AI and Fintech Synergy: Strengthening Financial Stability in Islamic and Conventional Banks

Abstract

1. Introduction

2. Literature Review

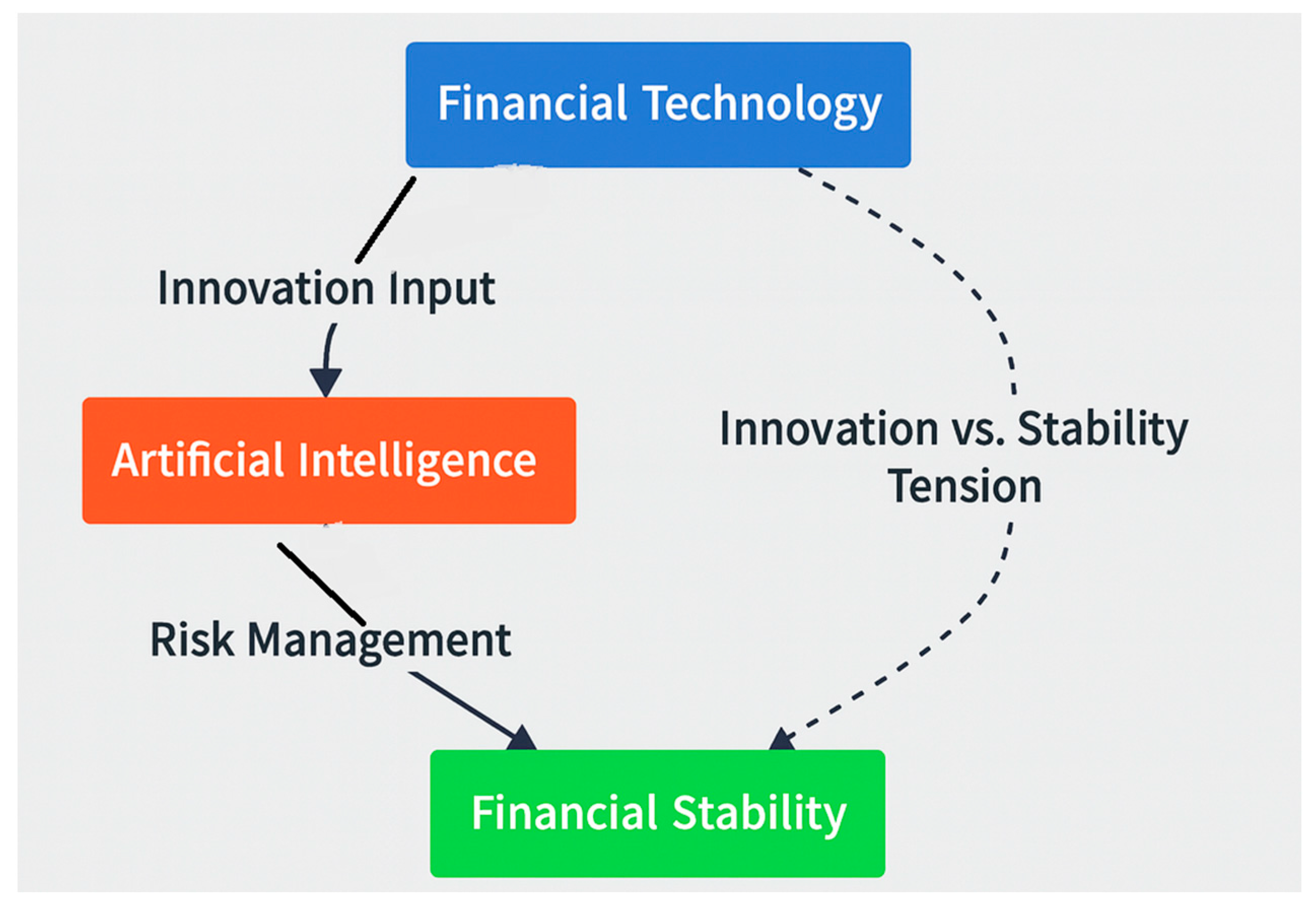

3. Conceptual Framework and Hypothesis

4. Methodology

5. Results

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Abakah, E. J. A., Tiwari, A. K., Ghosh, S., & Doğan, B. (2023). Dynamic effect of Bitcoin, Fintech and artificial intelligence stocks on eco-friendly assets, Islamic stocks and conventional financial markets: Another look using quantile-based approaches. Technological Forecasting and Social Change, 192, 122566. [Google Scholar] [CrossRef]

