Evaluation of Cyclic Gas Injection in Enhanced Recovery from Unconventional Light Oil Reservoirs: Effect of Gas Type and Fracture Spacing

Abstract

:1. Introduction

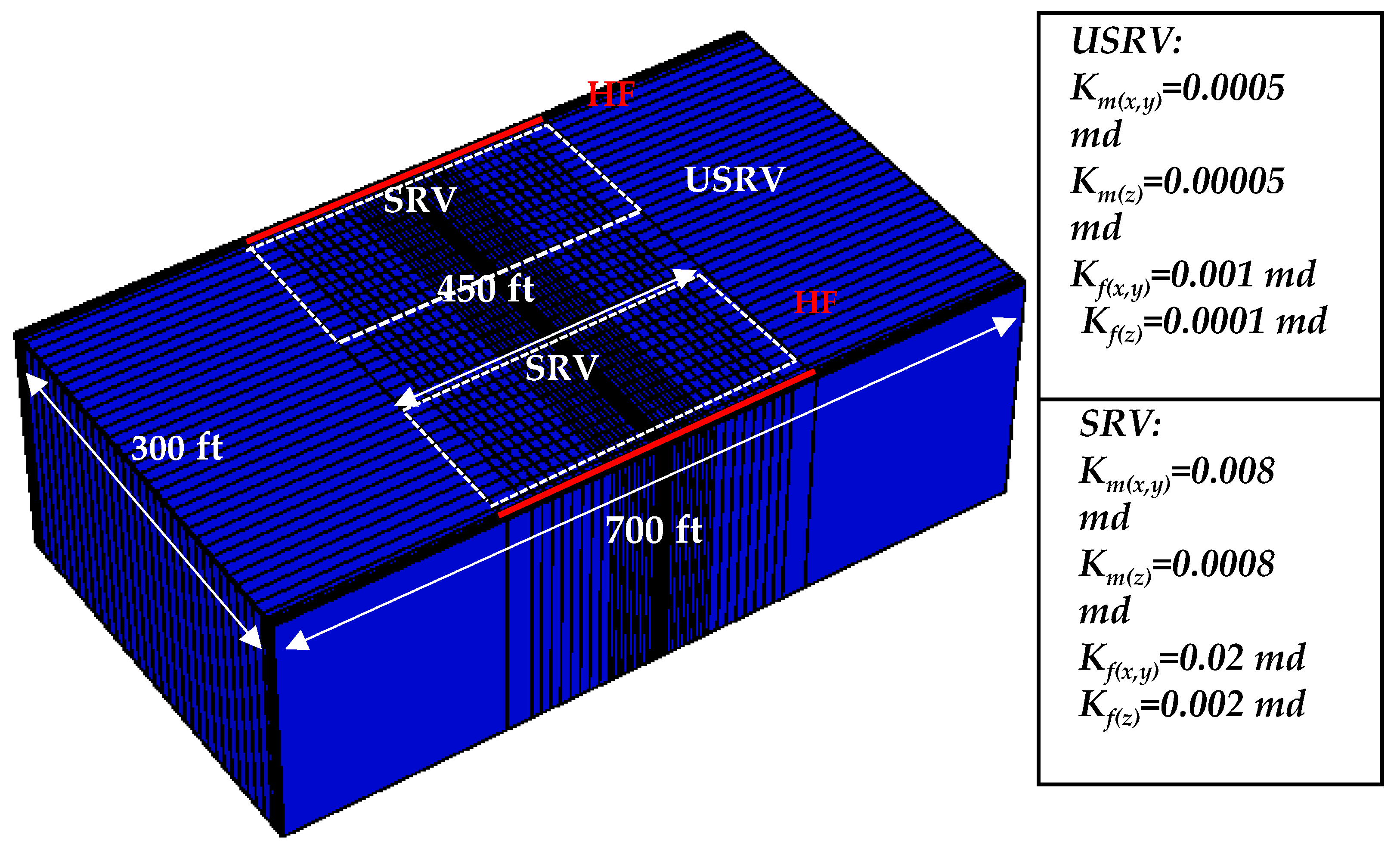

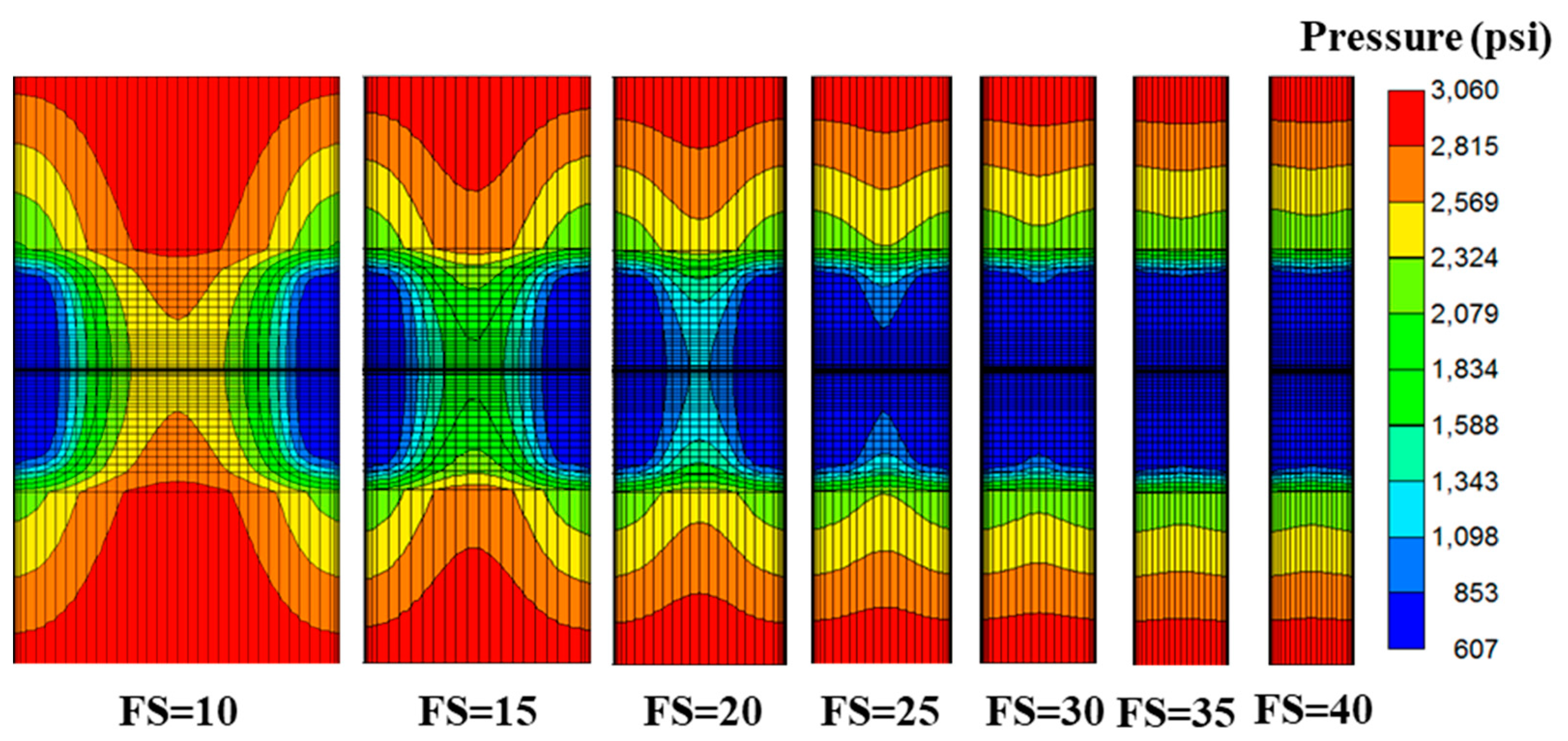

2. Model Construction

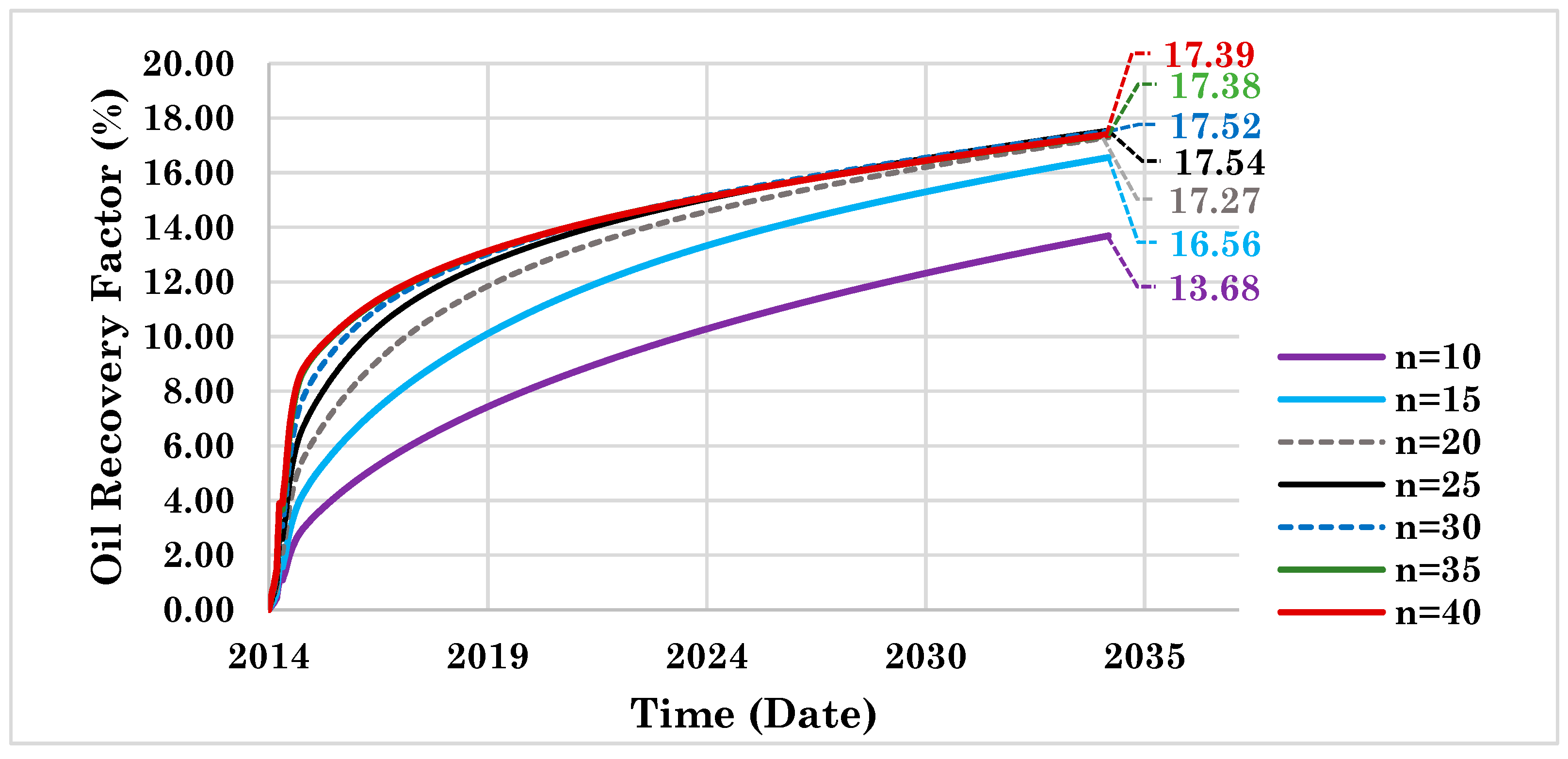

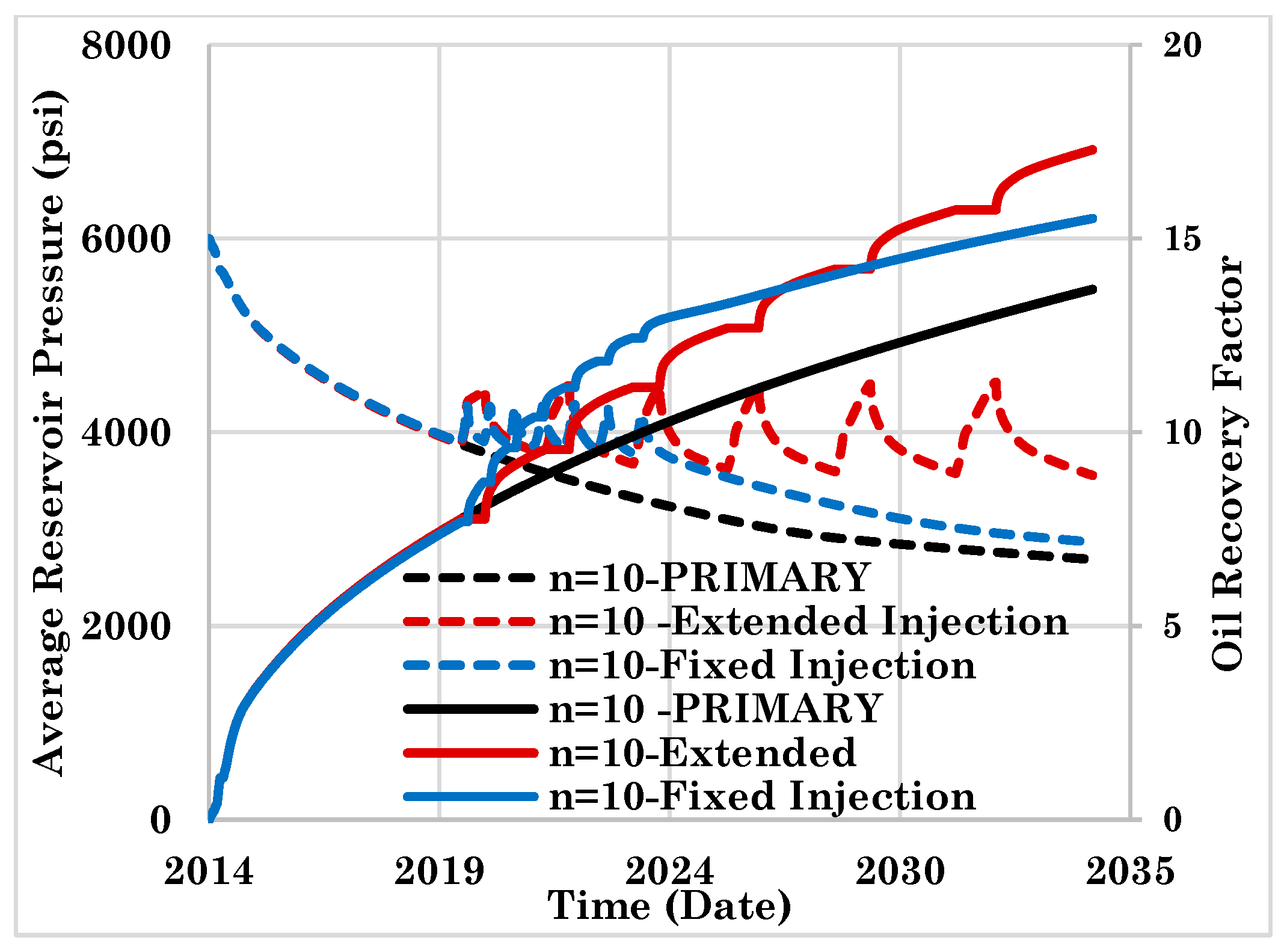

2.1. Design of Cyclic Gas Injection

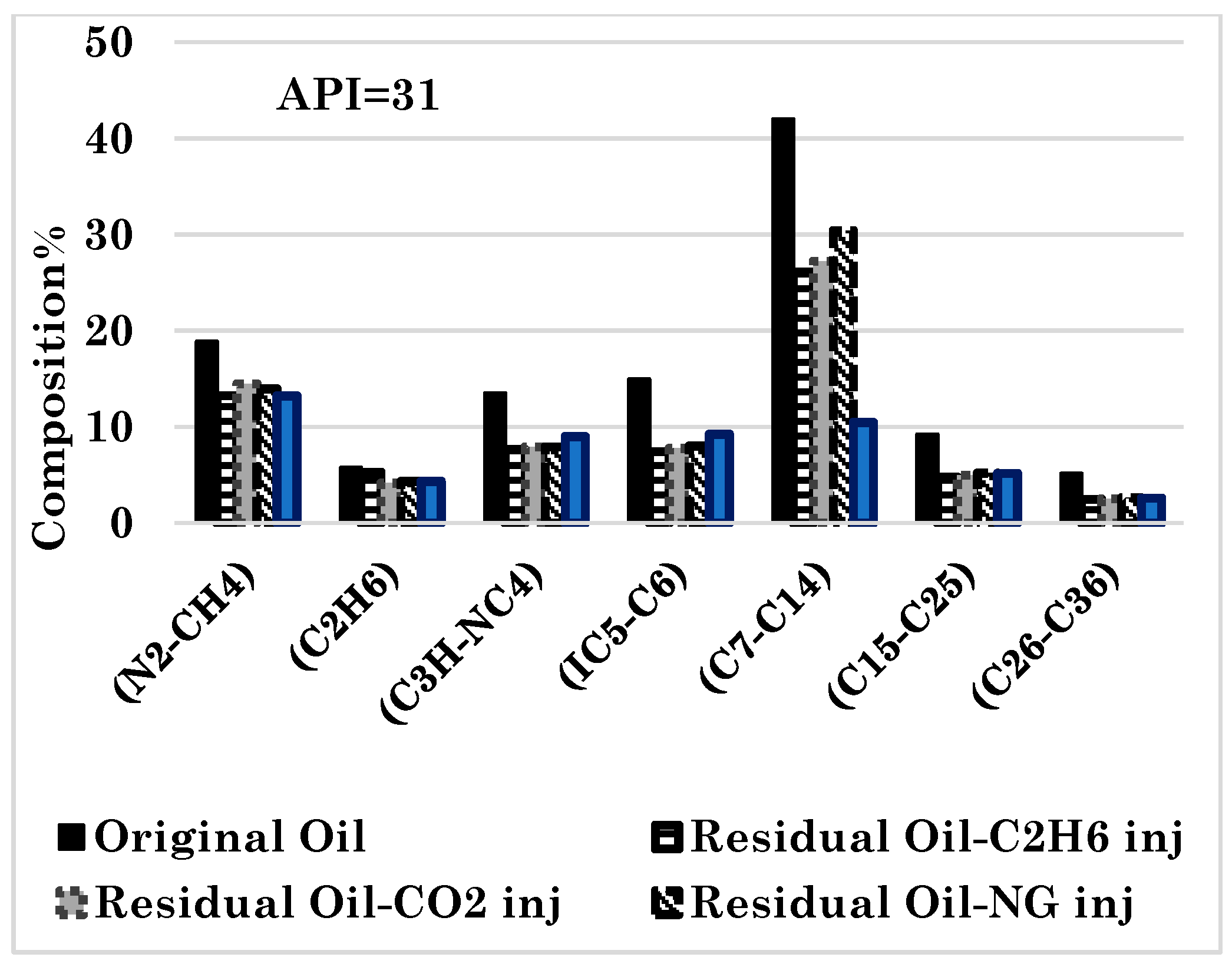

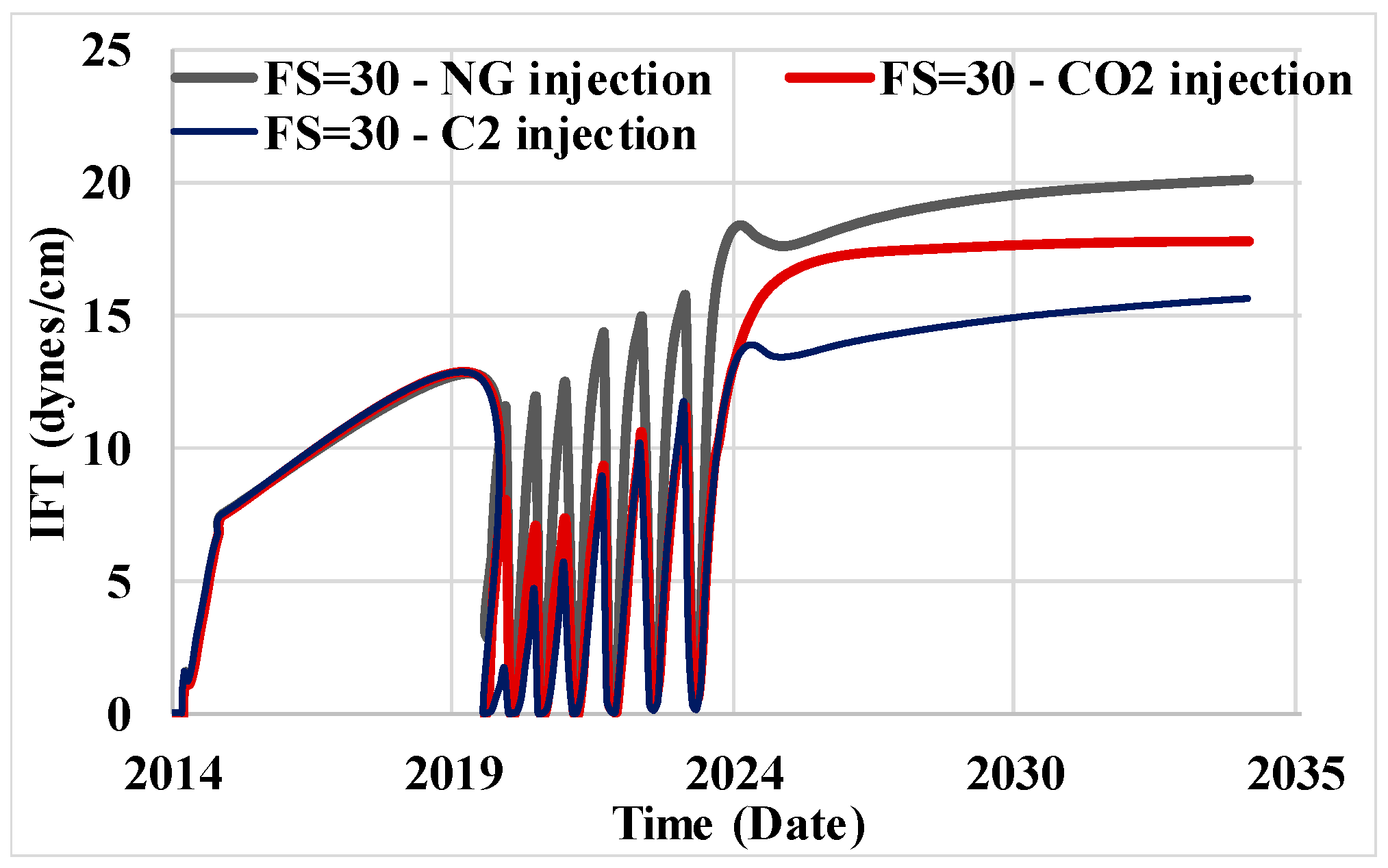

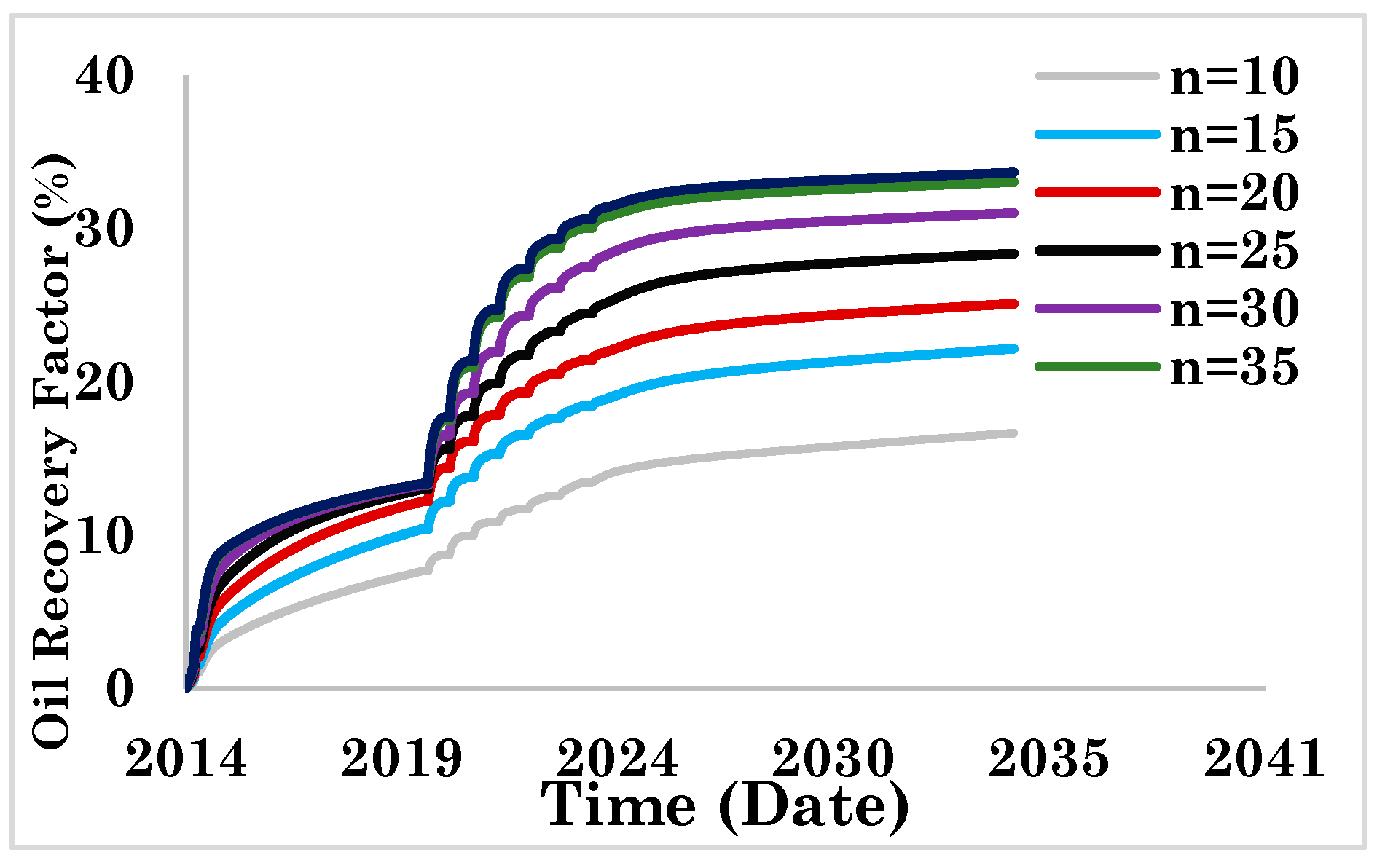

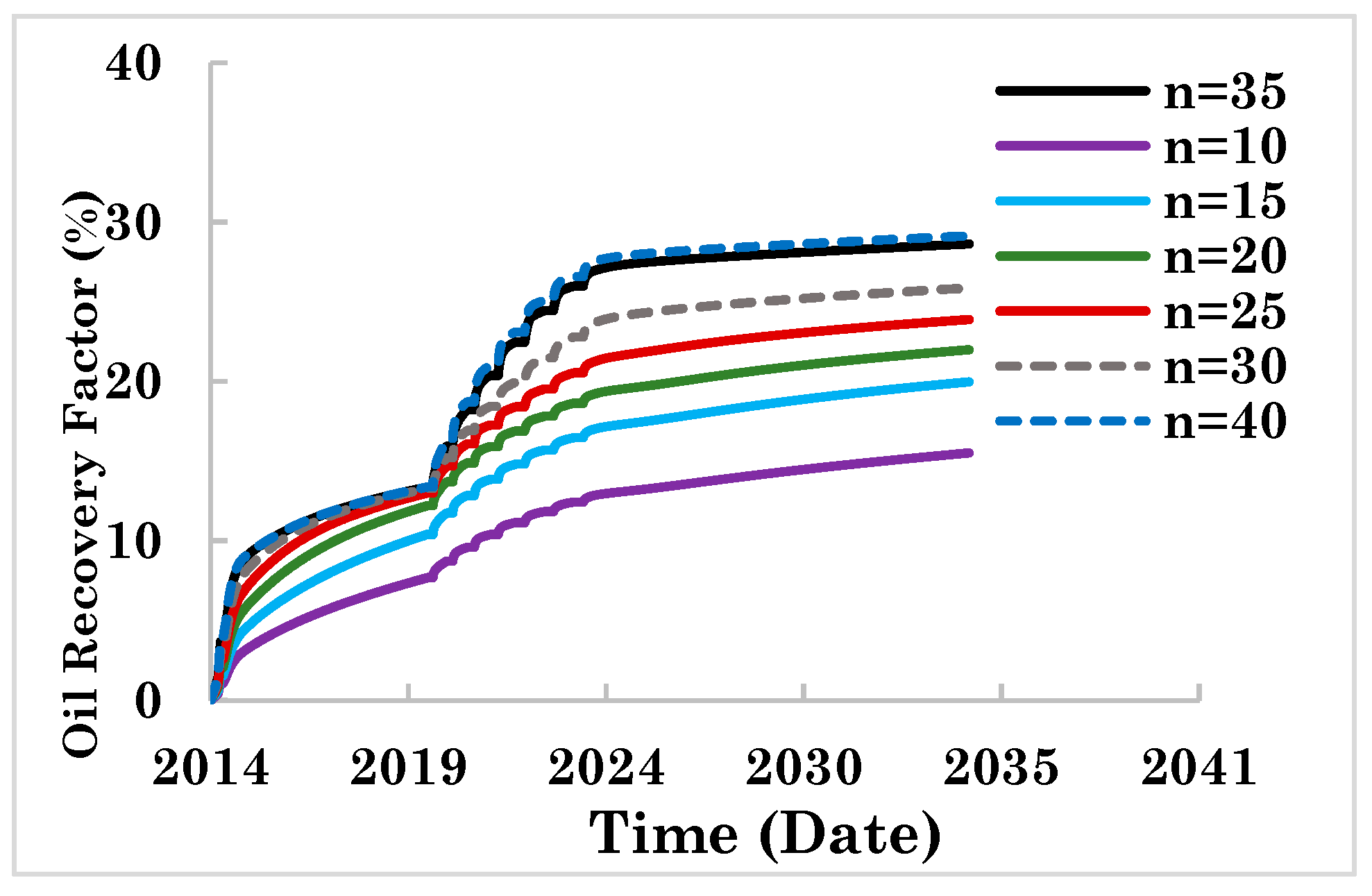

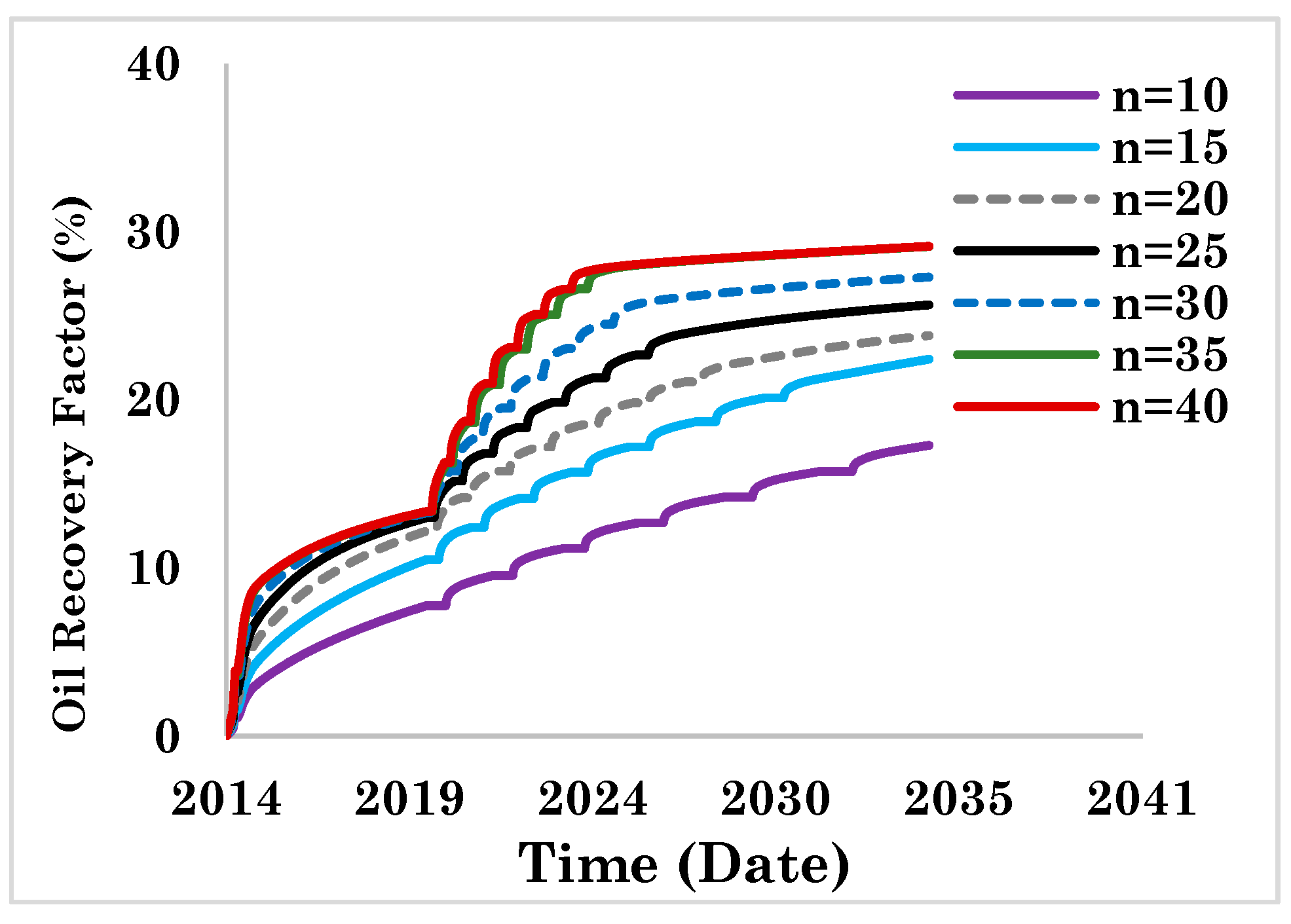

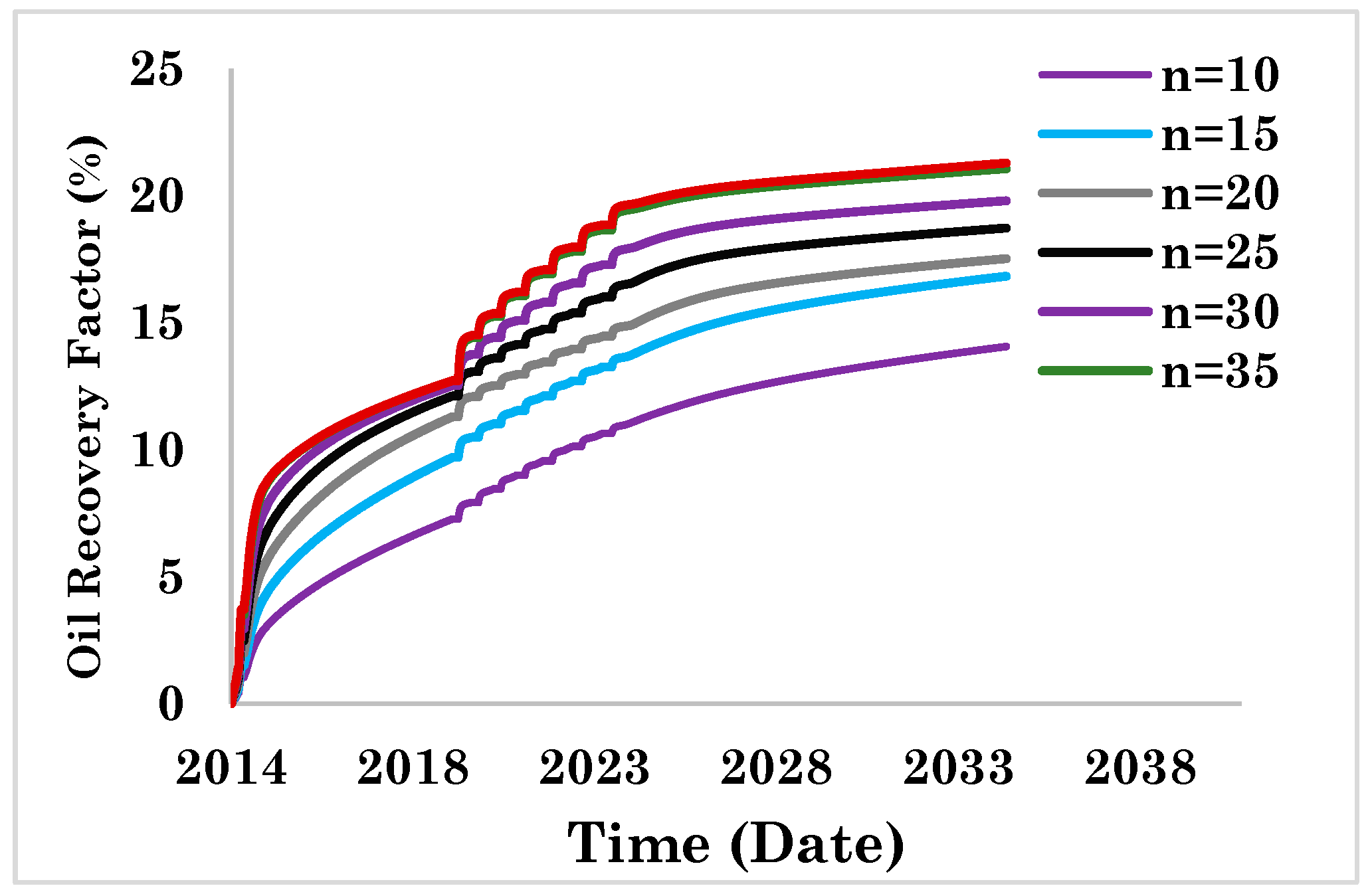

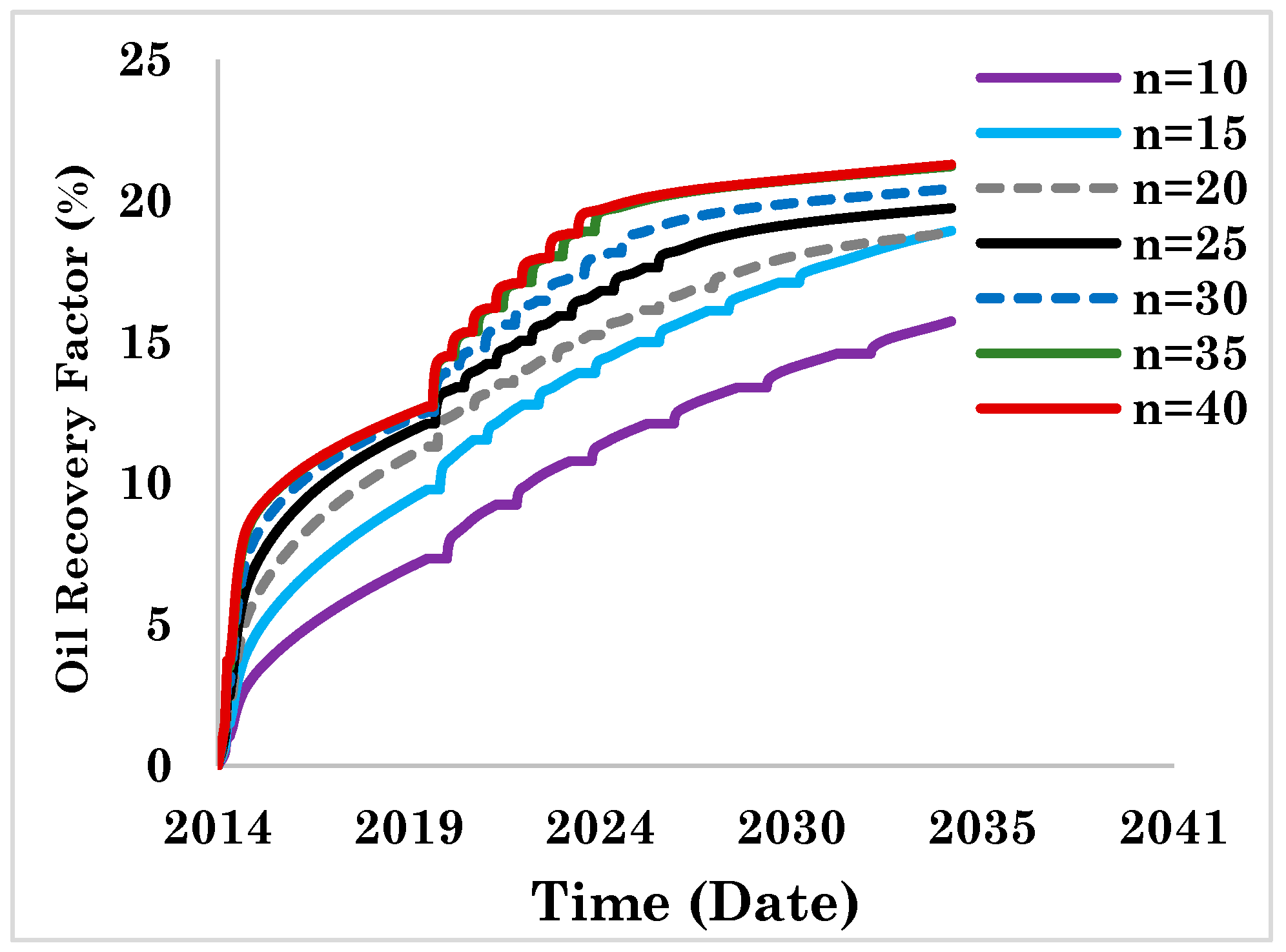

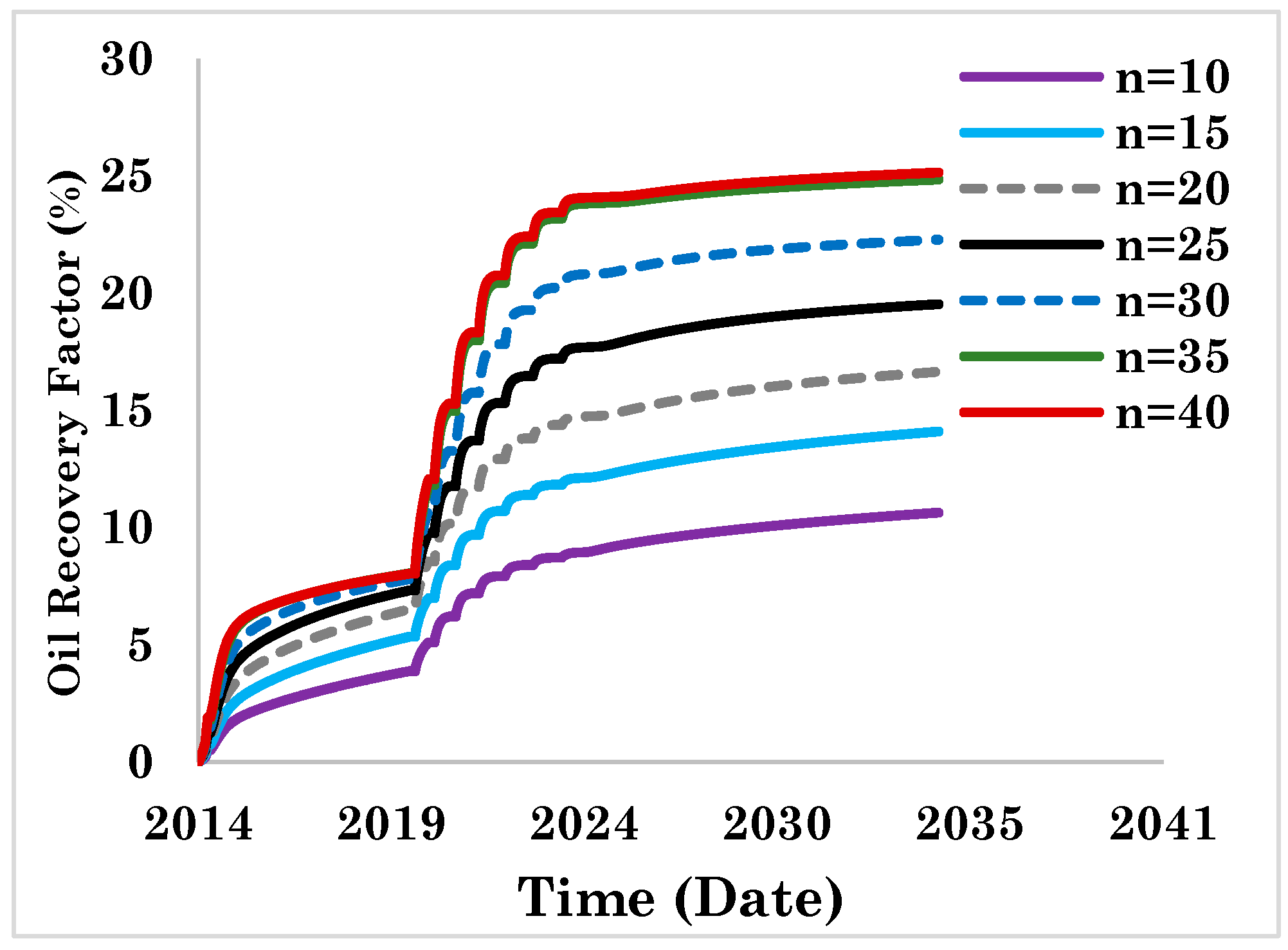

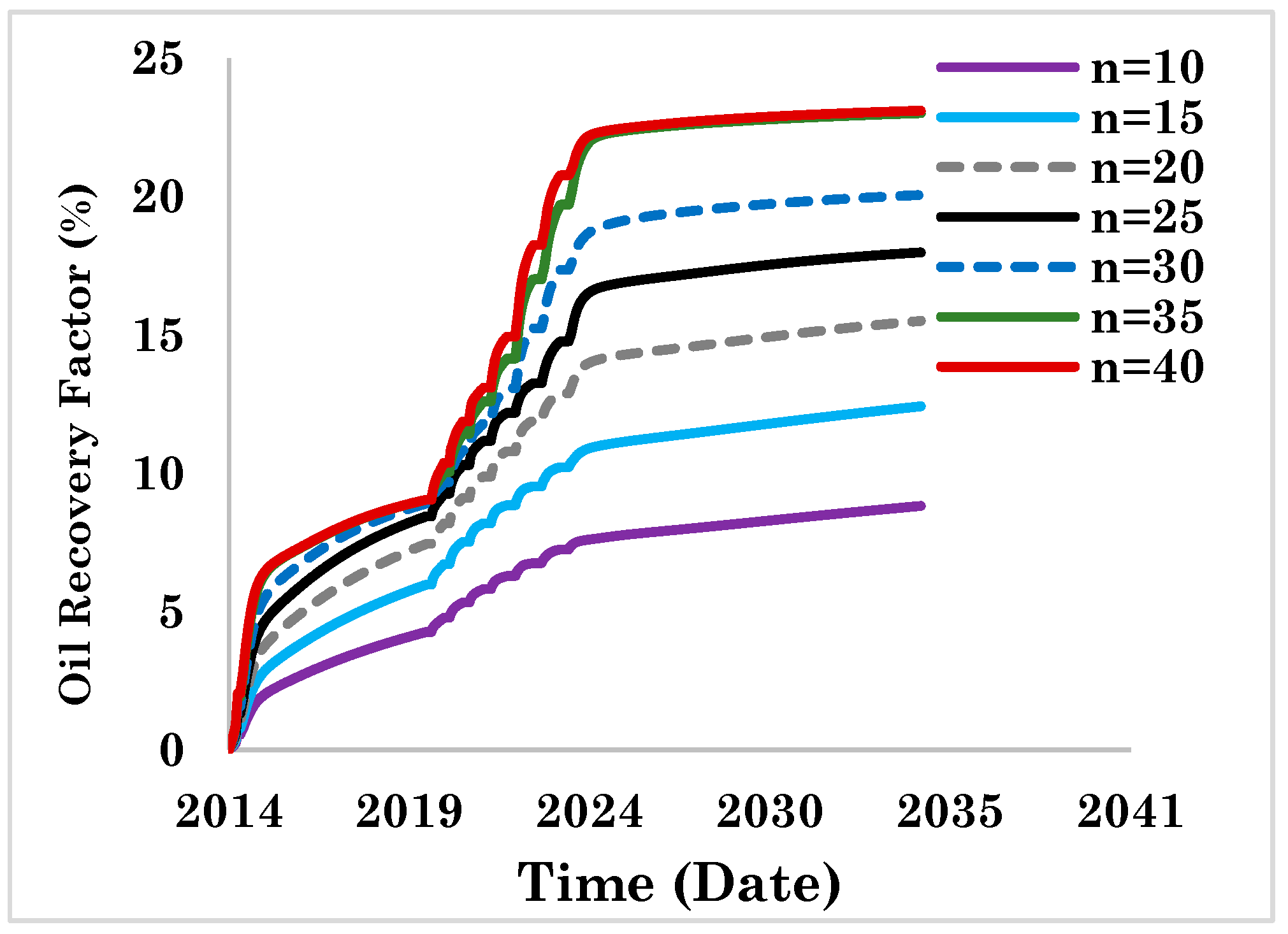

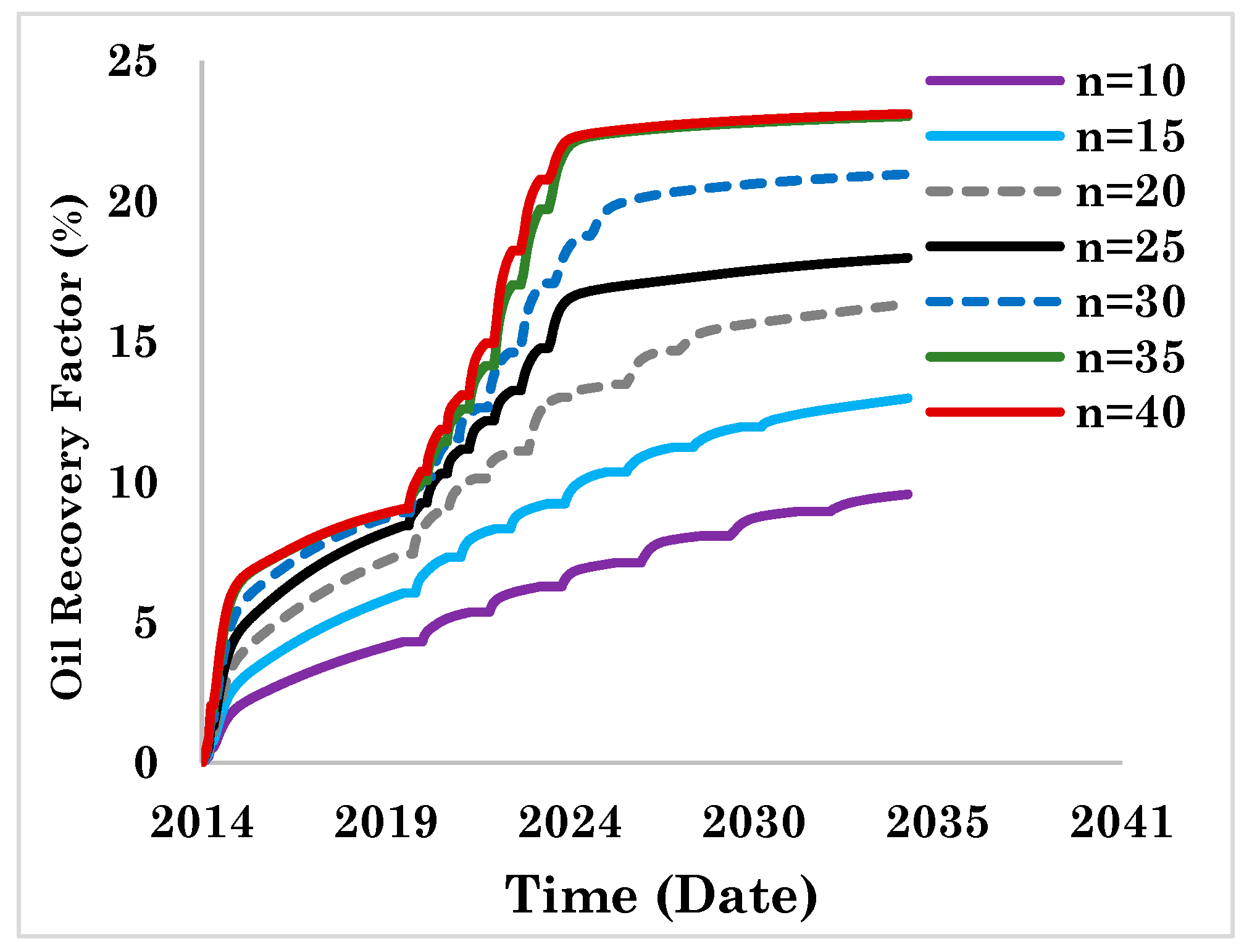

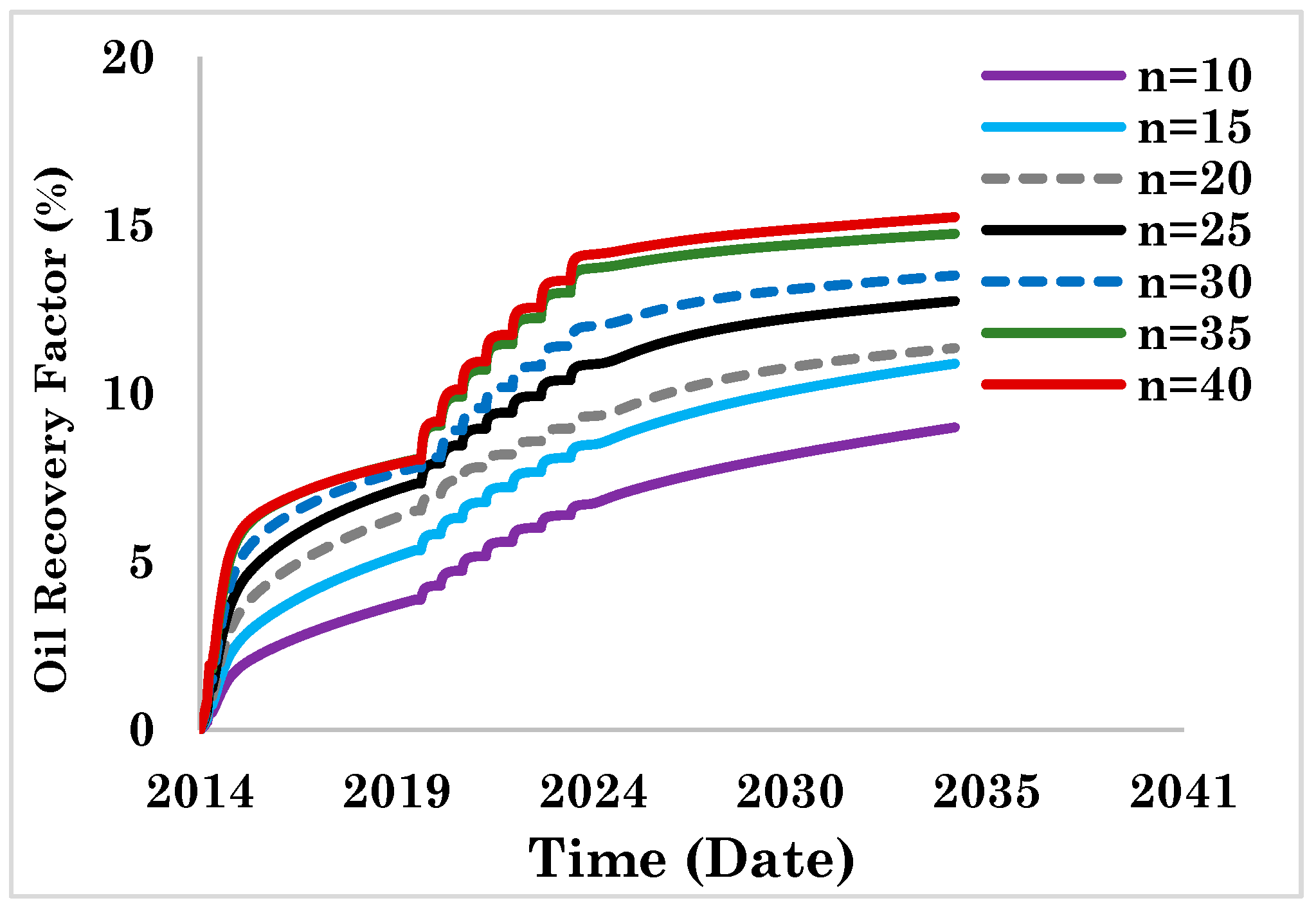

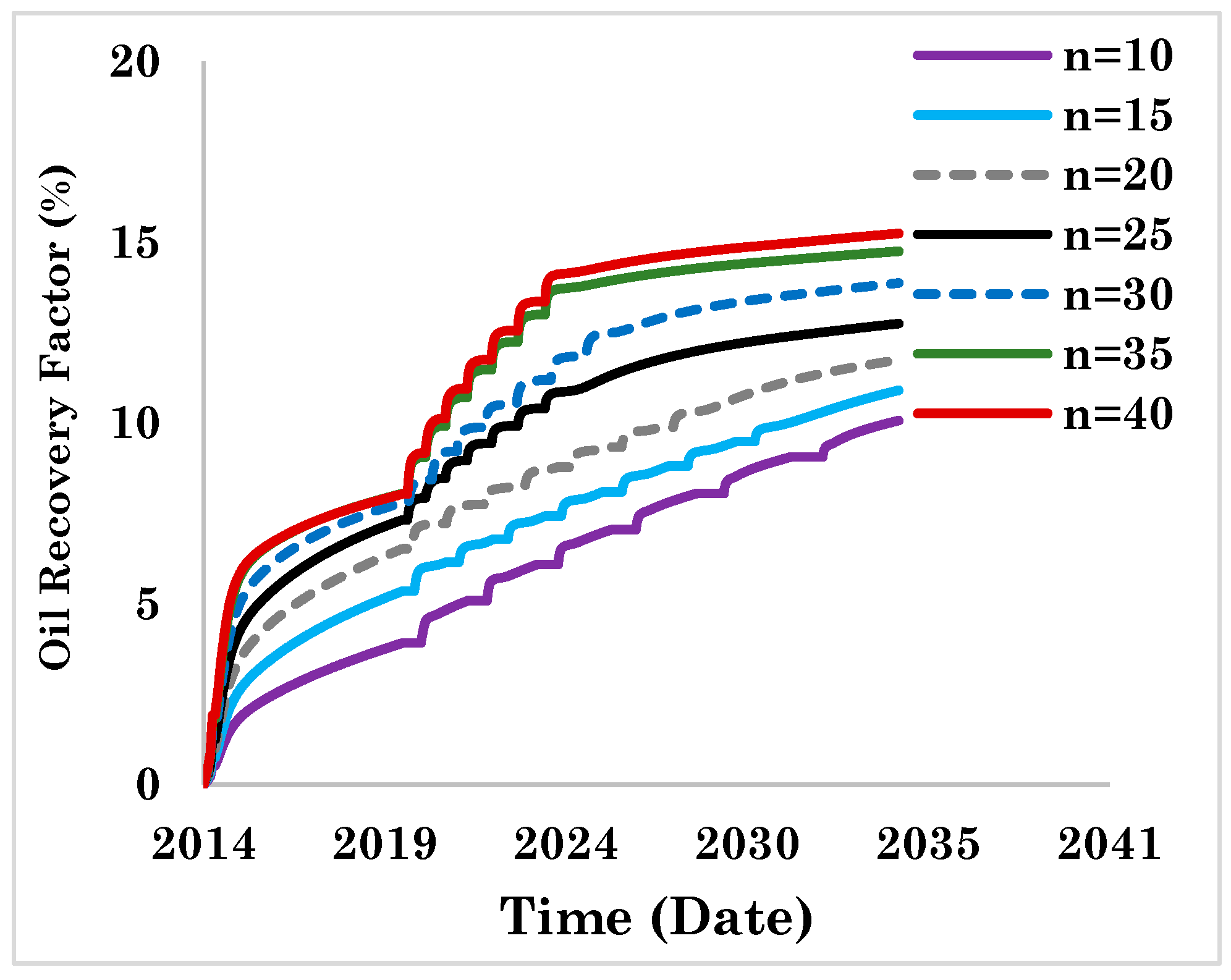

2.2. Effect of Injection Gas

2.3. Effect of Gas Type Coupled with Fracture Spacing

2.4. Economic Assumptions

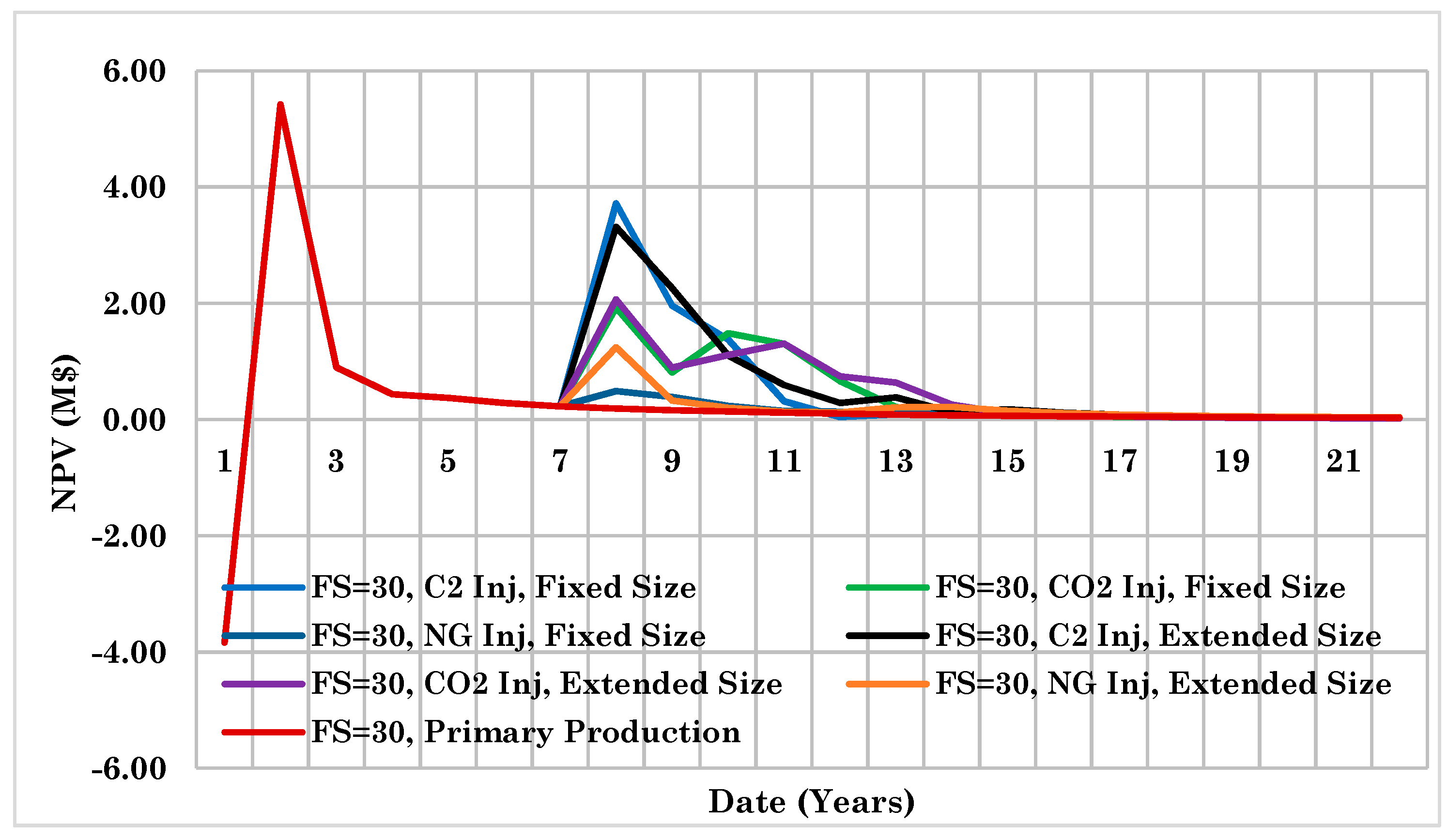

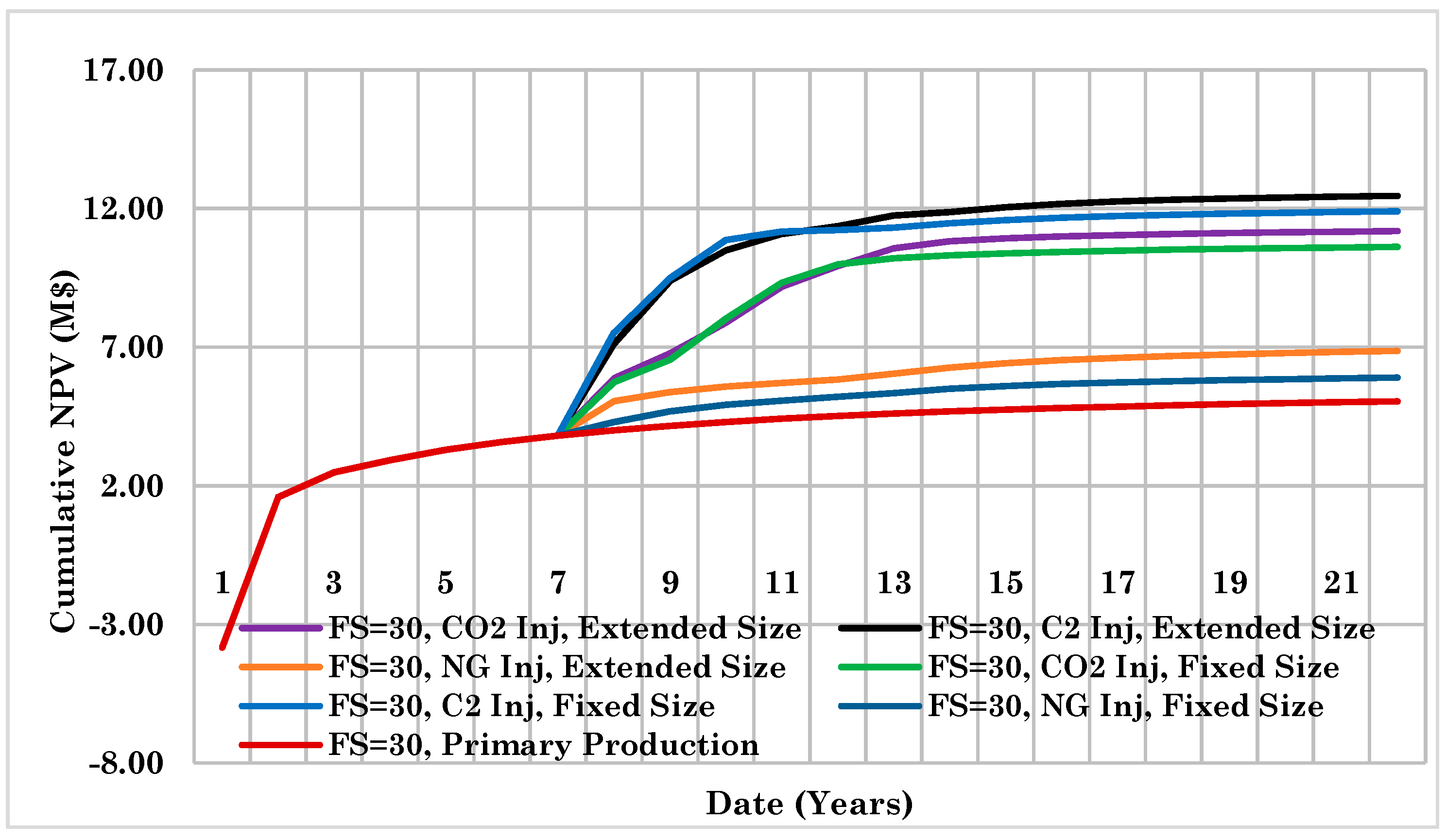

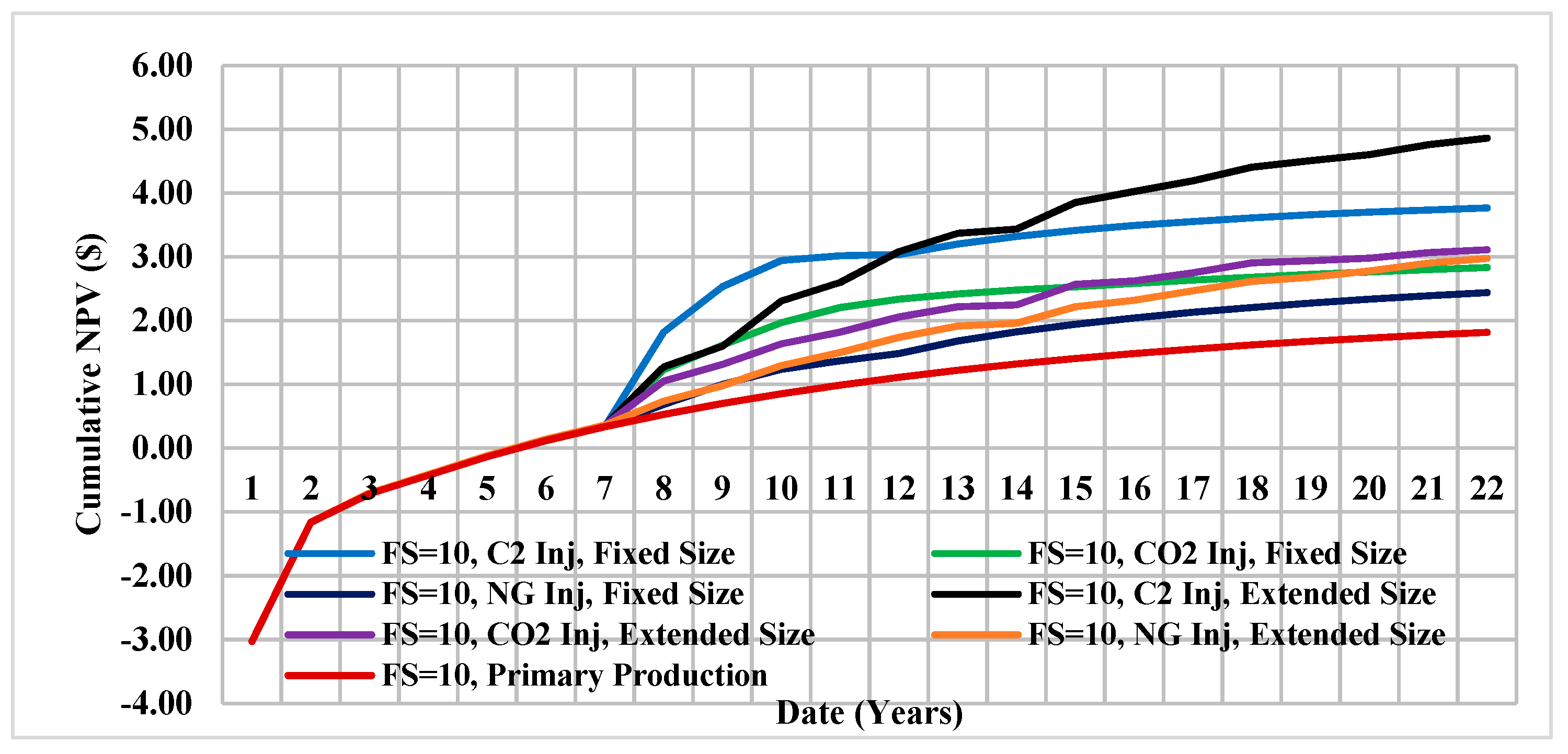

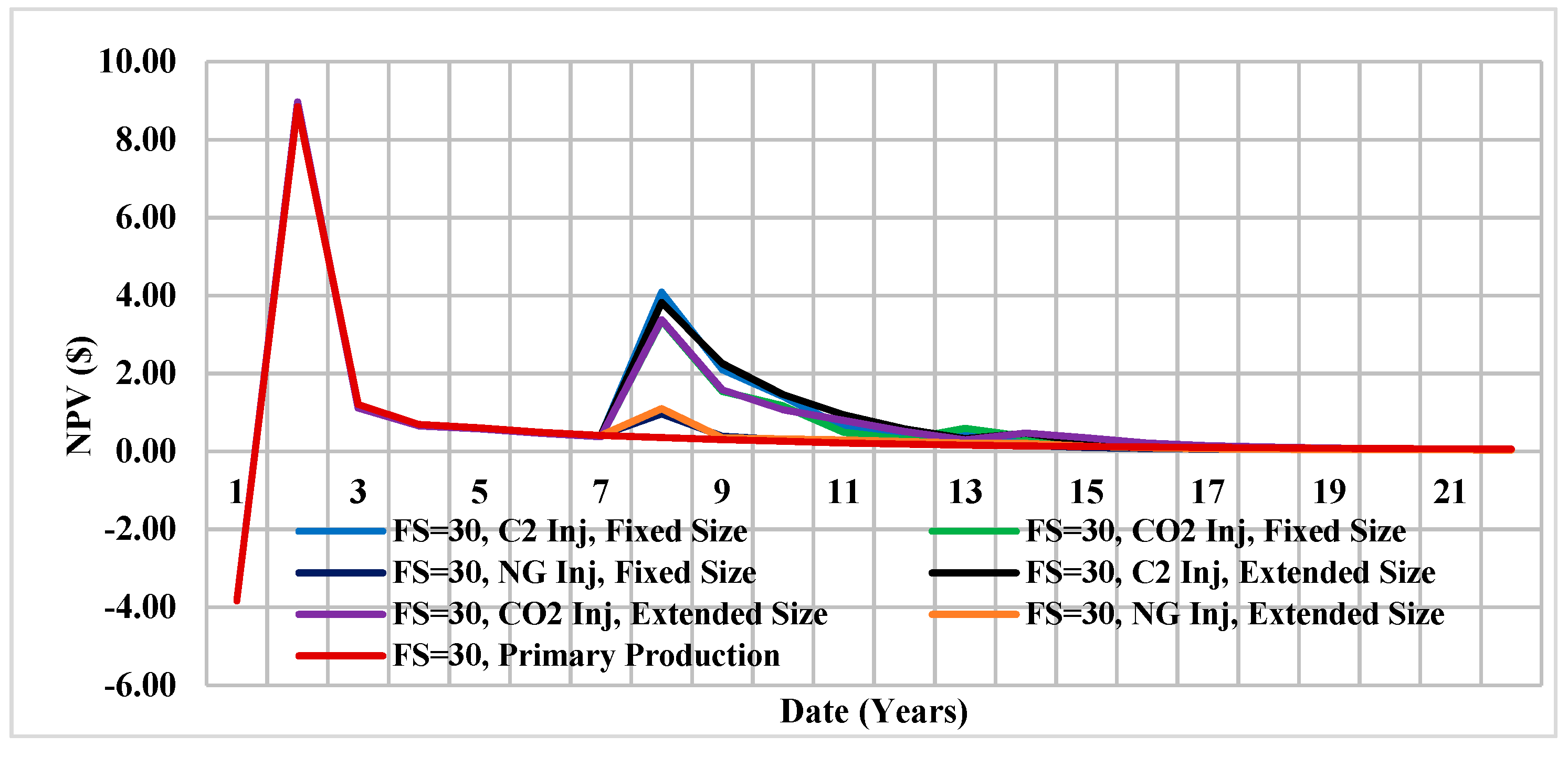

3. Economic Analysis Results

3.1. 38° API Oil

3.2. 31° API Oil

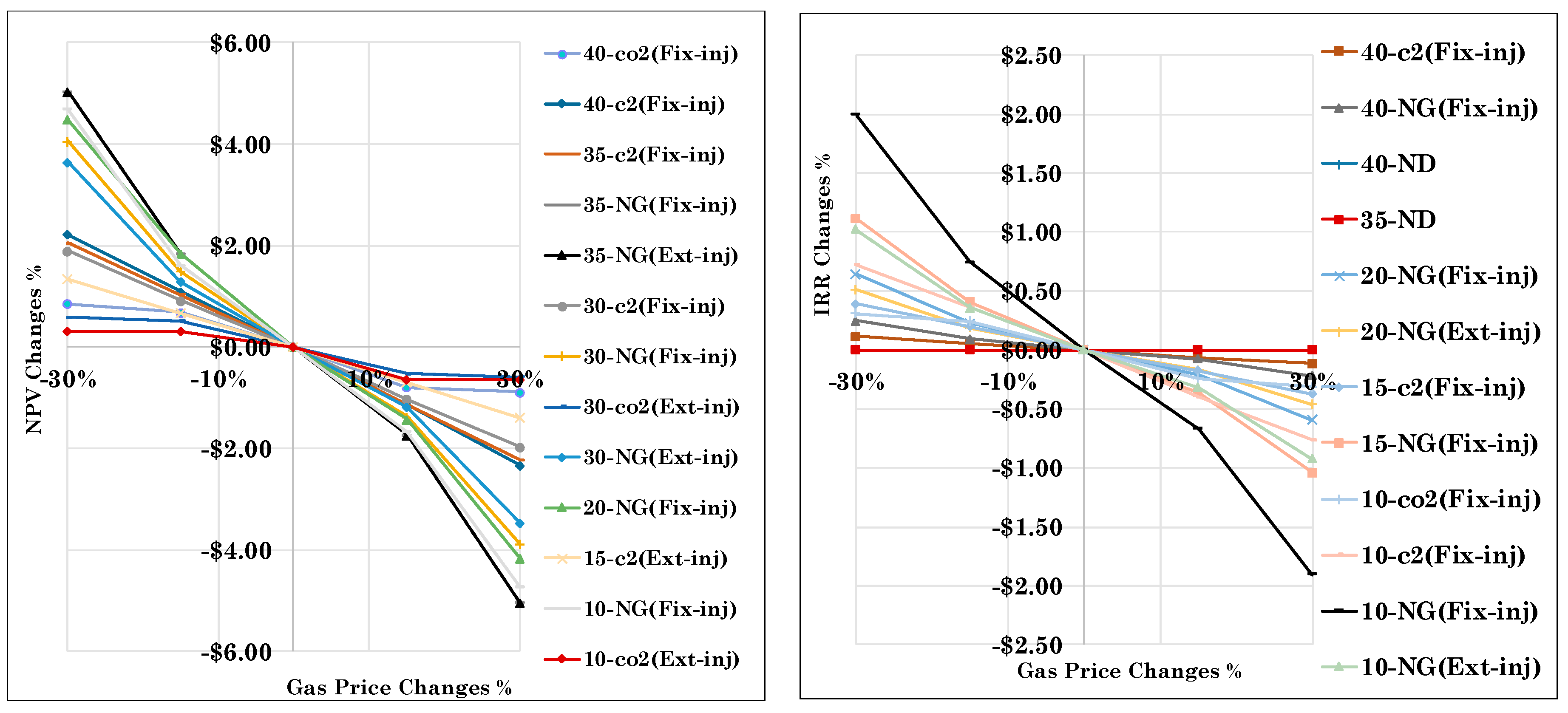

4. Economic Indicators Sensitivity Analysis

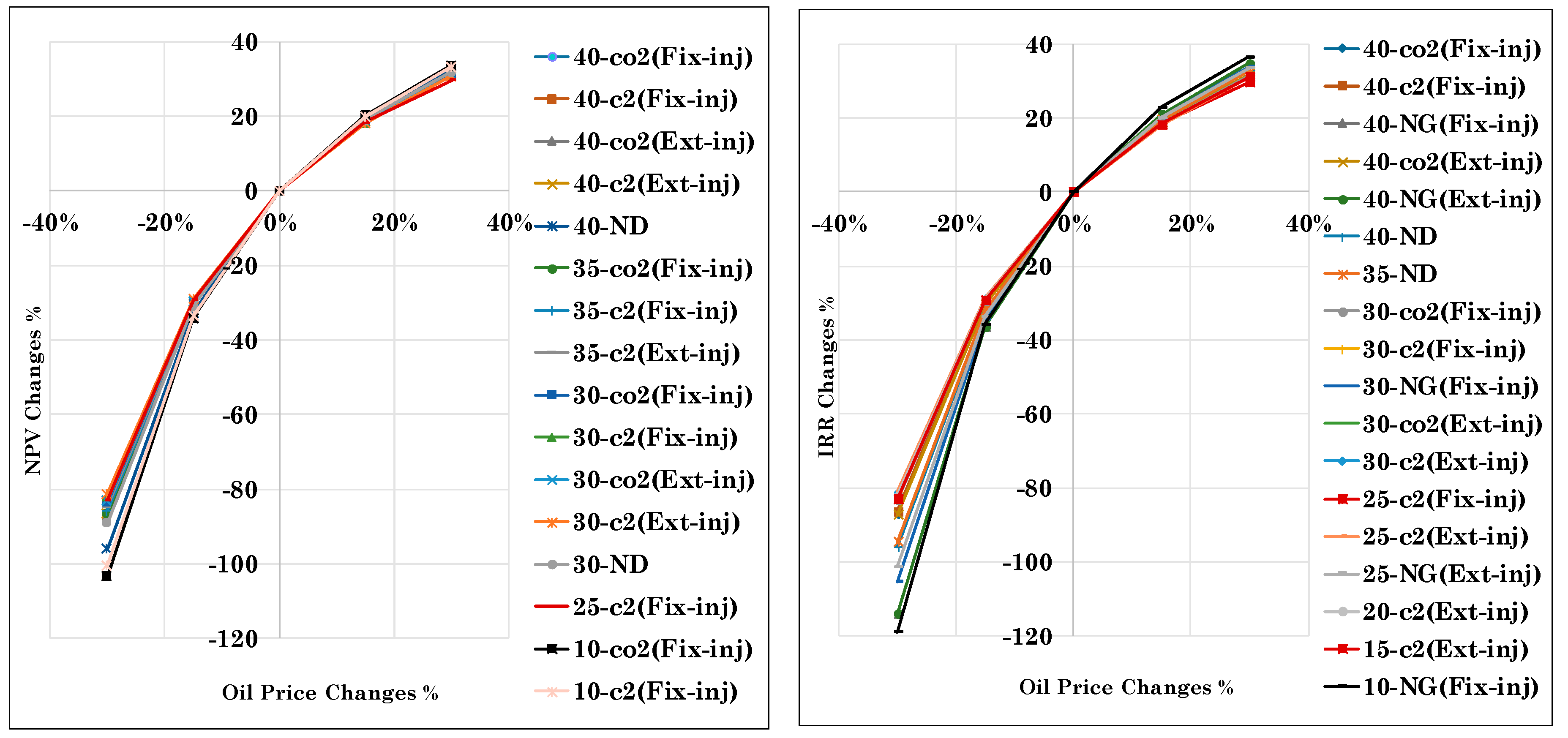

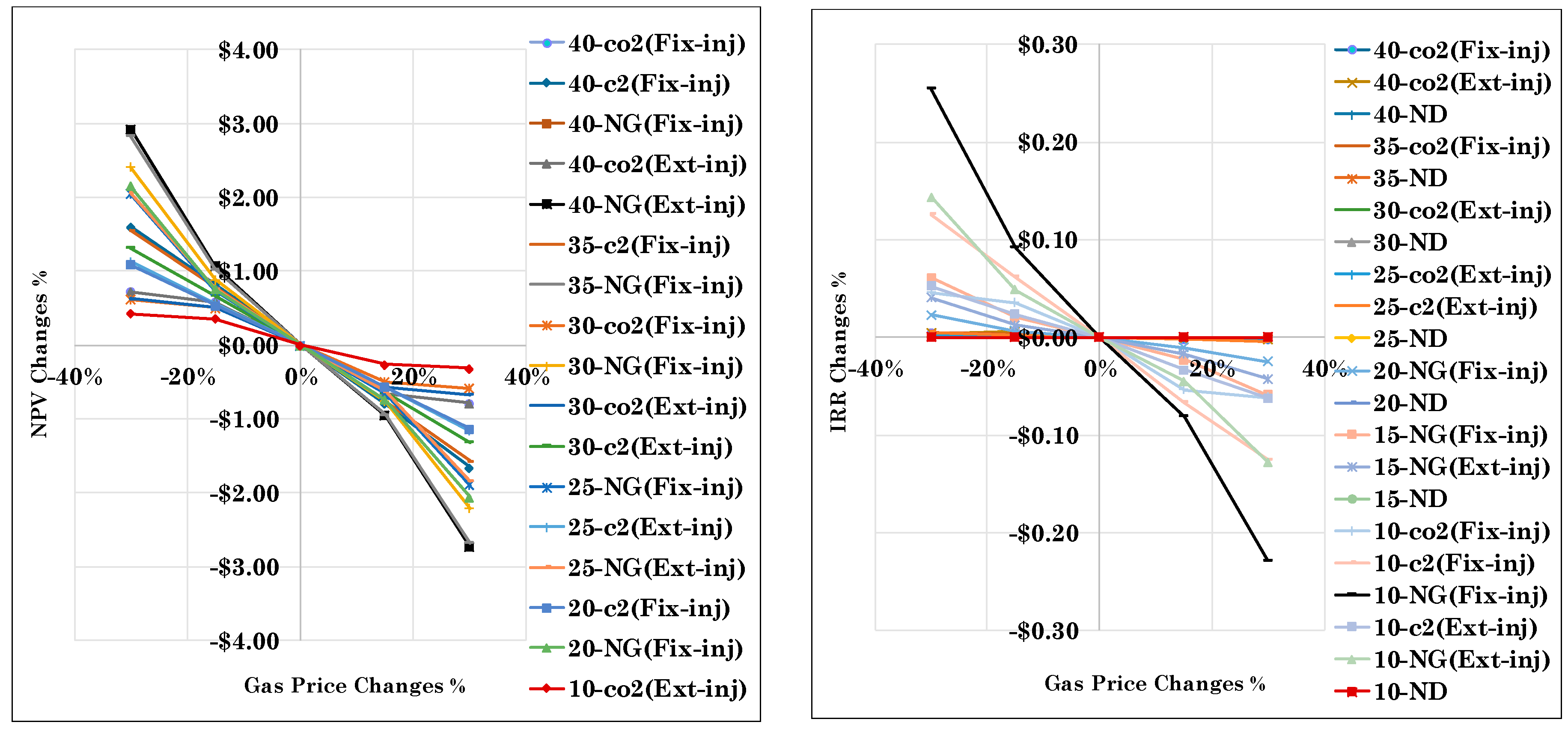

4.1. 38° API Oil

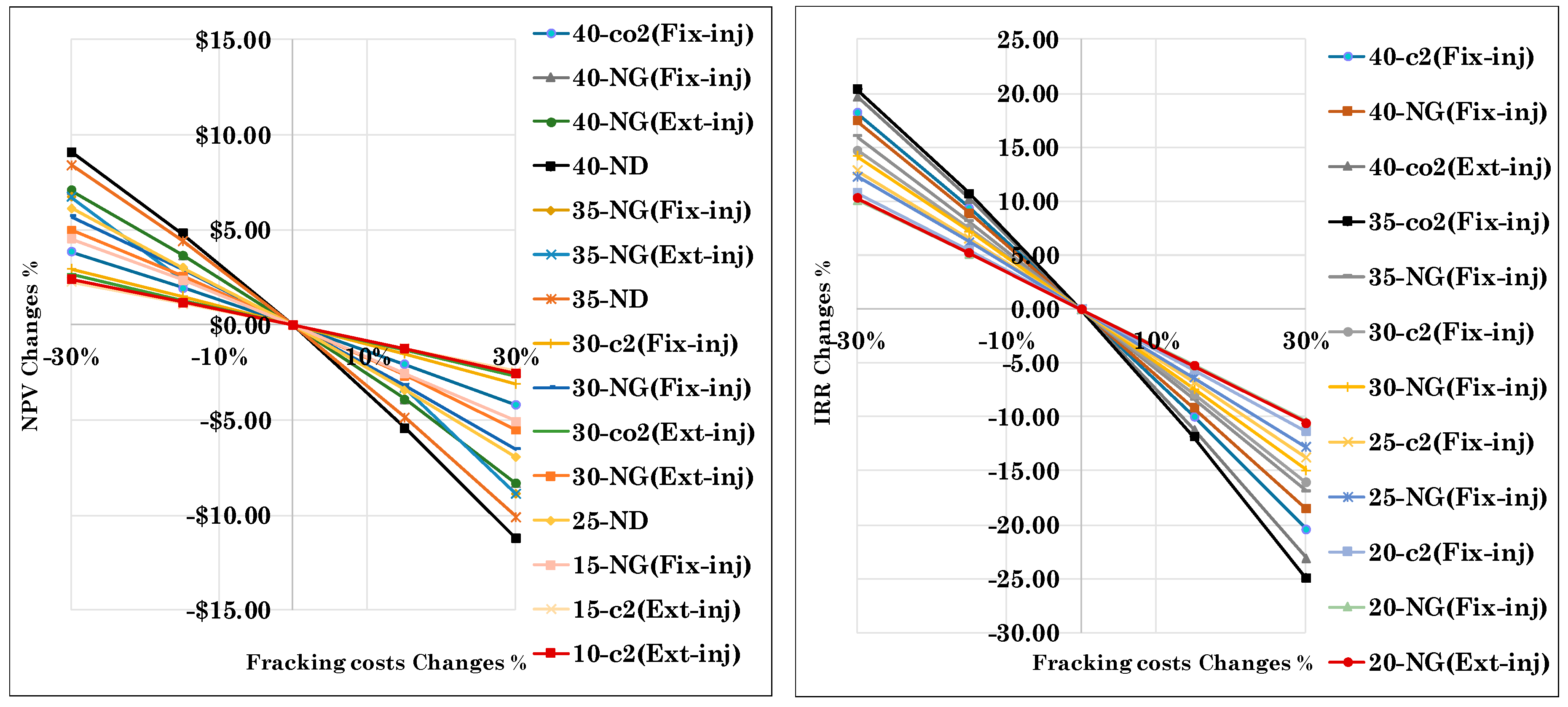

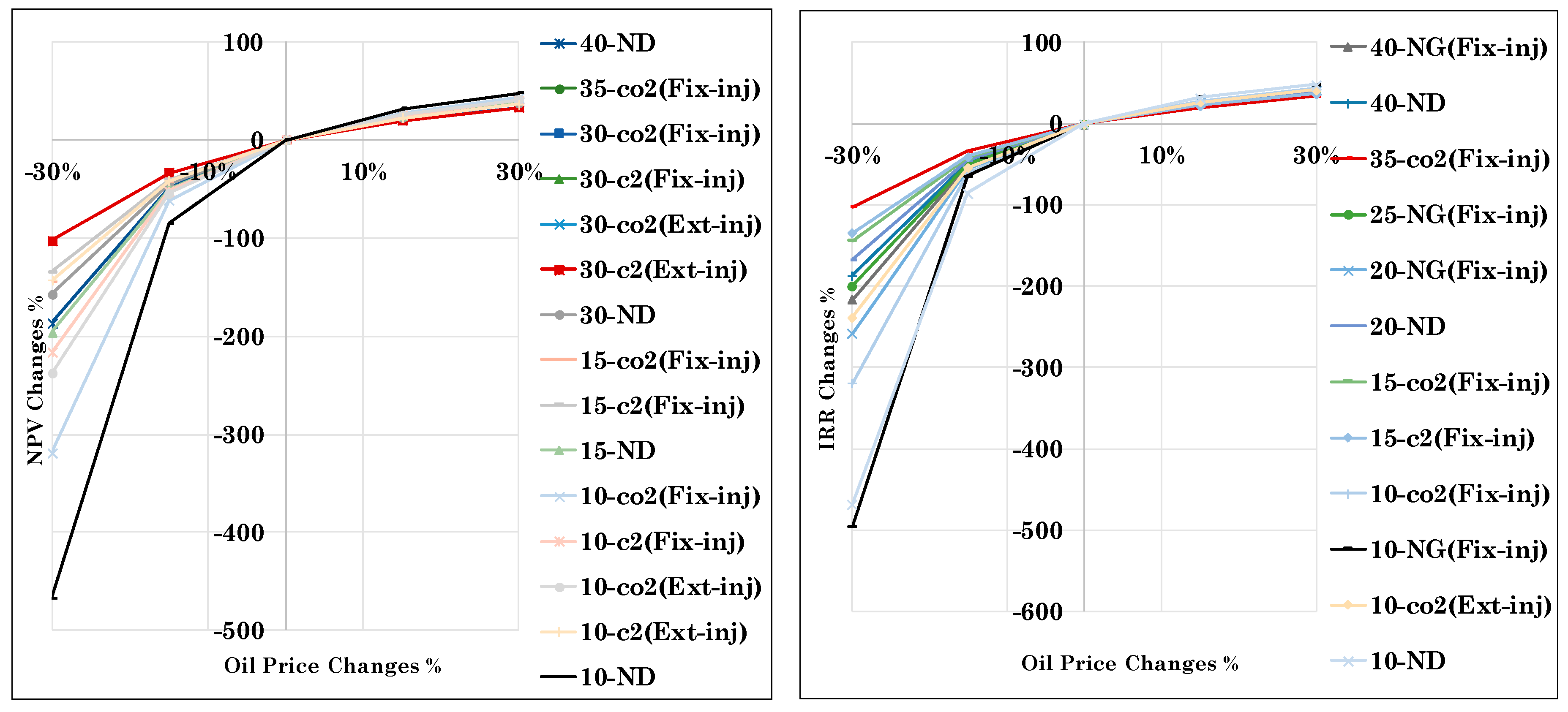

4.2. 31° API Oil

5. Conclusions

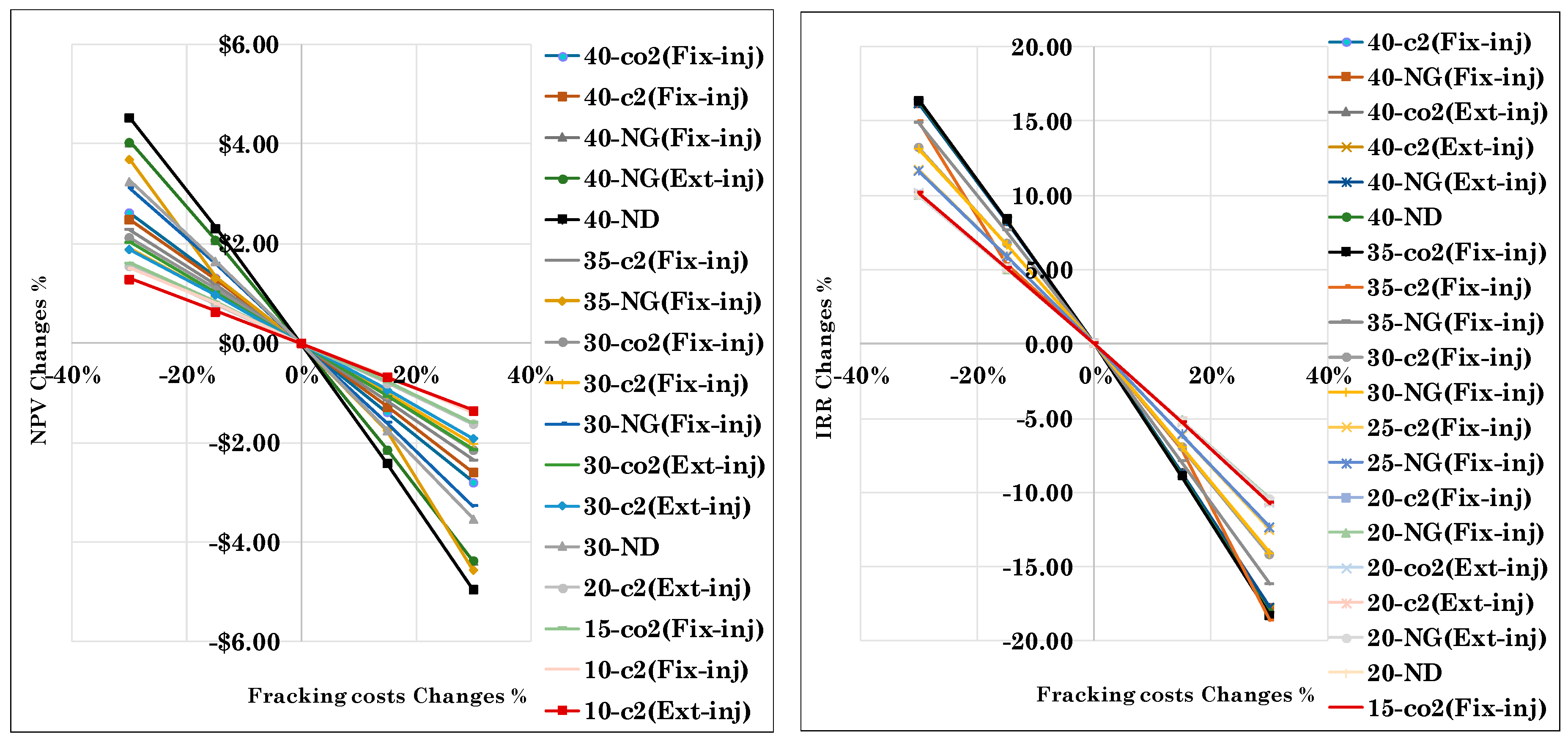

