The Moderating Role of SSB Conflicts of Interest and Audit Committee Independence in Good Corporate Governance and Islamic Bank Performance in Indonesia

Abstract

1. Introduction

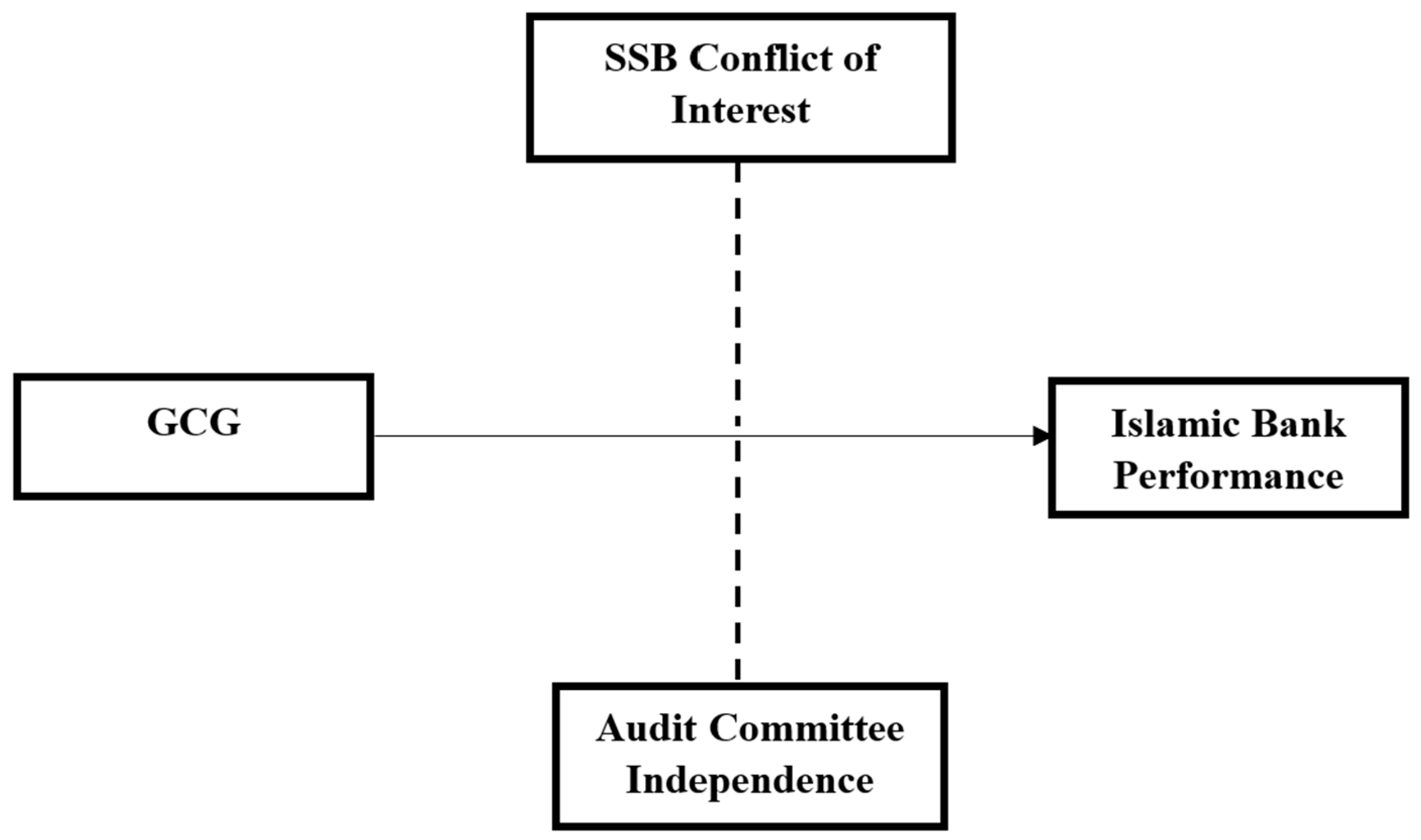

- How does Good Corporate Governance (GCG) influence the financial performance of Islamic banks in Indonesia?

- Does the proportion of Sharia Supervisory Board (SSB) members with conflicts of interest weaken the relationship between GCG and Islamic bank financial performance?

- Does the proportion of independent Audit Committee (AC) members strengthen the relationship between GCG and Islamic bank financial performance?

