The Oil Market Reactions to OPEC’s Announcements

Abstract

1. Introduction

2. Research Hypothesis

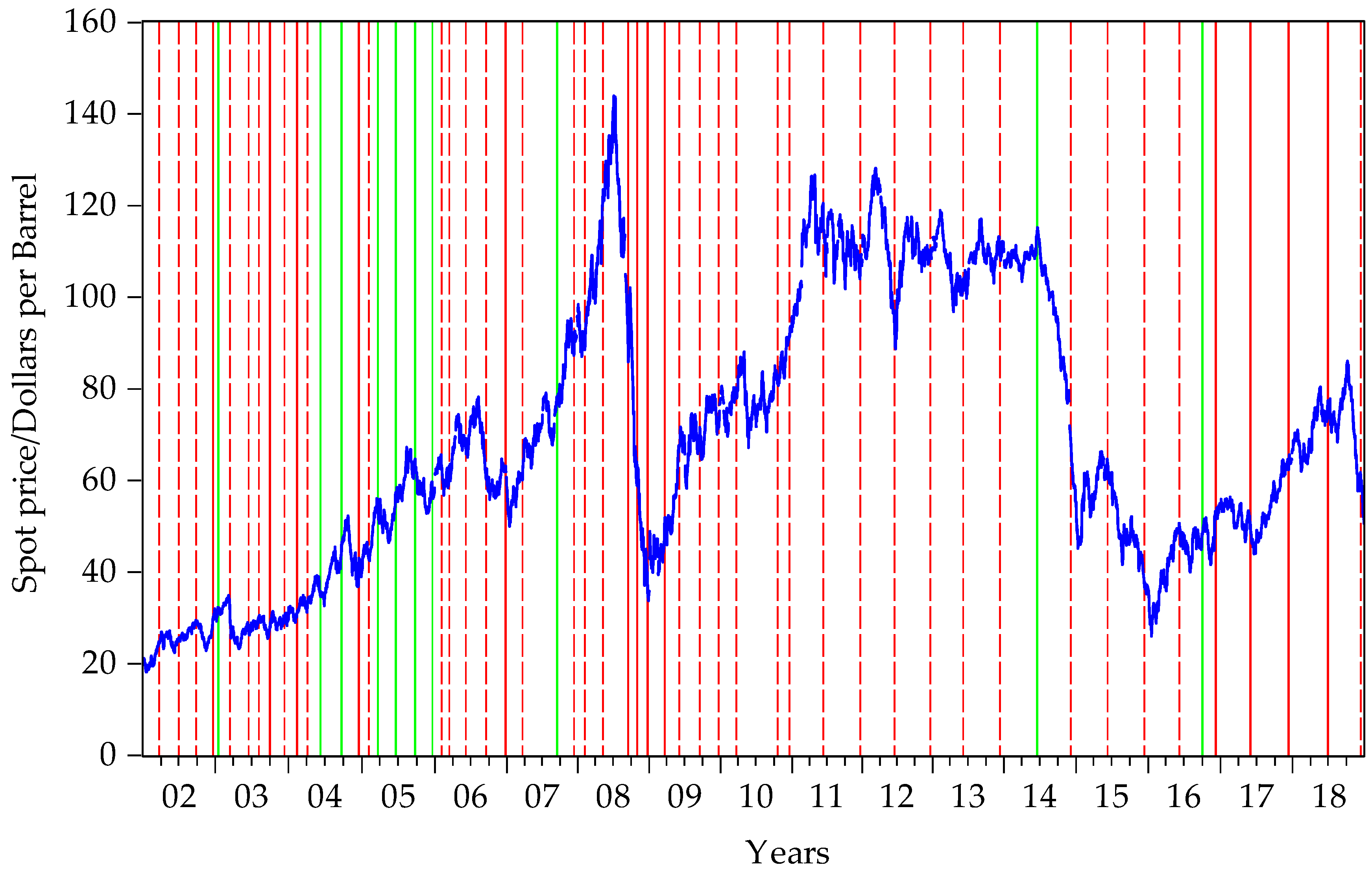

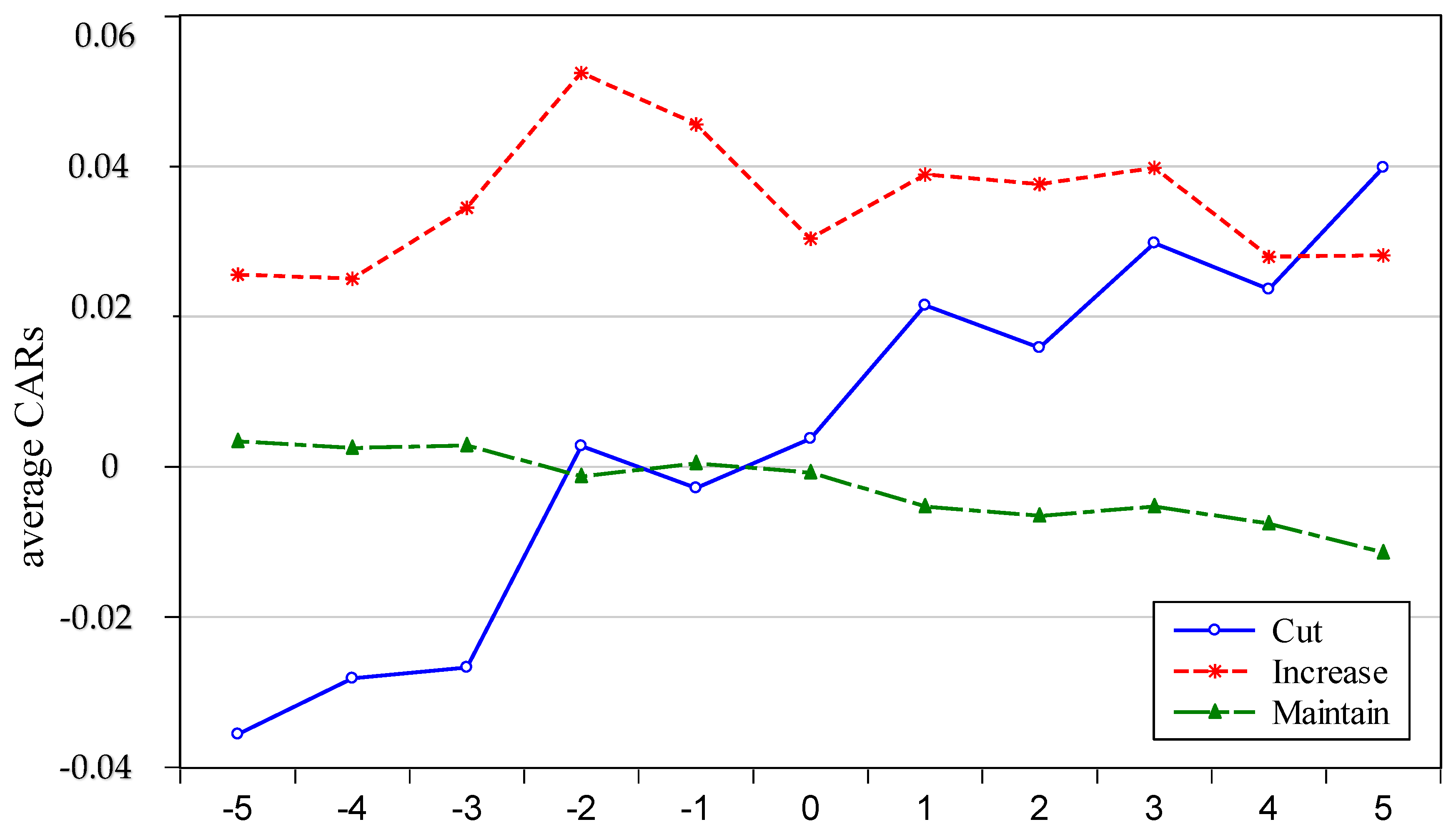

3. The Oil Price Reactions to OPEC’s Announcements

3.1. Event Study Methodology

