The Good, the Bad, and the Bankrupt: A Super-Efficiency DEA and LASSO Approach Predicting Corporate Failure

Abstract

1. Introduction

2. Literature Review

2.1. Overview of Previous Corporate Failure Prediction Models

2.2. Corporate Failure and DEA

2.3. Variable Selection Techniques

3. Steps of the Methodology

3.1. Sample

3.2. Logistic LASSO Regression

3.3. Data Envelopment Analysis (DEA)

3.4. Logistic Regression (LR)

3.5. Malmquist Productivity Index (MPI)

4. Empirical Analysis

4.1. Variable Selection with Logistic LASSO (Stage 1)

4.2. Modified Super-SBM-DEA Model Performance Evaluation (Stage 2)

4.3. Comparison with Logistic Regression (Stage 3)

4.4. Productivity Analysis—Malmquist DEA (Stage 4)

5. Concluding Remarks and New Research Avenues

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Agarwal, V., & Taffler, R. (2008). Comparing the performance of market-based and accounting-based bankruptcy prediction models. Journal of Banking and Finance, 32(8), 1541–1551. [Google Scholar] [CrossRef]

- Altman, E. I. (1968). Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. The Journal of Finance, 23(4), 589–609. [Google Scholar] [CrossRef]

- Altman, E. I. (1984). A further empirical investigation of the bankruptcy cost question. Journal of Finance, 34, 1067–1089. [Google Scholar] [CrossRef]

- Amendola, A., Restaino, M., & Sensini, L. (2011). Variable selection in default risk models. The Journal of Risk Model Validation, 5(1), 3–19. [Google Scholar] [CrossRef]

- Aziz, M. A., & Dar, H. A. (2006). Predicting corporate bankruptcy: Where we stand? Corporate Governance, 6(1), 18–33. [Google Scholar] [CrossRef]

- Balcaen, S., & Ooghe, H. (2006). 35 years of studies on business failure: An overview of the classic statistical methodologies and their related problems. British Accounting Review, 38(1), 63–93. [Google Scholar] [CrossRef]

- Beaver, W. (1966). Financial ratios as predictors of failure. Empirical research in accounting: Selected studies. Journal of Accounting Research, 4, 71–111. [Google Scholar] [CrossRef]

- Bharath, S. T., & Shumway, T. (2008). Forecasting default with the Merton distance to default model. Review of Financial Studies, 21(3), 1339–1369. [Google Scholar] [CrossRef]

- Cao, Y., Liu, X., Zhai, J., & Hua, S. (2022). A two-stage Bayesian network model for corporate bankruptcy prediction. International Journal of Finance and Economics, 27(1), 455–472. [Google Scholar] [CrossRef]

- Charnes, A., Cooper, W. W., & Rhodes, E. (1978). Measuring the efficiency of decision making units. European Journal of Operational Research, 2(6), 429–444. [Google Scholar] [CrossRef]

- Chen, Y., Tsionas, M. G., & Zelenyuk, V. (2021). LASSO+DEA for small and big wide data. Omega, 102, 102419. [Google Scholar] [CrossRef]

- Christopoulos, A. G., Dokas, I. G., Kalantonis, P., & Koukkou, T. (2019a). Investigation of financial distress with a dynamic logit based on the linkage between liquidity and profitability status of listed firms. Journal of the Operational Research Society, 70(10), 1817–1829. [Google Scholar] [CrossRef]

- Christopoulos, A. G., Dokas, I. G., Kollias, I., & Leventides, J. (2019b). An implementation of soft set theory in the variables selection process for corporate failure prediction models. Evidence from NASDAQ listed firms. Bulletin of Applied Economics, 6(1), 1–20. [Google Scholar]

- Cielen, A., Peeters, L., & Vanhoof, K. (2004). Bankruptcy prediction using a data envelopment analysis. European Journal of Operational Research, 154(2), 526–532. [Google Scholar] [CrossRef]

- Cooper, W. W., Park, K. S., & Pastor, J. T. (1999). RAM: A range measure of inefficiency for use with additive models, and relations to other models and measures in DEA. Journal of Productivity Analysis, 11(1), 5–42. [Google Scholar] [CrossRef]

- Das, S., Hanouna, P., & Sarin, A. (2009). Accounting-based versus market-based cross-sectional models of CDS spreads. Journal of Banking & Finance, 33(4), 719–730. [Google Scholar] [CrossRef]

