Abstract

The purpose of this study was to establish the determinants of crowdfunding campaign successes of African small-to-medium enterprises (SMEs) during the COVID-19 pandemic. The study utilised cross-sectional data, which were collected from TheCrowdDataCentre database. This consisted of 215 crowdfunding projects in Africa during the COVID-19 pandemic. The logistic and ordinary least squares (OLS) regression models were specified to test the research questions of the study. The results of the study documented that the average pledged amount and number of backers variables were positively and significantly related to crowdfunding success. This accords with the signalling theory. Many backers and higher amount pledges signal investor confidence in the project. The results of the study also show that a crowdfunding campaign’s success was positively related to the number of updates. This is consistent with the information asymmetry theory, as frequent updates symptomize transparency; hence, backers will have more information, which will spur them to invest more in the project. These results provide guidelines to practitioners and entrepreneurs on the factors that are important in harnessing crowdfunding resources from crowdfunding sources to ensure the financial sustainability of SMEs as the world emerges from the COVID-19 pandemic.

1. Introduction

The sustainability of entrepreneurs is of paramount importance as entrepreneurs act as important agents of economic growth. The financial sustainability of small-to-medium enterprises (SMEs) remains an enigma that continues to occupy the research discourse. SMEs, despite their contributions to the economic and social development of nations, face the challenge of accessing finances from traditional sources. Arguably, in the worst-case scenario, this threatens their survival and sustainability. The COVID-19 pandemic accentuated the problem of limited access to finances with the hardening of traditional credit markets. Globally, entrepreneurship provides an estimated 60% of employment, yet these firms face challenges in accessing financing [1]. Given the perennial challenge of SMEs accessing financing from traditional financial institutions, crowdfunding has emerged as an alternative form of finance. The sustainability of SMEs, gross domestic product (GDP), entrepreneurship, and employment have been impacted by the COVID-19 pandemic [2].

The alternative source of financing, known as crowdfunding, seems to be a viable source of finance for SMEs that is more effective than traditional sources [3]. Crowdfunding is a financing method where the project owner collects small amounts of money from many funders known as backers (or the ‘crowd’). Raised funds are made up of small investments from a variety of individual backers. Projects and potential backers mostly connect through online platforms without standard financial intermediaries [4]. Providers of funds who establish these platforms mainly act as facilitators and intermediaries who connect projects and investors [5].

In 2020, the COVID-19 pandemic resulted in major disruptions, whereby all sectors of the economy, including SMEs and entrepreneurs, experienced tremendous sales drops [6]. SMEs and entrepreneurs were not able to access financing from traditional financial markets due to insufficient funds being available. In the context of the COVID-19 pandemic, traditional financing markets, such as banks and angel and venture capital were not able to mobilise funds due to social distancing policies instituted by governments [7]. Digital crowdfunding platforms became alternative sources of financing for SMEs and entrepreneurs during the COVID-19 pandemic due to the physical distancing requirements [8]. As a result, digital financial technology has increased exponentially, overcoming the limitations imposed by the COVID-19 pandemic [9]. Consequently, crowdfunding platforms have emerged as alternative sources to provide finance to SMEs and entrepreneurs alike.

There are two types of crowdfunding models: the non-investment model and investment model. First, the two forms of crowdfunding investment models involve equity-based crowdfunding and lending-based crowdfunding. Equity-based funding is where the backers contribute money in exchange for a return on the investment; lending-based crowdfunding is where a contribution is made in exchange for interest repayment within a specified period [10]. Second, for the non-investment crowdfunding model, the donation-based model is the main model. The donation-based model is described as the acceptance of money without any expectation of return, whereas with the reward-based model is described as the acceptance of money in exchange for a reward [11]. Consequently, reward-based crowdfunding remains the largest worldwide due to its popularity and usage [3]. SMEs and entrepreneurs prefer to raise financing through crowdfunding in order to obviate the need to pledge collateral or due to the external control of a shareholder.

Crowdfunding has experienced tremendous growth, growing into a global multibillion-dollar business in the last five years [12]. Massolution [13] showed that lending-based crowdfunding reached USD 25 billion, donation-based crowdfunding reached USD 2.85 billion, reward-based reached USD 2.68 billion, and equity-based reached USD 2.50 billion globally. In 2019, the crowdfunding volume was estimated to reach an estimated USD 28.8 billion. In the African continent, the adoption of crowdfunding is relatively sluggish. According to the World Bank Group [14], crowdfunding has the potential to increase access to financial resources in relation to traditional financing in Africa. Based on data from the Cambridge Centre for Alternative Finance (CCAF), the popularity of crowdfunding usage in the African continent increased with volume in all crowdfunding models, reaching USD 182 million in 2016 (growing 118% from USD 83 million in 2015) [15]. Despite the lower adoption of crowdfunding in Africa, it has potential to grow tremendously. Arguably, the biggest impediments to the adoption of crowdfunding in Africa might be explained by the limited understanding of internet technology by its populace and underdeveloped information communication technology (ICT) infrastructure.

To date, there is limited scholarly knowledge on crowdfunding in the African continent; most studies focused on developed countries, such as England, the United States of America, and China [4,16,17,18]. Moreover, there was little literature on crowdfunding focusing on Africa during the COVID-19 pandemic. Hence, this study fills the research gaps identified by scholars such as Wachira [11], Zribi [7], and Igra et al. [19]. Further, although there are studies that examined the effects of the COVID-19 pandemic on crowdfunding performances [7,8,19,20,21], these studies were confined to developed countries; hence, their findings do not necessarily yield similar results for Africa. Therefore, the current study responds to the limitations of these studies by focusing on Africa as a unit of analysis.

