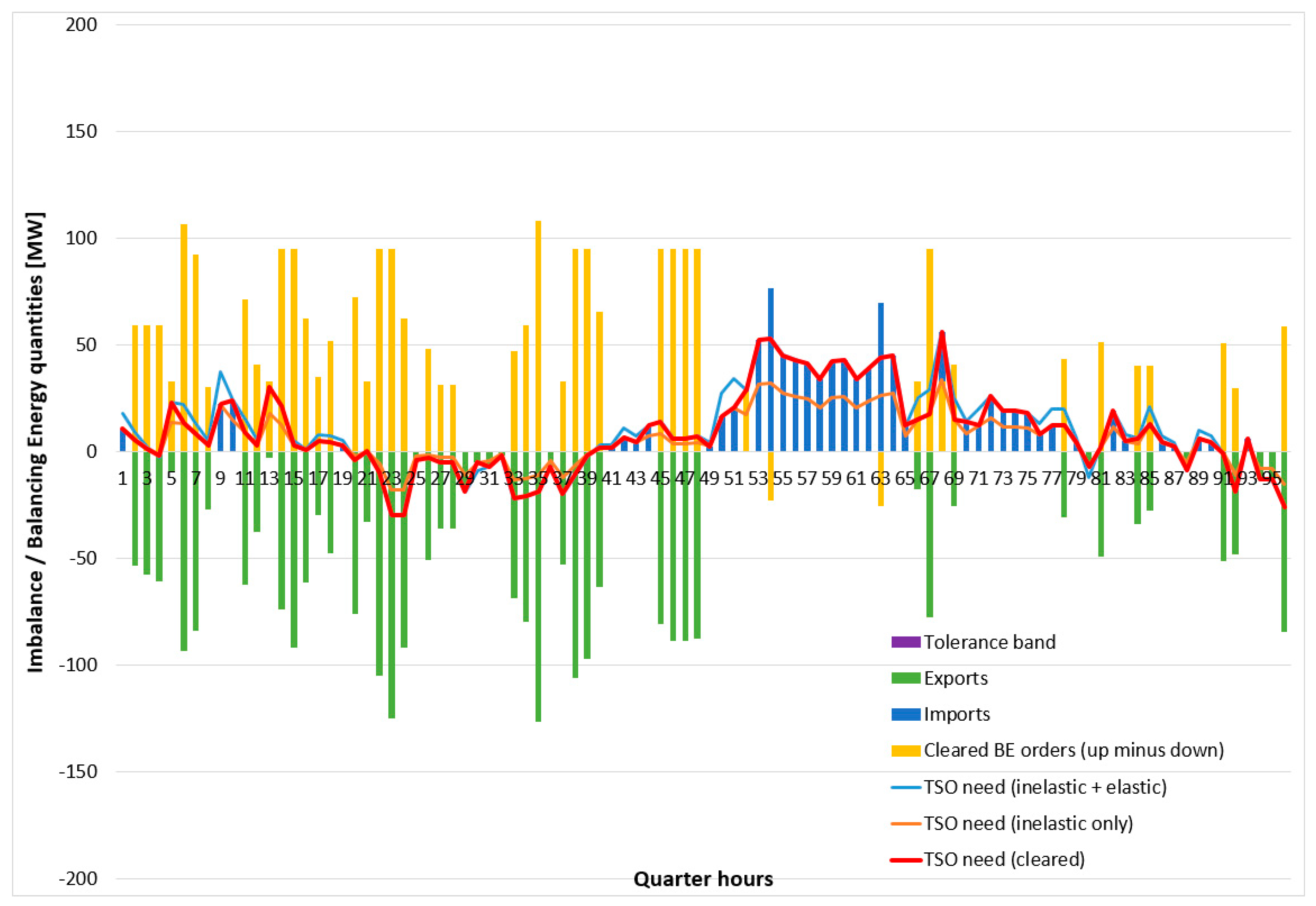

- The activated BE from local or neighboring BSPs/BSEs covers the inelastic TSO need plus a portion (0–100%) of the elastic TSO need. The red bold line in Figure 11, Figure 12, Figure 13, Figure 14, Figure 15 and Figure 16 expresses the total cleared TSO need which always lies between the orange (inelastic TSO need) and blue (inelastic plus elastic TSO need) lines. The clearing status between these two lines depends on the order price of the elastic TSO needs and the respective BEO prices of BSPs.

- (c)

- The TSOs’ needs are covered by both local resources (orange bars) or by resources in neighboring countries (imports shown with blue bars), considering the available CZC of the interconnections. For example, in Portugal at the after-midnight (2–10) and night (19–21) h, the TSO needs are mainly covered by local resources, whereas at hours 11–18, these are mainly covered by imported BE from Spain.

- (d)

- In some cases, the local TSO needs may be quite small (e.g., in Switzerland), but the local resources are called to provide large amounts of upward BE to cover the needs of neighboring TSOs through respective exports (green bars in Figure 14).

- (e)

- In general, there are several cases where BSPs/BSEs are awarded upward BE (i.e., they are called to increase their production) to accommodate exports (e.g., in Switzerland and Greece), or inversely they are awarded downward BE (they are called to decrease their production) to accommodate imports (e.g., Italy).