- Deakin, E. B. (1972). A discriminant analysis of predictors of business failure. Journal of Accounting Research, 10(1), 167–179. [Google Scholar] [CrossRef]

- Dimitras, A. I., Zanakis, S. H., & Zopounidis, C. (1996). A survey of business failures with an emphasis on prediction methods and industrial applications. European Journal of Operational Research, 90, 487–513. [Google Scholar] [CrossRef]

- Ding, Y., Song, X., & Zen, Y. (2008). Forecasting financial condition of Chinese listed companies based on support vector machine. Expert Systems with Applications, 34(4), 3081–3089. [Google Scholar] [CrossRef]

- Doumpos, M., Kosmidou, K., Baourakis, G., & Zopounidis, C. (2002). Credit risk assessment using a multicriteria hierarchical discrimination approach. European Journal of Operational Research, 138, 392–412. [Google Scholar] [CrossRef]

- Fang, H. H., Lee, H. S., Hwang, S. N., & Chung, C. C. (2013). A slacks-based measure of super-efficiency in data envelopment analysis: An alternative approach. Omega, 41(4), 731–734. [Google Scholar] [CrossRef]

- Färe, R., Grosskopf, S., & Lovell, C. A. K. (1994). Production frontiers. University Press Cambridge. [Google Scholar]

- Färe, R., Grosskopf, S., & Roos, P. (1998). Malmquist productivity indexes: A survey of theory and practice. In Index numbers: Essays in honour of Sten Malmquist (pp. 127–190). Springer. [Google Scholar]

- Hastie, T., Tibshirani, R., & Friedman, J. (2009). The elements of statistical learning: Data mining, inference, and prediction (2nd ed.). Springer. [Google Scholar]

- Hillegeist, S. A., Keating, E. K., Cram, D. P., & Lundstedt, K. G. (2004). Assessing the probability of bankruptcy. Review of Accounting Studies, 9(1), 5–34. [Google Scholar] [CrossRef]

- James, G., Witten, D., Hastie, T., & Tibshirani, R. (2013). An introduction to statistical learning with applications in R. Springer. [Google Scholar]

- Lee, C.-Y., & Cai, J.-Y. (2020). LASSO variable selection in data envelopment analysis with small datasets. Omega, 91, 102019. [Google Scholar] [CrossRef]

- Li, Z., Crook, J., & Andreeva, G. (2017). Dynamic prediction of financial distress using Malmquist DEA. Expert Systems with Applications, 80, 94–106. [Google Scholar] [CrossRef]

- Li, Z., Feng, C., & Tang, Y. (2022). Bank efficiency and failure prediction: A nonparametric and dynamic model based on data envelopment analysis. Annals of Operations Research, 315(1), 279–315. [Google Scholar] [CrossRef]

- Lin, F., Liang, D., & Chen, E. (2011). Financial ratio selection for business crisis prediction. Expert Systems with Applications, 38, 15094–15102. [Google Scholar] [CrossRef]

- Lin, F., Liang, D., & Chu, W. S. (2010). The role of non-financial features related to corporate governance in business crisis prediction. Journal of Marine Science and Technology, 18(4), 504–513. [Google Scholar] [CrossRef]

- Lin, R., Yang, W., & Huang, H. (2019). A modified slacks-based super-efficiency measure in the presence of negative data. Computers and Industrial Engineering, 135, 39–52. [Google Scholar] [CrossRef]

- Mare, D. S. (2012, June 18–20). Contribution of macroeconomic factors to the prediction of small bank failures. 4th International IFABS Conference, Valencia, Spain. [Google Scholar][Green Version]

- Martens, D., Bruynseels, L., Baesens, B., Willekens, M., & Vanthienen, J. (2008). Predicting going concern opinion with data mining. Decision Support Systems, 45(4), 765–777. [Google Scholar] [CrossRef]

- Min, J. H., & Lee, Y. C. (2005). Bankruptcy prediction using support vector machine with optimal choice of kernel function parameters. Expert Systems with Applications, 28, 603–614. [Google Scholar] [CrossRef]

- Mokrišová, M., & Horváthová, J. (2023). Domain knowledge features versus LASSO features in predicting risk of corporate bankruptcy—DEA approach. Risks, 11(11), 199. [Google Scholar] [CrossRef]

