The Institutionalization of the Consistency and Comparability Principle in the European Companies

Abstract

1. Introduction

2. Literature Review

2.1. The Consistency and Comparability of Environmental Reporting

- -

- On a basis that is consistent over time

- -

- In a way that enables comparison with other organizations to the extent it is material to the organization’s own ability to create value over time.’

- (a)

- Comparability with the performance disclosed in the previous periods. In order to achieve this, the company should present the same indicators and use the same methodology in order to compute the indicators. Also, the values of the indicators presented in a year should not be changed in the next year’s report for the base year;

- (b)

- Comparability with the objectives involves the presentation of the objectives and the discussion in the next year of the way in which the objectives were reached;

- (c)

- Comparability with other organizations only if this is possible, as everybody acknowledges that it is difficult to compare the incomparable, especially if we talk about companies in different activity domains.

2.2. Policy Actions and Private Initiatives Regarding the Energy and Emissions

3. Research Method

3.1. Sample Selection

3.2. Data Collection

- -

- 1: if the EPI was reported;

- -

- 0: if the EPI was not reported.

- C1: the indicator had to be quantitative (expressed by absolute or relative measures);

- C2: the indicator had to be included in all the versions of the GRI references applicable.

- -

- 1 point for the homogeneous disclosure of an indicator in all three years;

- -

- 2 points for the homogeneous disclosure of the same indicator in two of the three years under examination, respectively

- -

- 3 points for the different disclosure of an indicator in each of the three years.

3.3. Institutional Theory

4. Results and Discussion

4.1. The Comparability of GRI’s Environmental Performance Indicators

4.2. The Consistency of GRI’s Environmental Performance Indicators

- The organization ‘D’ reported information on the indicators EN 17 ‘Other indirect greenhouse gas (GHG) emissions (Scope 3)’ (G3.0), respectively EN 24 ‘Weight of transported, imported, exported, or treated waste deemed hazardous under the terms of the Basel Convention Annex I, II, III, and VIII, and percentage of transported waste shipped internationally’ (G3.0) for the first time in 2013, and on the indicator EN10 ‘Percentage and total volume of water recycled and reused’ (G4) in 2016;

- The organization ‘E’ presented information on the indicator EN 19 ‘Emissions of ozone-depleting substances by weight’ (G3.1) for the first time in 2013. In 2016, beginning with the SRS application, it changed the manner of detailing the disclosed information;

- The organization ‘F’ presented the indicator EN20 ‘NO, SO, and other significant air emissions by type and weight’ (G3.0) only in 2010; in the following years it gave up presenting them. Also, the indicator EN3 ‘Direct energy consumption by primary energy source’ was presented only in 2010 and 2013 (G3.0 and G3.1).

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

Nomenclature

| C | Criteria |

| CSR | Corporate Social Responsibility |

| ED | European Directive |

| EMAS | Eco-Management and Audit Scheme |

| EN | Environmental |

| EPI | Environmental performance indicators |

| EU | European Union |

| G | Guidelines |

| GHG | Greenhouse Gas |

| GRI | Global Reporting Initiative |

| IEA | International Energy Agency |

| IIRC | International Integrated Reporting Council |

| IIRC’s PP | International Integrated Reporting Council’s Pilot Programme |

| IIRF | International Integrated Reporting Framework |

| ISO | International Organization for Standardization |

| ODS | Ozone-depleting substances |

| RE | Renewable energy |

| SRS | Sustainability Reporting Standards |

| PV | Photovoltaic |

| UK | United Kingdom |

Appendix A

| Organizations | Countries | Years | GRI Version |

|---|---|---|---|

| Basic Materials/Chemicals (3) | |||

| A | The Netherlands | 2010 | Citing GRI |

| 2013 | G3.1 | ||

| 2016 | G4 | ||

| B | Germany | 2010 | G3.0 |

| 2013 | G3.1 | ||

| 2016 | G4 | ||

| C | Belgium | 2010 | Citing GRI |

| 2013 | G4 | ||

| 2016 | SRS | ||

| Industrials/Transportation (3) | |||

| D | Italy | 2010 | - |

| 2013 | G3.1 | ||

| 2016 | G4 | ||

| E | Germany | 2010 | G3.0 |

| 2013 | G3.1 | ||

| 2016 | SRS | ||

| F | The Netherlands | 2010 | G3.0 |

| 2013 | G3.1 | ||

| 2016 | G4 | ||

| Oil & Gas (4) | |||

| G | Italy | 2010 | G3.0 |

| 2013 | G3.1 | ||

| 2016 | G4 | ||

| H | Spain | 2010 | G3.0 |

| 2013 | G3.1 | ||

| 2016 | G4 | ||

| I | Russian Federation | 2010 | G3.0 |

| 2013 | G4 | ||

| 2016 | G4 | ||

| J | Italy | 2010 | G3.0 |

| 2013 | G4 | ||

| 2016 | G4 | ||

Appendix B

| G3.0/3.1 (2006/2011) -1- | G4 (2013) -2- | SRS (2016) -3- | GRI Environmental Indicators |

|---|---|---|---|

| G3.0/3.1-EN1 | G4-EN1 | 301-1 | ‘Materials used by weight or volume’ (1,2,3) |

| G3.0/3.1-EN2 | G4-EN2 | 301-2 | ‘Percentage of materials used that are recycled input materials’ (1,2)/‘Recycled input materials used’ (3) |

| G3.0/3.1-EN3 | G4-EN3 | 302-1 | ‘Direct energy consumption by primary energy source’ (1)/‘Energy consumption within the organization’ (2,3) |

| G3.0/3.1-EN4 | G4-EN4 | 302-2 | ‘Indirect energy consumption by primary source’ (1)/‘Energy consumption outside of the organization’ (2,3) |

| G3.0/3.1-EN5 | G4-EN6 | 302-4 | ‘Energy saved due to conservation and efficiency improvements’ (1)/‘Reduction of energy consumption’ (2,3) |