2. Theoretical Review

3. Methods

- Full-fledged Islamic Commercial Banks (Bank Umum Syariah) as per OJK regulations.

- Islamic banks consistently published their annual reports throughout the observation period (2014–2023).

- Islamic banks, whose annual reports provided the complete data necessary for all the variables used in this study.

3.1. Operational Definitions and Measurement of Variables

- Islamic Bank Financial Performance (Dependent Variable): Measured by Return on Assets (ROA), a widely accepted profitability ratio calculated as net profit divided by total assets. A higher ROA indicates greater efficiency in utilizing assets to generate profits. ROA was chosen as a robust measure of financial performance because it reflects both profitability and asset utilization efficiency, providing a comprehensive view of a bank’s operational success.

- Good Corporate Governance (GCG) (Independent Variable): Measured using the GCG self-assessment scores published in the annual reports of Islamic banks. These scores are typically assessed based on OJK regulations (for example, POJK No. 5/POJK.03/2016 concerning Good Corporate Governance for commercial banks), covering aspects such as transparency, accountability, responsibility, independence, and fairness. Scores are usually provided on a scale (e.g., 1 to 5, where 1 is “very poor” and 5 is “very good”). Higher scores indicate better GCG implementation. While acknowledging the subjectivity and limited scale of self-assessment scores, these scores are justified for capturing the multidimensional construct of good corporate governance because they are based on standardized regulatory frameworks provided by the OJK. These frameworks mandate a comprehensive evaluation of key GCG principles (transparency, accountability, responsibility, independence, and fairness), ensuring a structured and consistent assessment. Furthermore, given the highly regulated nature of the banking industry, self-assessments, when regularly monitored by regulatory bodies, provide an official and publicly reported proxy for compliance and quality of governance. OJK’s oversight adds a layer of credibility to these internal assessments, making them a practical and accessible measure for cross-sectional and time-series analysis within the Indonesian context.

- SSB Conflicts of Interest (Moderating Variable 1): Measured by the proportion of SSB members who hold cross-memberships in other Islamic Financial Institutions (IFIs) or positions in the management/board of directors of the same or other Islamic banks. This was calculated as the number of SSB members with identified conflicts of interest divided by the total number of SSB members. A higher proportion indicates greater potential for conflicts of interest. This measure was chosen to quantify the potential for conflicts of interest, reflecting the extent to which SSB members’ multiple affiliations might compromise their objectivity and independence.

- Audit Committee (AC) independence (Moderating Variable 2): Measured by the proportion of independent members within the Audit Committee. This was calculated as the number of independent AC members divided by the total number of AC members. A higher proportion indicates greater AC independence, which is expected to enhance oversight capabilities. This variable reflects the commitment of Islamic banks to transparent and unbiased financial oversight, which is crucial for effective corporate governance.

3.2. Econometric Model and Data Analysis

4. Empirical Findings

4.1. Regression Results

4.2. Robustness Test Results

5. Discussions

5.1. The Effect of GCG on Financial Performance

5.2. The Moderating Effect of SSB Conflict of Interest

5.3. The Moderating Effect of Audit Committee Independence

5.4. Multicollinearity and Robustness Checks

6. Conclusions, Implications, and Future Research

6.1. Implications

- For Practitioners (Islamic Banks) should prioritize establishing and maintaining independent audit committees to strengthen their governance frameworks and enhance financial performance. While SSB cross-membership did not show a detrimental moderating effect in this study, banks should still implement robust oversight mechanisms to effectively manage any potential conflicts of interest that may arise. Focusing on improving overall GCG practices is crucial as it directly contributes to better financial outcomes.

- For Regulators (Indonesian Financial Services Authority—OJK and similar bodies), regulatory bodies like the OJK should continue to emphasize and enforce the importance of audit committee independence in their governance guidelines for Islamic banks. This study reinforces the notion that strong, independent oversight through the AC is a key driver of financial performance in the Islamic banking sector. Regulators may also consider providing clearer guidelines or frameworks for managing the potential benefits and risks associated with SSB cross-membership.

- For Stakeholders (Investors and Customers), the positive relationship between GCG and financial performance suggests that investors and customers can consider strong GCG practices, particularly the independence of the Audit Committee, as a positive indicator of an Islamic bank’s stability and profitability.