- Amongst the variables, oil price is the most influential factor in project’s NPV and IRR. Oil price decline has a dramatic effect on NPV and IRR and −30% changes leads to 467% decrease in NPV while 30% increment in oil price only results in 48% higher NPV.

- When the oil price declines by 30% and 15%, cumulative NPV is reduced by −100.24% and −33.39%, meaning that while keeping the rest of the costs constant, 30% decrease in oil price may lead to negative NPV and IRR, making the project uneconomic. This trend is seen in scenarios for FS = 10-C2 (fixed) and FS = 10-CO2 (fixed). The scenario of FS = 25-C2 (fixed) is showing the minimum reduction in NPV. Almost all the scenarios will result in 30%−33% and 19%−20% increment of NPV if the oil price increases by 30% and 15% respectively. Variation in IRR lies between −120% and −80% with 30% decline in oil price and between −28% to −35% with 15% decline in oil price.

- Fracking cost has fewer effects on the profit compared with oil price. If the fracking cost decreases by 30% and 15%, NPV increases by 1.29% to 4.59% and 0.7% to 2.31% respectively. 30% and 15% increase in fracturing costs results in 9.96% and 1.36 decrease in NPV.

- Gas price is the factor with minimum effect on the economic responses. 30% and 15% reduction in gas prices lead to 0.43–2.93% and 0.38% to 1.05% increment in NPVs respectively. The scenario with the most benefit is FS = 40-NG (fixed and extended) and scenario with the least profit is FS = 10-CO2 (extended). 30% and 15% increase in gas price yields to 0.31–2.73% and 0.26–0.91% incremental in NPV.

- Scenarios with minimum influences on the project’s economic in terms of NPV are fracking cost for n = 10-C2 (extended), oil price for n = 30-C2 (extended) and gas price for n = 10-CO2 (extended).