The reward-based crowdfunding model was utilised for this study as it is the leading crowdfunding model with potential to finance entrepreneurs and SMEs. Thus, this study fills the gap in the academic literature by focusing on the determinants of crowdfunding campaign successes of African SMEs during the COVID-19 pandemic. This inquiry was partly motivated by the realization that the sustainability of SMEs is critical for economic growth as SMEs serve as the catalyst for economic development in Africa in particular. As such, the main aim of the study was to determine the factors that influenced the crowdfunding successes of African SMEs during the COVID-19 pandemic.

The rest of the paper is organised as follows: Section 2 reviews the related literature and presents the hypotheses of the study. Section 3 describes the research methodology employed in the study. The empirical findings of the study are presented and discussed in Section 4. Section 5 concludes the study.

2. Review of Related Literature and Hypotheses Development

2.1. Theoretical Framework

The theoretical foundations of this study are firmly anchored on the pecking order of information asymmetry and signalling theories. The setting theory agenda also influences crowdfunding success. An additional source of finance, known as crowdfunding, has emerged for entrepreneurs to tap into. Notwithstanding, entrepreneurs mostly rely on internal financing before considering external sources of finance (for example, bank loans or venture capital), which is consistent with the pecking order theory. However, information asymmetries exist between entrepreneurs or fund seekers and external financing [22]. Regarding crowdfunding, the problem of information asymmetry has the potential to limit the investors or backers from contributing to the project’s initiator. As a result, the worthy crowdfunding project could go unfunded due to the limited information provided to the backers and investors [23].

More backers for a crowdfunding campaign may send the signal of crowdfunding success. The availability of information may attract the crowd in making decisions, i.e., whether to contribute or not. The signal theory by Ross [24] and Spence [25] states that entrepreneurial activities provide or convey worthy information to the investors and backers to enable them to make contributions or invest in a crowdfunding campaign. The theory indicates that between these two parties (the crowd and project creator), one party must examine how to communicate or signal information and the other party must interpret the information provided in order to make informed decisions. The signalling theory has potential to identify all behaviours of individuals when accessing information provided on the crowdfunding platform [26]. Hence, the theory was adopted to determine factors influencing the crowdfunding performances in the African continent during the COVID-19 crisis. Mainly, the information conveyed influences the crowd to consider the campaign’s initiatives. The crowdfunding platform presents transparency by disclosing the project creator and fund seeker in the process of raising financing. The project creator may provide limited information to the supporters or backers of the project, which creates the problem of information asymmetry.

The common feature amongst all types of crowdfunding campaigns is that, in contrast to more conventional sources of finance, financial means are derived from a range of backers. Funding mechanisms of these crowdfunding platforms are often based on a minimum target amount (or an all-or-nothing principle) and come with a fixed timeframe to attract investors [4]. According to these crowdfunding principles, projects only receive funding if the raised sum meets the overall targeted investment sum or a lower minimum threshold, which ensures the practicability of the project. If the project cannot reach its target within the given timeframe, the collected sum goes back to the investors. Each project initiator sets a funding goal within the default maximum and a minimum amount given by the platform providers. Another principle used by crowdfunding platforms is the ‘keep-what-you-raise’ approach. In this case, no threshold needs to be reached. The project initiator receives all funds that have been collected within the set timeframe. Typically, the timeframe for projects to raise money ranges from 30 to 90 days.

The agenda setting theory also has a bearing on crowdfunding success as it has an impact on social media policies. According to the social media theory, the social tie involves the interaction between two parties, namely the project creator and backers or the crowd [27]. The strength of a social bond is determined by a combination of time, emotional intensity, intimacy, and reciprocity, which characterize the bond [28]. Therefore, social media in relation to crowdfunding remains an important contribution to the success performance. Intimate communication through social media, such as Facebook, Twitter, LinkedIn, is considered to be a strong tie [29]. As a result, crowdfunding platform provide social interaction accounts and, thus, share their projects statuses with the crowd [30].

Innovation relies on digital transformational entrepreneurs, which include changes in business settings [9]. Therefore, crowdfunding is a social change that occurs through entrepreneurial innovative financing activities that occur digitally. Ratten et al. [31] defined the transformational social entrepreneurship theory as innovative business activities being developed to respond to social issues. Hence, from the vantage point of the transformational entrepreneur social theory, crowdfunding has the potential to overcome problems created by the COVID-19 pandemic in relation to access to finance. A crowdfunding platform alleviates the limited access to financing due to its popularity and growth, especially in Africa [11].

2.2. Reward-Based Crowdfunding Model

This study is based on the reward-based crowdfunding model. Reward-based crowdfunding refers to a project creator or SME that promises to provide backers with a non-monetary reward in exchange for money (they are essentially contributing to the project campaign success in the future) [32]. The reward-based platform is the largest popular crowdfunding platform that provides funds to SMEs [33]. It is divided into two stakeholders: backers and SMEs. The SMEs create crowdfunding projects and sell them to backers in exchange for money and rewards. Such rewards may be in the form of monetary value or non-monetary value, which attract backer contributions to the crowdfunding campaign.

2.3. Hypotheses Development

In this subsection, we present the hypotheses that underpin this study. We discuss these next.

- The availability of videos and images.

The presence of images on a crowdfunding platform enables the crowd or backers to decide whether to support the project campaign [34]. Therefore, the presence of visuals increases the quality and trust concerning the crowdfunding campaign. Hence, the availability of videos and images reduces the information asymmetry between the project creator and backers. The presence of images and videos on the crowdfunding platform signal a creator’s preparedness, which attracts a large number of backers [35]. Hence, the project creator appears to be more personal and human, decreasing the distance between the backers and project creator (entrepreneur). Therefore, the presence of images and videos signals a strong tie between project creators (SMEs) and backers.

