Inappropriate Corporate Strategies: Latin American Companies That Increase Their Value by Short-Term Liabilities

Abstract

1. Introduction

2. Consolidation of the Financialization Process in Corporations

3. Materials, Methods, and Model Specification

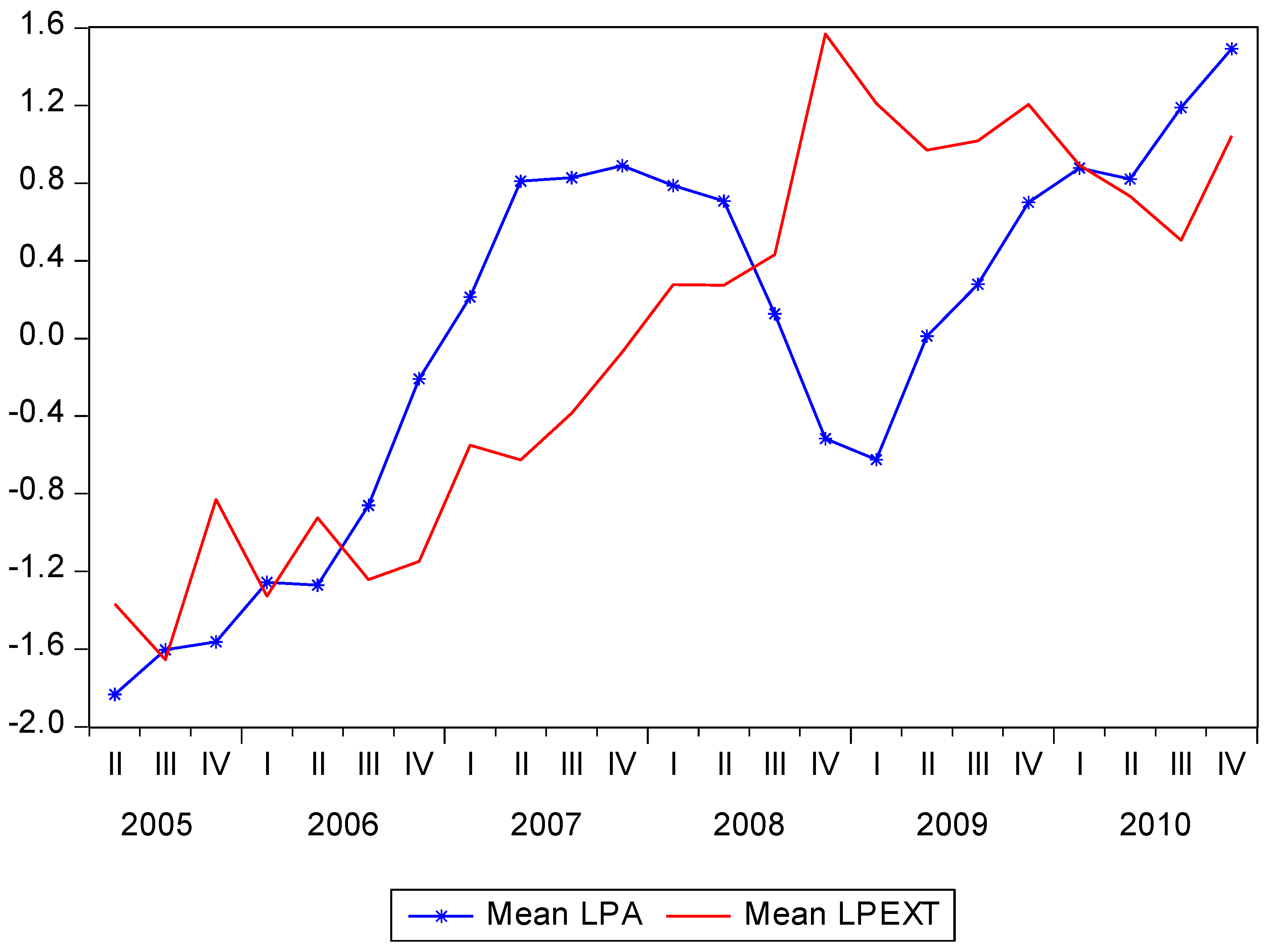

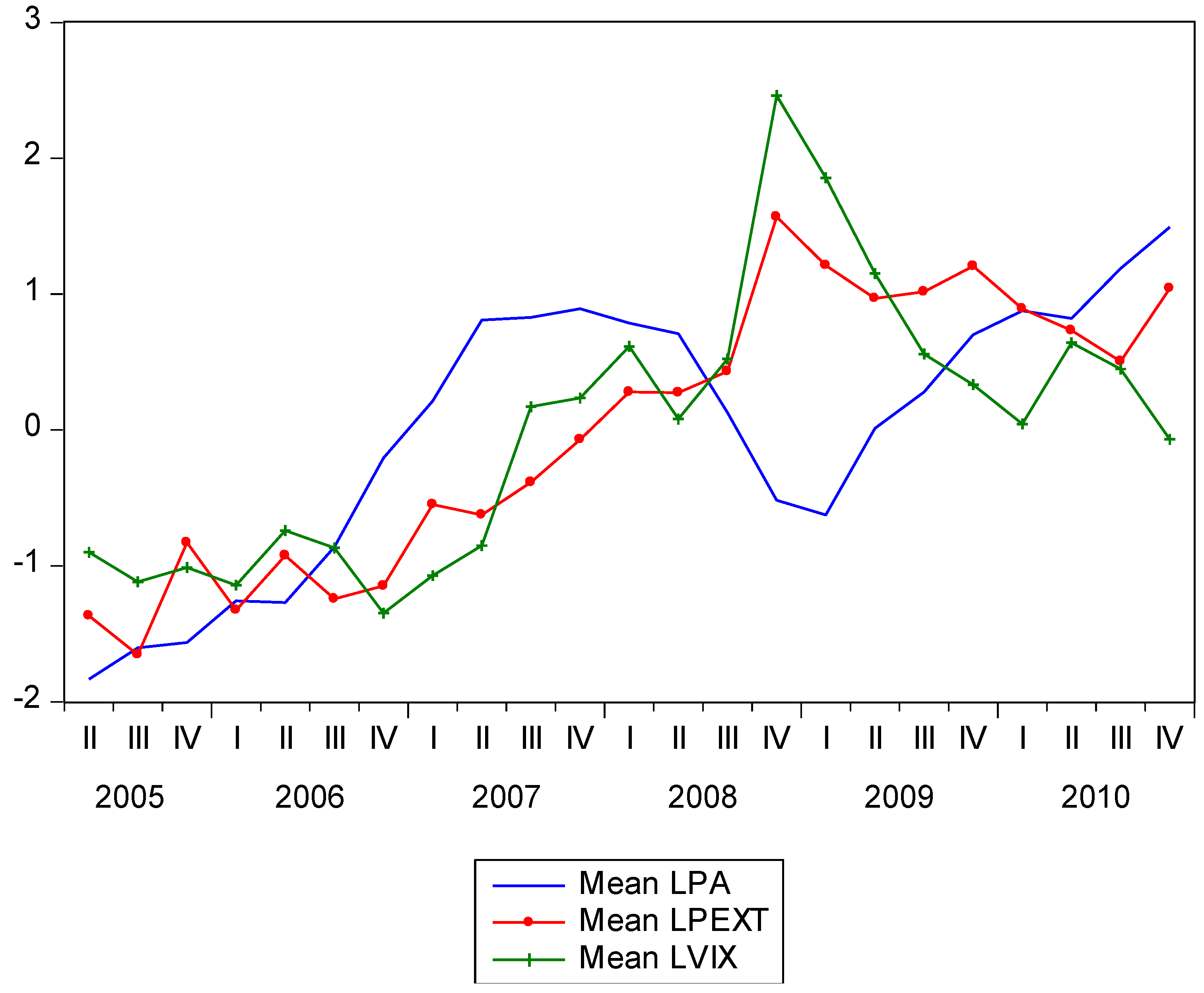

4. Results

5. Discussion and Conclusions

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Mexican Corporations | Brazilian Corporations | Chilean Corporations |

