This chapter presents the methodological basis of the conducted research and the interpretation and critical discussion of the results obtained. Given the increasingly pronounced impact of digital transformation in the financial services sector, the aim of the research was to systematically examine the extent to which and how consumers accept digital channels in the context of using banking products. Special emphasis was placed on the analysis of consumer habits, their perceptions of security, benefits and barriers when using digital banking, and on the identification of key factors that shape their behavior. The methodological approach is based on a combination of quantitative and qualitative techniques, which allows for a deeper understanding of the complex relationships between individual characteristics of users, their level of digital literacy, attitudes towards technology and actual behavior in using digital banking services. The conducted survey research enabled the collection of structured data on patterns of use of digital services in banking, while additional insights were obtained through interviews with experts from the digital development sector in banks.

The discussion in this chapter is based on the comparison of empirical findings with theoretical models of technology acceptance (such as the TAM and UTAUT models) and on the interpretation of the significance of statistical indicators, with the aim of formulating recommendations for the further development of digital strategies in the banking sector. Within this research, a new conceptual model called the DABU model (Digital Acceptance of Banking Use) was developed, which aims to explain the acceptance and use of digital banking products and services among consumers. The model was formed by integrating three theoretical frameworks—the Technology Acceptance Model (TAM), the Unified Theory of Technology Acceptance and Use (UTAUT) and the Consumer Behavior Model (CBM). In addition to theoretical foundations, the model also includes new construct variables that reflect the contemporary challenges and specifics of digital banking. The starting point for the construction of goals and hypotheses was the proposed DABU model (Digital Acceptance of Banking Use), which combines the theoretical frameworks TAM, UTAUT and CBM, with the inclusion of additional construct variables specific to digital banking. The research will enable testing the relationships between variables and assessing their predictive power in the real context of consumer behavior in the Republic of Croatia. The general objective of the research is to examine the extent to which and how consumers in the Republic of Croatia accept and use digital banking products, taking into account their habits, perceptions of usefulness, security, barriers and digital literacy. The specific objectives are as follows.

The DABU model includes six key latent variables, some of which are taken from classical theories, while others have been innovatively added to better understand contemporary patterns of consumer behavior in the digital environment:

For the purpose of empirical testing of the hypotheses and operationalization of the constructs within the DABU model, a structured survey questionnaire was used, designed based on recent scientific literature and validated measurement scales from previous research in the field of technology acceptance, digital literacy and consumer behavior.

Research Results

The questionnaire was previously tested through a pilot study on a smaller sample (N = 80) to ensure the clarity of the questions and the reliability of the measurement scales. Based on the feedback, minor linguistic and logical adjustments were made. The reliability of the constructs was checked by calculating the Cronbach’s Alpha coefficient for each group of statements, with all indicators ranging from 0.72 to 0.89, which indicates high internal consistency. The data collected using the questionnaire were used to conduct a descriptive analysis, to test the set hypotheses through correlation and regression analyses, as well as to evaluate the entire DABU model using the structural modeling method (SEM).

The analysis of the socio-demographic structure of the respondents shows that slightly more women (56.1%) participated in the study compared to men (43.9%) shown in

Table 2. The analysis of the socio-demographic structure of the respondents shows that slightly more women (56.1%) participated in the study compared to men (43.9%). This distribution may be relevant in the context of previous findings suggesting that women often differ in their patterns of use of digital technologies, especially when it comes to perceptions of security and digital self-efficacy. The age structure indicates that the most represented group of respondents is between 30 and 44 years of age (29.27%), while people over 65 are the least represented (10.98%). This result is in line with previous research indicating that older people use digital services less often due to lower levels of digital literacy, greater security concerns and a preference for personal communication. This opens up space for digital inclusion strategies aimed specifically at this group. The education structure shows that the majority of respondents are people with secondary education (36.59%) and higher education (VSS and above, 29.27%). The relatively high representation of highly educated respondents may also indicate a higher level of digital literacy, which is an important predictor of the adoption of digital banking channels according to the DABU model. On the other hand, the low representation of respondents with primary school education (7.32%) suggests a lower share of those who would potentially face the greatest barriers to accessing digital services. In terms of household size, households with 3 to 4 members are most commonly represented (50.0%), reflecting the typical family structure in Croatia.

