Lifetime Degradation Cost Analysis for Li-Ion Batteries in Capacity Markets using Accurate Physics-Based Models

Abstract

1. Introduction

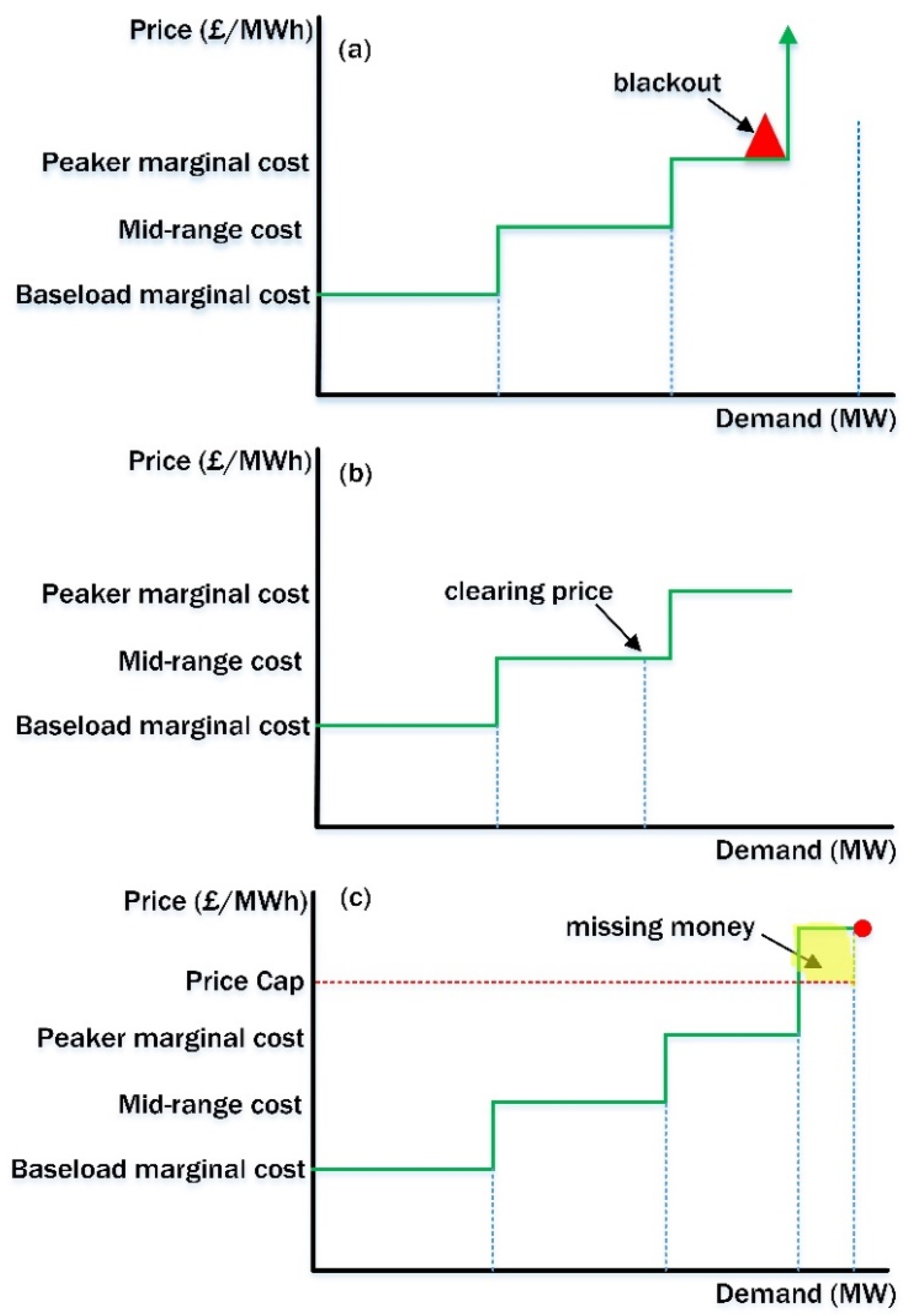

2. Capacity Market Fundamentals

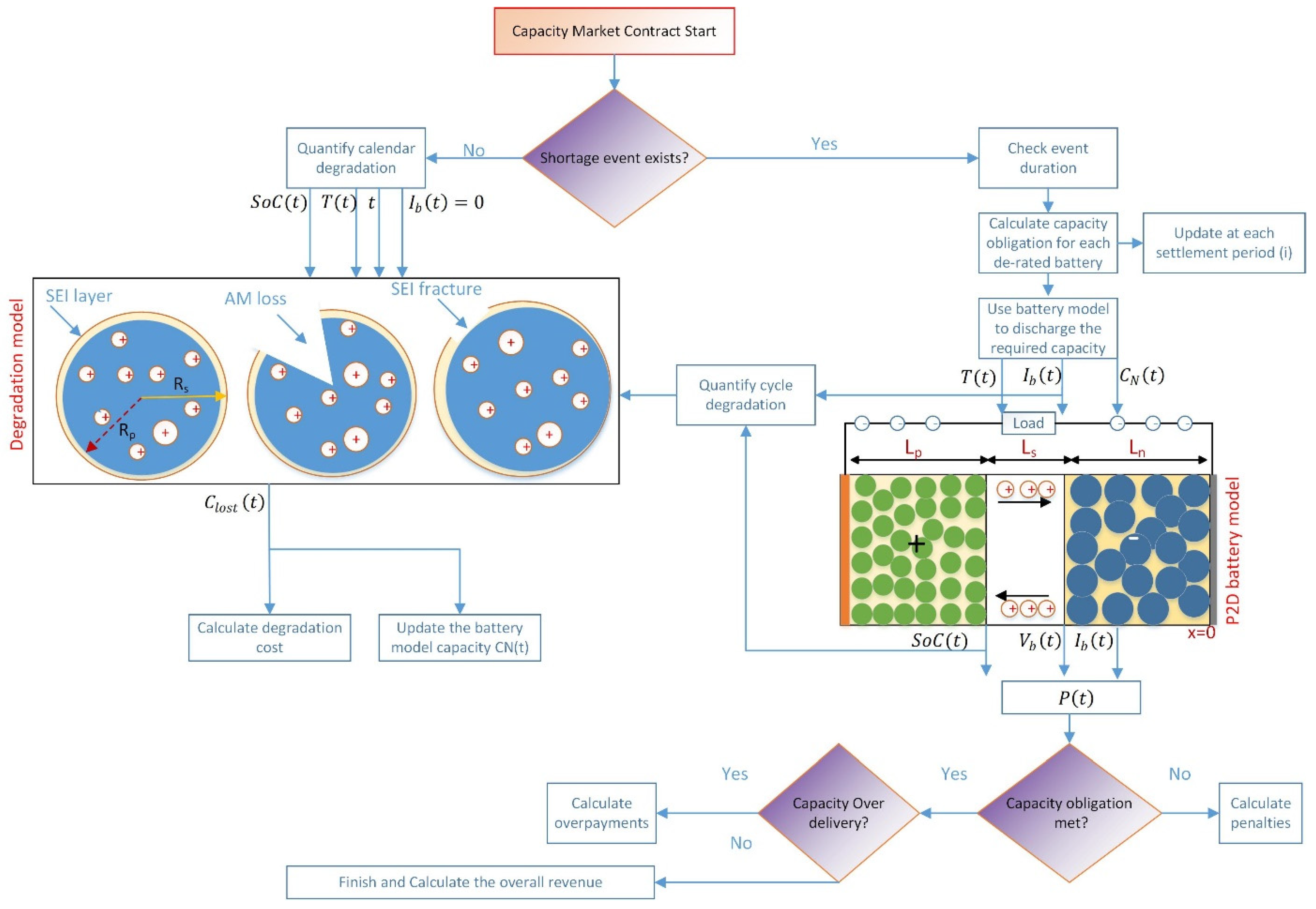

