Abstract

Sustainability issues in supply chains have received increasingly significant concern. Facing incentives such as environmental tax and consumer environmental awareness, firms and even retailers have started to make sustainability investments. To evaluate the retailer’s contribution to sustainability issues, we study a supply chain with one manufacturer and two symmetric competing retailers who have the option to make sustainable investment in their upstream members directly in green technology or clean production. We investigate the optimal sustainable investment and operation decisions under three power structures: (1) firms have the same power (Nash game); (2) the manufacturer is more powerful (Manufacturer-lead Stackelberg game) and (3) the retailers are more powerful (Retailer-lead Stackelberg game). By analyzing the optimal decisions and the economic performances, we show that the retailers always have incentives to make sustainable investment in all power structures. However, the retailers’ power affects firms’ decisions, the economic and the environmental performances. When the investment cost is low, the emission reduction due to investment is the most significant with less powerful retailers. With relatively high investment cost, whether the retailers having more power make more sustainable investment depends on the unit tax saving and effect factor of emission reduction on the demand. From the environmental perspective, simultaneous games may conduct the most significant total emission reduction in most cases. We also consider an asymmetric case and compare it with the symmetric one.

1. Introduction

Increasingly crucial environmental issues, such as carbon emission, have received concerns in both academia and industry. Many countries, such as the USA, have adopted carbon emission regulations to deal with these issues. Among these regulations, environmental tax has been shown to be an efficient one to reduce the carbon emission [1]. As a result, many firms have incentives to invest in green technologies to reduce carbon emissions and get tax credits accordingly [2].

Regarding the market response, literature also has shown that consumers are willing to pay more for the products labeled as green products [3]. The so-called consumer environmental awareness is also an incentive for firms to make sustainable investment. Hence, in a supply chain, the sustainable investment may benefit not only the manufacturer by reducing the carbon emission, but also the retailer from the demand side. As a result, retailer’s involvement in sustainability programs has been observed [4,5]. More interestingly, some retailers, such as Marks & Spencer (UK), make sustainable investment directly in their manufacturer’s clean production. Based on its sustainability report, Marks & Spencer spent over 200 million pounds in 2007 for sustainable projects including the investment in the suppliers’ manufacturing [6]. It is safe to address that the retailers nowadays have an incentive to contribute to sustainability issues, such as emission reduction, directly by making investment in clean manufacturing. Note that most of the recently disclosed sustainability report shows that the retailers sustainable investment project is made by the huge ones [6,7]. It is also an interesting direction to investigate whether the retailers with less power would be hurt or benefit when they participate in sustainable investment, though very little effort has been made in the existing literature or industrial reports to explore this issue.

Motivated by the above industrial practices, in this paper, we investigate how a retailer contributes to sustainability issues by evaluating the investment in sustainability and related performances. Specifically, we consider two retailers’ orders from a common manufacturer and competing in retail price. Each retailer has the option to make sustainable investment directly in the common manufacturer’s clean production and make announcements about it to stimulate the sales. The common manufacturer benefits from the sustainable investment by reducing emissions and related tax. In addition, the manufacturer has the option to change wholesale prices to affect the retailers’ sustainable investment. Taking the retailers’ position in the supply chain into consideration, we also study the impact of power structure on the retailers’ sustainable investment and related performance of the supply chain. We analyze the manufacturer’s wholesale price, the carbon emission reduction level due to the retailers’ investment and retail price in Nash Game, Manufacturer-lead Stackelberg Game and Retailer-lead Stackelberg Game, respectively. After deriving the optimal solutions, the manufacturer’s wholesale price, the retailers’ carbon emission reduction level and retail prices, for various cases associated with these three supply chain power structures, we conduct some comparisons to show managerial insights. By comparing the optimal decisions and retailers’ profits, we investigate the retailers’ incentive of sustainable investment. In addition, we also compare the manufacturer’s profit and analyze how the manufacturer reacts by adjusting the wholesale price with the retailers’ investment. Then, from the environmental perspective, we analyze the impact of the retailers’ power on the investment and environmental performance such as emission reduction. Furthermore, we extend our results in an asymmetric setting where only one of the retailers makes the investment. We show that the emission reduction per unit due to a single retailer’s investment is higher than that in the both retailer invest scenario in the sequential games (i.e., Manufacturer-lead and Retailer-lead Stackelberg Game), though it is more beneficial for the environment due to the total emission reduction when both retailers make the sustainable investment. To the best of our knowledge, this paper is the first to study the effects of competitive retailers’ sustainable investment in supply chains with different power structures.

The rest of the paper is organized as follows. Literature review is demonstrated in Section 2. In Section 3, we introduce the retailers’ and manufacturer’s decision models under three different power structures. In Section 4, we derive the optimal solutions with the retailers’ sustainable investment in different power structures, respectively. The optimal solutions, profits and environmental performances in different structures are compared and managerial insights are derived in Section 5. In this section, we also extend our result to an asymmetric setting. We conclude this paper and point out some directions of future research in the last section. All proofs are relegated to Appendix A.

2. Literature Review

This paper is related to three streams of research of supply chain management in the literature, i.e., sustainable supply chain management, supply chain management with competition and the impact of the power structure.

