1. Introduction

In the past decade, the integration of environmental, social, and governance (ESG) practices into corporate strategy has evolved from a peripheral concern to a central pillar of long-term competitiveness and sustainability. Across global capital markets, firms are increasingly expected to go beyond traditional financial disclosures and demonstrate transparent ESG engagement as part of their accountability to diverse stakeholders (

Christensen et al., 2021;

Mansor et al., 2021;

Tettamanzi et al., 2022). ESG practices, when embedded strategically, are believed not only to improve corporate reputation and legitimacy but also to foster organizational innovation, reduce operational risk, and drive long-term firm value. However, the empirical relationship between ESG practices and firm performance remains contested, especially in the context of developing economies where institutional voids and stakeholder priorities may differ from those in developed markets (

Hassouna & Salem, 2021;

Malik & Kashiramka, 2024;

Rao et al., 2023).

Recent literature has begun to explore how ESG practices may catalyze green innovations defined as the development or application of eco-friendly technologies, processes, or products aimed at reducing environmental harm while improving firm capabilities (

Lian et al., 2023;

Tariq et al., 2017;

Y. Wang & Wang, 2024). ESG-related policies, especially environmental initiatives, are hypothesized to stimulate internal innovation by redirecting corporate resources toward sustainability-driven R&D and fostering a culture of compliance and proactive adaptation (

Demirel & Kesidou, 2019;

Y. Wang & Wang, 2024). However, most existing studies have either focused on developed economies or examined ESG–financial performance links in isolation, thereby overlooking the potential mediating role of green innovation and the contextual nuances of emerging markets. This presents a notable gap in the knowledge of how ESG generates comprehensive value, especially in areas where institutional frameworks and stakeholder expectations are undergoing rapid transformation.

This study addresses these gaps by investigating whether ESG practices contribute to both green innovation and financial success among publicly listed firms across ASEAN countries, using panel data spanning from 2019 to 2023. The ASEAN region provides an ideal setting for this inquiry, given its rapid economic development, increasing regulatory emphasis on corporate sustainability, and growing investor demand for ESG-aligned assets (

Arayssi et al., 2019;

Waworuntu et al., 2014). Nevertheless, ESG adoption and disclosure remain uneven across member states, raising important questions about their real economic impact within such diverse institutional environments (

Krueger et al., 2024).

Drawing on an unbalanced panel dataset of firms operating in key sectors such as energy, manufacturing, and technology across multiple ASEAN countries, this study employs panel regression techniques, specifically fixed-effects and random-effects models, to examine the direct effects of ESG practices on green innovation and financial performance. Financial performance is measured using two metrics: return on assets (ROA), and Tobin’s Q, capturing both accounting-based profitability and market-based valuation. Green innovation performance is assessed through firm-level disclosures and innovation activity indicators related to environmental technologies. Additionally, the study investigates whether green innovation serves as a mediating mechanism through which ESG practices enhance financial outcomes.

Addressing these research gaps, this study makes several notable contributions to the existing body of knowledge. First, it pioneers a regionally specific analysis of ESG practices within the ASEAN context, addressing a significant void in the understanding of sustainability in this rapidly expanding economic region that has been underexplored. Second, by concurrently investigating green innovation and financial results, this research comprehensively connects two previously distinct areas of sustainability research, providing a more integrated perspective. Third, it delivers strong empirical evidence supporting the critical mediating role of green innovation, clarifying the complex process through which ESG engagement is converted into sustained firm value. Practically, the findings offer timely guidance for managers aiming to align ESG strategy with innovation and financial goals. For policymakers, the results inform the design of ESG reporting frameworks that encourage both environmental responsibility and competitiveness. For investors, the study enhances understanding of how ESG transparency correlates with long-term value creation in emerging market settings. Considering the aforementioned gaps and contributions, this study focuses on assessing how environmental, social, and governance practices affect green innovation and financial performance among publicly traded companies in ASEAN countries. It investigates the direct effects of ESG on both green innovation and financial success, with a significant emphasis on the mediating role of green innovation in the association between comprehensive ESG practices and long-term market value.

The remainder of this paper is organized as follows.

Section 2 provides an empirical review and develops the research hypotheses.

Section 3 describes the dataset, variable definitions, and econometric methodology.

Section 4 presents the results, including descriptive statistics, correlation analysis, and panel regression outcomes.

Section 5 offers a discussion of the theoretical and practical implications.

Section 6 concludes the study, and

Section 7 outlines its limitations and directions for future research.

2. Empirical Review and Hypothesis Development

This section serves as a comprehensive empirical review and establishes the theoretical foundation for the study’s hypotheses. Our analysis of the relationships between ESG practices, green innovation, and financial performance is largely underpinned by foundational theories such as stakeholder theory (

Demiraj et al., 2025;

Freeman et al., 2010;

X. Zhang et al., 2024). This theory posits that sustainable firm performance is achieved not solely by maximizing shareholder wealth, but by effectively managing relationships with all relevant stakeholder groups, including employees, customers, suppliers, communities, and the environment. Engaging with these diverse stakeholders (as captured by ESG practices) can build trust, enhance reputation, and foster legitimacy, which in turn drives organizational innovation and contributes to long-term financial outcomes. Furthermore, the emphasis on developing capabilities through eco-friendly initiatives implicitly draws from strategic management views that link firm resources and capabilities to competitive advantage. The following subsections review the relevant literature and present the specific hypotheses developed for this study.