- Mousavi, M. M., Ouenniche, J., & Tone, K. (2023). A dynamic performance evaluation of distress prediction models. Journal of Forecasting, 42(4), 756–784. [Google Scholar] [CrossRef]

- Mousavi, M. M., Ouenniche, J., & Xu, B. (2015). Performance evaluation of bankruptcy prediction models: An orientation-free super-efficiency DEA-based framework. International Review of Financial Analysis, 42, 64–75. [Google Scholar] [CrossRef]

- Odom, M. D., & Sharda, R. (1990). A neural network model for bankruptcy prediction. IJCNN International Conference on Neural Networks, 2, 163–168. [Google Scholar] [CrossRef]

- Ohlson, J. A. (1980). Financial ratios and the probabilistic prediction of bankruptcy. Journal of Accounting Research, 18(1), 109–131. [Google Scholar] [CrossRef]

- Paradi, J. C., & Simak, P. C. (2004). Using DEA and worst practice DEA in Credit risk evaluation. Journal of Productivity Analysis, 21, 153–165. [Google Scholar] [CrossRef]

- Paradi, J. C., Wilson, D., & Yang, X. (2014). Data Envelopment analysis of corporate failure for non-manufacturing firms using a slacks-based measure. Journal of Service Science and Management, 7(4), 277–290. [Google Scholar] [CrossRef]

- Pereira, J. M., Basto, M., & da Silva, A. F. (2016). The logistic lasso and ridge regression in predicting corporate failure. Procedia Economics and Finance, 39, 634–641. [Google Scholar] [CrossRef]

- Premachandra, I. M., Bhabra, G. S., & Sueyoshi, T. (2009). DEA as a tool for bankruptcy assessment: A comparative study with logistic regression technique. European Journal of Operational Research, 193(2), 412–424. [Google Scholar] [CrossRef]

- Premachandra, I. M., Chen, Y., & Watson, J. (2011). DEA as a tool for predicting corporate failure and success: A case of bankruptcy assessment. Omega, 39(6), 620–626. [Google Scholar] [CrossRef]

- Sharp, J. A., Meng, W., & Liu, W. (2007). A modified slacks-based measure model for data envelopment analysis with ‘natural’ negative outputs and inputs. Journal of the Operational Research Society, 58(12), 1672–1677. [Google Scholar] [CrossRef]

- Shetty, U., Pakkala, T. P. M., & Mallikarjunappa, T. (2012). A modified directional distance formulation of DEA to assess bankruptcy: An application to IT/ITES companies in India. Expert Systems with Applications, 39(2), 1988–1997. [Google Scholar] [CrossRef]

- Shin, K.-S., Soo Lee, T., & Kim, H.-J. (2005). An application of support vector machines in bankruptcy prediction model. Expert Systems with Applications, 28, 127–135. [Google Scholar] [CrossRef]

- Shumway, T. (2001). Forecasting bankruptcy more accurately: A simple Hazard model. The Journal of Business, 74(1), 101–124. [Google Scholar] [CrossRef]

- Sueyoshi, T., & Goto, M. (2009). Methodological comparison between DEA (data envelopment analysis) and DEA-DA (discriminant analysis) from the perspective of bankruptcy assessment. European Journal of Operational Research, 199(2), 561–575. [Google Scholar] [CrossRef]

- Sueyoshi, T., & Sekitani, K. (2009). An occurrence of multiple projections in DEA-based measurement of technical efficiency: Theoretical comparison among DEA models from desirable properties. European Journal of Operational Research, 196, 764–794. [Google Scholar] [CrossRef]

- Tian, S., & Yu, Y. (2017). Financial ratios and bankruptcy predictions: An international evidence. International Review of Economics and Finance, 51, 510–526. [Google Scholar] [CrossRef]

- Tian, S., Yu, Y., & Guo, H. (2015). Variable selection and corporate bankruptcy forecasts. Journal of Banking and Finance, 52, 89–100. [Google Scholar] [CrossRef]

- Tibshirani, R. (1996). Regression shrinkage and selection via the lasso. Journal of the Royal Statistical Society, Series B, 58, 267–288. [Google Scholar] [CrossRef]