The videos and images appearing on the crowdfunding campaign page attract the backers to invest and contribute to the crowdfunding project [18]. The presence of images and videos on the project page attracts the backers and supporters to contribute to the project campaign [36,37]. The presence of videos is seen as an effective source of information and likely impacts how backers evaluate the project and the success of the project, eliminating confusion concerning the project campaign [38]. The image and video usage on the crowdfunding campaign has the probability to increase the success of the campaign [39]. Campaign projects without images and videos have a high probability of unsuccessful performances. The image usage promotes a project campaign and makes it easier for backers, investors, family, and friends to be aware of the campaign [40]. These views are supported by Huang et al. [41], who indicated that text messages have limited performances on crowdfunding compared to video and visual images. Contrarily, Butticè et al. [42] and Petitjean [34] reported a negative relationship between videos/images and crowdfunding success. As a result, we hypothesise that:

Hypothesis 1

(H1). The presence of videos will have positive and significant influences on the success of a crowdfunding campaign.

Hypothesis 2

(H2). The availability of images on the project page increases the probability of the project’s success.

- The presence of project updates.

Consistent updates made between the project creator and backers signal the crowdfunding success [16]. Updates during a campaign show that the creator is staying in touch with the crowd; it allows creators to present new insights into the project’s progress and communicate further information. Information may include the current status of the project or new features that will be unlocked when a funding threshold is reached. The success of crowdfunding relies on transparency and trustworthiness [11]. Hence, updates strengthen the relationship between backers and the project creator, and as a result, increase the probability of success. Sharing information and communicating during a campaign in the form of updates decreases the problems concerning information asymmetry, creating a unified consensus [35]. Continuous updates made on the crowdfunding platform reduce the weak social ties between backers and SMEs.

The more updates made on the crowdfunding page, the more backers will be attracted to it, which will increase the crowdfunding performance. Updates are communicative mechanisms that provide additional information about the business ideas of entrepreneurs to potential investors [43]. The more updates provided on the crowdfunding campaign project, the more it has the potential to attract more investors or backers, which will ultimately lead to crowdfunding success. Furthermore, the study conducted by de Larrea et al. [44] showed that the absence of updates decreased crowdfunding success. According to Lagazio et al. [45], projects with updates increase the involvement of many contributors and backers to invest or donate into the project campaign. In line with the previous findings from the literature, the proposed hypothesis is as follows:

Hypothesis 3

(H3). Project updates will have positive and significant influences on the crowdfunding campaign’s success.

- The duration of the project.

The duration of the crowdfunding campaign is the period in which the project creator or SME attempts to access financing from the backers. However, the period differs based on the crowdfunding platform; for example, Kickstarter ranges from 1 to 60 days and Indiegogo ranges from 1 to 40 days. Mollick [4] reported that a short duration signals trustworthiness and confidence to backers (or the crowd) in regard to supporting the project campaign. Furthermore, backers may not doubt the crowdfunding’s ability to access finance.

The duration of the project campaign has the probability to influence the performance of a crowdfunding campaign. According to Mollick [4], a longer duration time has less of a probability of success in crowdfunding because it signals a lack of confidence. These views are supported by Anglin et al. [46], who contended that a longer duration decreases the confidence of backers or supporters in regard to contributing to the project campaign. A longer duration of the crowdfunding campaign indicates a negative influence on the crowdfunding success. Most backers will perceive that there is a lack of confidence if the project duration is long [4]. The shorter duration of the project campaign provides backers with quality time and confidence. The longer duration of the crowdfunding project campaign has broader visibility and awareness but it might be perceived as a lack of trust to funders/backers, which will ultimately decrease the probability of success [47]. Further, Cordova et al. [48] documented that a longer duration increases the chances of success on the crowdfunding performance with the reward-based model. The expectation of the study is that the visibility of a crowdfunding project that is longer will decrease the probability of success. Hence, we hypothesise that:

Hypothesis 4

(H4). The duration decreases the probability of the crowdfunding project’s success.

- Actual funding amount.

Regarding the amount of money raised in millions (USD) from a crowdfunding platform, in later multiple regressions, the natural logarithm (of the actual funding amount plus 1) is used. The actual amount of money raised is used as the control variable and has the probability of success performance. The actual funding amount raised is used as the control variable. The number of funders as well as the average funding amount per funder, as potential mediators, improves the crowdfunding success. On the other hand, a small number of backers decreases the probability of success. The average funding amount of a project increases the probability of the crowdfunding performance [49]. However, in some instances where there is less risk concerning the project campaign, there is a high probability of success [50]. Crowdfunding is characterised by less risk and a transparent source of finance. Hence, the research hypothesis put forward is:

Hypothesis 5

(H5). The actual funding amount increases the probability of the crowdfunding project’s success.

- The number of backers.

The backers are persuaded by the rewards promised after contributions are made on the crowdfunding campaign’s project [51]. The rewards provided to backers in exchange for money contribute to the campaign’s success. The project creator is responsible for building trust among backers regarding their willingness to contribute to the crowdfunding success [35]. Furthermore, it signals crowdfunding success due to the higher number of backers willing to support the campaign.

