1. Introduction

Family-owned businesses generate nearly three-quarters of global gross domestic product (GDP), accounting for

$60−70 trillion in annual revenue, and employ approximately three-fifths of the global workforce (

Sligh, 2024). The 500 largest family-owned firms collectively represent the world’s third-largest economic force when ranked by total revenue (

Ernst & Young, 2021). A defining feature of these firms is the persistence of family control across generations, which reflects a long-term orientation in strategic and organizational decision-making (

Walsh & Seward, 1990;

Zellweger, 2007;

Ward, 2011). This characteristic has particular relevance as economies such as China pivot from rapid GDP growth to more sustainable, quality-driven development grounded in technological advancement and industrial upgrading (

Betti, 2024). In such dynamic and competitive environments, innovation becomes critical to sustaining firm performance over time (

Duran et al., 2016;

Qi & Chau, 2018). Family firms—despite their global prominence—face unique governance-related challenges and advantages in pursuing innovation, shaped by their ownership structures and intergenerational priorities.

Despite substantial research on governance and innovation in family firms, limited attention has been paid to the influence of family member education as a determinant of innovation. The extant literature presents mixed findings regarding the impact of family control on R&D investment and innovation outcomes. Some studies find that family firms underinvest in R&D (

Block, 2012), potentially due to heightened risk aversion (

Chen et al., 2020). And family-owned firms may cultivate self-perceptions in which family-oriented goals serve as negative signals to prospective talented candidates (

Basco et al., 2023). In contrast, interview data indicate that higher technological content in products is associated with higher educational attainment among company founders (

Dou et al., 2019;

Madsen et al., 2003). Moreover, family CEOs with substantive control rights appear more willing to invest in R&D (

Zulfiqar et al., 2021). This study contributes to the ongoing debate by explicitly analyzing the impact of family member education on innovation and evaluating the moderating roles of industry competition and information transparency.

Using a dataset comprising 14,338 firm-year observations from 3097 unique Chinese publicly listed family firms between 2015 and 2023, this study presents four key findings. First, top management team (TMT) family members’ education positively influences firm innovation inputs, measured by the proportion of R&D personnel and capitalized R&D investment. Second, the positive association between family member education and firm innovation input is stronger when industry competition intensifies, information transparency is high, or firm size is relatively small. Third, family member education influences firm innovation partly through the channels of reduced asset tangibility, reduced ownership concentration, and increased management fees. Fourth, the positive effect of family member education on firm innovation is primarily observed in the manufacturing and service sectors, with no significant relationship found in the agriculture sector. Finally, endogeneity concerns are alleviated through the use of lagged independent variables, two-stage least squares (2SLS) regressions, and panel vector autoregressions. The results remain robust when firm innovation is alternatively measured by the number of authorized patents.

This study contributes to the literature in several distinct ways. First, it deepens the understanding of the determinants of firm innovation (

He & Tian, 2020;

Wan et al., 2005). Prior research highlights the role of external conditions, including financial market development (

Hsu et al., 2014), government corruption (

Ayyagari et al., 2014), government subsidies (

Ding & Zhang, 2023), and regional gambling preferences (

Chen et al., 2014). Internal mechanisms also matter, such as CEO characteristics (

Barker & Mueller, 2002;

Li et al., 2023) and corporate taxation (

Mukherjee et al., 2017;

Atanassov & Liu, 2020). This study fills a gap by identifying the educational background of TMT family members as a novel determinant of innovation in Chinese family firms.

Second, this study advances the literature on the implications of TMT educational background. Prior research links TMT educational background to firm performance (

Jalbert et al., 2002;

Diaz-Fernandez et al., 2014), corporate risk-taking (

Zhang et al., 2023), corporate social responsibility (

Wen et al., 2024), default risk (

Zheng et al., 2024), entrepreneurial strategic orientation (

Yang & Wang, 2014), strategic consensus (

Knight et al., 1999), and innovation performance (

Xu & Hu, 2023;

Daellenbach et al., 1999). This study addresses a gap by documenting firm innovation as a novel outcome of TMT educational background in Chinese family firms.

Third, this study investigates the moderating roles of industry competition and information transparency, thereby offering a more granular understanding of the external contingencies that facilitate or hinder innovation. It further analyzes how the educational backgrounds of family members shape both the composition of R&D personnel and the scale of innovation investment across diverse industries, thereby generating practical implications for corporate managers, institutional investors, and policymakers aiming to develop targeted strategies that enhance innovation capacity in family-controlled enterprises. In addition, this study also sheds light on internal corporate governance mechanisms. The educational background of TMT family members represents an informal governance channel that shapes strategic decision-making and innovation investment, particularly in emerging market family firms. These insights align with the broader discourse on evolving corporate governance structures.

The remainder of the paper is structured as follows.

Section 2 reviews the relevant literature and formulates the testable hypotheses.

Section 3 outlines the data sources and empirical methodology.

Section 4 reports the main empirical findings.

Section 5 discusses the results and their implications.

Section 6 concludes, noting limitations and directions for future research.

2. Literature Review and Hypotheses Development

2.1. Determinants of Firm Innovation

Firm innovation is influenced by a variety of external factors that shape a firm’s strategic behavior and resource allocation. Prior research has highlighted the significant role of contextual environments in driving innovation outcomes (

He & Tian, 2020;

Wan et al., 2005). External factors such as financial market development (

Hsu et al., 2014), government corruption (

Ayyagari et al., 2014), and government support—including subsidies and tax incentives—have been shown to affect firms’ R&D investment and innovation performance (

Zuo & Lin, 2022;

Xia, 2024;

Kang & Park, 2012). Corruption, in particular, may reduce innovation incentives by distorting resource allocation (

Huang & Yuan, 2021). In contrast, well-designed government subsidies can reduce innovation costs and stimulate technological advancement (

Ding & Zhang, 2023). Political ties also significantly influence firm innovation in China, with central government connections enhancing innovation performance more effectively than local government ties (

Kwak et al., 2023). Moreover, social and cultural dimensions such as regional gambling preferences have also been found to correlate with corporate risk-taking and innovation behavior (

Chen et al., 2014). Lastly, access to external finance and the alleviation of financing constraints remain critical for innovation, especially for younger and smaller firms (

Brown et al., 2009).

Firm innovation is also strongly influenced by internal characteristics, including financial strength, governance structures, and human capital.

Greve (

2003) adopts a behavioral theory and shows that superior performance reduces both R&D intensity and innovation output. In contrast, profitability stimulates subsequent innovation among firms in high-technological-opportunity industries (

Audretsch, 1995). Innovation outcomes are also shaped by firm size and age (

Hansen, 1992;

Stock et al., 2002).

Iqbal et al. (

2022) find that financial leverage impedes input-side innovation but enhances output-side innovation, as proxied by patent counts. Using panel data on Chinese listed firms from 2002 to 2011,

Rong et al. (

2017) document that institutional ownership promotes innovation, particularly under heightened market competition. Meta-analytic evidence suggests that board characteristics—specifically meeting frequency and the proportions of independent and external directors—exhibit the strongest associations with firm innovation (

Sierra-Morán et al., 2024). Empirical findings confirm a positive and statistically significant relationship between board diversity and innovation outcomes (

Makkonen, 2022). Firms with gender-diverse boards generate more patents, more novel patents, and demonstrate higher innovation efficiency (

Griffin et al., 2021). Organizational culture also plays a critical role, with developmental cultures—characterized by flexibility and external orientation—being most conducive to innovation, while hierarchical cultures—marked by control and internal focus—are least aligned with innovative goals (

Büschgens et al., 2013). Finally, CEOs’ multicultural backgrounds are also shown to influence firm-level innovation (

Li et al., 2023).

2.2. Impacts of TMT Educational Background

Jalbert et al. (

2002) document a significant relationship between CEO educational background and firm performance, as measured by both return on assets (ROA) and Tobin’s Q, suggesting that educational attainment may shape managerial ability and strategic decision-making. Drawing on primary data from two Spanish databases,

Diaz-Fernandez et al. (

2014) find that diversity in the education levels of TMT members exerts a negative and statistically significant effect on corporate performance. Using a sample of firms in the financial sector listed on the Nigerian Stock Exchange,

Saidu (

2019) reports that CEO educational background contributes positively to firm profitability, implying that higher education enhances managerial competence in complex, regulated environments. In contrast,

Wang et al. (

2015) show that TMT functional heterogeneity fails to improve firm performance and is significantly negatively associated with short-term outcomes. Focusing on Taiwanese publicly listed firms disclosing corporate social responsibility reports,

Lee et al. (

2021) find that heterogeneity in TMT educational background has a detrimental impact on firm performance, with the adoption of greenhouse gas emission strategies mediating this relationship.