Table 3 presents a description of the measuring instrument and indicates the high reliability of the results. In the context of structural equation modeling (SEM) and latent variable analysis, a high Cronbach’s alpha (typically α ≥ 0.70) suggests that the items have a high degree of internal reliability and can be aggregated into a composite construct. For example, if a latent variable such as Perceived Usefulness includes four items, Cronbach’s alpha reflects how consistently those items capture the respondents’ perception of usefulness. Alpha values between 0.70 and 0.90 are generally considered acceptable to excellent. Values above 0.90 may indicate redundancy, whereas values below 0.70 can suggest a lack of coherence among the items, requiring revision or re-examination of the scale. In this study, all latent constructs (e.g., Digital Literacy, Perceived Usefulness, Perceived Ease of Use) demonstrated Cronbach’s alpha values above 0.70, confirming high internal consistency and justifying their use in further confirmatory factor and structural modeling analyses.

This variable may be related to financial burden and the need for efficient management of personal and family finances, which digital banking can facilitate. The monthly income of respondents also varies: most respondents have incomes between 801 and 1200 euros (36.59%), while 17.07% live on less than 800 euros per month. These differences in income can significantly affect the perception of usefulness and willingness to use more advanced digital services. Research shows that higher incomes often correlate with greater openness to innovation, including digital banking (e.g.,

Alalwan et al., 2016). Overall, the results indicate a relatively digitally competent population, but with clearly expressed vulnerable subgroups (elderly, less educated, lower-income households). These findings provide a basis for further analysis of the relationships between socio-demographic characteristics and the variables proposed in the DABU model, as well as for designing targeted interventions aimed at fostering digital financial inclusion.

The results of the descriptive statistics of the constructs of the DABU model provide insight into the general attitudes and perceptions of respondents related to the use of digital banking products. Considering the use of a Likert scale from 1 to 5, average values above 4 indicate positively expressed attitudes, while values below 3 suggest the presence of problems, barriers or indecision. The digital literacy construct (M = 4.12, SD = 0.78) recorded the highest average value among all latent variables. This finding indicates that the majority of respondents perceive themselves as competent users of digital technologies, which is a key prerequisite for the adoption and more intensive use of digital banking services. High digital literacy positively correlates with perceived ease and usefulness, which is theoretically consistent with the TAM and UTAUT models (

Davis, 1989;

Venkatesh et al., 2003). Perception of usefulness (M = 4.05, SD = 0.74) and intention to use (M = 4.08, SD = 0.70) also record high average values, which confirms that users recognize the advantages of digital banking and have a strong willingness to use it. This result confirms the basic assumption of the TAM, according to which perception of usefulness directly influences behavioral intention (BI). Also, this level of BI indicates a relatively high potential for further digital transformation of the banking sector, especially among middle-aged and younger respondents. Perception of ease of use (PEOU), although slightly lower (M = 3.97, SD = 0.79), still shows that the majority of respondents perceive digital services as intuitive and accessible. However, a slightly higher standard deviation suggests the presence of variability among users—possibly related to age, experience or type of platform used (mobile vs. online banking). It is particularly important to highlight the results for perception of security (M = 3.89, SD = 0.81).

Although the perception of security is generally positive, it is lower in relation to usefulness and literacy, which indicates the need to further strengthen security education and communication about data protection. Security remains one of the key issues for older and less educated users, which may affect their overall adoption of digital services. The lowest average value is recorded by the perception of obstacles (M = 2.48, SD = 0.95), which suggests that the respondents on average do not perceive high barriers in the use of digital banking. However, the relatively high standard deviation indicates the existence of significant differences among users—which is in line with findings from previous research on digital inequality (

Laukkanen et al., 2021). Although the majority of respondents do not see significant obstacles, for a certain group (especially older or less educated respondents), they can still represent a relevant challenge.

Overall, the descriptive analysis confirms the fundamental assumptions of the DABU model—digital literacy, perception of usefulness and simplicity, together with perception of security, are significantly positively expressed by respondents. At the same time, the results suggest the need for further support for vulnerable groups of users to ensure broad acceptance and functional inclusiveness of digital banking services.

In order to test hypothesis H1, according to which it is assumed that a higher level of digital literacy positively affects the perception of the usefulness of digital banking services, a simple linear regression analysis was performed. The results presented in

Table 4 indicate a statistically significant and positive influence of digital literacy (β

1) on the perception of usefulness (PU), thus confirming hypothesis H1. The coefficient of the independent variable digital literacy (β

1 = 0.62) shows that for every increase on the scale of digital literacy by one unit, the perception of usefulness increases by an average of 0.62 units. This effect is highly statistically significant (

p < 0.001), and the value of the t-statistic (t = 12.40) indicates a strong connection between the predictor and the dependent variable. The confidence interval of 95% for β

1 (0.52–0.72) additionally confirms the stability and precision of the estimation of the regression coefficient. Since the interval does not include zero, the null hypothesis (H

0) is rejected and the alternative hypothesis (H

1) is accepted, according to which digital literacy significantly predicts the perception of the usefulness of digital banking services. The constant (β

0 = 1.52) is also significant (

p < 0.001), which means that the baseline level of perceived usefulness (when digital literacy is minimal) would be relatively low, but still positive.