| GGIGANTE | EMBRAER | ANTARES |

| GMEXICO | SADIA | SCHWAGER |

| MOCTEZUMA | ARACRUZ | LATAM |

| ELEKTRA | LOJA | FALABELLA |

| TELEVISA | KLABIN | CENCOSUD |

| G TMM | SAO MARTINO | ALMENDRAL |

| LIVEPOOL | ALPARGATAS | AES GENER |

| MEXCHEM | CESP | BLUMAR |

| PEÑOLES | ||

| POSADAS | ||

| HERDEZ |

Appendix B

| Sargan Test | ||

| Instrument specification: | ||

| @DYN(LPA,-2) LEXCP LOGRBG LTDC LIPC | ||

| J-statistic | Instrument rank | Prob(Jstatistic) |

| 28.25720 | 29 | 0.8984 |

| Arellano–Bond Serial Correlation Test | ||||

| Included observations: 251 | ||||

| Test order | m-Statistic | rho | SE(rho) | Prob. |

| AR(1) | −3.776010 | −13.695326 | 3.626931 | 0.0002 |

| AR(2) | −0.227225 | −0.509775 | 2.243480 | 0.8202 |

References

- Aikman, David, Andrew G. Haldane, and Benjamin D. Nelson. 2015. Curbing the credit cycle. The Economic Journal 125: 1072–109. [Google Scholar] [CrossRef]

- Allayannis, George, and James P. Weston. 2001. The use of foreign currency derivatives and firm market value. Review of Financial Studies 14: 243–76. [Google Scholar] [CrossRef]

- Alter, Adrian, and Selim Elekdag. 2020. Emerging market corporate leverage and global financial conditions. Journal of Corporate Finance 62: 101590. [Google Scholar] [CrossRef]

- Amiram, Dan, Zahn Bozanic, James D. Cox, Quentin Dupont, Jonathan M. Karpoff, and Richard Sloan. 2018. Financial reporting fraud and other forms of misconduct: A multidisciplinary review of the literature. Review of Accounting Studies 23: 732–83. [Google Scholar] [CrossRef]

- Andersson, Tord, Pauline Gleadle, Colin Haslam, and Nick Tsitsianis. 2010. Bio-pharma: A financialized business model. Critical Perspectives on Accounting 21: 631–41. [Google Scholar] [CrossRef]

- Archel Domench, Pablo, and Mauricio Gómez Villegas. 2014. Crisis de la valoración contable en el capitalismo cognitivo. Innovar 24: 103–16. [Google Scholar] [CrossRef]

- Aretz, Kevin, Söhnke M. Bartram, and Gunter Dufey. 2007. Why Hedge? Rationales for Corporate Hedging and Value Implications. Journal of Risk Finance 8: 434–49. Available online: https://www.emerald.com/insight/content/doi/10.1108/15265940710834735/full/html?mobileUi=0&fullSc=1&mbSc=1&fullSc=1 (accessed on 1 September 2022). [CrossRef]

- Baines, Joseph, and Sandy Brian Hager. 2021. The great debt divergence and its implications for the Covid-19 crisis: Mapping corporate leverage as power. New Political Economy 26: 885–901. [Google Scholar] [CrossRef]

- Beneish, Messod D., Charles M.C. Lee, and D. Craig Nichols. 2013. Earnings manipulation and expected returns. Financial Analysts Journal 69: 55–82. [Google Scholar] [CrossRef]

- Berggrun, Luis, Emilio Cardona, and Edmundo Lizarzaburu. 2020. Firm profitability and expected stock returns: Evidence from Latin America. Research in International Business and Finance 51: 101119. [Google Scholar] [CrossRef]

- Bernanke, Ben S. 1993. Credit in the Macroeconomy. Quarterly Review, Federal Reserve Bank of New York. (Spring). pp. 50–70. Available online: https://core.ac.uk/download/pdf/6290968.pdf (accessed on 1 September 2022).

- Borio, Claudio. 2014. The financial cycle and macroeconomics: What have we learnt? Journal of Banking & Finance 45: 182–98. [Google Scholar] [CrossRef]

- Boyer, Robert. 2000. Is a finance-led growth regime a viable alternative to Fordism? A preliminary analysis. Economy and Society 29: 111–45. [Google Scholar] [CrossRef]

- Bräuning, Falk, and Victoria Ivashina. 2020. US monetary policy and emerging market credit cycles. Journal of Monetary Economics 112: 57–76. [Google Scholar] [CrossRef]

- Bun, Maurice J.G., and Vasilis Sarafidis. 2015. Dynamic panel data models. The Oxford Handbook of Panel Data 1: 76–110. [Google Scholar]

- Castro, José Antonio Morales. 2009. Análisis de los Instrumentos Financieros Derivados en la Bolsa Mexicana. Economía Informa 1: 112–25. Available online: http://132.248.45.5/publicaciones/econinforma/pdfs/361/08joseantoniomorales.pdf (accessed on 1 August 2022).