2.1. ESG Practices and Green Innovation

The connection between ESG practices and green innovation has gained increasing attention in both academic and policy discussions. Scholars argue that ESG initiatives, especially those targeting environmental sustainability, can foster innovation by prompting firms to develop cleaner technologies, improve resource efficiency, and reduce long-term operational risks (

Ahmad et al., 2023;

K. Wang et al., 2023;

Y. Wang & Wang, 2024). For instance, environmental disclosure requirements may incentivize firms to invest in R&D that aligns with ecological goals, while social and governance practices can create the institutional culture needed to support innovation (

Mbanyele et al., 2022;

Y. Zhang et al., 2020). In ASEAN countries, where regulatory enforcement and sustainability pressures are rapidly evolving, green innovation emerges as both a response to stakeholder demand and a potential source of competitive advantage (

Tolliver et al., 2020). ESG practices, while diverse, exert a collective influence on green innovation through several key channels. Environmental efforts, such as aggressive carbon emission reduction targets, directly encourage firms to allocate resources towards research and development of cleaner technologies and processes (

Ahmad et al., 2023;

Y. Wang & Wang, 2024). Simultaneously, robust social practices, including equitable labor relations and community involvement, cultivate a favorable organizational climate, attracting skilled individuals and boosting employee morale, both of which are crucial for fostering creativity and pioneering innovations (

Mbanyele et al., 2022;

Y. Zhang et al., 2020). Furthermore, sound governance frameworks promote transparency, accountability, and efficient resource distribution, enabling sustained, long-term investments in innovation initiatives, free from excessive short-term demands. Within the ASEAN region, escalating regulatory focus on sustainability, coupled with heightened consumer consciousness, further motivates firms to harness their comprehensive ESG commitment to stimulate green innovation as a means of gaining a competitive edge (

Tolliver et al., 2020).

Empirical evidence suggests that firms with high ESG scores are more likely to pursue green innovation projects and report higher levels of patenting in green technologies (

Din et al., 2024;

Tseng et al., 2012). However, this relationship may vary across ESG dimensions. Environmental initiatives are more directly linked to innovation outputs, while social and governance factors play a supporting role through organizational learning and ethical leadership (

Lian et al., 2023). Despite these insights, studies specifically examining the ESG green innovation nexus in ASEAN markets remain limited, particularly those employing panel data across multiple countries and sectors.

H1. ESG practices positively influence green innovation among publicly listed firms in ASEAN countries.

2.2. Green Innovation and Financial Performance

The financial benefits of green innovation have been widely debated. Green innovation can reduce costs over the long term by enhancing energy efficiency, reducing waste, and minimizing regulatory penalties. It may also improve brand value and stakeholder trust, thereby boosting revenues and market valuation (

Calza et al., 2017). In ASEAN’s emerging economies, where sustainability concerns are growing but resources are constrained, the financial performance of green innovation becomes particularly critical for strategic decision-making.

Recent empirical studies indicate that green innovation is positively associated with return on assets (ROA) and Tobin’s Q in sectors such as manufacturing and energy (

Calza et al., 2017;

Shu et al., 2014). However, others caution that the returns from such innovations may be delayed, especially when initial R&D investments are high and regulatory incentives are weak (

Dong et al., 2024;

Kwon et al., 2024). Therefore, the performance implications of green innovation in ASEAN firms warrant further investigation.

H2. Green innovation positively affects the financial performance of publicly listed firms in ASEAN.

2.3. ESG Practices and Financial Performance

The direct relationship between ESG practices—whether measured through individual environmental, social, and governance dimensions or as a composite average score—and firm performance has been examined in various contexts, with mixed findings. Prior scholarly work reveals a spectrum of outcomes regarding the relationship between ESG practices and firm performance. Some studies suggest a positive correlation, while others indicate a negative or negligible impact, implying that the effect of ESG is context-dependent and not uniformly observed. ESG disclosure is argued to reduce information asymmetry, attract long-term investors, and improve risk management (

Alsayegh et al., 2020). However, it may also impose costs related to compliance, reporting, and stakeholder engagement that affect profitability in the short term (

Q. Zhang et al., 2023). The variability in these results frequently arises from differing theoretical perspectives, such as contingency theory, which suggests that the effectiveness of ESG practices is not definitive but rather conditional on a range of contextual variables. In the ASEAN context, recent studies show varying results depending on the ESG component, sectoral differences, and national regulations (

Ming et al., 2024). Consequently, a sophisticated understanding of institutional frameworks, market development, and industry characteristics is essential for a refined analysis of the relationship between ESG factors and performance.