- Adeniyi, A. C., & Okusi, O. (2024). Ethical AI governance, financing, and human well-being in the 21st century. African Journal of Humanities and Contemporary Education Research, 17(1), 193–205. [Google Scholar] [CrossRef]

- Agrawal, S. (2021). Integrating digital wallets: Advancements in contactless payment technologies. International Journal of Intelligent Automation and Computing, 4(8), 1–14. [Google Scholar]

- Agur, I., Peria, S. M., & Rochon, C. (2020). Digital financial services and the pandemic: Opportunities and risks for emerging and developing economies (International Monetary Fund Special Series on COVID-19, Transactions). International Monetary Fund (IMF). [Google Scholar]

- Akhtar, M., Salman, A., Ghafoor, K. A., & Kamran, M. (2024). Artificial intelligence, financial services knowledge, government support, and user innovativeness: Exploring the moderated-mediated path to fintech adoption. Heliyon, 10(21), e39521. [Google Scholar] [CrossRef]

- Alagood, J., Prybutok, G., & Prybutok, V. R. (2023). Navigating privacy and data safety: The implications of increased online activity among older adults post-covid-19 induced isolation. Information, 14(6), 346. [Google Scholar] [CrossRef]

- Ali, G., Mijwil, M. M., Buruga, B. A., & Abotaleb, M. (2024). A Comprehensive review on cybersecurity issues and their mitigation measures in Fintech. Iraqi Journal for Computer Science and Mathematics, 5(3), 12. [Google Scholar] [CrossRef]

- Ally, A. M. (2025). Artificial intelligence (AI) and financial technology (FinTech) in Tanzania; legal and regulatory issues. International Journal of Law and Management. Ahead of print. [Google Scholar] [CrossRef]

- Amnas, M. B., Selvam, M., & Kathiravan, C. (2024). The potential of a fintech-driven model in enabling financial inclusion. In Data-driven modelling and predictive analytics in business and finance (pp. 172–185). Auerbach Publications. [Google Scholar]

- Anakpo, G., Xhate, Z., & Mishi, S. (2023). The policies, practices, and challenges of digital financial inclusion for sustainable development: The case of the developing economy. Fintech, 2(2), 327–343. [Google Scholar] [CrossRef]

- Arefin, S. (2023). Beginning of artificial intelligence: Does Fintech promote banks financial performance through e-transaction easiness? Annals of Artificial Intelligence and Data Sciences, 1(1), 1–11. [Google Scholar]

- Arner, D. W., Buckley, R. P., Zetzsche, D. A., & Veidt, R. (2020). Sustainability, Fintech and financial inclusion. European Business Organization Law Review, 21, 7–35. [Google Scholar] [CrossRef]

- Arsyad, I., Kharisma, D. B., & Wiwoho, J. (2025). Artificial intelligence and Islamic finance industry: Problems and oversight. International Journal of Law and Management. Ahead of print. [Google Scholar]

- Arugula, B. (2024). Ethical AI in financial services: Balancing innovation and compliance. International Journal of Artificial Intelligence, Data Science, and Machine Learning, 5(3), 46–54. [Google Scholar] [CrossRef]

- Ashoer, M., Jebarajakirthy, C., Lim, X. J., Mas’ud, M., & Sahabuddin, Z. A. (2024). Mobile Fintech, digital financial inclusion, and gender gap at the bottom of the pyramid: An extension of mobile technology acceptance model. Procedia Computer Science, 234, 1253–1260. [Google Scholar] [CrossRef]

- Awotunde, J. B., Adeniyi, E. A., Ogundokun, R. O., & Ayo, F. E. (2021). Application of big data with Fintech in financial services. In Fintech with artificial intelligence, big data, and blockchain (pp. 107–132). Springer. [Google Scholar]

