Multi-Objective Market Clearing Model with an Autonomous Demand Response Scheme

Abstract

1. Introduction

1.1. Aims and Motivations

- (1)

- The elasticity estimation will be biased if the replacement of other inputs for the use of electricity occurs. Furthermore, this is disregarded by the models used to determine price elasticity. On the other hand, inclusion of such detailed information is not only hard to acquire but also increases the complexity of the model;

- (2)

- The nonlinear structure of tariff plans and aggregation of metered behavior of the consumption over time creates associate simultaneity problems between marginal prices and consumption;

- (3)

- The price elasticity may vary widely across various sectors (residential, commercial and industrial) and regions, so an exact estimation needs awareness of the mix of sectors and the disaggregation of the information which is intractable currently. For example, a methodology for day-ahead prediction and shaping of dynamic demand response is presented in [7], based on the application of Monte Carlo simulations and an artificial neural network.

1.2. Literature Review and Background

- (1)

- DR models based on the price elasticity of demand definition; these models reflect the changes in customer demand in response to changing the electricity tariffs. To this end, the economic approach of responsive loads has been calculated based on the idea of price elasticity of demand curve to maximize the customer’s utility function. In this respect, several papers considered fix price elasticity values [13,14], while others assumed flexible price elasticity factors [15,16]. Moreover, various relations of demand vs. price have been considered using linear, quadratic, exponential, and logarithmic functions to find out a conservative model for customer behavior in order to have less error in DR implementation [17,18]. However, the major challenge of the works in this category are related to the estimation of customer elasticity and participation level which restricts the applicability of these models due to significant errors in the accessible DR amount.

- (2)

- DR models based on the DR aggregator or DR provider definition; these models aggregate small electricity customer responses and submit the aggregated offers on behalf of them in the electricity market in order to maximize its own profits as a virtual generation company. In such DR models, several constraints have been integrated into the model in order to meet the customer’s needs and convenience. A decentralized approach is presented with price-based signals sent to consumers and demand-based signals sent to the aggregator from consumers in [19]. According to the supply side, a function bidding model for DR is formulated [20]. A bidding strategy of the virtual power plants in the day-ahead market, the intra-day demand response exchange market, and the balancing market is modeled in [21]. The minimum and maximum load reduction duration (besides load reduction initiation cost) were considered in the participant’s load reduction offer packages in [22]. DR treated as a virtual generation resource in [23] whose marginal cost and relevant constraints such as DR magnitude, duration and frequency were modeled according to customer information. The technical constraints of customers including the energy limit, minimum and maximum available capacities, maximum rate of energy change from one period to the next, minimum and maximum duration of the DR event, and the frequency of the DR events were integrated into the DR aggregator trading framework in [24]. In developing the power electricity market, there are different types of uncertainties that could change the day-ahead generation scheduling of the units. In the current paper, all the uncertainties about the behavior of the DR provider and elasticity of the customers are modeled for the independent system operator (ISO) to present secure generation scheduling with consideration of the all uncertainties on the side of the DR providers.

1.3. Contributions

- We propose a novel DR framework that eliminates the need to estimate customer reactions in response to DR programs with the aim of reducing DR uncertainty and consequently enhancing DR development in power system operation from the ISO point of view in the presence of renewable units;