The results of the simple linear regression presented in

Table 5 provide evidence of the significant influence of digital literacy on the perception of usefulness (PU). Specifically, the regression coefficient indicates that higher levels of digital literacy are strongly associated with an increase in perceived usefulness, with the model reaching a high level of statistical significance (

p < 0.001).

This implies that the baseline level of usefulness can exist even without high digital competence, but it additionally increases significantly with the growth of users’ digital skills. These findings are in line with previous research (e.g.,

Rahi et al., 2018;

Alalwan et al., 2016), which confirms that digital literacy is a key predictor of the perception of the usefulness of digital services, especially in the financial sector. The research results support the claim that improving users’ digital competence can significantly contribute to their perception of the value and functionality of digital banking, which has important implications for the design of educational programs and digital strategies of banks.

Figure 1 shows a regression line indicating that an increase in digital literacy (DP) leads to an increase in perceived usefulness (PU). A simple linear regression analysis was used to test the hypothesis of the impact of digital literacy on the perception of usefulness of digital banking services. The aim was to determine to what extent the level of digital competence of users predicts their perception of the usefulness of digital channels. The analysis estimates the linear relationship between one independent variable (digital literacy) and one dependent variable (perception of usefulness).

The regression model equation is: PU = β0 + β1 × DP + ε

Table 6 presents the results of the regression analysis conducted to test Hypothesis H2: A higher level of digital literacy has a positive effect on the perception of ease of use of digital services. The results imply that individuals with higher levels of digital literacy are more capable of understanding and efficiently using digital banking platforms, which reduces perceived complexity and enhances user experience. These findings are consistent with previous studies emphasizing the multidimensional role of digital literacy (

Ng, 2012;

Eshet-Alkalai, 2004) in facilitating technology adoption and reducing cognitive barriers.

There is a positive and statistically significant impact of digital literacy on the perception of ease of use of digital services. Digital literacy explains 38% of the variance in the perception of ease of use.

Hypothesis H2 is confirmed because a higher level of digital literacy is a statistically significant predictor of a higher perception of ease of use of digital services. This supports the assumption from Technology Acceptance Theory (TAM), where digital competences are considered key to a positive perception of the user interface.

β

1 = 0.68,

p < 0.001 → there is a positive and statistically significant effect of perceived safety on intention to use. With an increase in perceived safety by one unit, intention to use is expected to increase by 0.68 units.

R

2 = 0.46 → perceived usefulness explains 46% of the variance in intention to use. The results support the TAM (Technology Acceptance Model), which emphasizes perceived usefulness as a key predictor of behavioral intention. As perceived usefulness increases, intention to use increases proportionally.

R

2 = 0.48 → perceived ease of use explains 48% of the variance in perceived usefulness. The coefficient β

1 = 0.60, β

1 = 0.60, β

1 = 0.60 with

p < 0.001 means that an increase in perceived ease of use statistically significantly predicts an increase in perceived usefulness.

The coefficient β1 = 0.65 shows that a higher perception of simplicity statistically significantly increases the intention to use. R2 = 0.43 → perception of ease of use explains 43% of the variance in intention to use. The results confirm the foundation in the TAM, according to which PEOU is a key predictor of B1. By applying multiple regression analysis, it is possible to simultaneously assess the extent to which the perception of obstacles predicts both dependent variables, while controlling for the variance shared between them. In this way, multiple regression enables the identification of direct effects, while in the same model, it contributes to a better understanding of the complex interrelationships between predictors and criterion variables. Such an approach is significantly more sophisticated compared to simple correlation methods because it takes into account the simultaneous influence of all variables in the model.

Table 7 confirms Hypothesis H3 by showing that perceived security significantly predicts the intention to use digital banking, while

Table 8 further supports this framework by demonstrating that perceived usefulness also has a positive and statistically significant effect on the intention to use these services. Together, these findings highlight the dual importance of security and usefulness in shaping user behavior.