3. Methods

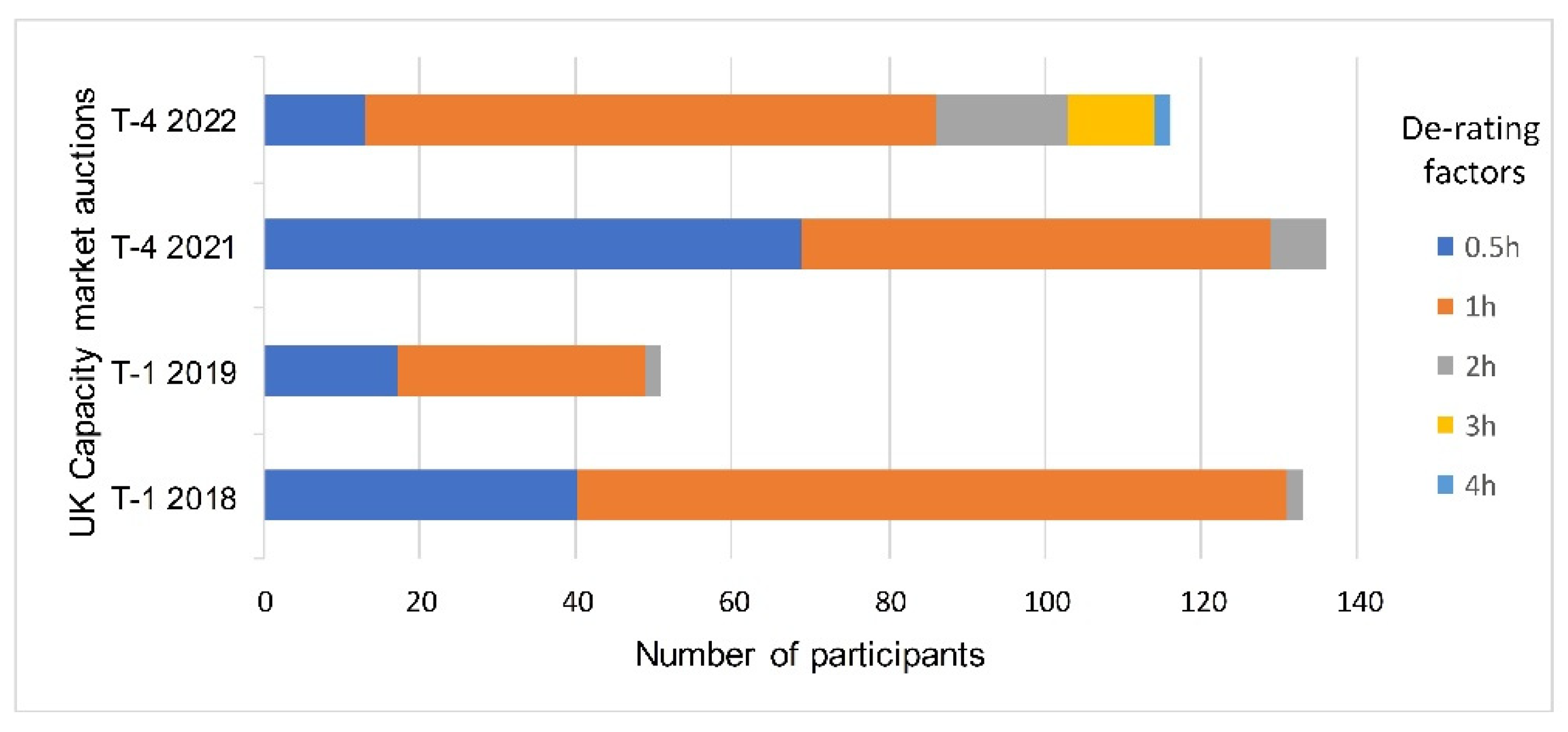

3.1. Problem Setup

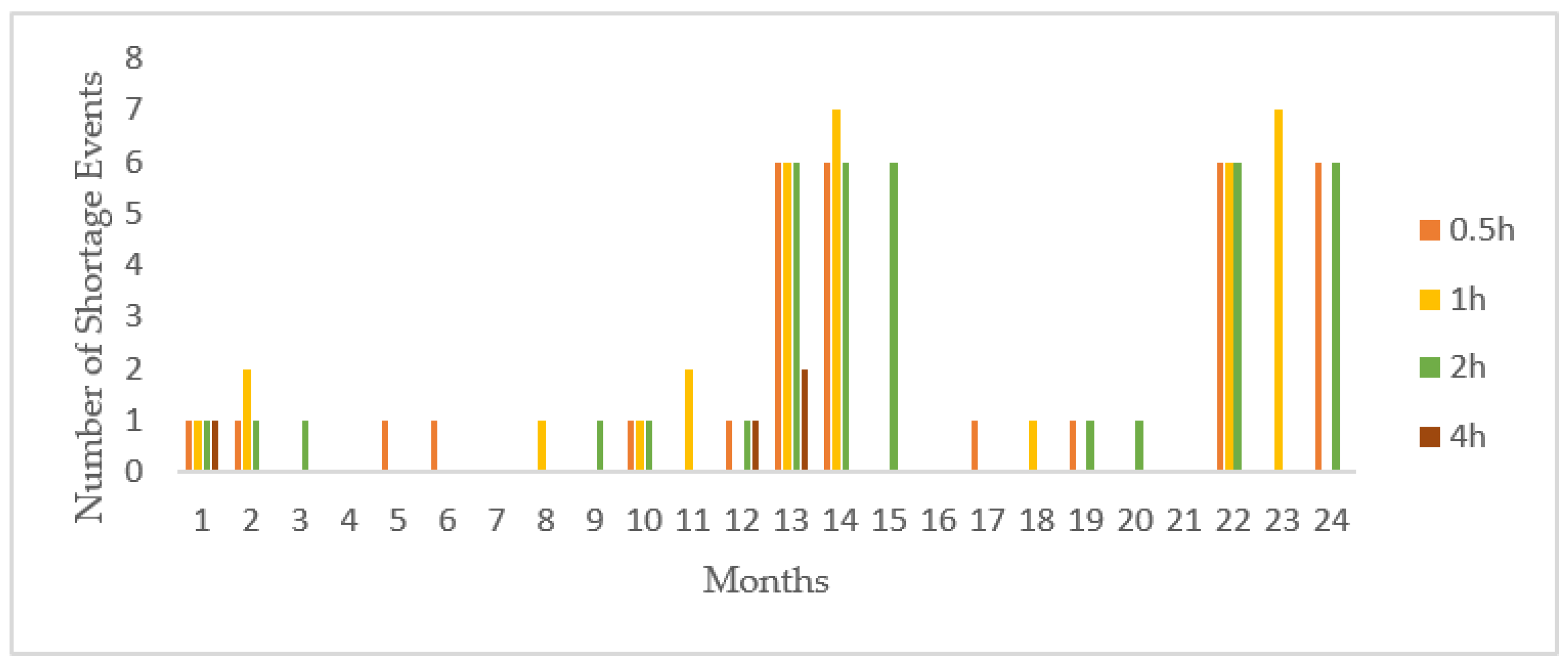

3.2. Battery Cycling Profile

3.3. Battery and Degradation Models

3.3.1. Battery Model

3.3.2. Degradation Model