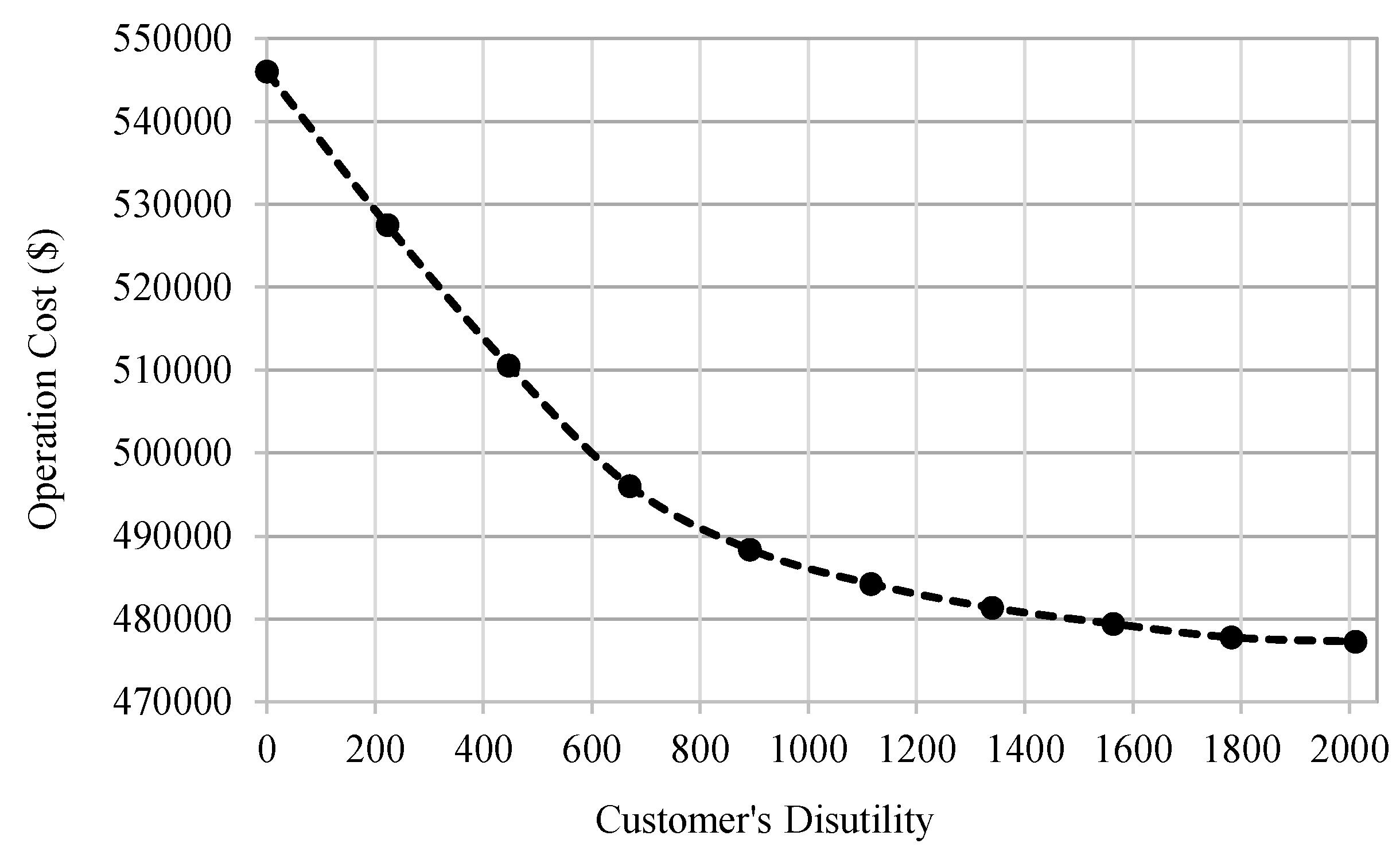

- To present a bi-objective approach including among its objective functions the operation cost and customer disutility in order to gain a cost-efficient generation dispatch in energy and reserve markets, taking into account customer disutility as a result of participation in DR programs.