The relationship between overall ESG practices and financial performance is complex and can manifest through various channels. From an environmental (E) perspective, initial investments in eco-friendly practices may incur short-term costs, potentially dampening accounting-based performance (ROA). However, these investments are increasingly viewed by the market as indicators of long-term resilience and risk management, leading to enhanced market valuation (Tobin’s Q) (

Ming et al., 2024). Social (S) engagement, such as fostering employee satisfaction and strong community ties, often directly improves operational efficiency, reduces employee turnover, and strengthens brand loyalty, translating into both higher profitability and market appeal. Lastly, sound governance (G) practices lead to reduced agency costs, improved investor confidence, and better decision-making, which can attract long-term capital and enhance firm value, though immediate impacts on accounting profits can be mixed due to compliance costs (

Zhan, 2023). This study will investigate the aggregate impact of these interwoven ESG dimensions on firm financial outcomes.

While environmental practices can signal commitment to sustainability and enhance market valuation, they may reduce operating margins in the near term. Social practices often enhance employee morale and customer loyalty but may yield uneven financial benefits. Governance practices contribute to institutional quality and investor protection, but symbolic compliance can dilute their impact (

Zhan, 2023). These findings suggest that ESG–financial performance links are complex and merit separate evaluation. To strengthen empirical validity, this study evaluates both disaggregated ESG scores (ENVDS, SOCDS, GOVDS) and a composite measure (AVG_ESG) to determine whether overall ESG disclosure exerts a stronger influence than its individual components. This dual approach also enables robustness checks and comparative insights across models.

H3. ESG practices have a significant impact on the financial performance of publicly listed firms in ASEAN.

2.4. Mediation Effect of Green Innovation

Given that ESG practices can stimulate innovation and that innovation can drive performance, an important question is whether green innovation acts as a mediating mechanism between ESG engagement and financial success. Mediation theory suggests that ESG practices may not directly yield financial gains but may do so indirectly through fostering capabilities such as innovation (

Xu & Zhu, 2024). Studies in China and Europe have demonstrated partial mediation effects of innovation on the ESG–performance relationship, but research in ASEAN remains scarce.

This study thus explores whether green innovation serves as an explanatory bridge between ESG disclosure and firm-level financial outcomes in the ASEAN context.

H4. Green innovation mediates the relationship between ESG practices and financial performance.

