Financial Uncertainty from a Dual Shock at Global Level–Insights from Kuwait

Abstract

:1. Introduction

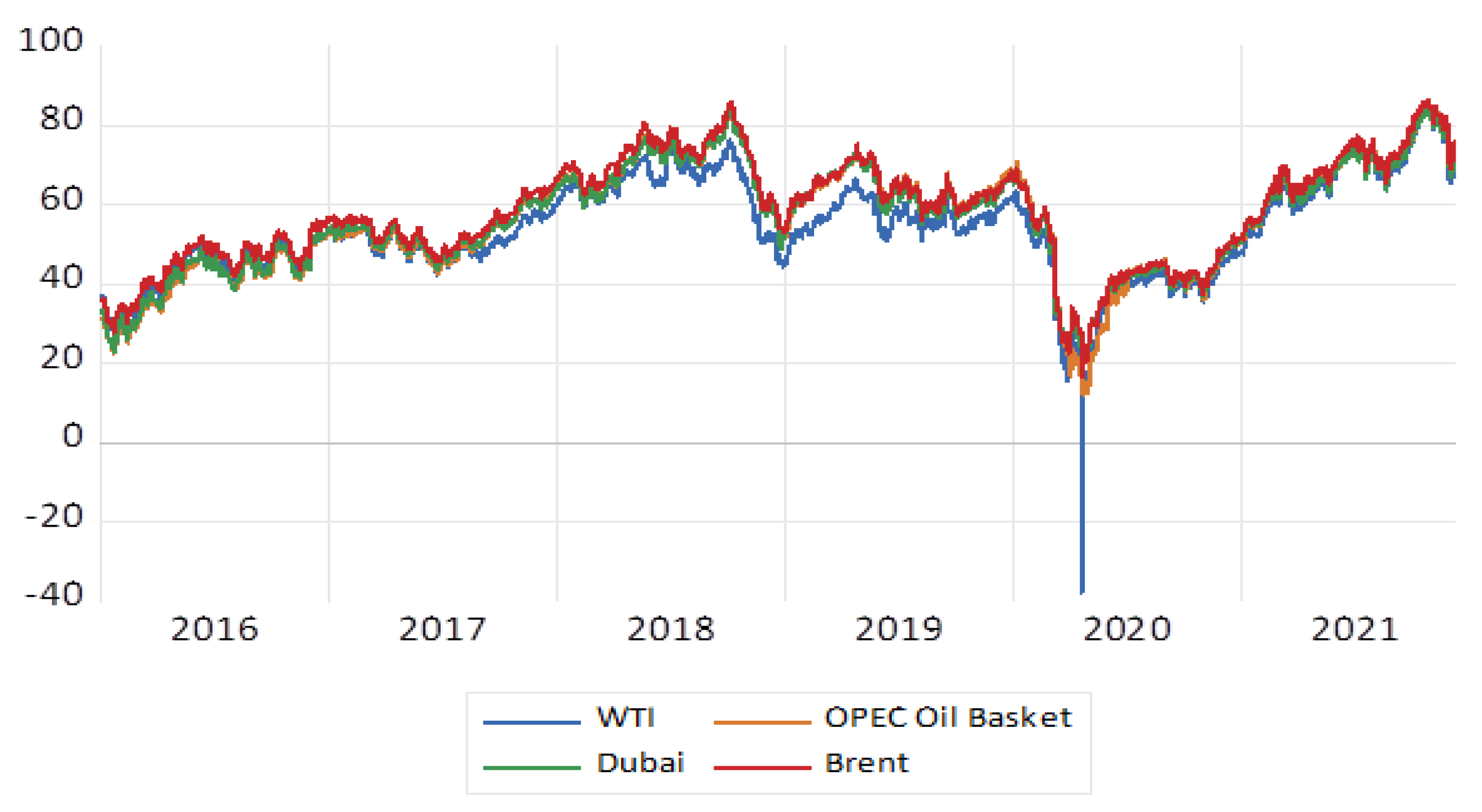

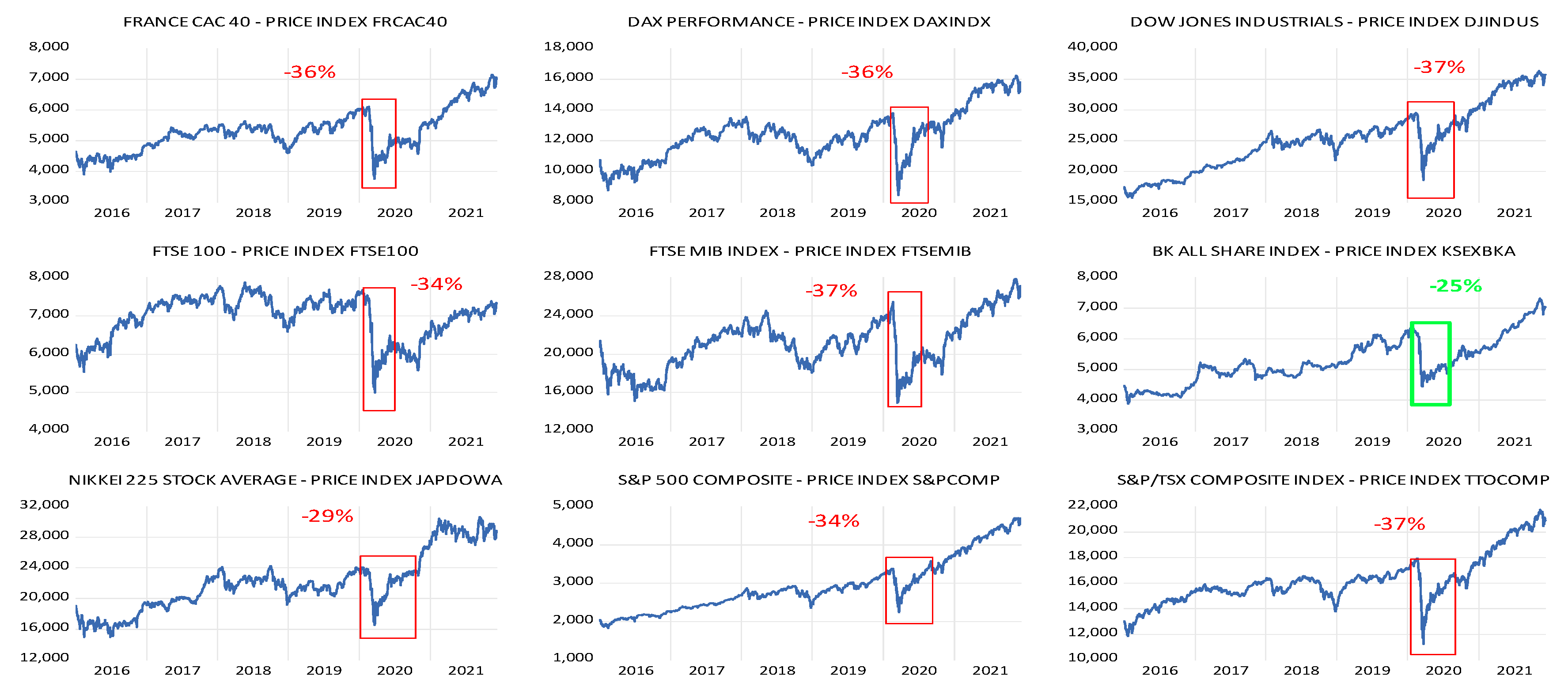

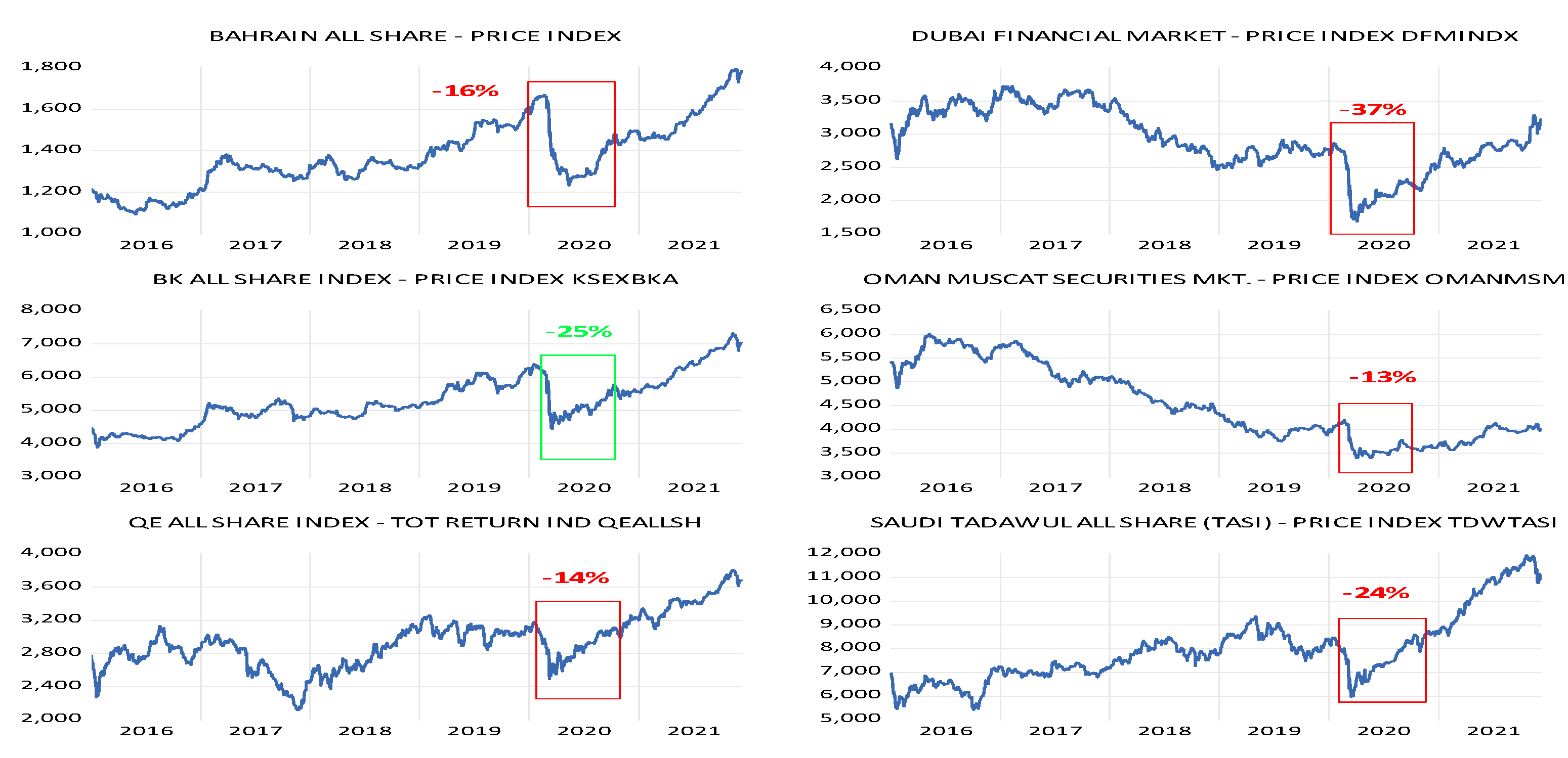

2. 2020 Dual Economic Shock

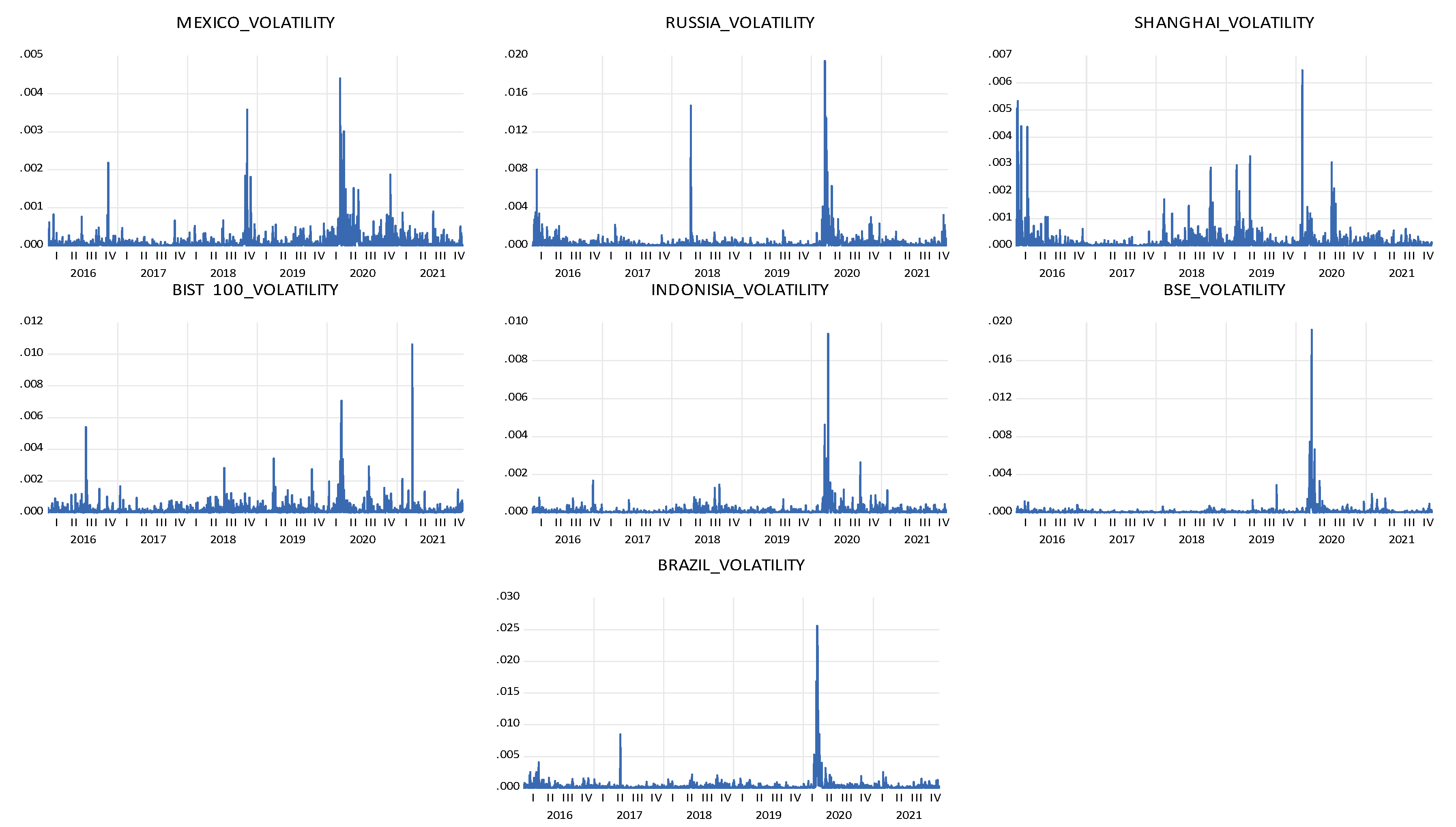

2.1. The Impact of COVID-19 on Global Stock Markets