In addition to affecting firm performance, TMT educational backgrounds also influence corporate risk metrics. Utilizing a large panel of 4681 firm-year observations from 2012 to 2020,

Zhang et al. (

2023) find that CEO educational background is negatively associated with corporate risk-taking, suggesting that better-educated executives adopt more prudent financial policies. Similarly,

Zheng et al. (

2024) demonstrate that higher levels of executive education reduce corporate default risk, supporting the notion that educational attainment enhances risk management capabilities.

Herrmann and Datta (

2005) show that firms with greater international diversification tend to be led by TMTs with more advanced educational qualifications, indicating that global strategic initiatives may require cognitively complex leadership.

Beyond performance and risk, educational attributes also influence firms’ social and strategic orientations.

Wen et al. (

2024) reveal that CEO gender, age, education, and career experience are positively associated with corporate social responsibility engagement, suggesting that diverse life experiences enrich social awareness and stakeholder responsiveness.

Yang and Wang (

2014) examine whether educational heterogeneity within TMTs affects firms’ entrepreneurial strategic orientation, finding mixed evidence of its influence on strategic boldness and proactivity. Complementing this view,

Knight et al. (

1999) report that TMT diversity undermines strategic consensus, implying that although diversity may increase knowledge breadth, it can simultaneously reduce alignment in strategic vision.

2.3. Impacts of TMT Education on Firm Innovation

Based on a sample of 437 publicly listed Taiwanese firms from 2006 to 2012,

Kuo et al. (

2018) conclude that director education significantly influences firm R&D investment, with higher educational attainment among directors associated with greater R&D intensity. Likewise,

Çerez et al. (

2024) find that a graduate-level educational average among board members positively affects firm-level R&D expenditure. Analyzing a sample of 1,374 listed Chinese companies,

Wang et al. (

2019) report that a higher proportion of doctorate-holding directors significantly increases the likelihood of R&D engagement. Firms led by CEOs with advanced science-related degrees also exhibit elevated R&D spending (

Barker & Mueller, 2002).

Liu et al. (

2010) provide evidence that returnee entrepreneurs—those educated abroad—are more innovation-oriented than their domestically educated counterparts. Using firm-level data on Chinese listed firms and TMT scholarly publication records from 2000 to 2021,

Xu and Hu (

2023) find that the academic competence of TMTs contributes positively to firms’ innovation performance.

Daellenbach et al. (

1999) report a positive association between the technical orientation of the TMT and elevated levels of R&D intensity relative to industry averages.

TMT educational diversity is also economically relevant.

Midavaine et al. (

2016) demonstrate that educational diversity within corporate boards contributes positively to R&D investment. Drawing on a sample of 3888 Swedish firms,

Mohammadi et al. (

2017) argue that higher education diversity within the workforce is linked to enhanced radical innovation outcomes.

Bolli et al. (

2018) find that vertical educational diversity significantly increases the extensive margin of R&D activity and the incidence of product innovation, particularly with respect to novel product development.

Bello-Pintado and Bianchi (

2020) document a robust, positive, linear, and statistically significant relationship between horizontal educational diversity and the intensity of technological innovation activities.

Duran et al. (

2016) argue that family firms—due to concentrated ownership, heightened control, and the salience of nonfinancial objectives—exhibit greater innovation output relative to nonfamily firms.

Block (

2012) similarly finds that founder ownership has a positive impact not only on R&D intensity but also on R&D productivity. Consistent with this line of reasoning, the following hypothesis is proposed:

Hypothesis 1: TMT family members’ education positively impacts Chinese family firms’ innovation.

2.4. Moderating Role of Industry Competition

While TMT educational background consistently promotes firm innovation, recent research emphasizes that industry competition substantially moderates this relationship. Intense rivalry amplifies environmental uncertainty and compels firms to innovate swiftly to maintain competitiveness and ensure survival (

Tang et al., 2015). In such high-stakes contexts, TMTs with stronger educational credentials are better positioned to identify nascent technological trajectories, make informed strategic decisions amidst complexity, and manage R&D activities with greater efficiency and foresight (

Barker & Mueller, 2002). As a result, the value of human capital embedded in TMT education becomes more salient under conditions of heightened competitive pressure.

Empirical findings support this contingency framework.

Basit et al. (

2022) demonstrate that intensified foreign competition significantly strengthens the effect of knowledge-based competencies on innovation, particularly within service industries relative to manufacturing.

Le (

2024) finds that competitive intensity positively moderates the impact of knowledge sharing on product innovation. Cross-sectional evidence further reveals that the positive influence of CEOs’ multicultural backgrounds on innovation output is more pronounced when firms operate in highly competitive industries (

Li et al., 2023). Similarly,

Singh and Chakraborty (

2024) show that family firms increase R&D investment in response to growing domestic product market rivalry. Motivated by the empirical patterns and contextual reasoning outlined above, the following hypothesis is proposed:

Hypothesis 2: The positive impact of TMT family members’ education on Chinese family firms’ innovation is stronger under greater industry competition.

2.5. Moderating Role of Information Transparency

In Chinese family firms, the educational background of TMT family members equips them with advanced knowledge and strategic capability, both of which are important drivers of innovation. However, whether this potential is realized often depends on the level of information transparency (

Zhong, 2018). Information transparency is vital in corporate governance, as it mitigates information asymmetry between insiders and outsiders (

Bushman & Smith, 2003;

Bhattacharya & Ritter, 1983). When transparency is high—characterized by greater analyst coverage and timely disclosures—external stakeholders such as investors are better able to evaluate the competence and strategic intent of family executives (

He & Yin, 2019). In such contexts, the educational attainment of TMT family members is more likely to be perceived as a credible signal of leadership quality, enhancing legitimacy and facilitating access to capital and support for innovation. Conversely, under low transparency, even highly educated TMT members may be perceived as beneficiaries of nepotism, and their innovation-related decisions may be met with skepticism or underinvestment. Therefore, higher information transparency strengthens the positive relationship between TMT family members’ education and firm innovation by improving external perception, resource availability, and decision-making credibility.

The empirical evidence supports the preceding logic. The association between CEOs’ multicultural backgrounds and firm innovation is more pronounced in settings with high, rather than low, information transparency (

Li et al., 2023). Transparency positively moderates the link between knowledge sourcing and innovative behavior (

Che et al., 2019), as greater openness enhances the internalization of external knowledge into innovation outputs.

Shen et al. (

2020) show that the academic backgrounds of TMT members mitigate information asymmetry, thereby fostering innovation.

Brown and Martinsson (

2019) report significantly higher levels of R&D and patenting in more transparent information environments. These effects are most salient in industries dependent on external equity, suggesting that transparency reduces the information costs associated with arm’s-length financing.

Wang and Zhang (

2023) further argue that transparency-oriented firms exhibit a stronger propensity for innovation. Driven by the empirical patterns and contextual rationale discussed above, the following hypothesis is advanced:

Hypothesis 3: The positive impact of TMT family members’ education on Chinese family firms’ innovation is stronger under higher levels of information transparency.

3. Data and Methodology

3.1. Methodology

Following

Liu et al. (

2023), this study measures the dependent variable, firm innovation, along two dimensions: (1) the proportion of R&D personnel to all employees (

RDPerson); and (2) the ratio of R&D investment to operating income (

RDInvest).

1The key explanatory variable, TMT family members’ educational background (

FamilyEdu), is measured as the average education level of all TMT family members within each firm-year. The original data classify education into seven categories: (1) secondary vocational school and below, (2) junior college, (3) bachelor’s degree, (4) master’s degree, (5) doctoral degree, (6) others, and (7) MBA/EMBA. Following

Zhang et al. (

2023), and recognizing that doctoral degrees typically carry greater academic prestige than MBAs, this study recodes MBA as five, doctoral as six, and excludes a small number of observations classified as “others.”

To test Hypothesis 1, the following fixed-effects regression model is estimated to examine the impact of TMT family members’ education on firm innovation:

where

i denotes firm

i and

t denotes year

t.

RD refers to either the proportion of R&D personnel among total employees (

RDPerson) or the ratio of R&D expenditure to operating revenue (

RDInvest).

FamilyEdu denotes the average educational level of TMT family members.

FirmSize is defined as the natural logarithm of total assets.

FirmAge is measured as the natural logarithm of one plus the number of years since the firm’s inception.

Leverage is the firm’s total liabilities divided by total assets.

Tangibility is the ratio of net fixed assets to total assets.