The number of backers supporting the project campaign is influenced by the number of rewards offered [47]. A larger number of backers supporting the project campaign increases the probability of success [52]. These findings are supported by the findings by Abdeldayem et al. [53] and Sum [54]. However, the results are not in line with the findings by Hobbs [55]. The backers and creators increase the probability of the crowdfunding success [17]. It is, therefore, an important indicator of crowdfunding success since it attracts backers to contribute to the project campaign. Hence, the research hypothesis is as follows:

Hypothesis 6

(H6). The larger number of backers increases the probability of the crowdfunding campaign’s success.

3. Research Methodology

A quantitative research approach was adopted in this study. This was premised on testing the existing theories of crowdfunding in the African continent. Secondary data were extracted from the TheCrowdDataCentre database. Purposive sampling was adopted for the study. This entailed the analysis of secondary data extracted from the database for the period 28 December 2019 to 31 December 2020, which coincided with the COVID-19 pandemic. This period coincided with the lockdowns imposed by many governments during the COVID-19 pandemic. The cross-sectional data were utilised on crowd-funding campaigns in African countries.

Leading crowdfunding platforms, such as such as Kickstarter, Indiegogo, and Fundraised were utilised for the study. There were 215 campaigns. To test our hypotheses, logistic and OLS regression analyses were conducted using EViews software. The diagnostic tests were applied to ensure that the estimated model did not suffer from any outliers. Correlation analysis and vector inflation variance (VIF) tests were conducted to ensure the goodness of fit of the estimated model. The variables utilised in the study are described in Table 1.

Table 1.

Variable definitions.

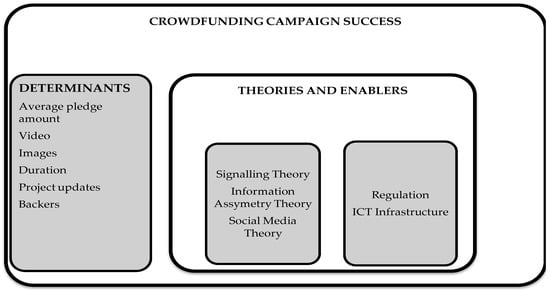

Figure 1 depicts the conceptual framework for this study. This entails the theories that have a bearing on the crowdfunding campaign’s success as well as the determinants. The enablers of a crowdfunding campaign’s success are also documented.

Figure 1.

Conceptual framework. Source: authors’ own compilation.

The following logistic model was specified to test the hypotheses of the study:

where

ε represents the error term.

β represents the slope of the regression equation, which can be interpreted when there is a change in the value of Y and X rather than using log odds when there is a change in the log odd of the even occurring (Y = 1), if even is successful, it is influenced by an increase in one unit of the independent variables.

Equation (1) can, thus, be expressed as follows:

Table 2 the sampled number of projects and crowdfunding categories.

Table 2.

Category distribution from the sample.

4. Empirical Results and Discussion of Findings

This section presents the empirical findings of the study. Table 3 presents the summary statistics of the study. The campaign success (CS) and the dependent variable assumed a mean value of 0.15 with a standard deviation of 0.36. The variation of the dependent variable ranges from 0.00 to 1.00. The average pledge (AVP) has a mean value of 2.16 and a standard deviation of 2.11, a maximum value of 8.38, and a minimum of 0.00. The duration of a campaign has a mean value of 42.11 and a standard deviation of 17.60, with a variation range from 3.00 to 41.00. The image has a variation of ranges, from 0.00 to 1.00, with a mean value of 0.76 and standard deviation of 0.43. Backers (BCK) have a mean value of 1.39 and a standard deviation of 1.77 with a minimum value of 0.00 and a maximum of 7.80. The project update (UPD) assumes a mean value of 1.59 and standard deviation of 4.86 with a variation from 0.00 to 41.00. Lastly, the presence of video (VD) has a mean value of 0.55 with a standard deviation of 0.50, ranging between 0.00 and 1.00.

Table 3.

Summary of the statistics.

The correlation matrix and the variance inflation factor values are presented in Table 4. A positive association was established between a campaign’s success and all other variables other than duration, which was negatively related. The highest collinearity was 72% between the backers and crowdfunding success, which was the highest compared to other independent variables. As a results of a higher correlation between BCK and CS, the variance inflation factor (VIF) was applied to validate the regressor between backers and the crowdfunding success.

Table 4.

Correlation matrix and variance inflation factors of the predictors.

The VIF test results presented in Table 4 confirmed that there was no problem with multicollinearity since the threshold of 5 was not exceeded [56]. The correlation matrix shows that there was no problem with multicollinearity amongst the variables since the threshold of 0.80 did not exceed the regressor variables. Based on the econometric analysis, there were no regressor variables that were highly correlated; we can sufficiently assume that there is no problem with multicollinearity in the model [57].

The results as presented in the correlation matrix also document that the campaign success was negatively associated to the duration at the 5% level of significance. This finding resonates with those of Liang et al. [58] and Kuo et al. [59], who found a negative significant relationship between duration and a crowdfunding campaign’s success. This implies that the longer the duration of the crowdfunding campaign, the slimmer the chances of success. This is logical since more time in between a project’s start and end dates in a crowdfunding platform can discourage backers and investors as they will have concerns about the reliability of the project and timely delivery.

The logistic regression results of the study are presented in Table 5. The Pseudo R-squared value is 0.6817, which shows a good fit of the model, as recommended by Domencich et al. [60]. Based on the model, guidelines indicate that a value larger than 0.2–0.4 is an excellent fit for logistic model 1 (Table 5). The ordinary least square (OLS) is presented in model 2 (Table 5). The results show an R-square of 0.54 (54%). This indicates that a 54% variation of the independent variables is fully explained in the model. Additionally, the predictors of the model were statistically significant at the 1% level (p < 0.000).