- (f)

- The simultaneous cross-zonal BE procurement in regional basis levels the TSO needs’ spikes that may occur in a single market, by providing “support” from neighboring countries through respective imports/exports (depending on the sign of the TSO needs). This is evident, e.g., in France, where a large positive TSO need spike occurs at hours 4–7, which is mostly covered by imports from Switzerland and Spain. Actually, the TSO need is mostly “shaved” in a relatively low quantity (about 300 MW), and the local resources cover only the “shaved” TSO need.

- (g)

- In the central-dispatch markets (Greece, Italy) there are no elastic TSO needs; hence, the Figure 15 and Figure 16 are simpler, containing only the cleared TSO need (which coincides with the inelastic TSO need), the local cleared BEOs and the imports/exports to neighboring markets. It should be noted that the mandatorily activated BEOs of such markets are included in the cleared BE quantities (orange bars) in both figures.

- (h)

- The orange lines internalize (net) any counter-activations due to the non-intuitive situation of upward BEOs being offered with a price lower than respective downward BEOs. The counter-activations provide a higher profit to TSOs, and the opportunity of such activations has been included in the LIBRA platform [17].

- (i)

- In a cross-zonal BE procurement scheme, it is highly unlikely that the tolerance band shall be used to ease the clearing process (in the presence of large indivisible blocks, as theoretically expected), due to the fact that imports/exports act implicitly as slack variables for a bidding zone’s imbalance needs, providing the necessary upward/downward flexibility to meet exactly the TSO’s needs without the activation of the tolerance band. The more interconnected a power system is (e.g., in central Europe with a meshed network), the easier it is to resolve the system’s imbalance needs using local or cross-border resources.

- i.

- the CZC with the neighboring country (Spain) has been zeroized in both directions for all RTUs;

- ii.

- the upward BEO quantity of an indivisible order has been set to a level (i.e., 375 MW) higher than the TSO needs for the 1st hour of the day, and the respective order price was reduced to a negative number (i.e., −2 €/MWh); and

- iii.

- all downward BEO prices have been decreased to levels below the order price referred in action (ii) above (i.e., lower than −2 €/MWh).