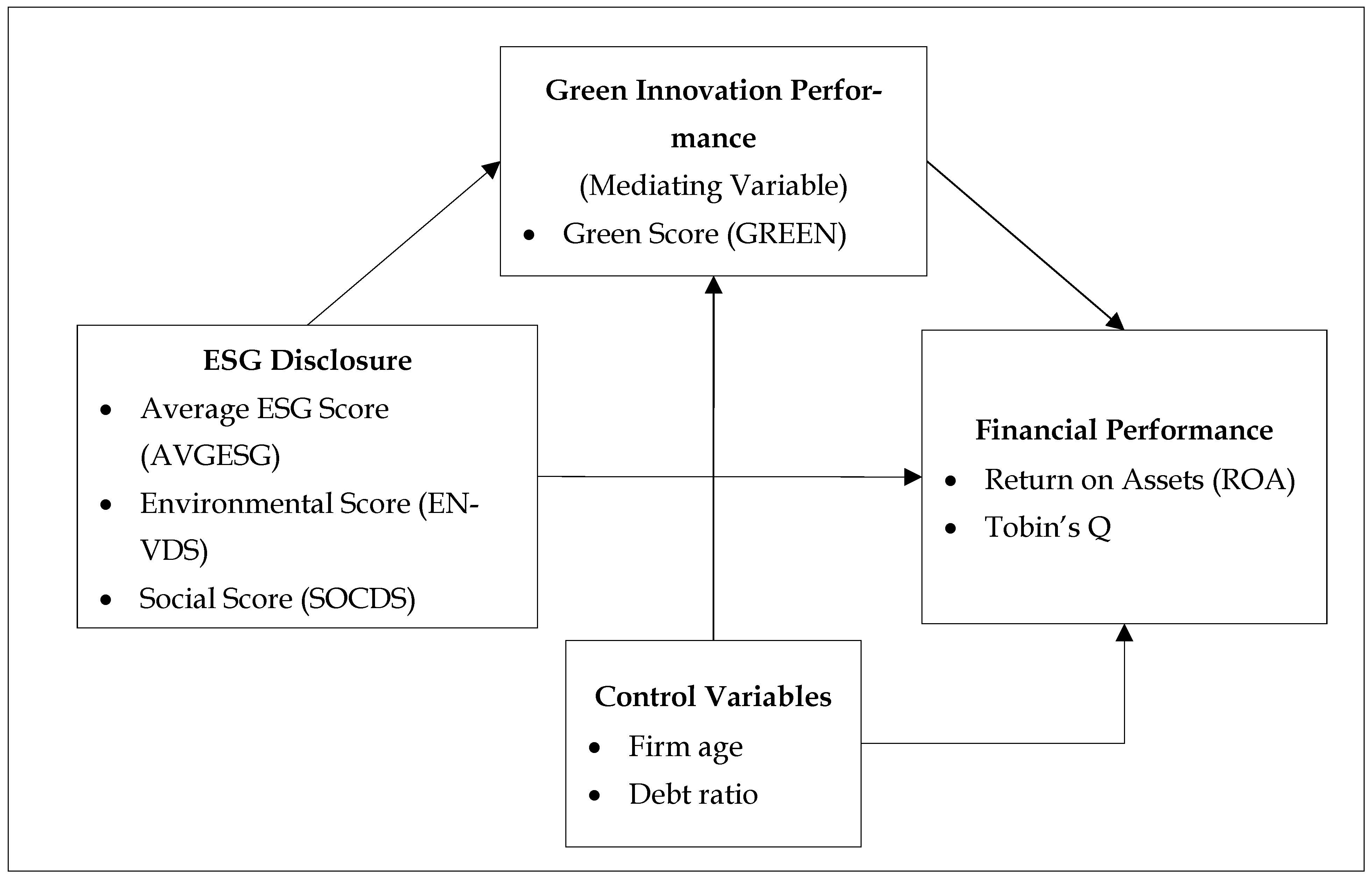

These relationships are illustrated in

Figure 1, which presents the conceptual framework of the study. ESG practices are expected to influence financial performance both directly and indirectly via green innovation. Control variables include firm age, and debt ratio, which are commonly used in firm performance modeling.

3. Research Methodology

3.1. Sample and Data Collection

This study investigates the extent to which environmental, social, and governance (ESG) practices influence green innovation and financial performance among publicly listed firms in ASEAN member countries. The target population comprises all companies listed on the stock exchanges of six ASEAN countries (Indonesia, Malaysia, Philippines, Singapore, Thailand, and Vietnam) as of January 2025, representing a total of 5268 firms. The population includes companies listed before the year 2019, and the data were compiled from Refinitiv Eikon and national stock exchange sources. A non-probability sampling method, specifically purposive sampling, was employed to identify firms that meet the study’s research objectives. The inclusion criteria were as follows: (1) firms must be listed on one of the six ASEAN stock exchanges; (2) firms in the financial sector—including banks, finance and securities companies, and insurance providers (both life and non-life)—were excluded due to their unique operational characteristics, capital structures, and distinct performance measurement frameworks (

Chouaibi et al., 2022); and (3) eligible firms must have complete and consistent data available from 2019 to 2023 for three key dimensions: sustainability performance, green innovation performance, and financial performance.

Ultimately, 174 companies met all eligibility requirements, representing approximately 3.30% of the total population. These firms span a range of sectors that are both environmentally relevant and innovation-driven, including energy, manufacturing, industrials, technology, real estate and construction, and consumer-related industries. These sectors are typically characterized by significant environmental impact and high levels of resource utilization, placing them under intense regulatory scrutiny and stakeholder oversight. Consequently, they are commonly regarded as environmentally sensitive industries. At the same time, these industries are heavily reliant on technological advancement, continuous process improvements, and product innovation features that classify them as innovation-intensive. Their heightened exposure to sustainability-related risks and opportunities ensures the strategic relevance of ESG and innovation efforts in their corporate agendas.

Table 1 provides a breakdown of the total listed firms, the population after excluding financial sector companies, and the final selected sample, disaggregated by country.

The panel dataset covers a five-year period from 2019 to 2023, enabling an examination of both cross-sectional differences and longitudinal effects. Secondary data on firm characteristics, financial indicators, and innovation activities were extracted from annual reports, sustainability disclosures, and financial statements obtained through national stock exchange databases and company websites. Green innovation performance was proxied using the Green Innovation Score (GREEN), derived from firm-level disclosures of eco-friendly R&D projects, clean technology patents, environmental product launches, and ISO 14001 certifications (

Camilleri, 2022). This score was constructed based on a standardized content analysis rubric and scaled from 0 to 100. ESG disclosure data were sourced from the Refinitiv ESG database, which applies a consistent and validated scoring framework across three dimensions: environmental (ENVDS), social (SOCDS), and governance (GOVDS). This framework ensures comparability and standardization of ESG scores across all covered countries and throughout the study period (2019–2023). Each score ranges from 0 to 100, reflecting the depth, transparency, and quality of firm-level ESG disclosures. The use of continuous ESG scores—rather than dichotomous indicators—enhances measurement precision and facilitates more nuanced econometric analysis (

Demiraj et al., 2025;

Krappel et al., 2021). The sample included 174 publicly listed firms from ASEAN countries over a five-year period (2019–2023), resulting in a potential 870 firm-year observations. After removing firms with incomplete ESG disclosure or missing financial variables, the final usable sample consists of 360 firm-year observations, reflecting an unbalanced panel structure. This panel structure enables the application of advanced econometric techniques such as fixed-effects and random-effects models to control for unobservable firm-level heterogeneity and time-specific shocks. Robust standard errors were used to address potential issues of heteroskedasticity and autocorrelation, thereby enhancing the reliability of the empirical results.

3.2. Variable Description

This study utilizes a comprehensive set of variables to empirically examine the relationships among ESG practices, green innovation, and firm financial performance across publicly listed companies in ASEAN economies from 2019 to 2023.