6.2. Limitations and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Ajili, H., & Bouri, A. (2018). Corporate governance quality of Islamic banks: Measurement and effect on financial performance. International Journal of Islamic and Middle Eastern Finance and Management, 11(3), 470–487. [Google Scholar] [CrossRef]

- Alam, M. K., Ahmad, A. U. F., & Muneeza, A. (2022). External Sharī‘ah audit and review committee Vis-a-Vis Sharī‘ah compliance quality and accountability: A case of Islamic banks in Bangladesh. Journal of Public Affairs, 22(1), 1–10. [Google Scholar] [CrossRef]

- Al Qazzaz, H. R. (2008). Conflicts of interest and impartiality. Available online: https://www.tiri.org/index.php (accessed on 15 March 2024).

- Al Thnaibat, M., Al-Hajaya, K., & Alshhadat, M. Q. (2024). Do the characteristics of the Sharia Supervisory Board affect the Islamic banks’ performance? Evidence from Arab countries. Journal of Financial Reporting and Accounting, 22(5), 1–21. [Google Scholar] [CrossRef]

- Aslam, E., & Haron, R. (2020). Does corporate governance affect the performance of Islamic banks? New insight into Islamic countries. Corporate Governance, 20(6), 1073–1090. [Google Scholar] [CrossRef]

- Chan, K. C., & Li, J. (2008). Audit committee and firm value: Evidence on outside top executives as expert-independent directors. Corporate Governance: An International Review, 16(1), 16–31. [Google Scholar] [CrossRef]

- Chazi, A., Khallaf, A., & Zantout, Z. (2018). Corporate governance and bank performance: Islamic versus non-Islamic banks in GCC countries. The Journal of Developing Areas, 52(2), 109–126. [Google Scholar] [CrossRef]

- Choudhury, M. A., & Alam, M. N. (2013). Corporate governance in Islamic perspective. International Journal of Islamic and Middle Eastern Finance and Management, 6(3), 180–199. [Google Scholar] [CrossRef]

- Darma, E. S., & Afandi, A. (2021). The role of Islamic corporate governance and risk toward Islamic banking performance: Evidence from Indonesia. Journal of Accounting and Investment, 22(3), 517–538. [Google Scholar] [CrossRef]

- Darwanto, & Chariri, A. (2019). Corporate governance and financial performance in Islamic banks: The role of the sharia supervisory board in multiple-layer management. Banks and Bank Systems, 14(4), 183–191. [Google Scholar] [CrossRef]

- Elamer, A. A., Ntim, C. G., Abdou, H. A., & Pyke, C. (2020). Sharia supervisory boards, governance structures and operational risk disclosures: Evidence from Islamic banks in MENA countries. Global Finance Journal, 46, 100488. [Google Scholar] [CrossRef]

- Fitrijanti, T., & Yadiati, W. (2018). The influence of Islamic governance on minimizing non-compliance with Sharia. Accounting and Finance Review, 3(3), 70–76. [Google Scholar] [CrossRef] [PubMed]

- Garas, S. N. (2012a). The conflicts of interest inside the Shari’a supervisory board. International Journal of Islamic and Middle Eastern Finance and Management, 5(2), 88–105. [Google Scholar] [CrossRef]

- Garas, S. N. (2012b). The control of the Shari’a Supervisory Board in the Islamic financial institutions. International Journal of Islamic and Middle Eastern Finance and Management, 5(1), 8–24. [Google Scholar] [CrossRef]

- Grassa, R. (2013). Shariah supervisory system in Islamic financial institutions: New issues and challenges: A comparative analysis between Southeast Asia models and GCC models. Humanomics, 29(4), 333–348. [Google Scholar] [CrossRef]

- Gujarati, D. N., & Porter, D. C. (2009). Basic econometrics (5th ed.). McGraw-Hill Irwin. [Google Scholar]

- Gyamerah, S., Amo, H. F., & Adomako, S. (2020). Corporate governance and the financial performance of commercial banks in Ghana. Journal of Research in Emerging Markets, 2(4), 33–47. [Google Scholar] [CrossRef]

- Hamsyi, N. F. (2019). The impact of good corporate governance and Sharia compliance on the profitability of Indonesia’s Sharia banks. Problems and Perspectives in Management, 17(1), 56–66. [Google Scholar] [CrossRef]

- Handa, R. (2018). Does corporate governance affect financial performance: A study of select Indian banks. Asian Economic and Financial Review, 8(4), 478–486. [Google Scholar] [CrossRef]