- Banna, H., & Alam, M. R. (2021). Impact of digital financial inclusion on ASEAN banking stability: Implications for the post-COVID-19 era. Studies in Economics and Finance, 38(2), 504–523. [Google Scholar] [CrossRef]

- Beaverstock, J., Leaver, A., & Tischer, D. (2023). How financial products organize spatial networks: Analyzing collateralized debt obligations and collateralized loan obligations as “networked products”. Environment and Planning A: Economy and Space, 55(4), 969–996. [Google Scholar] [CrossRef]

- Belkhir, M., Naceur, S. B., Candelon, B., & Wijnandts, J. C. (2022). Macroprudential policies, economic growth and banking crises. Emerging Markets Review, 53, 100936. [Google Scholar] [CrossRef]

- Bouchetara, M., Zerouti, M., & Zouambi, A. R. (2024). Leveraging artificial intelligence (AI) in public sector financial risk management: Innovations, challenges, and future directions. EDPACS, 69(9), 124–144. [Google Scholar] [CrossRef]

- Cao, S. S., Jiang, W., & Lei, L. G. (2024). Applied AI for finance and accounting: Alternative data and opportunities. Pacific-Basin Finance Journal, 84, 102307. [Google Scholar] [CrossRef]

- Chand, S. A., Singh, B., Narayan, K., & Chand, A. (2025). The impact of financial technology (FinTech) on bank risk-taking and profitability in small developing island states: A study of Fiji. Journal of Risk and Financial Management, 18(7), 366. [Google Scholar] [CrossRef]

- Chauhan, R. S., Riis, C., Adhikari, S., Derrible, S., Zheleva, E., Choudhury, C. F., & Pereira, F. C. (2024). Determining causality in travel mode choice. Travel Behaviour and Society, 36, 100789. [Google Scholar] [CrossRef]

- Chemtai, F. (2023). Microfinance innovations, intrapreneurial process and financial inclusion of selected microfinance institutions’ customers in north rift region, Kenya [Doctoral dissertation, Kisii University]. [Google Scholar]

- Cheng, L., Varshney, K. R., & Liu, H. (2021). Socially responsible AI algorithms: Issues, purposes, and challenges. Journal of Artificial Intelligence Research, 71, 1137–1181. [Google Scholar] [CrossRef]

- Chikri, H., & Kassou, M. (2024). Financial revolution: Innovation powered by FinTech and artificial intelligence. Journal of Theoretical and Applied Information Technology, 102(9), 4145–4157. [Google Scholar]

- Choudhary, P., & Thenmozhi, M. (2024). Fintech and financial sector: ADO analysis and future research agenda. International Review of Financial Analysis, 93, 103201. [Google Scholar] [CrossRef]

- Dewasiri, N. J., Dharmarathna, D. G., & Choudhary, M. (2024). Leveraging artificial intelligence for enhanced risk management in banking: A systematic literature review. In Artificial intelligence enabled management: An emerging economy perspective (pp. 197–213). De Gruyter. [Google Scholar]

- Duran, R. E., & Griffin, P. (2021). Smart contracts: Will Fintech be the catalyst for the next global financial crisis? Journal of Financial Regulation and Compliance, 29(1), 104–122. [Google Scholar] [CrossRef]

- Durongkadej, I., Hu, W., & Wang, H. E. (2024). How artificial intelligence incidents affect banks and financial services firms? A study of five firms. Finance Research Letters, 70, 106279. [Google Scholar] [CrossRef]

- Ediagbonya, V., & Tioluwani, C. (2023). The role of Fintech in driving financial inclusion in developing and emerging markets: Issues, challenges and prospects. Technological Sustainability, 2(1), 100–119. [Google Scholar] [CrossRef]

- Ezzahid, E., & Elouaourti, Z. (2021). Financial inclusion, mobile banking, informal finance and financial exclusion: Micro-level evidence from Morocco. International Journal of Social Economics, 48(7), 1060–1086. [Google Scholar] [CrossRef]

- Fundira, M., & Mbohwa, C. (2025). AI ethics in banking services: A systematic and bibliometric review of regulatory and consumer perspectives. Discover Artificial Intelligence, 5(1), 319. [Google Scholar] [CrossRef]