SOE is a dummy variable equal to one if the firm is a state-owned enterprise and zero otherwise.

SaleGrow is the percentage growth rate in sales.

ROA is the return on assets, defined as net income divided by total assets.

Loss is a dummy variable equal to one if the firm reports negative net income and zero otherwise.

InstiOwn measures institutional ownership, defined as the shares held by institutional investors divided by total shares outstanding.

BoardSize is the natural logarithm of the number of directors on the board.

BoardIndep is the proportion of independent directors, calculated as the number of independent directors divided by the total number of directors.

Duality is a dummy variable equal to one if the CEO simultaneously serves as board chairman, and zero otherwise.

TMTPay is the natural logarithm of total annual compensation paid to the TMT, including directors, supervisors, and senior executives.

IndustryFE denotes industry fixed effects,

YearFE denotes year fixed effects, and

ε is the error term.

2 The definitions of all variables are provided in

Table 1.

3.2. Data

The data source is the China Stock Market & Accounting Research (CSMAR) Database. The empirical analysis is limited to publicly listed family firms in China. Data on TMT family members’ educational backgrounds are drawn from the sub-dataset of “Family Firms” in CSMAR. R&D personnel ratios and investment intensity are extracted from the sub-dataset of “Listed Firms’ R&D and Innovation” in CSMAR. After merging the independent and dependent variables, the final sample period spans 2015 to 2023, as observations outside this range account for less than 1% of the data.

Control variables are also retrieved from CSMAR to capture firm characteristics, including firm size, firm age, leverage, asset tangibility, a state-owned enterprise dummy, sales growth, ROA, and a negative net income dummy. Additional control variables include board-level governance features, such as board size, board independence, and CEO duality. Institutional ownership and total TMT compensation are also included as controls.

Special-treatment stocks are excluded from the sample due to their elevated delisting risk. Following the removal of observations with missing data, all variables are winsorized at the 1st and 99th percentiles. The resulting sample includes 14,338 firm-year observations, representing 3097 unique A-share listed Chinese family firms.

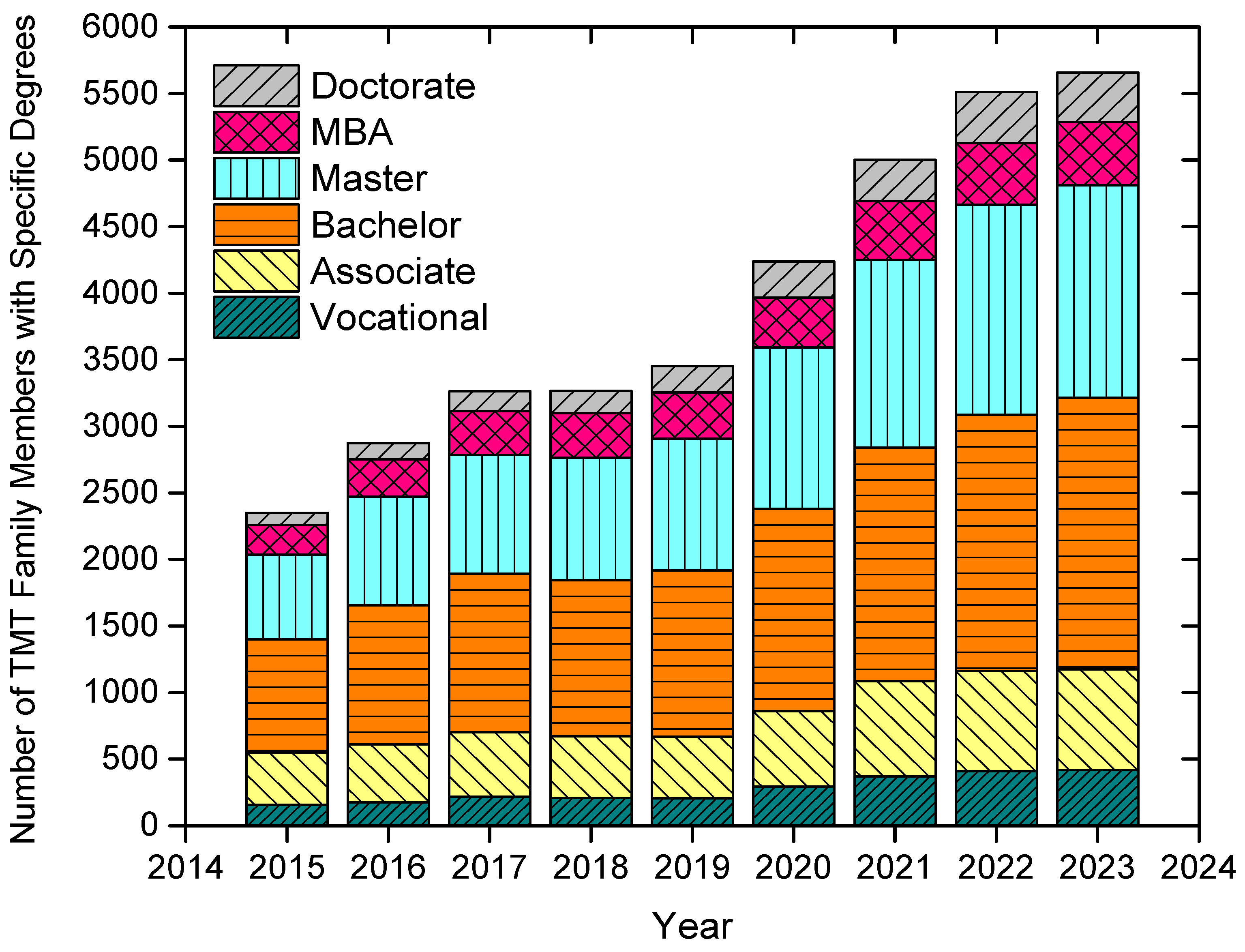

For the key explanatory variable,

Figure 1 presents the time trend of each educational degree category among Chinese family firms from 2015 to 2023. The number of bachelor’s and master’s degrees increases significantly over time, whereas other degrees remain relatively stable.

4. Results

4.1. Descriptive Statistics

Table 2 presents descriptive statistics for the variables. The mean value of

RDPerson is 18.855%, indicating that family firms place considerable emphasis on R&D personnel. The standard deviation of

RDPerson is 13.939%, suggesting substantial variation in the deployment of R&D staff. Similarly,

RDInvest has a mean of 6.487% and a standard deviation of 6.114%, also reflecting considerable heterogeneity. The average

FamilyEdu score is 3.403, consistent with

Figure 1, which shows that most TMT family members hold either a bachelor’s degree (

FamilyEdu = 3) or a master’s degree (

FamilyEdu = 4). Regarding firm characteristics, the average log of firm size is 21.842, and the mean log of firm age is 2.920. The mean leverage ratio is 35.4%, while the average asset tangibility is 17.7%. The mean value of the

SOE dummy is 3.9%, implying that 96.1% of family firms are non-state-owned, as expected. The average sales growth rate and ROA are 16.4% and 4.7%, respectively, suggesting moderate profitability and strong revenue growth. Negative earnings are observed in 12.2% of firm-years. Institutional ownership averages 32.6%. The mean log of board size is 2.058, with independent directors comprising 38.116%. Finally, 44.7% of CEOs concurrently serve as board chairmen, and average logged TMT pay is 15.464.

Table 3 presents pairwise correlations among the variables. The results indicate that

RDPerson and

RDInvest are significantly positively correlated with

FamilyEdu at the 1% level, suggesting that higher levels of family education enhance firm innovation. Among the control variables, firm size, firm age, leverage, asset tangibility, ROA, institutional ownership, and board size exhibit significant negative correlations with firm innovation at the 1% level. In contrast, the negative earnings dummy, board independence, CEO duality dummy, and TMT pay are significantly positively associated with firm innovation at the 1% level. Most explanatory variables display correlation coefficients below 0.5, implying that multicollinearity is unlikely to pose a concern.

To further examine the issue of multicollinearity, the variance inflation factor (VIF) test is performed, with results presented in

Table 4. The VIF test quantifies the extent to which the variance of a coefficient is inflated due to linear dependence among regressors. According to

Hair et al. (

2013), a VIF value exceeding 10 indicates severe multicollinearity that may bias estimation outcomes. The VIF values reported in

Table 4 are well below this threshold, suggesting that multicollinearity is not a significant concern.

4.2. Baseline Regressions

Table 5 reports the results of univariate and multivariate fixed-effects regressions of firm innovation on the education level of TMT family members, as specified in Equation (1).