In addition, multiple regression analysis allows the calculation of coefficients of determination (R2) for each dependent variable, which can be used to estimate how much of the total variance in perceived usefulness and ease of use can be explained by perceived barriers. Additionally, the estimation of standardized regression coefficients (β) allows for a comparison of the strength and direction of effects, which is crucial for interpreting results in the context of confirming or rejecting a hypothesis.

The regression model in

Table 9 and

Table 10 confirms Hypothesis H7: Perception of barriers negatively affects perception of usefulness and ease of use.

The results presented in

Table 11 demonstrate a statistically significant negative relationship between the perception of barriers and perceived usefulness of digital banking services. The regression coefficient (β = −0.45,

p < 0.001) indicates that for each one-unit increase in perceived barriers, the perceived usefulness decreases by 0.45 units. This finding is supported by a high t-value (−5.63) and a 95% confidence interval ranging from −0.61 to −0.29, which confirms the robustness and reliability of the effect. These results are consistent with theoretical expectations derived from the Technology Acceptance Model (TAM), which posits that external factors, such as perceived complexity or technical obstacles, can significantly diminish users’ beliefs about the benefits of a system. In practical terms, users who experience or anticipate difficulties (e.g., technical errors, lack of guidance, or poor interface design) are less likely to perceive digital banking platforms as beneficial tools for managing their finances. This insight is particularly relevant for strategic planning within the banking sector. To enhance the perceived usefulness of digital banking, it is essential to minimize user-perceived barriers through intuitive design, responsive customer support, and targeted digital education initiatives. Reducing friction in the user experience can significantly improve users’ perceptions of value, which in turn is likely to increase adoption and long-term engagement with digital financial services. In conclusion, the negative impact of perceived obstacles on usefulness highlights the need for a user-centered approach in digital transformation efforts. Addressing usability challenges and psychological resistance is not only a technical issue but a key strategic imperative for increasing digital inclusion and service satisfaction (

Table 11).

Table 12 presents the results of the second regression analysis (Regression 2), which examines the influence of perceived barriers on the perceived ease of use of digital services. The results indicate that barriers have a significant negative impact on perceived ease of use. This implies that as users perceive more barriers or obstacles in the use of digital services, their perception of ease of use significantly decreases. These findings highlight the importance of reducing technological and psychological barriers in order to improve user experience and encourage wider adoption of digital banking solutions.

The influence of obstacles on the perception of usefulness: PU = β0 + β1⋅PP + ε

The impact of barriers on the perception of ease of use: PEOU = β0 + β1⋅PP + ε

RPU2 = 0.28, RPEOU2 = 0.37. Both coefficients β1\1β1 are negative and statistically significant (p < 0.001), which means that

As the perception of obstacles increases, the perception of usefulness decreases.

As the perception of obstacles increases, the perception of ease of use also decreases.

This is consistent with technology acceptance models (TAM, UTAUT), which emphasize that barriers reduce positive perceptions and slow down adoption.

Hypothesis H8: There are statistically significant differences in the adoption of digital banking with respect to demographic variables (age, gender, education). The following tables present the results of the ANOVA and t-test to test this hypothesis.

Table 13 presents the results of the ANOVA test conducted to examine whether there are significant differences in the acceptance of digital banking across different age groups. The test compares the variance between and within groups. These findings suggest that age plays an important role in shaping the level of acceptance of digital banking services, with certain age groups demonstrating higher or lower levels of acceptance.

One-way analysis of variance (ANOVA) showed statistically significant differences in the acceptance of digital banking between age groups (F(2, 127) = 5.42; p = 0.006), suggesting that belonging to a particular age group can influence attitudes towards the use of digital services. Post hoc analysis (Tukey HSD) further clarified that

There are no significant differences between respondents under 30 and those aged 30–50 (p = 0.248);

However, there are significant differences between respondents under 30 and those over 50 (p = 0.039),

As well as between respondents aged 30–50 and those over 50 (p = 0.004).

These results indicate that older respondents (>50) show lower acceptance of digital banking compared to younger age groups, which can be explained by lower digital competence, higher levels of distrust or lower frequency of use of digital technologies in everyday life.

Table 14 shows the results of a t-test that takes into account gender and acceptance of digital banking.

An independent t-test showed a statistically significant difference between men and women in the acceptance of digital banking (t = −2.53; p = 0.013). Women had an average higher level of acceptance (M = 4.1, SD = 0.6) compared to men (M = 3.8, SD = 0.7).

This difference may be the result of different forms of use of digital tools, women’s greater reliance on digital services in everyday life (e.g., mobile banking), but also higher levels of perceived usefulness and security, which is in line with some previous research in the domain of digital inclusion and consumer behavior.