| G3.0/3.1-EN8 | G4-EN8 | 303-1 | ‘Total water withdrawal by source’ (1,2,3) |

| G3.0/3.1-EN10 | G4-EN10 | 303-3 | ‘Percentage and total volume of water recycled and reused’ (1,2)/‘Water recycled and reused’ (3) |

| G3.0/3.1-EN15 | G4-EN14 | 304-4 | ‘Number of IUCN red list species and national conservation list species with habitats in areas affected by operations, by level of extinction risk’ (1)/‘Total number of IUCN red list species and national conservation list species with habitats in areas affected by operations, by level of extinction risk’ (2)/‘IUCN red list species and national conservation list species with habitats in areas affected by operations’ (3) |

| G3.0/3.1-EN16 | G4-EN15 | 305-1 | ‘Direct greenhouse gas (GHG) emissions (Scope 1)’ (2)/‘Direct (Scope 1) GHG emissions’ (3) |

| G3.0/3.1-EN17 | G4-EN17 | 305-3 | ‘Other indirect greenhouse gas (GHG) emissions (Scope 3)’ (1,2)/‘Other indirect (Scope 3) GHG emissions’ (3) |

| G3.0/3.1-EN19 | G4-EN20 | 305-6 | ‘Emissions of ozone-depleting substances by weight’ (1)/‘Emissions of ozone-depleting substances (ODS)’ (2,3) |

| G3.0/3.1-EN20 | G4-EN21 | 305-7 | ‘NO, SO, and other significant air emissions by type and weight’/‘NOX, SOX, and other significant air emissions’ (1,2)/‘Nitrogen oxides (NOX), sulfur oxides (SOX), and other significant air emissions’ (3) |

| G3.0/3.1-EN21 | G4-EN22 | 306-1 | ‘Total water discharge by quality and destination’ (1,2)/‘Water discharge by quality and destination’ (3) |

| G3.0/3.1-EN22 | G4-EN23 | 306-2 | ‘Total weight of waste by type and disposal method’ (1,2)/‘Waste by type and disposal method’ (3) |

| G3.0/3.1-EN23 | G4-EN24 | 306-3 | ‘Total number and volume of significant spills’ (1,2)/‘Significant spills’ (3) |

| G3.0/3.1-EN24 | G4-EN25 | 306-4 | ‘Weight of transported, imported, exported, or treated waste deemed hazardous under the terms of the Basel Convention Annex I, II, III, and VIII, and percentage of transported waste shipped internationally’ (1)/‘Weight of transported, imported, exported, or treated waste deemed hazardous under the terms of the Basel Convention 2’ (2)/‘Transport of hazardous waste’ (3) |

| G3.0/3.1-EN27 | G4-EN28 | 301-3 | ‘Percentage of products sold and their packaging materials that are reclaimed by category’ (1,2)/‘Reclaimed products and their packaging materials’ (3) |

| G3.0/3.1-EN28 | G4-EN29 | 307-1 | ‘Monetary value of significant fines and total number of non-monetary sanctions for non-compliance with environmental laws and regulations’ (2)/‘Non-compliance with laws or regulations’ (3) |

References

- Boiral, O.; Henri, J. Is Sustainability Performance Comparable? A Study of GRI Reports of Mining Organizations. Bus. Soc. 2015, 56, 283–317. [Google Scholar] [CrossRef]

- Dragomir, V.D. Sustainability Reporting: A Case for Corporate Accountability, 1st ed.; ASE Publishing House: Bucharest, Romania, 2012. [Google Scholar]

- EY. Is Your Nonfinancial Performance Revealing the True Value of Your Business to Investors? 2017. Available online: https://www.ey.com/Publication/vwLUAssets/EY_-_Nonfinancial_performance_may_influence_investors/$FILE/ey-nonfinancial-performance-may-influence-investors.pdf (accessed on 22 July 2018).

- Kolk, A. A decade of sustainability reporting: Developments and significance. Int. J. Environ. Sustain. Dev. 2004, 3, 51–64. [Google Scholar] [CrossRef]

- Bebbington, J.; Larrinaga, C.; Moneva, J.M. Corporate social reporting and reputation risk management. Acc. Audit. Acc. J. 2008, 21, 337–361. [Google Scholar] [CrossRef]

- Michelon, G. Sustainability Disclosure and Reputation: A Comparative Study. Corp. Reputat. Rev. 2011, 14, 79–96. [Google Scholar] [CrossRef]

- Center for Corporate Citizenship; EY, Value of Sustainability Reporting. Available online: http://www.confluencellc.com/uploads/3/7/9/6/37965831/valueofsustainabilitysummary.pdf (accessed on 22 July 2017).

- Adams, C.A.; McNicholas, P. Making a difference: Sustainability reporting, accountability and organisational change. Acc. Audit. Acc. J. 2007, 20, 382–402. [Google Scholar] [CrossRef]

- Epstein, M.J.; Roy, M.J. Sustainability in Action: Identifying and Measuring the Key Performance Drivers. Long Range Plan. 2001, 34, 585–604. [Google Scholar] [CrossRef]

- Robinson, H.S.; Anumba, C.J.; Carrillo, P.M.; Al-Ghassani, A.M. STEPS: A knowledge management maturity roadmap for corporate sustainability. Bus. Process Manag. J. 2006, 12, 793–808. [Google Scholar] [CrossRef]

- Lozano, R.; Huisingh, D. Inter-linking issues and dimensions in sustainability reporting. J. Clean. Prod. 2011, 19, 99–107. [Google Scholar] [CrossRef]

- Berns, M.; Townend, A.; Khayat, Z.; Balagopal, B.; Reeves, M.; Hopkins, M.S.; Kruschwitz, N. Sustainability and Competitive Advantage. MIT Sloan Manag. Rev. 2009, 51, 19–26. [Google Scholar]

- KPMG. KPMG International Survey of Corporate Responsibility Reporting 2005. Available online: https://commdev.org/userfiles/files/1274_file_D2.pdf (accessed on 21 July 2018).