3 The estimates reveal that TMT family member education exerts a significantly positive effect on firm innovation at the 1% level, indicating that firms with more highly educated TMT family members allocate greater resources to R&D personnel and expenditures. This evidence supports Hypothesis 1 and aligns with recent findings that more educated directors are perceived as more committed to R&D (

Kuo et al., 2018;

Çerez et al., 2024;

Wang et al., 2019). The coefficient on family education is also economically significant. For example, based on the multivariate result in Column 2, a one-standard-deviation increase in family education corresponds to a 1.256% (=1.242 × 1.011) increase in

RDPerson, which accounts for 9% (=1.256/13.939) of the standard deviation of

RDPerson. Similarly, based on Column 4, a one-standard-deviation rise in family education corresponds to a 0.685% (=0.678 × 1.011) increase in

RDInvest, representing 11% (=0.685/6.114) of the standard deviation of

RDInvest.

Regarding the control variables, firm size and firm age display a significant negative relationship with firm innovation, implying that smaller and younger firms engage more heavily in R&D activities. As expected, leverage and asset tangibility are negatively related to innovation, suggesting that lower leverage and greater liquidity foster R&D activities. ROA shows a negative coefficient, while the Loss dummy yields a positive coefficient, indicating that more profitable firms allocate less to R&D activities. CEO-chairman duality and TMT compensation are both positively associated with firm innovation.

4.3. Moderating Effect of Industry Competition

This section investigates whether industry competition moderates the relationship between TMT family members’ education and firm innovation. The Herfindahl-Hirschman Index (HHI), a widely adopted metric of industry concentration, is computed as the sum of squared market shares of all firms in a given industry. A higher HHI reflects greater market concentration and lower competitive intensity (

Rhoades, 1993). HHI data are obtained from CSMAR, where

HHIRev measures industry concentration by summing the squared revenue shares of firms. Following

Hu et al. (

2023) and

Li et al. (

2023), this study incorporates

HHIRev and its interaction with family education into the regression model:

Table 6 reports the results on the moderating effect of industry competition. The interaction term coefficients are negative and statistically significant at the 1% level. As industry concentration (

HHIRev) decreases—indicating heightened industry competition—the positive effect of TMT family member education on firm innovation becomes more pronounced. These findings lend support to Hypothesis 2. The coefficient on

FamilyEdu remains positive and statistically significant. The coefficients on control variables and the adjusted

R-squared are comparable to those reported in the baseline regression in

Table 5.

4.4. Moderating Effect of Information Transparency

This section examines how information transparency moderates the relationship between TMT family members’ education and firm innovation (

Li et al., 2023). Firm-level transparency data are obtained from CSMAR, where companies are categorized into four transparency levels: A (Excellent), B (Good), C (Pass), and D (Fail). The sample is partitioned based on contemporaneous transparency ratings, and the fixed effects regressions specified in Equation (1) are re-estimated for each subsample.

Table 7 presents the results. As transparency improves, the coefficient on

FamilyEdu increases progressively from 0.386 to 0.593, 1.183, and 1.544. Statistical significance also strengthens, rising from insignificance to the 10% level and then to the 1% level. Note that the coefficient on

FamilyEdu is only marginally significant at the 10% level when transparency equals C (Pass). TMT family members’ education exerts a statistically significant positive effect on

RDPerson under high information transparency (excellent or good), but not under lower transparency (pass or fail). These findings support Hypothesis 3, which posits that the positive effect of TMT family member education on firm innovation is amplified under greater information transparency.

4.5. Moderating Effect of Firm Size

This section examines whether firm size moderates the relationship between TMT family members’ education and firm innovation (

K. Wang et al., 2024). Firms are classified into small and large-firm subsamples each year based on the median firm size. The fixed effects regressions specified in Equation (1) are then re-estimated for each subsample.

Table 8 reports the results. As firm size increases, the coefficient on

FamilyEdu declines from 1.380 to 0.999 for

RDPerson, and from 0.809 to 0.519 for

RDInvest. Statistical significance remains at the 1% level. These results indicate that the positive effect of TMT family education is stronger among smaller firms.

4.6. Mediation Analysis

To better understand the mechanism through which the education of TMT family members influences firm innovation, a three-step regression approach is employed to examine the mediating effect (

Baron & Kenny, 1986):

where

Mediator denotes asset tangibility (

Tangibility), total ownership by the five largest shareholders (

Top5), or the management fee ratio (

ManageFee), respectively.

Table 9 presents the mediation analysis based on the three-step approach. In Column 1, the coefficient on

FamilyEdu is 1.356 and significant at the 1% level, capturing the total effect on firm innovation (

RDPerson). Columns 2−4 show that

FamilyEdu significantly decreases asset tangibility (

Tangibility, −0.006) and ownership concentration (

Top5, −0.017), while increasing the management fee ratio (

ManageFee, 0.004), with all effects significant at the 1% level. Column 5 indicates that these mediators are each significantly associated with innovation at the 1% level. The estimated indirect effects suggest that

FamilyEdu fosters innovation by reducing asset tangibility (−0.006 × −19.607/1.356 = 8.7% of the total effect), lowering ownership concentration (−0.017 × −7.725/1.356 = 9.7%), and increasing the management fee ratio (0.004 × 30.910/1.356 = 9.1%). Collectively, these three indirect channels suggestively explain approximately 27.5% of the total effect.

The mediation analysis identifies three significant channels through which TMT family members’ education influences firm innovation. First, Tangibility accounts for 8.7% of the total effect and is negatively associated with education, indicating that more highly educated family executives reduce the proportion of tangible assets. This shift reflects a greater allocation of resources toward intangible assets such as R&D, patents, and brands, which are critical for innovation. By prioritizing knowledge- and technology-based investments, highly educated executives foster conditions conducive to innovation. Second, Top5 (ownership concentration of the five largest shareholders) accounts for 9.7% of the total effect and is also negatively related to education, suggesting that higher-educated family executives are linked to more dispersed ownership structures. Lower ownership concentration can lessen the influence of large shareholders’ potentially conservative or risk-averse preferences, thereby allowing greater managerial discretion, fostering more independent decision-making, and enabling the firm to pursue innovative projects with greater strategic flexibility. Third, ManageFee (management fee ratio) accounts for 9.1% of the total effect and is positively associated with education, implying that highly educated family executives allocate more resources to administrative, R&D management, and marketing activities. Such expenditures often reflect the operational costs of innovation-related initiatives, thereby directly supporting higher innovation output.

Finally, it is important to note that while the mediation analysis provides insight into potential pathways through which family education influences innovation, the results should be viewed as suggestive rather than conclusive. Given the observational design, mediation estimates cannot fully establish causality, but they highlight plausible mechanisms that complement the baseline findings.

4.7. Different Industries

Chinese firms are broadly classified into three main sectors: primary industry (agriculture), secondary industry (manufacturing), and tertiary industry (services). Following

Liu et al. (

2024), the sample is classified into three industry subsamples and Equation (1) is re-estimated to examine industry effects. The result, presented in

Table 10, indicate that the coefficient on

FamilyEdu loses significance within the agriculture sector. In contrast, the coefficients on

FamilyEdu remain positive and statistically significant at the 1% level in the manufacturing sector and at the 5% level in the service sector. The magnitude of the

FamilyEdu coefficient is greater in the manufacturing sector than in the service sector. However, the adjusted

R-squared in the service sector exceeds that of the manufacturing sector. Collectively, these findings suggest that the positive effect of TMT family members’ education on firm innovation is present in the manufacturing and service sectors but is not evident in the agriculture sector.

4.8. Lagged Independent Variable

Endogeneity concerns arise in the baseline regression specified in Equation (1). Reverse causality is plausible, whereby firms with higher innovation may attract TMT family members with higher educational attainment. Alternatively, unobserved third-party factors may simultaneously influence both TMT family member education and firm innovation, resulting in a spurious positive association. Following

Liu et al. (

2024) and

L. Wang et al. (

2024), this concern is addressed by re-estimating Equation (1) using a one-year lag of the independent variable. If the coefficient on the lagged independent variable remains significant, it alleviates concerns about reverse causality. The following regression specification is employed:

Consistent with expectations, the results presented in

Table 11 indicate that the one-year-lagged

FamilyEdu exerts a significantly positive effect on firm innovation. The coefficients on lagged

FamilyEdu are 1.192 and 0.694, closely aligned with the 1.242 and 0.678 reported in

Table 5 for

RDPerson and

RDInvest, respectively. And both coefficients are statistically significant at the 1% level. The adjusted

R-squared values are 0.413 and 0.413, also comparable to the 0.409 and 0.417 in

Table 5 for

RDPerson and

RDInvest, respectively. Overall, the findings in

Table 11 lend support to Hypothesis 1, suggesting that the education of TMT family members positively influences firm innovation rather than reflecting reverse causality.