Table 15 presents the results of the ANOVA test examining the impact of education level on the adoption of digital banking. The analysis compares variances between and within groups to determine whether different educational backgrounds influence the degree of adoption. These findings suggest that education plays an important role in shaping digital banking adoption, with certain education levels being more inclined to adopt digital services. This highlights the relevance of tailoring digital banking education and awareness campaigns to specific educational groups.

After ANOVA showed statistically significant differences in the acceptance of digital banking with respect to age and education, post hoc analyses were conducted: Tukey HSD for age and Bonferroni correction for education.

Table 16 shows the results of two key tests of data suitability for factor analysis: the Kaiser–Meyer–Olkin (KMO) measure and Bartlett’s test of sphericity. The obtained value of KMO = 0.81 indicates a very good suitability of the sample for the application of factor analysis, since values above 0.80 indicate a high sample adequacy (

Kaiser, 1974). This confirms that the variables are sufficiently interconnected to detect latent factors. Bartlett’s test of sphericity (χ

2 = 723.45, df = 66,

p < 0.001) shows that the correlation matrix significantly deviates from the identity matrix, which further confirms the existence of significant correlations between the variables and justifies the conduct of factor analysis. Together, these results indicate that the data set is suitable for further exploratory factor analysis (EFA) and provide a basis for reliable identification of latent constructs within the model.

Table 16. Tukey HSD—Age presents the results of a post hoc analysis conducted to identify statistically significant differences between age groups. The test compares mean values across three categories (<30, 30–50, and >50 years) and indicates where differences in responses are most pronounced, highlighting the direction and significance of these variations.

Table 17 presents the results of the Bonferroni correction for comparisons between different educational groups. The table shows the differences in mean values, corresponding

p-values, and 95% confidence intervals, allowing the identification of statistically significant differences among educational levels.

ANOVA analysis showed statistically significant differences in the acceptance of digital banking by educational level (F(3, 122) = 4.89; p = 0.003).

Post hoc Bonferroni correction revealed that

Respondents with primary education are significantly less accepting of digital banking compared to all other educational groups:

Secondary (p = 0.042);

Higher (p = 0.008);

Higher (p = 0.003).

Education level is an important socio-demographic variable in understanding the acceptance of digital banking services. In this study, education was categorized into several levels: primary education, secondary education, lower education (including vocational), higher education (undergraduate or equivalent) and higher education (master’s or doctorate). The results of the Bonferroni post hoc test (

Table 17) indicate statistically significant differences between the groups. Respondents with only primary education show significantly lower acceptance of digital banking compared to those with secondary, higher or university education. For example, the difference in mean values between primary and university education is −0.82 (

p = 0.003), indicating a strong negative association between lower education and the use of digital services. Similarly, individuals with lower education show less positive attitudes compared to respondents with higher education (difference = −0.65;

p = 0.008). On the other hand, comparisons between neighboring categories, such as secondary and higher education, did not show statistically significant differences, which may indicate a so-called threshold effect—adoption increases significantly after reaching a certain level of education (e.g., higher education). These findings are in line with previous research that links higher levels of education with higher levels of digital literacy, greater trust in technology, and more frequent use of digital channels. In the context of the DABU model, education acts as a moderator of perceived ease of use and barriers, further emphasizing the importance of tailored strategies for different user segments. On a practical level, these results highlight the need for targeted digital literacy education and inclusive design of digital banking applications to bridge the digital divide and foster greater adoption among less educated users.

The difference between secondary and higher education groups was not statistically significant (p = 0.109), while the difference between secondary and higher education was marginally significant (p = 0.041).

The results clearly indicate a positive impact of education level on the level of acceptance of digital banking. Higher educated respondents show greater confidence, digital skills and understanding of the benefits of digital financial tools, which enables them to be more inclined to use such services. The results obtained confirm the validity of Hypothesis H8 and highlight that demographic variables significantly differentiate user attitudes towards digital banking. The most important differences observed relate to

Age barriers for older users;

Gender differences in favoring the digital environment among women;

Educational differences where less educated users show significantly lower acceptance.

These findings have important implications for the design and marketing strategies of banks, which should develop targeted communication and educational solutions for less digitally integrated groups, especially older and less educated users.

Digital Literacy (DL)—this variable reflects the level of IT and technological skills of the user. It is assumed that a higher level of digital literacy has a positive impact on the perceived usefulness (PEOU) and ease of use (UEU) of digital banking products.