Table 5.

The regression analysis results.

The results show that campaign success (CS) is positively and significantly related to the average pledge (AVP) variable at the 5% level of significance. This means that the higher the average pledge by backers, the higher the probability of success of the crowdfunding campaign. This finding corroborates those of Fourkan [61], Petitjean [34], and Zhang et al. [3], who reported that the amount pledged positively and significantly impacted the success of the crowdfunding campaign. Higher amounts pledged by investors signal their confidence in the project. This is consistent with the signalling theory.

The results of the logistic regression also show that the presence of images and videos had an insignificantly negative effect on the crowdfunding campaign’s success. These findings are in accordance with those of Petitjean [34] and Tan et al. [38]; contrary to the findings by Kedas et al. [36], amongst others. The results of the study also show that a campaign’s success was positively and significantly impacted by the backers. The result was highly significant at the 1% level of significance. This implies that the higher the number of backers for a crowdfunding campaign, the higher the likelihood of success. This is in accordance with the signalling theory. A 1% increase in backers increases the probability of success by 1.76%. This is consistent with the results of existing studies, such as Wachira [11] and Petitjean [34], who found a positive and significant relationship between backers and crowdfunding success.

The OLS results in model 2, as presented in Table 5, revealed a positive and highly significant relationship between the number of backers, campaign update variables, and the crowdfunding campaign success variable. The results imply that updates and backers increase the probability of success. The findings are supported by Yin et al. [62]. The positive relationship between updates and campaign success can be attributable to the information asymmetry theory. With more updates, the information gap is narrowed and, hence, investors are likely to fund the project. However, the average pledge (AVP), duration (DRN), image (IM), and video (VD) were found to be negatively related, but insignificantly affected the crowdfunding campaign’s success. The negative relationship between the average pledge and crowdfunding success was supported by Kedas et al. [36] but contradicts the finding of Cox et al. [27]. Therefore, the results of previous studies concerning the relationship between the average pledge and campaign success were inconsistent. Regarding duration, video and image findings were confirmed by Hsieh et al. [63], Wang et al. [37], Tan et al. [38], and Butticè et al. [42]. Contrary to these findings were the results by Liang et al. [58], Petitjean [34], and Kedas et al. [36]. As such, there was no universal finding regarding the determinants of crowdfunding success during the COVID-19 pandemic.

For robustness checks, model 3 was estimated. We utilised an alternative proxy to measure crowdfunding success. In this case, the average pledged amount (AVP) was employed as the dependent variable. The results of the study, as documented in Table 5, indicate that the number of backers is robust to the alternative measures of a crowdfunding campaign’s success.

The results of the study are summarised in Table 6 and Table 7. They show that the determinants of a crowdfunding campaign’s success during the COVID-19 pandemic were the average pledge, number of backers, and duration of the campaign. These are in line with prior expectations.

Table 6.

Summary of findings based on the logistic regression.

Table 7.

Summary of Findings based on OLS regression.

5. Conclusions

Crowdfunding platforms were alternative sources of financing for many SMEs and entrepreneurs during the COVID-19 pandemic in Africa. As such, the aim of this study was to establish the determinants of crowdfunding campaign successes of African SMEs during the COVID-19 pandemic. The study employed a sample of 215 crowdfunding projects for the period from 28 December 2019 to 31 December 2020, which coincided with hard lockdowns during the COVID-19 pandemic. Secondary data were collected from the TheCrowdDataCentre database. Logistic and OLS regression were applied to analyse the cross-sectional data.

The main findings of the study were that the crowdfunding campaign’s success was positively related to the average pledged amount, updates, and the number of backers of the campaign’s variables. These findings are consistent with the signalling and information asymmetry theories. The results of the study also showed that a campaign’s success was negatively related to the duration of the campaign. Thus, it is recommended that African SMEs that seek to raise funding from crowdfunding sources intensify their marketing efforts in order to have many investors and backers contributing toward their campaigns. In this regard, social media could be leveraged for better outcomes. In the same breadth, they should strive to shorten the durations of their campaigns as this is negatively related to a campaign’s success.

To the best of our knowledge, this study is the first to contribute to the literature regarding the success of crowdfunding campaigns during COVID-19 with a focus on Africa. The study makes theoretical contributions in the sense that the research validated information asymmetry, transformational entrepreneurs, and signalling theories in relation to the research hypotheses, and laid the foundation for the adoption of crowdfunding as an alternative source for financing in developing countries. The second contribution of the study is that it serves as a practical guide for entrepreneurs, backers, and project creators to design crowdfunding models that will increase the probability of success of crowdfunding campaigns (as enunciated in the paper). For SMEs, the study will serve as a practical guide for entrepreneurs looking to use different types of crowdfunding models to successfully access financing. For regulators, we proffer to the following policy advice.

The limited regulatory framework seems to curtail the growth of the crowdfunding capital market. The limited regulatory framework on crowdfunding exists in Africa, which limits the growth of crowdfunding volume [64]. Further, the findings contribute to knowledge-based decisions for governments when establishing goals and criteria for funding programs that have the potential to assist entrepreneurs.

The crowdfunding study will possibly provide a proper solution to the lack of financing for SMEs in the African continent, including those that face limited access to financing, particularly during a reactionary crisis. However, the development and growth of crowdfunding in African countries are limited by the lack regulatory frameworks and problems with internet and digital payment penetration, online legal transactions, and the lack of awareness and trust by supporters.