Author Contributions

Funding

Conflicts of Interest

References

- U.S. Geological Survey 2013 Assessment of Undiscovered Resources in the Bakken and Three Forks Formations of the U.S. Williston Basin Province. Available online: https://pubs.er.usgs.gov/publication/70145284 (accessed on 9 April 2019).

- U.S. Energy Information Administration (EIA). Available online: https://www.eia.gov/ (accessed on 9 April 2019).

- Kolb, R.W. The Natural Gas Revolution: At the Pivot of the World’s Energy Future, 1st ed.; Pearson FT Press: Upper Saddle River, NJ, USA, 2013. [Google Scholar]

- Drilling Productivity Report. Available online: https://www.eia.gov/petroleum/drilling/pdf/dpr-full.pdf (accessed on 9 April 2019).

- Kulkarni, M.M. Immiscible and Miscible Gas-Oil Displacements in Porous Media. Master’s Thesis, Louisiana State University, Baton Rouge, LA, USA, 2003. [Google Scholar]

- Moritis, G. EOR Survey. Oil Gas J. 2006, 104, 37–57. [Google Scholar]

- IEA. CO2 Storge in Depleted oil Fields Report of the Greenhouse R&D Programme; IEA: Paris, France, 2009. [Google Scholar]

- Bardon, C.; Corlay, P.; Longeron, D.; Miller, B. CO2 Huff ‘n’Puff Revives Shallow Light-Oil-Depleted Reservoirs. SPE Reserv. Eng. 1994, 9, 92–100. [Google Scholar] [CrossRef]

- Mohammed, S.; Jennifer, L.; Singhal, A.K.; Sim, S.S. Screening criteria for CO2 huff‘n’puff operations. In Proceedings of the SPE/DOE Symposium on Improved Oil Recovery, Tulsa, OK, USA, 22–26 April 2006; Society of Petroleum Engineers: Houston, TX, USA, 2006. [Google Scholar]