4.9. Two-Stage Least Squares Regressions

To further address the endogeneity issue, a 2SLS regression is implemented. Consistent with

Liu et al. (

2024) and

Hu et al. (

2023), the annual industry-average value of the independent variable (

FamilyEdu) is employed as the instrumental variable.

In the first stage, Equation (7) regresses

FamilyEdu on the industry-average

FamilyEdu (

MeanFamilyEdu), which serves as the instrumental variable. The second stage then uses the predicted value (

PredFamilyEdu) from the first stage to estimate firm innovation in Equation (8). Prior studies suggest that industry-average independent variables are valid instruments (

Liu et al., 2024;

Hu et al., 2023). The rationale is that firms within the same industry tend to exhibit similar

FamilyEdu, making a firm’s

FamilyEdu more influenced by industry-wide factors than by firm-specific characteristics. This instrumental variable is presumed to be exogenous. Specifically, firm innovation is unlikely to be associated with industry-average

FamilyEdu, as innovation is a firm-level rather than industry-level behavior. Similarly, prior studies also suggest that the lagged independent variable may serve as a valid instrument (

Lu et al., 2025;

Ye & Zhang, 2025). In Equation (7), the instrument variable,

MeanFamilyEdu, may be replaced with a one-year-lagged family education variable, which satisfies relevance because it is strongly correlated with current education owing to serial correlation. It also satisfies exogeneity because, given the temporal gap, it is unlikely to be directly related to the current dependent variable, firm innovation, except through its correlation with current education.

Columns 1−3 of

Table 12 present the results of the 2SLS regression using industry-average family education as the instrumental variable. The first-stage estimates, consistent with Equation (7), indicate that the coefficient on the industry-average

FamilyEdu is 0.985 and statistically significant at the 1% level, mitigating concerns regarding weak instruments. It also shows that the instrument,

MeanFamilyEdu, is strongly correlated with the firm’s own

FamilyEdu (Cragg-Donald Wald F-statistic = 1050.09), far exceeding the

Stock and Yogo’s (

2002) 10% maximal IV size critical value of 16.38, indicating no weak instrument concern. The Kleibergen-Paap rank LM statistic (χ

2 = 766.28,

p < 0.001) rejects the null of underidentification, confirming the instrument’s relevance. In the second stage, following Equation (8), the results in Columns 2−3 reveal a statistically significant positive association between the predicted

FamilyEdu and firm innovation, with coefficients of 7.914 and 3.534 at the 1% level for

RDPerson and

RDInvest, respectively.

Columns 4−6 of

Table 12 present the results of the 2SLS regression using one-year-lagged family education as the instrumental variable. The results are similar to the preceding case using industry-average family education as the instrument. The large

F-statistic indicates that the lagged family education is not a weak instrument. The second-stage coefficients are also positive and statistically significant at the 1% level. Overall, the instrumental variable regression results are consistent with the baseline regression estimates, offering additional support for Hypothesis 1. The findings reinforce a causal interpretation running from TMT family members’ education to firm innovation, rather than the reverse.

4.10. Panel Vector Autoregression and Granger Causality Tests

To further address concerns regarding dynamic endogeneity and potential reverse causality, this study estimates panel vector autoregression models using the system-GMM approach developed by

Abrigo and Love (

2016). Specifically, the joint dynamics are examined between TMT family members’ educational background (

FamilyEdu) and two firm innovation input measures, R&D personnel ratio (

RDPerson) and R&D investment intensity (

RDInvest). The models use one lag and employ lagged instruments from periods 1 to 3. The results are given in

Table 13.

Granger causality Wald tests indicate that FamilyEdu Granger-causes both RDPerson (χ2 = 3.921, p = 0.048) and RDInvest (χ2 = 3.881, p = 0.049), while the reverse directions are statistically insignificant (p = 0.585 and p = 0.236, respectively). These findings reinforce the directional interpretation from TMT education to firm innovations and bolster the identification strategy employed.

4.11. Alternative Measure of Firm Innovation

The preceding analysis employed R&D personnel (

RDPerson) and capitalized R&D expenditures (

RDInvest), which capture firm innovation inputs rather than actual innovation outputs or outcomes. To ensure robustness, we replace

RDPerson or

RDInvest in Equation (1) with the number of authorized patents (

NumPatents), which provides a more complete picture of firm innovation. The results, reported in

Table 14, show that the coefficient on

FamilyEdu is 0.092 and 0.042, statistically significant at the 1% and 5% levels in univariate and multivariate fixed-effects regressions, respectively. These findings further support Hypothesis 1, namely, that TMT family members’ education positively influences innovation in Chinese family firms. Note, however, that the sample size for NumPatents (2215 observations) is considerably smaller than for

RDPerson and

RDInvest (14,338 observations) due to missing patent data in the CSMAR database, which explains why we use R&D inputs as our baseline dependent variable.

5. Discussion

This study reinforces and extends prior evidence linking TMT characteristics to firm innovation by uniquely focusing on the educational backgrounds of family-member executives in Chinese family firms. The findings are consistent with earlier studies, though the target groups differ. Several studies report a positive association between board-level education and innovation (

Kuo et al., 2018;

Çerez et al., 2024;

Wang et al., 2019).

Barker and Mueller (

2002) and

Liu et al. (

2010) similarly document a positive link between CEO education and firm innovation. However, those studies focus narrowly on board members or CEOs, whereas the present analysis encompasses the broader TMT, including directors, supervisors, and senior executives.

Xu and Hu (

2023) and

Daellenbach et al. (

1999) also find a positive association between TMT education and innovation, yet the present sample differs by restricting attention to family firms, where TMT roles are occupied specifically by family members. These results offer theoretical support for the view that human capital embedded in TMTs, particularly within family-controlled contexts, plays a central role in shaping innovation outcomes.

This study also adds nuance to the existing literature by identifying critical boundary conditions that moderate the relationship between family education and innovation. Specifically, the results indicate that this positive relationship is intensified in environments characterized by greater industry competition, consistent with prior evidence that external pressures enhance the role of human capital in driving innovation (

Li et al., 2023;

Le, 2024;

Basit et al., 2022). Moreover, it is shown that higher levels of information transparency also strengthen this relationship, aligning with earlier findings that transparency reinforces the effectiveness of human capital in shaping innovation outcomes (

Li et al., 2023;

Che et al., 2019). This result also echoes broader evidence that transparency improves firm-level innovation capacity (

Brown & Martinsson, 2019;

Wang & Zhang, 2023). These findings offer theoretical insight into how contextual factors interact with managerial attributes to influence innovation, and suggest that institutional reforms promoting transparency and competition can amplify the benefits of executive human capital.

Moreover, the results reveal sectoral heterogeneity in the strength of this relationship: while manufacturing and service firms exhibit a strong and statistically significant association between family education and R&D intensity, no such relationship is observed in the agricultural sector. This finding mirrors sector-specific results reported by

Liu et al. (

2024), who show that the positive effect of employee stock ownership plans on environmental, social, and governance ratings is significant only in manufacturing and service firms, but not in agriculture. The present results suggest that the strategic value of family human capital may be context-dependent, shaped by sectoral variation in technical demands and capital intensity.

In our 2SLS analysis, we recognize that the industry-average FamilyEdu instrument may risk violating the exclusion restriction if industry-level human capital spillovers directly influence firm innovation. To address this concern, we also employ the one-year-lagged FamilyEdu as an alternative instrument, which is less likely to be affected by contemporaneous industry spillovers and thus provides a cleaner source of identification. Importantly, the results remain highly consistent across both instruments, lending confidence to the robustness of our causal interpretation. The choice of the two IVs reflects a trade-off between data breadth and instrument purity.

Finally, the generalizability of the present findings may be shaped by China’s distinctive institutional and cultural context. In the Chinese capital market, family-controlled firms represent a substantial subset of publicly listed companies, where founding families often maintain significant ownership stakes and executive influence (

Walsh & Seward, 1990;

Zellweger, 2007;

Ward, 2011). The Confucian emphasis on education, hierarchy, and seniority may enhance the perceived legitimacy and strategic authority of highly educated family executives (

Liao & Liu, 2024;

Chen et al., 2022). Moreover, China’s evolving market institutions, which combine government intervention with private sector expansion, create an environment where family executives with advanced education can more effectively manage regulatory complexity and mobilize external resources (

Peng et al., 2008). These cultural and institutional features may intensify the observed link between family education and innovation. In institutional contexts characterized by more dispersed ownership and stronger formal governance, this relationship may be attenuated. As such, the Chinese setting may condition the external validity of the results and highlight the role of family-based human capital in emerging markets.