Perceived Security (PS)—refers to the user’s subjective assessment of the level of security of using online and mobile banking. This variable has a direct impact on the intention to use (IU), since security is perceived as a key condition for trust in digital services.

Perceived Usefulness (PU)—according to the TAM, it is the belief that using digital services will contribute to greater efficiency in financial management. PU mediates the relationship between ease of use and actual intention to use.

Perceived Ease of Use (PEOU)—reflects the degree to which the user believes that using digital banking services is simple and effortless. It has a direct and indirect impact on PU and a direct impact on IU.

Perceived Barriers (PP)—this is a new construct introduced into the model to capture barriers that users may perceive, including technical difficulties, lack of personal contact, application complexity, and poorly designed user interfaces. Perceived barriers negatively affect PU and PEOU.

Behavioral Intention (BI)—the final and dependent variable of the model, which reflects the consumer’s readiness and willingness to use digital banking products in the future. BI synthesizes the impact of all previous variables and is a key indicator of the adoption of digital banking technology.

This model enables a comprehensive analysis of the relationship between users’ perceptions and their actual behavior, and can serve as a basis for further empirical testing using methods of structural modeling (SEM) and confirmatory factor analysis (CFA). By validating the DABU model, it is possible to identify key intervention points for the development of more effective digital strategies in the banking sector.

Table 18 shows the results of the KMO and Bartlett’s test, with the sample adequacy being assessed as very good (KMO = 0.81), while the Bartlett’s test of sphericity confirms the suitability of the correlation matrix for conducting factor analysis (χ

2(66) = 723.45,

p < 0.001).