- Harisa, E., Adam, M., & Meutia, I. (2019). Effect of quality of good corporate governance disclosure, leverage and firm size on profitability of Islamic commercial banks. International Journal of Economics and Financial Issues, 9(4), 189–196. [Google Scholar] [CrossRef]

- Haryati, S., & Kristijadi, E. (2014). The effect of GCG implementation and risk profile on financial performance at go-public national commercial banks. Journal of Indonesian Economy and Business, 29(3), 237–250. [Google Scholar]

- Hussien, M. E., Alam, M. M., Murad, M. W., & Wahid, A. (2019). The performance of Islamic banks during the 2008 global financial crisis evidence from the gulf cooperation council countries. Journal of Islamic Accounting and Business Research, 10(3), 407–420. [Google Scholar] [CrossRef]

- Iramani, R. R., Mongid, A., & Muazaroh, M. (2018). Positive contribution of the good corporate governance rating to stability and performance: Evidence from Indonesia. Problems and Perspectives in Management, 16(2), 1–11. [Google Scholar] [CrossRef]

- Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305–360. [Google Scholar] [CrossRef]

- Karim, R. A. A. (1990). The independence of religious and external auditors: The case of Islamic banks. Accounting, Auditing & Accountability Journal, 3(3), 34–44. [Google Scholar] [CrossRef]

- Khalid, A. A. (2020). Role of audit and governance committee for internal Shariah audit effectiveness in Islamic banks. Asian Journal of Accounting Research, 5(1), 81–89. [Google Scholar] [CrossRef]

- Khan, I., & Zahid, S. N. (2020). The impact of Shari’ah and corporate governance on Islamic banks performance: Evidence from Asia. International Journal of Islamic and Middle Eastern Finance and Management, 13(3), 483–501. [Google Scholar] [CrossRef]

- Kusuma, H., & Ayumardani, A. (2016). The corporate governance efficiency and Islamic bank performance: An Indonesian evidence. Polish Journal of Management Studies, 13(1), 111–120. [Google Scholar] [CrossRef]

- Minaryanti, A. A., & Mihajat, M. I. S. (2024). A systematic literature review on the role of sharia governance in improving financial performance in sharia banking. Journal of Islamic Accounting and Business Research, 15(4), 553–568. [Google Scholar] [CrossRef]

- Mnif, Y., & Tahari, M. (2020). Corporate governance and compliance with AAOIFI governance standards by Islamic banks. International Journal of Islamic and Middle Eastern Finance and Management, 13(5), 891–918. [Google Scholar] [CrossRef]

- Mollah, S., Hassan, M. K., Al Farooque, O., & Mobarek, A. (2017). The governance, risk-taking, and performance of Islamic banks. Journal of Financial Services Research, 51(2), 195–219. [Google Scholar] [CrossRef]

- Mukhibad, H., Nurkhin, A., Waluyo Jati, K., & Yudo Jayanto, P. (2022). Corporate governance and Islamic law compliance risk. Cogent Economics and Finance, 10(1), 2111057. [Google Scholar] [CrossRef]

- Muneeza, A., & Hassan, R. (2014). Shari’ah corporate governance: The need for a special governance code. Corporate Governance, 14(1), 120–129. [Google Scholar] [CrossRef]

- Nomran, N. M., Haron, R., & Hassan, R. (2018). Shari’ah supervisory board characteristics effects on Islamic banks’ performance: Evidence from Malaysia. International Journal of Bank Marketing, 36(2), 290–304. [Google Scholar] [CrossRef]

- Nurkhin, A., Kusmuriyanto, Widiyanto, W., Kania Widiatami, A., & Nur Aeni, I. (2023). Do corporate governance implementation and bank characteristics improve the performance of Indonesian Islamic banking? Before-COVID-19 pandemic analysis. Banks and Bank Systems, 18(3), 126–135. [Google Scholar] [CrossRef]

- Otoritas Jasa Keuangan. (2023). Laporan perkembangan keuangan Syariah Indonesia. Otoritas Jasa Keuangan.