6. Conclusions

Using a comprehensive dataset comprising 14,338 firm-year observations from 3097 publicly listed Chinese family firms over the period 2015−2023, this study yields six key findings. First, the education levels of TMT family members positively influence innovation inputs, measured by the proportion of R&D personnel and capitalized R&D investments. This suggests that educated family members are more likely to prioritize and allocate resources toward innovation as part of their managerial strategy. Second, the positive effect of TMT family member education on innovation intensifies in highly competitive industries. In such environments, firms face greater pressure to innovate for survival and growth, and educated family members are better equipped to identify opportunities, adjust strategic direction, and deploy resources effectively, thereby enhancing innovation outcomes. Third, high levels of information transparency strengthen the positive effect of TMT family member education on innovation inputs. In more transparent firms, greater information availability reduces asymmetry and enhances oversight, enabling educated family members to make more informed, accountable, and strategically aligned decisions. Fourth, the moderating role of firm size is evident: the positive relationship between TMT family member education and innovation inputs is more pronounced among smaller firms, where resource constraints and limited managerial depth make the influence of educated family members more consequential. Fifth, several potential mechanisms are identified: TMT family member education promotes firm innovation partly through reduced asset tangibility, reduced ownership concentration, and increased management fees, with these suggested pathways explaining approximately 27.5% of the total effect. Sixth, the influence of TMT family members’ education varies across sectors: it has a significant positive impact on R&D personnel in the manufacturing and service sectors but is insignificant in the agricultural sector. Finally, endogeneity concerns are mitigated using lagged independent variable regressions, 2SLS estimation, and panel vector autoregressions. The results remain consistent when firm innovation is measured alternatively by the number of authorized patents.

This research contributes to the existing literature in several ways. First, it adds to the literature on the determinants of firm innovation by identifying the educational background of TMT family members as a novel driver of innovation in Chinese family firms. Second, it contributes to the literature on the effects of TMT educational background by documenting firm innovation as a previously unexplored outcome in this context. Third, it examines the moderating roles of external factors such as industry competition and information transparency, offering a more nuanced understanding of the conditions under which innovation in family firms is enhanced. Fourth, it investigates the heterogeneous effects of family members’ education on firm innovation across industries, yielding practical insights for managers, investors, and policymakers seeking to promote innovation in family-controlled firms. Finally, from a governance perspective, the findings suggest that family member education functions as a form of internal governance leverage. It reflects an evolving mode of human capital-based governance, particularly salient in emerging markets where formal governance mechanisms may be complemented or substituted by family influence. In this regard, the study contributes to the broader discourse on the transformation of corporate governance in the context of socio-cultural and institutional change.

Despite these contributions, the study is subject to certain limitations. First, the analysis focuses solely on publicly listed family firms in China, which may constrain the generalizability of the findings to private firms or family businesses in other national settings. Future research could address this limitation by extending the analysis to include private family firms or by exploring similar dynamics across different countries and cultural environments. Second, the study relies on quantitative proxies for education and innovation, which, although informative, may not fully capture the qualitative dimensions of these constructs. For example, informal learning, managerial experience, or cultural perceptions of education and innovation may offer valuable supplementary context. Future studies could incorporate qualitative methods, such as interviews or case studies, to provide deeper insights into the intricate relationships among family member education, innovation, and external conditions. Third, the innovation measures employed in this study are focused on input-based proxies, namely R&D personnel and investment intensity, due to their broad availability and consistency across firms. While these metrics capture managerial commitment to innovation, they may not fully reflect realized outcomes or the effectiveness of innovation activities. Future research could incorporate output-based indicators, such as the number of patents granted, patent citations, or innovation efficiency, to offer a more comprehensive understanding of how educational backgrounds influence firm-level innovation performance. Fourth, while this study uses robust empirical methods, including fixed-effects, instrumental variable regressions, and dynamic panel modeling, the possibility of omitted variable bias or unobserved heterogeneity remains. By addressing these limitations, future research could build upon the present study to advance our understanding of how family firms pursue innovation amid an increasingly competitive global landscape.

Author Contributions

Conceptualization, Y.Y.; methodology, Y.Y. and J.Z.; software, Y.Y. and J.Z.; validation, Y.Y., Z.H., Z.W. and J.Z.; formal analysis, Y.Y., Z.H., Z.W. and J.Z.; investigation, Y.Y., Z.H., Z.W. and J.Z.; resources, Y.Y. and J.Z.; data curation, Y.Y. and J.Z.; writing—original draft preparation, Y.Y.; writing—review and editing, Y.Y., Z.H., Z.W. and J.Z.; visualization, Y.Y. and J.Z.; supervision, J.Z.; project administration, J.Z.; funding acquisition, J.Z. All authors have read and agreed to the published version of the manuscript.

Funding

This research was supported by the Wenzhou Association for Science and Technology—Service and Technology Innovation Program (jczc0254), the General Program of the Zhejiang Provincial Department of Education (Y202353438), the Wenzhou-Kean University International Collaborative Research Program (ICRP2023002), and the Wenzhou-Kean University Student Partnering with Faculty Research Program (WKUSPF202411).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The original data presented in the study are openly available in the commercially subscribed China Stock Market & Accounting Research Database at [

https://data.csmar.com/, accessed on 15 May 2024].

Conflicts of Interest

The authors declare no conflicts of interest.

Notes

| 1 | Note that the proportions of R&D personnel and investment emphasize firm innovation rather than innovation efficiency. The number of patents is commonly employed as a proxy for innovation efficiency. We conducted a robustness check using the number of patents as the dependent variable in Table 14. However, due to data limitations, the sample size is much smaller than in our main analysis, rendering the findings less reliable. Therefore, this study emphasizes the effort to promote innovation rather than the outcomes of innovation. |

| 2 | We did not employ firm fixed effects because the primary explanatory variable, FamilyEdu, exhibits insufficient within-firm variation. Therefore, firm fixed effects are not suitable. Instead, we adopt year and industry fixed effects. |

| 3 | All regressions report robust standard errors, adjusted for heteroskedasticity, in parentheses. As a robustness check, we re-estimate the baseline regressions in Table 5 with firm-clustered standard errors, allowing residuals to be correlated within firms across years while assuming independence across firms. The baseline results hold, as all four coefficients on FamilyEdu in Table 5 remain positive and statistically significant at the 1% level. |

References

- Abrigo, M. R., & Love, I. (2016). Estimation of panel vector autoregression in Stata. Stata Journal, 16(3), 778−804. [Google Scholar] [CrossRef]

- Atanassov, J., & Liu, X. (2020). Can corporate income tax cuts stimulate innovation? Journal of Financial and Quantitative Analysis, 55(5), 1415−1465. [Google Scholar] [CrossRef]

- Audretsch, D. B. (1995). Firm profitability, growth, and innovation. Review of Industrial Organization, 10, 579−588. [Google Scholar] [CrossRef]

- Ayyagari, M., Demirgüç-Kunt, A., & Maksimovic, V. (2014). Bribe payments and innovation in developing countries: Are innovating firms disproportionately affected? Journal of Financial and Quantitative Analysis, 49(1), 51−75. [Google Scholar] [CrossRef]

- Barker, V. L., III, & Mueller, G. C. (2002). CEO characteristics and firm R&D spending. Management Science, 48(6), 782−801. [Google Scholar] [CrossRef]

- Baron, R. M., & Kenny, D. A. (1986). The moderator-mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. Journal of Personality and Social Psychology, 51(6), 1173. [Google Scholar] [CrossRef]

- Basco, R., Bassetti, T., Dal Maso, L., & Lattanzi, N. (2023). Why and when do family firms invest less in talent management? The suppressor effect of risk aversion. Journal of Management and Governance, 27(1), 101−130. [Google Scholar] [CrossRef]

- Basit, S. A., Kuhn, T., & Cantner, U. (2022). The role of market competition for knowledge competencies, R&D and innovation: An empirical analysis for German firms. European Journal of Management Studies, 27(2), 229−253. [Google Scholar] [CrossRef]

- Bello-Pintado, A., & Bianchi, C. (2020). Workforce education diversity, work organization and innovation propensity. European Journal of Innovation Management, 24(3), 756−776. [Google Scholar] [CrossRef]

- Betti, F. (2024). How China’s shifting industries are reshaping its long-term growth model. World Economic Forum. Available online: https://www.weforum.org/stories/2024/06/how-china-s-shifting-industries-are-reshaping-its-long-term-growth-model (accessed on 16 June 2025).