Integrating the sustainability issues into the operational decisions, researchers have shown that sustainable investment and adjusted operations decisions may improve supply chain member’s performance from both economic and environmental perspectives [5]. Sustainability investment made by the manufacturer is widely observed in literature of sustainable supply chain management. Drake et al. [2] show the impact of emission tax and emission cap-and-trade regulations on the manufacturer’s sustainable investment decision. There is also some literature that views the consumer environmental awareness as another incentive of sustainable investment made by the manufacturer [8]. Taking consideration of the consumer environmental awareness, Li and Shen [9] investigate the sustainable investment problem by developing a model combining the non-profit manufacturer and for-profit manufacturer. Note that papers that investigate the manufacturer’s role in sustainability issues are abundant, while only a few research studies focus on the retailer’s contribution from the environmental perspective. Dong et al. [3] study how the retailer’s procurement policy with environmental awareness consumers affects the manufacturer’s decision when it is under the carbon cap-and-trade regulation. Toptal et al. [4] study the joint decisions of ordering and sustainable investment under different policies such as carbon cap, tax and cap-and-trade, from the retailer’s perspective. Also considering the sustainable investment made by retailers, in this paper, we focus on the effects of the retailers’ power on their sustainability investment and performance in the competitive environment.

Some recent papers discuss the sustainable efforts made by firms with competition; however, these papers focus on manufacturers’ competition rather than the retailers’ competition. For instance, [10] examine how competition affects the firm’s investment in sustainability issues. [11] view the consumers environmental awareness as an incentive and investigate the impact on a two-stage supply chain with manufacturers’ competition. Considering product competition, [12] discuss the impact of consumer environmental awareness on and channel coordination within a two-stage supply chain. In our paper, we investigate the retailers’ sustainable investment decision in different power structures and discuss retailers’ competition. Accordingly, our study is also related with the research stream that adopts game-theoretical approaches in problems with retailer competition (see, e.g., [13,14,15]). Differentiating from this stream of studies that consider retailers’ retail price [16,17], inventory [18], sales effort [19] competitions and literature focusing on coordination in competitive environment [20,21,22], we consider that both retailers compete with retail price. Our paper makes a contribution to this stream of literature by exploring the joint effect of power structures and competition on the retailers’ investment in sustainability issues and showing how the retailers contribute to the environment.

Some papers study the impacts of different power structures on the supply chain members’ operations decisions. Ertek and Griffin [23] discuss the impact of power structure in a supply chain with a supplier and a buyer. Also based on a two-stage supply chain, Majumder and Srinivasan [24] explore the impact of leadership on the performance from a supply chain’s perspective. Besides the impact of different power structures on supply chain performance, Xue et al. [25] also examine how the supply chain member’s power affects the consumer surplus. Focused on the impacts of power structure on supply chain, Shi et al. [26] extend the previous results by considering uncertain demand. Specifically, some research considers the impact of power structures in a competitive environment. For example, Choi [27] analyzes the impact of power structure with the consideration of price competition. With a dual channel supply chain setting, Chen et al. [28] investigate the influence of power structure on the retail service. Zheng et al. [29] explore the effect of power structure in the closed-loop supply chain with dual-channel. Note that the majority of the above work did not consider the sustainability issues. A few existing papers have discussed the joint effect of different power structure and the sustainable efforts on the performance of a supply chain. Chen et al. [30] is one of the early papers that examine the joint effect of power structure and the manufacturer’s sustainable efforts on the supply chain coordination. With similar power structure settings, Shi et al. [31] discuss the sustainability investment issues with stochastic demand. The two papers consider the manufacturer’s sustainable investment only, while Shi et al. [5] investigate the retailer’s sustainable effort under different power structures with deterministic settings. Differing from the three papers, we discuss the retailers’ sustainable investment problem in different power structures with competition.

3. Modeling Framework

We consider a two-tier supply chain where a common manufacturer (indexed by M) sells a single type of products to two duopoly retailers (indexed by ) with wholesale price (resp. ) per unit. As observed in the industry practices and literature, both retailers have the option to invest in the manufacturer’s adoption of sustainable technology, due to the consumers’ environmental awareness. The retailer i’s sustainable investment costs are related to the unit carbon emission reduction level () per unit product. Following Shi et al. [5], we assume that the investment cost is increasing and convex in the emission reduction level where is the investment cost coefficient.

We consider deterministic market demand, which equals the retailers’ order quantity. The two retailers compete in one market with retail prices, which is denoted as . Another decision for the retailer i is the sustainable investment, which is reflected by the emission reduction level per unit product and denoted as . We call it emission reduction level for short. In addition, the retailers usually make an announcement or mark their contribution to sustainability through environmental disclosure (e.g., [6,7]), hence consumers can distinguish their sustainable efforts and make purchasing decisions based on different emission reduction levels from the retailers’ investment. Then, the demand quantity of retailer i is

where b implies the competition intensity of the two retailers and r shows the degree of consumers environmental awareness. Similar demand functions can also be observed in [3,5,9].

Then, the profit function of retailer i is

Note that the emission reduction may bring about the environmental tax credit for the manufacturer. We denote the saving of environmental tax as t per unit emission reduction. In addition, the manufacturer produces the product with unit cost c. Then, we denote the profit function of the manufacturer as

To avoid the trial result, following [5,9], we assume that and .