3.2. The Reaction of Oil Price to Announcements

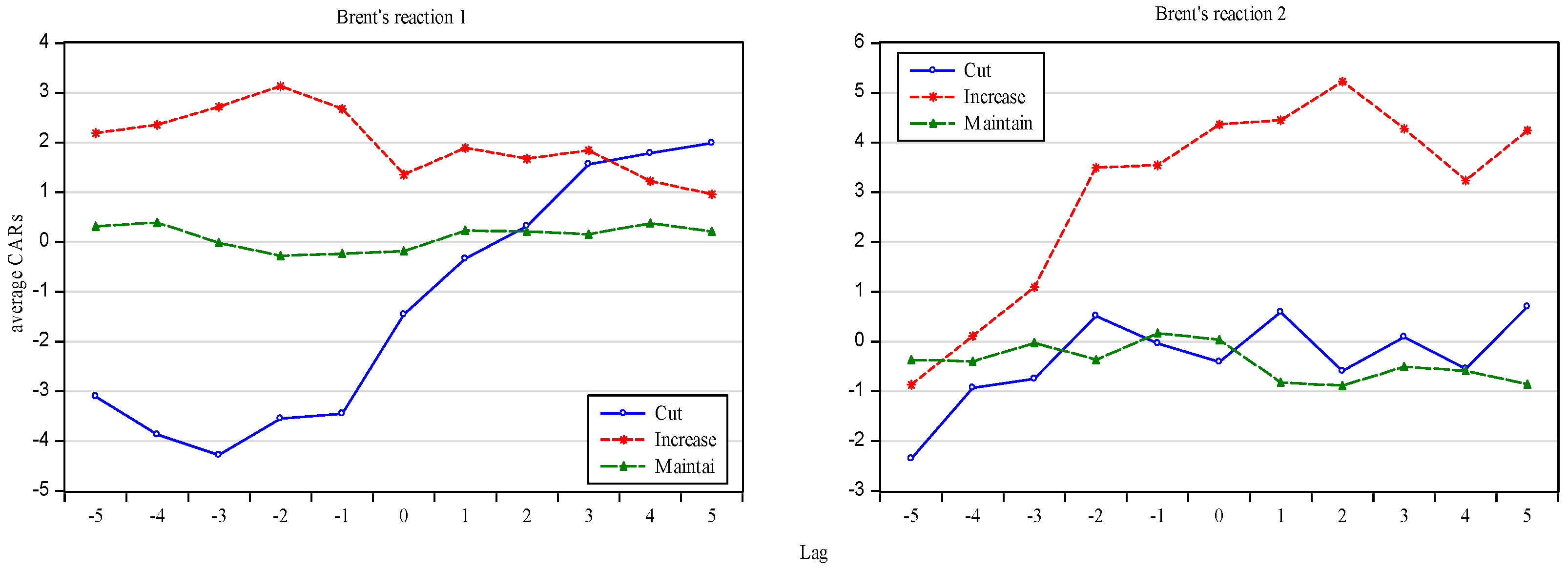

4. The Oil Risk Reactions to OPEC’s Announcements

4.1. Linear Model Specification

4.2. The Reactions of Oil Risks to Announcements

5. Conclusions and Policy Implications

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Brown, S.P.; Huntington, H.G. OPEC and world oil security. Energy Policy 2017, 108, 512–523. [Google Scholar] [CrossRef]

- Gkillas, K.; Gupta, R.; Wohar, M.E. Volatility jumps: The role of geopolitical risks. Financ. Res. Lett. 2018, 27, 247–258. [Google Scholar] [CrossRef]