There were several limitations to this study. It was confined to the COVID-19 pandemic period. Ex-post-pandemic studies could be conducted to establish whether digital acceleration (technology adoption) in the pandemic affected the crowdfunding campaign successes of SMEs. In addition to that, this was a cross-sectional study, which did not provide comparative scenarios before, during, and after the COVID-19 pandemic in Africa. Future studies can be conducted on the effectiveness of regulating crowdfunding in Africa. Moreover future studies could include other models in the African continent, such as equity and lending-based models.

Author Contributions

Conceptualization, L.P.M. and A.B.S.; methodology, L.P.M.; software, L.P.M.; validation, L.P.M. and A.B.S.; formal analysis, L.P.M.; investigation, L.P.M.; resources, L.P.M.; data curation, L.P.M.; writing—original draft preparation, L.P.M.; writing—review and editing, A.B.S.; visualization, L.P.M. and A.B.S.; supervision, A.B.S.; project administration, L.P.M.; funding acquisition, L.P.M. and A.B.S. All authors have read and agreed to the published version of the manuscript.

Funding

The APC was funded by the University of South Africa.

Institutional Review Board Statement

Not applicable.

Data Availability Statement

Data available upon request.

Acknowledgments

Attendees at the Global Development Finance Conference and the World Finance Conference (Turin, Italy) for their valuable inputs on this paper. We also wish to thank Daniel Makina for his valuable inputs. We are also indebted to Khethiwe Marais for the Language editing of the manuscript.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Sahay, M.R.; von Allmen MU, E.; Lahreche, M.A.; Khera, P.; Ogawa, M.S.; Bazarbash, M.; Beaton, M.K. The Promise of Fintech: Financial Inclusion in the Post COVID-19 Era; International Monetary Fund: Washington, DC, USA, 2020. [Google Scholar]

- Kumar, V.; Rani, R. Performance Evaluation of Selected Banking Stocks Listed on Bombay Stock Exchange During Pre & Post Covid-19 Crisis. Int. J. Innov. Econ. Dev. 2021, 7, 53–61. [Google Scholar]

- Zhang, X.; Liu, X.; Wang, X.; Zhao, H.; Zhang, W. Exploring the Effects of Social Capital on Crowdfunding Performance: A holistic analysis from the empirical and predictive views. Comput. Hum. Behav. 2022, 126, 2–17. [Google Scholar] [CrossRef]

- Mollick, E. The dynamics of crowdfunding: An exploratory study. J. Bus. Ventur. 2014, 29, 1–16. [Google Scholar] [CrossRef]

- Belleflamme, P.; Omrani, N.; Peitz, M. The economics of crowdfunding platforms. Inf. Econ. Policy 2015, 33, 11–28. [Google Scholar] [CrossRef]

- Deitrick, L.; Tinkler, T.; Young, E.; Strawser, C.C.; Meschen, C.; Manriques, N.; Beatty, B. Nonprofit Sector Response to COVID-19; The Nonprofit Institute, University of San Diego: San Diego, CA, USA, 2020; Volume 3, pp. 1–7. Available online: https://digital.sandiego.edu/npi-npissues/4 (accessed on 4 October 2022).

- Zribi, S. Effects of social influence on crowdfunding performance: Implications of the covid-19 pandemic. Humanit. Soc. Sci. Commun. 2022, 9, 192. [Google Scholar] [CrossRef]

- Santos, M.; Dias, R.M.T.S. Financial return of crowdfunding platforms: Are funding trends and success rates changing in the Covid-19 era? J. Innov. Bus. Manag. 2021, 13, 57–64. [Google Scholar] [CrossRef]

- Ratten, V. Digital platform usage amongst female sport technology entrepreneurs. J. Small Bus. Entrep. 2022, 1–24. [Google Scholar] [CrossRef]

- Shneor, R.; Mrzygłód, U.; Adamska-Mieruszewska, J.; Fornalska-Skurczyńska, A. The role of social trust in reward crowdfunding campaigns’ design and success. Electron. Mark. 2021, 32, 1103–1118. [Google Scholar] [CrossRef]

- Wachira, V.K. Crowdfunding in Kenya: Factors for Successful Campaign. Public Financ. Q. 2021, 3, 413–428. [Google Scholar]

- Cumming, D.; Hornuf, L. The Economics of Crowdfunding; Palgrave Macmillan: Cham, Switzerland, 2018. [Google Scholar]

- Massolution. Massolution Crowdfunding Industry 2015 Report. [pdf] Massolution. 2016. Available online: https://www.smv.gob.pe/Biblioteca/temp/catalogacion/C8789.pdf (accessed on 4 October 2022).

- The World Bank Group. Crowdfunding in Emerging Markets: Lessons from East African Startups; The World Bank Group: Washington, DC, USA, 2015. [Google Scholar]

- Ziegler, T.; Suresh, K.; Garvey, K.; Rowan, P.; Zhang, B.Z.; Obijiaku, A.; Rui, H. The 2nd Annual Middle East & Africa Alternative Finance Industry Report. 2020. Available online: https://www.jbs.cam.ac.uk/wp-content/uploads/2020/08/2018-06-ccaf-africa-middle-east-alternative-finance-report.pdf (accessed on 4 October 2022).