In order to investigate the impact of the retailers’ position in the supply chain on the decisions and environmental performance, we consider three different supply chain power structures.

- Nash Game (N): the two sites of the supply chain, the manufacturer and the retailers, have the same power. They play a Nash game in which they decide on the wholesale price and carbon emission reduction level through investment and retail price, simultaneously. The optimal decisions are Nash equilibrium in which each firm’s decisions are the best response of the others’ decisions.

- Manufacturer-lead Stackelberg Game (M): The manufacturer is more powerful than the two retailers. Accordingly, it is a Stackelberg game where the manufacturer plays as the leader. We call it M-lead game for short. The decision sequence is as follows: the manufacturer first decides the wholesale price; then, the two retailers decide their own retail price and the emission reduction level to respond to the wholesale price simultaneously.

- Retailer-lead Stackelberg Game (R): The two retailers are more powerful than the manufacturer. It is a Stackelberg game where the retailers are leaders in the supply chain. We call it R-lead game for short. In the decision sequence, the two retailers decide their own emission reduction level through investment and retail price simultaneously. Then, the manufacturer responds by setting the wholesale price.

The power structures we described above are widely discussed in the literature of supply chain management. Different power structures represent supply chain members’ different bargaining power or positions in the supply chain. The same structures are considered not only in the environmental topics (Shi et al. [5], Chen et al. [30], Shi et al. [31]) but also in the issues of optimal price policy (Chen et al. [28], Ertek and Griffin [23], Cai et al. [32], Luo et al. [33]), channel competition (Choi [27], Zheng et al. [29], Wu et al. [34]), channel selection (Xue et al. [25], Chen and Wang [35]) and so on.

4. Analysis of Different Power Structures

First, we discuss the optimal decisions and profits in different power structures. The retailer i’s optimal retail price and emission reduction level is denoted as and in different power structures, respectively, where . Note that the optimal retail price (i.e., ) is obtained by searching the optimal contribution margin , essentially. In addition, the manufacturer’s optimal wholesale price towards the retailer i is denoted as . We have the following lemma:

Lemma 1.

The retailers’ optimal decisions are all symmetric. The optimal decisions under each power structure are shown in the Table 1,

Table 1.

Optimal decisions.

The lemma shows the existence and uniqueness of the optimal decisions of the retailers and manufacturer, respectively.

Focused on the impact of the investment cost coefficient on all supply chain members’ decisions, we further analyze the retailers’ role after they made sustainable investment.

Corollary 1.

The monotonicity of the optimal emission reduction level, retail price and wholesale price in λ are represented as follows:

- 1.

- , , are all decreasing in λ.

- 2.

- and are decreasing in λ. is increasing in λ only when .

- 3.

- is increasing in λ only when . is increasing in λ. is increasing in λ only when .

It is consistent with intuition that each retailer’s emission reduction level (i.e., ) decreases in investment cost (i.e., ). As a result, the drop of emission reduction level due to high investment cost will reduce the demand, which is affected by the sustainability investment. In order to attract demand purchasing, the retailers have to drop the retail price in Nash game and R-lead game. Interestingly, whether the retail price decreases in in an M-lead game depends on the relationship between and r. Note that the former represents the tax reduction effect on the manufacturer side due to emission reduction per unit product, while the latter denotes the marginal effect of the emission reduction on the demand. Acting as a follower, each retailer faces a wholesale price positively related with sustainable investment cost in an M-lead game. When the market demand is notably stimulated by the emission reduction level (i.e., ), the retailers still adopt a relatively low retail price in an M-lead game as they do in Nash and R-lead game. However, when the increase of demand is not quite significant due to less sensitivity towards sustainability (i.e., ), each retailer attempts to raise retail prices to keep the profit margin, as the sustainable investment cost increases. This implies that, to a certain extent, the sustainable investment cost is partially transferred to the consumers in an M-lead game with demand that has weak environmental awareness. As the sustainable investment cost decreases, which brings about more significant sustainable investment and environmental tax reduction, the manufacturer has an incentive to reduce the wholesale price in most cases unless the tax credit is relatively low (i.e., and in Nash and R-lead game, respectively).

The following lemma concludes the manufacturer and retailers’ profits under different power structures with both retailers’ investment.

Lemma 2.

The retailers’ and manufacturer’s optimal profits under different power structures are demonstrated in Table 2,

Table 2.

Optimal profits with both retailers’ investment.

5. Comparison and Insights

In this section, we analyze the retailers’ role in sustainability issues by investigating the retailers’ motivation of sustainable investment, the optimal decisions, economic and environmental performances with respect to retailers’ powers. We first show the retailers’ incentive of investment by comparing optimal decisions and profits, and then discuss the related performances in different power structures.

5.1. Incentive of Retailers’ Sustainable Investment in Different Power Structures

To emphasize the motivation of sustainable investment, we define a benchmark case, under which neither of the retailers make an investment. We use ‘’ above the notations to represent this case. By setting and in the original model, then holds . Then, we solve and present the manufacturer and retailers’ optimal decisions and profits in no investment scenarios in Table 3.

Table 3.

Optimal decisions and profits in no investment scenario.