- Loutia, A.; Mellios, C.; Andriosopoulos, K. Do OPEC announcements influence oil prices? Energy Policy 2016, 90, 262–272. [Google Scholar] [CrossRef]

- Liao, G.; Li, Z.; Du, Z.; Liu, Y. The Heterogeneous Interconnections between Supply or Demand Side and Oil Risks. Energies 2019, 12, 2226. [Google Scholar] [CrossRef]

- Balcilar, M.; Ozdemir, Z.A. The nexus between the oil price and its volatility risk in a stochastic volatility in the mean model with time-varying parameters. Resour. Policy 2019, 61, 572–584. [Google Scholar] [CrossRef]

- Chen, H.; Liao, H.; Tang, B.J.; Wei, Y.M. Impacts of OPEC’s political risk on the international crude oil prices: An empirical analysis based on the SVAR models. Energy Econ. 2016, 57, 42–49. [Google Scholar] [CrossRef]

- Draper, D.W. The behavior of event-related returns on oil futures contracts. J. Futures Mark. 1984, 4, 125. [Google Scholar] [CrossRef]

- Liu, L.X.; Shu, H.; Wei, K.J. The impacts of political uncertainty on asset prices: Evidence from the Bo scandal in China. J. Financ. Econ. 2017, 125, 286–310. [Google Scholar] [CrossRef]

- Weisbrod, E. Stockholders’ Unrealized Returns and the Market Reaction to Financial Disclosures. J. Financ. 2019, 74, 899–942. [Google Scholar] [CrossRef]

- Kurov, A.; Stan, R. Monetary policy uncertainty and the market reaction to macroeconomic news. J. Bank. Financ. 2018, 86, 127–142. [Google Scholar] [CrossRef]

- Benkraiem, R.; Lahiani, A.; Miloudi, A.; Shahbaz, M. New insights into the US stock market reactions to energy price shocks. J. Int. Financ. Mark. Inst. Money 2018, 56, 169–187. [Google Scholar] [CrossRef]

- Val, F.D.F.; Klotzle, M.C.; Pinto, A.C.F.; Barbedo, C.H.D.S. Stock market reaction to monetary policy: An event study analysis of the Brazilian case. Emerg. Mark. Financ. Trade 2018, 54, 2577–2595. [Google Scholar] [CrossRef]

- Ji, Q.; Guo, J.F. Oil price volatility and oil-related events: An Internet concern study perspective. Appl. Energy 2015, 137, 256–264. [Google Scholar] [CrossRef]

- Wang, J.; Wang, J. Forecasting energy market indices with recurrent neural networks: Case study of crude oil price fluctuations. Energy 2016, 102, 365–374. [Google Scholar] [CrossRef]

- Bloch, H.; Rafiq, S.; Salim, R. Economic growth with coal, oil and renewable energy consumption in China: Prospects for fuel substitution. Econ. Model. 2015, 44, 104–115. [Google Scholar] [CrossRef]

- Cunado, J.; Jo, S.; de Gracia, F.P. Macroeconomic impacts of oil price shocks in Asian economies. Energy Policy 2015, 86, 867–879. [Google Scholar] [CrossRef]

- Phan, D.H.B.; Sharma, S.S.; Narayan, P.K. Oil price and stock returns of consumers and producers of crude oil. J. Int. Financ. Mark. Inst. Money 2015, 34, 245–262. [Google Scholar] [CrossRef]

- Dai, Y.H.; Xie, W.J.; Jiang, Z.Q.; Jiang, G.J.; Zhou, W.X. Correlation structure and principal components in the global crude oil market. Empir. Econ. 2016, 51, 1501–1519. [Google Scholar] [CrossRef]

- Mertzanis, C. Complexity, big data and financial stability. Quant. Financ. Econ. 2018, 2, 637–660. [Google Scholar] [CrossRef]