- Zhang, Y.P.; Sayegh, S.G.; Huang, S.; Dong, M. Laboratory Investigation of Enhanced Light-Oil Recovery by CO/Flue Gas Huff-n-Puff Process. J. Can. Petrol. Technol. 2004, 45. [Google Scholar] [CrossRef]

- Koottungal, L. Worldwide EOR Survey. Oil Gas J. 2014, 112, 79–91. [Google Scholar]

- Tunio, S.Q.; Tunio, A.H.; Ghirano, N.A.; El Adawy, Z.M. Comparison of different enhanced oil recovery techniques for better oil productivity. Int. J. Appl. Sci. Technol. 2011, 1, 143–153. [Google Scholar]

- Yu, W.; Lashgari, H.; Sepehrnoori, K. Simulation study of CO2 huff-n-puff process in Bakken tight oil reservoirs. In Proceedings of the SPE Western North American and Rocky Mountain Joint Meeting, Denver, CO, USA, 16–18 April 2014. [Google Scholar]

- Alharthy, N.; Teklu, T.; Kazemi, H.; Graves, R.; Hawthorne, S.; Braunberger, J.; Kurtoglu, B. Enhanced oil recovery in liquid-rich shale reservoirs: Laboratory to field. In Proceedings of the SPE Annual Technical Conference and Exhibition, Houston, TX, USA, 17–18 April 2015. [Google Scholar]

- Hawthorne, S.B.; Gorecki, C.D.; Sorensen, J.A.; Steadman, E.N.; Harju, J.A.; Melzer, S. Hydrocarbon mobilization mechanisms from upper, middle, and lower Bakken reservoir rocks exposed to CO2. In Proceedings of the SPE Unconventional Resources Conference, Calgary, ON, Canada, 5–7 November 2013. [Google Scholar]

- Todd, M.R.; Cobb, W.M.; McCarter, E.D. CO2 flood performance evaluation for the Cornell Unit, Wasson San Andres field. J. Petrol. Technol. 1982, 34, 2–271. [Google Scholar] [CrossRef]

- Hsu, C.F.; Morell, J.I.; Falls, A.H. Field-scale CO2 flood simulations and their impact on the performance of the Wasson Denver unit. SPE Reserv. Eng. 1997, 12, 4–11. [Google Scholar] [CrossRef]