To show the incentive of sustainable investment, we first compare the optimal wholesale prices with/without retailers’ investment, respectively.

Proposition 1.

In the Nash game, we have when ; otherwise, .

In the M-lead game, we have .

In the R-lead game, we have when ; otherwise, .

This proposition shows that the retailers will be charged at a lower wholesale prices by making sustainable investment in most cases. Interestingly, in both R-lead game and Nash game, the retailer is charged a higher wholesale price after making sustainable investment, when the unit savings of environmental tax is relatively lower than the improvement of demand due to sustainability investment (i.e., and ). It implies that when the manufacturer has less power (i.e., Nash game and R-lead game), it attempts to raise its wholesale price when the benefit in tax reduction is dominated by the increased demand, when the retailers take responsibility to make sustainable investment. It also hints that the retailers’ motivation for sustainable investment may be hurt in the above scenarios.

Next, we compare the optimal retail prices in scenarios with and without sustainable investment under each power structure, respectively.

Proposition 2.

In the Nash game, we have .

In the M-lead game, we have when ; otherwise, .

In the R-lead game, we have .

This proposition further shows that the retailers are able to utilize the power to charge higher retail prices with sustainable investment (i.e., and ). However, when the manufacturer is the leader of the supply chain, the retailers may have to drop the retail prices with sustainable investment if the tax reduction is dominated by the increased demand (i.e., ).

From Propositions 1 and 2, the impacts of sustainable investment on the optimal wholesale price and retail price are different in each power structure. In addition, the joint effect of the wholesale price and retail price on the retailers’ profit is not clear. Then, we compare the retailers’ optimal profits directly with/without investment to show the retailers’ motivation of sustainable investment under different power structures, respectively. In addition, we compare the manufacturer’s profits as well. The following proposition concludes the results.

Proposition 3.

The retailers and the manufacturer always gain more profit when both the retailers make sustainable investment than that in the no investment scenario (i.e., and , ).

This proposition shows that both retailers have an incentive to make sustainable investment in all power structures due to the profit improvement. In addition, the manufacturer gains benefit by the retailers’ investment from the tax reduction and increased demand, even if he yields some contribution margin to the retailers sometimes in the previous analysis. Combining with the results in Propositions 1 and 2, the incentive of retailers’ investment is from the joint effect of wholesale prices and retail prices with sustainable investment.

5.2. Impact of Retailers’ Power on Decisions and Performances

In this subsection, we discuss how the retailers’ power affects the supply chain members’ decision and related performances. First, we investigate the impact of the retailers’ power on the optimal wholesale prices, by comparing them in different power structures. Regarding the effect of power structure on the manufacturer’s optimal wholesale price, we have the following proposition:

Proposition 4.

1. When , ; otherwise, . 2. .

The proposition indicates that the wholesale price is decreasing in the retailers’ power (), when the sustainable investment cost is relatively large (i.e., ). It implies that when the sustainable investment cost is high, the retailers may have less incentive to make the investment and the manufacturer may face the drop of environmental tax credit and demand with environmental awareness. As a result, the manufacturer utilizes his power to charge a high wholesale price. However, we find that when the investment cost is relatively low, the wholesale price as a function of the retailers’ power is inverse U-shape (i.e., and ). It implies that when the sustainable investment cost is low, the manufacturer has to yield an amount of revenue in sequential games (i.e., R-lead game and M-lead game) to induce and compensate the retailers’ high sustainable investment.

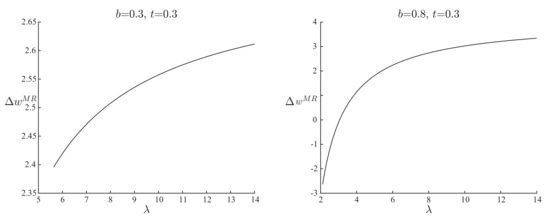

Unfortunately, analytical comparison of the optimal wholesale prices in an M-lead game and R-lead game is intractable. Hence, we further investigate the manufacturer’s optimal wholesale price in an M-lead game and R-lead game, respectively, through numerical analysis. For the values of parameters, we set , , and consider a market with moderate competition by setting while considering a market with intense competition by letting . Denoting , we change from to 14. The result is shown in Figure 1.

Figure 1.

The difference of and .

From the numerical study, when the competition is moderate enough (i.e., ), always hold. When the competition is intense (i.e., ), only when is relatively small. Facing a market with moderate competition, the retailers’ incentive of demand stimulation from sustainable investment may become weak. As a result, they will suffer from a high wholesale price when they have less power (i.e., ). However, when the retailers face a highly competitive market, and the sustainable investment cost is relatively low, they will make more sustainable investment to attract demands, which may reduce the wholesale price as their power increases (i.e., ).

Then, regarding the effect of power structure on the retailers’ optimal retail prices, we have the following proposition:

Proposition 5.