- Tinoco, M. H., & Wilson, N. (2013). Financial distress and bankruptcy prediction among listed companies using accounting, market and macroeconomic variables. International Review of Financial Analysis, 30, 394–419. [Google Scholar] [CrossRef]

- Tone, K. (2001). A slacks-based measure of efficiency in data envelopment analysis. European Journal of Operational Research, 130, 498–509. [Google Scholar] [CrossRef]

- Tone, K. (2002). A slacks-based measure of super-efficiency in data envelopment analysis. European Journal of Operational Research, 143(1), 32–41. [Google Scholar] [CrossRef]

- Veganzones, D., & Severin, E. (2021). Corporate failure prediction models in the twenty-first century: A review. European Business Review, 33(2), 204–226. [Google Scholar] [CrossRef]

- Warner, J. (1977). Bankruptcy costs: Some evidence. Journal of Finance, 32, 337–347. [Google Scholar] [CrossRef]

- Xu, W., Xiao, Z., Dang, Z., Yang, D., & Yang, X. (2014). Financial ratio selection for business failure prediction using soft set theory. Knowledge-Based Systems, 63, 59–67. [Google Scholar] [CrossRef]

- Zmijewski, M. E. (1984). Methodological issues related to the estimation of financial distress prediction models. Journal of Accounting Research, 22, 59–82. [Google Scholar] [CrossRef]

| No | Financial Ratios | ||

|---|---|---|---|

| 1 | Current Ratio (CACL) | 23 | Total Equity to Total Liabilities (TETL) |

| 2 | Acid Test Ratio (ATR) | 24 | Net Working Capital to Non-Current Liabilities (WCNCL) |

| 3 | Cash Ratio (CR) | 25 | Equity plus Non-Current Liabilities to Non-Current Assets (ENCLNCA) |

| 4 | Cash Flow to Total Assets (CFTA) | 26 | Working Capital to Total Liabilities (WCTL) |

| 5 | Sales to Total Assets (STA) | 27 | Total Equity to Non-Current Assets (TENCA) |

| 6 | Total Assets Turnover (TAT) | 28 | Non-Current Assets to Non-Current Liabilities (NCANCL) |

| 7 | Fixed Assets Turnover (FATR) | 29 | Financial Leverage (FL) |

| 8 | Account Receivables Turnover (ART) | 30 | Total Liabilities to Total Assets plus Total Equity (TLTATE) |

| 9 | Net Proft Margin (NPM) | 31 | Total Liabilities to EBITDA (TLEBITDA) |

| 10 | Net Income to Total Assets (NITA) | 32 | Total Liabilities to Total Assets (TLTA) |

| 11 | Pretax Margin (PTM) | 33 | Earnings Per Share (EPS) |

| 12 | Operating Profit Margin (OPM) | 34 | Cash from Operating Activities to Total Liabilities (CFOTL) |

| 13 | EBITDA Margin (EBITDAM) | 35 | Earnings Before Interest and Taxes to Total Assets (EBITTA) |

| 14 | Return on Assets (ROA) | 36 | Retained Earnings to Total Assets (RETA) |

| 15 | Gross Profit Margin (GPM) | 37 | Working Capital to Sales (WCA) |

| 16 | Working Capital to Total Assets (WCTA) | 38 | Current Liabilities to Sales (CLS) |

| 17 | Current Assets to Total Assets (CATA) | 39 | Quick Assets to Sales (QAS) |

| 18 | Quick Assets to Total Assets (QATA) | 40 | Operating Expenses to Total Revenue (OER) |

| 19 | Current Liabilities to Total Assets (CLTA) | 41 | Cash Flow to Total Liabilities (CFTL) |

| 20 | Working Capital to Current Assets (WCCA) | 42 | Cash Flow to Sales (CFS) |

| 21 | Total Equity to Total Assets (TETA) | 43 | Net Income to Weighted Average Common Shares Outstanding (NIWACSO) |