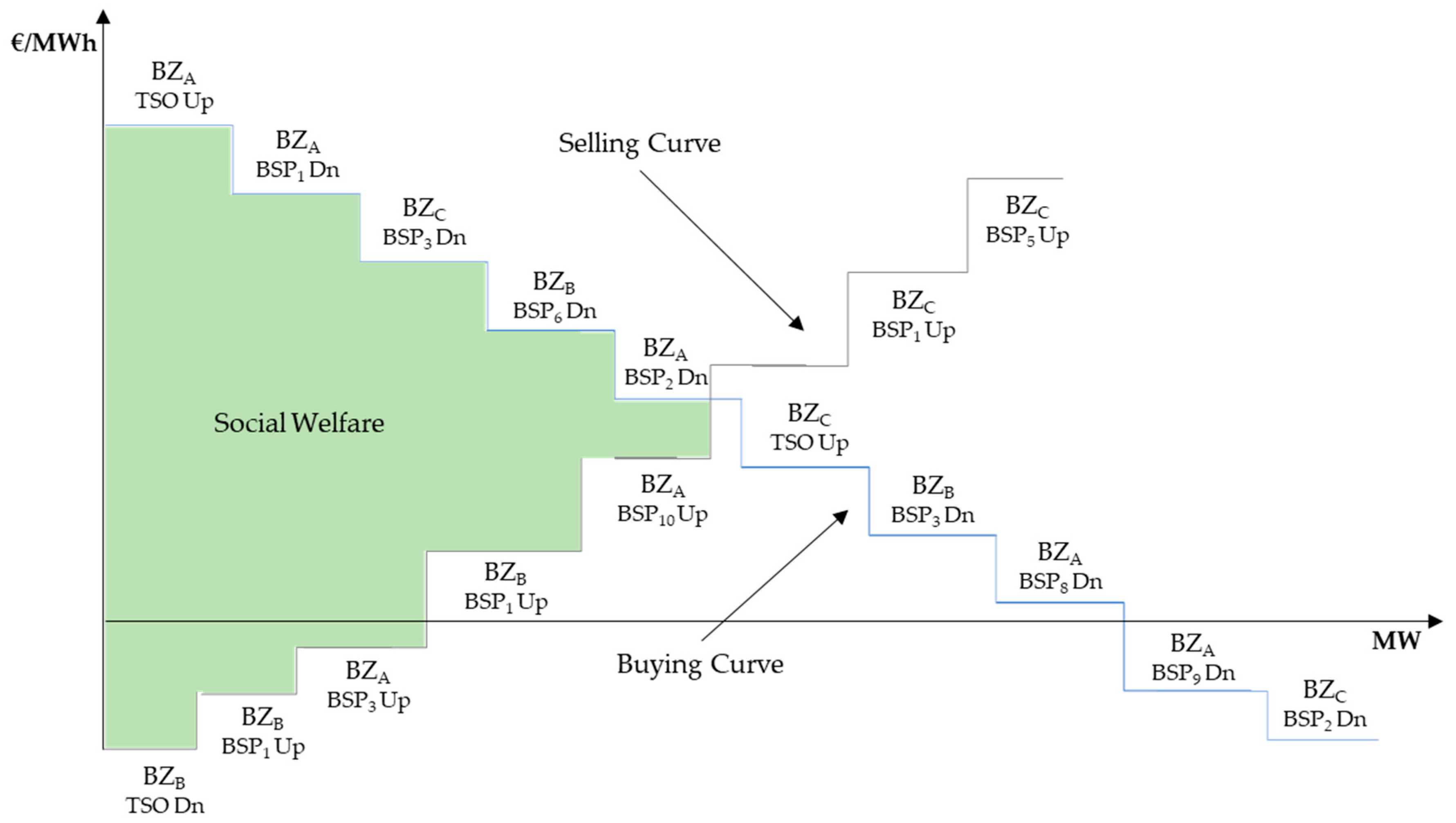

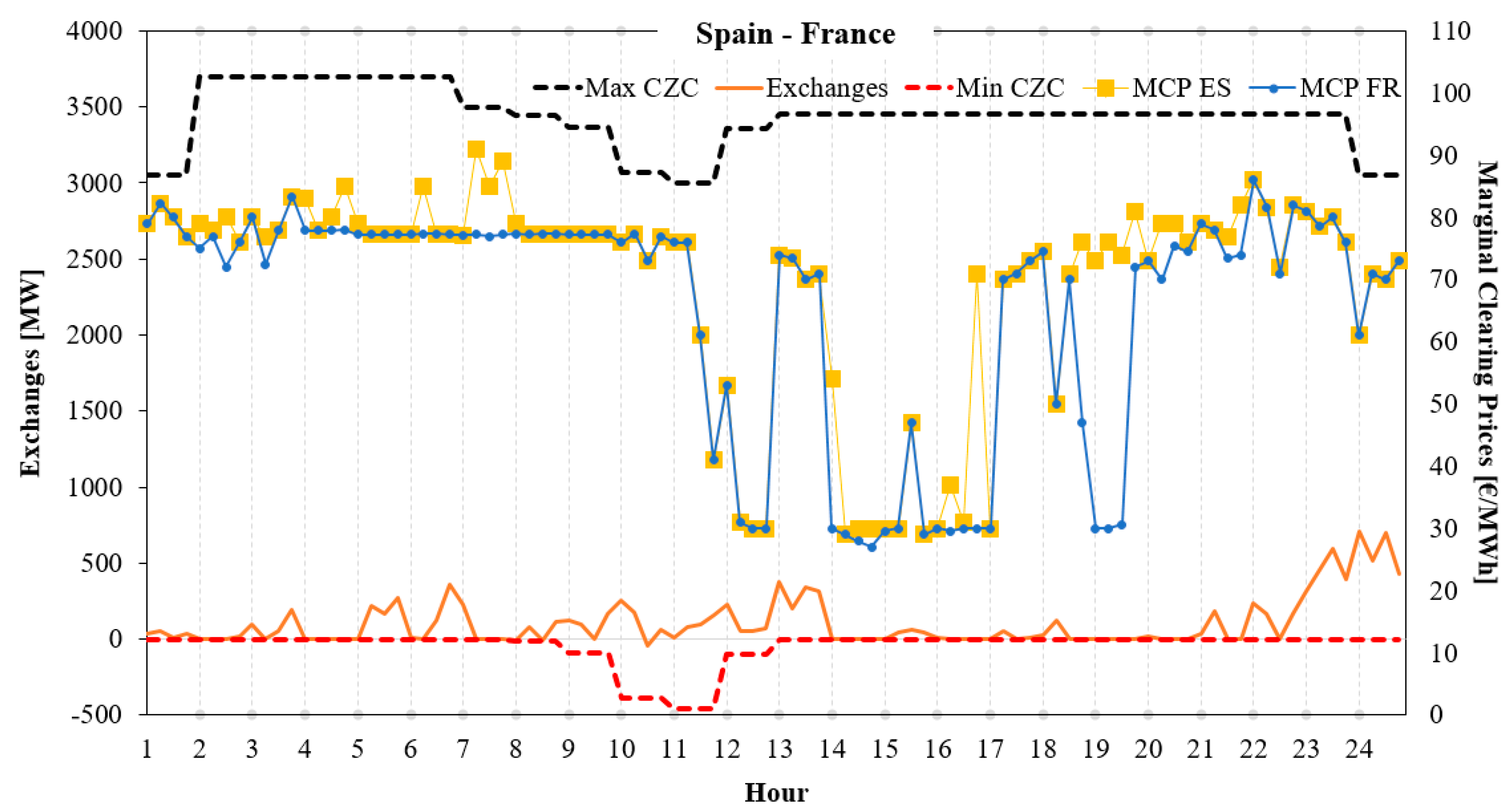

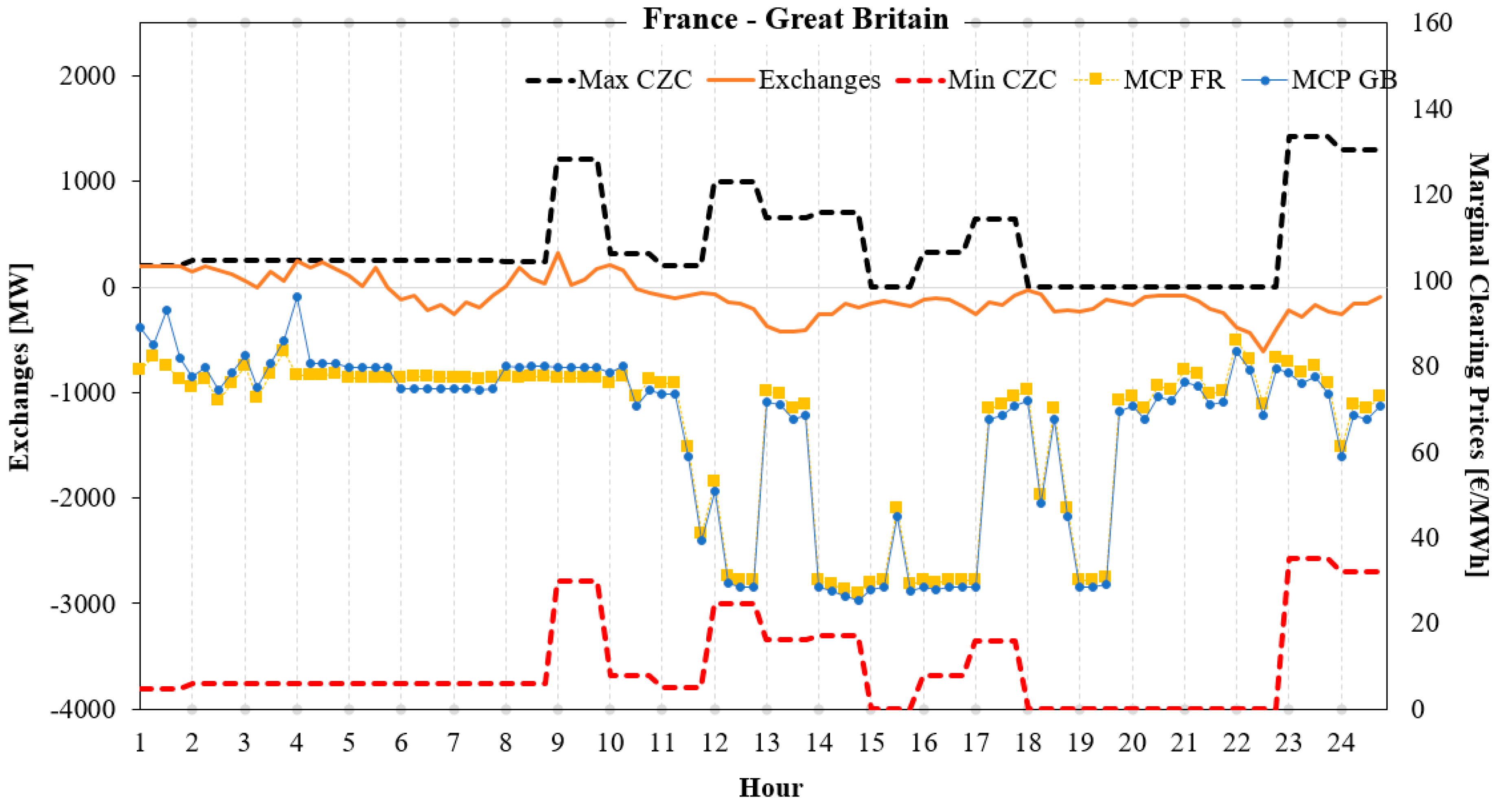

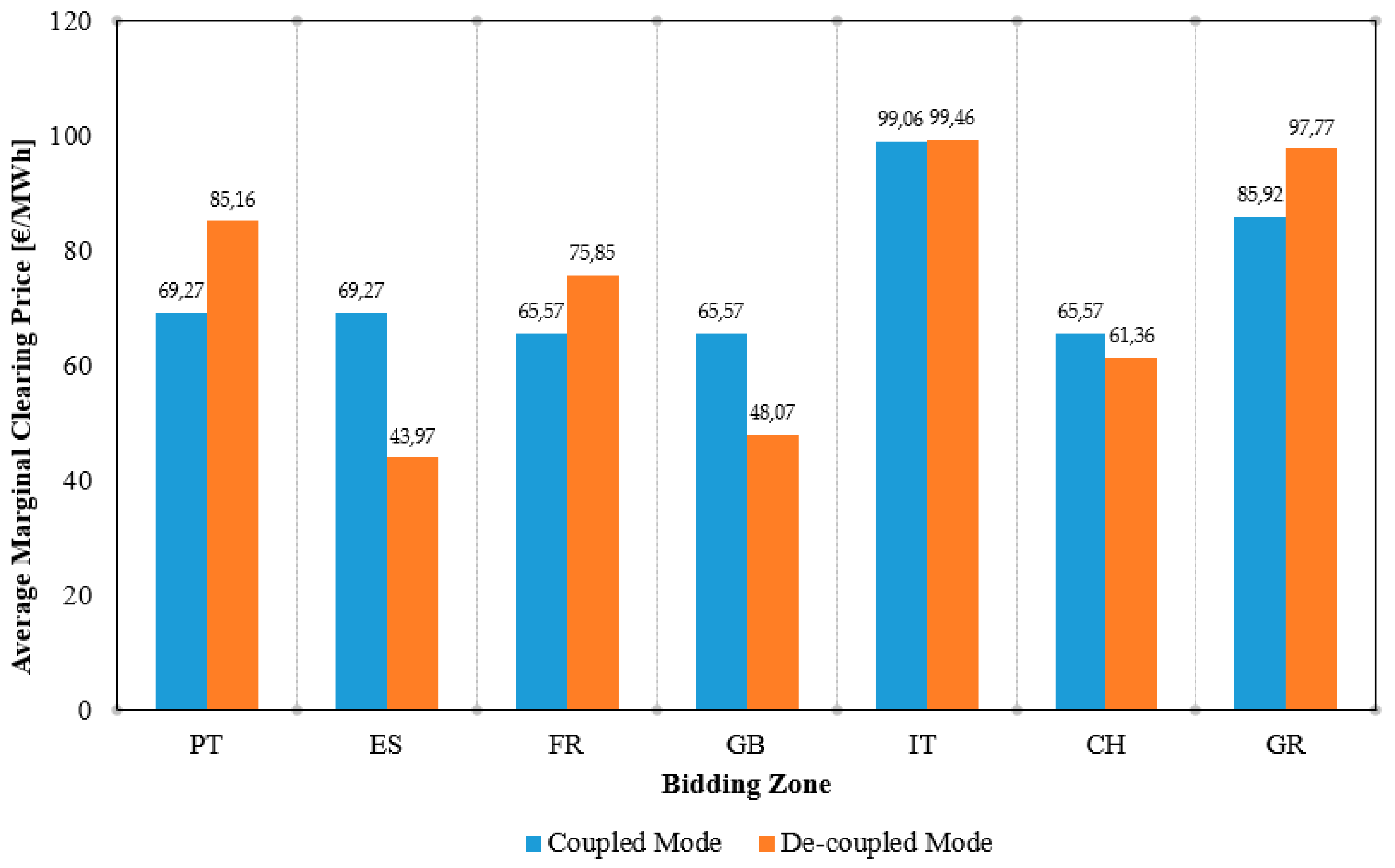

- (a)

- leads to the full or partial convergence of MCPs. As illustrated in Figure 20, in the coupled mode, a price convergence (identical average MCPs) is observed between Portugal and Spain and between France, Great Britain, and Switzerland. On the other hand, in the de-coupled mode, such market areas attain different average MCPs for the reference day;

- (b)

- is beneficial from the TSO market perspective and thus for end-consumers, since it leads to higher overall social welfare. In our case, when a regional coupling is applied, the welfare amounts to 924,472.58 € while in an isolated mode (zero CZCs between bidding zones) the respective welfare equals to 523,671.87 €.

5.2.2. Order Clearing Results

5.3. Computational Issues

6. Conclusions

- (a)

- the inclusion of all order types of BEOs and the analytical mathematical representation of their clearing conditions;

- (b)