- Ghouse, G., Bhatti, M. I., & Nasrullah, M. J. (2025). The impact of financial inclusion, Fintech, HDI, and green finance on environmental sustainability in E-7 countries. Finance Research Letters, 72, 106617. [Google Scholar] [CrossRef]

- Guo, H., & Polak, P. (2021). Artificial intelligence and financial technology Fintech: How AI is being used under the pandemic in 2020. In The fourth industrial revolution: Implementation of artificial intelligence for growing business success (pp. 169–186). Springer. [Google Scholar]

- Hendarti, Y., Winarno, B., & Aprilianto, M. P. (2024). Use of blockchain technology and AI in sharia financial risk management. Jurnal Ekuisci, 1(3), 155–163. [Google Scholar] [CrossRef]

- Hossain, M. S., & Sultana, M. (2024). Digitalization of corporate finance and firm performance: Global evidence and analysis. Journal of Financial Economic Policy, 16(4), 501–539. [Google Scholar] [CrossRef]

- Ishak, M. N., & Mohamed, A. (2023). Harmonization of Islamic economics with artificial intelligence: Towards an ethical and innovative economic paradigm. Al-Kharaj: Journal of Islamic Economic and Business, 5(4). [Google Scholar] [CrossRef]

- Jakšič, M., & Marinč, M. (2019). Relationship banking and information technology: The role of artificial intelligence and FinTech. Risk Management, 21(1), 1–18. [Google Scholar] [CrossRef]

- Jashwanth, G. M. (2024). Study on usage of artificial intelligence in FinTech industry. International Journal for Science Technology and Engineering, 12(8), 520–549. [Google Scholar] [CrossRef]

- Jefferson, P. T. (2021). Banks vs. shadow banks: Evidence from the 2015 FHA mortgage insurance premium cut [Doctoral dissertation, Olin Business School]. [Google Scholar]

- Kabulova, J. (2023). Impact of Fintech innovation on the financial sector’s stability. Available online: https://etalpykla.vilniustech.lt/handle/123456789/111133 (accessed on 22 December 2025).

- Katsiampa, P., McGuinness, P. B., Serbera, J. P., & Zhao, K. (2022). The financial and prudential performance of Chinese banks and Fintech lenders in the era of digitalization. Review of Quantitative Finance and Accounting, 58(4), 1451–1503. [Google Scholar] [CrossRef]

- Khalil, M. A., Hadid, M., Padmanabhan, R., Elomri, A., & Kerbache, L. (2025). An integrated artificial intelligence and optimization model for operational efficiency and risk reduction in letter of credit examination process. Decision Analytics Journal, 14, 100552. [Google Scholar] [CrossRef]

- Lucas, M., Bem-haja, P., Santos, S., Figueiredo, H., Ferreira Dias, M., & Amorim, M. (2022). Digital proficiency: Sorting real gaps from myths among higher education students. British Journal of Educational Technology, 53(6), 1885–1914. [Google Scholar] [CrossRef]

- Ma, C. Q., Liu, X., Klein, T., & Ren, Y. S. (2025). Decoding the nexus: How Fintech and AI stocks drive the future of sustainable finance. International Review of Economics & Finance, 98, 103877. [Google Scholar] [CrossRef]

- Mabe, Q. M., & Simo-Kengne, B. D. (2025). The impact of Fintech risk on bank performance in Africa: The PVAR approach. Journal of Risk and Financial Management, 18(8), 456. [Google Scholar] [CrossRef]

- Manikandan, M., Venkatesh, P., Chitra, D., Krishnamoorthi, M., Ramu, M., & Senthilnathan, C. R. (2024, October 8–9). An impact of artificial intelligence in Fintech. 2024 International Conference on Power, Energy, Control and Transmission Systems (ICPECTS) (pp. 1–3), Chennai, India. [Google Scholar] [CrossRef]

- Maple, C., Szpruch, L., Epiphaniou, G., Staykova, K., Singh, S., Penwarden, W., Wen, Y., Wang, Z., Hariharan, J., & Avramovic, P. (2023). The AI revolution: Opportunities and challenges for the finance sector. arXiv, arXiv:2308.16538. [Google Scholar] [CrossRef]