| 22 | Current Liabilities to Total Liabilities (CLTL) |

| No | Financial Ratios | Sig. * |

|---|---|---|

| 1 | Current Ratio (CACL) | 0.002 |

| 2 | Acid Test Ratio (ATR) | 0.003 |

| 3 | Net Profit Margin (NPM) | 0.000 |

| 4 | Net Income to Total Assets (NITA) | 0.000 |

| 5 | Pretax Margin (PTM) | 0.000 |

| 6 | Operating Profit Margin (OPM) | 0.000 |

| 7 | EBITDA Margin (EBITDAM) | 0.026 |

| 8 | Return on Assets (ROA) | 0.000 |

| 9 | Working Capital to Total Assets (WCTA) | 0.001 |

| 10 | Current Liabilities to Total Assets (CLTA) | 0.000 |

| 11 | Working Capital to Current Assets (WCCA) | 0.002 |

| 12 | Total Equity to Total Assets (TETA) | 0.000 |

| 13 | Total Equity to Total Liabilities (TETL) | 0.000 |

| 14 | Net Working Capital to Non-Current Liabilities (WCNCL) | 0.000 |

| 15 | Equity plus Non-Current Liabilities to Non-Current Assets (ENCLNCA) | 0.001 |

| 16 | Working Capital to Total Liabilities (WCTL) | 0.000 |

| 17 | Total Equity to Non-Current Assets (TENCA) | 0.000 |

| 18 | Total Liabilities to Total Assets plus Total Equity (TLTATE) | 0.000 |

| 19 | Total Liabilities to Total Assets (TLTA) | 0.000 |

| 20 | Earnings Per Share (EPS) | 0.001 |

| 21 | Cash from Operating Activities to Total Liabilities (CFOTL) | 0.000 |

| 22 | Earnings Before Interest and Taxes to Total Assets (EBITTA) | 0.008 |

| 23 | Retained Earnings to Total Assets (RETA) | 0.000 |

| 24 | Working Capital to Sales (WCA) | 0.002 |

| 25 | Current Liabilities to Sales (CLS) | 0.001 |

| 26 | Operating Expenses to Total Revenue (OER) | 0.000 |

| 27 | Cash Flow to Total Liabilities (CFTL) | 0.008 |

| 28 | Net Income to Weighted Average Common Shares Outstanding (NIWACSO) | 0.001 |

| ID | Description | Lambda | No. of Nonzero Coef. | CV Mean Deviance |

|---|---|---|---|---|

| 1 | First lambda | 0.288631 | 0 | 1.402111 |

| 14 | Lambda before | 0.0861173 | 4 | 1.101192 |

| * 15 | Selected lambda | 0.0784669 | 5 | 1.099664 |

| 16 | Lambda after | 0.0714961 | 5 | 1.100356 |

| 19 | Last lambda | 0.0540842 | 6 | 1.109833 |

| CACL | NPM | EBITDAM | TLTA | EBITTA | RETA | CLS | CFTL | |

|---|---|---|---|---|---|---|---|---|

| CACL | 1.000 | 0.208 | −0.166 | −0.420 | −0.040 | 0.425 | −0.749 | 0.205 |

| NPM | 0.208 | 1.000 | 0.249 | −0.354 | 0.474 | 0.496 | −0.227 | 0.066 |

| EBITDAM | −0.166 | 0.249 | 1.000 | −0.146 | 0.770 | 0.056 | 0.013 | 0.091 |

| TLTA | −0.420 | −0.354 | −0.146 | 1.000 | −0.141 | −0.693 | 0.526 | −0.523 |

| EBITTA | −0.040 | 0.474 | 0.770 | −0.141 | 1.000 | 0.176 | −0.036 | −0.146 |

| RETA | 0.425 | 0.496 | 0.056 | −0.693 | 0.176 | 1.000 | −0.531 | 0.325 |

| CLS | −0.749 | −0.227 | 0.013 | 0.526 | −0.036 | −0.531 | 1.000 | −0.394 |

| CFTL | 0.205 | 0.066 | 0.091 | −0.523 | −0.146 | 0.325 | −0.394 | 1.000 |

| Inputs (Lower the Worst) | Outputs (Higher the Worst) |

|---|---|

| Logistic LASSO-Selected Variables | |

| Return on Assets (ROA) | Current Liabilities/Total Assets (CLTA) |

| Working Capital/Total Liabilities (WCTL) | |

| Total Equity/Non-Current Assets (TENCA) | |

| Cash from Operating Activities/Total Liabilities (CFOTL) | |

| Other selected variables | |

| Current Ratio (CACL) | Total Liabilities/Total Assets (TLTA) |

| Net Profit Margin (NPM) | Current Liabilities/Sales (CLS) |

| EBITDA Margin (EBITDAM) | |

| Retained Earnings/Total Assets (RETA) | |

| Earnings Before Interest and Taxes/Total Assets (EBITTA) | |

| Cash Flow/Total Liabilities (CFTL) |

| Cut-Off Point | Model 1 Overall Prediction Accuracy | Model 1 Sensitivity | Model 1 Specificity | Model 2 Overall Prediction Accuracy | Model 2 Sensitivity | Model 2 Specificity |