- Asghari, K.; Dong, M.; Shire, J.; Coleridge, T.J.; Nagrampa, J.; Grassick, J. Development of a correlation between performance of CO2 flooding and the past performance of waterflooding in Weyburn oil field. SPE Prod. Oper. 2007, 22, 260–264. [Google Scholar] [CrossRef]

- Wan, T. Evaluation of the EOR Potential in Shale Oil Reservoirs by Cyclic Gas Injection. Ph.D. Thesis, Texas Tech University, Lubbock, TX, USA, 2013. [Google Scholar]

- Sheng, J.J.; Mody, F.; Griffith, P.J.; Barnes, W.N. Potential to increase condensate oil production by huff-n-puff gas injection in a shale condensate reservoir. J. Nat. Gas Sci. Eng. 2016, 28, 46–51. [Google Scholar] [CrossRef]

- Li, L.; Sheng, J.J.; Xu, J. Gas Selection for huff-n-puff EOR in shale oil reservoirs based upon experimental and numerical study. In Proceedings of the SPE Unconventional Resources Conference, Calgary, AB Canada, 15–16 February 2017; Society of Petroleum Engineers: Houston, TX, USA, 2017. [Google Scholar]

- Ali, S.; Farouq, M.; Thomas, S. A Realistic Look at Enhanced oil Recovery. Sci. Iran. 1994, 1, 3. [Google Scholar]

- Hejazi, S.H.; Assef, Y.; Tavallali, M.; Popli, A. Cyclic CO2-EOR in the Bakken Formation: Variable cycle sizes and coupled reservoir response effects. Fuel 2017, 210, 758–767. [Google Scholar] [CrossRef]

- Zhou, S.; Zhuang, X.; Rabczuk, T. A phase-field modeling approach of fracture propagation in poroelastic media. Eng. Geol. 2018, 240, 189–203. [Google Scholar] [CrossRef]

- Cockin, A.P. Prudhoe Bay Miscible Gas Distribution. In Proceedings of the SPE Western Regional Meeting, Anchorage, AK, USA, 26–28 May 1993; Society of Petroleum Engineers: Houston, TX, USA, 1993. [Google Scholar]