- Chan-Lau, Jorge A. 2005. Hedging Foreign Exchange Risk in Chile: Markets and instruments. IMF Working Paper. WP/05/37. pp. 1–24. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=687209# (accessed on 1 August 2022).

- Cid Aranda, Carlos, Mauricio Jara Bertín, Carlos Maquieira Villanueva, and Pablo San Martín Mosqueira. 2017. Instrumentos derivados, concentración de propiedad y valor de la firma. Evidencia para Chile. El Trimestre Económico 84: 947–74. [Google Scholar] [CrossRef]

- Corona Dueñas, José Asunción. 2012. Análisis de la utilización de derivados financieros en las empresas no financieras mexicanas y su efecto en las cotizaciones bursátiles. Atlantic Review of Economics 1: 1–33. Available online: https://www.econstor.eu/handle/10419/67359 (accessed on 1 August 2022).

- De Souza Murcia, Flavia Cruz, Fernando Dal-Ri Murcia, and Elisete Dahmer Pfitscher. 2017. Playing with financial weapons of mass destruction: The derivatives loss of Sadia. International Journal of Disclosure and Governance 14: 173–89. Available online: https://link.springer.com/article/10.1057/s41310-017-0019-6 (accessed on 1 August 2022). [CrossRef]

- Dell’Arriccia, Giovanni, Deniz Igan, Luc Laeven, and Hui Tong. 2012. Policies for Macrofinancial Stability: How to Deal with Credit Booms. IMF Discussion Note. April, pp. 1–46. Available online: https://www.imf.org/external/pubs/ft/sdn/2012/sdn1206.pdf (accessed on 1 August 2022).

- DeMarzo, Peter M., and Darrell Duffie. 1995. Corporate Incentives for Hedging and Hedge Accounting. Review of Financial Studies 8: 743–71. [Google Scholar] [CrossRef]

- Dodd, Randall, and Stephany Griffith-Jones. 2006. Report on Derivatives Markets: Stabilizing or Speculative Impact on Chile and a Comparison with Brazil. CEPAL/ECLAC Working Paper. pp. 1–46. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1647212 (accessed on 1 August 2022).

- Dore, Ronald. 2008. Financialization of the global economy. Industrial and Corporate Change 17: 1097–112. [Google Scholar] [CrossRef]

- Eichengreen, Barry, and Ricardo Hausmann. 1999. Exchange Rates and Financial Fragility. NBER Working Paper 7418. Cambridge: National Bureau of Economic Research. [Google Scholar] [CrossRef]

- Ezzamel, Mahmoud, Hugh Willmott, and Frank Worthington. 2008. Manufacturing shareholder value: The role of accounting in organizational transformation. Accounting, Organizations and Society 33: 107–40. [Google Scholar] [CrossRef]

- Farhi, Maryse, and Roberto Alexandre Zanchetta Borghi. 2009. Operations with financial derivatives of corporations from emerging economies. Estudos Avançados. 23, pp. 169–88. Available online: https://www.scielo.br/j/ea/a/kBf5sdJJpLsQbG9jDKGKPsv/?format=pdf&lang=en (accessed on 1 September 2022).

- Farhi, Maryse. 2017. Foreign exchange derivatives and financial fragility in Brazil. In The Brazilian Economy Since the Great Financial Crisis of 2007/2008. Cham: Palgrave Macmillan, pp. 307–35. [Google Scholar]

- Fich, Eliezer M., and Anil Shivdasani. 2007. Financial fraud, director reputation, and shareholder wealth. Journal of Financial Economics 86: 306–36. [Google Scholar] [CrossRef]

- Foley, Duncan K. 2003. Financial fragility in developing economies. In Development Economics and Structuralist Macroeconomics. Edited by Amitava Krishna Dutt and Jaime Ross. Cheltenham: Edward Elgar, pp. 157–68. [Google Scholar]

- Funk, Russell J., and Daniel Hirschman. 2014. Derivatives and deregulation: Financial innovation and the demise of Glass–Steagall. Administrative Science Quarterly 59: 669–704. [Google Scholar] [CrossRef]