4. Results

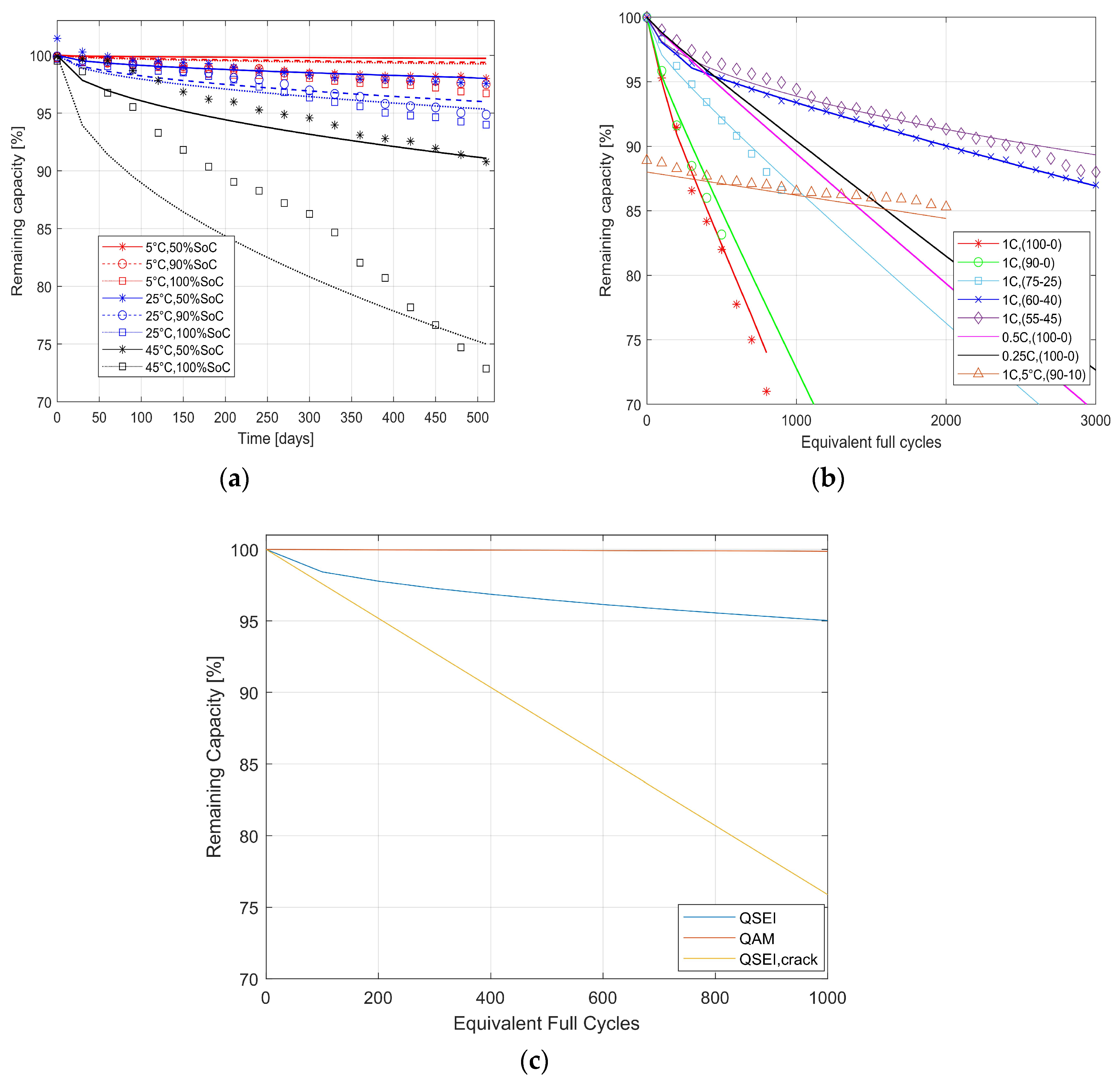

4.1. Accuracy of Battery and Degradation Models

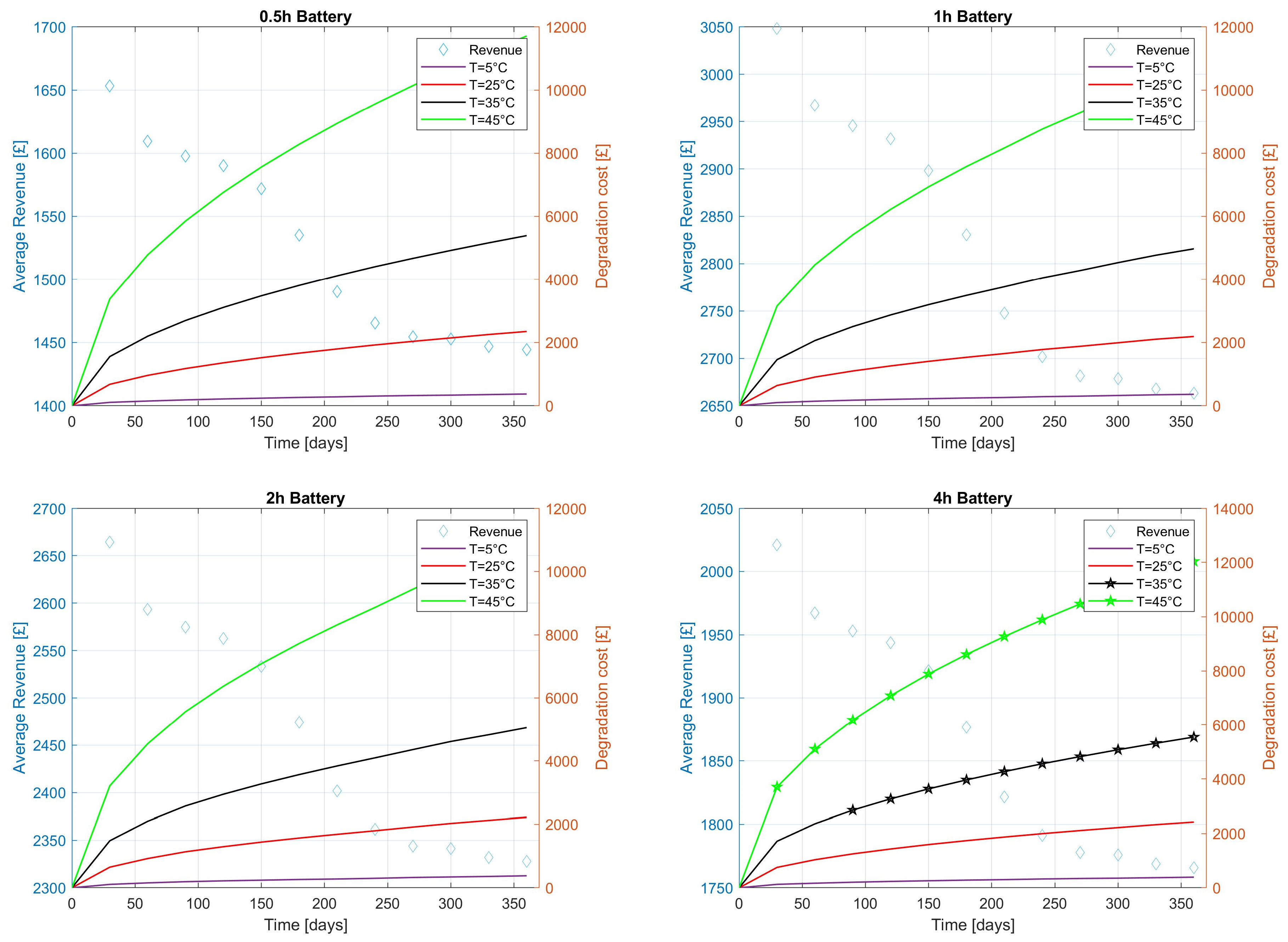

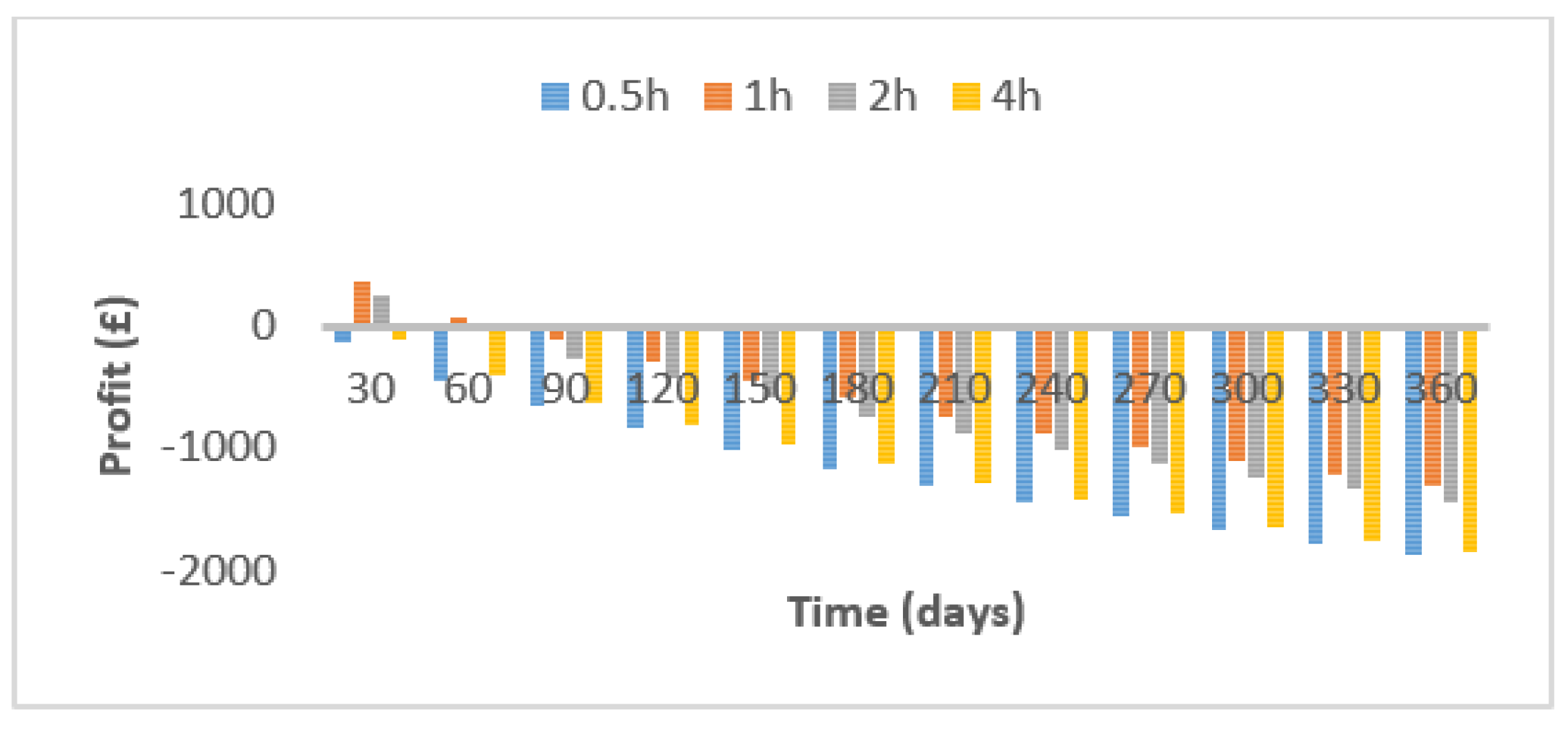

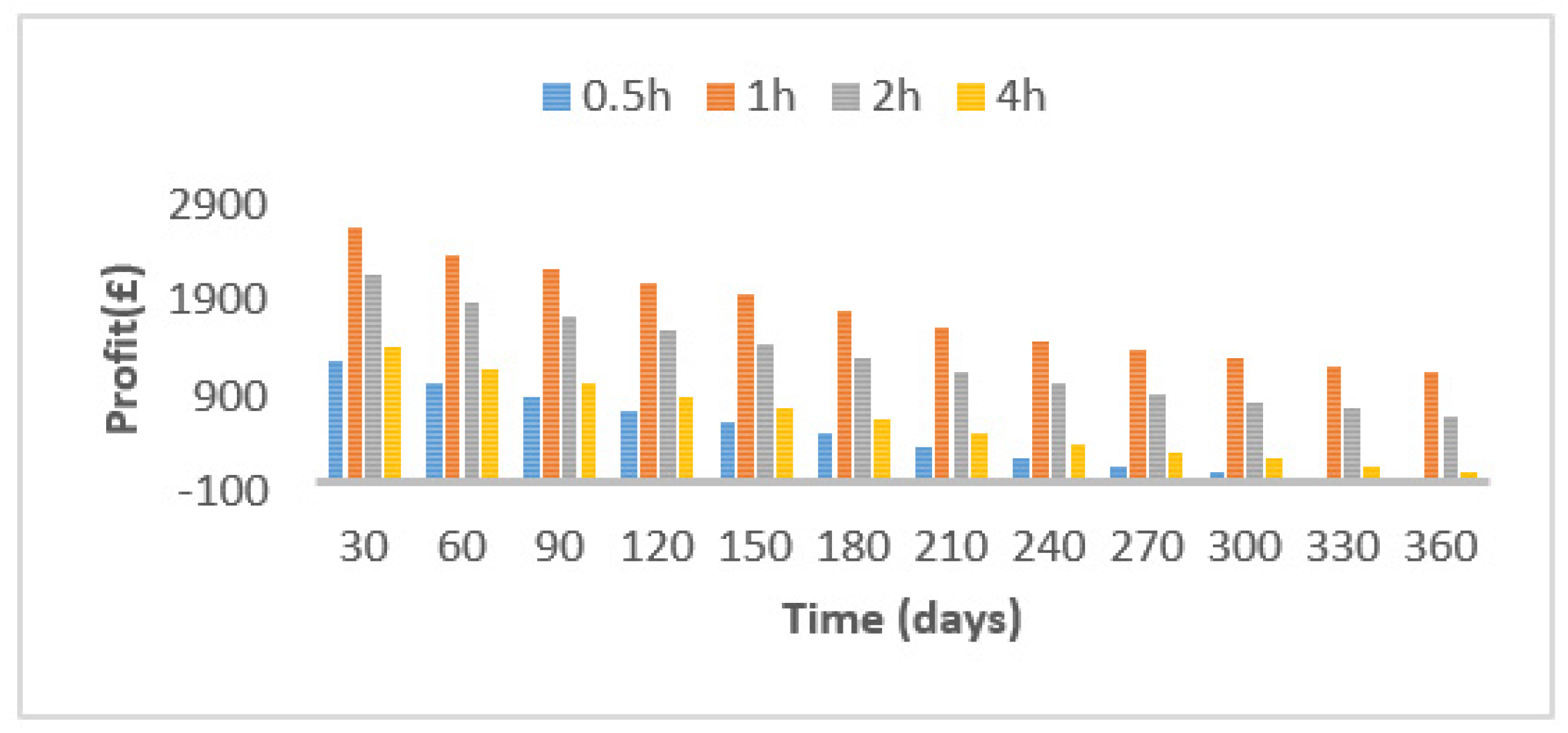