- DeRuiter, R.A.; Nash, L.J.; Singletary, M.S. Solubility and displacement behavior of a viscous crude with CO2 and hydrocarbon gases. SPE Reserv. Eng. 1994, 9, 101–106. [Google Scholar] [CrossRef]

- Sharma, G.D. Development of Effective Gas Solvents Including Carbon Dioxide for the Improved Recovery of West Sak Oil. No. DOE/FE/61114-2; Alaska Univ., Petroleum Development Lab.: Fairbanks, AK, USA, 1990. [Google Scholar]

- McGuire, P.L.; Okuno, R.; Gould, T.L.; Lake, L. Ethane-based EOR: An innovative and profitable EOR opportunity for a low price environment. In Proceedings of the SPE Improved Oil Recovery Conference, Tulsa, OK, USA, 11–13 April 2016; Society of Petroleum Engineers: Houston, TX, USA, 2016. [Google Scholar]

- Natural Gas Futures Contract 1. Available online: https://www.eia.gov/dnav/ng/hist/rngc1A.htm (accessed on 4 November 2018).

- Natural Gas Prices Are a Function of Market Supply and Demand. Available online: https://www.eia.gov/energyexplained/index.cfm?page=natural_gas_factors_affecting_prices (accessed on 19 December 2018).

- Assef, Y.; Almao, P.P.; Pourafshary, P. Miscibility Effects on Performance of Cyclic CO2 Injection in Hysteretic Tight Oil Reservoirs. In Proceedings of the Abu Dhabi International Petroleum Exhibition & Conference, Abu Dhabi, UAE, 12–15 November 2018; Society of Petroleum Engineers: Houston, TX, USA, 2018. [Google Scholar]

- Assef, Y.; Kantzas, A.; Almao, P.P. Numerical modelling of cyclic CO2 injection in unconventional tight oil resources; trivial effects of heterogeneity and hysteresis in Bakken formation. Fuel 2019, 236, 1512–1528. [Google Scholar] [CrossRef]

