The Correlation between Energy Cost Share, Human, and Economic Development: Using Time Series Data from Australasia, Europe, North America, and the BRICS Nations

Abstract

1. Introduction

1.1. Socio-Economic Effects of Energy

1.2. Energy Metric Analysis

1.3. Summary of Literature and Objectives of the Paper

2. Research Methodology

2.1. Country Selection for Investigation

2.2. ECS Data

2.3. GDP Data

2.4. GNI Per Capita Data

2.5. HDI Indices

2.6. Correlation Test

2.7. Analysis

- i

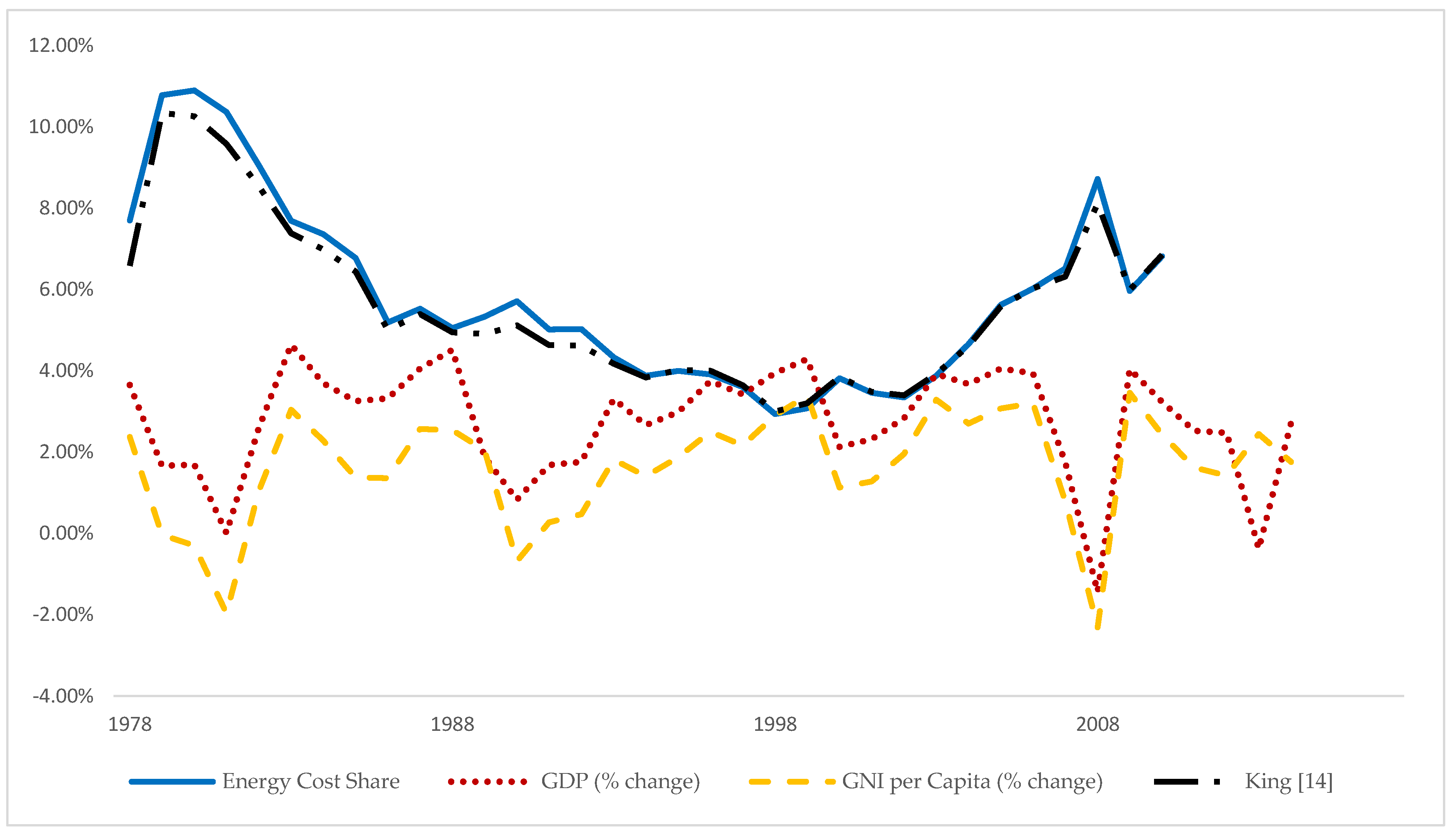

- Graphs comparing the ECS to economic and human indicators for the time series data were plotted for each country, each region, and for all countries. From these, an understanding of how each indicator trends in relation to a change in energy expenditure was obtained. Any patterns or thresholds were identified.