- KPMG. The KPMG Survey of Corporate Responsibility Reporting 2017. Available online: https://assets.kpmg.com/content/dam/kpmg/xx/pdf/2017/10/kpmg-survey-of-corporate-responsibility-reporting-2017.pdf (accessed on 21 July 2018).

- KPMG, GRI, UNEP Centre for Corporate Governance in Africa 2016. Carrots & Sticks. Global Trends in Sustainability Reporting Regulation and Policy. Available online: https://assets.kpmg.com/content/dam/kpmg/pdf/2016/05/carrots-and-sticks-may-2016.pdf (accessed on 7 August 2017).

- Barbu, E.; Dumontier, P.; Feleagă, N.; Feleagă, L. Mandatory Environmental Disclosures by Companies Complying with IASs/IFRSs: The Cases of France, Germany, and the UK. Int. J. Acc. 2014, 49, 231–247. [Google Scholar] [CrossRef]

- Saghroun, J.; Eglem, J.Y. A la recherche de la performance globale de l’entreprise: La perception des analystes financiers. Comptab. Contrôl. Audit 2008, 1, 93–118. [Google Scholar] [CrossRef]

- World Economic Forum. Accelerating the Transition towards Sustainable Investing-Strategic Options for Investors, Corporations and Other Key Stakeholders; World Economic Forum: Geneva, Switzerland, 2011. [Google Scholar]

- De Villiers, C.; Rouse, P.; Kerr, J. A New Conceptual Model of Influences Driving Sustainability Based on Case Evidence of The Integration of Corporate Sustainability Management Control and Reporting. J. Clean. Prod. 2016, 136, 78–85. [Google Scholar] [CrossRef]

- Tilling, M.V.; Tilt, C.A. The edge of legitimacy. Voluntary social and environmental reporting in Rothmans’ 1956–1999 annual reports. Acc. Audit. Acc. J. 2010, 23, 55–81. [Google Scholar] [CrossRef]

- O’Donovan, G. Environmental disclosures in the annual report. Extending the applicability and predictive power of legitimacy theory. Acc. Audit. Acc. J. 2002, 15, 344–371. [Google Scholar] [CrossRef]

- Global Reporting Initiative, Sustainability Reporting Guidelines 2002. Available online: https://www.epeat.net/documents/EPEATreferences/GRIguidelines.pdf (accessed on 15 January 2017).

- Déjean, F.; Gond, J.-P.; Leca, B. Measuring the unmeasured: An institutional entrepreneur strategy in an emerging industry. Hum. Relat. 2004, 57, 741–764. [Google Scholar] [CrossRef]

- Waddock, S. Building a new institutional infrastructure for corporate responsibility. Acad. Manag. Perspect. 2008, 22, 87–108. [Google Scholar] [CrossRef]

- Delmas, M.; Blass, V. Measuring corporate environmental performance: The trade-offs of sustainability ratings. Bus. Strateg. Environ. 2010, 19, 217–219. [Google Scholar] [CrossRef]

- Ștefănescu, A.; Tănase, G.L. The development of a corporate governance assessment model for the Romanian public sector. Audit Financ. 2016, 14, 1173–1180. [Google Scholar] [CrossRef]

- EY Tomorrow’s Investment Rules: Global Survey of Institutional Investors on Non-Financial Performance, EYGM Limited. Available online: https://www.eycom.ch/en/Publications/20140502-Tomorrows-investment-rules-a-global-survey/download (accessed on 22 September 2017).

- Albu, N.; Albu, C.; Dumitru, M.; Dumitru, V.F. Plurality or Convergence in Sustainability Reporting Standards? Amfiteatru Econ. 2013, 15, 729–742. [Google Scholar]

- Dumitru, M.; Gușe, R.G.; Feleagă, L.; Mangiuc, D.M.; Feldioreanu, A.I. Marketing Communications of Value Creation in Sustainable Organizations. The Practice of Integrated Reports. Amfiteatru Econ. 2015, 17, 955–976. [Google Scholar]

- Calu, D.A.; Dumitru, M.; Glăvan, M.E.; Gușe, R.G. (Non)Financial Reporting (A)Symmetries in the Case of Amusement Parks in Europe. Amfiteatru Econ. 2016, 18, 1015–1033. [Google Scholar]

- Isaksson, R.; Steimle, U. What does GRI-reporting tell us about corporate sustainability? TQM J. 2009, 21, 168–181. [Google Scholar] [CrossRef]

- Doni, F.; Gasperini, A.; Pavone, P. Early adopters of integrated reporting: The case of the mining industry in South Africa. Afr. J. Bus. Manag. 2016, 10, 187–208. [Google Scholar] [CrossRef]

- Herzig, C.; Schaltegger, S. Corporate Sustainability Reporting. An Overview. In Sustainability Accounting and Reporting, 1st ed.; Schaltegger, S., Bennett, M., Burritt, R., Eds.; Springer: Dordrecht, The Netherlands, 2006; pp. 301–324. [Google Scholar]

- Hahn, T.; Figge, F.; Figge, F. Beyond the bounded instrumentality in current corporate sustainability research: Toward an inclusive notion of profitability. J. Bus. Ethics 2011, 104, 325–345. [Google Scholar] [CrossRef]

- Rahman, N.; Post, C. Measurement issues in environmental corporate social responsibility (ECSR): Toward a transparent, reliable, and construct valid instrument. J. Bus. Ethics 2012, 105, 307–319. [Google Scholar] [CrossRef]

- Singh, R.K.; Murty, H.R.; Gupta, S.K.; Dikshit, A.K. An overview of sustainability assessment methodologies. Ecol. Indic. 2012, 15, 281–299. [Google Scholar] [CrossRef]

- Simnett, R.; Huggins, A. Integrated reporting and assurance: Where can research add value? Sustain. Acc. Manag. Policy J. 2015, 6, 29–53. [Google Scholar] [CrossRef]