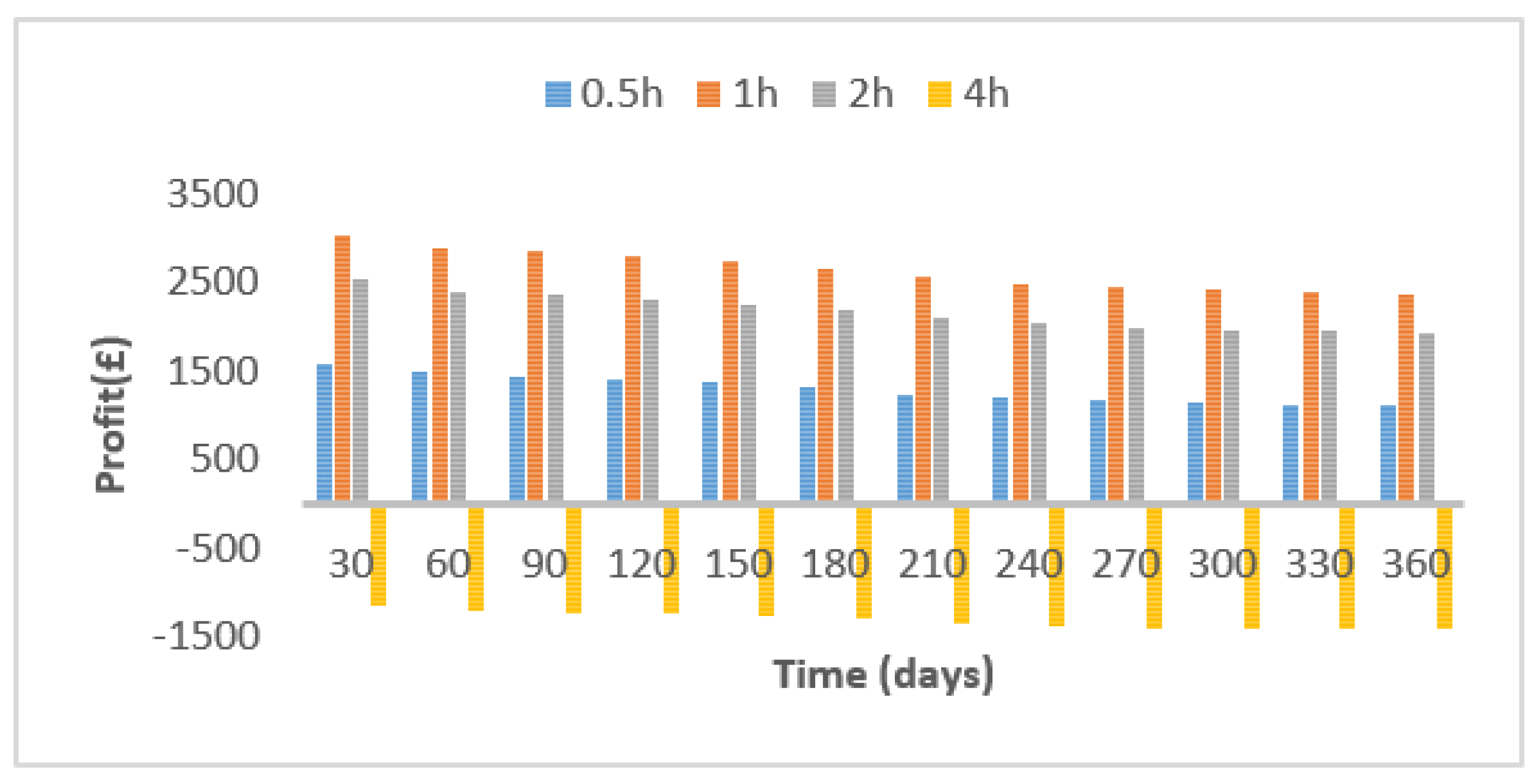

4.2. Revenue and Degradation Costs in the Capacity Market

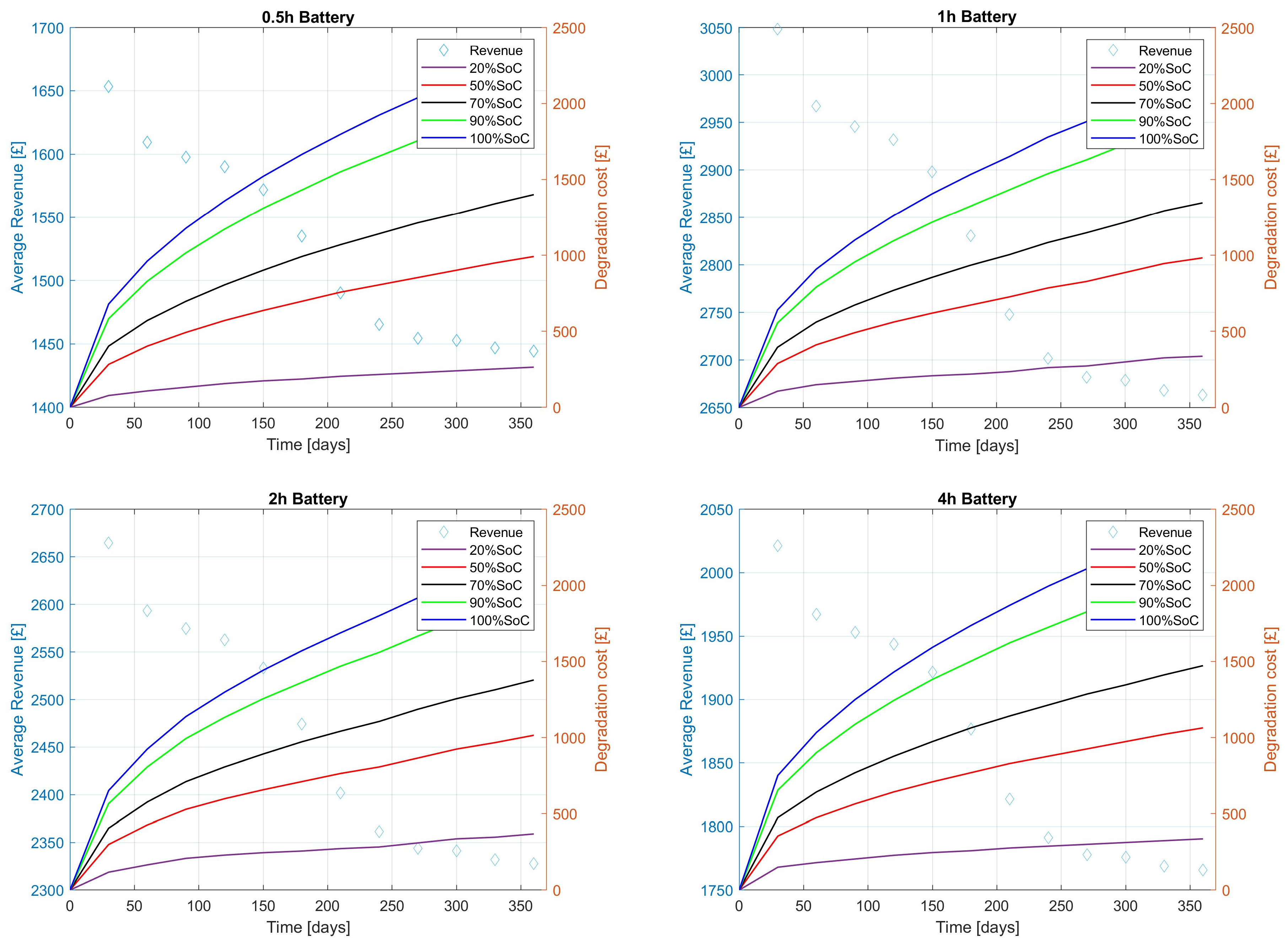

4.3. Sensitivity Analysis

4.3.1. Capacity Market Price Change Effects

4.3.2. Degradation Cost Effects