- ii

- Overall Pearson correlations for the entire time series data were established to confirm if there was a relation. Ccorrelation coefficients were then calculated, along with their corresponding p-values. This was done for zero, one, two, and three year lags being applied to GDP and GNI per capita change.

- iii

- As ECS has a noticeable effect on the economy once a certain threshold has been exceeded [12], correlation coefficients were found over periods of time, where the ECS threshold established in (i) was calculated. This was done for the metrics where a correlation was identified.

3. Results and Discussions

3.1. Global Dynamics

3.2. ECS vs Economic Development

3.3. ECS vs Societal Development

3.3.1. ECS vs GNI Per Capita

3.3.2. ECS vs. Health and Education Indices

3.4. Time Lag Effects

3.5. Regional Analysis

- The nations from the Mediterranean region (Italy, France, and Spain), as well as South Africa, were all seen to have similar traits. Including similar ECS shapes over the period being analysed, very similar estimated ECS thresholds, as well as correlations with roughly the same magnitude. Italy, France, and Spain, situated very close together, could make up a region of similar economic and social dynamics to ECS. The actual prices to produce energy in this region may be very similar to all countries. Two possibilities could give reasons for why South Africa’s ECS curve is similar to those of the Mediterranean nations. One is the climate is similar. The second is that the Apartheid regime may have split the South African nation into two. One part of society controls most the wealth, creating an economy similar to the dynamics of a European country. The majority of society was tasked with providing cheap labour in order for big business to succeed. Contributing to this is the fact that many of South Africa’s poor use biofuel for their energy needs. By excluding biofuels, this study focusses more on the nation’s wealthy residential and business sector.

- China and Russia make up another group of countries with similar dynamics. Both these nations had extremely high ECS peaks around 1980 (40% and 34%, respectively) and a very high average ECS value throughout the period, as well as resilience towards high ECS values. Reasons explaining these traits included the fact that these countries have large amounts of fuel stocks that supply their nation with fuel. These nations also included planned economy principles that may have allowed their countries to react differently in the face of high ECS prices.

- Similarities were also noted for a group of countries that were not situated close together geographically. These were Germany, the UK, and the USA. The estimated ECS thresholds for these three countries, for the two periods of high ECS, were very similar (5.1%, 4.9%, and 4.9%, respectively) Furthermore, these countries had much stronger correlations for the second peak in ECS, even though the estimated ECS threshold for the second period was lower than that of the first. Although the energy mixes of these countries had similarities, a more plausible reason for the common dynamics could be the high industrial share in the global economy that these countries had throughout the period being analysed. The ‘All Country’ ECS dynamics were very similar to these nations, indicating that a collapse in these three economies will cause widespread damage globally.

4. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Stern, D.I. The role of energy in economic growth. Ann. N. Y. Acad. Sci. 2011, 1219, 26–51. [Google Scholar] [CrossRef] [PubMed]

- Aucott, M.; Hall, C. Does a Change in Price of Fuel Affect GDP Growth? An Examination of the U.S. Data from 1950–2013. Energies 2014, 7, 6558–6570. [Google Scholar] [CrossRef]

- Heun, M.K.; Santos, J.; Brockway, P.E.; Pruim, R.; Domingos, T.; Sakai, M. From Theory to Econometrics to Energy Policy: Cautionary Tales for Policymaking Using Aggregate Production Functions. Energies 2017, 10, 203. [Google Scholar] [CrossRef]

- Ozturk, I. A literature survey on energy–growth nexus. Energy Policy 2010, 38, 340–349. [Google Scholar] [CrossRef]

- Moore, H. Global Prosperity and Sustainable Development Goals. J. Int. Dev. 2015, 27, 801–815. [Google Scholar] [CrossRef]

- Fioramonti, L. Gross Domestic Problem: The Politics behind the World’s Most Powerful Number; Zed Books: London, UK, 2013. [Google Scholar]

- UNDP. Human Development Report 2005; Hoechstetter Printing: New York, NY, USA, 2005. [Google Scholar]

- D’amelio, M.; Garrone, P.; Piscitello, L. Can Multinational Enterprises Light up Developing Countries? Evidences from the Access to Electricity in sub-Saharan Africa. World Dev. 2016, 88, 12–32. [Google Scholar] [CrossRef]

- Kanagawa, M.; Nakata, T. Analysis of the energy access improvement and its socio-economic impacts in rural areas of developing countries. Ecol. Econ. 2007, 62, 319–329. [Google Scholar] [CrossRef]

- Lenz, L.; Munyehirwe, A.; Peters, J.; Sievert, M. Does Large-Scale Infrastructure Investment Alleviate Poverty? Impacts of Rwanda’s Electricity Access Roll-Out Program. World Dev. 2017, 89, 88–110. [Google Scholar] [CrossRef]