1.4. Paper Organization

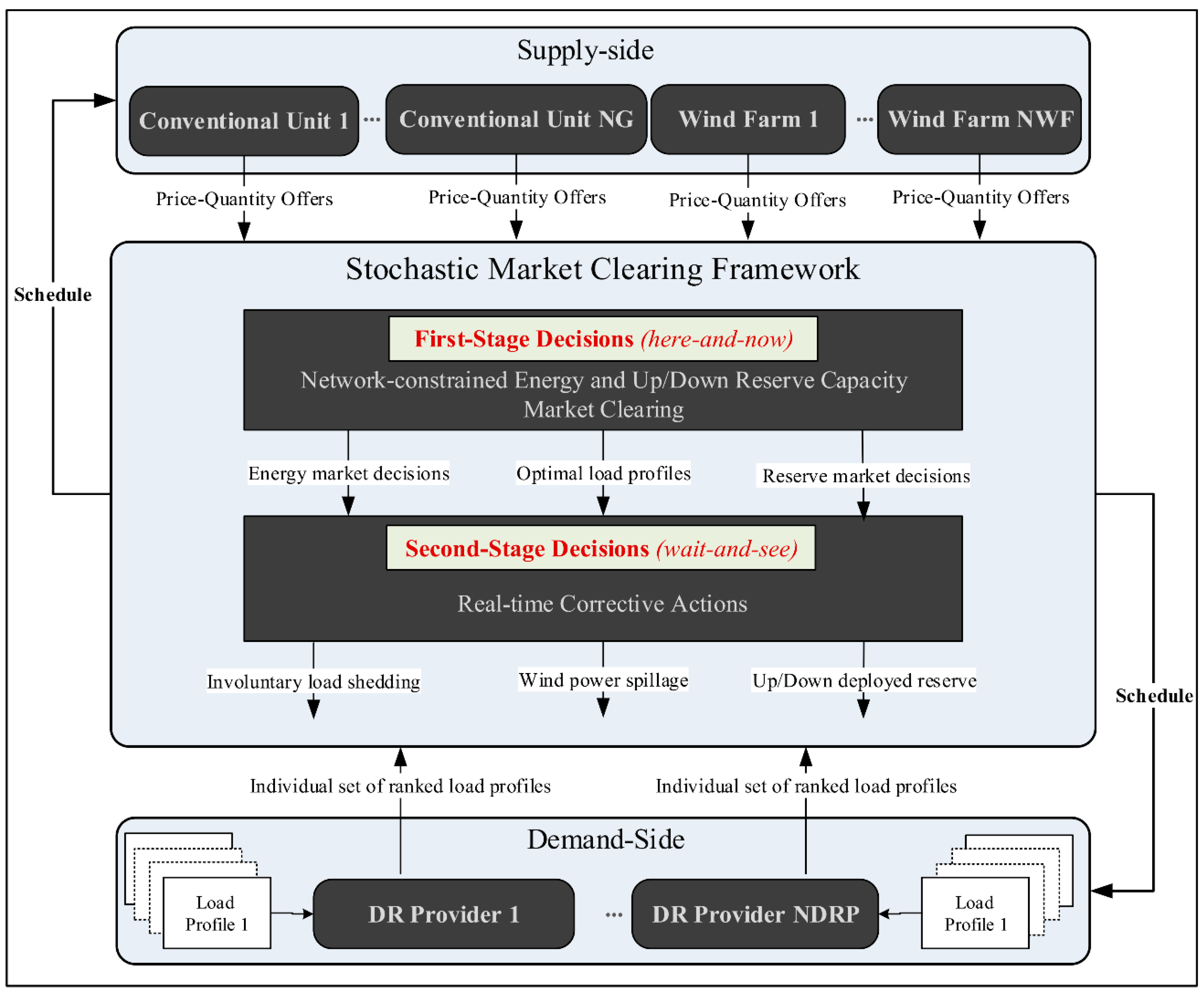

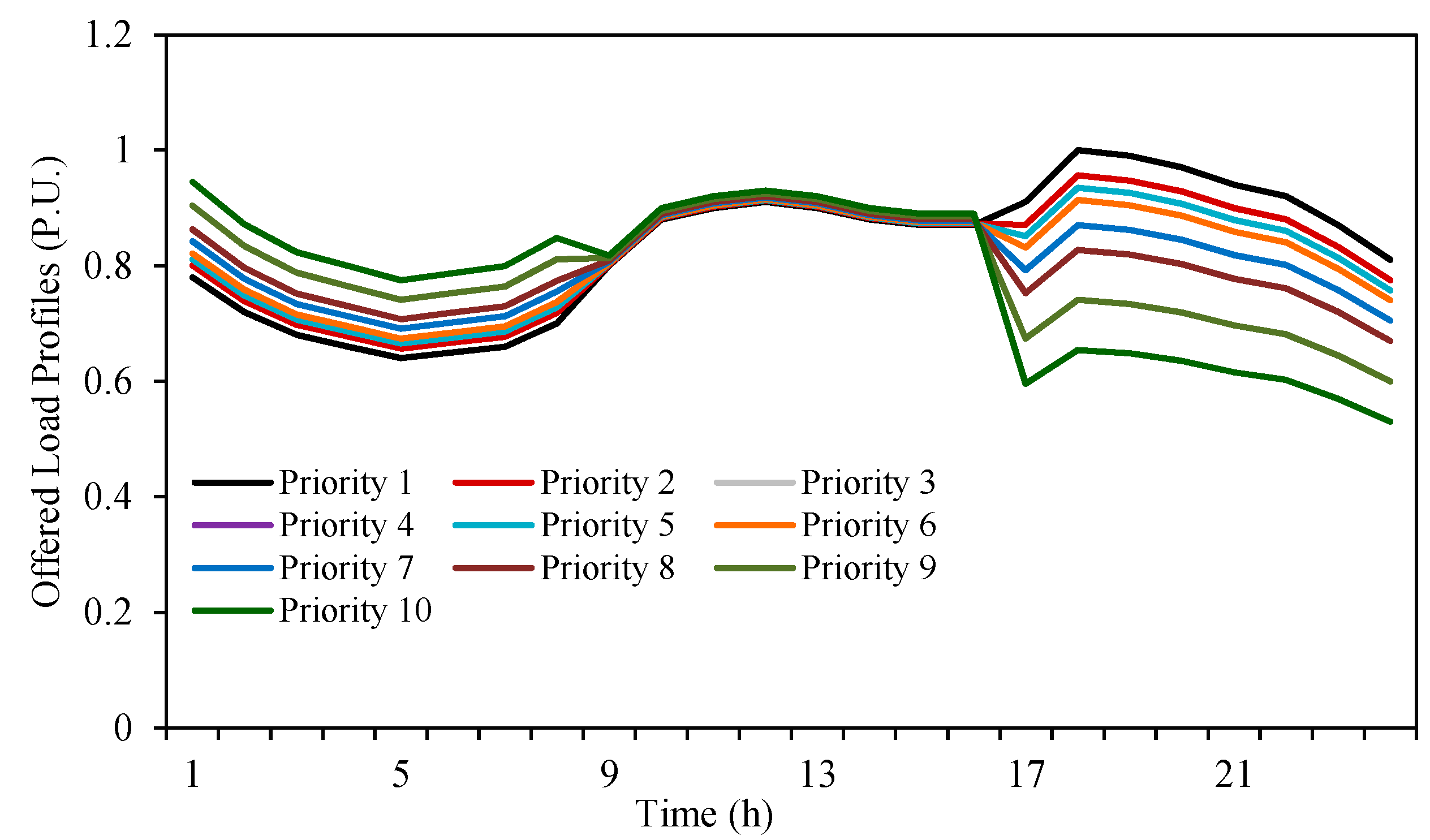

2. ADR Scheme Modeling

3. Multi-Objective Decision-Making Framework

3.1. Objective Functions

3.2. Solution Methodology

3.3. Constraints

4. Numerical Studies

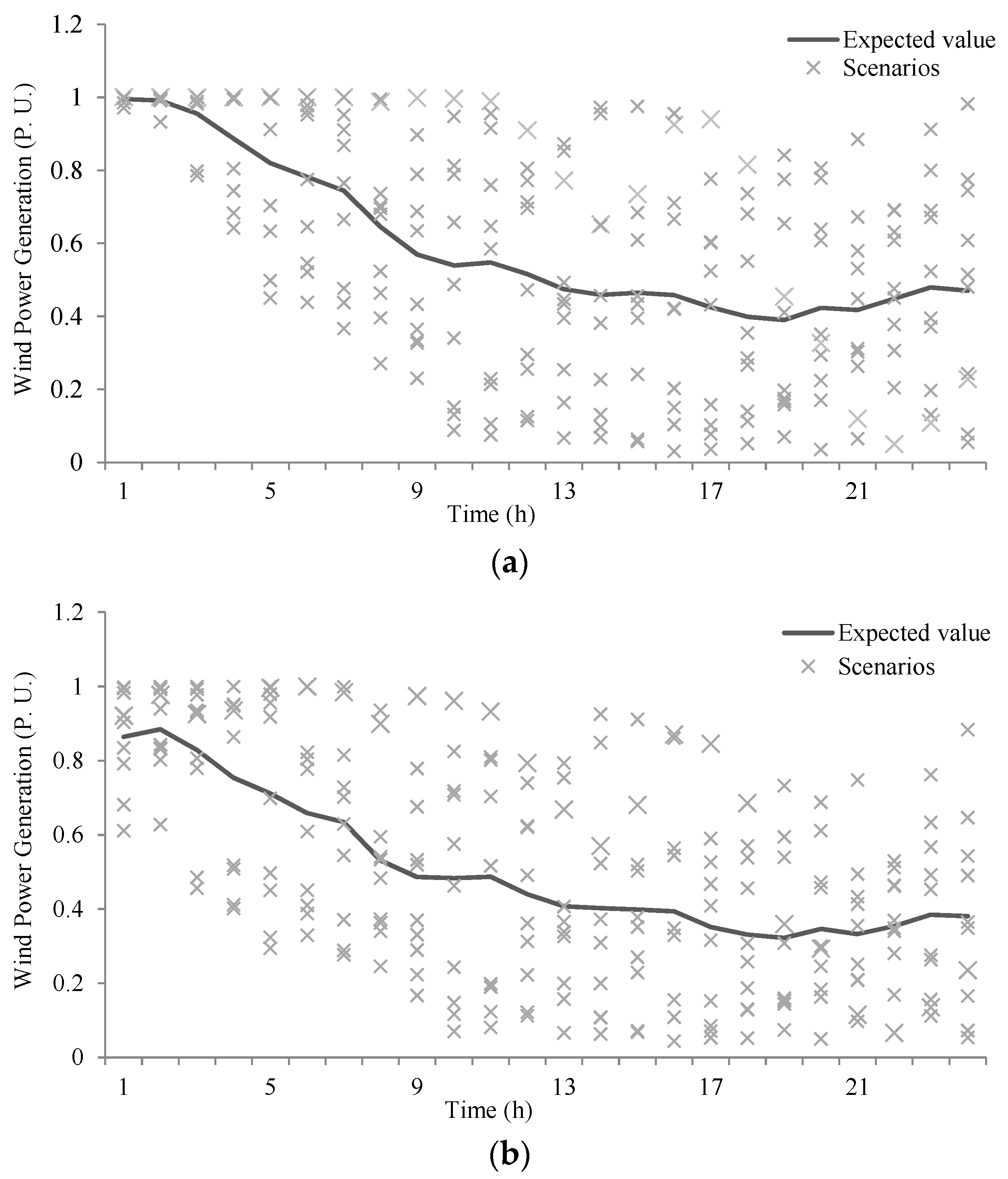

4.1. Input Data Description and Specification

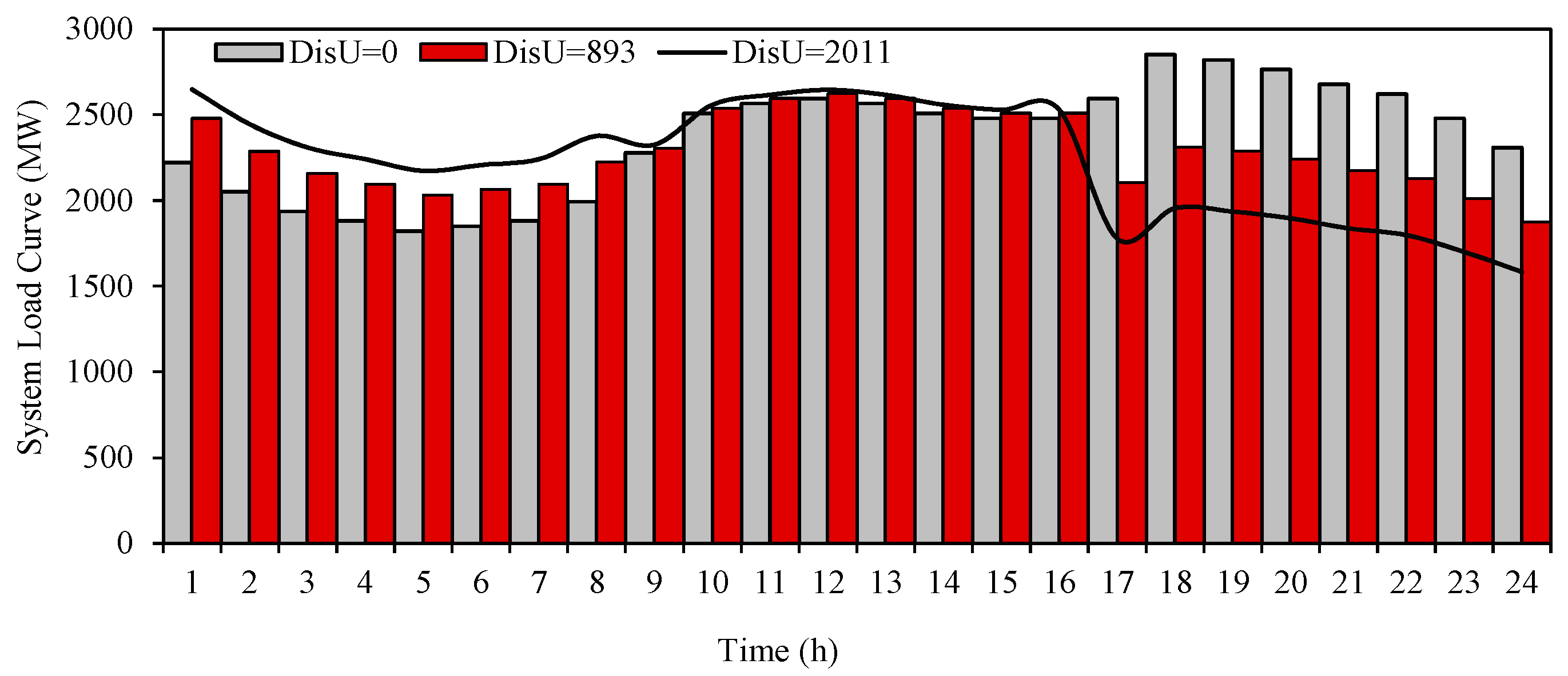

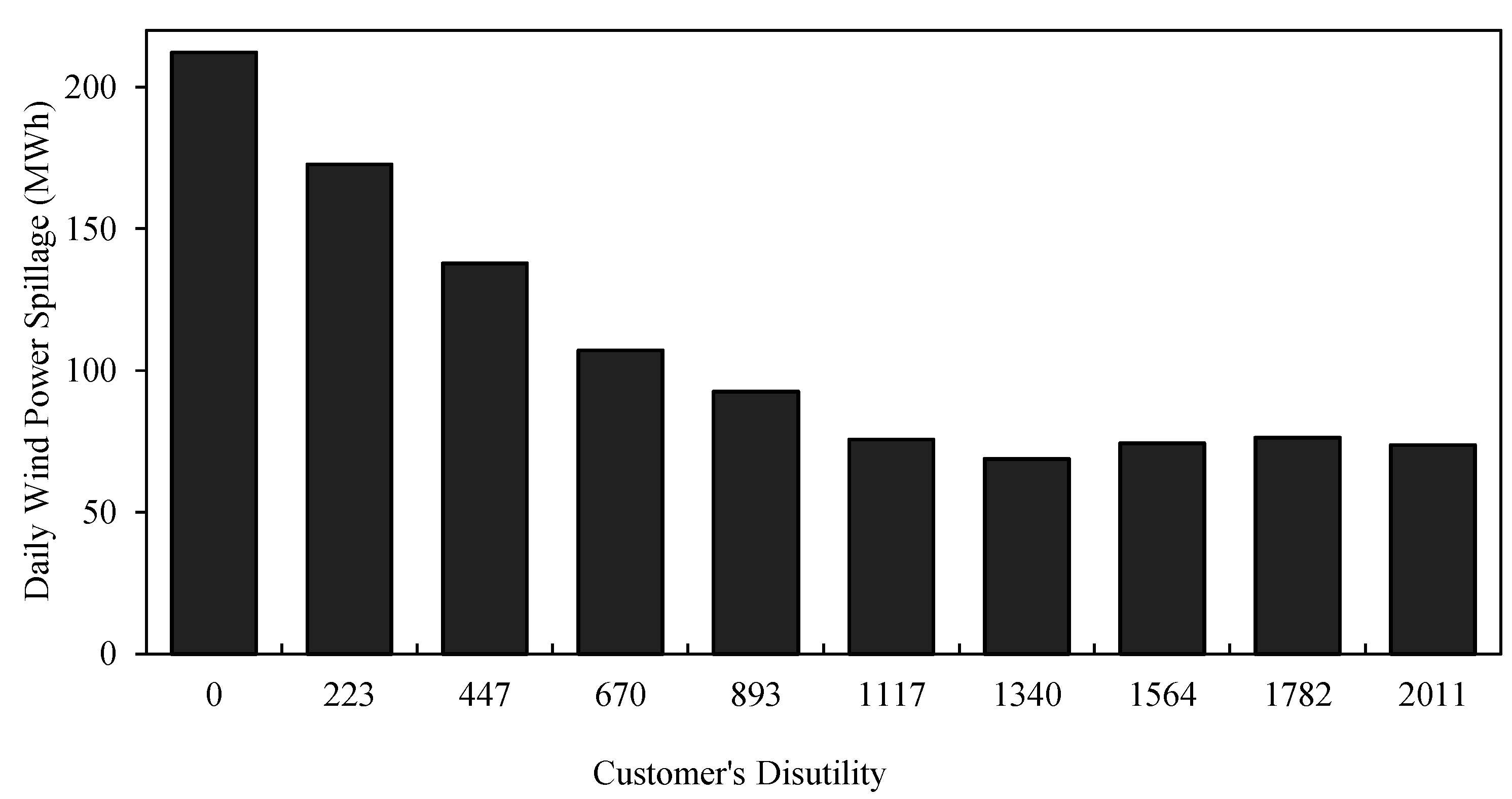

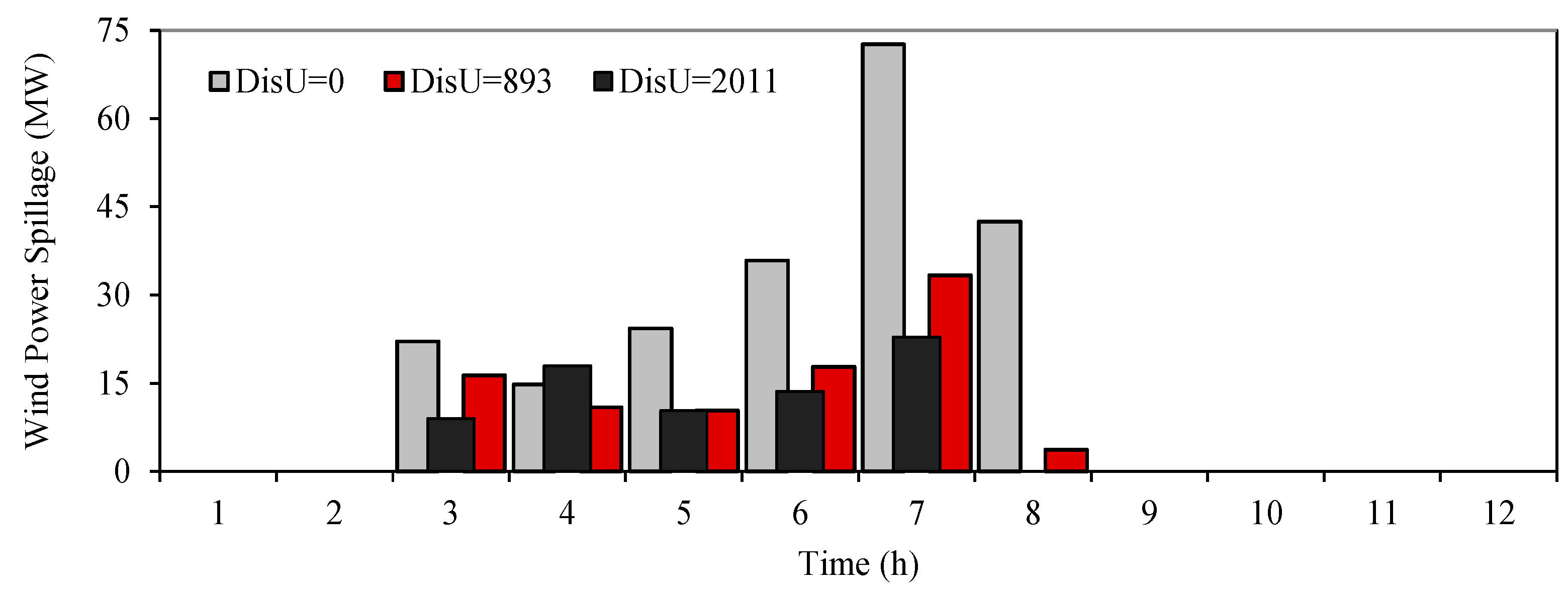

4.2. Simulation Results and Discussions

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

Nomenclature

| Indices | |

| System buses | |

| Conventional units | |

| DR providers | |

| Loads | |

| Transmission lines | |

| Number of wind farms | |

| Time periods | |

| Number of different scenarios | |