4.3.3. De-rating Factor Effects

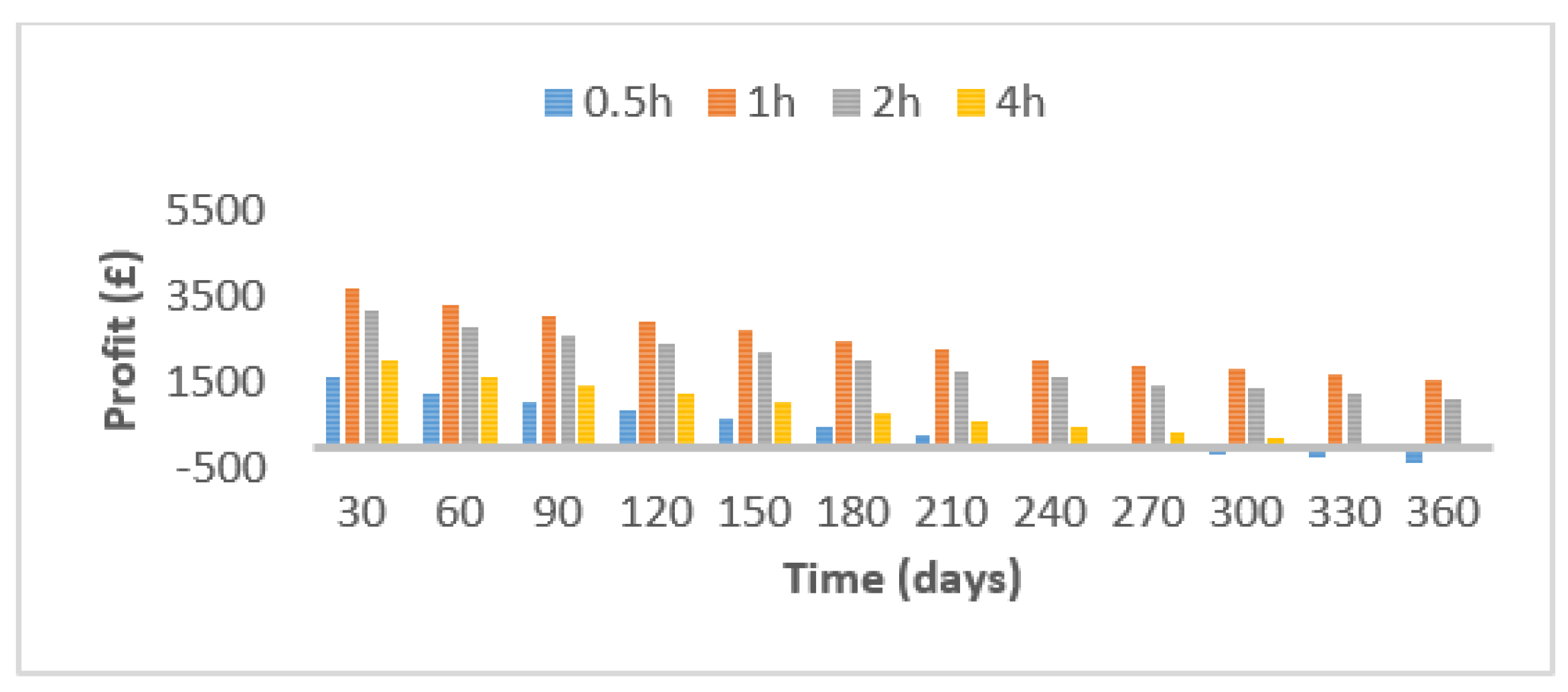

4.3.4. Increased Shortage Events in the CM

5. Conclusions and Future Work

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| Parameters | Domain | Reference | ||