2.2. Volatility Performance of the Kuwait Stock Market in a Global Context

3. Research Methodology and Methods

3.1. GARCH and FIGARCH Models

3.1.1. GARCH (p,q)

3.1.2. FIGARCH(1,d,1)

4. Research Findings

4.1. Stationarity Findings

4.2. Volatility Findings

4.2.1. G7 Findings

4.2.2. E7 Volatility Findings

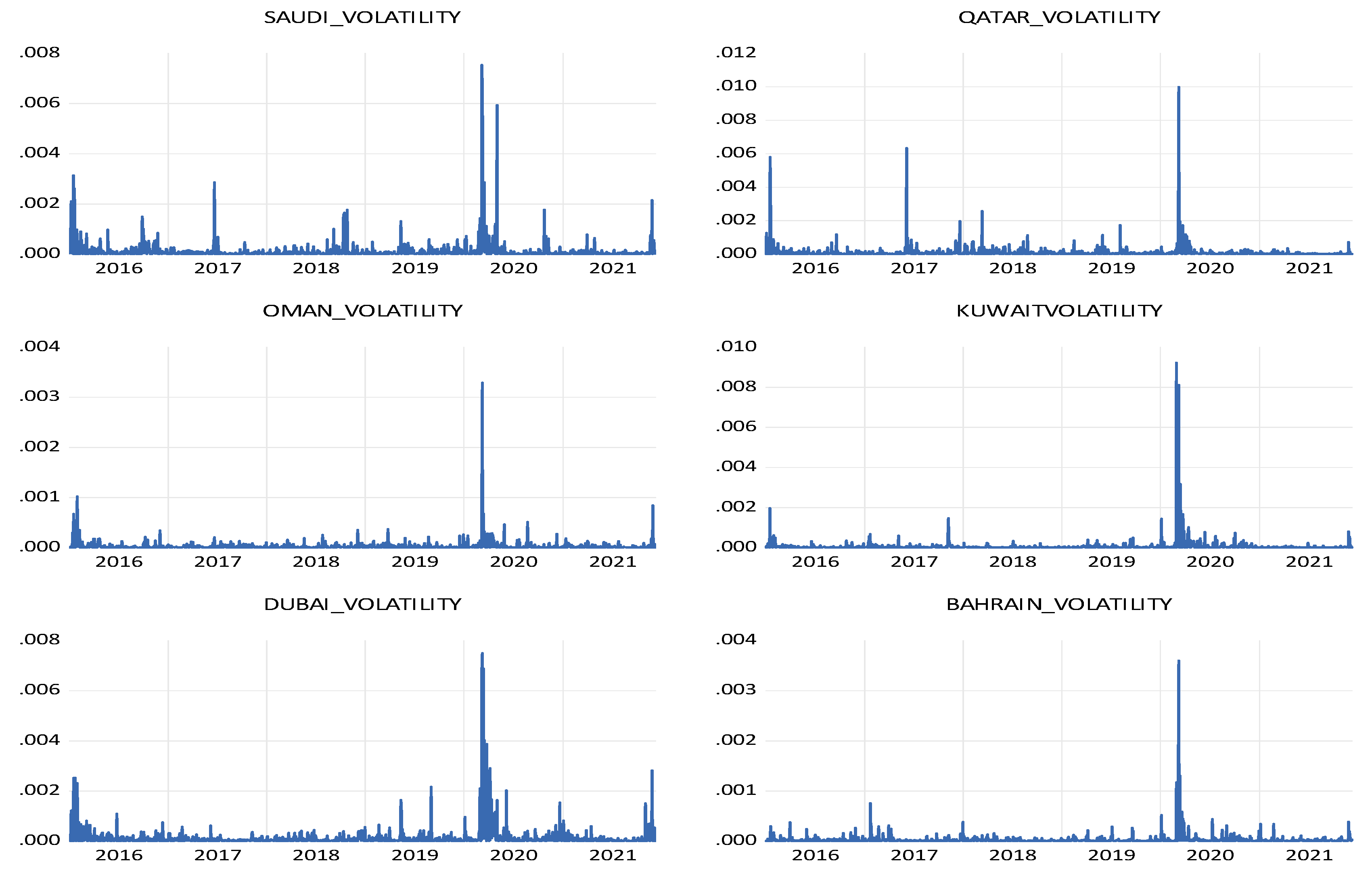

4.2.3. GCC Volatility Findings

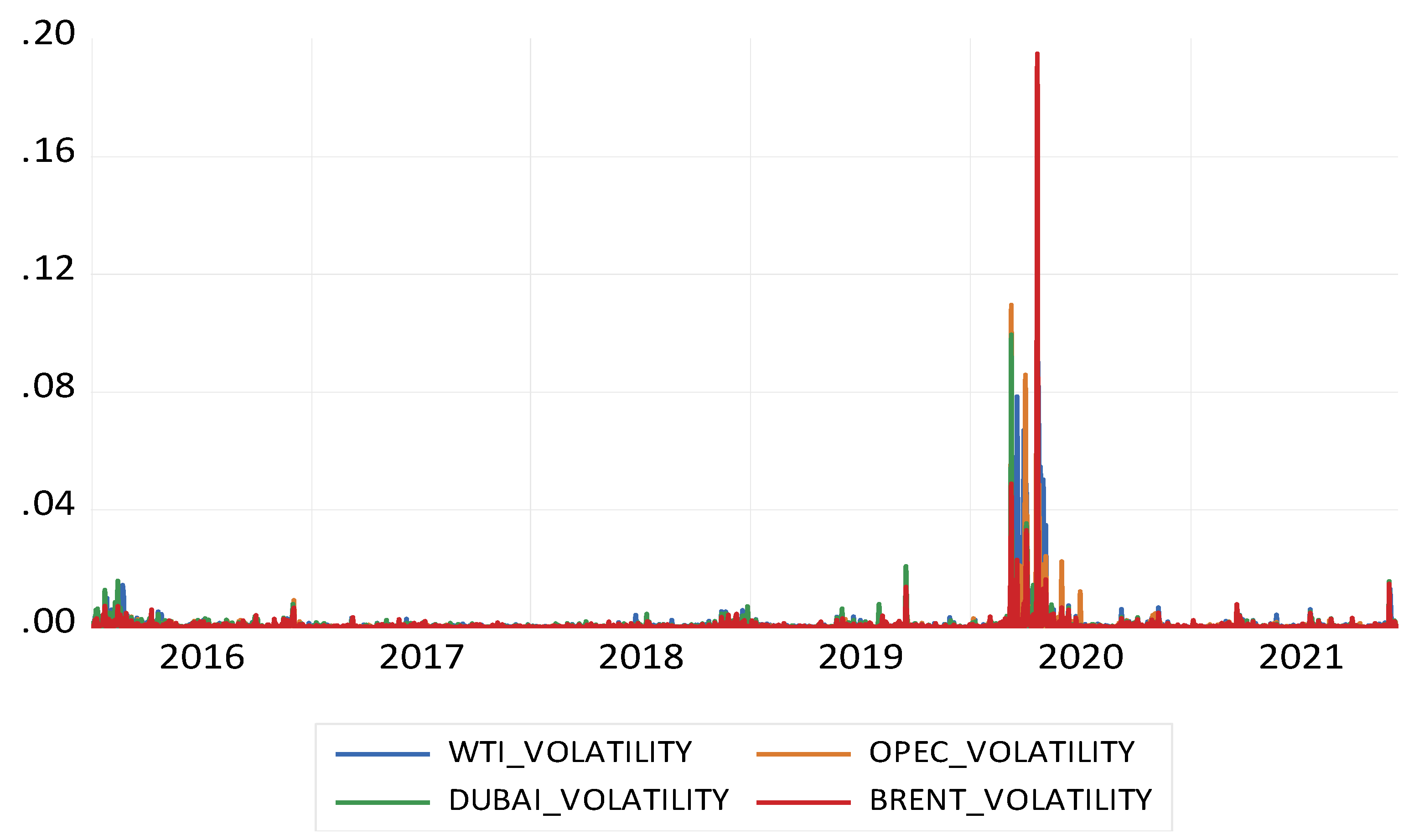

4.2.4. Oil Benchmarks Volatility Findings

5. Discussion

Research Limitations

6. Conclusions

7. Patents

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Authors | Country | Variables | Period | Outcomes |