| Segment for linearized fuel cost | |

| Candidate load profiles | |

| Parameters | |

| Offered energy cost of conventional units | |

| Up/down capacity reserve cost of conventional units | |

| Up/down deployed reserve cost of conventional units | |

| Cost of wind spillage | |

| Minimum production cost of generation units | |

| Start-up cost of generation units | |

| Maximum/minimum output of units | |

| Ramp up/down constraints of units | |

| Minimum up/down time of generation units | |

| Startup/shutdown ramp rate limit for units | |

| Forecasted wind generation of wind farms | |

| Real-time wind generation of wind farms | |

| Initial candidate load profiles submitted by DR providers | |

| Load profile rank of DR providers | |

| Value of lost load j at time t | |

| Reactance of power transmission line l | |

| Maximum capacity of power transmission line l | |

| Probability of occurrence of scenario | |

| Variables | |

| Binary on/off status indicator of units | |

| Start-up cost of conventional units | |

| Binary indicator of selected load profile of DR providers | |

| Scheduled up/down reserve capacity of units | |

| Individual final selected load profiles of DR providers | |

| Generation of segment m in linearized fuel cost curve | |

| Power flow through transmission line l | |

| Load shedding of load j | |

| Voltage angle at bus b | |

| Scheduled wind power of wind farms | |

| Wind power spillage of wind farms | |

| Real-time power generation of units | |

| Deployed up/down spinning reserve of units | |

References

- Albadi, M.H.; El-Saadany, E.F. A summary of demand response in electricity markets. Elecr. Power Syst. Res. 2008, 78, 1989–1996. [Google Scholar] [CrossRef]

- Hajibandeh, N.; Ehsan, M.; Soleymani, S.; Shafie-khah, M.; Catalao, J.P. The Mutual Impact of Demand Response Programs and Renewable Energies: A Survey. Energies 2017, 10, 1353. [Google Scholar] [CrossRef]

- Hajibandeh, N.; Shafie-khah, M.; Osório, G.J.; Catalão, J.P. A New Approach for Market Power Detection in Renewable-based Electricity Markets. In Proceedings of the 17th International Conference IEEE EEEIC, Milan, Italy, 6–9 June 2017. [Google Scholar]

- Durvasulu, V.; Hansen, T.M. Benefits of a Demand Response Exchange Participating in Existing Bulk-Power Markets. Energies 2018, 11, 3361. [Google Scholar] [CrossRef]