- Kuppuswamy, V.; Bayus, B.L. Crowdfunding creative ideas: The dynamics of project backers. In The Economics of Crowdfunding; Palgrave Macmillan: Cham, Switzerland, 2018; pp. 151–182. [Google Scholar]

- Wang, N.; Li, Q.; Liang, H.; Ye, T.; Ge, S. Understanding the importance of interaction between creators and backers in crowdfunding success. Electron. Commer. Res. Appl. 2018, 27, 106–117. [Google Scholar] [CrossRef]

- Pinkow, F.; Emmerich, P. Re-Examining Crowdfunding Success: How the Crowdfunding Goal Moderates the Relationship of Success Factors and Crowdfunding Performance. Central Eur. Bus. Rev. 2021, 10, 91–114. [Google Scholar] [CrossRef]

- Igra, M.; Kenworthy, N.; Luchsinger, C.; Jung, J.K. Crowdfunding as a response to COVID-19: Increasing inequities at a time of crisis. Soc. Sci. Med. 2021, 282, 114105. [Google Scholar] [CrossRef]

- Farhoud, M.; Shah, S.; Stenholm, P.; Kibler, E.; Renko, M.; Terjesen, S. Social enterprise crowdfunding in an acute crisis. J. Bus. Ventur. Insights 2021, 15, e00211. [Google Scholar] [CrossRef]

- Liu, Z.-J.; Panfilova, E.; Mikhaylov, A.; Kurilova, A. COVID-19 crisis impact on the stability between parties in crowdfunding and crowdsourcing. Wirel. Pers. Commun. 2021, 122, 915–930. [Google Scholar] [CrossRef] [PubMed]

- Jensen, M.C.; Meckling, W.H. Theory of the firm: Managerial behavior, agency costs and ownership structure. J. Financ. Econ. 1976, 3, 305–360. [Google Scholar] [CrossRef]

- Crosetto, P.; Regner, T. It’s never too late: Funding dynamics and self pledges in reward-based crowdfunding. Res. Policy 2018, 47, 1463–1477. [Google Scholar] [CrossRef]

- Ross, S.A. The Determination of Financial Structure: The Incentive-Signalling Approach. Bell J. Econ. 1977, 8, 23–40. [Google Scholar] [CrossRef]

- Spence, M. Job market signaling. In Uncertainty in Economics; Harvard University Press: Cambridge, MA, USA, 1973; pp. 281–306. [Google Scholar]

- Connelly, B.L.; Certo, S.T.; Ireland, R.D.; Reutzel, C.R. Signaling Theory: A Review and Assessment. J. Manag. 2011, 37, 39–67. [Google Scholar] [CrossRef]

- Cox, J.; Tosatto, J.; Nguyen, T. For love or money? The effect of deadline proximity on completion contributions in online crowdfunding. Int. J. Entrep. Behav. Res. 2022, 28, 1026–1049. [Google Scholar] [CrossRef]

- Granovetter, M.S. The Strength of Weak Ties. Am. J. Sociol. 1973, 78, 1360–1380. [Google Scholar] [CrossRef]

- Waterloo, S.F.; Baumgartner, S.E.; Peter, J.; Valkenburg, P.M. Norms of online expressions of emotion: Comparing Facebook, Twitter, Instagram, and WhatsApp. New Media Soc. 2018, 20, 1813–1831. [Google Scholar] [CrossRef] [PubMed]

- Liu, Y.; Chen, Y.; Fan, Z.-P. Do social network crowds help fundraising campaigns? Effects of social influence on crowdfunding performance. J. Bus. Res. 2021, 122, 97–108. [Google Scholar] [CrossRef]

- Ratten, V.; Jones, P. Transformational Entrepreneurship: An Overview; Routledge: New York, NY, USA, 2018. [Google Scholar]

- Regner, T.; Crosetto, P. The experience matters: Participation-related rewards increase the success chances of crowdfunding campaigns. Econ. Innov. New Technol. 2020, 30, 843–856. [Google Scholar] [CrossRef]

- Moradi, M.; Badrinarayanan, V. The effects of brand prominence and narrative features on crowdfunding success for entrepreneurial aftermarket enterprises. J. Bus. Res. 2021, 124, 286–298. [Google Scholar] [CrossRef]

- Petitjean, M. What explains the success of reward-based crowdfunding campaigns as they unfold? Evidence from the French crowdfunding platform KissKissBankBank. Financ. Res. Lett. 2018, 26, 9–14. [Google Scholar] [CrossRef]

- Kunz, M.M.; Englisch, O.; Beck, J.; Bretschneider, U. Sometimes You Win, Sometimes You Learn—Success Factors in Reward-Based Crowdfunding. 2016, pp. 467–478. Available online: https://www.alexandria.unisg.ch/247841/1/JML_558.pdf (accessed on 4 October 2022).

- Kedas, S.; Sarkar, S. Putting your money where your mouth is—The role of rewards in a value-based understanding of restaurant crowdfunding. Int. J. Contemp. Hosp. Manag. 2022. ahead-of-print. [Google Scholar] [CrossRef]

- Wang, W.; Chen, W.; Zhu, K.; Wang, H. Emphasizing the entrepreneur or the idea? The impact of text content emphasis on investment decisions in crowdfunding. Decis. Support Syst. 2020, 136, 113341. [Google Scholar] [CrossRef]

- Tan, Y.H.; Reddy, S.K. Crowdfunding digital platforms: Backer networks and their impact on project outcomes. Soc. Networks 2021, 64, 158–172. [Google Scholar] [CrossRef]

- Courtney, C.; Dutta, S.; Li, Y. Resolving Information Asymmetry: Signaling, Endorsement, and Crowdfunding Success. Entrep. Theory Pract. 2017, 41, 265–290. [Google Scholar] [CrossRef]

- Tu, T.T.T.; Anh, D.P.; Thu, T.T.H. Exploring Factors Influencing the Success of Crowdfunding Campaigns of Startups in Vietnam. Account. Financ. Res. 2018, 7, 1–19. [Google Scholar]