- Reuter, M.; Messner, M. Lobbying on the integrated reporting framework: An analysis of comment letters to the 2011 discussion paper of the IIRC. Acc. Audit. Acc. J. 2015, 2, 365–402. [Google Scholar] [CrossRef]

- Dragomir, V.D. The disclosure of industrial greenhouse gas emissions: A critical assessment of corporate sustainability reports. J. Clean. Prod. 2012, 29–30, 222–237. [Google Scholar] [CrossRef]

- Eccles, R.; Krzus, M.; Rogers, J.; Serafeim, G. The need for sector-specific materiality and sustainability reporting standards. J. Appl. Corp. Financ. 2012, 24, 8–14. [Google Scholar] [CrossRef]

- Nguyen, Q.A.; Hens, L. Environmental performance of the cement industry in Vietnam: The influence of ISO 14001 certification. J. Clean. Prod. 2015, 96, 362–378. [Google Scholar] [CrossRef]

- Laxe, F.G.; Bermúdez, F.M.; Palmero, F.M.; Novo-Corti, I. Sustainability and the Spanish port system. Analysis of the relationship between economic and environmental indicators. Mar. Pollut. Bull. 2016, 113, 232–239. [Google Scholar] [CrossRef] [PubMed]

- Lucato, W.C.; Costa, E.M.; de Oliveira Neto, G.C. The environmental performance of SMEs in the Brazilian textile industry and the relationship with their financial performance. J. Environ. Manag. 2017, 203, 550–556. [Google Scholar] [CrossRef]

- Rowbottom, N.; Locke, J. The emergence of integrated reporting. In Proceedings of the 7th Asia-Pacific Interdisciplinary Research in Accounting Conference, Kobe, Japan, 26–28 July 2013. [Google Scholar]

- Global Reporting Initiative & International Integrated Reporting Council, GRI and IIRC Deepen Cooperation to Shape the Future of Corporate Reporting. 2013. Available online: https://www.globalreporting.org/information/news-and-press-center/Pages/GRI-and-IIRC-deepen-cooperation-to-shape-the-future-of-corporate-reporting.aspx (accessed on 20 January 2017).

- European Union Directive as Regards Disclosure of Non-Financial and Diversity Information by Certain Large Undertakings and Groups, 2014/95/EU. 2014. Available online: http://eur-lex.europa.eu/legalcontent/EN/TXT/PDF/?uri=CELEX:32014L0095&from=EN/ (accessed on 26 January 2017).

- La Torre, M.; Sabelfeld, S.; Blomkvist, M.; Tarquinio, L.; Dumay, J. Harmonising non-financial reporting regulation in Europe: Practical forces and projections for future research. Med. Acc. Res. 2018, 26, 598–621. [Google Scholar] [CrossRef]

- Carini, C.; Rocca, L.; Veneziani, M.; Teodori, C. Ex-Ante Impact Assessment of Sustainability Information—The Directive 2014/95. Sustainability 2018, 10, 560. [Google Scholar] [CrossRef]

- Venturelli, A.; Caputo, F.; Cosma, S.; Leopizzi, R.; Pizzi, S. Directive 2014/95/EU: Are Italian companies already compliant? Sustainability 2017, 9, 1385. [Google Scholar] [CrossRef]

- International Integrated Reporting Council, IIRC Pilot Programme Business Network 2013. Available online: http://integratedreporting.org/wp-content/uploads/2013/12/IIRC-PP-Yearbook-2013_PDF4_PAGES.pdf (accessed on 10 December 2016).

- Global Reporting Initiative, Reporting Principles and Standard Disclosures—Part I. 2011. Available online: https://www.globalreporting.org/resourcelibrary/GRIG4-Part1-Reporting-Principles-and-Standard-Disclosures.pdf (accessed on 15 January 2017).

- IEA, Energy Technology Perspectives 2017. Available online: https://eneken.ieej.or.jp/data/7432.pdf (accessed on 28 November 2018).

- Helliwell, R.; Tomei, I. Practicing stewardship: EU biofuels policy and certification in the UK and Guatemala. Agric. Hum. Values 2017, 34, 473–484. [Google Scholar] [CrossRef]

- REN21. Renewables 2017 Global Status Report; REN21 Secretariat: Paris, France, 2017; pp. 1–302. [Google Scholar]

- Sarasa-Maestro, C.J.; Dufo-Lopez, R.; Bernal-Agustín, J.L. Photovoltaic remuneration policies in the European Union. Energy Policy 2013, 55, 317–328. [Google Scholar] [CrossRef]

- García-Alvarez, M.T.; Cabeza-García, L.; Soares, I. Assessment of energy policies to promote photovoltaic generation in the European Union. Energy 2018, 151, 864–874. [Google Scholar] [CrossRef]

- Falcone, P.M.; Lopolito, A.; Sica, E. The networking dynamics of the Italian biofuel industry in time of crisis: Finding an effective instrument mix for fostering a sustainable energy transition. Energy Policy 2018, 112, 334–348. [Google Scholar] [CrossRef]

- Ortega-Izquierdo, M.; del Río, P. Benefits and costs of renewable electricity in Europe. Renew. Sustain. Energy Rev. 2016, 61, 372–383. [Google Scholar] [CrossRef]

- Nepal, R.; Jamasb, T.; Tisdell, C.A. On environmental impacts of market-based reforms: Evidence from the European and Central Asian transition economies. Renew. Sustain. Energy Rev. 2017, 73, 44–52. [Google Scholar] [CrossRef]

- Scarlat, N.; Dallemand, J.F.; Monforti-Ferrario, F.; Banja, M.; Motola, V. Renewable energy policy framework and bioenergy contribution in the European Union—An overview from National Renewable Energy Action Plans and Progress Reports. Renew. Sustain. Energy Rev. 2015, 51, 969–985. [Google Scholar] [CrossRef]