- Nguyen, D.T.; Negnevitsky, M.; de Groot, M. Walrasian market clearing for demand. IEEE Trans. Power Syst. 2012, 27, 535–544. [Google Scholar] [CrossRef]

- Reiss, P.C. Household Electricity Demand, Revisited. Rev. Econ. Stud. 2005, 72, 853–883. [Google Scholar] [CrossRef]

- Xu, Y.; Milanovic, J.V. Day-Ahead Prediction and Shaping of Dynamic Response of Demand at Bulk Supply Points. IEEE Trans. Power Syst. 2016, 31, 3100–3108. [Google Scholar] [CrossRef]

- Rassaei, F.; Soh, W.; Chua, K. Distributed Scalable Autonomous Market-Based Demand Response via Residential Plug-In Electric Vehicles in Smart Grids. IEEE Trans. Smart Grid 2018, 9, 3281–3290. [Google Scholar] [CrossRef]

- Siano, P. Demand response and smart grids—A survey. Renew. Sustain. Energy Rev. 2014, 30, 461–478. [Google Scholar] [CrossRef]

- Boßmann, T.; Eser, E.J. Model-based assessment of demand-response measures—A comprehensive literature review. Renew. Sustain. Energy Rev. 2016, 57, 1637–1656. [Google Scholar] [CrossRef]

- Hajibandeh, N.; Shafie-khah, M.; Osório, G.J.; Aghaei, J.; Catalão, J.P.S. A heuristic multi-objective multi-criteria demand response planning in a system with high penetration of wind power generators. Appl. Energy 2018, 212, 721–732. [Google Scholar] [CrossRef]

- Hu, Q.; Li, F.; Fang, X.; Bai, L. A Framework of Residential Demand Aggregation with Financial Incentives. IEEE Trans. Smart Grid 2018, 9, 497–505. [Google Scholar] [CrossRef]

- Aalami, H.A.; Moghaddam, M.P.; Yousefi, G.R. Demand response modeling considering interruptible/curtailable loads and capacity market programs. Appl. Energy 2010, 87, 243–250. [Google Scholar] [CrossRef]

- Aalami, H.A.; Moghaddam, M.P.; Yousefi, G.R. Modeling and prioritizing demand response programs in power markets. Electr. Power Syst. Res. 2010, 80, 426–435. [Google Scholar] [CrossRef]

- Moghaddam, M.P.; Abdollahi, A.; Rashidinejad, M. Flexible demand response programs modeling in competitive electricity markets. Appl. Energy 2011, 88, 3257–3269. [Google Scholar] [CrossRef]

- Aghaei, J.; Alizadeh, M.I.; Siano, P.; Heidari, A. Contribution of emergency demand response programs in power system reliability. Energy 2016, 103, 688–696. [Google Scholar] [CrossRef]

- Aalami, H.A.; Moghaddam, M.P.; Yousefi, G.R. Evaluation of nonlinear models for time-based rates demand response programs. Int. J. Electr. Power Energy Syst. 2015, 65, 282–290. [Google Scholar] [CrossRef]

- Rahmani-andebili, M. Investigating effects of responsive loads models on unit commitment collaborated with demand-side resource. IET Gener. Transm. Distrib. 2013, 7, 420–430. [Google Scholar] [CrossRef]

- Sarker, M.R.; Ortega-Vazquez, M.A.; Kirschen, D.S. Optimal coordination and scheduling of demand response via monetary incentives. IEEE Trans. Smart Grid 2015, 6, 1341–1352. [Google Scholar] [CrossRef]

- Li, N.; Chen, L.; Dahleh, M.A. Demand response using linear supply function bidding. IEEE Trans. Smart Grid 2015, 6, 1827–1838. [Google Scholar] [CrossRef]

- Nguyen, H.T.; Le, L.B.; Wang, Z. A Bidding Strategy for Virtual Power Plants with Intraday Demand Response Exchange Market Using Stochastic Programming. IEEE Trans. Ind. Appl. 2018, 54, 3044–3055. [Google Scholar] [CrossRef]

- Parvania, M.; Fotuhi-Firuzabad, M. Integrating load reduction into wholesale energy market with application to wind power integration. IEEE Syst. J. 2012, 6, 35–45. [Google Scholar] [CrossRef]

- Kwag, H.G.; Kim, J.O. Optimal combined scheduling of generation and demand response with demand resource constraints. Appl. Energy 2012, 96, 161–170. [Google Scholar] [CrossRef]

- Mahmoudi, N.; Heydarian-Forushani, E.; Shafie-khah, M.; Saha, T.K.; Golshan, M.E.H.; Siano, P. A bottom-up approach for demand response aggregators’ participation in electricity markets. Electr. Power Syst. Res. 2017, 143, 121–129. [Google Scholar] [CrossRef]

- Zhao, C.; Wang, J.; Watson, J.P.; Guan, Y. Multi-stage robust unit commitment considering wind and demand response uncertainties. IEEE Trans. Power Syst. 2013, 28, 2708–2717. [Google Scholar] [CrossRef]

- Ming, H.; Xie, L.; Campi, M.; Garatti, S.; Kumar, P.R. Scenario-based Economic Dispatch with Uncertain Demand Response. IEEE Trans. Smart Grid 2017. [Google Scholar] [CrossRef]