|---|---|---|---|---|

| Al-Shami and Ibrahim (2013) | Kuwait | inflation rate, money supply, interest rate, oil prices and unemployment rate. | January 2001 to December 2010 | A positive relation between inflation rate, money supply (M2), oil prices, and stock returns. |

| Al Hayky and Naim (2016) | Bahrain, Qatar, Kuwait, Saudi Arabia, U.A.E. Oman | Dynamic relationship between oil prices and Kuwait stock exchange index | monthly-data from November 2006 to February 2015 | The Kuwait stock market index has a positive and significant relationship with oil prices during the high volatility periods but no relationship during low volatility periods |

| Merza and Almusawi (2016) | Kuwait | inflation rate, money supply, interest rate, oil prices and unemployment rate. | January 2001 to December 2010 | A positive relationship between the inflation rate, money supply (M2) and oil prices and stock returns. |

| Kisswani and Elian (2017) | Kuwait | Relationship between Kuwait stock market (KSE) and oil prices (Brent and WTI) at a sectoral level The study analysed ten major sectors in Kuwait | 3 January 2000, until 9 December 2015, for | The systematic long-run effect between oil prices and some Kuwait sectoral stock prices. The empirical result offers evidence of a short-run systematic effect in the case of WTI price, but no evidence of a systematic effect was found in the case of Brent. |

| Elian and Kisswani (2018) | Kuwait | Oil prices (Brent) (WTI) affect the stock market returns in the context of ‘Kuwait stock market’ (KSE.) | daily data 3 January 2000 until 9 December 2015 | There is a long-run relationship between Kuwait stock market returns and both oil prices (Brent and WTI) in which the daily oil price shocks have a negative impact on stock returns. |

| Al-Kandari and Abul (2019) | Kuwait | M2, three months deposit interest rate, oil prices, US to Kuwaiti dinar exchange rate and inflation rate. | monthly data 2005–2018 | The study confirms a short-run relationship between oil and Kuwait stock market. |

| Alshihab and Al Shammari (2020) | Kuwait | Fluctuations of the oil prices on the Kuwait stock market returns | month-to-month period of 2000 to 2020 | The long run showed that the price of oil has a positive relationship with stock market returns. The study confirmed that changes in Kuwaiti stock market returns are affected by oil price fluctuations in the short run. |

| Al Refai et al. (2022) | Bahrain, Qatar, Kuwait, Saudi Arabia, U.A.E. Oman | examined the impact of Covid-19 cases and oil prices shocks | sub-sample 5 January 2017, to 10 March 2020, and 11 March to 17 September 2020 | Their findings illustrate that Kuwait’s stock market responded to positive and negative oil price shocks. |

Appendix B

| G7 Countries | ||

|---|---|---|

| Country | Short-Form | Definition |

| Germany | DAX 30 | Deutsche Altien Xchange (DAX) Performance Index |

| U.S.A | Dow Jones Industrials | The Dow Jones Industrial Average |

| France | CAC-40 | Cotation Assistee en Continu (CAC) 40 Index |

| UK | FTSE 100 | Financial Times stock exchange FTSE100 index |

| Italy | FTSE-MIB | Milano Indice di Borsa |

| Japan | NIKKEI 225 | NIKKEI 225 index |

| Canada | S&P-TSX | S&P-TSX composed index |

| USA | S&P 500 | Standard and Poor 500 composite index |

| E7 Countries | ||

| BRAZIL | BOVESPA | Brasil Bolsa Balcão |

| TURKEY | BIST NATIONAL 100 | Borsa İstanbul |

| RUSSIA | RTS INDEX | 50 Russian stocks traded on the Moscow Exchange |

| MEXICO | IPC (BOLSA) | Bolsa Mexica de Valores |

| INDONEASIA | IDEX | Indonesia Stock Exchange (IDX) |

| CHINA | SHANGHAI | Shanghai Composite Index |

| INDIA | BSE | Bombay Stock Exchange (BSE.) |

| GCC countries | ||

| UAE | DUBAI | Dubai Financial Market |

| Qatar | Qatar | Qatar Composite Index |

| SAUDI | TASI | Saudi Stock Exchange |

| Bahrain | Bahrain | Bahrain All Share Index |

| Kuwait | BKA. | Boursa Kuwait |

| Oman | Oman | Muscat Security Market |

| Oil Prices | ||

| USA | WTI | West Texas |

| U.K | Brent | Brent Blend |

| UAE. | Dubai | Dubai |

| OPEC | OPEC | OPEC Reference basket |

| 1 | See the following link from the WHO at: https://covid19.who.int/table, accessed on 11 March 2020. |

| 2 | For the sake of brevity the results from the residual checks are not included in the paper, but they are available upon request. |

References

- Abdulrazzaq, Yousef M., Lucia Morales, and Joseph Coughlan. 2019. Oil Sector Spillover Effects to the Kuwait Stock Market in the Context of Uncertainty. Economics, Management, and Financial Markets 14: 21–37. [Google Scholar]

- Al Ajmi, Mesfer Mahdi Al Mesfer. 2020. The Impact of the Covid-19 Pandemic on Boursa KuwaitReturn Volatility. International Journal of Business and Management Research 9: 2347–4696. [Google Scholar] [CrossRef]

- Al Hayky, Ahmed, and Nizam Naim. 2016. The relationship between oil price and stock market index: An empirical study from Kuwait. Paper presented at the Middle East Economic Association 15th International, Doha, Qatar, March 23–25; Available online: https://www.dohainstitute.edu.qa/MEEA2016/ (accessed on 29 August 2022).

- Al Refai, Hisham, Rami Zeitun, and Mohamed Abdel-Aziz Eissa. 2022. Impact of Global Health Crisis and Oil Price Shocks on Stock Markets in the GCC. Finance Research Letters 45: 102130. [Google Scholar] [CrossRef] [PubMed]

- Albulescu, Claudiu. 2020. Coronavirus and financial volatility: 40 days of fasting and fear. arXiv arXiv:2003.04005. [Google Scholar] [CrossRef]

- Alexander, Carol. 2001. Market Models: A Guide to Financial Data Analysis. New York: John Wiley. [Google Scholar]

- Al-Kandari, Ahmad M., and Sadeq J. Abul. 2019. The impact of macroeconomic variables on stock prices in Kuwait. International Journal of Business and Management 14: 99–112. [Google Scholar] [CrossRef] [Green Version]

- Al-Kandari, Ahmad M., and Sadeq J. Abul. 2020. Financial Liberalization and Kuwaiti Stock Market Behaviour. International Journal of Economics, Commerce and Management 8: 72–95. [Google Scholar]

- Alotaibi, Talal A. N. M. S., and Lucía Morales. 2022. Economic Instability in the Gulf Region: Insights from a Dual Shock. Theoretical Economics Letters 12: 1407–16. [Google Scholar] [CrossRef]

- Al-Shami, Hamdan Ahmed Ali, and Yusnidah Ibrahim. 2013. The effects of macro-economic indicators on stock returns: Evidence from Kuwait stock market. American Journal of Economics 3: 57–66. [Google Scholar] [CrossRef]

- Alshihab, Salem, and Nayef Al Shammari. 2020. Are Kuwaiti Stock Returns Affected by Fluctuations in Oil Prices? International Journal of Financial Research 11: 1–9. [Google Scholar] [CrossRef]

- Alshogeathri, Mofleh Ali Mofleh. 2011. Macroeconomic Determinants of the Stock Market Movements: Empirical Evidence from the Saudi Stock Market. Manhattan: Kansas State University. [Google Scholar]

- Asteriou, Dimitrios, and Stephen G. Hall. 2011. Applied Econometrics, 2nd ed. Hampshire: Palgrave Macmillan. [Google Scholar]

- Baillie, Richard T., Tim Bollerslev, and Hans Ole Mikkelsen. 1996. Fractionally Integrated Generalised Autoregressive Conditional Heteroskedasticity. Journal of Econometrics 74: 3–30. [Google Scholar] [CrossRef]

- Baldwin, Richard, and B. Weder Di Mauro. 2020. Economics in the time of COVID-19: A new eBook. VOX CEPR Policy Portal. pp. 2–3. Available online: https://voxeu.org/article/economics-time-covid-19-new-ebook (accessed on 2 September 2022).