3.2.1. Dependent Variables

Financial performance was assessed through two indicators that reflect both accounting-based and market-based outcomes.

Return on assets (ROA): Calculated as net income divided by total assets, ROA measures a firm’s efficiency in utilizing its assets to generate earnings (

Oncioiu et al., 2020).

Tobin’s Q: Computed as the ratio of the market value of a firm’s assets to their book value, Tobin’s Q reflects market perceptions of a firm’s growth prospects and investment efficiency (

Yusi, 2019).

3.2.2. Independent Variables

The core independent variables are the three ESG disclosure scores derived from the Refinitiv ESG database.

Environmental Disclosure Score (ENVDS): Measures transparency in reporting environmental issues such as carbon emissions, energy consumption, water usage, and climate change mitigation strategies.

Social Disclosure Score (SOCDS): Captures disclosures related to labor practices, diversity, customer responsibility, and community engagement.

Governance Disclosure Score (GOVDS): Reflects governance practices such as board independence, executive compensation, shareholder rights, and anti-corruption policies.

Average ESG Score (AVG_ESG): Computed as the arithmetic mean of ENVDS, SOCDS, and GOVDS, this variable provides a composite measure of a firm’s overall ESG disclosure performance. Including the average score facilitates robustness checks and allows comparison with disaggregated models (

Demirel & Kesidou, 2019;

Liu et al., 2023).

All ESG scores are measured on a continuous scale ranging from 0 to 100, ensuring comparability across firms and over time. The use of disaggregated ESG dimensions provides a more granular understanding than composite indices, allowing for the analysis of differential effects across ESG components.

3.2.3. Mediating Variable

Green Innovation Score (GREEN): This score was constructed through content analysis of firm-level sustainability and annual reports. It captures the extent to which companies disclose activities such as green R&D, clean technology investment, product eco-innovation, and environmental certifications (e.g., ISO 14001). The score ranges from 0 to 100 and serves as the mediating variable linking ESG practices and financial performance (

Demirel & Kesidou, 2019;

Liu et al., 2023).

3.2.4. Control Variables

To isolate the effects of ESG and innovation, the following control variables were included:

Firm Age (AGE): Measured as the natural logarithm of the number of years since incorporation, reflecting organizational maturity and stability (

Hu & Zhang, 2023);

Leverage (TDTTA): The ratio of total debt to total assets, indicating capital structure and financial risk (

Rouf, 2018).

A summary of all variables, their measurements, and expected signs is presented in

Table 2.

3.3. Model Specification and Analytical Techniques

To empirically assess the impact of ESG practices on green innovation and firm financial performance, this study adopts panel regression techniques. Both fixed-effects (FE) and random-effects (RE) models were estimated to control for unobserved firm-level heterogeneity and time-invariant characteristics. The Hausman specification test (

Baltagi, 2008) was employed to determine the more appropriate model. The fixed-effects method is particularly useful for controlling time-invariant unobservable characteristics unique to each firm. This implicitly accounts for differences stemming from specific national institutional contexts or inherent industry-specific attributes that remain constant throughout the study. While acknowledging the individual effects of each ESG dimension, this study initially examined the collective impact of ESG practices to capture the comprehensive effect of sustainability engagement, a prevalent approach in early ESG research within emerging markets.

Two main regression models were tested. The first specification disaggregates ESG into its three components: environmental (ENVDS), social (SOCDS), and governance (GOVDS). The second specification uses the average ESG score (AVG_ESG) as a composite indicator to assess the overall impact of ESG disclosure. These models are expressed as:

where:

i indexes firm, and t denotes year (2019–2023);

Performanceit represents the dependent variables: return on assets (ROA) and Tobin’s Q, estimated in separate models;

µi captures unobserved firm-specific effects, and εit is the idiosyncratic error term.

In addition to these direct effects, the mediating role of green innovation (GREEN) is examined following

Baron and Kenny’s (

1986) causal-step framework (

Baron & Kenny, 1986). The mediation analysis is supported by Sobel tests and bootstrapped confidence intervals. The mediation structure is modeled as:

Model 2 (Mediation Step 1—ESG

→ GREEN):

Model 3 (Mediation Step 2—GREEN

→ Performance):

In all models, Zit denotes the vector of control variables, including AGE and TDTTA. Robust standard errors were used to correct for heteroskedasticity, and multicollinearity was evaluated using correlation matrices and variance inflation factors (VIF). All statistical analyses were conducted using Stata version 17. This methodological framework allows for rigorous testing of both the direct and indirect effects of ESG practices on firm outcomes and offers insight into the value-transmitting role of green innovation in the ASEAN context.

4. Results

This section presents empirical findings from the panel regression analysis and interprets them in light of the study’s hypotheses. The analysis begins with descriptive statistics and correlation matrices, followed by regression results using both fixed-effects and random-effects models. The Hausman test was used to determine the more appropriate model specification.