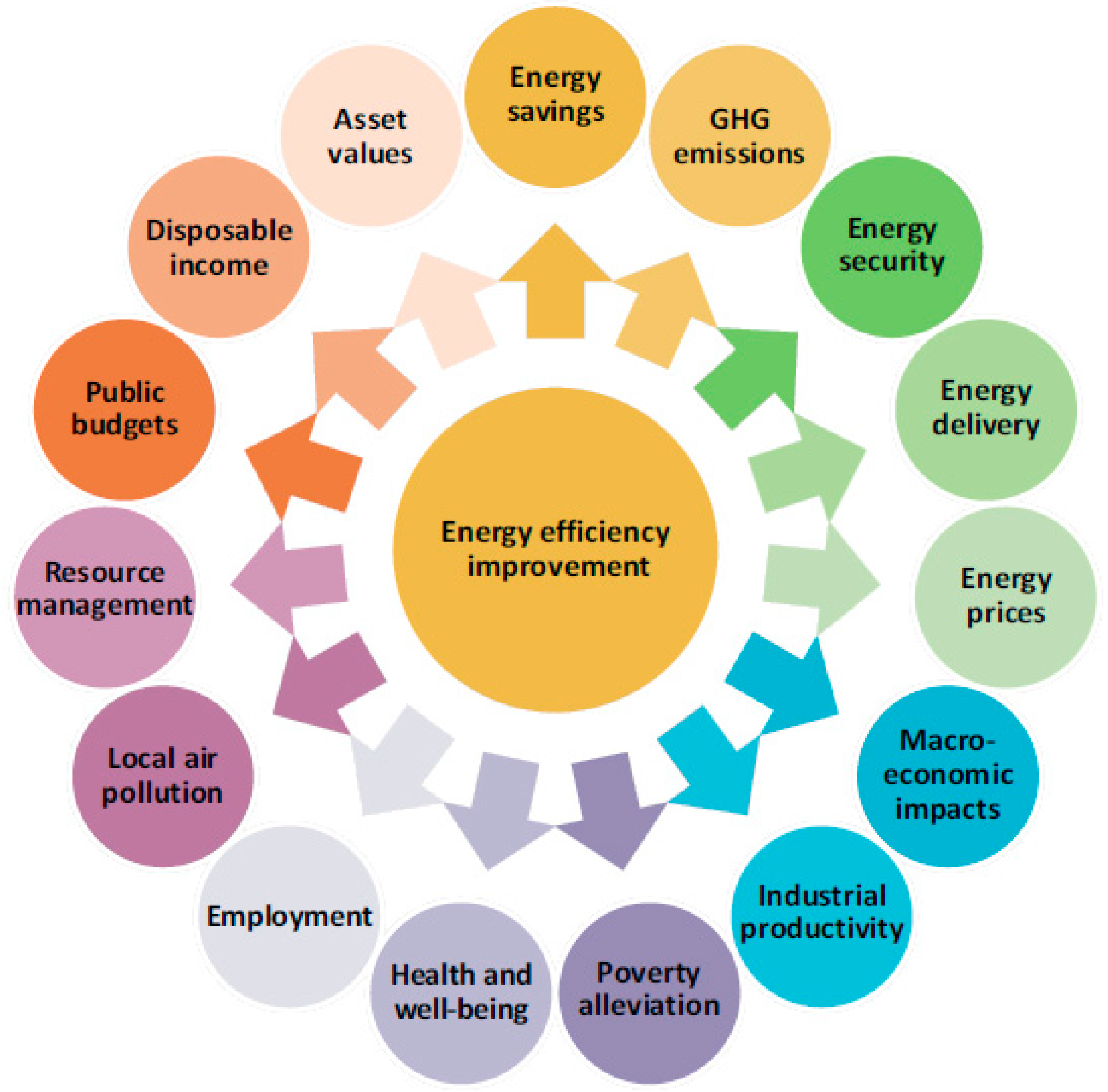

- IEA. Capturing the Multiple Benefits of Energy Efficiency 2014. Available online: https://www.iea.org/publications/freepublications/publication/Multiple_Benefits_of_Energy_Efficiency.pdf (accessed on 28 November 2018).

- Cucchiella, F.; D’Adamo, I.; Gastaldi, M.; Koh, S.C.L.; Rosa, P. A comparison of environmental and energetic performance of European countries: A sustainability index. Renew. Sustain. Energy Rev. 2017, 78, 401–413. [Google Scholar] [CrossRef]

- European Commission Roadmap to a Resource Efficient Europe. COM(2011)571, 2011. Office for Official Publications of the European Communities. Available online: http://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:52011DC0571 (accessed on 19 December 2017).

- Sherman, W.; Diguilio, L. The Second Round Of G3 Reports: Is Triple Bottom Line Reporting Becoming More Comparable? J. Bus. Econ. Res. 2010, 8, 59–77. [Google Scholar] [CrossRef]

- Krippendorff, K. Content Analysis: An Introduction to Its Methodology; Sage Publications, Inc.: Thousand Oaks, CA, USA, 1980. [Google Scholar]

- Global Reporting Initiative, Sustainability Reporting Guidelines—Version 3.0. 2006. Available online: https://www.globalreporting.org/resourcelibrary/G3-Guidelines-Incl-Technical-Protocol.pdf (accessed on 15 January 2017).

- Global Reporting Initiative, Sustainability Reporting Guidelines—Version 3.1. 2011. Available online: https://www.globalreporting.org/resourcelibrary/G3.1-Guidelines-Incl-Technical-Protocol.pdf (accessed on 15 January 2017).

- Global Reporting Initiative, Implementation Manual—Part II. 2011. Available online: https://www.globalreporting.org/resourcelibrary/GRIG4-Part2-Implementation-Manual.pdf (accessed on 15 January 2017).

- Global Reporting Initiative, Consolidated Set of GRI Sustainability Reporting Standards 2016. Available online: https://www.globalreporting.org/standards/gri-standards-download-center/consolidated-set-of-gri-standards/ (accessed on 15 January 2017).