- Ben Ameur, Hachmi, and Waël Louhichi. 2022. The Brexit impact on European market co-movements. Annals of Operations Research 313: 1387–1403. [Google Scholar] [CrossRef] [PubMed]

- Bentes, Sonia, and Manuel Mendes da Cruz. 2011. Is Stock Market Volatility Persistent? A Fractionally Integrated Approach. Instituto Superior de Contabilidade e Administração de Lisboa, Comunicações. Available online: http://hdl.handle.net/10400.21/1403 (accessed on 29 August 2022).

- Bentes, Sónia R. 2021. How COVID-19 has affected stock market persistence? Evidence from the G7’s. Physica A: Statistical Mechanics and Its Applications 581: 126210. [Google Scholar] [CrossRef]

- Bollerslev, Tim. 1986. Generalised autoregressive conditional heteroskedasticity. Journal of Econometrics 31: 307–27. [Google Scholar] [CrossRef] [Green Version]

- Breinlich, Holger, Elsa Leromain, Dennis Novy, Thomas Sampson, and Ahmed Usman. 2018. The Economic Effects of Brexit: Evidence from the Stock Market. Fiscal Studies 39: 581–623. [Google Scholar] [CrossRef]

- Di Matteo, Tiziana, Tomaso Aste, and Michel M. Dacorogna. 2003. Scaling behaviors in differently developed markets. Physica A 324: 183–88. [Google Scholar] [CrossRef]

- Elian, Mohammad I., and Khalid M. Kisswani. 2018. Oil price changes and stock market returns: Cointegration evidence from emerging market. Economic Change and Restructuring 51: 317–37. [Google Scholar] [CrossRef]

- Engle, Robert F. 1982. Autoregressive conditional heteroscedasticity with estimates of the variance of United Kingdom inflation. Econometrica: Journal of the Econometric Society 50: 987–1007. [Google Scholar] [CrossRef]

- Engle, Robert F., Victor K. Ng, and Michael Rothschild. 1990. Asset pricing with a factor-ARCH covariance structure: Empirical estimates for treasury bills. Journal of Econometrics 45: 213–37. [Google Scholar]

- European Commission. 2022. REPowerEU: A Plan to Rapidly Reduce Dependence on Russian Fossil Fuels and Fast forward the Green Transition. Available online: https://ec.europa.eu/commission/presscorner/detail/en/ip_22_3131 (accessed on 18 May 2022).

- Fama, Eugene F., Lawrence Fisher, Michael C. Jensen, and Richard Roll. 1969. The adjustment of stock prices to new information. International Economic Review 10: 1–12. [Google Scholar] [CrossRef]

- Grau-Carles, Pilar. 2000. Empirical evidence of long-range correlation in stock returns. Physica A 287: 396–404. [Google Scholar] [CrossRef]

- Ha, Jongrim, M. Ayhan Kose, and Franziska Ohnsorge. 2021. Inflation during the Pandemic: What Happened? What Is Next? CEPR Discussion Paper No. 16328. [Google Scholar] [CrossRef]

- Härdle, Wolfgang K., and Julius Mungo. 2007. Long memory persistence in the factor of implied volatility dynamics. International Research Journal of Finance and Economics 18: 213–30. [Google Scholar] [CrossRef] [Green Version]

- Jackson, James K., Martin A. Weiss, Andres B. Schwarzenberg, and Rebecca M. Nelson. 2020. Global Economic Effects of COVID-19. Congressional Research Service R46270; Washington, DC: Congressional Research Service. Available online: https://crsreports.congress.gov (accessed on 29 August 2022).

- Jawadi, Fredj, and Mohamed Sellami. 2021. On the Effect of Oil Price in the Context of Covid-19. International Journal of Finance & Economics 27: 3924–33. [Google Scholar] [CrossRef]

- Karmakar, Madhusudan. 2005. Modeling conditional volatility of the Indian stock markets. Vikalpa 30: 21–38. [Google Scholar] [CrossRef] [Green Version]

- Kisswani, Khalid M., and Mohammad I. Elian. 2017. Exploring the nexus between oil prices and sectoral stock prices: Nonlinear evidence from Kuwait stock exchange. Cogent Economics & Finance 5: 1286061. [Google Scholar] [CrossRef]

- Merza, Ebrahim, and S. Almusawi. 2016. Factors affecting the performance of Kuwait Stock Market. Journal of Sustainable Development 9: 23–32. [Google Scholar] [CrossRef] [Green Version]

- Mittnik, Stefan, Frank J. Fabozzi, Sergio M. Focardi, Svetlozar T. Rachev, and Teo Jašić. 2007. Financial Econometrics: From Basics to Advanced Modeling Techniques. New York: John Wiley & Sons. [Google Scholar]

- Morales, Lucía, and Bernadette Andreosso-O’Callaghan. 2020. COVID19: Global Stock Markets “Black Swan”. Critical Letters in Economics & Finance 1: 1. [Google Scholar] [CrossRef]

- Ng, H. S. Raymond, and Kai-Pui Lam. 2006. How does Sample Size Affect GARCH Models? Paper presented at the 2006 Joint Conference on Information Sciences, Kaohsiung, Taiwan, October 8–11; Amsterdam: Atlantis Press, p. 3. [Google Scholar] [CrossRef] [Green Version]

- OECD. 2020. OECD Responses to Coronavirus (VOCID-19). The Impact of Coronaviurs (COVID-19) and the Global Price Shock on the Fiscal Position of Oil-Exporting Developing Countries. Available online: https://www.oecd.org/coronavirus/policy-responses/the-impact-of-coronavirus-covid-19-and-the-global-oil-price-shock-on-the-fiscal-position-of-oil-exporting-developing-countries-8bafbd95/ (accessed on 30 August 2020).

- Qiao, Kenan, Zhengyang Liu, Bai Huang, Yuying Sun, and Shouyang Wang. 2021. Brexit and its impact on the US stock market. Journal of Systems Science and Complexity 34: 1044–62. [Google Scholar] [CrossRef]

- Rastogi, Shailesh. 2014. The financial crisis of 2008 and stock market volatility–analysis and impact on emerging economies pre and post crisis. Afro-Asian Journal of Finance and Accounting 4: 443–59. [Google Scholar] [CrossRef]

- Ruiz Estrada, M. A. 2020. The Impact of COVID-19 on the World Oil Prices. SSRN Electronic Journal. Available online: https://ssrn.com/abstract=3583429 (accessed on 29 August 2022).

- Salatas, H. 2017. Value-at-Risk in the Presence of Asymmetry: The FIGARGH Model. Master’s dissertation. SSRN Electronic Journal. Available online: https://www.semanticscholar.org/paper/Value-at-Risk-in-the-Presence-of-Asymmetry-%3A-The-Salatas/ac4d16d97db70ad9a50b4581f6fc62efb6db1441 (accessed on 29 August 2022).