- Geyer-Klingeberg, Jerome, Markus Hang, and Andreas Rathgeber. 2021. Corporate financial hedging and firm value: A meta-analysis. The European Journal of Finance 27: 461–85. [Google Scholar] [CrossRef]

- Giraldo-Prieto, César Augusto, Gabriel Jaime González Uribe, Cristhian Vesga Bermejo, and Diana Carolina Ferreira Herrera. 2017. Coberturas financieras con derivados y su incidencia en el valor de mercado en empresas colombianas que cotizan en bolsa. Contaduría y Administración 62: 1572–90. [Google Scholar] [CrossRef]

- Gómez-González, José Eduardo, Carlos Eduardo León Rincón, and Karen Juliet Leiton Rodríguez. 2012. Does the use of foreign 1currency derivatives affect firms’ market value? Evidence from Colombia. Emerging Markets Finance and Trade 48: 50–66. [Google Scholar] [CrossRef]

- Graham, John R., and Daniel A. Rogers. 2002. Do firms hedge in response to tax incentives? The Journal of Finance 57: 815–39. [Google Scholar] [CrossRef]

- Gromb, Denis, and Dimitri Vayanos. 2010. Limits of arbitrage. Annual Review of Financial Economics 2: 251–75. [Google Scholar] [CrossRef]

- Han, Bada. 2021. Transmission of Global Financial Shocks: Which Capital Flows Matter? pp. 1–103. Available online: http://rcea.org/wp-content/uploads/2021/05/Han.pdf (accessed on 1 September 2022).

- Hansen, Erwin, and Stuart Hyde. 2010. Determinants of corporate exchange rate exposure and implications for investors: Evidence from Chilean firms. Manchester Business School Research Paper (606). pp. 1–24. Available online: https://www.econstor.eu/handle/10419/50671 (accessed on 1 September 2022).

- Holmstrom, Bengt. 2015. Understanding the Role of Debt in the Financial System Bank for International Settlements. BIS Working paper No. 479. pp. 1–42. Available online: https://www.bis.org/publ/work479.pdf (accessed on 1 September 2022).

- Iliopoulos, Panagiotis, and Dariusz Wójcik. 2021. The multiple faces of financialization: Financial and business services in the US economy, 1997–2020. Competition & Change 1: 1–22. [Google Scholar] [CrossRef]

- Olivares, Aurora Jaramillo, and Marcela Jaramillo Jaramillo. 2016. Crisis financiera del 2008: Efecto en las empresas listadas en la Bolsa Mexicana de Valores. Revista Mexicana de Economía y Finanzas. Nueva Época/Mexican Journal of Economics and Finance. 11, pp. 161–77. Available online: http://www.scielo.org.mx/scielo.php?pid=S1665-53462016000300161&script=sci_arttext (accessed on 1 September 2022).

- Jaramillo, Marcela Jaramillo, María Antonieta, and García Benau. 2012. Reacción del mercado de valores mexicano ante los escándalos financieros evidencia empírica. Revista Mexicana de Economía y Finanzas. Nueva Época/Mexican Journal of Economics and Finance 7: 129–53. Available online: https://www.redalyc.org/articulo.oa?id=423739517002 (accessed on 1 August 2022).

- Jordá, Òscar, Moritz H.P. Schularick, and Alan M. Taylor. 2011. When Credit Bites Back: Leverage, Business Cycles and Crises. Federal Reserve Bank of San Francisco Working Paper Series; No. 17261. San Francisco: Federal Reserve Bank, pp. 1–42. [Google Scholar] [CrossRef]

- Kamil, Herman. 2008. How Do Exchange Rate Regimes Affect Firms’ Incentives to Hedge Exchange Rate Risk. Washington, DC: International Monetary Fund, pp. 1–39. Available online: https://www.snb.ch/n/mmr/reference/sem_2008_09_22_kamil/source/sem_2008_09_22_kamil.n.pdf (accessed on 1 September 2022).