- the combination of self-dispatch and central dispatch market setups; for the latter, a pre-process is implemented before the clearing process for the conversion of BEOs to standard products (i.e., multi-part fully divisible orders) as required by EBGL;

- (c)

- the consideration of both elastic and inelastic orders submitted by the participating TSOs to cover their needs;

- (d)

- the inclusion of the tolerance band concept in the model constraints; and

- (e)

- the inclusion of ramping constraints for the central dispatch bidding zones in the overall regional clearing model for technical feasibility purposes.

Author Contributions

Funding

Conflicts of Interest

Abbreviations

| aFRR | automatic Frequency Restoration Reserve |

| AOF | Activation Optimization Function |

| BE | Balancing Energy |

| BEO | Balancing Energy Order |

| BSE | Balance Service Entity |

| BSP | Balance Service Provider |

| CCGT | Combined Cycle Gas Turbine |

| CMOL | Common Merit Order List |

| CZC | Cross Zonal Capacity |

| FCR | Frequency Containment Reserve |

| mFRR | manual Frequency Restoration Reserve |

| MILP | Mixed Integer Linear Programming |

| OCGT | Open Cycle Gas Turbine |

| RR | Replacement Reserve |

| RTU | Real-Time Unit |

| TSO | Transmission System Operator |

Nomenclature

| Real Time Units (RTUs) of RR Clearing horizon; | |

| Balancing service entities participating in the balancing market | |

| Set of orders submitted by BSPs, where | |

| All inelastic/elastic orders submitted by TSOs to cover their needs where are the subsets of upward and downward TSO orders | |

| All orders submitted by the BSPs of the self-dispatch systems, where are the subsets of upward and downward orders | |

| All multi-part orders submitted by BSPs of the central-dispatch markets per BSE, where are the subsets of upward and downward multi-part orders | |

| Bidding Zones, where are the subsets of the bidding zones applying the self-dispatch model and the central-dispatch model respectively | |

| Direction of the balancing energy orders submitted by the TSO and the BSPs (upward or downward) | |

| Steps of the multi-part balancing energy orders submitted by the TSO and the BSPs (upward or downward) of central-dispatch systems | |

| Interconnections lines, where are the subsets of AC and DC interconnections | |