- Bhattacharya, S., & Ritter, J. R. (1983). Innovation and communication: Signalling with partial disclosure. Review of Economic Studies, 50(2), 331−346. [Google Scholar] [CrossRef]

- Block, J. H. (2012). R&D investments in family and founder firms: An agency perspective. Journal of Business Venturing, 27(2), 248−265. [Google Scholar] [CrossRef]

- Bolli, T., Renold, U., & Wörter, M. (2018). Vertical educational diversity and innovation performance. Economics of Innovation and New Technology, 27(2), 107−131. [Google Scholar] [CrossRef]

- Brown, J. R., Fazzari, S. M., & Petersen, B. C. (2009). Financing innovation and growth: Cash flow, external equity, and the 1990s R&D boom. Journal of Finance, 64(1), 151−185. [Google Scholar]

- Brown, J. R., & Martinsson, G. (2019). Does transparency stifle or facilitate innovation? Management Science, 65(4), 1600−1623. [Google Scholar] [CrossRef]

- Bushman, R. M., & Smith, A. J. (2003). Transparency, financial accounting information, and corporate governance. Economic Policy Review, 9(1), 65−87. [Google Scholar]

- Büschgens, T., Bausch, A., & Balkin, D. B. (2013). Organizational culture and innovation: A meta-analytic review. Journal of Product Innovation Management, 30(4), 763–781. [Google Scholar] [CrossRef]

- Che, T., Wu, Z., Wang, Y., & Yang, R. (2019). Impacts of knowledge sourcing on employee innovation: The moderating effect of information transparency. Journal of Knowledge Management, 23(2), 221−239. [Google Scholar] [CrossRef]

- Chen, Y., Lin, P., Tsao, H. T., & Jin, S. (2022). How does Confucian culture affect technological innovation? Evidence from family enterprises in China. PLoS ONE, 17(6), e0269220. [Google Scholar] [CrossRef] [PubMed]

- Chen, Y., Podolski, E. J., Rhee, S. G., & Veeraraghavan, M. (2014). Local gambling preferences and corporate innovative success. Journal of Financial and Quantitative Analysis, 49(1), 77−106. [Google Scholar] [CrossRef]

- Chen, Y., Wang, Y., Hu, D., & Zhou, Z. (2020). Government R&D subsidies, information asymmetry, and the role of foreign investors: Evidence from a quasi-natural experiment on the shanghai-Hong Kong stock connect. Technological Forecasting and Social Change, 158, 120162. [Google Scholar]

- Çerez, S., Merter, A. K., Balcıoğlu, Y. S., & Özer, G. (2024). The Impact of board characteristics on R&D investments: The role of education level and age. In International conference on banking and finance perspectives (pp. 199–212). Springer Nature Switzerland. [Google Scholar] [CrossRef]

- Daellenbach, U. S., McCarthy, A. M., & Schoenecker, T. S. (1999). Commitment to innovation: The impact of top management team characteristics. R&D Management, 29(3), 199−208. [Google Scholar] [CrossRef]

- Diaz-Fernandez, M. C., Gonzalez-Rodriguez, M. R., & Pawlak, M. (2014). Top management demographic characteristics and company performance. Industrial Management & Data Systems, 114(3), 365−386. [Google Scholar] [CrossRef]

- Ding, Z., & Zhang, J. (2023). The impact of government subsidies on the innovation of new energy vehicle companies. International Journal of Monetary Economics and Finance, 16(3–4), 213−221. [Google Scholar] [CrossRef]

- Dou, J., Su, E., & Wang, S. (2019). When does family ownership promote proactive environmental strategy? The role of the firm’s long-term orientation. Journal of Business Ethics, 158, 81−95. [Google Scholar] [CrossRef]

- Duran, P., Kammerlander, N., Van Essen, M., & Zellweger, T. (2016). Doing more with less: Innovation input and output in family firms. Academy of Management Journal, 59(4), 1224−1264. [Google Scholar] [CrossRef]

- Ernst, & Young. (2021). How the world’s largest family businesses are proving their resilience. Available online: https://www.ey.com/en_ro/insights/family-enterprise/how-the-worlds-largest-family-businesses-are-proving-their-resilience (accessed on 16 June 2025).

- Greve, H. R. (2003). A behavioral theory of R&D expenditures and innovations: Evidence from shipbuilding. Academy of Management Journal, 46(6), 685−702. [Google Scholar]

- Griffin, D., Li, K., & Xu, T. (2021). Board gender diversity and corporate innovation: International evidence. Journal of Financial and Quantitative Analysis, 56(1), 123−154. [Google Scholar] [CrossRef]

- Hair, J. F., Black, W. C., Babin, B. J., & Anderson, R. E. (2013). Multivariate data analysis. Pearson Higher Education. [Google Scholar]

- Hansen, J. A. (1992). Innovation, firm size, and firm age. Small Business Economics, 4, 37−44. [Google Scholar] [CrossRef]

- He, J., & Tian, X. (2020). Institutions and innovation. Annual Review of Financial Economics, 12(1), 377−398. [Google Scholar] [CrossRef]

- He, X., & Yin, C. (2019). The impact of strategic deviance on analysts’ earnings forecasts: Evidence from China. Nankai Business Review International, 10(3), 362−381. [Google Scholar] [CrossRef]

- Herrmann, P., & Datta, D. K. (2005). Relationships between top management team characteristics and international diversification: An empirical investigation. British Journal of Management, 16(1), 69−78. [Google Scholar] [CrossRef]

- Hsu, P. H., Tian, X., & Xu, Y. (2014). Financial development and innovation: Cross-country evidence. Journal of Financial Economics, 112(1), 116−135. [Google Scholar] [CrossRef]

- Hu, J., Li, K., Xia, Y., & Zhang, J. (2023). Gender diversity and financial flexibility: Evidence from China. International Review of Financial Analysis, 90, 102934. [Google Scholar] [CrossRef]

- Huang, Q., & Yuan, T. (2021). Does political corruption impede firm innovation? Evidence from the United States. Journal of Financial and Quantitative Analysis, 56(1), 213−248. [Google Scholar] [CrossRef]

- Iqbal, N., Xu, J. F., Fareed, Z., Wan, G., & Ma, L. (2022). Financial leverage and corporate innovation in Chinese public-listed firms. European Journal of Innovation Management, 25(1), 299−323. [Google Scholar] [CrossRef]

- Jalbert, T., Rao, R. P., & Jalbert, M. (2002). Does school matter? An empirical analysis of CEO education, compensation, and firm performance. International Business and Economics Research Journal, 1(1), 83−98. [Google Scholar] [CrossRef]

- Kang, K. N., & Park, H. (2012). Influence of government R&D support and inter-firm collaborations on innovation in Korean biotechnology SMEs. Technovation, 32(1), 68−78. [Google Scholar]

- Knight, D., Pearce, C. L., Smith, K. G., Olian, J. D., Sims, H. P., Smith, K. A., & Flood, P. (1999). Top management team diversity, group process, and strategic consensus. Strategic Management Journal, 20(5), 445−465. [Google Scholar] [CrossRef]

- Kuo, H. C., Wang, L. H., & Yeh, L. J. (2018). The role of education of directors in influencing firm R&D investment. Asia Pacific Management Review, 23(2), 108−120. [Google Scholar] [CrossRef]

- Kwak, J., Chang, S. Y., & Jin, M. (2023). The effects of political ties on innovation performance in China: Differences between central and local governments. Asian Business & Management, 22(1), 300−329. [Google Scholar]

- Le, P. B. (2024). Applying knowledge-based human resource management to drive innovation: The roles of knowledge sharing and competitive intensity. Management Research Review, 47(4), 602−621. [Google Scholar] [CrossRef]

- Lee, T., Liu, W. T., & Yu, J. X. (2021). Does TMT composition matter to environmental policy and firm performance? The role of organizational slack. Corporate Social Responsibility and Environmental Management, 28(1), 196−213. [Google Scholar] [CrossRef]

- Li, K., Xia, Y., & Zhang, J. (2023). CEOs’ multicultural backgrounds and firm innovation: Evidence from China. Finance Research Letters, 57, 104255. [Google Scholar] [CrossRef]

- Liao, Z., & Liu, Y. (2024). Confucian culture, environmental innovation, and family firms’ performance: The moderating role of market competition. Business Strategy and the Environment, 33(8), 8900−8910. [Google Scholar] [CrossRef]

- Liu, M., Shan, Y., & Li, Y. (2023). Heterogeneous Partners, R&D cooperation and corporate innovation capability: Evidence from Chinese manufacturing firms. Technology in Society, 72, 102183. [Google Scholar]