- Wu, H.; Shahidehpour, M.; Alabdulwahab, A.; Abusorrah, A. Demand response exchange in the stochastic day-ahead scheduling with variable renewable generation. IEEE Trans. Sustain. Energy 2015, 6, 516–525. [Google Scholar] [CrossRef]

- Kwag, H.G.; Kim, J.O. Reliability modeling of demand response considering uncertainty of customer behavior. Appl. Energy 2014, 122, 24–33. [Google Scholar] [CrossRef]

- Hajibandeh, N.; Shafie-khah, M.; Talari, S.; Catalão, J. The Impacts of Demand Response on the Efficiency of Energy Markets in Presence of Wind. In Farms 8th Advanced Doctoral Conference on Computing, Electrical and Industrial Systems; Springer: Cham, Switzerland, 2017; pp. 287–296. [Google Scholar]

- Heydarian-Forushani, E.; Golshan, M.E.H.; Siano, P. Evaluating the Operational Flexibility of Generation Mixture with an Innovative Techno-Economic Measure. IEEE Trans. Power Syst. 2018, 33, 2205–2218. [Google Scholar] [CrossRef]

- Mnatsakanyan, A.; Kennedy, S.W. A novel demand response model with an application for a virtual power plant. IEEE Trans. Smart Grid 2015, 6, 230–237. [Google Scholar] [CrossRef]

- Praktiknjo, A. The Value of Lost Load for Sectoral Load Shedding Measures: The German Case with 51 Sectors. Energies 2016, 9, 116. [Google Scholar] [CrossRef]

- Aghaei, J.; Alizadeh, M.I. Multiobjective self-scheduling of CHP-based microgrids considering demand response programs and ESSs. Energy 2013, 55, 1044–1054. [Google Scholar] [CrossRef]

- Mohseni-Bonab, S.M.; Rabiee, A.; Mohammadi-Ivatloo, B. Voltage stability constrained multi-objective optimal reactive power dispatch under load and wind power uncertainties: A stochastic approach. Renew. Energy 2016, 85, 598–609. [Google Scholar] [CrossRef]

- Bouri, E.; Assad, J.E. The Lebanese Electricity Woes: An Estimation of the Economical Costs of Power Interruptions. Energies 2016, 9, 583. [Google Scholar] [CrossRef]

- Oh, H. Demand-Side Management with a State Space Consideration. Energies 2018, 11, 2444. [Google Scholar] [CrossRef]

- Reliability Test System Task Force. The IEEE reliability test system—1996. IEEE Trans. Power Syst. 1999, 14, 1010–1020. [Google Scholar]

- Morales, J.M.; Conejo, A.J.; Pérez-Ruiz, J. Short-term trading for a wind power producer. IEEE Trans. Power Syst. 2010, 25, 554–564. [Google Scholar] [CrossRef]

- Ippolito, L.; Loia, V.; Siano, P. Extended fuzzy C-means and genetic algorithms to optimize power flow management in hybrid electric vehicles. Fuzzy Optim. Decis. Mak. 2003, 2, 359–374. [Google Scholar] [CrossRef]

- GAMS—A User’s Guide. Available online: http://www.gams.com/dd/docs/bigdocs/GAMSUsersGuide.pdf (accessed on 1 October 2018).

| Customer’s Disutility = 0 | ||||||||||||||||||||||||

| Unit No. | Hours (1–24) | |||||||||||||||||||||||

| 1–9 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 10–13 | 1 | 1 | 1 | 0 | 0 | 0 | 0 | 0 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| 14–16 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 0 |

| 17–26 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| Customer’s Disutility = 2011 | ||||||||||||||||||||||||

| Unit No. | Hours (1–24) | |||||||||||||||||||||||

| 1–9 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 10–13 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 14–16 | 1 | 1 | 1 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 17–26 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| Obtained Results | Customer Responsiveness Level | ||

|---|---|---|---|

| 0% | 20% | 40% | |

| Operation Cost ($) | 545,992 | 520,966 | 499,407 |

| Daily Wind Spillage (MWh) | 212.2 | 163.9 | 116.2 |

| Conventional Units Ramping (MW) | 5079.5 | 4894.2 | 4878.9 |

| Startup Number of Conventional Units | 14 | 6 | 1 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hajibandeh, N.; Shafie-khah, M.; Badakhshan, S.; Aghaei, J.; Mariano, S.J.P.S.; Catalão, J.P.S. Multi-Objective Market Clearing Model with an Autonomous Demand Response Scheme. Energies 2019, 12, 1261. https://doi.org/10.3390/en12071261

Hajibandeh N, Shafie-khah M, Badakhshan S, Aghaei J, Mariano SJPS, Catalão JPS. Multi-Objective Market Clearing Model with an Autonomous Demand Response Scheme. Energies. 2019; 12(7):1261. https://doi.org/10.3390/en12071261

Chicago/Turabian StyleHajibandeh, Neda, Miadreza Shafie-khah, Sobhan Badakhshan, Jamshid Aghaei, Sílvio J. P. S. Mariano, and João P. S. Catalão. 2019. "Multi-Objective Market Clearing Model with an Autonomous Demand Response Scheme" Energies 12, no. 7: 1261. https://doi.org/10.3390/en12071261

APA StyleHajibandeh, N., Shafie-khah, M., Badakhshan, S., Aghaei, J., Mariano, S. J. P. S., & Catalão, J. P. S. (2019). Multi-Objective Market Clearing Model with an Autonomous Demand Response Scheme. Energies, 12(7), 1261. https://doi.org/10.3390/en12071261