| Fully divisible balancing energy orders | |

| Divisible balancing energy orders | |

| Indivisible balancing energy orders | |

| Linked fully divisible balancing energy orders | |

| Linked divisible balancing energy orders | |

| Linked indivisible balancing energy orders | |

| Exclusive in volume fully divisible balancing energy orders | |

| Exclusive in volume divisible balancing energy orders | |

| Exclusive in volume indivisible balancing energy orders | |

| Exclusive in volume linked fully divisible balancing energy orders | |

| Exclusive in volume linked divisible balancing energy orders | |

| Exclusive in volume linked indivisible balancing energy orders | |

| Exclusive in time fully divisible balancing energy orders | |

| Exclusive in time divisible balancing energy orders | |

| Exclusive in time indivisible balancing energy orders | |

| Multi-part fully divisible balancing energy orders | |

| Multi-part divisible balancing energy orders | |

| Multi-part indivisible balancing energy orders | |

| Exclusive groups either in volume or in time |

| Price of balancing energy order or in direction dr in RTU t (€/MWh) | |

| Price of step k of balancing energy order in direction dr in RTU t (€/MWh) | |

| Quantity of balancing energy order or in direction dr in RTU t (MW) | |

| Quantity of step k of balancing energy order in direction dr in RTU t (€/MWh) | |

| Minimum Acceptance Ratio of balancing energy order or in direction dr in RTU t (p.u.), where | |

| Minimum Acceptance Ratio of step k of balancing energy order in direction dr in RTU t (p.u.) | |

| Available cross zonal capacity of interconnection l in RTU t (MW) for both directions (+ corresponds to the capacity from bidding zone bz to bidding zone bz’ and − corresponds to the capacity from bidding zone bz’ to bidding zone bz) | |

| Parameter denoting the maximum tolerance band of balancing energy order in direction dr in RTU t (MW) | |

| Parameter denoting that DC interconnection l begins/ends from/to bidding zone bz, if equal to 1; otherwise it is equal to 0 | |

| Desired flow of interconnection l in RTU t (MW) imposed for controllability purposes (+ corresponds to the flow from bidding zone bz to bidding zone bz’ and - corresponds to the flow from bidding zone bz’ to bidding zone bz) | |

| Market schedule of balancing energy order in RTU t (MW) | |

| Ramp up/down rate of balancing energy order (MW/min) | |

| Manual activation by the TSO (in central dispatch markets) of balancing energy order in direction dr in RTU t (MW) | |

| Loss factor of DC interconnection l (%) |

| Acceptance ratio of balancing energy order or submitted by BSPs in direction dr and in RTU t | |

| Acceptance ratio of balancing energy order submitted by the TSO in direction dr and in RTU t | |

| Binary variable indicating if indivisible balancing energy order is activated in direction dr in RTU t | |

| Binary variable indicating if step k of balancing energy order is activated in direction dr in RTU t | |

| Binary variable indicating if balancing energy order or is activated in direction dr where | |

| Binary variable indicating if balancing energy order or is activated in direction dr in RTU t where | |

| Commercial exchange in interconnection l in RTU t (MW) | |

| Positive variables utilized in the power flow variable decomposition schema for DC interconnection l in RTU t (MW) (+ corresponds to the flow from bidding zone bz to bidding zone bz’ and - corresponds to the flow from bidding zone bz’ to bidding zone bz) | |

| Cleared tolerance band of balancing energy order in direction dr in RTU t (MW) | |

| Cleared quantity of step k of balancing energy order in direction dr in RTU t (MW) |

References

- European Commission. Market Legislation. Available online: https://bit.ly/2QDKDhg (accessed on 28 April 2020).

- Booz and Company; Newbery, D.; Strbac, G.; Pudjianto, D.; Noel, P.; Fisher, L. Benefits of an Integrated European Energy Market. Available online: https://bit.ly/2QC3OYu (accessed on 28 April 2020).

- Newbery, D.; Strbac, G.; Viehoff, I. The benefits of integrating European electricity markets. Energy Policy 2016, 94, 253–263. Available online: https://bit.ly/2sC95HJ (accessed on 28 April 2020). [CrossRef]

- ENTSO-E. Implementation of Intraday and Day-Ahead Coupling as Well as Forward Capacity Allocation. Available online: https://bit.ly/2KMteQO (accessed on 28 April 2020).

- ENTSO-E. Electricity Balancing. Available online: https://bit.ly/39AlHzQ (accessed on 28 April 2020).

- ACER. Working towards a Single Energy Market to the Benefits of all EU Consumers. Available online: https://bit.ly/2QyrfC3 (accessed on 28 April 2020).

- European Commission. Integration of Electricity Balancing Markets and Regional Procurement of Balancing Reserves. Final Report 2016. Available online: https://bit.ly/2rFQf1P (accessed on 28 April 2020).

- Roben, F. Comparison of European Power Balancing Markets–Barriers to Integration. In Proceedings of the 15th International Conference on the European Energy Market, Łódź, Poland, 27–29 June 2018; Available online: https://bit.ly/2Q7U4Gz (accessed on 28 April 2020).

- Esterl, T.; Kaser, S.; Zani, A. Harmonization issues for cross-border balancing markets: Regulatory and economic analysis. In Proceedings of the 13th International Conference on the European Energy Market, Porto, Spain, 6–9 June 2016; Available online: https://bit.ly/2Q7PRTg (accessed on 28 April 2020).

- ENTSO-E. Commission Regulation (EU) 2017/2195 of 23 November 2017 Establishing a Guideline on Electricity balancing. Available online: https://bit.ly/3563hDD (accessed on 28 April 2020).

- ENTSO-E. Frequency Containment Reserves. Available online: https://bit.ly/36c8j2L (accessed on 28 April 2020).

- ENTSO-E. Imbalance Netting. Available online: https://bit.ly/2u5jmMZ (accessed on 28 April 2020).