- Mhlanga, D. (2020). Industry 4.0 in finance: The impact of artificial intelligence (AI) on digital financial inclusion. International Journal of Financial Studies, 8(3), 45. [Google Scholar] [CrossRef]

- Mhlanga, D. (2022). Digital financial inclusion, and the way forward for emerging markets: Towards sustainable development. In Digital financial inclusion: Revisiting poverty theories in the context of the fourth industrial revolution (pp. 323–341). Springer International Publishing. [Google Scholar]

- Mohamad, S. N. A., Dali, N. R. S. M., & Basah, M. Y. A. (2024). Navigating the moral compass of Halal FinTech in Islamic finance: Harvesting benefits while curbing risks. In Emerging technology and crisis management in the Halal industry: Issues and recent developments (pp. 157–171). Springer Nature. [Google Scholar]

- Moharrak, M., & Mogaji, E. (2025). Generative AI in banking: Empirical insights on integration, challenges and opportunities in a regulated industry. International Journal of Bank Marketing, 43(4), 871–896. [Google Scholar] [CrossRef]

- Murinde, V., Rizopoulos, E., & Zachariadis, M. (2022). The impact of the Fintech revolution on the future of banking: Opportunities and risks. International Review of Financial Analysis, 81, 102103. [Google Scholar] [CrossRef]

- Nguyen, L., Tran, S., & Ho, T. (2022). Fintech credit, bank regulations and bank performance: A cross-country analysis. Asia-Pacific Journal of Business Administration, 14(4), 445–466. [Google Scholar] [CrossRef]

- Nichkasova, Y., & Shmarlouskaya, H. (2020). Financial technologies as a driving force for business model transformation in the banking sector. International Journal of Business and Globalisation, 25(4), 419–447. [Google Scholar] [CrossRef]

- Osabutey, E. L., & Jackson, T. (2024). Mobile money and financial inclusion in Africa: Emerging themes, challenges and policy implications. Technological Forecasting and Social Change, 202, 123339. [Google Scholar] [CrossRef]

- Oyasiji, O., Okesiji, A., Imediegwu, C. C., Elebe, O., & Filani, O. M. (2023). Ethical AI in financial decision-making: Transparency, bias, and regulation. International Journal of Scientific Research in Computer Science, Engineering and Information Technology, 9(5), 453–471. [Google Scholar]

- Ozturk, I., & Ullah, S. (2022). Does digital financial inclusion matter for economic growth and environmental sustainability in OBRI economies? An empirical analysis. Resources, Conservation and Recycling, 185, 106489. [Google Scholar] [CrossRef]

- Parvin, S. R., & Panakaje, N. (2022). A study on the prospects and challenges of digital financial Inclusion. International Journal of Case Studies in Business, IT and Education (IJCSBE), 6(2), 469–480. [Google Scholar] [CrossRef]

- Passanisi, F. (2024). Fintech as a transformative model for financial inclusion: A systematic review [Master’s dissertation, University of Malta]. [Google Scholar]

- Pattnaik, D., Ray, S., & Raman, R. (2024). Applications of artificial intelligence and machine learning in the financial services industry: A bibliometric review. Heliyon, 10(1), e23492. [Google Scholar] [CrossRef]

- Rahman, T., Joe, N. M., & Jalil, M. A. (2024). Governance apathy and systemic barriers in enforcing shariah compliance: A critical study of islamic banking practices in Bangladesh. International Journal of Social and Business Studies, 2(2), 52–71. [Google Scholar]

- Rambe, P., & Khaola, P. (2022). The impact of innovation on agribusiness competitiveness: The mediating role of technology transfer and productivity. European Journal of Innovation Management, 25(3), 741–773. [Google Scholar] [CrossRef]

- Ristanović, V., Primorac, D., & Mulović Trgovac, A. (2025). Banking in the age of blockchain and FinTech: A hybrid efficiency framework for emerging economies. Journal of Risk and Financial Management, 18(8), 458. [Google Scholar] [CrossRef]

- Rosa, G. J., Valente, B. D., de los Campos, G., Wu, X. L., Gianola, D., & Silva, M. A. (2011). Inferring causal phenotype networks using structural equation models. Genetics Selection Evolution, 43, 6. [Google Scholar] [CrossRef] [PubMed]