- Ketokivi, Mikko, and Cameron N. McIntosh. 2017. Addressing the endogeneity dilemma in operations management research: Theoretical, empirical, and pragmatic considerations. Journal of Operations Management 52: 1–14. [Google Scholar] [CrossRef]

- Klinge, Tobias J., Rodrigo Fernandez, and Manuel B. Aalbers. 2021. Whither corporate financialization? A literature review. Geography Compass 15: e12588. [Google Scholar] [CrossRef]

- Krznar, Ivo, and Troy D. Matheson. 2017. Financial and business cycles in Brazil. International Monetary Fund, pp. 1–29. Available online: https://www.imf.org/en/Publications/WP/Issues/2017/01/24/Financial-and-Business-Cycles-in-Brazil-44577 (accessed on 1 September 2022).

- Labra, Romilio, and Celia Torrecillas. 2018. Estimating dynamic Panel data. A practical approach to perform long panels. Revista Colombiana de Estadística 41: 31–52. [Google Scholar] [CrossRef]

- Lazonick, William, and Mary O’sullivan. 2000. Maximizing shareholder value: A new ideology for corporate governance. Economy and Society 29: 13–35. [Google Scholar] [CrossRef]

- Lu, Guanyi, Xin David Ding, David Xiaosong Peng, and Howard Hao-Chun Chuang. 2018. Addressing endogeneity in operations management research: Recent developments, common problems, and directions for future research. Journal of Operations Management 64: 53–64. [Google Scholar] [CrossRef]

- MacKenzie, Donald, and Yuval Millo. 2003. Constructing a market, performing theory: The historical sociology of a financial derivatives Exchange. American Journal of Sociology 109: 107–45. [Google Scholar] [CrossRef]

- Mader, Philip, Daniel Mertens, and Natascha Van der Zwan. 2020. The Routledge International Handbook of Financialization. London: Routledge, p. 1. [Google Scholar]

- Modigliani, Franco, and Merton H. Miller. 1958. The cost of capital, corporation finance and the theory of investment. The American Economic Review 48: 261–97. Available online: https://www.jstor.org/stable/1809766 (accessed on 1 September 2022).

- Orhangazi, Özgür. 2008. Financialization and capital accumulation in the nonfinancial corporate sector: A theoretical and empirical investigation on the us economy, 1973–2003. Cambridge Journal of Economics 32: 863–86. [Google Scholar] [CrossRef]

- Persons, John C., and Vincent A. Warther. 1997. Boom and bust patterns in the adoption of financial innovations. The Review of Financial Studies 10: 939–67. [Google Scholar] [CrossRef]

- Pinilla Bedoya, Jhon, and Juan David Martínez Muñoz. 2020. Efecto de los derivados financieros en el valor de las empresas latinoamericanas. Contaduría y Administración 65: 1–23. [Google Scholar] [CrossRef]

- Rabinovich, Joel, and Rodrigo Pérez Artica. 2022. Cash holdings and corporate financialization: Evidence from listed Latin American firms. Competition & Change 1. [Google Scholar] [CrossRef]

- Reis, Nadine, and Felipe Antunes de Oliveira. 2021. Peripheral financialization and the transformation of dependency: A view from Latin America. Review of International Political Economy 1: 1–24. [Google Scholar] [CrossRef]

- Rey, Hélène. 2015. Dilemma Not Trilemma: The Global Financial Cycle and Monetary Policy Independence. NBER Working Paper No. 21162. Cambridge: National Bureau of Economic Research, pp. 1–42. [Google Scholar] [CrossRef]

- Román de la Sancha, Luis Ignacio, Federico Hernández Álvarez, and Gabriel Rodríguez García. 2019. Co-movimientos entre los Índices Accionarios y los Ciclos Económicos de Estados Unidos y México. Revista Mexicana de Economía y Finanzas 14: 693–714. [Google Scholar] [CrossRef]

- Rungcharoenkitkul, Phurichai, Claudio Borio, and Piti Disyatat. 2019. Monetary Policy Hysteresis and the Financial Cycle. Bank for International Settlements. BIS Working paper No. 817. pp. 1–44. Available online: https://www.bis.org/publ/work817.pdf (accessed on 1 September 2022).