- Ramly, Z., Datuk, N., & Nordin, H. M. (2018). Sharia supervision board, board independence, risk committee and risk-taking of Islamic banks in Malaysia. International Journal of Economics and Financial Issues, 8(4), 290–300. [Google Scholar]

- Rashid, A. (2013). CEO duality and agency cost: Evidence from Bangladesh. Journal of Management and Governance, 17(4), 989–1008. [Google Scholar] [CrossRef]

- Srairi, S., Bourkhis, K., & Houcine, A. (2022). Does bank governance affect risk and efficiency? Evidence from Islamic banks in GCC countries. International Journal of Islamic and Middle Eastern Finance and Management, 15(3), 644–663. [Google Scholar] [CrossRef]

- Sulub, S. A., Salleh, Z., & Hashim, H. A. (2020). Corporate governance, SSB strength and the use of internal audit function by Islamic banks: Evidence from Sudan. Journal of Islamic Accounting and Business Research, 11(1), 152–167. [Google Scholar] [CrossRef]

- Surat Edaran Bank Indonesia Nomor 15. (2013). Available online: https://peraturan.bpk.go.id/Details/136591/peraturan-bi-no-1515pbi2013-tahun-2013 (accessed on 20 March 2024).

- Van Essen, M., Engelen, P. J., & Carney, M. (2013). Does “good” corporate governance help in a crisis? The impact of country- and firm-level governance mechanisms in the European financial crisis. Corporate Governance: An International Review, 21(3), 201–224. [Google Scholar] [CrossRef]

- Widarjono, A. (2018). Ekonometrika. pengantar dan aplikasinya disertai panduan eviews (5th ed.). UPP STIM YKPN. [Google Scholar]

- Yammeesri, J., & Herath, S. K. (2010). Board characteristics and corporate value: Evidence from Thailand. Corporate Governance, 10(3), 279–292. [Google Scholar] [CrossRef]

| Variables | Codes | Definition | References |

|---|---|---|---|

| Bank Performance Indicator (Independent) Return on Assets | ROA | Ratio of operating income over assets | (Aslam & Haron, 2020; Harisa et al., 2019; Elamer et al., 2020) |

| SSB and AC Characteristics (Moderator) Ratio of Dual SSB | Z1 | Proportion of Dual SSB Members. | (Rashid, 2013; Yammeesri & Herath, 2010) |

| Ratio of Independent AC | Z2 | Proportion of Independent Board members on Audit Committee. | (Van Essen et al., 2013; Yammeesri & Herath, 2010) |

| Good Corporate Governance (Dependent) Self-Assessed GCG Score | GCG | The results of the self-assessment of GCG rating in accordance with Bank Indonesia and OJK regulation (Surat Edaran Bank Indonesia Nomor 15, 2013). | (Harisa et al., 2019; Haryati & Kristijadi, 2014) |

| Bank Characteristics (Control Variables) | |||

| Bank Size | K1 | Bank total assets. | (Srairi et al., 2022; Elamer et al., 2020; Darwanto & Chariri, 2019) |

| Gross Non-Performing Loan | K2 | The ratio of gross non-performing loan. | (Mukhibad et al., 2022; Darwanto & Chariri, 2019; Haryati & Kristijadi, 2014) |

| Net Non-Performing Loan | K3 | The ratio of net non-performing loan. | (Mukhibad et al., 2022; Darwanto & Chariri, 2019; Haryati & Kristijadi, 2014) |

| Capital Adequacy Ratio | K6 | The ratio of Total Capital to Risk Weighted Assets (RWA). | (Darwanto & Chariri, 2019) |

| Efficiency Ratio | K7 | Operations efficiency, which is percentage of cost to income. | (Haryati & Kristijadi, 2014) |

| Financing to Deposit Ratio | K8 | Financing to total deposit ratio. | (Iramani et al., 2018). |