- Bildirici, M.E.; Badur, M.M. The effects of oil prices on confidence and stock return in China, India and Russia. Quant. Financ. Econ 2018, 2, 884–903. [Google Scholar] [CrossRef]

- Fattouh, B.; Mahadeva, L. OPEC: What difference has it made? Annu. Rev. Resour. Econ 2013, 5, 427–443. [Google Scholar] [CrossRef]

- Mănescu, C.B.; Nuño, G. Quantitative effects of the shale oil revolution. Energy Policy 2015, 86, 855–866. [Google Scholar] [CrossRef]

- Klein, T. Trends and contagion in WTI and Brent crude oil spot and futures markets-The role of OPEC in the last decade. Energy Econ. 2018, 75, 636–646. [Google Scholar] [CrossRef]

- Wirl, F.; Kujundzic, A. The impact of OPEC Conference outcomes on world oil prices 1984–2001. Energy J. 2004, 25, 45–62. [Google Scholar] [CrossRef]

- Genc, T.S. OPEC and demand response to crude oil prices. Energy Econ. 2017, 66, 238–246. [Google Scholar] [CrossRef][Green Version]

- Schmidbauer, H.; Rösch, A. OPEC news announcements: Effects on oil price expectation and volatility. Energy Econ. 2012, 34, 1656–1663. [Google Scholar] [CrossRef]

- Mensi, W.; Hammoudeh, S.; Yoon, S.M. How do OPEC news and structural breaks impact returns and volatility in crude oil markets? Further evidence from a long memory process. Energy Econ. 2014, 42, 343–354. [Google Scholar] [CrossRef]

- Pierru, A.; Smith, J.L.; Zamrik, T. OPEC’s Impact on Oil Price Volatility: The Role of Spare Capacity. Energy J. 2018, 39, 103–122. [Google Scholar] [CrossRef]

- Lin, S.X.; Tamvakis, M. OPEC announcements and their effects on crude oil prices. Energy Policy 2010, 38, 1010–1016. [Google Scholar] [CrossRef]

- Baumeister, C.; Kilian, L. Forty years of oil price fluctuations: Why the price of oil may still surprise us. J. Econ. Perspect. 2016, 30, 139–160. [Google Scholar] [CrossRef]

- Hong, Y.; Liu, Y.; Wang, S. Granger causality in risk and detection of extreme risk spillover between financial markets. J. Econ. 2009, 150, 271–287. [Google Scholar] [CrossRef]

- Wen, D.; Wang, G.J.; Ma, C.; Wang, Y. Risk spillovers between oil and stock markets: A VAR for VaR analysis. Energy Econ. 2019, 80, 524–535. [Google Scholar] [CrossRef]

- Juvenal, L.; Petrella, I. Speculation in the oil market. J. Appl. Econ. 2015, 30, 621–649. [Google Scholar] [CrossRef]

- Zhang, Y.J.; Zhang, L. Interpreting the crude oil price movements: Evidence from the Markov regime switching model. Appl. Energy 2015, 143, 96–109. [Google Scholar] [CrossRef]

- Gallo, A.; Mason, P.; Shapiro, S.; Fabritius, M. What is behind the increase in oil prices? Analyzing oil consumption and supply relationship with oil price. Energy 2010, 35, 4126–4141. [Google Scholar] [CrossRef]

- Li, Z.; Dong, H.; Huang, Z.; Failler, P. Impact of Foreign Direct Investment on Environmental Performance. Sustainability 2019, 11, 3538. [Google Scholar] [CrossRef]

- MacKinlay, A.C. Event studies in economics and finance. J. Econ. Lit. 1997, 35, 13–39. [Google Scholar]

- Al Rousan, S.; Sbia, R.; Tas, B.K.O. A dynamic network analysis of the world oil market: Analysis of OPEC and non-OPEC members. Energy Econ. 2018, 75, 28–41. [Google Scholar] [CrossRef]