|---|---|---|---|---|

| Positive Electrode | Separator | Negative Electrode | ||

| Bruggeman coefficient | 1.5 | |||

| Faraday constant, F | 96,485 | |||

| Gas constant, R | 8.314 | |||

| Thickness, L | 41.16 | 17 | 74.83 | [72] |

| Active material volume fraction, | 0.43 | 0.55 | [83] | |

| Electrolyte volume fraction, | 0.33 | 0.54 | 0.332 | [83] |

| Particle size, (µm) | 11.3 | 27.2 | a | |

| Maximum lithium concentration in the solid, | 88,102 | 29934 | a | |

| Electrolyte initial lithium concentration | 1200 | [83] | ||

| Transference number, | 0.363 | 0.363 | 0.363 | [66] |

| Activity dependence, | 1 | 1 | 1 | [72] |

| Charge transfer coefficient, | 0.5 | 0.5 | ||

| Stoichiometry at 100% SoC, | 0.35 | 0.77 | a | |

| Stoichiometry at 0% SoC, | 0.92 | 0.02 | a | |

| Reference temperature, | 298.15 | |||

| Electrical conductivity, | 100 | 100 | ||

| Active material area, A(m) | 0.0383 | 0.0391 | [72] | |

| Open circuit potential for positive electrode, | [84] | |||

| Open circuit potential for negative electrode | ||||

| Electrolyte ionic conductivity, | [72] | |||

| Lithium diffusion in the electrolyte, | [72] | |||

| Lithium diffusion in the positive electrode | [72] | |||

| Lithium diffusion in the negative electrode | [72] | |||

| Reaction rate in the positive electrode, | [72] | |||

| Reaction rate in the negative electrode, | [72] | |||

Appendix B

References

- Cucchiella, F.; D’Adamo, I.; Gastaldi, M. Future Trajectories of Renewable Energy Consumption in the European Union. Resources 2018, 7, 10. [Google Scholar] [CrossRef]

- British Petroleum. BP Statistical Review of World Energy; British Petroleum: London, UK, 2019; Available online: https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy-economics/statistical-review/bp-stats-review-2019-renewable-energy.pdf (accessed on 16 January 2020).

- Kumar, J.; Parthasarathy, C.; Västi, M.; Laaksonen, H.; Shafie-Khah, M.; Kauhaniemi, K. Sizing and Allocation of Battery Energy Storage Systems in Åland Islands for Large-Scale Integration of Renewables and Electric Ferry Charging Stations. Energies 2020, 13, 317. [Google Scholar] [CrossRef]

- Khalili, S.; Rantanen, E.; Bogdanov, D.; Breyer, C. Global Transportation Demand Development with Impacts on the Energy Demand and Greenhouse Gas Emissions in a Climate-Constrained World. Energies 2019, 12, 3870. [Google Scholar] [CrossRef]

- Lisin, E.; Strielkowski, W.; Chernova, V.; Fomina, A. Assessment of the Territorial Energy Security in the Context of Energy Systems Integration. Energies 2018, 11, 3284. [Google Scholar] [CrossRef]

- Heylen, E.; Deconinck, G.; Van Hertem, D. Review and classification of reliability indicators for power systems with a high share of renewable energy sources. Renew. Sustain. Energy Rev. 2018, 97, 554–568. [Google Scholar] [CrossRef]

- Short, M.; Crosbie, T.; Dawood, M.; Dawood, N. Load forecasting and dispatch optimisation for decentralised co-generation plant with dual energy storage. Appl. Energy 2017, 186, 304–320. [Google Scholar] [CrossRef]

- Park, S.H.; Hussain, A.; Kim, H.M. Impact Analysis of Survivability-Oriented Demand Response on Islanded Operation of Networked Microgrids with High Penetration of Renewables. Energies 2019, 12, 452. [Google Scholar] [CrossRef]

- Kong, Q.; Fowler, M.; Entchev, E.; Ribberink, H.; McCallum, R. The Role of Charging Infrastructure in Electric Vehicle Implementation within Smart Grids. Energies 2018, 11, 3362. [Google Scholar] [CrossRef]

- Strielkowski, W.; Streimikiene, D.; Fomina, A.; Semenova, E. Internet of Energy (IoE) and High-Renewables Electricity System Market Design. Energies 2019, 12, 4790. [Google Scholar] [CrossRef]

- Tucki, K.; Orynycz, O.; Wasiak, A.; Świć, A.; Dybaś, W. Capacity Market Implementation in Poland: Analysis of a Survey on Consequences for the Electricity Market and for Energy Management. Energies 2019, 12, 839. [Google Scholar] [CrossRef]

- Gerard, H.; Rivero Puente, E.I.; Six, D. Coordination between transmission and distribution system operators in the electricity sector: A conceptual framework. Util. Policy 2018, 50, 40–48. [Google Scholar] [CrossRef]

- Albertus, P.; Manser, J.S.; Litzelman, S. Long-Duration Electricity Storage Applications, Economics, and Technologies. Joule 2020, 4, 21–32. [Google Scholar] [CrossRef]

- Mastropietro, P.; Rodilla, P.; Batlle, C. De-rating of wind and solar resources in capacity mechanisms: A review of international experiences. Renew. Sustain. Energy Rev. 2019, 112, 253–262. [Google Scholar] [CrossRef]

- Bublitz, A.; Keles, D.; Zimmermann, F.; Fraunholz, C.; Fichtner, W. A survey on electricity market design: Insights from theory and real-world implementations of capacity remuneration mechanisms. Energy Econ. 2019, 80, 1059–1078. [Google Scholar] [CrossRef]

- Lee, A.; Vörös, M.; Dose, W.M.; Niklas, J.; Poluektov, O.; Schaller, R.D.; Iddir, H.; Maroni, V.A.; Lee, E.; Ingram, B.; et al. Photo-accelerated fast charging of lithium-ion batteries. Nat. Commun. 2019, 10, 4946. [Google Scholar] [CrossRef] [PubMed]

- Sioshansi, R.; Madaeni, S.H.; Denholm, P. A Dynamic Programming Approach to Estimate the Capacity Value of Energy Storage. IEEE Trans. Power Syst. 2014, 29, 395–403. [Google Scholar] [CrossRef]

- Khan, A.S.M.; Verzijlbergh, R.A.; Sakinci, O.C.; De Vries, L.J. How do demand response and electrical energy storage affect (the need for) a capacity market? Appl. Energy 2018, 214, 39–62. [Google Scholar] [CrossRef]

- Staffell, I.; Rustomji, M. Maximising the value of electricity storage. J. Energy Storage 2016, 8, 212–225. [Google Scholar] [CrossRef]

- Teng, F.; Strbac, G. Business cases for energy storage with multiple service provision. J. Mod. Power Syst. Clean Energy 2016, 4, 615–625. [Google Scholar] [CrossRef]

- Xu, B.; Oudalov, A.; Ulbig, A.; Andersson, G.; Kirschen, D.S. Modeling of Lithium-Ion Battery Degradation for Cell Life Assessment. IEEE Trans. Smart Grid 2018, 9, 1131–1140. [Google Scholar] [CrossRef]

- Castagneto Gissey, G.; Dodds, P.E.; Radcliffe, J. Market and regulatory barriers to electrical energy storage innovation. Renew. Sustain. Energy Rev. 2018, 82, 781–790. [Google Scholar] [CrossRef]

- Chen, H.; Baker, S.; Benner, S.; Berner, A.; Liu, J. PJM Integrates Energy Storage: Their Technologies and Wholesale Products. IEEE Power Energy Mag. 2017, 15, 59–67. [Google Scholar] [CrossRef]

- Kumar, A.; Meena, N.K.; Singh, A.R.; Deng, Y.; He, X.; Bansal, R.C.; Kumar, P. Strategic integration of battery energy storage systems with the provision of distributed ancillary services in active distribution systems. Appl. Energy 2019, 253, 113503. [Google Scholar] [CrossRef]

- Askeland, M.; Jaehnert, S.; Korpås, M. Equilibrium assessment of storage technologies in a power market with capacity remuneration. Sustain. Energy Technol. Assess. 2019, 31, 228–235. [Google Scholar] [CrossRef]

- Haas, J.; Cebulla, F.; Nowak, W.; Rahmann, C.; Palma-Behnke, R. A multi-service approach for planning the optimal mix of energy storage technologies in a fully-renewable power supply. Energy Convers. Manag. 2018, 178, 355–368. [Google Scholar] [CrossRef]

- Lorenzi, G.; da Silva Vieira, R.; Santos Silva, C.A.; Martin, A. Techno-economic analysis of utility-scale energy storage in island settings. J. Energy Storage 2019, 21, 691–705. [Google Scholar] [CrossRef]

- Greenwood, D.M.; Lim, K.Y.; Patsios, C.; Lyons, P.F.; Lim, Y.S.; Taylor, P.C. Frequency response services designed for energy storage. Appl. Energy 2017, 203, 115–127. [Google Scholar] [CrossRef]