- Nkomo, J. Energy use, poverty and development in the SADC. J. Energy South. Afr. 2007, 18, 10–17. [Google Scholar]

- Bashmakov, I. Three laws of energy transitions. Energy Policy 2007, 35, 3583–3594. [Google Scholar] [CrossRef]

- King, C. Comparing World Economic and Net Energy Metrics, Part 3: Macroeconomic Historical and Future Perspectives. Energies 2015, 8, 12997–13020. [Google Scholar] [CrossRef]

- Fizaine, F.; Court, V. Energy expenditure, economic growth, and the minimum EROI of society. Energy Policy 2016, 95, 172–186. [Google Scholar] [CrossRef]

- IEA. World Energy Outlook 2016; IEA: Paris, France, 2016. [Google Scholar]

- IEA. Energy and Air Pollution 2016; IEA: Paris, France, 2016. [Google Scholar]

- Arshad, A.; Zakaria, M.; Xi, J. Energy prices and economic growth in Pakistan: A macro-economic analysis. Renew. Sustain. Energy Rev. 2015, 55, 25–33. [Google Scholar] [CrossRef]

- Murphy, D.; Hall, C. Energy return on investment, peak oil, and the end of economic growth. Ann. N. Y. Acad. Sci. 2011, 1219, 52–72. [Google Scholar] [CrossRef] [PubMed]

- Chang, T.; Huang, C.; Lee, M. Threshold effect of the economic growth rate on the renewable energy development from a change in energy price: Evidence from OECD countries. Energy Policy 2009, 37, 5796–5802. [Google Scholar] [CrossRef]

- Gan, J.; Smith, C. Drivers for renewable energy: A comparison among OECD countries. Biomass Bioenergy 2011, 35, 4497–4503. [Google Scholar] [CrossRef]

- Worldbank. Available online: http://databank.worldbank.org/data (accessed on 15 May 2017).

- OECD Database. Available online: http://www.oecd-ilibrary.org.ez.sun.ac.za/statistics (accessed on 16 May 2017).

- United Nations Development Programme. Available online: http://hdr.undp.org/en/content/expected-years-schooling-children-years (accessed on 18 May 2017).

| Australasia | Europe | North America | BRICS |

|---|---|---|---|

| Australia | France | Canada | Brazil |

| New Zealand | Germany | Mexico | Russia |

| Italy | United States of America | India | |

| Spain | China | ||

| United Kingdom | South Africa |

| Country | Strongest Correlation Coefficient | p-Value | Year Lag | Year Lags Affected |

|---|---|---|---|---|

| Australia | −0.304 | 0.086 | 1 | 1 |

| Brazil | - | - | - | - |

| Canada | −0.319 | 0.070 | 1 | 1 |

| China | - | - | - | - |

| France | −0.340 | 0.053 | 1 | 1 |

| Germany | - | - | - | - |

| India | - | - | - | - |

| Italy | −0.351 | 0.045 | 1 | 1, 2 |

| Mexico | - | - | - | - |

| New Zealand | - | - | - | - |

| Russia | - | - | - | - |

| South Africa | - | - | - | - |

| Spain | −0.661 | 2.9 × 10−5 | 2 | 0, 1, 2, 3 |

| UK | −0.337 | 0.055 | 1 | 1 |

| USA | - | - | - | - |

| Region | ||||

| Australasia | −0.329 | 0.062 | 1 | 1 |

| BRICS | −0.314 | 0.075 | 2 | 2, 3 |

| Europe | - | - | - | - |

| North America | - | - | - | - |

| All Countries | −0.434 | 0.012 | 1 | 1 |

| Average | −0.377 | 0.050 | - | - |

| Country | Strongest Correlation Coefficient | p-Value | ECS Threshold | Year Lag |

|---|---|---|---|---|

| Australia | −0.681 | 0.004 | 3.4% (Lower Threshold) | 1 |

| Brazil | −0.898 | 0.038 | 6.5% | 2 |

| Canada | −0.943 | 0.005 | 6.8% | 1 |

| China | −0.842 | 0.018 | 25.2% | 1 |

| France | −0.949 | 0.013 | 4% | 1 |

| Germany | −0.854 | 0.065 | 5.1% | 1 |

| India | - | - | - | - |

| Italy | −0.854 | 0.029 | 3.9% | 2 |

| Mexico | −0.958 | 0.004 | 6.4% | 1 |

| New Zealand | −0.690 | 0.085 | 4.8% | 0 |

| Russia | −0.866 | 0.026 | 11.6% | 1 |

| South Africa | −0.855 | 0.014 | 3.4% | 1 |

| Spain | −0.855 | 0.030 | 4.3% | 1 |

| UK | −0.900 | 0.014 | 4.9% | 1 |

| USA | −0.939 | 0.005 | 4.9% | 1 |

| Region | ||||

| Australasia | −0.981 | 0.091 | 3% (Lower Threshold) | 1 |

| BRICS | −0.915 | 0.011 | 9.9% | 2 |

| Europe | −0.857 | 0.007 | 6.3% | 1 |

| North America | −0.833 | 0.020 | 5.1% | 1 |

| All Countries | −0.857 | 0.029 | 7.7% | 1 |

| Average | −0.870 | 0.027 | - | - |

| Country | Strongest Correlation Coefficient | p-Value | Year Lag | Year Lags Affected |