- Sezgin, Funda Hatice, Yilmaz Bayar, Laura Herta, and Marius Dan Gavriletea. 2021. Do environmental stringency policies and human development reduce CO2 emissions? Evidence from G7 and BRICS economies. International Journal of Environmental Research and Public Health 18: 6727. [Google Scholar] [CrossRef]

- Su, Jung-Bin. 2021. How to Promote the Performance of Parametric Volatility Forecasts in the Stock Market? A Neural Networks Approach. Entropy 23: 1151. [Google Scholar] [CrossRef]

- Taheri, Noushin. 2014. The Impact of Oil Price on Stock Markets: Evidence from Developed Markets. Ph.D. dissertation, Eastern Mediterranean University (EMU)-Doğu Akdeniz Üniversitesi (DAÜ), Famagusta, Cyprus. Available online: http://hdl.handle.net/11129/1312 (accessed on 25 August 2022).

- Yousef, Ibrahim. 2020. Spillover of COVID-19: Impact on stock market volatility. International Journal of Psychosocial Rehabilitation 24: 18069–81. [Google Scholar] [CrossRef]

| G7 Prices | ||||||||

|---|---|---|---|---|---|---|---|---|

| CAC40 | DAX | DOW | FTSEE100 | FTSEE_MIB | NIK225 | SP_500 | SP_TSX | |

| Mean | 5289.547 | 12,392.04 | 25,228.47 | 6957.002 | 21,062.09 | 22,043.23 | 2930.174 | 16,200.59 |

| Std. Dev. | 667.7198 | 1624.917 | 5095.301 | 560.7568 | 2708.554 | 3758.534 | 698.8947 | 1911.047 |

| Skewness | 0.508426 | 0.323883 | 0.296818 | −0.854301 | 0.099389 | 0.497230 | 0.856064 | 0.809701 |

| Kurtosis | 3.006647 | 2.853291 | 2.488434 | 2.826973 | 2.453807 | 2.648013 | 2.965448 | 3.765438 |

| Jarque-Bera | 66.82441 | 28.50770 | 39.68649 | 190.5959 | 21.83284 | 71.91763 | 189.5179 | 207.3403 |

| Probability | 0.000000 | 0.000001 | 0.000000 | 0.000000 | 0.000018 | 0.000000 | 0.000000 | 0.000000 |

| G7 Returns | ||||||||

| CAC40R | DAXR | DOWR | FTSEE100R | FTSEE_MIBR | NIK225R | SP_500R | SP_TSXR | |

| Mean | 0.000266 | 0.000242 | 0.000464 | 0.000103 | 0.000145 | 0.000266 | 0.000533 | 0.000307 |

| Std. Dev. | 0.011939 | 0.012177 | 0.011902 | 0.010442 | 0.014481 | 0.012344 | 0.011429 | 0.010126 |

| Skewness | −1.324078 | −0.967532 | −1.199691 | −1.078655 | −2.195639 | −0.209841 | −1.143895 | −2.099587 |

| Kurtosis | 19.75326 | 18.61260 | 30.27275 | 19.57829 | 29.25117 | 9.255081 | 26.31705 | 54.93787 |

| Jarque-Bera | 18,579.62 | 15,984.22 | 48,409.09 | 18,050.64 | 45,751.31 | 2538.265 | 35,451.01 | 175,355.1 |

| Probability | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| E7 Prices | |||||||

|---|---|---|---|---|---|---|---|

| BRAZIL | BSE100 | INDONISIA | MEXICO | RUSSIA | SHANGHAI | BIST 100 | |

| Mean | 86,362.76 | 11,327.99 | 5759.162 | 45,476.27 | 1223.424 | 3123.852 | 1060.451 |

| Std. Dev. | 22,883.80 | 2545.121 | 579.1687 | 4266.577 | 239.0116 | 278.9278 | 232.6517 |

| Skewness | −0.065500 | 0.978917 | −0.615834 | −0.664609 | 0.494991 | −0.042083 | 0.887424 |

| Kurtosis | 2.003040 | 3.666062 | 2.412220 | 2.850342 | 3.179866 | 2.215041 | 3.591154 |

| Jarque-Bera | 65.34168 | 276.3850 | 120.3633 | 115.6281 | 65.42743 | 40.27714 | 226.1583 |

| Probability | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| E7 Returns | |||||||

| BRAZILR | BSE100R | INDONISIAR | MEXICOR | RUSSIAR | SHANGHAIR | TURKEYR | |

| Mean | 0.000579 | 0.000510 | 0.000238 | 0.000113 | 0.000496 | 0.000024 | 0.000672 |

| Std. Dev. | 0.016670 | 0.010932 | 0.009776 | 0.010138 | 0.016161 | 0.011066 | 0.013238 |

| Skewness | −1.315873 | −1.719867 | −0.019816 | −0.597218 | −1.150530 | −1.103178 | −0.981545 |

| Kurtosis | 20.22241 | 28.47389 | 13.87721 | 7.797338 | 14.39119 | 11.26366 | 8.917113 |

| Jarque-Bera | 19,603.46 | 42,673.50 | 7641.196 | 1578.490 | 8722.245 | 4724.665 | 2510.092 |

| Probability | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| GCC prices | ||||||

|---|---|---|---|---|---|---|

| Bahrain | Dubai | Kuwait | Qatar | Saudi | Oman | |

| Mean | 1373.505 | 2926.980 | 5264.773 | 2936.463 | 7958.605 | 4526.922 |

| Std. Dev. | 156.7539 | 471.4857 | 734.5464 | 320.7747 | 1405.781 | 778.0595 |

| Skewness | 0.429677 | −0.260928 | 0.492258 | 0.166400 | 0.946562 | 0.383964 |

| Kurtosis | 2.733524 | 2.393174 | 2.813190 | 3.149955 | 3.599616 | 1.752582 |

| Jarque-Bera | 52.31390 | 41.39697 | 64.89441 | 8.610821 | 254.8462 | 138.6701 |

| Probability | 0.000000 | 0.000000 | 0.000000 | 0.013495 | 0.000000 | 0.000000 |

| GCC returns | ||||||

| Bahrain | Dubai | Kuwait | Qatar | Saudi | Oman | |

| Mean | 0.000248 | 0.0000152 | 0.000293 | 0.000182 | 0.000296 | −0.000193 |

| Std. Dev. | 0.005143 | 0.010979 | 0.007999 | 0.009559 | 0.010416 | 0.005147 |

| Skewness | −1.506418 | −0.653869 | −3.190621 | −1.263180 | −1.187625 | −0.940610 |

| Kurtosis | 21.43615 | 14.44610 | 40.38432 | 18.81032 | 14.48466 | 16.67683 |

| Jarque-Bera | 22,537.57 | 8571.714 | 92,890.71 | 16,555.86 | 8882.749 | 12,309.25 |

| Probability | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| Oil Prices | ||||

|---|---|---|---|---|

| BRENT | DUBAI | OPEC | WTI | |

| Mean | 58.15781 | 56.25103 | 56.12941 | 53.72606 |

| Std. Dev. | 13.41835 | 13.44321 | 14.45190 | 12.57164 |

| Skewness | −0.250214 | −0.278254 | −0.420205 | −0.243291 |

| Kurtosis | 2.535989 | 2.446104 | 2.696566 | 3.204172 |

| Jarque-Bera | 30.09810 | 39.84141 | 51.59412 | 17.99466 |

| Probability | 0.000000 | 0.000000 | 0.000000 | 0.000124 |

| Oil Returns | ||||

| BRENTR | DUBAIR | OPECR | WTIR | |

| Mean | 0.000474 | 0.000513 | 0.000568 | 0.000419 |

| Std. Dev. | 0.026910 | 0.026348 | 0.026952 | 0.032927 |

| Skewness | −2.748229 | −0.969671 | −1.822894 | −1.058766 |

| Kurtosis | 58.55986 | 21.97041 | 40.09242 | 37.67027 |

| Jarque-Bera | 201,313.3 | 23,484.92 | 89,715.24 | 77,920.53 |

| Probability | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| Returns | PricesPrices | |||||||