| Variable | Coef. | Std. Err | t | Probability |

|---|---|---|---|---|

| gcg | −3.89 | 0.87 | −4.45 | 0.000 (***) |

| Constanta | 8.14 | 1.82 | 4.47 | 0.000 (***) |

| Variable | Coef. | Std. Err | t | Probability |

|---|---|---|---|---|

| gcg | −4.03 | 0.90 | −4.48 | 0.000 (***) |

| Z2 | 0.04 | 0.13 | 0.31 | 0.755 |

| Percentage of Z2 | 0.12 | 0.12 | 1.04 | 0.299 |

| Z1 | 0.01 | 0.02 | 0.67 | 0.501 |

| Constanta | 2.39 | 13.77 | 0.17 | 0.863 |

| Variable | Coef. | Std. Err | t | Probability |

|---|---|---|---|---|

| gcg | −4.09 | 0.86 | −4.73 | 0.000 (***) |

| Z2 | 0.08 | 0.04 | 2.06 | 0.042 (**) |

| _cons | 7.85 | 1.80 | 4.37 | 0.000 (***) |

| Variable | Coef. | Std. Err | t | Probability |

|---|---|---|---|---|

| gcg | −6.96 | 9.15 | −0.76 | 0.449 |

| Z2 | 0.00 | 0.29 | 0 | 0.997 |

| Percentage of Z2 | 0.08 | 0.12 | 0.64 | 0.525 |

| Z1 | −0.02 | 0.06 | −0.27 | 0.791 |

| Z2_gcg | 0.03 | 0.10 | 0.35 | 0.728 |

| Percentage of Z2_gcg | 0.08 | 0.02 | 3.44 | 0.000 (***) |

| Z1_gcg | 0.01 | 0.03 | 0.30 | 0.763 |

| _cons | 5.126 | 28.476 | 0.180 | 0.858 |

| gcg | −3.62 | 1.20 | −3.02 | 0.003 (***) |

| Percentage of Z2_gcg | 0.086 | 0.019 | 4.440 | 0.000 (***) |

| _cons | 5.437 | 2.464 | 2.210 | 0.03 (**) |

| gcg | −2.80 | 0.87 | −3.20 | 0.002 (***) |

| Percentage of Z2_gcg | 0.076 | 0.016 | 4.780 | 0.000 (***) |

| clta | 0.884 | 0.468 | 1.890 | 0.062 (*) |

| cnpf | −0.27 | 0.10 | −2.67 | 0.009 (***) |

| cnpfn | 0.34 | 0.42 | 0.81 | 0.423 |

| cnim | −0.126 | 0.065 | −1.920 | 0.058 (*) |

| cncar | 0.02 | 0.01 | 1.75 | 0.084 (*) |

| cnfdr | 0.02 | 0.01 | 2.22 | 0.029 (**) |

| _cons | −11.387 | 8.063 | −1.410 | 0.161 |

| Test | Hasil | ||

|---|---|---|---|

| Chow test | CEM/FEM | ||

| F(9, 82) | 0.98 | ||

| Prob | 0.4607 | CEM | |

| Hausman test | FEM/REM | ||

| chi2(8) | 6.4 | ||

| Prob | 0.603 | REM | |

| LM Test | REM/CEM | ||

| chibar2(01) | 1.96 | ||

| Prob | 0.0808 | CEM |

| Multicollinearity | |

|---|---|

| Mean VIF | 1.55 |

| Normality distribution error term | |

| Shapiro–Wilk W test for normal data | |

| Prob Z | 0.83389 |

| Heteroscedasticity | |

| chi2(1) | 0.01 |

| Prob | 0.9096 |

| autocorrelation | |

| F(1, 9) | 2.354 |

| Prob | 0.1593 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Simanjuntak, J.M.; Faizi, F.; Kusuma, A.S. The Moderating Role of SSB Conflicts of Interest and Audit Committee Independence in Good Corporate Governance and Islamic Bank Performance in Indonesia. J. Risk Financial Manag. 2025, 18, 466. https://doi.org/10.3390/jrfm18080466

Simanjuntak JM, Faizi F, Kusuma AS. The Moderating Role of SSB Conflicts of Interest and Audit Committee Independence in Good Corporate Governance and Islamic Bank Performance in Indonesia. Journal of Risk and Financial Management. 2025; 18(8):466. https://doi.org/10.3390/jrfm18080466

Chicago/Turabian StyleSimanjuntak, Jerry Marmen, Faizi Faizi, and Airlangga Surya Kusuma. 2025. "The Moderating Role of SSB Conflicts of Interest and Audit Committee Independence in Good Corporate Governance and Islamic Bank Performance in Indonesia" Journal of Risk and Financial Management 18, no. 8: 466. https://doi.org/10.3390/jrfm18080466

APA StyleSimanjuntak, J. M., Faizi, F., & Kusuma, A. S. (2025). The Moderating Role of SSB Conflicts of Interest and Audit Committee Independence in Good Corporate Governance and Islamic Bank Performance in Indonesia. Journal of Risk and Financial Management, 18(8), 466. https://doi.org/10.3390/jrfm18080466