Table 3 presents the descriptive statistics for the variables based on a panel dataset of 90 publicly listed firms in ASEAN countries over the period 2019–2023. The average return on assets (ROA) is 6.91% (SD = 5.69), indicating moderate variation in firms’ operational profitability. Tobin’s Q, a market-based measure of firm valuation, has a mean of 2.04 with values ranging from 0.26 to 6.52, suggesting notable differences in how the market values firms across the region. The ESG disclosure scores show considerable heterogeneity. The Environmental Disclosure Score (ENVDS) averages 44.12 (SD = 13.05), while the Social Disclosure Score (SOCDS) and Governance Disclosure Score (GOVDS) average 49.83 (SD = 14.30) and 55.22 (SD = 10.01), respectively. The composite ESG score (AVG_ESG), calculated as the average of the three dimensions, has a mean of 49.72 (SD = 11.58), with scores ranging from 18.25 to 85.00. These statistics indicate diverse levels of engagement with sustainability reporting among firms. The average total debt to total assets ratio (TDTTA) is 37.75% (SD = 15.63), reflecting moderate use of leverage in capital structure. The average firm age is 24.1 years (SD = 8.3), suggesting that the sample includes both relatively young and well-established companies.

Table 4 displays the correlation matrix. As expected, the three ESG sub-scores (ENVDS, SOCDS, GOVDS) exhibit strong positive correlations with one another, suggesting that firms active in one sustainability dimension tend to perform well in others. Notably, SOCDS continues to show the strongest positive association with Tobin’s Q (r = 0.36) and ROA (r = 0.40), reflecting its close link with stakeholder engagement and market valuation. The composite AVG_ESG score is also moderately correlated with financial performance metrics, particularly TBQ (r = 0.34), supporting the relevance of ESG integration for firm value.

Prior to estimating the regression models, multicollinearity diagnostics were conducted. Given that ENVDS, SOCDS, and GOVDS exhibited high pairwise correlations with AVG_ESG (r > 0.80), variance inflation factor (VIF) scores were computed. All VIF values were below the common threshold of 5, indicating that multicollinearity was not a serious concern in the models. To determine the appropriate panel regression model, the Hausman specification test was performed to compare the fixed-effects and random-effects estimators. The test yielded a chi-square statistic of χ

2 = 22.46 with a p-value less than 0.01, leading to the rejection of the null hypothesis that the random-effects estimator is consistent. Therefore, the fixed-effects model was deemed more appropriate for the analysis. Panel regression results using fixed effects (as preferred by the Hausman test) are reported in

Table 5.

To further examine the mediating role of green innovation as hypothesized in H4, the study conducted a three-step mediation analysis, supported by the Sobel test and bootstrapped confidence intervals (

Baltagi, 2008). The mediation models employed the composite ESG score (AVG_ESG) as the independent variable to capture the holistic effect of ESG practices on green innovation and firm performance. This approach enables an overall assessment of ESG engagement but does not disentangle the distinct contributions of environmental, social, and governance dimensions. The objective was to determine whether green innovation acts as a transmission mechanism through which ESG practices affect firm performance. Mediation analysis was conducted separately for both return on assets (ROA) and Tobin’s Q (TBQ). The results are presented in

Table 6.

5. Discussion

This study provides a nuanced understanding of the heterogeneous impacts of ESG disclosures on firm financial performance within the ASEAN context. The descriptive statistics underscore considerable variation across firms in terms of profitability (ROA), market valuation (Tobin’s Q), and ESG transparency. Such heterogeneity reflects the diverse institutional environments, regulatory frameworks, firm-level capabilities, and stages of ESG adoption maturity within the region, offering a rich empirical ground for exploring differential ESG–performance linkages. The wide dispersion of ROA values (mean = 6.91%, ranging from −4.32% to 25.48%) highlights the substantial differences in operational efficiency and profitability among ASEAN firms. Similarly, the variation in Tobin’s Q (mean = 2.04, range = 0.26 to 6.52) suggests differing investor expectations regarding firm growth potential and investment efficiency. ESG disclosure scores also exhibit notable standard deviations for ENVDS (13.05), SOCDS (14.30), and GOVDS (10.01), which indicate the varying degrees of ESG integration and transparency across firms. These variations underscore the fragmented landscape of sustainability implementation and justify the disaggregated analytical approach employed in this study.

The moderate yet statistically significant correlations among ESG dimensions suggest that firms generally adopt a multi-dimensional approach to ESG engagement, though the intensity and quality of implementation may differ across dimensions. However, the varied correlations with financial indicators emphasize that the relationship between ESG activities and firm performance is complex and potentially non-linear. Although our aggregate hypothesis (H3) anticipated a positive effect of ESG engagement on firm performance, the disaggregated analysis reveals distinct patterns across the three ESG pillars. Each dimension exhibits unique and sometimes contradictory associations with performance outcomes, underlining the need to analyze ESG components separately rather than relying on composite indices alone. Specifically, environmental disclosure (ENVDS) shows a negative and statistically significant impact on ROA, implying that environmental initiatives—such as adopting clean technologies or meeting regulatory compliance—may impose short-term financial burdens. These findings are consistent with prior research emphasizing the cost-intensive nature of environmental investments in developing economies (

Ming et al., 2024). However, ENVDS also exerts a positive and significant influence on Tobin’s Q, suggesting that investors perceive long-term environmental strategies as credible signals of proactive risk management and strategic foresight. This duality supports H1 and reflects the time-lagged nature of returns from environmental sustainability.