- ENTSO-E. PICASSO Project. Available online: https://bit.ly/2F7I7KA (accessed on 28 April 2020).

- ENTSO-E. Manually Activated Reserves Initiative. Available online: https://bit.ly/3562UJf (accessed on 28 April 2020).

- N-Side. MARI Algorithm Design Principles. Available online: https://bit.ly/3eqA2R2 (accessed on 28 April 2020).

- ENTSO-E. TERRE Project. Available online: https://bit.ly/2QvOKM9 (accessed on 28 April 2020).

- ENTSO-E. Explanatory Document to the Proposal of all Transmission System Operators Performing the Reserve Replacement for the Implementation Framework for the Exchange of Balancing Energy from Replacement Reserves. Available online: https://bit.ly/357gImv (accessed on 28 April 2020).

- ACER. Annual Report on the Results of Monitoring the Internal Electricity and Natural Gas Markets in 2017. Available online: https://bit.ly/2ti7vKU (accessed on 28 April 2020).

- ENTSO-E. An Overview of the European Balancing Market and Electricity Balancing Guideline. Available online: https://bit.ly/2W9zmYA (accessed on 28 April 2020).

- N-Side. PCR and EUPHEMIA Algorithm. Available online: https://bit.ly/39pETjF (accessed on 28 April 2020).

- Chatzigiannis, D.I.; Dourbois, G.A.; Biskas, P.N.; Bakirtzis, A.G. European day-ahead electricity market clearing model. Electr. Power Syst. Res. 2016, 140, 225–239. Available online: https://bit.ly/39oN9Al (accessed on 28 April 2020). [CrossRef]

- Lam, L.H.; Valentin, I.; Bovo, C. European day-ahead electricity market coupling: Discussion, modeling, and case study. Electr. Power Syst. Res. 2018, 150, 80–92. Available online: https://bit.ly/36bpocX (accessed on 28 April 2020). [CrossRef]

- Zani, A.; Migliavacca, G. Pan-European Balancing Market: Benefits for the Italian Power System. In Proceedings of the AEIT Annual Conference, Trieste, Italy, 19 September 2014; Available online: https://bit.ly/2F4WOhz (accessed on 28 April 2020).

- Frade, P.M.S.; Shafie-khah, M.; Santana, J.J.E.; Catalao, J.P.S. Cooperation in ancillary services: Portuguese strategic perspective on replacement reserves. Energy Strategy Rev. 2019, 23, 142–151. Available online: https://bit.ly/39AnCV4 (accessed on 28 April 2020). [CrossRef]

- Gebrekiros, Y.; Doorman, G. Balancing Energy Market Integration in Northern Europe—Modeling and Case Study. In Proceedings of the IEEE Power and Energy Society General Meeting, National Harbor, MD, USA, 27–31 July 2014; Available online: https://bit.ly/2sqdmOu (accessed on 28 April 2020).

- Haberg, M. Optimal Activation and Congestion Management in the European Balancing Energy Market. Ph.D. Thesis, Norwegian University of Science and Technology, Trondheim, Norway, November 2019. Available online: https://bit.ly/3aJ7aB8 (accessed on 28 April 2020).

- de Haan, J.E.S. Cross-Border Balancing in Europe: Ensuring Frequency Quality within the Constraints of the Interconnected Transmission System. Available online: https://bit.ly/39pr4BJ (accessed on 28 April 2020).

- Jeriha, J.; Lakic, E.; Gubina, A.F. Innovative solutions for integrating the energy balancing market (mFFR). In Proceedings of the 16th International Conference on the European Energy Market, Ljubljana, Slovenia, 18–20 September 2019; Available online: https://bit.ly/2Qr2Oq0 (accessed on 28 April 2020).

- Kannavou, M.; Zampara, M.; Capros, P. Modelling the EU Internal Electricity Market: The PRIMES-IEM Model. Energies 2019, 12, 2887. Available online: https://bit.ly/2syiNL9 (accessed on 28 April 2020). [CrossRef]

- ELEXON. Project TERRE Implementation into GB Market Arrangements. Available online: https://bit.ly/2QytwgI (accessed on 28 April 2020).

- RTE. TERRE Project. Available online: https://bit.ly/2MH7d78 (accessed on 28 April 2020).

- ENTSO-E. Trans European Replacement Reserves Exchange (TERRE) project to deliver a European platform for the exchange of balancing energy from replacement reserves based on LIBRA solution live in January 2020. Available online: https://bit.ly/3fb94Oz (accessed on 28 April 2020).

- ENTSO-E. The proposal of all Transmission System Operators Performing the Reserve Replacement Process for the Implementation Framework for the Exchange of Balancing Energy from Replacement Reserves. Available online: https://bit.ly/3c5eAzf (accessed on 28 April 2020).

- ENTSO-E. Survey on Ancillary Services Procurement, Balancing Market Design 2018. Available online: https://bit.ly/2yh9zWv (accessed on 28 April 2020).

- Marneris, I.G.; Biskas, P.N. Integrated Scheduling Model for Central Dispatch Systems in Europe. In Proceedings of the IEEE PowerTech Conference, Eindhoven, The Netherlands, 29 June–2 July 2015; pp. 1–6. Available online: https://bit.ly/2sxKpA5 (accessed on 28 April 2020).