|---|---|---|---|---|---|---|

| 0.55 | 57% | 100% | 13% | 61% | 76% | 47% |

| 0.6 | 64% | 100% | 29% | 62% | 73% | 51% |

| 0.61 | 64% | 100% | 29% | 62% | 71% | 53% |

| 0.62 | 66% | 100% | 31% | 61% | 67% | 56% |

| 0.63 | 66% | 100% | 31% | 64% | 67% | 62% |

| 0.64 | 67% | 100% | 33% | 63% | 64% | 62% |

| 0.65 | 70% | 100% | 40% | 64% | 64% | 64% |

| 0.66 | 71% | 100% | 42% | 64% | 64% | 64% |

| 0.67 | 72% | 100% | 44% | 64% | 64% | 64% |

| 0.68 | 76% | 98% | 53% | 64% | 64% | 64% |

| 0.69 | 76% | 96% | 56% | 64% | 62% | 67% |

| 0.7 | 74% | 93% | 56% | 67% | 62% | 71% |

| 0.71 | 81% | 93% | 69% | 68% | 60% | 76% |

| 0.72 | 82% | 93% | 71% | 67% | 56% | 78% |

| 0.73 | 86% | 91% | 80% | 67% | 53% | 80% |

| 0.74 | 84% | 89% | 80% | 68% | 49% | 87% |

| 0.75 | 83% | 82% | 84% | 70% | 49% | 91% |

| 0.76 | 82% | 78% | 87% | 71% | 49% | 93% |

| 0.8 | 77% | 64% | 89% | 69% | 40% | 98% |

| 0.85 | 66% | 38% | 93% | 61% | 24% | 98% |

| 0.9 | 58% | 22% | 93% | 59% | 20% | 98% |

| 0.95 | 57% | 18% | 96% | 59% | 20% | 98% |

| 1 | 57% | 18% | 96% | 59% | 20% | 98% |

| Model | Sensitivity | Specificity | Overall Prediction Accuracy | Type I Error | Type II Error |

|---|---|---|---|---|---|

| Modified super-SBM-DEA with logistic LASSO-selected variables | 91.1% | 80% | 85.6% | 8.9% | 20% |

| Modified super-SBM-DEA with other variables | 66.7% | 62.2% | 64.4% | 33.3% | 37.8% |

| Model | Sensitivity | Specificity | Overall Prediction Accuracy | Type I Error | Type II Error |

|---|---|---|---|---|---|

| LR with logistic LASSO-selected variables | 82.2% | 77.8% | 80% | 17.8% | 22.2% |