|---|---|---|---|---|---|---|---|---|

| G7 | ADF | PP | KPSS * | lags | ADF | PP | KPSS * | Lags |

| CAC−40 | −39.1311 (0.0000) | −39.1992 (0.0000) | 0.06288 (0.739000) | 0 | 0.905493 (0.7869) | 1.102971 (0.7167) | 2.44178 (0.739000) | 1 |

| DAX | −39.8231 (0.0000) | −39.8574 (0.0000) | 0.043763 (0.739000) | 0 | −1.25996 (0.6500) | −1.35873 (0.6038) | 2.635266 | 1 |

| DOW | −12.0682 (0.0000) | −47.4828 (0.0001) | 0.029875 (0.739000) | 9 | −0.87707 (0.7958) | −0.57271 (0.874) | 4.208865 | 10 |

| FTSEE−100 | −39.8899 (0.0000) | −39.8936 (0.0000) | 0.062976 (0.739000) | 0 | −2.47008 (0.1231) | −2.49244 (0.1175) | 0.601998 | 1 |

| FTSEE_MIB | −26.3578 (0.0000) | −42.0435 (0.0000) | 0.083753 (0.739000) | 2 | 1.473205 (0.5472) | 1.737985 (0.4118) | 1.850557 | 1 |

| Nikkei−225 | −40.3251 (0.0000) | −40.3212 (0.0000) | 0.057721 (0.739000) | 0 | 0.895518 (0.7901) | 0.914543 (0.784) | 3.575692 | 1 |

| S&P500 | −11.9827 (0.0000) | −48.3939 (0.0001) | 0.070294 (0.739000) | 9 | 0.213192 (0.9734) | 0.541773 0.9881 | 4.211441 | 10 |

| S&P-TSX | −12.8414 (0.0000) | −46.4586 (0.0001) | 0.04685 (0.739000) | 7 | −1.52392 (0.5214) | −1.12548 (0.7077) | 3.024149 | 8 |

| Returns | Prices | |||||||

|---|---|---|---|---|---|---|---|---|

| E7 | ADF | PP | KPSS * | Lags | ADF | PP | KPSS * | Lags |

| TURKEY | −38.6391 (0.0000) | −38.765 (0.0000) | 0.163642 | 0 | 1.956619 (0.9999) | 1.302195 (0.9987) | 3.371059 | 1 |

| BRAZIL | −45.9358 (0.0001) | −45.3963 (0.0001) | 0.125707 | 1 | −1.7012 (0.4305) | −1.79155 (0.385) | 4.313622 | 2 |

| Indonesia | −37.2066 (0.0000) | −37.2674 (0.0000) | 0.088002 | 0 | −2.04716 (0.2667) | −2.1554 (0.2231) | 1.020901 | 1 |

| Mexico | −37.2846 (0.0000) | −37.2316 (0.0000) | 0.100463 | 0 | −1.83143 (0.3654) | −1.80461 (0.3786) | 0.785645 | 1 |

| Russia | −40.1799 (0.0000) | −40.1864 (0.0000) | 0.047403 | 0 | −1.68253 (0.4400) | −1.76879 (0.3964) | 3.439044 | 1 |

| BSE100 | −16.6838 (0.0000) | −40.3195 (0.0000) | 0.104646 | 6 | 0.46492 (0.9855) | 0.408541 (0.9833) | 3.430955 | 1 |

| Shanghai | −41.4445 (0.0000) | −41.3982 (0.0000) | 0.156396 | 0 | −2.21347 (0.2016) | −2.22213 (0.1985) | 1.131125 | 1 |

| Returns | Prices | |||||||

|---|---|---|---|---|---|---|---|---|

| GCC | ADF | PP | KPSS * | Lags | ADF | PP | KPSS * | Lags |

| Bahrain | 23.9287 (0.0000) | 36.3923 (0.0000) | 0.163642 | 3 | −0.40241 (0.9064) | −0.1814 (0.9383) | 3.38354 | 7 |

| Dubai | 35.5196 (0.0000) | 36.5589 (0.0000) | 0.127087 | 1 | −1.2989 (0.6321) | −1.52308 (0.5218) | 3.162082 | 2 |

| Kuwait | 33.5391 (0.0000) | 33.8347 (0.0000) | 0.073448 | 5 | −0.40294 (0.9063) | −0.55905 (0.8769) | 3.433574 | 6 |

| Qatar | 37.5455 (0.0000) | 37.7328 (0.0000) | 0.086213 | 1 | −0.8174 0.8135 | −1.10685 (0.7152) | 2.586876 | 2 |

| Saudi Arabia | 34.7529 (0.0000) | 35.0339 (0.0000) | 0.085712 | 5 | −0.43677 (0.9004) | −0.50296 (0.8882) | 3.124048 | 2 |

| Oman | −30.58239 (0.0000) | −30.60818 (0.0000) | 0.149798 | 1 | −1.027663 (0.7453) | −1.056701 (0.7453) | 4.434236 | 2 |

| Returns | Price | |||||||

|---|---|---|---|---|---|---|---|---|

| OIL | ADF | PP | KPSS * | Lags | ADF | PP | KPSS * | Lags |

| Brent | 38.1946 (0.0000) | −38.217 (0.0000) | 0.07235 (0.739000) | 0 | −1.98352 (0.2943) | −2.06769 (0.2581) | 0.75734 | 1 |

| Dubai | 39.7635 (0.0000) | 39.8059 (0.0000) | 0.082546 (0.739000) | 0 | −2.07198 (0.2563) | −2.06098 (0.2609) | 0.911146 | 1 |

| OPEC | 37.6637 (0.0000) | 38.5049 (0.0000) | 0.069871 (0.739000) | 2 | −1.84347 (0.3596) | −1.97708 (0.2972) | 0.892014 | 1 |

| WTI | −30.673 (0.0000) | 39.1462 (0.0000) | 0.04562 (0.739000) | 0 | −1.96184 (0.304) | −2.11726 (0.2379) | 0.668896 | 4 |

| G7 COUNTRIES | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| GARCH(1,1) | S&P-TSX | Dow- | FTSE-MIB | DAX | CAC-40 | FTSEE-100 | S&P500 | NIKKEI-225 | |

| w | 2.18 × 10−6 (0.0000) | 4.17 × 10−6 (0.0000) | 7.29 × 10−6 (0.0000) | 4.96 × 10−6 (0.0000) | 6.46 × 10−6 (0.0000) | 4.05 × 10−6 (0.0000) | 4.34 × 10−6 (0.0000) | 7.22 × 10−6 (0.0000) | |

| α | 0.20666 (0.0000) | 0.221959 (0.0000) | 0.140486 (0.0000) | 0.113911 (0.0000) | 0.179019 (0.0000) | 0.122174 (0.0000) | 0.236205 (0.0000) | 0.11597 (0.0000) | |

| β | 0.763728 (0.0000) | 0.743244 (0.0000) | 0.824016 (0.0000) | 0.848021 (0.0000) | 0.777263 (0.0000) | 0.831288 (0.0000) | 0.73032 (0.0000) | 0.834064 (0.0000) | |

| α+β | 0.97039 | 0.96520 | 0.964502 | 0.96193 | 0.95628 | 0.95346 | 0.966525 | 0.95003 | |