1. When , ; otherwise, . 2. .

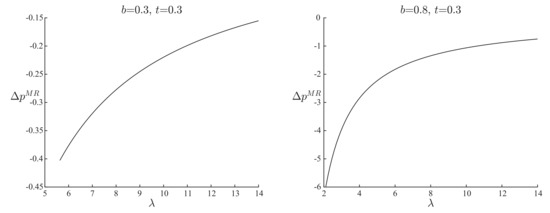

From Proposition 5, we find that the comparison between M-lead game and Nash game is coincident with that in the wholesale price. However, the relation of retail prices is different from the wholesale prices in Nash game and R-lead games. It implies that sustainable investment may benefit the retailers significantly in R-lead scenario, since they obtain a high profit margin from the relatively low wholesale price and high retail price. For the more complex comparison between M-lead and R-lead game, we show the results of numerical analysis with different competition intensity, tax rate and investment cost, which is shown in Figure 2.

Figure 2.

The difference of and .

Denote that . Varying the competition intensity, tax rate and investment cost, respectively, we find the retailers always charge higher prices when the they are more powerful (). To sum up, retailers charge highest prices under R-lead game, and the relationship of prices between Nash game and M-lead game depends on the investment cost.

Next, we will show the impact of retailers’ power from the environmental perspective. We compare the optimal emission reduction levels between any two power structures. The results are demonstrated as follows:

Proposition 6.

The comparison of carbon emission reduction level in each scenario is demonstrated as follows.

- 1.

- When , ; otherwise, .

- 2.

- When , ; otherwise, .

- 3.

- When , ; otherwise, .

Proposition 6 implies that the sustainable effort, which is reflected by emission reduction per unit, depends on the investment cost coefficient and the ratio of unit tax credit and consumer’s environmental awareness. When the investment cost is relatively low, the M-lead game conducts the highest investment in sustainable effort. The reason for the result is that the retailers have a strong incentive to make sustainable investment with low investment cost; however, they utilize their power to reduce the amount of sustainable investment under certain conditions. On the other hand, it also hints that when the sustainable investment cost is relatively high, the retailers have less motivation to make sustainable investment. However, the retailers makes more investment as they are more powerful in the supply chain. Interestingly, the comparison of emission reduction between Nash game and R-lead game is only dependent on the unit tax saving and consumer environmental awareness. Note that when the consumer’s environmental awareness is relatively significant, retailers with less power attempt to invest more in sustainability issues.

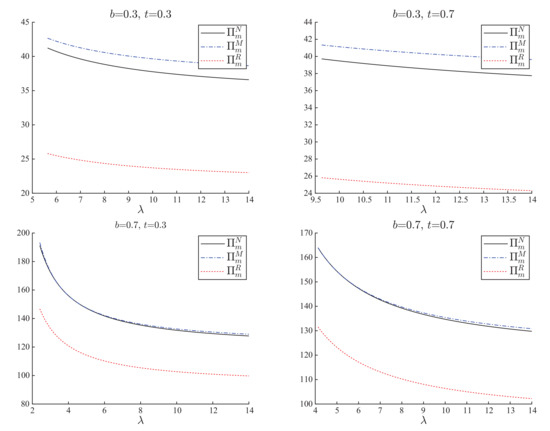

To further investigate the retailers’ contribution from the environmental perspective, we investigate the total carbon emission reduction, which is defined as . As shown in Figure 3, in most of the cases, the total carbon emission reduction is the most significant when all of the firms are equally powerful and lowest when the manufacturer has more power. It implies that simultaneous games benefit the environment with the most significant carbon emission reduction. However, when the tax rate is high with moderate competition or low investment cost, the sequential game, in which the retailer acts as a leader, brings about the most total carbon emission reduction. It hints that the retailers’ dominating position in the supply chain benefits the environment more in the sequential game. The M-lead game also conducts the highest total carbon emission reduction quantity with intense competition, low tax rate and low investment cost. From the numerical analysis, we also find when , there is . It is interesting that lower investment in sustainability (i.e., ) brings about more significant total carbon emission reduction (i.e., ) due to the high ordering quantity.

Figure 3.

Total carbon emission reduction quantity.

In order to investigate the impact of different power structures on the economic performance, we further compare the firms’ profit by numerical analysis. Notice that the results of comparison rely on parameters , b and . Without loss of generality, we fix , and normalize in the following numerical studies. To investigate the impacts of investment cost coefficient, the tax rate and the intense of competition, we vary the value of with different combinations of b and t. The setting satisfies assumptions in our model. The following figures summarize the comparison of retailers’ profits.

From Figure 4, in most cases, the retailers’ profits are the highest in R-lead game while the lowest in an M-lead game. The retailers’ profits are higher in an M-lead game than that in Nash game (i.e., ), when the investment cost is low and the competition is intense (i.e., b is large). In addition, if the tax rate t is low enough, the retailers’ profits in an M-lead game are even higher than that in R-lead game (i.e., ).

Figure 4.

The retailers’ optimal profits.

Next, we compare the manufacturer’s profit in each scenario. From Figure 5, from the aspect of the manufacturer, we find that the manufacturer’s profit increases his power in the supply chain (i.e., ).

Figure 5.

The manufacturer’s optimal profits.

5.3. Extension

Note that we have investigated the sustainability issues in a symmetric setting, where both the retailers will or will not invest at the same time. Next, we extend the result to an asymmetric scenario, where only one retailer makes the sustainable investment under different supply chain structures. In the asymmetric setting, we assume that the manufacturer may charge different wholesale prices for the two retailers. Denote and as the profits of the retailers and the manufacturer; without loss of generality, we assume that only retailer 2 makes sustainable investment. Then, the profits of the retailers and manufacturer are as follows:

where , . Then, we compare the unit/total emission reduction and the optimal profits of the firms with that in the symmetric investment scenario numerically.