- DiMaggio, P.; Powell, W. The iron cage revisited: Institutional isomorphism and collective rationality in organizational fields. Am. Sociol. Rev. 1983, 48, 147–160. [Google Scholar] [CrossRef]

- Powell, W.; DiMaggio, P. The New Institutionalism in Organizational Analysis; University of Chicago Press: Chicago, IL, USA, 1997. [Google Scholar]

- Dumitru, M.; Dyduch, J.; Gușe, R.G.; Krasodomska, J. Corporate reporting practices in Poland and Romania—An ex-ante study to the new non-financial reporting European Directive. Acc. Eur. 2017, 14, 279–304. [Google Scholar] [CrossRef]

- Islam, M.A.; Deegan, C. Media pressures and corporate disclosure of social responsibility performance information: A study of two global clothing and sports retail companies. Acc. Bus. Res. 2010, 40, 131–148. [Google Scholar] [CrossRef]

- De Villiers, C.; Alexander, D. The institutionalization of corporate social responsibility reporting. Br. Acc. Rev. 2014, 46, 198–212. [Google Scholar] [CrossRef]

- Azapagic, A. Developing a framework for sustainable development indicators for the mining and minerals industry. J. Clean. Prod. 2004, 12, 639–662. [Google Scholar] [CrossRef]

- Solvay Annual Integrated Report 2016. Available online: https://www.solvay.com/en/investors/publications/reports/2016-annual-report.html (accessed on 11 July 2017).

- Dragomir, V.D. How do we measure corporate environmental performance? A critical review. J. Clean. Prod. 2018, 196, 1124–1157. [Google Scholar] [CrossRef]

- Dragomir, V.D. Environmentally sensitive disclosures and financial performance in a European setting. J. Acc. Organ. Chang. 2010, 6, 359–388. [Google Scholar] [CrossRef]

- Holder-Webb, L.; Cohen, J.R.; Nath, L.; Wood, D. The Supply of Corporate Social Responsibility Disclosures Among, U.S. Firms. J. Bus. Ethics 2009, 84, 497–527. [Google Scholar] [CrossRef]

- Hahn, R.; Lülfs, R. Legitimizing Negative Aspects in GRI-Oriented Sustainability Reporting: A Qualitative Analysis of Corporate Disclosure Strategies. J. Bus. Ethics 2014, 123, 401–420. [Google Scholar] [CrossRef]

- Calu, A.; Negrei, C.; Calu, D.A.; Avram, V. Reporting of Non-Financial Performance Indicators—A Useful Tool for a Sustainable Marketing Strategy. Amfiteatru Econ. 2015, 17, 977–993. [Google Scholar]

- Paun, D.; Bray, S.; Yamaguchi, T.; You, S. A Sustainability Performance Assessment Tool: The SPA System. J. Sustain. Educ. 2016, 12, 1–20. [Google Scholar]

- James, M.L. The benefits of sustainability and integrated reporting: An investigation of accounting majors’ perceptions. J. Legal Ethical Regul. Issues 2015, 18, 1–20. [Google Scholar]

| Items | 2020 (Established in 2007) | 2030 (Established in 2014) |

|---|---|---|

| Reduction in GHG emissions (base year: 1990) | 20% | 40% |

| Energy obtained from renewable sources | 20% | 27% |

| Improvement in energy efficiency | 20% | 27% |

| Description | Total | Sensitive Companies | Non-Sensitive Companies |

|---|---|---|---|

| Total number of companies | 49 | 10 | 39 |

| Companies applying GRI guidelines, of which: | 35 | 10 | 25 |

| 28 | 8 | 20 |

| 6 | 2 | 4 |

| 1 | 0 | 1 |

| Total number of reports analysed | 69 | 30 (three investigated years) | 39 (one investigated year) |

| Indicator | Sensitive (max = 10) | Non-Sensitive (max = 25) | All Companies (max = 35) | Difference |