- Huang, Z.; Chiu, C.L.; Mo, S.; Marjerison, R. The nature of crowdfunding in China: Initial evidence. Asia Pac. J. Innov. Entrep. 2018, 12, 300–322. [Google Scholar] [CrossRef]

- Butticè, V.; Noonan, D. Active backers, product commercialisation and product quality after a crowdfunding campaign: A comparison between first-time and repeated entrepreneurs. Int. Small Bus. J. 2020, 38, 111–134. [Google Scholar] [CrossRef]

- Block, J.; Hornuf, L.; Moritz, A. Which updates during an equity crowdfunding campaign increase crowd participation? Small Bus. Econ. 2018, 50, 3–27. [Google Scholar] [CrossRef]

- de Larrea, G.L.; Altin, M.; Singh, D. Determinants of success of restaurant crowdfunding. Int. J. Hosp. Manag. 2019, 78, 150–158. [Google Scholar] [CrossRef]

- Lagazio, C.; Querci, F. Exploring the multi-sided nature of crowdfunding campaign success. J. Bus. Res. 2018, 90, 318–324. [Google Scholar] [CrossRef]

- Anglin, A.H.; Short, J.C.; Drover, W.; Stevenson, R.M.; McKenny, A.F.; Allison, T.H. The power of positivity? The influence of positive psychological capital language on crowdfunding performance. J. Bus. Ventur. 2018, 33, 470–492. [Google Scholar] [CrossRef]

- Bilau, J.; Pires, J. What is the Role of Networks and Geography in Reward-based Crowdfunding Success. In Proceedings of the European Conference on Innovation and Entrepreneurship, ECIE, Aveiro, Portugal, 20–21 September 2018; pp. 102–111. [Google Scholar]

- Cordova, A.; Dolci, J.; Gianfrate, G. The determinants of crowdfunding success: Evidence from technology projects. Procedia-Soc. Behav. Sci. 2015, 181, 115–124. [Google Scholar] [CrossRef]

- Hörisch, J.; Tenner, I. How environmental and social orientations influence the funding success of investment-based crowdfunding: The mediating role of the number of funders and the average funding amount. Technol. Forecast. Soc. Chang. 2020, 161, 120311. [Google Scholar] [CrossRef]

- Pahlke, J.; Strasser, S.; Vieider, F.M. Responsibility effects in decision making under risk. J. Risk Uncertain. 2015, 51, 125–146. [Google Scholar] [CrossRef]

- Zhou, M.J.; Lu, B.; Fan, W.P.; Wang, G.A. Project description and crowdfunding success: An exploratory study. Inf. Syst. Front. 2018, 20, 259–274. [Google Scholar] [CrossRef]

- Ahlers, G.K.; Cumming, D.; Günther, C.; Schweizer, D. Signaling in equity crowdfunding. Entrep. Theory Pract. 2015, 39, 955–980. [Google Scholar] [CrossRef]

- Abdeldayem, M.; Aldulaimi, S. Entrepreneurial finance and crowdfunding in the Middle East. Int. J. Organ. Anal. 2021. ahead-of-print. [Google Scholar] [CrossRef]

- Sum, J.Y.; Chan, K.X.; Lee AS, G.; Tan, S.Y.; Wong, Y.Y. The Determinants for Successful Crowd-Funding in Malaysia. Doctoral Dissertation, UTAR, Sungai Long, SGR, Malaysia, 2019. Available online: http://eprints.utar.edu.my/3907/1/fyp_BF_2019_SJY_-_1607083.pdf (accessed on 14 September 2022).

- Hobbs, J.; Grigore, G.; Molesworth, M. Success in the management of crowdfunding projects in the creative industries. Internet Res. 2016, 26, 146–166. [Google Scholar] [CrossRef]

- James, G.; Witten, D.; Hastie, T.; Tibshirani, R. An Introduction to Statistical Learning; Springer: New York, NY, USA, 2013; Volume 112. [Google Scholar]

- Wooldridge, J.M. Correlated random effects models with unbalanced panels. J. Econom. 2019, 211, 137–150. [Google Scholar] [CrossRef]

- Liang, X.; Hu, X.; Jiang, J. Research on the Effects of Information Description on Crowdfunding Success within a Sustainable Economy—The Perspective of Information Communication. Sustainability 2020, 12, 650. [Google Scholar] [CrossRef]

- Kuo, Y.-F.; Lin, C.-H.; Hou, J.-R. The effects of anchoring on backers’ pledge in reward-based crowdfunding: Evidence from Taiwanese market. Internet Res. 2020, 31, 635–653. [Google Scholar] [CrossRef]

- Domencich, T.A.; McFadden, D. Urban Travel Demand—A Behavioral Analysis (No. Monograph). 1975. Available online: https://trid.trb.org/view/48594 (accessed on 1 July 2022).

- Fourkan, M. Crowdfunding: Antecedents of number of backers and success of a project. Int. J. Small Bus. Entrep. Res. 2021, 9, 1–13. [Google Scholar]

- Yin, C.; Liu, L.; Mirkovski, K. Does more crowd participation bring more value to crowdfunding projects? The perspective of crowd capital. Internet Res. 2019, 29, 1149–1170. [Google Scholar] [CrossRef]

- Hsieh, H.-C.; Vu, T.H.C. The impact of economic policy uncertainty on crowdfunding success. J. Int. Financ. Mark. Inst. Money 2021, 75, 101418. [Google Scholar] [CrossRef]

- Adjakou, O.J.L. Crowdfunding: Genesis and Comprehensive Review of Its State in Africa. Open J. Bus. Manag. 2021, 9, 557–585. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).