- Denholm, P.; Nunemaker, J.; Gagnon, P.; Cole, W. The potential for battery energy storage to provide peaking capacity in the United States. Renew. Energy 2019, 151, 1269–1277. [Google Scholar] [CrossRef]

- Andrenacci, N.; Chiodo, E.; Lauria, D.; Mottola, F. Life Cycle Estimation of Battery Energy Storage Systems for Primary Frequency Regulation. Energies 2018, 11, 3320. [Google Scholar] [CrossRef]

- Martins, R.; Hesse, C.H.; Jungbauer, J.; Vorbuchner, T.; Musilek, P. Optimal Component Sizing for Peak Shaving in Battery Energy Storage System for Industrial Applications. Energies 2018, 11, 2048. [Google Scholar] [CrossRef]

- Xu, B.; Zhao, J.; Zheng, T.; Litvinov, E.; Kirschen, D.S. Factoring the Cycle Aging Cost of Batteries Participating in Electricity Markets. IEEE Trans. Power Syst. 2018, 33, 2248–2259. [Google Scholar] [CrossRef]

- Kies, A. Joint optimisation of arbitrage profits and battery life degradation for grid storage application of battery electric vehicles. J. Phys. Conf. Ser. 2018, 977, 012005. [Google Scholar] [CrossRef]

- Petit, M.; Prada, E.; Sauvant-Moynot, V. Development of an empirical aging model for Li-ion batteries and application to assess the impact of Vehicle-to-Grid strategies on battery lifetime. Appl. Energy 2016, 172, 398–407. [Google Scholar] [CrossRef]

- Thompson, A.W. Economic implications of lithium ion battery degradation for Vehicle-to-Grid (V2X) services. J. Power Sources 2018, 396, 691–709. [Google Scholar] [CrossRef]

- Reniers, J.M.; Mulder, G.; Howey, D.A. Review and Performance Comparison of Mechanical-Chemical Degradation Models for Lithium-Ion Batteries. J. Electrochem. Soc. 2019, 166, A3189–A3200. [Google Scholar] [CrossRef]

- Maheshwari, A.; Paterakis, N.G.; Santarelli, M.; Gibescu, M. Optimizing the operation of energy storage using a non-linear lithium-ion battery degradation model. Appl. Energy 2020, 261, 114360. [Google Scholar] [CrossRef]

- Dubarry, M.; Devie, A.; Stein, K.; Tun, M.; Matsuura, M.; Rocheleau, R. Battery Energy Storage System battery durability and reliability under electric utility grid operations: Analysis of 3 years of real usage. J. Power Sources 2017, 338, 65–73. [Google Scholar] [CrossRef]

- Wankmüller, F.; Thimmapuram, P.R.; Gallagher, K.G.; Botterud, A. Impact of battery degradation on energy arbitrage revenue of grid-level energy storage. J. Energy Storage 2017, 10, 56–66. [Google Scholar] [CrossRef]

- Purvins, A.; Sumner, M. Optimal management of stationary lithium-ion battery system in electricity distribution grids. J. Power Sources 2013, 242, 742–755. [Google Scholar] [CrossRef]

- Pimm, A.J.; Palczewski, J.; Morris, R.; Cockerill, T.T.; Taylor, P.G. Community energy storage: A case study in the UK using a linear programming method. Energy Convers. Manag. 2020, 205, 112388. [Google Scholar] [CrossRef]

- Dufo-López, R.; Bernal-Agustín, J.L. Techno-economic analysis of grid-connected battery storage. Energy Convers. Manag. 2015, 91, 394–404. [Google Scholar] [CrossRef]

- Patsios, C.; Wu, B.; Chatzinikolaou, E.; Rogers, D.J.; Wade, N.; Brandon, N.P.; Taylor, P. An integrated approach for the analysis and control of grid connected energy storage systems. J. Energy Storage 2016, 5, 48–61. [Google Scholar] [CrossRef]

- Weißhar, B.; Bessler, W.G. Model-based degradation assessment of lithium-ion batteries in a smart microgrid. In Proceedings of the 2015 International Conference on Smart Grid and Clean Energy Technologies (ICSGCE), Offenburg, Germany, 20–23 October 2015; pp. 134–138. [Google Scholar]

- Reniers, J.M.; Mulder, G.; Ober-Blöbaum, S.; Howey, D.A. Improving optimal control of grid-connected lithium-ion batteries through more accurate battery and degradation modelling. J. Power Sources 2018, 379, 91–102. [Google Scholar] [CrossRef]

- Birkl, C.R.; Roberts, M.R.; McTurk, E.; Bruce, P.G.; Howey, D.A. Degradation diagnostics for lithium ion cells. J. Power Sources 2017, 341, 373–386. [Google Scholar] [CrossRef]

- Usera, I.; Rodilla, P.; Burger, S.; Herrero, I.; Batlle, C. The Regulatory Debate About Energy Storage Systems: State of the Art and Open Issues. IEEE Power Energy Mag. 2017, 15, 42–50. [Google Scholar] [CrossRef]

- Gailani, A.; Al-Greer, M.; Short, M.; Crosbie, T. Degradation Cost Analysis of Li-Ion Batteries in the Capacity Market with Different Degradation Models. Electronics 2020, 9, 90. [Google Scholar] [CrossRef]

- Cramton, P.; Ockenfels, A. Economics and design of capacity markets for the power sector. In Interdisziplinäre Aspekte der Energiewirtschaft; Springer: Berlin/Heidelberg, Germany, 2016; pp. 191–212. [Google Scholar]

- Cramton, P.; Ockenfels, A.; Stoft, S. Capacity Market Fundamentals. Econ. Energy Environ. Policy 2013, 2. [Google Scholar] [CrossRef]

- Ashokkumar Parmar, A.; Pranav B Darji, B. Capacity market functioning with renewable capacity integration and global practices. Electr. J. 2020, 33, 106708. [Google Scholar] [CrossRef]

- Energy Emergencies Executive Committee (E3C). GB Power System Disruption on 9 August 2019; UK Government: London, UK, 2020. Available online: https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/855767/e3c-gb-power-disruption-9-august-2019-final-report.pdf (accessed on 3 February 2020).

- Cramton, P. Electricity market design. Oxf. Rev. Econ. Policy 2017, 33, 589–612. [Google Scholar] [CrossRef]

- Sioshansi, F.P. Competitive Electricity Markets: Design, Implementation, Performance; Elsevier: Amsterdam, The Netherlands, 2011. [Google Scholar]

- Gailani, A.; Crosbie, T.; Al-Greer, M.; Short, M.; Dawood, N. On the Role of Regulatory Policy on the Business Case for Energy Storage in Both EU and UK Energy Systems: Barriers and Enablers. Energies 2020, 13, 1080. [Google Scholar] [CrossRef]

- Fraunholz, C.; Keles, D.; Fichtner, W. On the Role of Electricity Storage in Capacity Remuneration Mechanisms; Karlsruhe Institute of Technology (KIT): Karlsruhe, Germany, 2019. [Google Scholar]

- National Grid. Capacity Market Registers; National Grid: London, UK, 2019; Available online: https://www.emrdeliverybody.com/CM/Registers.aspx (accessed on 25 April 2019).

- Slipac, G.; Zeljko, M.; Šljivac, D. Importance of Reliability Criterion in Power System Expansion Planning. Energies 2019, 12, 1714. [Google Scholar] [CrossRef]

- Söder, L.; Tómasson, E.; Estanqueiro, A.; Flynn, D.; Hodge, B.M.; Kiviluoma, J.; Korpås, M.; Neau, E.; Couto, A.; Pudjianto, D.; et al. Review of wind generation within adequacy calculations and capacity markets for different power systems. Renew. Sustain. Energy Rev. 2020, 119, 109540. [Google Scholar] [CrossRef]

- THEMA Consulting Group. Capacity Adequacy in the Nordic Electricity Market; Nordic Energy: Oslo, Norway, 2015; Available online: https://www.nordicenergy.org/wp-content/uploads/2015/08/capacity_adequacy_THEMA_2015-1.pdf (accessed on 16 March 2020).