|---|---|---|---|---|

| 0 | 1 | 2 | 3 | 4 = 1 − 2 |

| Materials (average in %) | 35.00% | 44.00% | 41.43% | −9.00% |

| G4-EN1 | 5 | 15 | 20 | |

| G4-EN2 | 2 | 7 | 9 | |

| Energy (average in %) | 58.00% | 65.60% | 63.43% | −7.60% |

| G4-EN3 | 7 | 22 | 29 | |

| G4-EN4 | 4 | 9 | 13 | |

| G4-EN6 | 8 | 21 | 29 | |

| G4-EN5 | 6 | 15 | 21 | |

| G4-EN7 | 4 | 15 | 19 | |

| Water (average in %) | 66.67% | 26.67% | 38.10% | 40.00% |

| G4-EN8 | 7 | 13 | 20 | |

| G4-EN9 | 6 | 3 | 9 | |

| G4-EN10 | 7 | 4 | 11 | |

| Biodiversity (average in %) | 52.50% | 17.00% | 27.14% | 35.50% |

| G4-EN11 | 6 | 3 | 9 | |

| G4-EN12 | 5 | 7 | 12 | |

| G4-EN13 | 6 | 4 | 10 | |

| G4-EN14 | 4 | 3 | 7 | |

| Emissions (average in %) | 70.00% | 65.14% | 66.53% | 4.86% |

| G4-EN15 | 8 | 21 | 29 | |

| G4-EN16 | 9 | 21 | 30 | |

| G4-EN17 | 8 | 20 | 28 | |

| G4-EN18 | 7 | 14 | 21 | |

| G4-EN19 | 6 | 20 | 26 | |

| G4-EN20 | 4 | 8 | 12 | |

| G4-EN21 | 7 | 10 | 17 | |

| Effluents and Waste (average in %) | 62.00% | 33.60% | 41.71% | 28.40% |

| G4-EN22 | 8 | 8 | 16 | |

| G4-EN23 | 8 | 17 | 25 | |

| G4-EN24 | 7 | 7 | 14 | |

| G4-EN25 | 4 | 4 | 8 | |

| G4-EN26 | 4 | 6 | 10 | |

| Products and services (average in %) | 30.00% | 26.00% | 27.14% | 4.00% |

| G4-EN27 | 3 | 9 | 12 | |

| G4-EN28 | 3 | 4 | 7 | |

| Compliance (average in %) | 60.00% | 36.00% | 42.85% | 24.00% |

| G4-EN29 | 6 | 9 | 15 | |

| Transport (average in %) | 40.00% | 24.00% | 28.57% | 16.00% |

| G4-EN30 | 4 | 6 | 10 | |

| Overall (average in %) | 60.00% | 33.00% | 40.71% | 27.00% |

| G4-EN31 | 7 | 6 | 13 | |

| G4-EN32 | 8 | 10 | 18 | |

| G4-EN33 | 6 | 11 | 17 | |

| G4-EN34 | 3 | 6 | 9 | |

| Minimum | 30.00% | 17.00% | 27.14% | 4.00% |

| Maximum | 70.00% | 65.60% | 66.53% | 40.00% |

| Standard deviation | 13.74% | 16.61% | - | - |

| Categories | Sensitive | Global Compact | ISO 14001 | ISO 9001 | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Yes (Average) | No (Average) | p-Value | Yes (Average) | No (Average) | p-Value | Yes (Average) | No (Average) | p-Value | Yes (Average) | No (Average) | p-Value | |

| No. of companies | 10 | 25 | - | 24 | 11 | - | 23 | 12 | - | 10 | 25 | - |

| Materials | 0.35 | 0.44 | 0.665 | 0.42 | 0.41 | 0.975 | 0.46 | 0.33 | 0.536 | 0.40 | 0.42 | 0.887 |

| Energy | 0.58 | 0.66 | 0.651 | 0.69 | 0.51 | 0.195 | 0.78 | 0.35 | 0.001 | 0.84 | 0.55 | 0.051 |

| Water | 0.67 | 0.27 | 0.023 | 0.36 | 0.42 | 0.793 | 0.41 | 0.33 | 0.630 | 0.37 | 0.39 | 0.955 |

| Biodiversity | 0.53 | 0.17 | 0.018 | 0.23 | 0.36 | 0.566 | 0.36 | 0.10 | 0.038 | 0.43 | 0.21 | 0.170 |

| Emissions | 0.7 | 0.65 | 0.476 | 0.69 | 0.61 | 0.662 | 0.80 | 0.42 | 0.001 | 0.89 | 0.58 | 0.013 |

| Effluents and waste | 0.62 | 0.34 | 0.60 | 0.41 | 0.44 | 0.933 | 0.48 | 0.30 | 0.174 | 0.40 | 0.42 | 0.969 |

| Products and services | 0.3 | 0.26 | 0.888 | 0.29 | 0.23 | 0.643 | 0.35 | 0.13 | 0.093 | 0.30 | 0.26 | 0.634 |

| Compliance | 0.6 | 0.36 | 0.001 | 0.46 | 0.36 | 0.001 | 0.57 | 0.17 | 0.001 | 0.50 | 0.40 | 0.001 |

| Transport | 0.4 | 0.24 | 0.001 | 0.29 | 0.27 | 0.001 | 0.30 | 0.25 | 0.001 | 0.20 | 0.32 | 0.001 |

| Overall | 0.6 | 0.33 | 0.029 | 0.40 | 0.43 | 0.86 | 0.46 | 0.31 | 0.229 | 0.48 | 0.38 | 0.438 |

| All the indicators | 0.53 | 0.37 | 0.100 | 0.42 | 0.40 | 0.799 | 0.50 | 0.27 | 0.009 | 0.48 | 0.39 | 0.243 |