- Rosenstein, P. A. (2022). The future of finance: The potential for the United States to harness the promise of financial technology (Fintech) and pave the way for a new age of financial innovation and inclusion [Doctoral dissertation, Johns Hopkins University]. [Google Scholar]

- Rymarczyk, J. (2021). The impact of industrial revolution 4.0 on international trade. Entrepreneurial Business and Economics Review, 9(1), 105–117. [Google Scholar] [CrossRef]

- Sant’Anna, D. A., & Figueiredo, P. N. (2024). Fintech innovation: Is it beneficial or detrimental to financial inclusion and financial stability? A systematic literature review and research directions. Emerging Markets Review, 60, 101140. [Google Scholar] [CrossRef]

- Shaikh, A. A., Glavee-Geo, R., Karjaluoto, H., & Hinson, R. E. (2023). Mobile money as a driver of digital financial inclusion. Technological Forecasting and Social Change, 186, 122158. [Google Scholar] [CrossRef]

- Sikalao-Lekobane, O. L. (2022). The impact of Fintech credit on financial stability: An empirical study [Doctoral dissertation, Bournemouth University]. [Google Scholar]

- Sikalao-Lekobane, O. L. (2024). Does FinTech credit enhance or disrupt financial stability? International Review of Economics & Finance, 96, 103489. [Google Scholar] [CrossRef]

- Spring, M., Faulconbridge, J., & Sarwar, A. (2022). How information technology automates and augments processes: Insights from Artificial-Intelligence-based systems in professional service operations. Journal of Operations Management, 68(6–7), 592–618. [Google Scholar] [CrossRef]

- Sun, J., Zhang, C., Zhang, R., Ji, Y., & Ding, J. (2025). Spillover dynamics and determinants between Fintech institutions and commercial banks based on the complex network and random forest fusion. Pacific-Basin Finance Journal, 91, 102713. [Google Scholar] [CrossRef]

- Svetlova, E. (2022). AI ethics and systemic risks in finance. AI and Ethics, 2(4), 713–725. [Google Scholar] [CrossRef]

- Upadhyaya, H. (2024). Digital education and economic transformation: Bridging the gap. Meadow Publication. [Google Scholar]

- Xuan, S., Hu, J., Yin, J., Li, Y., & Peng, J. (2025). The role of FinTech in shaping urban innovation: A study of financial markets from the perspective of the patent renewal model. Pacific-Basin Finance Journal, 91, 102750. [Google Scholar] [CrossRef]

- Yaqoobi, A. A. (2022). The governance of public–private partnerships: Complexity, uncertainty and incompleteness [Doctoral dissertation, University of Leicester]. [Google Scholar]

- Yoshida, E. (2019). Fintech-enabled islamic financial system and financial stability. In Islamic monetary economics and institutions: Theory and practice (pp. 181–192). Springer. [Google Scholar]

- Zaman, A., Tlemsani, I., Matthews, R., & Mohamed Hashim, M. A. (2025). Assessing the potential of blockchain technology for Islamic crypto assets. Competitiveness Review: An International Business Journal, 35(2), 229–250. [Google Scholar] [CrossRef]

- Zhao, D., Jia, Y., & Djurišić, A. B. (2023). FinTech is impacting the financial industry (pp. 29–51). Springer Nature. [Google Scholar] [CrossRef]