Figure 6 shows the comparison of the unit and total emission reduction quantities. It is interesting to observe that the emission reduction per unit in a single retailer’s investment case is higher than that in the both retailers’ investment scenario when the manufacturer has more power. However, it is more beneficial for the environment due to the total emission reduction when both retailers make the sustainable investment. This observation is consistent with intuition.

Figure 6.

Unit/total carbon emission reduction in the symmetric/asymmetric investment situations.

Figure 7 compares the retailers’ profits and the manufacturer’s profits in the symmetric investment case, the asymmetric investment case and no investment case, respectively. From the aspect of the manufacturer, we find that the manufacturer’s profit increases in the number of retailers who make investment in sustainability. From the retailers’ aspect, the preferences are more complicated. In Nash game and R-lead game, the free-rider gets benefits from his rival’s investment in asymmetric scenario and his rival makes more investment profits than the free-rider. Hence, the free-rider has motivation to join the sustainable investment project, since the profit is higher in both retailers’ investment cases. However, when they are in an M-lead game with high investment cost, the free-rider will be hurt by its rival’s sustainable investment under this power structure (i.e., ). In that case, the free rider has more incentive to join the sustainable investment project.

Figure 7.

Profit comparison among different investment situations.

The results in the above analysis show that the sustainability investment benefits both the manufacturer and the competing retailers no matter who has more power. It provides evidence of incentive which stimulates the retailers to make the investment. It also explains the reason that the retailer like Marks & Spencer is willing to invest in its manufacturer in sustainability. On one hand, the powerful retailers may gain more profits from the sustainability investment. On the other hand, the investment will also help the small retailers gain benefits from profit improvement with intense competition. Furthermore, both of the weak retailers should make the investment to avoid a loss.

6. Conclusions

In this paper, we consider a sustainability investment problem of two competing retailers. The relationship of supply chain parties is considered in different power structures: all the firms have the same power, the manufacturer is more powerful, and the two retailers are more powerful. We model the three scenarios as three games: Nash game, M-lead stackelberg game and R-lead stackelberg game. After solving the equilibrium in each game, we analyze the monotonicity of optimal decisions in the investment cost coefficient. The results show that when the investment is getting inefficient, the retailers will always invest less no matter what the power structure is. However, the wholesale price and retail price decisions may increase or decrease depending on the power structure and the ratio of the unit tax saving and the effect factor of emission reduction. Considering the no investment situation as the benchmark, we point out that the manufacturer and retailers’ incentives of sustainability investment comes from the profit improvement, though the impacts of sustainable investment on the wholesale price and retail price are more complicated. The results show that the retailers are always willing to make sustainable investment in the common manufacturer for profit improvement, even if they are followers in the supply chain. We also show the impact of the retailers’ power on the decisions and firms’ performances. From the environmental perspective, when the sustainable investment cost is low, the retailers invest the most if they are the followers of the game, while their investment increases their power, when the investment cost is high and the incentive from consumer environmental awareness dominates the tax reduction. Furthermore, in most cases, simultaneous games bring about the most significant total emission reduction. We also consider the asymmetric setting with only one of the retailers making a sustainable investment. The comparison result shows that, although the free-rider benefits from his rival’s investment in most of the cases, he also will be hurt when the retailers are less powerful. Furthermore, the free-rider is always willing to join the investment project for profit improvement.

This paper can be viewed as an early exploration to understand the retailers’ contribution to sustainability issues by investing in the clean manufacturing directly in different power structures. However, several limitations exist in this paper. From the aspect of technique, we failed to present the condition that the manufacturer charges a higher wholesale price when he is more powerful. The similar limitation also appears in the analysis of retail prices. Instead, we show a rough but reasonable result in a numerical way. From the aspect of managerial insight, limited by the supply chain structure in the model, the conclusions are applicative only when the retailers are symmetric in the competition. The relationship between competing retailers and manufacturer in the real supply chain is much more complex. The conclusions of this paper only present the incentive of retailers’ sustainability investment in a specific situation. Consequently, the present model has pointed out some potential future research directions. Firstly, the demand in our model is deterministic. Accordingly, one of the directions for future research is to explore a problem with stochastic demand models. In addition, it will be interesting to further investigate the supply chain coordination with different contracts with retailers’ sustainable efforts and competition. Moreover, we may also consider that the manufacturer has an option to make sustainable investment. Furthermore, our model may be extended by considering multiple types of sustainable products made by different manufacturers in a more complex setting such as chain-to-chain competition.

Funding

This research was funded by National Natural Science Foundation of China grant number 71501097.

Conflicts of Interest

The author declares no conflict of interest. The founding sponsors had no role in the design of the study; in the collection, analyses, or interpretation of data; in the writing of the manuscript, and in the decision to publish the results.

Appendix A

Proof of Lemma 1.

Given the wholesale price, each retailer decides the marginal contribution per unit product, which is denoted as , essentially. It ensures obtaining traceable analytical results.