|---|---|---|---|---|

| Australia | −0.343 | 0.051 | 1 | 1 |

| Brazil | - | - | - | - |

| Canada | −0.354 | 0.043 | 1 | 1 |

| China | - | - | - | - |

| France | −0.315 | 0.074 | 1 | 1 |

| Germany | - | - | - | - |

| India | - | - | - | - |

| Italy | −0.381 | 0.029 | 1 | 1, 2 |

| Mexico | - | - | - | - |

| New Zealand | - | - | - | - |

| Russia | - | - | - | - |

| South Africa | - | - | - | - |

| Spain | −0.671 | 1.9 × 10−5 | 1 | 0, 1, 2, 3 |

| UK | −0.301 | 0.088 | 1 | 1 |

| USA | - | - | - | - |

| Region | ||||

| Australasia | −0.394 | 0.023 | 1 | 0, 1, 2 |

| BRICS | −0.488 | 0.004 | 2 | 1, 2, 3 |

| Europe | - | - | - | - |

| North America | −0.319 | 0.071 | 1 | 1 |

| All Countries | −0.539 | 0.001 | 1 | 0, 1, 2, 3 |

| Average | −0.411 | 0.038 | - | - |

| Country | Highest ECS Correlation | p-Value | ECS Threshold | Year Lag |

|---|---|---|---|---|

| Australia | −0.655 | 0.006 | 3.4% (Lower Threshold) | 1 |

| Brazil | −0.884 | 0.047 | 6.5% | 2 |

| Canada | −0.907 | 0.013 | 6.8% | 1 |

| China | −0.836 | 0.019 | 25.2% | 1 |

| France | −0.940 | 0.018 | 4% | 1 |

| Germany | −0.835 | 0.078 | 5.1% | 1 |

| India | - | - | - | - |

| Italy | −0.885 | 0.019 | 3.9% | 2 |

| Mexico | −0.934 | 0.006 | 6.4% | 1 |

| New Zealand | −0.817 | 0.025 | 4.8% | 0 |

| Russia | −0.860 | 0.028 | 11.6% | 1 |

| South Africa | −0.923 | 0.003 | 3.4% | 1 |

| Spain | −0.962 | 0.002 | 4.3% | 1 |

| UK | −0.910 | 0.011 | 4.9% | 1 |

| USA | −0.960 | 0.002 | 4.9% | 1 |

| Region | ||||

| Australasia | −0.972 | 0.028 | 3% (Lower Threshold) | 1 |

| BRICS | −0.908 | 0.012 | 9.9% | 2 |

| Europe | −0.874 | 0.005 | 6.3% | 1 |

| North America | −0.904 | 0.013 | 5.1% | 1 |

| All Countries | −0.880 | 0.021 | 7.7% | 1 |

| Average | −0.887 | 0.029 | - | - |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Roberts, R.; Musango, J.K.; Brent, A.C.; Heun, M.K. The Correlation between Energy Cost Share, Human, and Economic Development: Using Time Series Data from Australasia, Europe, North America, and the BRICS Nations. Energies 2018, 11, 2405. https://doi.org/10.3390/en11092405

Roberts R, Musango JK, Brent AC, Heun MK. The Correlation between Energy Cost Share, Human, and Economic Development: Using Time Series Data from Australasia, Europe, North America, and the BRICS Nations. Energies. 2018; 11(9):2405. https://doi.org/10.3390/en11092405

Chicago/Turabian StyleRoberts, Ryan, Josephine Kaviti Musango, Alan Colin Brent, and Matthew Kuperus Heun. 2018. "The Correlation between Energy Cost Share, Human, and Economic Development: Using Time Series Data from Australasia, Europe, North America, and the BRICS Nations" Energies 11, no. 9: 2405. https://doi.org/10.3390/en11092405

APA StyleRoberts, R., Musango, J. K., Brent, A. C., & Heun, M. K. (2018). The Correlation between Energy Cost Share, Human, and Economic Development: Using Time Series Data from Australasia, Europe, North America, and the BRICS Nations. Energies, 11(9), 2405. https://doi.org/10.3390/en11092405