In contrast, social disclosure (SOCDS) demonstrates a consistently positive and significant effect on both ROA and Tobin’s Q, confirming H2. This indicates that socially responsible practices such as fair labor treatment, community engagement, and inclusive hiring generate tangible benefits for firms through enhanced employee morale, customer loyalty, and reputational capital (

Nadarajah & Udayakumara, 2015). The convergence of internal (ROA) and external (Tobin’s Q) benefits highlights the broad-based value proposition of social responsibility. The findings for governance disclosure (GOVDS) are more ambivalent. A negative impact on ROA suggests that compliance with good governance standards may entail administrative or restructuring costs, which could weigh down short-term profitability. This effect might be more pronounced in sectors such as infrastructure, energy, or family-owned conglomerates, where governance reform requires complex stakeholder negotiations and institutional realignment. Additionally, in less regulated ASEAN economies, weak enforcement of corporate governance codes may lead to inconsistent adoption, causing variation in cost-benefit realization across firms. Meanwhile, the weakly positive relationship with Tobin’s Q implies that investors recognize governance as a long-term value enhancer, even if its immediate impact on operations is limited. These results offer only partial support for H3 and reflect the complex institutional environments across ASEAN markets, where differences in legal traditions, enforcement mechanisms, and ownership structures may shape the materiality of governance disclosures (

Zhan, 2023;

Kyere & Ausloos, 2020).

The control variables behave as expected. Leverage (TDTTA) consistently shows a negative effect on firm performance, aligning with financial risk theory, which suggests that high debt levels can constrain firm agility and increase vulnerability. Moreover, firm age is negatively associated with ROA, potentially due to structural inertia or diminishing adaptability in older organizations (

Shen & Chih, 2007;

Silwal, 2016). These findings reinforce the importance of capital structure and organizational lifecycle in determining firm performance. Importantly, the study confirms the partial mediating role of green innovation in the ESG–performance relationship. When green innovation is introduced as a mediator, the direct effects of ESG disclosures on ROA and Tobin’s Q diminish, while the indirect effects become statistically significant. This supports H4 and indicates that ESG engagement—particularly in the environmental and governance domains—can stimulate sustainability-oriented innovation, which subsequently enhances both operational efficiency and market valuation. The positive and significant coefficients of green innovation on ROA (β = 0.21,

p = 0.017) and Tobin’s Q (β = 0.18,

p = 0.031) further underscore its pivotal role in driving financial success. Although the results of green innovation are not presented in a standalone regression, the mediation analysis clearly affirms its influence. Compared to studies in developed markets, such as the EU and the US, where ESG integration is more institutionalized (

Eccles & Klimenko, 2019;

Friede et al., 2015), the results in ASEAN markets reflect a more fragmented but rapidly evolving ESG–performance relationship. This underlines the region’s unique regulatory and cultural landscape, warranting tailored policy and managerial strategies.

6. Conclusions

This study provides empirical evidence on how environmental, social, and governance (ESG) disclosure is associated with green innovation and financial performance among publicly listed firms in ASEAN economies during the period 2019 to 2023. Using an unbalanced panel dataset and applying fixed-effects regression, the analysis offers nuanced insights into the relevance of ESG transparency and sustainability-driven innovation in emerging market contexts. The findings reveal several key patterns. First, environmental disclosure is negatively associated with return on assets, suggesting that sustainability initiatives may entail short-term costs. However, it is positively related to market valuation, implying that investors perceive long-term environmental commitment as a signal of strategic foresight and resilience. Second, social disclosure shows a consistently positive and significant relationship with both accounting-based and market-based performance, highlighting the financial value of initiatives focused on employee welfare, diversity, and community engagement. Third, governance disclosure yields are slightly negative in terms of profitability and insignificant in terms of market valuation, pointing to differences in governance quality or stakeholder perception across firms.

Importantly, the study confirms that green innovation partially mediates the relationship between ESG disclosure and financial performance. ESG engagement, particularly in the environmental and governance dimensions, stimulates innovation activity, which subsequently enhances both operational efficiency and market value. The inclusion of an average ESG score as a robustness measure further confirms the explanatory power of overall ESG engagement, while reinforcing the analytical value of examining each ESG pillar independently. Firm-specific characteristics also behave as expected: higher leverage weakens performance, and older firms tend to be less profitable—likely due to reduced agility and innovation capacity.

6.1. Theoretical Implications

The study contributes to theory by extending the stakeholder theory perspective into the ESG–performance relationship through the lens of green innovation. The findings support the view that ESG practices not only reflect stakeholder responsiveness but also serve as capability-building mechanisms that foster innovation. This integration moves beyond simple linear relationships and highlights the mediating role of innovation as a strategic resource linking sustainability initiatives to long-term firm value. Furthermore, the study reinforces strategic management theory by demonstrating how ESG-aligned resource allocation enhances firm competitiveness, especially within the institutional complexities of emerging markets. These findings also yield several strategic implications. First, they reaffirm the strategic value of ESG engagement as a driver of firm performance, beyond its traditional role as a compliance obligation, particularly in emerging ASEAN economies, where regulatory landscapes and stakeholder expectations are rapidly evolving. Second, they highlight the necessity of treating ESG components as distinct strategic levers, given the heterogeneity in their financial implications. Third, they identify green innovation as a pivotal mechanism through which ESG initiatives, especially in the environmental and governance domains, translate into improved financial performance, thereby reinforcing the business case for embedding innovation within sustainability strategies.