- When all the firms have the same power, we solve the three firms’ decisions simultaneously. The first-order derivatives are , , The Hesse matrix of retailer’s profit function isThe Hesse matrix of manufacturer’s profit function isTherefore, we solve the optimal decisions by . Thus, we get , , , , where . Furthermore, it is obvious that and .

- When the manufacturer is more powerful, given the wholesale price, we solve the optimal reduction levels and retail prices of two retailers. The first-order derivatives are , From , we get and . Substituting into the manufacturer’s profit function, we get . We solve the optimal wholesale price by . Thus, we get , , , , where . Furthermore, it is obvious that and .

- When the two retailers are more powerful, given the reduction levels and the retail prices, we first solve the optimal wholesale price. The first-order derivatives are . By solving , we get . Substituting the optimal respond wholesale price into retailers profit functions, we get , . Therefore, we get the optimal decisions by .Thus, we get , , , , where . Furthermore, it is obvious that and .

□

Proof of Corollary 1.

- Notice that , and are all increasing in . Then, we get , , are all decreasing in .

- The first-order derivative of optimal retail prices in are , , . It is easy to find that and are negative because of . is positive only when .

- The first-order derivative of optimal wholesale prices in are , , . It is easy to find that is positive only when . Because , is positive. By solving the equation in t, we get the solutions are and . Notice that the first solution is negative; therefore, is positive only when .

□

Proof of Propositions 1 and 2.

In the Nash game, , therefore, . , when we have , when we have . In the M-lead game, , when we have , when we have . ; therefore, . In the R-lead game, ; therefore, . , when we have , when we have . □

Proof of Proposition 3.

Notice that the benchmark model equals the situation in which the retailer fixes the carbon emission reduction decision as 0 in our model. Thus, because of the optimality, it is obvious that .

We next compare the manufacturer’s optimal profits. In the Nash game, we have ; therefore, . In the M-lead game, we have ; therefore, . In the R-lead game, we have ; therefore, . □

Proof of Proposition 4.

- The difference between and is . Obviously, the formula is positive only when . The constraint of has been considered in the proof of Proposition 6.

- Notice that . Therefore, it is easy to find that .

□

Proof of Proposition 5.

- The difference between and is . Obviously, the formula is positive only when . The constraint of has been considered in the proof of Proposition 6.

- The difference between and is . With the assumption , it is obvious that . Therefore, .

□

Proof of Proposition 6.

- The difference between and is . Obviously, the formula is negative only when . Consider the constraint of ; solving the equation in t, we get only when and .

- The difference between and is . The signal of the formula is independent from . When we get .

- The difference between and is . Obviously, the formula is positive only when .

□

References

- Krass, D.; Nedorezov, T.; Ovchinnikov, A. Environmental taxes and the choice of green technology. Prod. Oper. Manag.. 2013, 22, 1035–1055. [Google Scholar] [CrossRef]

- Drake, D.F.; Kleindorfer, P.R.; Van Wassenhove, L.N. Technology choice and capacity portfolios under emissions regulation. Prod. Oper. Manag. 2015, 25, 1006–1025. [Google Scholar] [CrossRef]

- Dong, C.; Shen, B.; Chow, P.S.; Yang, L.; Ng, C.T. Sustainability investment under cap-and-trade regulation. Ann. Oper. Res. 2016, 240, 509–531. [Google Scholar] [CrossRef]

- Toptal, A.; Özlü, H.; Konur, D. Joint decisions on inventory replenishment and emission reduction investment under different emission regulations. Int. J. Prod. Res. 2014, 52, 243–269. [Google Scholar] [CrossRef]

- Shi, X.; Qian, Y.; Dong, C. Economic and Environmental Performance of Fashion Supply Chain: The Joint Effect of Power Structure and Sustainable Investment. Sustainability 2017, 9, 961. [Google Scholar] [CrossRef]

- Marks&Spencer Plan A Report 2016. Available online: http://planareport.marksandspencer.com/M&S_PlanA_Report_2016.pdf (accessed on 15 June 2016).

- NIKE Sustainable Business Report 2017. Available online: https://sustainability-nike.s3.amazonaws.com/wp-content/uploads/2018/05/18175102/NIKE-FY1617-Sustainable-Business-Report_FINAL.pdf (accessed on 15 June 2016).

- Du, S.; Zhu, J.; Jiao, H.; Ye, W. Game-theoretical analysis for supply chain with consumer preference to low carbon. Int. J. Prod. Res. 2015, 53, 3753–3768. [Google Scholar] [CrossRef]

- Li, Q.; Shen, B. Sustainable Design Operations in the Supply Chain: Non-Profit Manufacturer vs. For-Profit Manufacturer. Sustainability 2016, 8, 639. [Google Scholar] [CrossRef]

- Yalabik, B.; Fairchild, R.J. Customer, regulatory, and competitive pressure as drivers of environmental innovation. Int. J. Prod. Econ. 2011, 131, 519–527. [Google Scholar] [CrossRef]

- Liu, Z.L.; Anderson, T.D.; Cruz, J.M. Consumer environmental awareness and competition in two-stage supply chains. Eur. J. Oper. Res. 2012, 218, 602–613. [Google Scholar] [CrossRef]