- Ghassan, H.B.; AlHajhoj, H.R. Long run dynamic volatilities between OPEC and non-OPEC crude oil prices. Appl. Energy 2016, 169, 384–394. [Google Scholar] [CrossRef]

- Kisswani, K.M. Does OPEC act as a cartel? Empirical investigation of coordination behavior. Energy Policy 2016, 97, 171–180. [Google Scholar] [CrossRef]

- Tsai, C.L. How do US stock returns respond differently to oil price shocks pre-crisis, within the financial crisis, and post-crisis? Energy Econ. 2015, 50, 47–62. [Google Scholar] [CrossRef]

- Bampinas, G.; Panagiotidis, T. On the relationship between oil and gold before and after financial crisis: Linear, nonlinear and time-varying causality testing. Stud. Nonlinear Dyn. Econ. 2015, 19, 657–668. [Google Scholar] [CrossRef]

- Bouri, E. Return and volatility linkages between oil prices and the Lebanese stock market in crisis periods. Energy 2015, 89, 365–371. [Google Scholar] [CrossRef]

- Chen, Z.M.; Wang, L.; Zhang, X.B.; Zheng, X. The co-movement and asymmetry between energy and grain prices: Evidence from the crude oil and corn markets. Energies 2019, 12, 1373. [Google Scholar] [CrossRef]

- Dičpinigaitienė, V.; Novickytė, L. Application of systemic risk measurement methods: A systematic review and meta-analysis using a network approach. Quant. Financ. Econ. 2018, 2, 798–820. [Google Scholar] [CrossRef]

- Ferraty, F.; Quintela-Del-Río, A. Conditional VAR and Expected Shortfall: A New Functional Approach. Econ. Rev. 2016, 35, 263–292. [Google Scholar] [CrossRef]

- Jacobs, M., Jr.; Sensenbrenner, F.J. A comparison of methodologies in the stress testing of credit risk–alternative scenario and dependency constructs. Quant. Financ. Econ. 2018, 2, 294–324. [Google Scholar] [CrossRef]

- Righi, M.B.; Borenstein, D. A simulation comparison of risk measures for portfolio optimization. Financ. Res. Lett. 2018, 24, 105–112. [Google Scholar] [CrossRef]

- Li, Z.H.; Dong, H.; Huang, Z.H.; Failler, P. Asymmetric Effects on Risks of Virtual Financial Assets (VFAs) in different regimes: A Case of Bitcoin. Quant. Financ. Econ. 2018, 2, 860–883. [Google Scholar] [CrossRef]

- Dong, H.; Liu, Y.; Chang, J.Q. The heterogeneous linkage of economic policy uncertainty and oil return risks. Green Financ. 2019, 1, 46–66. [Google Scholar] [CrossRef]

- Gong, X.; Wen, F.; Xia, X.H.; Huang, J.; Pan, B. Investigating the risk-return trade-off for crude oil futures using high-frequency data. Appl. Energy 2017, 196, 152–161. [Google Scholar] [CrossRef]

- Engle, R.F.; Manganelli, S. CAViaR: Conditional Autoregressive Value at Risk by Regression Quantiles. J. Bus. Econ. Stat. 2004, 22, 367–381. [Google Scholar] [CrossRef]

- Behrouzifar, M.; Araghi, E.S.; Meibodi, A.E. OPEC behavior: The volume of oil reserves announced. Energy Policy 2019, 127, 500–522. [Google Scholar] [CrossRef]

- Huang, Z.; Liao, G.; Li, Z. Loaning scale and government subsidy for promoting green innovation. Technol. Forecast. Soc. Chang. 2019, 144, 148–156. [Google Scholar] [CrossRef]

- Gupta, R.; Yoon, S.M. OPEC news and predictability of oil futures returns and volatility: Evidence from a nonparametric causality-in-quantiles approach. N. Am. J. Econ. Financ. 2018, 45, 206–214. [Google Scholar] [CrossRef]