- Tabrizy, V.A. Investigated Miscible CO2 Flooding for Enhancing Oil Recovery in Wettability Altered Chalk and Sandstone Rocks. Ph.D. Thesis, University of Stavanger, Stavanger, Norway, 2012. [Google Scholar]

- Hawthorne, S.B.; Miller, D.J.; Jin, L.; Gorecki, C.D. Rapid and simple capillary-rise/vanishing interfacial tension method to determine crude oil minimum miscibility pressure: Pure and mixed CO2, methane, and ethane. Energy Fuels 2016, 30, 6365–6372. [Google Scholar] [CrossRef]

- Hawthorne, S.B.; Miller, D.J.; Sorensen, J.A.; Gorecki, C.D.; Steadman, E.N.; Harju, J.A. Effects of reservoir temperature and percent levels of methane and ethane on CO2/Oil MMP values as determined using vanishing interfacial tension/capillary rise. Energy Procedia 2017, 114, 5287–5298. [Google Scholar] [CrossRef]

- Trends in U.S. Oil and Natural Gas Upstream Costs, Independent Statistics & Analysis. U.S. Energy Information Administration. Available online: www.eia.gov (accessed on 23 March 2016).

- 2015 Carbon Dioxide Price Forecast. Available online: http://www.synapse-energy.com/sites/default/files/2015%20Carbon%20Dioxide%20Price%20Report.pdf (accessed on 3 March 2015).

- Hydrocarbon Gas Liquid Prices Are Related to Oil and Natural Gas Prices and Are Related to Supply and Demand. Available online: https://www.eia.gov/energyexplained/index.cfm?page=hgls_prices (accessed on 19 December 2018).

- Short-Term Energy Outlook. Available online: https://www.eia.gov/outlooks/steo/report/natgas.php (accessed on 9 April 2019).

- Canada’s Energy Future 2016: Energy Supply and Demand Projections to 2040. Available online: https://www.neb-one.gc.ca/nrg/ntgrtd/ftr/2016/index-eng.html (accessed on 9 April 2019).