| Variable | Mean | Standard Error | Min | Max |

|---|---|---|---|---|

| Financial Stability | 56.474 | 3.8433 | 0.4752 | 388.08 |

| AI | 75.658 | 37.163 | 16 | 186 |

| Fintech | 1,625,421 | 5,515,031 | 10,949 | 39,000,000 |

| Management Quality | 0.3860 | 0.2018 | 0.0426 | 1.2478 |

| ROA | 0.0169 | 0.0105 | −0.0056 | 0.0562 |

| ROE | 0.1753 | 0.0051 | −0.0196 | 0.5429 |

| Liquidity Risk | 8.1986 | 38.880 | 1.0100 | 245.34 |

| Size of Bank | 317,000,000 | 1,010,000,000 | 44,099 | 4,180,000,000 |

| Non-Performing Loans | 0.0339 | 0.0239 | 0.0006 | 0.1206 |

| Capitalization | 0.1932 | 0.2168 | 0.0447 | 0.8397 |

| Capital Adequacy Ratio | 0.1922 | 0.0437 | 0.1030 | 0.3270 |

| Unemployment | 5.9874 | 4.5913 | 0.1300 | 19.837 |

| Inflation | 11.877 | 26.418 | −26.296 | 168.95 |

| GDP Growth | 3.322 | 9.204 | −32.909 | 63.440 |

| Variable | Mean | Standard Error | Min | Max |

|---|---|---|---|---|

| Financial Stability | 38.1712 | 1.5633 | 6.7985 | 351.78 |

| AI | 75.658 | 37.163 | 16 | 186 |

| Fintech | 1,700,543 | 5,662,085 | 10,948.77 | 39,000,000 |

| Management Quality | 0.3920 | 0.2056 | 0.0426 | 1.2478 |

| ROA | 0.0171 | 0.0107 | −0.0056 | 0.0562 |

| ROE | 0.1340 | 0.0070 | −0.8199 | 0.9162 |

| Liquidity Risk | 8.4183 | 39.971 | 1.010 | 245.34 |

| Size of Bank | 124,000,000 | 620,000,000 | 44,098.87 | 4,180,000,000 |

| Non-Performing Loans | 0.0344 | 0.0245 | 0.0006 | 0.1206 |

| Capitalization | 0.1612 | 0.1745 | 0.0447 | 0.8397 |

| Capital Adequacy Ratio | 0.1923 | 0.0447 | 0.1030 | 0.3270 |

| Unemployment | 5.2554 | 3.5034 | 0.1300 | 15.701 |

| Inflation | 12.484 | 27.058 | −26.296 | 168.95 |

| GDP Growth | 3.405 | 9.454 | −32.909 | 63.440 |

| (1) | (2) | (3) | |

|---|---|---|---|

| Variables | Fin Stability | AI | Management Quality |

| AI | −0.234 *** | ||

| (0.0724) | |||

| Management Quality | −1.422 | ||

| (13.07) | |||

| ROA | −131.3 | ||

| (316.2) | |||

| ROE | −38.88 | ||

| (40.37) | |||

| Liquidity Risk (liquid) | 95.16 ** | ||

| (39.96) | |||

| Size of Bank | 1.84 × 10−9 | ||

| (3.20 × 10−8) | |||

| Non-Performing Loans (NPL) | −90.79 * | ||

| (51.59) | |||

| Unemployment (unempl) | −0.329 | ||

| (0.455) | |||

| Inflation | −0.185 ** | ||

| (0.0767) | |||

| GDP Growth (GDP) | 0.455 ** | ||

| (0.214) | |||

| Fintech | −7.51 × 10−7 * | ||

| (4.33 × 10−7) | |||

| Capital Adequacy Ratio (CAR) | 0.519 *** | ||

| (0.178) | |||

| Capitalization | 0.361 | ||

| (0.321) | |||

| var(e.fin_stab) | |||

| var(e.AI_readiness) | |||

| var(e.Management_quality) | |||

| Constant | −39.48 | 74.90 *** | 0.188 *** |

| (47.88) | (3.225) | (0.0367) | |

| McFadden R2 | 0.2581 | 0.3168 | 0.3119 |

| McFadden Adj R2 | 0.2238 | 0.2851 | 0.2750 |

| LM2 test | 3.2775 | 6.0936 | 6.0876 |

| LR test | 72.493 *** | 64.302 *** | 80.234 *** |

| RMSEA | 0.0453 | 0.0224 | 0.0372 |

| CFI | 0.9508 | 0.95239 | 0.9624 |

| TLI | 0.9672 | 0.9845 | 0.9768 |

| (1) | (2) | (3) | |

|---|---|---|---|

| Variables | Financial Stability | AI | Management Quality |

| AI | −0.232 *** | ||