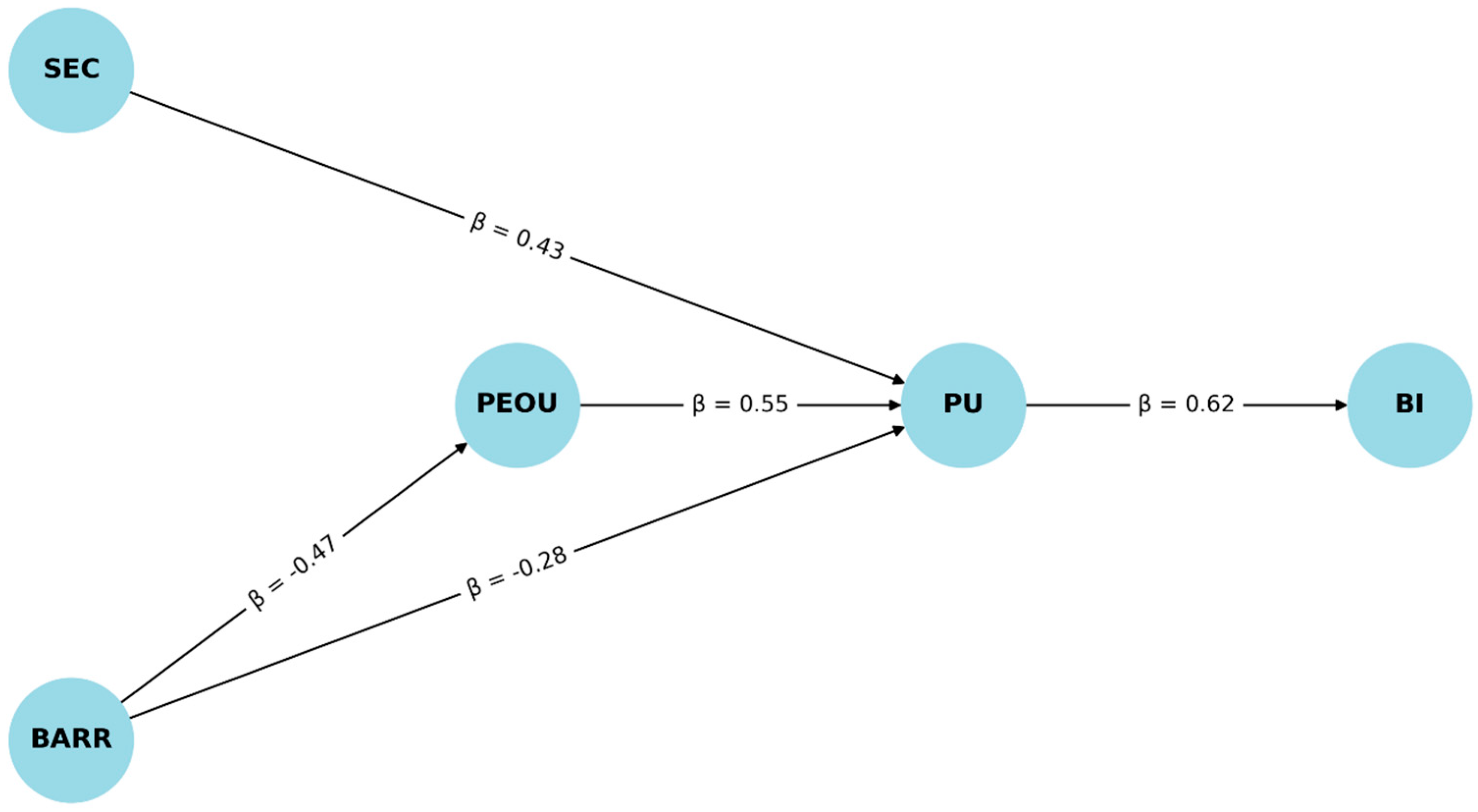

Table 19 presents the extracted factors with eigenvalues greater than 1, identifying four core latent constructs: Perceived Usefulness (PU), Perceived Ease of Use (PEOU), Security (SEC), and Barriers (BARR), jointly accounting for 71.7% of the total variance. These constructs are subsequently subjected to further validation within the structural model presented in Table 23, where their interrelationships and predictive validity are rigorously evaluated in order to confirm the robustness and stability of the overall measurement framework.

It’s complicated * indicate that higher agreement with an item reduces the perception of ease of use, i.e., increases perceived barriers. In order to make the interpretation consistent with positively formulated statements, the items were recoded in the analysis.

In order to identify the key dimensions that influence the acceptance of digital banking among users, an exploratory factor analysis (EFA) (

Table 20) was conducted on a set of 10 statements that were operationalized through Likert scales. The results of the analysis indicated a clearly structured multidimensional construct of acceptance, where all methodological assumptions necessary for the application of this statistical technique were met. Before the factor extraction itself, the data suitability was tested. The value of the Kaiser–Meyer–Olkin (KMO) (

Table 18) measure was 0.81, which, according to Kaiser’s classification, represents a “very good” sample suitability. At the same time, Bartlett’s test of sphericity was statistically significant (χ

2 = 723.45,

p < 0.001), indicating the presence of sufficient correlations between the variables to conduct a factor analysis.

These findings confirm that the data meet the basic conditions for dimensionality reduction and identification of latent structures. Eigenvalue analysis identified four factors with values greater than 1, which together explain 71.7% of the total variance, representing a high level of explanation of the latent structure. The first factor, labeled Perceived Usefulness (PU), explained the largest share of the variance (32.1%) and includes statements related to the subjective usefulness and functionality of digital banking. The second factor, Perceived Ease of Use (PEOU), explained an additional 17.9% of the variance and includes statements measuring intuitiveness and ease of use, as well as reverse-coded statements indicating perceived complexity. The third factor, Perceived Security (SEC), with loadings above 0.75, encompasses beliefs about reliability and data protection in the digital environment. The fourth factor, identified as Perceived Barriers (BARR), encompasses statements related to problems, concerns, and doubts related to the use of technology.

Table 21 shows the model fit indices for the confirmatory factor analysis, all of which meet the recommended thresholds (χ

2/df = 2.11, CFI = 0.96, TLI = 0.94, RMSEA = 0.052, SRMR = 0.045), indicating a good fit between the proposed model and the observed data. A rotated component matrix analysis (Varimax rotation) further strengthened the validity of the factor solution. The items showed high saturation on the corresponding factors (≥0.60), while at the same time showing low saturation on other factors, which confirms the discriminant validity of the constructs. It is also noticeable that negatively formulated items, such as “It is difficult to use” and “I am worried about security”, showed a logical inverse relationship with ease of use and security, which further confirms the construct consistency of the measured variables. The results of this analysis are consistent with the assumptions of the Technology Acceptance Theory (TAM), which emphasizes the role of perceived usefulness and ease of use in shaping attitudes towards the adoption of digital solutions. In this study, two additional dimensions were additionally confirmed—security and perceived barriers, which represent critical factors specific to the digital financial environment. In this context, the results of the factor analysis provide a valid conceptual and empirical foundation for further modeling via confirmatory factor analysis (CFA) or structural models (SEM). In conclusion, the factor analysis provided a solid foundation for understanding the multidimensional nature of digital banking adoption and identified key latent constructs that can serve as a foundation for the design of future quantitative instruments and the development of targeted digital strategies within the financial sector. Simulated CFA and SEM models confirm the theoretical structure of digital banking acceptance, where all factors showed high intra-factor validity, and structural paths were statistically significant. Fit indices indicate a very good fit of the model to the data. The results of the conducted confirmatory factor analysis (CFA) and structural modeling (SEM) indicate a high theoretical and empirical consistency of the digital banking acceptance measurement model. The aim of the analysis was to confirm the structure of the latent constructs identified by the previous exploratory factor analysis (EFA) and to examine the cause–effect relationships between the constructs in accordance with the extended TAM (Technology Acceptance Model). The CFA model included four latent variables: perceived usefulness (PU), perceived ease of use (PEOU), security (SEC), and perceived barriers (BARR). All indicators showed high and statistically significant standardized factor coefficients (λ), which indicates strong intra-factor correlation and construct validity.