- Li, Z.; Liao, G.; Wang, Z.; Huang, Z. Green loan and subsidy for promoting clean production innovation. J. Clean Prod. 2018, 187, 421–431. [Google Scholar] [CrossRef]

- Behar, A.; Ritz, R.A. OPEC vs US shale: Analyzing the shift to a market-share strategy. Energy Econ. 2017, 63, 185–198. [Google Scholar] [CrossRef]

- Golombek, R.; Irarrazabal, A.A.; Ma, L. OPEC’s market power: An empirical dominant firm model for the oil market. Energy Econ. 2018, 70, 98–115. [Google Scholar] [CrossRef]

- Ghoddusi, H.; Nili, M.; Rastad, M. On quota violations of OPEC members. Energy Econ. 2017, 68, 410–422. [Google Scholar] [CrossRef]

- Liu, B.Y.; Ji, Q.; Fan, Y. Dynamic return-volatility dependence and risk measure of CoVaR in the oil market: A time-varying mixed copula model. Energy Econ. 2017, 68, 53–65. [Google Scholar] [CrossRef]

| OPEC Meeting | Number of Announcements |

|---|---|

| OPEC production cut | 13 |

| OPEC production increase | 10 |

| OPEC production maintain | 34 |

| Total OPEC meeting | 57 |

| Variables | Abbreviation | Description | |

|---|---|---|---|

| Dependent variables | Oil risks | Risk | The oil return risks which are measured by the asymmetric slope model. |

| Explanatory variables | OPEC increase | inc | Dummy variable equal to one if the periods belong to the “increase sample” and zero otherwise. |

| OPEC cut | cut | Dummy variable equal to one if the periods belong to the “cut sample” and zero otherwise. | |

| OPEC maintain | mai | Dummy variable equal to one if the periods belong to “maintain sample” and zero otherwise. | |

| Control variables | Oil supply | OP | OPEC oil production. |

| Oil demand | STO | OECD total commercial oil stocks. | |

| World economy | WGDP | The growth rate of global economy. | |

| Future returns | FR | The monthly log-returns in the NYMEX WTI | |

| Product price | PRO | The gasoline price. |

| Model | (1) | (2) | (3) | (4) | (5) |

|---|---|---|---|---|---|

| Variables | |||||

| c | 2.099 *** (0.593) | 0.396 (0.583) | 0.614 (0.496) | 0.642 (0.534) | 1.711 ** (0.648) |

| inc | −0.014 * (0.008) | −0.007 (0.009) | 1.059 *** (0.269) | −0.187 (0.008) | 0.197 (0.605) |

| cut | −0.005 (0.008) | 0.281 (0.377) | 1.072 *** (0.269) | 0.004 (0.175) | 0.605 (0.372) |