| (0.0762) | |||

| Management Quality | −7.068 | ||

| (14.71) | |||

| ROA | −388.7 | ||

| (379.2) | |||

| ROE | −23.85 | ||

| (49.12) | |||

| Liquidity Risk (liquid) | 134.6 *** | ||

| (51.55) | |||

| Size of Bank | 5.24 × 10−10 | ||

| (3.37 × 10−8) | |||

| Non-Performing Loans (NPL) | −66.15 | ||

| (89.62) | |||

| Unemployment (unempl) | −0.422 | ||

| (0.501) | |||

| Inflation | −0.189 ** | ||

| (0.0821) | |||

| GDP Growth (GDP) | 0.504 ** | ||

| (0.223) | |||

| Fintech | −8.13 × 10−7 * | ||

| (4.41 × 10−7) | |||

| Capital Adequacy Ratio (CAR) | 0.231 | ||

| (0.222) | |||

| Capitalization | 0.206 | ||

| (0.372) | |||

| var(e.fin_stab) | |||

| var(e.AI_readiness) | |||

| var(e.Management_quality) | |||

| Constant | −79.08 | 75.54 *** | 0.271 *** |

| (61.13) | (3.478) | (0.0443) | |

| McFadden R2 | 0.2772 | 0.2363 | 0.2914 |

| McFadden Adj R2 | 0.227 | 0.2104 | 0.2688 |

| LM2 test | 4.2971 | 3.1172 | 5.5641 |

| LR test | 83.602 *** | 61.083 *** | 82.495 *** |

| RMSEA | 0.0161 | 0.0412 | 0.0437 |

| CFI | 0.9623 | 0.9982 | 0.9788 |

| TLI | 0.9759 | 0.9732 | 0.9644 |

| Dep Variable: Financial Stability | Conventional Banks | Islamic Banks |

|---|---|---|

| AI | −0.234 *** (0.0724) | −0.232 *** (0.0762) |

| Management Quality | −1.422 (13.07) | −7.068 (14.71) |

| ROA | −131.3 (316.2) | −388.7 (379.2) |

| ROE | −38.88 (40.37) | −23.85 (49.12) |

| Liquidity Risk | 95.16 ** (39.96) | 134.6 *** (51.55) |

| Size of Bank | 1.84 × 10−9 (3.20 × 10−8) | 5.24 × 10−10 (3.37 × 10−8) |

| Non-Performing Loans (NPLs) | −90.79 * (51.59) | −66.15 (89.62) |

| Unemployment | −0.329 (0.455) | −0.422 (0.501) |

| Inflation | −0.185 ** (0.0767) | −0.189 ** (0.0821) |

| GDP Growth | 0.455 ** (0.214) | 0.504 ** (0.223) |

| Fintech | −7.51 × 10−7 * (4.33 × 10−7) | −8.13 × 10−7 * (4.41 × 10−7) |

| CAR | 0.519 *** (0.178) | 0.231 (0.222) |

| Capitalization | 0.361 (0.321) | 0.206 (0.372) |

| Constant | −39.48 (47.88) | −79.08 (61.13) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2026 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license.

Share and Cite

Alahmad, F.A.; Ghouse, G.; Bhatti, M.I. AI and Fintech Synergy: Strengthening Financial Stability in Islamic and Conventional Banks. J. Risk Financial Manag. 2026, 19, 21. https://doi.org/10.3390/jrfm19010021

Alahmad FA, Ghouse G, Bhatti MI. AI and Fintech Synergy: Strengthening Financial Stability in Islamic and Conventional Banks. Journal of Risk and Financial Management. 2026; 19(1):21. https://doi.org/10.3390/jrfm19010021

Chicago/Turabian StyleAlahmad, Fahad Abdulrahman, Ghulam Ghouse, and Muhammad Ishaq Bhatti. 2026. "AI and Fintech Synergy: Strengthening Financial Stability in Islamic and Conventional Banks" Journal of Risk and Financial Management 19, no. 1: 21. https://doi.org/10.3390/jrfm19010021

APA StyleAlahmad, F. A., Ghouse, G., & Bhatti, M. I. (2026). AI and Fintech Synergy: Strengthening Financial Stability in Islamic and Conventional Banks. Journal of Risk and Financial Management, 19(1), 21. https://doi.org/10.3390/jrfm19010021