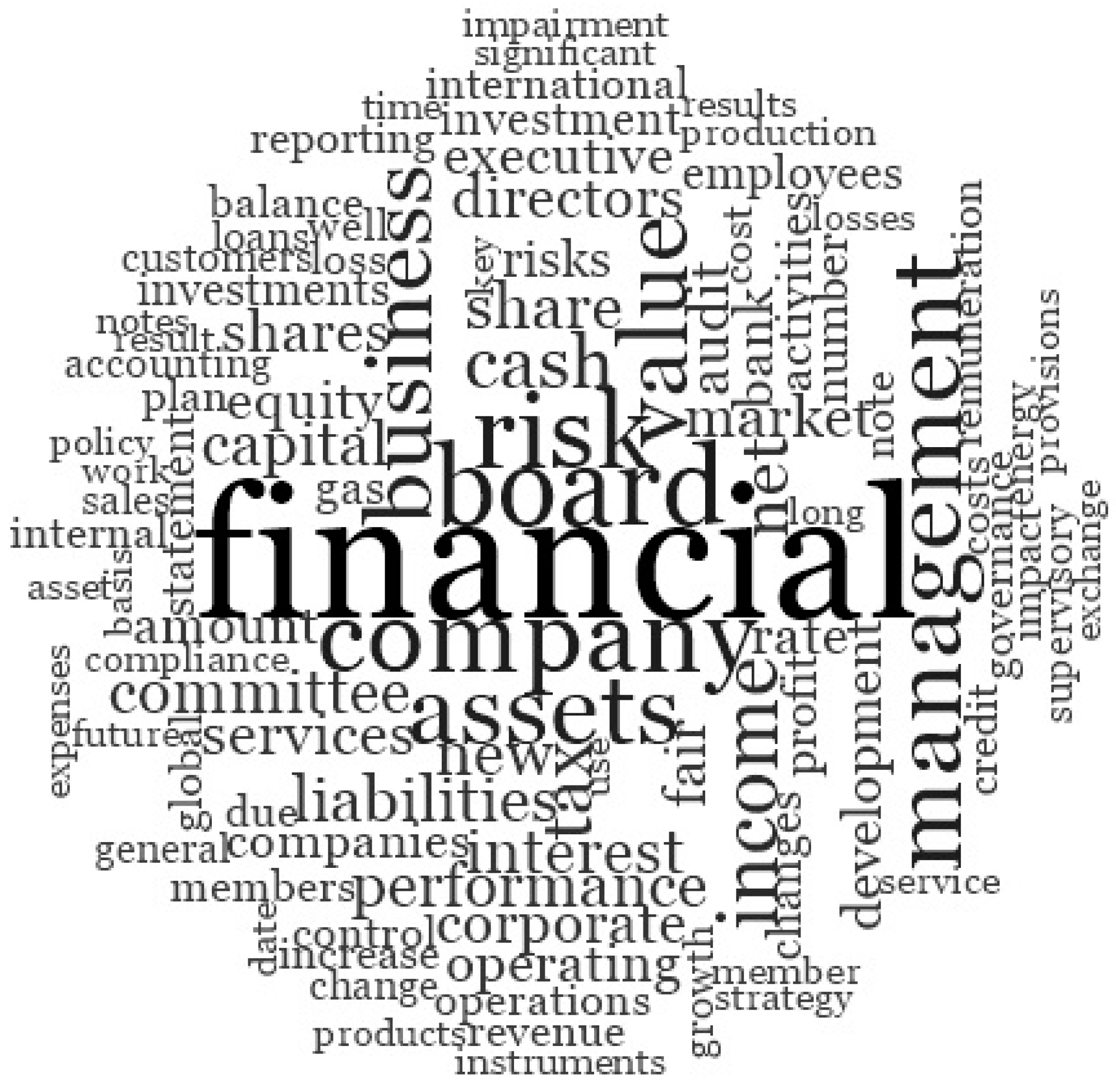

| Word | Place | Frequency |

|---|---|---|

| Services | 35 | 7285 |

| Gas | 65 | 5120 |

| Energy | 101 | 3947 |

| Compliance | 110 | 3663 |

| Products | 128 | 3428 |

| Emissions | 278 | 2021 |

| Overall | 512 | 1243 |

| Water | 521 | 1235 |

| Materials | 602 | 1094 |

| Waste | 660 | 997 |

| Transport | 850 | 759 |

| Biodiversity | 0 | 0 |

| Effluents | 0 | 0 |

| Organizations | Total Score | Number of Indicators | Average Score | Number of GRI Versions |

|---|---|---|---|---|

| 0 | 1 | 2 | 3 = 1/2 | 4 |

| Basic Materials/Chemicals | ||||

| A | 12 | 10 | 1.20 | 3 |

| B | 14 | 12 | 1.17 | 3 |

| C | 19 | 11 | 1.73 | 3 |

| Mean | 15.00 | 11.00 | 1.36 | 3 |

| Median | 14.00 | 11.00 | 1.20 | 3 |

| Industrials | ||||

| D | 23 | 12 | 1.92 | 3 |

| E | 15 | 13 | 1.15 | 3 |

| F | 12 | 6 | 2.00 | 3 |

| Mean | 16.67 | 10.33 | 1.69 | 3 |

| Median | 15.00 | 12.00 | 1.92 | 3 |

| Oil & Gas | ||||

| G | 21 | 12 | 1.75 | 3 |

| H | 17 | 14 | 1.21 | 3 |

| I | 23 | 14 | 1.64 | 2 |

| J | 11 | 8 | 1.38 | 2 |

| Mean | 18.00 | 12.00 | 1.50 | 2.5 |

| Median | 19.00 | 13.00 | 1.51 | 2.5 |

| No. of organizations | 10 | 10 | 10 | 10 |

| Mean | 16.70 | 11.20 | 1.51 | 2.8 |

| Min | 11 | 6 | 1.15 | 2 |

| Max | 23 | 14 | 2.00 | 3 |

| Standard deviation | 4.60 | 2.57 | 0.33 | 0.42 |

| Median | 16.00 | 12.00 | 1.51 | 3 |

| Organization | Indicator | 2010 | 2013 | 2016 |

|---|---|---|---|---|

| C | 306-2 ‘Waste by type and disposal method’ (e.g., non-hazardous waste) | 3658 kilotons | 1,688,882 tons | 1463 metric tons |

| D | 303-1 ‘Total water withdrawal by source’ | 549,240 m3 | - | over 1.8 Mn cubic metres |

| I | 302-1 ‘Energy consumption within the organization’ | 3.997 × 1016 J | 2.58 × 1017 J | 338.2 million gigajoules |

| Year of the Report | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 |

|---|---|---|---|---|---|---|---|

| Direct GHG emissions (declared in 2016) | 48.7 | 52.1 | 47.6 | 42.0 | 41.6 | ||

| Direct GHG emissions (declared in 2013) | 49.13 | 52.5 | 47.3 | ||||

| Direct GHG emissions (declared in 2010) | 61.99 | 57.66 | 60.68 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Avram, V.; Calu, D.A.; Dumitru, V.F.; Dumitru, M.; Glăvan, M.E.; Jinga, G. The Institutionalization of the Consistency and Comparability Principle in the European Companies. Energies 2018, 11, 3456. https://doi.org/10.3390/en11123456

Avram V, Calu DA, Dumitru VF, Dumitru M, Glăvan ME, Jinga G. The Institutionalization of the Consistency and Comparability Principle in the European Companies. Energies. 2018; 11(12):3456. https://doi.org/10.3390/en11123456

Chicago/Turabian StyleAvram, Viorel, Daniela Artemisa Calu, Valentin Florentin Dumitru, Mădălina Dumitru, Mariana Elena Glăvan, and Gabriel Jinga. 2018. "The Institutionalization of the Consistency and Comparability Principle in the European Companies" Energies 11, no. 12: 3456. https://doi.org/10.3390/en11123456

APA StyleAvram, V., Calu, D. A., Dumitru, V. F., Dumitru, M., Glăvan, M. E., & Jinga, G. (2018). The Institutionalization of the Consistency and Comparability Principle in the European Companies. Energies, 11(12), 3456. https://doi.org/10.3390/en11123456