- Schiozer, Rafael F., and Richard Saito. 2009. The determinants of currency risk management in Latin American nonfinancial firms. Emerging Markets Finance and Trade 45: 49–71. [Google Scholar] [CrossRef]

- Schnabel, Isabel, and Hyun Song Shin. 2004. A model of financial market liquidity based on arbitrageur capital. Journal of European Economic Association 2: 929–68. [Google Scholar] [CrossRef]

- Schularick, Moritz, and Alan M. Taylor. 2012. Credit booms gone bust: Monetary policy, leverage cycles, and financial crises. American Economic Review 102: 1029–61. [Google Scholar] [CrossRef]

- Schwartz, Herman Mark. 2021. Global secular stagnation and the rise of intellectual property monopoly. Review of International Political Economy 29: 1–26. [Google Scholar] [CrossRef]

- Toporowski, Jan. 2005. Theories of Financial Disturbance. An Examination of Critical Theories of Finance from Adam Smith to the Present Day. Northampton: Edward Elgar Publishing, pp. 1–208. [Google Scholar]

- Tsomocos, Dimitrios P. 2003. Equilibrium analysis, banking, contagion and financial fragility. Bank of England Quarterly Bulletin 43: 53. Available online: https://www.proquest.com/openview/7b696bd0d1d492737d1e5287d980138c/1.pdf?pq-origsite=gscholar&cbl=35225 (accessed on 1 August 2022). [CrossRef]

- Tulum, Öner, and William Lazonick. 2018. Financialized corporations in a national innovation system: The US pharmaceutical industry. International Journal of Political Economy 47: 281–316. [Google Scholar] [CrossRef]

- Ullah, Subhan, Ghasem Zaefarian, and Farid Ullah. 2020. How to use instrumental variables in addressing endogeneity? A step-by-step procedure for non-specialists. Industrial Marketing Management 96: A1–A6. [Google Scholar] [CrossRef]

- Villavicencio, Giovanni. 2021. Subordinate financialization and debt securitization in Latin America: The experiences of Argentina, Mexico and Brazil. El Trimestre Económico 88: 181–200. [Google Scholar] [CrossRef]

- Whitley, Richard. 2003. From the search for universal correlations to the institutional structuring of economic organization and change: The development and future of organization studies. Organization 10: 481–501. [Google Scholar] [CrossRef]

- Willmott, Hugh Christopher, Marie-Laure Djelic, Andre Spicer, Martin Parker, Charles Perrow, Derek S. Pugh, J.-C. Spender, Jean-Pascal Gond, Renéten Bos, Armin Beverungen, and et al. 2016. The modern corporation statement on management. Humanistic Management Network. Research Paper Series No. 51/16. pp. 1–7. Available online: https://ssrn.com/abstract=2863077 (accessed on 1 August 2022). [CrossRef][Green Version]

- Yan, Chuanpeng, and Kevin X. D. Huang. 2020. Financial cycle and business cycle: An empirical analysis based on the data from the US. Economic Modelling 93: 693–701. [Google Scholar] [CrossRef]

| Var. Explained | LPAt |

|---|---|

| GMM Method | |

| Explanatory | 2 steps |

| LPAt-1 | 0.8382 *** |

| (0.0066) | |

| PASEXTt | 0.0905 ** |

| (0.0069) | |

| LVIXt | −0.1528 |

| (0.0164) | |

| Observations | 551 |

| J-statistic | 28.25 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Feregrino, J.; Espinosa-Cristia, J.F.; Lay, N.; Leyton, L. Inappropriate Corporate Strategies: Latin American Companies That Increase Their Value by Short-Term Liabilities. Int. J. Financial Stud. 2022, 10, 100. https://doi.org/10.3390/ijfs10040100

Feregrino J, Espinosa-Cristia JF, Lay N, Leyton L. Inappropriate Corporate Strategies: Latin American Companies That Increase Their Value by Short-Term Liabilities. International Journal of Financial Studies. 2022; 10(4):100. https://doi.org/10.3390/ijfs10040100

Chicago/Turabian StyleFeregrino, Jorge, Juan Felipe Espinosa-Cristia, Nelson Lay, and Luis Leyton. 2022. "Inappropriate Corporate Strategies: Latin American Companies That Increase Their Value by Short-Term Liabilities" International Journal of Financial Studies 10, no. 4: 100. https://doi.org/10.3390/ijfs10040100

APA StyleFeregrino, J., Espinosa-Cristia, J. F., Lay, N., & Leyton, L. (2022). Inappropriate Corporate Strategies: Latin American Companies That Increase Their Value by Short-Term Liabilities. International Journal of Financial Studies, 10(4), 100. https://doi.org/10.3390/ijfs10040100