- What is the Formula for Calculating Net Present Value (NPV)? Available online: https://www.investopedia.com/ask/answers/032615/what-formula-calculating-net-present-value-npv.asp (accessed on 9 April 2019).

| Stage# | Fracture Spacing (ft) | Injection Cycle Length (Days) | Production Cycle Length (Days) | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 1 | 2 | 3 | 4 | 5 | 6 | ||

| n = 10 | 900 | 40 | 40 | 48 | 56 | 64 | 64 | 64 | 112 | 120 | 128 | 144 | 160 | 168 |

| n = 15 | 600 | 26 | 26 | 32 | 37 | 42 | 42 | 42 | 74 | 80 | 85 | 96 | 106 | 112 |

| n = 20 | 450 | 20 | 20 | 24 | 28 | 32 | 32 | 32 | 56 | 60 | 64 | 72 | 80 | 84 |

| n = 25 | 360 | 16 | 16 | 19 | 22 | 25 | 25 | 25 | 44 | 48 | 51 | 57 | 64 | 67 |

| n = 30 | 300 | 13 | 13 | 16 | 18 | 21 | 21 | 21 | 37 | 40 | 42 | 48 | 53 | 56 |

| n = 35 | 257 | 11 | 11 | 13 | 16 | 18 | 18 | 18 | 32 | 34 | 36 | 41 | 45 | 48 |

| n = 40 | 225 | 10 | 10 | 12 | 14 | 16 | 16 | 16 | 28 | 30 | 32 | 36 | 40 | 42 |

| Frac #/Scenario | n = 10 | n = 15 | n = 15 | |||

|---|---|---|---|---|---|---|

| Fixed | Extended | Fixed | Extended | Fixed | Extended | |

| C2 | 16.64% | 20.27% | 22.14% | 26.12% | 25.07 | 28.35 |

| CO2 | 15.50% | 17.28% | 19.97% | 22.4% | 21.99 | 23.83 |

| NG | 14.05 | 15.73 | 16.82 | 18.93 | 17.51 | 19.64 |

| FS/Oil API | Economic Indicator | Fixed-C2 | Fixed-CO2 | Fixed-NG | Extended-C2 | Extended-CO2 | Extended-NG | ND |

|---|---|---|---|---|---|---|---|---|

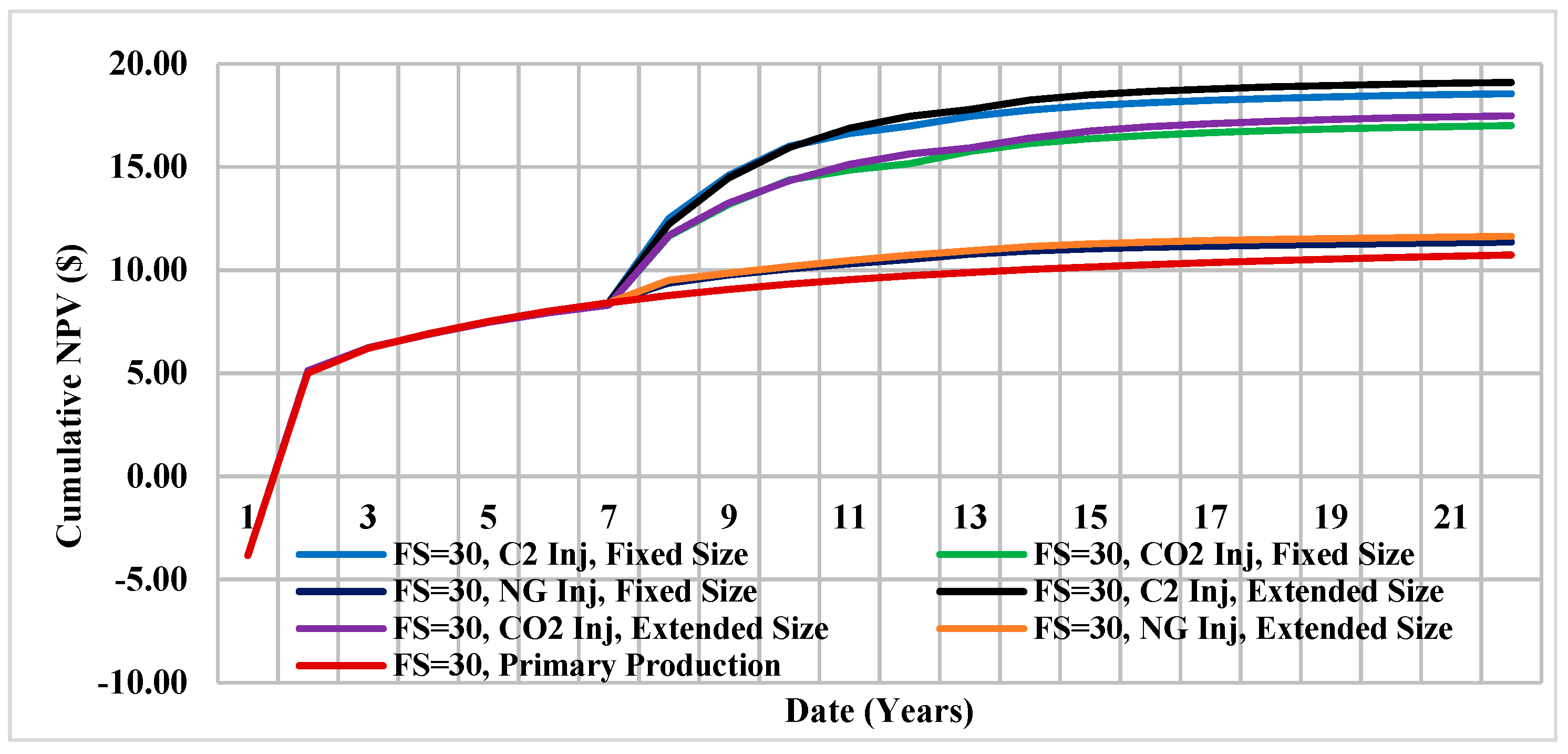

| n = 30, 38 API | RF(%) | 30.87 | 28.38 | 19.79 | 32.02 | 29.51 | 20.42 | 16.77 |

| Cum NPV (MM$) | 18.55 | 17 | 11.35 | 19.09 | 17.48 | 11.64 | 10.73 | |

| IRR | 168.04 | 169.82 | 167.6 | 168.02 | 169.82 | 167.61 | 167.4 | |

| n = 30, 31 API | RF(%) | 22.27 | 20.062 | 13.51 | 23.05 | 20.96 | 13.87 | 10.03 |

| Cum NPV (MM$) | 14.45 | 11.18 | 6.87 | 11.9 | 10.61 | 5.9 | 5.05 | |

| IRR | 82.08 | 80.44 | 78.85 | 82.26 | 80.34 | 77.8 | 77.24 | |

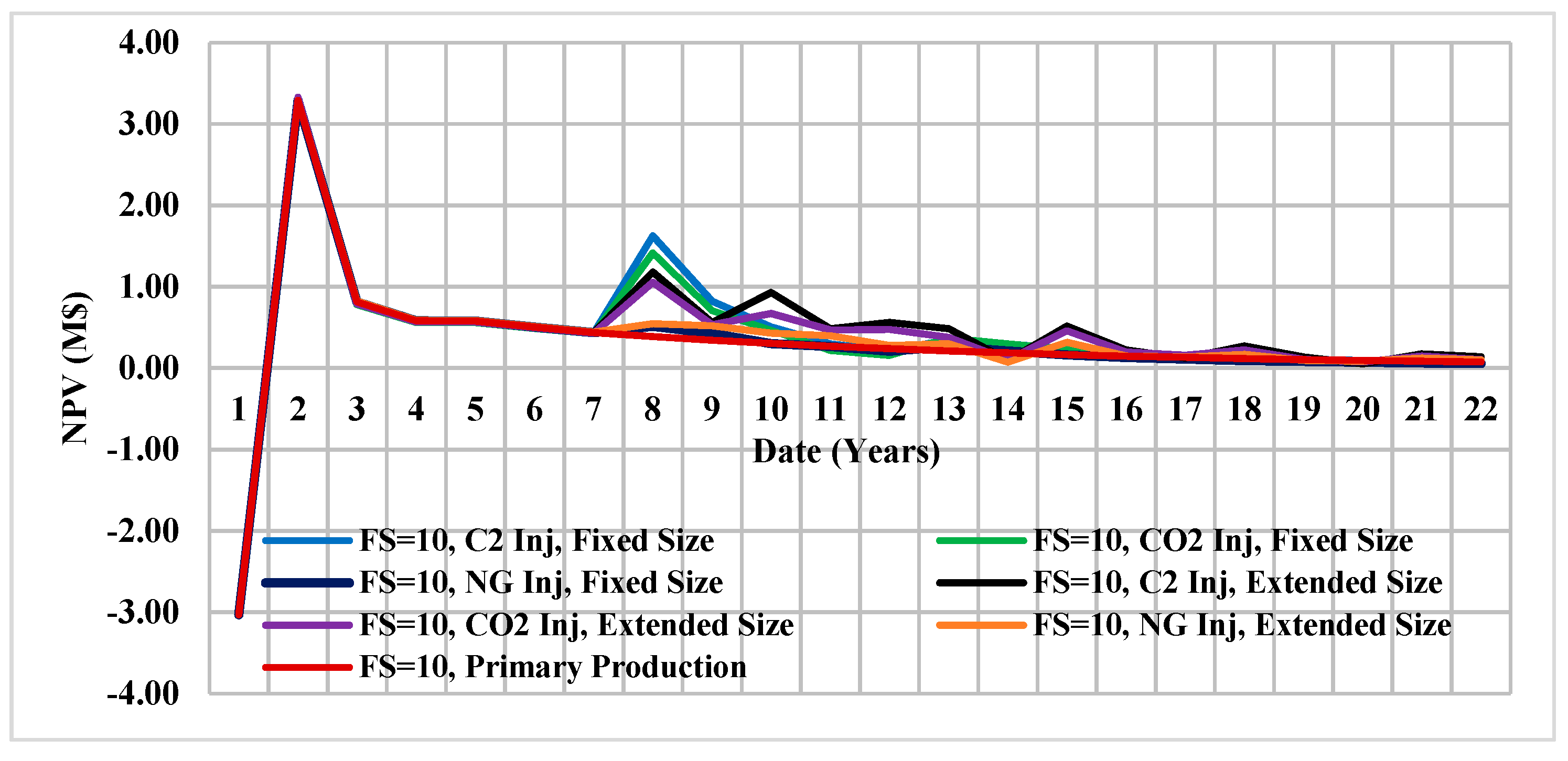

| n = 10, 38 API | RF (%) | 17.7 | 16.61 | 14.05 | 19.54 | 17.79 | 15.73 | 12.92 |

| Cum NPV (MM$) | 8.36 | 7.76 | 6.13 | 9.15 | 8.3 | 6.93 | 6.04 | |

| IRR | 64.04 | 63.4 | 61.39 | 63.91 | 63.32 | 62.17 | 61.04 | |

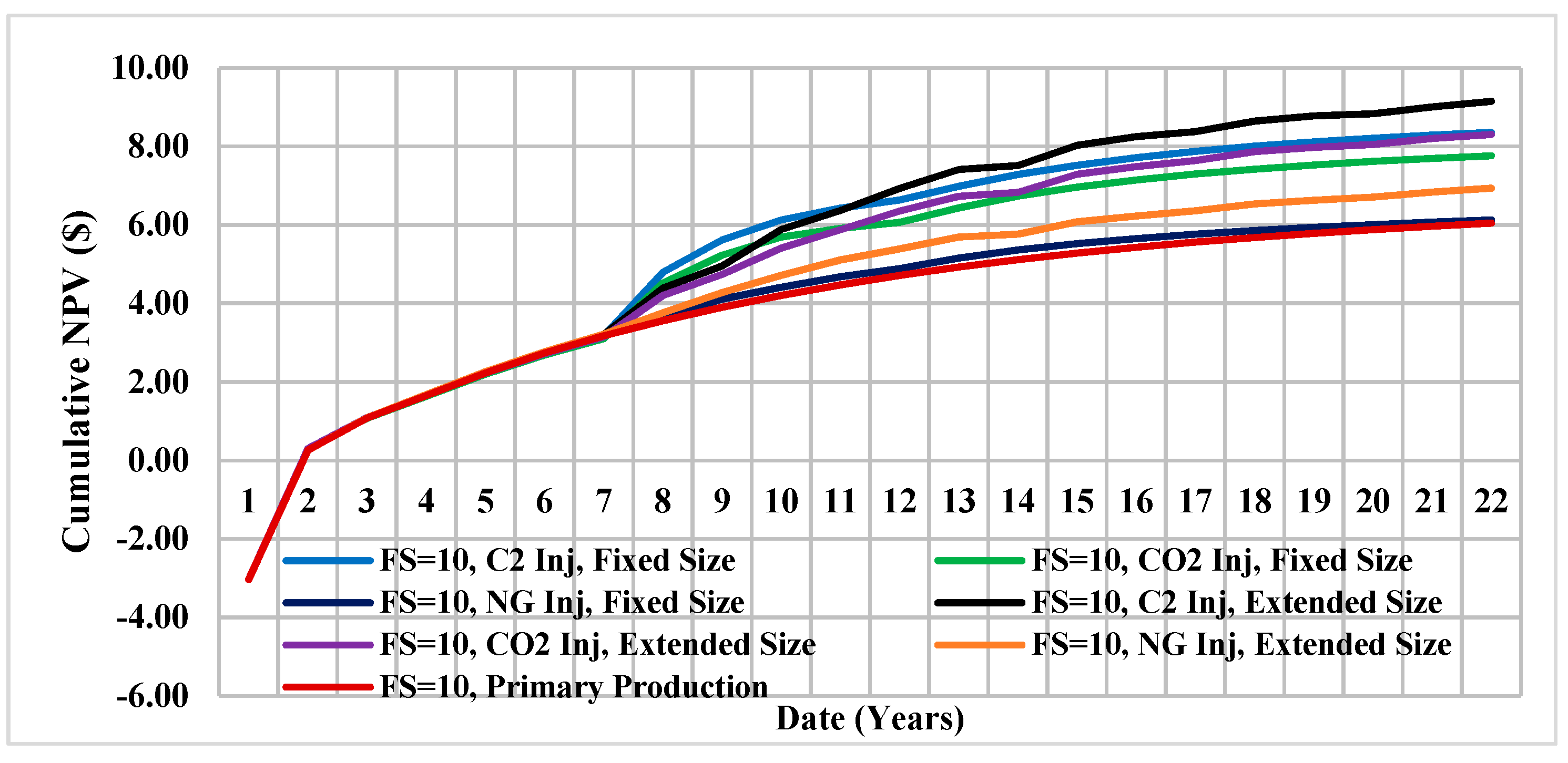

| n = 10, 31 API | RF (%) | 10.63 | 10.63 | 8.22 | 13.24 | 10.06 | 9.56 | 6.78 |

| Cum NPV (MM$) | 3.77 | 3.77 | 2.83 | 2.44 | 4.86 | 2.98 | 1.82 | |

| IRR | 30.21 | 27 | 24.06 | 29.93 | 26.46 | 25.18 | 21.69 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Assef, Y.; Pereira Almao, P. Evaluation of Cyclic Gas Injection in Enhanced Recovery from Unconventional Light Oil Reservoirs: Effect of Gas Type and Fracture Spacing. Energies 2019, 12, 1370. https://doi.org/10.3390/en12071370

Assef Y, Pereira Almao P. Evaluation of Cyclic Gas Injection in Enhanced Recovery from Unconventional Light Oil Reservoirs: Effect of Gas Type and Fracture Spacing. Energies. 2019; 12(7):1370. https://doi.org/10.3390/en12071370

Chicago/Turabian StyleAssef, Yasaman, and Pedro Pereira Almao. 2019. "Evaluation of Cyclic Gas Injection in Enhanced Recovery from Unconventional Light Oil Reservoirs: Effect of Gas Type and Fracture Spacing" Energies 12, no. 7: 1370. https://doi.org/10.3390/en12071370

APA StyleAssef, Y., & Pereira Almao, P. (2019). Evaluation of Cyclic Gas Injection in Enhanced Recovery from Unconventional Light Oil Reservoirs: Effect of Gas Type and Fracture Spacing. Energies, 12(7), 1370. https://doi.org/10.3390/en12071370