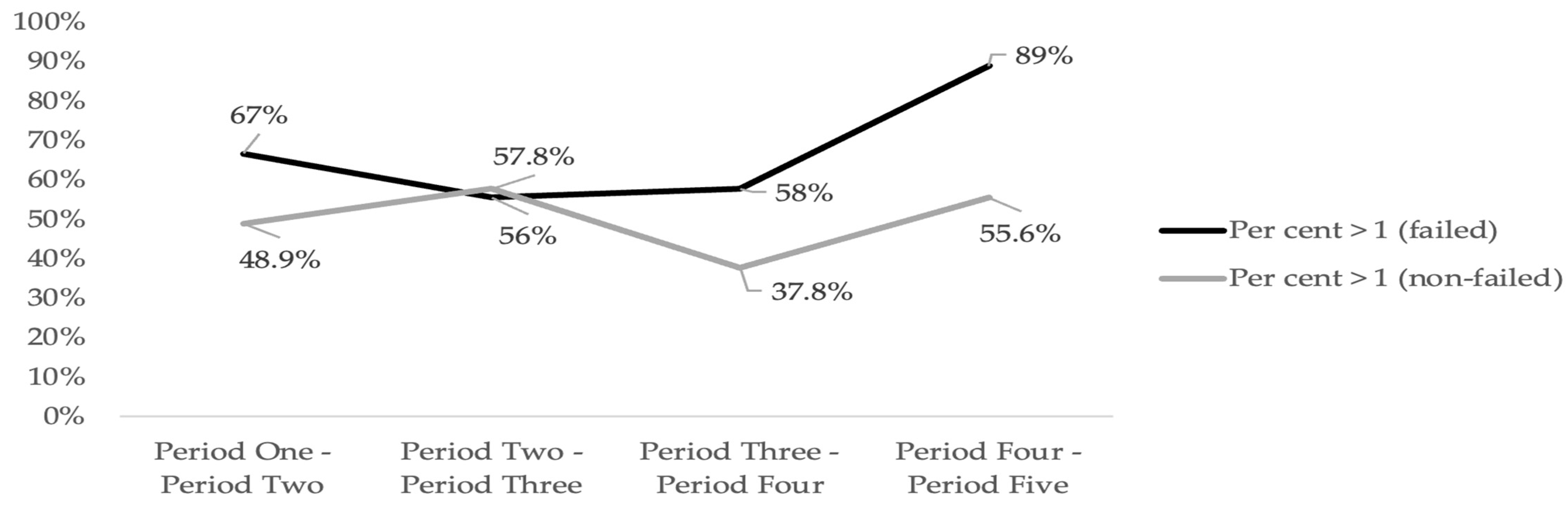

| Failure Status | Period One–Period Two | Period Two–Period Three | Period Three–Period Four | Period Four–Period Five | |

|---|---|---|---|---|---|

| Yes | MPI | 1.03 | 1.01 | 1.02 | 1.12 |

| % | 3 | 1 | 2 | 12 | |

| PEFFCH | 1.11 | 1.10 | 0.98 | 1.04 | |

| % | 11 | 10 | −2 | 4 | |

| TECH | 0.93 | 0.92 | 1.04 | 1.07 | |

| % | −7 | −8 | 4 | 7 | |

| No | MPI | 0.97 | 1.05 | 1.09 | 1.06 |

| % | −3 | 5 | 9 | 6 | |

| PEFFCH | 1.03 | 1.14 | 0.99 | 0.92 | |

| % | 3 | 14 | −1 | −8 | |

| TECH | 0.93 | 0.92 | 1.08 | 1.15 | |

| % | −7 | −8 | 8 | 15 |

| Failure Status | Index | >1 Between All Periods | >1 Between Three Periods | >1 Between Two Periods | >1 Between One Period |

|---|---|---|---|---|---|

| Yes | MPI | 9% | 53% | 36% | 2% |

| PEFFCH | 9% | 56% | 31% | 4% | |

| TECH | 2% | 4% | 84% | 9% | |

| No | MPI | 2% | 24% | 44% | 29% |

| PEFFCH | 2% | 13% | 71% | 13% | |

| TECH | 2% | 11% | 73% | 13% |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Dokas, I.; Geronikolaou, G.; Katsimardou, S.; Spyromitros, E. The Good, the Bad, and the Bankrupt: A Super-Efficiency DEA and LASSO Approach Predicting Corporate Failure. J. Risk Financial Manag. 2025, 18, 471. https://doi.org/10.3390/jrfm18090471

Dokas I, Geronikolaou G, Katsimardou S, Spyromitros E. The Good, the Bad, and the Bankrupt: A Super-Efficiency DEA and LASSO Approach Predicting Corporate Failure. Journal of Risk and Financial Management. 2025; 18(9):471. https://doi.org/10.3390/jrfm18090471

Chicago/Turabian StyleDokas, Ioannis, George Geronikolaou, Sofia Katsimardou, and Eleftherios Spyromitros. 2025. "The Good, the Bad, and the Bankrupt: A Super-Efficiency DEA and LASSO Approach Predicting Corporate Failure" Journal of Risk and Financial Management 18, no. 9: 471. https://doi.org/10.3390/jrfm18090471

APA StyleDokas, I., Geronikolaou, G., Katsimardou, S., & Spyromitros, E. (2025). The Good, the Bad, and the Bankrupt: A Super-Efficiency DEA and LASSO Approach Predicting Corporate Failure. Journal of Risk and Financial Management, 18(9), 471. https://doi.org/10.3390/jrfm18090471