| OP × cut | −0.077 (0.106) | 0.286 * (0.128) | |||

| OP × mai | 0.302 *** (0.076) | 0.457 *** (0.096) | |||

| OP × inc | 0.051 (0.175) | 0.398 * (0.187) | |||

| OP | 0.426 *** (0.094) | ||||

| STO | −0.378 *** (0.098) | −0.008 (0.073) | −0.151 * (0.069) | −0.038 (0.067) | −0.344 *** (0.101) |

| WGDP | −0.024 *** (0.006) | −0.018 ** (0.006) | −0.021 *** (0.006) | −0.018 ** (0.006) | −0.023 *** (0.006) |

| FR | −0.130 *** (0.035) | –0.159 *** (0.036) | −0.138 *** (0.035) | −0.159 *** (0.036) | −0.126 *** (0.035) |

| PRO | −0.074 *** (0.014) | −0.019 (0.009) | −0.049 *** (0.010) | −0.022 * (0.008) | −0.073 *** (0.014) |

| Observations | 204 | 204 | 204 | 204 | 204 |

| adjusted-R2 | 0.236 | 0.159 | 0.219 | 0.157 | 0.238 |

| F | 9.969 *** | 6.506 *** | 9.177 *** | 6.426 *** | 8.079 *** |

| ARCH | 1.152 | 2.148 * | 1.661 * | 2.088 * | 1.231 |

| Period | 2002M01–2008M08 | 2008M09–2018M12 | |||||

|---|---|---|---|---|---|---|---|

| (1) | (2) | (1) | (2) | (3) | (4) | (5) | |

| Variables | |||||||

| c | −1.742 (1.158) | −1.788 (1.335) | 7.190 *** (1.056) | 4.815 *** (1.142) | 5.633 *** (0.979) | 6.471 *** (1.084) | 5.059 *** (1.180) |

| inc | −0.016 * (0.009) | −0.053 (0.666) | –0.003 (0.014) | –0.004 (0.014) | 2.547 *** (0.614) | –0.172 (1.569) | 1.028 (1.482) |

| cut | 0.003 (0.010) | 0.161 (0.459) | −4.08 × 10 –5 (0.010) | 2.894 ** (1.001) | 2.564 ** (0.616) | 0.006 (0.010) | 4.077 *** (1.023) |

| OP × cut | 0.199 (0.173) | –0.801 ** (0.277) | −0.451 (0.291) | ||||

| OP × mai | 0.244 (0.157) | 0.714 *** (0.172) | 0.682 *** (0.191) | ||||

| OP × inc | 0.255 (0.174) | 0.047 (0.439) | 0.393 (0.447) | ||||

| OP | 0.239 * (0.131) | 0.453 * (0.193) | |||||

| STO | 0.179 (0.145) | 0.183 (0.155) | −0.958 *** (0.167) | −0.489 *** (0.130) | −0.886 *** (0.121) | −0.679 *** (0.125) | −0.811 *** (0.166) |

| WGDP | 0.006 (0.015) | 0.005 (0.016) | 0.004 (0.009) | 0.016 (0.009) | 0.009 (0.008) | 0.008 (0.009) | 0.013 (0.009) |

| FR | 0.069 (0.054) | 0.068 (0.055) | −0.110 * (0.043) | −0.129 ** (0.041) | −0.095 * (0.041) | −0.136 ** (0.043) | −0.088 * (0.041) |

| PRO | −0.064 ** (0.020) | −0.063 ** (0.021) | −0.189 *** (0.026) | −0.138 *** (0.025) | −0.178 *** (0.023) | −0.165 *** (0.024) | −0.16 *** (0.025) |

| Observations | 80 | 80 | 124 | 124 | 124 | 124 | 124 |

| adjusted-R2 | 0.110 | 0.086 | 0.434 | 0.447 | 0.484 | 0.407 | 0.495 |

| F | 2.396 * | 1.832 * | 14.499 *** | 15.215 *** | 17.501 *** | 13.093 *** | 14.395 *** |

| ARCH | 0.588 | 0.521 | 0.739 | 0.729 | 0.450 | 0.746 | 0.569 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, Y.; Dong, H.; Failler, P. The Oil Market Reactions to OPEC’s Announcements. Energies 2019, 12, 3238. https://doi.org/10.3390/en12173238

Liu Y, Dong H, Failler P. The Oil Market Reactions to OPEC’s Announcements. Energies. 2019; 12(17):3238. https://doi.org/10.3390/en12173238

Chicago/Turabian StyleLiu, Yue, Hao Dong, and Pierre Failler. 2019. "The Oil Market Reactions to OPEC’s Announcements" Energies 12, no. 17: 3238. https://doi.org/10.3390/en12173238

APA StyleLiu, Y., Dong, H., & Failler, P. (2019). The Oil Market Reactions to OPEC’s Announcements. Energies, 12(17), 3238. https://doi.org/10.3390/en12173238