| Half-life (days) | 24 | 20 | 20 | 18 | 16 | 15 | 21 | 14 | |

| FIGARCH(1,1) | w | 2.32 × 10−6 (0.0005) | 4.94 × 10−6 (0.0000) | 7.73 × 10−6 (0.0000) | 5.72 × 10−6 (0.0000) | 8.33 × 10−6 (0.0000) | 3.37 × 10−6 0.0061 | 4.95 × 10−6 0.0000 | 1.57 × 10−5 0.0001 |

| α | 0.169839 (0.0454) | 0.015178 (0.8326) | 0.183796 (0.0001) | 0.067884 (0.2082) | −0.056357 (0.4219) | 0.295065 (0.0027) | 0.043248 (0.5787) | −0.194230 (0.2318) | |

| β | 0.513544 (0.0000) | 0.461361 (0.0000) | 0.549464 (0.0000) | 0.476279 (0.0000) | 0.360457 (0.0001) | 0.489335 (0.0002) | 0.435936 (0.0000) | −0.045886 (0.7927) | |

| d | 0.642651 (0.0000) | 0.66737 (0.0000) | 0.542572 (0.0000) | 0.525644 (0.0000) | 0.564086 (0.0000) | 0.380181 (0.0000) | 0.633111 (0.0000) | 0.298796 (0.0000) | |

| E7 COUNTRIES | ||||||||

|---|---|---|---|---|---|---|---|---|

| GARCH(1,1) | BOVESPA | BIST 100 | RTS INDEX | BOLSA | IDEX | SHANGHAI | BSE 100 | |

| w | 1.15 × 10−5 (0.0000) | 1.55 × 10−5 0.0002 | 4.61 × 10−6 (0.0000) | 3.72 × 10−6 (0.0000) | 3.74 × 10−6 (0.0000) | 1.50 × 10−6 (0.0000) | 2.08 × 10−6 (0.0000) | |

| α | 0.090865 (0.0000) | 0.073298 (0.0000) | 0.073949 (0.0000) | 0.118014 (0.0000) | 0.104727 (0.0000) | 0.064525 (0.0000) | 0.091972 (0.0000) | |

| β | 0.855811 (0.0000) | 0.838354 (0.0000) | 0.908133 (0.0000) | 0.843706 (0.0000) | 0.850918 (0.0000) | 0.923037 (0.0000) | 0.887281 (0.0000) | |

| α+β | 0.946676 | 0.911652 | 0.982082 | 0.96172 | 0.955645 | 0.987562 | 0.979253 | |

| Half-life (days) | 13 | 8 | 39 | 18 | 16 | 56 | 34 | |

| FIGARCH(1,1) | w | 6.97 × 10−5 (0.0000) | 4.31 × 10−5 0.0022 | 3.13 × 10−6 0.0070 | 6.44 × 10−6 0.0019 | 4.47 × 10−6 0.0039 | 9.79 × 10−7 0.4686 | 3.56 × 10−6 (0.0012) |

| α | −0.582253 (0.0000) | 0.008691 (0.9622) | −0.094854 (0.1173) | −0.066332 (0.6128) | 0.351761 (0.0017) | −0.023439 (0.0000) | 0.120816 (0.0614) | |

| β | −0.505079 (0.0005) | 0.148466 (0.4605) | 0.90082 (0.0000) | 0.17695 (0.2282) | 0.506512 (0.0000) | 0.917799 (0.0000) | 0.498124 (0.0000) | |

| d | 0.186585 (0.0000) | 0.196344 (0.0000) | 0.985848 (0.0000) | 0.359226 (0.0000) | 0.310872 (0.0000) | 0.996757 (0.0000) | 0.48343 (0.0000) | |

| GCC COUNTRIES | |||||||

|---|---|---|---|---|---|---|---|

| GARCH (1,1) | Kuwait | Dubai | Qatar | Saudi | Bahrain | Oman | |

| w | 2.47 × 10−6 (0.0000) | 4.16 × 10−6 (0.0000) | 3.15 × 10−6 (0.0000) | 3.60 × 10−6 (0.0000) | 4.68 × 10−6 (0.0000) | 2.40 × 10−6 (0.0000) | |

| α | 0.156627 (0.0000) | 0.104032 (0.0000) | 0.131418 (0.0000) | 0.147074 (0.0000) | 0.148637 (0.0000) | 0.155814 (0.0000) | |

| β | 0.813056 (0.0000) | 0.853152 (0.0000) | 0.841201 (0.0000) | 0.821419 (0.0000) | 0.647571 (0.0000) | 0.749127 (0.0000) | |

| α+β | 0.969683 | 0.957184 | 0.972619 | 0.968493 | 0.796208 | 0.904941 | |

| Half-life (days) | 23 | 16 | 25 | 22 | 4 | 8 | |

| FIGARCH (1,1) | w | 3.14 × 10−6 (0.0000) | 3.01 × 10−6 (0.0000) | 3.21 × 10−6 (0.0000) | 1.61 × 10−6 (0.0000) | 4.15 × 10−6 (0.0000) | 1.87 × 10−6 (0.0000) |

| α | 0.005245 (0.8741) | 0.297341 (0.0000) | 0.156179 (0.0000) | −0.09125 0.154 | 0.771257 (0.0000) | 0.155616 (0.0028) | |

| β | 0.658701 (0.0000) | 0.713121 (0.0000) | 0.609766 (0.0000) | 0.901126 (0.0000) | 0.647162 (0.0000) | 0.560132 (0.0000) | |

| d | 0.765222 (0.0000) | 0.60103 (0.0000) | 0.615344 (0.0000) | 1.175244 (0.0000) | 0.03101 (0.0360) | 0.603413 (0.0000) | |

| OIL PRICES | |||||

|---|---|---|---|---|---|

| GARCH(1,1) | Brent | Dubai | OPEC | WTI | |

| w | 1.26 × 10−5 (0.0000) | 1.82 × 10−5 (0.0000) | 1.03 × 10−5 (0.0000) | 2.00 × 10−5 (0.0000) | |

| α | 0.116171 (0.0000) | 0.118827 (0.0000) | 0.170954 (0.0000) | 0.123824 (0.0000) | |

| β | 0.868401 (0.0000) | 0.85692 (0.0000) | 0.82298 (0.0000) | 0.864216 (0.0000) | |

| α+β | 0.984572 | 0.975747 | 0.993934 | 0.98804 | |

| Half-life (days) | 45 | 29 | 114 | 58 | |

| FIGARCH(1,1) | W | 9.09 × 10−6 (0.0000) | 1.19 × 10−5 (0.0000) | 8.20 × 10−6 (0.0000) | 1.30 × 10−5 (0.0000) |

| α | −0.018239 (0.7201) | 0.001973 (0.9781) | −0.001668 (0.9616) | 0.00685 0.1143 | |

| β | 0.881135 (0.0000) | 0.869669 (0.0000) | 0.85176 (0.0000) | 0.870597 (0.0000) | |

| d | 1.034108 (0.0000) | 1.012828 (0.0000) | 1.037388 (0.0000) | 1.010829 (0.0000) | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Alotaibi, T.A.N.M.S.; Morales, L. Financial Uncertainty from a Dual Shock at Global Level–Insights from Kuwait. Int. J. Financial Stud. 2022, 10, 101. https://doi.org/10.3390/ijfs10040101

Alotaibi TANMS, Morales L. Financial Uncertainty from a Dual Shock at Global Level–Insights from Kuwait. International Journal of Financial Studies. 2022; 10(4):101. https://doi.org/10.3390/ijfs10040101

Chicago/Turabian StyleAlotaibi, Talal A. N. M. S., and Lucía Morales. 2022. "Financial Uncertainty from a Dual Shock at Global Level–Insights from Kuwait" International Journal of Financial Studies 10, no. 4: 101. https://doi.org/10.3390/ijfs10040101