6.2. Managerial Implications

For corporate managers, the results underscore the importance of embedding ESG strategies within core business operations and innovation objectives. While environmental initiatives may incur short-term costs, they deliver long-term value through enhanced market trust. Social programs that improve employee engagement, diversity, and stakeholder relationships yield both tangible and reputational benefits. Governance practices should be designed not only to ensure compliance but also to enable strategic flexibility and investor confidence. Managers should align ESG disclosures with innovation-driven goals to position their firms competitively in increasingly ESG-conscious markets.

For policymakers, the findings suggest a need to develop ESG disclosure frameworks that are both contextually sensitive and institutionally enforceable across ASEAN countries. Given the observed variation in governance quality and ESG impact, regulators should promote clearer, harmonized standards and encourage third-party assurance to reduce greenwashing. Public support for green innovation through tax incentives, grants, or ESG-linked financing can further amplify the performance benefits of sustainability investments. National strategies that combine regulatory enforcement with capacity-building (especially for SMEs) will enhance ESG engagement and drive inclusive, innovation-led growth in the region.

7. Limitations and Future Research

While this study offers novel insights into how ESG practices influence green innovation and financial performance in the ASEAN context, several limitations should be acknowledged to guide future research. First, the current dataset, while encompassing ASEAN economies, is confined to 174 publicly listed firms across a five-year timeframe, yielding 870 firm-year observations. Although this sample size offers preliminary insights, it inherently restricts the statistical power of the tests and elevates the potential for Type II errors, thus questioning the stability and generalizability of the findings. Given the intrinsic diversity of ASEAN economies and sectors, this limited sample size may not comprehensively represent the broader spectrum of firms in the region; consequently, the results might be disproportionately affected by unique instances or unrepresentative data points. This study acknowledges the heterogeneous institutional, regulatory, and cultural contexts across ASEAN countries, along with the varying significance of ESG issues across diverse industries, which could lead to differential impacts. Although our fixed-effects models control unobserved firm-specific time-invariant heterogeneity, a more extensive dataset would bolster the stability and robustness of the results. Fully disaggregating ESG effects by country or sector remains a salient direction for future research. Such investigations could employ a cross-regional design comparing ASEAN with OECD or other regional blocks to capture broader institutional variations or explore sector-specific models or interaction effects to reveal heterogeneous ESG–performance linkages in greater detail across industries and national settings. Second, ESG data in this study were obtained exclusively from the Refinitiv database. While Refinitiv provides standardized ESG scoring, it may not fully capture disclosure quality, credibility, or assurance. Future research could incorporate alternative data sources (e.g., MSCI, Sustainalytics) or complement quantitative ratings with content analysis, keyword-based metrics, or third-party assurance indicators to differentiate symbolic from substantive ESG engagement. Third, while employing panel regression with fixed-effects aids in controlling time-invariant heterogeneity, it incompletely resolves the issues of potential reverse causality or dynamic endogeneity. Specifically, the current models presume a unidirectional effect from ESG on innovation and performance, which may neglect the possibility that firms with superior performance are more capable or incentivized to implement extensive ESG practices. Although fixed effects alleviate some omitted variable bias, they do not conclusively establish a robust causal relationship in the presence of such endogeneity. To fortify causal inference and more effectively capture the dynamic relationships among variables, future studies could apply more advanced econometric techniques, such as instrumental variables, the Generalized Method of Moments, utilize lagged regressors within dynamic panel models, or quasi-experimental methods such as difference-in-differences (DiD). Fourth, this study examines financial performance over a five-year horizon, capturing short- to medium-term effects. However, many ESG initiatives—particularly those aimed at green innovation—are long-term and strategic in nature. Longitudinal studies spanning a decade or more could better capture ESG’s sustained impact on competitive advantage, innovation capability, and resilience. Finally, although this study incorporates crucial firm-specific controls, such as firm age and leverage, and accounts for time-invariant industry characteristics through fixed-effects models, the breadth of control variables examined was limited. Firm size, a frequently cited confounding factor in studies of firm performance, was notably absent from our primary models; this omission has the potential to introduce biased estimates. Furthermore, the study’s treatment of ESG effects does not extend beyond basic fixed effects to fully disaggregate by sector. Given that the materiality of ESG dimensions is likely to differ across industries—for instance, environmental disclosure might hold greater financial significance in high-emission sectors, while governance issues may be more salient in finance and professional services—future research should consider integrating a wider array of firm-level controls, such as firm size, and exploring more granular sector-specific models or interaction effects to elucidate heterogeneous ESG–performance linkages with greater precision.