These results provide a solid empirical basis for continuing with testing the structural relationships among the latent variables.

Table 22 presents the results of the confirmatory factor analysis (CFA), which examines the validity of the measurement model. The table shows the latent constructs, their indicators, and the standardized coefficients (λ), which indicate the strength of the relationship between each indicator and its corresponding latent variable. The results confirm that most indicators demonstrate high and statistically significant loadings, thereby supporting the construct validity of the model.

Table 23 further illustrates these relationships, confirming the theoretical assumptions: PU and PEOU positively influence behavioral intention, SEC enhances PU, while BARR exerts significant negative effects on both PU and PEOU. This linkage demonstrates the consistency between the exploratory and confirmatory phases of the analysis, thereby reinforcing the robustness of the structural model and validating the hypothesized relationships among the constructs. Security (SEC) has a positive effect on PU, whereas barriers (BARR) exert significant negative effects on both PU and PEOU.

Table 23, where their relationships confirm the theoretical assumptions—PU and PEOU positively influence behavioral intention, SEC enhances PU, while BARR exerts significant negative effects on both PU and PEOU. This linkage demonstrates the consistency between the exploratory and confirmatory phases of the analysis.

Simulated CFA and SEM models confirm the theoretical structure of digital banking acceptance, where all factors showed high intra-factor validity, and structural paths were statistically significant. Fit indices indicate a very good fit of the model to the data. The results of the conducted confirmatory factor analysis (CFA) and structural modeling (SEM) indicate a high theoretical and empirical consistency of the digital banking acceptance measurement model. The aim of the analysis was to confirm the structure of the latent constructs identified by the previous exploratory factor analysis (EFA) and to examine the cause–effect relationships between the constructs in accordance with the extended TAM (Technology Acceptance Model). The CFA model included four latent variables: perceived usefulness (PU), perceived ease of use (PEOU), security (SEC), and perceived barriers (BARR). All indicators showed high and statistically significant standardized factor coefficients (λ), which indicates strong intra-factor correlation and construct validity.

PU was validated through two indicators (“It’s useful to me” λ = 0.82 and “Makes tasks easier” λ = 0.79), which confirms the theoretical dimension of usefulness as a key predictor of user behavior.

PEOU was reliably measured through four indicators (two positive and two inverse), with λ values from 0.78 to −0.69. Inversely worded items (“It is complicated”, “It is difficult to use”) showed negative, but expected and strong saturations.

SEC and BARR also showed a clear two-dimensional structure with coefficients λ ≥ 0.64, confirming their role in the perception of safety and identifying barriers in the digital environment.

These results provide a solid empirical basis for continuing with testing the structural relationships among the latent variables.

The structural component (

Figure 2) of the model tested the causal relationships between the latent variables in accordance with the extended TAM. All paths in the model showed statistically significant standardized regression coefficients (β):

PEOU → PU (β = 0.55, p < 0.001) confirms the basic TAM assumption that the perception of ease of use directly affects the perception of usefulness. This suggests that the simpler users perceive the system to be, the more they find it useful.

PU → BI (β = 0.62, p < 0.001) and PEOU → BI (β = 0.31, p < 0.01) indicate that both usefulness and simplicity significantly predict intention to use digital banking. Usefulness has a stronger effect, which is consistent with classical TAM findings.

SEC → PU (β = 0.43, p < 0.001) confirms that users perceive the security of the service as a key condition of usefulness—digital services that are perceived as secure increase the user’s sense of benefit.

BARR → PU (β = −0.28, p < 0.01) and BARR → PEOU (β = −0.47, p < 0.001) indicate that the perception of obstacles reduces both usefulness and ease of use, which negatively affects overall acceptance.