- Liu, X., Wright, M., Filatotchev, I., Dai, O., & Lu, J. (2010). Human mobility and international knowledge spillovers: Evidence from high-tech small and medium enterprises in an emerging market. Strategic Entrepreneurship Journal, 4(4), 340–355. [Google Scholar] [CrossRef]

- Liu, Y., McDowell, S., Xue, C., & Zhang, J. (2024). Environmental, social, and governance performance: The role of Chinese employee stock ownership plans. Environmental Economics, 25(2), 1−12. [Google Scholar] [CrossRef]

- Lu, K., Onuk, C. B., Xia, Y., & Zhang, J. (2025). ESG ratings and financial performance in the global hospitality industry. Journal of Risk and Financial Management, 18(1), 24. [Google Scholar] [CrossRef]

- Madsen, H., Neergaard, H., & Ulhøi, J. P. (2003). Knowledge-intensive entrepreneurship and human capital. Journal of Small Business and Enterprise Development, 10(4), 426–434. [Google Scholar] [CrossRef]

- Makkonen, T. (2022). Board diversity and firm innovation: A meta-analysis. European Journal of Innovation Management, 25(6), 941−960. [Google Scholar] [CrossRef]

- Midavaine, J., Dolfsma, W., & Aalbers, R. (2016). Board diversity and R&D investment. Management Decision, 54(3), 558−569. [Google Scholar]

- Mohammadi, A., Broström, A., & Franzoni, C. (2017). Workforce composition and innovation: How diversity in employees’ ethnic and educational backgrounds facilitates firm-level innovativeness. Journal of Product Innovation Management, 34(4), 406–426. [Google Scholar] [CrossRef]

- Mukherjee, A., Singh, M., & Žaldokas, A. (2017). Do corporate taxes hinder innovation? Journal of Financial Economics, 124(1), 195−221. [Google Scholar] [CrossRef]

- Peng, M. W., Wang, D. Y., & Jiang, Y. (2008). An institution-based view of international business strategy: A focus on emerging economies. Journal of International Business Studies, 39(5), 920−936. [Google Scholar] [CrossRef]

- Qi, C., & Chau, P. Y. K. (2018). Will enterprise social networking systems promote knowledge management and organizational learning? An empirical study. Journal of Organizational Computing and Electronic Commerce, 28(1), 31−57. [Google Scholar] [CrossRef]

- Rhoades, S. A. (1993). The Herfindahl-Hirschman Index. Federal Reserve Bulletin, 79(3), 188−189. [Google Scholar]

- Rong, Z., Wu, X., & Boeing, P. (2017). The effect of institutional ownership on firm innovation: Evidence from Chinese listed firms. Research Policy, 46(9), 1533−1551. [Google Scholar] [CrossRef]

- Saidu, S. (2019). CEO characteristics and firm performance: Focus on origin, education and ownership. Journal of Global Entrepreneurship Research, 9(1), 29. [Google Scholar] [CrossRef]

- Shen, H., Lan, F., Xiong, H., Lv, J., & Jian, J. (2020). Does top management Team’s academic experience promote corporate innovation? Evidence from China. Economic Modelling, 89, 464−475. [Google Scholar] [CrossRef]

- Sierra-Morán, J., Cabeza-García, L., González-Álvarez, N., & Botella, J. (2024). The board of directors and firm innovation: A meta-analytical review. BRQ Business Research Quarterly, 27(2), 182−207. [Google Scholar] [CrossRef]

- Singh, S., & Chakraborty, I. (2024). Family involvement, innovation and product market competition. Economics of Transition and Institutional Change, 32(2), 361−386. [Google Scholar] [CrossRef]

- Sligh, R. (2024). Why do family businesses matter? Family Business Consulting Group. Available online: https://www.thefbcg.com/resource/why-do-family-businesses-matter (accessed on 16 June 2025).

- Stock, G. N., Greis, N. P., & Fischer, W. A. (2002). Firm size and dynamic technological innovation. Technovation, 22(9), 537−549. [Google Scholar] [CrossRef]

- Stock, J. H., & Yogo, M. (2002). Testing for weak instruments in linear IV regression. Working paper. Available online: https://www.nber.org/papers/t0284 (accessed on 16 June 2025).

- Tang, Y., Li, J., & Yang, H. (2015). What I see, what I do: How executive hubris affects firm innovation. Journal of Management, 41(6), 1698−1723. [Google Scholar] [CrossRef]

- Walsh, J. P., & Seward, J. K. (1990). On the efficiency of internal and external corporate control mechanisms. Academy of Management Review, 15(3), 421−458. [Google Scholar] [CrossRef]

- Wan, D., Ong, C. H., & Lee, F. (2005). Determinants of firm innovation in Singapore. Technovation, 25(3), 261−268. [Google Scholar] [CrossRef]

- Wang, C., Yang, J., Cheng, Z., & Ni, C. (2019). Postgraduate education of board members and R&D investment—Evidence from China. Sustainability, 11(22), 6524. [Google Scholar]

- Wang, G., & Zhang, Q. (2023). Transparency, governance, and innovation: Unveiling the impact of environmental information disclosure on corporate value and green innovation capabilities. International Journal of Operations and Quantitative Management, 29(4), 54−70. [Google Scholar]

- Wang, K., Ma, J., Xue, C., & Zhang, J. (2024). Board gender diversity and firm performance: Recent evidence from Japan. Journal of Risk and Financial Management, 17(1), 20. [Google Scholar] [CrossRef]

- Wang, L., Weng, Z., Xue, C., & Zhang, J. (2024). ESG ratings and stock performance in the internet industry. Investment Management & Financial Innovations, 21(1), 38. [Google Scholar]

- Wang, X., Ma, L., & Wang, Y. (2015). The impact of TMT functional background on firm performance: Evidence from listed companies in China’s IT industry. Nankai Business Review International, 6(3), 281−311. [Google Scholar] [CrossRef]

- Ward, J. (2011). Keeping the family business healthy: How to plan for continuing growth, profitability, and family leadership. Springer. [Google Scholar]

- Wen, R., Xue, C., & Zhang, J. (2024). The relationship between CEO characteristics and corporate social responsibility: Evidence from China. In W. A. Barnett, & B. S. Sergi (Eds.), The finance-innovation nexus: Implications for socio-economic development (International Symposia in Economic Theory and Econometrics) (Vol. 34, pp. 1–13). Emerald Publishing Limited. [Google Scholar]

- Xia, Y. (2024). The impact of R&D subsidies on firm innovation in different supervision situations: Analysis from pharmaceutical companies in China. Technology Analysis & Strategic Management, 36(8), 1792−1809. [Google Scholar]

- Xu, W., & Hu, R. (2023). Top management team academic competence, university-industry collaboration, proximity and innovation performance: A moderated mediating effect analysis. Management Decision. ahead-of-print. [Google Scholar] [CrossRef]

- Yang, L., & Wang, D. (2014). The impacts of top management team characteristics on entrepreneurial strategic orientation: The moderating effects of industrial environment and corporate ownership. Management Decision, 52(2), 378−409. [Google Scholar] [CrossRef]

- Ye, C., & Zhang, J. (2025). How does customer concentration affect firm innovation in the Chinese pharmaceutical industry? Journal of the Knowledge Economy. ahead-of-print. [Google Scholar] [CrossRef]

- Zellweger, T. (2007). Time horizon, costs of equity capital, and generic investment strategies of firms. Family Business Review, 20(1), 1−15. [Google Scholar] [CrossRef]

- Zhang, J., Xue, C., & Zhang, J. (2023). The impact of CEO educational background on corporate risk-taking in China. Journal of Risk and Financial Management, 16(1), 9. [Google Scholar] [CrossRef]

- Zheng, Y., Zheng, M., & Zhang, J. (2024). Executive educational background, corporate governance and corporate default risk. Finance Research Letters, 67, 105785. [Google Scholar] [CrossRef]

- Zhong, R. I. (2018). Transparency and firm innovation. Journal of Accounting and Economics, 66(1), 67−93. [Google Scholar] [CrossRef]

- Zulfiqar, M., Zhang, R., Khan, N., & Chen, S. (2021). Behavior towards R&D investment of family firms CEOs: The role of psychological attribute. Psychology Research and Behavior Management, 14, 595−620. [Google Scholar]

- Zuo, Z., & Lin, Z. (2022). Government R&D subsidies and firm innovation performance: The moderating role of accounting information quality. Journal of Innovation & Knowledge, 7(2), 100176. [Google Scholar] [CrossRef]

| Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).