- Marneris, I.G.; Roumkos, C.; Biskas, P. Towards Balancing Market Integration: Conversion Process for Balancing Energy Offers of Central-Dispatch Systems. IEEE Trans. Power Syst. 2019, 35, 293–303. Available online: https://bit.ly/2F3cPEP (accessed on 28 April 2020). [CrossRef]

- Genesi, C.; Marannino, P.; Montagna, M.; Rossi, S.; Siviero, I.; Zanellini, F. Coordinated implicit allocation of the CBTCs for the integration of the national European electricity markets. In Proceedings of the 2008 IEEE Power and Energy Society General Meeting—Conversion and Delivery of Electrical Energy in the 21st Century, Pittsburgh, PA, USA, 20–24 July 2008; pp. 1–8. Available online: https://bit.ly/3ddI9jt (accessed on 29 May 2020).

- Meeus, L. Implicit auctioning on the Kontek Cable: Third time lucky? Energy Econ. 2011, 33, 413–418. Available online: https://bit.ly/2X92vVA (accessed on 29 May 2020). [CrossRef]

- EuroPEX. Using Implicit Auctions to Manage Cross-Border Congestion: Decentralized Market Coupling. In Proceedings of the Tenth Meeting of the European Electricity Regulatory Forum, Rome, Italy, 8–9 July 2003; Available online: https://bit.ly/2M4UrPr (accessed on 29 May 2020).

- Hoffler, F.; Wittmann, T. Netting of Capacity in Interconnector Auctions. Energy J. 2006, 28, 113–144. Available online: https://bit.ly/36EaFbD (accessed on 29 May 2020). [CrossRef][Green Version]

- Amprion Transmission System Operator. Multi Regional Coupling (MRC). Available online: https://bit.ly/3dhX5NL (accessed on 29 May 2020).

- Hungarian Power Exchange. 4M Market Coupling Overview. Available online: https://bit.ly/36MOQXe (accessed on 29 May 2020).

- Kath, C. Modeling Intraday Markets under the New Advances of the Cross-Border Intraday Project (XBID): Evidence from the German Intraday Market. Energies 2019, 12, 4339. Available online: https://bit.ly/3cfPduz (accessed on 29 May 2020). [CrossRef]

- ENTSO-E. Transparency Platform. Available online: https://bit.ly/3bRsupu (accessed on 28 April 2020).

- ENTSO-E. Mid-Term Adequacy Forecast 2019. Available online: https://bit.ly/2KOBDDn (accessed on 28 April 2020).

- ResearchGate. TERRE AOF Input Data. Available online: https://bit.ly/3h1VyxC (accessed on 28 April 2020).

- General Algebraic Modeling System. Available online: http://www.gams.com (accessed on 28 April 2020).

| Market | BSE Category | Num | Capacity (MW) | Upward RR BEO (€/MWh) | Downward RR BEO (€/MWh) |

|---|---|---|---|---|---|

| Greece | Lignite | 14 | 3912 | 57–77 | 0–7.5 |

| CCGT | 10 | 4239 | 90–110 | 20–34 | |

| OCGT | 3 | 147 | 120 | 50 | |

| Hydro | 18 | 3110 | 125–141 | 55–71 | |

| Italy | Coal | 17 | 7056 | 50–53 | 10–13 |

| CCGT | 72 | 37,094 | 77–78.5 | 37–38.5 | |

| OCGT | 1 | 248 | 97 | 57 | |

| Oil | 3 | 1210 | 128–130 | 88–90 | |

| Hydro 1 | 3 | 21,970 | 150–152 | 110–112 | |

| Portugal | 70–110 | 15–30 | |||

| Spain | 70–110 | 15–30 | |||

| France | 70–110 | 15–30 | |||

| Great Britain | 70–110 | 15–30 | |||

| Switzerland | 70–110 | 12–33 |

| Market | A. Sum of Absolute Upward and Downward TSO Needs [MWh] | B. Absolute Value of the Net BE Activations from Local BSPs [MWh] | C = B/A [%] |

|---|---|---|---|

| PT | 7013 | 2835 | 40.43% |

| ES | 15,224 | 3106 | 20.40% |

| FR | 19,321 | 2753 | 14.25% |

| GB | 25,540 | 1971 | 7.72% |

| CH | 31,839 | 750 | 2.35% |

| IT | 2594 | 7250 | 279.55% |

| GR | 3723 | 5139 | 138.03% |

| TOTAL | 105,252 | 23,804 | 22.62% |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Roumkos, C.; Biskas, P.; Marneris, I. Modeling Framework Simulating the TERRE Activation Optimization Function. Energies 2020, 13, 2966. https://doi.org/10.3390/en13112966

Roumkos C, Biskas P, Marneris I. Modeling Framework Simulating the TERRE Activation Optimization Function. Energies. 2020; 13(11):2966. https://doi.org/10.3390/en13112966

Chicago/Turabian StyleRoumkos, Christos, Pandelis Biskas, and Ilias Marneris. 2020. "Modeling Framework Simulating the TERRE Activation Optimization Function" Energies 13, no. 11: 2966. https://doi.org/10.3390/en13112966

APA StyleRoumkos, C., Biskas, P., & Marneris, I. (2020). Modeling Framework Simulating the TERRE Activation Optimization Function. Energies, 13(11), 2966. https://doi.org/10.3390/en13112966