- Zhang, L.; Wang, J.; You, J. Consumer environmental awareness and channel coordination with two substitutable products. Eur. J. Oper. Res. 2015, 241, 63–73. [Google Scholar] [CrossRef]

- Cachon, G.P.; Netessine, S. Game theory in supply chain analysis. In Models, Methods, and Applications for Innovative Decision Making; Johnson, M.P., Norman, B., Secomandi, N., Gray, P., Greenberg, H.J., Eds.; Informs: New York, NY, USA, 2006; pp. 200–233. [Google Scholar]

- Feng, Q.; Lu, X. The strategic perils of low cost out-sourcing. Manage. Sci. 2012, 58, 1196–1210. [Google Scholar] [CrossRef]

- Feng, Q.; Lu, X. The role of contract negotiation and industry structure in production outsourcing. Prod. Oper. Mana. 2013, 22, 1299–1319. [Google Scholar] [CrossRef]

- Anderson, E.J.; Bao, Y. Price competition with integrated and decentralized supply chains. Eur. J. Oper. Res. 2010, 200, 227–234. [Google Scholar] [CrossRef]

- Wang, Z.; Hu, M. Committed versus contingent pricing under competition. Prod. Oper. Manag. 2014, 23, 1919–1936. [Google Scholar] [CrossRef]

- Zhao, X.; Atkins, D.R. Newsvendors under simultaneous price and inventory competition. Manuf. Ser. Oper. Manag. 2008, 10, 539–546. [Google Scholar] [CrossRef]

- Giri, B.C.; Sharma, S. Manufacturer’s pricing strategy in a two-level supply chain with competing retailers and advertising cost dependent demand. Econ. Model. 2014, 38, 102–111. [Google Scholar] [CrossRef]

- Bernstein, F.; Federgruen, A. Pricing and replenishment strategies in a distribution system with competing retailers. Oper. Res. 2003, 51, 409–426. [Google Scholar] [CrossRef]

- Xiao, T.; Qi, X. Price competition, cost and demand disruptions and coordination of a supply chain with one manufacturer and two competing retailers. Omega 2008, 36, 741–753. [Google Scholar] [CrossRef]

- Cao, E.; Wan, C.; Lai, M. Coordination of a supply chain with one manufacturer and multiple competing retailers under simultaneous demand and cost disruptions. Int. J. Prod. Econ. 2013, 141, 425–433. [Google Scholar]

- Ertek, G.; Griffin, P.M. Supplier-and buyer-driven channels in a two-stage supply chain. IIE Trans. 2002, 34, 691–700. [Google Scholar] [CrossRef]

- Majumder, P.; Srinivasan, A. Leader location, cooperation, and coordination in serial supply chains. Prod. Oper. Manag. 2006, 15, 22. [Google Scholar]

- Xue, W.; Demirag, O.C.; Niu, B. Supply chain performance and consumer surplus under alternative structures of channel dominance. Eur. J. Oper. Res. 2014, 239, 130–145. [Google Scholar] [CrossRef]

- Shi, R.; Zhang, J.; Ru, J. Impacts of power structure on supply chains with uncertain demand. Prod. Oper. Manag. 2013, 22, 1232–1249. [Google Scholar] [CrossRef]

- Choi, S.C. Price competition in a channel structure with a common retailer. Market. Sci. 1991, 10, 271–296. [Google Scholar] [CrossRef]

- Chen, X.; Wang, X.; Jiang, X. The impact of power structure on the retail service supply chain with an O2O mixed channel. J. Oper. Res. Soc. 2016, 67, 294–301. [Google Scholar] [CrossRef]

- Zheng, B.; Yang, C.; Yang, J.; Zhang, M. Dual-channel closed loop supply chains: Forward channel competition, power structures and coordination. Int. J. Prod. Res. 2017, 1–18. [Google Scholar] [CrossRef]

- Chen, X.; Wang, X.; Chan, H.K. Manufacturer and retailer coordination for environmental and economic competitiveness: A power perspective. Trans. Res. Part E Logist. Trans. Rev. 2017, 97, 268–281. [Google Scholar] [CrossRef]

- Shi, X.; Zhang, X.; Dong, C.; Wen, S. Economic Performance and Emission Reduction of Supply Chains in Different Power Structures: Perspective of Sustainable Investment. Energies 2018, 11, 983. [Google Scholar] [CrossRef]

- Cai, G.G.; Zhang, Z.G.; Zhang, M. Game theoretical perspectives on dual-channel supply chain competition with price discounts and pricing schemes. Int. J. Prod. Econ. 2009, 117, 80–96. [Google Scholar] [CrossRef]

- Luo, Z.; Chen, X.; Chen, J.; Wang, X. Optimal pricing policies for differentiated brands under different supply chain power structures. Eur. J. Oper. Res. 2017, 259, 437–451. [Google Scholar] [CrossRef]

- Wu, C.H.; Chen, C.W.; Hsieh, C.C. Competitive pricing decisions in a two-echelon supply chain with horizontal and vertical competition. Int. J. Prod. Econ. 2012, 135, 265–274. [Google Scholar] [CrossRef]

- Chen, X.; Wang, X. Free or bundled: channel selection decisions under different power structures. Omega 2015, 53, 11–20. [Google Scholar] [CrossRef]

© 2018 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).