- Bhagwat, P.C.; Iychettira, K.K.; Richstein, J.C.; Chappin, E.J.L.; De Vries, L.J. The effectiveness of capacity markets in the presence of a high portfolio share of renewable energy sources. Util. Policy 2017, 48, 76–91. [Google Scholar] [CrossRef]

- Bhagwat, P.C.; Marcheselli, A.; Richstein, J.C.; Chappin, E.J.L.; De Vries, L.J. An analysis of a forward capacity market with long-term contracts. Energy Policy 2017, 111, 255–267. [Google Scholar] [CrossRef]

- Gallo Cassarino, T.; Sharp, E.; Barrett, M. The impact of social and weather drivers on the historical electricity demand in Europe. Appl. Energy 2018, 229, 176–185. [Google Scholar] [CrossRef]

- National Grid. Duration-Limited Storage De-Rating Factor Assessment—Final Report; National Grid: London, UK, 2017; Available online: https://www.emrdeliverybody.com/Lists/Latest%20News/Attachments/150/Duration%20Limited%20Storage%20De-Rating%20Factor%20Assessment%20-%20Final.pdf (accessed on 18 April 2019).

- Doyle, M. Modeling of Galvanostatic Charge and Discharge of the Lithium/Polymer/Insertion Cell. J. Electrochem. Soc. 1993, 140, 1526. [Google Scholar] [CrossRef]

- Plett, G.L. Battery Management Systems, Volume I: Battery Modeling; Artech House: Norwood, MA, USA, 2015. [Google Scholar]

- Jin, X.; Vora, A.; Hoshing, V.; Saha, T.; Shaver, G.; García, R.E.; Wasynczuk, O.; Varigonda, S. Physically-based reduced-order capacity loss model for graphite anodes in Li-ion battery cells. J. Power Sources 2017, 342, 750–761. [Google Scholar] [CrossRef]

- Laresgoiti, I.; Käbitz, S.; Ecker, M.; Sauer, D.U. Modeling mechanical degradation in lithium ion batteries during cycling: Solid electrolyte interphase fracture. J. Power Sources 2015, 300, 112–122. [Google Scholar] [CrossRef]

- Prada, E.; Di Domenico, D.; Creff, Y.; Bernard, J.; Sauvant-Moynot, V.; Huet, F. A Simplified Electrochemical and Thermal Aging Model of LiFePO4-Graphite Li-ion Batteries: Power and Capacity Fade Simulations. J. Electrochem. Soc. 2013, 160, A616–A628. [Google Scholar] [CrossRef]

- Jin, X.; Liu, C. Physics-based control-oriented reduced-order degradation model for LiNiMnCoO2—Graphite cell. Electrochim. Acta 2019, 312, 188–201. [Google Scholar] [CrossRef]

- Zhang, H.L.; Li, F.; Liu, C.; Tan, J.; Cheng, H.M. New Insight into the Solid Electrolyte Interphase with Use of a Focused Ion Beam. J. Phys. Chem. B 2005, 109, 22205–22211. [Google Scholar] [CrossRef] [PubMed]

- Hosseinzadeh, E.; Genieser, R.; Worwood, D.; Barai, A.; Marco, J.; Jennings, P. A systematic approach for electrochemical-thermal modelling of a large format lithium-ion battery for electric vehicle application. J. Power Sources 2018, 382, 77–94. [Google Scholar] [CrossRef]

- Li, J.; Wang, D.; Pecht, M. An electrochemical model for high C-rate conditions in lithium-ion batteries. J. Power Sources 2019, 436, 226885. [Google Scholar] [CrossRef]

- Kasnatscheew, J.; Rodehorst, U.; Streipert, B.; Wiemers-Meyer, S.; Jakelski, R.; Wagner, R.; Laskovic, I.C.; Winter, M. Learning from overpotentials in lithium ion batteries: A case study on the LiNi1/3Co1/3Mn1/3O2 (NCM) cathode. J. Electrochem. Soc. 2016, 163, A2943–A2950. [Google Scholar] [CrossRef]

- Ouyang, D.; He, Y.; Weng, J.; Liu, J.; Chen, M.; Wang, J. Influence of low temperature conditions on lithium-ion batteries and the application of an insulation material. RSC Adv. 2019, 9, 9053–9066. [Google Scholar] [CrossRef]

- Kasnatscheew, J.; Evertz, M.; Streipert, B.; Wagner, R.; Nowak, S.; Cekic Laskovic, I.; Winter, M. Improving cycle life of layered lithium transition metal oxide (LiMO2) based positive electrodes for Li ion batteries by smart selection of the electrochemical charge conditions. J. Power Sources 2017, 359, 458–467. [Google Scholar] [CrossRef]

- Sotta, D. MAT4BAT Advanced Materials for Batteries Project; EU Commision: Brussles, Belgium, 2017; Available online: https://cordis.europa.eu/project/rcn/109052/reporting/en (accessed on 20 July 2019).

- Schmalstieg, J.; Käbitz, S.; Ecker, M.; Sauer, D.U. A holistic aging model for Li(NiMnCo)O2 based 18650 lithium-ion batteries. J. Power Sources 2014, 257, 325–334. [Google Scholar] [CrossRef]

- National Grid ESO. 2019 Four Year Ahead Capacity Auction (T-4) Delivery Year 2023/24; National Grid: London, UK, 2020; Available online: https://www.emrdeliverybody.com/CM/Auction-Results-1.aspx (accessed on 6 May 2020).

- National Grid. Transitional Capacity Market Auction for 2016/17; National Grid: London, UK, 2016; Available online: https://www.emrdeliverybody.com/CM/Auction-Results-1.aspx (accessed on 30 April 2020).

- National Grid. T-1 Capacity Market Auction for 2018/19; National Grid: London, UK, 2018; Available online: https://www.emrdeliverybody.com/CM/Auction-Results-1.aspx (accessed on 30 April 2020).

- Philippot, M.; Alvarez, G.; Ayerbe, E.; Van Mierlo, J.; Messagie, M. Eco-Efficiency of a Lithium-Ion Battery for Electric Vehicles: Influence of Manufacturing Country and Commodity Prices on GHG Emissions and Costs. Batteries 2019, 5, 23. [Google Scholar] [CrossRef]

- Li, J.; Cheng, Y.; Ai, L.; Jia, M.; Du, S.; Yin, B.; Woo, S.; Zhang, H. 3D simulation on the internal distributed properties of lithium-ion battery with planar tabbed configuration. J. Power Sources 2015, 293, 993–1005. [Google Scholar] [CrossRef]

- Tanim, T.R.; Rahn, C.D.; Wang, C.Y. A Temperature Dependent, Single Particle, Lithium Ion Cell Model Including Electrolyte Diffusion. J. Dyn. Syst. Meas. Control 2014, 137. [Google Scholar] [CrossRef]

| Battery Energy Capacity (MWh) | Generated Power (MW) | De-Rating (h) |

|---|---|---|

| 2 | 2 | 0.5 |

| 2 | 2 | 1 |

| 2 | 1 | 2 |

| 2 | 0.5 | 4 |

| Temperatures | Degradation Model Type | |||||

|---|---|---|---|---|---|---|

| Empirical | Semiempirical | Physics | ||||

| Calendar | Cycle | Calendar | Cycle | Calendar | Cycle | |

| Low temperatures (5 °C onwards) | A | U | O | A | A | A |

| Medium temperatures (25 °C onwards) | A | A | A | A | A | A |

| High temperatures (45 °C onwards) | A | E | A | A | A | A |

| Temperatures | Profit in (£) When Degradation Cost is Calculated Using the Below Models | ||

|---|---|---|---|

| Empirical | Semiempirical | Physics | |

| 5 °C | 18,862 | −16,962 | 31,608 |

| 25 °C | 4716 | 12,409 | 16,417 |

| 45 °C | −52,580 | −22,054 | −56,284 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gailani, A.; Al-Greer, M.; Short, M.; Crosbie, T.; Dawood, N. Lifetime Degradation Cost Analysis for Li-Ion Batteries in Capacity Markets using Accurate Physics-Based Models. Energies 2020, 13, 2816. https://doi.org/10.3390/en13112816

Gailani A, Al-Greer M, Short M, Crosbie T, Dawood N. Lifetime Degradation Cost Analysis for Li-Ion Batteries in Capacity Markets using Accurate Physics-Based Models. Energies. 2020; 13(11):2816. https://doi.org/10.3390/en13112816

Chicago/Turabian StyleGailani, Ahmed, Maher Al-Greer, Michael Short, Tracey Crosbie, and Nashwan Dawood. 2020. "Lifetime Degradation Cost Analysis for Li-Ion Batteries in Capacity Markets using Accurate Physics-Based Models" Energies 13, no. 11: 2816. https://doi.org/10.3390/en13112816

APA StyleGailani, A., Al-Greer, M., Short, M., Crosbie, T., & Dawood, N. (2020). Lifetime Degradation Cost Analysis for Li-Ion Batteries in Capacity Markets using Accurate Physics-Based Models. Energies, 13(11), 2816. https://doi.org/10.3390/en13112816